战略管理(中英文)

- 格式:ppt

- 大小:2.11 MB

- 文档页数:33

名词解释:1、Strategy: An integrated and coordinated set of commitments & actions designed to exploit core competencies and gain a competitive advantage.2、Strategic Management: Strategic Management is the process through which organizations analyze and learn from their internal and external environments, establish strategic direction, create strategies that are intended to help achieve established goals, and execute those strategies, all in an effort to satisfy key organizational stakeholders.3、Strategic Management consists of the analysis, decisions and actions an organization undertakes in order to create and sustain competitive advantages.4、The strategic management process includes the activities of internal and external analysis, establishment of strategic direction, development of strategies for the corporate and business levels of the organization, development and execution of an implementation plan, and the establishment of strategic controls.5、Vertical integration: The term is used to describe the extent to which a firm is involved in several stages of the industry supply chain.6、Horizontal integration: The process of acquiring or merging with industry competitors to achieve the competitive advantages that arise from a large size and scope of operations.7、Diversification strategy describes the scope of the firm in terms of the industries and markets in which it competes.8、Related diversification implies organizational involvement in activities that are somehow related to the dominant or “core” business of the organization, often through common markets or similar technologies.9、Unrelated diversification does not depend on any pattern of relatedness. Unrelated diversification has lower profitability and higher risks than those pursuing other corporate-level strategies such as concentration or related diversification.10、Organizational fit: When two organizations or business units are merged or acquisition happened, and the organizational management processes, cultures, system, and structures are matching(similar), this is organizational fit.11、Marketing strategy: Marketing strategy is the plan for investing marketing efforts and resources (advertising, branding, distribution, etc.)to achieve business goals.To support growth strategiesTo support a stability or retrenchment strategy12、Economies of scale: Economies of scale refers to the cost advantages that an enterprise obtains due to expansion. There are factors that cause a producer’s average cost per unit to fall as the scale of output is increased. "Economies of scale" is a long run concept and refers to reductions in unit cost as the size of a facility and the usage levels of other inputs increase.(1)Economies of scale. Unit cost reductions associated with a large scale of output •Larger production runs•Larger facilities•Allocating fixed costs(2)Diseconomies of scale. Unit cost increases associated with a large scale of output•Increased bureaucracy associated with large-scale enterprises•Resulting managerial inefficiencies13、True economies of scale are cost advantages associated with large-sized facilities rather than with increased volume through an existing facility.14、Life cycle of an industry: Refers to the stages of Introduction, Growth, Maturity and Decline, portrays how salesvolume for a product or an entire industry changes over its lifetime and helps to understand the dynamic nature of strategy.15、So-called product life cycle: Refers to the product from entering the market ,the market cycle, until final out of the market experience.简答论述:一、潜在竞争者出现面临的障碍都有哪些障碍并举例(Potential competitors∕Entry Barriers P31)Potential competitors∕Entry Barriers: Forces that keep new entrants out, providing a level of protection for existing competitors, are called entry barriers.Examples of entry barriers commonly found in many industries include the following:1、Economies of scale, which occur when it is more efficient to produce a product in a large facility at higher volume.2、Large capital requirements,also known as start-up costs ,can prevent a small competitor from entering an industry.3、High levels of products differentiation ,which means that some firms enjoy a loyal customer base, making it harder for a new firm to draw away customers.4、High switching costs ,applying not only to suppliers, can be used to preserve established firms in an industry.5、Limited access to distribution channels,which may prevent new companies from getting their products to market.6、Government policies and regulations that limit entry into industry,effectively preventing new competition.7、Existing firm procession of resources that are difficult to duplicate in the short term. Such as patents, favorable locations, proprietary product technology, government subsidies, or access to scarce raw materials.(Cost disadvantages independent of scale)8、A past history of aggressive retaliation by industry competitors toward new entrants.(Threat of new entries)二、什么样资源、能力能使企业形成持续核心竞争力?(Sustainable competitive advantage P46 )Internal resources and capabilities fall into five: human, physical, financial, knowledge, and organizational.In general, capabilities and resource become strengths with the potential to create a competitive advantage if two conditions are met.1.The resource or capabilities are value.2.The resource or capabilities are unique.In addition, a unique and valuable resources or capability actually becomes a competitive advantage if the following additional conditions are met:1.The organization is suited to exploitation of the resourceor capability.2.T he firm’s managers are aware of the potential of theresource or capability to lead to a competitive advantageand have taken steps to realize the advantage.Finally, a resource or capability can be a source of sustainable competitive advantage if two additional conditions are met:1.The resource or capabilities are difficult or expensive to imitate.2.No readily available substitutes exist.三、企业的社会责任感的概念以及包含哪些重点内容?(Social responsibility P15上课补充的)Social responsibility:the expectation that businesses or individuals will strive to improve the overall welfare of society.1、Economic responsibility. Such as the obligation to beproductive and profitable and meet the consumer needs of society.2、Legal responsibility.To achieve economic goals withinthe confines of established laws.3、Moral obligations. To abide by unwritten codes, norms,and values implicitly derived from society.4、Discretionary responsibility. Volitional or philanthropicin nature.