习题商业银行管理学

- 格式:doc

- 大小:98.00 KB

- 文档页数:17

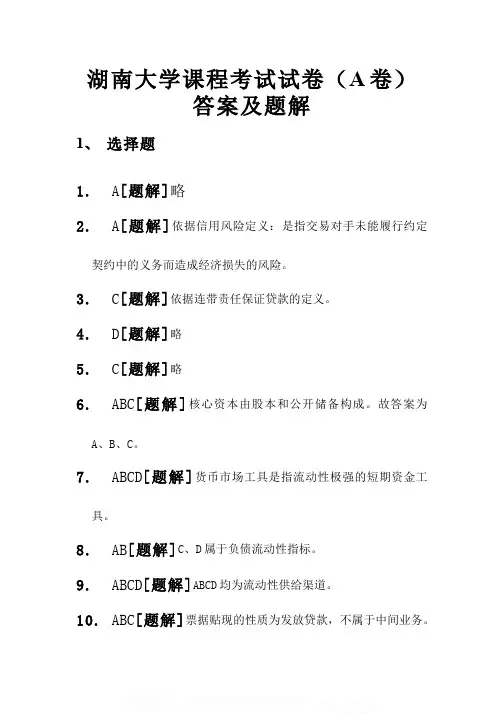

湖南大学课程考试试卷(A卷)答案及题解1、选择题1.A[题解]略2.A[题解]依据信用风险定义:是指交易对手未能履行约定契约中的义务而造成经济损失的风险。

3.C[题解]依据连带责任保证贷款的定义。

4.D[题解]略5.C[题解]略6.ABC[题解]核心资本由股本和公开储备构成。

故答案为A、B、C。

7.ABCD[题解]货币市场工具是指流动性极强的短期资金工具。

8.AB[题解]C、D属于负债流动性指标。

9.ABCD[题解]ABCD均为流动性供给渠道。

10.ABC[题解]票据贴现的性质为发放贷款,不属于中间业务。

2、判断题1.×[题解]历史上第一家股份制银行是英格兰银行。

2.×[题解]银行资本金的功能还有营业功能、管理功能等。

3.√[题解]放松金融管制是指金融创新,加强金融监管是指监管风险,二者并不矛盾。

4.×[题解]当今商业银行的体制是以分支行形式为主。

5.√[题解]略。

6.×[题解]商业银行向中央银行的借款只能用于调剂头寸、补充储备不足。

7.×[题解]贷记卡是先消费后还款;借记卡是先存款后消费。

8.×[题解]关注类贷款是指借款人偿还贷款本息仍属正常。

9.×[题解]商业银行的资产的流动性关注变现能力,和价值损益无关。

10.×[题解]利率上升时,敏感性缺口应保持为正值才能增加利息净收入。

三、名词解释1.中间业务1.[题解]中间业务是指不构成商业银行表内资产和表内负债、形成银行非利息收入的业务。

2.消费信贷2[题解]消费贷款是商业银行向消费者个人发放的用于购买消费品或支付其他费用的贷款。

3.信用风险3.[题解]信用风险又称违约风险,是指交易对手未能履行约定契约中的义务而造成经济损失的风险,即受信人不能履行还本付息的责任而使授信人的预期收益与实际收益发生偏离的可能性。

4.预期收入理论4.[题解]预期收入理论是指商业银行以借款人未来收入为基础而估算其还债计划,并据以安排其放款的期限结构,便能维持银行的流动性。

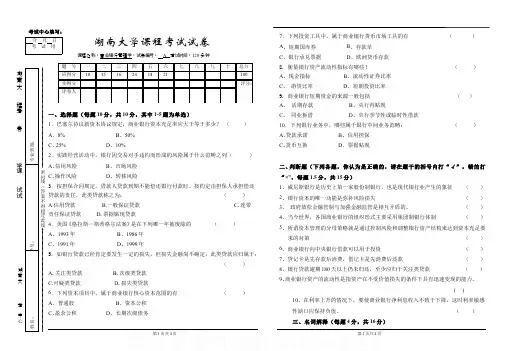

考试中心填写:湖南大程考卷学课试试湖南大考中心密封线(答案不得超过此线)湖南大学课程考试试卷程名课称:商行管理业银学;卷:试编号 A 考:试时间120分钟一、选择题(每题10分,共10分,其中1-5题为单选)1.巴塞尔协议新资本协议规定,商业银行资本充足率应大于等于多少? ()A、8%B、50%C、25%D、10%2.实践经营活动中,银行因交易对手违约而形成的风险属于什么范畴之列( )A、信用风险B、市场风险C、操作风险D、转移风险3.按担保合同规定,借款人贷款到期不能偿还银行付款时、按约定由担保人承担偿还贷款的责任,此类贷款称之为:()A.信用贷款B.一般保证贷款C.连带责任保证贷款 D.票据贴现贷款4.美国《格拉斯—斯蒂格尔法案》是在下列哪一年被废除的()A、1993年B、1986年C、1991年D、1999年5.如银行贷款已经肯定要发生一定的损失,但损失金融尚不确定,此类贷款应归属于:()A.关注类贷款B.次级类贷款C.可疑类贷款D.损失类贷款6.下列资本项目中,属于商业银行核心资本范围的有()A、普通股B、资本公积C、盈余公积D、长期次级债务7.下列投资工具中,属于商业银行货币市场工具的有( )A、短期国库券B、存款单C、银行承兑票据D、欧洲货币存款8. 衡量银行资产流动性指标有哪些? ( )A、现金指标B、流动性证券比率C、 游资比率D、短期投资比率9. 商业银行短期资金的来源一般包括 ()A、 活期存款B、央行再贴现C、 同业拆借D、央行季节性或临时性借款10.下列银行业务中,哪些属于银行中间业务范畴:()A、贷款承诺B、信用担保C、货币互换D、票据贴现二、判断题(下列各题,你认为是正确的,请在题干的括号内打“√”,错的打“×”,每题1.5分,共15分)1、威尼斯银行是历史上第一家股份制银行,也是现代银行业产生的象征 ( )2、银行资本的唯一功能是弥补风险损失 ( )3、 政府放松金融管制与加强金融监管是相互矛盾的。

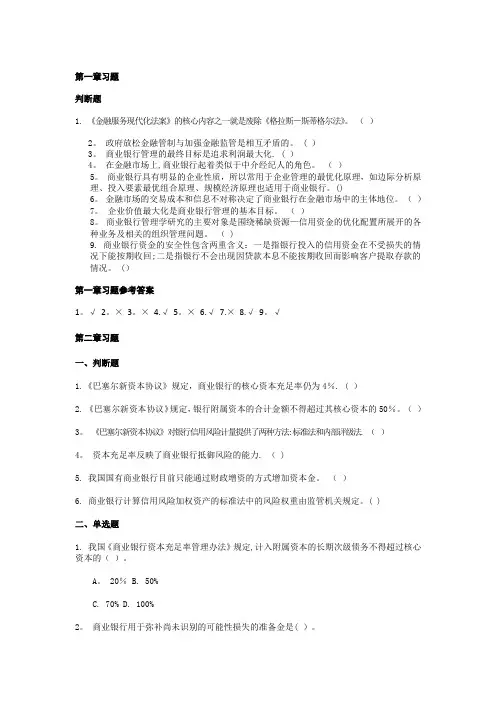

第一章习题判断题1. 《金融服务现代化法案》的核心内容之一就是废除《格拉斯-斯蒂格尔法》。

()2。

政府放松金融管制与加强金融监管是相互矛盾的。

( )3。

商业银行管理的最终目标是追求利润最大化. ( )4。

在金融市场上,商业银行起着类似于中介经纪人的角色。

()5。

商业银行具有明显的企业性质,所以常用于企业管理的最优化原理,如边际分析原理、投入要素最优组合原理、规模经济原理也适用于商业银行。

()6。

金融市场的交易成本和信息不对称决定了商业银行在金融市场中的主体地位。

()7。

企业价值最大化是商业银行管理的基本目标。

()8。

商业银行管理学研究的主要对象是围绕稀缺资源—信用资金的优化配置所展开的各种业务及相关的组织管理问题。

( )9. 商业银行资金的安全性包含两重含义:一是指银行投入的信用资金在不受损失的情况下能按期收回;二是指银行不会出现因贷款本息不能按期收回而影响客户提取存款的情况。

()第一章习题参考答案1。

√2。

×3。

×4.√5。

×6.√7.×8.√9。

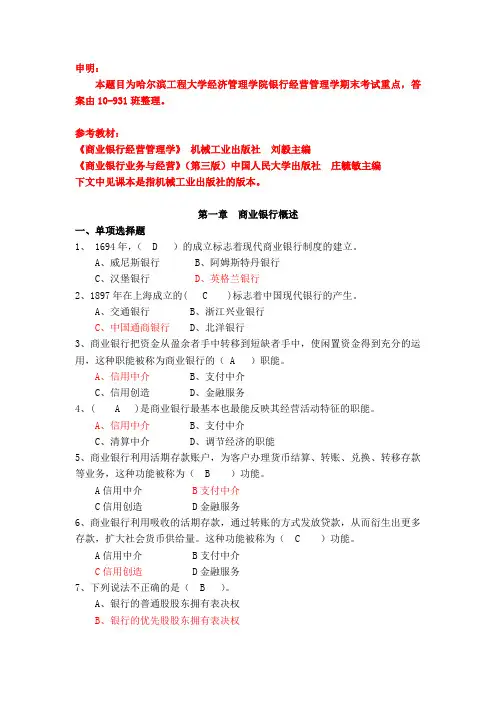

√第二章习题一、判断题1.《巴塞尔新资本协议》规定,商业银行的核心资本充足率仍为4%. ( )2. 《巴塞尔新资本协议》规定,银行附属资本的合计金额不得超过其核心资本的50%。

()3。

《巴塞尔新资本协议》对银行信用风险计量提供了两种方法:标准法和内部评级法. ()4。

资本充足率反映了商业银行抵御风险的能力. ( )5. 我国国有商业银行目前只能通过财政增资的方式增加资本金。

()6. 商业银行计算信用风险加权资产的标准法中的风险权重由监管机关规定。

( )二、单选题1. 我国《商业银行资本充足率管理办法》规定,计入附属资本的长期次级债务不得超过核心资本的()。

A。

20% B. 50%C. 70%D. 100%2。

商业银行用于弥补尚未识别的可能性损失的准备金是( )。

A. 一般准备金B. 专项准备金C. 特殊准备金D. 风险准备金3。

申明:本题目为哈尔滨工程大学经济管理学院银行经营管理学期末考试重点,答案由10-931班整理。

参考教材:《商业银行经营管理学》机械工业出版社刘毅主编《商业银行业务与经营》(第三版)中国人民大学出版社庄毓敏主编下文中见课本是指机械工业出版社的版本。

第一章商业银行概述一、单项选择题1、 1694年,( D )的成立标志着现代商业银行制度的建立。

A、威尼斯银行B、阿姆斯特丹银行C、汉堡银行D、英格兰银行2、1897年在上海成立的( C )标志着中国现代银行的产生。

A、交通银行B、浙江兴业银行C、中国通商银行D、北洋银行3、商业银行把资金从盈余者手中转移到短缺者手中,使闲置资金得到充分的运用,这种职能被称为商业银行的( A )职能。

