国际会计课后作业二(附答案)

- 格式:doc

- 大小:131.00 KB

- 文档页数:8

国际会计课后习题答案国际会计课后习题答案在学习国际会计的过程中,课后习题是巩固知识和理解的重要环节。

通过解答习题,我们可以更好地掌握会计原理和方法,提高自己的会计思维和分析能力。

本文将为大家提供一些国际会计课后习题的答案,并对其中的一些重要概念进行解析和讨论。

1. 在国际会计准则体系中,资产的定义是什么?请举例说明。

答案:根据国际会计准则体系,资产是指企业拥有的具有经济利益并且能够被可靠计量的资源。

这些资源可以是物质的,如土地、建筑物、设备等;也可以是非物质的,如专利权、商标权等。

例如,一家公司拥有一座办公楼和一批生产设备,这些都可以被视为该公司的资产。

2. 什么是会计准则的重要特征?为什么会计准则的一致性很重要?答案:会计准则的重要特征包括可理解性、相关性、可靠性和比较性。

其中,一致性是指在同一会计期间内,企业在处理同类交易和事件时应采用相同的会计政策和方法。

一致性的重要性在于它可以确保企业的财务报表具有可比性,使用户能够更好地进行横向和纵向的比较分析,从而做出正确的决策。

3. 什么是财务报表的基本要素?请简要介绍每个要素的含义。

答案:财务报表的基本要素包括资产、负债、所有者权益、收入和费用。

资产是指企业拥有的具有经济利益的资源;负债是指企业对外部经济利益的现时义务;所有者权益是指企业所有者对企业净资产的权益;收入是指企业在经营活动中获得的经济利益的流入;费用是指企业在经营活动中为获取收入所支出的经济利益的流出。

4. 请解释会计准则中的“谨慎原则”和“实质重于形式”原则。

答案:谨慎原则是指在不确定性和风险存在的情况下,会计人员应该对企业的财务状况和经营成果进行保守估计,避免对企业的财务报表进行过度乐观的呈现。

实质重于形式原则是指在处理会计事务时,应该以事物的实质为依据,而不是仅仅根据其法律形式来决定其会计处理方式。

这两个原则都是为了保证财务报表的真实性和可靠性。

5. 请解释会计准则中的“货币计量原则”和“历史成本原则”。

《国际会计》模拟题

一、简答题

1、研究各国会计环境的特征及差异有什么意义?

2、解释跨国公司处理交易暴露的四种基本思路。

3、简述国际会计准则的认可和实施情况。

4、促使合并报表实务产生和发展的因素主要有哪些?

5、简述一般购买力会计模式的优点及局限性。

二、论述题

1、影响会计发展的因素主要有哪些?按照它们对会计发展产生影响的重要

程度从高到低排序,然后就你所排列的最高项目和最低项目给出合理的解释。

2、通货膨胀对历史成本原则、配比原则及稳健原则产生了什么样的影响?。

第一章练习题解答习题1.名词解释1.1国际会计的概念: 国际会计(International Accounting)。

国际会计内容广阔但研究时间较短,因此,较难有一个确切的定义。

美国加州理工大学教授M.Zafar Iqbal等认为,国际会计是针对国际间经济业务的会计,是对不同国家会计准则的比较,以及世界范围内的会计准则的协调。

而美国会计学家Weirch 和Anderson则进一步将国际会计细化为三个概念,即跨国公司会计(Multinational Corporation Accounting)、比较会计(Comparative accounting)和世界会计(World Accounting)。

1.2跨国公司会计: 从跨国公司会计视角认为国际会计主要是为了处理跨国公司母公司与子公司之间的会计问题,其研究领域较为狭窄,应用范围较为单一,只是停留在国际会计产生的直接动因——国际贸易与跨国公司这一点上,而未将其理论全面化和高度化。

因此,代表的只是国际会计发展的初级对各个国家不同的会计模式进行研究和比较。

包括各国的会计理论、会计准则、会计实务、会计环境等。

1.3比较会计: 相对跨国公司会计而言,比较会计上升到了一定的高度和深度,是由点及面、从具体到抽象的质的飞跃,同时,又是承上启下的关键性转折。

因为它不仅是对跨国公司会计的扩充与深化;更主要的是为世界会计奠定了坚实的基础。

1.4世界会计: 世界会计是从全球的角度出发,致力于建设一套世界各国普遍接受的统一和标准的会计模式,这是国际会计的理想和终极奋斗目标,其意义是显而易见的。

它能使会计更好地为世界经济一体化而服务。

但由于会计受社会环境和经济环境的制约与影响,各个国家的政治、法律、经济及文化背景的巨大差异,使得这一工程必将是艰巨而困难的而只有经历了比较会计这一阶段,通过对各个国家会计情况的分析与对比,才能综合制定出全球统一的会计模式。

因此,世界会计是建立在比较会计基础之上的,目前及未来国际会计研究的重点。

国际会计第9版课后答案pdf1、某公司为一般纳税人,2019年6月购入商品并取得增值税专用发票,价款100万元,增值税率13%;支付运费取得增值税专用发票,运费不含税价款为30万元,增值税率9%,则该批商品的入账成本为()。

[单选题] *A.130万元(正确答案)B.7万元C.3万元D.113万元2、下列项目中,不属于非流动负债的是()[单选题] *A.长期借款B.应付债券C.专项应付款D.预收的货款(正确答案)3、.(年嘉兴三模考)()就是会计在经济管理中固有的、内在的客观功能。

[单选题] * A会计的含义B会计的特点C会计的任务D会计的职能(正确答案)4、.(年浙江省第二次联考)会计人员的职业道德规范不包括()[单选题] *A操守为重、不做假账(正确答案)B爱岗敬业、诚实守信C、廉洁自律、客观公正D坚持准则、提高技能5、企业出售固定资产应交的增值税,应借记的会计科目是()。

[单选题] *A.税金及附加B.固定资产清理(正确答案)C.营业外支出D.其他业务成本6、.(年嘉兴二模考)企业对固定资产计提折旧以()假设为基本前提。

[单选题] *A会计主体B持续经营(正确答案)C会计分期D货币计量7、某企业自创一项专利,并经过有关部门审核注册获得其专利权。

该项专利权的研究开发费为15万元,其中开发阶段符合资本化条件的支出8万元;发生的注册登记费2万元,律师费1万元。

该项专利权的入账价值为()。

[单选题] *A.15万元B.21万元C.11万元(正确答案)D.18万元8、.(年浙江省高职考)下列项目中,不属于企业会计核算对象的经济活动是()[单选题] *A购买设备B请购原材料(正确答案)C接受捐赠D利润分配9、企业生产车间使用的固定资产发生的下列支出中,直接计入当期损益的是( )。

[单选题] *A.购入时发生的安装费用B.发生的装修费用C.购入时发生的运杂费D.发生的修理费(正确答案)10、已达到预定可使用状态但未办理竣工决算的固定资产,应根据()作暂估价值转入固定资产,待竣工决算后再作调整。

国际会计课后题答案版 Pleasure Group Office【T985AB-B866SYT-B182C-BS682T-STT18】第1章国际会计的形成与发展一、讨论题为什么说市场国际化,特别是货币市场和资本市场的国际化是会计国际化的主要推动力国际贸易和国际经济技术合作,促使会计成为一种国际商业语言。

特别是国际货币市场和资本市场的兴起向进入市场的贷款人或筹资者提出了应提供在国际间可比且可靠的财务信息的要求(即国际财务报告趋同化的要求),更成为会计国际化的主要推动力。

跨国公司是否在百分之百地推动会计国际化说明你的观点。

不是。

跨国公司对推动会计国际化有其两面性:一方面,基于其跨国经营和国际筹资的需要,他们希望通过会计国际化来缩小和协调国别差异;另一方面,他们又十分重视利用各国现存的会计差异来谋取财务利益。

后者也推动了各国会计模式和重要会计方法的国际比较研究。

(注意:“会计国际化”大体上与“会计的国际协调化”概念一致,而与国际会计研究中的“国别会计”观点对立)会计随商业活动的扩展而传播,你同意这种说法吗从历史发展的进程谈谈你的看法。

同意。

可主要就前殖民帝国的会计向其原殖民地传播、工业革命后西方会计的发展及在世界范围内的广泛传播以及第二次世界大战以后美国会计的影响在一定程度上主宰着世界各地的会计发展等历史事实,加以讨论。

哪些特定会计方法具有国际性质把外币交易和外币报表的折算引入会计领域,是会计国际化带来的独特问题。

它与由此引发的跨国企业合并和国际合并财务报表与外币折算相互关联和制约的问题,以及各国的物价变动影响在国际合并财务报表中如何处理和调整的问题,从20世纪70年代以来,就成为国际会计研究中既需协调一致但又矛盾重重的“三大难题”。

