会计专业外文资料及翻译

- 格式:doc

- 大小:89.00 KB

- 文档页数:8

Master's thesis, University of LondonInformation technology and accounting management with the use is the relevant value of information analysis and use, and various factors of production based on the value creation of corporate accounting and management contributions to the study of accounting will be the main content. No use of information technology, there is any enterprise information and accounting information to promote the implementation of value chain management will lose technical support, there is no theory of innovation value chain management, accounting, and information technology development, there is no power. In this paper, the meaning of information to start, leads to the meaning of accounting information, accounting information describes the development process, the second part of the analysis of the status quo of accounting information, analysis of its use in theproblems, the third part of the proposed accounting information on the implementation of the strategic analysis.Keywords: accounting, information technology strategyI. Introduction(A) BackgroundThe development of accounting information in China has gone through more than 20 years, accounting information theory and practical application of talent, the accounting information system software has gradually matured, and, and theproduction, supply and marketing, human resources management, cost control and other aspects of the formation of an integrated management information system software. But the company found accounting information in the status of the development of enterprises is extremely uneven, a lot of strength and standardized management of large enterprises have been using the integrated accounting information system "ERP" is the management software, and the introduction of new ideas with the value of the supply chain management chain management system, and also the majority of the total business is still in the initial stage of the use of computerized accounting, or even manually. Enterprise management is still in the coexistence of traditional and modern, our corporate accounting information so early, the senior co-existence of the phenomenon will not surprise. Accounting information must be improved to facilitate the management of change. The essence of the value chain to value chain to implement the core business processes node changes, if companies choose the value chain as the core business process change, business management will enable a major step forward, it promotes corporate accounting development of information technology.(B) SignificanceWhile accounting information in China's time is not long, its nature and content to be further studied, but it is undeniable, with the advent of the information society, accounting, information technology will be an irresistible inevitable trend of the accounting information The current accounting both in theory and in practice will have a huge impact.First, to achieve after the accounting information, accounting information system will truly become a business management information system, a subsystem. The business enterprise is able to automatically capture the enterprise's internal and external information related to accounting, and together with the company's internal accounting information system for real-time processing. Accounting from the limitations of traditional accounting afterwards freed, and thus play a greater management control of accounting functions, business and information so that users can readily use the corporate accounting information to the business of the future financial situation to make a reasonable forecast, management and development of enterprises to make the right decisions. Second, the accounting assumptions, in particular, is no longer the traditional accounting entity with real money and plant business, it will include some of the online virtual companies and network companies,which for the common goal, in short time together, when the completion of specificgoals will soon dissolve, and its continuing operations, accounting, staging and monetary measures the basic premise of all will be affected. Implementation of accounting information, the enterprise network and external networks to achieve the Internet, users of accounting information can always obtain the relevant accounting information. Comprehensive application of information technology has greatly improved the timeliness of the information, the predictive value of information and feedback is also greatly enhance the value of information flow is also much faster, can contribute positively to the improvement of economic management. Other accounting information systems through direct access to relevant data and analysis, reducing theman-made fraud, thus greatly improving the reliability of accounting information and the quality of information.Third, today's accounting software processes basically simulate manual accounting processes and design. Implementation of accounting information, the accounting system is no longer isolated, but with a real-time processing, highly automated system, which with other business systems and external connections, you can directly read data from other systems, and a series of processing, processing, storage and transmission. Accounting reports can also be used for real-time electronic means associated newspaper report, the user can always obtain useful accounting information for decision-making, improve efficiency, promote economic development.21st century will be an information-oriented society, today's society is the "knowledge economy" era forward, In today's competitive environment, the accounting officer must not only well versed in the basic principles of accounting, computerized accounting techniques to master , but also learn some sense of organization, behavioral factors, decision-making process and communication technology and other aspects of the basic theory. Accounting information representsnew accounting ideas and concepts, the traditional accounting theory and modern information technology, network technology, a combination of product development is the inevitable trend of modern accounting. It must seize opportunities, meet challenges, and strive to promote the development of China's accounting information.II An overview of the accounting information(A) the meaning of informationBegan in the 1940s wave of information technology, beginning aroused great attention in all aspects, from the 1960s, scholars began to have "information" and "information society" and so on. 1963 Japanese scholars Tidal plum out in its "Information Industry science" for the first time that "information technology" concept. As information technology there is not long, the actual development and very rapid development of information society itself changes, the understanding of information technology are not the same. For example, "information is the communication of modern, computer and rationalize the general term", "information is computerized, modern communication and network technology", "information is e-commerce" and "information is computerized," " information is information technology and information industry in the economic and social development andplay a leading role in increasing the process ", and so on. Information technologyrevolution and the industrial revolution is the result of information from the three aspects, namely, the digitization of information, information networks, information and intelligent. "Digital information is the basis of information, the information network is the basic characteristics of information technology, information, and information technology is the development of intelligent features."(B) The information content of accountingThe concept of accounting information in 2000, the Shenzhen Municipal Finance Bureau and the Shenzhen Kingdee Software Technology Co., Ltd in Shenzhen's "new situation, management accounting software market, Information Theory Symposiumaccounting expert forum" on the make is the accounting computerized product development to a new stage. Theoretical understanding of information technology sector have different views, such as technical concept, the process concept, elements and outlook, and thus the concept of accounting information will have a different set, HU Ran star of accounting information as defined by the use of more the status quo. "Accounting information is based on the system in the enterprise of science, management science, application of modern information technology, integration of enterprise business processes and accounting processes, the establishment of accounting information systems; full development and use of accounting information resources, timely and accurate to the enterprise internal and external users of accounting information to provide useful support to strengthen the role of accounting to reflect and monitor the overall process. "As can be seen from this statement, the accounting information is the process of concept, it conveys such meanings: First, the means of access to information networks, communications and databases; Second, business processes and accounting processes to be re- whole, to better reflect the timeliness of information provided; third-to-business cash flow, physical flow and information flow throughout theimplementation of real-time control; Fourth, the spatial extent of the accounting information to expand information coverage, including information and currency non-monetary information internal information and external information, and so on. Professor Yang Zhou Nan the study of accounting information has its own unique, she will be introduced to the theory of value chain management accounting information in the field, made a "value chain management, accounting, information technology," the new concept, and that the "value chain management accounting information is the value chain to achieve important environmental accounting management and technology base. " And discussed the value chain management accounting information in the target location, technology platform, business process management models, standards, audit system, and in ten areas of change. Expand the meaning of accounting information.