A、信用中介B、支付中介C、信用创造D、金融服务4、( A )是商业银行最基本也最能反映其经营活动特征的职能。

A、信用中介B、支付中介C、清算中介D、调节经济的职能5、商业银行利用活期存款账户,为客户办理货币结算、转账、兑换、转移存款等业务,这种功能被称为( B )功能。

A信用中介 B支付中介C信用创造 D金融服务6、商业银行利用吸收的活期存款,通过转账的方式发放贷款,从而衍生出更多存款,扩大社会货币供给量。

这种功能被称为( C )功能。

A信用中介 B支付中介C信用创造 D金融服务7、下列说法不正确的是( B )。

A、银行的普通股股东拥有表决权B、银行的优先股股东拥有表决权C、股东大会有权选举董事和监事D、股东大会可以决定银行的经营方针和投资计划8、商业银行经营活动的最终目标是( C )。

A、安全性目标B、流动性目标C、盈利性目标D、合法性目标9、属于商业银行一级准备的是( C )。

A、短期证券B、短期票据C、库存现金D、存款10、商业银行是( B )。

A、事业单位B、特殊企业C、国家机关D、商业机构二、多项选择题1、商业银行的职能有( ABCD )。

A、信用中介职能B、支付中介职能C、信用创造职能D、金融服务职能2、现代商业银行产生途径有( AB )。

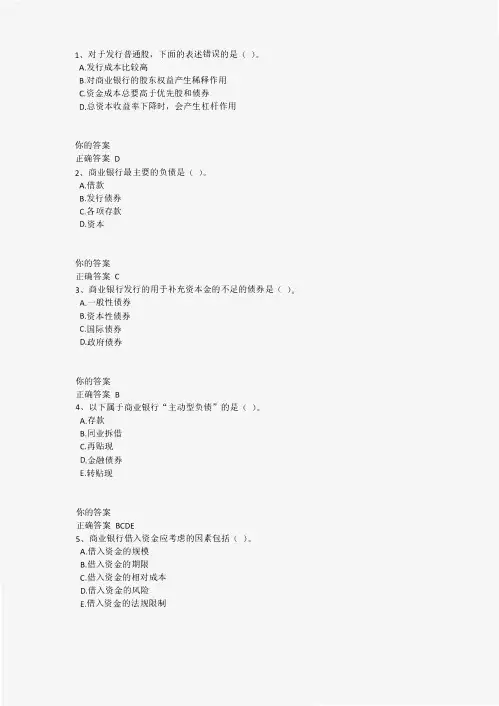

1、对千发行普通股,下面的表述错误的是()。

A发行成本比较高B对商业银行的股东权益产生稀释作用c资金成本总要高千优先股和债券D.总资本收益率下降时,会产生杠杆作用你的答案正确答案D2、商业银行最主要的负债是()。

A借款B发行债券c各项存款D.资本你的答案正确答案c3、商业银行发行的用千补充资本金的不足的债券是()。

A.一般性债券B.资本性债券C. 国际债券D. 政府债券你的答案正确答案B4、以下属千商业银行“主动型负债"的是()。

A.存款B同业拆借c再贴现D金融债券E.转贴现你的答案正确答案BCDE5、商业银行借入资金应考虑的因素包括()。

A借入资金的规模B借入资金的期限C借入资金的相对成本D借入资金的风险E.借入资金的法规限制你的答案正确答案ABCDE6、商业银行资金的安全性指的是银行投入的信用资金在不受损失的情况下能如期收回。

()A正确B.错误你的答案正确答案A7、CDs存单是一种面额较大、不记名发行但不能在二级市场流通转让的定期存款凭证。

()A.正确B.错误你的答案正确答案B8、商业银行管理学研究的主要对象是围绕稀缺资源信用资金的优化配置所展开的各种业务及相关的组织管理问题。

()A.正确B.错误你的答案正确答案A9、对商业银行来说存款并不是越多越好。

()A.正确B. 错误你的答案正确答案A10、我国目前资本市场利率仍然是市场利率与计划利率并存()A正确B.错误你的答案正确答案A1、商业银行收入的主要来源是()。

A租赁收入B证券销售收入C手续费收入D.利息收入你的答案正确答案D2、由千对环境条件等外部因素判断失误而给银行带来损失的风险一般归纳千()。

A信用风险B.市场风险c操作风险D国家风险你的答案正确答案c3、《巴塞尔协议》规定商业银行的核心资本与风险加权资产的比例关系是()。

A.�8%B.�8%C.兰4%D.�4%你的答案正确答案A4、产业分析落后导致银行不恰当的贷款支持属千()。

A信用风险B.市场风险c操作风险D国家风险你的答案正确答案A5、商业银行用千弥补尚未识别的可能性损失的准备金是()。

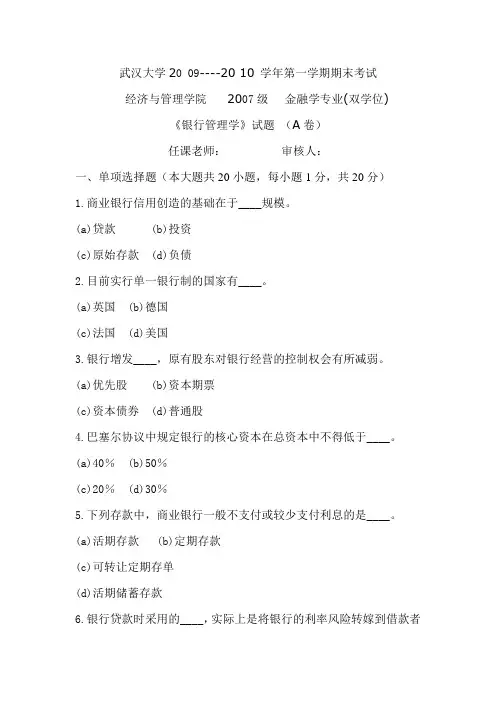

武汉大学20 09----20 10 学年第一学期期末考试经济与管理学院 2007级金融学专业(双学位)《银行管理学》试题(A卷)任课老师:审核人:一、单项选择题(本大题共20小题,每小题1分,共20分)1.商业银行信用创造的基础在于____规模。

(a)贷款(b)投资(c)原始存款(d)负债2.目前实行单一银行制的国家有____。

(a)英国(b)德国(c)法国(d)美国3.银行增发____,原有股东对银行经营的控制权会有所减弱。

(a)优先股(b)资本期票(c)资本债券(d)普通股4.巴塞尔协议中规定银行的核心资本在总资本中不得低于____。

(a)40%(b)50%(c)20%(d)30%5.下列存款中,商业银行一般不支付或较少支付利息的是____。

(a)活期存款 (b)定期存款(c)可转让定期存单(d)活期储蓄存款6.银行贷款时采用的____,实际上是将银行的利率风险转嫁到借款者头上。

(a)固定利率(b)基础利率(c)优惠利率(d)浮动利率7.在利率互换交易中,交易双方在约定的一段时间内交换的是____。

(a)资产(b)本金(c)负债(d)利息8. 银行针对风险建立多级准备,属于____。

(a)准备策略 (b)规避策略(c)分散策略 (d)转嫁策略9. 下述流动性管理策略中,哪种方法忽视了负债方面的流动性____。

(a)缺口监察法(b)状态处理法(c)资金分配法(d)资金集合法10.银行将资金投放在各种不同期限的证券上,且每种期限购买数量相同的投资方法为____。

(a)杠铃式投资法(b)趋势投资法(c)梯形投资法(d)有效证券组合投资法11.在资产分配法中,____大多用于第一准备资产和第二准备资产。

(a)活期存款(b)定期存款(c)储蓄存款(d)资本金12.英格兰银行的建立标志着资本主义现代银行制度的正式确立,它成立于____。

(a)1836年(b)1694年(c)1764年(d)1894年13.《巴塞尔协议》规定,至1992年底所有从事国际业务的大银行,其资本对风险加权化资产的目标标准比率应为____。

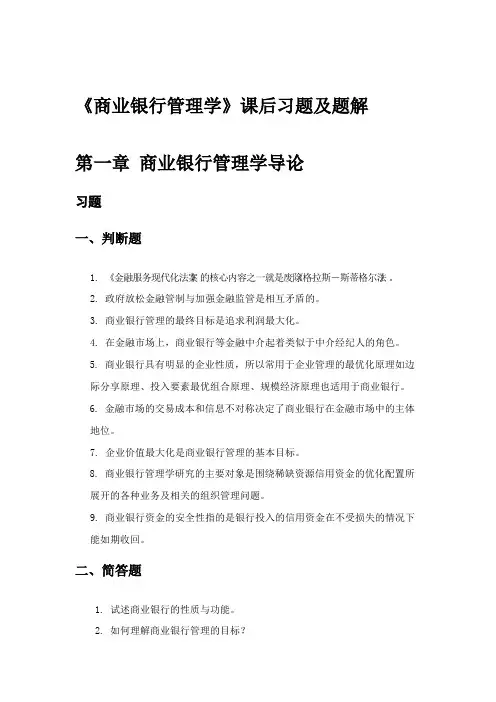

《商业银行管理学》课后习题及题解第一章商业银行管理学导论习题一、判断题1. 《金融服务现代化法案》的核心内容之一就是废除《格拉斯-斯蒂格尔法》。

2. 政府放松金融管制与加强金融监管是相互矛盾的。

3. 商业银行管理的最终目标是追求利润最大化。

4. 在金融市场上,商业银行等金融中介起着类似于中介经纪人的角色。

5. 商业银行具有明显的企业性质,所以常用于企业管理的最优化原理如边际分享原理、投入要素最优组合原理、规模经济原理也适用于商业银行。

6. 金融市场的交易成本和信息不对称决定了商业银行在金融市场中的主体地位。

7. 企业价值最大化是商业银行管理的基本目标。

8. 商业银行管理学研究的主要对象是围绕稀缺资源信用资金的优化配置所展开的各种业务及相关的组织管理问题。

9. 商业银行资金的安全性指的是银行投入的信用资金在不受损失的情况下能如期收回。

二、简答题1. 试述商业银行的性质与功能。

2. 如何理解商业银行管理的目标?3. 现代商业银行经营的特点有哪些?4. 商业银行管理学的研究对象和内容是什么?5. 如何看待“三性”平衡之间的关系?三、论述题1. 论述商业银行的三性目标是什么,如何处理三者之间的关系。