在世纪之交,金融工具(特别是衍生工具)的创新引发的会计处理问题,给传统的会计概念和实务带来了巨大的冲击,成为各国会计准则机构联合攻关、仍未妥善解决的难题。

此外,国际税务会计也是值得关注的课题。

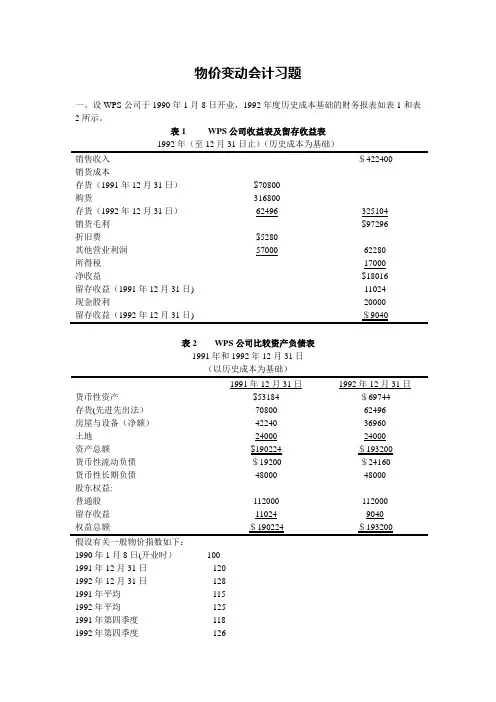

物价变动会计习题一、设WPS公司于1990年1月8日开业,1992年度历史成本基础的财务报表如表1和表2所示。

表1 WPS公司收益表及留存收益表1992年(至12月31日止)(历史成本为基础)销售收入$422400销货成本存货(1991年12月31日)$70800购货316800存货(1992年12月31日)62496 325104销货毛利$97296折旧费$5280其他营业利润57000 62280所得税17000净收益$18016留存收益(1991年12月31日) 11024现金股利20000留存收益(1992年12月31日) $9040表2 WPS公司比较资产负债表1991年和1992年12月31日(以历史成本为基础)1991年12月31日1992年12月31日货币性资产$53184 $69744存货(先进先出法)70800 62496房屋与设备(净额)42240 36960土地24000 24000资产总额$190224 $193200货币性流动负债$19200 $24160货币性长期负债48000 48000股东权益:普通股112000 112000留存收益11024 90401990年1月8日(开业时)1001991年12月31日1201992年12月31日1281991年平均1151992年平均1251991年第四季度1181992年第四季度126再假设其他有关重要资料如下:(1)每年均按先进先出法计量存货,每年末的库存存货均为当年第四季度均匀购入。

(2)房屋与设备、土地均于开业时一次性购置,按10年、直线法提房屋与设备的折旧,不考虑预计净残值。

(3)普通股均于开业时对外发行。

(4)当年的销货收入、购货成本、其他营业费用与所得税在当年内均匀发生.(5)现金股利的分派在1992年12月31日完成。

(6)一般购买力为年末美元。

1、要求:按照一般购买力会计模式重编资产负债表、收益和留存收益表以及购买力损益计算表以上题中的表1与表2为基础,另补充有关资料如下:2、以现行成本为基础的销货成本为$345600。

国际会计课后题答案整理版第1章国际会计的形成与发展一、讨论题1.1 为什么说市场国际化,特别是货币市场和资本市场的国际化是会计国际化的主要推动力?国际贸易和国际经济技术合作,促使会计成为一种国际商业语言。

特别是国际货币市场和资本市场的兴起向进入市场的贷款人或筹资者提出了应提供在国际间可比且可靠的财务信息的要求(即国际财务报告趋同化的要求),更成为会计国际化的主要推动力。

1.2 跨国公司是否在百分之百地推动会计国际化?说明你的观点。

不是。

跨国公司对推动会计国际化有其两面性:一方面,基于其跨国经营和国际筹资的需要,他们希望通过会计国际化来缩小和协调国别差异;另一方面,他们又十分重视利用各国现存的会计差异来谋取财务利益。

后者也推动了各国会计模式和重要会计方法的国际比较研究。

(注意:“会计国际化”大体上与“会计的国际协调化”概念一致,而与国际会计研究中的“国别会计”观点对立)1.3 会计随商业活动的扩展而传播,你同意这种说法吗?从历史发展的进程谈谈你的看法。

同意。

可主要就前殖民帝国的会计向其原殖民地传播、工业革命后西方会计的发展及在世界范围内的广泛传播以及第二次世界大战以后美国会计的影响在一定程度上主宰着世界各地的会计发展等历史事实,加以讨论。

1.4 哪些特定会计方法具有国际性质?把外币交易和外币报表的折算引入会计领域,是会计国际化带来的独特问题。

它与由此引发的跨国企业合并和国际合并财务报表与外币折算相互关联和制约的问题,以及各国的物价变动影响在国际合并财务报表中如何处理和调整的问题,从20世纪70年代以来,就成为国际会计研究中既需协调一致但又矛盾重重的“三大难题”。

在世纪之交,金融工具(特别是衍生工具)的创新引发的会计处理问题,给传统的会计概念和实务带来了巨大的冲击,成为各国会计准则机构联合攻关、仍未妥善解决的难题。

此外,国际税务会计也是值得关注的课题。

1.5 你对会计国际化和国家化之间的矛盾及其消长有何看法?会计国际化和国家化的矛盾实际上反映了经济全球化与各国的国家利益之间的矛盾及其消长过程。

2019会计继续教育课后测验试题答案(二)选择题:1、2018年12月1日国家发展改革委联合人民银行、财政部等()个部委联合签署《关于对会计领域违法失信相关责任主体实施联合惩戒的合作备忘录》。

A22B5C10D12正确答案:A2、下列属于联合惩戒措施的有()。

A罚款、限制从事会计工作、追究刑事责任等惩戒措施B记入会计从业人员信用档案C通过财政部网站、“信用中国”网站及其他主要新闻网站向社会公布D实施行业惩戒正确答案:ABCD3、法定代表人,应当是具有完全民事行为能力的中国公民,且为该单位主要行政负责人,年龄一般不超过()周岁,无不良信用记录。

A70B65C60D50正确答案:A4、下列行为可以对单位并处三千元以上五万元以下的罚款;对其直接负责的主管人员和其他直接责任人员,可以处二千元以上二万元以下的罚款;属于国家工作人员的,还应当由其所在单位或者有关单位依法给予行政处分的有()。

A不依法设置会计账簿的B私设会计账簿的C随意变更会计处理方法的D向不同的会计资料使用者提供的财务会计报告编制依据不一致的正确答案:ABCD5、下列各项中,属于制定《会计专业技术人员继续教育规定》的法律依据是()。

A中华人民共和国会计法B中华人民共和国公司法C中华人民共和国证券法D《专业技术人员继续教育规定》正确答案:A6、下列各项中,属于会计专业技术人员继续教育工作管理体制的有()。

A统筹规划B分级负责D分类指导正确答案:ABD7、会计专业技术人员继续教育公需科目内容包括()。

A法律法规B技术信息C会计职业道德D会计法律法规正确答案:AB8、继续教育形式中,参加全国会计专业技术资格考试等会计相关考试,每通过一科考试或被录取的,折算为()学分。

A60B90C30D10正确答案:B9、会计人员的下列行为中,将列入严重失信会计人员列入“黑名单”的有()。

A提供虚假财务会计报告B做假账C挪用公款D贪污正确答案:ABCD10、会计诚信是会计人员工作的重要基础,会计人员()管理是会计人员管理的关键环节,因此有必要制定《指导意见》,统筹规划会计人员诚信建设工作。

第一章导论2.会计可以被看做是包括三个部分:计量、披露和审计。

这种分类的优点和缺点是什么?你能提出其他有效的分类吗?Advantage: Some might argue that measurement, disclosure, and external auditing are three distinct (although related) processes, involving different members of the company. For example, corporate attorneys often are involved in disclosure issues, but seldom intervene in measurement ssues. The Board of Directors works with the external auditors but not necessarily with the comptroller s office. Thus, discussion of accounting requirements and voluntary accounting choices in different jurisdictions is simplified by focusing on the three components of accounting. Disadvantage: measurement, disclosure and auditing are interdependent, and should not be viewed in isolation of one another. A company choosing to disclose as little as possible, for example, may use accounting measurement approaches that reduce the information content of financial statements, and select an external auditor who will be relatively lenient in enforcing accounting requirements. One alternative classification might include accounting (measurement and disclosure), and auditing. A second classification might include financial reporting (annual and interim reporting, regulatory filings) and ad hoc disclosure (press releases, analyst meetings, etc). Any classification is arbitrary, and potentially useful depending on its purpose.优势:一些人可能认为测量,披露和外部审计是三个不同的(虽然相关)流程,涉及公司的不同成员。