四、怎么实现低成本战略?How to Realize the Low-costStrategy (Cost leadership P95)Low-cost leadership allows a firm to compete by lowering prices when needed without becoming unprofitable.Firms pursuing a low-cost strategy will typically employ one or more of the following factors to create their low-cost position:1.High capacity utilization.When customer demand is highand the firm’s capacity is full utilized, fixed costs are spread over more units, lowering unit cost.2.Economic of scale. True economies of scale are costadvantages associated with large-sized facilities rather than with increased volume through an existing facility.3.Technological panies making investments incost-saving technologies are often trading an increase in fixed costs for a reduction in variable costs.4.Learning/experience effects.The learning curve effect saysthat the time required to complete a task will decrease as a predictable function of the number of times the task is repeated.Experience effects are the same thing as learning effects but relate to indirect labor as well as direct production labor.五、功能性(职能)战略的概念,发展比较好应具备什么特点?(Functional strategies P137)Functional strategies: Functional strategies are the plans for matching those skills, resources, and capabilities to the business and corporate strategies of the organization.The well-developed Functional strategies should have the following Characters:1.Decisions made within each function will be consistent with each other.2.Decisions made within one function will be consistent with those in other functions.3.Decisions made within functions will be consistent with the strategies of the business.六、改善组织学习质量、提高组织学习数量,控制系统应该具备什么特征?(To enhance the quality of organizational learning ,these control systems should have the following characters )a) Information generated by the control system should be an important and recurring item to be addressed by the highest levels of management.b) The control process should also be given frequent and regular attention from operating managers at all levels of the organization.c) Data from the system should be interpreted and discussed inface-to-face meeting among superiors and subordinates.d) The success of the control process relies on the continual challenge and debate of underlying data, assumptions, and strategies.小论文:多元化战略,结合实际认识,优缺点,对企业发展的影响。

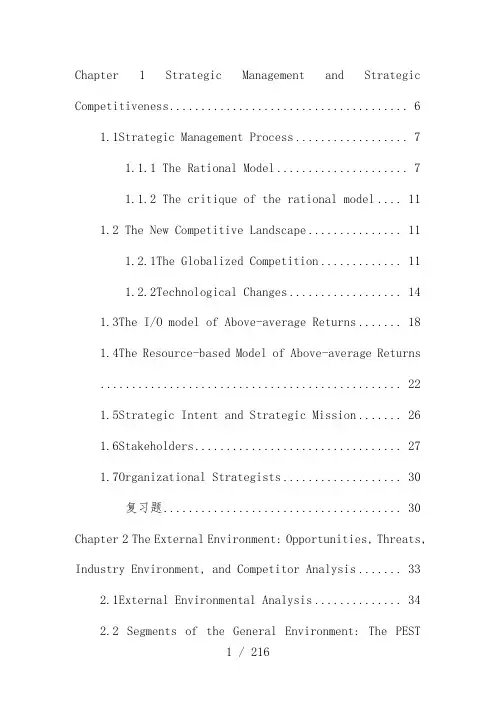

Chapter 1 Strategic Management and Strategic Competitiveness (6)1.1Strategic Management Process (7)1.1.1 The Rational Model (7)1.1.2 The critique of the rational model (11)1.2 The New Competitive Landscape (11)1.2.1The Globalized Competition (11)1.2.2Technological Changes (14)1.3The I/O model of Above-average Returns (18)1.4The Resource-based Model of Above-average Returns (22)1.5Strategic Intent and Strategic Mission (26)1.6Stakeholders (27)1.7Organizational Strategists (30)复习题 (30)Chapter 2 The External Environment: Opportunities, Threats, Industry Environment, and Competitor Analysis (33)2.1External Environmental Analysis (34)2.2 Segments of the General Environment: The PESTAnalysis (37)2.3 Industry Environment Analysis: The Five ForcesModel (39)2.4 Strategic Group Analysis (50)2.5 Competitor Analysis (51)复习题 (52)Chapter 3 The Internal Environment: Resources, Capabilities, and Core Competencies (55)3.1 The importance of Internal Analysis (56)3.2 Resources, Capabilities, and Core Competencies (59)3.2.1 Resources (59)3.2.2 Capabilities (62)3.2.3 Core Competencies (64)3.3 Steps in a Resource-based Strategic Analysis 663.4 Value Chain Analysis (75)复习题 (77)Chapter 4 Business-Level Strategy (78)4.1 Customers: Who, What, and How (79)4.1.1 Who: Determining the customers to serve 804.1.2 What: Determining the customer needs tosatisfy (81)4.1.3 How: Determining core competenciesnecessary to satisfy customers’ needs (82)4.2 Types of Business-level Strategy (82)4.3 Cost Leadership Strategy (84)4.4 Differentiation Strategy (89)4.5 Focus Strategies (94)4.6 Integrated Low-Cost/Differentiation Strategy 96复习题 (100)Chapter 5 Corporate-Level Strategy (103)5.1 Corporate-level Strategy and Levels ofDiversification (104)5.2 Reasons for Diversification (107)5.3 Techniques for Analyzing Diversified Companies’Portfolios (108)复习题 (111)Chapter 6 Acquisition and Restructuring Strategies . 1136.1 Reasons for Acquisitions and Problems in AchievingSuccess (113)6.2 Attributes of Successful Acquisitions (115)6.3 Restructuring (116)复习题 (117)Chapter 7 International Strategy (121)7.1 Opportunities and Outcomes of InternationalStrategy (122)7.2 International Business-level Strategy (127)复习题 (130)Chapter 8 Cooperative Strategy (133)8.1Types of and Reasons for Cooperative Strategies (134)8.2Business-level and Corporate-level CooperativeStrategies (137)8.2.1 Business-Level Cooperative Strategies 1378.2.2 Corporate-Level Cooperative Strategies 1398.3Network Strategies (141)8.4Competitive Risks with Cooperative Strategies 143Chapter 9 Corporate Governance (149)9.1 Corporate Governance Mechanisms (150)9.2 Separation of Ownership and Managerial Control (154)9.3 Five Governance Mechanisms (160)9.3.1 Ownership Concentration (160)9.3.2 Board of Directors (162)9.3.3 Executive Compensation (164)9.3.4 The Multidivisional Structure (167)9.3.5 Market for Corporate Control (168)复习题 (169)Chapter 10 Organizational Structure and Controls (172)10.1 Evolutionary Patterns of Strategy andOrganizational Structure (172)10.1.1 Simple Structure (175)10.1.2 Functional Structure (177)10.1.3 Multidivisional Structure (183)10.2 Implementing International Strategies:Organizational Structure and Control (195)10.2.1 Using the Worldwide Geographic AreaStructure to Implement the Multi-domesticStrategy (195)10.2.2 Using the Worldwide Product DivisionalStructure to Implement the Global Strategy . 198复习题 (202)Chapter 11 Corporate Entrepreneurship and Innovation 20211.1 Innovation and Corporate Entrepreneurship . 20311.2Internal Corporate Venturing (208)复习题 (216)Chapter 1 Strategic Management and Strategic CompetitivenessLearning ObjectivesAfter reading this chapter, you should be able to ·Defining strategic competitiveness, competitive advantage, and above-average returns.·Discuss the challenge of strategic management.·Describe the new competitive landscape and how it is beingshaped by global and technological changes.·Use the industrial organization(I/O) model to explain how firms can earn above-average returns.·Use the resource-based model to explain how firms can earn above-average returns.·Describe strategic intent and strategic mission and discuss their value to the strategic management process.·Define stakeholders and describe the three primary stakeholder groups’ ability to influence organizations.·Describe the work of strategists.