最新外专业会计学习题答案

- 格式:doc

- 大小:92.50 KB

- 文档页数:20

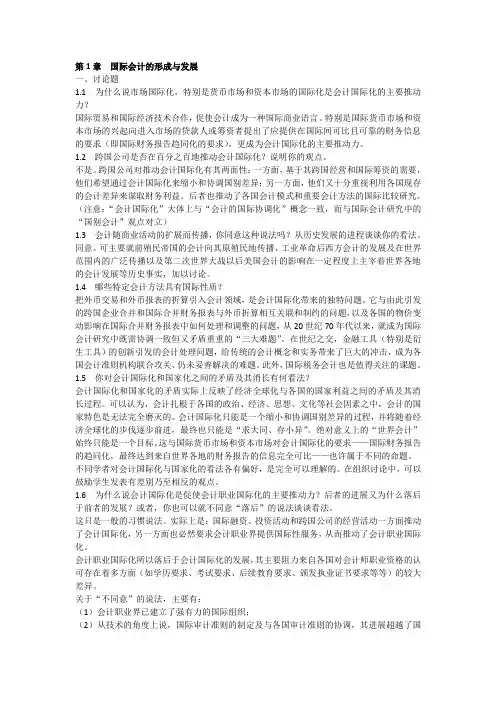

第1章国际会计的形成与发展一、讨论题1.1 为什么说市场国际化,特别是货币市场和资本市场的国际化是会计国际化的主要推动力?国际贸易和国际经济技术合作,促使会计成为一种国际商业语言。

特别是国际货币市场和资本市场的兴起向进入市场的贷款人或筹资者提出了应提供在国际间可比且可靠的财务信息的要求(即国际财务报告趋同化的要求),更成为会计国际化的主要推动力。

1.2 跨国公司是否在百分之百地推动会计国际化?说明你的观点。

不是。

跨国公司对推动会计国际化有其两面性:一方面,基于其跨国经营和国际筹资的需要,他们希望通过会计国际化来缩小和协调国别差异;另一方面,他们又十分重视利用各国现存的会计差异来谋取财务利益。

后者也推动了各国会计模式和重要会计方法的国际比较研究。

(注意:“会计国际化”大体上与“会计的国际协调化”概念一致,而与国际会计研究中的“国别会计”观点对立)1.3 会计随商业活动的扩展而传播,你同意这种说法吗?从历史发展的进程谈谈你的看法。

同意。

可主要就前殖民帝国的会计向其原殖民地传播、工业革命后西方会计的发展及在世界范围内的广泛传播以及第二次世界大战以后美国会计的影响在一定程度上主宰着世界各地的会计发展等历史事实,加以讨论。

1.4 哪些特定会计方法具有国际性质?把外币交易和外币报表的折算引入会计领域,是会计国际化带来的独特问题。

它与由此引发的跨国企业合并和国际合并财务报表与外币折算相互关联和制约的问题,以及各国的物价变动影响在国际合并财务报表中如何处理和调整的问题,从20世纪70年代以来,就成为国际会计研究中既需协调一致但又矛盾重重的“三大难题”。

在世纪之交,金融工具(特别是衍生工具)的创新引发的会计处理问题,给传统的会计概念和实务带来了巨大的冲击,成为各国会计准则机构联合攻关、仍未妥善解决的难题。

此外,国际税务会计也是值得关注的课题。

1.5 你对会计国际化和国家化之间的矛盾及其消长有何看法?会计国际化和国家化的矛盾实际上反映了经济全球化与各国的国家利益之间的矛盾及其消长过程。

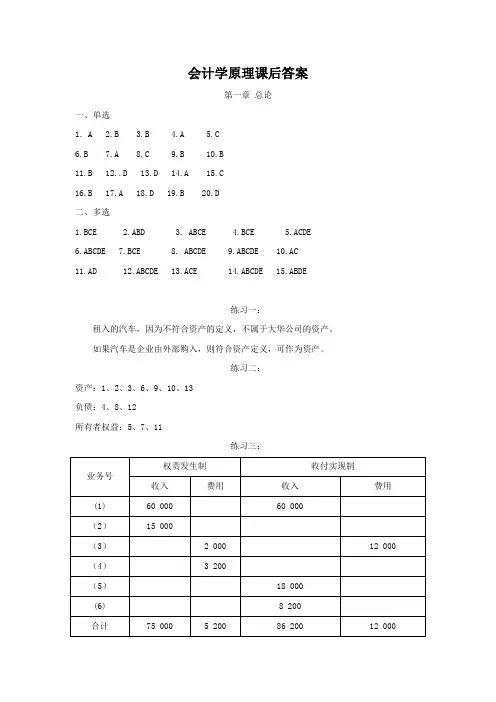

会计学原理课后答案第一章总论一、单选1.A 2.B 3.B 4.A 5.C6.B7.A8.C9.B 10.B11.B 12..D 13.D 14.A 15.C16.B 17.A 18.D 19.B 20.D二、多选1.BCE2.ABD3. ABCE4.BCE5.ACDE6.ABCDE7.BCE8. ABCDE9.ABCDE 10.AC11.AD 12.ABCDE 13.ACE 14.ABCDE 15.ABDE练习一:租入的汽车,因为不符合资产的定义,不属于大华公司的资产。

