2016FRM考试整套FRM资料

- 格式:docx

- 大小:32.79 KB

- 文档页数:2

FRM求助编辑百科名片FRM (Financial Risk Manager)是全球金融风险管理领域的一种国际资格认证,由美国―全球风险管理协会‖(GARP)设立。

2010年起,由全球风险管理协会举办的金融风险管理师(FRM)考试将于每年5月和11月中下旬在全球四十多个城市同时举行。

目录FRM简介(1)什么是FRM(2)GARP简介(3)FRM影响力其他资料一、综合类问题二、考试报名类问题三、考试费用类问题四、FRM考点类问题五、考试准备类问题六、参加考试类问题七、参加FRM考试之后八、提交工作经验之后九、GARP会员类问题FRM介绍1.什么是FRM2. FRM公信力如何?3.FRM 公正性如何?FRM报名注意事项5. 怎样报名FRM?6. 报考资格如何?7. 考试费用如何?如何报名:10. 考试能否延期?11. 考点在哪?12. 能否转让给别人考试?13. 考试的考点可以更改吗?14. 为何考试报名费会不一样而且越来越贵?15. 如何准备FRM考试?16. 必须读GARP指定的教科书吗?17. NOTES 和HANDBOOK有什么区别?18. 考哪些内容?19. 这些科目在考试的时候题目是归类的吗?20. 用什么计算器?如何用?21. 全球考试通过率22. 对英文水平要求有多高?23. 对数学有什么要求?24. 准考证什么时候发?2009, the last Full FRM examVB窗口文件扩展名FRM 粉丝关系管理展开FRM简介(1)什么是FRM(2)GARP简介(3)FRM影响力其他资料一、综合类问题二、考试报名类问题三、考试费用类问题四、FRM考点类问题五、考试准备类问题六、参加考试类问题七、参加FRM考试之后八、提交工作经验之后九、GARP会员类问题FRM介绍1.什么是FRM2. FRM公信力如何?3.FRM 公正性如何?FRM报名注意事项5. 怎样报名FRM?6. 报考资格如何?7. 考试费用如何?如何报名:10. 考试能否延期?11. 考点在哪?12. 能否转让给别人考试?13. 考试的考点可以更改吗?14. 为何考试报名费会不一样而且越来越贵?15. 如何准备FRM考试?16. 必须读GARP指定的教科书吗?17. NOTES 和HANDBOOK有什么区别?18. 考哪些内容?19. 这些科目在考试的时候题目是归类的吗?20. 用什么计算器?如何用?21. 全球考试通过率22. 对英文水平要求有多高?23. 对数学有什么要求?24. 准考证什么时候发?2009, the last Full FRM examVB窗口文件扩展名FRM 粉丝关系管理FRM简介(1)什么是FRMFRM (Financial Risk Manager)是全球金融风险管理领域顶级的权威国际资格认证,由美国―全球风险管理协会‖(Global Association of Risk Professionals ,简称GARP)设立。

[键入文字] 专注国际财经教育

考试教材

(1)考FRM需要的复习时间

候选人的准备时间,取决于他们事先专业经验水平、 学术背景和熟悉的概念。

针

对 2012 年 5 月FRM 部分考生的调查表明,平均准备约 240 小时。

GARP建议应考人员复习备考时间约为14周。

(2)考FRM需要具备怎样的能力

一定的英文的阅读能力以及您的决心与毅力,商科相关背景当然尤佳,但不是必要条件。

(3)教材和参考书

1. Financial Risk Manager Handbook

2. GARP指定的core reading

3. SCHWESER 编写的NOTES

FRM考试所用教材主要为Handbook和Notes,以这2套教材为主,当然FRM也有辅助学习资料core readings,这个书目总9000多页,涉及风控领域方方面面和工作实务中的问题较相符,但是考试不考,可以用于考试外扩充知识。

请注意:FRM考试的专业性较强,所用教材的难度也相对其他考试较难。

FRM考试不强制购买官方教材,考生报考时可以选择是否购买FRM官方教材。

官方教材Handbook的费用是125美金+7%的关税+49美金运费,总的费用相对较高,不建议考生在报考时选择原版官方教材。

Notes是美国著名CFA FRM培训机构Kaplan编著,全世界90%的考生都是采用此类辅导教材。

Notes编排简明扼要,要点突出,重点突出,逻辑关系和知识体系按照官方教材Handbook编排。

备考时以Handbook为主线,Notes为辅助的策略学习。

FRM考试备考资料全集-frm考试论坛FRM考试备考资料全集-frm考试论坛!你准备参加2016年11月FRM考试了,终于做了这个决定,别人怎么劝我都听不到!那么,问题来了?怎么备考呢?如何备考FRM考试呢?2016年11月FRM考试备考可以看哪些资料呢?它们有什么特点?FRM备考资料列表1、Study Guide:GARP协会提供的原版书籍列表。

2、Aims:GARP协会提供的考纲。

Kaplan Notes中也能够找到。

3、Core reading:GARP协会考纲上所列书籍。

优点:覆盖知识点全面,能帮助正确理解考纲所考知识点。

缺点:资料繁多,不适用于复习时间有限的学员。

4、Handbook:GARP协会推荐备考书籍。

优点:浓缩知识点,有条理。

缺点:缺少部分考点章节,且均为不可忽略的章节。

如使用Handbook作为主要复习资料,需要补充相关的资料。

5、Notes:培训机构Kaplan制作的备考书籍。

优点:完全根据考纲进行讲解,知识点覆盖全面。

缺点:没有条理,不易理解,对知识点的把握受限于编写者的理解,对考点的把握不够准确。

6、Practice Exam:GARP每年提供的模拟题,09年以前不分1,2级。

近期的模拟题日趋简单,难度以前几年的模拟题较接近考试情况。

建议有时间的话从07、08年开始都要做,感受一下。

7、Notes Exam:Kaplan制作的模拟题。

有一定难度,有时间也可以做一下。

8、quicksheet:方便查阅重要知识点及公式。

9、习题集:各种培训机构自行出的题目,这个只推荐那些跟着机构上课的同学使用。

另附FRM考试报名流程1、首先你需要准备的是双币信用卡和护照/驾照。

注意事项:在信用卡上有Visa,Master标记,支持外币(美元)支付。

在支付前,请先了解您的信用卡额度是否能支付考试费用。

其次就是需要护照或者驾照了。

这里需注意,当你报名的时候,一定要牢记,你报名所准备的证件,在考试的时候要带同一证件。

2016年frm文件都有哪些资料?2016年frm教材有哪些?如何备考?frm小编整理了官方资料和考生常用备考教材,供大家参考!1.FRM官方教材这是GARP协会给出的官方教材,考生们可以选择购买。

分成了Part I Books、Part II Books、Digital FRM Exam Part I eBooks、Digital FRM Exam Part II eBooks,即有纸质版和电子版两种。

纸质版的价格分别是$240,$295;电子版的价格是$150和$295。

2.HandbookFRM Handbook是著名教授Philippe Jorion应FRM考试委员会之邀,编撰的在金融风险管理领域非常知名的著作。

这本书随着GARP协会FRM考试的考纲而随之更新。

所以对于通过FRM考试非常重要。

GARP协会发布的Core Reading Course Pack是一套核心读物,融合了最经典的经济金融教材和当今最前沿的研究和论文,但是里面是不包含FRM考试题目的。

FRM Handbook不仅会对FRM知识体系进行介绍,同时涵盖了FRM历年的考试真题,对于最新的第六版Handbook,里面记载了近年考试的真题,对于通过FRM考试具有极高的参考价值。

3.NotesSchweser Notes是美国一家FRM培训机构Kaplan出品的备考资料,其浓缩了FRM的核心考点,是根据FRM考纲便携的简写本;而Handbook是GARP协会对FRM考试的教科书Core Reading做的浓缩精简材料,是每位FRM考生的必备资料。

目前众多FRM考生都采取两者相结合的方式来看书,可以涵盖所有知识点。

这套学习资料根据每年FRM考纲编写,深入浅出而又要言不烦,各种知识背景和工作经历的考生均能从中受益,是FRM考试的必备教材。

notes是Kaplan编写的备考教材,对考纲覆盖很全面,不过没什么条理。

相对而言,handbook则讲的比较细致,但是缺少一部分考点的内容。

frm考试内容真题及答案解析FRM考试内容真题及答案解析FRM(金融风险管理师)考试是金融行业内一项非常重要的资格认证,对于风险管理和金融领域的从业人员来说尤为重要。

FRM考试涵盖了众多的知识点和技能要求,对考生的综合素质有着较高的要求。

在备考过程中,熟悉真题并进行解析是提高成绩的有效方法之一。

本文将为大家带来一些FRM考试的真题及其解析,希望对考生有所帮助。

一、考试内容介绍FRM考试分为两个级别,分别为FRM考试(Part I)和FRM考试(Part II)。

其中,Part I主要涵盖了演化化金融行业,金融市场和产品以及风险管理等方面的知识。

Part II主要着重于风险管理的具体问题和工具。

二、真题解析下面将介绍一道经典的FRM考试题目,并带来详细的解读。

【题目】假设有一个均值为0,方差为1的随机变量X。

在观察中,首先观察X,如果X大于1,观察结束;如果X小于等于1,继续观察下一个随机变量。

如果观察n个随机变量,才能大于1,则观察结束。

求这个观察过程发生的期望次数。

【解析】这道题目涉及到随机变量的概率,我们可以通过数学概率的方法来求解。

首先,设该观察过程发生的期望次数为E(n),其中n表示观察的次数。

当n=1时,观察过程发生的期望次数为E(1)。

当X>1时,观察结束,所以E(1)=1。

当n>1时,观察过程发生的期望次数为E(n)。

根据题目中的描述可知,第一次观察结果是X小于等于1的概率为1/2,即P(X<=1)=1/2。

那么第一次观察结果是X大于1的概率为1-P(X<=1)=1/2。

当第一次观察结果是X小于等于1时,继续观察下一个随机变量,此时已经观察了一次,还需要观察n-1次,所以E(n)=(1/2)E(n-1)。

当第一次观察结果是X大于1时,观察结束,所以E(n)=1。

将上述两种情况相加,得到E(n)=1/2E(n-1)+1/2根据此公式可以递归求解E(n),最终得到E(n)=n。

2016FRM一级FinancialMarketAndProduct知识框架图,

专治遗忘...

