XX国内银行招股说明书(香港联交所-英汉对照)

- 格式:doc

- 大小:46.50 KB

- 文档页数:14

新视角全国商情93 法商英语翻译初探———以招股说明书为例郑昊霞(北京工商大学外国语学院,北京100048) 摘要:Katharina Reiss的翻译类型学理论认为文本按交际功能区可分信息型文本、表达型文本、呼吁型文本。

法律文本属于呼吁型文本。

这对于招股说明书这一特定法律文件的文本类型分析及翻译过程中的策略选择具有指导意义。

分析表明招股说明书是带有信息功能的呼吁型文本,实际上是一种混合型文本,因此对其所采用的翻译策略和方法是适用于两种文本类型的混合的策略和方法。

关键词:招股说明书;信息型文本;呼吁型文本一、引言根据Katharina Reiss的翻译类型学理论,不同类型的文本根据其类型特征应该采取不同的翻译策略。

按照主体交际功能分类,主要有信息型文本(informative text)、表达型文本(expressive text)、呼吁型文本(operative text)。

法律的主要功能在于规范人们的行为,呼吁人们应该去做什么,禁止做什么。

因此,从理论上讲,绝大多数法律文本应该属于呼吁型文本。

作为呼吁型文本,法律文本的翻译应采用特定的策略和方法。

招股说明书(prospectus,简称为招股书)是一家企业在上市过程中必须具备的最重要最核心的法律文件。

只要是募集股份,无论是发起人向社会公开募集股份,还是已成立的股份有限公司发行的新的股份,都必须制定招股说明书,并予以公告。

招股书通常由拟上市企业聘请的中介机构负责撰写,主要包括投资银行、律师事务所、会计师事务所等,其中律师事务所负责文件的执笔,企业和相关中介机构负责提供相关部分的内容。

招股书定稿完成后,须报请监管部门审批,再将招股书向社会公开发布。

本文论及的是我国内陆企业前往香港特区公开募集股份时所需制定的招股书。

选择在香港上市发行股票的企业,除了履行与在内陆上市类似的相关手续之外,还需要将律师事务所撰写完成的招股说明书(prospectus,香港称之为招股章程,招股书或发行章程)的英文稿译成汉语,并最终提供英汉两种语言版本的招股书,因而涉及到招股说明书的英译汉问题。

中国各大交易所上市标准对比1.引言1.1 概述中国各大交易所上市标准对比的文章旨在比较中国各大交易所的上市标准,并探讨这些标准对中国企业选择交易所及中国交易所上市标准的发展趋势所产生的影响。

本文将对上海证券交易所、深圳证券交易所、香港交易所、纽约证券交易所、伦敦证券交易所和日本证券交易所的上市标准进行详细对比,并分析这些标准之间的差异以及其对企业的影响。

在全球资本市场中,各个交易所制定了一系列标准,以确保上市企业的质量和透明度。

这些标准包括财务报告要求、市值要求、公司治理要求等,不同交易所对这些要求的设定可能存在差异。

了解这些差异有助于企业了解选择哪个交易所上市的利弊,进而为企业的发展提供战略指导。

本文将首先介绍各个交易所的上市标准,其中包括上海证券交易所、深圳证券交易所、香港交易所、纽约证券交易所、伦敦证券交易所和日本证券交易所。

从上市标准的角度来看,这些交易所在财务报告、资本要求、治理要求等方面存在差异。

接下来,文章将对这些上市标准进行比较分析。

我们将探讨差异所带来的影响,例如,某些交易所对公司财务报告的要求更为严格,可能会增加企业的财务披露压力,但也能提高市场参与者对企业的信任程度。

同时,我们还将分析不同标准对中国企业选择交易所的影响,了解到底哪些因素会影响中国企业选择一家交易所进行上市。

最后,我们将展望中国交易所上市标准的发展趋势。

随着中国经济的不断发展和国际化进程的推进,中国交易所将面临着更多的挑战和机遇。

因此,了解中国交易所上市标准的发展趋势对企业和投资者来说将具有重要意义。

通过本文的研究,希望能够帮助读者更好地了解中国各大交易所的上市标准,以及这些标准对企业和市场的影响。

同时,本文也希望为中国企业选择交易所和中国交易所上市标准的未来发展提供一些参考和思考。

1.2 文章结构本文将对中国各大交易所的上市标准进行比较,以探讨不同交易所对企业上市的要求和规定。

文章分为如下几个部分:第一部分为引言,包括概述、文章结构和目的。

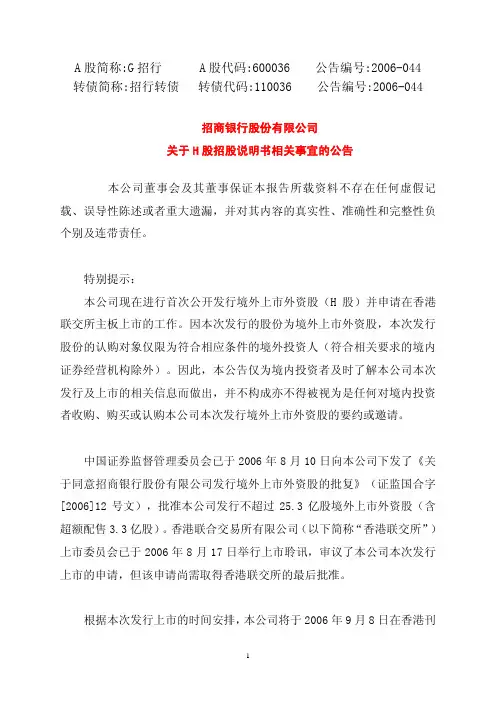

A股简称:G招行 A股代码:600036 公告编号:2006-044 转债简称:招行转债 转债代码:110036 公告编号:2006-044

招商银行股份有限公司

关于H股招股说明书相关事宜的公告

本公司董事会及其董事保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

特别提示:

本公司现在进行首次公开发行境外上市外资股(H股)并申请在香港联交所主板上市的工作。

因本次发行的股份为境外上市外资股,本次发行股份的认购对象仅限为符合相应条件的境外投资人(符合相关要求的境内证券经营机构除外)。

因此,本公告仅为境内投资者及时了解本公司本次发行及上市的相关信息而做出,并不构成亦不得被视为是任何对境内投资者收购、购买或认购本公司本次发行境外上市外资股的要约或邀请。

中国证券监督管理委员会已于2006年8月10日向本公司下发了《关于同意招商银行股份有限公司发行境外上市外资股的批复》(证监国合字[2006]12号文),批准本公司发行不超过25.3亿股境外上市外资股(含超额配售3.3亿股)。

香港联合交易所有限公司(以下简称“香港联交所”)上市委员会已于2006年8月17日举行上市聆讯,审议了本公司本次发行上市的申请,但该申请尚需取得香港联交所的最后批准。

根据本次发行上市的时间安排,本公司将于2006年9月8日在香港刊

1。

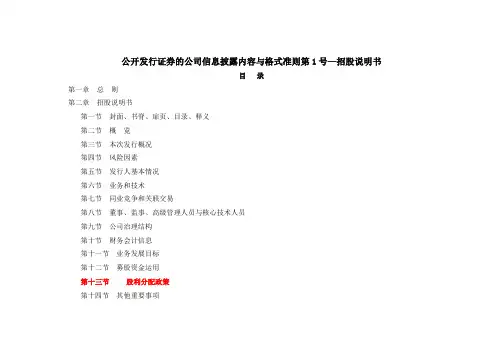

公开发行证券的公司信息披露内容与格式准则第1号—招股说明书

目录

第一章总则

第二章招股说明书

第一节封面、书脊、扉页、目录、释义

第二节概览

第三节本次发行概况

第四节风险因素

第五节发行人基本情况

第六节业务和技术

第七节同业竞争和关联交易

第八节董事、监事、高级管理人员与核心技术人员

第九节公司治理结构

第十节财务会计信息

第十一节业务发展目标

第十二节募股资金运用

第十三节股利分配政策

第十四节其他重要事项

第十五节董事及有关中介机构声明

第十六节附录和备查文件

第三章招股说明书摘要

第一节特别提示和风险因素

第二节本次发行概况

第三节发行人基本情况

第四节募股资金运用

第五节其他重要事项

第六节本次发行各方当事人和发行时间安排第七节附录和备查文件

第四章附则。

第1篇第一章总则一、公司概况DDC Enterprise Limited(以下简称“公司”或“DDC”)是一家专注于科技创新、智慧城市解决方案和绿色能源领域的领先企业。

公司成立于XX年,总部位于中国XX省XX市。

公司致力于为客户提供一站式的智慧城市解决方案,包括智慧交通、智慧能源、智慧环保等领域。

公司凭借强大的技术研发能力、丰富的行业经验和专业的服务团队,已在国内市场树立了良好的品牌形象。

二、招股说明书目的本招股说明书旨在向投资者全面介绍公司的基本情况、业务模式、财务状况、风险因素等,以便投资者充分了解公司,作出明智的投资决策。

第二章公司基本情况一、公司简介DDC Enterprise Limited成立于XX年,注册资本XX万元。

公司主要从事以下业务:1. 智慧城市解决方案:为客户提供智慧交通、智慧能源、智慧环保等领域的整体解决方案;2. 绿色能源:研发、生产、销售太阳能光伏产品;3. 研发与创新:进行新技术、新产品的研究与开发。

