成本会计英文版模拟题

- 格式:doc

- 大小:185.00 KB

- 文档页数:49

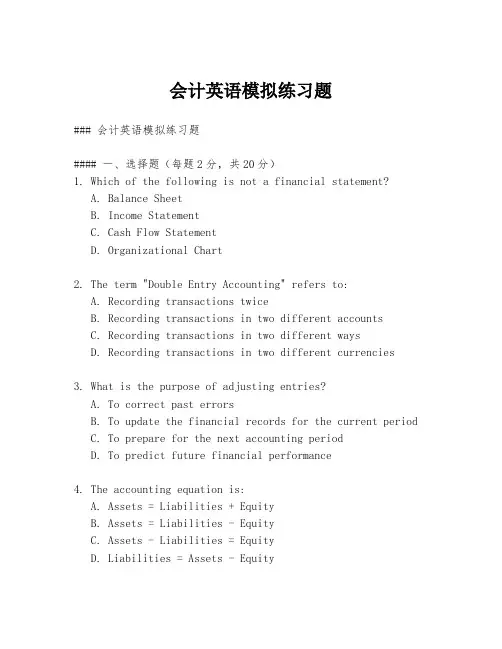

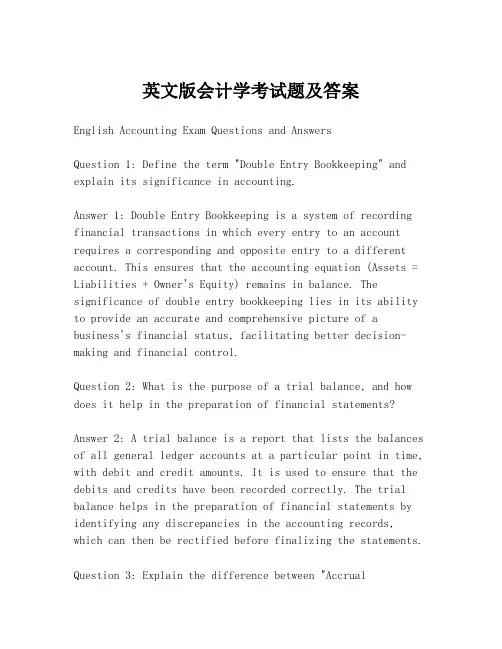

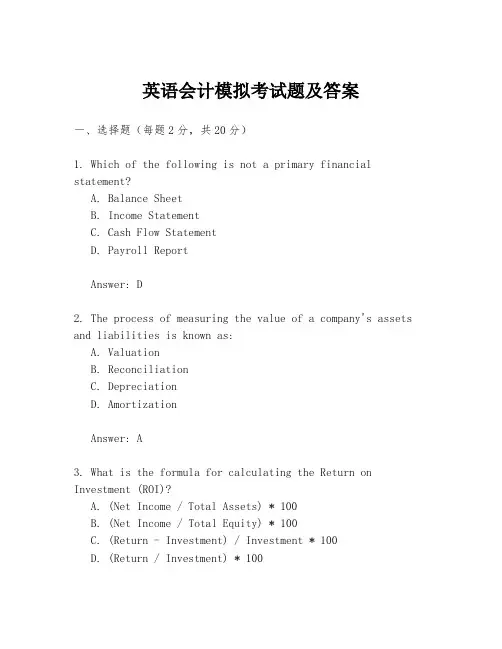

会计英语模拟练习题### 会计英语模拟练习题#### 一、选择题(每题2分,共20分)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Organizational Chart2. The term "Double Entry Accounting" refers to:A. Recording transactions twiceB. Recording transactions in two different accountsC. Recording transactions in two different waysD. Recording transactions in two different currencies3. What is the purpose of adjusting entries?A. To correct past errorsB. To update the financial records for the current periodC. To prepare for the next accounting periodD. To predict future financial performance4. The accounting equation is:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Liabilities = Assets - Equity5. Which of the following is not a type of inventory valuation?A. FIFOB. LIFOC. Weighted AverageD. Net Present Value#### 二、填空题(每题2分,共20分)6. The process of recording financial transactions in the order they occur is known as __________.7. The __________ is a summary of the changes in a company's financial position over a period of time.8. A __________ is an expense that has been incurred but not yet paid.9. The __________ method of depreciation allocates the cost of a fixed asset over its useful life.10. The __________ is the difference between the opening and closing balances of an account.#### 三、简答题(每题15分,共40分)11. Explain the concept of "matching principle" in accounting and its importance.12. Describe the steps involved in preparing a balance sheet.#### 四、案例分析题(20分)13. Assume you are an accountant for a small business. The business has just completed its fiscal year. You have been provided with the following information:- Total revenue for the year: $500,000- Cost of goods sold: $300,000- Operating expenses: $100,000- Depreciation expense: $20,000- Interest expense: $10,000Calculate the net income of the business and prepare a brief income statement in English.Note: This is a simulated exercise intended for educational purposes only. The questions and answers provided are for illustrative purposes and may not reflect actual accounting practices or standards.。