Chapter 2Development and ClassificationDiscussion Questions1.a)Sources of finance. Where capital markets/shareholders are the principal source offinance, accounting focuses on profitability, stewardship, and a fair presentation ofresults and financial position. There are high levels of disclosure in publishedfinancial statements. When banks are the principal source of finance, accountingtends to be conservative and disclosures are usually relatively low (banks have directaccess to information). When governments are the principal source of finance,accounting is aimed at the information needs of government agencies such as taxcollection, assembling macroeconomic statistics, or compliance with macroeconomicgoals.b)Legal system. Accounting in code law countries tends to be highly prescriptive,detailed, and procedural, designed to cover every possible circumstance. Accountingstandards are a part of national laws. Accounting in common law countries is moreadaptive and innovative and tends to allow more judgment to suit the circumstance.Accounting standards are set in the private sector.c)Taxation. This tends to parallel the legal system. In common law countries (whereaccounting standards are set by the accounting profession), accounting and taxationare separate. In code law countries (where accounting standards are national laws),accounting and taxation are essentially the same.d)Political and economic ties. Accounting technology and expertise is imported andexported based on the contacts that nations have with each other through commerce,conquest, etc.e)Inflation. Historical cost accounting is the basis for initially recording transactionsaround the world. Inflation puts stress on the historical cost principle. Whereinflation is high, accounting adjusts recorded amounts to reflect price level changes.f)Level of economic development. This factor defines the difficulty and types of theaccounting issues that are faced in a nation. Accounting is complex where businesstransactions are complex (in highly developed economies); it is simpler wheretransactions are simpler (in less developed countries).g)Education levels. This factor defines the limits of accounting sophistication in anation. Accounting cannot get very sophisticated where education levels arerelatively low (unless the country imports accounting training or its citizens are sentelsewhere for it).2.The text lists seven environmental circumstances asserted to have direct effects on accountingdevelopment. We judgmentally rank the list as follows:a.Sources of financeb.Legal systemc.Taxationd.Political and economic tiescation levelsf.Inflationg.Level of economic developmentStudents may wish to alter this ranking and justify their own. It should also be pointed out that the rankings for certain countries may be quite different.Capital markets as a source of finance are driving accounting development today. This phenomenon is the reason why the European Union decided to abandon its own effort at developing European accounting principles and require IFRS for EU listed companies. It is behind the convergence movement described in Chapter 8. The chapter argues that the fair presentation versus legal compliance classification describes accounting today better than the one based on legal system. This argument is consistent with sources of finance as the driver of accounting development today.Level of economic development exerts only a moderate effect. This is because developing economies tend to import accounting technologies (and training) from developed countries. For example, many countries in emerging market economies are adapting sophisticated Western accounting systems in order to enhance their development efforts.3.Culture underlies institutional and other arrangements in a nation that directly affect accountingdevelopment. Individualism, power distance, and uncertainty avoidance are likely to be the most important influences. Individualism, small power distance, and weak uncertainty avoidance tend to be correlated with and found in common law countries with fair presentation accounting. There is a strong accounting profession, accountants rely on professional judgment, and capital markets are the principal source of finance.Collectivism, large power distance, and strong uncertainty avoidance tend to be correlated with and found in code law countries with legal compliance accounting. The profession is relatively weak - accounting is influenced by law, instead. Accounting is more conservative and prescriptive, and banks and governments are the principal sources of finance.4.This question is controversial and there is no consensus of opinion at present. However, as notedin the answer to question 3, culture exerts a second-order effect on accounting. It underlies institutional and other arrangements in a nation that directly affect accounting development. We feel that economic and legal factors are more clearly linked to specific features of accounting, whereas cultural variables are linked to broader generalizations about accounting. Thus, we argue that economic and legal factors explain national differences in accounting practice better than culture.5.Generally speaking, these patterns of accounting development are still valid today, but less sothan in 1967. The descriptions of accounting in the chapter for the respective exemplar countries are broadly true. However, note that the Netherlands is really the only country that can be described by the microeconomic pattern. There are also only a few countries that follow the macroeconomic pattern. The independent discipline approach is not as ad hoc as it was in 1967.Most of these countries (in particular, the United Kingdom and United States) now have conceptual frameworks to guide accounting policy formulation. The uniform accounting approach is less relevant as more and more countries privatize their economies.We expect these patterns to break down in the future as financial reporting converges around International Financial Reporting Standards. As discussed in this chapter, the trend is for fair presentation accounting at the consolidated financial statement level. The macroeconomic and the uniform approaches will persist in certain code law countries at the individual company financial statement level (for example, for tax collection purposes). The microeconomic andindependent discipline approaches have always been fair presentation oriented. So, they will likely disappear due to convergence, as discussed above.6.Conservative measurements and secretive disclosures tend to be correlated. At the same time,less emphasis on conservative measurements and transparent disclosures also tend to be correlated. This is largely to due to the principal source of finance in a country. Banks and governments are concerned about the safety net that conservatism affords; and because they tend to have direct access to information, public disclosure is less important. Capital markets demanda fair presentation of financial position and results of operations along with high levels ofdisclosure7.Classifications are a way of viewing the world. They abstract from complexity and revealfundamental characteristics that members of the group have in common and that distinguish the various groups from each other. Classifications provide the basic structure for understanding what is alike and what is different in accounting around the world. By identifying similarities and differences, our understanding of accounting systems is improved.8.Judgmental classifications rely on knowledge, intuition and experience. Empirically derivedclassifications apply statistical methods to databases of accounting principles and practices around the world. This chapter discusses Mueller’s four approaches in acc ounting development (1967), which is essentially a judgmental classification of accounting. The fair presentation versus legal compliance classification and classifications based on legal systems are also judgmental, though largely supported by empirical data.9.The chapter discusses three major accounting classifications. The first is the one by Mueller(1967):•Macroeconomic approach, where accounting practice is designed to enhancemacroeconomic goals;•Microeconomic approach, where accounting develops from the principles ofmicroeconomics;•Independent discipline approach, where accounting develops from business practices based on judgment and trial-and-error; and•Uniform approach, where accounting is standardized so it can be used as a tool of administrative control by central government.The second classification is the one based on legal systems, which closely parallels the third classification based on practice systems. Generally speaking, the features of common law accounting (legal system) are those described for fair presentation accounting (practice system).The features of code law accounting (legal system) are those described for legal compliance accounting (practice system).Fair presentation (common law) emphasizes substance over form and is oriented toward the decision needs of external investors. Thus, it is capital markets oriented. Financial statements help investors judge managerial performance and predict future cash flows and profitability.Extensive disclosures provide additional relevant information for these purposesLegal compliance (code law) accounting is designed to satisfy government-imposed requirements such as calculating taxable income or complying with the national governmen t’s macroeconomic plan. The income amount may also be the basis for dividends paid to shareholders and bonusespaid to employees. Conservative measurements ensure that prudent amounts are distributed and smooth income brings stable tax, dividend and bonus payouts.As noted above, fair presentation accounting is associated with common law countries, while legal compliance accounting is associated with code law countries. However, many companies from code law countries now follow International Financial Reporting Standards in their consolidated financial statements. IFRS are based on the principles of fair presentation.10.The chapter contends that many accounting distinctions at the national level are becoming blurredbecause of global capital market pressures. An increasing number of companies are listing on multiple stock exchanges. This has pressured accounting policy makers around the world to harmonize (converge) reporting requirements. This has also pressured companies to devise financial reporting practices that satisfy multiple requirements and user groups. At the same time, some code law countries where accounting is aimed at legal compliance have dual reporting.Consolidated financial statements are aimed at fair presentation (IFRS), while individual company financial statements continue to be aimed at legal compliance.11.Our preference for classifying based on fair presentation versus legal compliance over legalsystem follows from the answer to question 10. Many companies from code law countries now prepare two sets of financial statements. Consolidated financial statements follow fair presentation principles, while individual company accounts follow legal compliance principles.Listed companies from the European Union now follow International Financial Reporting Standards in their consolidated financial statements. IFRS are based on fair presentation principles.12.In your authors’ opinion, the prospects for the harmonization of national systems of accounting islow. As the chapter demonstrates, accounting satisfies the information needs of its users and develops in response environmental circumstances. Unless these forces converge, there is little reason to expect accounting to converge. Also, taxation is a fundamental influence on accounting in many countries - it is the reason accounting exists in the first place. Unless governments are willing to relinquish their sovereignty over such matters, national accounting systems cannot be harmonized. At the national level, accounting systems are too entrenched.However, the story is different at the transnational (or international) level for consolidated financial statements. Convergence is occurring here, driven by the globalization of capital markets. Companies now seek capital from around the world and must appeal to the information needs of a worldwide investor group. The type of information these investors seek is similar, regardless of where they reside. This same force drove the European Union requirement for listed companies to comply with International Financial Reporting Standards starting in 2005.This means dual reporting for many companies, especially those from European countries where accounting is legalistic and tax-driven. Local financial statements will be prepared in compliance with local laws and accounting standards, but secondary financial statements will be prepared for the worldwide investor group. Consolidated financial reporting is converging onto fair presentation based on IFRS.Exercises1. a. The dominant factor influencing accounting development in Taiwan is political andeconomic ties, namely those with the United States since the 1950s. In 1949, defeated bythe Communists, Chiang Kai-shek fled to Taiwan and set up a provisional governmentthere. Taiwan soon began receiving substantial U.S. economic aid to prevent the furtherspread of Communism. Taiwan is a dynamic capitalist economy and the United States isthe country’s largest trading partner. Taiwan is an economic power that is a leadingproducer of high-technology goods. Services make up more than two-thirds of GDP.Nevertheless, small, family owned businesses are the basis for the economy. Taiwan hasa credit-based, rather than capital markets-based financial system. Its (Germanic) codelaw legal system dates from the years (1895 – 1945) when Taiwan was a Japanese colony.Given the influence of the United States, it can be expected that taxation will not directlyimpact financial reporting (despite the code law legal system). Additional developmentfactors are a low level of inflation and high education level (literacy rate approaching 100percent).b.Overall, one would expect accounting to resemble U.S. accounting, emphasizing a fairpresentation and full disclosure as opposed to compliance with legal requirements.Accountants can be expected to exercise judgment and not merely follow the rules or thetax laws.c.The above prediction is accurate according to the fifth edition of this textbook (PrenticeHall, 2005) and Ronald Ma, ed., Financial Reporting in the Pacific Asia Region,Singapore: World Scientific Publishing (1997). Accounting in Taiwan is largely basedon U.S. accounting. Accounting standard-setting is a private sector activity, modeled afterthe U.S. Financial Accounting Standards Board.2.Gambia and India (both former British colonies) have common law legal systems, while Belgium,Czech Republic, Mexico, Senegal (former French colony), and Taiwan have code law legal systems. China’s legal system is not derived