二、公司组织结构公司组织结构包括董事会、监事会、高级管理层和各部门。

董事会负责公司的战略决策和监督;监事会负责监督董事会和管理层的工作;高级管理层负责公司的日常运营;各部门负责各自业务领域的具体工作。

三、公司股权结构公司股权结构如下:- 国家股东:XX%- 自然人股东:XX%- 境外股东:XX%第三章业务模式一、智慧城市解决方案公司智慧城市解决方案业务主要包括以下几个方面:1. 智慧交通:通过智能交通管理系统,优化交通流量,提高道路通行效率,降低交通拥堵;2. 智慧能源:通过智能能源管理系统,实现能源的合理分配和高效利用,降低能源消耗;3. 智慧环保:通过智能环保系统,对环境污染进行实时监测和治理,保护生态环境。

二、绿色能源公司绿色能源业务主要包括以下几个方面:1. 太阳能光伏产品研发:公司拥有一支专业的研发团队,致力于太阳能光伏产品的研发和创新;2. 太阳能光伏产品生产:公司拥有多条太阳能光伏生产线,可满足国内外市场需求;3. 太阳能光伏产品销售:公司通过线上线下渠道,将太阳能光伏产品销售到全国各地。

某银行招股意向书范例________银行股份有限公司首次公开发行股票(A股)招股意向书摘要http:____________________年___月___日___:___中国证券网-_____证券报第一节重大事项提示经中国证监会核准,本行在境内进行本次A股发行。

本行同时在境外进行H股的发行。

本招股意向书是本行仅为在中国境内公开发行A股股份而披露的。

除用于在中国境内发行本行A股股份外,本招股意向书并不构成出售任何证券的要约或对任何方发出的购买任何证券的要约邀请。

本招股意向书不得用作且不构成在任何其他司法辖区或在任何其他情况下的要约和要约邀请。

除中国境内、香港或日本之外,本行并未采取任何行动或准许任何人在任何司法辖区公开发行本行股份,本行亦未采取任何行动或准许任何人在中国境外的任何司法辖区分发本招股意向书。

在任何其他司法辖区分发本招股意向书或发行本行股份可能是一种受当地法律法规限制或禁止的行为,除非这种行为已根据当地的证券法律法规进行注册登记或得到豁免。

就本次A股发行,A股投资者仅可使用本招股意向书及本行就本次A股发行披露的相关信息,而不得使用或依赖本行于境外依法向合资格H股投资者披露的H股招股说明书及H股发行相关信息。

本行特别提示投资者:本次A股发行与同时进行的H股发行并非互为条件。

由于境内外会计准则和监管要求的区别,本招股意向书与境外分发的H股招股说明书在内容与格式方面可能存在若干差异,提请投资者关注。

此外,对于本行_____年____月____日至上市日期间实现的可供分配利润,不进行分红,归新老股东共享。

第二节本次发行概况第三节发行人基本情况一、本行基本情况1.发行人名称(中文):________银行股份有限公司发行人名称(英文):_______________________________2.注册资本:______________万元3.法定代表人:_________4.成立日期:_________年____月_____日5.住所:____________________________邮政编码:______________6.电话号码:______________7.传真号码:______________8.互联网网址:http:______________9.电子信箱:______________二、公司简要历史沿革(一)历史沿革本行是经国务院办公厅及人民银行的批准,于________年________月________日在________集团原银行部基础上改组而成,原名_______实业银行。

商业银行募股说明书通用模板**商业银行股份有限公司(以下简称“本行”)为引入优质战略投资者,完善法人治理,增强资本实力和市场竞争能力,进一步提高金融服务水平,现面向社会公开募集股份。

[特别声明]一、本募股说明书依据《中华人民共和国公司法》、《中华人民共和国商业银行法》、《中华人民共和国银行业监督管理法》和《中国银监会农村中小金融机构行政许可事项实施办法》(银监会令〔2015〕第3号)等法律法规的相关规定,并按照本行章程的要求,结合本行的实际情况编写。

二、本募股说明书旨在为投资者提供本次增加资本金的基本情况和本行的基本情况,本行承诺其中不存在任何虚假记载、误导性陈述或重大遗漏,并对其真实性、准确性、完整性承担法律责任。

三、本行没有委托或授权其他任何组织或个人提供未在本募股说明书中列载的信息和对本募股说明书作任何解释或说明,投资者如有任何疑问可向本行咨询。

一、募集股金运用本次募集资金面值部分拟全部用于充实本行股本金,溢价部分用于化解不良资产和增加资本公积。

在满足资本充足率等监管指标要求的情况下,本行将进一步扩大业务规模,增强经营实力,拓展新的效益增长点,取得更大的经营利润,以更有力地扶持民营企业和助推地方经济发展,更好地回报股东。

二、增效扩股方案(一)扩股方式:面向社会公开募集股金。

(二)扩股原则:1、依法合规,公平公开;2、同股同权,同股同利;3、风险自担,利益共享;(三)扩股额度:人民币50,000万元,补充本行资本金到100,000万元。

(四)股金定价:每股价格为人民币1元,另外,投资者需按每股人民币0.8元出资,用于购买本行的不良资产或增加资本公积。

(五)股权设置:本次扩股对象为企业法人和自然人,单一企业法人出资额度不得低于200万元,单一自然人出资额度不得低于50万元。

(六)自然人入股条件:1、有完全民事行为能力的中国公民;2、有良好的社会声誉和诚信记录,无犯罪记录;3、入股资金为自有资金,不得以委托资金、债务资金等非自由资金入股;4、银保监会规定的其他审慎性条件。