如果汽车是企业由外部购入,则符合资产定义,可作为资产。

练习二:资产:1、2、3、6、9、10、13负债:4、8、12所有者权益:5、7、11练习三:练习四:第二章账户与复式记账一、单选1.A2.B3.D4.D5.B6.B7.C8.B9.A 10.A二、多选1.ABCD2.ACDE3.ACDE4.BDE5.ABC6.CD7.ABC8.ABCE9.AC 10.BCE 11.BCE练习题:练习一2010年7月:期初所有者权益=250,000-209,000=41,000期末所有者权益=295,000-231,000=64,000(1) 利润=64,000-41,000-25,000=-2,000(2) 利润=64,000-41,000+15,000=38,000(3) 利润=64,000-41,000-45,000+8,000=-14,000(4) 利润=64,000-41,000=23,000练习二1、资产增加,所有者权益增加;2、一项资产增加,一项资产减少;3、资产增加,负债增加;4、资产减少,负债减少;5、一项负债减少,一项负债增加;6、一项资产减少,一项资产增加;7、资产减少,所有者权益减少 8、一项所有者权益增加,一项所有者权益减少9、负债增加,所有者权益减少 10、一项资产减少,一项资产增加练习三1、(1) 资产一增一减:银行存款减少50,000元,原材料增加50,000;(2) 负债一增一减:短期借款增加100,000元,应付账款减少100,000元;(3) 所有者权益一增一减:资本公积减少30,000元,实收资本增加30,000元;(4) 资产增加,所有者权益增加:固定资产增加200,000元,资本公积增加200,000元;(5) 资产减少,所有者权益减少:银行存款减少50,000元,实收资本减少50,000元.2、1月初:资产总额=1,000,000负债总额=200,000+150,000=350,000所有者权益总额=600,000+50,000=650,0001月末:资产总额=1,000,000-(50,000-50,000)+200,000-50,000=1,150,000 负债总额=350,000+(100,000-100,000)=350,000所有者权益总额=650,000+(30,000-30,000)+200,000-50,000=800,000练习四:1、(1) 资产增加负债增加:银行存款增加20万,短期借款增加20万(2) 资产减少负债减少:银行存款减少15万,应付账款减少15万;(3) 负债一增一减:应付票据增加5万,应付账款减少5万;(4) 资产减少,负债减少:库存现金减少8万,应付职工薪酬减少8万.2、2010年1月初:资产总额=150万负债总额=50万所有者权益总额=100万2010年1月末:资产总额=150+20-15-8=147万负债总额=50+20-15+5-5-8=47万所有者权益总额=100万练习五:银行存款期初余额 33 460① 40 000② 30 000③ 22 000④ 35 000⑤ 55⑥ 4 800⑦ 12 000 本期发生额 75 055 68 800 期末余额 39 715练习六资产类:(4)、(5)、(7)、(10)、(15)负债类:(1) 、(3) 、(13)、(17)、(19)所有者权益:(2)、(6)、(16)、(20)成本类:(8)、(18)收入类:(11)、(12)费用类:(14)、(9)虚账户:(9)、(11)、(12)、(14)调整类:(6)、(15)结算类:(1)、(3)、(4)、(17)、(19)盘存类:(5)练习七练习八1、借:银行存款 75 000贷:实收资本 75 0002、借:库存商品 27 000贷:应付账款 27 0003、借:银行存款 15 000贷:应收账款 15 0004、借:库存现金 50 000贷:银行存款 50 0005、借:销售费用 50 000贷:应付职工薪酬 50 0006、借:应收账款 62 000银行存款 128 000贷:主营业务收入 190 0007、借:销售费用 180贷:库存现金 1808、借:销售费用 47 820贷:银行存款 47 8209、借:应付账款 24 800贷:银行存款 24 80010、借:固定资产 55 000贷:银行存款 15 000应付账款 40 00011、借:应付职工薪酬 50 000贷:库存现金 50 000库存现金应收账款本期发生额 50 000 50 180 本期发生额 62 000 15 000 期末余额 320 期末余额 74 000银行存款库存商品本期发生额 218 000 92 620 本期发生额 27 000期末余额 137 380 期末余额 80 000固定资产应付账款本期发生额 55 000 本期发生额 24 800 67 000 期末余额 161 000 期末余额 60 700销售费用应付职工薪酬本期发生额 98 000 本期发生额 50 000 50 000 期末余额 98 000 期末余额 0主营业务收入实收资本本期发生额 190 000 本期发生额 75 000 期末余额 190 000 期末余额 255 000本期发生额及余额试算平蘅表2010年5月总表科目期初余额本期发生额期末余额借方贷方借方贷方借方贷方库存现金 500 50 000 50 180 320银行存款 12 000 218 000 137 620 92 380应收账款 27 000 62 000 15 000 74 000库存商品 53 000 27 000 80 000固定资产 106 000 55 000 161 000应付账款 18 500 24 800 67 000 60 700销售费用 98 000 98 000应付职工薪酬 50 000 50 000主营业务收入 190 000 190 000实收资本 180 000 75 000 255 000总计 198 500 198 500 584 800 584 800 505 700 505 700练习九1、借:固定资产 400 000贷:实收资本 400 0002、借:银行存款 50 000贷:短期借款 50 0003、借:原材料 12 000贷:银行存款 12 0004、借:生产成本 8 000贷:原材料 8 0005、借:应付账款 40 000贷:银行存款 40 0006、借:银行存款 60 000贷:实收资本 60 0007、借:其他应收款 1 000贷:库存现金 1 0008、借:原材料 45 000贷:应付账款 45 0009、借:固定资产 160 000贷:银行存款 160 00010、借:制造费用 100贷:库存现金 10011、借:银行存款 6 000库存现金 600贷:应收账款 6 60012、借:管理费用 980库存现金 20贷:其他应收款 1 00013、借:库存现金 22 000贷:银行存款 22 000练习十1.借:银行存款 200 000贷:实收资本 200 0002.借:固定资产 40 000贷:银行存款 40 0003.借:原材料 15 000贷:应付账款 15 0004.借:库存现金 2 000贷:银行存款 2 0005.借:银行存款 20 000贷:短期借款 20 0006.借:应付账款 35 000贷:银行存款 35 0007.借:生产成本 12 000贷:原材料 12 0008 .借:短期借款 30 000贷:银行存款 30 000《会计学原理》第3章参考答案自测题一、单项选择题1. C2. B3. C4. B5. D6. A7. C8. B9. C 10. D二、多项选择题1. BCD2. ACE3.AC4. ABC5. BCD6.ACDE7.ACDE8.ABCDE9. ABC 10.ABC三、判断题1. ×2. √3. √4. √5. ×6. ×7.×8.×9.× 10.×练习题习题一1.借:银行存款 3 000 000固定资产 200 000原材料 100 000应交税金—应交增值税(进项税额)17 000无形资产 56 000贷:实收资本 3 373 0002.借:银行存款 150 000贷:短期借款 150 0003.借:银行存款 117 000贷:长期借款 117 0004.借:短期借款 50 000长期借款 100 000贷:银行存款 150 000习题二1.编制会计分录:(1)借:在途物资—A材料 10 000应交税费—应交增值税(进项税额) 1 700贷:银行存款 11 700(2)①借:在途物资—A材料 500贷:库存现金 500②借:原材料—A材料 10 500贷:在途物资—A材料 10 500(3)借:在途物资—B材料 5 000—C材料 20 000应交税费—应交增值税(进项税额)4 250 贷:应付票据 29 250(4)分配率=6 000/(500+1 000)=4(元/千克)B材料应分摊的运杂费=500×4=2 000(元)C材料应分摊的运杂费=1 000×4=4 000(元)借:在途物资—B材料 2 000—C材料 4 000贷:银行存款 6 000(5)借:原材料—B材料 7 000—C材料 24 000贷:在途物资—B材料 7 000—C材料 24 000(6)借:应付票据 29 250贷:银行存款 29 2502.计算采购成本A材料的采购成本= 10 000+500= 10 500 (元)B材料的采购成本= 5 000+2 000= 7 000 (元)C材料的采购成本= 20 000+4 000= 24 000 (元)习题三1.编制会计分录(1)借:生产成本—甲产品 16 600—乙产品 12 825制造费用 3 030管理费用 1 120贷:原材料—A材料 9 555—B材料 6 020—C材料 18 000(2)借:生产成本—甲产品 5 000—乙产品 4 000制造费用 3 000管理费用 3 000贷:应付职工薪酬 15 000(3)①借:库存现金 15 000贷:银行存款 15 000②借:应付职工薪酬 15 000贷:库存现金 15 000(4)借:制造费用 400贷:库存现金 400(5)借:管理费用 230库存现金 70贷:其他应收款 300(6)借:管理费用 370制造费用 1 020贷:银行存款 1 390(7)借:制造费用 1 120贷:银行存款 1 120(8)借:制造费用 800贷:原材料 800(9)借:管理费用 1 000制造费用 2 000贷:银行存款 3 000(10)借:管理费用 300贷:库存现金 300(11)借:待摊费用 240贷:库存现金 240 借:管理费用 80贷:待摊费用 80 (12)借:财务费用 900贷:应付利息/预提费用 900(13)借:制造费用 1 000管理费用 500贷:累计折旧 1 5002.登账略习题四(1)借:银行存款 46 800 贷:主营业务收入 40 000 应交税金—应交增值税(销项税额) 6 800(2)借:应收账款—精艺工厂 35 100 贷:主营业务收入 30 000 应交税金—应交增值税(销项税额) 5 100(3)借:销售费用 1 000 贷:银行存款 1 000 (4)借:销售费用 1 000 贷:应付职工薪酬 1 000(5)借:销售费用 1 500 贷:银行存款 1 500(6)借:银行存款 936 贷:其他业务收入 800 应交税费—应交增值税(销项税额) 136(7)借:其他业务成本 525贷:原材料—A材料 525(8)借:银行存款 35 100贷:应收账款—精艺工厂 35 100习题五1.编制会计分录(1)该厂采用生产工人工资作为制造费用的分配标准。