from code law, but more closely resembles code law than common law. Gambia and India have fair presentation accounting because of the British colonial influence and Senegal has legal compliance accounting because of French colonial influence. As members of the European Union, both Belgium and the Czech Republic require International Financial Reporting Standards (fair presentation) for consolidated financial statements. China is also basing its reporting standards on IFRS. Because of U.S. influence, Mexico and Taiwan have fair presentation accounting.3.For each of the three comparative accounting development patterns to be identified, four U.S.examples are listed. (Students were asked to identify two examples each.)a.The macro-economic pattern1.Accounting for investment tax credits.2.Disclosure of corporate social responsibility activities.3.Selected application of accelerated depreciation methods.4.Disclosure of oil and gas reserves by oil companies.b.The micro-economic pattern1.Mark to market accounting for financial instruments.2.Segmental financial reporting according to FASB Statement No. 131.3.Pension accounting and disclosure of pension liabilities.4.Industry-specific accounting, e.g., for banks, insurance companies, public utilities,railroads.c.The independent discipline approach1.The realization principle.2.Reporting of business income as a residual between realized revenues andrecognized expenses for a given period.3.Classifying assets and liabilities as current and noncurrent on the balance sheet.4.Foreign exchange translation according to FASB Statement No. 52.4.The answer to the question depends on the countries and the companies chosen. In general, onewould expect students to discuss measurement and disclosure issues. Accounting in common law countries is based on fairness and substance over form, whereas in code law countries it stresses legal compliance, including tax laws. Thus, accounting and tax are separate in the former, but the same in the latter. Specific practices where this distinction is most obvious is in accounting for depreciation, leases, pensions, and deferred income taxes. Accounting in code law countries tends to be more conservative and it is common to see discretionary reserves used to smooth income. Of course, these are broad generalizations.Disclosure involves the amount and type. Generally, higher levels are found in common law countries and lower levels are found in code law countries. It is difficult to generalize about disclosure types. Students ought to compare such issues as disclosure of accounting policies, segment information, contingent liabilities, and social and nonfinancial matters.This exercise also lends itself to a group project where one student takes one company and another student takes the other. The length of the answer will vary depending on how in-depth the instructor wants to be.One reason why the similarities and differences may not conform to expectations is due to the type of company chosen. Large multinational corporations, especially from code law countries, often have different reporting than their domestic counterparts. Their disclosure levels are more extensive and they may not use home GAAP. All EU listed companies must now prepare consolidated statements using IFRS. It is useful to compare the two companies chosen on the basis of size, extent of multinational operations, and international listing status. Also note that the Netherlands has always followed “common law” accounting (i.e., fair presentation) even though it is a code law country.5.At the time of writing, the 2005 annual report was the most recent one available. The stockexchanges with the most foreign listed companies were New York (452), London (334), Nasdaq (332), Euronext (293), and Luxembourg (206). The attraction of New York, London, and Nasdaq for foreign companies is that these are the major capital markets in the world. Euronext and Luxembourg attract many European companies.The stock exchanges with the highest proportion of foreign to total listed companies were Luxembourg (84%), Bermuda (66%), Mexico (54%), Swiss (29%), and Euronext (23%). As noted, Luxembourg and Euronext attract many European companies. The Swiss Exchange does as well. Bermuda is known as a financial center with easy laws, which may explain its high proportion. The Mexican Exchange attracts companies from Central and South America.6.Arguably the most serious obstacle to accounting harmonization in the EU is that common andcode law countries are both represented. This determines how standards are set and the basic orientation of accounting. However, differences can be noted in every developmental factor discussed in the chapter, including the cultural dimension. Nevertheless, the economic and political ties among the member countries are a dominant force supporting EU harmonization —the group is committed to economic integration, including a single currency, the euro. EU countries are converging on fair presentation accounting for consolidated financial statements, propelled by market forces such as these.7.For the ten countries joining the EU in 2004 and the two countries joining in 2007, the level ofeconomic development and the fact that they lack developed capital markets (system of finance) is likely to be the most serious obstacles for achieving accounting harmonization with the rest of the EU. Most of these countries are still expanding their market economies from ones that were centrally planned. Accounting expertise is also still being developed.8. a. The individualism scores are: China (20), the Czech Republic (58), France (71),Germany (67), India (48), Japan (46), Mexico (30), the Netherlands (80), the UnitedKingdom (89), and the United States (91).b.Countries with high individualism scores are France, Germany, the Netherlands, UnitedKingdom, and United States. Countries with medium individualism scores are CzechRepublic, India, and Japan. Countries with low individualism scores are China andMexico.c.According to Gray, high individualism is associated with professionalism, flexibility,optimism, and transparency. (Note to instructors: After reading Chapters 3 and 4,students will recognize that these characterize Dutch, U.K. and U.S. accounting, but notFrench and German accounting. [Note also that the Netherlands, U.K., and U.S. have thehighest individualism scores of all 10 countries.]) According to Gray, low individualismis associated with statutory control, uniformity, conservatism, and secrecy. (Note toinstructors: After reading Chapters 3 and 4, students will recognize that only statutorycontrol and (to some extent) secrecy is associated with China, while only secrecy isassociated with Mexico. Gray’s prediction for these two countries is not very good.)Medium individualism scores presumably predict accounting values ‘in the middle’.(Note to instructors: After reading Chapters 3 and 4, students will recognize that theCzech Republic, India, and Japan do not really fall ‘in the middle’ on Gray’s accountingvalues. The Czech Republic and Japan generally reflect the accounting values ofstatutory control, uniformity, conservatism, and secrecy. India is generally associatedwith professionalism, flexibility, optimism, and transparency.)9. a. The uncertainty avoidance scores are: China (30), the Czech Republic (74), France (86),Germany (65), India (40), Japan (92), Mexico (82), the Netherlands (53), the UnitedKingdom (35), and the United States (46).b.Countries with high uncertainty avoidance scores are the Czech Republic, France,Germany, Japan, and Mexico. Countries with medium uncertainty avoidance scores areIndia, the Netherlands, and the United States. Countries with low uncertainty avoidancescores are China and the United Kingdom.c.According to Gray, high uncertainty avoidance is associated with statutory control,uniformity, conservatism, and secrecy. (Note to instructors: After reading Chapters 3 and4, students will recognize that Gray’s prediction describes accounting well for the CzechRepublic, France, and Germany. The prediction describes Japan before the “Big Bang”,but less so now. Except for secrecy, the prediction does not describe accounting valuesin Mexico.) According to Gray, low uncertainty avoidance is associated withprofessionalism, flexibility, optimism, and transparency. (Note to instructors: Afterreading Chapters 3 and 4, students will recognize that these are features of U.K.accounting, but not China.) Medium uncertainty avoidance scores presumably predictaccounting values ‘in the middle’. (Note to instructors: After reading Chapters 3 and 4,students will recognize that India, the Netherlands, and the United States have similaraccounting values to the United Kingdom. Gray’s prediction for these three countries isnot very good.)d.The only consistent prediction between Exercise 8 (individualism) and Exercise 9(uncertainty avoidance) is that for the United Kingdom. Gray’s model linking cultureand accounting is valid for the U.K. The model’s prediction s are exactly opposite forChina, but in neither case does it predict China’s accounting values very well. Based onindividualism, the model does a “good job” predicting the accounting values in theNetherlands, U.K., and U.S., but a “poor or moderate” job predicting accounting valuesin the other seven countries. Based on uncertainty avoidance, the model does a “good job”predicting accounting values in the Czech Republic, France, Germany, Japan, and U.K.,but a “poor or moderate” job prediction accounting in the other five countries. Overall,one would have to conclude that the success of Gray’s model linking culture andaccounting is modest at best.10.The following table summarizes the use of IFRS by domestic listed companies in the 10 countriesidentified, according to the IAS Plus Web site at the time of writing:The five countries of the European Union require their domestic listed companies to use IFRS.This EU requirement is discussed in the chapter. India, Japan, Mexico, and the United States require their domestic listed companies to use national GAAP, not IFRS. The implication is that these four countries believe that their own national standards better reflect financial reporting to various constituencies than do IFRS. (However, Chapter 4 discusses that these four countries are converging their national GAAP with IFRS.) China requires some domestic listed companies to use IFRS. The inference is that IFRS are relevant for some but not all domestic Chinese companies. (Chapter 4 notes that Chinese companies issuing so-called B-shares (shares to foreign investors) must prepare English language financial statements. One might infer that companies with B-shares would also be required to use IFRS. Chapter 4 also discusses that China is converging national GAAP to IFRS.)11.France: With banks and government as the main sources of finance, we can expectconservative and uniform measurements. With code law legal system, the focus is on complying with the law. The link to taxation means that measurements are also tax-oriented. Political and economic ties with the rest of Europe suggest that French accounting may influence and be influenced by other European countries. Low inflation indicates a low likelihood of inflationadjustments. The levels of economic development and education suggest sophisticated accounting.India: With the government and stock market as the main sources of finance, we can expect a mixed (and inconsistent) orientation –uniformity but also fair presentation. The common law legal system and separation between tax and financial accounting indicate fair presentation accounting. The political and economic ties to the U.K. and U.S.A. also suggest fair presentation accounting. (Economic ties to China are probably unimportant in describing Indian accounting.) Low inflation suggests a low likelihood of inflation adjustments. The levels of economic development and education suggest less complex accounting standards and practices.Japan: With banks as the main source of finance, we can expect conservative accounting measurements. With the code law legal system, focus is on complying with the law. The link to taxation means that measurements are also tax-oriented. Political and economic ties to theU.S.A. indicate some U.S. influence on Japanese accounting. (Economic ties to China are probably unimportant in describing Japanese accounting.) Low inflation suggests a low likelihood of inflation adjustments. The levels of economic development and education suggest sophisticated accounting.United Kingdom: With the stock market as the main source of finance, we can expect fair presentation accounting. Fair presentation accounting can also be expected because the U.K.has common law, and taxation and accounting are separate (i.e., not linked). Political and economic ties to the U.S.A. and Europe suggest accounting influence is felt to and from both areas. Low inflation indicates a low likelihood of inflation adjustments. The levels of economic development and education suggest sophisticated accounting.United States: With the stock market as the main source of finance, we can expect fair presentation accounting. Fair presentation accounting can also be expected because the U.S.A.has common law, and taxation and accounting are separate (i.e., not linked). Political and economic ties to the Canada and Mexico most likely mean that these two countries are influenced by the U.S.A., rather than the other way around. Low inflation indicates a low likelihood of inflation adjustments. The levels of economic development and education suggest sophisticated accounting.12.The irreversible globalization of capital markets and increasing trend of multiple stock exchangelistings is causing more and more companies to adopt fair presentation accounting for their worldwide audience. The chapter notes how accounting distinctions are becoming blurred.Chapter 3 also notes how Germany and Chapter 4 shows how Japan have established standard setting organizations for the purpose of adopting reporting standards for consolidated financial statements that are in line with International Financial Reporting Standards. Standard setters in the United States, Canada, Australia, and many other countries are committed to converging their financial reporting with IFRS. Finally, the European Union now requires EU-listed companies to follow IFRS in their consolidated financial statements from 2005 on.Thus, we believe that the two-way split proposed in the chapter (fair presentation versus legal compliance) will be even more significant than it is now. Countries already oriented toward fair presentation (such as Australia, Canada, the Netherlands, United Kingdom, United States) will converge around International Financial Reporting Standards. Regardless of the home country of the company concerned, consolidated financial statements will be prepared on a fair presentation/full disclosure basis, as can be seen in the EU 2005 requirement. Countries that。

