德勤个贷评分卡开发项目(全书版本)

- 格式:pdf

- 大小:1.94 MB

- 文档页数:44

A Partnership with ARGUSProgram OverviewARGUS Valuation-DCF Software Certification ProgramGeorgia State University’s J. Mack RobinsonCollege of Business, in partnership with ArgusSoftware®, is introducing the UniversityCertification Program for ARGUS Valuation–DCF.The ARGUS Valuation–DCF software is widelyrecognized as the industry gold standard forcommercial real estate cash flow projection, investment and valuation analysis. The ARGUS Valuation – DCF software is used extensively to facilitate large-scale transactions, analyze asset performance and optimize portfolio allocation decisions in commercial real estate.The ARGUS Software Certification (ASC) Program is designed as a two-day intensive course to create and validate experts in the market. The ASC designation is respected by commercial real estate companies worldwide as a testament to the valuable skillset acquired by program participants. The University Certification Program combines theory and application, demonstrating the broad potential of the ARGUS Valuation – DCF software while providing participants with an understanding of the underlying purpose.Program ContentPart One—Fundamentals:An overview of ARGUS Valuation – DCF basic functionality includes a thorough understanding of property description and measurements, timing of cash flows and inflation, tenant rent rolls, rent changes, rent abatements, market leasing assumptions, space absorption, vacancy, leasing commissions, other sources of potential revenue, fixed vs. variable expenses, capital expenditures, purchase and resale prices, direct capitalization, cap rates, debt financing, present value discounting, along with tenant and property level reporting.Part Two—Intermediate:An in-depth exploration of the ARGUS Valuation – DCF software covers detailed reimbursement methods, grossing up expenses, reference accounts, step rents, CPI adjusted rents, percentage rents from retail sales, tenant level parking, detailed rentabatements, detailed leasing commissions, stacking plans, and portfolio analysis.Case studies will be used throughout to demonstrate these applications. Thematerials provided include extensive review questions to prepare programparticipants for the certification exam. Upon successful completion of ARGUScertification exam, participants achieve certified status in ARGUS Valuation-DCF.Program Participants (Who Should Attend?)The ARGUS Valuation-DCF Software Certification Program is designed for:▪Individuals who are familiar with basic commercial real estate concepts and investment decisions, but would like to expand their skillset to include proficiency in ARGUS Valuation –DCF and deepen their understanding of current methods used in commercial real estateanalysis.▪Individuals who may be new to ARGUS Valuation – DCF, but would like to achieve an intermediate-level competency and obtain the ARGUS Software Certification (ASC) designation to distinguish their resumes and boost their marketability to prospective employers.▪Professionals who may have already used ARGUS Valuation – DCF in the past and are interested in qualifying for the ARGUS Software Certification (ASC) designation to validate their expertise.▪Managers and directors who would like to implement the use of ARGUS Valuation – DCF at their firm.Professionals who benefit from ARGUS Valuation–DCF include:▪Appraisers▪Asset managers▪Commercial brokers▪Consultants▪Developers▪Investment analysts▪Leasing managers▪Lenders/underwriters▪Portfolio and fund managersProgram BenefitsProgram participants will return to the industry with the knowledge and skills to:▪Quickly and accurately analyze commercial real estate assets and transactions▪Forecast property cash flows▪Develop leasing strategies, business and marketing plans▪Assess market realities and risks▪Calculate investment values and returns▪Share asset and transactional data with clients, partners and colleagues▪Generate customized property and portfolio reportsThe ARGUS Software Certification (ASC) Program, in partnership with Georgia State University’s J. Mack Robinson College of Business, is a fast-paced, highly-interactive two-day course designed to help you earn one of the most highly respected certifications in the industry.Program Faculty DirectorThe faculty director for this program is Jon Wiley, ASC, Ph.D., AssistantProfessor in the Department of Real Estate at Robinson College of Business.He currently teaches Real Estate Development and Real Estate Financing inthe M.S.R.E. and M.B.A. programs at Georgia State. His primary interest is inenhancing the quality of business decisions in commercial real estate throughresearch and education. Since 2006, he has published 20 articles oncommercial real estate, investment, valuation, development, brokerage andsustainable real estate in leading academic real estate journals including RealEstate Economics, Journal of Real Estate Finance and Economics and Journalof Real Estate Research. He has held faculty positions at Georgia State, Clemson University and College of Charleston and has taught ARGUS software to hundreds of students, including as early as 2004 at The University of Alabama.Program CertificateBelow is an example of the certificate you will receive upon program completion:Program LocationThe ARGUS Valuation-DCF Software Certification Program is held at the GSU Buckhead Center located in the heart of Atlanta’s business and financial di strict. The Center is located on floors 4, 5 and 6 of the Tower Place 200 building (pictured at lower right) and offers easy access to I-85 and Georgia 400. The Center offers 12 high-technology classrooms, 28 breakout rooms, and an Innovation Lab.ARGUS Valuation-DCF Software Certification Program A Partnership with ARGUS Software®Program Details and RegistrationWhen: Date Option One:August 9-10, 2013;Two-Day Program, Friday & Saturday, 8:30 AM to 4:30 PMDate Option Two:October 25-26, 2013;Two-Day Program, Friday & Saturday, 8:30 AM to 4:30 PM Location: Georgia State University, Robinson College of Business, Buckhead CenterTower Place 200, Classroom 620; 3348 Peachtree Road NE, Atlanta, GA 30326Cost:ARGUS Valuation-DCF Software Certification Program$1,950 per person, standard registration fee$1,650 per person, REIAC members or companies sending a team of two or more$1,350 per person, GSU students and alumniNote: The fee covers tuition, temporary ARGUS Valuation-DCF software license, booksand materials, one (1) ARGUS Valuation-DCF Software Certification exam fee,continental breakfast, lunch, afternoon snacks, wireless Internet, and parking.About the J. Mack Robinson College of BusinessThe largest business school in the South and part of a major research institution, the J. Mack Robinson College of Business at Georgia State University is located in Atlanta, an epicenter of business and a gateway to the world. With programs on four continents and students from 150 countries, the College is world-wide and world-class. Its part-time MBA program is ranked #7 in the nation and has been in the top 10 for fourteen consecutive years. The College has 200 faculty, 7,400 students and 65,000 alumni. Noted for an emphasis on educating leaders, GSU has produced more of Georgia’s top executives with graduate degrees than any other school in the nation.About the Department of Real EstateThe Department of Real Estate at the J. Mack Robinson College of Business at Georgia State University is ranked #10 in the country for its undergraduate program. The department offers a range of degree options including a bachelor’s, an MBA concentration, a MS in real estate, and a Ph.D. in real estate. The real estate major at the College offers a broad-based curriculum that provides a balance of theory and practice. Our programs emphasize the following major components—real estate appraisal, corporate real estate, development, finance, investments, and market analysis. A degree in real estate gives graduates the foundation necessary to succeed in this exciting industry.Register Online or CallRegister online at or by calling Shelley Nelson at 404-413-3932.。