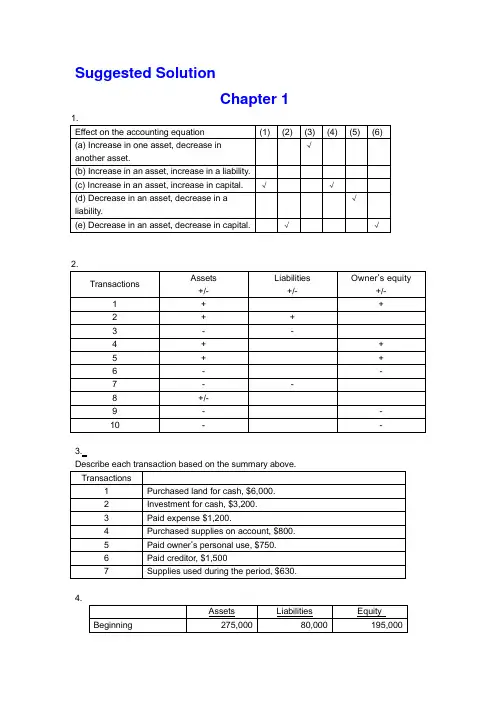

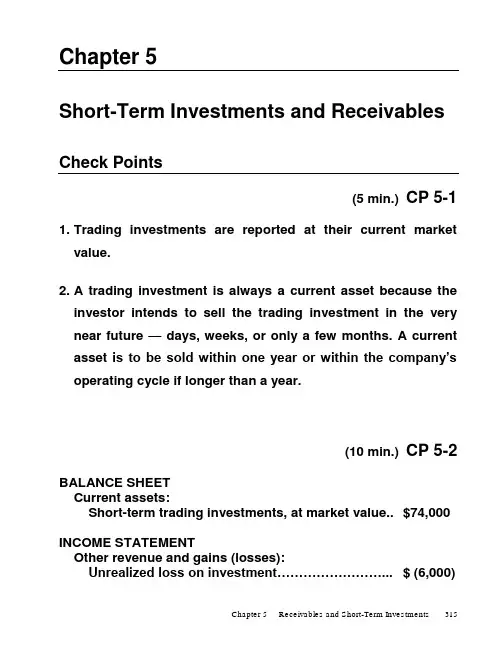

Suggested SolutionChapter 13.4.5.(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ................................................... 1,800 b.Revenue ................................................................... 4,500Accounts receivable ...................................... 4,500c.Owner’s withdrawals ................................................ 1,500Salaries Expense ............................................ 1,500 d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue 2,100Service revenue 2,100Consultant expense 900Prepaid consultant 900Unearned revenue 3,000Service revenue 3,000 4.1. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31. Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202. April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73. (a) As a whole: the ending inventory=685(b) applied separately to each product: the ending inventory=6254. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c) first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 –60,000) * 10% =49,5003. (1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004. Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005. a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000 December 31, 2009 Cash 42,500Investment in K 42,500Investment in K 146,000Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory 198,000Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000Cr: Notes Payable 300,000b. Dr: Interest Expenses (for notes on June 11) 12,100Cr: Interest Payable 12,100Dr: Interest Expenses (for notes on June 12) 8,175Cr: Interest Payable 8,175c. Balance sheet presentation:Notes Payable 498,000 Accrued Interest on Notes Payable 20,275d. For Green:Dr: Notes Payable 198,000 Interest Payable 12,100Interest Expense 7,700Cr: Cash 217,800For Western:Dr: Notes Payable 300,000Interest Payable 8,175Interest Expense 18,825Cr: Cash 327,0002.(1) 208 Deferred income tax is a liability 2,400Income tax payable 21,600 209 Deferred income tax is an asset 600 Income tax payable 26,100(2) 208: Dr: Tax expense 24,000Cr: Income tax payable 21,600 Deferred income tax 2,400 209: Dr: Tax expense 25,500 Deferred income tax 600Cr: Income tax payable 26,100 (3) 208: Income statement: tax expense 24,000Balance sheet: income tax payable 21,600 209: Income statement: tax expense 25,500 Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))b. 7.8% (20000000*12 %* (1-35%)/20000000)5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000 +Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61. Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2. July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3. a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d. Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25).g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory ....................................................................................... 480,000 Cash/Accounts payable .......................................................... 480,000 To record purchase of inventoryInventory ....................................................................................... 124,000 Cash/Accounts payable .......................................................... 124,000 To record refurbishment of inventoryAccounts receivable ...................................................................... 310,000 Sales revenue ......................................................................... 310,000 To record sale of goods on accountCost of goods sold ........................................................................ 220,000 Inventory ................................................................................. 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ......................................................................... 15,500* Allowance for sales returns (B/S) ........................................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ......................................................................... 31,000* Provision for warranties (B/S) ................................................. 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns .......................................................... 12,400 Accounts receivable ............................................................... 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) ....................................................... 18,600 Cash/Accounts payable .......................................................... 18,600 To record expenditures in year 1 for warranty workCash .............................................................................................. 297,600*Accounts receivable ............................................................... 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) ....................................................... 8,400 Cash/Accounts payable .......................................................... 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:Year 1Inventory ....................................................................................... 480,000 Cash/Accounts payable .......................................................... 480,000 To record purchase of inventoryInventory ....................................................................................... 124,000 Cash/Accounts payable .......................................................... 124,000 To record refurbishment of inventoryAccounts receivable ...................................................................... 310,000 Inventory ................................................................................. 220,000 Deferred gross margin ............................................................ 90,000 To record sale of goods on accountDeferred gross margin .................................................................. 12,400 Accounts receivable ............................................................... 12,400 To record return of goods within the 30-day return period. It is assumed the goods haveno value and are disposed of.Deferred warranty costs (B/S) ...................................................... 18,600 Cash/Accounts payable .......................................................... 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash .............................................................................................. 297,600* Accounts receivable ............................................................... 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................................................ 8,400 Cash/Accounts payable .......................................................... 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin .................................................................. **77,600Cost of goods sold ........................................................................ 220,000 Sales revenue ......................................................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ......................................................................... 27,000* Deferred warranty costs ......................................................... 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after the warranty periodhas expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that itwill eventually earn on the sales. The performance criteria might also be invoked here.The performance criterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determine the percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recorded in revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30% $ 6,0002006 $20,000 × 70% $ 14,0002007 $20,000 × 100% $ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction project would be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under thepercentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress .................. 5,400 7,550 5,850 Cash, payables, etc. ..... 5,400 7,550 5,850 2. Progress billings:Accounts receivable ............ 3,100 4,900 12,000 Progress billings ............ 3,100 4,900 12,000 3. Collections on billings:Cash .................................... 2,400 4,000 12,400 Accounts receivable ...... 2,400 4,000 12,400 4. Recognition of profit:Construction in progress ..... 600 450 150Construction expense.......... 5,400 7,550 5,850 Revenue from long-termcontract ...................... 6,000 8,000 6,000 5. To close construction in progress:Progress billings .................. 20,000 Construction in progress .20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000 Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a. The three criteria of revenue recognition are performance, measurability, andcollectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service, performance may mean quitedifferent points of revenue recognition. For example, for the sale of products, IAS18 defines performance as the point when the seller of the goods has transferred therisks and rewards of ownership to the buyer. Normally, this means that performance is done at the time of sale. Although the seller may have performed much of the work prior to the sale (production, selling efforts, etc.), there is still significant risk to theseller that a buyer may not be found. Therefore, from a reliability point of view,revenue recognition is delayed until the point of sale. Also, there may be significant risks remaining with the seller of the product even after the sale. Warranties given by the seller are a risk that remains with the seller. However, if this risk can be reliably estimated at the time of sale, revenue can be recognized at the point of sale.Performance is quite different under a long-term construction contract. Here,performance really is considered to be a measure of the work done. Revenue isrecognized over the production period as the work is performed. It is intended toreflect the amount of effort expended by the seller (contractor). Although legal titlewon’t transfer to the buyer until the project is completed, revenue can be recognized because there is a known and committed buyer. If the contractor is not able toestimate how much of the work has been done (perhaps because he or she can’treliably estimate how much work must still be done), then profit would not berecognized until the extent of performance is known.Measurability means that the seller or service provider must be able to reliablyestimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set). However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account.This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment. As long as the seller is able to make this estimate, it is appropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection ofamounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenuerecognition.b. Because of the performance criterion of revenue recognition, it would seem to bemost appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example,that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because,in many cases, there are still significant risks that are retained by the seller (risk of not being able to sell the product, for example). There are also measurement risks (knowingthe selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser tobuy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100) $ 20,000 Additional lessons ((200 × 8) × $30) 48,000 Examinations ((200 × 80%) × $130) 20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15 + $3)) 3,600 Additional lessons ((200 × 8) × $3)) 4,800Examinations ((200 × 80%) × $30) 4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000) 36,000Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division 2,100,000 Enterprise net profit $ 3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a) Cash received from customers = 816,000(b) Cash payments for purchases of merchandise. =468,000(c) Cash payments for operating expenses. = 268,200(d) Income taxes paid. =36,9003.Cash sales …………………………………………... $9,000 Payment of accounts payable ……………………….-48,000 Payment of income tax ………………………………-13,000 Payment of interest ……………………………..…..-16,000 Collection of accounts receivable ……………………93,000 Payment of salaries and wages ……………………….. -34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000Add: increases in current liabilities 180,000Net cash flows from operating -200,000Investing activitiesSale of land -50,000Purchase of PPE -1,500,000Net cash flows from investing -1,550,000Financing activitiesIssuance of common shares 400,000Payment of cash dividend -50,000Issuance of non-current liabilities 1,000,000Net cash flows from financing 1,350,000 Net changes in cash -400,000 5.。

