税务英语对话

- 格式:doc

- 大小:200.50 KB

- 文档页数:99

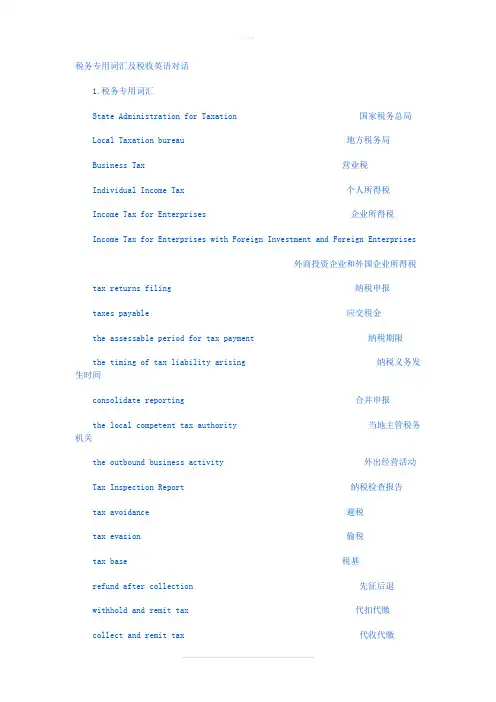

税务专用词汇及税收英语对话1.税务专用词汇State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises 企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 避税tax evasion 偷税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 扣缴所得税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区2. 税收英语对话――营业税标题:能介绍一下营业税的知识吗TOPIC: Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer: my company will begin business soon, but I have little knowledge about the business tax. Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

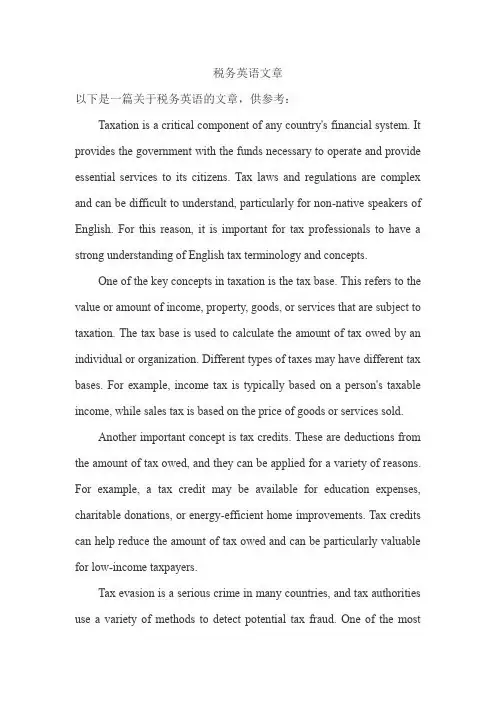

税务英语文章以下是一篇关于税务英语的文章,供参考:Taxation is a critical component of any country's financial system. It provides the government with the funds necessary to operate and provide essential services to its citizens. Tax laws and regulations are complex and can be difficult to understand, particularly for non-native speakers of English. For this reason, it is important for tax professionals to have a strong understanding of English tax terminology and concepts.One of the key concepts in taxation is the tax base. This refers to the value or amount of income, property, goods, or services that are subject to taxation. The tax base is used to calculate the amount of tax owed by an individual or organization. Different types of taxes may have different tax bases. For example, income tax is typically based on a person's taxable income, while sales tax is based on the price of goods or services sold.Another important concept is tax credits. These are deductions from the amount of tax owed, and they can be applied for a variety of reasons. For example, a tax credit may be available for education expenses, charitable donations, or energy-efficient home improvements. Tax credits can help reduce the amount of tax owed and can be particularly valuable for low-income taxpayers.Tax evasion is a serious crime in many countries, and tax authorities use a variety of methods to detect potential tax fraud. One of the mostcommon methods is through audits, which involve a review of an individual or organization's financial records to ensure that all income and deductions have been reported accurately. Tax authorities may also use computer algorithms to detect potential fraud.Taxation is a complex and ever-changing field, and it is important for tax professionals to stay up-to-date with the latest laws and regulations. English-language tax resources, such as tax journals and online databases, can be valuable tools for keeping informed about changes in the tax landscape.In conclusion, a strong understanding of tax terminology and concepts is essential for tax professionals working in an English-speaking context. With the right training and resources, tax professionals can navigate the complex world of taxation and ensure that their clients are in compliance with tax laws and regulations.以下是另一篇关于税务英语的文章,供参考:As businesses expand globally, tax professionals must navigate the complexities of international tax laws and regulations. English plays a critical role in this field, as it is the primary language used in many international tax agreements and treaties.One of the key concepts in international taxation is transfer pricing. This refers to the practice of pricing goods and services between affiliated companies in different countries. Transfer pricing can be used to shiftprofits to countries with lower tax rates, and as a result, it has become a major area of concern for tax authorities around the world. Transfer pricing rules are complex and can vary by country, so it is important for tax professionals to have a strong understanding of the relevant terminology and concepts in English.Another important concept in international taxation is the permanent establishment. This refers to a fixed place of business in a foreign country, such as a branch office or factory. When a business has a permanent establishment in a foreign country, it may be subject to taxes in that country. The rules for determining whether a permanent establishment exists can be complicated, so tax professionals must be familiar with the relevant English-language tax treaties and laws.Tax treaties are a critical component of international taxation, as they provide a framework for avoiding double taxation and resolving disputes between countries. Many tax treaties are written in English, so it is important for tax professionals to have a strong understanding of the relevant terminology and concepts. Some common terms that appear in tax treaties include "taxable presence," "dividends," and "withholding tax."In addition to tax treaties, there are also international tax organizations that play a key role in shaping tax policy around the world. These organizations, such as the Organization for Economic Cooperationand Development (OECD), publish guidelines and recommendations for countries to follow in order to ensure consistency and fairness in international taxation.In conclusion, international taxation is a complex and rapidly-changing field. Tax professionals must have a strong understanding of English tax terminology and concepts in order to navigate the complex web of tax laws and regulations. With the right training and resources, tax professionals can stay up-to-date with the latest developments in international taxation and provide valuable advice to their clients.。

