外贸函电09[1].09_专Lecture_17_Terms_of_payment_(Unit_8)

- 格式:ppt

- 大小:409.00 KB

- 文档页数:2

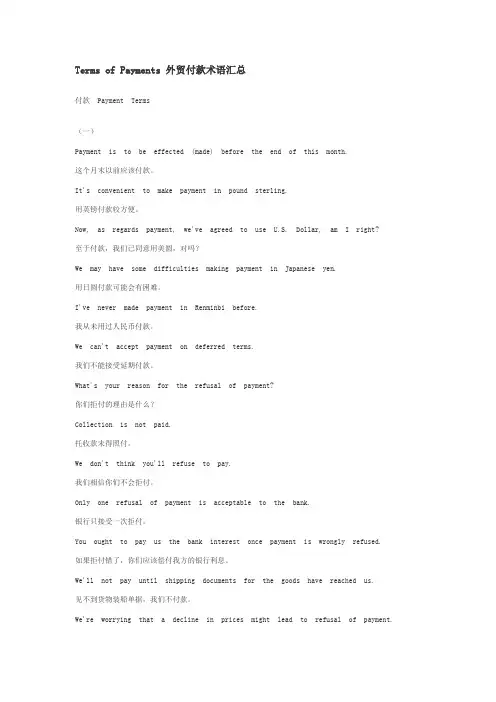

Terms of Payments 外贸付款术语汇总付款Payment Terms(一)Payment is to be effected (made) before the end of this month.这个月末以前应该付款。

It's convenient to make payment in pound sterling.用英镑付款较方便。

Now, as regards payment, we've agreed to use U.S. Dollar, am I right?至于付款,我们已同意用美圆,对吗?We may have some difficulties making payment in Japanese yen.用日圆付款可能会有困难。

I've never made payment in Renminbi before.我从未用过人民币付款。

We can't accept payment on deferred terms.我们不能接受延期付款。

What's your reason for the refusal of payment?你们拒付的理由是什么?Collection is not paid.托收款未得照付。

We don't think you'll refuse to pay.我们相信你们不会拒付。

Only one refusal of payment is acceptable to the bank.银行只接受一次拒付。

You ought to pay us the bank interest once payment is wrongly refused.如果拒付错了,你们应该偿付我方的银行利息。

We'll not pay until shipping documents for the goods have reached us.见不到货物装船单据,我们不付款。

Lesson 2Enquiries(询价)例1:询问按样生产问题敬启者:贵公司是否能按照我们的要求丝网印刷运动衫(T-恤衫)?目前,我方正扩展自己的业务,想增加收藏版产品的生产。

我们正在寻找能够按照我们要求的标准和设计进行生产的生产商。

由于所生产的运动衫是为了满足收藏,补缺市场的需求,质量方面要求非常严格。

虽然,每一种设计图案所生产的运动衫的数目可能不是很大,但是我们愿意出高于普通运动衫的价格。

同时,各种设计图案的知识产权属于我方所有,贵公司在未经我们的同意,是不允许生产复制品或者将图案卖给第三方的。

为了确保收藏价值,任何有工艺缺陷的产品需要被销毁。

我们严禁这些产品在其它任何市场,包括贵公司所在国的国内市场上出售。

如果贵公司对这项合作感兴趣的话,请报最低离岸价,并说明最早的交货周期。

如果贵方价格具有竞争力,并且交货时间可以接受,我方打算与贵方长期合作。

盼早日接到贵公司的答复。

例2:寻求供货敬启者:我们接受所有器具生产商和五金器皿供应商的报价。

但我们只需要整箱数量,请提供以下信息:·完整的生产线和详细的介绍·20英尺集装箱的价格,每一种集装箱可以有2到4个模型·交货和运输的时间·质量保证方针·付款条件请务必保证所提供的模型是按照美国能量的衡量标准所生产的。