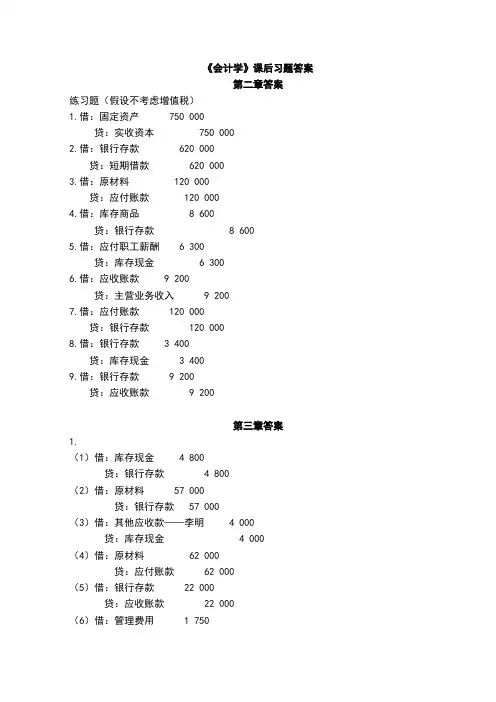

《会计学》课后习题答案第二章答案练习题(假设不考虑增值税)1.借:固定资产 750 000贷:实收资本 750 0002.借:银行存款 620 000贷:短期借款 620 0003.借:原材料 120 000贷:应付账款 120 0004.借:库存商品 8 600贷:银行存款 8 6005.借:应付职工薪酬 6 300贷:库存现金 6 3006.借:应收账款 9 200贷:主营业务收入 9 2007.借:应付账款 120 000贷:银行存款 120 0008.借:银行存款 3 400贷:库存现金 3 4009.借:银行存款 9 200贷:应收账款 9 200第三章答案1.(1)借:库存现金 4 800贷:银行存款 4 800(2)借:原材料 57 000贷:银行存款 57 000(3)借:其他应收款——李明 4 000贷:库存现金 4 000(4)借:原材料 62 000贷:应付账款 62 000(5)借:银行存款 22 000贷:应收账款 22 000(6)借:管理费用 1 750贷:库存现金 1 750(7)借:应付账款 62 000贷:银行存款 62 000(8)借:银行存款 126 000贷:主营业务收入 126 000 (9)借:管理费用 3 300库存现金 700贷:其他应收款——李明 4 000 (10)借:银行存款 2 400贷:库存现金 2 400登记三栏式现金日记账和银行存款日记账(略)。

2.(1)采用红字更正法:借:原材料贷:银行存款借:固定资产 3 400贷:银行存款 3 400(2)采用补充登记法借:银行存款 5 400贷:应收账款 5 400(3)采用红字更正法借:银行存款贷:主营业务收入第四章答案1.答案:(1)借:库存现金 300贷:银行存款 300(2)借:其他应收款 1 800贷:银行存款 1 800(3)借:其他应收款—备用金 1 000贷:库存现金 1 000(4)借:库存现金 150管理费用 1 650贷:其他应收款 1 800(5)借:其他货币资金—外埠存款 32 000贷:银行存款 32 000(6)借:管理费用 600贷:库存现金 600(7)①发现现金溢余:借:库存现金 36贷:待处理财产损溢—待处理流动资产损溢 36②批准处理:借:待处理财产损溢—待处理流动资产损溢 36贷:营业外收入 36(8)①发现现金短缺:借:待处理财产损溢—待处理流动资产损溢 58贷:库存现金 58②批准处理:借:管理费用 58贷:待处理财产损溢—待处理流动资产损溢 58(9)借:原材料 26 000应交税费—应交增值税(进项税额) 4 420贷:其他货币资金—外埠存款 30420 借:银行存款 1 580贷:其他货币资金—外埠存款 1 5802.银行存款余额调节表2009年6月30日单位:元3.(1)贴现息= 30 000×4×12%9=900(元) 贴现所得=30 000—900= 29 100 (元)(2)到期价值=45 000×(1+90×360%6)= 45 675(元) 贴现息= 45 675×(90-20)×360%9= 799.31(元) 贴现所得= 45 675—799.31=44 875.69(元) 有关的账务处理如下: 借:银行存款 73975.69 财务费用 1699.31 贷:应收票据 75 675 4.(1)第一年年末开始提取坏账准备时,当年应计提的坏账准备为 3 200元(640 000×5‰),会计分录为:借:资产减值损失 3 200 贷:坏账准备 3 200(2) 第二年发生坏账损失5000元,会计分录为: 借:坏账准备 5 000 贷:应收账款 5 000第二年年末计提坏账准备时,当年应保持的坏账准备贷方余额为 3 600元(720000×5‰),而“坏账准备”账户的期末借方余额为1 800元,因此,应补提坏账准备5 400元,会计分录为:借:资产减值损失 5 400 贷:坏账准备 5 400(3)第三年发生坏账损失3 000元,会计分录为: 借:坏账准备 3 000 贷:应收账款 3 000上年已冲销的坏账5000元又收回,,会计分录为: 借:应收账款 5 000 贷:坏账准备 5 000 借:银行存款 5 000 贷:应收账款 5 000第三年年末计提坏账准备时,当年应保持的坏账准备贷方余额为2150元(430000×5‰),而“坏账准备”账户的期末贷方余额为5600元,应冲销坏账准备3 450元,有关的会计分录为:借:坏账准备 3 450贷:资产减值损失 3 450第五章答案1.答案:(1)发出A材料的单位成本=(20000-2000+2200+37000+51500+600)/(2000+2950+5000+50)=109300/10000=10.93(元/公斤)(2)①借:原材料 2000贷:应付账款2000②借:原材料 2200应交税金——应交增值税(进项税额) 306贷:银行存款2506③借:在途物资 37000应交税金——应交增值税(进项税额) 6120贷:银行存款43120④借:原材料 37000贷:在途物资37000⑤借:原材料 51500应交税金——应交增值税(进项税额) 8415银行存款 20085贷:其他货币资金80000⑥借:原材料 600贷:生产成本600⑦借:生产成本 65580制造费用 10930管理费用 10930贷:原材料87440解析:发出材料的单位成本为10.93元,则基本生产车间领用的材料为6 000*10.93=65 580元,应计入生产成本;车间管理部门领用的材料为1 000*10.93=10 930元,应计入制造费用;管理部门领用材料为1 000*10.93=10 930元,应计入管理费用。