Discussion Draft: July 30, 2004[LOGO][安瑞科集團][ENRIC INVESTMENT GROUP LIMITED](Incorporated in the Cayman Islands with limited liability)LISTING ONTHE GROWTH ENTERPRISE MARKET OFTHE STOCK EXCHANGE OF HONG KONG LIMITEDBY WAY OF PLACINGNumber of Placing Shares : [*] Shares (subject to Offer Size AdjustmentOption)Offer Price : HK$[*] per Offer ShareNominal Value : HK$[*] per ShareBoard Lot : [*]Stock Code : [*]Global Co-ordinator and SponsorChina Everbright Capital LimitedUnderwriters[*]The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus.A copy of this prospectus, having attached thereto the documents specified in the paragraph headed “Documents delivered to the Registrar of Companies” in Appendix [VII] to this prospectus, has been registered by the Registrar of Companies in Hong Kong as required by section 342C of the Companies Ordinance (Chapter 32 of the Laws of Hong Kong). The Securities and Futures Commission of Hong Kong and the Registrar of Companies in Hong Kong take no responsibility for the contents of this prospectus or the documents referred to above.The Placing Price is expected to be fixed by agreement between the Company and China Everbright Capital Limited (on behalf of the Underwriters) on the Price Determination Date, which is currently scheduled on or before [*]. The Placing Price will not be more than HK$[*] per Share and is expected to be not less than HK$[*] per Share. If the Company, [*] and China Everbright Capital Limited (on behalf of the Underwriters) are unable to reach an agreement on the Placing Price by that date or such later date as agreed by the Company, [*] and China Everbright Capital Limited (on behalf of the Underwriters), the Placing will not become unconditional and will not proceed.[The obligations of the Underwriters to procure applicants to subscribe for, or failing which themselves to subscribe for, the Placing Shares are subject to termination if certain events including, without limitation, any act of God, war, riot, public disorder, civil commotion, economic sanctions, fire, flood, explosion, epidemic, terrorism, strike or lock-out or any escalation of hostilities involving Hong Kong, the PRC, the US occurs at any time before [6:00 p.m.] on [*], the day immediately preceding the expectedListing Date.][**] 2004PRICE DETERMINATION (NOTE 2) ............................................................................................. [*] Allotment of Shares on or before ...................................................................................................... [*] Announcement of the level of indication ofinterests in the Placing [and whether the Offer SizeAdjustment Option] has been exercised to be publishedon the GEM website at on or before ..................................................................... [*] Despatch of Share certificate(s) on or before (Note 3) ...................................................................... [*] Dealings in the Shares on GEM to commence on ............................................................................. [*] Notes:1. All dates and times refer to Hong Kong local time.2. The Price Determination Date is expected to be on or before [*].3. Placees of Shares will receive the share certificates for the Placing Shares via CCASS. Share certificates are expectedto be issued in the name of HKSCC Nominees Limited and deposited directly into CCASS on or before [*] for credit to the respective CCASS participants’ or investor participants’ stock accounts designated by the Underwriters or the placees, as the case may be. No temporary document of title will be issued.4. For details of the structure of the Placing, including its conditions, please see the section headed “Structure andconditions of the Placing” in this prospectus.Page CHARACTERISTICS OF GEM (i)EXPECTED TIMETABLE (ii)SUMMARY OF THIS PROSPECTUS (1)DEFINITIONS ............................................................................................................... [*] GLOSSARY ............................................................................................................... [*] RISK FACTORS ............................................................................................................... [*] WAIVER FROM STRICT COMPLIANCE WITH THE GEM LISTING RULES .................... [*] CONNECTED TRANSACTIONS ............................................................................................... [*] INFORMATION ABOUT THIS PROSPECTUS AND THE PLACING.................................... [*] DIRECTORS AND PARTIES INVOLVED IN THE PLACING ................................................ [*] CORPORATE INFORMATION .................................................................................................. [*] INDUSTRIAL OVERVIEW ........................................................................................................ [*] BUSINESS ............................................................................................................... [*] [INTRODUCTION .......................................................................................................... [*] STRENGTHS OF THE GROUP ..................................................................................... [*] SHAREHOLDING STRUCTURE .................................................................................. [*] HISTORY AND DEVELOPMENT ................................................................................ [*] PRODUCTS ..................................................................................................................... [*] PRODUCTION FACILITIES ......................................................................................... [*] RAW MATERIALS ........................................................................................................ [*] QUALITY CONTROL .................................................................................................... [*] LICENCES, PERMITS AND REGISTRATIONS .......................................................... [*] RESEARCH AND DEVELOPMENT ............................................................................ [*] SALES AND MARKETING ........................................................................................... [*] COMPETITION .............................................................................................................. [*] NON-COMPETITION UNDERTAKINGS .................................................................... [*] INTELLECTUAL PROPERTY ...................................................................................... [*]ENVIRONMENTAL ISSUES ......................................................................................... [*] INSURANCE] ................................................................................................................. [*] STATEMENT OF ACTIVE BUSINESS PURSUITS ................................................................. [*] STATEMENT OF BUSINESS OBJECTIVES AND STRATEGIES .......................................... [*] DIRECTORS, SENIOR MANAGEMENT AND STAFF............................................................ [*] SUBSTANTIAL, INITIAL MANAGEMENT AND SIGNIFICANT SHAREHOLDERS ......... [*] SHARE CAPITAL ............................................................................................................... [*] FINANCIAL INFORMATION .................................................................................................... [*] UNDERWRITING ............................................................................................................... [*] STRUCTURE AND CONDITIONS OF THE PLACING ........................................................... [*] APPENDIX I ACCOUNTANTS’ REPORT ................................................................ [*] APPENDIX II PROFORMA FINANCIAL INFORMATION ...................................... [*] APPENDIX III PROFIT FORECAST ............................................................................ [*] APPENDIX IV PROPERTY VALUATION .................................................................. [*] APPENDIX V SUMMARY OF THE CONSTITUTION OF THE COMPANYAND THE LAWS OF THE [CAYMAN ISLANDS] ............................ [*] APPENDIX VI STATUTORY AND GENERAL INFORMATION ............................. [*] APPENDIX VII DOCUMENTS DELIVERED AND AVAILABLE FORINSPECTION ........................................................................................ [*][*]In this prospectus, unless the context otherwise requires, the following expressions have the meanings set out below. Certain other terms are explained in the this section headed “Glossary”.“Anhui BVI”Enric Anhui Investment Limited, an investment holdingcompany incorporated in the British Virgin Islands on 29April 2002 and is wholly owned by EIGL“associate(s)”has the meaning ascribed thereto in the GEM Listing Rules “Bengbu CompressorFactory”蚌埠壓縮機厰“Board”the board of Directors“business day”any day (other than a Saturday) on which banks in HongKong are generally open for business“Capitalisation Issue”the issue of Share to be made upon the application of part ofthe share premium account of the Company referred to in thesection headed “Written resolutions of all the shareholders ofthe Company passed on [*] 2004” in Appendix [VI] to thisprospectus“CCASS”the Central Clearing and Settlement System established andoperated by HKSCC“China” or “PRC”the People’s Republic of China which, for the purposes ofthis prospectus, excludes Hong Kong, Taiwan and the MacauSpecial Administrative Region of the PRC“China Everbright Capital” or “Sponsor”China Everbright Capital Limited, a deemed licensed corporation to carry out regulated activities of advising on securities and corporate finance under the SFO“Company”[Enric Investment Group Limited], an exempted companyincorporated in the Cayman Islands on [*] under theCompanies Law with limited liability“Companies Law”[the Companies Law (2003 Revision) (Cap. 22) of theCayman Islands as amended, supplemented or otherwisemodified from time to time]“Companies Ordinance” the Companies Ordinance (Chapter 32 of the Laws of HongKong)“connected persons(s)”has the meaning ascribed thereto under the GEM ListingRules“Controlling Shareholder”[*]“Director(s)”the director(s) of the Company“Easywin”Easywin Enterprises Limited, a company incorporated in theBritish Virgin Islands on 18 July 2000 with limitedliability, which is owned as to 50% by Mr. Wang and 50%by Ms. Zhao“EIGL”Enric Investment Group Limited, a limited companyincorporated in the British Virgin Islands on 1 May 2002 andis wholly-owned by Easywin“Enric Bengbu”安瑞科(蚌埠)厭縮機有限公司, a Sino-foreign joint venturecompany with limited liability incorporated in the PRCunder the joint venture laws[“Euro”][the single currency adopted by the participating memberstates from time to time of the European Union inaccordance with the Treaty on European Union signed on 7February 1992 (as amended)]“GEM”the Growth Enterprise Market of the Stock Exchange “GEM Listing Committee”the listing sub-committee of the board of the Stock Exchangewith responsibility for GEM“GEM Listing Rules”the Rules Governing the Listing of Securities on GEM “GEM website”the website of GEM with the domain name of“Greater China Region”the PRC, Hong Kong, Taiwan and the Macau SpecialAdministrative Region of the PRC“Group”the Company and its subsidiaries“HKSCC” Hong Kong Securities Clearing Company Limited“Hong Kong” or “HK”the Hong Kong Special Administrative Region of the PRC “HK$” or “HK dollars”Hong Kong dollars and cents respectively, the lawful and“cents” currency of Hong Kong“Independent Third Party” or “Independent Third Parties”person(s) or company(ies) which is/are independent of any member of the Group, the Directors, the chief executives, the Initial Management Shareholders and the substantial shareholders of the Company, its subsidiaries and any of their respective associates“Initial Management the initial management shareholder(s) (as defined in theShareholder(s)”GEM Listing Rules) of the Company, being [*] as describedin the section headed “Substantial, Initial Management andSign ificant Shareholders” in this prospectus“L angfang Guofu”廊坊國富投資有限公司,a company incorporated in thePRC with limited libility“Latest Practicable Date”[*], being the latest practicable date prior to the printing ofthis prospectus for ascertaining certain information containedin this prospectus“Listing Date”the date on which the trading of the Shares on GEMcommences, which is expected to be [*]“Listing Rules”the Rules Governing the Listing of Securities on the StockExchange“Lock-up Period”commencing on the date of this prospectus and ending on the12 months period from the Listing Date (both datesinclusive)“Main Board”the securities market operated by the Stock Exchange priorto the establishment of GEM and which stock marketcontinues to be operated by the Stock Exchange in parallelwith GEM. For the avoidance of doubt, the Main Boardexcludes GEM[“MOC”][中國人民共和國商務部(Ministry of Commerce of thePRC)][“MOFTEC”][中國對外貿易經濟合作部(Ministry of Foreign Trade andEconomic Corporation of the PRC)]“Mr. Wang”Mr. Wang Yusuo (王玉鎖先生), the chairman and anexecutive director of Xinao Group, and the spouse of Ms.Zhao“Ms. Zhao”Ms. Zhao Baoju (趙寶菊女士), a non-executive director ofthe Xinao Group, and the spouse of Mr. Wang[“Offer Size Adjustment Option”] [the option granted by the Company to the Underwriters pursuant to the Underwriting Agreement, exercisable by the mutual consent of the Company and [*] to allot and issue up to an aggregate of [*] additional new Shares at the Placing