过去一年,我跟何旋花了很多时间画CFA的框架图给考生,然后就一直有FRM的考生问我们有FRM的框架图么。

可惜一直没能静下心来画,对那些曾经找我们要FRM框架图的小伙伴真是充满歉意。

不知道他们是不是已经脱离FRM苦海了。

终于,2016年11月的考试,我跟何旋将所有学科的框架图制作完毕,免费提供给大家,愿大家顺利通过考试。

“ 品职出品FRM一级、二级框架图”

首发,免费获取啦~!

苦读FRM原版书

看懂比赚钱还慢

遗忘比花钱还快

FRM秘籍惊现江湖

品职出品FRM一级、二级框架图首发专治风中凌乱,专治难懂遗忘

FRM一级框架图

Financial Market And Product

免费获取合集方法

这个冬天11月,FRM一级、二级即将华山论剑,没有秘籍在手,

怎么敢逞英雄!

李斯克何旋两位老师秘制多时,费尽心血FRM一级、二级框架图,就这么轻而易举的GET了!

心急的同学,可以在本公众号后台回复“FRM框架图”,可以知道如何一次性免费获取,最后200本FRM框架图合集的方法。

注:公众号的账号是CFAPASS,中文名称是“李老师与何老师的CFA学习课堂”

品职教育

品味职场,为梦想而生。

frm证书考试内容

frm证书考试内容分为frm一级和二级,具体如下:

frm一级考试共四门科目,包括《风险管理基础》、《定量分析》、《估值与风险模型》、《金融市场与产品》。

其中,《风险管理基础》相当于整个frm的入门学科,主要是概念类内容;《定量分析》涉及的主要内容是概统的基础知识,主要是一些数学模型和公式;《估值与风险模型》有关金融风险的模型;《金融市场与产品》聚焦固定收益和衍生品,学习金融市场的各类产品。

frm二级考试共六门科目,包括《市场风险计量和管理》、《信用风险计量和管理》、《操作风险与弹性》、《流动性与资金风险计量和管理》、《风险管理和投资管理》、《当期金融市场热点问题》。

以上信息仅供参考,建议查阅frm官方网站获取更准确的信息。

2016年FRM考试大纲公布PARTⅠ(共100题)1.Foundations of Risk Management风险管理基础(大约占20%)2.Quantitative Analysis数量分析(大约占20%)3.Financial Markets and Products金融市场与金融产品(大约占30%)4.Valuation and Risk Models估值与风险建模(大约占30%)PARTⅡ(共80题)1.Market Risk Measurement and Management市场风险管理与测量(大约占25%)2.Credit Risk Measurement and Management信用风险管理与测量(大约占25%)3.Operational and Integrated Risk Management操作及综合风险管理(大约占25%)4.Risk Management and Investment Management投资风险管理(大约占15%)5.Current Issues in Financial Markets金融市场前沿话题(大约占10%)注:FRM考试的各科试题随机分散在试卷中,没有先后次序。