(C) The development of accounting information1 era of computerized accountingFunding from the Ministry of Finance in 1978, Chinches First Automobile Works began a pilot computerized accounting, accounting information in China's development has gone through more than 20 years, in its early stage of developmentthat the era of computerized accounting, computer applications accounting in the accounting field to produce a major change, the accounting staff work from reimbursement heavy afterwards freed, so that participants are management accounting staff time, improve the quality of accounting information and timeliness of the initial training of accounting software boom market, develop a group of composite talent, creating a number of accounting software company, to the standardization of computerized accounting, commercial, universal, professional development, and for corporate information and provide a good experience, and promote enterprise management software development. But the rapid development of modern information technology on the traditional computerized accounting system had a tremendousimpact on the theoretical basis of accounting, the timeliness of accounting reports and other challenges. Xiao ravioli the traditional computerized accounting of the main problems are summarized as follows: "First, the traditional manual accounting, computerized accounting simulation only, although the financial accounting software to improve the efficiency and quality of accounting information, but accounting processing procedures and methods are basically just a set of procedures to move the hand up the computer; Second, the traditional accounting information system is the internal information 'islands' in the computerized implementation, financial data and business can not be shared, resulting in confined to the financial sector financial software to use, and internal business units are not well connected. other departments can not directly access to financial data; Third, the traditional accounting information system and outside the enterprise information system isolation and all business transactions or to open by hand, according to the paper documents the first, and then entered into the computer; Fourth, the traditional accounting information system lags behind the development of modern information technology now INTERNET-INTRANET technology has reached the stage that we can not imagine, if we are still deal with isolated cases of the PC, then the business of managementdecision-making, budgeting, investment and production decisions will be errors due to insufficient amount of information; the fifth, only in the most traditional computerized accounting electronic data processing stage. China's implementation of accounting computing of the unit, most just use computerized accounting basic accounting, and a large number of financial management and financial analysis, is still a manual process; the sixth, in place of traditional computerized software development, function is not fully, to use the resulting inconvenient. "(2) Accounting information ageWhen the network technology and the maturity of domestic accounting software, financial, and timely exchange of business data has a technical support, and therefore the accounting information age has arrived. 2000, accounting information theorists first proposed the term is, and has been widely recognized. This reference is to the service management functions of accounting on the present and future information environment into account, is changing attitudes, is to seek greater development. Accounting information on the target even pay attention to accounting in business management on the central role; more dependent on the technology of modern network technology; focus on the functional areas of management accountinginformation and decision analysis; status in the system as a management systemintegral part; in the information transmission on the basis of authorization to acquire or output the information in the internal and external systems.Time accounting information more open and diversity. Openness is the high degree of sharing of accounting information resources, large amounts of data information between the departments within the enterprise, between enterprises within the group and between groups and external corporate unlimited or limited authorization of information exchange. Diversity performance of accounting information is no longer a single financial account table data, but also a lot of non-monetary forms of information; is no longer the only direct data or after a simplesummary of the data, but also includes many qualitative and quantitative analysis after can respond to different information needs of those recycling information; not only by Rose-year tradition of staging statistics accounting information, more of a point in time information, that is its real-time.Third, the use of accounting information Analysis(A) the status of the use of accounting informationImplementation of information technology in business process, the software provider to the enterprise managers have always praised their own software in the technical structure and how the information model is refined, is how the demand for enterprise management, and that enterprises should make what change in order to play the software management functions. But it did, most did not use information technology for the enterprise software providers to create the initial promised value. Even companies and managers think that the use of information systems management in the past rigid, not as labor management more convenient and flexible. This information management system is a failure of management systems; it is only concerned about the use of technology, while ignoring the way people access to information and requirements. U.S. information technology specialist Thomas. H •Davenport claims, in order to change the unsatisfactory status of information technology, must be people-oriented principle. Effective information management must first focus on how people think about the application of information, rather than how to use the machine. In people-oriented information management strategy, the reality of diversity to be concerned about the information; to emphasize the effective use of information and wide sharing; to make information technology solutions to solve current practical problems; to allow for different interpretations of the same message; to that enterprises to obtain the desired effect is considered the ultimate success; to specific problems to establish the appropriate structure; to promote and strengthen the method by adjusting the behavior of members of the organization; to the user's need to design their own applications. Body belongs to large enterprises, has been large-scale enterprise management, and financial strength. Before the introduction of the enterprise, there are three companies will have to implement ERP management system, and is part of the implementation of these enterprises are large-scale department stores and supermarket chains. Both with 16 companies have at least one financial software business management software companies, one of the six companies of the business management software such as inventory managementsoftware and financial software to achieve the integration, these companies are outside the supermarket. Local department stores and supermarket chains do little to achieve integration.Large supermarket chains in spite of the ERP management system, but and foreign retail giants such as Wal-Mart, Carrefour, B & Q, in comparison, China's domestic retail business of information technology still in its infancy. For example, Wal-Mart is the first use of computers to track inventory in retail enterprises (1969), is the earliest use of bar code (1980), the use of EDI with suppliers for better coordination (1985), launch its own communication satellite (1986) and use the wireless scanning guns (late 1980s) of retail companies. Now, Wal-Mart is the world'smost spare no effort to implement RFID Technology Company. Our domestic retail enterprises and applications providers are basically in a bystander.(B) The use of accounting information the problems1 lack of capital investmentAccording to the survey, not the type of business is accounting information in capital investment are also significant differences, in general, in terms of information technology also significantly less capital investment. Some small retail businesses, especially those franchise retail stores, its turnover of 100 million or less, the profit of 10 million or less. These companies invest in information technology capital is almost zero. For example, there is a franchise of computer accessories supplies store, operated by no less than one thousand kinds of varieties of goods, commodities Invoicing also only manual bookkeeping, the occurrence of errors is often a matter, but in a short time do not want to invest in this area. Manager believes that the purchase of small Invoicing software is several thousand to more than a million, do not necessarily apply to buy back their own and do not find someone to develop such talent. This situation represents the general attitude of some small businesses. Some of the economic benefits of better information technology in the retail business is also aserious shortage of capital investment. Local department store is a large-scale, high-profile retailer, sales of 4 billion last year, more than 300 million annual profit. This year is expected to increase by 1 million sales. So far the company has a network version of the UF of a financial accounting software and a software company developing your inventory management software, for a total capital of less than 30 million, if $ 1 million plus investment in hardware terms, the company's information construction accounts for the year total investment capital ratio of .325% of sales. According to statistics, the total number of enterprises in China accounted for 99.6% of the 40 million SMEs, of which 74% of enterprise information into sales revenue accounted for less than 1%, usually abroad, 2% -3%. Defined in accordance with the latest standards for SMEs to divide, retail enterprises with annual sales of more than 150 million people or more than 500 the number of workers should belong to large-scale retail enterprises. In other words, the department stores are large retail companies, invested in information technology should be more than 1% of the funds, but the fact is much lower than the ratio. From the survey found the same with the size of the retail mall business investment in information technology is basically the same proportion.