Price]“Placing” the conditional placing of the Placing Shares at the PlacingPrice, [subject to the Offer Size Adjustment Option,] asfurther described in the section headed “Structure andconditions of the Placing” in this prospectus“Placing Price” HK$[*] per Placing Share (exclusive of brokerage fees, theStock Exchange trading fee, investor compensation levy andSFC transaction levy), being the price at which the PlacingShares are to be subscribed for and issued pursuant to thePlacing“Placing Shares”[*] new Shares initially being offered by the Company forsubscription under the Placing, [together with, whererelevant, any additional Shares which may be issuedpursuant to the exercise of the Offer Size AdjustmentOption]“PRC Government” the central government of the PRC including allgovernmental subdivisions (including provincial, municipaland other regional or local government entities) andinstrumentalities thereof[“Pre-IPO Share Option Scheme”] [the pre-IPO share option scheme adopted by the shareholders of the Company on [*], the principal terms of which are set out in the paragraph headed “Pre-IPO Share Option Scheme” in Appendix [VI] to this prospectus]“Price Determination Date”on or before [*] (or such other date as agreed by theCompany and China Everbright Capital (for itself and onbehalf of the Underwriters), being the date on which thePlacing Price is fixed for the purpose of the Placing. “Relevant Securities”has the meaning ascribed thereto under Rule 13.15 of theGEM Listing Rules“Reorganisation”the corporate reorganisation which the Group underwent inpreparation of the listing of the Shares on GEM, details ofwhich are set out in the paragraph headed “Corporatereorganisation” in Appendix [VI] to this prospectus “RMB”Renminbi, the lawful currency of the PRC [“SETC”][中華人民共和國國家經濟貿易委員會(State Economicand Trade Commission of the PRC)]“SFC”the Securities and Futures Commission of Hong Kong “SFO”the Securities and Futures Ordinance (Chapter 571 of theLaws of Hong Kong)[“Share Option Scheme”] [the share option scheme conditionally adopted by theshareholders of the Company on [[*]], the principal terms ofwhich are set out in the paragraph headed “Share OptionScheme” in Appendix [VI] to this prospectus]“Share(s)” share(s) of HK$[*] each in the share capital of the Company “Shijiazhuang BVI”Enric Shijiazhuang Investment Limited, an investmentholding company incorporated in the British Virgin Islandson 29 April 2002 and is wholly owned by EIGL “Shijiazhuang Enric”石家莊安瑞科氣體機械有限公司, a Sino-foreign jointventure company with limited liability incorporated in thePRC under the joint venture laws“Shijiazhuang Industrial石家莊化工機械厰Factory”[“State”]the central government of the PRC[“State Council”][中華人民共和國國務院(State Council of the PRC)] “Stock Exchange”The Stock Exchange of Hong Kong Limited“subsidiary”has the meaning ascribed thereto in section 2 of theCompanies Ordinance (as amended from time to time) “Track Record Period”the two years ended [*] and [*]“Underwriters”[*]“Underwriting Agreement”the underwriting agreement dated [*] and entered into by, theCompany, the Sponsor, the Initial ManagementShareholders, the executive Directors and the Underwriters,particulars of which are summarised in the section headed“Underwriting” in this prospectus“US” or “United States” the United States of America“US$” US dollars, the lawful currency of the United States “WTO”World Trade Organisation“Xinao Group”Xinao Gas Holdings Limited, an exempted companyincorporated in the Cayman Islands on 20 July 2000 withlimited liability. Its shares were listed on the Main Board byway of an introduction pursuant to the Listing Rules on [*] “X inao Shijiazhaung”新奧集團石家莊化工厰機械股份有限公司,a joint stocklimited company incorporated in the PRC“%”per cent.All dates and times in this prospectus refer to Hong Kong time unless otherwise stated. Unless otherwise specified in this prospectus, amounts denominated in RMB have been translated, for the purpose of illustration only, into Hong Kong dollars as follows:HK$1.00 = RMB[1.06]US$1.00 = HK$[7.8]No representation is made that any amounts in RMB, HK$ or US$ could have been or could be converted at the above rate or at any other rates or at all.English names of the PRC – incorporated companies and entities have been included in this prospectus for identification purposes only. In the event of any in consistency, the Chinese name prevails.This glossary contains certain definitions and other terms as they relate to the Group and as they are used in this prospectus. As such, these definitions may not correspond to standard industry definitions.“CNG” Compressed Natural Gas“LNG”Liquefied Natural Gas“ISO”The international organisation for standardisation, aworldwide federation of national standards bodies of about148 countries[*]RISK FACTORS RELATING TO THE GROUPReliance on major suppliersFor each of the two years ended 31 December 2003 and the [*] months ended [*] 2004, purchases from the largest supplier of the Group, [name of supplier], which is a [*] supplier of the Group and is independent of and not connected with any of the directors, chief executives, supervisors, substantial shareholders or management shareholders of the Group or its subsidiary or any of their respective associates, accounted for approximately [*]% of the total purchases of the Group respectively and the Group’s purchases from the five largest suppliers accounted for approximately [*]%, [*]% and [*]% of the total purchases of the Group respectively. If the Group’s major suppliers cease to supply to the Group or increase the price of the materials and the Group is not able to identify an alternative source of such materials, the operation and profitability of the Group may be adversely affected.Reliance on major customersA significant portion of the Group’s revenues has been, and may continue to be, derived from a limited number of customers. For each of the three years ended [*], the Group’s sales to its largest customer, [*], accounted for approximately [*]%, [*]% and [*]% of the Group’s turnov er respectively and the Group’s sales to its five largest customers accounted for approximately [*]%, [*]% and [*]% of the Group’s turnover respectively. The five largest customers of the Group are independent of and not connected with any of the directors, chief executives, supervisors, substantial shareholders or management shareholders of the Group or its subsidiary or any of their respective associates. In the event that the Group fails to secure new contracts from such major customers, and is not able to obtain new customers and/or any of the major customers encounters operating and/or financial difficulties, the Group’s business and financial position may be adversely affected.Reliance on senior managementThe Group’s success is attributable to, amo ng other things, the contribution and continuous service and performance of the Group’s senior management team as stated in the section headed “Directors, supervisors, senior management and staff”. Each executive Director hasentered into a service contract with the Group for a term of three years commencing from the Listing Date. However, there is no assurance that the Group is able to retain member(s) of the senior management team or recruit further competent personnel for its future development. The u nanticipated departure of any member of the Group’s senior management team without immediate and adequate replacement or the inability to recruit competent successor(s) or further competent personnel for its future development could have a material adverse impact on the Group’s business.Reliance on skilled employeesThe Group possesses key and unique technology in the gas machinery field. In order to maintain its competitiveness, it has successfully trained a group of experienced and skilled employees to engage in the Group’s product development. Although the Group has largely increased the salary and benefits of these skilled employees, the loss of services of any of them may have a material adverse effect on the Group. The Group believes that its future success will depend, to a large extent, on its ability to attract and motivate highly-skilled managerial employees. Such employees are in [great] demand in the gas machinery field in the PRC. There can be no assurance that the Group can retain its skilled employees or that it can attract or retain such employees in the future. Failure of the Group to recruit and retain the necessary employees may have a material adverse effect on the Group’s business and operation.Risks relating to the gas machinery marketThe Group produces a variety of products for the gas machinery market which include all kinds of high pressure containers, different kinds of industrial chemical tankers, CNG vehicles and a range of natural gas station facilities. These are very specialised and durable products which do not need to be replaced regularly. As such, the Group’s sales and financial conditions may be adversely affected if the Group fails to enhance the use of existing products or launch and introduce new products for the gas machinery market in a timely manner.Reliance on other related industriesThe production and sale of the Group’s major products are largely dependent on the development of related industries. For instance, the sale of facilities used in CNG stations depend on each countries’ restrictions on the development of the natural gas industry; CNG vehicles are mainly used for the transportation of natural gas to nearby stations and the sale of such vehicles are affected by the source and consumption of natural gas. In addition, the sale of different kinds of compressors and industrial chemical tankers are affected by the development of relevant industries using these compressors and compressor vessels. Although the Group’s major products are used in key indus tries that are encouraged by the PRC government, if changes are made to existing government policies, the Group’s sales to such industries will be adversely affected.Risks associated with the purchase of raw materialsThe Group currently out-source the processing of materials for its major products. In addition, most of the key components such as [steel pipes] and [casting] used in the production of the Group’s products are subject to price fluctuations. As such, potential investors should be aware that any delay in the supply of out-sourced processing materialsand any significant fluctuation in the prices of the Group’s major raw materials may have an adverse impact on the Group’s operation and profitability.Risks associated with product managementThe Group’s product development strategy is associated with the development of the energy and fuel industry. As such, the Group produces a variety of products which are used in different sectors of the gas industry. With increased product variation, the Group may encounter difficulty in research and development, product management, sales management as well as the provision of after-sales services. The Group intends to centrally manage the production of its products and other logistics as well as set up different sales teams to implement different sales strategies. However, the Group cannot guarantee that its future strategies and plans will succeed. Therefore, if the Group cannot modify its current product management and sales strategies, the business, operations and financial conditions of the Group may be adversely affected.[Product liabilityThe products developed or to be developed by the Group are critical to the operations of its customers. Should there be any defect or error in such products that cause damage to operations and/or business of the customers, the Group may have to incur additional expenses either to rectify the defect or error or to indemnify the customers for any losses that the customers may suffer.As at the Latest Practicable Date, so far as the Directors are aware, no legal claim was made against the Group by any of the customers of the Group in relation to any products and services provided by the Group. Nevertheless, there is no assurance that such claim will not be made in the future.In addition, the Group has maintained no insurance to cover any liability arising from or as a result of any defect in its products. [The agreements entered into between the Group and its customers do not contain any warranty clause in the sale of its products [and the customers are entitled to have an inspection period ranging from [one] to [three] months after delivery of the products,] the Directors therefore are of the view that the liability as a result of product defects is remote and the insurance coverage for product liability is not necessary]1.As a result, occurrence of product liability arising from the Group’s operation could have a material adverse impact on the Group’s business and financial position.][Environmental protectionThe G roup’s operations are subject to environmental protection laws and regulations promulgated by both national and local environmental protection authorities of the PRC. The Directors believe that all of the Group’s facilities and operations are in material compliance with requirements of the relevant environmental protection laws and regulations. However, the amendment of existing laws or regulations may impose additional or more stringent requirements. In addition, the Group’s compliance with such laws or regulations may require the Group to incur significant capital expenditures or other obligations or liabilities, which could create a substantial financial burden on the Group.1Company to provide standard form customer agreement。