---2、FRM评分标准FRM考试考生只知道考试是否通过,而不知道确切的考分。

FRM及格分数线由考生的绝对分数以及排名前5%的考生的平均分的比例决定,答错的题目不扣分。

FRM(PART 1)侧重基本的金融工具理论知识,金融市场基础知识和它们的详细定义,以及计量风险的方法。

此部分考试的目标是确保FRM考生更好的理解作为一个成功的金融风险管理者需要了解的基本金融工具的知识。

考试更侧重于概念的理解而非实用性。

FRM(PART 2)强调金融风险管理应用的相关概念,更侧重于在FRM第一部分的基础上测试考生应用金融工具的能力。

并将风险计量方法延伸到风险价值方法之外。

和第一部分考试相比,第二部分考试更多的是有关案例分析和并更以实践为导向。

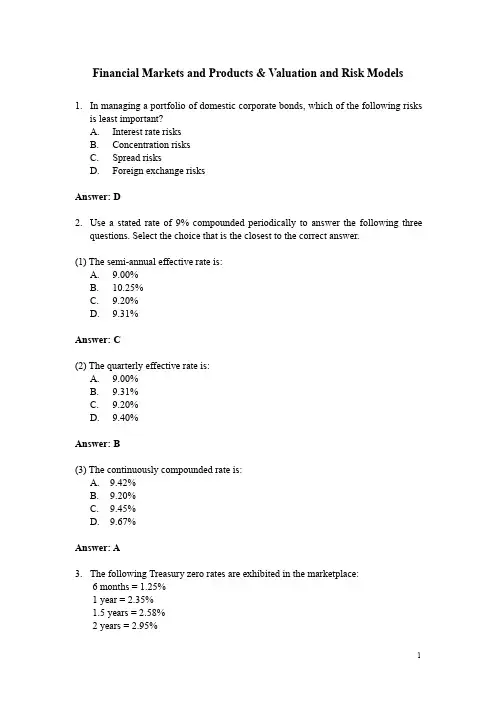

Financial Markets and Products & Valuation and Risk Models1.In managing a portfolio of domestic corporate bonds, which of the following risksis least important?A.Interest rate risksB.Concentration risksC.Spread risksD.Foreign exchange risksAnswer: De a stated rate of 9% compounded periodically to answer the following threequestions. Select the choice that is the closest to the correct answer.(1) The semi-annual effective rate is:A.9.00%B.10.25%C.9.20%D.9.31%Answer: C(2) The quarterly effective rate is:A.9.00%B.9.31%C.9.20%D.9.40%Answer: B(3) The continuously compounded rate is:A.9.42%B.9.20%C.9.45%D.9.67%Answer: A3.The following Treasury zero rates are exhibited in the marketplace: 6 months = 1.25% 1 year = 2.35%1.5 years =2.58% 2 years = 2.95%Assuming continuous compounding, the price of a 2-year Treasury bond that paysa 6 percent semiannual coupon is closest to:A.105.20B.103.42C.108.66D.105.90Answer: D4. A two-year zero-coupon bond issued by corporate XYZ is currently rated A. Oneyear from now XYZ is expected to remain at A with 85% probability, upgraded to AA with 5% probability, and downgraded to BBB with 10% probability. The risk free rate is flat at 4%. The credit spreads are flat at 40, 80, and 150 basis points for AA, A, and BBB rated issuers, respectively. All rates are compounded annually.Estimate the expected value of the zero-coupon bond one year from now (for USD 100 face amount). Fixed Income Securities:D 92.59D 95.33D 95.37D 95.42Answer: C5.Assuming the long-term yield on a perpetual note is 5%, compute the dollar valueof a 1 bp. Increase in the yield (DV01) for a perpetual note paying a USD 1,000,000 annual coupon.A.-20,000B.-30,000C.-40,000D.-50,000Answer: C6.Given the following portfolio of bonds:What is the value of the portfolio’s DV01 (Dollar value of 1 basis point)?A.8,019B.8,294C.8,584D.8,813Answer: C7.Assuming other things constant, bonds of equal maturity will still have differentDV01 per USD 100 face value. Their DV01 per USD 100 face value will be in the following sequence of highest value to lowest value:A.Premium bonds, par bonds, zero coupon bondsB.Zero coupon bonds, Premium bonds, par bondsC.Premium bonds, zero coupon bonds, par bondsD.Zero coupon bonds, par bonds, Premium bondsAnswer: A8.Which of the following statements about standard fixed rate government bondswith no optionality is TRUE?I.Higher coupon implies shorter duration.II.Higher yield implies shorter duration.III.Longer maturity implies larger convexity.A.I and II onlyB.II and III onlyC.I and III onlyD.I, II, and IIIAnswer: D9.Which of the following is not a property of bond duration?A.For zero-coupon bonds, Macaulay duration of the bond equals its years tomaturity.B.Duration is usually inversely related to the coupon of a bond.C.Duration is usually higher for higher yields to maturity.D.Duration is higher as the number of years to maturity for a bond selling atpar or above increases.Answer: C10.Estimated price changes using only duration tend to:A.Overestimate the increase in price that occurs with a decrease in yield forlarge changes in yield.B.Underestimate the decrease in price that occurs with a increase in yield forlarge changes in yield.C.Overestimate the increase in price that occurs with a decrease in yield forsmall changes in yield.D.Underestimate the increase in price that occurs with a decrease in yield forlarge changes in yield.Answer: D11.A portfolio consists of two positions: One position is long $100M of a two yearbond priced at 101 with a duration of 1.7; the other position is short $50M of a five year bond priced at 99 with a duration of 4.1. What is the duration of the portfolio?A.0.68B.0.61C.-0.68D.-0.61Answer: D12.A zero-coupon bond with a maturity of 10 years has an annual effective yield of10%. What is the closest value for its modified duration?A.9B.10C.100D.Insufficient InformationAnswer: A13.A portfolio manager uses her valuation model to estimate the value of a bondportfolio at USD 125.482 million.The term structure is ing the same model,she estimates that the value of the portfolio would increase to USD 127.723 million if all the interest rates fell by 30bp and would decrease to USD 122.164 million if all the interest rates rose by ing these estimates,the effective duration of the bond is closest to :A. 8.38B. 16.76C. 7.38D. 14.77Answer: C14.A portfolio manager has a bond position worth USD 100 million. The position hasa modified duration of eight years and a convexity of 150 years. Assume that theterm structure is flat. By how much does the value of the position change if interest rates increase by 25 basis points?D -2,046,875D -2,187,500D -1,953,125D -1,906,250Answer: C15.An investment in a callable bond can be analytically decomposed into a:A.Long position in a non-callable bond and a short position in a put optionB.Short position in a non-callable bond and a long position in a call optionC.Long position in a non-callable bond and a long position in a call optionD.Long position in a non-callable and a short position in a call optionAnswer: D16.A European bank exchanges euros for USD, lends them at the U.S. risk-free rate,and simultaneously enters into a forward contract to sell the loan proceeds for euros at loan maturity. If the net effect of these transactions is to earn the risk-free euro rate, it is an example of:A.ArbitrageB.Spot-forward equalityC.Interest rate parityD.The law of one priceAnswer: C17.At the inception of a six-month forward contract on a stock index, the value of theindex was $1,150, the interest rate was 4.4%, and the continuous dividend was1.8%. Three months later, the value of the index is $1,075. Which of the followingstatement is True? The value of the:A.long position is $82.41.B.long position is $47.56.C.short position is $47.56.D.long position is -$82.41.Answer: D18.Assuming the 92-day and 274 day interest rate is 8% (act/360, money market yield)compute the 182-day forward rate starting in 92 days (act/360, money market yield).A.7.8%B.8.0%C.8.2%D.8.4%Answer: B19.The 1-year US dollar interest rate is 3% and the 1-year Canadian dollar interestrate is 4.5%. The current USD/CAD spot exchange rate is 1.5000. Calculate the 1-year forward rate.A. 1.5225B. 1.5218C. 1.5207D. 1.5199Answer: B20.The price of a three-year zero coupon government bond is 85.16. The price of asimilar four-year bond is 79.81. What is the one-year implied forward rate form year 3 to year 4?A. 5.4%B. 5.5%C. 5.8%D. 6.7%Answer: D21.The clearinghouse in a futures contract performs all but which of the followingroles? The clearing house:A.guarantees traders against default from another party.B.splits each trade and acts as a buyer to futures sellers and as a seller tofutures buyers.C.allows traders to reverse their position without having to contract the otherside of the position.D.guarantees the physical delivery of the underlying asset to the buyer offuture contracts.Answer: D22.A weakening of the basis is a consequence of the:A.Spot price increasing faster than the futures price over time.B.Spot price moving according to hyper-arithmetic Brownian motion.C.Futures price increasing faster than the spot price over time.D.Futures price moving according to hyper-arithmetic Brownian motion. Answer: C23.Which of the following statements best describes marking-to-market of a futurescontract? At the:A.End of the day, the maintenance margin is increased for traders who lost anddecreased for traders who gained.B.Conclusion of each trade, the gains or losses from all previous trades in thefutures contract are tallied.C.Maturity of the futures contract, the gains or losses are tallied to the trader’saccount.D.End of the day, the gains or losses are tallied to the trader’s account. Answer: D24.A trader buys one wheat contract (underlying = 5,000 bushels) at a price of $3.05per bushel. The initial margin on the contract is $4,500 and the maintenance margin is $3,750. At what price will the trader receive a maintenance margin call?A.$2.30B.$2.90C.$3.20D.$3.80Answer: B25.The S&P 500 index is trading at 1,025. The S&P 500 pays an expected dividendyield of 1.2% and the current risk-free rate is 2.75%. The value of a 3-month futures contract on the S&P 500 index is closest to:A.$1,028.98B.$1,108.59C.$984.86D.$1,025.00Answer: A26.The current spot price of gold is $325/oz and the price of 90-day gold futurescontract (nominal amount of 100 oz) is $315. If 90-day Treasury bills are trading at yields of 3.55% - 3.58% and storage and delivery costs are ignored, what is the potential arbitrage profit per contract?A.$1,266B.$1,286C.$1,334D.$1,344Answer: C27.Which of the following statements describing the role of a convenience yield inpricing commodity futures is true? The convenience yield:I.will cause contango in the futures pricing relationship.II.Effectively reduces the cost of carry in the futures pricing relationship.III.Eliminates the potential for arbitrage between the futures and spot price.IV.Accounts for additional costs for storing an asset in the futures pricing relationship.A.I onlyB.II onlyC.II, III, and IV onlyD.I and II onlyAnswer: B28.A firm is going to buy 10,000 barrels of West Texas Intermediate Crude Oil. Itplans to hedge the purchase using the Brent Crude Oil futures contract. The correlation between the spot and futures prices is 0.72. The volatility of the spot price is 0.35 per year. The volatility of the Brent Crude Oil futures price is 0.27 per year. What is the hedge ratio for the firm?A. 0.9333B. 0.5554C. 0.8198D. 1.2099Answer: A29.The hedge ratio is the ratio of derivatives to a spot position (or vice versa thatachieves an objective such as minimizing or eliminating risk. Suppose that the standard deviation of quarterly changes in the price of a commodity is 0.57, the standard deviation of quarterly changes in the price of a futures contract on the commodity is 0.85, and the covariance between the two changes is 0.3876. What is the optimal hedge ratio for a 3.-month contract?A.0.1893B.0.2135C.0.2381D.0.2599Answer: D30.Consider an equity portfolio with market value of USD 100M and a beta of 1.5with respect to the S&P 500 Index. The current S&P 500 index level is 1000 and each futures contract is for delivery of USD 250 times the index level. Which of the following strategy will reduce the beta of the equity portfolio to 0.8?A.Long 600 S&P 500 futures contractsB.Short 600 S&P 500 futures contractsC.Long 280 S&P 500 futures contractsD.Short 280 S&P 500 futures contractsAnswer: D31.Corporates normally use FRAs to:A.Lock-in the cost of borrowing in the futureB.Lock-in the cost of lending in the futureC.Hedge future currency exposuresD.Create future currency exposuresAnswer: A32.An investor has entered into a forward rate agreement(FRA) where she hascontracted to pay a fixed rate of 5 percent on $5,000,000 based on the quarterly rate in three months. If interest rates are compounded quarterly, and the floating rate is 2 percent in three months, what is the payoff at the end of the sixth month?The investor will:A.make a payment of $37,500.B.receive a payment of $37,500.C.make a payment of $75,000.D.receive a payment of $75,000.Answer: A33.Consider the following 6x9 FRA ,Assume the buyer of the FRA agrees to acontract rate of 6.35% on a notional amount of 10 million USD ,Calculate the settlement amount of the seller if the settlement rate is 6.85%. Assume a 30/360 day count basis.A.–12,500B.–12,290C.+12,500D.+12,290Answer: B34.XYZ Corporation plans to issue a 10-year bond 6 months from now. XYZ wouldlike to hedge the risk that interest rates might rise significantly over the next 6 months. In order to effect this, the treasurer is contemplating entering into a swap transaction. Under the swap, she should:A.Pay fixed and receive LIBORB.Pay LIBOR and receive fixedC.Either swap (a or b above) will workD.Neither swap (a or b above) will workAnswer: A35.Consider the following plain vanilla swap. Party A pays a fixed rate 8.29% perannum on a semiannual basis (180/360), and receives from Party B LIBOR+30 basis point. The current six-month LIBOR rate is 7.35% per annum. The notional principal is $25M. What is the net swap payment of Party AA.$20,000B.$40,000C.$80,000D.$110,000Answer: C36.A trader executes a $420 million 5-year pay fixed swap(duration 4.433) with oneclient and a $385 million 10year receive fixed swap(duration 7.581) with another client shortly afterwards. Assuming that the 5-year rate is 4.15 % and 10-year rate is 5.38 % and that all contracts are transacted at par, how can the trader hedge his net delta position?A.Buy 4,227 Eurodollar contractsB.Sell 4,227 Eurodollar contractsC.Buy 7,185 Eurodollar contractsD.Sell 7,185 Eurodollar contractsAnswer: B37.Assume an investor with a short position is about to deliver a bond and has fourbonds to choose from which are listed in the following table. The last settlement price is $95.75 (this is the quoted futures price). Determine which bond is the cheapest-to-deliver.Bond Quoted Bond Price Conversion Factor1 99 1.012 125 1.243 103 1.064 115 1.14A. Bond 1B. Bond 2C. Bond 3D. Bond 4Answer: C38.What is the lower pricing bound for a European call option with a strike price of80 and one year until expiration? The price of the underlying asset is 90, and the1-year interest rate is 5% per annum. Assume continuous compounding of interest.A.14.61B.13.90C.10.00D. 5.90Answer: B39.According to Put-Call parity, buying a call option on a stock is equivalent to:A.Writing a put, buying the stock, and selling short bonds (borrowing).B.Writing a put, selling the stock, and buying bonds (lending).C.Buying a put, selling the stock, and buying bonds (lending).D.Buying a put, buying the stock, and selling short bonds (borrowing). Answer: D40.Jeff is an arbitrage trader, and he wants to calculate the implied dividend yield ona stock while looking at the over-the-counter price of a 5-year put and call (bothEuropean-style) on that same stock. He has the following data:• Initial stock price = USD 85• Strike price = USD 90• Continuous risk-free rate = 5%• Underlying stock volatility = unknown• Call price = USD 10• Put price = USD 15What is the continuous implied dividend yield of that stock?A. 2.48%B. 4.69%C. 5.34%D.7.71%Answer: C41.The current price of a stock is $55. A put option with $50 strike price thatexpires in 3 months is available. If N(d1)=0.8133, N(d2)=0.7779, the underlying stock exhibits an annual standard deviation of 25 percent, and current risk free rates are 3.25 percent, the Black-Scholes value of the put is closet to:A.$0.75B.$1.25C.$1.50D.$5.00Answer: A42.Which of the following is the riskiest form of speculation using options contracts?A.Setting up a spread using call optionsB.Buying put optionsC.Writing naked call optionsD.Writing naked put optionsAnswer: C43.A long position in a put option can be synthetically produced by:A.Long position in the underlying and a short position in a call.B.Short position in the underlying and a long position in a call.C.Long position in the underlying and a long position in a put.D.Short position in the underlying and a short position in a put.Answer: B44.ABEX Corporation common stock is selling for $50.00 per share. Both anAmerican call option and a European call option are available on ABEX common, and each have identical strike prices and expiration dates. Which of the following statements concerning these two options is TRUE?A.Because the American and European options have identical terms and arewritten against the same common stock, they will have identical optionpremiums.B.The greater flexibility allowed in exercising the American option willnormally result in a higher market value relative to an otherwise identicalEuropean option.C.The American option will have a higher option premium, because theAmerican security markets are larger than the European markets.D.The European option will normally have a higher option premium because oftheir relative scarcity compared to American options.Answer: B45.Put option values increase as a result of increases in which of the followingfactors?I.V olatilityII.DividendsIII.Stock PriceIV.Time to expirationA.I, II, and IV onlyB.I, III, and IV onlyC.II and IV onlyD.I and III onlyAnswer: A46.Your firm has no prior derivatives trades with its counterparty Super Bank. Yourboss wants you to evaluate some trades she is considering. in particular, she wants to know which of the following trades will increase your firm’s credit risk exposure to Super Bank:I.Buying a put optionII.Selling a put optionIII.Buying a forward contractIV.Selling a forward contractA.I and II onlyB.II and IV onlyC.III and IV onlyD.I, III, and IV onlyAnswer: D47.Which of the following statements about a floor is true?A.floor is a put option and protects against a fall in interest ratesB.floor is a call option and protects against a fall in interest ratesC.floor is a put option and protects against a rise in interest ratesD.floor is a call option and protects against a rise in interest ratesAnswer: A48.You are given the following information about a call option:• Time to maturity = 2 years• Continuous risk-free rate = 4%• Continuous dividend yield = 1%• N(d1) = 0.64Calculate the delta of this option.A.-0.64B.0.36C.0.63D.0.64Answer: C49.Call and put option values are most sensitive to changes in the volatility of theunderlying when:A.both calls and puts are deep in-the-money.B.both puts and calls are deep out-of-the-money.C.calls are deep out-of-the-money and puts are deep in-the-money.D.both calls and puts are at-the-money.Answer: D50.What is the reason for undertaking a Vega hedging? To minimize the:A.Possibility of counterparty default risk.B.Potential loss as a result of a change in the volatility of the underlying sourceof risk.C.Adverse effect due to the government regulation.D.Potential loss as a result of a large movement in the underlying source ofrisk.Answer: B51.Suppose an existing short option position is delta-neutral, but has a gamma of−600. Also assume that there exists a traded option with a delta of 0.75 and a gamma of 1.50. In order to maintain the position gamma-neutral and delta-neutral, which of the following is the appropriate strategy to implement?A. Buy 400 options and sell 300 shares of the underlying asset.B. Buy 300 options and sell 400 shares of the underlying asset.C. Sell 400 options and buy 300 shares of the underlying asset.D. Sell 300 options and buy 400 shares of the underlying asset.Answer: A52.W hich of the following is not an assumption of the BS options pricing model?A. The price of the underlying moves in a continuous fashionB. The interest rate changes randomly over timeC. The instantaneous variance of the return of the underlying is constantD. Markets are perfect,i.e.short sales are allowed,there are on transaction costs or taxes,andmarkets operate continuously.Answer: B53.If risk is defined as a potential for unexpected loss, which factors contribute to therisk of a short call option position?A.Delta, vega, rhoB.Vega, rhoC.Delta, vega, gamma, rhoD.Delta, vega, gamma, theta, rhoAnswer: C54.If risk is defined as a potential for unexpected loss, which factors contribute to therisk of a long straddle position?A.Delta, vega, rhoB.Vega, rhoC.Delta, vega, gamma, rhoD.Delta, vega, gamma, theta, rhoAnswer: B55.Long a call on a stock and short a call on the same stock with a higher strike priceand same maturity is called:A. A bull spreadB. A bear spreadC. A calendar spreadD. A butterfly spreadAnswer: A56.Consider a bullish spread option strategy of buying one call option with a $30exercise price at a premium of $3 and writing a call option with a $40 exercise price at a premium of $1.50. If the price of the stock increases to $42 at expiration and the option is exercised on the expiration date, the net profit per share at expiration (ignoring transaction costs) will be:A.$8.50B.$9.00C.$9.50D.$12.50Answer: A57.An investor sells a June 2008 call of ABC Limited with a strike price of USD 45for USD 3 and buys a June 2008 call of ABC Limited with a strike price of USD40 for USD 5. What is the name of this strategy and the maximum profit and lossthe investor could incur?A.Bear Spread, Maximum Loss USD 2, Maximum Profit USD 3B.Bull Spread, Maximum Loss Unlimited, Maximum Profit USD 3C.Bear Spread, Maximum Loss USD 2, Maximum Profit UnlimitedD.Bull Spread, Maximum Loss USD 2, Maximum Profit USD 3Answer: D58.Which of the following actions would be most profitable when a trader expects asharp rise in interest rates?A.Sell a payer swaption.B.Buy a payer swaption.C.Sell a receiver swaption.D.Buy a receiver swaption.Answer: B59.Initially, the call option on Big Kahuna Inc. with 90 days to maturity trades atUSD 1.40. The option has a delta of 0.5739. A dealer sells 200 call option contracts, and to delta-hedge the position, the dealer purchases 11,478 shares of the stock at the current market price of USD 100 per share. The following day, the prices of both the stock and the call option increase. Consequently, delta increases to 0.7040. To maintain the delta hedge, the dealer shouldA.sell 2,602 sharesB.sell 1,493 sharesC.purchase 1,493 sharesD.purchase 2,602 sharesAnswer: D60.A risk manager for bank XYZ, Mark is considering writing a 6 month American put optionon a non-dividend paying stock ABC. The current stock price is USD 50 and the strike price of the option is USD 52. In order to find the no-atbitrage price of the option, Mark uses a two-step binomial tree model. The stock price can go up or down by 20% each period. Mark’s view is that the stock price has an 80% probability of going up each period and a 20% probability of going down. The risk-free rate is 12% per annum with continuous compounding.What is the risk-neutral probability of the stock price going up in a single step?A. 34.5%B. 57.6%C. 65.5%D. 80.0%Answer: B61.Given the following 30 ordered simulated percentage returns of an asset, calculatethe VaR and expected shortfall (both expressed in terms of returns) at a 90% confidence level.-16, -14, -10, -7, -7, -5, -4, -4, -4, -3, -1, -1, 0, 0, 0, 1, 2, 2, 4, 6, 7, 8, 9, 11, 12, 12, 14, 18, 21, 23A.VaR (90%) = 10, Expected shortfall = 14B.VaR (90%) = 10, Expected shortfall = 15C.VaR (90%) = 14, Expected shortfall = 15D.VaR (90%) = 18, Expected shortfall = 22Answer: B62.What is the correct interpretation of a $3 million overnight VaR figure with 99%confidence level?A.The institution can be expected to lose at most $3 million in 1 out of next100 days.B.The institution can be expected to lose at least $3 million in 95 out of next100 days.C.The institution can be expected to lose at least $3million in 1 out of next 100days.D.The institution can be expected to lose at most $6 million in 2 out of next100 days.Answer: C63.In the presence of fat tails in the distribution of returns, VaR based on thedelta-normal method would (for a linear portfolio):A.underestimate the true VaRB.be the same as the true VaRC.overestimate the true VaRD.cannot be determined from the information providedAnswer: A64.Value at risk (VaR) measures should be supplemented by portfolio stress testingbecause:A.VaR does not indicate how large the losses will be beyond the specifiedconfidence level.B.stress testing provides a precise maximum loss level.C.VaR measures are correct only 95% of the time.D.stress testing scenarios incorporate reasonably probable events.Answer: A65.Assume we calculate a one-week VaR for a natural gas position by rescaling thedaily VaR using the square-root rule. Let us now assume that we determine the “true” gas price process to be mean reverting and recalculate the VaR. Which of the following statements is true?A.The recalculated VaR will be less than the original VaRB.The recalculated VaR will be equal to the original VaRC.The recalculated VaR will be greater than the original VaRD.There is no necessary relation between the recalculated VaR and the originalVaRAnswer: A66.If a portfolio with a VaR of 200 is combined with a portfolio with a VaR of 500,the VaR of the combination could be:I.Less than 200.II.Less than 500.III.More than 200.IV.More than 500.A.I and IIB.III and IVC.I, II and IVD.II, III and IVAnswer: D67.Consider the following portfolio consisting only of stock Alpha. Stock Alpha has amarket value of $635,000 and an annualized volatility of 28%. Calculate the VaR assuming normally distributed returns with a 99% confidence interval for a 10-day holding period and 252 business days in a year. The daily expected return is assumed to be zero.A.$56,225B.$69,420C.$82,525D.$96,375Answer: C68.Babson Bank is interested in knowing the risk exposure of their assets for variousprobabilities and time horizons. Babson has estimated that the annual variance (based on a 250 day year) of their $638 million asset portfolio is 151.29. If Z1%, Z5%, Z10%, are 2.32, 1.65, and 1.28, respectively, which of the following statements is false? The maximum dollar loss that can be expected to be exceeded:A.5% of the time in any six month period is $64.74 millionB.1% of the time on any given day is $11.51 millionC.10% of the time in any given quarter is $50.22 millionD.1% of the time in any given week is $25.25 millionAnswer: A69.The VaR on a portfolio using a 1-day horizon is USD 100 million. The VaR usinga 10-day horizon is:D 316 million if returns are not independently and identically distributedD 316 million if returns are independently and identically distributedD 100 million since VaR does not depend on any day horizonD 31.6 million irrespective of any other factorsAnswer: B70.If stock returns are independently, identically, normally distribution and the annualvolatility is 30%, then the daily VaR at the 99% confidence level of a stock market portfolio is approximately。