2. 试结合我国实际论述商业银行在金融体系中的作用。

第一章习题参考答案一、判断题1.√2.×3.×4.√5.×6.√7.×8.√9.√二、略;三、略。

第二章商业银行资本金管理习题一、判断题1. 新巴塞尔资本协议规定,商业银行的核心资本充足率仍为4%。

2. 巴塞尔协议规定,银行附属资本的合计金额不得超过其核心资本的50%。

3. 新巴塞尔资本协议对银行信用风险提供了两种方法:标准法和内部模型法。

4. 资本充足率反映了商业银行抵御风险的能力。

5. 我国国有商业银行目前只能通过财政增资的方式增加资本金。

6. 商业银行计算信用风险加权资产的标准法中的风险权重由监管机关规定。

二、单选题1. 我国《商业银行资本充足率管理办法》规定,计入附属资本的长期次级债务不得超过核心资本的。

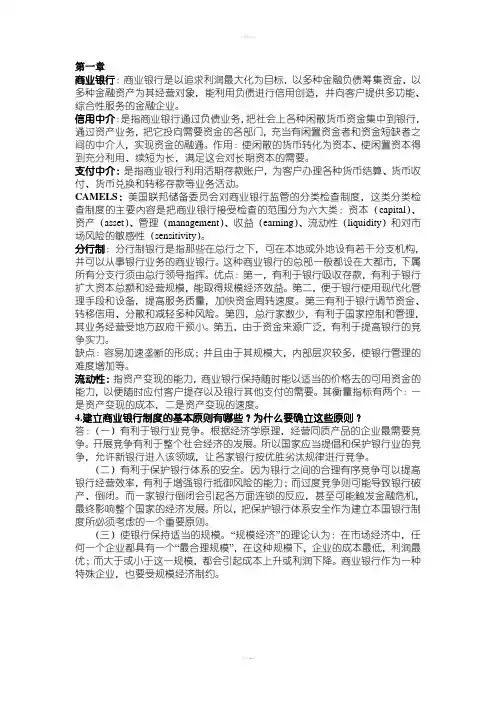

商业银行:商业银行是以追求利润最大化为目标,以多种金融负债筹集资金,以多种金融资产为其经营对象,能利用负债进行信用创造,并向客户提供多功能、综合性服务的金融企业。

信用中介:是指商业银行通过负债业务,把社会上各种闲散货币资金集中到银行,通过资产业务,把它投向需要资金的各部门,充当有闲置资金者和资金短缺者之间的中介人,实现资金的融通。

作用:使闲散的货币转化为资本、使闲置资本得到充分利用、续短为长,满足这会对长期资本的需要。

支付中介:是指商业银行利用活期存款账户,为客户办理各种货币结算、货币收付、货币兑换和转移存款等业务活动。

CAMELS:美国联邦储备委员会对商业银行监管的分类检查制度,这类分类检查制度的主要内容是把商业银行接受检查的范围分为六大类:资本(capital)、资产(asset)、管理(management)、收益(earning)、流动性(liquidity)和对市场风险的敏感性(sensitivity)。