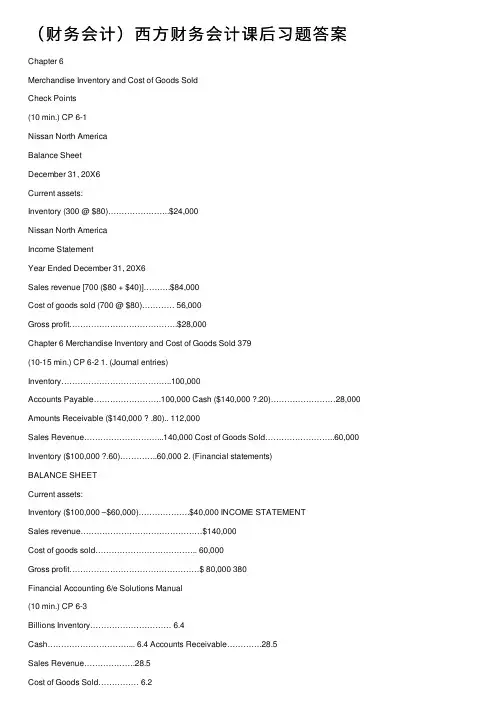

(财务会计)西⽅财务会计课后习题答案Chapter 6Merchandise Inventory and Cost of Goods SoldCheck Points(10 min.) CP 6-1Nissan North AmericaBalance SheetDecember 31, 20X6Current assets:Inventory (300 @ $80)…………………..$24,000Nissan North AmericaIncome StatementYear Ended December 31, 20X6Sales revenue [700 ($80 + $40)]……….$84,000Cost of goods sold (700 @ $80)………… 56,000Gross profit………………………………….$28,000Chapter 6 Merchandise Inventory and Cost of Goods Sold 379(10-15 min.) CP 6-2 1. (Journal entries) Inventory…………………………………..100,000Accounts Payable…………………….100,000 Cash ($140,000 ?.20)……………………28,000 Amounts Receivable ($140,000 ? .80).. 112,000Sales Revenue………………………...140,000 Cost of Goods Sold……………………..60,000 Inventory ($100,000 ?.60)…………..60,000 2. (Financial statements)BALANCE SHEETCurrent assets:Inventory ($100,000 –$60,000)……………….$40,000 INCOME STATEMENTSales revenue………………………………………$140,000Cost of goods sold……………………………….. 60,000Gross profit…………………………………………$ 80,000 380Financial Accounting 6/e Solutions Manual(10 min.) CP 6-3Billions Inventory………………………… 6.4Cash…………………………... 6.4 Accounts Receivable………….28.5Sales Revenue……………….28.5Cost of Goods Sold…………… 6.2Inventory……………………... 6.2 Cash………………………………26.3Accounts Receivable……….26.3Chapter 6 Merchandise Inventory and Cost of Goods Sold 381(10 min.) CP 6-41. I nventory costs are increasing from $10 to $14 to $18 per unit.2. FIFO results in the highest cost of ending inventory($360)because under FIFO the ending inventory is costed at the last costs incurred during the period. When costs are increasing, the last costs are the highest costs.FIFO results in the lowest cost of goods sold. This occurs because the oldest costs are assigned to cost of goods sold. When costs are increasing, the oldest costs are the lowest.FIFO results in the highest gross profit because cost of goods sold, the expense, is the lowest. (Sales revenue is unaffected by the inventory costing method.)3. LIFO results in the lowest cost of ending inventory($240)because under LIFO, the ending inventory is costed at the oldest costs. When costs are increasing, the oldest costs are the lowest costs.LIFO results in the highest cost of goods sold. This occurs because the last costs of the period are assigned to cost of goods sold. When costs are increasing, the last costs are the highest.LIFO results in the lowest gross profit because cost of goods sold, the expense, is the highest. (Sales revenue is unaffected by the inventory costing method.)382Financial Accounting 6/e Solutions Manual(10 min.) CP 6-5a b cAverageCost FIFO LIFO Cost of goods sold:Average (50 @ $15*) $750FIFO (10 @ $10) + (25 @ $14) + (15 @ $18) $720LIFO (25 @ $18) + (25 @ $14) $800 Ending inventory:Average (10 @ $15*) $150FIFO (10 @ $18) $180LIFO (10 @ $10) $100 _____*Average cost= ($100 + $350 + $450)= $15per unit (10 + 25 + 25)Chapter 6 Merchandise Inventory and Cost of Goods Sold 383(10-15 min.) CP 6-6Kinko’sIncome StatementYear Ended December 31, 20XXAverage FIFO LIFO Sales revenue (600 ? $20) $12,000 $12,000 $12,000 Cost of goods sold (600 ? $9.90*)5,940(100 ? $9) + (500 ? $10) 5,900(600 ? $10) 6,000 Gross profit 6,060 6,100 6,000 Operating expenses 4,000 4,000 4,000 Net income $ 2,060 $ 2,100 $ 2,000 _____*Beginning inventory (100 @ $9.20)…………..$ 920 Purchases (700 @ $10)………………………… 7,000Goods available…………………….……………$7,920 Average cost per unit $7,920 / 800 units…$ 9.90384Financial Accounting 6/e Solutions Manual(10 min.) CP 6-7Kinko’sIncome StatementYear Ended December 31, 20XXAverage FIFO LIFO Sales revenue (600 ? $20) $12,000 $12,000 $12,000 Cost of goods sold (600 ? $9.90*)5,940(100 ? $9) + (500 ? $10) 5,900(600 ? $10) ______ ______ 6,000 Gross profit 6,060 6,100 6,000 Operating expenses 4,000 4,000 4,000 Income before income tax $ 2,060Income tax expense (40%) $ 824*From CP 6-6(5 min.) CP 6-8 Lands’ End managers can delay purchases of inventory until the next year. Under LIFO, high inventory costs that would have been paid for inventory do not become expense as cost of goods sold in the current year. As a result, the current year’s income statement reports a higher net income than Lands’ End would have reported if the company had replaced inventory before year end.Chapter 6 Merchandise Inventory and Cost of Goods Sold 385(5-10 min.) CP 6-9Millions BALANCE SHEETCurrent assets:Inventories, at market (which is lower than cost).. $ 330 INCOME STATEMENTCost of goods sold [$1,001 + ($333 – $330)]…………$1,004 386Financial Accounting 6/e Solutions Manual(10 min.) CP 6-101. FIFO2. LIFO Gross profitpercentage:Gross profit= $460*= 46%$340**= 34%Net sales revenue $1,000 $1,000 _____* $1,000 – $540 = $460** $1,000 – $660 = $340Inventory turnover:Cost of goods sold= $540 $660Average inventory ($100 + $360) / 2 ($100 + $240) / 2= 2.3 times = 3.9 times3. Gross profit percentage — FIFO looks better.4. Inventory turnover — LIFO looks better.Chapter 6 Merchandise Inventory and Cost of Goods Sold 387(10-15 min.) CP 6-11 1. Beginning inventory……………………………... $ 300,000+ Purchases……………………………………….… 1,600,000 = Goods available…………………………………... 1,900,000 –Cost of goods sol d………………………………. (1,800,000) = Ending inventory……………………………….…2. Beginning inventory……………………………..+ Purchases……………………………………….…= Goods available…………………………………...–Cost of goods sold:Sales revenue……………………….$3,000,000Less estimated gross profit (40%) (1,200,000)Estimated cost of goods sold……………….= Estimated cost of ending inventory…………... $ 100,000 388Financial Accounting 6/e Solutions Manual(5-10 min.) CP 6-12CorrectAmount(Millions)a. Inventory ($333 + $3)…………………………………$ 336b. Net sales (unchanged)……………………………….$1,755c. Cost of goods sold ($1,001 –$3)…………………...$ 998d. Gross profit ($754 + $3)……………………….……..$ 757(10 min.) CP 6-13 1. Last year’s reported g ross profit was understated.Correct gross profit last year was $5.6 million ($4.0 + $1.6). 2. This year’s gross profit is overstated.Correct gross profit for this year is $3.2 million ($4.8 – $1.6).3. Lang’s perspective is better because correcting the errorchanges the trend of correct gross profit from up (good) to down (bad), as follows:MillionsLast Year This Year Trend Reported gross profit……..$4.0 $4.8 Up (Good) Correct gross profit……….$5.6 $3.2 Down (Bad) Chapter 6 Merchandise Inventory and Cost of Goods Sold 389(5-10 min.) CP 6-14 1. Ethical. There is nothing wrong with buying inventorywhenever a company wishes.2. Ethical. Same idea as 1.3. Unethical. The company falsified its reported amounts ofinventory and net income.4. Unethical. The company falsified its reported inventorypurchases, cost of goods sold, and net income in order to cheat the government (and the people) out of income tax.5. Unethical. The company falsified its reported amount ofinventory in order to cheat the government (and the people) out of taxes.390Financial Accounting 6/e Solutions ManualExercises(15-20 min.) E 6-1 Req. 1 (journal entried)Perpetual System1. Purchases: ThousandsInventory…………………….……….… 2,200Accounts Payable………………….2,2002. Sales:Cash ($3,500 ?.20) (700)Accounts Receivable ($3,500 ? .80). 2,800Sales Revenue…………….……….3,500 Cost of Goods Sold………………….. 2,100 Inventory………………….………....2,100Req. 2 (financial statement amounts)BALANCE SHEET Thousands Current assets:Inventory ($370 + $2,200 – $2,100)... $ 470 INCOME STATEMENTSales revenue…………………………….$3,500Cost of goods sold……………………… 2,100Gross profit……………………………….$1,400Chapter 6 Merchandise Inventory and Cost of Goods Sold 391(15-25 min.) E 6-2JournalDATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT1 Inventory ($640 + $1,870 + $900)……….3,410Accounts Payable………………………3,4102 Accounts Receivable (17 @ $500)……...8,500Sales Revenue…………………………..8,500 Cost of Goods Sold……………………….2,800* Inventory…………………………………2,8003 Sales revenue………………………………$8,500Cost of goods sold……………………….. 2,800Gross profit…………………………………$5,700Ending inventory ($800 + $3,410 –$2,800)……...$1,410 _____*(9 @ $160) + (8 @ $170) = $2,800392Financial Accounting 6/e Solutions Manual(10-15 min.) E 6-3 1.Cost of Goods Sold Ending Inventory(a) Specificunit cost (6 @ $160) + (11 @ $170) = $2,830 (3 @ $160) + (5 @ $180) = $1,380 (b) Averagecost 17 ? $168.40* = $2,863 8 ? $168.40* = $1,347 _____*Average cost per unit = ($800 + $640 + $1,870 + $900)= $168.40(5 + 4 + 11 + 5)(c) FIFO (9 @ $160) + (8 @ $170) = $2,800 (5 @ $180) + (3 @ $170) $1,410(d) LIFO (5 @ $180) + (11 @ $170) + (1 @ $160) $2,930 (8 @ $160) $1,2802. LIFO produces the highest cost of goods sold.FIFO produces the lowest cost of goods sold.The increase in inventory cost from $160 to $170 to $180 per unit causes the difference in cost of goods sold. Chapter 6 Merchandise Inventory and Cost of Goods Sold 393(15-20 min.) E 6-4 Cost of goods sold:LIFO ($2,930) –FIFO ($2,800)…………………………$130 Incom e tax rate……………………………………….. .35 LIFO advantage in tax savings…………………………..$ 46(15 min.) E 6-51. a. FIFOCost of goods sold:(5 @ $90) + (5 @ $95)……………...$925Ending inventory:7 @ $95………………………………$665b. LIFOCost of goods sold:10 @ $95……………………………..$950Ending inventory:(5 @ $90) + (2 @ $95)……………...$6402.VPA, Inc.Income StatementMonth Ended May 31, 20XXSales revenue (3 @ $150) + (7 @ $155)................$1,535 Cost of goods sold. (925)Gross profit (610)Operating expenses (310)Income before income tax (300)Income tax expense (40%) (120)Net income………………………………………………$ 180 394Financial Accounting 6/e Solutions Manual(15 min.) E 6-6Millions1. Gross profit: FIFO LIFOSales revenue……………………………………$4.9 $4.9 Cost of goods soldFIFO: 600,000 ?$7…………………………… 4.2LIFO: (400,000 ? $5) + (100,000 ? $6)+ (100,000 ?$7)……………………… 3.3 Gross profit………………………………………$ .7 $1.6 2. Gross profit under FIFO and LIFO differ because inventorycosts decreased during the period.If you base your prediction on the decrease in inventory unit cost, then, yes, you would predict that LIFO gross profit would be higher.But if you assume that FIFO produces higher gross profit, then, no, the actual result does not follow your prediction. Chapter 6 Merchandise Inventory and Cost of Goods Sold 395(15-20 min.) E 6-7 DATE: _____________TO: Rick TaborFROM: Student NameSUBJECT: Proposal for Saving Income TaxWe can save income tax by buying above-normal quantities of inventory before the end of the year. Inventory costs are rising, and the company uses the LIFO inventory method. Under LIFO, the higher cost of year-end purchases of inventory goes straight into cost of goods sold. This increases cost of goods sold and decreases net income and income taxes. Because our inventory levels are lower than normal, we need the inventory anyway. In effect, we can use our cash to buy inventory or to pay income taxes. I think it would be wiser to buy inventory.396Financial Accounting 6/e Solutions Manual(10-15 min.) E 6-8 Specificunit cost 1. Used to account for automobiles, jewelry, and art objects.Average 2. Provides a middle-ground measure of ending inventory and cost of goods sold.FIFO 3. Maximizes reported income.LIFO 4. Matches the most current cost of goods sold against sales revenue.LIFO 5. Results in an old measure of the cost of ending inventory.LIFO 6. Generally associated with saving income taxes. FIFO 7. Results in a cost of ending inventory that is close to the current cost of replacing the inventory.LIFO 8. Enables a company to buy high-cost inventory at year end and thereby to decrease reportedincome.LIFO 9. Enables a company to keep reported income from dropping lower by liquidating older layers ofinventory.LCM 10. Writes inventory down when replacement cost drops below historical cost.Chapter 6 Merchandise Inventory and Cost of Goods Sold 397。