盼早日接到贵公司的答复。

安德鲁·斯蒂文Lesson 3Replies to Enquiries(回复询函)例1:肯定答复敬启者:感谢贵公司对A&M设备的关注。

我方很高兴提供贵所要求的信息。

现报离岸价如下:如需更多信息,请发送电子邮件或登陆Yahoo聊天室与我方在线洽谈。

我方的电子信箱地址为AnMequip@,我们通常于办公时间在线。

谨上例2,拒绝提供价格信息敬启者:感谢贵方的询函。

非常感谢贵方对我们的运动服装感兴趣。

因为我们不直接向销费者销售服装,批发价是我们和经销商之间的秘密。

这是对我们商业伙伴的忠诚和信誉的回报。

Terms of PaymentWarm- upHow many instruments of payment do you know?How many basic methods of payment do you know?Have you ever heard about L/C?Why is L/C generally used in international trade?Learning objectives⏹To learn the basic three instruments of payment –bill of exchange, promissory note and cheque.⏹To learn the modes of payment in int’l trade – remittance, collection, letter of credit.⏹To be aware of the advantage and disadvantage under different payment methods.⏹To learn the letter of asking for easier terms⏹To learn the letter of replying for negotiate payment termsTerms of PaymentThe terms of payment are an important part of the sales contract both sellers and buyers are concerned about.Conditions under which the seller and buyer agree to settle the financial amount of the sales contract.International payment arrangements are much complicated because:Financial instruments⏹In int’l trade, currencies and bills are two major means of payment.⏹It is difficult for the buyer to pay and the seller to deliver the goods face to face.⏹They use documents to fulfill their respective obligations, i.e., the seller delivers the goods and is paid against the documents, meanwhile the buyer makes payment and get the goods against the documents. Banks are intermediaries, and bills are instruments of payment.Instruments of Int’l SettlementClassification of drafts1.According to time when the draft falls due:----Sight (Demand ) Bill(Draft)----Time ( Usance) Bill (Draft)2.According to the Shipping documents attached or not:----Clean Bill (no conditions)----Documentary Bill3.According to who the drawer is:----Commercial Bill----Banker’s Bill※An Example of a Banker’s DraftAn Example of a Commercial DraftPromissory Note 本票中国建设银行现金支票样本Three Main Methods of PaymentTypes of RemittanceRemittance is chiefly used forPayment in advance;Cash with order;Delivery first and payment afterwards;Small quantity of goods;Commission;Sundry chargesTypes of Remittance⏹Mail Transfer, M/T⏹Cheap but slow, seldom used⏹Telegraphic Transfer, T/T⏹Fast and safe for exporter to get the money⏹The most commonly used type of remittance⏹Demand Draft, D/D⏹Flexible to draw money⏹Convenient for the exporterTypes of CollectionTypes of Collection⏹Collection belongs to commercial credit.⏹The banker only functions as a middleman, and his obligation is only to provide services of delivering documents and collect payment. The seller sends goods first, and gets payment later. Whether the seller can get the payment or not is reliable on the buyer’s credit. The buyer gets financing from the seller.Letter of Credit, L/C信用证⏹A L/C is a conditional written undertaking given by bank on the request of an importer to pay at sight or at determinable future date a certain amount of money to the exporter against stipulated documents, provided that the terms and conditions of the credit are complied with.Letter of Credit, L/C信用证The Characteristics of L/CThe advantages of using an L/CIt is reliable and safe for both sellers and buyers.Because the issuing bank use its own credit to guarantee the payment of orders.The disadvantages of using an L/CComplicated procedure of applying for a L/CBanks will charge service fee for issuing a L/C, therefore it add more cost to the buyer.Confirmed , Irrevocable,Documentary Credit, at sight⏹Modes of payment means a series of acts or operations to realize the funds flow from one country to another.Modes of Int’l PaymentDocumentary CreditRevocable Documentary CreditIrrevocable Documentary CreditConfirmed Irrevocable CreditSight Payment Credit/Negotiation Credit议付Deferred Payment Credit/Acceptance Credit承兑Transferable CreditNon-transferable CreditRevolving Credit循环信用证Reciprocal Credit对开Anticipatory Credit预支信用证Remittance and Collectioncommercial credit offered by companies.Letter of Creditbanker’s credit offered by banks.Letter of CreditL/C: the most generally used method of payment, which is reliable and safe for both sellers and buyers.Characteristics of L/C(1) L/C is an independent instrument compared to contract, and not affected by contract.(2) The bank bears responsibility of First Payment.(3) The bank bears responsibility of the documents not the commodity itself.---- “Document Business”(4) L/C is an agreement among the bankers, beneficiary, opener and all other parties concerned and all parties concerned will be bound by the term on L/C.Terms of PaymentQuestionsQuestionsMain points of Asking for easier paymentOpening:a.reference to the relative order or contract; Mention the contract, goods, etc.Body :b.putting forward favorable payment terms; Propose the terms of paymentC.stating the reasons;Closing:d.expecting acceptance. Wish the reader to accept.Sample letter study1. Agree to the requirements:Opening:a.receiving the letter; State that you have received the letter.Body :b.acceptance of the payment terms;C.stating the reasons of acceptance;Give your reply of agreeing or refusing and your reason.Closing :d.expecting cooperation of acceptance. State your good will and your wish to do business with the reader.2. disagree to the requirements:Opening:a.receiving the letter;Body :b.expressing refusal and stating reasons;C.providing suggestions of new payment terms or insisting on previous terms;Closing :d.hoping to cooperate in the future.Amending payment termsWords & PhrasesDear Mr. Smith,Referring to the contract No. 123, we place an order with you for12000 Spinning Machine (纺纱机) Parts.In the past, our purchases of Spinning Machine Parts from you havenormally been paid by confirmed, irrevocable letters of credit. Thisarrangement has cost us a great deal of money. From the moment weopen the credit until our buyers pay us normally it ties up funds for aboutfour months. This is currently a particularly serious problem for us in view ofthe difficult economic climate and the prevailing high interest rates.If you could offer us easier payment terms, it would probably lead to anincrease in business between our companies. We propose either cash againstdocuments on arrival of goods, or drawing on us at three months’ s ight.We hope our request will meet with your agreement and look forward toyour early reply.Writing StepsUseful ExpressionsUseful ExpressionsWords & PhrasesDear Mr. Clinton,We enclose our Order No. 365. We have examined thespecifications and price list for your range of cotton shirts andnow wish to place an order with you.In the past we have traded with you on a sight credit basis.We would now like to propose a different arrangement. Whenthe goods are ready for shipment and the freight spacebooked, you will fax us and we will then remit the full amountby telegraphic transfer (T/T).We are asking for this payment so that we can giveour customers a specific delivery date and also save theexpense of opening a letter of credit. As we believe thatthis arrangement should make little difference to you andhelp with our sales, we trust that you will agree to ourrequest.We look forward to receiving confirmation of our orderand your agreement to the new arrangements forpayment.Writing StepsUseful ExpressionsUseful ExpressionsWords & PhrasesWriting StepsUseful ExpressionsUseful ExpressionsWords & PhrasesDear Mr. Merton,Thank you for your letter of 11 November 2005.We have considered your request for a trial deliveryof china on documents against acceptance terms, butregret to say that we cannot agree to your proposal.As an exception, the best we can do for the trial is tooffer D/P.If you accept our proposal you run very little risk, sinceour china is well known for its quality, attractive design andreasonable price. Our lines sell very well all over the worldand have done so far for the last 50 years. We do not thinkyou will have any difficult in achieving a satisfactoryvolume of sales.If you find our proposal acceptable, please let us knowand we can then expedite the transaction.Yours sincerely ,Writing StepsUseful ExpressionsAnalyzing the letterParagraph 1: identifying the referenceParagraph 2: accepting the proposal, giving the reasonsParagraph 3: making it clear that the concession does not apply to future transactions Paragraph 4: detailing the enclosureLanguage Points1. pay v. 付款1) pay in advance 预付2) pay by installments 分期付款3) pay on delivery 货到付款4) pay by 30 days L/Cpay by time L/C at 30 days以见票后30天议付的信用证付款5) pay by sight L/C 以即期信用证付款We trust you will pay our draft on presentation.我们相信你方在见到我们的汇票时即照付。