第5章国际会计协调化■教学目的与要求一、教学目的通过本章和第6章的学习,既要求学生能深刻领会国际会计协调化的含义和当前的强劲趋势,也要求学生了解各种国际性政府间机构(如联合国会计和报告国际准则政府间专家工作组、经济合作与发展组织常设会计准则工作组)、区域性国家联盟(如欧洲联盟)、官方机构国际组织(如证券委员会国际组织)以及民间国际组织(特别是会计职业界的国际组织,如国际会计师联合会和国际会计准则委员会以及区域性会计师联合会)对国际会计协调化所作的努力和成果。

本章介绍除国际会计准则委员会(将在第6章介绍)以外的各主要国际组织的作用和成果。

二、学习要求1.深刻理解国际会计协调化的含义。

2.了解推动国际会计协调化的6个主要国际组织的性质。

3.在推动国际会计协调化的其他国际组织中,关注欧洲会计师联合会和亚太会计师联合会。

4.了解有助于国际会计协调化的其他国际组织。

5.理解联合国会计和报告国际准则政府间专家工作组现今的作用只是推动国际会计协调化的权威性国际论坛。

6.着重理解欧洲联盟是推动国际会计协调化最具成效的区域性国家联盟。

7.了解经济合作与发展组织国际投资和跨国企业委员会及其常设会计准则工作组的活动。

8.了解证券交易委员会国际组织(IOSCO)作为官方机构的国际组织在国际协调中的重要作用。

9.着重理解国际会计师联合会的活动及国际审计准则。

■教学要点、重点与难点一、教学要点(一)国际会计协调化的含义较深入的阐明:1.对国际会计协调化(即会计的国际协调化),至今尚无公认的严谨的定义。

综合各家之说(参见教本),可以把国际会计协调化理解为:(1)国际会计协调化是一个限制和缩小会计差异,形成一套可接受的准则(标准)和惯例的过程;(2)其目的在于促进各国(和地区)的会计实务和财务信息的可比性;(3)国际会计协调化的意图在于归纳不同的会计制度,把多样化的实务组合成能产生共同协作结果的有序结构。

2.国际会计协调化的作用在于:(1)有助于进行国际商贸和经济合作活动;(2)促进了外国企业在国际货币市场融资(特别是在国际资本市场发行证券)时需提供的财务报表的可比性;(3)有利于跨国投资,便于跨国公司合并其分布在世界各地的子公司的财务报表。

国际会计课后作业⼆(附答案)Exercises: Foreign Currency Accounting 姓名:班级:学号:成绩:A.Answer the questions below1.Fluctuating exchange rates cause several major issues in accounting for foreign currency translation, what are they?( or the primary problem about foreign currency translation are ?)The Answer:(1)Which exchange rate should be used to translate foreign currency balancesto domestic currency?(2)Which foreign currency assets and liabilities are exposed to exchange ratechanges?(3)How should translation gains and losses be accounted for?B. Explain to the Conceptsdirect quoteThe exchange rate specifies the number of domestic currency unitsneeded to acquire a unit of foreign currency.indirect quoteThe exchange rate specifies the price of a unit of the domesticcurrency in terms of the foreign currency.current rateThe exchange rate in effect at the relevant financial statement date.functional currencyThe primary currency in which an entity does business and generates and spends cash. It is usually the currency of the country where the entity is located and the currency in which the books of record are maintainedhistorical rateThe foreign exchange rate that prevailed when a foreign currency asset or liability was first acquired or incurred.monetary itemsObligations to pay or rights to receive a fixed number of currency units in the future.settlement dateThe date on which a payable is paid or a receivable is collected.C. Drills of Business Transaction1.XYZ is a U.S. company, its foreign exchange business as below:On Dec. 1, 2008 ,XYZ company purchases a quantity of merchandise , on that day the exchange rate is UK£0.6169=US$1 .Assume the transaction costs is UK£81050,payment period is 60 days.Assume the following exchange rates :December 31,2008 UK£0.6150=US$1January 31,2009 UK£0.6159=US$1Required:Prepared double entries under Two-transaction Perspective when transaction ,statement and transaction settlement date.1. On Dec. 1, 2008. Transaction DateDr. Merchandise Inventory $131382.72Cr. Accounts Payable $131382.72£81050÷0.61692. On Dec. 31,2008. Statement DateDr. Foreign Exchange Loss $405.9Cr. Accounts Payable $405.9£81050÷(0.6150-0.6169)3. On Jan. 31,2009. Settlement Date(1)Dr. Accounts Payable $192.58Cr. Foreign Exchange Gain $192.58£81050÷(0.6159-0.6150)(2)Dr. Accounts Payable $131596.04Cr. Cash $131596.042.Assume that a U.S. firm imports (exports) equipment from Germany on March 1 for €200,000 when the exchange rate is $1.3112 per euro. Payment in euro does not have to be made until April 30. Assume that on March 31, the exchange rate is $1.3500 per euro and on April 30 is $1.3300 .Required:(1)Give the journal entries under the two-transaction perspective to the U.S. firm.(2)Give the journal entries under the single-transaction perspective to the U.S.firm.Under the single-transaction perspectivea. When the firm as an importer.1. On March 1. Transaction DateDr. Equipment $262,240Cr. Accounts Payable $262,240£200,000x1.31122. On March 31. Statement DateDr. Equipment $7,760Cr. Accounts Payable $7,760£200,000 x (1.3500-1.3112)3. On April 31. Settlement Date(1)Dr. Accounts Payable $4,000Cr. Equipment $4,000 £200,000 x (1.3300-1.3500)(2)Dr. Accounts Payable $266,000Cr. Cash $266,000 Under the two-transaction perspectivea. When the firm as an importer.1. On March 1. Transaction DateDr. Equipment $262,240Cr. Accounts Payable $262,240 £200,000x1.31122. On March 31. Statement DateDr. Foreign Exchange Loss $7,760Cr. Accounts Payable $7,760 £200,000 x (1.3500-1.3112)3. On April 31. Settlement Date(1)Dr. Accounts Payable $4,000Cr. Foreign Exchange Gain $4,000 £200,000 x (1.3300-1.3500) (2)Dr. Accounts Payable $266,000Cr. Cash $266,000 Under the single-transaction perspectivea. When the firm as an exporter.1. On March 1. Transaction DateDr. Accounts Receivable $262,240Cr. Sales $262,240 £200,000x1.31122. On March 31. Statement DateDr. Accounts Receivable $7,760Cr. Sales $7,760 £200,000 x (1.3500-1.3112)3. On April 31. Settlement Date(1)Dr. Sales $4,000Cr. Accounts Receivable $4,000 £200,000 x (1.3300-1.3500) (2)Dr. Cash $266,000Cr. Accounts Receivable $266,000Under the two-transaction perspectivea. When the firm as an exporter.1. On March 1. Transaction DateDr. Accounts Receivable $262,240Cr. Sales $262,240£200,000x1.31122. On March 31. Statement DateDr. Accounts Receivable $7,760Cr. Foreign Exchange Gain $7,760£200,000 x (1.3500-1.3112)3. On April 31. Settlement Date(1)Dr. Foreign Exchange Loss $4,000Cr. Accounts Receivable $4,000£200,000 x (1.3300-1.3500)(2)Dr. Cash $266,000Cr. Accounts Receivable $266,0003. On January 1, assume that a U.S. firm borrows 5 million Swiss francs (CHF) for three years at 6 percent interest paid semiannually in Swiss francs .The principal does not have to be repaid until the end of loan. Assume also that the loan is adjusted for any exchange rate change every six months. Assume the following exchange rates for the first year:January 1 $0.8000June 30 $0.7900December 31 $0.8800The average exchange rate for the first six months was $.7960 and for the next six months was $.8500.Required:Please prepare the journal entries for the first year.On January 1Cash $ 4,000,000Loan payble $ 4,000,000CHF 5,000,000 x0.80000On June 30(1) Loan Payable $50,000Foreign Exchange Gain $50,000CHF 5,000,000 x(0.80000-0.7900)(2)Interest Expense $119,400Foreign Exchange Gain $900Cash $118,500Interest Expense:CHF 5,000,000 x. (0.06/2) x0.7960 = CHF 150,000x..7960 =$119,400Interest Paid:CHF 5,000,000 x. (0.06/2) x0.7900 = CHF 150,000x..7900=$118,500On December 31(1) Foreign Exchange Gain $450,000Loan Payable $450,000CHF 5,000,000 x(0.8800-0.7900)(2)Interest Expense $127,500Foreign Exchange Loss $4,500Cash $132,000Interest Expense:CHF 5,000,000 x. (0.06/2) x0.8500. = CHF 150,000x0.8500 =$127,500Interest Paid:CHF 5,000,000 x. (0.06/2) x0.8800 = CHF 150,000x..8800=$132,0004.Suppose X company is a subsidiary of a Chinese company located in anothercountry.The FC is functional currency .The balance sheet,income statement and related exchange rate listed below: Required: Use the current and temporal method to translate the balance sheet and income statement which expressed at FC into Chinese RMB yuan .Financial Statements of X Subsidiary CompanyBalance Sheet 12/31/2007 12/31/2008 Cash FC 500 Account receivable 1 500 Inventories(market) 1 000 3 000 Fixed assets 8 000 Accumulated depreciation (1 000) Long-term notes receivable 3 000 Total assets FC 15 000 Account payable FC 2 000 Short-term debt 1 000 Long-term liabilities 3 000 Stock capital8 000 Retained earnings 1 000 Total liabilities and owner’s equity FC 15 000Income Statement Year ended 12/31/2008 Sales FC20 000 Cost of sales FC12 000Depreciation 1 000Administrative expenses 3 000Income before tax FC 4 000 Income tax 1 500 Net income FC 2 500 Retained earnings(31/12/2007) 3 500 Total FC 6 000 Dividend distribution 3 000 Retained earnings(31/12/2008)FC 3 000 Suppose Exchange rates and related data for calendar 2008 were as follows1) December 31,2008FC1RMB¥0.502) Average during 2008 FC1RMB¥0.443) Average during 4th quarter ,2008 FC1RMB¥0.424)On stock offering date FC1RMB¥0.455)On dividend distribution date FC1RMB¥0.466)On the date acquisition of fixed assets FC1RMB¥0.437) On the date long-term notes receivable occurred FC1RMB¥0.448)On the date long-term debt occurred FC1RMB¥0.489)December 31,2007 inventory cost FC1000,FC1RMB¥0.40(C)FC1RMB ¥0.41(H)10) retained earnings on December 31,2007 is RMB ¥1400(under current method)11) retained earnings on December 31,2007 is RMB ¥1500(under temporal method)12) Suppose purchases cost of inventory in 2008 is FC14000.Required: Use the current rate method and temporal method to translate the balance sheet and income statement which expressed at FC into Chinese RMB yuan.1. CURRENT METHOD:X 公司收益及留存收益表X公司资产负债表①来源于本年折算后的收益与留存收益表.②7500-(1000+500+1500+3600+1120)=-220 TEMPORAL METHOD:X 公司资产负债表X 公司收益及留存收益表②来源于本年折算后的资产负债表③根据:销货成本=期初存货成本+本期购货成本-期末存货成本= FC1000 x0.40+ FC14000 x0.44- FC3000 x0.50=¥5,060 ④折算损益=¥8800-5060-430-1320-950=¥1040。