会计学第四版课本习题答案会计学是一门研究如何确认、计量、记录和报告财务信息的学科,它在企业决策和经济活动中起着至关重要的作用。

随着会计准则的不断更新和实践的深入,会计学教材也在不断地更新和修订。

第四版会计学课本习题答案为学生提供了一个检验自己学习成果的机会,同时也帮助教师在教学过程中进行参考。

在会计学的学习过程中,理解会计基本概念、掌握会计准则和原则、熟悉会计程序和方法是非常关键的。

课本习题答案可以帮助学生更好地理解这些知识点,并在实际应用中加以运用。

会计基础概念会计基础概念是学习会计的起点,包括会计要素、会计假设、会计原则等。

例如,资产、负债、所有者权益、收入、费用和利润是会计的六大要素,它们构成了企业财务报表的基础。

会计假设包括会计主体、持续经营、货币计量和历史成本等,这些假设为会计提供了一个稳定的操作环境。

会计准则和原则会计准则和原则是指导会计实践的基本规范。

国际财务报告准则(IFRS)和美国通用会计准则(GAAP)是两个主要的会计准则体系。

这些准则规定了会计信息的确认、计量和报告方式,确保了会计信息的准确性和可比性。

会计程序和方法会计程序和方法涉及到会计信息的收集、处理和报告。

从凭证的编制到账簿的登记,再到财务报表的编制,每一步都需要遵循一定的程序和方法。

例如,权责发生制原则要求企业在收入和费用发生时进行确认,而不是在收到或支付现金时。

习题答案示例以下是一些会计学课本习题的答案示例,以帮助学生理解会计处理的具体操作:1. 问题:如何确定企业的资产价值?答案:企业的资产价值应根据历史成本原则确定,即资产的原始购买成本或制造成本,减去累计折旧。