·Explain the strategic management process.1.1Strategic Management Process1.1.1 The Rational ModelStrategic competitiveness(战略竞争力) is achieved when a firm successfully formulates and implements a value-creating strategy. When a firm implements a value-creating strategy of which other companies are unable to duplicate the benefits or find it too costly to imitate, this firm has a sustained or sustainablecompetitive advantage(持续的或可持续的竞争优势). The speed with which competitors are able to acquire the skills needed to duplicate the benefits of a firm’s value-creating strategy determines how long a competitive advantage will last. Understanding how to exploit its competitive advantage is necessary for a firm to earn above-average returns. Above-average returns(高于平均的或超额回报) are returns in excess of what an investor expects to earn from other investment with a similar amount of risk.Risk(风险) is an investor’s uncertainty about the economic gains or losses that will result from a particular investment. Firms that are without a competitive advantage or that are not competing in an attractive industry earn, at best, only average returns. Average returns(平均回报)are returns equal to those an investor expects to earn from other investments with a similar amount of risk. In the long run, an inability to earn at least average returns results in failure. Failure occurs because investors will choose to invest in firms that earn at least average returns andwill withdraw their investments from firms that earn less. Dynamic in nature, the strategic management process (战略治理过程)is the full set of commitments, decisions, and actions required for a firm to achieve strategic competitiveness and earn above-average returns. It is used to match the conditions of an ever-changing market and competitive structure with a firm’s continuously evolving resources, capabilities, and competencies.Figure 1.1 The Strategic Management ProcessNotes: the letter S in SWOT denotes strengths, Wweaknesses,O opportunities, T threats.1.1.2 The critique of the rational model1.Setting objectives is the cornerstone of strategic planning. But, incentive un-compatibility(激励不相容)usually leads to inconsistency between objectives that the firm has stated and objectives that the managers are actually pursuing.2.The predictability of the environment is the core assumption of strategic planning. But, irreversibility and uncertainty(不确定性)usually lead to the unpredictability of the environment.3.Another assumption of strategic planning is that strategists are rational. Virtually,stra tegists’ rationality is bounded(战略家的理性是有限的)and strategic formulation reflects the internal politics of the organization.1.2 The New Competitive Landscape1.2.1The Globalized CompetitionThe fundamental nature of competition in many of theworld’s industries is changing. The pace of this change is relentless and is increasing. Even determining the boundaries of an industry or a firm(行业或企业的边界) has become challenging. Consider, for example, how advances in interactive computer networks and telecommunications have blurred the definition of the “television”industry. Conventional sources of competitive advantage(传统的竞争优势的源泉) such as economies of scale(规模经济) and huge advertising budgets(巨额广告预算) are not as effective in the new competitive landscape. Moreover, the traditional managerial mind-set(传统的治理者心态) cannot lead a firm to strategic competitiveness in the new competitive landscape. In its place, managers must adopt a new mind-set ——one that values flexibility, speed, innovation, integration, and the challenges that evolve from constantly changing conditions(看重灵活性、速度、创新、整合和从不断变化的环境中产生的挑战的心态). Strategic flexibility(战略的敏捷性) is a set of capabilities firms use to respond to various demands and opportunities thatare a part of dynamic and uncertain competitive environments. Such flexibility means that a firm can match quickly its resources with an environmental opportunity(快速地使其资源与环境的机遇匹配).A global economy(全球经济) is one in which goods, services, people, and ideas move freely across geographic borders. It significantly expands and complicates a firm’s competitive environment. To achieve strategic competitiveness in the global economy, a firm must view the world as its marketplace.In globalized markets(全球化的市场) and industries, financial capital might be obtained in one national market and used to buy raw materials in another one. Manufacturing equipment bought from a third national market can be used to produce products that are sold in a fourth market. Thus, globalization increases the range of opportunities for firms competing in the new competitive landscape.The internationalization of markets and industries makes it increasingly difficult to think of some firms asdomestic companies(本国公司).Global competition has increased performance standards(绩效标准) in many dimensions, including those of quality, cost, productivity, production introduction time, and smooth, flowing operations.The development of newly industrialized countries(新兴工业化国家) is changing the global competitive landscape and significantly increasing competition in global markets. The economic development of Asian countries outside of Japan is increasing the significance of Asian markets. In the new competitive landscape, firms are challenged to develop the optimal level of globalization(最优的全球化水平).1.2.2Technological ChangesThere are three categories of technological trends and conditions through which technology is significantly altering the nature of competition(竞争的性质).·Increasing rate of technological change and diffusion(不断上升的技术变迁率和扩散率)Both the rate of technology changes and the speed at which new technologies become available and are used have increased substantially over the last 20 years. Perpetual innovation(持续的创新) is a term used to describe how rapidly and consistently new, information-intensive technologies (信息密集的技术)replace older ones. The shorter product life cycles(产品生命周期) resulting from these rapid diffusions of new technologies place a competitive premium on being able to quickly introduce new goods and services into the marketplace. In fact, when products become somewhat indistinguishable because of the widespread and rapid diffusion of technologies, speed to market(产品进入市场的速度) may be the only source of competitive advantage. Some evidence suggests that after only 12 to 18 months, companies likely will have gathered information about their competitors’R&D and product decisions. Often, merely a few weeks pass before a new American-made product introduced in U.S. markets is copied, manufactured, and shipped to the United States by one ormore companies in Asia.Today’s rate of technological diffusion stifles the protection firms possessed previously through their patents(专利). Patents are now thought by many to be an effective way of protecting proprietary technology(专利技术) primarily in the pharmaceutical and chemical industries only. Many firms competing in the electronics industry often do not apply for patents to prevent competitors from gaining access to the technological knowledge included in the patent application(包含在专利申请中的技术知识).