frm考试试卷考试时间:120分钟一、选择题(每题2分,共20分)1. 以下哪项不是金融风险管理师(FRM)考试的科目?A. 风险管理基础B. 量化分析C. 投资组合管理D. 信用风险测量与管理2. 根据FRM考试要求,以下哪项是风险管理的核心原则?A. 风险规避B. 风险转移C. 风险识别D. 风险接受3. 在FRM考试中,市场风险通常不包括以下哪项?A. 利率风险B. 汇率风险C. 信用风险D. 商品价格风险4. 以下哪项不是FRM考试中讨论的衍生品类型?A. 期权B. 期货C. 债券D. 掉期5. 根据FRM考试内容,以下哪项是风险管理流程的第一步?A. 风险识别B. 风险评估C. 风险监控D. 风险报告6. 在FRM考试中,以下哪项是操作风险的来源?A. 市场波动B. 信用违约C. 人为错误D. 自然灾害7. FRM考试中,以下哪项不是风险度量的方法?A. 价值在险(VaR)B. 期望损失C. 压力测试D. 资产负债表分析8. 以下哪项不是FRM考试中讨论的信用评级机构?A. 标准普尔B. 穆迪C. 惠誉D. 道琼斯9. 根据FRM考试要求,以下哪项是风险管理的最终目标?A. 增加收益B. 降低成本C. 确保资产安全D. 创造风险10. 在FRM考试中,以下哪项不是风险管理策略?A. 风险规避B. 风险转移C. 风险接受D. 风险创造二、简答题(每题10分,共30分)1. 请简述风险管理在金融行业中的重要性。