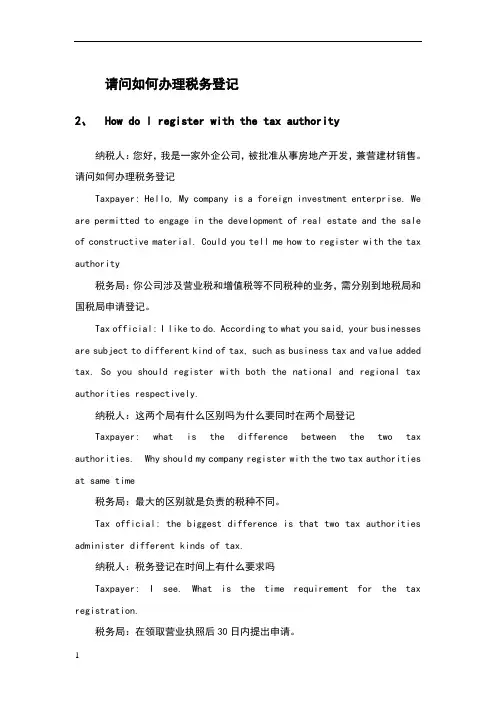

1请问如何办理税务登记2、How do I register with the tax authority纳税人:您好,我是一家外企公司,被批准从事房地产开发,兼营建材销售。

请问如何办理税务登记Taxpayer: Hello, My company is a foreign investment enterprise. We are permitted to engage in the development of real estate and the sale of constructive material. Could you tell me how to register with the tax authority税务局:你公司涉及营业税和增值税等不同税种的业务,需分别到地税局和国税局申请登记。

Tax official: I like to do. According to what you said, your businesses are subject to different kind of tax, such as business tax and value added tax. So you should register with both the national and regional tax authorities respectively.纳税人:这两个局有什么区别吗为什么要同时在两个局登记Taxpayer: what is the difference between the two tax authorities. Why should my company register with the two tax authorities at same time税务局:最大的区别就是负责的税种不同。

Tax official: the biggest difference is that two tax authorities administer different kinds of tax.纳税人:税务登记在时间上有什么要求吗Taxpayer: I see. What is the time requirement for the tax registration.税务局:在领取营业执照后30日内提出申请。

