国际财务管理作业Chapter 3 - Test Bank

- 格式:pdf

- 大小:136.87 KB

- 文档页数:16

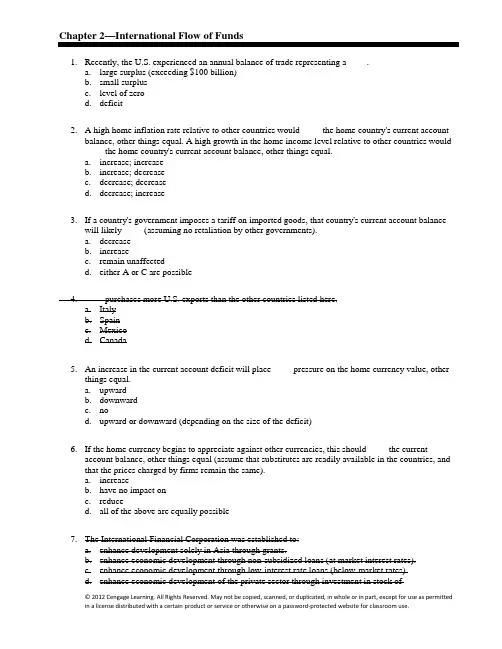

Chapter 2—International Flow of Funds1. Recently, the U.S. experienced an annual balance of trade representing a ____.a. large surplus (exceeding $100 billion)b. small surplusc. level of zerod. deficit2. A high home inflation rate relative to other countries would ____ the home country's current accountbalance, other things equal. A high growth in the home income level relative to other countries would ____ the home country's current account balance, other things equal.a. increase; increaseb. increase; decreasec. decrease; decreased. decrease; increase3. If a country's government imposes a tariff on imported goods, that country's current account balancewill likely ____ (assuming no retaliation by other governments).a. decreaseb. increasec. remain unaffectedd. either A or C are possible4. ____ purchases more U.S. exports than the other countries listed here.a. Italyb. Spainc. Mexicod. Canada5. An increase in the current account deficit will place ____ pressure on the home currency value, otherthings equal.a. upwardb. downwardc. nod. upward or downward (depending on the size of the deficit)6. If the home currency begins to appreciate against other currencies, this should ____ the currentaccount balance, other things equal (assume that substitutes are readily available in the countries, and that the prices charged by firms remain the same).a. increaseb. have no impact onc. reduced. all of the above are equally possible7. The International Financial Corporation was established to:a. enhance development solely in Asia through grants.b. enhance economic development through non-subsidized loans (at market interest rates).c. enhance economic development through low-interest rate loans (below-market rates).d. enhance economic development of the private sector through investment in stock ofcorporations.8. The World Bank was established to:a. enhance development solely in Asia through grants.b. enhance economic development through non-subsidized loans (at market interest rates).c. enhance economic development through low-interest rate loans (below-market rates).d. enhance economic development of the private sector through investment in stock ofcorporations.9. The International Development Association was established to:a. enhance development solely in Asia through grants.b. enhance economic development through non-subsidized loans (at market interest rates).c. enhance economic development through low-interest rate loans (below-market rates).d. enhance economic development of the private sector through investment in stock ofcorporations.10. Which of the following would likely have the least direct influence on a country's current account?a. inflation.b. national income.c. exchange rates.d. tariffs.e. a tax on income earned from foreign stocks.11. The "J curve" effect describes:a. the continuous long-term inverse relationship between a country's current account balanceand the country's growth in gross national product.b. the short-run tendency for a country's balance of trade to deteriorate even while itscurrency is depreciating.c. the tendency for exporters to initially reduce the price of goods when their own currencyappreciates.d. the reaction of a country's currency to initially depreciate after the country's inflation ratedeclines.12. An increase in the use of quotas is expected to:a. reduce the country's current account balance, if other governments do not retaliate.b. increase the country's current account balance, if other governments do not retaliate.c. have no impact on the country's current account balance unless other governmentsretaliate.d. increase the volume of a country's trade with other countries.13. The U.S. typically has a balance of trade surplus in its trade with ____.a. Chinab. Japanc. A and Bd. none of the above14. The North American Free Trade Agreement (NAFTA) increased restrictions on:a. trade between Canada and Mexico.b. trade between Canada and the U.S.c. direct foreign investment in Mexico by U.S. firms.d. none of the above.15. According to the text, international trade (exports plus imports combined) as a percentage of GDP is:a. higher in the U.S. than in European countries.b. lower in the U.S. than in European countries.c. higher in the U.S. than in about half the European countries, and lower in the U.S. than theothers.d. about the same in the U.S. as in European countries.16. The direct foreign investment positions by U.S. firms have generally ____ over time. Restrictions bygovernments on direct foreign investment have generally ___ over time.a. increased; increasedb. increased; decreasedc. decreased; decreasedd. decreased; increased17. Which of the following countries purchases the largest amount of exports by U.S. firms?a. Mexicob. Japanc. Canadad. France18. The primary component of the current account is the:a. balance of trade.b. balance of money market flows.c. balance of capital market flows.d. unilateral transfers.19. As a result of the European Union, restrictions on exports between ____ were reduced or eliminated.a. member countries and the U.S.b. member countriesc. member countries and European non-membersd. none of the above20. Over the last several years, international trade has generally:a. increased for most major countries.b. decreased for most major countries.c. stayed about constant for most major countries.d. increased for about half the major countries and decreased for the others.21. Which is not a concern about the North American Free Trade Agreement (NAFTA)?a. its impact on U.S. inflation.b. its impact on U.S. unemployment.c. lower environmental standards in Mexico.d. different health laws for workers in Mexico.22. A General Agreement on Tariffs and Trade (GATT) accord in 1993 called for:a. increased trade restrictions outside of North America.b. lower trade restrictions around the world.c. uniform environmental standards around the world.d. uniform worker health laws.23. Which of the following is mentioned in the text as a possible means by which the government mayattempt to improve its balance of trade position (increase its exports or reduce its imports).a. It could attempt to reduce its home currency's value.b. The government could require firms to engage in outsourcing.c. The government could require that its local firms pursue outsourcing.d. All of the above are mentioned.24. The demand for U.S. exports tends to increase when:a. economic growth in foreign countries decreases.b. the currencies of foreign countries strengthen against the dollar.c. U.S. inflation rises.d. none of the above.25. "Dumping" is used in the text to represent the:a. exporting of goods that do not meet quality standards.b. sales of junk bonds to foreign countries.c. removal of foreign subsidiaries by the host government.d. exporting of goods at prices below cost.26. ____ is (are) income received by investors on foreign investments in financial assets (securities).a. Portfolio incomeb. Direct foreign incomec. Unilateral transfersd. Factor income27. A weak home currency may not be a perfect solution to correct a balance of trade deficit because:a. it reduces the prices of imports paid by local companies.b. it increases the prices of exports by local companies.c. it prevents international trade transactions from being prearranged.d. foreign companies may reduce the prices of their products to stay competitive.28. Intracompany trade makes up approximately ____ percent of all international trade.a. 50b. 70c. 25d. 13e. 529. Like the International Monetary Fund (IMF), the ____ is composed of a collection of nations asmembers. However, unlike the IMF, it uses the private rather than the government sector to achieve its objectives.a. World Bankb. International Financial Corporation (IFC)c. World Trade Organization (WTO)d. International Development Association (IDA)e. Bank for International Settlements (BIS)30. The World Bank's Multilateral Investment Guarantee Agency (MIGA):a. offers various forms of export insurance.b. offers various forms of import insurance.c. offers various forms of exchange rate risk insurance.d. provides loans to developing countries.e. offers various forms of political risk insurance.31. Also known as the "central banks' central bank," the ____ attempts to facilitate cooperation amongcountries with regard to international transactions and provides assistance to countries experiencing a financial crisis.a. World Bankb. International Financial Corporation (IFC)c. World Trade Organizationd. International Development Association (IDA)e. Bank for International Settlements (BIS)32. Direct foreign investment into the U.S. represents a ____.a. capital inflowb. trade inflowc. capital outflowd. trade outflow33. A balance of trade surplus indicates an excess of imports