宏观经济学双语分析解析

- 格式:ppt

- 大小:151.50 KB

- 文档页数:34

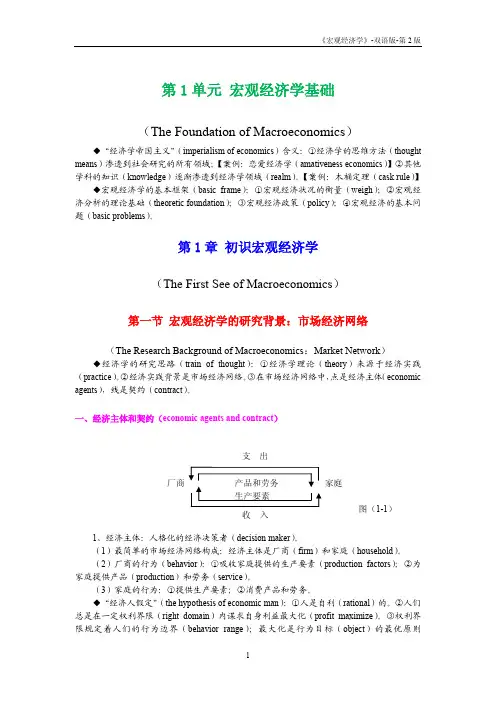

宏观经济学原理曼昆名词解释微观经济学(microeconomics),研究家庭和企业如何做出决策,以及它们如何在市场上相互影响。

宏观经济学(macroeconomics),研究整体经济现象,包括通货膨胀、失业和经济增长。

国内生产总值GDP(gross domestic product),在某一既定时期,一个国家内生产的所有最终物品与服务的市场价值。

消费(consumption),家庭除购买新住房之外,用于物品与服务的支出。

投资(investment),用于资本设备、存货和建筑物的支出,包括家庭用于购买新住房的支出。

政府购买(government purchase),地方、州和联邦政府用于物品与服务的支出。

净出口(net export),外国人对国内生产的物品的支出(出口),减国内居民对外国物品的支出(进口)。

名义GDP(nominal GDP),按现期价格评价的物品与服务的生产。

真实GDP(real GDP),按不变价格评价的物品与服务的生产。

(总之,名义GDP是用当年价格来评价经济中物品与服务生产的价值,真实GDP是用不变的GDP平减指数(GDP, deflator),用名义GDP与真实GDP的比率乘以100计算的物价水平衡量指标。

消费物价指数CPI(consumer price index),普通消费者所购买的物品与服务的总费用的衡量指标。

通货膨胀率(inflation rate),从前一个时期以来,物价指数变动的百分比。

生产物价指数(producer price index),企业所购买的一篮子物品运服务的费用的衡量指标。

指数化(indexation),根据法律或合同按照通货膨胀的影响,对货币数量的自动调整。

名义利率(nominal interest rate),通常公布的、未根据通货膨胀的影响,校正的利率。

真实利率(real interest rate),根据通货膨胀的影响校正过的利率。

宏观经济学MEASUREING A NATION’S INCOME一国收入的衡量Microeconomics the study of how households and firms make decisions and how they interact in markets.微观经济学:研究家庭和企业如何做出决策,以及他们如何在市场上相互交易。

Macroeconomics the study of economy-wide phenomena,including inflation,unemployment,and economic growth宏观经济学:研究整体经济现象,包括通货膨胀、失业和经济增长。

GDP is the market value of final goods and services produced within a country in a given period of time.国内生产总值GDP:给定时期的一个经济体内生产的所有最终产品和服务的市场价值Consumption is spending by households on goods and services, with the exception of purchased of new housing.消费:除了购买新住房,家庭用于物品与劳务的支出。

Investment is spending on capital equipment inventories, and structures, including household purchases of new housing.投资:用于资本设备、存货和建筑物的支出,包括家庭用于购买新住房的支出。

Government purchases are spending on goods and services by local, state, and federal government.政府支出:地方、州和联邦政府用于物品和与劳务的支出。