国内银行海外上市招股书(中英对照)国内银行海外上市招股书原文INDUSTRY OVERVIEWThe information set forth below is mainly about the PRC banking sector. It is derived from official sources. While our Directors have exercised reasonable care in compiling and reproducing the information, it has not been independently verified by the Company, the Directors, the Underwritersor any of our or their respective affiliates or advisers. This information may not be consistent with other information compiled within or outside the PRC. In particular (but without limitation), a number of overseas market observers have estimated that the level of the non-performing loans in the PRC banking system may be considerably higher than the figures cited herein, and if such estimates are true, the level o f the PRC banking system’s assets and some of the other related figures included inthis section may be overstated.OVERVIEWThe PRC banking market is one of the fastest growing banking markets in the world. According to the Almanac of China’s Finance and Banking, from 1999 to 2004, total Renminbi deposits received by financial institutions in the PRC increased 121.1%, from RMB10,878 billion to RMB24,053 billion, and total Renminbi loans provided by financial institutions in the PRC increased 89.2%, from RMB9,373 billion to RMB17,736 billion. The following table sets forth the total Renminbi loans, total Renminbi deposits and individual savings deposits in the PRC from 1999 to 2004:XXXSource: The People’s Bank of ChinaThe expansion of the PRC banking market has benefited primarily from the underlying economic growth and the resulting wealth creation and accumulation since the start of the PRC’s economic modernization in 1978. The following table sets forth GDP and GDP per capita in the PRC from 1999 to 2003:XXXDOMESTIC PARTICIPANTS IN THE PRC BANKING SECTORThe PRC banking sector is comprised of wholly state-owned banks, joint stock commercial banks, policy banks, urban commercial banks, rural commercial banks, rural cooperative banks, urban credit cooperatives, rural credit cooperatives and foreign-invested financial institutions. The table below sets forth the number and market share of each type of banking institution as of December 31, 2003.Number Market share based on total assetsBig Four (1) . . . . . . . . . . . ..Joint stock commercial banks (2) . . . .Policy banks . . . . . . . .Urban commercial banks . . . .Rural commercial banks . . .Urban credit cooperatives . . . .Rural credit cooperatives . . .China Post Savings . . . . . . .Foreign-invested financial institutions . . . .Source: Almanac of China’s Finance and Banking and the People’s Bank of China.(1) Includes Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China andChina Construction Bank.(2) Includes Bank of Communications, Citic Industrial Bank, China Everbright Bank, Hua Xia Bank, China Minsheng Bank, Guangdong Development Bank, Shenzhen Development Bank, China Merchants Bank, Industrial Bank, and Shanghai Pudong Development Bank.Big FourThe big four commercial banks, namely, Industrial and Commercial Bank of China, or ICBC,Agricultural Bank of China, or ABC, Bank of China, or BOC, and China Construction Bank, or CCB (together, the "Big Four") have traditionally dominated the PRC banking industry. As of December 31, 2004, according to the PBOC, they accounted for 53.6% of total assets of financial institutions in thePRC.Joint Stock Commercial BanksAccording to the CBRC, as of December 31, 2004, there were 12 joint stock commercial banks inthe PRC with a nationwide banking license. As of the same date, we were the largest among thesebanks in terms of total assets. Joint stock commercial banks generally have diversified shareholders, including, among others, local government entities and state-owned enterprises. Established mostly inthe late 1980s and early 1990s, these joint stock commercial banks have gradually increased theircollective market share while the market share of the Big Four has gradually decreased. As ofDecember 31, 2004, according to the CBRC, they accounted for approximately 14.9% of total assetsof financial institutions in the PRC.Policy BanksThree policy banks, China Development Bank, Export-Import Bank of China and Agricultural Development Bank of China, which were established to allow the Big Four to concentrate oncommercial lending, are principally mandated to finance government-sponsored projects.Other Domestic Banking InstitutionsOther domestic PRC financial institutions engaged in commercial banking business include urban commercial banks, rural commercial banks, rural cooperative banks, urban credit cooperatives and ruralcredit cooperatives.PRC BANKING SECTOR REFORMReforming the banking sector is one of the major challenges of economic reform undertaken by the PRC government. These reforms have focused primarily on the improvement of the legal andregulatory framework; the enhancement of asset quality and the capital base; and the liberalization ofinterestrates.Improvement of the legal and regulatory frameworkThe steps taken by the PRC government to improve the legal and regulatory framework include:--the establishment of an independent central banking system, originally with the PBOC as both thecentral bank and the banking supervisory authority;--the establishment of the CBRC in April 2003 to take over the banking supervisory and regulatoryfunctions of the PBOC; and--the implementation of new corporate governance and management standards across all PRC financial institutions. See the section headed "Supervision and Regulation".Improvement of asset quality and enhancement of capital baseThe PRC banking sector has been historically burdened with large portfolios of non-performing loans. According to the CBRC, outstanding non-performing loans at the Big Four, policy banks and joint stock commercial banks amounted to approximately RMB1.7 trillion at the end of 2004, representing 13.2%of the total loans in the PRC. The following table sets forth certain information regarding thenon-performing loans of state-owned and joint stock commercial banks as of the date indicated:Non-performing loans by category:Substandard . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Doubtful . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Non-performing loans by types of banks:Big Four . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Joint stock commercial banks (1) . . . . . . . . . . . . . . . . . . . . .Source: China Banking Regulatory Commission(1) Includes Bank of Communications, Citic Industrial Bank, China Everbright Bank, Hua Xia Bank,Minsheng Bank, Guangdong Development Bank, Shenzhen Development Bank, China Merchants Bank, Industrial Bank, Shanghai Pudong Development Bank and Evergrowing Bank.Due to the large amount of non-performing loans in the PRC banking industry, the PRC government has taken various measures to resolve the non-performing loan problem and improve the capitaladequacy levels of PRC banks. In 1999, the PRC government established four asset managementcompanies to assume and resolve the non-performing loans transferred from the Big Four. In 1999,the Big Four transferred an aggregate of RMB1.4 trillion in assets to the four asset managementcompanies. In 2004, CCB, BOC and our Company similarly transferred over RMB330 billion ofnon-performing loans to Cinda. In an effort to allow banks as well as regulators to better monitor bank asset quality in accordance with international practice, a five-category classification system was formally implemented in 2002.In conjunction with the transfer of these non-performing loans, regulators also employed capitalinjection measures to enhance the capital base of commercial banks. In 1998, a total of RMB270billion was injected into the Big Four. In 2004, another US$45 billion was injected into BOC and CCB for their recapitalization. In 2004, our Company was the recipient of a RMB18 billion capital injection. Fordetails, see the section headed "Our Reorganization and Restructuring - Financial Restructuring".Interest Rate ReformPRC commercial banks set the interest rates of their Renminbi deposits and loans in accordance with the benchmark rates published and modified by the PBOC from time to time. However, the PRCgovernment has taken gradual measures to liberalize interest rates by widening the band within which commercial banks may set their Renminbi lending rates around the benchmark rates.In January 1987, the PBOC for the first time allowed PRC commercial banks to set the interest rates forRenminbi-denominated lending within a range that is 10% lower to 20% higher than the PBOCbenchmark rate. After incremental changes in the intervening years, on January 1, 2004, the PBOCfurther extended the upper limit of Renminbi-denominated lending rates, except for mortgages andpolicy loans, to no higher than 70% of the benchmark rate. Subsequently, on October 29, 2004, thePBOC removed the upper limit for Renminbi-denominated lending rates while retaining the lower limitfor such rates. Effective on the same date, all deposit-taking institutions are now allowed to decrease (but not increase) Renminbi-denominated deposit rates to below the corresponding PBOC benchmarkrates. See the section headed "Supervision and Regulation" for further details.FOREIGN COMPETITION IN THE PRC BANKING SECTORForeign financial institutions can conduct banking business in the PRC by establishing branches in the PRC, forming joint venture financial institutions with PRC financial institutions, or establishing whollyforeign-owned financial institutions. According to the Almanac of China’s Finance and Banking, as of December 31, 2003, the PRC government had given its approval to 64 foreign banks to open 169branches and sub-branches and to set up 15 wholly foreign-owned commercial banks, joint venturecommercial banks and finance companies in the PRC. As of December 31, 2003, according to thePBOC, foreign-invested financial institutions accounted for 1.5% of the total assets of financialinstitutions in the PRC.PRC laws and regulations also permit foreign financial institutions to purchase or subscribe for limited equity interests in PRC banks. Currently, a foreign financial institution can purchase or subscribe for upto 20% of the equity interest in a PRC bank. HSBC, for example, purchased a 19.90% stake in ourCompany in August 2004.Although the scale of foreign banks’ activities in the PRC remains limited by regulatory constraints,the PRC banking sector has been gradually opening to foreign entities. Upon the PRC’s entry into the WTO, foreign banks were permitted to offer foreign currency-denominated products and services inthe PRC without any geographic or client restrictions. Starting December 11, 2004, foreign banks have been permitted to offer Renminbi-denominated services and products to PRC enterprises in 18 majorcities including, among others, Beijing and Shanghai. At the end of 2006, the PRC banking sector willbe fully opened to foreign banks without any restrictions on business scope or geography. As a result, competition in the PRC banking sector from foreign banks is expected to intensify.In addition, the Mainland and Hong Kong Closer Economic Partnership Arrangement, a free trade agreement commonly known as the CEPA, became effective on January 1, 2004. The CEPA enablessmaller Hong Kong banks to enter the PRC banking sector, which we expect will increase thecompetition in the PRC banking industry. For example, under the CEPA, commercial banks incorporated in Hong Kong with US$6 billion or more in total assets are qualified to apply for the establishment ofbranches in the PRC. By comparison, under the relevant PBOC and CBRC regulations, commercial banks incorporated in other jurisdictions must have US$20 billion or more in total assets to be qualified toapply for the establishment of branches.GROWTH IN RETAIL BANKINGAlthough corporate banking continues to be the main business for most PRC commercial banks,retail banking products and services have also grown significantly. For example, according to the PBOC, consumer loans outstanding rose from RMB17.2 billion at the end of 1998 to RMB1,573.3 billion at the end of 2003, representing 9.9% of total loans outstanding and 13.5% of GDP. However, the level ofconsumer lending in the PRC is still significantly below that in other countries.Bank CardsWhile bank card penetration in the PRC remains low in comparison to developed countries, the bank card business experienced rapid growth in recent years. The total cards outstanding increased from383 million as of December 31, 2001 to 762 million as of December 31, 2004, according to the PBOC. The growth has also been accompanied by an expansion of the electronic banking terminal network.Debit cards have been the primary type of bank card in the PRC. As of December 31, 2004, debitcards outstanding amounted to 663 million. As of the same date, there were 98 million credit cardsissued. The development of the credit card market has so far been limited by a variety of reasons,including strict regulation on licensing, underdevelopment of a national payment infrastructure and the absence of a nationwide consumer credit information system. However, with an increasing number oflicences for banks to engage in credit card business being issued, the development of China UnionPay and the establishment of a national personal credit database as promoted by the PBOC, the credit cardindustry is expected to grow significantly in the future.Residential MortgagesDemand for housing in the PRC increased significantly in the 1990s when the PRC governmentbegan its housing reform by eliminating housing benefits for employees of state-owned enterprises and civil servants. As of December 31, 2004, the total outstanding balance of residential mortgagesreached RMB1.6 trillion, approximately 38 times the balance at the end of 1998. Mortgage lendingaccounts for a majority of consumer lending by PRC banks. The residential mortgage market has, as aresult, become a significant factor for sustained economic growth in the PRC. Although the PRCgovernment has adopted measures to tighten its policies on lending to the real estate industry starting in 2003, residential mortgage loans have continued to grow at a rapid pace.XXX行业概况下列资料主要与中国银行业相关。