UNIT 4 TERMS OF PAYMENTI.Teaching Aims and RequirementsBy learning this unit, the students are supposed to be able to1. Know the basic instruments and methods of payment terms2. Write letters concerning international paymentII. Contents1.Methods of payment in international trade.2.The kinds of L/C3.The operation of L/C4. The structure of a business letter abour discussing the terms of paymentIII. Focus on and Difficulties1.The procedure of asking to open and extend an L/C2.The amendment to yhe L/CIV. Teaching steps1.The types of business letter about the terms of payment1) 开证函(1)谈及订单或合同项下货物(2)提出支付方式的要求及理由(3)强调惯例做法,请给与理解(4)卖方同意买方要求,则表明相互通融,对对方的要求予以考虑以及对成功合作的意愿;卖方若拒绝买方要求,则表明自己做法的合理性,必然性2) 改证函(1)确认收到信用证,指出不符点(2)要求改证,对不符点内容的修改(3)望早日收到修改书2. Useful pattern1.Opening L/C(1)We enclose an application form for documentary credit and shall beglad if you will arrange to open our account an irrevocable L/C for $40,000 in favour of ABC Company, the credit to be valid until July12.(2)We write to inform you that we have today established with Bank ofChina an irrevocable documentary L/C in your favor for the amount of $53,000 covering1,000 sets of TV.2.Rushing L/C(1)Please expedite /rush the L/C so that we can execute the ordersmoothly.(2)As the goods have been ready, please rush the L/C covering S/CA V_231.(3)The shipment date is approaching. It would be advisable for you toopen the L/C covering your Oder No.341 the soonest possible so as to effect the shipment within the stipulated time.3.Amending L/C(1)We have received your L/C No.123 and on checking up the clauses/onperusal/on examination of the clauses, have regretfully found the following discrepancies in it.(2)We have amended the quantity as 250 metric tons.(3)We have found the amount of your L/C is insufficient. Please increasethe unit price US$3 to US$3.5 and the total amount to $ 60,000.V. Practical Writing敬启者:我们已收到你方11月8日的来信,要求我们以承兑交单方式发运你方一批手提电脑。