Current economic circumstances and the trend of macroeconomic policy in ChinaMarketing 1010800106 孙浚轩1010800109 李晗Current macroeconomic circumstances of China is not bad . At present ,financial crisis is becoming even more violent. Under such circumstances , it is important to figure out whether our country should keep conducting tight monetary policy and whether the policy of appreciation of the RMB can be carried out ,what function the financial policy should have .So, please follow my step, let us solve these problems.External economyOK, firstly, let us conclude the current circumstance of international economy in three F, namely, FinancialCrisis/Fuel Crisis/Food Crisis.Therefore, the Crisis is hardly to reach “the beginning of the end”but might be “the end of the beginning”.,Internal economy1.Subprime Crisis has direct and indirect ways toinfluence Our Country.Obviously, the cradle of subprime crisis is U.S. Somemortgage and bond which Chinese banks bought haveshrunk. To make it worse, China is the country whichheld most of American’s bond. With the developmentof Subprime Crisis , it may change the direction ofinternational capital flow and might cause hot moneyflow into China. Subprime Crisis and the glide of U.Seconomy will cause dollars devalue constantly. So, theprice of international goods which accounts in dollarswill increase and it will cause China domesticinflation. What is more, the glide of U.S economywill cause trade protectionism in U.S .2.The slow down of U.S economy has a big impact onChina export because U.S is the biggest importcountry for China.3.The inflation which happens in China now is theresult of an overheated economy. On the one hand,the cost increasing and the demand pull influenced it.On the other hand, the international price of oil, foodand other goods increase fiercely which has a bigimpact on China inflation.We have already seen the circumstance which we live in now, then, let us see the specific problems in our economy.Problems in economy1.Relying on overseas market excessively.At present, foreign trade interdependency of our country is nearly 67% while the developed countries is nearly 25%. The motive power of our country’s increasing are investment and export. And the domestic demand is obvious not enough. The focus expression of economic pattern disorder is the imbalance of overseas market demand and domestic demand. What is more important, excess production capacity is too serious. Financial Crisis caused overseas market demand wither , so more andmore products cannot be exported and the unemployment is inevitable .2.Foreign capital has intervene many fields in our economy.According to the survey, in China’s 30 majority industry, 20 has been intervened by foreign capital deeply. Till 2008, U.S has been investing China enterprise about 60 thousands, and the capital is nearly 60000millions. As it can be seen, our initiative is controlled by other countries.cking of core technology and independent innovationMaybe it seems a historical problems in economy, right?Recent years, high and new technology products’export is increasing fast ! In 2010. It occupies nearly 65% in total export.But you gotta know that, 80% products’core technology are controlled by foreign merchant. So some industries are not competitive ,but monopolized by some big corporations Obviously, the externality is too heavy.4.Consumption lacks motive powerPoor countries are better off pursuing outward-oriented policies.But our country depends on foreign markets too much. We have been emphasized”pull domestic consumption”for about ten years but cannot make a breakthrough all the time, and domestic consumption rate is not rising but falling constantly.5.Inflation cannot be stopped in a short timeInflation’s occurrence and development is always lag behind an overheated economy about several quarters. At present , China’s economic growth rate reach up to 10.4%,still exceed potential economic growth speed. The inflation pressure will remain in the next period of time. International oil, food prices’increasing leads to the rising of the cost of production in China, thus cause the ascend of PPI. Also, CPI will rise too due to more and more good prices’ increasing,Aiming at these problems, we can make some foresight of our economy and some reasonable advises although our thoughts are still immature. HoHo~Here are my suggestions and analysis.My Measures and Suggestions(1)T o develop domestic economy.Our domestic economy has faced many obstacles. Domestic economic risks mainly include:1. Inflation is likely changing into deflation. 2.Domestic capital inflow may become capital gushy.ernment policy caused economy instability. Thegovernment is leading the economy now, causing some problems.So we need a competitive market. A real competition should depend on benefits, brand, technology…. Therefore, our innovation is gonna be in this aspect. We have to change the relation of government and market, glowing enterprises’own vigor.(2)Regulate foreign capital’impact. Develop domestic stock market.In view of the hot money inflow, we can change foreign exchange reverse into RMB capital ,making domestic market liquidity, using stock rights in exchange for dollars .In this very period, our enterprises can merger similar foreign enterprises, strengthening ourselves . And we have to go out, trying to buy hightechnology, resources goods, building more and more transaction relations, stretching our industry chain. In some extents, we can reduce foreign capital impact.(3)Enhancing our firms’ innovation ability.Independent innovation has become national strategy, but it is not equal to self dependence. We all know that Japan is a independent country, But in the early estate, Japan also depends on absorbing advanced technology from other developed countries. With constant absorbing and improving, Japan gradually mastered certain ability., then, its’ ability become stronger and stronger. So, our country’s enterprises especially have to learn to take advantage of resources around the world, including economic resources, technology resources, human resources and so on . To corporate and innovate in open type ,our innovation ability can improve little by little.(4)Increasing educational input and strengthen property rights protectionYeah, as you know, our country is always emphasizing the importance of education, but our form of public education is still unsound such as the brain drain and creativity education. So we have to increase educational input and provide high qualityeducation to avoid brain drain and such problems.Property rights? Oh, no , this word seems ridiculous in China But we got to deal with this word in a serious attitude. An important prerequisite for the price system to work is an economy-wide respect for property rights. So we should formulatea complete law to protect property rights.(5) Expand domestic demand.Our country’s finance is surplus last year, government’s liability occupies only 20% in GDP. This makes room for the government to carry out proactive fiscal policy. 1. The government can stimulate enterprise investment and individual consumption by the measures of the transition of value-added tax and enhancing personal income tax exemption. 2. We can increase peasants’disposable income to imitate their consumption and increase investment in village base installation by some effective ways. unch some key and large scale projects as soon as possible to develop related industries, expanding domestic demand.(6) Keeping RMB appreciated slowly to improve economicpatternTo hold exchange rate steadily, central bank has to intervene foreign exchange market in a large scale, buying dollars,releasing RMB.For preventing inflation, we should increase reserve fund rate. But because of the expectation of appreciation of the RMB ,foreign capital will inflow .Capital liquidity increases more. Our country choose to let RMB appreciate slowly to guarantee export. But it caused hot money inflow. So the only measure we can take to prevent hot money inflow is to conduct capital control.That’s all for my homework. Thanks for viewing,.~!。