·The Information Age(信息时代)Dramatic changes in information technology have occurred in recent years. Personal computers, cellular phones, artificial intelligence(人工智能), virtual reality(虚拟现实), and massive databases are a few examples of how information is used differently as a result of technological developments. Someone believes that electronic mail (E-mail) systems are the firstmanifestation of a revolution in the flow and management of information in companies throughout the world. An important outcome of these changes is that the ability to access and effectively use information has become an important source of competitive advantage in virtually all industries.·Increasing Knowledge Intensity(不断提高的知识密度) Knowledge is the basis of technology. In the new competitive landscape, knowledge is a critical organizational resource and is increasingly a valuable source of competitive advantage. Because of this, many companies now strive to transmute the accumulated knowledge of individual employees into a corporate asset(把个体性职员积存起来的知识转变成公司的资产).Figure 1.2 The New Competitive Landscape1.3The I/O model of Above-average ReturnsFrom the 1960s through the 1980s, the external environment was thought to be the primary determinants of strategies firms selected. The industrial organization model explains the dominant influence of the external environment on firms’ strategic actions. This model specifies that the industry chosen in which to compete has a stronger influence on a firm’s performance than do the choices managers make inside their organizations. Firm performance is believed to be predicted primarily by a range of an industry’s properties(行业属性), including economies of scale(规模经济),barriers to entry(进入壁垒), diversification(产品多元化), product differentiation(产品差异), and the degree of concentration(行业集中度). The I/O model has four underlying assumptions. First, the external environment is assumed to impose pressures and constraints that determine the strategies that would result in above-average returns. Second, most firms competing within a particular industry are assumed to control similar strategically relevant resources and pursue similar strategies. Third, it is assumed that resources used to implement strategies are highly mobile across firms. Because of resource mobility, any resource differences that might develop between firms will be short lived. Fourth, organizational decision makers are assumed to be rational and committed to acting in the firm’s best interests as shown by their profit maximizing behavior(利润最大化行为).The I/O model challenges firms to locate the most attractive industry in which to compete. Competitiveness generally can be increased only when firms find the industry with the highest profit potential(具有最高的利润潜能的行业) and learn how to use their resources to implement the strategy required by the structural characteristics in that industry(行业的结构特征所要求的战略). The five forces model of competition(竞争的五力模型) is an analytical tool used to help firms with this task. This model suggests that an industry’s potential profitability(行业的潜在的赢利性) is a function of interactions among five forces. A firm can use this model to understand an industry’s profit potential and the strategy that should be implemented to establish a defensible competitive position(可防卫的竞争位置). Typically, this model suggests that firms can earn above-average returns by implementing a cost leadership strategy(成本领先战略) or a differentiation strategy(差异化战略).Figure 1.3 The I/O Model of Superior Returns1.4The Resource-based Model of Above-average Returns The resource-based model (基于资源的模型) assumes that each organization is a bundle of unique resources and capabilities that provides the basis for its strategy and is the primary source of its returns. According to this model, differences in firms ’ performances across time are driven primarily by organization ’s unique resources and capabilities rather than by an industry ’s structural characteristics (企业绩效的跨时差异要紧是由组织的独特的资源的能力而非行业的特征驱动的).This model also assumes that over time, firms acquire different resources and develop unique capabilities. As such, all firms competing within a particular industry may not possess the same strategically relevant resources and capabilities. Another assumption of this model is that resources may not be highly mobile across firms. The differencesinresources(资源上的差异) form the basis of competitive advantage.Resources (资源)are inputs into a firm’s production process, such as capital equipment, the skills of individual employees, patents, finance, and talented managers. In general, a firm’s resources can be classified into three categories: physical, human, and organizational capital(实物资本、人力资本和组织资本). Individual resources alone may not yield a competitive advantage. In general, it is through the combination and integration of sets of resources that competitive advantages are formed(竞争优势是通过组合和整合资源集形成的). A capability(能力) is the capacity for a set of resources to integratively perform a task or an activity. Through continued use, capabilities become stronger and more difficulty for competitors to understand and imitate(通过持续的使用,能力变得更强和更加难以被对手理解和模仿). As a source of competitive advantage, a resource should be valuable, rare, costly to imitate, and non-substitutable.Resources are valuable(有战略价值的) when they allow a firm to exploit opportunities and or/neutralize threats in its external environment; they are rare(稀有的) when possessed by few, if any, current and potential competitors; they are costly to imitate(模仿代价高昂的) when other firms either cannot obtain them or at a cost disadvantage to obtain them compared to the firm that already possesses them; they are non-substitutable(不可替代的) when they have no structural equivalents.The resource-based model of competitive advantage suggests that a firm’s unique resources and capabilities provide the basis for a strategy. The strategy chosen should allow the firm to best exploit its core competencies(最佳地利用其核心竞争力) relative to opportunities in the external environment. Core competencies(核心竞争力) are resources and capabilities that serve as a source of competitive advantage.Figure 1.4 The Resource-based Model of Superior Returns1.5Strategic Intent and Strategic MissionStrategic intent(战略意图) is the leveraging of a firm’s internal resources, capabilities, and core competencies to accomplish the firm’s goals in the competitive environment. Strategic intent reflects what a firm is capable of doing as a result of its core competencies and the unique ways they can be used to exploit a competitive advantage. The following examples are expression of strategic intent.