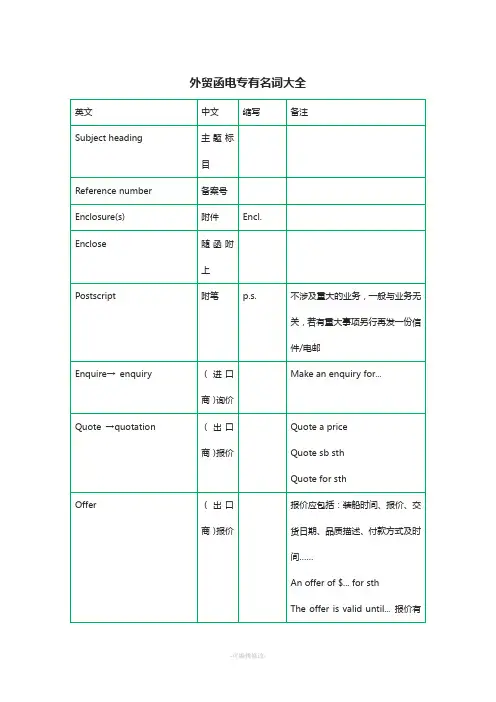

09年自考《外贸函电》第五课至第九课复习重点询价和报盘:1.description of an article/name of commodity意思是商品名称。

在商业书信中,我们常常可以看到许多表示商品或货物的词汇,如:commodity,goods,article,merchandise,cargo,material,item,product,supply,order 等。

下面简单介绍一下这些词汇的用法:commodity是比力正式的用语,通常指较大范围的商品,尤其指一个国家的主要商品。

Commodity是可数名词。

goods不是指一件商品,而是统指货物。

Goods永远是复数形式,不能与数词连用。

Merchandise 也是泛指商品,不特指某一商品,但没有复数形式,前面也不成加不定冠词。

article 作商品解时,常常指一种商品,而不是指一类商品,同一种商品而有不同规格,商品编货号,常用此词,如在课文中。

Cargo = goods carried in a ship.即船上所载的货物。

如:The steamer sailed with full cargo.该轮满载起航。

注意这里不能用goods 代替cargo.说与装运有关的货物时也可以用cargo,但不如goods普通。

如:We expect to ship the goods (可用cargo)in a few days. 如果不是在船上的货物,又跟装运没有关系的货物,不能用cargo,如:As soon as the goods (不能用cargo)are available,we will call you.material 一般指作原料用的商品。

item 名词item本义是“项目”,但在商业函件中常用来代表前面提到的货物,如:We note your are interested in walnut meat but regret to advise that this item is not available at present. 尤其在介绍目录中的商品项目时常用此词,如:You can buy these items through the catalogue. 你能从目录中买到这些项目。