(2) For their own interests and resist cooperation with upstream and downstreambusinessesSome retailers believe that if the composition of upstream and downstream enterprises and their value chain, then this value chain to increase the total value is given, other means to make their own alliance to get more companies will get less. Therefore, the value chain between the various value chains Alliance is a competitive relationship. In such a concept under the guidance of the retail business is often not the whole value chain from the perspective of value-added, but rather in order to pursue their own interests at the expense of maximizing the interests of the entire value chain. Therefore, in the retail business and corporate transactions in theupstream, suppliers repeatedly lower prices, even the ones who enjoy the suppliers as their main source of profit; the supplier is to conceal their true costs, even as the retail price increases in disguise counterattack. The two sides are not creating value chain from the overall effectiveness of view, but to build their own profit loss in the value chain based on the Alliance. This is clearly not the goal of value chain management. Retailers should change their ideas, we must seek to maximize their own interests into the overall interests of the pursuit of maximizing the value chain, and clear corporate profits should manage to get through the value chain, value chain, rather than from the body to acquire Alliance.Other retailers do not want their business data, or other important sales information and customer information available to the supplier, even if the enterprise also needs to control access rights, let alone to disclose outside the enterprise. This deep-rooted tradition of understanding between suppliers and retailers so that the lack of a good spirit of cooperation. The basic goal of value chain management is the management process by improving the transparency of the entire value chain to improve the efficiency of resource allocation and profit levels, sharing of information resources. This will not only make the core of the value chain within the enterpriseand value chain alliances between enterprises can receive timely, flexible and actionable information resources to enable them to fully grasp the value chain cooperation between the Alliance information, market information, other business decision-making information, but also enables the company starting from the global value chain to arrange production and services.Management rather than the promoterLearned in the survey had had some local retailers, accounting information for what is not understood, was 67.19% in visitors who do not know what is accounting information, never heard of value chain management, the company has implemented a complete information technology solutions tend to say, very often referred to our information management staff to answer. Managers of these companies as the information because of competitive pressures is a helpless and passive choice, their knowledge of information technology know much, but not condescending and general staff to receive formal training, and such of the lack of knowledge of information technology initiative to accept the manager's attitude will inevitably lead to the loss of authority in this regard, they naturally will not be a promoter of information technology, and will be the task entrusted to the information management staff.Regardless of the information management company executives in the company'sposition that tall, and its authority is inferior to general manager, when stakeholders hinder the process of information, the information management staff had no ability to advance the information technology revolution. In addition, information management staffs are often professional and technical personnel, their lack of business knowledge and management capabilities, enterprise information process will be based more on business instead of computer hardware and software technical problems. In this case, information management will become powerless. If you rely on information technology to promote information management, failure becomes inevitable.Positioned correctly in the accounting functions of informationOne view is that the accounting functions will be limited to record a variety of business information behind them, while in charge of foreign tax returns and financial statements submitted to the traditional. Hold this view tend to be small retail business managers. They see the accounting for tax accounting and treasury accounting, they need to get that information from the accounting major is the number of day and monthly cash flow to pay the tax number. For the case of commodity stocks more business managers to ask, but regardless of the amount of inventory accounting and inventory carrying costs. This is because much small retail business to avoid taxes from the perspective of the book to create a false inventory, accounting, accounts payable data is the tax department. Based on this purpose, the managers of these enterprises will not consider business management systems and financial accounting system for data sharing. Learned from the survey 62.5% of the enterprises is not the business management software and financial accounting software and docking. Managers first consider the purchase of inventory management system is more than the amount due to the types of products, often caused by hand-billing and out of the workload and error rate increased only alternative. In the early stages of business development, accounting information for managers attitude and understanding of theaccounting function to reduce the tax burden may have a role, but this effect is not really benefit from the long-term stable development of enterprises to consider, once the risk of tax laws increased, the negative effect caused by low-would offset the tax benefits.Accounting, information technology implementation strategy analysis(A) Strategic and tactical implementation services for enterpriseFirm's strategic goal is to guide the development of accounting information based strategy; it must be its direction. In the absence of this direction, it will not clear the company's future direction, it is impossible to the accounting information to provide a clear strategic goal orientation, so the implementation of accounting information in the development of strategy must first clear the overall development strategy. Such enterprises to implement low-cost competitive strategy in the case of the accounting information of the implementation strategy will have a significant impact. The purpose of this strategy is to provide quality low cost products, and use price advantage over competitors. The accounting information in order to meet the strategic needs to be broken down by value chain analysis of cost control point, the development of procurement, production process, the operational procedures,marketing and other aspects of cost control standards, the design of cost control pointof cost information collection, transmission, aggregation, evaluation methods, to establish the accounting staff in the cost assessment in the central position, the establishment of cost control, reward and punishment system, and so on.(B) The implementation of management concepts update strategyManagers and internal employees know a lot of information technology is superficial, is generally believed that is a documentation of business processes and translate into something the computer can use to help companies accelerate the transmission of information; solutions manual has been the basis of the business can not solve management problems, but did not think for management improvement.Managers tend to think only of the benefits of information into management, but has not been established to promote information technology and management thinking in need of change, not concerned about the information technology business processes are likely to face adjustment and the adjustment of rules. Managers must also recognize that while changes in the general population and also including employees, their thoughts must also go to follow the changes in business, change from passive acceptance to active acceptance. Thus thinking of updating educational enterprise information has become an indispensable step in the process. Haier's Zhang proposed a "re-process reengineering first person who first recycling recycling concept." In order to promote the implementation of information technology in the process change, reversing the employees, especially the concept of corporate management, Zhang himself as a teacher, teaching stage process reengineering to promote the guiding ideology, and the formation of discussion of the program to verify in practice. Total number of trained close to 20,000.Some people think that advanced management information system implies a system of advanced management concepts, this argument has some truth, but the use of advanced information systems and management concepts to improve the。