2. 描述FRM考试中所讨论的资本充足率(CAR)的作用及其计算方法。

3. 解释FRM考试中提到的风险价值(VaR)的概念,并说明其在风险管理中的应用。

三、案例分析题(每题25分,共50分)1. 假设你是一家银行的风险管理部门负责人,你发现银行的贷款组合中存在较高的信用风险。

请分析可能的原因,并提出相应的风险管理策略。

2. 你所在的金融机构计划进入一个新的市场,但该市场的市场风险较高。

高顿FRM 官网: 2016年的frm 教材电子版在哪里有下载frm 教材有哪些?很多考生希望在碎片时间也能看教材,这时候电子版则为更好的选择,那么frm 教材电子版有哪些?GARP 协会官方参考教材:《Financial Risk Manager Handbook 》6th.本书是金融风险管理师认证的核心教材,结构清晰、见解深刻,是FRM 考试必备的参考资料。

但内容对考点的覆盖不够全面,建议考生结合考试大纲和notes 一起学习。

本书有中文版和电子版。

GARP 协会官方教材GARP 将所有指定的reading paper 打包为一套阅读材料,总计数千页。

内容详尽、知识点覆盖全面。

但由于是reading paper 的合集,知识点之间缺乏逻辑联系,而且内容过于庞杂,不适合作为FRM 考试的教材,仅可用于特定专题研究参考。

本书也有电子版,在报名是即可购买,考生可以根据自身情况选择,不过小编建议考生们备考不要选用这本教材。

Kaplan Schweser 公司全球研发团队编写的《Kaplan Schweser Study Notes 》:Kaplan Schweser 是Kaplan 教育集团的全资子公司。

每年有超过90%的FRM 考生使用Kaplan Schweser 公司编写的教材,其FRM 教材及在线学习产品也受到GARP 协会的高度肯定和广大FRM 考生的一致认可。

这套学习资料根据每年FRM 考纲编写,深入浅出而又要言不烦,各种知识背景和工作经历的考生均能从中受益,是FRM 考试的必备教材。

Kaplan Schweser 还出版包括在线题库、在线重点难点突破讲座在内的全套FRM 教材体系。

Notes 也是有电子版的。

建议大家要利用好相应的题库。

frm一级二级资料一级资料:FRM考试简介FRM(金融风险管理师)考试是国际上公认的金融风险管理领域最重要的专业资格认证之一。

FRM考试由国际金融风险管理协会(GARP)主办,覆盖金融市场、金融工程、风险管理等领域的知识点。

FRM 考试分为两级,分别是FRM一级和FRM二级。

二级资料:FRM一级考试内容概述FRM一级考试的内容主要包括四个方面:金融市场与产品、风险管理与投资组合理论、金融机构和风险管理实践、量化分析。

下面将分别介绍这四个方面的内容。

1. 金融市场与产品金融市场与产品是FRM一级考试的基础知识部分,包括金融市场的结构和功能、股票、债券、期货、期权等金融产品的特点和交易方式。

考生需要掌握不同金融市场的运作规则,了解各种金融产品的基本特点和投资策略。

2. 风险管理与投资组合理论风险管理与投资组合理论是FRM一级考试的核心内容,包括风险管理的基本概念、风险度量和评估方法、投资组合理论和资产定价模型等。

考生需要掌握风险管理的各种工具和技术,了解投资组合的构建和管理方法。

3. 金融机构和风险管理实践金融机构和风险管理实践是FRM一级考试的实践应用部分,包括商业银行、保险公司、资产管理公司等金融机构的业务和风险管理实践。

考生需要了解金融机构的运营模式和风险管理流程,熟悉各种金融产品的风险特征。

4. 量化分析量化分析是FRM一级考试的技术方法部分,包括概率统计、时间序列分析、回归分析等数学和统计学方法在风险管理中的应用。

考生需要掌握各种量化分析技术,能够运用统计模型和计算工具进行风险测量和风险控制。

总结FRM一级考试内容涵盖了金融市场与产品、风险管理与投资组合理论、金融机构和风险管理实践、量化分析等方面的知识点。

考生需要全面掌握这些知识,并能够灵活运用于实际工作中。

通过FRM一级考试的学习和认证,考生将能够在金融行业中从事风险管理相关的工作,并为机构和个人提供专业的风险管理服务。

2016年frm一级习题分享FRM一级的考试题量非常的大,加上时间紧张,平均算来2分钟就需要完成一题。

而很多时候,题干非常长,若不能及时抓住关键词,就难以完成考试。

大家在平时的练习中,一定要锻炼自己的答题感觉,提高读题、做题速度。

接下来财经小编整理了一些frm一级习题,供大家练习。

FRM考试内容:每年5月和11月的第三个星期六举行,一级和二级可同时报考。

FRM一级与二级的考试内容分别由以下九大部分:FRM一级考试(Part I)(共100题单选题)1.风险管理基础(Foundations of Risk Management)(20%)2.数量分析(Quantitative Analysis)(20%)3.金融市场与金融产品(Financial Markets and Products)品(30%)4.估值与风险模型(Valuation and Risk Models)(30%)FRM二级考试(Part II)(共80题单选题)1.市场风险测量与管理(Market Risk Measurement and Management)(25%)2.信用风险测量与管理(Credit Risk Measurement and Management)(25%)3.操作与系统风险管理(Operational and Integrated Risk Management)(25%)4.风险管理与投资管理(Risk Management and Investment Management)(15%)5.当前金融市场形势(Current Issues in Financial Markets)(10%)注:FRM考试的各科试题随机分散在试卷中,没有先后次序。