招股说明书中英双语概述招股说明书是公司在进行首次公开募股时发布的重要文件,用于向投资者详细说明公司的经营状况、财务状况以及发行股份的相关细则。

本文将以中英双语的形式撰写一个招股说明书的示范文档。

公司概况公司简介公司名称:XXXX有限公司\ 注册地:XXXXX\ 成立日期:XXXX年XX月XX日\ 行业:XXXXX公司使命中文:我们的使命是为客户提供优质的产品和服务,满足他们的需求,促进行业的发展。

英文:Our mission is to provide excellent products and services to our customers, meet their needs, and promote industry development.公司愿景中文:我们的愿景是成为行业的领导者,为客户创造价值,为员工提供发展机会,并为股东创造持续增长的回报。

英文:Our vision is to become the industry leader, create value for our customers, provide development opportunities for our employees, and generate sustainable returns for our shareholders.公司业务业务范围中文:公司主要从事XXXXX业务,涵盖XXX领域的销售、研发和服务。

英文:The company mainly engages in XXXXX business, covering sales, research and development, and services in the XXX field.产品和服务中文:公司的主要产品包括XXXXX和XXXXX,提供XXXXX服务和技术支持。

英文:The company’s main products include XXXXX and XXXXX, providing XXXXX services and technical support.公司财务状况资产状况中文:截至XXXX年XX月XX日,公司总资产为XXXXX万元,其中包括XXXXX万元的流动资产和XXXXX万元的非流动资产。

招股说明书英文翻译【篇一:阿里巴巴招股说明书翻译】阿里巴巴招股说明书组长:吕昌超组员:云子梁史晓君陈巧康露丹目录一、阿里巴巴集团ipo招股书摘要: (4)(一) 我们的使命 ............................................... 4 (二) 我们的业务 ............................................... 4 (三) 我们的关键指标: ......................................... 5 (四) 我们的规模 ............................................... 6 (五) 我们生态系统参与者的规模 ................................. 7 (六) 我们平台的网络效应 ....................................... 7 (七) 我们的市场机遇 ........................................... 8 (八) 我们的优势 ............................................... 8 (九) 我们的战略 .............................................. 10 (十) 阿里巴巴合伙人制度 ...................................... 10 (十一) 我们的挑战........................................... 11 (十二) 公司历史............................................. 11 二、财务和运营综合数据摘要.. (11)(一) 损益表综合数据摘要: .................................... 12 (二) 资产负债表综合数据摘要 .................................. 14 (三) 运营数据摘要 ............................................ 14 三、风险因素:.. (15)(一) 与业务和行业有关的风险: ................................ 15 (二) 与公司组织结构有关的风险: .............................. 24 四、我们的历史和公司结构. (28)(一) 阿里巴巴发展史 .......................................... 28 (二) 我们和软银以及雅虎的关系 ................................ 29 (三) 我们的公司结构 .......................................... 30 五、财务与运营数据选择 (30)(一) 我们的货币化模型 ........................................ 30 (二) 实现并增强货币化的能力 .................................. 32 (三) 经营成果 (37)下面的表列出了我们列出经营期内现金流的基本状况。

农业银行香港IPO招股说明书(中英)Agricultural Bank of China Hong Kong IPO ProspectusOverviewThis prospectus provides detailed information regarding the Initial Public Offering (IPO) of the Agricultural Bank of China (ABC) Hong Kong. The prospectus explores the background and business operations of ABC, as well as the terms and conditions of the IPO. It aims to provide potential investors with a comprehensive understanding of ABC, its financial status, and future prospects.1. IntroductionThe first section of this prospectus provides a brief introduction to ABC, including its establishment, key milestones, and its position as one of the leading financial institutions in China. It highlights the bank's focus on agricultural financing and rural development.2. Business OperationsThis section delves into the core business areas of ABC, emphasizing its comprehensive financial services and strong presence across various sectors. It outlines the bank's key business segments, including corporate banking, retail banking, treasury operations, and investment banking. The prospectus also underlines ABC's commitment to promoting sustainable development and corporate social responsibility.3. Financial PerformanceAn analysis of ABC's financial status forms the central theme of this section. It provides an in-depth overview of the bank's financial statements, including balance sheets, income statements, and cash flow statements over the past few years. The prospectus incorporates key financial ratios, such as profitability indicators, liquidity ratios, and capital adequacy ratios. It also highlights ABC's achievements in asset quality management and risk control.4. Market Overview and Competitive LandscapeHere, the prospectus evaluates the market environment in which ABC operates, including the macroeconomic conditions and regulatory framework in Hong Kong and mainland China. It discusses the competitive landscape and identifies opportunities and challenges in the banking industry. Emphasis is placed on ABC's strategies to maintain its competitive advantage and expand its market share.5. IPO Details and Offering StructureThis section outlines the details of the IPO, including the number of shares being offered, the offering structure, and the indicative offer price range. It provides information on the use of proceeds and the lock-up arrangement for existing shareholders. The prospectus also highlights the major underwriters and their roles in the IPO process.6. Key RisksA comprehensive analysis of the risks associated with investment in ABC follows, including market risks, credit risks, operational risks, and regulatory risks. The prospectus aims to provide potential investors with a clear understanding of the risks inherent in investing in ABC shares.7. Corporate GovernanceThis section focuses on ABC's commitment to sound corporate governance practices. It discusses the composition of the board of directors, key committees, and their respective roles and responsibilities. The prospectus also highlights ABC's internal control systems, risk management procedures, and adherence to international best practices.8. Future OutlookThe prospectus concludes with an overview of ABC's future strategy and growth prospects. It discusses the bank's plans for expanding its business, optimizing its product and service offerings, and further leveraging technology and digital innovation. The goal is to provide potential investors with confidence in the bank's long-term growth potential.In conclusion, this prospectus outlines the key details and information regarding the Agricultural Bank of China Hong Kong IPO. It provides potential investors with a comprehensive understanding of ABC's business operations, financial performance, market position, and growth prospects. It is an essential document for any investor considering participation in the IPO.。

