- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Tax Liability interest, dividends, capital gain moving expenses, educator (or loss), business income (or expenses, self-employed

loss), pensions, farm income (or health insurance premium

Charitable contributions, home

loss), rents, royalties, Social payments, student loan

mortgage interest, state and

Security benefits, etc.

payments, tuition and fees,

17-5

Evaluating the H-S Criterion

Equity – treats likes alike Efficiency – treats all forms of income the

same; decisions made on the basis of economic value not tax consequences

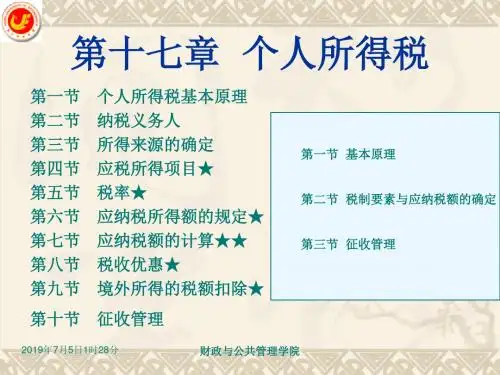

CHAPTER 17

THE PERSONAL INCOME TAX

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

Computation of Federal Personal Income Wages and compensation, Trade or business expenses,

Tax liability before credexictesss of regular tax liability

- Tax credits

Regular tax liability

Pay tax or claim refund

17-2

Haig-Simons Income (Comprehensive Income)

Income = Consumption + DNet Worth Maximum consumption taxpayers can enjoy

without spending down their wealth Anything received that can be used, either

• Ttaaxxarabtlee Income rcaaDrtn.eCdds.eictfFtaocfiopr.r;sridtPtati-vhThliegdaimaeseineelndd-StPshoeastaourxalymtyrlwittaoeeoibrbtnvhiutltehiaytirenyteitcvruod’oessismdiAcnaeergMbteeldeATrmidMtl,,iiaTnbebilAiatysMeinT.

17-6

Excludable Forms of Money Income

Interest on State & Local Bonds Some dividends Capital gains Employer contributions to benefit plans Some types of saving

Transfer payments, including Social Security benefits, unemployment compensation, and welfare

Capital gains

Realized versus unrealized

Income in kind

Imputed rent

17-4

Some Practical and Conceptual Problems

Computing income net of business expenses Computing capital gains and losses Computing imputed income from durables Valuing in-kind servicld twaixth, aindcdoitmioenal child tax, EITC, Six HorOdPinEaraynrdatLeisfetime Learning,

reimbursed employee expenses; Phase out with income; Differs by filing status

now or later, to purchase goods and services Subtract costs of earning income

17-3

Items Included in H-S Income

Employer pension contributions and insurance purchase

- Exemptions (1e0l%ec,tr1ic5%ve,h2ic5l%es,, health coverage 28ta%x, 3a3d%op,t3io5n%, )m; ortgage interest,

- Larger of standscrdtiehfaftietaliudrressra;mdbnseydpndefditlcieesniapagdlevinnudgecsntctioconatrnreibcuorteirodniit,,temized deductions

local taxes, medical expenses

Tax Base

alimony paid, etc.

in excess of 7.5% of AGI, casualty and theft losses, non-

- “Above-the-line” Pdheasde-uoucttions