贷中行为评分卡(B卡)模型一、风控业务背景随着新客获客成本越来越高,贷中客户管理越来越重要,包括额度管理(提降额度)、利率调整、提单意愿预测、流失倾向预测、营销响应预测等。

行为评分卡(Behavior Scoring)是一种根据客户在账户使用期间所产生的各种行为,动态预测客户风险的评分模型。

其像是对客户过去一段时间的动态表现录像,然后与其在未来时间的一些状态照片对比。

本文以信用卡和小额信贷分期产品为例,介绍行为评分卡(B卡)的基本知识。

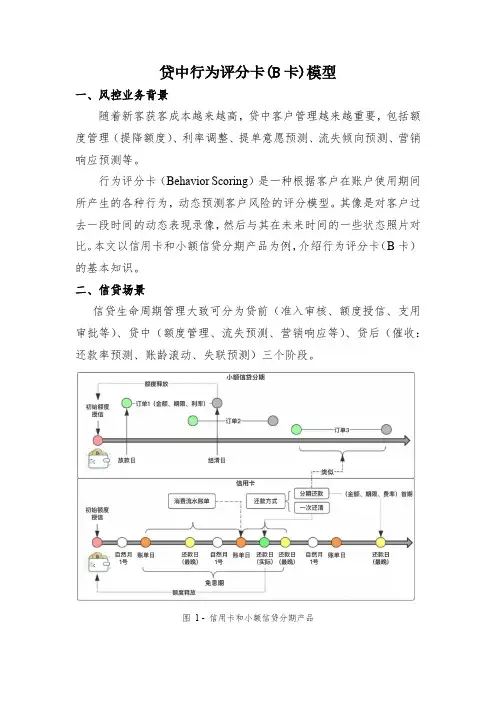

二、信贷场景信贷生命周期管理大致可分为贷前(准入审核、额度授信、支用审批等)、贷中(额度管理、流失预测、营销响应等)、贷后(催收:还款率预测、账龄滚动、失联预测)三个阶段。