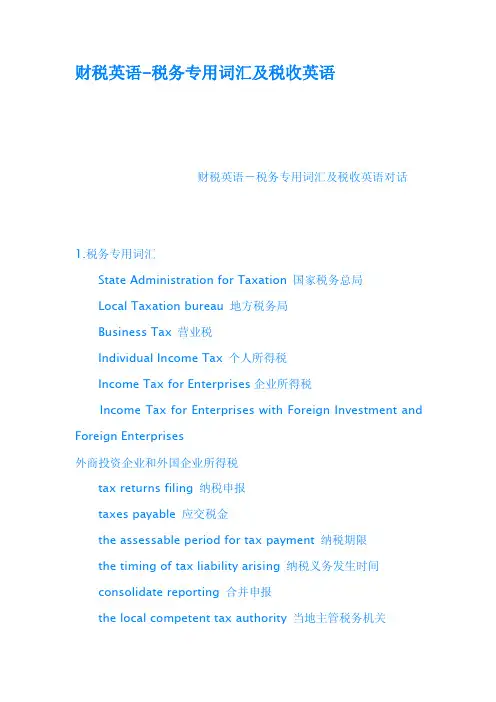

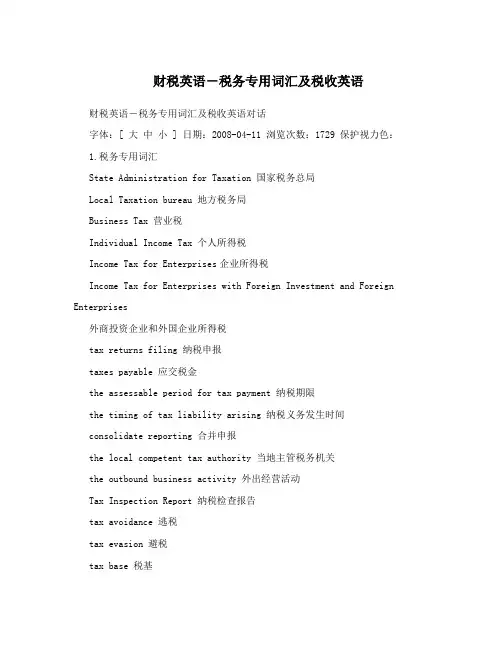

财税英语-税务专用词汇及税收英语财税英语-税务专用词汇及税收英语对话1.税务专用词汇State Administration for Taxation国家税务总局Local Taxation bureau地方税务局Business Tax营业税Individual Income Tax个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing纳税申报taxes payable应交税金the assessable period for tax payment纳税期限the timing of tax liability arising纳税义务发生时间consolidate reporting合并申报the local competent tax authority当地主管税务机关the outbound business activity外出经营活动Tax Inspection Report纳税检查报告tax avoidance逃税tax evasion避税tax base税基refund after collection先征后退withhold and remit tax代扣代缴collect and remit tax代收代缴income from authors remuneration稿酬所得income from remuneration for personal service劳务报酬所得income from lease of property财产租赁所得income from transfer of property财产转让所得contingent income偶然所得resident居民non-resident非居民tax year纳税年度temporary trips out of临时离境flat rate比例税率withholding income tax预提税withholding at source源泉扣缴State Treasury国库tax preference税收优惠the first profit-making year第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise出口型企业technologically advanced enterprise先进技术企业Special Economic Zone经济特区2.税收英语对话――营业税标题:能介绍一下营业税的知识吗TOPIC:Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer:my company will begin business soon,but I have little knowledgeabout the business tax.Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

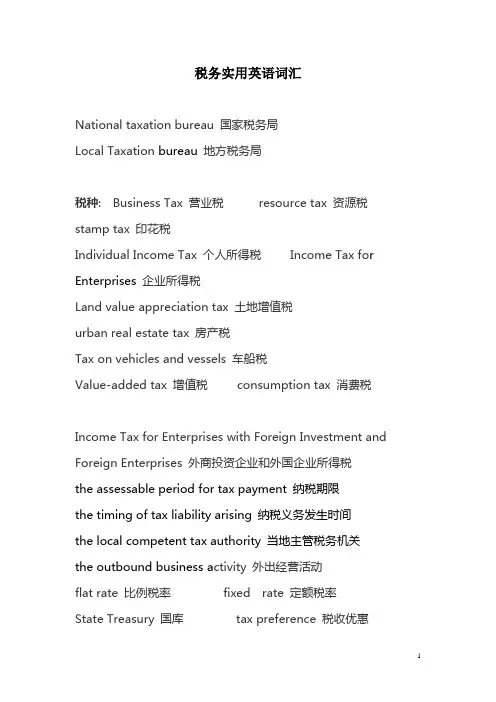

税务实用英语词汇National taxation bureau 国家税务局Local Taxation bureau地方税务局税种: Business Tax 营业税 resource tax 资源税stamp tax 印花税Individual Income Tax 个人所得税 Income Tax fo r Enterprises企业所得税Land value appreciation tax 土地增值税urban real estate tax 房产税Tax on vehicles and vessels 车船税Value-added tax 增值税 consumption tax 消费税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises 外商投资企业和外国企业所得税the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间the local competent tax authority 当地主管税务机关the outbound business a ctivity 外出经营活动flat rate 比例税率 fixed rate 定额税率State Treasury 国库 tax preference 税收优惠办税大厅 tax service hall税务登记表 tax registration form税务登记证 tax registration certificate工商营业执照 industrial and commercial business license组织机构代码 organization code certificate身份证 identity card公司的印章 company’s stamp纳税申报 tax return纳税申报表 tax return form纳税人识别号 tax payer ID(identifier)纳税代码 tax code税票 tax receipt发票 invoice税务登记Tax registrationDialogueMr. John, who works in a foreign enterprise, comes to the tax service hall for tax registration.一位在外企工作的约翰先生走进办税服务大厅来办理税务登记。