招股说明书范本(最新版)定稿版招股说明书范本招股说明书范本招股说明书经政府有关部门批准后,即具有法律效力,公司发行股份和发起人、社会公众认购股份的一切行为,除应遵守国家有关规定外,都要遵守招股说明书中的有关规定,违反者,要承担相应的责任。

招股说明书范本一、释义在本招股说明书中,下列简称意义如招股说明书经政府有关部门批准后,即具有法律效力,公司发行股份和发起人、社会公众认购股份的一切行为,除应遵守国家有关规定外,都要遵守招股说明书中的有关规定,违反者,要承担相应的责任。

招股说明书范本一、释义在本招股说明书中,下列简称意义如下:本公司:指股份有限公司。

筹委会:指股份有限公司筹备委员会,在公司董事会成立之前,本筹委会行使董事会职能。

股票:指记名式普通股权证。

元:指人民币元。

二、序言本公司是为适应改革开放和市场经济发展的需要,由________等几家单位发起,经________批准组建的股份制企业。

本招股说明书经中国人民银行________分行批准,旨在为本公司此次定向募集股份及今后上市提供本公司的基本资料,以告投资者。

本公司筹委会深信本说明书并无遗漏任何事实、以至本说明书有误导成分,公司筹委会就本说明书所载资料之准确性、完整性负共同及个别之责任。

三、股本与注册资本若本公司此次募集股份达到预期目的,则本公司股本构成为:公司注册资本________万元,每股等额1元。

通过发起人认购和向境内社会法人及本企业内部职工发行股票募集资金。

发起人认购________万股,占股本总额________%。

定稿版其中:(略)向其他法人募集________万股,占股份总额________%。

向本企业内部职工募集________万股,占股份总额的________%。

四、股票发售八、公司资料(一)公司名称: 股份有限公司(二)经营范围:(略)九、资金投向本次股票发售所得收入额共________万元。

主要用于________吨苯胺工程、艾菲石油勘探、花岗岩石材、PV异型材、________三星级宾馆等。

北京银行招股意向书(通用13篇)北京银行招股篇1尊敬的领导:您好!首先感谢您在百忙之中抽出宝贵的时间来阅读这封自荐信。

我叫_,怀着对贵银行的尊重与向往,我真挚地写了这封自荐信,向您展示一个完全真实的我。

大学以来,我一直刻苦学习,勤奋钻研。

经过老师的精心培养和个人努力,我系统地掌握了法律学科的专业知识,获得了全国大学生英语知识竞赛一等奖、国家助学金以及学院励志奖学金。

在专科毕业的同时也顺利地拿到了辽宁大学自考本科文凭。

理论联系实践是很重要的。

在校期间我积极参加社团活动,寒暑假参加了_团市委组织的扶贫家教活动并获得了家长们的好评,接受了_日报社的采访与报道。

大二时,凭借着自身对金融方面知识的爱好与学习,经过学校老师的推荐,我从上海浦东发展银行_分行的兼职招聘中脱颖而出,进行了为期整整一年的兼职工作。

兼职结束后我又顺利地通过了广东发展银行_分行的招聘考试(点钞5分钟18把,计算器5分钟6道题),顺利地成为了渤海支行营业部的全柜员。

8月——8月被_团市委调往庄河市纪律检查委员会监察局执法监察室(学校推荐优秀毕业生,_团市委确定为支援北三市大学生志愿者)。

希望贵银行能给我一个发展的平台,我会好好珍惜它,为实现自己的人生价值而奋斗,最重要的是为贵银行事业的发展增砖添瓦。

最后,祝贵银行事业欣欣向荣、业绩蒸蒸日上,也祝您身体健健康康、万事如意! 此致此致敬礼就业意向人:___年_月_日北京银行招股意向书篇2尊敬_银行的领导:您好!感谢您在百忙之中抽时间阅读这封求职信。

我叫__,是__的一名应届毕业生(于20_年6月毕业)。

怀着对贵公司的尊重与向往,我真挚地写了这封自荐信,向您呈上我的,介绍材料,成绩单以及荣誉证书等材料。

首先,我应聘的是贵行的综合柜员或银行客户经理助理的职位,因为之前在银行实习过一段时间,对银行营业部的工作有一定的了解,一个合格的银行工作人员不仅在办理业务时要认真仔细,更要善于与客户沟通,态度热情,技能与态度并重。

股票基本知识股票是股份有限公司在筹集资金时向出资人发行的股份凭证。

股票代表着其持有者(即股东)对股份公司的所有权。

这种所有权是一种综合权利,如参加股东大会、投票表决、参与公司的重大决策、收取股息或分享红利等。

同一类别的每一份股票所代表的公司所有权是相等的。

每个股东所拥有的公司所有权分额的大小,取决于其持有的股票得数量占公司总股本的比重。

股东是公司的所有者,以其出资分额为限对公司负有限责任,承担风险,分享收益。

:股票根据公司业绩分为ST,被进行特别处理的股票;摘帽是指原来是ST股:指境内上市公司连续两年亏损了。

的,现在去掉ST垃圾股:经营亏损或违规的公司的股票。

元以上绩优股:公司经营很好,业绩很好,每股收益0.5蓝筹股:股票市场上,那些在其所属行业内占有重要支配性地位、业绩优良,成交活跃、红利优厚的大公司股票称为蓝筹股。

但由中资企业直接控制或持有三成半股权以上的上市是指那些在香港上市,红筹股:.公司股份题材股:是指具有某种特别内涵的股票,而这一内涵通常会被当作一种选股和炒作题材,成为股市的热点。

证券市场的发展不能完全靠一些“兴奋点”来支持,但也不可能只有“面”的推进而无“点”的突破。

在某种意义上,一个又一个“兴奋点”的形成过程,也就证券市场的发展过程。

例如奥运版块,期货版块等的抄作。

依据股票的上市地点和所面对的投资者区分A股、B股、H股、N股、S股等股的正式名称是人民币普通股票。

它是由我国境内的公司发行,供境内机构、组A.股A织、或个人(不含台、港、澳投资者)以人民币认购和交易的普通股票。

我国股票市场经过几年快速发展,已经初具规模。

股的正式名称是人民币特种股票。

它是以人民币标明面值,以外币认购和买卖,B在境内(上海、深圳)证券交易所上市交易的。

它的投资人限于:外国的自然人、法人和其他组织,香港、澳门、台湾地区的自然人、法人和其他组织,定居在国外股的投资人,主要是上述几的中国公民,中国证监会规定的其他投资人。