分行制:分行制银行是指那些在总行之下,可在本地或外地设有若干分支机构,并可以从事银行业务的商业银行。

这种商业银行的总部一般都设在大都市,下属所有分支行须由总行领导指挥。

优点:第一,有利于银行吸收存款,有利于银行扩大资本总额和经营规模,能取得规模经济效益。

第二,便于银行使用现代化管理手段和设备,提高服务质量,加快资金周转速度。

第三有利于银行调节资金、转移信用、分散和减轻多种风险。

第四,总行家数少,有利于国家控制和管理,其业务经营受地方政府干预小。

第五,由于资金来源广泛,有利于提高银行的竞争实力。

缺点:容易加速垄断的形成;并且由于其规模大,内部层次较多,使银行管理的难度增加等。

流动性:指资产变现的能力,商业银行保持随时能以适当的价格去的可用资金的能力,以便随时应付客户提存以及银行其他支付的需要。

其衡量指标有两个:一是资产变现的成本,二是资产变现的速度。

4.建立商业银行制度的基本原则有哪些?为什么要确立这些原则?答:(一)有利于银行业竞争。

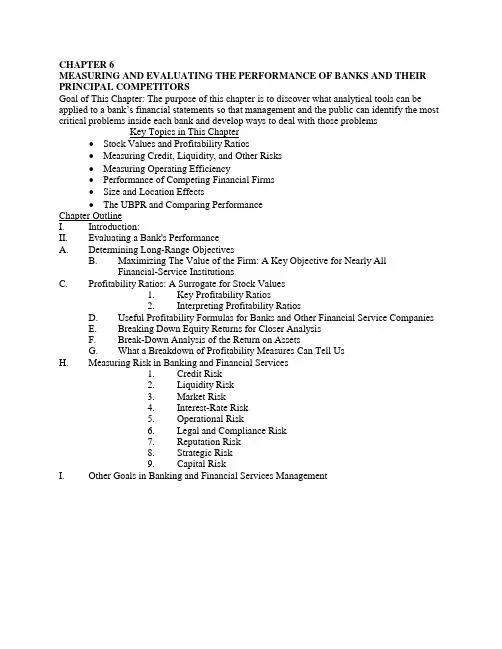

CHAPTER 6MEASURING AND EVALUATING THE PERFORMANCE OF BANKS AND THEIR PRINCIPAL COMPETITORSGoal of This Chapter: The purpose of this chapter is to discover what analytical tools can be applied to a bank’s financial statements so that management and the public can identify the most critical problems inside each bank and develop ways to deal with those problemsKey Topics in This Chapter•Stock Values and Profitability Ratios•Measuring Credit, Liquidity, and Other Risks•Measuring Operating Efficiency•Performance of Competing Financial Firms•Size and Location Effects•The UBPR and Comparing PerformanceChapter OutlineI. Introduction:II. Evaluating a Bank's PerformanceA. Determining Long-Range ObjectivesB. Maximizing The Value of the Firm: A Key Objective for Nearly AllFinancial-Service InstitutionsC. Profitability Ratios: A Surrogate for Stock Values1. Key Profitability Ratios2. Interpreting Profitability RatiosD. Useful Profitability Formulas for Banks and Other Financial Service CompaniesE. Breaking Down Equity Returns for Closer AnalysisF. Break-Down Analysis of the Return on AssetsG. What a Breakdown of Profitability Measures Can Tell UsH. Measuring Risk in Banking and Financial Services1. Credit Risk2. Liquidity Risk3. Market Risk4. Interest-Rate Risk5. Operational Risk6. Legal and Compliance Risk7. Reputation Risk8. Strategic Risk9. Capital RiskI. Other Goals in Banking and Financial Services ManagementIII. Performance Indicators among Banking’s Key CompetitorsIV. The Impact of Size on PerformanceA. Size, Location and Regulatory Bias in Analyzing The Performance of Banks andCompeting Financial InstitutionsB. Using Financial Ratios and Other Analytical Tools to Track BankPerformance--The UBPR.V. Summary of the ChapterAppendix to the Chapter - Improving the Performance of Financial Firms Through Knowledge: Sources of Information on the Financial-Services IndustryConcept Checks6-1. Why should banks and other corporate financial firms be concerned about their level of profitability and exposure to risk?Banks in the U.S. and most other countries are private businesses that must attract capital from the public to fund their operations. If profits are inadequate or if risk is excessive, they will have greater difficulty in obtaining capital and their funding costs will grow, eroding profitability. Bank stockholders, depositors, and bank examiners representing the regulatory community are all interested in the quality of bank performance. The stockholders are primarily concerned with profitability as a key factor in determining their total return from holding bank stock, while depositors (especially large corporate depositors) and examiners typically focus on bank risk exposure.6-2. What individuals or groups are likely to be interested in these dimensions of performance for a bank or other financial institution?The individuals or groups likely to be interested in bank profitability and risk include other banks lending to a particular bank, borrowers, large depositors, holders of long-term debt capital issued by banks, bank stockholders, and the regulatory community.6-3. What factors influence the stock price of a financial-services corporation?A bank's stock price is affected by all those factors affecting its profitability and risk exposure, particularly its rate of return on equity capital and risk to shareholder earnings. A bank can raise its stock price by creating an expectation in the minds of investors of greater earnings in the future, by lowering the bank's perceived risk exposure, or by a combination of increases in expected earnings and reduced risk.6-4. Suppose that a bank is expected to pay an annual dividend of $4 per share on its stock in the current period and dividends are expected to grow 5 percent a year every year, and the minimum required return to equity capital based on the bank's perceived level of risk is 10 percent. Can you estimate the current value of the bank's stock?In this constant dividend growth rate problem the current value of the bank's stock would be: P o = D1 / (k – g) = $4 / (0.10 – 0.05) = $80.6-5. What is return on equity capital and what aspect of performance is it supposed to measure? Can you see how this performance measure might be useful to the managers of financial firms? Return on equity capital is the ratio of Net Income/Total Equity Capital. It represents the rate of return earned on the funds invested in the bank by its stockholders. Financial firms have stockholders, too who are interested in the return on the funds that they invested.6-6 Suppose a bank reports that its net income for the current year is $51 million, its assets totally $1,144 million, and its liabilities amount to $926 million. What is its return on equity capital? Is the ROE you have calculated good or bad? What information do you need to answer this last question?The bank's return on equity capital should be:ROE = Net Income = $51 million = .098 or 9.8 percentEquity Capital $1,444 mill.-$926 mill.In order to evaluate the performance of the bank, you have to compare the ROE to the ROE of some major competitors or some industry average.6-7 What is the return on assets (ROA), and why is it important? Might the ROA measure be important to banking’s key competitors?Return on assets is the ratio of Net Income/Total Assets. The rate of return secured on a bank's total assets indicates the efficiency of its management in generating net income from all of the resources (assets) committed to the institution. This would be important to banks and their major competitors.6-8. A bank estimates that its total revenues will amount to $155 million and its total expenses (including taxes) will equal $107 million this year. Its liabilities total $4,960 million while its equity capital amounts to $52 million. What is the bank's return on assets? Is this ROA high or low? How could you find out?The bank's return on assets would be:ROA = Net Income = $155 mill. - $107 mill. = 0.0096 or 0.96 percent Total Assets $4,960 mill. + $52 mill.The size of this bank's ROA should be compared with the ROA's of other banks similar in size and location to determine if this bank's ROA is high or low relative to the average forcomparable banks.6-9. Why do the managers of financial firms often pay close attention today to the net interest margin and noninterest margin? To the earnings spread?The net interest margin (NIM) indicates how successful the bank has been in borrowing funds from the cheapest sources and in maintaining an adequate spread between its returns on loans and security investments and the cost of its borrowed funds. If the NIM rises, loan and security income must be rising or the average cost of funds must be falling or both. A declining NIM is undesirable because the bank's interest spread is being squeezed, usually because of rising interest costs on deposits and other borrowings and because of increased competition today.In contrast, the noninterest margin reflects the banks spread between its noninterest income (such as service fees on deposits) and its noninterest expenses (especially salaries and wages and overhead expenses). For most banks the noninterest margin is negative. Management will usually attempt to expand fee income, while controlling closely the growth of noninterest expenses in order to make a negative noninterest margin less negative.The earnings spread measures the effectiveness of the bank's intermediation function of borrowing and lending money, which, of course, is the bank's primary way of generating earnings. As competition increases, the spread between the average yields on assets and the average cost of liabilities will be squeezed, forcing the bank's management to search for alternative sources of income, such as fees from various services the bank offers.6-10. Suppose a banker tells you that his bank in the year just completed had total interest expenses on all borrowings of $12 million and noninterest expense of $5 million, while interest income from earning assets totaled $16 million and noninterest revenues added to a total of $2 million. Suppose further that assets amounted to $480 million of which earning assets represented 85 percent of total assets, while total interest-bearing liabilities amounted to 75 percent of total assets. See if you can determine this bank's net interest and noninterest margins and its earnings base and earnings spread for the most recent year.The bank's net interest and noninterest margins must be:Net Interest = $16 mill. - $12 mill. Noninterest = $2 mill. - $5 mill.Margin $480 mill. Margin $480 mill.=.00833 = -.00625The bank's earnings spread and earnings base are:Earnings = $16 mill. - $12 mill.Spread $480 mill * 0.85 $480 mill. * 0.75= .0392 =.0333Earnings Base = $480 mill. - $480 mill. * 0.15 = 0.85 or 85 percent$480 mill.6-11. What are the principal components of ROE and what do each of these components measure?The principal components of ROE are:a. The net profit margin or net after-tax income to operating revenues which reflects the effectiveness of a bank's expense control program;b. The degree of asset utilization or ratio of operating revenues to total assets which measures the effectiveness of managing the bank's assets, especially the loan portfolio; and,c. The equity multiplier or ratio of total assets to total equity capital which measures a bank's use of leverage in funding its operations.6-12. Suppose a bank has an ROA of 0.80 percent and an equity multiplier of 12x. What is its ROE? Suppose this bank's ROA falls to 0.60 percent. What size equity multiplier must it have to hold its ROE unchanged?The bank's ROE is:ROE = 0.80 percent *12 = 9.60 percent.If ROA falls to 0.60 percent, the bank's ROE and equity multiplier can be determined from: ROE = 9.60% = 0.60 percent * Equity MultiplierEquity Multiplier = 9.60 percent = 16x.0.60 percent6-13. Suppose a bank reports net income of $12, before-tax net income of $15, operating revenues of $100, assets of $600, and $50 in equity capital. What is the bank's ROE?Tax-management efficiency indicator? Expense control efficiency indicator? Asset management efficiency indicator? Funds management efficiency indicator?The bank's ROE must be: ROE = 50$12$ = 0.24 or 24 percent Its tax-management, expense control, asset management, and funds management efficiency indicators are:Tax Management = $12 Expense Control = $15Efficiency indicator $15 Efficiency Indicator $100= .8 or 80 percent =.15 or 15 percentAsset Management = $100 Funds Management = $600Efficiency Indicator $600 Efficiency Indicator $50= 0.1666 or 16.67 percent = 12 x6-14. What are the most important components of ROA and what aspects of a financial institution’s performance do they reflect?The principal components of ROA are:a. Total Interest Income Less Total Interest Expense divided by Total Assets, measuring a bank's success at intermediating funds between borrowers and lenders;b. Provision for Loan Losses divided by Total Assets which measures management's ability to control loan losses and manage a bank's tax exposure;c. Noninterest Income less Noninterest Expenses divided by Total Assets, which indicates the ability of management to control salaries and wages and other noninterest costs and generate tee income;d. Net Income Before Taxes divided by Total Assets, which measures operating efficiency and expense control; ande. Applicable Taxes divided by Total Assets, which is an index of tax management effectiveness. 