over exports.a. Trueb. False34. A weakening of the U.S. dollar with respect to the British pound would likely reduce the U.S. exportsto Britain and increase U.S. imports from Britain over time.a. Trueb. False35. The World Bank extends loans only to developed nations, while the International DevelopmentAssociation (IDA) extends loans only to developing nations.a. Trueb. False36. The World Bank frequently enters into cofinancing agreements. Under these agreements, financing isprovided by the World Bank and/or official aid agencies, export credit agencies, or commercial banks.a. Trueb. False37. The balance of payments is a measurement of all transactions between domestic and foreign residentsover a specified period of time.a. Trueb. False38. Changes in country ownership of long-term and short-term assets are measured in the balance ofpayments with the capital account.a. Trueb. False39. Portfolio investment represents transactions involving long-term financial assets (such as stocks andbonds) between countries that do not affect the transfer of control.a. Trueb. False40. The current account represents the investment in fixed assets in foreign countries that can be used toconduct business operations.a. Trueb. False41. Exporting of products by one country to other countries at prices below cost is called elasticity.a. Trueb. False42. Direct foreign investment by U.S.-based MNCs occurs primarily in the Bahamas and Brazil.a. Trueb. False43. The J curve effect is the initial worsening of the U.S. trade balance due to a weakening dollar becauseof established trade relationships that are not easily changed; as the dollar weakens, the dollar value of imports initially rises before the U.S. trade balance is improved.a. Trueb. False44. Portfolio investments represent transactions involving long-term financial assets (such as stocks andbonds) between countries that do not affect the transfer of control.a. Trueb. False45. Intracompany trade represents the exporting of products by one country to other countries below cost.a. Trueb. False46. A tariff is a maximum limit on imports.a. Trueb. False47. A country's net outflow of funds ____ affect its interest rates, and ____ affect its economic conditions.a. does; doesb. does; does notc. does not; does notd. does not; does48. The sale of patent rights by a U.S. firm to a Russian firm reflects a credit to the U.S. balance ofpayments account.a. Trueb. False49. A U.S. purchase of patent rights from a firm in Mexico reflects a credit to the U.S. balance ofpayments account.a. Trueb. False50. Regarding the U.S. balance of payments, capital account items are relatively minor compared to thefinancial account items.a. Trueb. False51. In recent years, the U.S. has had a relatively (compared to other countries) ____ balance of trade ____with China.a. small; surplusb. large; surplusc. small; deficitd. large; deficit52. The Central American Trade Agreement (CAFTA) is intended to raise tariffs and regulations betweenthe U.S., the Dominican Republic, and Central American countries.a. Trueb. False53. U.S. government officials would likely prefer that China devalue the yuan against the dollar.a. Trueb. False54. Assume that some U.S. firms will purchase supplies from either China or from U.S. firms. If theChinese yuan appreciates against the dollar, it should reduce the U.S. balance of trade deficit with China.a. Trueb. False55. Assume the U.S. has a balance of trade surplus with the country of Thor. When individuals in Thormanufacture CDs and DVDs that look almost exactly like the original product produced in the U.S.and other countries, they ____ the U.S. balance of trade surplus with Thor. This activity is called ____.a. reduce; flippingb. reduce; piratingc. increase; piratingd. increase; flipping56. Japan's annual interest rate has been relatively ____ compared to other countries for several years,because the supply of funds in its credit market has been very ____.a. low; smallb. high; smallc. low; larged. high; large57. Without the international capital flows, there would be ____ funding available in the U.S. across allrisk levels, and the cost of funding would be ____ regardless of the firm's risk level.a. more; lowerb. more; higherc. less; lowerd. less; higher58. The primary component of the capital account is the balance of trade.a. Trueb. False59. A balance of trade surplus indicates an excess of merchandise imports over merchandise exports.a. Trueb. False60. An American tourist visiting Germany and spending money there (for lodging, food, etc.) will reducethe U.S. current account deficit and reduce Germany's current account balance.a. Trueb. False61. A balance of trade deficit indicates an excess of imports over exports.a. Trueb. False62. The capital account reflects changes in country ownership of long-term (but not short-term) assets.a. Trueb. False63. Outsourcing allows some MNCs to reduce costs but shifts jobs to other countries.a. Trueb. False64. A weakening of the U.S. dollar with respect to the British pound would likely reduce U.S. exports tothe U.K. and increase U.S. imports from the U.K.a. Trueb. False65. The World Bank extends loans only to developed nations, while the International DevelopmentAssociation (IDA) extends loans only to developing nations.a. Trueb. False66. The ____ is the difference between exports and imports.a. balance of tradeb. balance on goods and servicesc. balance of paymentsd. current accounte. capital account67. Which of the following will probably not result in an increase in a country's current account balance(assuming everything else constant)?a. A decrease in the country's rate of inflationb. A decrease in the country's national income levelc. An increase in government restrictions in the form of tariffs or quotasd. An appreciation of the country's currencye. All of the above will result in an increased current account balance.68. Which of the following factors probably does not directly affect a country's capital account and itscomponents?a. Inflationb. Interest ratesc. Withholding taxes on foreign incomed. Exchange rate movementse. All of the above will directly affect a country's capital account.69. The ____, an accord among 117 nations, called for lower tariffs around the world.a. General Agreement on Tariffs and Trade (GATT)b. North American Free Trade Agreement (NAFTA)c. Single European Act of 1987d. European Union Accorde. None of the above70. Which of the following is not likely to represent a strategy by the government of Country X to reduceits balance of trade deficit with Country Y?a. The government of Country X eliminates environmental restrictions.b. The government of Country X subsidizes firms in its country to facilitate dumping.c. The government of Country X provides tax breaks to firms in specific industries.d. The government of Country X removes a tariff on goods imported from Country Y.71. Which of the following statements is not true?a. Exporters commonly complain that they are being mistreated because the currency of theircountry is too weak.b. Outsourcing affects the balance of trade because it means that a service is purchased inanother country.c. Sometimes, trade policies are used to punish countries for various actions.d. Tariffs imposed by the EU have caused some friction between EU countries thatcommonly import products and other EU countries.e. All of the above are true.72. Which of the following would increase the current account of Country X? Country Y is Country X'ssole trading partner.a. Inflation increases in countries X and Y by comparable amounts.b. Country X's and Country Y's currencies depreciate by the same amount.c. Country X imposes tariffs on imports from Country Y, and Country Y retaliates byimposing an identical tax on X's exports.d. The central banks of Country X and Country Y reduce the money supply to increaseinterest rates.e. Country X imposes a quota on imports, and Country Y retaliates by imposing an identicalquota on X's exports.73. ____ represent aid, grants, and gifts from one country to another.a. Transfer paymentsb. Factor incomec. The balance of traded. The balance of paymentse. The capital account74. Which of the following is not a goal of the International Monetary Fund (IMF)?a. To promote cooperation among countries on international monetary issuesb. To promote stability in exchange ratesc. To enhance a country's long-term economic growth via the extension of structuraladjustment loansd. To promote free tradee. To promote free mobility of capital funds across countries75. According to the "J curve effect," a weakening of the U.S. dollar relative to its trading partners'currencies would result in an initial ____ in the current account balance, followed by a subsequent ____ in the current account balance.a. decrease; increaseb. increase; decreasec. decrease; decreased. increase; increase。