第1章国际会计的形成与发展一、讨论题为什么说市场国际化,特别是货币市场和资本市场的国际化是会计国际化的主要推动力国际贸易和国际经济技术合作,促使会计成为一种国际商业语言。

特别是国际货币市场和资本市场的兴起向进入市场的贷款人或筹资者提出了应提供在国际间可比且可靠的财务信息的要求(即国际财务报告趋同化的要求),更成为会计国际化的主要推动力。

跨国公司是否在百分之百地推动会计国际化说明你的观点。

不是。

跨国公司对推动会计国际化有其两面性:一方面,基于其跨国经营和国际筹资的需要,他们希望通过会计国际化来缩小和协调国别差异;另一方面,他们又十分重视利用各国现存的会计差异来谋取财务利益。

后者也推动了各国会计模式和重要会计方法的国际比较研究。

(注意:“会计国际化”大体上与“会计的国际协调化”概念一致,而与国际会计研究中的“国别会计”观点对立)会计随商业活动的扩展而传播,你同意这种说法吗从历史发展的进程谈谈你的看法。

同意。

可主要就前殖民帝国的会计向其原殖民地传播、工业革命后西方会计的发展及在世界范围内的广泛传播以及第二次世界大战以后美国会计的影响在一定程度上主宰着世界各地的会计发展等历史事实,加以讨论。

哪些特定会计方法具有国际性质把外币交易和外币报表的折算引入会计领域,是会计国际化带来的独特问题。

它与由此引发的跨国企业合并和国际合并财务报表与外币折算相互关联和制约的问题,以及各国的物价变动影响在国际合并财务报表中如何处理和调整的问题,从20世纪70年代以来,就成为国际会计研究中既需协调一致但又矛盾重重的“三大难题”。

在世纪之交,金融工具(特别是衍生工具)的创新引发的会计处理问题,给传统的会计概念和实务带来了巨大的冲击,成为各国会计准则机构联合攻关、仍未妥善解决的难题。

此外,国际税务会计也是值得关注的课题。

你对会计国际化和国家化之间的矛盾及其消长有何看法会计国际化和国家化的矛盾实际上反映了经济全球化与各国的国家利益之间的矛盾及其消长过程。

国际会计学课后答案【篇一:国际会计第七版英文版课后答案(第六章)】foreign currency translationdiscussion questions solutions1. foreign currency translation is the process of restating a foreign account balance from one currency to another. foreign currency conversion is the process of physically exchanging one currency for another.2. in the foreign exchange spot market, currencies bought and sold must be delivered immediately,normally within 2 business days. thus a singaporean tourist buying u.s. dollars at the airportbefore boarding a plane for new york would hand over singapore dollars and immediatelyreceive the equivalent amount in u.s. dollars. the forward market handles agreements toexchange a fixed amount of one currency for another on an agreed date in the future. forexample, a french manufacturer exporting goods invoiced in euros to a japanese importer on 60- day credit terms would buy a forward contract to sell yen for euros 2 months in the future.transactions in the swap market involve the simultaneous purchase (or sale) of one currency inthe spot market and the sale (or purchase) of the same currency in the forward market. thus, acanadian investor wishing to take advantage of higher interest rates on 6-month treasury bills inthe united states would buy u.s. dollars with canadian dollars in the spot market and invest inthe united states. to guard against a fall in the value of the u.s. dollar before maturity (whenthe u.s. dollar proceeds are converted back to canadian dollars), the canadian investor wouldsimultaneously enter into a forward contract to sell u.s. dollars for canadian dollars 6 months inthe future at today s forward exchange rate.3. the question refers to alternative exchange rates that are used to translate foreign financialstatements. the current rate is the exchange rate at the financial statement date. it issometimes called the year-end or closing rate. the historical rate is the exchange rate at the timeof the underlying transaction. the average rate is the average of various exchange rates during afiscal period. since the average ratenormally is used to translate income statement items, it isoften weighted to reflect any seasonal changes in the volume of transactions during the period.translation gains and losses do not occur if exchange rates do not change. however, ifexchange rates change, the use of current and average rates causes translation gains and losses.these do not occur when the historical rate is used because the same (constant) rate is used eachperiod.4. in this example, the mexican affiliate s canadian dollar loan is denominated in canadian dollars.however, because the mexican affiliate’s functional currency is u.s. dollars, the peso equivalentof the canadian dollar borrowing would be remeasured in u.s. dollars prior to consolidation. ifthe mexican affiliate’s functional currency were the peso, the canadian dollar loan would beremeasured in pesos before being translated to u.s. dollars.5. a transaction gain or loss occurs when a foreign currency transaction, e.g., a foreign currencyborrowing, is settled at a different exchange rate than that which prevailed when the transactionwas originally incurred. in this case there is an exchange of one currency for another. atranslation gain or loss, on the other hand, is simply the result of a restatement process. there isno physical exchange of currencies involved.6. it is not possible to combine, add, or subtract accounting measurements expressed in differentcurrencies; thus, it is necessary to translate those accounts that are measured or denominated in aforeign currency into a single reporting currency. foreign currency translation can involverestatement or remeasurement. in restatement, the local (functional) currency is kept as the unitof measure; that is, the translation process multiplies the financial results and relationships in thelocal currency accounts by a constant, the current rate. in contrast, remeasurement translateslocal currency results as if the underlying transactions had taken place in the reporting(functional) currency of the parent company; for example, it changes the unit of measure of aforeign subsidiary from its local (foreign) currency to the u.s. dollar.7. major advantages and limitations of each of the major translation methods follow.current rate methodadvantages:a. retains the initial relationships in the foreign currency statements.b. simple to apply.limitations:a. violates the basic purpose of consolidation, which is to present the results of a parent and its subsidiaries as if they were a single entity.b. inconsistent with historical cost.c. presumes that all local assets and liabilities are subject to exchange risk.d. while stockholders equity adjustments shield an mnc s bottom line from translation gains and losses, such adjustments could distort certain financial ratios and be confusing.current-noncurrent methodadvantages:a. distortions in translated gross margins are reduced as inventories and translated at the current rate.b. reported earnings are shielded from the distorting effects of currency fluctuations as excess translation gains are deferred and used to offset future translation losses.limitations:a. uses balance sheet classification as basis for translation.b. assumes all current assets are exposed to exchange risk regardless of their form.c. assumes long-term debt is sheltered from exchange rate risk.monetary-nonmonetary methodadvantages:a. reflects changes in domestic currency equivalent of long-term debt on a timely basis.limitations:a. assumes that only monetary assets and liabilities are subject to exchange rate risk.b. exchange rate changes distort profit margins as sales transacted at current prices are matched against cost of sales measured at historical prices.c. uses balance sheet classification as basis for translation.d. nonmonetary items stated at current market values are translated at historical rates.temporal methodadvantages:a. theoretically valid: compatible with any accounting measurement method.b. has the effect of translating foreign subsidiaries operations as if they were originally transacted in the home currency, which is desirable for foreign operations that are extensions of the parent’s activities. limitation:a. a company increases its earnings volatility by recognizing translation gains and losses currently. in arguing for one translation method over another, your students should eventually realize that, in the present state of the art, there is probably no one translation method that is appropriate for all circumstances in which translations occur and for all purposes thattranslation serves. it is probably more fruitful to have students identify circumstances in which they think one translation method is more appropriate than another.8. the current rate method is appropriate when the foreign entity being consolidated is largely independent of the parent company. conditions which would justify this methodology is when the foreign affiliate tends to generate and expend cash flows in the local currency, sells a product locally so that its selling price is largely insulated from exchange rate changes, incurs expenses locally, finances its self locally and does not have very many transactions with the parentcompany. in contrast, the temporal method seems appropriate in those instances when theforeign affiliate’s operatio ns are integrally related to the parent company. conditions which would justify use of the temporal method are when the foreign affiliate transacts business in the parent currency and remits such cash flows to the parent company, sells a product largely in the parent country and whose selling price is sensitive to exchange rate changes,sources its factor inputs from the parent company, receives most of its financing from the parent and has a large two way flow of transactions with it.9. the history of foreign currency translation in the united states suggests that the development of accounting principles does not depend on theoretical considerations so much as on political, institutional, and economic influences that affect accounting standard setting. it may be morerealistic to recognize that theoretically sound solutions are impossible as long as policyprescriptions are evaluated on practical grounds. without specific choice criteria derived frominvestor decision models, it is fruitless to argue the conceptual merits of competing accountingtreatments. it is far more productive to admit that foreign currency translation choices are simplyarbitrary.readers of consolidated financial statements should know that the foreign currency translationmethod used is one of several alternatives, and this should be disclosed. this approach is moreopen and reduces the chance that readers will draw misleading inferences.10. foreign inflation, in particular, the differential rate of inflation between the country in which a subsidiary is located and the country of its parent determines foreign exchange rates.these rates, in turn, are used to translate foreign currency balances to parent currency.11. in the united kingdom, financial statements of affiliates domiciled in hyperinflationaryenvironments must first be adjusted to current price levels and then translated using the current rate; in the united states, the temporal method would be employed. the second part of this question is designed to get students from abroad to find out what companies in their homecountries are doing and thereby be in a position to share their new found knowledge with their classmates. they need simply get on the internet and read the footnotes of a major multinational company in their home country.12. under fas no. 52, the parent currency is designated as the functional currency for an affiliate, whose operations are considered to be an integral part of the parent company’s operations.accordingly, anything that affects consolidated earnings, including foreign currency translationgains and losses, is relevant to parent company shareholders and is included in reported earnings.in contrast, when a foreign affiliate s operations are independent of the parent s, the localcurrency is designated as its functional currency. since the focus is on the affiliate s localperformance, translation gains and losses that arise solely from consolidation are irrelevant and,therefore, are not included in consolidated income.exercises solutions1. ¥250,000,000 x .008557 = $2,139,250.the difference is due to rounding.。