IMPLEMENTING ENVIRONMENTAL COSTACCOUNTING IN SMALL AND MEDIUM-SIZEDCOMPANIES1.ENVIRONMENTAL COST ACCOUNTING IN SMESSince its inception some 30 years ago, Environmental Cost Accounting (ECA) has reached a stage of development where individual ECA systems are separated from the core accounting system based an assessment of environmental costs with (see Fichter et al., 1997, Letmathe and Wagner , 2002).As environmental costs are commonly assessed as overhead costs, neither the older concepts of full costs accounting nor the relatively recent one of direct costing appear to represent an appropriate basis for the implementation of ECA. Similar to developments in conventional accounting, the theoretical and conceptual sphere of ECA has focused on process-based accounting since the 1990s (see Hallay and Pfriem, 1992, Fischer and Blasius, 1995, BMU/UBA, 1996, Heller et al., 1995, Letmathe, 1998, Spengler and H.hre, 1998).Taking available concepts of ECA into consideration, process-based concepts seem the best option regarding the establishment of ECA (see Heupel and Wendisch , 2002). These concepts, however, have to be continuously revised to ensure that they work well when applied in small and medium-sized companies.Based on the framework for Environmental Management Accounting presented in Burritt et al. (2002), our concept of ECA focuses on two main groups of environmentally related impacts. These are environmentally induced financial effects and company-related effects on environmental systems (see Burritt and Schaltegger, 2000, p.58). Each of these impacts relate to specific categories of financial and environmental information. The environmentally induced financial effects are represented by monetary environmental information and the effects on environmental systems are represented by physical environmental information. Conventional accounting deals with both – monetary as well as physical units – but does not focus on environmental impact as such. To arrive at a practical solution to the implementation of E CA in a company’s existing accounting system, and to comply with the problem of distinguishing between monetary and physical aspects, an integrated concept is required. As physical information is often the basis for the monetary information (e.g. kilograms of a raw material are the basis for the monetary valuation of raw material consumption), the integration of this information into the accounting system database is essential. From there, the generation of physical environmental and monetary (environmental) information would in many cases be feasible. For many companies, the priority would be monetary (environmental) information for use in for instance decisions regarding resource consumptions and investments. The use of ECA in small andmedium-sized enterprises (SME) is still relatively rare, so practical examples available in the literature are few and far between. One problem is that the definitions of SMEs vary between countries (see Kosmider, 1993 and Reinemann, 1999). In our work the criteria shown in Table 1 are used to describe small and medium-sized enterprises.Table 1. Criteria of small and medium-sized enterprisesNumber of employees TurnoverUp to 500employees Turnover up to EUR 50mManagement Organization- Owner-cum-entrepreneur -Divisional organization is rare- Varies from a patriarchal management -Short flow of information style in traditional companies and teamwork -Strong personal commitmentin start-up companies -Instruction and controlling with- Top-down planning in old companies direct personal contact- Delegation is rare- Low level of formality- High flexibilityFinance Personnel- family company -easy to survey number of employees- limited possibilities of financing -wide expertise-high satisfaction of employeesSupply chain Innovation-closely involved in local -high potential of innovationeconomic cycles in special fields- intense relationship with customersand suppliersKeeping these characteristics in mind, the chosen ECA approach should be easy to apply, should facilitate the handling of complex structures and at the same time be suited to the special needs of SMEs.Despite their size SMEs are increasingly implementing Enterprise Resource Planning (ERP) systems like SAP R/3, Oracle and Peoplesoft. ERP systems support business processes across organizational, temporal and geographical boundaries using one integrated database. The primary use of ERP systems is for planning and controlling production and administration processes of an enterprise. In SMEs however, they are often individually designed and thus not standardized making the integration of for instance software that supports ECA implementation problematic. Examples could be tools like the “eco-efficiency” approach of IMU (2003) or Umberto (2003) because these solutions work with the database of more comprehensive software solutions like SAP, Oracle, Navision or others. Umberto software for example (see Umberto, 2003) would require large investments and great background knowledge of ECA – which is not available in most SMEs.The ECA approach suggested in this chapter is based on an integrative solution –meaning that an individually developed database is used, and the ECA solution adopted draws on the existing cost accounting procedures in the company. In contrast to other ECA approaches, the aim was to create an accounting system that enables the companies to individually obtain the relevant cost information. The aim of the research was thus to find out what cost information is relevant for the company’s decision on environmental issues and how to obtain it.2.METHOD FOR IMPLEMENTING ECASetting up an ECA system requires a systematic procedure. The project thus developed a method for implementing ECA in the companies that participated in the project; this is shown in Figure 1. During the implementation of the project it proved convenient to form a core team assigned with corresponding tasks drawing on employees in various departments. Such a team should consist of one or two persons from the production department as well as two from accounting and corporate environmental issues, if available. Depending on the stage of the project and kind of inquiry being considered, additional corporate members may be added to the project team to respond to issues such as IT, logistics, warehousing etc.Phase 1: Production Process VisualizationAt the beginning, the project team must be briefed thoroughly on the current corporate situation and on the accounting situation. To this end, the existing corporate accounting structure and the related corporate information transfer should be analyzed thoroughly. Following the concept of an input/output analysis, how materials find their ways into and out of the company is assessed. The next step is to present the flow of material and goods discovered and assessed in a flow model. To ensure the completeness and integrity of such a systematic analysis, any input and output is to be taken into consideration. Only a detailed analysis of material and energy flows from the point they enter the company until they leave it as products, waste, waste water or emissions enables the company to detect cost-saving potentials that at later stages of the project may involve more efficient material use, advanced process reliability and overview, improved capacity loads, reduced waste disposal costs, better transparency of costs and more reliable assessment of legal issues. As a first approach, simplified corporate flow models, standardizedstand-alone models for supplier(s), warehouse and isolated production segments were established and only combined after completion. With such standard elements and prototypes defined, a company can readily develop an integrated flow model with production process(es), production lines or a production process as a whole. From the view of later adoption of the existing corporate accounting to ECA, such visualization helps detect, determine, assess and then separate primary from secondary processes. Phase 2: Modification of AccountingIn addition to the visualization of material and energy flows, modeling principal and peripheral corporate processes helps prevent problems involving too high shares of overhead costs on the net product result. The flow model allows processes to be determined directly or at least partially identified as cost drivers. This allows identifying and separating repetitive processing activity with comparably few options from those with more likely ones for potential improvement.By focusing on principal issues of corporate cost priorities and on those costs that have been assessed and assigned to their causes least appropriately so far, corporate procedures such as preparing bids, setting up production machinery, ordering (raw) material and related process parameters such as order positions, setting up cycles of machinery, and order items can be defined accurately. Putting several partial processes with their isolated costs into context allows principal processes to emerge; these form the basis of process-oriented accounting. Ultimately, the cost drivers of the processes assessed are the actual reference points for assigning and accounting overhead costs. The percentage surcharges on costs such as labor costs are replaced by process parameters measuring efficiency (see Foster and Gupta, 1990).Some corporate processes such as management, controlling and personnel remain inadequately assessed with cost drivers assigned to product-related cost accounting. Therefore, costs of the processes mentioned, irrelevant to the measure of production activity, have to be assessed and surcharged with a conventional percentage.At manufacturing companies participating in the project,computer-integrated manufacturing systems allow a more flexible and scope-oriented production (eco-monies of scope), whereas before only homogenous quantities (of products) could be produced under reasonable economic conditions (economies of scale). ECA inevitably prevents effects of allocation, complexity and digression and becomes a valuable controlling instrument where classical/conventional accounting arrangements systematically fail to facilitate proper decisions. Thus, individually adopted process-based accounting produces potentially valuable information for any kind of decision about internal processing or external sourcing (e.g. make-or-buy decisions).Phase 3: Harmonization of Corporate Data – Compiling and Acquisition On the way to a transparent and systematic information system, it is convenient to check core corporate information systems of procurement and logistics, production planning, and waste disposal with reference to their capability to provide the necessary precise figures for the determined material/energy flow model and for previously identified principal and peripheral processes. During the course of the project, a few modifications within existing information systems were, in most cases, sufficient to comply with these requirements; otherwise, a completely new softwaremodule would have had to be installed without prior analysis to satisfy the data requirements.Phase 4: Database conceptsWithin the concept of a transparent accounting system, process-based accounting can provide comprehensive and systematic information both on corporate material/ energy flows and so-called overhead costs. To deliver reliable figures over time, it is essential to integrate a permanent integration of the algorithms discussed above into the corporate information system(s). Such permanent integration and its practical use may be achieved by applying one of three software solutions (see Figure 2).For small companies with specific production processes, an integrated concept is best suited, i.e. conventional andenvironmental/process-oriented accounting merge together in one common system solution.For medium-sized companies, with already existing integrated production/ accounting platforms, an interface solution to such a system might be suitable. ECA, then, is set up as an independent software module outside the existing corporate ERP system and needs to be fed data continuously. By using identical conventions for inventory-data definitions within the ECA software, misinterpretation of data can be avoided.Phase 5: Training and CoachingFor the permanent use of ECA, continuous training of employees on all matters discussed remains essential. To achieve a long-term potential of improved efficiency, the users of ECA applications and systems must be able to continuously detect and integrate corporate process modifications and changes in order to integrate them into ECA and, later, to process them properly.。