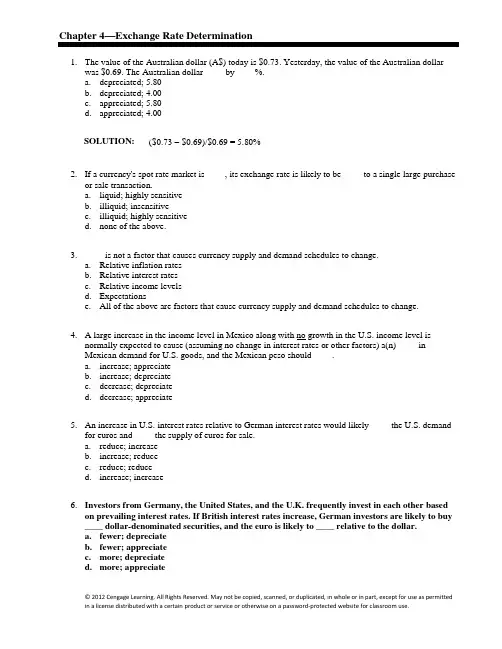

Chapter 4—Exchange Rate Determination1. The value of the Australian dollar (A$) today is $0.73. Yesterday, the value of the Australian dollarwas $0.69. The Australian dollar ____ by ____%.a. depreciated; 5.80b. depreciated; 4.00c. appreciated; 5.80d. appreciated; 4.00SOLUTION: ($0.73 − $0.69)/$0.69 = 5.80%2. If a currency's spot rate market is ____, its exchange rate is likely to be ____ to a single large purchaseor sale transaction.a. liquid; highly sensitiveb. illiquid; insensitivec. illiquid; highly sensitived. none of the above.3. ____ is not a factor that causes currency supply and demand schedules to change.a. Relative inflation ratesb. Relative interest ratesc. Relative income levelsd. Expectationse. All of the above are factors that cause currency supply and demand schedules to change.4. A large increase in the income level in Mexico along with no growth in the U.S. income level isnormally expected to cause (assuming no change in interest rates or other factors) a(n) ____ inMexican demand for U.S. goods, and the Mexican peso should ____.a. increase; appreciateb. increase; depreciatec. decrease; depreciated. decrease; appreciate5. An increase in U.S. interest rates relative to German interest rates would likely ____ the U.S. demandfor euros and ____ the supply of euros for sale.a. reduce; increaseb. increase; reducec. reduce; reduced. increase; increase6. Investors from Germany, the United States, and the U.K. frequently invest in each other basedon prevailing interest rates. If British interest rates increase, German investors are likely to buy ____ dollar-denominated securities, and the euro is likely to ____ relative to the dollar.a. fewer; depreciateb. fewer; appreciatec. more; depreciated. more; appreciate7. When the "real" interest rate is relatively low in a given country, then the currency of that country istypically expected to be:a. weak, since the country's quoted interest rate would be high relative to the inflation rate.b. strong, since the country's quoted interest rate would be low relative to the inflation rate.c. strong, since the country's quoted interest rate would be high relative to the inflation rate.d. weak, since the country's quoted interest rate would be low relative to the inflation rate.8. Assume that the inflation rate becomes much higher in the U.K. relative to the U.S. This will place____ pressure on the value of the British pound. Also, assume that interest rates in the U.K. begin to rise relative to interest rates in the U.S. The change in interest rates will place ____ pressure on the value of the British pound.a. upward; downwardb. upward; upwardc. downward; upwardd. downward; downward9. In general, when speculating on exchange rate movements, the speculator will borrow the currencythat is expected to appreciate and invest in the country whose currency is expected to depreciate.a. Trueb. False10. Baylor Bank believes the New Zealand dollar will appreciate over the next five days from $.48 to$.50. The following annual interest rates apply:Currency Lending Rate Borrowing RateDollars 7.10% 7.50%New Zealand dollar (NZ$) 6.80% 7.25%Baylor Bank has the capacity to borrow either NZ$10 million or $5 million. If Baylor Bank's forecast is correct, what will its dollar profit be from speculation over the five-day period (assuming it does not use any of its existing consumer deposits to capitalize on its expectations)?a. $521,325.b. $500,520.c. $104,262.d. $413,419.e. $208,044.SOLUTION:1. Borrow $5 million.2. Convert to NZ$: $5,000,000/$.48 = NZ$10,416,667.3. Invest the NZ$ at an annualized rate of 6.80% over five days.NZ$10,416,667 × [1 + 6.80% (5/360)]= NZ$10,426,5054. Convert the NZ$ back to dollars:NZ$10,426,505 × $.50 = $5,213,2525. Repay the dollars borrowed. The repayment amount is:$5,000,000 × [1 + 7.5% (5/360)]= $5,000,000 × [1.00104]= $5,005,2086. After repaying the loan, the remaining dollar profit is:$5,213,252 − $5,005,208 = $208,04411. Assume the following information regarding U.S. and European annualized interest rates:Currency Lending Rate Borrowing RateU.S. Dollar ($) 6.73% 7.20%Euro (€) 6.80% 7.28%Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13.Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?a. $579,845.b. $583,800.c. $588,200.d. $584,245.e. $980,245.SOLUTION:1. Borrow €20 million.2. Convert the €20 million to €20,000,000 × $1.13 = $22,600,000.3. Invest the $22,600,000 at an annualized rate of 6.73% for 90 days.$22,600,000 × [1 + 6.73% (90/360)]= $22,980,2454. Determine euros owed: €20,000,000 × [1 + 7.28% (90/360)] = €20,364,000.5. Determine dollars needed to repay euro loan: €20,364,000 × $1.10 = $22,400,400.6. The dollar profit is $22,980,245 − $22,400,400 = $579,845.12. The equilibrium exchange rate of pounds is $1.70. At an exchange rate of $1.72 per pound:a. U.S. demand for pounds would exceed the supply of pounds for sale and there would be ashortage of pounds in the foreign exchange market.b. U.S. demand for pounds would be less than the supply of pounds for sale and there wouldbe a shortage of pounds in the foreign exchange market.c. U.S. demand for pounds would exceed the supply of pounds for sale and there would be asurplus of pounds in the foreign exchange market.d. U.S. demand for pounds would be less than the supply of pounds for sale and there wouldbe a surplus of pounds in the foreign exchange market.e. U.S. demand for pounds would be equal to the supply of pounds for sale and there wouldbe a shortage of pounds in the foreign exchange market.13. Assume that Swiss investors have francs available to invest in securities, and they initially view U.S.and British interest rates as equally attractive. Now assume that U.S. interest rates increase while British interest rates stay the same. This would likely cause:a. the Swiss demand for dollars to decrease and the dollar will depreciate against the pound.b. the Swiss demand for dollars to increase and the dollar will depreciate against the Swissfranc.c. the Swiss demand for dollars to increase and the dollar will appreciate against the Swissfranc.d. the Swiss demand for dollars to decrease and the dollar will appreciate against the pound.14. The real interest rate adjusts the nominal interest rate for:a. exchange rate movements.b. income growth.c. inflation.d. government controls.e. none of the above15. If U.S. inflation suddenly increased while European inflation stayed the same, there would be:a. an increased U.S. demand for euros and an increased supply of euros for sale.b. a decreased U.S. demand for euros and an increased supply of euros for sale.c. a decreased U.S. demand for euros and a decreased supply of euros for sale.d. an increased U.S. demand for euros and a decreased supply of euros for sale.16. If inflation in New Zealand suddenly increased while U.S. inflation stayed the same, there would be:a. an inward shift in the demand schedule for NZ$ and an outward shift in the supplyschedule for NZ$.b. an outward shift in the demand schedule for NZ$ and an inward shift in the supplyschedule for NZ$.c. an outward shift in the demand schedule for NZ$ and an outward shift in the supplyschedule for NZ$.d. an inward shift in the demand schedule for NZ$ and an inward shift in the supply schedulefor NZ$.17. If the U.S. and Japan engage in substantial financial flows but little trade, ____ directly influencestheir exchange rate the most. If the U.S. and Switzerland engage in much trade but little financial flows, ____ directly influences their exchange rate the most.a. interest rate differentials; interest rate differentialsb. inflation and interest rate differentials; interest rate differentialsc. income and interest rate differentials; inflation differentialsd. interest rate differentials; inflation and income differentialse. inflation and income differentials; interest rate differentials18. If inflation increases substantially in Australia while U.S. inflation remains unchanged, this is expectedto place ____ pressure on the value of the Australian dollar with respect to the U.S. dollar.a. upwardb. downwardc. either upward or downward (depending on the degree of the increase in Australianinflation)d. none of the above; there will be no impact19. Assume that British corporations begin to purchase more supplies from the U.S. as a result of severallabor strikes by British suppliers. This action reflects:a. an increased demand for British pounds.b. a decrease in the demand for British pounds.c. an increase in the supply of British pounds for sale.d. a decrease in the supply of British pounds for sale.20. The exchange rates of smaller countries are very stable because the market for their currency is veryliquid.a. Trueb. False21. The phrase "the dollar was mixed in trading" means that:a. the dollar was strong in some periods and weak in other periods over the last month.b. the volume of trading was very high in some periods and low in other periods.c. the dollar was involved in some currency transactions, but not others.d. the dollar strengthened against some currencies and weakened against others.22. Assume that the U.S. places a strict quota on goods imported from Chile and that Chile does notretaliate. Holding other factors constant, this event should immediately cause the U.S. demand for Chilean pesos to ____ and the value of the peso to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increase23. Any event that increases the U.S. demand for euros should result in a(n) ____ in the value of the eurowith respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollar24. Any event that reduces the U.S. demand for Japanese yen should result in a(n) ____ in the value of theJapanese yen with respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollar25. Any event that increases the supply of British pounds to be exchanged for U.S. dollars should result ina(n) ____ in the value of the British pound with respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollar26. Any event that reduces the supply of Swiss francs to be exchanged for U.S. dollars should result in a(n)____ in the value of the Swiss franc with respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollar27. Assume that the U.S. experiences a significant decline in income, while Japan's income remains steady.This event should place ____ pressure on the value of the Japanese yen, other things being equal.