6-15. If a bank has a net interest margin of 2.50%, a noninterest margin of -1.85%, and a ratio of provision for loan losses, taxes, security gains, and extraordinary items of -0.47%, what is its ROA?The bank's ROA must be:ROA = 2.50 percent - 1.85 percent - 0.47 percent = 0.18 percent6-16. To what different kinds of risk are banks and their financial-service competitors subjected today?a. Credit Risk -- the probability that loans and securities the bank holds will not pay out as promised.b. Liquidity Risk -- the probability the bank will not have sufficient cash on hand in the volume needed precisely when cash demands arise.c. Market Risk -- the probability that the value of assets held by the bank will decline due to falling market prices.d. Interest-Rate Risk - the possibility or probability interest rates will change, subjecting the bank to lower profits or a lower value for the firm’s capital.e. Operational Risk –the uncertainly regarding a financial firm’s earnings due to failures in computer systems, employee misconduct, floods, lightening strikes and other similar events.f. Legal and Compliance Risk –the uncertainty regarding a financial firm’s earnings due to actions taken by our legal system or due to a violation of rules and regulationsg. Reputation Risk – the uncertainty due to public opinion or the variability in earnings due to positive or negative publicity about the financial firmh. Strategic Risk – the uncertainty in earnings due to adverse business decisions, lack or responsiveness to changes and other poor decisions by managementi. Capital Risk – the risk that the value of the assets will decline below the value of the liabilities. All of the other risks listed above can affect earnings and the value of the assets and liabilities and therefore can have an effect on the capital position of the firm.6-17. What items on a bank's balance sheet and income statement can be used to measure its risk exposure? To what other financial institutions do these risk measures apply?There are several alternative measures of risk in banking and financial service firms. Capital risk is often measured by bank capital ratios, such as the ratio of total capital to total assets or total capital to risk assets. Credit risk can be tracked by such ratios as net loan losses to total loans or relative to total capital. Liquidity risk can be followed by using such ratios as cash assets to total assets or by total loans to total assets. Interest-rate risk may be indicated by such ratios as interest-sensitive liabilities to interest-sensitive assets or the ratio of money-market borrowings to money-market assets.6-18. A bank reports that the total amount of its net loans and leases outstanding is $936 million,its assets total $1,324 million, its equity capital amounts to $110 million, and it holds $1,150 million in deposits, all expressed in book value. The estimated market values of the bank's total assets and equity capital are $1,443 million and $130 million, respectively. The bank's stock is currently valued at $60 per share with annual per-share earnings of $2.50. Uninsured deposits amount to $243 million and money market borrowings total $132 million, while nonperforming loans currently amount to $43 million and the bank just charged off $21 million in loans. Calculateas many of the bank's risk measures as you can from the foregoing data.Net Loans and Leases = $936 mill. Uninsured Deposits $243 mill.Total Assets $1,324 mill. Total Deposits $1,150 mill.0.7069 or 70.69 percent 0.2113 or 21.13 percentEquity Capital = $130 mill. Stock Price $60Total Assets $1,443 mill. Earnings Per Share $2.50 = 0.0901 or 9.01 percent = 24 XNonperforming Assets = $43 mill. =0.0459 or 4.59 percentNet Loans and Leases $936 mill.Charge-offs of loans = $21 Purchased Funds = $243 mill. + $132 mill. Total Loans and Leases $936 Total Liabilities $1,324 mill. - $110 mill.=.0224 or 2.24 percent .3089 or 30.89 percentBook Value of Assets = $1324 =0.9175 or 91.75 percentMarket Value of Assets $1443Problems6-1. An investor holds the stock of First National Bank of Imoh and expects to receive a dividend of $12 per share at the end of the year. Stock analysts have recently predicted that the bank’s dividends will grow at approximately 3 percent a yea r indefinitely into the future. If this is true, and if the appropriate risk-adjusted cost of capital (discount rate) for the bank is 15 percent, what should be the current stock price per share of Imoh’s stock?6-2. Suppose that stockbrokers have projected that Poquoson Bank and Trust Company will pay a dividend of $3 per share on its common stock at the end of the year; a dividend of $4.50 per share is expected for the next year and $6 per share in the following year. The risk-adjusted cost of capital for banks in Poquoson’s risk class is 17 percent. If an investor holding Poquoson’s stock plans to hold that stock for only three years and hopes to sell it at a price of $55 per share, what should the value of the bank’s stock be in today’s market?P0 = $43.94 per share.6-3 Depositors Savings Association has a ratio of equity capital to total assets of 7.5 percent. In contrast, Newton Savings reports an equity capital to asset ratio of 6 percent. What is the value of the equity multiplier for each of these institutions? Suppose that both institutions have an ROA of 0.85 percent. What must each institution’s return on equity capital be? What do your calculations tell you about the benefits of having as little equity capital as regulations or the marketplace will allow?Depositors Savings Association has an equity-to-asset ratio of 7.5 percent which means its equity multiplier must be:= 1 / 0.075 = 13.33x1/ (Equity Capital / Assets) = AssetsEquityCapitalIn contrast, Newton Savings has an equity multiplier of:= 16.67x1/ (Equity Capital / Assets) = 10.06With an ROA of 0.85 percent Depositors Savings Association would have an ROE of: ROE = 0.85 x 13.33x = 11.33 percent.With an ROA of .85 percent Newton Savings would have an ROE of:ROE = 0.85 x 16.67x = 14.17 percentIn this case Newton Savings is making greater use of financial leverage and is generating a higher return on equity capital.6-4. The latest report of condition and income and expense statement for Galloping Merchants National Bank are as shown in the following tables:Galloping Merchants National BankInterest Fees on Loans $65Interest Dividends on Securities 12Total Interest Income 77Interest Paid on Deposits 49Interest on Nondeposit Borrowings 6Total Interest Expense 55Net Interest Income 22Provision for Loan Losses 2Noninterest Income and Fees 7Noninterest Expenses:Salaries and Employee Benefits 12Overhead Expenses 5Other Noninterest Expenses 3Total Noninterest Expenses 20Net Noninterest Income -13Pre Tax Operating Income 7Securities Gains (or Losses) 1Pre Tax Net Operating Income 8Taxes 1Net Operating Income 7Net Extraordinary Income -1Net Income $6FTE 40Galloping Merchants National BankReport of ConditionCash and Due From Banks $100 Demand Deposits $190Investment Securities $150 Savings Deposts $180Federal Funds Sold $10 Time Deposits $470Net Loans $670 Federal Funds Purch $69(ALL 25) Total Liabilities $900(Unearned Income 5) Common Stock $20Plant and Equipment $50 Surplus $25Retained Earnings $35Total Assets $980 Total Ca $80Total Earnings Assets $830 Interest BearingDeposits $650Fill in the missing items on the income and expense statement. Using these statements, calculate the following performance measures:6-5. The following information is for Shallow National BankInterest Income $2,100Interest Expense $1,400Total Assets $30,000Securities Gains (losses) $21Earning Assets $25,000Total Liabilities $27,000Taxes Paid $16Shares of Common Stock 5,000Noninterest income $700Noninterest Expense $900Provision for LoanLosses $100ROE = $405 ROA = $405$30,000 -$27,000$30,0000.135 or 13.5 percent 0.0135 or 1.35percentEarnings = $405 = $.081 per sharePer Share 5000Net Interest = $2100 -$1400 = $700 = 0.028 or 2.8percentMargin $25,000 $25,000Net Noninterest = $700 -$900= -$200 = 0.008or .8 percent Margin $25,000 $25,000Net Operating = ($2100 + $700) – ($1,400 + $900+ $100) = $400 =0.0133or 1.33percentMargin $30,000 $30,000Suppose interest income, interest expenses, noninterest income, and noninterest expenses each increase by 5 percent, with all other items remaining unchanged.Interest Income $2,205Interest Expense $1,470Total Assets $30,000Securities Gains (losses) $21Earning Assets $25,000Total Liabilities $27,000Taxes Paid $16Shares of Common Stock 5,000Noninterest income $735Noninterest Expense $945Provision for LoanLosses $100ROE = $430 ROA = $430$30,000 -$27,000$30,0000.1433 or 14.33 percent 0.0143 or 1.43percentEarnings = $430 = $.086 per sharePer Share 5000Net Interest = $2205 -$1470 = $735 = 0.0294 or 2.94percentMargin $25,000 $25,000Net Noninterest = $735 -$945 = -$210 = 0.0084 or .84percentMargin $25,000 $25,000Net Operating = ($2205 + $735) – ($1,470 + $945+ $100) = $425 =0.0142or 1.42percentMargin $30,000 $30,000On the other hand, suppose Shallow’s interest income, interest expenses, noninterest income, and noninterest expenses decline by 5 percent, again with all other factors held equal. How would the bank’s ROE, ROA and per share earnings change?Interest Income $1995Interest Expense $1,330Total Assets $30,000Securities Gains (losses) $21Earning Assets $25,000Total Liabnilities $27,000Taxes Paid $16Shares of Common Stock 5,000Noninterest income $665Noninterest Expense $855Provision for LoanLosses $100ROE = $380 ROA = $380$30,000 -$27,000$30,0000.1267 or 12.67 percent 0.0127 or 1.27percentEarnings = $380 = $.076 per sharePer Share 5000Net Interest = $1995 -$1330 = $665 = 0.0266 or 2.66percentMargin $25,000 $25,000Net Noninterest = $665 -$855 = -$190 = 0.0076 or .76percentMargin $25,000 $25,000Net Operating = ($1995 + $665) – ($1,330 + $855+ $100) = $375 =0.0125or 1.25percentMargin $30,000 $30,0006-6. Blue and White National Bank holds total assets of $1.69 billion and equity capital of $139 million and has just posted an ROA of 1.1 percent. What is this bank’s ROE?:ROE = ROA * Total AssetsEquity Capital = 0.011 * $1,690$139= 0.1337 or 13.37%R0A increases by 50%, with no change in assets or equity capital.Therefore, the new ROA = 0.011 * 1.5 = 0.0165 or 1.65%.New ROE = 1.65% * 12.16 = 20.06%This represents a 50% increase in ROE. With no changes in assets or equity, the investors' funds are more effectively utilized, generating additional income and making the bank more profitable. Alternative Scenario 2:ROA decreases by 50%, with no change in equity or assets.Therefore, the new ROA = 0.011 * 0.5 = 0.0055 or 0.55%.New ROE = 0.55% * 12.16 = 6.69%This represents a 50% decrease in ROE. The bank's management has been less efficient, in this case, in managing their lending and/or investing functions or their operating costs.Alternative Scenario 3:ROA = 0.011 or 1.1% (as in the original problem)Total assets double in size to $3.38 billion and equity capital doubles in size to $278 million. Therefore, the equity multiplier (i.e. total assets/equity capital) remains the same (E.M. =$3,380/$278 = 12.16). As a result, there is no change in ROE from the original situation (i.e.), 1.1% * 12.16 = 13.38%).Alternative Scenario 4:This, of course, is just the reverse of scenario 3. Since the changes in both assets and equity capital are the same, the ratio of the two (i.e., the equity multiplier) remains constant. As a result, there is again no change in ROE.E.M. = Total Assets/Equity Capital = $845/$69.5 = 12.16.Therefore, ROE = 1.1% * 12.16 = 13.38%.6-7. Monarch State Bank reports total operating revenues of $135 million, with total operating expenses of $121 million, and owes taxes of $2 million. It has total assets of $1.00 billion and total liabilities of $900 million and has just posed an ROA of 1.1o percent. What is the bank’s ROE? Net Income after Taxes = $135 million -$121 million -$2 million = $12 millionEquity Capital = $1.00 billion - $900 million = $100 million= $12 million / $100 million = 0.12 or 12%.ROE = Net Income after TaxesEquity CapitalAlternative Scenario 1: How will the ROE for Monarch State Bank change if total operating expenses, taxes and total operating revenues each grow by 10 percent while assets and liabilities stay fixed.Total revenues = $135 million * 1.10 = $148.5 millionTotal expenses = $121 million * 1.10 = $133.1 millionTax liability = $2 million * 1.10 = $2.2 millionNet Income after Taxes = $148.5 - $133.1 - $2.2 = $13.2 millionROE = $13.2 million/$100 million = 0.132 or 13.2%Change in ROE = (13.2%-12%)/12% = 10%Alternative Scenario 2: Suppose Monarch State’s total assets and total liabilities increase by 10 percent, but its revenues and expenses (including taxes) are unchanged. How will the bank’s ROE change?Total assets increase by 10% (Total assets = $ 1.0 * 1.10 = $1.1 billion)Total liabilities increase by 10% (Total liabilities = $900 million * 1.10 = $990Revenues and expenses (including taxes) remain unchanged.Solution: Equity Capital = $1.1 billion - $990 million = $110 millionROE = $12 = .1091$110 10.91 percent= 10.91% - 12% = -1.09% = -.0908% Therefore change inROE12% 12% (ROE decreases by9.08%)Alternative Scenario 3: Can you determine what will happen to ROE if both operating revenues and expenses (including taxes) decline by 10 percent, with the bank’s total assets and liabilities held constant?Total revenues decline by 10% (Total revenues = $135 million * 0.90 = $121.5 million)Total expenses decline by 10% (Total expenses = $121 million * 0.9 = $108.9 million)Tax liability declines by 10% (Tax liability = $2 * 0.9 = $1.8 million)Assets and liabilities remain unchanged (Therefore, equity remains unchanged)Solution: Net Income after Tax = $121.5 million - 108.9 million - $1.8 million = $10.8 ROE = $10.8 million = 0.108 = 10.8%$100 millionTherefore change in ROE = 10.8% - 12% = -1.2% = -.1012% 12% (ROE decreases by 10%) Alternative Scenario 4: What does ROE become if Monarch State’s assets and liabilities decreaseby 10 percent, while its operating revenues, taxes and operating expenses do not change?Total assets = $1.0 billion * 0.9 = $900 millionTotal liabilities = $900 million * 0.9 =$810 millionEquity capital = $900 million - $810 million = $90 millionROE = $12 = .1333$90 13.33 percent6-8. Suppose a stockholder owned thrift institution is projected to achieve a 1.25 percent ROA during the coming year. What must its ratio of total assets to total equity capital be if it is to achieveits target ROE of 12 percent? If ROA unexpectedly falls to .75 percent, what assets-to-capital ratio must it then have to reach a 12 percent ROE?ROE = ROA * (Total Assets/Equity Capital)Total Assets = ROE = 12% = 9.6 xEquity Capital ROA 1.25%If ROA unexpectedly falls to 0.75% and target ROE remains 12%:12% = .75% * Total AssetsEquity CapitalTotal Assets = 12% =16 xEquity Capital .75%。