“To become a high-performance multinational energy company——not the biggest, but the best.”“Its our strategic intent that customers worldwide view us as their most valued pharmaceutical partner.”“To be the top performer in everything.”“To catch up with and beat Caterpillar.”Strategic mission(战略使命) is a statement of a firm’s unique purpose and the scope of its operations in productand market terms. An effective strategic mission establishes a firm’s individuality and is exciting, inspiring, and relevant to all stakeholders(利害相关者). Together, strategic intent and strategic mission yield the insights required to formulate and implement the firm’s strategies(制定和执行企业战略所要求的洞见). When a firm is strategically competitive and earning above-average returns, it has the capacity to satisfy its stakeholders’interests(满足其利害相关者的利益).1.6StakeholdersStakeholders(企业的利害相关者) are the individuals and groups who can affect and are affected by the strategic outcomes achieved and who have enforceable claims on a firm’s performance(对企业绩效的可实施的要求权). Claims against an organization’s performance are enforced through a stakeholder’s ability to withhold participation essential to a firm’s survival, competitiveness, and profitability. Stakeholders continue to support an organization when its performance meets or exceeds theirexpectations. However, every stakeholder does not have the same level of influence. The more critical and valued a stakeholder’s participation is, the greater a firm’s dependency on it. Greater dependence, in turn, results in more potential influence for the stakeholder over a firm’s commitments, decisions, and actions.The stakeholders involved with a firm’s operations can be separated into three groups. Each of these stakeholder groups expects those making strategic decisions in a firm to provide the leadership through which their valued objectives will be accomplished(提供有助于实现他们看重的目标的领导). But these groups’ objectives often differ from one another, sometimes placing managers in situations where trade-offs have to be made(有时置经理于必须作出二难选择的情形中). It is important that those responsible for managing stakeholder relationships in a country outside their native land use a global mind-set. A global mind-set(全球心态) is the capacity to appreciate the beliefs, values, behaviors, and business practices ofindividuals and organizations from a variety of regions and cultures.The firm’s stakeholders and their interests Capital market stakeholders Goals and Objectives •Shareholders dividends, profit rate•Creditors security of loan Product market stakeholders:•Customers perceived value of the good or the service•Suppliers profitable sales, paymentfor goods, long-termrelationship•Host communities pollution, employment, aids, taxinside-organization stakeholders•Employees monetary and non-monetary interests•Managers monetary andnon-monetary interests1.7Organizational StrategistsSmall organizations may have a single strategist. In many cases, this person owns the firm and is deeply involved with its daily operations. At the other extreme, large, diversified firms(多元化的企业) have many top-level managers. In addition to the CEO and other top-level officials(e.g., chief operating officer and chief financial officer操作总监和财务总监), they have managers who are responsible for the performance of individual business units(个体性业务单位).Typically, stakeholders have high expectations of top-level managers, particularly the CEO. Some believe that every organizational failure is actually a failure of those who hold the final responsibility for the quality and effectiveness of a firm’s decisions and actions.复习题1.解释下列概念:战略竞争力、高于平均的回报、平均回报、风险、战略治理过程、激励不相容、有限理性、战略的敏捷性、资源、能力、核心竞争力、战略意图、战略使命、企业的利害相关者2. 战略竞争力概念中所隐含的前提性假设是什么?企业猎取可持续的战略竞争力的关键或曰前提是什么?什么决定着企业的战略竞争力可维持的时刻的长短?3.战略治理过程的理性模型有何不足?什么缘故各国战略治理教材仍把它作为要紧内容进行讲授?4.传统的企业竞争优势的源泉是什么?在新竞争情景中什么更重要?5.什么缘故讲市场和行业的国际化使要把某些公司看成本国公司越来越困难?6.什么缘故讲在技术快速扩散和传播的情况下,产品进入市场的速度或许是竞争优势的唯一源泉?7.什么缘故药品行业和化学行业的企业比较情愿申请专利,而电子行业的企业一般不情愿申请专利?8.什么缘故讲猎取和有效利用信息的能力已成为所有行业中的竞争优势的重要源泉?9.试述塑造新竞争情景的要紧力量。

1.管理与组织导论管理者:(manager)基层管理者:(first-line managers)中层管理者:(middle managers)高层管理者:(top managers)管理:(management)效率:(efficiency)效果:(effectiveness)计划:(planning)组织:(organizing)领导:(leading)控制:(controlling)管理角色:(management roles)人际关系角色:(interpersonal roles)信息传递角色:(informational roles)决策制定角色:(descisional roles)技术技能:(technical skills)人际技能:(human skills)概念技能:(conceptual skills)管理的普遍性:(universality of management)2.管理的历史劳动分工:(division of labor)工作专业化:(job specialization)工业革命:(industrific revolution)科学管理:(scientific management)一般行政管理理论:(general administrative theory) 管理原则:(principles of management)官僚行政组织:(bureaucracy)定量方法:(quantitative approach)组织行为:(organizational behavior)霍桑研究系统:(Hawthorne studies systems)封闭系统:(closed systems)开放系统:(open systems)权变理论:(contingency approach)劳动力多元化:(workforce diversity)电子企业:(e-business)电子商务:(e-commerce)内部网:(intranet)学习型组织:(learning organization)知识管理:(knowledge management)质量管理:(quality management)3.组织文化与环境管理万能论:(omnipotent view of management) 管理象征论:(symbolil view of management)组织文化:(organization culture)强文化:(strong cultures)社会化:(socialization)工作场所精神境界:(workplace spirituality)外部环境:(external environment)具体环境:(specific environment)一般环境:(general environment)环境的不确定性:(environment uncertainty)环境的复杂性:(environment complexity)利益相关群体:(stakholders)4.全球环境中的管理狭隘主义:(parochialism)民族中心论:(ethnocentric attitude)多国中心论:(polycentric attitude)全球中心论:(geocentric attitude)跨国公司:(multinational corporation)多国公司:(multidomestic corporation)全球公司:(global company)跨国或无边界组织:(transnational or boredrless organization) 初始全球化组织:(born globals)全球外购:(global sourcing)出口:(exporting)进口:(importing)许可证经营:(licensing)许可经营:(franchising)战略同盟:(strategic alliance)合资企业:(joint venture)外国子公司:(foreign subsidiary)市场经济:(market economy)计划经济:(command economy)民族文化:(national culture)5.社会责任与管理道德古典观点:(classical view)社会经济学观点:(socioeconomic view)社会义务:(social obligation)社会响应:(social responsiveness)社会责任:(social responsinility)社会屏障筛选:(social screening)管理的绿色化:(gerrning of management)以价值观为基础的管理:(values-based management) 道德:(ethics)自我强度控制点:(ego strength locus of control)道德准则:(code of ethics)社会企业家:(social entrepreneur)社会影响管理:(social impact management)6.制定决策决策:(decisions)决策制定过程:(decision-making process)决策标准问题:(decision criteria problem)理性的:(rational)有限理性:(bounded rationality)满意的承诺升级:(satisfied escalation of commitment) 直觉决策:(intuitive decision making)结构良好问题:(structured problems)程序化决策:(programmed decision)程序:(procedure)规则:(rule)政策:(policy)结构不良问题:(unstructured problems)非程序化决策:(nonprogrammed decisions) 确定性:(certainty)风险性:(risk)命令型风格:(directive style)分析型风格:(analytic style)概念型风格:(conceptual style)行为型风格:(behavioral style)启发法:(heuristics)7.