(Assume that interest rates and other factors are not affected.)a. upwardb. downwardc. nod. upward and downward (offsetting)28. News of a potential surge in U.S. inflation and zero Chilean inflation places ____ pressure on the valueof the Chilean peso. The pressure will occur ____.a. upward; only after the U.S. inflation surgesb. downward; only after the U.S. inflation surgesc. upward; immediatelyd. downward; immediately29. Assume that Canada places a strict quota on goods imported from the U.S. and that the U.S. does notretaliate. Holding other factors constant, this event should immediately cause the supply of Canadian dollars to be exchanged for U.S. dollars to ____ and the value of the Canadian dollar to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increase30. Assume that Japan places a strict quota on goods imported from the U.S. and the U.S. places a strictquota on goods imported from Japan. This event should immediately cause the U.S. demand forJapanese yen to ____, and the supply of Japanese yen to be exchanged for U.S. dollars to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increase31. Which of the following is not mentioned in the text as a factor affecting exchange rates?a. relative interest rates.b. relative inflation rates.c. government controls.d. expectations.e. all of the above are mentioned in the text as factors affecting exchange rates.32. If a country experiences high inflation relative to the U.S., its exports to the U.S. should ____, itsimports should ____, and there is ____ pressure on its currency's equilibrium value.a. decrease; increase; upwardb. decrease; decrease; upwardc. increase; decrease; downwardd. decrease; increase; downwarde. increase; decrease; upward33. If a country experiences an increase in interest rates relative to U.S. interest rates, the inflow of U.S.funds to purchase its securities should ____, the outflow of its funds to purchase U.S. securities should ____, and there is ____ pressure on its currency's equilibrium value.a. increase; decrease; downwardb. decrease; increase; upwardc. increase; decrease; upwardd. decrease; increase; downwarde. increase; increase; upward34. An increase in U.S. inflation relative to Singapore inflation places upward pressure on the Singaporedollar.a. Trueb. False35. When expecting a foreign currency to depreciate, a possible way to speculate on this movement is toborrow dollars, convert the proceeds to the foreign currency, lend in the foreign country, and use the proceeds from this investment to repay the dollar loan.a. Trueb. False36. Since supply and demand for a currency are constant (primarily due to government intervention),currency values seldom fluctuate.a. Trueb. False37. Relatively high Japanese inflation may result in an increase in the supply of yen for sale and areduction in the demand for yen.a. Trueb. False38. The main effect of interest rate movements on exchange rates is through their effect on internationaltrade.a. Trueb. False39. Country X frequently engages in trade flows with the U.S. (such as imports and exports). Country Yfrequently engages in capital flows with the U.S. (such as financial investments). Everything else held constant, an increase in U.S. interest rates would affect the exchange rate of Country X's currency more than the exchange rate of Country Y's currency.a. Trueb. False40. Increases in relative income in one country vs. another result in an increase in the first country'scurrency value.a. Trueb. False41. Trade-related foreign exchange transactions are more responsive to news than financial flowtransactions.a. Trueb. False42. Signals regarding future actions of market participants in the foreign exchange market sometimesresult in overreactions.a. Trueb. False43. The markets that have a smaller amount of foreign exchange trading for speculatory purposes than fortrade purposes will likely experience more volatility than those where trade flows play a larger role.a. Trueb. False44. Liquidity of a currency can affect the extent to which speculation can impact the currency's value.a. Trueb. False45. Forecasting a currency's future value is difficult, because it is difficult to identify how the factorsaffecting the currency value will change, and how they will interact to impact the currency's value.a. Trueb. False46. The standard deviation should be applied to values rather than percentage movements when comparingvolatility among currencies.a. Trueb. False47. Movements of foreign currencies tend to be more volatile for shorter time horizons.a. Trueb. False48. If a currency's spot market is ____, its exchange rate is likely to be ____ to a single large purchase orsale transaction.a. liquid; highly sensitiveb. illiquid; insensitivec. liquid; insensitived. none of the above49. The value of euro was $1.30 last week. During last week the euro depreciated by 5%. What is thevalue of euro today?a. $1.365b. $1.235c. $1.330d. $1.30SOLUTION: $1.3 × (1 − .05) = $1.23550. Government controls can only affect the supply of a given currency for sale and not the demand.a. Trueb. False51. If one foreign currency will appreciate against the dollar, then all foreign currencies will appreciateagainst the dollar but by different degrees.a. Trueb. False52. Assume that the income levels in U.K. start to rise, while U.S. income levels remain unchanged. Thiswill place ____ pressure on the value of British pound. Also, assume that U.S. interest rates rise, while the British pound remains unchanged. This will place ____ pressure on the value of British pound.a. downward; downwardb. upward; downwardc. upward; upwardd. downward; upward53. If the Fed announces that it will decrease the U.S. interest rates, and European Central Bank takes noaction, then the value of euro will ____ against the value of U.S. dollar. The Fed's action is called ____ intervention.a. appreciate; directb. depreciate; directc. appreciate; indirectd. depreciate; indirect54. Assume that the total value of investment transactions between U.S. and Mexico is minimal. Alsoassume that total dollar value of trade transactions between these two countries is very large. Now assume that Mexico's inflation has suddenly increased, and Mexican interest rates have suddenlyincreased. Overall, this would put ____ pressure on the value of Mexican peso. The inflation effect should be ____ pronounced than the interest rate effect.a. downward; moreb. upward; morec. downward; lessd. upward; less55. If U.S. experiences a sudden surge in inflation and surge in interest rates while Japanese inflation andinterest rates remain unchanged, the value of Japanese yen will ____ against the U.S. dollar.a. appreciateb. depreciatec. remain unchangedd. cannot be determined from the information provided.56. If the Japanese yen is expected to appreciate against the U.S. dollar and interest rates in the U.S. andJapan are similar, banks may try speculating on this anticipated exchange rate movement by borrowing ____ and investing in ____.a. yen; dollarsb. yen; yenc. dollars; yend. dollars; dollars57. British investors frequently invest in the U.S. or Italy, depending on the prevailing interest rates. IfItalian interest rates suddenly rise high above U.S. rates, the investors will ____ the supply of pounds to be exchanged for dollars and thus put ____ pressure on the value of the pound against the U.S.dollar.a. increase; downwardb. decrease; upwardc. increase; upwardd. decrease; downward58. The equilibrium exchange rate of the Swiss franc is $0.90. At an exchange rate $.83:a. U.S. demand for Swiss francs would exceed the supply of francs for sale and there wouldbe a shortage of francs in the foreign exchange market.b. U.S. demand for Swiss francs would be less than the supply of francs for sale and therewould be a shortage of francs in the foreign exchange market.c. U.S. demand for Swiss francs would exceed the supply of francs for sale and there wouldbe a surplus of francs in the foreign exchange market.d. U.S. demand for Swiss francs would be less than the supply of francs for sale and therewould be a surplus of Swiss francs in the foreign exchange market.59. Financial flow foreign exchange transactions are more responsive to news than trade-relatedtransactions.a. Trueb. False60. Assume that the British government eliminates all controls on imports by British companies. Otherthings being equal, the U.S. demand for pounds would ____, the supply of pounds for sale would ____, and the equilibrium value of the pound would ____.a. increase; increase; increaseb. decrease; increase; decreasec. remain unchanged; increase; decreased. remain unchanged; increase; increase61. Country X frequently engages in trade flows with the U.S. (such as imports and exports). Country Yfrequently engages in capital flows with the U.S. (such as financial investments). Everything else held constant, an increase in U.S. inflation would affect the exchange rate of Country Y's currency more than the exchange rate of Country X's currency.a. Trueb. False62. Assume that U.S. inflation is expected to surge in the near future. The expectation of surge in inflationwill most likely place ____ pressure on U.S. dollar immediately.a. upwardb. downwardc. nod. cannot be determined63. When the Japanese yen appreciates against the U.S. dollar, this means that the U.S. dollar isstrengthening relative to the yen.a. Trueb. False64. Illiquid currencies tend to exhibit less volatile exchange rate movements than liquid currencies.a. Trueb. False65. The supply curve for a currency is downward sloping since U.S. corporations would be encouraged topurchase more foreign goods when the foreign currency is worth less.a. Trueb. False66. Relatively high Japanese inflation may result in an increase in the supply of yen for sale and areduction in the demand for yen, other things being equal.a. Trueb. False67. If the British government desires an appreciation in its currency with respect to the U.S. dollar, itwould consider intervening in the foreign exchange market by buying dollars with pounds.a. Trueb. False68. Country X frequently engages in trade flows with the U.S. (such as imports and exports). Country Yfrequently engages in financial flows with the U.S. (such as financial investments). Everything else held constant, an increase in U.S. interest rates would affect the exchange rate of Country X's currency more than the exchange rate of Country Y's currency.a. Trueb. False69. Illiquid currencies tend to exhibit ____ volatile exchange rate movements, as the equilibrium prices oftheir currencies adjust to ____ changes in supply and demand conditions.a. less; even minorb. less; only largec. more; even minord. more; only largee. none of the above70. Which of the following is not mentioned in the text as a factor affecting exchange rates?a. Relative interest ratesb. Relative inflation ratesc. Government controlsd. Expectationse. All of the above are mentioned in the text as factors affecting exchange rates.71. Which of the following events would most likely result in an appreciation of the U.S. dollar?a. U.S. inflation is very high.b. The Fed indicates that it will raise U.S. interest rates.c. Future U.S. interest rates are expected to decline.d. Japan is expected to increase interest rates in the near future.72. Which of the following interactions will likely have the least effect on the dollar's value? Assumeeverything else is held constant.a. A reduction in U.S. inflation accompanied by an increase in real U.S. interest ratesb. A reduction in U.S. inflation accompanied by an increase in nominal U.S. interest ratesc. An increase in U.S. inflation accompanied by an increase in nominal, but not real, U.S.interest ratesd. An increase in Singapore's inflation accompanied by an increase in real U.S. interest ratese. An increase in Singapore's interest rates accompanied by an increase in U.S. inflation.73. If a country experiences high inflation relative to the U.S., its exports to the U.S. should ____, itsimports should ____, and there is ____ pressure on its currency's equilibrium value.a. decrease; increase; upwardb. decrease; decrease; upwardc. increase; decrease; downwardd. decrease; increase; downwarde. increase; decrease; upward74. If a country experiences an increase in interest rates relative to U.S. interest rates, the inflow of U.S.funds to purchase its securities should ____, the outflow of its funds to purchase U.S. securities should ____, and there is ____ pressure on its currency's equilibrium value.a. increase; decrease; downwardb. decrease; increase; upwardc. increase; decrease; upwardd. decrease; increase; downwarde. increase; increase; upward。