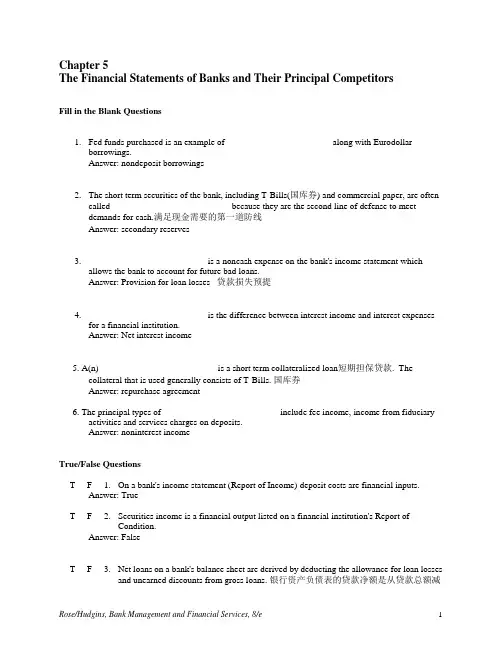

Chapter 5The Financial Statements of Banks and Their Principal CompetitorsFill in the Blank Questions1. Fed funds purchased is an example of _______________________ along with Eurodollarborrowings.Answer: nondeposit borrowings2. The short term securities of the bank, including T-Bills(国库券) and commercial paper, are oftencalled __________________________ because they are the second line of defense to meetdemands for cash.满足现金需要的第一道防线Answer: secondary reserves3. __________________________ is a noncash expense on the bank's income statement whichallows the bank to account for future bad loans.Answer: Provision for loan losses 贷款损失预提4. __________________________ is the difference between interest income and interest expensesfor a financial institution.Answer: Net interest income5. A(n)__________________________ is a short term collateralized loan短期担保贷款. Thecollateral that is used generally consists of T-Bills. 国库券Answer: repurchase agreement6. The principal types of__________________________ include fee income, income from fiduciaryactivities and services charges on deposits.Answer: noninterest incomeTrue/False QuestionsT F 1. On a bank's income statement (Report of Income) deposit costs are financial inputs.Answer: TrueT F 2. Securities income is a financial output listed on a financial institution's Report of Condition.Answer: FalseT F 3. Net loans on a bank's balance sheet are derived by deducting the allowance for loan losses and unearned discounts from gross loans. 银行资产负债表的贷款净额是从贷款总额减去贷款损失准备和未实现的贴现息Answer: TrueT F 4. Most banks report securities gains as a component of their total noninterest income.Answer: FalseT F 5. Recoveries on loans previously charged off are added to the Provision for Loan Losses (PLL) account on a bank's income statement.已注销贷款的收回应记入银行利润表的贷款损失预提账户Answer: FalseT F 6. Loan-loss reserves set aside to cover a particular loan or loans expected to be a problem or present the bank with above-average risk are known as specific reserves.特种准备Answer: TrueT F 7. Off-balance-sheet items 表外项目for a bank are fee generating transactions which are not recorded on their balance sheet.Answer: TrueT F 8. In looking at comparative balance sheets, it can be seen that large banks rely more heavily on nondeposit borrowings while small banks rely more heavily on deposits.Answer: TrueT F 9. Off-balance-sheet items for banks have declined in recent years.Answer: FalseT F 10. Except for banks, Savings & Loans 储蓄贷款协会and Savings Banks hold the most deposits.Answer: TrueMultiple Choice Questions1.Bank assets fall into each of the following categories except:A)Loans.B)Investment securities.C)Demand deposits.活期存款D)Noninterest cash and due from banks.现金和同业存款E)Other assets.Answer: C2.Which of the following adjustments are made to gross loans and leases to obtain net loans andleases?A)The loan and lease loss allowance is subtracted from gross loans 贷款租赁损失准备从贷款总额中扣除B)Unearned income is subtracted from gross interest receivedC)Investment income is added to gross interest receivedD) A and B.E) A. and C.Answer: D3.An example of a contra-asset account is: 一个与资产相反的账户是A)The loan and lease loss allowance. 贷款损失准备B)Unearned income.C)Buildings and equipment.D)Revenue bonds.E)The provision for loan loss.贷款损失预提Answer: A4. A financial institution's bad-debt reserve坏账准备, as reported on its balance sheet, is called:A) Unearned income or discountB) Allowance for possible loan lossesC) Intangible assets 无形资产D) Customer liability on acceptances 客户承兑负债E) None of the aboveAnswer: B5. When a bank serves as a security dealer for certain kinds of securities (mainly federal, state, and local government obligations) the value of these securities is usually recorded in what account on a bank's Report of Condition?A) Investment SecuritiesB) Taxable and Tax-Exempt Securities 免税债券C) Trading Account SecuritiesD) Secondary ReservesE) None of the aboveAnswer: C6. The difference between noninterest income and noninterest expenses on a bank's Report of Income is called:A) Net Profit MarginB) Net Interest IncomeC) Net Income After Provision for Possible Loan LossesD) Income or Loss Before Income TaxesE) Net Noninterest IncomeAnswer: E9. Noninterest revenue sources for a bank are called:A) Commitment fees on loans 贷款承诺费B) Fee income 手续费收入C) Supplemental income 补充收入D) Noninterest margin 非利息收入E) None of the above.Answer: B10. A bank's temporary lending of excess reserves to other banks is labeled on the balance sheet as:A) Fed Funds PurchasedB) Fed Funds SoldC) Money Market DepositsD) Securities Purchased for Resale 逆回购E) None of the aboveAnswer: B15. Which of the following accounts is sometimes called the bank's primary reserves?第一准备A) Cash and deposits due from bank 现金和同业存款B) Investment securitiesC) Trading account securitiesD) Fed funds soldE) None of the aboveAnswer: A16. Which of the following assets is the largest asset item on the bank's balance sheet?A) SecuritiesB) CashC) LoansD) Bank Premises 银行固定资产E) None of the aboveAnswer: C\。

《商业银行管理学》课后习题参考答案第一章1.金融制度对现代经济体系的运行起到了什么作用?(1)配置功能(2)节约功能(3)激励功能(4)调节功能2.商业银行在整个金融体系中有哪些功能?(1)金融服务功能(2)信用创造功能3.美国、英国、日本和德国的商业银行制度特征是什么?比较英美和日德的银行制度差异。

美国:是金融制度创新和金融产品创新的中心,拥有健全的法律法规对银行进行管制;竞争的激烈,使得美国商业银行具有完善的管理体系和较高的管理水平;受到双重银行体系的管制,即联邦和州权力机构都掌握着管制银行的权利。

英国:成立最早,经验丰富,实行分支行制;银行系统种类齐全、数量众多,按英国的分类,英国的银行主要包括清算银行,商人银行,贴现行,其他英国银行和海外银行等机构;不存在正式的制度化的银行管理机构,惟一的监管机构是作为中央银行的英格兰银行;典型的实行分业经营的国家。

日本:货币的统一发行集中到中央银行-日本银行;商业银行按区域划分的,具体可分为两大类型,即都市银行和地方银行;受到广泛的政府管制;二战前仿效英国业务分离的做法,之后随着环境的变化和经济的发展日本银行从1998年开始实行混业经营。

德国:由统一的中央银行-德意志联邦银行,统一发行货币,且德意志联邦银行被认为是欧洲各国中最具有独立性的中央银行。

德国银行高度集中,实行全能化的银行制度,密集程度是欧盟各国中最高的。

区别:英美在其业务上侧重存款的管理,而日德则侧重在贷款方面。

英美制度完善,有利于银行之间的竞争,日德法律体系发展相对缓慢。

4.根据你对我国银行业的认识,讨论我国银行业在国民经济中的地位以及制度特征。

答:地位:(1)我国的商业银行已成为整个国民经济活动的中枢(2)我国的商业银行的业务活动对全社会的货币供给具有重要影响(3)商业银行已经成为社会经济活动的信息中心(4)商业银行已经成为国家实施宏观经济政策的重要途径和基础(5)商业银行成了社会资本运动的中心制度特征:建立商业银行原则,有利于银行竞争,有利于保护银行体系安全与稳定,使银行保持适当规模。

《银行经营管理学》试题及答案一、名词解释(5道题)1. 存款准备金率2. 资本充足率3. 资产负债管理4. 不良贷款5. 流动性风险答案:1. 存款准备金率:指银行必须按规定比例将其吸收的存款存入中央银行的存款准备金账户中,以确保银行体系的稳定和安全。

2. 资本充足率:是银行资本总额与其风险加权资产总额之比,用于衡量银行抵御风险的能力。

3. 资产负债管理:是银行对其资产和负债进行综合管理和协调,以确保其流动性、安全性和盈利性。

4. 不良贷款:指贷款到期后,借款人未能按期还本付息,或有明确迹象表明无法偿还的贷款。

5. 流动性风险:指银行在需要时无法以合理的成本迅速变现资产或获取资金,从而影响其偿付能力的风险。

二、填空题(5道题)1. 商业银行的三大主要业务包括______、______和______。

2. 贷款损失准备金是指银行为覆盖贷款损失而提取的______。

3. 存款利率与贷款利率的差异称为______。

4. 巴塞尔协议是由______提出的国际银行监管标准。

5. 信用风险是指借款人或交易对手未能履行______的风险。

答案:1. 商业银行的三大主要业务包括存款业务、贷款业务和中间业务。

2. 贷款损失准备金是指银行为覆盖贷款损失而提取的准备金。

3. 存款利率与贷款利率的差异称为利差。

4. 巴塞尔协议是由巴塞尔银行监管委员会提出的国际银行监管标准。

5. 信用风险是指借款人或交易对手未能履行合同义务的风险。

三、单项选择题(5道题)1. 以下哪一项是衡量银行盈利能力的主要指标?- A. 资本充足率- B. 净息差- C. 不良贷款率- D. 流动性比率2. 商业银行通过购买和出售政府债券进行的业务属于:- A. 存款业务- B. 贷款业务- C. 投资业务- D. 中间业务3. 银行在经营过程中,为了保持流动性,通常会持有大量的:- A. 固定资产- B. 现金及现金等价物- C. 长期债券- D. 不动产4. 哪一种贷款通常风险较高?- A. 房屋抵押贷款- B. 汽车贷款- C. 信用卡贷款- D. 学生贷款5. 银行的主要收入来源是:- A. 存款利息- B. 贷款利息- C. 服务费- D. 投资收益答案:1. B. 净息差2. C. 投资业务3. B. 现金及现金等价物4. C. 信用卡贷款5. B. 贷款利息四、多项选择题(5道题)1. 银行的流动性管理措施包括:- A. 提高存款利率- B. 增加现金储备- C. 缩短贷款期限- D. 出售流动性资产2. 以下哪些因素会影响银行的资本充足率?- A. 贷款质量- B. 利率水平- C. 风险加权资产- D. 监管要求3. 银行的风险管理包括哪些方面?- A. 信用风险管理- B. 市场风险管理- C. 操作风险管理- D. 流动性风险管理4. 商业银行的中间业务包括:- A. 支票清算- B. 信用证业务- C. 外汇买卖- D. 保管箱租赁5. 下列属于银行资产管理策略的是:- A. 分散化投资- B. 增加资本储备- C. 控制风险资产比例- D. 调整资产结构答案:1. B. 增加现金储备,C. 缩短贷款期限,D. 出售流动性资产2. A. 贷款质量,C. 风险加权资产,D. 监管要求3. A. 信用风险管理,B. 市场风险管理,C. 操作风险管理,D. 流动性风险管理4. A. 支票清算,B. 信用证业务,C. 外汇买卖,D. 保管箱租赁5. A. 分散化投资,C. 控制风险资产比例,D. 调整资产结构五、判断题(5道题)1. 存款准备金率越高,银行可用来贷款的资金越多。

