Terms of payment 国际贸易支付方式教学文稿

- 格式:doc

- 大小:751.00 KB

- 文档页数:10

Terms of Payment⽀付条款Brief Introduction⽬前,国际贸易中常⽤的付款⽅式( payment terms)有:汇付(Remittance)、托收(Collection )、信⽤证(Letter of Cred it)三种⽅式。

⼤⾦额交易时主要是⽤到信⽤证,⼩买卖当然是⽤托收和汇付来完成。

作为国际结算中的⼀个重要组成部分,对外贸易货款的⽀付⼀般是利⽤汇票这种⽀付凭据通过银⾏进⾏的。

汇票中的跟单汇票(Documentary Draft)是对外贸易中最常⽤的⼀种⽀付⼯具。

汇票按付款时间的不同,分为即期汇票和远期汇票两种。

Basic Expressions1. Our terms of payment are by a confirmed irrevocable letter of credit by draft at sight.我们的⽀付⽅式是以保兑不可撤消的、凭即期汇票⽀付的信⽤证。

2. Since the total amount is so big and the world monetary market is rather unstable at the moment, we can not ac cept any terms of payment other than a Letter of Credit.因为这次交易额⼤,⽽且⽬前国际⾦融市场很不稳定,所以我们除接受信⽤证付款外,不能接受别的付款⽅式。

3. We would suggest that for this particular order you let us have a D/D, on receipt of which we shall ship the goods on the first available steamer.此次订货,我们建议你们使眉雌诨闫薄J盏礁没闫焙螅 颐墙 ?/span> 货物装上第⼀条可定到的船。

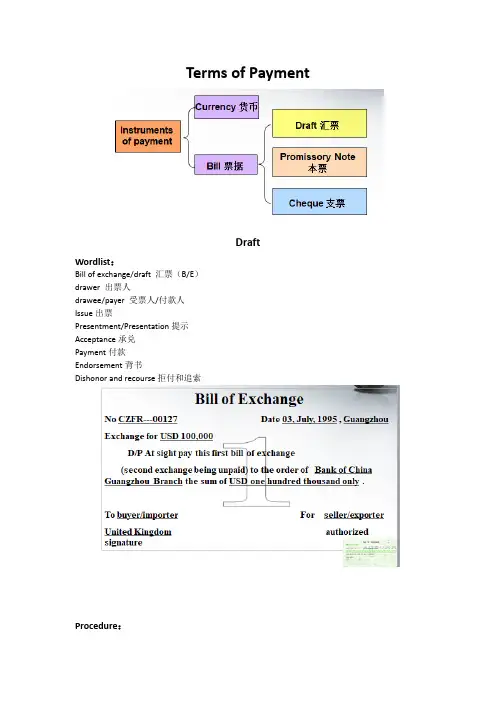

Terms of PaymentDraft Wordlist:Bill of exchange/draft 汇票(B/E)drawer 出票人drawee/payer 受票人/付款人Issue出票Presentment/Presentation提示Acceptance承兑Payment付款Endorsement背书Dishonor and recourse拒付和追索Procedure:1)出票(issue)。

出票人在汇票上填写付款人、付款金额、付款日期和地点以及受款人等项目,签字后交付给收款人的行为2)提示(presentation)。

提示是持票人将汇票提交付款人要求付款人承兑或付款的行为,是持票人要求取得票据权利的必要程序.either the delivery of documents under a credit to the issuing bank or nominated bank or the documents so delivered交单指向开证行或指定银行提交信用证项下单据的行为,或指按此方式提交的单据.3)承兑(acceptance)。

指付款人在持票人向其提示远期汇票时,在汇票上签名,承诺在汇票到期时付款的行为。

具体做法是付款人在汇票正面写明“承兑(accepted)”字样,注明承兑日期,签章后交还持票人。

付款人一旦对汇票作承兑,即成为承兑人,以债务人的地位承担汇票到期时付款的法律责任。

4)付款(payment)。

付款人在汇票到期日,向提示汇票的合法持票人按汇票上的金额付全款.持票人将汇票注销后交给付款人作为收款证明。

汇票所代表的债务债权关系即告终止。

5)背书(endorsement).票据包括汇票是可流通转让的证券。

根据我国《票据法》规定,除非出票人在汇票上记载“不得转让”外,汇票的收款人拥有以记名背书的方式转让汇票权利。

即在汇票背面签上自己的名字,并加注被背书人的名称,然后把汇票交给被背书人即受让人,受让人成为持票人,是票据的债权人.6)拒付和追索(dishonor & recourse)。