中国海洋大学本科生课程大纲一、课程介绍1.课程描述(中英文):宏观经济学课的U的是帮助学生重点掌握初级宏观经济学基础理论,提高学生用经济学理论分析实际经济问题的能力,使学生对国民收入决定理论和宏观经济学政策等方面有一定的了解,并能够用所学理论框架分析现实中宏观经济问题。

本课程应指定学生有计划的阅读经济学相关著作,理解经济学基本分析框架,通过对各类经济问题进行分析和归类,掌握宏观经济学基本理论并能用于分析实际问题。

The purpose of macroeconomics course is to help students master the basic theory of primary macroeconomics, improve their ability to analyze practical economic problems with economic theory, make students have a certain understanding of national income determination theory and macroeconomic policies, and be able to analyze real macroeconomic problems with the theoretical framework learned. In this course, students are required to read economics related works in a planned way, understand the basic analysis framework of economics, and master the basic theories of macroeconomics and be able to analyze practical problems by analyzing and classifying various economic problems.2.设计思路:本课程从国民收入核算和宏观经济概况入手,通过引入国民收入决定理论,指导学生理解宏观经济各变量之间的内在关联,从而掌握宏观经济理论的基本框架。

宏观经济学专业术语1.Macroeconomics 宏观经济学对经济总体行为的分析,主要研究产出.收入.价格水平.对外贸易.失业和其他总体经济变量。

(参见微观经济学,microeconomics)。

2. Final goods 最终产品旨在最终使用而非转卖或进一步加工的商品。

3.Flow vs. stock 流量与存量流量是指,带有时间跨度或曰在一个时段上所累积变动的量(好比通过一个河段的水流)。

存量则指,在某一个时点上某一变量的量值(如同湖中所盛的水)。

收人代表每一年的美元流入数,因此是一个流量。

而到1998年12月为止某人的财富则是一个存量。

4. Intermediate goods 中间产品经过一些制造或加工过程,但还没有达到最终产品阶段的产品。

例如,钢铁和棉纱就是中间产品。

Income 收入5.个人或国家一段时期内(通常为一年)所新增的工资.利息.红利和其他进帐的流量。

6.Personal income 个人收入衡量税收抵扣前收入的一个指标,确切地说,等于可支配个人收入加上净税收。

7.Personal saving 个人储蓄收人中没有被消费的部分,是个人可支配收入与消费之间的差额。

8.Personal savings rate 个人储蓄率和National savings rate 国民储蓄率以百分比形式表示的个人储蓄与个人可支配收入的比率。

储蓄(Saving)储蓄是指消费者用于消费以外的节省部分。

National savings rate 国民储蓄率则是全部储蓄(私人储蓄和公共储蓄)除以国内净产值。

9.National savings rate 国民储蓄率全部储蓄(私人储蓄和公共储蓄)除以国内净产值。

10.Income tax,personal 个人所得税对个人收入课征的税。

收入包括工资.薪金,或租金.红利.利息等资产收入。

在美国,个人所得税采取累进制(graduated),即高收入者的平均税率要高于低收入者。