商业银行习题及答案一、选择题1. 商业银行的主要经营范围是:A. 存款业务B. 贷款业务C. 资金清算D. 承销业务答案:A、B、C、D2. 商业银行的主要职能是:A. 吸收储蓄B. 发放贷款C. 支付结算D. 提供金融咨询答案:A、B、C、D3. 商业银行的资本金主要来源于:A. 股东出资B. 利润积累C. 吸收存款D. 贷款收回答案:A、B、C、D4. 商业银行在金融市场上的角色主要包括:A. 资金供给者B. 资金需求者C. 资金交易者D. 资金监管者答案:A、B、C、D5. 商业银行的监管机构是:A. 中国人民银行B. 银监会C. 证监会D. 财政部答案:B二、填空题1. 商业银行的存款业务包括__________两部分。

答案:活期存款和定期存款2. 商业银行的信用创造是指基于______________的贷款。

答案:存款准备金3. 商业银行的票据业务指商业银行发行和贴现____________的业务。

答案:银行承兑的汇票4. 商业银行的外汇业务主要包括____________和国际结算。

答案:外汇买卖5. 商业银行的贷款业务分为___________和非担保贷款。

答案:担保贷款三、简答题1. 商业银行的风险管理主要包括哪些方面?答案:商业银行的风险管理主要包括信用风险、市场风险、操作风险和流动性风险等方面。

信用风险是指贷款违约、担保风险等;市场风险是指利率风险、汇率风险等;操作风险是指人为错误或意外事件带来的风险;流动性风险是指资金短缺或无法及时变现的风险。

2. 商业银行的中间业务是什么?答案:商业银行的中间业务是指除存款业务和贷款业务之外的其他业务,包括资金清算、承销业务、证券投资、信用卡业务等。

3. 商业银行的资金来源主要有哪些?答案:商业银行的资金来源主要包括吸收存款、发行债券、向央行借款、从其他金融机构融资等途径。

4. 商业银行的承销业务是指什么?答案:商业银行的承销业务是指代理企业、政府或其他机构发行证券,包括企业债、股票等,并负责在二级市场上进行交易和流通。

《商业银行管理学》课后习题及题解第一章商业银行管理学导论习题一、判断题1. 《金融服务现代化法案》的核心内容之一就是废除《格拉斯-斯蒂格尔法》。

2。

政府放松金融管制与加强金融监管是相互矛盾的.3。

商业银行管理的最终目标是追求利润最大化。

4.在金融市场上,商业银行等金融中介起着类似于中介经纪人的角色.5. 商业银行具有明显的企业性质,所以常用于企业管理的最优化原理如边际分享原理、投入要素最优组合原理、规模经济原理也适用于商业银行。

6。

金融市场的交易成本和信息不对称决定了商业银行在金融市场中的主体地位.7。

企业价值最大化是商业银行管理的基本目标。

8。

商业银行管理学研究的主要对象是围绕稀缺资源信用资金的优化配置所展开的各种业务及相关的组织管理问题.9. 商业银行资金的安全性指的是银行投入的信用资金在不受损失的情况下能如期收回.二、简答题1。

试述商业银行的性质与功能.2。

如何理解商业银行管理的目标?3. 现代商业银行经营的特点有哪些? 4。

商业银行管理学的研究对象和内容是什么?5。

如何看待“三性"平衡之间的关系?三、论述题1. 论述商业银行的三性目标是什么,如何处理三者之间的关系。

2. 试结合我国实际论述商业银行在金融体系中的作用。

第一章习题参考答案一、判断题1.√2.× 3.× 4.√5.×6。

√7.×8。

√9。

√二、略;三、略.第二章商业银行资本金管理习题一、判断题1.新巴塞尔资本协议规定,商业银行的核心资本充足率仍为4%.2.巴塞尔协议规定,银行附属资本的合计金额不得超过其核心资本的50%.3。

新巴塞尔资本协议对银行信用风险提供了两种方法:标准法和内部模型法。

4. 资本充足率反映了商业银行抵御风险的能力。

5。

我国国有商业银行目前只能通过财政增资的方式增加资本金.6。

商业银行计算信用风险加权资产的标准法中的风险权重由监管机关规定.二、单选题1。

我国《商业银行资本充足率管理办法》规定,计入附属资本的长期次级债务不得超过核心资本的.A.20%B。

复习题1一、判断题1、《金融服务现代化法案》的核心内容之一就是废除《格拉斯-斯蒂格尔法》。

()2、五级分类法中,不良贷款包括可疑贷款和损失贷款两类。

()3、一般情况下商业银行向中央银行借款只能用于调剂头寸,补充储备不足。

()4、质押贷款的质物主要指借款人或第三人的不动产。

()5、补偿性余额实际上是银行变相提高贷款利率的一种表现形式。

()6、贷记卡是先存款后消费,借记卡是先消费后还款。

()7、敏感性缺口为负,市场利率上涨时,银行净利息收入呈上升的趋势。

()8、新巴塞尔资本协议对银行信用风险提供了两种方法:标准法和内部模型法。

()9、商业银行证券投资中的梯形期限策略多为中小银行采用。

()10、银行承兑汇票属于银行汇票的一种。

()二、名词解释题1、回购协议2、次级贷款3、承诺费4、操作风险5、ROE三、简答题1、商业银行的职能是什么。

2、商业银行存款定价的方法及各自的内涵是什么。

3、简要分析商业银行人力资源的特点。

4、衡量商业银行流动性的市场信号指标有哪些。

5、简述商业银行贷款的分类。

6、商业银行兼并与收购的动机是什么。

四、论述题1、论述商业银行资产和负债管理理论演变的三个阶段,以及各自强调的管理重心和所处环境差异是什么。

2、试从交易成本和信息不对称的角度论述商业银行在金融市场中的作用。

五、计算1、张三看中了一套100平方米的住房,房价是2000元/平方米,房款为200,000元。

按照银行规定,张三首付了30%的款项,余下的款项靠住房贷款支持,贷款期限为5年,贷款利率为6.12%。

问张三每月应等额偿还本息多少元?复习题2一、判断题1、商业银行能够消除金融市场上存在的交易成本。

()2、商业银行借助表外业务能够扩大其信用规模。

()3、欧洲货币市场借款一般以LIBOR为基准。

()4、对于国家助学贷款,国家财政给予100%的贴息。

()5、补偿性余额实际上是银行变相提高贷款利率的一种表现形式。

()6、市场渗透定价法不强调利润对成本的弥补。

1.市场细分商业银行按照客户需要、爱好、及对金融产品的购买动机、购买行为、购买能力等方面的差异性和相似性,运用系统方法把整个金融市场划分为若干个子市场2.流动性风险指商业银行虽然有清偿能力,但无法及时获得充足资金或无法以合理成本及时获得充足资金以应对资产增长或支付到期债务的风险。

3.住房抵押贷款证券化指银行等金融机构将其所持有的个人住房抵押贷款债券权转让给一家专业机构,该机构通过一定的形式(如担保)将债权重新进行包装组合,再以债权的未来现金流为抵押,在资本市场上发行证券的一种融资行为4.利率互换是指两笔货币相同、债务额相同(本金相同)、期限相同的资金,但交易双方分别以固定利率和浮动利率借款,为了降低资金成本和利率风险,双方做固定利率与浮动利率的调换。

5.操作风险指由于不完善或有问题的内部程序,人员及系统或外部事件所造成损失的可能性。

6.中间业务影响因素有:经营环境;硬件设施及人才方面;金融产品种类方面;管理办法及操作程序。

7.保理指卖方在与买方签约并交付货物后,将发票提交保付代理人(保理人),保付代理人相应地付款给卖方,然后按照商务合同的条款,保理人向买方收取应收帐款。

它是继汇款、托收和信用证之后的一种融资代理业务。

8.全面质量管理是企业管理中的一种科学管理方法,强调“全员”的质量意识,建立“全过程”的质量保证体系,以质量责任制为核心,以标准化工作为手段,努力提高工作质量,目的在于保证产品质量。

9.福费廷是指对大宗国际贸易应收帐款按照无追索权的原则进行的贴现。

又称卖断,还有人称“包买”,它是国际贸易中一种特殊的融资方式。

10.次级贷款贷款的缺陷已经很明显,借款人依靠其正常经营收入已经无法偿还贷款本息,而不得不通过重新融资或拆东墙补西墙的办法来归还贷款。

11. 易变性存款对市场利率的波动及外部经济因素变动敏感的存款。

该类存款稳定性差,不能作为行稳定资金的来源。

12. 内部评级法新巴塞尔协议中用于评定信用风险的方法。

第三章商业银行财务报表一、客观题一.单选题1. 银行的证券投资组合中哪类债券基本不存在信用风险,安全性高,可在二级市场转让占有较大份额,并作为其主要组成部分?A、公司债券B、政府债券C、公司股票D、共同基金2. 银行承兑行为反映在未清结承兑余额未结清的客户对银行承兑的负债表中未清结承兑余额方的哪个账户中?A、未清结承兑余额B、未结清的客户对银行承兑的负债C、证券投资D、其他资产3. 在评价银行流动性风险时下列哪个指标的设计考虑了银行一些表外业务的影响?A、证券资产/总资产B、预期现金流量比C、现金资产国库券/总资产D、净贷款/总资产二.多选题1. 现金资产一般包括以下哪些?A、库存现金B、在途托收现金C、代理行存款D、在央行的存款2. 在评价银行绩效当中,营业收入比率或称资产运用率,可分解为下面哪些重要部分A、股本收益率B、资产的平均利息收益率C、资产的平均非利息收益率D、净利息收益率3. 银行主要承担的风险包括下列哪些?A、信用风险B、流动性风险C、利率风险D、清偿力风险三.判断题1. 损益表又称利润表反映商业银行在某一特定日期全部资产、负债和所有权益状况的报表,是静态的会计报表对错2. 资产收益率是管理效率指标,反映银行管理层将银行资产转化为纯收入的能力。

对错二、主观题1.银行资产负债表中主要项目有哪些?其重要程度如何?银行资产负债表的编制是根据"资产=负债+所有者权益"这一平衡公式,按设定的分类标准和顺序,将报告日银行的资产、负债和权益的各具体项目予以适当排列编制而成。