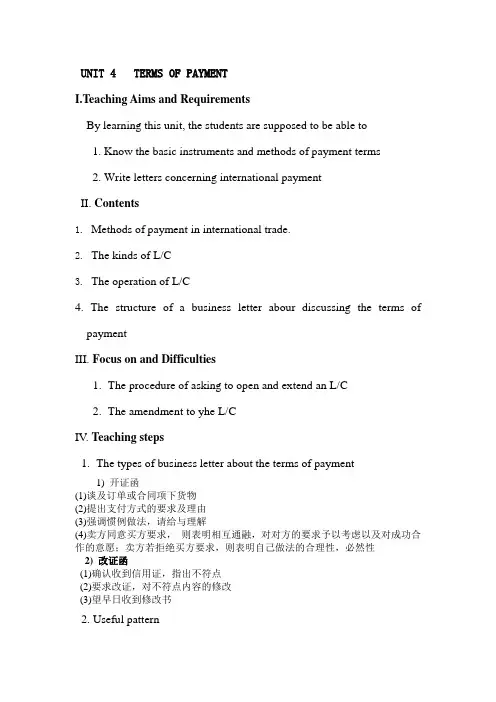

UNIT 4 TERMS OF PAYMENTI.Teaching Aims and RequirementsBy learning this unit, the students are supposed to be able to1. Know the basic instruments and methods of payment terms2. Write letters concerning international paymentII. Contents1.Methods of payment in international trade.2.The kinds of L/C3.The operation of L/C4. The structure of a business letter abour discussing the terms of paymentIII. Focus on and Difficulties1.The procedure of asking to open and extend an L/C2.The amendment to yhe L/CIV. Teaching steps1.The types of business letter about the terms of payment1) 开证函(1)谈及订单或合同项下货物(2)提出支付方式的要求及理由(3)强调惯例做法,请给与理解(4)卖方同意买方要求,则表明相互通融,对对方的要求予以考虑以及对成功合作的意愿;卖方若拒绝买方要求,则表明自己做法的合理性,必然性2) 改证函(1)确认收到信用证,指出不符点(2)要求改证,对不符点内容的修改(3)望早日收到修改书2. Useful pattern1.Opening L/C(1)We enclose an application form for documentary credit and shall beglad if you will arrange to open our account an irrevocable L/C for $40,000 in favour of ABC Company, the credit to be valid until July12.(2)We write to inform you that we have today established with Bank ofChina an irrevocable documentary L/C in your favor for the amount of $53,000 covering1,000 sets of TV.2.Rushing L/C(1)Please expedite /rush the L/C so that we can execute the ordersmoothly.(2)As the goods have been ready, please rush the L/C covering S/CA V_231.(3)The shipment date is approaching. It would be advisable for you toopen the L/C covering your Oder No.341 the soonest possible so as to effect the shipment within the stipulated time.3.Amending L/C(1)We have received your L/C No.123 and on checking up the clauses/onperusal/on examination of the clauses, have regretfully found the following discrepancies in it.(2)We have amended the quantity as 250 metric tons.(3)We have found the amount of your L/C is insufficient. Please increasethe unit price US$3 to US$3.5 and the total amount to $ 60,000.V. Practical Writing敬启者:我们已收到你方11月8日的来信,要求我们以承兑交单方式发运你方一批手提电脑。

Unit 6: Terms of Payment 教案教学目标1.学生能够理解并掌握付款方式的种类和特点。

2.学生能够根据实际情况选择合适的付款方式。

3.学生能够了解并认识到付款方式在国际贸易中的重要性。

4.培养学生的跨文化交流意识和国际贸易知识。

教学内容1.付款方式的种类:信用证、电汇、托收、西联汇款等。

2.各种付款方式的操作流程和特点。

3.国际贸易中付款方式的谈判和选择。

教学难点与重点•重点:各种付款方式的操作流程和特点。

•难点:如何根据实际情况选择合适的付款方式,以及付款方式在国际贸易中的风险和注意事项。

教具和多媒体资源1.投影仪及PPT演示文稿2.付款方式流程图及特点表格3.国际贸易实际案例视频或音频资料教学方法1.激活学生的前知:通过提问学生日常生活中的付款方式,引导学生思考国际贸易中的付款方式。