标题:泽稷网校FRM的参考书有哪些?首先介绍一下目前比较常见的一些FRM参考书和习题库。

1、Study Guide:GARP协会提供的原版书籍列表。

2、Aims:GARP协会提供的考纲。

Kaplan Notes中也能够找到。

3、原版书:GARP协会考纲上所列书籍。

优点:覆盖知识点全面,能帮助正确理解考纲所考知识点。

缺点:资料繁多,不适用于复习时间有限的学员。

不得不说,这本书厚达9000页,比牛津词典还厉害。

FRM小编认为,除非你时间无比充裕且热爱阅读英文原版书,否则备考的时候还是别把它作为主要复习资料。

4、Handbook:GARP协会推荐备考书籍。

优点:浓缩知识点,有条理。

缺点:缺少部分考点章节,且均为不可忽略的章节。

老师建议,如使用Handbook作为主要复习资料,需要补充相关的资料,避免遗漏重要考点。

此外,还必须关注一下每年考纲的变化,很可能会从这些变化中出题。

5、Notes:培训机构Kaplan制作的备考书籍。

优点:完全根据考纲进行讲解,知识点覆盖全面。

缺点:没有条理,不易理解,对知识点的把握受限于编写者的理解,对考点的把握不够准确。

很多学员都会将notes和handbook结合使用,效果更好。

6、Practice Exam:GARP每年提供的模拟题,09年以前不分1,2级。

近期的模拟题日趋简单,难度以前几年的模拟题较接近考试情况。

建议有时间的话从07、08年开始都要做,感受一下。

7、Notes Exam:Kaplan制作的模拟题。

有一定难度,有时间也可以做一下。

FRM学习之handbookHandbook是金融风险管理师认证的核心教材,结构清晰、见解深刻,是FRM考试必备的参考资料。

但内容过于简洁,适合有相关知识背景和实务工作经验的考生,适用于考前强化复习使用。

一般来说,对于零基础的考生,已经通过FRM考试的考生认为最好将core reading和handbook结合来看。

在看handbook时遇到不懂的地方,就去core reading 中查阅。

frm 二级百题期货风险管理二级考题 - 风险管理策略期货市场作为金融市场的重要组成部分,具有较高的风险性。

有效的风险管理策略对于投资者来说至关重要。

下面将介绍几种常见的期货风险管理策略。

首先是止损单策略。

止损单是一种设置在期货合约价格下方的委托单,用于控制投资者的损失。

当价格跌破止损价位时,止损单自动触发,触发时以市价进行交易。

通过设定适当的止损价位,投资者可以限制损失的额度,并及时止损,避免继续亏损。

其次是套利策略。

套利是通过同时购买和出售不同市场上密切相关但价格存在差异的期货合约,以获取无风险利润的交易策略。

通过套利,投资者可以利用市场上的价格差异来获得风险较低的收益。

常见的套利策略包括跨市场套利、时间套利和跨品种套利等。

第三是多空对冲策略。

多空对冲是指投资者同时开设多头和空头两个相对的头寸,以抵消市场风险。

在市场中,多头头寸代表看涨期货合约的持仓,而空头头寸代表看跌期货合约的持仓。

通过多空对冲,投资者可以有效地规避市场波动带来的风险,实现风险的最小化。

最后是动态资金管理策略。

这种策略基于投资者对市场行情的判断,调整投资组合的资金配置,以应对市场变化。

动态资金管理包括增减仓位、调整止损价位和利润目标等。

投资者可以根据市场风险程度和预期回报来灵活调整仓位和风险控制参数,从而实现风险的有效管理。

总的来说,期货风险管理策略是投资者在期货市场中进行风险控制的重要手段。

止损单策略、套利策略、多空对冲策略和动态资金管理策略是投资者常用的风险管理策略。

投资者可以根据自身的投资目标和风险承受能力,选择合适的策略来实现风险的有效管理。

单选题1.On a multiple choice exam with four choices for each of six questions, what is theprobability that a student gets less than two questions correct simply by guessing?(D)A. 0.46%B. 23.73%C. 35.60%D 53.39%2. A portfolio manager enters into a total rate of return swap as the total return receiver.Under which of the following situations would the portfolio manager be required tomake a net outlay to the counterparty? (C)A. If the transaction was initiated as a hedge, then no outlay was required.B.There was a capital gain on the reference asset.C. The market value of the reference asset decreased significantly.D. The spread between the reference asset and the benchmark asset changed.3.Which type of distribution produces the lowest probability for a variable to exceed aspecified extreme value 'X' which is greater than the mean assuming thedistributions all have the same mean and variance? (D)A. A leptokurtic distribution with a kurtosis of 4.B. A leptokurtic distribution with a kurtosis of 8.C. A normal distribution.D. A platykurtic distribution4.Given two random variables X and Y, what is the Variance of X given Variance[Y]= 100,Variance [4X - 3Y] = 2,700 and the correlation between X and Y is 0.5? (D)A. 56.3B. 113.3C. 159.9D 225.05.Which of the following reduce a credit exposure by shortening the effective maturityof a position? (A)I. Liquidity putII. Credit triggerA. Both I and IIB. I but not IIC. II but not ID. Neither of I or II6.In a securitized transaction, over-collateralization results when (D)A. The originator puts aside some cash in a reserve account to absorb credit losses.B. A securitization transaction carves up the cash flows generated from the asset pool into various pieces.C. The interest payments and other fees received on the assets in the pool exceed the interest payment made on the ABS plus the fee paid to service the assets along with miscellaneous expenses.D. The value of the assets in the pool exceeds the amount of Asset Backed Security (ABS) involved.7.The payoff of some hedge fund strategies is commonly identified with the payoff ofoption strategies.The payoff of a long look-back straddle correspond best to thepayoff of (C)A. A trend following strategy.B. A fixed-income arbitrage strategy.C. A fixed-income convergence strategy.D. A spread trading strategy.8.Suppose the rate on 1-year zero-coupon corporate bonds is 13.5% and the impliedprobability of default is 3.96%. Assume LGD is 100%. Based on the giveninformation, the 1-year T-bill rate is closest to: (B)A. 4.49%B. 9.00%C. 6.74%D. 6.00%9. A portfolio manager wants to hedge his bond portfolio against changes in interestrates. He intends to buy a put option with a strike price below the portfolio’s currentprice in order to protect against rising interest rates. He also wants to sell a calloption with a strike price above the portfolio’s current price in order to reduce thecost of buying the put option. What strategy is the manager using? (C)A. Bear spreadB. StrangleC. CollarD. Straddle10.Paul Graham, FRM is analyzing the sales growth of a baby product launched threeyears ago by a regional company. He assesses that three factors contribute heavilytowards the growth and comes up with the following results:Y = b + 1.5 X1 + 1.2X2 + 3X3Sum of Squared Regression [SSR] = 869.76Sum of Squared Errors [SEE] = 22.12Determine what proportion of sales growth is explained by the regression results. (C)A. 0.36B. 0.98C. 0.64D. 0.5511.Which of the following is not a limitation of using the Capital Asset Pricing Modelto measure equity requirements for operational risk? (D)A. Measurement error in separately measuring levered and un-levered beta.B. Time lags in variables like tax and regulation being reflected in historical beta estimates.C. Requires detailed knowledge of profit and loss accounting to go from beta to a specific measure of operational risk.D. All of the above.12.Bank Omega’s foreign currency trading desk is composed of 2 dealers; dealer A,who holds a long position of 10 million CHF against the USD, and dealer B, whoholds a long position of 10 million SGD against the USD. The current spot rates forUSD/CHF and USD/SGD are 1.2350 and 1.5905 respectively.Using the variance/covariance approach, you worked out the 1 day, 95%VAR of dealer A to be USD77,632 and that of dealer B to be USD27,911. If the correlation coefficient between the SGD and CHF is +0.602 and assuming that these are the only trading exposures for dealer A and dealer B, what would you report as the 1 day, 95%VAR of Bank Omega’s foreign currency trading desk using the variance/covariance approach? (A)A. USD 97,027B. USD 105,543C. USD 113,932D. Cannot be determined due to insufficient data13.All else being equal, which of the following options would cost more than plainvanilla options? (B)I. lookback optionsII. barrier optionsIII. Asian optionsIV. chooser optionsA. I onlyB. I and IVC. II and IIID. I, III and IV14.Under the Internal ratings-based approach of the Basel II accord for securitizationexposures, an Asset-backed commerci al paper’s (ABCP), which of the followingdoes ‘Thickness of exposure’ refer to? (B)A. The average ‘number of years’ the bank has been associated with the borrower as a lender.B. It is the ratio of the ‘nominal size of the tranche of interest’ to ‘the no tional amount of exposures’in the pool.C. It is the ratio of the ‘amount of all securitization exposures subordinate to the tranche in question’to ‘the amount of exposures in the pool’.D. The average ‘amount’ of the exposure (international) to the group of borrowers in the pool converted to Euros.15.Assuming other things constant, bonds of equal maturity will still have differentDV01 per USD 100 Face Value. Their DV01 per USD 100 Face Value will be in thefollowing sequence of Highest Value to Lowest Value: (B)A. Zero Coupon Bonds, Par Bonds, Premium BondsB. Premium Bonds, Par Bonds, Zero Coupon BondsC. Premium Bonds, Zero Coupon Bonds, Par Bonds,D. Zero Coupon Bonds, Premium Bonds, Par Bonds16.The risk-neutral default probability and the real-world (or physical) defaultprobability are used in the analysis of credit risk. Which one of the followingstatements on their uses is correct? (B)A. Real-world default probability should be used in scenario analyses of potential future losses from defaults, and real-world default probability should also be used in valuing creditderivatives.B. Real-world default probability should be used in scenario analyses of potential future losses from defaults, but risk-neutral default probability should be used in valuing credit derivatives.C. Risk-neutral default probability should be used in scenario analyses of potential future losses from defaults, and risk-neutral default probability should also be used in valuing credit derivatives.D. Risk-neutral default probability should be used in scenario analyses of potential future losses from defaults, but real-world default probability should also be used in valuing credit derivatives.17.You are given the following information about a call option:• Time to maturity = 2 years• Continuous risk-free rate = 4%• Continuous dividend yield = 1%• N(d1) = 0.64Calculate the delta of this option. (C)A. -0.64B. 0.36C. 0.63D. 0.6418.Which of the following statements about American options is false? (C)A. American options can be exercised at any time until maturityB. American options are always worth at least as much as European optionsC. American options can easily be valued with Monte Carlo simulationD. American options can be valued with binomial treesQuestions 19 and 20 use the following information.Consider a stock that pays no dividends, has a volatility of 25% per annum and an expected return of 13% per annum. Suppose that the current share price of the stock, S0, is USD 30. You decide to model the stock price behavior using a discrete-time version of geometric Brownian motion and to simulate paths of the stock price using Monte Carlo simulation. Let ∆t denote the time interval used and let St denote the stock price at time interval t. So, according to your model,s t + 1 = s t (1 + 0.13 ∆t + 0.25 ∆t ∑) where ∆is a standard normal variable.19.To implement this simulation, you generate a path of the stock price by starting at t= 0, generating a sample for ∑, updating the stock price according to the model,incrementing t by 1, and repeating this process until the end of the horizon isreached.Which of the following strategies for generating a sample for ⊗ will implement this simulation properly? (A)A. Generate a sample for ∑ by using the inverse of the standard normal cumulative distribution of a sample value drawn from a uniform distribution between 0 and 1.B. Generate a sample for ∑ by sampling from a normal distribution with mean 0.13 andstandard deviation 0.25.C. Generate a sample for ∑ by using the inverse of the standard normal cumulative distribution of a sample value drawn from a uniform distribution between 0 and 1. Use Cholesky decomposition to correlate this sample with the sample from the previous time interval.D. Generate a sample for ∑ by sampling from a normal distribution with mean 0.13 and standard deviation 0.25. Use Cholesky decomposition to correlate this sample with the sample from the previous time interval.20.You have implemented the simulation process discussed above using a time interval∆t = 0.001, and you are analyzing the following stock price path generated by yourimplementation. (B)Given this sample, which of the following simulation steps most likely contains an error?A. Calculation to update the stock price.B. Generation of random sample value for ∑.C. Calculation of the change in stock price during each period.D. None of the above.21.Under the comprehensive approach for foundation IRB, which of the followingmethods is used for calculating the effective loss given default (LGD*) where:• LGD* is the effect ive loss given default(considering risk mitigation measures)• LGD is that of the senior unsecured exposure before recognition of collateral (45%);• E is the current value of the exposure (i.e. cash lent or securities lent or posted);• E* is the exposur e value after risk mitigation• IRB-Internal Rating Based Approach (A)A. LGD* = LGD x (E* / E)B. LGD* = LGD x (E* )*(E)C. LGD* = LGD x (E* + E)D. LGD* = LGD x (E* - E)22.Suppose a 20-year annual coupon bond has a DV01 of 0.14865. Also suppose a12-year annual coupon bond, which will be used as the hedging instrument, has aDV01 of 0.09764. If the yield beta is 1.10, which of the following statementsaccurately describes the situation? CA. The hedging instrument is significantly more volatile than the position in the 20-year bond, and the hedge ratio is 1.67467.B. The position in the 20-year bond is significantly more volatile than the hedging instrument, and the hedge ratio is 0.72253.C. In order to have a perfectly hedged position, for every USD 1 of the 20-year bond, USD1.67467 of the 12-year bond should be shorted.D. In order to have a perfectly hedged position, for every USD 1 of the 20-year bond, USD0.72253 of the 12-year bond should be shorted.23.Which of the following statements about the differences between market andoperational value-at-risk at financial institutions are correct? (A)I. The distribution of operational risk events must include sufficient mass in the extreme tail, making an assumption of a lognormal distribution invalid.II. The typical time horizon of market VaR calculations is 1 day, whereas the typical time horizon of operational VaR calculations is 1 year.III. Since prices are sufficiently available for liquid assets at all times, the market risk of liquid assets can be modeled using continuous distributions, but the nature of operational risk events requires using discrete distributions.IV. Market VaR requires a higher confidence level than operational VaR.A. I, II, and IIIB. I, II and IVC. I, II, III and IVD. III and IV24.Which of the following is not a modeling approach to credit scoring? (D)A. k--nearest neighbor classifier models.B. Logit and Probit models.C. Fisher linear discriminant analysis.D. Bayesian vector autoregression.25.Suppose an existing short option position is delta-neutral, but has a gamma ofnegative 600. Also assume that there exists a traded option with a delta of 0.75 and agamma of 1.50. In order to maintain the position gamma-neutral and delta-neutral,which of the following is the appropriate strategy? (A)A. Buy 400 options and sell 300 shares of the underlying asset.B. Buy 300 options and sell 400 shares of the underlying asset.C. Sell 400 options and buy 300 shares of the underlying asset.D. Sell 300 options and buy 400 shares of the underlying asset.26.Which of the following is not a true statement about internal credit ratings? (D)A. The “at-the-point-in-time” approach makes heavy use of econometric modeling that relates current financial variables to estimated default risk.B. T he “through-the-cycle” approach is forward-looking and attempts to incorporate future economic scenarios into current default risk estimates.C. “At-the-point-in-time” credit scores volatility is much higher than “through-the-cycle” score volatility.D. A sound internal system uses at-the-point-in-time scoring for small-to-medium-sized companies and private firms and through-the-cycle scoring for large firms.27.Firm A has equity volatility of .3 and debt to firm value (debt to capitalization) of .4.Firm B has the same debt to firm value but its asset volatility is .3. Which statementabout firms A and B is true? (D)A The capital of Firm A is less than the leverage of Firm B.B The volatility of Firm A’s operations is greater than the volatility of Firm B’s o perations.C The equity of Firm B is less risky than the equity of Firm A.D The equity of Firm A is less risky than the equity of Firm B.28.One of the requirements while using IRB is full integration of the internal modelinto the overall management information systems of the institution and in themanagement of the banking book equity portfolio. Which of the following bestdescribes this requirement? (D)A Establishing investment hurdle rates and evaluating alternative investments.B Measuring and assessing equity portfolio performance (including the risk-adjusted performance).C Allocating economic capital to equity holdings and evaluating overall capital adequacy as required under Pillar 2.D All of the above.29.Fund A which pursues energy trading derivatives strategies is considering mergingwith Fund B, an equity derivatives trading operation. One of the primary driversbehind the merger talks is the possibility of savings on the technology andoperations staff supporting each firm’s trading environment. C ertain of the factsunderlying the merger discussions are as follows:Yearly Operations Cost Yearly Transaction Volume Avg. Cost of ProductionFund A 2,000,000 4 Bln .05%Fund B 1,200,000 6 Bln .02%Assuming Fund A and Fund B decided to merge and determine that through the combination they can support their combined trading activities at a total cost of 2,500,000, what would be the average cost of technology and operations for the combined firm. (D)A .52% due to diseconomies of scopeB .25% due to economies of scaleC .52% due to diseconomies of scaleD .25% due to economies of scope30.You are hired as the credit risk manager for a large bank. You find that the bank’scredits are poorly diversified. The bank has an extremely large exposure to one firmwith a BB rating. All its other loans have the equivalent of an AAA rating. Yourecommend that the bank diversify its credit exposures. After the bank follows youradvice, you are summoned to the CEO’s office and fired. The CEO says that theyfollowed your advice, acquired many small exposures to firms with BB ratings toreplace the large exposure, and all it did was to make the bank riskier because itscredit VaR increased. The bank measures its credit VaR as the maximum loss ofprincipal over one year at the 1% level. You seek advice from a consultant to makesure not to repeat the mistake you made. Which of the following explanationsprovided by the consultant is correct? (C)A VaR necessarily falls as diversification increases. Consequently, the bank’s software to compute VaR must be flawed.B The bank did not diversify since it replaced one exposure with a BB rating with multiple exposures with a BB rating.C The VaR would not have increased had the bank measured it as a shortfall relative to the expected value of the banking book.D The VaR would not have increased had the bank not used the normal distribution for the portfolio return.31.Assume we estimate volatility and calculate a one day VaR. If volatility is meanreverting what can we say about the t day VaR? (D)A It is less than the t * one day VaRB It is equal to t * one day VaRC It is greater than the t * one day VaRD It could be greater or less than the t * one day VaR32.Your firm is holding a short position in an Argentinean bond with a notional valueof ARS 5,000,000 and a coupon yield of 5.5%. Your model predicts the bond’syield will decrease over the coming year. You are asked to hedge the position. Yourrecommendation is to: (B)A Buy a credit default swapB Sell a credit-spread put optionC Short a credit-spread forwardD Buy a total rate of return swap33.Imagine a stack-and-roll hedge of monthly commodity deliveries that you continuefor the next five years. Assume the hedge ratio is adjusted to take into effect themistiming of cash flows but is not adjusted for the basis risk of the hedge. In whichof the following situations is your calendar basis risk likely to be greatest? (A)A. Stack and roll in the front month in oil futures.B. Stack and roll in the 12-month contract in natural gas futures.C. Stack and roll in the 3-year contract in gold futures.D. All four situations will have the same basis risk.34.Which of the following statements correctly describes the properties of operationalrisk management tools? (B)A. Key risk indicators are subjective measures that allow the risk manager to forecast losses.B. Causal networks utilize conditional probabilities.C. Actuarial models require a top down methodology.D. Earnings volatility models adjust automatically for macroeconomic risks.35.An analyst has compiled the following information on a portfolio:• Sortino Ratio: 0.82• Beta: 1.15• Expected return: 12.2%• Standard deviation: 16.4%• Benchmark return: 11.9%• Risk-free rate: 4.75%Calculate the semi-standard deviation of the portfolio? (D)A. 0.4%B. 8.2%C. 14.9%D. 9.08%36.Consider an asset worth USD 1 million whose 95th percentile VaR is USD 100,000(computed using the parametric method assuming the normal distribution). Supposethe bid-ask spread on the asset has a mean of USD 0.10 and a standard deviation ofUSD 0.30. What is the 95th percentile liquidity adjusted VaR assuming the marketrisk VaR and the liquidity risk piece are uncorrelated? (C)A. USD 200,000B. USD 344,000C. USD 444,000D. USD 688,000pany XYZ's pension fund has liabilities of USD 100 million and assets of USD120 million. The annual growth of the liabilities has an expected value of 5% with3% volatility. The annual return of the assets has an expected value of 8% with 12%volatility. The correlation between asset return and liability growth is 0.3. What isthe 95% surplus-at-risk? (D)A. USD 27.6 millionB USD 22.7 millionC. USD 13.8 millionD. USD 18.1 millionpany EFG is a large derivative market-maker that has many contracts withcounterparty JKL, some transacted in the same legal jurisdiction and others acrossdifferent legal jurisdictions. As a result, EFG has some contracts with JKL coveredunder legally enforceable netting agreement A, some contracts with JKL coveredunder legally enforceable netting agreement B, and some contracts with JKL withno netting agreement. Ignoring the effect of margin, if the current value (i.e., marketvalue of the contract minus collateral and recovery value) and the netting agreementstatus of each contract with JKL are as shown below, what is EFG’s currentcounterparty credit exposure to JKL? (D)A. USD 8,612B. USD 6,914C. USD 14,899D. USD 2,341rge banks typically allocate risk capital for credit, operational and market/ALMrisks. Which of the following statements ranks the typical amount of risk capitalallocated to these different risks correctly starting with the largest amount? (D)A. Market/ALM risk requires more risk capital than credit risk.B. Credit risk requires more risk capital than market/ALM risk which requires more risk capital than operational risk.C. Market/ALM risk requires more risk capital than operational risk but less than credit risk.D. Credit risk requires more risk capital than operational risk which requires more risk capital than market/ALM.40.The DataSoft Corporation has an employee pension scheme with fixed liabilitiesand a long time horizon reflecting its young workforce. The fund’s assets are USD 9billion and the present value of its liabilities is USD 8.8 billion. Which of thefollowing statements is/are incorrect? (C)I. The present value of long-term fixed payments behaves very much like a long position in a fixed rate bond.II. Surplus at Risk is a measure of relative risk.III. The DataSoft Corporation will be able to immunize its liabilities by investing USD 8 billion in long-term fixed rate bonds.A. I and IIB. II and IIIC. I and IIID. I, II and III41.Given the below data for the US dollar and Canadian dollar exchange rates, whichof the following statements is true? E[CAD|USD Rate] and E[USD|CAD Rate]denote the mean of the CAD|USD Rate and USD|CAD Rate, respectively.(B)A. E[CAD|USD Rate] = 1/E[USD|CAD Rate]B. E[USD|CAD Rate] >= 1/E[CAD|USD Rate]C. E[USD|CAD Rate] <= 1/E[CAD|USD Rate]D. E[CAD|USD Rate] = E[USD|CAD Rate]42.The following statements about combating model risk are true, except?I. If a position is known to have considerable model risk, a firm can limit its exposure to this source of model risk by imposing a tighter position limit. (B)II. If we always choose the model that takes into account the largest number of real-world factors that affect prices, this will help to reduce the firm’s exposure to model risk.III. Running regular stress tests or scenario analyses to test the volatility, correlation and liquidity assumptions in models helps reduce model risk.IV. Risk managers should check the traders’ pricing models, ensuring model calibration isup-to-date and that models are upgraded in line with market best practice, and to ensure that obsolete models are identified and taken out of use.A. None are trueB. II onlyC. I, III and IVD. I, II and III43.In an attempt to provide guidance on the additional steps to be taken by the privatesector to promote the efficiency, effectiveness and stability of the global financialsystem, the Counterparty Risk Management Policy Group II (CRMPG II) publisheda report in July 2005 containing recommendations and guiding principles.According to the CRMPG II report, which of the following statements relating toEmerging Issues is incorrect? (C)a. CRMPG II recommends that fiduciaries taking on risks associated with complex products should have the ability to aggregate risk across their entire pool of assets in order to understand portfolio level implications.b. CRMPG II recommends that hedge funds, on a voluntary basis, adopt the relevant Recommendations and Guiding Principles contained in their (CRMPG II) report.c. As a guiding principle in selling structured products to retail investors, financial intermediaries should consider whether disclosure appropriately conveys the fact that the secondary market value, at maturity, will be less than the issue price.d. As a guiding principle, senior management should conduct periodic reviews of the financial intermediary’s internal control s for the sale of complex products to retail investors.44.Consider a 6-month futures contract on the S&P 500, and suppose the current valueof the index is1330. Suppose the dividend yield is 1.5% annually for the stocksunderlying the index, and that the continuously compounded risk-free interest rate is5.5% annually. What is the cost of carry for this futures contract? (A)a. 4.0%b. -4.0%c. 2.0%d. -2.0%45.Which of the following factors will not necessarily increase the price of a Europeancall option on a dividend paying stock as this factor increases in value? (C)a. The risk free rate.b. The stock price.c. The time to expiration.d. The volatility of the stock price.46.In the Basel II Standardized Approach for operational risk, the beta factor serves asa proxy for the industry-wide relationship between the operational risk lossexperience for a given business line and the aggregate level of gross income for thatbusiness line. Which of the following business lines has the highest beta factor? (A)a. Corporate financeb. Retail bankingc. Commercial bankingd. Asset management47.You want to implement a portfolio insurance strategy using index futures designedto protect the value of a portfolio of stocks not paying any dividends. Assuming thevalue of your stock portfolio decreases, which strategy would you implement toprotect your portfolio? (D)a. Buy an amount of index futures equivalent to the change in the call delta x original portfolio value.b. Sell an amount of index futures equivalent to the change in the call delta x original portfolio value.c. Buy an amount of index futures equivalent to the change in the put delta x original portfolio value.d. Sell an amount of index futures equivalent to the change in the put delta x original portfolio value.ing a daily RiskMetrics EWMA model with a decay factor = 0.95 to develop aforecast of the conditional variance, which weight will be applied to the return thatis 4 days old? (B)a. 0.000b. 0.043c. 0.048d. 0.95049.Which of the following statements about credit risk models is most accurate? (C)a. KMV models offer a structural approach to measuring credit risk that is based on credit migration.b. CreditRisk+ models offer an actuarial approach to measuring credit risk that treats the bankruptcy and recovery processes as endogenous.c. KMV models are an extension of Merton’s Option Pricing Model employing equity price volatility as a proxy for asset price volatility.d. CreditRisk+ models, like the reduced-form models, use a chi-square distribution to describe default.50.Suppose the daily returns of a portfolio and a benchmark portfolio it is replicatingare as follows:What is the tracking error over the four day period? (A)a. 3.16 bpsb. 2 bpsc. 10 bpsd. 2.39 bps51.Assume that a portfolio underperformed its benchmark by 2% in the most recentmonth. In this scenario, (C)a. Alpha is “-2%” as it refers to the Outperformance / Underperformance Gap.b. Due to underperformance, Alpha is definitely negative and cannot be positive.c. Alpha may be positive or negative depending upon Beta and Risk Free Rate.d. Alpha is 2%.52.Assume you have empirical data showing historical returns v for a given financialvariable (e.g.: Forex rate), how could you perform a quick test of the validity of thepower law Prob(v > x) = Kx-a where x is large, as a good model of the tail of thedistribution? (D)。