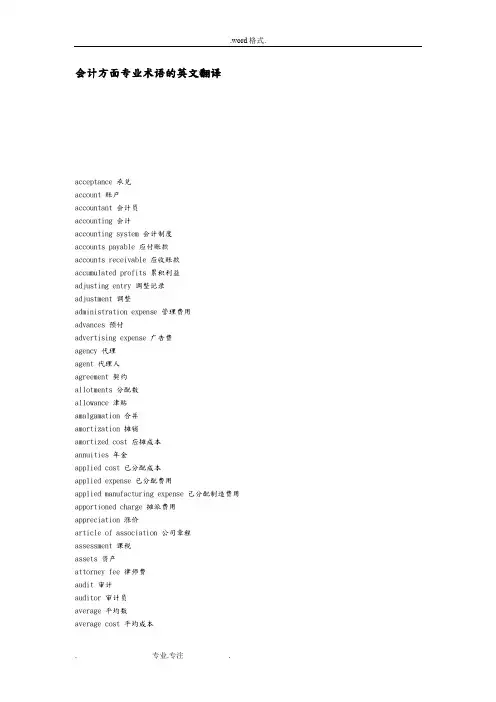

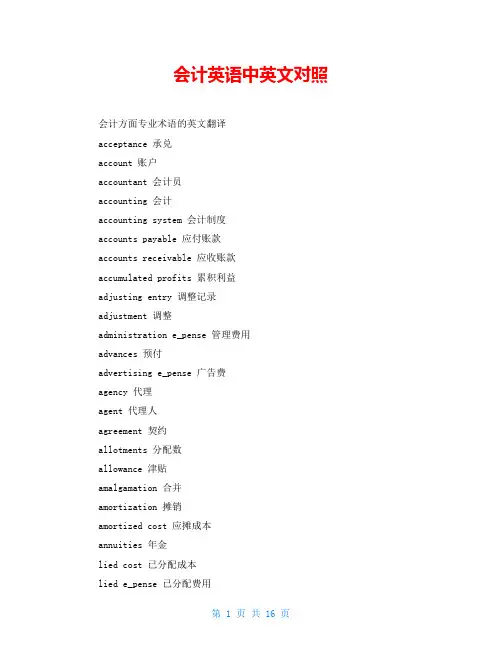

会计方面专业术语的英文翻译acceptance 承兑account 账户accountant 会计员accounting 会计accounting system 会计制度accounts payable 应付账款accounts receivable 应收账款accumulated profits 累积利益adjusting entry 调整记录adjustment 调整administration expense 管理费用advances 预付advertising expense 广告费agency 代理agent 代理人agreement 契约allotments 分配数allowance 津贴amalgamation 合并amortization 摊销amortized cost 应摊成本annuities 年金applied cost 已分配成本applied expense 已分配费用applied manufacturing expense 己分配制造费用apportioned charge 摊派费用appreciation 涨价article of association 公司章程assessment 课税assets 资产attorney fee 律师费audit 审计auditor 审计员average 平均数average cost 平均成本bad debt 坏账balance 余额balance sheet 资产负债表bank account 银行账户bank balance 银行结存bank charge 银行手续费bank deposit 银行存款bank discount 银行贴现bank draft 银行汇票bank loan 银行借款bank overdraft 银行透支bankers acceptance 银行承兑bankruptcy 破产bearer 持票人beneficiary 受益人bequest 遗产bill 票据bill of exchange 汇票bill of lading 提单bills discounted 贴现票据bills payable 应付票据bills receivable 应收票据board of directors 董事会bonds 债券bonus 红利book value 账面价值bookkeeper 簿记员bookkeeping 簿记branch office general ledger 支店往来账户broker 经纪人brought down 接前brought forward 接上页budget 预算by-product 副产品by-product sales 副产品销售capital 股本capital income 资本收益capital outlay 资本支出capital stock 股本capital stock certificate 股票carried down 移后carried forward 移下页cash 现金cash account 现金账户cash in bank 存银行现金cash on delivery 交货收款cash on hand 库存现金cash payment 现金支付cash purchase 现购cash sale 现沽cashier 出纳员cashiers check 本票certificate of deposit 存款单折certificate of indebtedness 借据certified check 保付支票certified public accountant 会计师charges 费用charge for remittances 汇水手续费charter 营业执照chartered accountant 会计师chattles 动产check 支票checkbook stub 支票存根closed account 己结清账户closing 结算closing entries 结账纪录closing stock 期末存货closing the book 结账columnar journal 多栏日记账combination 联合commission 佣金commodity 商品common stock 普通股company 公司compensation 赔偿compound interest 复利consignee 承销人consignment 寄销consignor 寄销人consolidated balance sheet 合并资产负债表consolidated profit and loss account 合并损益表consolidation 合并construction cost 营建成本construction revenue 营建收入contract 合同control account 统制账户copyright 版权corporation 公司cost 成本cost accounting 成本会计cost of labour 劳工成本cost of production 生产成本cost of manufacture 制造成本cost of sales 销货成本cost price 成本价格credit 贷方credit note 收款通知单creditor 债权人crossed check 横线支票current account 往来活期账户current asset 流动资产current liability 流动负债current profit and loss 本期损益debit 借方debt 债务debtor 债务人deed 契据deferred assets 递延资产deferred liabilities 递延负债delivery 交货delivery expense 送货费delivery order 出货单demand draft 即期汇票demand note 即期票据demurrage charge 延期费deposit 存款deposit slip 存款单depreciation 折旧direct cost 直接成本direct labour 直接人工director 董事discount 折扣discount on purchase 进货折扣discount on sale 销货折扣dishonoured check 退票dissolution 解散dividend 股利dividend payable 应付股利documentary bill 押汇汇票documents 单据double entry bookkeeping 复式簿记draft 汇票drawee 付款人drawer 出票人drawing 提款duplicate 副本duties and taxes 税捐earnings 业务收益endorser 背书人entertainment 交际费enterprise 企业equipment 设备estate 财产estimated cost 估计成本estimates 概算exchange 兑换exchange loss 兑换损失expenditure 经费expense 费用extension 延期face value 票面价值factor 代理商fair value 公平价值financial statement 财务报表financial year 财政年度finished goods 制成品finished parts 制成零件fixed asset 固定资产fixed cost 固定成本fixed deposit 定期存款fixed expense 固定费用foreman 工头franchise 专营权freight 运费funds 资金furniture and fixture 家俬及器具gain 利益general expense 总务费用general ledger 总分类账goods 货物goods in transit 在运货物goodwill 商誉government bonds 政府债券gross profit 毛利guarantee 保证guarantor 保证人idle time 停工时间import duty 进口税income 收入income tax 所得税income from joint venture 合营收益income from sale of assets 出售资产收入indirect cost 间接成本indirect expense 间接费用indirect labour 间接人工indorsement 背书installment 分期付款insurance 保险intangible asset 无形资产interest 利息interest rate 利率interest received 利息收入inter office account 内部往来intrinsic value 内在价值inventory 存货investment 投资investment income 投资收益invoice 发票item 项目job 工作job cost 工程成本joint venture 短期合伙journal 日记账labour 人工labour cost 人工成本land 土地lease 租约leasehold 租约ledger 分类账legal expense 律师费letter of credit 信用状liability 负债limited company 有限公司limited liability 有限负债limited partnership 有限合夥liquidation 清盘loan 借款long term liability 长期负债loss 损失loss on exchange 兑换损失machinery equipment 机器设备manufacturing expense 制造费用manufacturing cost 制造成本market price 市价materials 原村料material requisition 领料单medical fee 医药费merchandise 商品miscellaneous expense 杂项费用mortgage 抵押mortgagor 抵押人mortgagee 承押人movable property 动产net amount 净额net asset 资产净额net income 净收入net loss 净亏损net profit 纯利net value 净值notes 票据notes payable 应付票据notes receivable 应收票据opening stock 期初存货operating expense 营业费用order 订单organization expense 开办费original document 原始单据outlay 支出output 产量overdraft 透支opening stock 期初存货operating expense 营业费用order 订单organization expense 开办费original document 原始单据outlay 支出output 产量overdraft 透支quotation 报价rate 比率raw material 原料rebate 回扣receipt 收据receivable 应收款redemption 偿还refund 退款remittance 汇款rent 租金repair 修理费reserve 准备residual value 剩余价值retailer 零售商returns 退货revenue 收入salary 薪金sales 销货sale return 销货退回sale discount 销货折扣salvage 残值sample fee 样品scrap 废料scrap value 残余价值securities 证券security 抵押品selling commission 销货佣金selling expense 销货费用selling price 售价share capital 股份share certificate 股票shareholder 股东short term loan 短期借款sole proprietorship 独资spare parts 配件standard cost 标准成本stock 存货stocktake 盘点stock sheet 存货表subsidies 补助金sundry expense 杂项费用supporting document 附表surplus 盈余suspense account 暂记账户taxable profit 可徵税利润tax 税捐temporary payment 暂付款temporary receipt 暂收款time deposit 定期存款total cost 总成本trade creditor 进货客户trade debtor 销货客户trademark 商标transaction 交易transfer 转账transfer voucher 转账传票transportation 运输费travelling 差旅费trial balance 试算表trust 信托turnover 营业额unappropriated surplus 未分配盈余unit cost 单位成本unlimited company 无限公司unlimited liability 无限责任unpaid dividend 未付股利valuation 估价value 价值vendor 卖主voucher 传票wage rate 工资率wage 工资wage allocation sheet 工资分配表warehouse receipt 仓库收据welfare expense 褔利费wear and tear 秏损work order 工作通知单year end 年结Account 帐户Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant注册会计师Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室Income statement 损益表Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会Statement of cash flow 现金流量表Statement of financial position 财务状况表Tax accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系Assets 资产Business entity 企业个体Capital stock 股本Corporation 公司Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure 批露Expenses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设Inflation 通货膨涨Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量Operating activities 经营活动Owner's equity 所有者权益Partnership 合伙企业.word格式.Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业Solvency 清偿能力Stable-dollar assumption 稳定货币假设Stockholders 股东Stockholders' equity 股东权益Window dressing 门面粉饰. 专业.专注.。