计划的基础陈述目标:(stated goals)真实目标:(real goals)战略计划:(strategic plans)运营计划:(operational plans)长期计划:(long-term plans)短期计划:(short-term plans)具体计划:(specific plans)方向性计划:(directional plans)一次性计划:(single-used plans)持续性计划:(standing plans)传统目标:(traditional goal setting)手段-目标链:(means-ends chain)目标管理:(management by objectives)使命:(mission)承诺概念:(commitment concept)正式计划部门:(formal planning department) 8.战略管理战略管理:(strategic management)组织战略商业模式:(strategies business model ) 战略管理过程:(strategic management process) 机会:(opportunities)威胁:(threats)资源:(resources)能力:(capabilities)核心竞争力:(core competencies)SWOT分析法:(SWOT analysis)公司层战略:(corporate strategy)增长战略:(growth strategy)相关多元化:(related diversification)非相关多元化:(unrelated diversification) 稳定性战略:(stability strategy)更新战略:(renewal strategies)紧缩战略:(retrenchment strategy)扭转战略:(turnaround strategy)BCG矩阵:(BCG matrix)业务层战略:(business strategy)战略业务单元:(strategic business units) 竞争优势:(competitive advantage)成本领先战略:(cost leadership strategy) 遵循差异化战略:(differentiation strategy) 聚焦战略:(focus strategy)徘徊其间:(stuck in the middle)战略灵活性:(strategic flexibility)市场先入者:(first mover)9.计划的工具技术环境扫描:(environment scanning)竞争对手情报:(competitor intelligence) 预测:(forecasts)定量预测:(quantitative forecasting)定性预测:(qualitative forecasting)标杆比较:(benchmarking)资源:(resources)预算:(budget)甘特图:(Gantt chart)负荷图:(load chart)事件:(events)计划评审技术:(the program evaluation and review technique) 活动:(activities)松弛时间:(slack time)关键路径:(critical path)盈亏平衡分析:(breakeven analysis)线性规划:(linear programming)项目管理:(project management)脚本:(scenario)10.组织结构与设计组织结构设计:(organazational structure design)工作专门化:(work specialization)职能部门化:(functional departmentalization)产品部门化:(product departmentalization)地区部门化:(geographical departmentalization) 过程部门化:(process departmentalization)顾客部门化:(customer departmentalization)跨职能团队:(cross-functional teams)指挥链:(chain of command)职权:(authority)职责:(responsibility)统一指挥:(unity of command)管理跨度:(span of control)集权化:(centralization)分权化:(decentralization)员工授权:(employee empowerment)正规化:(formalization)机械式组织:(mechanistic organization)有机式组织:(organic organization)单件生产:(unit production)大批量生产:(mass production)连续生产:(process production)简单结构:(simple structure)职能型结构:(flanctional structure)事业部型结构:(divisional structure)团队结构:(team structure)矩阵型结构:(matrix structure)项目型结构:(project structure)无边界组织:(boundaryless organization) 虚拟组织:(virtual organization)学习型组织:(learning organization)组织结构图:(organizational charts) 11.沟通与信息技术沟通:(communication)人际沟通:(interpersonal communication) 组织沟通:(organizational communication) 信息:(message)编码:(encoding)解码:(decoding)沟通过程:(communication process)噪声:(noise)非语言沟通:(nonverbal communication) 体态语言:(body language)语调:(verbal intonation)过滤:(filtering)信息超载:(information overload)积极倾听:(active listening)正式沟通:(formal communication)非正式沟通:(informal communication)下行沟通:(upward communication)横向沟通:(lateral communication)斜向沟通:(diagonal communication)沟通网络:( communication networks)小道消息:(grape-vine)电子邮件:(e-mail)即时消息:(instant messaging)音频邮件:(voice-mail)电子数据交换:(electrinic data interchange) 电话会议:(teleconferencing)可视会议:(videoconferencing)网络会议:(webconferencing)内部互联网:(intranet)外部互联网:(Extranet)实践社区:(communities practive)12.人力资源管理高绩效工作实务:(high-performance work practices)人力资源管理过程:(human resource management process) 工会(labor union)反优先雇佣行动计划:(affirmative action)人力资源规划:(human resource planning)职务分析:(job analysis)职务说明书:(job description)职务规范:(job specification)招聘:(recruitment)解聘:(decriuitment)甄选:(selection)效度:(validity)信度:(reliability)工作抽样:(work samping)评估中心:(assessment centers)真实工作预览:(relistic job preview)上岗培训:(orientation)绩效管理系统:(performance management system)书面描述法:(written essay)关键事件法:(critical incidents)评分表法:(graphic rating scales)行为定位评分法:(behaviorally anchored rating scales) 多人比较法:(multiperson comparisons)360度反馈法:(360-degree feedback)基于技能薪酬:(skill-based pay)浮动工资:(variable pay)精简机构:(downsizing)性骚扰:(sexual harassment)基于家庭的福利:(family-friendly benefits)13.变革与创新管理组织变革:(organizational change)变革推动者:(change agent)组织发展:(organizational development)压力:(stress)14.行为的基础行为:(behavior)组织行为学:(organizational behavior)员工生产率:(employee productivity)离职率:(turnover)组织公民行为:(organizational citizen behavior)工作满意度:(job satisfaction)工作场所不当行为态度:(workplace misbehavior attitudes) 认知行为:(cognitive component)情感成分:(affective component)行为成分:(behavior component)组织承诺:(organizational commitment)组织支持感:(perceived organizational support)认知失调:(cognitive dissonance)态度调查:(attitude surveys)人格:(personality)马基雅维里主义:(machiavellianism)自尊:(self-esteem)自我控制:(self-monitoring)印象管理:(impression management)情绪:(emotion)情绪智力:(emotional Intelligence)知觉:(perception)归因理论:(attribution theory)基本归因错误:(fundamental attribution error)自我服务偏见:(self-serving bias)假设相似性:(assumed similarity)刻板印象:(stereotyping)晕轮效应:(halo effect)操作性条件反射:(operant conditioning)社会学习理论:(social learning theory)行为塑造:(shaping behavior)15.理解群体与团队群体:(group)形成阶段:(forming)震荡阶段:(storming)规范阶段:(norming)执行阶段:(performing)解体阶段:(adjourning)群体思维:(groupthink)地位:(status)社会惰化:(social loafing)群体内聚力:(group cohesiveness)冲突:(conflict)冲突的传统观点:(traditional view of conflict)冲突的人际关系观点:(human relations view of conflict)冲突的交互作用观点:(interactionist view of conflict) 积极冲突:(functional conflict)消极冲突:(disfunctional conflict)任务冲突:(task conflict)关系冲突:(relationship conflict)过程冲突:(process conflict)工作团队:(workteams)自我管理团队:(self-managed work teams)跨职能团队:(cross-functional team)虚拟团队:(virtual team)社会网络构造:(social network structure)16.激励员工动机:(motivation)需要层次理论:(hierarchy of needs theory)双因素理论:(two-factor theory)保健因素:(hygiene factors)激励因素:(motivators)三种需要理论:(three-needs theory)成就需要:(need for achievement)权力需要:(need for power)归属需要:(need for affiliation)目标设置理论:(goal-setting theory)自我效能感:(self-efficacy)强化理论:(reinforcement theory)强化物:(reinforcer)工作设计:(job design)工作扩大化:(job enlargement)工作丰富化:(job enrichment)工作深度:(job depth)工作特征模型:(job characteristics model) 公平理论:(equity theory)参照对象:(referents)分配公平:(distributive justice)程序公平:(procedural justice)期望理论:(expectancy theory)压缩工作周:(compressed workweek)弹性工作制:(flexible work hours)弹性时间制:(flextime)工作分担:(job sharing)远程办公:(telecommuting)账目公开管理:(open-book management)员工认可方案:(employee recognition programs)绩效工资方案:(pay-for-performance program)股票期权:(stock options)17.领导领导者:(leader)领导:(leadership)行为理论:(behavioral theories)独裁型风格:(authoeratic style)民主型风格:(democratic style)放任型风格:(laissez-faire style)定规维度:(initiating strueture)关怀维度:(consideration)高-高型领导者:(high-high leader)管理方格:(managerial grid)权变模型:(contingency model)最难共事着问卷:(least-preferred co-worker questionnaire) 情境领导理论:(situational leadership theory)成熟度:(readiness)领导者参与模型:(leader participation model)路径-目标理论:(path-goal theory)交易型领导者:(transactional leaders)变革型领导者:(transformational leaders) 领袖魅力型领导者:(charismatic leader) 愿景规划型领导:(visionary leadership) 法定权利:(legitimate power)强制权利:(coercive power)奖赏权力:(reward power)专家权利:(expert power)参照权利:(referent power)信誉:(credibility)信任:(trust)授权:(empowerment)18.控制的基础控制:(controlling)市场控制:(market control)官僚控制:(bureaucratic control)小集团控制:(clan control)控制过程:(control process)偏差范围:(range of variation)直接纠正行动:(immediate corrective)彻底纠正行动:(basic correvtive action)绩效:(performance)组织绩效:(organizational performance)生产率:(productivity)组织有效性:(organizational effectiveness)前馈控制:(feedforward control)同期控制:(concurrent control)走动管理:(management by walking around)反馈控制:(feedback control)经济附加值:(economic value added)市场附加值:(market valueadded)平衡计分卡:(balanced scorecard)管理信息系统:(management information system) 标杆比较:(benchmarking)员工偷窃:(employee theft)服务利润链:(service profit chain)公司治理:(corporate governance)19.运营与价值链管理运营管理:(operations management)制造型组织:(manufacturing organizations)服务型组织:(service organizations)价值链:(value chain)价值链管理:(value chain management) 组织过程:(organizational processes)知识产权:(intellectual processes)质量:(quality)批量定制:(mass customization)。