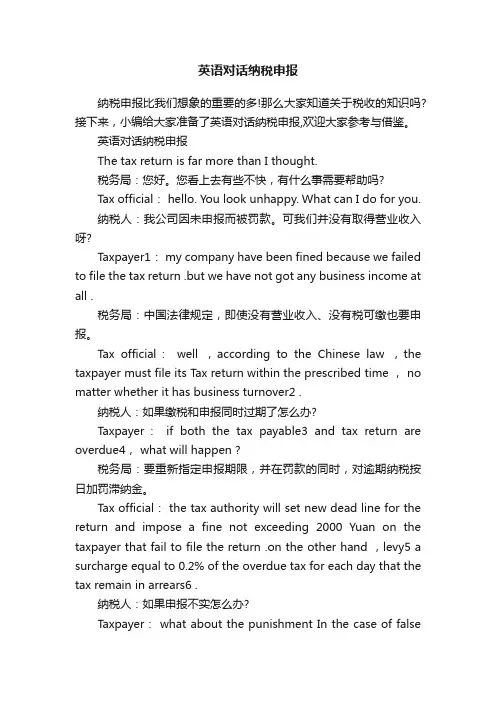

英语对话纳税申报纳税申报比我们想象的重要的多!那么大家知道关于税收的知识吗?接下来,小编给大家准备了英语对话纳税申报,欢迎大家参考与借鉴。

英语对话纳税申报The tax return is far more than I thought.税务局:您好。

您看上去有些不快,有什么事需要帮助吗?Tax official: hello. You look unhappy. What can I do for you.纳税人:我公司因未申报而被罚款。

可我们并没有取得营业收入呀?Taxpayer1: my company have been fined because we failed to file the tax return .but we have not got any business income at all .税务局:中国法律规定,即使没有营业收入、没有税可缴也要申报。

Tax official:well ,according to the Chinese law ,the taxpayer must file its Tax return within the prescribed time , no matter whether it has business turnover2 .纳税人:如果缴税和申报同时过期了怎么办?Taxpayer:if both the tax payable3 and tax return are overdue4, what will happen ?税务局:要重新指定申报期限,并在罚款的同时,对逾期纳税按日加罚滞纳金。

Tax official: the tax authority will set new dead line for the return and impose a fine not exceeding 2000 Yuan on the taxpayer that fail to file the return .on the other hand ,levy5 a surcharge equal to 0.2% of the overdue tax for each day that the tax remain in arrears6 .纳税人:如果申报不实怎么办?Taxpayer: what about the punishment In the case of falsetax return?税务局:如果是故意的,就要被定为偷税。

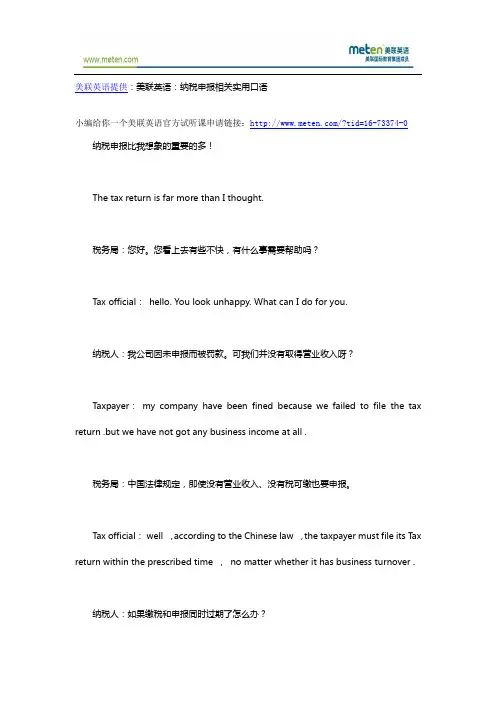

美联英语提供:美联英语:纳税申报相关实用口语小编给你一个美联英语官方试听课申请链接:/?tid=16-73374-0纳税申报比我想象的重要的多!The tax return is far more than I thought.税务局:您好。

您看上去有些不快,有什么事需要帮助吗?Tax official:hello. You look unhappy. What can I do for you.纳税人:我公司因未申报而被罚款。

可我们并没有取得营业收入呀?Taxpayer:my company have been fined because we failed to file the tax return .but we have not got any business income at all .税务局:中国法律规定,即使没有营业收入、没有税可缴也要申报。