关于会计的英语文章及翻译随着我国加入了WTO,对外交流不断扩大,对外经济业务也不断增涨。

社会及用人单位对会计人员专业英语(会计英语)水平的要求越来越高。

下面是店铺带来的,欢迎阅读!关于会计的英语文章及翻译1China's top banking regulator on Friday warned of growing risks to the country's financial system as a result of an unprecedented expansion in new loans and urged the country's lenders to improve their internal management.The statement by Liu Mingkang, chairman of the China Banking Regulatory Commission, may signal a more assertive stance from the body in the build-up to a top-level Communist party meeting scheduled for November that will set the country's economic agenda for the coming year.Chinese financial institutions extended Rmb8,185bn ($1,199bn) in local currency loans in the first eight months of this year, an increase of 164 per cent from the same period in 2008, a credit binge analysts say has been facilitated by a serious relaxation in lending standards.“This year, all kinds of risks have arisen in the banking sec tor along with the rapid credit expansion,” said Mr Liu in a written statement. “Banking institutions should always stick to the bottom line of compliance management, to lay a solid foundation for risk management.”For most of this year, the CBRC has been an almost lone voice within the government urging caution over the rapid loan growth and the potential for a future shock to the system.China's economic recovery has been largely fuelled by the flood of credit from the state-controlled banks but this hasprompted fears of fresh bubbles forming in the property and equities markets and raised the prospect that growth could falter as lending returns to a more sustainable level.“This is a high-risk strategy, since in prior eras, massive Chinese loan growth eventually led to massive Chinese non-performing loans and a banking sector that had to be recapitalised,” Michael Cembalest, chief investment officer at JPMorgan Global Wealth Management, said in a recent report.“The removal of loan quota limits once the g lobal recession hit may have unleashed a torrent of relaxed underwriting standards that will not be visible until the next downturn.”中国银行业最高监管机构上周五警告,由于新增贷款的空前扩张,中国金融体系面临的风险正日渐增加。

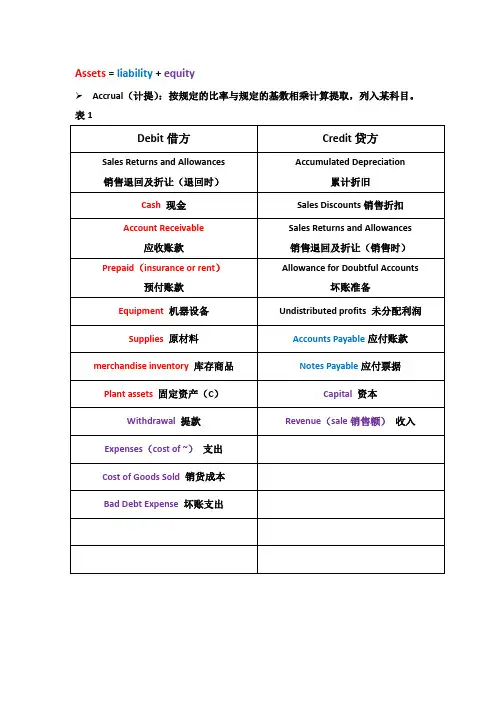

Assets = liability + equity➢Accrual(计提):按规定的比率与规定的基数相乘计算提取,列入某科目。

表1需要结转的科目(C):结转本期损益Income Summery:1、主营业务成本operating costs:一级科目,期末转到“本年利润”。

二级科目2、主营业务收入operating revenues:一级科目,期末转到“本年利润”。

3、管理费用operating expenses:一级科目,期末转到“主营业务成本”或“本年利润”。

二级科目4、财务费用financial expenses:一级科目,下设二级科目——手续费,期末转到“主营业务成本”或“本年利润”。

5、本年利润current profit:一级科目本年利润账户的余额表示年度内累计实现的净利润或净亏损,该账户平时不结转,年终一次性地转至“利润分配--未分配利润”账户:借:本年利润贷:利润分配--未分配利润盈利借:利润分配--未分配利润贷:本年利润亏损年终利润分配各明细账只有“未分配利润”有余额,需将其他明细账转平:借:利润分配--未分配利润贷:利润分配--提取盈余公积、向投资者分配利润等6、营业外收入non-operating revenue:一级科目指与生产经营过程无直接关系,应列入当期利润的收入。

是企业财务成果的组成部分。

例如,没收包装物押金收入、收回调入职工欠款、罚款净收入、免税转入营业外收入等等。

账务处理:1)企业转让固定资产时,先结转固定资产原值和已提累计折旧额,借记"固定资产清理"、"累计折旧"科目,贷记"固定资产"科目;收到双方协议价款,借记"银行存款",贷记"固定资产清理"科目;最后结转清理损益,若转出价款高于固定资产账面净值,借记"固定资产清理"科目,贷记"营业外收入"科目。