2023会计继续教育课后测验试题答案(二)选择题:1.2023年12月1日国家发展改革委联合人民银行、财政部等()个部委联合签订《有关对会计领域违法失信有关责任主体实行联合惩戒旳合作备忘录》。

A22B5C10D12对旳答案: A2.下列属于联合惩戒措施旳有()。

A罚款、限制从事会计工作、追究刑事责任等惩戒措施B记入会计从业人员信用档案C通过财政部网站、“信用中国”网站及其他重要新闻网站向社会公布D实行行业惩戒对旳答案: ABCD3.法定代表人, 应当是具有完全民事行为能力旳中国公民, 且为该单位重要行政负责人, 年龄一般不超过()周岁, 无不良信用记录。

A70B65C60D504.下列行为可以对单位并处三千元以上五万元如下旳罚款;对其直接负责旳主管人员和其他直接负责人员, 可以处二千元以上二万元如下旳罚款;属于国家工作人员旳, 还应当由其所在单位或者有关单位依法予以行政处分旳有()。

A不依法设置会计账簿旳B私设会计账簿旳C随意变更会计处理措施旳D向不一样旳会计资料使用者提供旳财务会计汇报编制根据不一致旳对旳答案: ABCD5.下列各项中, 属于制定《会计专业技术人员继续教育规定》旳法律根据是()。

A中华人民共和国会计法B中华人民共和国企业法C中华人民共和国证券法D《专业技术人员继续教育规定》对旳答案: A6.下列各项中, 属于会计专业技术人员继续教育工作管理体制旳有()。

A统筹规划B分级负责C互相监督D分类指导对旳答案: ABD7、会计专业技术人员继续教育公需科目内容包括()。

C会计职业道德D会计法律法规对旳答案: AB8、继续教育形式中, 参与全国会计专业技术资格考试等会计有关考试, 每通过一科考试或被录取旳, 折算为()学分。

A60B90C30D10对旳答案: B9、会计人员旳下列行为中, 将列入严重失信会计人员列入“黑名单”旳有()。

A提供虚假财务会计汇报B做假账C挪用公款D贪污对旳答案: ABCD10、会计诚信是会计人员工作旳重要基础, 会计人员()管理是会计人员管理旳关键环节, 因此有必要制定《指导意见》, 统筹规划会计人员诚信建设工作。

IASC是由来自澳大利亚、加拿大、法国、德国、日本、墨西哥、荷兰、英国和爱尔兰以及美国的会计职业团体于1973年发起成立的,其目标是制定和发布国际会计准则,促进国际会计的协调。

从1983年起,作为国际会计师联合会(IFAC)成员的所有会计职业团体均已成为IASC的成员。

中国于1998年5月正式加入IASC和国际会计师联合会。

到2000年,IASC已经拥有来自104个国家的143个成员。

1ASC的目标是,制定和发布国际会计准则,促进国际会计的协调。

截至2000年底,IASC已颁布41项国际会计准则(其中仍然有效的有36项)和24项解释公告。

国际会计准则委员会(IASC)承诺制定的核心准则(core standard)于2000年5月经证券委员会国际组织(I0SC0)认可并向各国资本市场推荐在跨境融资使用后,IASC的声誉空前提高,不仅伦敦证券交易所公开采用国际会计准则(IAS),欧盟还公告至2005年全体企业实施IAS.但是,美国SEC发表声明认为IAS 不是质量最好的准则,言下之意,美国是经济最发达的国家,因而美国FASB的准则是质量最高的。

在此情况下,IASC理事会(IASC Board)于1999年12月决议采纳战略工作组(Strategy Working Party)的未来规划建议,同意重组并投票选出7人组成的托管会提名委员会(Nominating Committee),提名委员会主席为时任美国SEC主席Arthur Levitt.提名委员会在2000年1月7日召开了第一次会议,决定设立由19人组成的托管会(Trustees),其主要职责是筹集资金、任命人员和日常监督。

2000年5月22日宣布选出的托管会成员,其主席为美国联邦储备局前主席Paul A.Volcker.2000年5月24日,IASC成员组织通过了重组决定和新章程(Constitution)。

2000年6月28日托管会任命英国ASB主席David Tweedie为重组后IASC 理事会(IASB)主席,于2001年1月1日起任职。

2019会计继续教育课后测验试题答案(二)选择题:1、2018年12月1日国家发展改革委联合人民银行、财政部等()个部委联合签署《关于对会计领域违法失信相关责任主体实施联合惩戒的合作备忘录》。

A22B5C10D12正确答案:A2、下列属于联合惩戒措施的有()。

A罚款、限制从事会计工作、追究刑事责任等惩戒措施B记入会计从业人员信用档案C通过财政部网站、“信用中国”网站及其他主要新闻网站向社会公布D实施行业惩戒正确答案:ABCD3、法定代表人,应当是具有完全民事行为能力的中国公民,且为该单位主要行政负责人,年龄一般不超过()周岁,无不良信用记录。

A70B65C60D50正确答案:A4、下列行为可以对单位并处三千元以上五万元以下的罚款;对其直接负责的主管人员和其他直接责任人员,可以处二千元以上二万元以下的罚款;属于国家工作人员的,还应当由其所在单位或者有关单位依法给予行政处分的有()。

A不依法设置会计账簿的B私设会计账簿的C随意变更会计处理方法的D向不同的会计资料使用者提供的财务会计报告编制依据不一致的正确答案:ABCD5、下列各项中,属于制定《会计专业技术人员继续教育规定》的法律依据是()。

A中华人民共和国会计法B中华人民共和国公司法C中华人民共和国证券法D《专业技术人员继续教育规定》正确答案:A6、下列各项中,属于会计专业技术人员继续教育工作管理体制的有()。