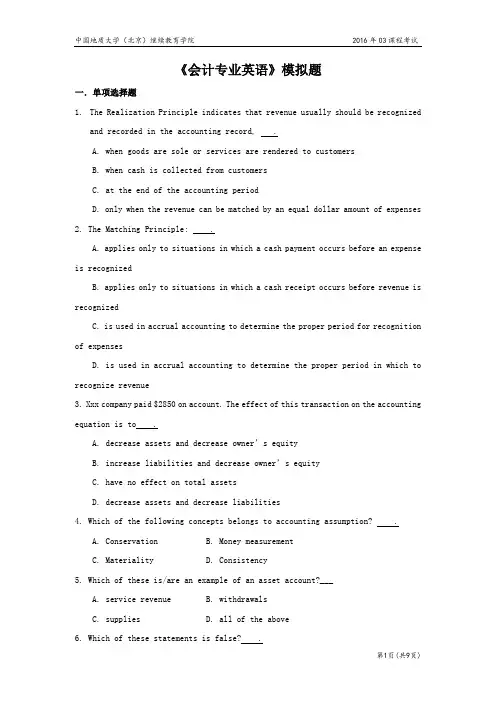

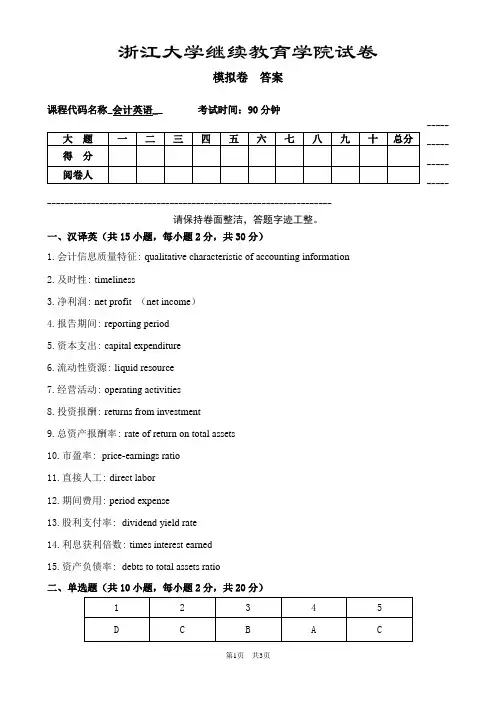

《会计专业英语》模拟题一.单项选择题1.The Realization Principle indicates that revenue usually should be recognizedand recorded in the accounting record, .A. when goods are sole or services are rendered to customersB. when cash is collected from customersC. at the end of the accounting periodD. only when the revenue can be matched by an equal dollar amount of expenses2. The Matching Principle: .A. applies only to situations in which a cash payment occurs before an expense is recognizedB. applies only to situations in which a cash receipt occurs before revenue is recognizedC. is used in accrual accounting to determine the proper period for recognition of expensesD. is used in accrual accounting to determine the proper period in which to recognize revenue3. Xxx company paid $2850 on account. The effect of this transaction on the accounting equation is to .A. decrease assets and decrease owner’s equityB. increase liabilities and decrease owner’s equityC. have no effect on total assetsD. decrease assets and decrease liabilities4. Which of the following concepts belongs to accounting assumption? .A. ConservationB. Money measurementC. MaterialityD. Consistency5. Which of these is/are an example of an asset account?___A. service revenueB. withdrawalsC. suppliesD. all of the above6. Which of these statements is false? .A. increase in assets and increase in revenues are recorded with a debitB. increase in liabilities and increase in owner’s e quity are recorded witha creditC. increase in both assets and withdrawals are recorded with a debitD. decreases in liabilities and increase in expenses are recorded with a debit二.判断题1. Accounting provides financial information that is only useful to business management. ( )2. The accounting process generates financial reports for both “internal” and “external” users. ( )3. The basic concept of double-entry accounting is that total debits must equal total credits for every business transaction.()4.A trial balance represents a listing of the ledger accounts and balances at a particular moment in time.()5. The ledger account provides a chronological order of transactions.()6. Post reference columns are found only in the journal, not in the ledger.()ually two signatures are required on a business check for it to be valid.()8.When a check is written by a business, the immediate effect is to reduce both the balance shown in the checkbook and the balance on the bank's records. ()9.The final amounts shown on both sides of the bank reconciliation statement are labeled "Adjusted Balances."()10. A leasehold is an example of a long-life asset.()11. The accounting reporting period agrees to the calendar year. ( )12.An increase in permanent capital is recorded as a credit to the account. ( )13. Dollar signs are used in the amount areas of the ledger accounts. ( )14.If the trial balance shows that the ledger is in balance, this means that the individual business transactions were recorded to the appropriate ledger accounts. ( )15. Every business transaction is first recorded in the journal. ( )16.Internal control of operations is equally complex in a small and in a large organization. ( )17.There are only two parties to a check: the person who writes it (the drawee) and the person to whom it is written (the payee). ( )18.Two documents used in preparing a bank reconciliation statement are the bank statement and the checkbook stubs.( )19. A common cause of inequality between the balances on the bank statement and in the checkbook is outstanding checks. ( )20.Depreciation expense is usually recorded at least once a year. ( )21.Amortization is the conversion of the cost of an intangible asset to an expense. ( )三.翻译题1. Sole Proprietorship Enterprises2. Profit cost and capital cost principle3. Double entry system4. Source documents5. Environmental accounting6. Matching principle7. Gross profit 8. Perpetual inventory system9. Intangible assets 10. 原始凭证11. 固定资产四.完成下列等式1. Accounting Equation:Assets =2. Perpetual inventory system:Ending Inv. =五.编制银行存款余额调节表The following information pertains to ABC company:(1)cash balance per bank July 31, $7263(2)July bank service charge not recorded by the depositor $15(3) cash balance per book July 31, $7190(4) Deposits in transit July 31, $1700(5)Note for $1000 collected for ABC in July by bank plus interest $36, and charge $20 for service. The collection has not been recorded byABC and no interest has been accrued(6)Outstanding checks July 31 , $772Prepare Bank reconciliation at July 31.六.编写借贷会计分录On July 1, N. B. Edgar opened Coin-Op Laundry. Edgar’s acco untantlisted the following chart of accounts:Cash Supplies Prepaid Insurance EquipmentFurniture and Fixtures Accounts PayableN. B. Edgar, Capital N. B. Edgar, DrawingLaundry Revenue Wages ExpenseRent Expense Utilities Expense Miscellaneous ExpenseDuring July, the following transactions were completed:a.Edgar deposited $20,000 in a bank account in the name of the business.b.Bought tables and chairs for cash, $450c.Paid the rent for the current month, $705d.Bought washers and dryers from Eldon Equipment, $17,400, paying $4,000 incash and placing the balance on account.e.Bought laundry supplies on account from Borkal Distributors, $410.f.Sold services for cash, $862.g.Bought insurance for one year, $468.h.Paid on account to Eldon Equipment, a creditor, $550.i.Received and paid the electric bill, $118.j.Paid on account to Borkal Distributors, a creditor, $145.k.Sod services to customers for cash for the second half of the month, $881.l.Received and paid the bill for the business license, $45.m.Paid wages to an employee, $1,146.n.Edgar withdrew cash for personal use, $875.InstructionsRecord the transactions with “Dr.” and “Cr.”七.编制试算平衡表The bank statement of LA Company shows a final balance of $2119 as of March 31, the balance of the cash in the ledger as of that is $1552, LA accountant has taken the following steps.Prepare bank reconciliation at March 31.(1) Noted that the deposit made on March 31 was not recorded on the bank statement, $762.(2) Noted outstanding checks: no.921, $626. no.985, $69. no.986, $438.(3) Noted credit memo: note collected by the bank from ABC company ,$200, not recordedin the journal.(4) Noted debit memo: collection charge and service charge not recorded in the journal, $4.八.存货成本计算C asey Electronics’ ending inventory consists of 182 Model M43 CD players acquired through various purchases, as follows:Specific Purchase Number of Units Cost per Unit Total CostB e g i n n i n g i n v e n t o r y34$270$9180First purchase 60 282 16,920Second purchase 256 298 76,288Third purchase 164 312 51,168Total units available 514 $153,556Of the 514 units available for sale, 182 units are still on hand and 332 have been sold.Under the periodic inventory system, If Casey Electronics chooses LIFO method, how should it calculate the cost of the 182 CD players on hand?九.设立T形账户并编制试算平衡表(1) May1: Jill Jones and her family invested $8,000 in BBE Company and received 800 shares ofstock.(2) May2: BBE purchased an equipment for $2,500 cash.(3) May 8: BBE purchased a $15,000 truck. BBE paid $2,000 in cash and issued a note payablefor the remaining $13,000.(4) May 18: BBE sold services on account to ABC Lawns, $150. ABC Lawns agree to pay BBEwithin 30 days.(5) May 29: BBE provided services for a client and received $750 in cash.(6) May31:BBE purchased gasoline for the truck for $50 cash.Please Analyze the above transactions of BBE Company, set up its "T" accounts, and prepare a trial balance.参考答案:一.单项选择题1.A2.C3.D4.B5.C6.A二.判断题1.F2.T3.T4.T5.F6.F7.T8.F9.T 10.F11.F 12.T 13.F 14.F 15.T 16.F 17.F 18.T 19.T 20.T 21.T三.翻译题1. 独资企业2. 划分收益性支出与资本性支出3. 复式记帐法4. 原始凭证5.环境会计6. 配比原则7. 毛利8. 永序盘存制9.无形资产10. source document 11.fixed asset四.完成下列等式1. Accounting Equation:Assets = Liabilities + Owner's Equity2. Perpetual inventory system:Ending Inv. =Beg. Inv.+ Purchases-Cost of goods sold五.编制银行存款余额调节表ABC CompanyBank ReconciliationJuly 31 20Bank statement balance, July 31 $7263 Add. Deposits In Transit 17008963Deduct: Outstanding checks 772 Adjusted bank statement balance 8191Ledger balance of cash $7190 Add. Credit memo 10368226 Deduct: Bank service charge 2015Adjusted ledger balance of cash 8191 六.编写借贷会计分录A Dr. Cash 20000Cr. N. B. Edgar, Capital 20000B Dr. Furniture and Fixtures 450Cr. Cash 450C Dr. Rent Expense 705Cr. Cash 705D Dr. Equipment 17400Cr. Cash 4000Accounts Payable 13400E Dr. Supplies 410Cr. Accounts Payable 410F Dr. Cash 862Cr. Laundry Revenue 862G Dr. Prepaid Insurance 468Cr. Cash 468H Dr. Accounts Payable 550Cr. Cash 550I Dr. Utilities Expense 118Cr. Cash 118J Dr. Accounts Payable 145Cr. Cash 145K Dr. Cash 881Cr. Laundry Revenue 881L Dr. Miscellaneous Expense 45Cr. Cash 45M Dr. Wages Expense 1146Cr. Cash 1146N Dr. N. B. Edgar, Drawing 875Cr. Cash 875七.编制试算平衡表LA CompanyBank reconciliationMarch 31 2004Bank statement balance, March 31 $2119Add. Deposits In Transit 7622881Deduct: Outstanding checksNo. 921 $626No. 985 69No. 986 438 1133Adjusted bank statement balance 1748Ledger balance of cash $1552Add. Note collected by bank 2001752Deduct: Bank service & collection charges 4Adjusted Ledger Balance of Cash 1748八.存货成本计算34 Units(beginning inventory) @ $270 each = $918060 Units(first purchase) @ $282 each = 16920 88 Units(second purchase) @ $298 each = 26224182 Units $52324九.设立T形账户并编制试算平衡表。