会计英语中英文对照会计方面专业术语的英文翻译acceptance 承兑account 账户accountant 会计员accounting 会计accounting system 会计制度accounts payable 应付账款accounts receivable 应收账款accumulated profits 累积利益adjusting entry 调整记录adjustment 调整administration e_pense 管理费用advances 预付advertising e_pense 广告费agency 代理agent 代理人agreement 契约allotments 分配数allowance 津贴amalgamation 合并amortization 摊销amortized cost 应摊成本annuities 年金lied cost 已分配成本lied e_pense 已分配费用lied manufacturing e_pense 己分配制造费用ortioned charge 摊派费用reciation 涨价article of association 公司章程assessment 课税assets 资产attorney fee 律师费audit 审计auditor 审计员average 平均数average cost 平均成本bad debt 坏账balance 余额yybalance sheet 资产负债表bank account 银行账户bank balance 银行结存bank charge 银行手续费bank deposit 银行存款bank discount 银行贴现bank draft 银行汇票bank loan 银行借款bank overdraft 银行透支bankers acceptance 银行承兑bankruptcy 破产bearer 持票人beneficiary 受益人bequest 遗产bill 票据bill of e_change 汇票bill of lading 提单bills discounted 贴现票据bills payable 应付票据bills receivable 应收票据board of directors 董事会bonds 债券bonus 红利book value 账面价值bookkeeper 簿记员bookkeeping 簿记branch office general ledger 支店往来账户broker 经纪人brought down 接前brought forward 接上页budget 预算by-product 副产品by-product sales 副产品销售capital 股本capital ine 资本收益capital outlay 资本支出capital stock 股本capital stock certificate 股票carried down 移后carried forward 移下页cash 现金cash account 现金账户cash in bank 存银行现金cash on delivery 交货收款cash on hand 库存现金cash payment 现金支付cash purchase 现购cash sale 现沽cashier 出纳员cashiers check 本票certificate of deposit 存款单折certificate of indebtedness 借据certified check 保付支票certified public accountant 会计师charges 费用charge for remittances 汇水手续费charter 营业执照chartered accountant 会计师chattles 动产check 支票checkbook stub 支票存根closed account 己结清账户closing 结算closing entries 结账纪录closing stock 期末存货closing the book 结账columnar journal 多栏日记账bination 联合mission 佣金modity 商品mon stock 普通股pany 公司pensation 赔偿pound interest 复利consignee 承销人consignment 寄销consignor 寄销人consolidated balance sheet 合并资产负债表consolidated profit and loss account 合并损益表consolidation 合并construction cost 营建成本construction revenue 营建收入contract 合同control account 统制账户copyright 版权corporation 公司cost 成本cost accounting 成本会计cost of labour 劳工成本cost of production 生产成本cost of manufacture 制造成本cost of sales 销货成本cost price 成本价格credit 贷方credit note 收款通知单creditor 债权人crossed check 横线支票current account 往来活期账户current asset 流动资产current liability 流动负债current profit and loss 本期损益debit 借方debt 债务debtor 债务人deed 契据deferred assets 递延资产deferred liabilities 递延负债delivery 交货delivery e_pense 送货费delivery order 出货单demand draft 即期汇票demand note 即期票据demurrage charge 延期费deposit 存款deposit slip 存款单depreciation 折旧direct cost 直接成本direct labour 直接人工director 董事discount 折扣discount on purchase 进货折扣discount on sale 销货折扣dishonoured check 退票dissolution 解散dividend 股利dividend payable 应付股利documentary bill 押汇汇票documents 单据double entry bookkeeping 复式簿记draft 汇票drawee 付款人drawer 出票人drag 提款duplicate 副本duties and ta_es 税捐earnings 业务收益endorser 背书人entertainment 交际费enterprise 企业equipment 设备estate 财产estimated cost 估计成本estimates 概算e_change 兑换e_change loss 兑换损失e_penditure 经费e_pense 费用e_tension 延期face value 票面价值factor 代理商fair value 公平价值financial statement 财务报表financial year 财政年度finished goods 制成品finished parts 制成零件fi_ed asset 固定资产fi_ed cost 固定成本fi_ed deposit 定期存款fi_ed e_pense 固定费用foreman 工头franchise 专营权freight 运费funds 资金furniture and fi_ture 家俬及器具gain 利益general e_pense 总务费用general ledger 总分类账goods 货物goods in transit 在运货物goodwill 商誉government bonds 政府债券gross profit 毛利guarantee 保证guarantor 保证人idle time 停工时间import duty 进口税ine 收入ine ta_ 所得税ine from joint venture 合营收益ine from sale of assets 出售资产收入indirect cost 间接成本indirect e_pense 间接费用indirect labour 间接人工indorsement 背书installment 分期付款insurance 保险intangible asset 无形资产interest 利息interest rate 利率interest received 利息收入inter office account 内部往来intrinsic value 内在价值inventory 存货investment 投资investment ine 投资收益invoice 发票item 项目job 工作job cost 工程成本joint venture 短期合伙journal 日记账labour 人工labour cost 人工成本land 土地lease 租约leasehold 租约ledger 分类账legal e_pense 律师费letter of credit 信用状liability 负债limited pany 有限公司limited liability 有限负债limited partnership 有限合夥liquidation 清盘loan 借款long term liability 长期负债loss 损失loss on e_change 兑换损失machinery equipment 机器设备manufacturing e_pense 制造费用manufacturing cost 制造成本market price 市价materials 原村料material requisition 领料单medical fee 医药费merchandise 商品miscellaneous e_pense 杂项费用mortgage 抵押mortgagor 抵押人mortgagee 承押人movable property 动产amount 净额asset 资产净额ine 净收入loss 净亏损profit 纯利value 净值notes 票据notes payable 应付票据notes receivable 应收票据opening stock 期初存货operating e_pense 营业费用order 订单organization e_pense 开办费original document 原始单据outlay 支出output 产量overdraft 透支opening stock 期初存货operating e_pense 营业费用order 订单organization e_pense 开办费original document 原始单据outlay 支出output 产量overdraft 透支tation 报价rate 比率raw material 原料rebate 回扣receipt 收据receivable 应收款recoup 补偿redemption 偿还refund 退款remittance 汇款rent 租金repair 修理费reserve 准备residual value 剩余价值retailer 零售商returns 退货revenue 收入salary 薪金sales 销货sale return 销货退回sale discount 销货折扣salvage 残值sle fee 样品scrap 废料scrap value 残余价值securities 证券security 抵押品selling mission 销货佣金selling e_pense 销货费用selling price 售价share capital 股份share certificate 股票shareholder 股东short term loan 短期借款sole proprietorship 独资spare parts 配件standard cost 标准成本stock 存货stocktake 盘点stock sheet 存货表subsidies 补助金sundry e_pense 杂项费用supporting document 附表surplus 盈余suspense account 暂记账户ta_able profit 可徵税利润ta_ 税捐temporary payment 暂付款temporary receipt 暂收款time deposit 定期存款total 合计total cost 总成本trade creditor 进货客户trade debtor 销货客户trademark 商标transaction 交易transfer 转账transfer voucher 转账传票transportation 运输费travelling 差旅费trial balance 试算表trust 信托turnover 营业额unropriated surplus 未分配盈余unit cost 单位成本unlimited pany 无限公司unlimited liability 无限责任unpaid dividend 未付股利valuation 估价value 价值vendor 卖主voucher 传票wage rate 工资率wage 工资wage allocation sheet 工资分配表warehouse receipt 仓库收据welfare e_pense 褔利费wear and tear 秏损work order 工作通知单year end 年结Account 帐户Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant 注册会计师Cost accounting 成本会计E_ternal users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室Ine statement 损益表Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and E_change mission 证券交易委员会Statement of cash flow 现金流量表Statement of financial position 财务状况表Ta_ accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系Assets 资产Business entity 企业个体Capital stock 股本Corporation 公司Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure 批露E_penses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设Inflation 通货膨涨Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量Operating activities 经营活动Owner"s equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业Solvency 清偿能力Stable-dollar assumption 稳定货币假设Stockholders 股东Stockholders" equity 股东权益dow dressing 门面粉饰。