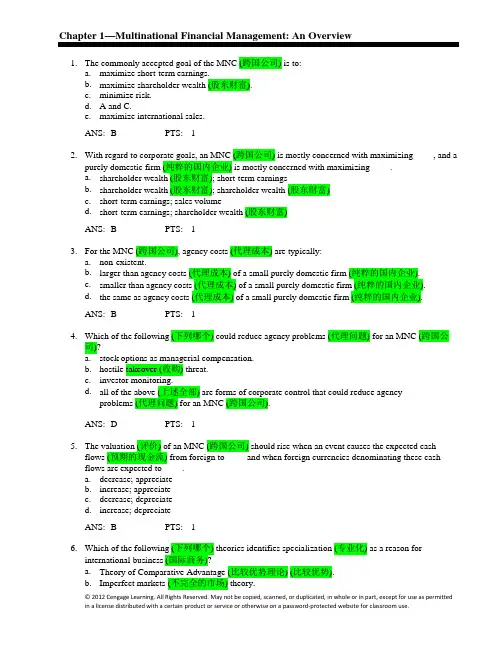

Chapter 1—Multinational Financial Management: An Overview1. The commonly accepted goal of the MNC (跨国公司) is to:a. maximize short-term earnings.b. maximize shareholder wealth (股东财富).c. minimize risk.d. A and C.e. maximize international sales.ANS: B PTS: 12. With regard to corporate goals, an MNC (跨国公司) is mostly concerned with maximizing ____, and apurely domestic firm (纯粹的国内企业) is mostly concerned with maximizing ____.a. shareholder wealth (股东财富); short-term earningsb. shareholder wealth (股东财富); shareholder wealth (股东财富)c. short-term earnings; sales volumed. short-term earnings; shareholder wealth (股东财富)ANS: B PTS: 13. For the MNC (跨国公司), agency costs (代理成本) are typically:a. non-existent.b. larger than agency costs (代理成本) of a small purely domestic firm (纯粹的国内企业).c. smaller than agency costs (代理成本) of a small purely domestic firm (纯粹的国内企业).d. the same as agency costs (代理成本) of a small purely domestic firm (纯粹的国内企业).ANS: B PTS: 14. Which of the following (下列哪个) could reduce agency problems (代理问题) for an MNC (跨国公司)?a. stock options as managerial compensation.b. hostile takeover (收购) threat.c. investor monitoring.d. all of the above (上述全部) are forms of corporate control that could reduce agencyproblems (代理问题) for an MNC (跨国公司).ANS: D PTS: 15. The valuation (评价) of an MNC (跨国公司) should rise when an event causes the expected cashflows (预期的现金流) from foreign to ____ and when foreign currencies denominating these cashflows are expected to ____.a. decrease; appreciateb. increase; appreciatec. decrease; depreciated. increase; depreciateANS: B PTS: 16. Which of the following (下列哪个) theories identifies specialization (专业化) as a reason forinternational business (国际商务)?a. Theory of Comparative Advantage (比较优势理论) (比较优势).b. Imperfect markets (不完全的市场) theory.c. product cycle (产品周期) theory.d. none of the aboveANS: A PTS: 17. Which of the following (下列哪个) theories identifies the non-transferability of resources (资源的不可转移性) as a reason for international business (国际商务)?a. Theory of Comparative Advantage (比较优势理论) (比较优势).b. Imperfect markets (不完全的市场) theory.c. product cycle (产品周期) theory.d. none of the aboveANS: B PTS: 18. Which of the following (下列哪个) theories suggests that firms seek to penetrate new markets (进入新的市场) over time?a. Theory of Comparative Advantage (比较优势理论) (比较优势).b. Imperfect markets (不完全的市场) theory.c. product cycle (产品周期) theory.d. none of the aboveANS: C PTS: 19. Which of the following (下列哪个) industries would most likely take advantage of lower costs insome less developed foreign countries?a. assembly line production.b. specialized professional services.c. nuclear missile planning.d. planning for more sophisticated computer technology.ANS: A PTS: 110. Due to the risks involved in international business (国际商务), firms should:a. only consider international business (国际商务) in major countries.b. maintain international business (国际商务) to no more than 20% of total business.c. maintain international business (国际商务) to no more than 35% of total business.d. none of the aboveANS: D PTS: 111. A product cycle (产品周期) is the process by which a firm provides a specialized sales or servicestrategy, support assistance, and possibly an initial investment in the franchise in exchange for periodic fees.a. Trueb. FalseANS: F PTS: 112. Licensing (许可) is the process by which a firm provides its technology (copyrights, patents,trademarks, or trade names) in exchange for fees or some other specified benefits.a. Trueb. FalseANS: T PTS: 113. The agency costs (代理成本) of an MNC (跨国公司) are likely to be lower if it:a. scatters its subsidiaries across many foreign countries.b. increases its volume of international business (国际商务).c. uses a centralized management style.d. A and B.ANS: C PTS: 114. An MNC (跨国公司) may be more exposed to agency problems (代理问题) if most of its shares areheld by:a. a few mutual funds (共同基金)b. a widely dispersed set of individual investorsc. a few pension funds (养老基金)d. all of the above (上述全部) would prevent agency problems (代理问题)ANS: B PTS: 115. The Sarbanes-Oxley Act improves corporate governance (公司治理) of MNCs (跨国公司) because it:a. makes executives more accountable for verifying financial statementsb. eliminates stock options as a form of compensationc. ties executive compensation to firm performanced. places a limit on the amount of funds that managers can spendANS: A PTS: 116. MNCs (跨国公司) can improve their internal control (内部控制) process by all of the following,except (除了):a. establishing a centralized data base of informationb. ensuring that all data are reported consistently among subsidiariesc. ensuring that the MNC (跨国公司) always borrows from countries where interest rates arelowestd. using a system that checks internal data for unusual discrepanciesANS: C PTS: 117. Franchising (特许经营) is the process by which national governments sell state owned operations tocorporations and other investors.a. Trueb. FalseANS: F PTS: 118. The parent of MNC (跨国公司) can implement compensation plans (补偿计划) that directly rewardthe subsidiary (子公司) managers for enhancing the value (价值) of the MNC (跨国公司).a. Trueb. FalseANS: T PTS: 119. If a publicly-traded MNC (跨国公司)'s managers make poor decisions that reduce its value (价值), itmay encourage other firms to acquire it.a. Trueb. FalseANS: T PTS: 120. Institutional investors such as mutual funds (共同基金) or pension funds (养老基金) which have largeholdings (控股) of an MNC (跨国公司)'s stock do not normally want to take control of it and therefore have no influence over management of the MNC (跨国公司).a. Trueb. FalseANS: F PTS: 121. In comparing exporting (出口) to direct foreign investment (国外直接投资) (DFI), an exporting (出口)operation will likely incur ____ fixed production costs (固定生产成本) and ____ transportation costs (运输成本) than DFI.a. higher; higherb. higher; lowerc. lower; lowerd. lower; higherANS: D PTS: 122. Which of the following (下列哪个) is an example of direct foreign investment (国外直接投资)?a. exporting (出口) to a country.b. establishing Licensing (许可) arrangements in a country.c. purchasing existing companies in a country.d. investing directly (without brokers) in foreign stocks.ANS: C PTS: 123. According to the text (教科书), a disadvantage of Licensing (许可) is that:a. it prevents a firm from importing (进口).b. it is difficult to ensure quality control of the production process.c. it prevents a firm from exporting (出口).d. none of the aboveANS: B PTS: 124. ____ are most commonly classified as a direct foreign investment (国外直接投资).a. Foreign acquisitions (国外并购)b. Purchases of international stocksc. Licensing (许可) agreementsd. Exporting (出口) transactionsANS: A PTS: 125. Imperfect markets (不完全的市场) represent conditions under which factors of production (生产要素)are immobile.a. Trueb. FalseANS: T PTS: 126. The Sarbanes-Oxley Act (SOX) was enacted in 2002 required MNCs (跨国公司) and other firms toimplement an internal reporting process that could be easily monitored by executives and the board of directors.a. Trueb. FalseANS: T PTS: 127. If markets were perfect, then labor and other costs of production would be perfectly stable (nomovement across borders).a. Trueb. FalseANS: F PTS: 128. The valuation (评价) of an MNC (跨国公司) is reduced if the required return on its investments inforeign countries is reduced.a. Trueb. FalseANS: F PTS: 129. Which of the following (下列哪个) is not mentioned in the text (教科书) as an additional riskresulting from international business (国际商务)?a. exchange rate fluctuations.b. political risk (政治风险).c. interest rate risk.d. exposure (曝险) to foreign economies.ANS: C PTS: 130. Licensing (许可) obligates a firm to provide ____, while Franchising (特许经营) obligates a firm toprovide ____.a. a specialized sales or service strategy; its technologyb. its technology; a specialized sales or service strategyc. its technology; its technologyd. a specialized sales or service strategy; a specialized sales or service strategye. its technology; an initial investmentANS: B PTS: 131. Which of the following (下列哪个) is not a way in which agency problems (代理问题) can be reducedthrough corporate control?a. executive compensation.b. threat of hostile takeover (收购).c. acquisition of a foreign subsidiary (子公司).d. monitoring by large shareholders.ANS: C PTS: 132. The goal of a multinational corporation (MNC (跨国公司)) is the maximization of shareholder wealth(股东财富).a. Trueb. FalseANS: T PTS: 133. A centralized management style, where major decisions about a foreign subsidiary (子公司) are madeby the parent company, results in an increase in agency costs (代理成本).a. Trueb. FalseANS: F PTS: 134. If a U.S. firm sets up a plant in Mexico to benefit from (受益于) low cost labor, it will likely have acomparative advantage (比较优势) over other firms in Mexico that sell the same product.a. Trueb. FalseANS: F PTS: 135. Although MNCs (跨国公司) may need to convert currencies occasionally, they do not face anyexchange rate risk (汇率风险), as exchange rates are stable over time.a. Trueb. FalseANS: F PTS: 136. One of the most prevalent factors conflicting with the realization of the goal of an MNC (跨国公司) isthe existence of agency problems (代理问题).a. Trueb. FalseANS: T PTS: 137. A centralized management style for an MNC (跨国公司) results in relatively (相对) high agency costs(代理成本).a. Trueb. FalseANS: F PTS: 138. The Imperfect markets (不完全的市场) theory states that factors of production (生产要素) aresomewhat immobile, allowing firms to capitalize on a foreign country's resources.a. Trueb. FalseANS: T PTS: 139. If a U.S.-based MNC (跨国公司) focused completely on importing (进口), then its valuation (评价)would likely be adversely affected (受到不利影响) if most currencies were expected to appreciate against the dollar over time.a. Trueb. FalseANS: T PTS: 140. The acquisition of a foreign subsidiary (子公司) is commonly considered by MNCs (跨国公司)because the cost is less expensive than establishing a new subsidiary (子公司) of the same size.a. Trueb. FalseANS: F PTS: 141. If a U.S.