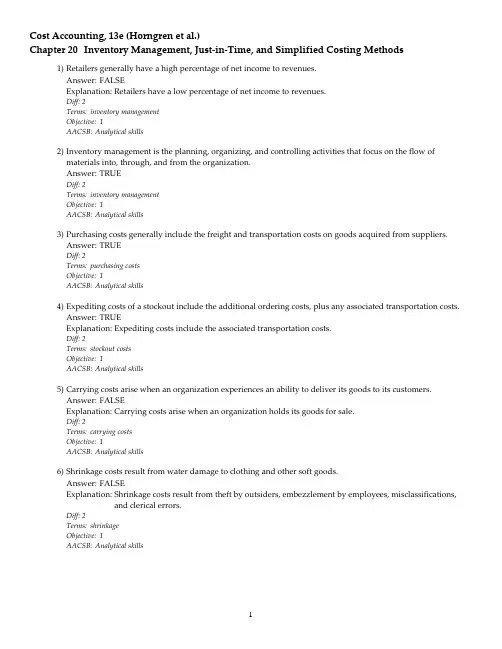

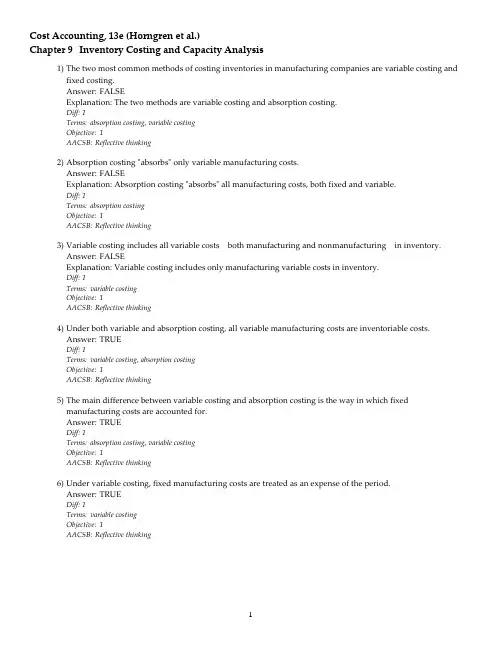

Cost Accounting, 13e (Horngren et al.)Chapter 20 Inventory Management, Just-in-Time, and Simplified Costing Methods1) Retailers generally have a high percentage of net income to revenues.Answer: FALSEExplanation: Retailers have a low percentage of net income to revenues.Diff: 2Terms: inventory managementObjective: 1AACSB: Analytical skills2) Inventory management is the planning, organizing, and controlling activities that focus on the flow ofmaterials into, through, and from the organization.Answer: TRUEDiff: 2Terms: inventory managementObjective: 1AACSB: Analytical skills3) Purchasing costs generally include the freight and transportation costs on goods acquired from suppliers.Answer: TRUEDiff: 2Terms: purchasing costsObjective: 1AACSB: Analytical skills4) Expediting costs of a stockout include the additional ordering costs, plus any associated transportation costs.Answer: TRUEExplanation: Expediting costs include the associated transportation costs.Diff: 2Terms: stockout costsObjective: 1AACSB: Analytical skills5) Carrying costs arise when an organization experiences an ability to deliver its goods to its customers.Answer: FALSEExplanation: Carrying costs arise when an organization holds its goods for sale.Diff: 2Terms: carrying costsObjective: 1AACSB: Analytical skills6) Shrinkage costs result from water damage to clothing and other soft goods.Answer: FALSEExplanation: Shrinkage costs result from theft by outsiders, embezzlement by employees, misclassifications, and clerical errors.Diff: 2Terms: shrinkageObjective: 1AACSB: Analytical skillscounted.Answer: TRUEDiff: 2Terms: shrinkageObjective: 1AACSB: Analytical skills8) All inventory costs are available in financial accounting systems.Answer: FALSEExplanation: Opportunity costs are rarely recorded in formal accounting systems and they are often a very significant cost component.Diff: 2Terms: shrinkageObjective: 1AACSB: Analytical skills9) Sharing inventory data throughout the supply chain leads to more "rush" orders occurring.Answer: FALSEExplanation: Sharing inventory data throughout the supply chain leads to fewer "rush" orders occurring.Diff: 2Terms: inventory managementObjective: 1AACSB: Analytical skills10) The simplest version of the Economic Order Quantity model incorporates only ordering costs, carrying costs,and purchasing costs into the calculation.Answer: FALSEExplanation: Purchasing costs are ignored in the Economic Order Quantity.Diff: 2Terms: economic order quantity (EOQ)Objective: 2AACSB: Analytical skills11) To determine the Economic Order Quantity, the relevant ordering costs are minimized and the relevantcarrying costs are maximized.Answer: FALSEExplanation: We minimize both the relevant ordering costs and the relevant carrying costs.Diff: 2Terms: economic order quantity (EOQ)Objective: 2AACSB: Analytical skills12) The Economic Order Quantity increases with demand and ordering costs and decreases with carrying costs.Answer: TRUEDiff: 2Terms: economic order quantity (EOQ)Objective: 2AACSB: Analytical skillscosts are equal.Answer: TRUEDiff: 2Terms: economic order quantity (EOQ)Objective: 2AACSB: Analytical skills14) When retailers are uncertain about demand for their products or availability of their products from thesuppliers, they often hold a fixed level of safety stock to make sure they will be able to fulfill the customers' needs.Answer: TRUEDiff: 2Terms: safety stockObjective: 2AACSB: Ethical reasoning15) The annual relevant carrying costs of inventory consist of incremental costs plus the opportunity cost ofcapital.Answer: TRUEDiff: 3Terms: carrying costsObjective: 3AACSB: Analytical skills16) Just-in-time purchasing requires organizations to place smaller purchase orders with their suppliers.Answer: TRUEDiff: 2Terms: just-in-time (JIT) purchasingObjective: 3AACSB: Analytical skills17) Just-in-time purchasing is guided solely by the economic order quantity.Answer: FALSEExplanation: Inventory management also includes purchasing costs, stockout costs, and quality costs.Diff: 2Terms: just-in-time (JIT) purchasing, economic order quantity (EOQ)Objective: 3AACSB: Analytical skills18) The higher level of variability at manufacturers rather than suppliers, and at retailers rather thanmanufacturers is called the "bullwhip effect."Answer: FALSEExplanation: The higher level of variability is at suppliers rather than manufacturers, and at manufacturers rather than at suppliers.Diff: 3Terms: inventory managementObjective: 3AACSB: Reflective thinking19) Just-in-time purchasing describes the flow of goods, services, and information from the initial sources ofmaterials and services to the delivery of products to consumers, regardless of whether those activities occur in the same organization or in other organizations.Answer: FALSEExplanation: Supply chain describes the flow of goods, services, and information from the initial sources of materials and services to the delivery of products to consumers, regardless of whether thoseactivities occur in the same organization or in other organizations.Diff: 3Terms: supply chainObjective: 4AACSB: Reflective thinking20) A "push-through" system, often described as a just-in-time system, emphasizes simplicity and closecoordination among work centers.Answer: FALSEExplanation: The narrative describes a Materials Requirement Planning system.Diff: 2Terms: just-in-time (JIT) productionObjective: 5AACSB: Communication21) Costs of setting up a production run are analogous to ordering costs in the Economic Order Quantity (EOQ)model.Answer: TRUEDiff: 2Terms: ordering costsObjective: 5AACSB: Analytical skills22) A "demand-pull" system, often described as a materials requirement planning system, focuses first on theforecasted amount and timing of finished goods and then determines the demand for materials components and subassemblies at each of the prior stages of production.Answer: FALSEExplanation: The narrative describes a push-through system.Diff: 2Terms: material requirements planning (MRP)Objective: 5AACSB: Reflective thinking23) In a just-in-time inventory system, there is less emphasis on the need to eliminate scrap and rework problems.Answer: FALSEExplanation: There is more emphasis on the need to eliminate scrap and rework problems.Diff: 2Terms: just-in-time (JIT) productionObjective: 5AACSB: Reflective thinking24) Just-in-time systems are similar to materials requirement planning systems in that both systems aredemand-pull systems.Answer: FALSEExplanation: Just-in-time systems are not similar to materials requirement planning systems in that just-in-time production is a demand-pull system and materials requirements planning is a push-throughapproach.Diff: 2Terms: just-in-time (JIT) production, materials requirements planning (MRP)Objective: 5, 6AACSB: Analytical skills25) A financial benefit of a just-in-time system is that inventory carrying costs are reduced.Answer: TRUEDiff: 2Terms: just-in-time (JIT) production, just-in-time (JIT) purchasingObjective: 6AACSB: Reflective thinking26) In a just-in-time system, suppliers are selected primarily on the basis of their ability to provide materials andproducts at the lowest possible price.Answer: FALSEExplanation: In a just-in-time system, suppliers are selected on the basis of their ability to deliver quality materials in a timely manner.Diff: 2Terms: just-in-time (JIT) production, just-in-time (JIT) purchasingObjective: 6AACSB: Reflective thinking27) An Enterprise Resource Planning (ERP) System comprises a single database that collects data and feeds itinto software applications supporting all of a company's business activities.Answer: TRUEDiff: 2Terms: enterprise resource planning (ERP) systemObjective: 6AACSB: Use of Information Technology28) In a backflush-costing system, no record of work in process appears in the accounting records.Answer: TRUEDiff: 3Terms: backflush costingObjective: 7AACSB: Reflective thinking29) Backflush costing is a costing system that omits recording some or all of the journal entries relating to thestages from purchase of direct materials to the sales of finished goods.Answer: TRUEDiff: 2Terms: backflush costingObjective: 7AACSB: Reflective thinking30) A trigger point refers to the inventory level at which a reorder is generated.Answer: FALSEExplanation: A trigger point refers to the point at which a journal entry is made.Diff: 2Terms: trigger pointObjective: 7AACSB: Reflective thinking31) A firm