银行资产项目:现金资产一般包括银行库存现金、在途托收现金、代理行存款和在央行的存款四部分。

现金资产是唯一可做法定存款准备金的资产项目,也是银行全部资产中流动性最强的部分,可以随时满足客户的提款要求和贷款请求,因而被称为一级准备。

但现金资产基本上是无收益的,因而银行在经营中总是力图在缴足准备金,确保银行流动性的前提下减少现金资产的持有。

第一章习题判断题1. 《金融服务现代化法案》的核心内容之一就是废除《格拉斯-斯蒂格尔法》。

()2. 政府放松金融管制与加强金融监管是相互矛盾的。

()3. 商业银行管理的最终目标是追求利润最大化。

()4. 在金融市场上,商业银行起着类似于中介经纪人的角色。

()5. 商业银行具有明显的企业性质,所以常用于企业管理的最优化原理,如边际分析原理、投入要素最优组合原理、规模经济原理也适用于商业银行。

()6. 金融市场的交易成本和信息不对称决定了商业银行在金融市场中的主体地位。

()7. 企业价值最大化是商业银行管理的基本目标。

()8. 商业银行管理学研究的主要对象是围绕稀缺资源—信用资金的优化配置所展开的各种业务及相关的组织管理问题。

()9. 商业银行资金的安全性包含两重含义:一是指银行投入的信用资金在不受损失的情况下能按期收回;二是指银行不会出现因贷款本息不能按期收回而影响客户提取存款的情况。

()第一章习题参考答案1.√2.×3.×4.√5.×6.√7.×8.√9.√第二章习题一、判断题1.《巴塞尔新资本协议》规定,商业银行的核心资本充足率仍为4%。

()2. 《巴塞尔新资本协议》规定,银行附属资本的合计金额不得超过其核心资本的50%。

()3. 《巴塞尔新资本协议》对银行信用风险计量提供了两种方法:标准法和内部评级法。

()4. 资本充足率反映了商业银行抵御风险的能力。

()5. 我国国有商业银行目前只能通过财政增资的方式增加资本金。

()6. 商业银行计算信用风险加权资产的标准法中的风险权重由监管机关规定。

()二、单选题1. 我国《商业银行资本充足率管理办法》规定,计入附属资本的长期次级债务不得超过核心资本的()。

A. 20%B. 50%C. 70%D. 100%2. 商业银行用于弥补尚未识别的可能性损失的准备金是()。

A. 一般准备金B. 专项准备金C. 特殊准备金D. 风险准备金3. 《巴塞尔协议》规定商业银行的核心资本与风险加权资产的比例关系()。

A. ≧8%B. ≦8%C. ≧4%D. ≦4%4. 票据贴现的期限最长不超过()。

A. 6个月B. 9个月C. 3个月D. 1个月第二章习题参考答案一、判断题1.×2.×3.√4.√5.×6.×二、单选题1. B2. A3. C4. A第三章习题一、判断题1. 商业银行向中央银行借款可以用于投资。

()2. 欧洲货币市场借款利率一般以为基准。

()3. 市场渗透定价法在短期内不强调利润对成本的弥补。

()4. 高负债是商业银行区别于其他企业的重要标志之一。

()5. 对商业银行来说存款并不是越多越好。

6. 存单是一种面额较大、不记名发行但不能在二级市场流通转让的定期存款凭证。

()7. 我国目前资本市场利率仍然是市场利率与计划利率并存。

()8. 负债是商业银行资金的全部来源。

()二、单项题1. 商业银行存款管理的目标不包括()。

A. 保持存款的稳定性B. 降低存款的成本率C. 降低存款的流动性D. 提高存款的增长率2. 存款按存款资金性质及计息范围划分为财政性存款和()。

A. 个人存款B. 定期存款C. 一般性存款D. 单位存款3. 使商业银行负债成本最低的存款为()。

A. 同业存款B. 有奖存款C. 定期存款D. 活期存款4. 商业银行的被动负债是()。

A. 发行债券B. 吸收存款C. 同业拆借D. 再贷款5. 下列借入负债中被采用“隔日放款”或今日货币形式的为()。

A. 同业拆借B. 回购协议C. 间接借款D. 再贴现6. 商业银行中长期借款包括()。

A.同业拆借 B. 回购协议C. 中央银行借款D. 发行长期金融债券7. 同业借款不包括()。

A. 同业拆借B. 再贴现C. 抵押借款D. 转贴现8. 目标利润定价法的核心在于()。

A. 严格测算各种存款的营业成本B. 计算存款的历史加权成本C. 确定存款的边际成本D. 确定存款的风险成本9. 商业银行吸收的存款中稳定性最好的是()。

A. 账户B. 定活两便存款C. 储蓄存款D. 自动转账服务账户10. 商业银行的存款成本除了利息支出,还包括()。

A. 办公费B. 员工工资C. 差旅费D. 非利息支出11. 关于同业拆借说法不正确的是()。

A. 同业拆借是一种比较纯粹的金融机构之间的资金融通行为。

B. 为规避风险,同业拆借一般要求担保。

C. 同业拆借一般不需向中央银行缴纳法定存款准备金,降低了银行的筹资成本。

D. 同业拆借资金只能作短期的用途。

三、多选题1. 商业银行负债按负债的流动性可分为()。

A. 流动负债B. 应付债券C. 其他长期负债D. 应付账款2. 下列属于存款的创新种类的是()。

A. 可转让支付命令账户B. 大额可转让定期存单C. 货币市场账户D. 个人退休金账户3. 影响存款成本定价的因素包括()。

A. 市场利率的水平B. 存款的期限结构C. 银行的盈利性D. 客户与银行的关系4. 商业银行借入资金应考虑的因素包括()。

A. 借入资金的规模B. 借入资金的期限C. 借入资金的相对成本D. 借入资金的风险E. 借入资金的法规限制5. 商业银行国内市场借款的主要方式有()。

A. 转贴现B. 向央行借款C. 同业拆借D. 发行金融债券E. 证券回购协议6. 价格定价法中价格表按收费条件包括()。

A. 免费定价B. 有条件免费定价C. 浮动费率D. 固定费率7. 以下属于商业银行“主动型负债”的是()。

A. 存款B. 同业拆借C. 再贴现D. 金融债券E. 转贴现四、计算题1. 假定一家银行筹集了500万的资金,包括200万的活期存款,300万定期存款与储蓄存款。

活期存款的利息和非利息成本为存款的8%,定期存款和储蓄存款总成本为10%。

假如储备要求减少银行可使用资金的数额为活期存款的15%,储蓄存款的5%。

求该银行负债的加权平均成本率。

2. 某银行可通过7%的存款利率吸引50万元新存款。

银行估计,若提供利率为7.5%,可筹集资金100万元;提供8%利率可筹集存款150万元;提供8.5%的利率可筹集存款200万元;提供9%的利率可筹集存款250万元。

如果银行投资资产的收益率为10%,由于贷款利率不随贷款量的增加而增加,贷款利率就是贷款的边际收益率。

存款为多少时银行可获得最大的利润呢?第三章习题参考答案一、判断题1.×2.√3.√4.√5.√6.×7.√8.×二、单选题1 2 3 4 5 6 7 8 9. C 10 11三、多选题1 2 3 4 5 6 7四、计算题1. 加权平均成本率=全部负债利息总额/全部负债平均余额×100%=[(200×8300×10%)/(200×85300×95%)] ×100%=10.11%2. 利润=贷款收益-存款成本(1)(107.5%)×100+50×7.550×72.75(2)(108%)×150+50×850×73.5(3)(108.5%)×200+50×8.550×73.75(4)(109%)×250+50×950×73.5所以采取第三种方案可以获得最大利润。

第四章习题一、判断题1. 五级分类法中,不良贷款包括可疑贷款和损失贷款两类。

()2. 质押贷款的质物指借款人或第三人的不动产。

()3. 补偿性余额实际上是银行变相提高贷款利率的一种表现形式。

()4. 资金边际成本是指商业银行每增加一单位可用于投资或贷款的资金所需支付的利息、费用成本。

()5. 一般保证条件下,借款人贷款到期没有归还银行贷款,保证人即应承担第一还款人责任。

()二、单选题1. 按担保合同规定,借款人贷款到期不能偿还银行付款时、按约定由担保人承担偿还贷款的责任,此类贷款称之为()。

A. 信用贷款B. 一般保证贷款C. 连带责任保证贷款D. 票据贴现贷款2. 如银行贷款已经肯定要发生一定的损失,但损失金额尚不确定,此类贷款应归属于()。

A. 关注类贷款B. 次级类贷款C. 可疑类贷款D. 损失类贷款3. 由于对环境条件等外部因素判断失误而给银行带来损失的风险,一般归纳于()。

A. 信用风险B. 市场风险C. 操作风险D. 国家风险4. 产业分析落后导致银行不恰当的贷款支持属于()。

A. 信用风险B. 市场风险C. 操作风险D. 国家风险三、多选题1. 下列措施中,哪些属于风险补偿机制范畴()。

A. 保险B. 抵押(或质押)C. 贷款组合D. 提取呆帐准备金2. 下列项目中,哪些属于银行贷款价格构成要素()。

A. 利率B. 承诺费C. 补偿余额D. 隐含条款3. 下列风险状况,哪些应归类于操作风险范畴?()。

A. 对借款人财务状况分析失误导致不能按期还款;B. 不科学的操作流程或工作程序;C. 缺乏科学.成文的信贷政策;D. 银行资产.负债组合不匹配。

4. 下列贷款项目中哪些应属于公司短期贷款()。

A. 票据贴现B. 证券交易商贷款C. 循环信贷融资D. 项目贷款四、计算分析题资料:某上市公司资产负债表(2009年9月30日)单位:元根据以上某公司资产负债表,计算以下财务指标:资产负债率;流动比率;速动比率;股权收益率;流动资产比率;财务杠杆比率。

第四章习题参考答案一、判断题1.×2.×3.√4.√5.√二、单选题1 2 3 4三、多选题1 2 3 4四、计算分析题资产负债率50.60%;流动比率1.21;速动比率0.89;股权收益率0.30;流动资产比率0.48%;财务杠杆比率2.32。

第六章习题一、计算题1. 假设一种5年期市政债券的收益率是10%,一种相应期限公司债券的收益率是15%,所得税税率是34%,银行应选择哪一种债券?2. 一张10年期美国长期国库券,面值为1000美元,当前各证券交易商的售价为775美元,该债券息票率为9%。

如果现在购入并持有至到期,其预期的到期收益率是多少?第六章习题参考答案一、计算题1. 市政债券的收益率为10%,公司债券的实际收益率为15%×(1-34%)=9.6%故银行选择市政债券。

2.()7751101=+∑=t t tr P其中 为每年的现金流入量。

利用插值法可计算出10.7%第九章习题 一、单选题1. 衡量商业银行负债流动性指标是 ( )。

A. 现金状况指标B. 流动性证券指标C. 游资比率D. 能力比率2. 将不同时期存款的最低点连成线,这就形成了商业银行的 ( )。

A. 易变性存款线B. 核心存款线C. 季节性贷款波动线D. 长期贷款趋势线3. 将不同时期贷款的最高点连成线,这就形成了商业银行的 ( )。