2.教学策略:讲解、示范、小组讨论、案例分析。

3.学生活动:角色扮演国际贸易中的买卖双方,模拟谈判付款方式。

教学过程1.导入:故事导入-讲述一个因为付款方式选择不当而导致的国际贸易纠纷。

引导学生思考合适的付款方式对贸易的重要性。

2.讲授新课:系统讲解信用证、电汇、托收、西联汇款等付款方式的操作流程和特点,结合PPT 演示文稿进行讲解。

3.巩固练习:分小组,每组选择一种付款方式,进行流程演示和特点分析。

组间进行互评和讨论。

4.归纳小结:回顾各种付款方式的操作流程和特点,强调选择合适付款方式的重要性。

总结国际贸易中付款方式的注意事项和风险。

评价与反馈1.设计评价策略:小组报告、口头反馈、教师观察。

2.为学生提供反馈:针对学生的演示和讨论,给出具体的反馈和建议,帮助学生更好地掌握知识。

作业布置1.总结各种付款方式的特点和适用场景。

2.分析一个实际的国际贸易案例,指出其付款方式的选择是否合理,为什么?并提出改进建议。

3.预习下一课内容,了解国际贸易中其他交易条款。

Terms of PaymentDraft Wordlist:Bill of exchange/draft 汇票(B/E)drawer 出票人drawee/payer 受票人/付款人Issue出票Presentment/Presentation提示Acceptance承兑Payment付款Endorsement背书Dishonor and recourse拒付和追索Procedure:1)出票(issue)。

出票人在汇票上填写付款人、付款金额、付款日期和地点以及受款人等项目,签字后交付给收款人的行为2)提示(presentation)。

提示是持票人将汇票提交付款人要求付款人承兑或付款的行为,是持票人要求取得票据权利的必要程序。

either the delivery of documents under a credit to the issuing bank or nominated bank or the documents so delivered交单指向开证行或指定银行提交信用证项下单据的行为,或指按此方式提交的单据。

3)承兑(acceptance)。

指付款人在持票人向其提示远期汇票时,在汇票上签名,承诺在汇票到期时付款的行为。

具体做法是付款人在汇票正面写明“承兑(accepted)”字样,注明承兑日期,签章后交还持票人。

付款人一旦对汇票作承兑,即成为承兑人,以债务人的地位承担汇票到期时付款的法律责任。

4)付款(payment)。

付款人在汇票到期日,向提示汇票的合法持票人按汇票上的金额付全款。

持票人将汇票注销后交给付款人作为收款证明。

汇票所代表的债务债权关系即告终止。

5)背书(endorsement)。

票据包括汇票是可流通转让的证券。

根据我国《票据法》规定,除非出票人在汇票上记载“不得转让”外,汇票的收款人拥有以记名背书的方式转让汇票权利。

即在汇票背面签上自己的名字,并加注被背书人的名称,然后把汇票交给被背书人即受让人,受让人成为持票人,是票据的债权人。

6)拒付和追索(dishonor & recourse)。

持票人向付款提示,付款人拒绝付款或拒绝承兑,均称拒付。

另外,付款人拒不见票死、亡或宣告破产,以致持票人无法实现提示,也称拒付。

Types:1)According to date:Sight Bill or Demand Draft or Draft at sight (即期汇票)Time Bill or Usance Bill or Draft after sight (远期汇票)2)According to drawerBanker’s Draft/Bill(银行汇票)Trade Draft/Bill(商业汇票)3)According to attaching shipping document or notDocumentary Bill(跟单汇票): accompanied by shipping documents.Clean Bill(光票): without4)According to different acceptor(承兑人)Trader’s Acceptance Bill(商业承兑汇票): drawn on and accepted by a traderBanker’s Acceptance Bill(银行承兑汇票): drawn on and accepted by a bankerPromissory Note一、定义出票人本人签发给受款人的、保证在见票时或在指定的或可确定的将来某一时间无条件支付一定金额的书面承诺。

二、种类1、现金支票--- 支票上印有“现金”字样,只能用于支取现金;2、转帐支票--- 支票上印有“转账”字样,只能用于转账;3、普通支票--- 支票上未印有“现金”或“转账”宇样,可以用于支取现金,也可以用于转账。

在普通支票左上角划两条平行线的,为划线支票,划线支票只能用于转账,不能用于支取现金。

CheckProcedure:Def:支票的出票人预留银行签章是银行审核支票付款的依据。

银行也可以与出票人约定使用支付密码,作为银行审核支付支票金额的条件。

Types:⑴记名支票(CHEQUE PAYABLE TO ORDER),是在支票受款人一栏,写明受款人姓名,如“支付XXX 或指定人”(PAY XXX OR ORDER),取款时须由受款人签章,方可支取。