using a backflush costing system will always use actual costs rather than standard costs.Answer: FALSEExplanation: A firm using a backflush costing system can use standard costs as well as actual costs.Diff: 2Terms: backflush costingObjective: 7AACSB: Reflective thinking32) The "flush" in backflush refers to the fact that there are no variances in a backflush costing system usingstandard costs.Answer: FALSEExplanation: The "flush" in backflush refers to the fact that costs are "flushed" out of the system after the product has been produced or sold.Diff: 2Terms: backflush costingObjective: 7AACSB: Reflective thinking33) Companies that have fast manufacturing lead times usually find that a version of backflush costing willreport cost numbers similar to what a sequential costing approach would report.Answer: TRUEDiff: 3Terms: backflush costingObjective: 8AACSB: Analytical skills34) Backflush costing is usually restricted to companies adopting JIT production methods.Answer: FALSEExplanation: Backflush costing is also helpful in companies that have fast manufacturing times, and that have very stable inventory.Diff: 3Terms: backflush costing, just-in-time (JIT) productionObjective: 8AACSB: Reflective thinking35) A positive aspect of backflush costing is the presence of the visible audit trail.Answer: FALSEExplanation: In backflush costing, the visible audit trail diminishes.Diff: 3Terms: backflush costingObjective: 8AACSB: Reflective thinking36) Lean accounting is a costing method that supports creating value for the customer by costing the entire valuestream, not individual products or departments, thereby eliminating waste in the accounting process.Answer: TRUEDiff: 3Terms: lean accountingObjective: 9AACSB: Reflective thinking37) Which of the following industries would have the highest cost of goods sold percentage relative to sales?A) computer manufacturersB) retail organizationsC) drug manufacturersD) The percentage will usually depend on the success of a particular company.Answer: BDiff: 2Terms: inventory managementObjective: 1AACSB: Reflective thinking38) The costs of goods acquired from suppliers including incoming freight or transportation costs are:A) purchasing costsB) ordering costsC) stockout costsD) carrying costsAnswer: ADiff: 2Terms: purchasing costsObjective: 1AACSB: Reflective thinking39) The costs of preparing, issuing, and paying purchase orders, plus receiving and inspecting the itemsincluded in orders is:A) purchasing costsB) ordering costsC) stockout costsD) carrying costsAnswer: BDiff: 2Terms: ordering costsObjective: 1AACSB: Reflective thinking40) The costs that result from theft of inventory are:A) shrinkage costsB) external failure costsC) stockout costsD) costs of qualityAnswer: ADiff: 2Terms: shrinkageObjective: 1AACSB: Reflective thinking41) The costs that result when a company runs out of a particular item for which there is a customer demand are:A) shrinkage costsB) shortage costsC) stockout costsD) EOQ estimation costsAnswer: CDiff: 2Terms: stockout costsObjective: 1AACSB: Reflective thinking42) The costs that result when features and characteristics of a product or service are not in conformance withthe specifications are:A) inspection costsB) costs of qualityC) purchasing costsD) design costsAnswer: BDiff: 2Terms: stockout costsObjective: 1AACSB: Reflective thinking43) The costs that result when a company holds an inventory of goods for sale:A) purchasing costsB) carrying costsC) opportunity costsD) interest costsAnswer: BDiff: 2Terms: stockout costsObjective: 1AACSB: Reflective thinking44) Quality costs include:A) purchasing costsB) ordering costsC) stockout costsD) prevention costsAnswer: DDiff: 2Terms: quality costsObjective: 1AACSB: Reflective thinking45) Obsolescence is an example of which cost category?A) carrying costsB) labor costsC) ordering costsD) quality costsAnswer: ADiff: 2Terms: carrying costsObjective: 2AACSB: Reflective thinking46) The costs associated with storage are an example of which cost category?A) quality costsB) labor costsC) ordering costsD) carrying costsAnswer: DDiff: 2Terms: carrying costsObjective: 2AACSB: Reflective thinking47) Which of the following is an assumption of the economic-order-quantity decision model?A) The quantity ordered can vary at each reorder point.B) Demand ordering costs and carrying costs fluctuate.C) There will be timely labor costs.D) No stockouts occur.Answer: DDiff: 2Terms: economic order quantity (EOQ)Objective: 2AACSB: Reflective thinking48) The economic order quantity ignores:A) purchasing costsB) relevant ordering costsC) stockout costsD) Both A and C are correct.Answer: DDiff: 3Terms: economic order quantity (EOQ)Objective: 2AACSB: Reflective thinking49) The purchase-order lead time is the:A) difference between the times an order is placed and deliveredB) difference between the products ordered and the products receivedC) discrepancies in purchase ordersD) time required to correct errors in the products receivedAnswer: ADiff: 2Terms: purchase-order lead timeObjective: 2AACSB: Reflective thinking50) Which of the following statements about the economic-order-quantity decision model is FALSE?A) It assumes purchasing costs are relevant when the cost per unit changes due to the quantity ordered.B) It assumes quality costs are irrelevant if quality is unaffected by the number of units purchased.C) It assumes stockout costs are irrelevant if no stockouts occur.D) It assumes ordering costs and carrying costs are relevant.Answer: ADiff: 3Terms: economic order quantity (EOQ)Objective: 2AACSB: Reflective thinking51) Relevant total costs in the economic-order-quantity decision model equal relevant ordering costs plusrelevant:A) carrying costsB) stockout costsC) quality costsD) purchasing costsAnswer: ADiff: 2Terms: economic order quantity (EOQ), ordering costs, carrying costsObjective: 2AACSB: Reflective thinking52) Phonic Goods is a distributor of videotapes. Tape-Disk Mart is a local retail outlet which sells blank andrecorded videos. Tape-Disk Mart purchases tapes from Phonic Goods at $3.00 per tape; tapes are shipped in packages of 20. Phonic Goods pays all incoming freight, and Tape-Disk Mart does not inspect the tapes due to Phonic Goods' reputation for high quality. Annual demand is 104,000 tapes at a rate of 4,000 tapes per week. Tape-Disk Mart earns 20% on its cash investments. The purchase-order lead time is two weeks. The following cost data are available:Relevant ordering costs per purchase order $90.50Carrying costs per package per year:Relevant insurance, materials handling,breakage, etc., per year $ 4.50What is the required annual return on investment per package?A) $60.00B) $2.50C) $12.00D) $0.60Answer: CExplanation: C) 20 tapes × $3.00 =$60.00$60.00 × 0.2 =$12.00Diff: 3Terms: ordering costs, carrying costsObjective: 3AACSB: Analytical skillsAnswer the following questions using the information below:Stereo Goods is a distributor of videotapes. Video Mart is a local retail outlet which sells blank and recorded videos.Video Mart purchases tapes from Stereo Goods at $5.00 per tape; tapes are shipped in packages of 25. Stereo Goods pays all incoming freight, and Video Mart does not inspect the tapes due to Stereo Goods' reputation for high quality. Annual demand is 104,000 tapes at a rate of 2,000 tapes per week. Video Mart earns 15% on its cash investments. Thepurchase -order lead time is one week. The following cost data are available:Relevant ordering costs per purchase order $94.50Carrying costs per package per year:Relevant insurance, materials handling,breakage, etc., per year $ 3.5053) What is the economic order quantity?A) 874 packagesB) 652 packagesC) 200 packagesD) 188 packagesAnswer:D Explanation: D) EOQ = The square root of [(2 × (104,000/25) × $94.50) / ($18.75 + $3.50)]EOQ = 188 packagesDiff: 2Terms:economic order quantity (EOQ) Objective:3 AACSB:Analytical skills 54) What are the relevant total costs?A) $6,150.50B) $4,182.56C) $2,560.20D) $1,951.70Answer:B Explanation: B) EOQ = The square root of [(2 × (104,000/25) × $94.50) / ($18.75 + $3.50)]EOQ = 188 packagesRTC = 2)]50.3$75.18($188[188]50.94$)25/000,104[(+⨯+⨯= $4,182.56 188 Diff: 3Terms:economic order quantity (EOQ), ordering costs, carrying costs Objective:3 AACSB:Analytical skills55) How many deliveries will be made during each time period?A) 22.1 deliveriesB) 26.0 deliveriesC) 29.4 deliveriesD) 32.0 deliveriesAnswer: AExplanation: A) EOQ = The square root of [(2 × (104,000/25) × $94.50) / ($18.75 + $3.50)]EOQ = 188 packages[(104,000 / 25) / 188] = 22.1 deliveriesDiff: 3Terms: economic order quantity (EOQ)Objective: 3AACSB: Analytical skillsAnswer the following questions using the information below:Green Grass Incorporated is a distributor of golf balls. Garry's Golf Supplies is a local retail outlet which sells golf balls. Garry's purchases the golf balls from Green Grass Incorporated at $0.75 per ball; the golf balls are shipped in cartons of 72. Green Grass Incorporated pays all incoming freight, and Garry's Golf Supplies does not inspect the balls due to Green Grass' reputation for high quality. Annual demand is 172,800 golf balls at a rate of 3,322 balls per week. Garry's Golf Supplies earns 12% on its cash investments. The purchase-order lead time is one week. The following cost data are available:Relevant ordering costs per purchase order $125.00Carrying costs per carton per year:Relevant insurance, materials handling,breakage, etc., per year $ 0.7756) If Garry's makes an order (1/12 of annual demand) once per month, what are the relevant total costs?A) $1,500B) $2,085.67C) 2,225.00D) $3,000.00Answer: CExplanation: C) Order Quantity = Annual Demand / 12 = 14,400 balls/month = 200 cartons per monthRTC = Ordering Costs + Carrying CostsCarrying Cost per carton =price × invest rate + insurance/handlingCarrying Cost per carton = ($.75 × 72 × 12%) + $0.77 = $7.25RTC = (12 × $125.00) + ((200/2) × $7.25) =$2,225.00Diff: 3Terms: economic order quantity (EOQ), ordering costs, carrying costsObjective: 3AACSB: Analytical skills57) What is the economic order quantity?A) 200 cartonsB) 288 cartonsC) 300 cartonsD) 388 cartonsAnswer: BExplanation: B) Annual Demand / 172,800 / 72 = 2,400 cartonsCarrying Cost per carton = ($.75 × 72 × 12%) + $0.77 = $7.25EOQ = The square root of [(2 × (172,800/72) × $125.00) / ($7.25)]EOQ = 287.7 cartons - round to 288Diff: 2Terms: economic order quantity (EOQ)Objective: 3AACSB: Analytical skills58) Purchasing at the EOQ recommended level, how many deliveries will be made during each time period?A) 2 deliveriesB) 6.0 deliveriesC) 8.3 deliveriesD) 12 deliveriesAnswer: CExplanation: C) Annual Demand / 172,800 / 72 = 2,400 cartonsCarrying Cost per carton = ($.75 × 72 × 12%) + $0.77 = $7.25EOQ = The square root of [(2 × (172,800/72) × $125.00) / ($7.25)]EOQ = 287.7 cartonsDeliveries = Annual Demand / EOQ = 8.3Diff: 3Terms: economic order quantity (EOQ)Objective: 3AACSB: Analytical skills59) Purchasing at the EOQ recommended level, what are the relevant total costs?A) $1,500.00B) $2,085.67C)$2,225.00 D) $3,000.00Answer:B Explanation: B) Annual Demand / 172,800 / 72 = 2,400 cartonsCarrying Cost per carton = ($.75 × 72 × 12%) + $0.77 = $7.25EOQ = The square root of [(2 × (172,800/72) × $125.00) / ($7.25)]EOQ = 287.7 cartonsRTC = 2)]25.7($7.287[7.287]00.125$)72/800,172[(⨯+⨯ = $2,085.67 Your solution might be slightly different based on rounding.Diff: 3Terms:economic order quantity (EOQ), ordering costs, carrying costs Objective:3 AACSB:Analytical skills Answer the following questions using the information below:The Wood Furniture company produces a specialty wood furniture product, and has the following information available concerning its inventory items:Relevant ordering costs per purchase order $150Relevant carrying costs per year:Required annual return on investment 10%Required other costs per year $1.40Annual demand is 10,000 packages per year. The purchase price per package is $16.60) What is the economic order quantity?A) 150,000 unitsB) 1,000 unitsC) 75,000 unitsD) 5,000 unitsAnswer:B Explanation: B) Unit carrying costs = ($16 × 0.10) + $1.40 = $3EOQ = The square root of [(2 × 10,000 × $150) / $3] = 1,000 unitsDiff: 3Terms:economic order quantity (EOQ) Objective:2 AACSB:Analytical skills61) What are the relevant total costs at the economic order quantity?A) $1,000B) $1,500C) $3,000D) $3,500Answer:C Explanation: C) Unit carrying costs = ($16 × 0.10) + $1.40 = $3EOQ = The square root of [(2 × 10,000 × $150) / $3] = 1,000 unitsRTC = ⎥⎦⎤⎢⎣⎡⨯+⨯2)3$000,1(000,1)150$000,10( = $3,000 Diff: 3Terms:economic order quantity (EOQ), ordering costs, carrying costs Objective:2 AACSB:Analytical skills 62) What are the total relevant costs, assuming the quantity ordered equals 500 units?A) $3,500B) $500C) $4,000D) $3,750Answer:D Explanation: D) RTC = ⎥⎦⎤⎢⎣⎡⨯+⨯2)3$500(500)150$000,10( = $3,750 Diff: 3Terms:economic order quantity (EOQ), ordering costs, carrying costs Objective:2 AACSB:Analytical skills 63) How many deliveries will be required at the economic order quantity?A) 1.0 deliveryB) 5.1 deliveriesC) 8.2 deliveriesD) 10.0 deliveriesAnswer:D Explanation: D) 10,000 / 1,000 = 10 deliveriesDiff: 3Terms:economic order quantity (EOQ) Objective:2 AACSB:Analytical skills 64) The annual relevant total costs are at a minimum when relevant:A) ordering costs are greater than the relevant carrying costsB) carrying costs are greater than the relevant ordering costsC) carrying costs are equal to relevant ordering costsD) None of these answers is correct.Answer:C Diff: 3Terms:economic order quantity (EOQ), ordering costs, carrying costs Objective:2 AACSB:Reflective thinking65) The reorder point is simplest to compute when:A) both demand and purchase-order lead times are known with certaintyB) the number of units sold variesC) the safety stock amount never variesD) the relevant ordering costs and the relevant carrying costs are equalAnswer: ADiff: 2Terms: economic order quantity (EOQ), reorder pointObjective: 3AACSB: Reflective thinking66) Diskette Company sells 200 discs per week. Purchase-order lead time is 1-1/2 weeks and the economic-orderquantity is 450 units. What is the reorder point?A) 200 unitsB) 300 unitsC) 750 unitsD) 1,125 unitsAnswer: BExplanation: B) 200 × 1.5= 300 unitsDiff: 2Terms: economic order quantity (EOQ), reorder pointObjective: 4AACSB: Analytical skills67) Wilson's Deli can predict with virtual certainty the demand for its products. Wilson's sells 20 hams perweek. Purchase-order lead time is 2 weeks and the economic-order quantity is 50 hams. What is the reorder point?A) 20 hamsB) 30 hamsC) 40 hamsD) 50 hamsAnswer: CExplanation: C) 20 × 2= 40 hamsDiff: 2Terms: economic order quantity (EOQ), reorder pointObjective: 4AACSB: Analytical skillsOwen-King Company sells optical equipment. Lens Company manufactures special glass lenses. Owen-King Company orders 5,200 lenses per year, 100 per week, at $20 per lens. Lens Company covers all shipping costs. Owen-King Company earns 30% on its cash investments. The purchase-order lead time is 2.5 weeks. Owen-King Company sells 125 lenses per week. The following data are available:Relevant ordering costs per purchase order $21.25Relevant insurance, materials handling, breakage,and so on, per year $ 2.5068) What is the economic order quantity for Owen-King Company?A) 325 lensesB) 297 lensesC) 210 lensesD) 161 lensesAnswer: DExplanation: D) EOQ = The square root of [(2 × 5,200 × $21.25) / (($20 × 30%) + $2.50)]EOQ = 161 lensesDiff: 2Terms: economic order quantity (EOQ)Objective: 4AACSB: Analytical skills69) What is the reorder point?A) 220.5 lensesB) 312.5 lensesC) 397.5 lensesD) 415.5 lensesAnswer: BExplanation: B) 125 lenses × 2.5 weeks = 312.5 lensesDiff: 2Terms: reorder pointObjective: 4AACSB: Analytical skillsThe following information applies to Labs Plus, which supplies microscopes to laboratories throughout the country. Labs Plus purchases the microscopes from a manufacturer which has a reputation for very high quality in its manufacturing operation.Annual demand (weekly demand= 1/52 of annual demand) 15,600 unitsOrders per year 20Lead time in days 15 daysCost of placing an order $10070) What are the annual relevant carrying costs, assuming each order was made at the economic-order-quantityamount?A) $200B) $1,000C) $2,000D) $6,000Answer: CExplanation: C) Annual carrying costs = annual ordering costs = $100 × 20 = $2,000Diff: 2Terms: economic order quantity (EOQ), carrying costsObjective: 2AACSB: Analytical skills71) What is the economic order quantity assuming each order was made at the economic-order-quantity amount?A) 15 unitsB) 20 unitsC) 780 unitsD) 1,040 unitsAnswer: CExplanation: C) 15,600/20 = 780Diff: 2Terms: economic order quantity (EOQ)Objective: 2AACSB: Analytical skills72) What is the reorder point?A) 780 unitsB) 643 unitsC) 1,560 unitsD) 1,680 unitsAnswer: BExplanation: B) 15,600/52 = 300/7 = 42.86 daily demand × 15 = 643Diff: 2Terms: reorder pointObjective: 1AACSB: Analytical skills。