战略管理双语资料范文(DOC 71页)部门: xxx时间: xxx整理范文,仅供参考,可下载自行编辑Chapter 1 Strateg ic Ma n a gem e nt a nd Str a tegic Com pe titiven e ss (4)1.1Strategic Management Process (4)1.1.1 The Rational Model (4)1.1.2 The critique of the rational model (5)1.2 The New Competitive Landscape (6)1.2.1The Globalized Competition (6)1.2.2Technological Changes (6)1.3The I/O model of Above-average Returns (8)1.4The Resource-based Model of Above-average Returns (9)1.5Strategic Intent and Strategic Mission (10)1.6Stakeholders (11)1.7Organizational Strategists (11)复习题 (12)Chapter 2 The External Environment: Opportunities, Threats, Industry Environment, and Competitor Analysis (13)2.1External Environmental Analysis (13)2.2 Segments of the General Environment: The PEST Analysis (14)2.3 Industry Environment Analysis: The Five Forces Model (14)2.4 Strategic Group Analysis (18)2.5 Competitor Analysis (18)复习题 (18)Chapter 3 The Internal Environment: Resources, Capabilities, and Core Competencies (20)3.1 The importance of Internal Analysis (20)3.2 Resources, Capabilities, and Core Competencies (21)3.2.1 Resources (21)3.2.2 Capabilities (22)3.2.3 Core Competencies (22)3.3 Steps in a Resource-based Strategic Analysis (23)3.4 Value Chain Analysis (26)复习题 (27)Chapter 4 Business-Level Strategy (27)4.1 Customers: Who, What, and How (28)4.1.1 Who: Determining the customers to serve (28)4.1.2 What: Determining the customer needs to satisfy (28)4.1.3 How: Determining core co mpetencies necessary to satisfy customers’ needs (28)4.2 Types of Business-level Strategy (29)4.3 Cost Leadership Strategy (29)4.4 Differentiation Strategy (31)4.5 Focus Strategies (32)4.6 Integrated Low-Cost/Differentiation Strategy (33)复习题 (34)Chapter 5 Corporate-Level Strategy (35)5.1 Corporate-level Strategy and Levels of Diversification (36)5.2 Reasons for Diversification (36)5.3 Techni ques for Analyzing Diversified Companies’ Portfolios (37)复习题 (38)Chapter 6 Acquisition and Restructuring Strategies (38)6.1 Reasons for Acquisitions and Problems in Achieving Success (38)6.2 Attributes of Successful Acquisitions (39)6.3 Restructuring (39)复习题 (40)Chapter 7 International Strategy (41)7.1 Opportunities and Outcomes of International Strategy (41)7.2 International Business-level Strategy (43)复习题 (44)Chapter 8 Cooperative Strategy (45)8.1Types of and Reasons for Cooperative Strategies (45)8.2Business-level and Corporate-level Cooperative Strategies (46)8.2.1 Business-Level Cooperative Strategies (46)8.2.2 Corporate-Level Cooperative Strategies (47)8.3Network Strategies (48)8.4Competitive Risks with Cooperative Strategies (48)Chapter 9 Corporate Governance (50)9.1 Corporate Governance Mechanisms (51)9.2 Separation of Ownership and Managerial Control (51)9.3 Five Governance Mechanisms (54)9.3.1 Ownership Concentration (54)9.3.2 Board of Directors (54)9.3.3 Executive Compensation (55)9.3.4 The Multidivisional Structure (55)9.3.5 Market for Corporate Control (56)复习题 (56)Chapter 10 Organizational Structure and Controls (57)10.1 Evolutionary Patterns of Strategy and Organizational Structure (57)10.1.1 Simple Structure (58)10.1.2 Functional Structure (59)10.1.3 Multidivisional Structure (61)10.2 Implementing International Strategies: Organizational Structure and Control (65)10.2.1 Using the Worldwide Geographic Area Structure to Implement the Multi-domestic Strategy (65)10.2.2 Using the Worldwide Product Divisional Structure to Implement the GlobalStrategy (66)复习题 (67)Chapter 11 Corporate Entrepreneurship and Innovation (67)11.1 Innovation and Corporate Entrepreneurship (68)11.2Internal Corporate V enturing (69)复习题 (71)Chapter 1 Strateg ic Ma n a gem e nt a nd Str a tegic Com pe titiven e ssLea r n i ng Objec t ivesAfter reading t h i s chapter, you should be a ble to·Defining strategic competitiveness, competitive advantage, and above-average returns.·Discuss the challenge of strategic management.·Describe the new competitive landscape and how it is being shaped by global and technological changes.·Use the industrial organization(I/O) model to explain how firms can earn above-average returns.·Use the resource-based model to explain how firms can earn above-average returns.·Describe strategic intent and strategic mission and discuss their value to the strategic management process.·Define stakeholders and describe the three primary stakeholder groups’ability to influence organizations.·Describe the work of strategists.·Explain the strategic management process.1.1Strategic Management Process1.1.1 The Rational ModelStrategic competitiveness(战略竞争力)is achieved when a firm successfully formulates and implements a value-creating strategy. When a firm implements a value-creating strategy of which other companies are unable to duplicate the benefits or find it too costly to imitate, this firm has a sustained or sustainable competitive advantage(持续的或可持续的竞争优势). The speed with which competitors are able to acquire the skills needed to duplicate the benefits of a firm’s value-creating strategy determines how long a competitive advantage will last. Understanding how to exploit its competitive advantage is necessary for a firm to earn above-average returns. Above-average returns(高于平均的或超额回报) are returns in excess of what an investor expects to earn from other investment with a similar amount of risk. Risk(风险) is an investor’s uncertainty about the economic gains or losses that will result from a particular investment. Firms that are without a competitive advantage or that are not competing in an attractive industry earn, at best, only average returns. Average returns(平均回报)are returns equal to those an investor expects to earn from other investments with a similar amount of risk. In the long run, an inability to earn at least average returns results in failure. Failure occurs because investors will choose to invest in firms that earn at least average returns and will withdraw their