INDUSTRY OVERVIEWThe information set forth below is mainly about the PRC banking sector. It is derived from official sources. While our Directors have exercised reasonable care in compiling and reproducing the information, it has not been independently verified by the Company, the Directors, the Underwriters or any of our or their respective affiliates or advisers. This information may not be consistent with other information compiled within or outside the PRC. In particular (but without limitation), a number of overseas market observers have estimated that the level of the non-performing loans in the PRC banking system may be considerably higher than the figures cited herein, and if such estimates are true, the level of the PRC banking system’s assets and some of the other related figures included in this section may be overstated.OVERVIEWThe PRC banking market is one of the fastest growing banking markets in the world. According to the Almanac of China’s Finance and Banking, from 1999 to 2004, total Renminbi deposits received by financial institutions in the PRC increased 121.1%, from RMB10,878 billion to RMB24,053 billion, and total Renminbi loans provided by financial institutions in the PRC increased 89.2%, from RMB9,373 billion to RMB17,736 billion. The following table sets forth the total Renminbi loans, total Renminbi deposits and individual savings deposits in the PRC from 1999 to 2004:XXXSource: The People’s Bank of ChinaThe expansion of the PRC banking market has benefited primarily from the underlying economic growth and the resulting wealth creation and accumulation since the start of the PRC’s economic modernization in 1978. The following table sets forth GDP and GDP per capita in the PRC from 1999to 2003:XXXDOMESTIC PARTICIPANTS IN THE PRC BANKING SECTORThe PRC banking sector is comprised of wholly state-owned banks, joint stock commercial banks, policy banks, urban commercial banks, rural commercial banks, rural cooperative banks, urban credit cooperatives, rural credit cooperatives and foreign-invested financial institutions. The table below sets forth the number and market share of each type of banking institution as of December 31, 2003.Number Market share based on total assetsBig Four (1) . . . . . . . . . . . ..Joint stock commercial banks (2) . . . .Policy banks . . . . . . . .Urban commercial banks . . . .Rural commercial banks . . .Urban credit cooperatives . . . .Rural credit cooperatives . . .China Post Savings . . . . . . .Foreign-invested financial institutions . . . .Source: Almanac of China’s Finance and Banking and the People’s Bank of China.(1) Includes Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China and China Construction Bank.(2) Includes Bank of Communications, Citic Industrial Bank, China Everbright Bank, Hua Xia Bank, China Minsheng Bank, Guangdong Development Bank, Shenzhen Development Bank, China Merchants Bank, Industrial Bank, and Shanghai PudongDevelopment Bank.Big FourThe big four commercial banks, namely, Industrial and Commercial Bank of China, or ICBC, Agricultural Bank of China, or ABC, Bank of China, or BOC, and China Construction Bank, or CCB (together, the "Big Four") have traditionally dominated the PRC banking industry. As of December 31, 2004, according to the PBOC, they accounted for 53.6% of total assets of financial institutions in thePRC.Joint Stock Commercial BanksAccording to the CBRC, as of December 31, 2004, there were 12 joint stock commercial banks in the PRC with a nationwide banking license. As of the same date, we were the largest among these banks in terms of total assets. Joint stock commercial banks generally have diversified shareholders, including, among others, local government entities and state-owned enterprises. Established mostly in the late 1980s and early 1990s, these joint stock commercial banks have gradually increased their collective market share while the market share of the Big Four has gradually decreased. As of December 31, 2004, according to the CBRC, they accounted for approximately 14.9% of total assets of financial institutions in the PRC.Policy BanksThree policy banks, China Development Bank, Export-Import Bank of China and Agricultural Development Bank of China, which were established to allow the Big Four to concentrate on commercial lending, are principally mandated to finance government-sponsored projects.Other Domestic Banking InstitutionsOther domestic PRC financial institutions engaged in commercial banking business include urban commercial banks, rural commercial banks, rural cooperative banks,urban credit cooperatives and rural credit cooperatives.PRC BANKING SECTOR REFORMReforming the banking sector is one of the major challenges of economic reform undertaken by the PRC government. These reforms have focused primarily on the improvement of the legal and regulatory framework; the enhancement of asset quality and the capital base; and the liberalization of interest rates.Improvement of the legal and regulatory frameworkThe steps taken by the PRC government to improve the legal and regulatory framework include:--the establishment of an independent central banking system, originally with the PBOC as both the central bank and the banking supervisory authority;--the establishment of the CBRC in April 2003 to take over the banking supervisory and regulatory functions of the PBOC; and--the implementation of new corporate governance and management standards across all PRC financial institutions. See the section headed "Supervision and Regulation".Improvement of asset quality and enhancement of capital baseThe PRC banking sector has been historically burdened with large portfolios of non-performing loans. According to the CBRC, outstanding non-performing loans at the Big Four, policy banks and joint stock commercial banks amounted to approximately RMB1.7 trillion at the end of 2004, representing 13.2% of the total loans in the PRC. The following table sets forth certain information regarding the non-performing loans of state-owned and joint stock commercial banks as of the date indicated:Non-performing loans by category:Substandard . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Doubtful . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Non-performing loans by types of banks:Big Four . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Joint stock commercial banks (1) . . . . . . . . . . . . . . . . . . . . .Source: China Banking Regulatory Commission(1) Includes Bank of Communications, Citic Industrial Bank, China Everbright Bank, Hua Xia Bank, Minsheng Bank, Guangdong Development Bank, Shenzhen Development Bank, China Merchants Bank, Industrial Bank, Shanghai Pudong Development Bank and Evergrowing Bank.Due to the large amount of non-performing loans in the PRC banking industry, the PRC government has taken various measures to resolve the non-performing loan problem and improve the capital adequacy levels of PRC banks. In 1999, the PRC government established four asset management companies to assume and resolve the non-performing loans transferred from the Big Four. In 1999, the Big Four transferred an aggregate of RMB1.4 trillion in assets to the four asset management companies. In 2004, CCB, BOC and our Company similarly transferred over RMB330 billion of non-performing loans to Cinda. In an effort to allow banks as well as regulators to better monitor bank asset quality in accordance with international practice, a five-category classification system was formally implemented in 2002.In conjunction with the transfer of these non-performing loans, regulators also employed capital injection measures to enhance the capital base of commercial banks. In 1998, a total of RMB270 billion was injected into the Big Four. In 2004, another US$45 billion was injected into BOC and CCB for their recapitalization. In 2004, our Company was the recipient of a RMB18 billion capital injection. For details, see the section headed "Our Reorganization and Restructuring - Financial Restructuring".Interest Rate ReformPRC commercial banks set the interest rates of their Renminbi deposits and loans in accordance with the benchmark rates published and modified by the PBOC from time to time. However, the PRC government has taken gradual measures to liberalize interest rates by widening the band within which commercial banks may set their Renminbi lending rates around the benchmark rates.In January 1987, the PBOC for the first time allowed PRC commercial banks to set the interest rates for Renminbi-denominated lending within a range that is 10% lower to 20% higher than the PBOC benchmark rate. After incremental changes in the intervening years, on January 1, 2004, the PBOC further extended the upper limit of Renminbi-denominated lending rates, except for mortgages and policy loans, to no higher than 70% of the benchmark rate. Subsequently, on October 29, 2004, the PBOC removed the upper limit for Renminbi-denominated lending rates while retaining the lower limit for such rates. Effective on the same date, all deposit-taking institutions are now allowed to decrease (but not increase) Renminbi-denominated deposit rates to below the corresponding PBOC benchmark rates. See the section headed "Supervision and Regulation" for further details.FOREIGN COMPETITION IN THE PRC BANKING SECTORForeign financial institutions can conduct banking business in the PRC by establishing branches in the PRC, forming joint venture financial institutions with PRC financial institutions, or establishing wholly foreign-owned financial institutions. According to the Almanac of China’s Finance and Banking, as of December 31, 2003, the PRC government had given its approval to 64 foreign banks to open 169 branches and sub-branches and to set up 15 wholly foreign-owned commercial banks, joint venture commercial banks and finance companies in the PRC. As of December 31, 2003, according to the PBOC, foreign-invested financial institutions accounted for 1.5% of the total assets of financial institutions in the PRC.PRC laws and regulations also permit foreign financial institutions to purchase or subscribe for limited equity interests in PRC banks. Currently, a foreign financial institution can purchase or subscribe for up to 20% of the equity interest in a PRC bank. HSBC, for example, purchased a 19.90% stake in our Company in August 2004.Although the scale of foreign banks’ activities in the PRC remains limited by regulatory constraints, the PRC banking sector has been gradually opening to foreign entities. Upon the PRC’s entry into t he WTO, foreign banks were permitted to offer foreign currency-denominated products and services in the PRC without any geographic or client restrictions. Starting December 11, 2004, foreign banks havebeen permitted to offer Renminbi-denominated services and products to PRC enterprises in 18 major cities including, among others, Beijing and Shanghai. At the end of 2006, the PRC banking sector will be fully opened to foreign banks without any restrictions on business scope or geography. As a result, competition in the PRC banking sector from foreign banks is expected to intensify.In addition, the Mainland and Hong Kong Closer Economic Partnership Arrangement, a free trade agreement commonly known as the CEPA, became effective on January 1, 2004. The CEPA enables smaller Hong Kong banks to enter the PRC banking sector, which we expect will increase the competition in the PRC banking industry. For example, under the CEPA, commercial banks incorporated in Hong Kong with US$6 billion or more in total assets are qualified to apply for the establishment of branches in the PRC. By comparison, under the relevant PBOC and CBRC regulations, commercial banks incorporated in other jurisdictions must have US$20 billion or more in total assets to be qualified to apply for the establishment of branches.GROWTH IN RETAIL BANKINGAlthough corporate banking continues to be the main business for most PRC commercial banks, retail banking products and services have also grown significantly. For example, according to the PBOC, consumer loans outstanding rose from RMB17.2 billion at the end of 1998 to RMB1,573.3 billion at the end of 2003, representing 9.9% of total loans outstanding and 13.5% of GDP. However, the level of consumer lending in the PRC is still significantly below that in other countries.Bank CardsWhile bank card penetration in the PRC remains low in comparison to developed countries, the bank card business experienced rapid growth in recent years. The total cards outstanding increased from 383 million as of December 31, 2001 to 762 million as of December 31, 2004, according to the PBOC. The growth has also been accompanied by an expansion of the electronic banking terminal network.Debit cards have been the primary type of bank card in the PRC. As of December 31, 2004, debit cards outstanding amounted to 663 million. As of the same date, there were 98 million credit cards issued. The development of the credit card market has so far been limited by a variety of reasons, including strict regulation on licensing, underdevelopment of a national payment infrastructure and the absence of a nationwide consumer credit information system. However, with an increasingnumber of licences for banks to engage in credit card business being issued, the development of China UnionPay and the establishment of a national personal credit database as promoted by the PBOC, the credit card industry is expected to grow significantly in the future.Residential MortgagesDemand for housing in the PRC increased significantly in the 1990s when the PRC government began its housing reform by eliminating housing benefits for employees of state-owned enterprises and civil servants. As of December 31, 2004, the total outstanding balance of residential mortgages reached RMB1.6 trillion, approximately 38 times the balance at the end of 1998. Mortgage lending accounts for a majority of consumer lending by PRC banks. The residential mortgage market has, as a result, become a significant factor for sustained economic growth in the PRC. Although the PRC government has adopted measures to tighten its policies on lending to the real estate industry starting in 2003, residential mortgage loans have continued to grow at a rapid pace. XXX中文翻译行业概况下列资料主要与中国银行业相关。