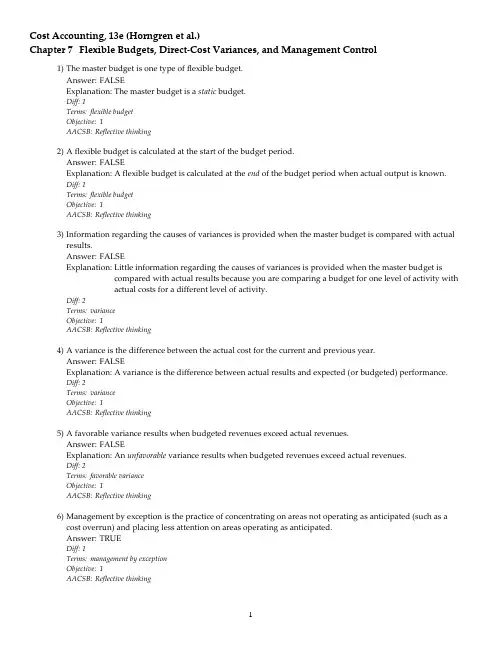

TRUE/FALSE1. Products, services, departments, and customers may be cost objects.Answer: True Difficulty: 1 Objective: 12. Costs are accounted for in two basic stages: assignment followed by accumulation.Answer: False Difficulty: 1 Objective: 1Costs are accounted for in two basic stages: accumulation followed by assignment. 3. Actual costs and budgeted costs are two different terms referring to the same thing.Answer: False Difficulty: 1 Objective: 1Budgeted costs are what is planned before the beginning of the accounting period,while actual costs are those costs compiled at the end of the accounting period.4. The same cost may be direct for one cost object and indirect for another cost object.Answer: True Difficulty: 3 Objective: 25. Assigning direct costs poses more problems than assigning indirect costs.Answer: False Difficulty: 2 Objective: 2Tracing direct costs is quite straightforward, whereas assigning indirect costs to anumber of different cost objects can be very challenging.6. Improvements in information-gathering technologies are making it possible to tracemore costs as direct.Answer: True Difficulty: 2 Objective: 27. Misallocated indirect costs may lead to promoting products that are not profitable.Answer: True Difficulty: 2 Objective: 28. The materiality of the cost is a factor in classifying the cost as a direct or indirect cost.Answer: True Difficulty: 2 Objective: 29. The cost of a customized machine only used in the production of a single productwould be classified as a direct cost.Answer: True Difficulty: 1 Objective: 210. Some fixed costs may be classified as direct manufacturing costs.Answer: True Difficulty: 1 Objective: 211. Fixed costs have no cost driver in the short run, but may have a cost driver in the longrun.Answer: True Difficulty: 2 Objective: 312. Costs that are difficult to change over the short run are always variable over the longrun.Answer: True Difficulty: 2 Objective: 313. Knowing whether a cost is a period or a product cost helps to estimate total costs at anew level of activity.Answer: False Difficulty: 2 Objective: 3Knowing whether a cost is a variable or a fixed cost helps to estimate total costs at a new level of activity.14. A decision maker cannot adjust capacity over the short run.Answer: True Difficulty: 1 Objective: 315. Fixed costs vary with the level of production or sales volume.Answer: False Difficulty: 1 Objective: 3Variable costs vary with the level of production or sales volume.16. Currently, most administrative personnel costs would be classified as fixed costs.Answer: True Difficulty: 1 Objective: 317. Fixed costs depend on the resources used, not the resources acquired.Answer: False Difficulty: 2 Objective: 3Fixed costs depend on the resources acquired, and not whether the resources are used or not.18. When making decisions using fixed costs, the focus should be on total costs and notunit costs.Answer: True Difficulty: 2 Objective: 419. When 50,000 units are produced the fixed cost is $10 per unit. Therefore, when100,000 units are produced fixed costs will remain at $10 per unit.Answer: False Difficulty: 3 Objective: 4When 100,000 units are produced fixed costs will decrease to $5 per unit.20. Service-sector companies provide services or intangible products to their customers.Answer: True Difficulty: 1 Objective: 5 MULTIPLE CHOICE37. Cost objects includea. products.b. customers.c. departments.d. all of the above.Answer: d Difficulty: 2 Objective: 138. Actual costs area. the costs incurred.b. budgeted costs.c. estimated costs.d. forecasted costs.Answer: a Difficulty: 1 Objective: 139. The general term used to identify both the tracing and the allocation of accumulatedcosts to a cost object isa. cost accumulation.b. cost assignment.c. cost tracing.d. conversion costing.Answer: b Difficulty: 1 Objective: 140. The collection of accounting data in some organized way isa. cost accumulation.b. cost assignment.c. cost tracing.d. conversion costing.Answer: a Difficulty: 1 Objective: 141. Cost tracing isa. the assignment of direct costs to the chosen cost object.b. a function of cost allocation.c. the process of tracking both direct and indirect costs associated with a cost object.d. the process of determining the actual cost of the cost object.Answer: a Difficulty: 2 Objective: 242. Cost allocation isa. the process of tracking both direct and indirect costs associated with a cost object.b. the process of determining the actual cost of the cost object.c. the assignment of indirect costs to the chosen cost object.d. a function of cost tracing.Answer: c Difficulty: 2 Objective: 243. The determination of a cost as being either direct or indirect depends upona. the accounting system.b. the allocation system.c. the cost tracing system.d. the cost object chosen.Answer: d Difficulty: 2 Objective: 244. Classifying a cost as either direct or indirect depends upona. the behavior of the cost in response to volume changes.b. whether the cost is expensed in the period in which it is incurred.c. whether the cost can be easily identified with the cost object.d. whether an expenditure is avoidable or not in the future.Answer: c Difficulty: 2 Objective: 245. A manufacturing plant produces two product lines: football equipment and hockeyequipment. Direct costs for the football equipment line are thea. beverages provided daily in the plant break room.b. monthly lease payments for a specialized piece of equipment needed tomanufacture the football helmet.c. salaries of the clerical staff that work in the company administrative offices.d. utilities paid for the manufacturing plant.Answer: b Difficulty: 2 Objective: 246. A manufacturing plant produces two product lines: football equipment and hockeyequipment. An indirect cost for the hockey equipment line is thea. material used to make the hockey sticks.b. labor to bind the shaft to the blade of the hockey stick.c. shift supervisor for the hockey line.d. plant supervisor.Answer: d Difficulty: 2 Objective: 247. Which one of the following items is a direct cost?a. Customer-service costs of a multiproduct firm; Product A is the cost object.b. Printing costs incurred for payroll check processing; payroll check processing isthe cost object.c. The salary of a maintenance supervisor in a multiproduct manufacturing plant;Product B is the cost object.d. Utility costs of the administrative offices; the accounting department is the costobject.Answer: b Difficulty: 2 Objective: 248. Indirect manufacturing costsa. can be traced to the product that created the costs.b. can be easily identified with the cost object.c. generally include the cost of material and the cost of labor.d. may include both variable and fixed costs.Answer: d Difficulty: 2 Objective: 249. All of the following are true EXCEPT that indirect costsa. may be included in prime costs.b. are not easily traced to products or services.c. vary with the selection of the cost object.d. may be included in manufacturing overhead.Answer: a Difficulty: 2 Objective: 250. Which statement is TRUE?a. All variable costs are direct costs.b. Because of a cost-benefit tradeoff, some direct costs may be treated as indirectcosts.c. All fixed costs are indirect costs.d. All direct costs are variable costs.Answer: b Difficulty: 3 Objective: 251. Cost behavior refers toa. classifying costs as either inventoriable or period costs.b. how costs react to a change in the level of activity.c. whether a particular expense has been ethically incurred.d. whether a cost is incurred in a manufacturing, merchandising, or servicecompany.Answer: b Difficulty: 2 Objective: 352. An understanding of the underlying behavior of costs helps in all of the followingEXCEPTa. costs can be better estimated as volume expands and contracts.b. true costs can be better evaluated.c. process inefficiencies can be better identified and as a result improved.d. sales volume can be better estimated.Answer: d Difficulty: 2 Objective: 3 53. At a plant where a union agreement sets annual salaries and conditions, annual laborcosts usuallya. are considered a variable cost.b. are considered a fixed cost.c. depend on the scheduling of floor workers.d. depend on the scheduling of production runs.Answer: b Difficulty: 2 Objective: 354. Variable costsa. are always indirect costs.b. increase in total when the actual level of activity increases.c. include most personnel costs and depreciation on machinery.d. can always be traced directly to the cost object.Answer: b Difficulty: 2 Objective: 355. Fixed costsa. may include either direct or indirect costs.b. vary with production or sales volumes.c. include parts and materials used to manufacture a product.d. can be adjusted in the short run to meet actual demands.Answer: a Difficulty: 2 