-based MNC (跨国公司) focused completely on exporting (出口), then its valuation (评价)would likely be adversely affected (受到不利影响) if most currencies were expected to appreciate against the dollar over time.a. Trueb. FalseANS: F PTS: 142. If markets were perfect, then labor and other costs of production would be easily transferable.a. Trueb. FalseANS: T PTS: 143. International trade (国际贸易):a. is a relatively (相对) conservative approach to foreign market penetration (市场渗透).b. entails minimal risk.c. does not require large amount of investment.d. all of the above (上述全部).ANS: D PTS: 144. Assume that (假设) an American firm wants to engage in international business (国际商务) withoutmajor investment (重大投资) in the foreign country. Which method is least (最不)appropriate in this situation?a. International trade (国际贸易)b. Licensing (许可)c. Franchising (特许经营)d. Direct foreign investment (国外直接投资)ANS: D PTS: 145. The valuation (评价) of MNC (跨国公司) accounts for all the cash flows received by the foreignsubsidiaries plus all the cash flows remitted by the subsidiaries.a. Trueb. FalseANS: F PTS: 146. The MNC (跨国公司)'s value (价值) depends on all of the following, except (除了):a. MNC (跨国公司)'s required rate of return (必要回报率)b. Amount of MNC (跨国公司)'s cash flows in particular currencyc. The exchange rate at which cash flows are converted to dollarsd. The value (价值) of MNC (跨国公司) depends on all of the above (上述全部) factorsANS: D PTS: 147. Which of the following (下列哪个) is not an example of political risk (政治风险)?a. Government may impose taxes on subsidiary (子公司)b. Government may impose barriers on subsidiary (子公司)c. Consumers may boycott the MNC (跨国公司)d. Consumers' income levels will decrease, thus decreasing consumption.ANS: D PTS: 148. A microeconomic perspective focuses on external forces such as economic conditions that can affectthe value (价值) of an MNC (跨国公司).a. Trueb. FalseANS: F PTS: 149. Assume that (假设) an MNC (跨国公司) has a subsidiary (子公司) in Italy, which exports its productsto various countries in Europe. Since all of the countries where it exports use Euro as their currency, this MNC (跨国公司) is not subject to the exchange rate risk (汇率风险).a. Trueb. FalseANS: F PTS: 150. International trade (国际贸易) generally results in ____ exposure (曝险) to international political risk(政治风险) and ____ exposure (曝险) to international economic conditions, when compared to other methods of international business (国际商务).a. higher; lowerb. higher; higherc. lower; higherd. lower; lowerANS: D PTS: 151. Assume that (假设) Boca Co. wants to expand its business to Japan, and wants complete control overthe operations in Japan. Which method of international business (国际商务) is most appropriate for Boca Co?a. Joint ventureb. Licensing (许可)c. Partial acquisition of existing Japanese firmd. Establishment (建立) of Japanese subsidiary (子公司)ANS: B PTS: 152. A decentralized management style of MNC (跨国公司) results in relatively (相对) high agency costs(代理成本).a. Trueb. FalseANS: T PTS: 153. The Establishment (建立) of a new subsidiary (子公司) is commonly considered by MNCs (跨国公司)because the cost is less expensive than acquiring a foreign subsidiary (子公司) of the same size.a. Trueb. FalseANS: T PTS: 154. Assume that (假设) Live Co. has expected cash flows (预期的现金流) of $200,000 from domesticoperations, SF200,000 from Swiss operations, and 150,000 euros from Italian operations at the end of the year. The Swiss franc's value (价值) and euro's value (价值) are expected to be $.83 and $1.29 respectively, at the end this year. What are the expected dollar cash flows of Live Co?a. $200,000b. $559,500c. $582,500d. $393,500ANS: B PTS: 155. Saller Co. has a subsidiary (子公司) in Mexico. The expected cash flows (预期的现金流) in pesos tobe received in the future from this subsidiary (子公司) have not changed since last month, but thevaluation (评价) of Saller Co. has declined since last month. What could've caused this decline invalue (价值)?a. A weaker Mexican economyb. Lower Mexican interest ratesc. Depreciation of the Mexican pesod. Appreciation of the Mexican peso.ANS: C PTS: 156. Jensen Co. wants to establish a new subsidiary (子公司) in Mexico that will sell computers to Mexicancustomers and remit earnings back to the U.S. parent. The value (价值) of this project will befavorably affected if the value (价值) of the peso ____ while it establishes the new subsidiary (子公司) and ____ when the subsidiary (子公司) starts operations.a. depreciates; appreciatesb. appreciates; appreciatesc. appreciates; depreciatesd. depreciates; depreciatesANS: A PTS: 157. A macroeconomic perspective focuses on the financial management decisions that affect the value (价值) of MNC (跨国公司).a. Trueb. FalseANS: F PTS: 158. An MNC (跨国公司) will always use the same required rate of return (必要回报率) in the valuation(评价) of foreign projects, as it would for its domestic projects.a. Trueb. FalseANS: F PTS: 159. Livingston Co. has a subsidiary (子公司) in Korea. The subsidiary (子公司) reinvests half of its netcash flows into operations and remits half to the parent. Livingston's expected cash flows (预期的现金流) from domestic business are $100,000 and the Korean subsidiary (子公司) is expected to generate 100 million Korean won at the end of the year. The expected value (价值) of won is $.0012. What are the expected dollar cash flows of Livingston Co.?a. $100,000b. $200,000c. $160,000d. $60,000ANS: C PTS: 160. A U.S.-based MNC (跨国公司) has many foreign subsidiaries in Europe and does not expect toincrease its investment there. Its value (价值) should increase if the value (价值) of the euro weakens over time.a. Trueb. FalseANS: F PTS: 161. If managers of foreign subsidiaries make decisions that maximize the value (价值)s of their respectivesubsidiaries, they automatically maximize the value (价值) of the entire corporation.a. Trueb. FalseANS: F PTS: 162. A decentralized management style, where subsidiary (子公司) managers make the relevant decisionsregarding their subsidiary (子公司), may result in better decision making, as subsidiary (子公司) managers are generally better informed about their subsidiary (子公司)'s operations.a. Trueb. FalseANS: T PTS: 163. U.S.-based MNCs (跨国公司) are typically not monitored by mutual funds (共同基金) and pensionfunds (养老基金), as these institutions (机构) rarely hold stock in MNCs (跨国公司).a. Trueb. FalseANS: F PTS: 164. The Sarbanes-Oxley Act ensures a more transparent process for managers to report on the productivityand financial condition of their firm.a. Trueb. FalseANS: T PTS: 165. The Theory of Comparative Advantage (比较优势理论) (比较优势) begins by assuming that a givenfirm first becomes established in its home country and may subsequently penetrate foreign markets via geographic or product differentiation.a. Trueb. FalseANS: F PTS: 166. Under the Imperfect markets (不完全的市场) Theory, it is assumed that factors of production (生产要素) are entirely mobile, so that firms can capitalize on a foreign country's resources.a. Trueb. FalseANS: F PTS: 167. Under the Product cycle (产品周期) Theory, foreign demand can be initially satisfied by exporting (出口).a. Trueb. FalseANS: T PTS: 168. Licensing (许可) allows firms to use their technology in foreign markets without a major investment(重大投资) in foreign countries.a. Trueb. FalseANS: T PTS: 169. International trade (国际贸易) is the most common form of direct foreign investment (国外直接投资)(DFI).a. Trueb. FalseANS: F PTS: 170. When the parent's home currency (本国货币) is weak, remitted funds from foreign subsidiaries willconvert to a smaller amount of the home currency (本国货币).a. Trueb. FalseANS: F PTS: 171. A purely domestic firm (纯粹的国内企业) may be affected by exchange rate fluctuations if it faces atleast (最不)some foreign competition.a. Trueb. FalseANS: T PTS: 172. One form of an exposure (曝险) to political risk (政治风险) is terrorism (恐怖主义).a. Trueb. FalseANS: T PTS: 173. The goal of a multinational corporation (MNC (跨国公司)) isa. The minimization of taxes remitted from foreign subsidiaries.b. The Establishment (建立) of subsidiaries in any country where operations would provide areturn over and above the cost of capital, even if better projects are available domestically.c. The maximization of shareholder wealth (股东财富).d. The maximization of social benefits resulting from actions such as the employment offoreign managers.ANS: C PTS: 174. Agency costs (代理成本) faced by multinational corporations (MNCs (跨国公司)) may be larger thanthose faced by purely domestic firm (纯粹的国内企业)s becausea. Monitoring of managers located in foreign countries is more difficult.b. Foreign subsidiary (子公司) managers raised in different cultures may not follow uniformgoals.c. MNCs (跨国公司) are relatively (相对) large.d. All of the above (上述全部)e. A and B onlyANS: D PTS: 175. Which of the following (下列哪个) is not one of the more common methods used by MNCs (跨国公司) to improve their internal control (内部控制) process?a. Establishing a centralized database of informationb. Ensuring that all data are reported consistently among subsidiariesc. Speeding the process by which all departments and all subsidiaries have access to the datathat they needd. Making executives more accountable for financial statements by personally verifying theiraccuracye. All of the above (上述全部) are common methods used by MNCs (跨国公司) to improvetheir internal control (内部控制) process.ANS: E PTS: 176. Which of the following (下列哪个) is not mentioned in the text (教科书) as a theory of internationalbusiness (国际商务)?a. Theory of Comparative Advantage (比较优势理论)b. Imperfect markets (不完全的市场) Theoryc. Product cycle (产品周期) Theoryd. Globalization of Business Theorye. All of the above (上述全部) are mentioned in the text (教科书) as theories of internationalbusiness (国际商务)ANS: D PTS: 177. The most risky method(s) by which firms conduct international business (国际商务) is (are):a. Franchising (特许经营).b. The acquisitions of existing operations (现有业务的收购).c. The Establishment (建立) of new subsidiaries.d. All of the above (上述全部)e. B and C onlyANS: E PTS: 178. The least (最不)risky method by which firms conduct international business (国际商务) is:a. Franchising (特许经营).b. The acquisitions of existing operations (现有业务的收购).c. International trade (国际贸易).d. The Establishment (建立) of new subsidiaries.e. Licensing (许可)ANS: C PTS: 179. Which of the following (下列哪个) does not constitute (构成) a form of direct foreign investment (国外直接投资)?a. Franchising (特许经营)b. International trade (国际贸易)c. Joint ventures (合资企业)d. Acquisitions of existing operationse. Establishment (建立) of new foreign subsidiariesANS: B PTS: 1。