2. 问题:在权责发生制下,企业何时确认收入?答案:在权责发生制下,企业应在收入实现时确认收入,即当企业已经提供了商品或服务,并且收入的金额可以可靠地计量,收入的实现是很可能的。

3. 问题:如何计算企业的净利润?答案:企业的净利润是收入减去费用后的余额。

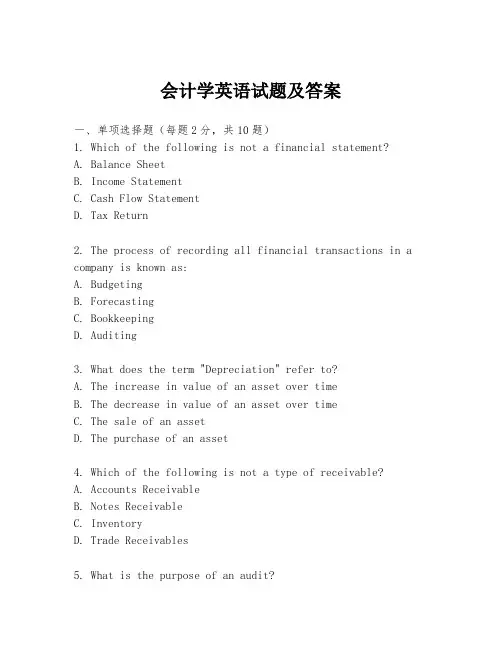

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

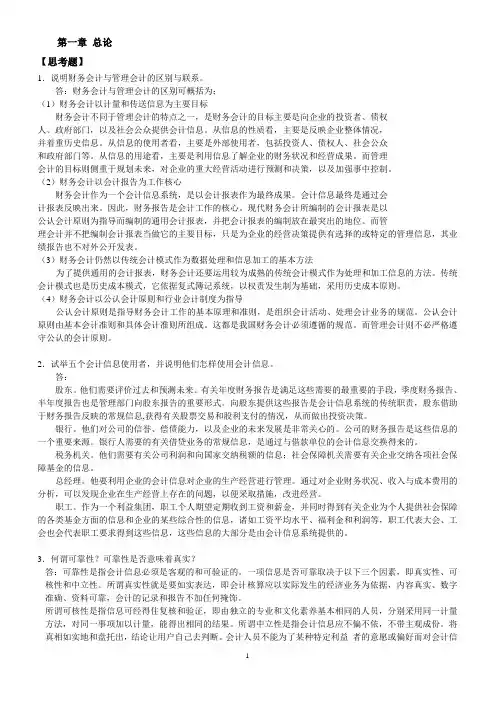

第一章总论【思考题】1.说明财务会计与管理会计的区别与联系。

答:财务会计与管理会计的区别可概括为;(1)财务会计以计量和传送信息为主要目标财务会计不同于管理会计的特点之一,是财务会计的目标主要是向企业的投资者、债权人、政府部门,以及社会公众提供会计信息。

从信息的性质看,主要是反映企业整体情况,并着重历史信息。

从信息的使用者看,主要是外部使用者,包括投资人、债权人、社会公众和政府部门等。

从信息的用途看,主要是利用信息了解企业的财务状况和经营成果。

而管理会计的目标则侧重于规划未来,对企业的重大经营活动进行预测和决策,以及加强事中控制。

(2)财务会计以会计报告为工作核心财务会计作为一个会计信息系统,是以会计报表作为最终成果。

会计信息最终是通过会计报表反映出来。

因此,财务报告是会计工作的核心。

现代财务会计所编制的会计报表是以公认会计原则为指导而编制的通用会计报表,并把会计报表的编制放在最突出的地位。

而管理会计并不把编制会计报表当做它的主要目标,只是为企业的经营决策提供有选择的或特定的管理信息,其业绩报告也不对外公开发表。

(3)财务会计仍然以传统会计模式作为数据处理和信息加工的基本方法为了提供通用的会计报表,财务会计还要运用较为成熟的传统会计模式作为处理和加工信息的方法。

传统会计模式也是历史成本模式,它依据复式簿记系统,以权责发生制为基础,采用历史成本原则。

(4)财务会计以公认会计原则和行业会计制度为指导公认会计原则是指导财务会计工作的基本原理和准则,是组织会计活动、处理会计业务的规范。

公认会计原则由基本会计准则和具体会计准则所组成。

这都是我国财务会计必须遵循的规范。

而管理会计则不必严格遵守公认的会计原则。

2.试举五个会计信息使用者,并说明他们怎样使用会计信息。

答:股东。

他们需要评价过去和预测未来。

有关年度财务报告是满足这些需要的最重要的手段,季度财务报告、半年度报告也是管理部门向股东报告的重要形式。

向股东提供这些报告是会计信息系统的传统职责,股东借助于财务报告反映的常规信息,获得有关股票交易和股利支付的情况,从而做出投资决策。

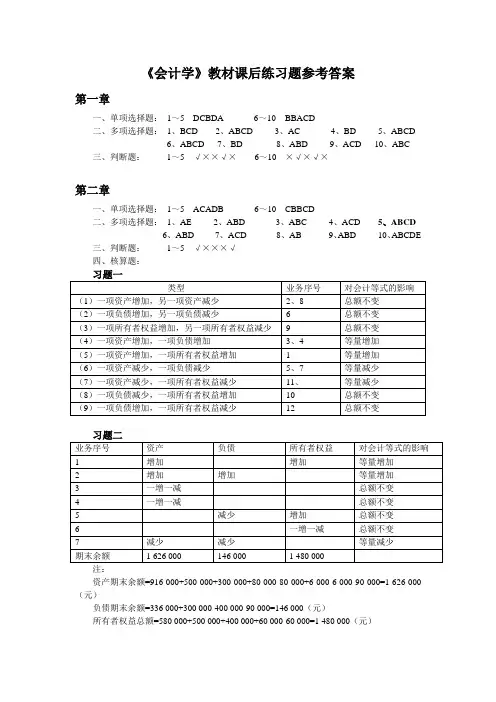

《会计学》教材课后练习题参考答案第一章一、单项选择题:1~5 DCBDA 6~10 BBACD二、多项选择题:1、BCD 2、ABCD 3、AC 4、BD 5、ABCD6、ABCD7、BD8、ABD9、ACD 10、ABC三、判断题:1~5 √××√×6~10 ×√×√×第二章一、单项选择题:1~5 ACADB 6~10 CBBCD二、多项选择题:1、AE 2、ABD 3、ABC 4、ACD 5、ABCD6、ABD7、ACD8、AB9、ABD 10、ABCDE三、判断题:1~5 √×××√四、核算题:资产期末余额=916 000+500 000+300 000+80 000-80 000+6 000-6 000-90 000=1 626 000(元)负债期末余额=336 000+300 000-400 000-90 000=146 000(元)所有者权益总额=580 000+500 000+400 000+60 000-60 000=1 480 000(元)习题三2、收入总额200 000元,费用总额=9 600+2 800+66 000+14 000+100 000=192 400(元)利润=收入-费用=200 000-192 400=7 600(元),该企业3月份盈利。