Objective: 356. Fixed costs depend ona. the amount of resources used.b. the amount of resources acquired.c. the volume of production.d. the volume of sales.Answer: b Difficulty: 3 Objective: 357. Which one of the following is a variable cost in an insurance company?a. Rentb. President's salaryc. Sales commissionsd. Property taxesAnswer: c Difficulty: 1 Objective: 358. Which of the following is a fixed cost in an automobile manufacturing plant?a. Administrative salariesb. Electricity used by assembly-line machinesc. Sales commissionsd. Windows for each car producedAnswer: a Difficulty: 2 Objective: 359. If each furnace required a hose that costs $20 and 2,000 furnaces are produced for themonth, the total cost for hoses isa. considered to be a direct fixed cost.b. considered to be a direct variable cost.c. considered to be an indirect fixed cost.d. considered to be an indirect variable cost.Answer: b Difficulty: 3 Objective: 360. The MOST likely cost driver of distribution costs isa. the number of parts within the product.b. the number of miles driven.c. the number of products manufactured.d. the number of production hours.Answer: b Difficulty: 2 Objective: 361. The MOST likely cost driver of direct material costs isa. the number of parts within the product.b. the number of miles driven.c. the number of products manufactured.d. the number of production hours.Answer: c Difficulty: 2 Objective: 362. Which of the following statements is FALSE?a. There is a cause-and-effect relationship between the cost driver and the level ofactivity.b. Fixed costs have cost drivers over the short run.c. Over the long run all costs have cost drivers.d. Volume of production is a cost driver of direct manufacturing costs.Answer: b Difficulty: 2 Objective: 363. A band of normal activity or volume in which specific cost-volume relationships aremaintained is referred to asa. the average range.b. the cost-allocation range.c. the cost driver range.d. the relevant range.Answer: d Difficulty: 1 Objective: 364. Within the relevant range, if there is a change in the level of the cost driver thena. total fixed costs and total variable costs will change.b. total fixed costs and total variable costs will remain the same.c. total fixed costs will remain the same and total variable costs will change.d. total fixed costs will change and total variable costs will remain the same.Answer: c Difficulty: 2 Objective: 365. Within the relevant range, if there is a change in the level of the cost driver thena. fixed and variable costs per unit will change.b. fixed and variable costs per unit will remain the same.c. fixed costs per unit will remain the same and variable costs per unit will change.d. fixed costs per unit will change and variable costs per unit will remain the same.Answer: d Difficulty: 2 Objective: 366. When 10,000 units are produced, fixed costs are $14 per unit. Therefore, when 20,000units are produced fixed costsa. will increase to $28 per unit.b. will remain at $14 per unit.c. will decrease to $7 per unit.d. will total $280,000.Answer: c Difficulty: 3 Objective: 467. When 10,000 units are produced, variable costs are $6 per unit. Therefore, when 20,000units are produceda. variable costs will total $120,000.b. variable costs will total $60,000.c. variable unit costs will increase to $12 per unit.d. variable unit costs will decrease to $3 per unit.Answer: a Difficulty: 3 Objective: 468. Christi Manufacturing provided the following information for last month.Sales $10,000Variable costs 3,000Fixed costs 5,000Operating income $2,000If sales double next month, what is the projected operating income?a. $4,000b. $7,000c. $9,000d. $12,000Answer: c Difficulty: 3 Objective: 4(10,000 x 2) - ($3,000 x 2) - $5,000 = $9,00069. Kym Manufacturing provided the following information for last month.Sales $12,000Variable costs 4,000Fixed costs 1,000Operating income $7,000If sales double next month, what is the projected operating income?a. $14,000b. $15,000c. $18,000d. $19,000Answer: b Difficulty: 3 Objective: 4(12,000 x 2) - ($4,000 x 2) - $1,000 = $15,00070. Wheel and Tire Manufacturing currently produces 1,000 tires per month. The followingper unit data apply for sales to regular customers:Direct materials $20Direct manufacturing labor 3Variable manufacturing overhead 6Fixed manufacturing overhead 10Total manufacturing costs $39The plant has capacity for 3,000 tires and is considering expanding production to 2,000 tires. What is the total cost of producing 2,000 tires?a. $39,000b. $78,000c. $68,000d. $62,000Answer: c Difficulty: 2 Objective: 4[($20 + $3 + $6) x 2,000 units] + ($10 x 1,000 units) = $68,00071. Tire and Spoke Manufacturing currently produces 1,000 bicycles per month. Thefollowing per unit data apply for sales to regular customers:Direct materials $50Direct manufacturing labor 5Variable manufacturing overhead 14Fixed manufacturing overhead 10Total manufacturing costs $79The plant has capacity for 3,000 bicycles and is considering expanding production to 2,000 bicycles. What is the per unit cost of producing 2,000 bicycles?a. $79 per unitb. $158 per unitc. $74 per unitd. $134 per unitAnswer: c Difficulty: 3 Objective: 4[($50 + $5 + $14) x 2,000 units] + ($10 x 1,000 units) = $148,000 / 2,000 units = $74 THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 72 AND 73.Axle and Wheel Manufacturing currently produces 1,000 axles per month. The following per unit data apply for sales to regular customers:Direct materials $30Direct manufacturing labor 5Variable manufacturing overhead 10Fixed manufacturing overhead 40Total manufacturing costs $8572 The plant has capacity for 2,000 axles and is considering expanding production to 1,500axles. What is the total cost of producing 1,500 axles?a. $85,000b. $170,000c. $107,500d. $102,500Answer: c Difficulty: 2 Objective: 4[($30 + $5 + $10) x 1,500 units] + ($40 x 1,000 units) = $107,50073. What is the per unit cost when producing 1,500 axles?a. $71.67b. $107.50c. $85.00d. $170.00Answer: a Difficulty: 2 Objective: 4$107,500 / 1,500 = $71.67THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 74 THROUGH 76. Pederson Company reported the following:Manufacturing costs $2,000,000Units manufactured 50,000Units sold 47,000 units sold for $75 per unitBeginning inventory 0 units74. What is the average manufacturing cost per unit?a. $40.00b. $42.55c. $00.025d. $75.00Answer: a Difficulty: 1 Objective: 4$2,000,000 / 50,000 = $40.0075. What is the amount of ending finished goods inventory?a. $1,880,000b. $120,000c. $225,000d. $105,000Answer: b Difficulty: 2 Objective: 4(50,000 - 47,000) x $40.00 = $120,00076. What is the amount of gross margin?a. $1,750,000b. $3,525,000c. $5,405,000d. $1,645,000Answer: d Difficulty: 3 Objective: 747,000 x ($75 - $40) = $1,645,000THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 77 THROUGH 79. The following information pertains to Alleigh’s Mannequins:Manufacturing costs $1,500,000Units manufactured 30,000Units sold 29,500 units sold for $85 per unitBeginning inventory 0 units77. What is the average manufacturing cost per unit?a. $50.00b. $50.85c. $17.65d. $85.00Answer: a Difficulty: 1 Objective: 4$1,500,000 / 30,000 = $50.0078. What is the amount of ending finished goods inventory?a. $42,500b. $25,424c. $25,000d. $1,475,000Answer: c Difficulty: 2 Objective: 4(30,000 - 29,500) x $50.00 = $25,00079. What is the amount of gross margin?a. $1,475,000b. $1,500,000c. $2,507,500d. $1,032,500Answer: d Difficulty: 3 Objective: 729,500 x ($85 - $50) = $1,032,50080. Which of the following companies is part of the service sector of our economy?a. Wal-Martb. Bank of Americac. General Motorsd. Answer: b Difficulty: 1 Objective: 581. Which of the following companies is part of the merchandising sector of our economy?a. General Motorsb. Intelc. The GAPd. Robert Meyer Accounting FirmAnswer: c Difficulty: 1 Objective: 582. Which of the following companies is part of the manufacturing sector of our economy?a. Nikeb. Barnes & Noblec. Corvette Law Firmd. Sears, Roebuck, and CompanyAnswer: a Difficulty: 1 Objective: 583. Service-sector companies reporta. only merchandise inventory.b. only finished goods inventory.c. direct materials inventory, work-in-process inventory, and finished goodsinventory accounts.d. no inventory accounts.Answer: d Difficulty: 1 Objective: 684. Manufacturing-sector companies reporta. only merchandise inventory.b. only finished goods inventory.c. direct materials inventory, work-in-process inventory, and finished goodsinventory accounts.d. no inventory accounts.Answer: c Difficulty: 1 Objective: 685. For a manufacturing company, direct material costs may be included ina. direct materials inventory only.b. merchandise inventory only.c. both work-in-process inventory and finished goods inventory.d. direct