图 1 - 信用卡和小额信贷分期产品如图1所示,我们以信用卡和小额信贷分期产品为例,分别介绍两者的特点:1. 信用卡信用卡在审批下卡前的阶段称为贷前,机构(银行、信用卡公司)会对客户风险综合评估,给予一个初始信用额度(如8000元)。

下卡并激活后,进入贷中阶段,期间客户可在信用额度范围内进行透支消费,每两个账单日之间的消费流水账单将在后一个账单日(例如每月8号)通知客户。

账单日至最晚还款日(例如每月26号)前,客户可以随时还款,期间免息。

还款方式一般支持一次性还清和分期还款。

分期还款将产生利息收入,因此对于机构而言,自然是希望客户分期,默认推荐项也就是这个(为提高转化率,UI设计时肯定在右手边)。

一旦客户逾期,那就进入贷后催收阶段。

2. 小额信贷分期在贷前阶段,小额信贷分期产品所产生的每笔支用订单都需审批,通过后才放款到客户手中。

放款后至结清的这段时间称为贷中。

订单具有金额、期限、利率等属性,其约定了出借人和借款人之间的契约。

与信用卡分期还款类似,小额信贷分期产品在每个还款日也必须偿还相应的本金和利息。

在客户发起支用申请订单后,将会生成一张还款计划表,如图2所示。

显然,该还款方式为等额本息,即:在还款期内,每月偿还同等数额的贷款(包括本金和利息)。

德勤尽职调查指导手册As companies navigate the complex landscape of due diligence investigations, Deloitte's comprehensive guide provides invaluable insights and best practices. 作为公司在尽职调查领域探索的指导,德勤全面的手册提供了宝贵的见解和最佳实践。

One key aspect addressed in the guide is the importance of conducting thorough background checks on potential investment targets or business partners. 这本手册中重点讨论的一个方面是对潜在投资目标或商业伙伴进行彻底的背景调查的重要性。

By meticulously analyzing the financial, operational, and legal aspects of a target company, organizations can better assess potential risks and opportunities. 通过精心分析目标公司的财务、运营和法律方面,组织可以更好地评估潜在风险和机会。

Moreover, the guide emphasizes the need for strong governance structures and compliance frameworks to mitigate the risk of regulatory violations. 此外,该指导手册强调了建立强大治理结构和合规框架的必要性,以减少违反监管规定的风险。

Another critical area covered in the guide is the importance of cultural due diligence when conducting cross-border transactions or partnerships. 指导手册中还涵盖的一个关键领域是在进行跨境交易或合作伙伴关系时,文化尽职调查的重要性。

2024年初级银行从业资格之初级个人贷款自我提分评估(附答案)单选题(共45题)1、个人汽车贷款所购车辆按用途可以划分为()。

A.自用车和商用车B.新车和二手车C.自用车和二手车D.新车和商用车【答案】 A2、下列关于等额本息还款法和等额本金还款法的说法,正确的是()。

A.两种方法都是常用的个人住房贷款还款方法,分别适合不同情况的借款人B.等额本息还款法优于等额本金还款法C.一般来说,经济尚未稳定而且初次贷款购房的人更适合采用等额本金还款法D.银行更倾向于采取等额本金还款法【答案】 A3、以下属于无担保流动资金贷款的是()。

A.中国银行的“幸福时贷”B.中国建设银行的“幸福时贷”C.中国农业银行的“幸福时贷”D.花旗银【答案】 D4、商业助学贷款贷前调查的重点内容不包括()。

A.材料一致性调查B.借款人身份、资信、经济状况和借款用途调查C.担保情况调查D.借款申请人所在学校社会声誉和竞争力调查【答案】 D5、对以所购车辆为抵押的个人汽车贷款,借款人需交贷款银行保管的单证有()。

A.购车发票复印件B.各种缴费凭证复印件C.机动车登记证原件D.行驶证复印件【答案】 D6、下列关于“间客式”个人汽车贷款模式的说法,不正确的是()。

A.“间客式”运行模式在目前个人汽车贷款市场中占主导地位B.“间客式”运行模式就是“先贷款,后买车”C.该模式涉及的第三方包括保险公司、担保公司D.部分经销商可以为借款人按时还款向银行进行连带责任保证或全程担保,并收取一定比例的管理费或担保费【答案】 B7、目前,银行最常见的个人贷款营销渠道不包括()。

A.合作机构营销B.网点机构营销C.电子银行营销D.上门拜访营销【答案】 D8、个人住房装修贷款的贷款期限一般为_______,最长不超过_______。

()A.1~2年;3年B.1~3年;5年:C.2~3年;5年D.1~2年;5年【答案】 B9、以下关于保证期间债权债务转让的说法,错误的是()。