3、资产总额=700 000+200 000-9 600-2 800-14 000-100 000=773 600(元)负债总额=200 000+66 000=266 000(元)所有者权益=500 000+7 600=507 600(元)习题六1、借:银行存款150 000贷:实收资本150 000 2、借:银行存款500 000贷:短期借款500 000 3、借:固定资产30 000贷:银行存款30 000 4、借:原材料20 000贷:银行存款12 000 应付账款8 000 5、借:银行存款8 000贷:库存现金8 000 6、借:应收账款30 000银行存款50 000贷:主营业务收入80 000 7、借:应收账款50 000贷:主营业务收入50 000 8、借:应付账款20 000贷:银行存款20 000 9、借:银行存款50 000贷:应收账款50 000 10、借:资本公积60 000贷:实收资本60 000习题七A、会计分录1、借:库存现金 6 000贷:银行存款 6 000 2、借:银行存款80 000贷:短期借款80 000 3、借:银行存款40 000贷:应收账款40 000 4、借:应付账款60 000贷:银行存款60 000 5、借:原材料30 000贷:应付账款30 000 6、借:应交税费20 000贷:银行存款20 000 7、借:固定资产55 000贷:应付账款55 000 8、借:实收资本70 000贷:长期借款70 000B、开设并登记有关账户(略)习题八1、借:固定资产20 058贷:银行存款20 058 编制付款凭证2、借:银行存款300 000贷:短期借款300 000 编制收款凭证3、借:库存现金 5 000贷:银行存款 5 000 编制付款凭证4、借:原材料35 200贷:银行存款20 000 应付账款15 200 编制两张凭证:一张付款凭证(金额为20 000元),一张转账凭证(金额为15 200元)习题九总分类账户总账科目:原材料明细科目:甲材料单位:吨总分类账户应付账款明细分类账户应付账款明细分类账户明细科目:绿叶公司习题十1、应采用“补充登记法”借:银行存款900 贷:应收账款900 借银行存款贷借应收账款贷2、应采用“红字更正法”借:管理费用 2 000贷:库存现金 2 000借:管理费用 2 000 贷:银行存款 2 000 借管理费用贷借库存现金贷借银行存款贷2 000 2 000 2 0002 000 2 0002 0003、应采用“红字更正法”借:应收账款34 315贷:主营业务收入34 315借:银行存款34 135 贷:主营业务收入34 135 借应收账款贷借主营业务收入贷借银行存款贷34 315 34 315 34 13534 31534 31534 1354、应采用“红字更正法”借:管理费用90贷:库存现金90借管理费用贷借库存现金贷870 87090905、应采用“划线更正法”借银行存款贷35 260(盖章)32 560第三章一、单项选择题:1~5 CADBA 6~10 DBBAC 11~13 ABC二、多项选择题:1、ACD 2、BCD 3、BCD 4、BC 5、AC 6、CD7、ABD 8、ACD 9、ABD 10、AD 11、ABCD 12、ACD三、判断题:1~5 ×√√√×6~10√××√×11~13√××四、核算题:习题一1、借:库存现金20 000贷:银行存款20 0002、借:库存现金600贷:其他业务收入6003、借:库存现金800贷:主营业务收入8004、借:其他应收款 2 000贷:库存现金 2 0005、借:管理费用 2 200贷:其他应收款——王力 2 000 库存现金2006、借:管理费用300贷:库存现金3007、借:应付职工薪酬800贷:库存现金800习题二1、借:库存现金20 000贷:银行存款20 0002、借:管理费用10 000贷:银行存款10 0003、借:银行存款30 000贷:主营业务收入30 0004、借:原材料25 000贷:应付账款25 0005、借:库存现金60 000贷:银行存款60 000 6、借:应付职工薪酬 1 000贷:银行存款 1 000 7、借:应付账款25 000贷:银行存款25 000习题三银行存款余额调节表习题四1、借:其他货币资金——外埠存款100 000贷:银行存款100 000 2、借:原材料80 000贷:其他货币资金——外埠存款80 000 3、借:银行存款20 000贷:其他货币资金——外埠存款20 000习题五1、借:应收票据70 200贷:主营业务收入60 000 应交税费——应交增值税(销项税额)10 200 2、借:银行存款70 200贷:应收票据70 200习题六1、借:应收票据35 100贷:主营业务收入30 000 应交税费——应交增值税(销项税额) 5 100 借:主营业务成本22 000 贷:库存商品22 000 2、贴现利息=35 100×10%×30/360=292.5(元)借:银行存款34 807. 5 财务费用292.5贷:短期借款35 100习题七1、销售商品时:借:应收账款——乙公司 2 106 000 贷:主营业务收入 1 800 000 应交税费——应交增值税(销项税额)306 000 2、收到款项时:借:银行存款 2 070 000 财务费用36 000贷:应收账款——乙公司 2 106 000习题八1、2001年末计提坏账准备时:借:资产减值损失 5 000 贷:坏账准备 5 000 2、2002年10月确认坏账损失时:借:坏账准备 1 400 贷:应收账款 1 400 3、2002年末计提坏账准备时:按应收账款余额应提坏账准备=1 200 000×5‰=6 000(元)计提坏账准备前“坏账准备”账户的贷方余额=5 000-1 400=3 600(元)年末实际计提坏账准备=6 000-3 600=2 400(元)借:资产减值损失 2 400 贷:坏账准备 2 400 4、2003年3月20日收回转销的坏账损失时:借:应收账款 1 000 贷:坏账准备 1 000 借:银行存款 1 000 贷:应收账款 1 000 5、2003年末计提坏账准备时:按应收账款余额应提坏账准备=1 000 000×5‰=5 000(元)计提坏账准备前“坏账准备”账户的贷方余额=6 000+1 000=7 000(元)年末实际计提坏账准备=5 000-7 000=-2 000(元)借:坏账准备 2 000 贷:资产减值损失 2 000习题九1、借:预付账款——B企业15 000贷:银行存款15 000 2、借:原材料30 000应交税费——应交增值税(进项税额) 5 100贷:预付账款——B企业35 100 3、借:预付账款——B企业20 100贷:银行存款20 100习题十1、先进先出法:10日领用原材料的成本=1 000×20+200×21=24 200(元)25日领用原材料的成本=400×21+1 100×22=32 600(元)本月发出材料成本=24 200+32 600=56 800(元)月末结存材料成本=20 000+12 600+44 000-56 800=19 800(元)2加权平均单价==21.28(元/件)本月发出材料成本=21.28×(1 200+1 500)=57 456(元)月末结存材料成本=20 000+12 600+44 000-57 456=19 144(元)3、移动平均法:10日发出原材料的单价==20.375(元/件)10日发出原材料成本=1 200×20.375=24 450(元)10日结存原材料成本==8 150(元)(400件)25日发出原材料的单价==21.73(元/件)25日发出原材料成本=21.73×1 500=32 595(元)25日结存原材料成本=8 150+44 000-32 595=19 555(元)本月发出材料成本=24 450+32 595=57 045(元)月末结存材料成本=20 000+12 600+44 000-57 045=19 555(元)习题十一1、借:材料采购21 600应交税费——应交增值税(进项税额) 3 672贷:银行存款25 272 2、借:材料采购30 000应交税费——应交增值税(进项税额) 5 10020 000+12 600贷:银行存款35 1003、不作分录4、借:原材料 5 600贷:应付账款 5 600 5、本月付款并验收入库甲材料的计划成本=22 000+29 700=51 700(元)借:原材料51 700 贷:材料采购51 700 本月付款并验收入库甲材料的实际成本=21 600+30 000=51 600(元)本月付款并验收入库甲材料的成本差异=51 600-51 700=-100(元)借:材料采购100 贷:材料成本差异100 6、借:生产成本34 000制造费用 4 000管理费用 1 000贷:原材料39 000 100%=1.6%本月发出甲材料的实际成本=39 000×(1+1.6%)=39 624(元)结转本月发出甲材料应负担的材料成本差异时:借:生产成本544 制造费用64管理费用16贷:材料成本差异624习题十二1、借:待处理财产损溢——待处理流动资产损溢117贷:原材料100 应交税费——应交增值税(进项税额转出)17 借:管理费用67 其他应收款——保管员50贷:待处理财产损溢——待处理流动资产损溢117 2、借:原材料75贷:待处理财产损溢——待处理流动资产损溢75 借:待处理财产损溢——待处理流动资产损溢75 贷:管理费用75 3、(1)2007年6月30日成本比可变现净值多1 500元,应计提存货跌价准备1 500元。