Tax official:well ,according to the Chinese law ,the taxpayer must file its T ax return within the prescribed time ,no matter whether it has business turnover .纳税人:如果缴税和申报同时过期了怎么办?Taxpayer:if both the tax payable and tax return are overdue,what will happen ?税务局:要重新指定申报期限,并在罚款的同时,对逾期纳税按日加罚滞纳金。

Tax official:the tax authority will set new dead line for the return and impose a fine not exceeding 2000 Yuan on the taxpayer that fail to file the return .on the other hand ,levy a surcharge equal to 0.2% of the overdue tax for each day that the tax remain in arrears .纳税人:如果申报不实怎么办?Taxpayer:what about the punishment In the case of false tax return?税务局:如果是故意的,就要被定为偷税。

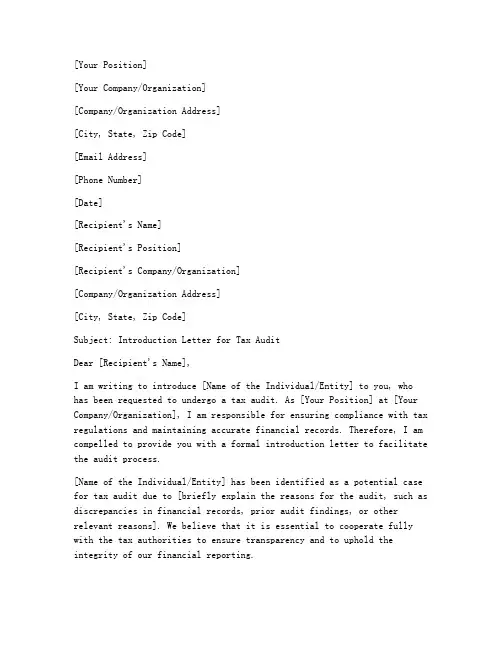

[Your Position][Your Company/Organization][Company/Organization Address][City, State, Zip Code][Email Address][Phone Number][Date][Recipient's Name][Recipient's Position][Recipient's Company/Organization][Company/Organization Address][City, State, Zip Code]Subject: Introduction Letter for Tax AuditDear [Recipient's Name],I am writing to introduce [Name of the Individual/Entity] to you, who has been requested to undergo a tax audit. As [Your Position] at [Your Company/Organization], I am responsible for ensuring compliance with tax regulations and maintaining accurate financial records. Therefore, I am compelled to provide you with a formal introduction letter to facilitate the audit process.[Name of the Individual/Entity] has been identified as a potential case for tax audit due to [briefly explain the reasons for the audit, such as discrepancies in financial records, prior audit findings, or other relevant reasons]. We believe that it is essential to cooperate fully with the tax authorities to ensure transparency and to uphold the integrity of our financial reporting.The following information provides a comprehensive overview of [Name of the Individual/Entity] and their relationship with [YourCompany/Organization]. Please find below the details:1. Personal/Company Information:- Full Name: [Name of the Individual/Entity]- Date of Birth: [Date of Birth]- Tax Identification Number: [Tax Identification Number]- Company Registration Number (if applicable): [Company Registration Number]2. Relationship with [Your Company/Organization]:- [Name of the Individual/Entity] has been associated with [Your Company/Organization] as [describe the individual's role or the entity's business relationship].- [Name of the Individual/Entity] has been employed/engaged with [Your Company/Organization] since [Start Date].- [Name of the Individual/Entity] has been responsible for [mention specific responsibilities or roles within the company].3. Financial Information:- [Name of the Individual/Entity] has been involved in [Your Company/Organization]'s financial transactions, including [mention specific transactions or areas of involvement].- [Name of the Individual/Entity] has access to [YourCompany/Organization]'s financial records and can provide relevant documentation for the audit.4. Compliance and Tax Records:- [Your Company/Organization] has maintained accurate and up-to-date tax records for [Name of the Individual/Entity].- We have provided all necessary documentation to support the tax positions taken by [Name of the Individual/Entity].- [Your Company/Organization] has fully cooperated with previous tax audits and has a history of compliance with tax regulations.We understand the importance of a smooth and efficient tax audit process. To facilitate this, we would like to request the following:1. Please inform us of the specific dates and times for the tax audit.2. Please provide any additional information or documentation requiredto conduct the audit effectively.3. We will assign a designated representative to be present during the audit to answer any questions and provide assistance as needed.We assure you that [Your Company/Organization] will provide full cooperation throughout the audit process. We value our relationship with the tax authorities and strive to maintain transparency and compliance with tax regulations.If you have any questions or require further information, please do not hesitate to contact me at [Your Email Address] or [Your Phone Number]. We are committed to addressing any concerns and ensuring a successful audit outcome.Thank you for your attention to this matter. We look forward to apositive and collaborative audit experience.Sincerely,[Your Name][Your Position][Your Company/Organization][Company/Organization Address][City, State, Zip Code][Email Address] [Phone Number]。