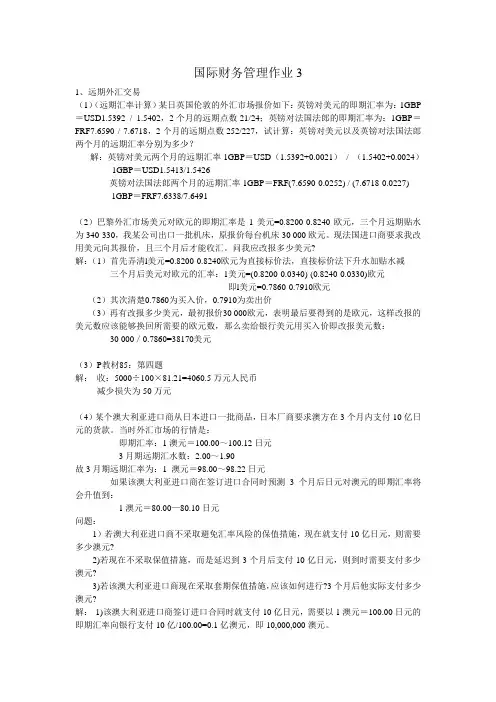

国际财务管理作业31、远期外汇交易(1)(远期汇率计算)某日英国伦敦的外汇市场报价如下:英镑对美元的即期汇率为:1GBP =USD1.5392 / 1.5402,2个月的远期点数21/24;英镑对法国法郎的即期汇率为:1GBP=FRF7.6590 / 7.6718,2个月的远期点数252/227,试计算:英镑对美元以及英镑对法国法郎两个月的远期汇率分别为多少?解:英镑对美元两个月的远期汇率1GBP=USD(1.5392+0.0021)/ (1.5402+0.0024)1GBP=USD1.5413/1.5426英镑对法国法郎两个月的远期汇率1GBP=FRF(7.6590-0.0252) / (7.6718-0.0227)1GBP=FRF7.6338/7.6491(2)巴黎外汇市场美元对欧元的即期汇率是1美元=0.8200-0.8240欧元,三个月远期贴水为340-330,我某公司出口一批机床,原报价每台机床30 000欧元。

现法国进口商要求我改用美元向其报价,且三个月后才能收汇。

问我应改报多少美元?解:(1)首先弄清l美元=0.8200-0.8240欧元为直接标价法,直接标价法下升水加贴水减三个月后美元对欧元的汇率:1美元=(0.8200-0.0340)-(0.8240-0.0330)欧元即l美元=0.7860-0.7910欧元(2)其次清楚0.7860为买入价,0.7910为卖出价(3)再有改报多少美元,最初报价30 000欧元,表明最后要得到的是欧元,这样改报的美元数应该能够换回所需要的欧元数,那么卖给银行美元用买入价即改报美元数:30 000/0.7860=38170美元(3)P教材85:第四题解:收:5000÷100×81.21=4060.5万元人民币减少损失为50万元(4)某个澳大利亚进口商从日本进口一批商品,日本厂商要求澳方在3个月内支付10亿日元的货款。

当时外汇市场的行情是:即期汇率:1澳元=100.00~100.12日元3月期远期汇水数:2.00~1.90故3月期远期汇率为:1 澳元=98.00~98.22日元如果该澳大利亚进口商在签订进口合同时预测3个月后日元对澳元的即期汇率将会升值到:1澳元=80.00—80.10日元问题:1)若澳大利亚进口商不采取避免汇率风险的保值措施,现在就支付10亿日元,则需要多少澳元?2)若现在不采取保值措施,而是延迟到3个月后支付10亿日元,则到时需要支付多少澳元?3)若该澳大利亚进口商现在采取套期保值措施,应该如何进行?3个月后他实际支付多少澳元?解:1)该澳大利亚进口商签订进口合同时就支付10亿日元,需要以1澳元=100.00日元的即期汇率向银行支付10亿/100.00=0.1亿澳元,即10,000,000澳元。

XX浙大远程教育国际财务管理练习题答案完美版第1章国际财务治理导论一、名词说明1.国际企业: 超越国界从事商业活动的企业,包括各种类型、各种规模的参与国际商务的企业。

国内生产、国际销售是国际企业最简单的国际业务。

跨国公司是国际企业进展的较高时期和典型代表。

2.许可经营:许可方企业向受许可方企业提供技术,包括版权、专利技术、技术诀窍或商标以换取使用费的一种经营方式。

当许可方企业与受许可方企业分别位于不同国家时,就形成了国家间的许可经营。

这种方式也能够被看作技术出口。

3.特许经营:是一种专门的许可经营方式,许可方通过向被许可方提供全套专业化企业经营手段,包括商标、企业组织、销售或服务策略和培训、技术支持等定期取得特许权使用费,被许可方则必须同意遵守严格的规则和程序以实现经营的标准化。

特许权使用费通常以被许可方的销售收入为基础收取。

4.分部式组织: 称事业部制组织结构。

其特点是在高层治理者之下,按地区或产品设置若干分部,实行“集中政策,分散经营”的集中领导下的分权治理。

5.混合式组织:事实上专门少有哪家企业是单纯采纳一种结构类型的,采纳两种以上组合方式的称为混合式结构。

6.分权模式: 子公司拥有充分的财务治理决策权,母公司关于其财务治理操纵以间接治理为主。

二、简答题1.国际财务治理与国内企业的财务治理内容有哪些的重要区别。

【答案】国际财务治理是指对国际企业的涉外经济活动进行的财务治理。

财务治理要紧涉及的是如何作出各种最佳的公司财务决定,比如通过适宜的投资、资产结构、股息政策以及人力资源治理,从而达到既定的公司目标(股东财宝最大化)。

国际财务治理与国内财务治理之间的区别要紧表达在以下几个方面:(1)跨国经营和财务活动受外汇风险的阻碍;(2)全球范畴内融资,寻求最佳全球融资战略;(3)跨国经营中商品和资金无法自由流淌;(4)对外投资为股东在全球范畴内分散风险。