A统筹规划B分级负责D分类指导正确答案:ABD7、会计专业技术人员继续教育公需科目内容包括()。

A法律法规B技术信息C会计职业道德D会计法律法规正确答案:AB8、继续教育形式中,参加全国会计专业技术资格考试等会计相关考试,每通过一科考试或被录取的,折算为()学分。

A60B90C30D10正确答案:B9、会计人员的下列行为中,将列入严重失信会计人员列入“黑名单”的有()。

A提供虚假财务会计报告B做假账C挪用公款D贪污正确答案:ABCD10、会计诚信是会计人员工作的重要基础,会计人员()管理是会计人员管理的关键环节,因此有必要制定《指导意见》,统筹规划会计人员诚信建设工作。

Exercises: Foreign Currency Accounting 姓名:班级:学号:成绩:A.Answer the questions below1.Fluctuating exchange rates cause several major issues in accounting for foreign currency translation, what are they?( or the primary problem about foreign currency translation are ?)The Answer:(1)Which exchange rate should be used to translate foreign currency balancesto domestic currency?(2)Which foreign currency assets and liabilities are exposed to exchange ratechanges?(3)How should translation gains and losses be accounted for?B. Explain to the Conceptsdirect quoteThe exchange rate specifies the number of domestic currency unitsneeded to acquire a unit of foreign currency.indirect quoteThe exchange rate specifies the price of a unit of the domesticcurrency in terms of the foreign currency.current rateThe exchange rate in effect at the relevant financial statement date.functional currencyThe primary currency in which an entity does business and generates and spends cash. It is usually the currency of the country where the entity is located and the currency in which the books of record are maintainedhistorical rateThe foreign exchange rate that prevailed when a foreign currency asset or liability was first acquired or incurred.monetary itemsObligations to pay or rights to receive a fixed number of currency units in the future.settlement dateThe date on which a payable is paid or a receivable is collected.C. Drills of Business Transaction1.XYZ is a U.S. company, its foreign exchange business as below:On Dec. 1, 2008 ,XYZ company purchases a quantity of merchandise , on that day the exchange rate is UK£0.6169=US$1 .Assume the transaction costs is UK£81050,payment period is 60 days.Assume the following exchange rates :December 31,2008 UK£0.6150=US$1January 31,2009 UK£0.6159=US$1Required:Prepared double entries under Two-transaction Perspective when transaction ,statement and transaction settlement date.1. On Dec. 1, 2008. Transaction DateDr. Merchandise Inventory $131382.72Cr. Accounts Payable $131382.72£81050÷0.61692. On Dec. 31,2008. Statement DateDr. Foreign Exchange Loss $405.9Cr. Accounts Payable $405.9£81050÷(0.6150-0.6169)3. On Jan. 31,2009. Settlement Date(1)Dr. Accounts Payable $192.58Cr. Foreign Exchange Gain $192.58£81050÷(0.6159-0.6150)(2)Dr. Accounts Payable $131596.04Cr. Cash $131596.042.Assume that a U.S. firm imports (exports) equipment from Germany on March 1 for €200,000 when the exchange rate is $1.3112 per euro. Payment in euro does not have to be made until April 30. Assume that on March 31, the exchange rate is $1.3500 per euro and on April 30 is $1.3300 .Required:(1)Give the journal entries under the two-transaction perspective to the U.S. firm.(2)Give the journal entries under the single-transaction perspective to the U.S.firm.Under the single-transaction perspectivea. When the firm as an importer.1. On March 1. Transaction DateDr. Equipment $262,240Cr. Accounts Payable $262,240£200,000x1.31122. On March 31. Statement DateDr. Equipment $7,760Cr. Accounts Payable $7,760£200,000 x (1.3500-1.3112)3. On April 31. Settlement Date(1)Dr. Accounts Payable $4,000Cr. Equipment $4,000 £200,000 x (1.3300-1.3500)(2)Dr. Accounts Payable $266,000Cr. Cash $266,000 Under the two-transaction perspectivea. When the firm as an importer.1. On March 1. Transaction DateDr. Equipment $262,240Cr. Accounts Payable $262,240 £200,000x1.31122. On March 31. Statement DateDr. Foreign Exchange Loss $7,760Cr. Accounts Payable $7,760 £200,000 x (1.3500-1.3112)3. On April 31. Settlement Date(1)Dr. Accounts Payable $4,000Cr. Foreign Exchange Gain $4,000 £200,000 x (1.3300-1.3500)(2)Dr. Accounts Payable $266,000Cr. Cash $266,000 Under the single-transaction perspectivea. When the firm as an exporter.1. On March 1. Transaction DateDr. Accounts Receivable $262,240Cr. Sales $262,240 £200,000x1.31122. On March 31. Statement DateDr. Accounts Receivable $7,760Cr. Sales $7,760 £200,000 x (1.3500-1.3112)3. On April 31. Settlement Date(1)Dr. Sales $4,000Cr. Accounts Receivable $4,000 £200,000 x (1.3300-1.3500)(2)Dr. Cash $266,000Cr. Accounts Receivable $266,000Under the two-transaction perspectivea. When the firm as an exporter.1. On March 1. Transaction DateDr. Accounts Receivable $262,240Cr. Sales $262,240£200,000x1.31122. On March 31. Statement DateDr. Accounts Receivable $7,760Cr. Foreign Exchange Gain $7,760£200,000 x (1.3500-1.3112)3. On April 31. Settlement Date(1)Dr. Foreign Exchange Loss $4,000Cr. Accounts Receivable $4,000£200,000 x (1.3300-1.3500)(2)Dr. Cash $266,000Cr. Accounts Receivable $266,0003. On January 1, assume that a U.S. firm borrows 5 million Swiss francs (CHF) for three years at 6 percent interest paid semiannually in Swiss francs .The principal does not have to be repaid until the end of loan. Assume also that the loan is adjusted for any exchange rate change every six months. Assume the following exchange rates for the first year:January 1 $0.8000June 30 $0.7900December 31 $0.8800The average exchange rate for the first six months was $.7960 and for the next six months was $.8500.Required:Please prepare the journal entries for the first year.On January 1Cash $ 4,000,000Loan payble $ 4,000,000CHF 5,000,000 x0.80000On June 30(1) Loan Payable $50,000Foreign Exchange Gain $50,000CHF 5,000,000 x(0.80000-0.7900)(2)Interest Expense $119,400Foreign Exchange Gain $900Cash $118,500Interest Expense:CHF 5,000,000 x. (0.06/2) x0.7960 = CHF 150,000x..7960 =$119,400Interest Paid:CHF 5,000,000 x. (0.06/2) x0.7900 = CHF 150,000x..7900=$118,500On December 31(1) Foreign Exchange Gain $450,000Loan Payable $450,000CHF 5,000,000 x(0.8800-0.7900)(2)Interest Expense $127,500Foreign Exchange Loss $4,500Cash $132,000Interest Expense:CHF 5,000,000 x. (0.06/2) x0.8500. = CHF 150,000x0.8500 =$127,500Interest Paid:CHF 5,000,000 x. (0.06/2) x0.8800 = CHF 150,000x..8800=$132,0004.Suppose X company is a subsidiary of a Chinese company located in anothercountry.The FC is functional currency .The balance sheet,income statement and related exchange rate listed below:Required: Use the current and temporal method to translate the balance sheet and income statement which expressed at FC into Chinese RMB yuan .Financial Statements of X Subsidiary CompanyBalance Sheet 12/31/2007 12/31/2008 Cash FC 500 Account receivable 1 500 Inventories(market) 1 000 3 000 Fixed assets 8 000 Accumulated depreciation (1 000) Long-term notes receivable 3 000 Total assets FC 15 000 Account payable FC 2 000 Short-term debt 1 000 Long-term liabilities 3 000 Stock capital8 000 Retained earnings 1 000 Total liabilities and owner’s equity FC 15 000Income Statement Year ended 12/31/2008 Sales FC20 000 Cost of sales FC12 000Depreciation 1 000Administrative expenses 3 000Income before tax FC 4 000 Income tax 1 500 Net income FC 2 500 Retained earnings(31/12/2007) 3 500 Total FC 6 000 Dividend distribution 3 000 Retained earnings(31/12/2008)FC 3 000 Suppose Exchange rates and related data for calendar 2008 were as follows1) December 31,2008FC1RMB¥0.502) Average during 2008 FC1RMB¥0.443) Average during 4th quarter ,2008 FC1RMB¥0.424)On stock offering date FC1RMB¥0.455)On dividend distribution date FC1RMB¥0.466)On the date acquisition of fixed assets FC1RMB¥0.437) On the date long-term notes receivable occurred FC1RMB¥0.448)On the date long-term debt occurred FC1RMB¥0.489)December 31,2007 inventory cost FC1000,FC1RMB¥0.40(C)FC1RMB ¥0.41(H)10) retained earnings on December 31,2007 is RMB ¥1400(under current method)11) retained earnings on December 31,2007 is RMB ¥1500(under temporal method)12) Suppose purchases cost of inventory in 2008 is FC14000.Required: Use the current rate method and temporal method to translate the balance sheet and income statement which expressed at FC into Chinese RMB yuan.1. CURRENT METHOD:X 公司收益及留存收益表X公司资产负债表①来源于本年折算后的收益与留存收益表.②7500-(1000+500+1500+3600+1120)=-220TEMPORAL METHOD:X 公司资产负债表X 公司收益及留存收益表②来源于本年折算后的资产负债表③根据:销货成本=期初存货成本+本期购货成本-期末存货成本= FC1000 x0.40+ FC14000 x0.44- FC3000 x0.50=¥5,060 ④折算损益=¥8800-5060-430-1320-950=¥1040。