税务稽查英语Tax Audit: An OverviewTax audit is a crucial process undertaken by tax authorities to ensure that individuals and businesses comply with the tax laws of a country. It involves a comprehensive examination of financial records, transactions, and other relevant documents to verify the accuracy and completeness of tax returns. In this article, we will discuss the significance of tax audit, its purpose, and the procedures followed during the audit process.The primary purpose of tax audit is to promote transparency and fairness in the tax system. It helps to identify and address discrepancies, errors, and potential cases of tax evasion or avoidance. By conducting tax audits, tax authorities can ensure that taxpayers are fulfilling their tax obligations, thereby maintaining social and economic stability. Additionally, tax audits facilitate the collection of accurate revenue, which is essential for funding government activities and providing public services.During a tax audit, various procedures are carried out to determine the accuracy of tax returns. These procedures may include reviewing financial statements, reconciling bank statements, examining invoices, receipts, and other supporting documents, and conducting interviews with taxpayers and their representatives. The tax authorities may also request additional information or clarification on certain transactions or expenses to ensure compliance with tax laws.Tax audit procedures may vary from country to country, and may also depend on the type of taxpayer being audited. Individuals, businesses, and corporations are all subject to tax audits, although the frequency and intensity of audits may differ based on factors such as the size of the taxpayer's operations and their compliance history. Generally, tax audits can be categorized into two types: desk audits and field audits.Desk audits are conducted in an office setting, where tax authorities review financial records and other relevant documents submitted by taxpayers. These audits are typically less intrusive and are more common for individual taxpayers or small businesses withstraightforward tax matters. Field audits, on the other hand, involve tax officials visiting the premises of the taxpayer to conduct a more thorough examination. Field audits are usually conducted for larger corporations or businesses with complex financial transactions.During a tax audit, it is important for taxpayers to cooperate fully with the tax authorities and provide all requested information and documents. Failure to cooperate or provide accurate information can lead to penalties, fines, or further investigation. It is advisable for taxpayers to maintain accurate and organized financial records throughout the year, which can facilitate the audit process and demonstrate compliance with tax laws.In conclusion, tax audit is a critical process in ensuring the fairness and integrity of the tax system. By conducting audits, tax authorities can verify the accuracy of tax returns and detect potential cases of tax evasion or avoidance. The procedures followed during a tax audit may vary, but they generally involve a comprehensive examination of financial records and other relevant documents. It is essential for taxpayers to cooperate fully with tax authorities during the audit process and maintain accurate financial records throughout the year.。

财税英语-税务专用词汇及税收英语财税英语-税务专用词汇及税收英语对话字体:[ 大中小 ] 日期:2008-04-11 浏览次数:1729 保护视力色:1.税务专用词汇State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区2. 税收英语对话――营业税标题:能介绍一下营业税的知识吗TOPIC: Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer: my company will begin business soon, but I have little knowledgeabout the business tax. Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

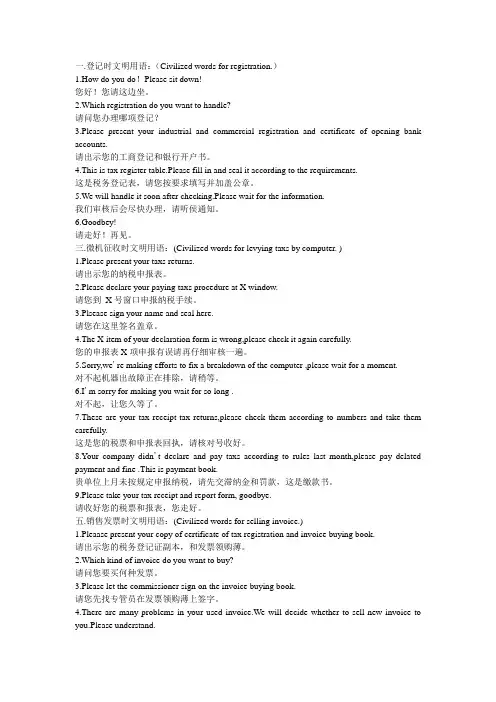

一.登记时文明用语:(Civilized words for registration.)1.How do you do!Please sit down!您好!您请这边坐。

2.Which registration do you want to handle?请问您办理哪项登记?3.Please present your industrial and commercial registration and certificate of opening bank accounts.请出示您的工商登记和银行开户书。

4.This is tax register table.Please fill in and seal it according to the requirements.这是税务登记表,请您按要求填写并加盖公章。