⑵不记名支票(CHEQUE PAYABLE TO BEARER),又称空白支票。

支票上不记载受款人姓名,只写“付来人”(PAY BEARER)。

取款时持票人无须在支票背后签章,即可支取。

⑶划线支票(CROSSED CHEQUE),是在支票正面划两道平行线的支票。

划线支票与一般支票不同。

一般支票可委托银行收款入账,也可由持票人自行提取现款。

而划线支票只能委托银行代收票款入账。

使用划线支票的目的是为了在支票遗失,被人冒领时,还可能通过银行代收的线索追回票款。

Modes of Int’l PaymentRemittance指不同国家(地区)间一方向另一方转移资金,也就是说,某一银行(汇出行)应其客户的要求,将一定货币金额转移至其海外分行或代理行,指示其付款给某一指定收款人。

Wordlist:remitting bank 汇出行the remitter 汇款方Mail Transfer, M/T 信汇payment order付款委托书Bills for Collection 托收票据Telegraphic Transfer, T/T 电汇Demand Draft, D/D 票汇Procedure:Types:1)Mail Transfer, M/T 信汇汇出行根据进口商的指示,以银行信件邮寄指示出口商所在地的汇入行,委托其向出口商或其指定人付款的汇款方式。

(Cheap but slow, seldom used)2)Telegraphic Transfer, T/T 电汇汇出行根据进口商的指示,以电报/电传/SWIFT等电讯方式指示出口商所在地的汇入行,委托其向出口商或其指定人付款的汇款方式。

(Fast and safe for exporter to get the money; The most commonly used type of remittance)3)Demand Draft, D/D 票汇进口商在本地银行购买银行汇票直接寄给出口商,出口商凭以向汇票上指定的银行收取款项的汇款方式。

(Flexible to draw money; Convenient for the exporter)Collection托收(Collection)是指债权人(出口人)出具债权凭证(汇票等)委托银行向债务人(进口人)收取货款的一种支付方式。

采用托收方式应注意的问题:1)严格审查客户资信2)贸易术语应争取使用CIF或CIP 以避免货物在途中发生损失,买方不接受单据和货物。

采用CIF或CIP,卖方尚可向保险公司索赔。

如争取不到上述术语,卖方可投保卖方利益险,以弥补以上损失。

Wordlist:The Drawer/Principal 委托人/出口方The Drawee付款人/进口方The Remitting Bank托收行/出口地银行The Collecting Bank代收行/进口地银行Clean Collection 光票托收Documentary Collection 跟单托收documents against payment (D/P)付款交单documents against acceptance (D/A)承兑交单Against: [表示交换关系]以...抵付; 凭...换取Financial documents金融单据(指汇票、本票、支票或者其它用于取得付款的类似凭证)Commercial documents 商业单据(指发票、运输单据、物权凭证或其它类似单据,或除金融单据以外的任何其它单据)Types:1)Clean Collection 光票托收It means collection of financial documents not accompanied by commercial documents. 指不附带商业单据的金融单据的托收。

Mainly used for small amount transaction, advance payment(预付款), installment payment(分期付款), commission and costs of samples etc.2)Documentary Collection 跟单托收It means collection of financial documents accompanied by commercial documents;指附带商业单据的金融单据的托收;(a) Documents Against Payment, D/P付款交单The collecting bank may release the documents only against immediate payment. It can be classified into D/P At Sight and D/P After Sight.出口商的交单是以进口商的付款为条件。

指出口商将汇票连同商业单据委托银行代收款项时,指示银行只有在进口商付清款项后才能将商业单据交给进口商。

又可分为即期和远期付款交单。

*Documents against Payment (D/P) 付款交单D/P at sightUpon presentation, the Buyer shall pay against documentary draft drawn by the Seller at sight. The shipping documents are to be delivered against payment only.D/P after sightThe Buyer s hall duly accept the documentary draft drawn by the Seller at××days’ sight upon first presentation and make payment on its maturity.(b) Documents Against Acceptance, D/A承兑交单The collecting bank may release the documents against the buyer’s acceptance of a draft (for instance, drawn payable 60~80 days after sight or due on a definite date). After acceptance, the buyer(importer) gains possession of the goods before the payment is made. The buyer will make payment when the time draft is mature.出口商的交单是以进口商在汇票上承兑为条件。