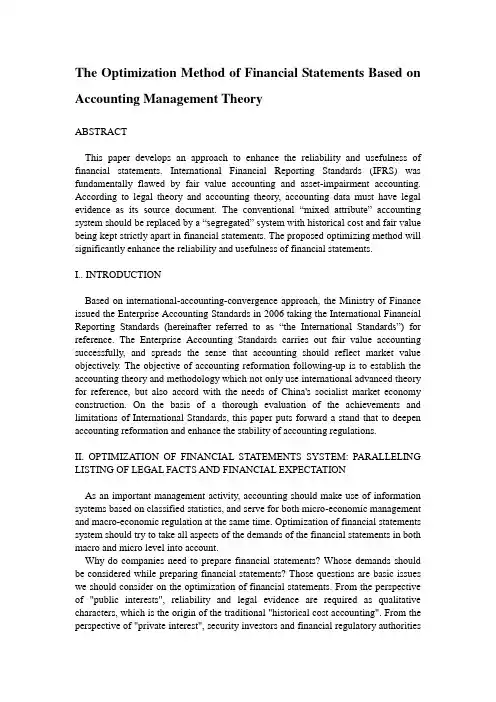

The Optimization Method of Financial Statements Based on Accounting Management TheoryABSTRACTThis paper develops an approach to enhance the reliability and usefulness of financial statements. International Financial Reporting Standards (IFRS) was fundamentally flawed by fair value accounting and asset-impairment accounting. According to legal theory and accounting theory, accounting data must have legal evidence as its source document. The conventional “mixed attribute” accounting system should be re placed by a “segregated” system with historical cost and fair value being kept strictly apart in financial statements. The proposed optimizing method will significantly enhance the reliability and usefulness of financial statements.I.. INTRODUCTIONBased on international-accounting-convergence approach, the Ministry of Finance issued the Enterprise Accounting Standards in 2006 taking the International Financial Reporting Standards (hereinafter referred to as “the International Standards”) for reference. The Enterprise Accounting Standards carries out fair value accounting successfully, and spreads the sense that accounting should reflect market value objectively. The objective of accounting reformation following-up is to establish the accounting theory and methodology which not only use international advanced theory for reference, but also accord with the needs of China's socialist market economy construction. On the basis of a thorough evaluation of the achievements and limitations of International Standards, this paper puts forward a stand that to deepen accounting reformation and enhance the stability of accounting regulations.II. OPTIMIZA TION OF FINANCIAL STATEMENTS SYSTEM: PARALLELING LISTING OF LEGAL FACTS AND FINANCIAL EXPECTA TIONAs an important management activity, accounting should make use of information systems based on classified statistics, and serve for both micro-economic management and macro-economic regulation at the same time. Optimization of financial statements system should try to take all aspects of the demands of the financial statements in both macro and micro level into account.Why do companies need to prepare financial statements? Whose demands should be considered while preparing financial statements? Those questions are basic issues we should consider on the optimization of financial statements. From the perspective of "public interests", reliability and legal evidence are required as qualitative characters, which is the origin of the traditional "historical cost accounting". From the perspective of "private interest", security investors and financial regulatory authoritieshope that financial statements reflect changes of market prices timely recording "objective" market conditions. This is the origin of "fair value accounting". Whether one set of financial statements can be compatible with these two different views and balance the public interest and private interest? To solve this problem, we design a new balance sheet and an income statement.From 1992 to 2006, a lot of new ideas and new perspectives are introduced into China's accounting practices from international accounting standards in a gradual manner during the accounting reform in China. These ideas and perspectives enriched the understanding of the financial statements in China. These achievements deserve our full assessment and should be fully affirmed. However, academia and standard-setters are also aware that International Standards are still in the process of developing .The purpose of proposing new formats of financial statements in this paper is to push forward the accounting reform into a deeper level on the basis of international convergence.III. THE PRACTICABILITY OF IMPROVING THE FINANCIAL STATEMENTS SYSTEMWhether the financial statements are able to maintain their stability? It is necessary to mobilize the initiatives of both supply-side and demand-side at the same time. We should consider whether financial statements could meet the demands of the macro-economic regulation and business administration, and whether they are popular with millions of accountants.Accountants are responsible for preparing financial statements and auditors are responsible for auditing. They will benefit from the implementation of the new financial statements.Firstly, for the accountants, under the isolated design of historical cost accounting and fair value accounting, their daily accounting practice is greatly simplified. Accounting process will not need assets impairment and fair value any longer. Accounting books will not record impairment and appreciation of assets any longer, for the historical cost accounting is comprehensively implemented. Fair value information will be recorded in accordance with assessment only at the balance sheet date and only in the annual financial statements. Historical cost accounting is more likely to be recognized by the tax authorities, which saves heavy workload of the tax adjustment. Accountants will not need to calculate the deferred income tax expense any longer, and the profit-after-tax in the solid line table is acknowledged by the Company Law, which solves the problem of determining the profit available for distribution.Accountants do not need to record the fair value information needed by security investors in the accounting books; instead, they only need to list the fair value information at the balance sheet date. In addition, because the data in the solid line table has legal credibility, so the legal risks of accountants can be well controlled. Secondly, the arbitrariness of the accounting process will be reduced, and the auditors’ review process will be greatly simplified. The independent auditors will not have to bear the considerable legal risk for the dotted-line table they audit, because the risk of fair value information has been prompted as "not supported by legalevidences". Accountants and auditors can quickly adapt to this financial statements system, without the need of training. In this way, they can save a lot of time to help companies to improve management efficiency. Surveys show that the above design of financial statements is popular with accountants and auditors. Since the workloads of accounting and auditing have been substantially reduced, therefore, the total expenses for auditing and evaluation will not exceed current level as well.In short, from the perspectives of both supply-side and demand-side, the improved financial statements are expected to enhance the usefulness of financial statements, without increase the burden of the supply-side.IV. CONCLUSIONS AND POLICY RECOMMENDATIONSThe current rule of mixed presentation of fair value data and historical cost data could be improved. The core concept of fair value is to make financial statements reflect the fair value of assets and liabilities, so that we can subtract the fair value of liabilities from assets to obtain the net fair value.However, the current International Standards do not implement this concept, but try to partly transform the historical cost accounting, which leads to mixed using of impairment accounting and fair value accounting. China's accounting academic research has followed up step by step since 1980s, and now has already introduced a mixed-attributes model into corporate financial statements.By distinguishing legal facts from financial expectations, we can balance public interests and private interests and can redesign the financial statements system with enhancing management efficiency and implementing higher-level laws as main objective. By presenting fair value and historical cost in one set of financial statements at the same time, the statements will not only meet the needs of keeping books according to domestic laws, but also meet the demand from financial regulatory authorities and security investorsWe hope that practitioners and theorists offer advices and suggestions on the problem of improving the financial statements to build a financial statements system which not only meets the domestic needs, but also converges with the International Standards.基于会计管理理论的财务报表的优化方法摘要本文提供了一个方法,以提高财务报表的可靠性和实用性。

毕业设计(论文)外文资料翻译题目:Inflation Accounting附件: 1.外文资料翻译译文;2.外文原文。