5.We will handle it soon after checking.Please wait for the information.我们审核后会尽快办理,请听侯通知。

6.Goodbey!请走好!再见。

三.微机征收时文明用语:(Civilized words for levying taxs by computer. )1.Please present your taxs returns.请出示您的纳税申报表。

2.Please declare your paying taxs procedure at X window.请您到X号窗口申报纳税手续。

3.Plsease sign your name and seal here.请您在这里签名盖章。

4.The X item of your declaration form is wrong,please check it again carefully.您的申报表X项申报有误请再仔细审核一遍。

5.Sorry,we're making efforts to fix a breakdown of the computer ,please wait for a moment.对不起机器出故障正在排除,请稍等。

税务工作者英语自我介绍英文回答:My name is [Your Name], and I am a tax professional with over [Number] years of experience. Throughout my career, I have developed a comprehensive understanding of tax laws and regulations, both domestically and internationally. My expertise lies in tax compliance, tax planning, and tax advisory services.As a seasoned tax professional, I possess a strong foundation in various tax areas, including individual and corporate income tax, sales tax, property tax, and international tax. I have extensive experience in preparing and reviewing tax returns, conducting tax audits, and resolving tax disputes with tax authorities.In addition to my technical proficiency, I am highly skilled in tax planning and advisory services. I collaborate closely with clients to develop tailored taxstrategies that minimize their tax liabilities while maximizing their tax savings. I provide proactive advice on tax-related matters, keeping clients informed of the latest tax developments and best practices.My passion for tax and my commitment to delivering exceptional service have consistently driven my success. I am highly detail-oriented, analytical, and possess strong problem-solving skills. I am adept at communicating complex tax concepts in a clear and concise manner, ensuring that clients fully understand their tax obligations and opportunities.Throughout my career, I have successfully managed tax engagements for a diverse range of clients, fromindividuals to small businesses, corporations, and non-profit organizations. My ability to adapt to different client needs and industries has enabled me to provide customized solutions that meet their specific requirements.中文回答:我是 [您的姓名],拥有超过 [年数] 年的税务专业经验。

[转贴]疯狂英语之税收英语精华篇疯狂英语之税收英语精华篇Chapter 1 Tax Registration一、税务登记1.Would you please tell me how to go through (or modify)tax registration.2.Please go to the Tax Registration Center.3.Please apply for tax registration for foreigners.4.Please fill out personal income tax record book for foreigners, and then present the book together withdocuments and certificates as listed in the record book.5.Excuse me, would you please explain to me thenecessary procedures for nullifying the tax registration?6.Please fill out the tax cancellation return form withyour company’s stamp.7.Here’s a list of the required documents and materials.8.Please give detailed information in the form of theforeigners in your company, so that we can cancel alltheir registration.9.We’ll go to your company to check on the cancellationof tax registration.10.Please submit supplement documents.1、请问如何办理税务(变更)登记?2、请到税务登记中心办理相关手续。

税务基本英语Taxation is an essential part of every citizen's life, ensuring the smooth functioning of government services.Understanding the basics of taxation can empower individuals to make informed financial decisions. It's about how the government collects revenue to fund public goods and services.Different types of taxes exist, such as income tax, sales tax, and property tax, each serving a specific purpose within the economy.Filing taxes can seem daunting, but with the right knowledge, it becomes a straightforward process. It's about declaring your income and paying the appropriate amount to the state.Tax deductions and credits can significantly reduce your tax liability. They are incentives provided by the government to encourage certain behaviors or investments.Staying compliant with tax laws is crucial. Penalties for tax evasion can be severe, affecting both your financial and legal standing.Education on tax matters is vital for all age groups. It helps in fostering a sense of responsibility and civic dutytowards the community.In conclusion, a basic understanding of taxation is not only beneficial for personal finance but also for contributing to the betterment of society.。

免税店退税英语对话:

关于办理退税的英文:

1 Is this the counter for tax refunds?

2 I would like to apply for/claim a tax refund.

3 Could you please show me the document?

4 Here is the tax refund form, and my ticket and boarding pass.

5 Can I see the merchandise?

6 How much of a refund can I get?

7 Your document seems to be in order. Here's your form.

8 What do!do now?

9 You have to send this form back to the company. There's a mail box there.

10 How long does it take to get the tax refund?

关于办理退税英文的意思:

1请问是在这里办退税吗?

2我要办理退税。

3请出示您的文件。

4这是我的退税单、机票和登机证。

5请出示您买的商品。

6请问可以退多少钱?

7您的文件应该没问题。

退税单还您。

8请问要怎么处理这张表?