investments from firms that earn less.Dynamic in nature, the strategic management process (战略管理过程)is the full set of commitments, decisions, and actions required for a firm to achieve strategic competitiveness and earn above-average returns. It is used to match the conditions of an ever-changing market and competitive structure with a firm’s continuously evolving resources, capabilities, and competencies.Figure 1.1 The Strategic Management ProcessNotes:the letter S in SWOT denotes strengths, W weaknesses, O opportunities, T threats.1.1.2 The critique of the rational model1.Setting objectives is the cornerstone of strategic planning. But, incentive un-compatibility(激励不相容)usually leads to inconsistency between objectives that the firm has stated and objectives that the managers are actually pursuing.2.The predictability of the environment is the core assumption of strategic planning. But, irreversibility and uncertainty(不确定性) usually lead to the unpredictability of the environment.3.Another assumption of strategic planning is that strategists are rational. Virtually,strategists’ rationality is bounded(战略家的理性是有限的)and strategic formulation reflects the internal politics of the organization.1.2 The New Competitive Landscape1.2.1The Globalized CompetitionThe fundamental nature of competition in many of the world’s industries is changing. The pace of this change is relentless and is increasing. Even determining the boundaries of an industry or a firm(行业或企业的边界)has become challenging. Consider, for example, how advances in interactive computer networks and telecommunications have blurred the definition of the “television”industry. Conventional sources of competitive advantage(传统的竞争优势的源泉) such as economies of scale(规模经济) and huge advertising budgets(巨额广告预算) are not as effective in the new competitive landscape. Moreover, the traditional managerial mind-set(传统的管理者心态) cannot lead a firm to strategic competitiveness in the new competitive landscape. In its place, managers must adopt a new mind-set——one that values flexibility, speed, innovation, integration, and the challenges that evolve from constantly changing conditions(看重灵活性、速度、创新、整合和从不断变化的环境中产生的挑战的心态). Strategic flexibility(战略的敏捷性) is a set of capabilities firms use to respond to various demands and opportunities that are a part of dynamic and uncertain competitive environments. Such flexibility means that a firm can match quickly its resources with an environmental opportunity(快速地使其资源与环境的机遇匹配).A global economy(全球经济) is one in which goods, services, people, and ideas move freely across geographic borders. It significantly expands and complicates a firm’s competitive environment. To achieve strategic competitiveness in the global economy, a firm must view the world as its marketplace.In globalized markets(全球化的市场) and industries, financial capital might be obtained in one national market and used to buy raw materials in another one. Manufacturing equipment bought from a third national market can be used to produce products that are sold in a fourth market. Thus, globalization increases the range of opportunities for firms competing in the new competitive landscape.The internationalization of markets and industries makes it increasingly difficult to think of some firms as domestic companies(本国公司).Global competition has increased performance standards(绩效标准) in many dimensions, including those of quality, cost, productivity, production introduction time, and smooth, flowing operations.The development of newly industrialized countries(新兴工业化国家) is changing the global competitive landscape and significantly increasing competition in global markets. The economic development of Asian countries outside of Japan is increasing the significance of Asian markets. In the new competitive landscape, firms are challenged to develop the optimal level of globalization(最优的全球化水平).1.2.2Technological ChangesThere are three categories of technological trends and conditions through which technology is significantly altering the nature of competition(竞争的性质).·Increasing rate of technological change and diffusion(不断上升的技术变迁率和扩散率) Both the rate of technology changes and the speed at which new technologies become available and are used have increased substantially over the last 20 years. Perpetual innovation(持续的创新) is a term used to describe how rapidly and consistently new, information-intensive technologies (信息密集的技术)replace older ones. The shorter product life cycles(产品生命周期) resulting from these rapid diffusions of new technologies place a competitive premium on being able to quickly introduce new goods and services into the marketplace. In fact, when products become somewhat indistinguishable because of the widespread and rapid diffusion of technologies, speed to market(产品进入市场的速度) may be the only source of competitive advantage. Some evidence suggests that after only 12 to 18 months, companies likely will have gathered information about their competitors’R&D and product decisions. Often, merely a few weeks pass before a new American-made product introduced in U.S. markets is copied, manufactured, and shipped to the United States by one or more companies in Asia.Today’s rate of technological diffusion stifles the protection firms possessed previously through their patents(专利). Patents are now thought by many to be an effective way of protecting proprietary technology(专利技术) primarily in the pharmaceutical and chemical industries only. Many firms competing in the electronics industry often do not apply for patents to prevent competitors from gaining access to the technological knowledge included in the patent application(包含在专利申请中的技术知识).·The Information Age(信息时代)Dramatic changes in information technology have occurred in recent years. Personal computers, cellular phones, artificial intelligence(人工智能), virtual reality(虚拟现实), and massive databases are a few examples of how information is used differently as a result of technological developments. Someone believes that electronic mail (E-mail) systems are the first manifestation of a revolution in the flow and management of information in companies throughout the world. An important outcome of these changes is that the ability to access and effectively use information has become an important source of competitive advantage in virtually all industries.·Increasing Knowledge Intensity(不断提高的知识密度)Knowledge is the basis of technology. In the new competitive landscape, knowledge is a critical organizational resource and is increasingly a valuable source of competitive advantage. Because of this, many companies now strive to transmute the accumulated knowledge of individual employees into a corporate asset(把个体性员工积累起来的知识转变成公司的资产).Figure 1.2 The New Competitive Landscape。