FRM考试题1. The NDF rate is set by .A. all of the aboveB. the four leading dealersC. the two counterparties of an NDF contractD. Reuters or Telerate2. The NDF is settled when .A. the NDF rate is higher than the current spot rateB. the difference between the NDF rate and the current spot rate is paid or receivedC. the principal amounts of the two currencies are exchangedD. both the principal and the difference are exchanged3. According to the passage, which of the following is not mentioned in the passage as the reason for the lower counterparty risks of an NDF ? .A. NDFs are exchange-traded productsB. NDFs are off-the-balance-sheet productsC. NDFs are non-cash productsD. The principal amounts are not exchanged4. The main purpose of a corporate in trading NDF is to .A. enhance the credit standing of their corporateB. maintain the value of their domestic currencyC. cover foreign currency exposuresD. add liquidity to their overseas investments5. The word "tenor" in the last paragraph means .A. counterpartyB. maturityC. nominal principalD. holder, in-due-course6. Before joining the Bank of England, Sir John was .A. a financial analystB. a government officialC. a senior butlerD. an accountant7. According to Sir John Gieve, which of the following is an advantage of London as an international financial center? .A. the crisis response and management of the government authoritiesB. the relative flexibility of the labor marketC. its unskilled labor and their financial knowledgeD. an ineffective and unfair regulatory and legal system8. Referring to paragraph 4, which of the following best explains why the concentration of skilled labor spurred innovation? .A. the concentration of skilled labor makes it possible to exchange new thoughts and ideasB. the skilled labor have multiple cultural backgroundsC. the people that work in the City of London are well educatedD. the skilled labor from New York are very innovative9. Compared to financial services sector, the manufacturing sector of UK employs .A. less workforce and accounts for lower percentage of the UK’s GDPB. less workforce and accounts for higher percentage of the UK’s GDPC. half the workforce and accounts for higher perce ntage of the UK’s GDPD. more workforce and accounts for lower percentage of theUK’s GDP10. That the British financial authorities are trying to improve crisis response and management is partly because .A. ill-judged decisions may throw away the Ci ty’s advantages.B. the regulatory environment is not so goodC. corruption could lead to crisis and damage the City’s advantagesD. operational disorder or fear about security could damage the City’s advantages11. Which of the following is one of the reasons why the CFOs were leaving their jobs at a faster rate than ever?A. the cost of labor was growing fastB. the CFOs were more pessimistic than their chief executivesC. the CFOs’ salaries are under expectationD. the pressure to deliver improved results was increasing12. The shorter tenure of CEOs and CFOs might eventually result in .A. their firm’s prospects being more uncertain than beforeB. higher demands of regulatorsC. top executive avoiding or changing projects that would pay off after they had left their jobsD. top executives being burnt-out13. It could be inferred from the article that the natural optimism of chief executives .A. encouraged the CFOs to think better about their firm’s prospectsB. had increased the pressure on CFOs to deliver improved resultsC. had been encouraged by the CFOsD. derived from their strategic imagination14. Which of the following is closest in meaning to “cook the books” (Line2, Para8)?A. to deliver improved operating resultsB. to make accounting records in compliance with demands of regulatorsC. to improve the bookkeeping processD. to provide fault accounting data15. The main idea of the article can best be summarizes as .A. optimistic chief executivesB. the hard time for CFOsC. the overly pessimism of CFOsD. the shorter tenure of CFOs16. The Sarbanes-Oxley act is most probably about .A. corporate scandalB. corporate managementC. corporate costD. corporate governance17. The word “backlash” (Line 3, Paragraph 2) most probably means .A. a violent forceB. a strong impetusC. a strong negative reactionD. a firm measure18. According to the text, separating the roles between chairman and chief executive is .A. a common practice in American companiesB. what many European companies doC. not a popular idea among American entrepreneursD. a must to keep the health of a company19. We learn from the text that a “staggered “board .A. is adverse to the increment of firm valueB. has been abolished by most American companiesC. gives its board members too much powerD. can be voted down by shareholders20. Toward the board practice of American companies, the writer’s attitude can be said to be .A. biasedB. objectiveC. pessimisticD. critical21. 设事件A发生的概率等于0.75,事件A发生而事件B不发生的概率等于0.6,事件A 与B相互独立,则:A、B同时发生的概率多少?A. 15%B. 25%C. 20%D. 30%22. 某人持有3只股票。

2016FRM考试整套FRM资料备考金融风险管理师,选好备考资料很重要,如何利用备考资料也很重要。

FRM小编为大家简单介绍一下考生常用的备考资料。

1.2016金融风险管理师Learning Objectives

这个Learning Objectives,是由协会公布的,为广大金融风险管理师考生而整理的金融风险管理师考试一个详细且明晰的框架。

考生们从中可以了解各部分所要考察的考点,若时间充足,还可以根据这个文件中给出的参考书籍去看看原书的内容。

这个文件包括了各部分所占考试比重,明确的课程阅读内容,以及各部分的主要考点。

协会还建议考生们在整个备考过程中都以它为指导。

简单来讲,就是一个简单的考生大纲,考生们在复习的时候根据大纲来复习,不要有所遗漏。

2.金融风险管理师官方教材

这是GARP协会给出的官方教材,考生们可以选择购买。

分成了Part I Books、Part II Books、Digital 金融风险管理师Exam Part I eBooks、Digital金融风险管理师Exam Part II eBooks,即有纸质版和电子版两种。

纸质版的价格分别是$240,$295;电子版的价格是$150和$295。

3、Handbook

handbook的好处就是重点集中、逻辑清晰且来源官方,缺点是更新慢没有包含许多新内容。

金融风险管理师考试不强制购买金融风险管理师官方教材,考生报考时可以选择是否购买金融风险管理师官方教材。

官方教材Handbook的费用是125美金+7%的关税+49美金运费,此外还有电子版,费用较高。

handbook也有相应的中文版,价格更低,对于英语基础不好的考生来说,也是个很好的选择。

4.Notes

Notes是由美国比较有名的培训机构Kaplan编写的备考书籍,它完全根据考纲进行讲解,知识点覆盖也更加全面。

不过缺点是没有条理,对于零基础考生来说,只看notes可能会复习得比较困难。

5.2016金融风险管理师Exam Study Guide and 2016金融风险管理师Exam Study Guide changes

FRM小编建议大家要重点看看金融风险管理师Exam Study Guide changes,其中明确了2016年金融风险管理师考试中一些变化的部分,有些是对教材做了更新,有些则是明显的增加考点,这些很可能会出现在今年的考试当中。

当然基础不好的考生们还可以选择报辅导班,例如FRM课程就附带多种备考资料,加上金融英语的前导课,全英文考试轻松拿下!除了以上这些,考生们还需要关注的就是官方给出的Study Guide了,备考时一定要看考试大纲,针对各个考点来完善自己的知识储备。