9您必须将这份表格寄回该公司。

那边就有邮筒。

10请问要多久才会收到退款呢?。

税务局工作英语自我介绍范文Hello, my name is [Your Name], and I am thrilled to introduce myself as a dedicated professional working at the Internal Revenue Service (IRS). With a strong background in accounting and a passion for ensuring the integrity of our tax system, I have been an integral part of the IRS team for the past [number of years].My primary role involves [briefly describe your role,e.g., reviewing tax returns, conducting audits, providing taxpayer assistance, etc.]. I have developed a keen eye for detail and a thorough understanding of the complex tax codes and regulations, which allows me to excel in my position.I hold a degree in [relevant degree, e.g., Accounting, Finance, etc.], and I am continuously working towards expanding my knowledge by participating in professional development courses and staying abreast of the latest tax law changes. My commitment to ongoing learning has not only enhanced my professional capabilities but also contributed to the efficiency and effectiveness of our department.At the IRS, I am proud to be part of a team that is dedicated to serving the public interest and upholding the highest standards of fiscal responsibility. My interpersonal skills and ability to communicate complex tax matters in a clear and understandable manner have been instrumental in building strong relationships with taxpayers and colleaguesalike.In addition to my professional responsibilities, I am also involved in [mention any community service, volunteer work, or extracurricular activities that relate to your role or showcase your character].I am excited about the opportunity to continue growing within the IRS and to contribute to the agency's mission of providing fair and effective tax administration. Thank you for your time, and I look forward to the possibility of working together.。

外贸税务检查英语对话这是有关外贸税务检查英语对话,快来看看吧。

A: Good morning.we are from Department of Baotou Tax Burea We would like to ask ,you somethinq about the tax navment of your panyA:早上好,我们是包头税务局的工作人员。

今天到贵公司是进展税务检查,我们想了解一下贵公司。

B:we wilcooperaie wiin you ana proviae true materials.B:我们会竭诚合作并提供真实可信的材料。

A:Could you please hand in plete aounting books and other materials?A:请贵公司出具完整的账簿还有其他材料B:Of course,wait a minute ,please .Here you are.B:当然,请稍等,给您。

A: We will take these materials back to make detailed inspection it you don't mind.and we will turn that back three days from now.A:假设你们不介意的话,我们要把这些材料带回去做详细的调查。

三天之后会把材料送回来。

B: Ok.B:好的。

A: We are done inspecting. here is the result. If there is no discrepancy.please sign at the bottom of the form.A:我们已经检查完毕,结果在这里。

假设没有什么问题的话,请在表格的下方签字。

B: I think the punishment fee is a little bit high,what should we do?B:我认为这罚金有点高,该怎么办?A:If so.you could ask for hearing testimony.apply for reexamination or bring suit against the tax authory.A:假设是这样的话,你们可以选择听证、复议和诉讼。

税务英语lesson 1

Lessen 1:

How to register with the taxation bureau?

请问如何办理税务登记?

Taxpayer: Hello!My company is a foreign enterprise,and we are engaged in the development of real estate and the sale of constructive material.Could you tell me how to register with the taxation bureau?

Tax official: I'd like to.According to what you said,you need to pay different kinds of taxes,such as business tax and value added tax.So you should register with both the national and local taxation bureau respectively.

Taxpayer: What is the difference between these two taxation bureaux?And why should my company register with them at the same time?

Tax official: The biggest difference is that they are in charge of different taxes. Taxpayer: I see. Is there any time requirement for registration? Tax official: You should register with the bureau within 30 days after you receive business license. Taxpayer: What should we do in the process of registration?

Tax official: To get and fill in the application form,and then present the related documents according to the economic type of your company.

Taxpayer: Can we use the copy of those materials?

Tax official: Yes,you can.

Taxpayer: How long will it take to finish the registration?

Tax official: Within 30 days after we receive the application.As soon as your application is approved, I will personally notice you to get the registration certificate. Taxpayer: What is the charge of the registration?

Tax official: 40 YUAN.

Taxpayer: By the way,could you tell me your telephone number and working time?

Tax official: Our telephone number is 64004857.We work from 8:30 AM to 11:30 AM and from 1:30 PM to 5:00 PM.

Taxpayer: Thank you .

Tax official: You are welcome .

New Words

register 登记,注册

taxation bureau 税务局,税务机

bureaux 政府机关,局(复数形式)enterprise 企业

be engaged in 从事,忙于,参加

real estate 房地产,不动产

such as例如

business tax 营业税

value added tax 增值税

the national taxation bureau 国家税务局

the local taxation bureau 地方税务局

respectively 分别地,各自地

at the same time 同时

in charge of 负责

business license 营业执照

application form 申请表

prescribe 规定

according to 根据

registration certificate 登记证

approve 认可,批准,同意

You are welcome. 别客气!

中文对照

第一课:请问如何办理税务登记?。