2.试述国际财务治理体系的内容。

【答案】国际财务治理体系的内容要紧包括:(1)国际财务治理环境。

CHAPTER 1 GLOBALIZATION AND THE MULTINATIONAL FIRM SUGGESTED ANSWERS TO END-OF-CHAPTER QUESTIONSQUESTIONS1. Why is it important to study international financial managementAnswer: We are now living in a world where all the major economic functions i.e. consumptionproduction and investment are highly globalized. It is thus essential for financial managers to fullyunderstand vital international dimensions of financial management. This global shift is in markedcontrast to a situation that existed when the authors of this book were learning finance some twenty yearsago.At that time most professors customarily and safely to some extent ignored international aspectsof finance. This mode of operation has become untenable since then.2. How is international financial management different from domestic financial managementAnswer: There are three major dimensions that set apart international finance from domestic finance.They are: 1. foreign exchange and political risks 2. market imperfections and 3. expanded opportunity set.3. Discuss the three major trends that have prevailed in international business during the last two decades.Answer: The 1980s brought a rapid integration of international capital and financial markets. Impetus forglobalized financial markets initially came from the governments of major countries that had begun toderegulate their foreign exchange and capital markets. The economic integration and globalization thatbegan in the eighties is picking up speed in the 1990s via privatization. Privatization is the process bywhich a country divests itself of the ownership and operation of a business venture by turning it over tothe free market system. Lastly trade liberalization and economic integration continued to proceed at boththe regional and global levels.4. How is a country‟s economic well-being enhanced through free international trade in goods andservicesAnswer: According to David Ricardo with free international trade it is mutually beneficial for twocountries to each specialize in the production of the goods that it can produce relatively most efficientlyand then trade those goods. By doing so the two countries can increase their combined productionwhich allows both countries to consume more of both goods. This argument remains valid even if acountry can produce both goods more efficiently than the other country. International trade is not a …zero-sum‟ game in which one country benefits at the expense of another country. Rather international tradecould be an …increasing-sum‟ game at which all players become winners.5. What considerations might limit the extent to which the theory of comparative advantage is realisticAnswer: The theory of comparative advantage was originally advanced by the nineteenth centuryeconomist David Ricardo as an explanation for why nations trade with one another. The theory claimsthat economic well-being is enhanced if each country‟s citizens produce what they have a comparativeadvantage in producing relative to the citizens of other countries and then trade products. Underlying thetheory are the assumptions of free trade between nations and that the factors of production landbuildings labor technology and capital are relatively immobile. To the extent that these assumptions donot hold the theory of comparative advantage will not realistically describe international trade.6. What are multinational corporations MNCs and what economic roles do they playAnswer: A multinational corporation MNC can be defined as a business firm incorporated in onecountry that has production and sales operations in several other countries. Indeed some MNCs haveoperations in dozens of different countries. MNCs obtain financing from major money centers around theworld in many different currencies to finance their operations. Global operations force the treasurer‟soffice to establish international banking relationships to place short-term fundsin several currencydenominations and to effectively manage foreign exchange risk.7. Mr. Ross Perot a former Presidential candidate of the Reform Party which is a third political party inthe United States had strongly objected to the creation of the North American Trade AgreementNAFTA which nonetheless was inaugurated in 1994 for the fear of losing American jobs to Mexicowhere it is much cheaper to hire workers. What are the merits and demerits of Mr. Perot‟s position onNAFTA Considering the recent economic developments in North America how would you assess Mr.Perot‟s position on NAFTAAnswer: Since the inception of NAFTA many American companies indeed have invested heavily inMexico sometimes relocating production from the United States to Mexico. Although this might havetemporarily caused unemployment of some American workers they were eventually rehired by otherindustries often for higher wages. Currently the unemployment rate in the U.S. is quite low by historicalstandard. At the same time Mexico has been experiencing a major economic boom. It seems clear thatboth Mexico and the U.S. have benefited from NAFTA. Mr. Perot‟s concern appears to hav e been illfounded.8. In 1995 a working group of French chief executive officers was set up by the Confederation of FrenchIndustry CNPF and the French Association of Private Companies AFEP to study the French corporategovernance structure. The group reported the following among other things “The board of directorsshould not simply aim at maximizing share values as in the U.K. and the U.S. Rather its goal should be toserve the company whose interests should be clearly distinguished from those of its shareholdersemployees creditors suppliers and clients but still equated with their general common interest which isto safeguard the prosperity and continuity of the company”. Evaluate the above recommendation of theworking group.Answer: The recommendations of the French working group clearly show that shareholder wealthmaximization is not a universally accepted goal of corporate management especially outside the UnitedStates and possibly a few other Anglo-Saxon countries including the United Kingdom and Canada. Tosome extent this may reflect the fact that share ownership is not wide spread in most other countries. InFrance about 15 of households own shares.9. Emphasizing the importance of voluntary compliance as opposed to enforcement in the aftermath ofcorporate scandals e.g. Enron and WorldCom U.S. President George W. Bush stated that while tougherlaws might help “ultimately the ethics of American business depends on the conscience of America‟sbusiness leaders.” Describe your view on this statement.Answer: There can be different answers to this question. If business leaders always behave with a highethical standard many of the corporate scandals we have seen lately might not have happened. Since wecannot fully depend on the ethical behavior on the part of business leaders the society should protectitself by adopting therules/regulations and governance structure that would induce business leaders tobehave in the interest of the society at large.10. Suppose you are interested in investing in shares of Nokia Corporation of Finland which is a worldleader in wireless communication. But before you make investment decision you would like to learnabout the company. Visit the website of CNN Financial network and collectinformation about Nokia including the recent stock price history and analysts‟ views of the company.Discuss what you learn about the company. Also discuss how the instantaneous access to information viainternet would affect the nature and workings of financial markets.Answer: As students might have learned from visiting the website information is readily available evenfor foreign companies like Nokia. Ready access to international information helpsintegrate financialmarkets dismantling barriers to international investment and financing. Integration however may help afinancial shock in one market to be transmitted to other markets.MINI CASE: NIKE‟S DECISION Nike a U.S.-based company with a globally recognized brand name manufactures athletic shoes insuch Asian developing countries as China Indonesia and Vietnam using subcontractors and sells theproducts in the U.S. and foreign markets. The company has no production facilities in the United States.In each of those Asian countries where Nike has production facilities the rates of unemployment andunderemployment are quite high. The wage rate is very low in those countries by the U.S. standardhourly wage rate in the manufacturing sector is less than one dollar in each of those countries which iscompared with about 18 in the U.S. In addition workers in those countries often are operating in poorand unhealthy environments and their rights are not well protected. Understandably Asian host countriesare eager to attract foreign investments like Nike‟s to develop their economies and raise the livingstandards of th eir citizens. Recently however Nike came under a world-wide criticism for its practice ofhiring workers for such a low pay “next to nothing” in the words of critics and condoning poor workingconditions in host countries. Evaluate and discuss various …ethical‟ as well as economic ramifications of Nike‟s decision toinvest in those Asian countries.Suggested Solution to Nike‟s Decision Obviously Nike‟s investments in such Asian countries as China Indonesia and Vietnam weremotivated to take advantage of low labor costs in those countries. While Nike was criticized for the poorworking conditions for its workers the company has recognized the problem and has substantiallyimproved the working environments recently. Although Nike‟s workers get paid very low wages by theWestern standard they probably are making substantially more than their local compatriots who are eitherunder- or unemployed. While Nike‟s detractors may have valid points one should not ignore the fact thatthe company is making contributions to the economic welfare of those Asian countries by creating jobopportunities. CHAPTER 1A THEORY OF COMPARATIVE ADVANTAGE SUGGESTED SOLUTIONS TO APPENDIX PROBLEMSPROBLEMS1. Country C can produce seven pounds of food or four yards of textiles per unit of input. Compute theopportunity cost of producing food instead of textiles. Similarly compute the opportunity cost ofproducing textiles instead of food.Solution: The opportunity cost of producing food instead of textiles is one yard of textiles per 7/4 1.75pounds of food. A pound of food has an opportunity cost of4/7 .57 yards of textiles.2. Consider the no-trade input/output situation presented in the following table for Countries X and Y.Assuming that free trade is allowed develop a scenario that will benefit the citizens of both countries.INPUT/OUTPUT WITHOUT TRADE_________________________________________________________________ ______ Country X YTotal___________________________________________________________________ _____I. Units of Input000000_____________________________________________________Food 70 60Textiles 4030______________________________________________________________________ __II. Output per Unit of Inputlbs or yards____________________________________________________Food 17 5Textiles 52_______________________________________________________________________ _III. Total Outputlbs or yards000000____________________________________________________Food 1190 300 1490Textiles 200 60260_____________________________________________________________________ ___IV. Consumptionlbs or yards000000___________________________________________________Food 1190 300 1490Textiles 200 60260_____________________________________________________________________ ___Solution: Examination of the no-trade input/output table indicates that Country X has an absoluteadvantage in the production of food and textiles. Country X can “trade off” one unit of productionneeded to produce 17 pounds of food for five yards of textiles. Thus a yard of textiles has an opportunitycost of 17/5 3.40 pounds of food or a pound of food has an opportunity cost of 5/17 .29 yards oftextiles. Analogously Country Y has an opportunity cost of 5/2 2.50 pounds of food per yard oftextiles or 2/5 .40 yards of textiles per pound of food. In terms of opportunity cost it is clear thatCountry X is relatively more efficient in producing food and Country Y is relatively more efficient inproducing textiles. Thus Country X Y has a comparative advantage in producing food textile iscomparison to Country Y X. When there are no restrictions or impediments to free trade the economic-well being of thecitizens of both countries is enhanced through trade. Suppose that Country X shifts 20000000 unitsfrom the production of textiles to the production of food where it has a comparative advantage and thatCountry Y shifts 60000000 units from the production of food to the production of textiles where it has acomparative advantage. Total output will now be 90000000 x 17 1530000000 pounds of food and20000000 x 5 100000000 90000000 x 2 180000000 280000000 yards of textiles.Further suppose that Country X and Country Y agree on a price of 3.00 pounds of food for one yard oftextiles and that Country X sells Country Y 330000000 pounds of food for 110000000 yards of textiles.Under free trade the following table shows that the citizens of Country X Y have increased theirconsumption of food by 10000000 30000000 pounds and textiles by 10000000 10000000 yards.INPUT/OUTPUT WITH FREE TRADE_________________________________________________________________ _________ Country X YTotal___________________________________________________________________ _______I. Units of Input 000000_______________________________________________________Food 90 0Textiles 2090______________________________________________________________________ ____II. Output per Unit of Input lbs or yards______________________________________________________Food 17 5Textiles 52_______________________________________________________________________ ___III. Total Output lbs or yards 000000_____________________________________________________Food 1530 0 1530Textiles 100 180280_____________________________________________________________________ _____IV. Consumption lbs or yards 000000_____________________________________________________Food 1200 330 1530Textiles 210 70280_____________________________________________________________________ _____ CHAPTER 3 BALANCE OF PAYMENTS SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSQUESTIONS1. Define the balance of payments.Answer: The balance of payments BOP can be defined as the statistical record of a country‟sinternational transactions over a certain period of time presented in the form of double-entry bookkeeping.2. Why would it be useful.。