materials inventory, work-in-process inventory, and finished goodsinventory accounts.Answer: d Difficulty: 3 Objective: 686. For a manufacturing company, direct labor costs may be included ina. direct materials inventory only.b. merchandise inventory only.c. both work-in-process inventory and finished goods inventory.d. direct materials inventory, work-in-process inventory, and finished goodsinventory accounts.Answer: c Difficulty: 3 Objective: 687. For a manufacturing company, indirect manufacturing costs may be included ina. direct materials inventory only.b. merchandise inventory only.c. both work-in-process inventory and finished goods inventory.d. direct materials inventory, work-in-process inventory, and finished goodsinventory accounts.Answer: c Difficulty: 3 Objective: 688. For a manufacturing-sector company, the cost of factory insurance is classified as aa. direct material cost.b. direct manufacturing labor cost.c. manufacturing overhead cost.d. period cost.Answer: c Difficulty: 1 Objective: 689. For a printing company, the cost of paper is classified as aa. direct material cost.b. direct manufacturing labor cost.c. manufacturing overhead cost.d. period cost.Answer: a Difficulty: 1 Objective: 690. Wages paid to machine operators on an assembly line are classified as aa. direct material cost.b. direct manufacturing labor cost.c. manufacturing overhead cost.d. period cost.Answer: b Difficulty: 1 Objective: 6 91. Manufacturing overhead costs in an automobile manufacturing plant MOST likelyincludea. labor costs of the painting department.b. indirect material costs such as lubricants.c. sales commissions.d. steering wheel costs.Answer: b Difficulty: 1 Objective: 692. Manufacturing overhead costs are also referred to asa. indirect manufacturing costs.b. prime costs.c. period costs.d. conversion costs.Answer: a Difficulty: 1 Objective: 6THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 93 THROUGH 97. Gilley Incorporated reported the following information:On January 31, 20x3:Job #101 was the only job in process with accumulated costs of $3,000.During February the following costs were added to production:Job #101 $10,000Job #102 $ 8,000Job #103 $ 7,000On February 28, 20x3:Job #101 was completed and sold for $18,000.Job #102 was completed but not sold.Job #103 remains in production.93. What is work-in-process inventory on February 28, 20x3?a. $7,000b. $8,000c. $25,000d. $3,000Answer: a Difficulty: 1 Objective: 6Job #103 $7,00094. What is finished goods inventory on February 28, 20x3?a. $7,000b. $8,000c. $21,000d. $10,000Answer: b Difficulty: 1 Objective: 6Job #102 $8,00095. What is cost of goods manufactured for February?a. $10,000b. $8,000c. $13,000d. $21,000Answer: d Difficulty: 3 Objective: 7(Job #101 $13,000) + (Job #102 $8,000)96. What is cost of goods sold for February?a. $18,000b. $10,000c. $13,000d. $21,000Answer: c Difficulty: 2 Objective: 7Job #101 $13,00097. What is gross margin for February?a. $5,000b. $18,000c. $8,000d. $13,000Answer: a Difficulty: 3 Objective: 7 $18,000 - $13,000 = $5,00098. The income statement of a manufacturing firm reportsa. period costs only.b. inventoriable costs only.c. both period and inventoriable costs.d. period and inventoriable costs but at different times, the reporting varies.Answer: c Difficulty: 2 Objective: 799. The income statement of a service-sector firm reportsa. period costs only.b. inventoriable costs only.c. both period and inventoriable costs.d. period and inventoriable costs but at different times, the reporting varies.Answer: a Difficulty: 2 Objective: 7 100. Manufacturing costs include all EXCEPTa. costs incurred inside the factory.b. both direct and indirect costs.c. both variable and fixed costs.d. both inventoriable and period costs.Answer: d Difficulty: 2 Objective: 7 101. Inventoriable costsa. include administrative and marketing costs.b. are expensed in the accounting period sold.c. are particularly useful in management accounting.d. are also referred to as nonmanufacturing costs.Answer: b Difficulty: 2 Objective: 7 102. Inventoriable costs are expensed on the income statementa. when direct materials for the product are purchased.b. after the products are manufactured.c. when the products are sold.d. not at any particular time, it varies.Answer: c Difficulty: 2 Objective: 7103. Costs that are initially recorded as assets and expensed when sold are referred to asa. period costs.b. inventoriable costs.c. variable costs.d. fixed costs.Answer: b Difficulty: 2 Objective: 7104. For merchandising companies, inventoriable costs includea. the cost of the goods themselves.b. incoming freight costs.c. insurance costs for the goods.d. all of the above.Answer: d Difficulty: 2 Objective: 7105. For manufacturing firms, inventoriable costs includea. plant supervisor salaries.b. research and development costs.c. costs of dealing with customers after the sale.d. distribution costs.Answer: a Difficulty: 2 Objective: 7106. A plant manufactures several different products. The wages of the plant supervisor can be classified as a(n)a. direct cost.b. inventoriable cost.c. variable cost.d. period cost.Answer: b Difficulty: 2 Objective: 7107. The cost of inventory reported on the balance sheet may include all of the following EXCEPTa. customer-service costs.b. wages of the plant supervisor.c. depreciation of the factory equipment.d. the cost of parts used in the manufacturing process.Answer: a Difficulty: 2 Objective: 7108. For a computer manufacturer, period costs include the cost ofa. the keyboard.b. labor used for assembly and packaging.c. distribution.d. assembly-line equipment.Answer: c Difficulty: 1 Objective: 7109. Period costsa. include only fixed costs.b. seldom influence financial success or failure.c. include the cost of selling, delivering, and after-sales support for customers.d. should be treated as an indirect cost rather than as a direct manufacturing cost.Answer: c Difficulty: 2 Objective: 7110. Period costsa. are treated as expenses in the period they are incurred.b. are directly traceable to products.c. include direct labor.d. are also referred to as manufacturing overhead costs.Answer: a Difficulty: 2 Objective: 7111. Which of the following is NOT a period cost?a. Marketing costsb. General and administrative costsc. Research and development costsd. Manufacturing costsAnswer: d Difficulty: 1 Objective: 7112. Costs expensed on the income statement in the accounting period incurred are referred to asa. direct costs.b. indirect costs.c. period costs.d. inventoriable costs.Answer: c Difficulty: 1 Objective: 7113. Prime costs includea. direct materials and direct manufacturing labor costs.b. direct manufacturing labor and manufacturing overhead costs.c. direct materials and manufacturing overhead costs.d. only direct materials.Answer: a Difficulty: 1 Objective: 7114. Conversion costs includea. direct materials and direct manufacturing labor costs.b. direct manufacturing labor and manufacturing overhead costs.c. direct materials and manufacturing overhead costs.d. only direct materials.Answer: b Difficulty: 1 Objective: 7115. Total manufacturing costs equala. direct materials + prime costs.b. direct materials + conversion costs.c. direct manufacturing labor costs + prime costs.d. direct manufacturing labor costs + conversion costs.Answer: b Difficulty: 2 Objective: 7116. The cost classification system used by manufacturing firms include all of the following EXCEPTa. direct materials costs and conversion costs.b. direct materials costs, direct manufacturing labor costs, and manufacturingoverhead costs.c. indirect materials costs, indirect manufacturing labor costs, and manufacturingoverhead costs.d. prime costs and manufacturing overhead costs.Answer: c Difficulty: 2 Objective: 7117. Manufacturing overhead costs may include all EXCEPTa. salaries of the plant janitorial staff.b. labor that can be traced to individual products.c. wages paid for unproductive time due to machine breakdowns.d. overtime premiums paid to plant workers.Answer: b Difficulty: 3 Objective: 7118. Debated items that some companies include as direct manufacturing labor includea. fringe benefits.b. vacation pay.c. training time.d. all of the above.Answer: d Difficulty: 2 Objective: 7119. Brenda Hicks is paid $10 an hour for straight-time and $15 an hour for overtime. One week she worked 42 hours, which included 2 hours of overtime. Compensation would be reported asa. $400 of direct labor and $30 of manufacturing overhead.b. $400 of direct labor and $zero of manufacturing overhead.c. $420 of direct labor and $10 of manufacturing overhead.d. $430 of direct labor and $zero of manufacturing overhead.Answer: c Difficulty: 2 Objective: 7Direct labor (42 hours x $10) + Overtime premium (2 hrs x $5) = $430。