公司理财双语知识重点

- 格式:docx

- 大小:2.71 MB

- 文档页数:35

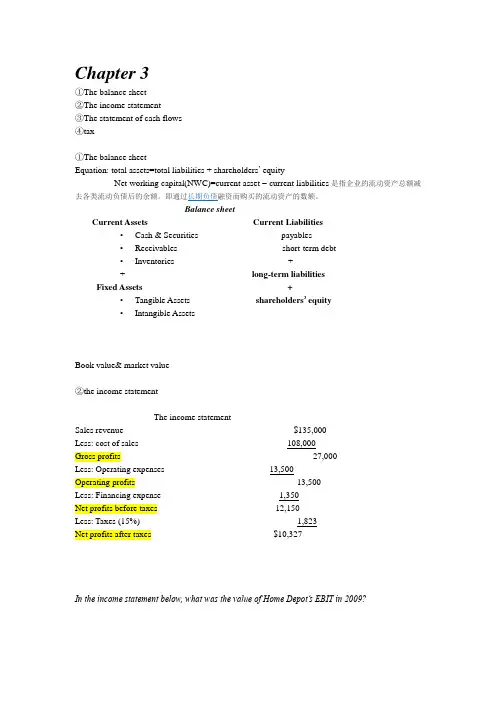

Chapter 3①The balance sheet②The income statement③The statement of cash flows④tax①The balance sheetEquation: total assets=total liabilities + shareholders’ equityNet working capital(NWC)=current asset – current liabilities是指企业的流动资产总额减Balance sheetCurrent Assets Current Liabilities•Cash & Securities payables•Receivables short-term debt•Inventories ++ long-term liabilitiesFixed Assets +•Tangible Assets shareholders’ equity•Intangible AssetsBook value& market value②the income statementThe income statementSales revenue $135,000Less: cost of sales 108,000Gross profits 27,000Less: Operating expenses 13,500Operating profits 13,500Less: Financing expense 1,350Net profits before taxes 12,150Less: Taxes (15%) 1,823Net profits after taxes $10,327In the income statement below, what was the value of Home Depot’s EBIT in 2009?EBIT = total Revenues -costs -deprecation③the statement of cash flowsExample:Net income for your firm was $10,000 last year. The depreciation expense was $2,500; accounts receivable increased $1,250; accounts payable increased $800; and inventories increased by $2,000.What was the total cash flow from operations for the period?Net income: 10,000Depreciation: 2,500Accounts Receivable: (1,250)Accounts Payable: 800Inventories: (2,000)Cash flow from operations: 10,050Free Cash FlowFree Cash Flow is cash available for distribution to investors after the firm pays for new investments or additions to working capital.Free cash flow = (EBIT – taxes + dep.) - change in net working capital- cap. expenditures④tax: 1.corporate tax2.personal tax一,marginal tax rate二,average tax rateChapter4MuaEvaBook rate of ruturnFinancial ratio (财务比率) and shareholders ’ valueThe Dupont systemprice x shares outstanding)Market value added: Market capitalization minus book value of equty.Market-to-book ratio=equityof value book equity of value market ...................Economic Value Added(EV A)Total capitalization: long-term debt + equityAfter tax operating income = after-tax interest + net incomeEVA :Show the firm’s truly created valueincome earned – income requiredBook Rates of Returnreturn on capital(ROC)资本收益率ROC=after-tax operating income/total capitalizationROC=after-tax operating income/average total capitalizationReturn on asset(ROA)资产收益率ROA=after-tax operating income/total assetsROA=after-tax operating income/average total assetsReturn on equity(ROE)股本回报率,产权回报率ROE=net income/equity因为是operating income 在上章可知operating income 是financial expenses 之前的,故还未减去interest ,故要加after-taxinterset)PPT 中关于ROA ,ROC ,ROE 的练习Financial ratios and shareholders ’ valueEconomic Value Added Operating Income* - [Cost of Capital Total Capitalization]=⨯Shareholder value depends on good investment and financing decisions.Financial Ratios help measure the success and soundness of these decisionsEfficiency RatiosAsset turnover ratio=sales/total assets at start of yearOr=sales/average total assetsReceivables turnover=sales/receivables at start of yearAverage collection period=receivables at start of year/average daily sales=365/receivable turnoverInventory turnover ratio=cost of goods sold/inventory at start of yearAverage days in inventory=inventory at start of year/daily cost of goods sold=365/inventory turnoverProfitability RatiosProfit margin(利润率)=net income/sales(IOPM)Operating profit margin=net income +after-tax interest/sales=after-tax operating income/salesLeverage Ratios杠杆率(debt and equity)Long-term debt ratio=long-term debt/long-term debt+equityLong-term debt equity ratio=long-term debt/equityMeasuring LeverageTotal debt ratio=total liability/total assetsTimes interest earned(利息保障率,利息保障倍数)=EBIT/interest payments用于衡量偿付贷款利息的能力Cash coverage ratio(现金涵盖比率)=EBIT+depreciation/interest paymentsLiquidity Ratios(短期还债能力指标/流动性指标)NWC to total assets ratio(经营运资金比)=net working capital/total assets(Net working capital=current asset – current liabilities) Current ratio(流动比率)=current assets/current liabilities(短期还债能力的一个指标)Quick ratio(速动比率)=cash + marketable securities(有价证券) + receivables/current liabilitiesCash ratio(现金比率)=cash + marketable securities/current liabilitiesThe Dupont systemROA= after-tax operating income/asset=assets sales x sales....income operating tax after -=assets turnover x operating profit margin=leverage ratio x asset turnover x operating profit margin x debt burden股息支付率 再投资率Or call sustainable growth rateChapter 5Future valuePresent valuePv of multiple cash flowsPerpetuitiesAnnutitiesFuture value of annutitiesAnnuities and annuities due EAR & APRAssets Sales Net Income Interest Net Income ROE=x x x Equity Assets Sales Net Income Interest++Dividends Payout Ratio=Earnings Earnings-Dividends Plowback Ratio=Earnings Growth in equity from plowback = Plowback Ratio ROE Earnings - Dividends Earnings Earnings Equity ⨯=⨯Earnings-Dividends = EquityInflationValuing real cash paymentsFuture valueSimple interest: FV simple =initial investment*(1+r*t)Compound interest: FV compound =initial investment*(1+r)tPresent valueDiscount rate: rDiscount factor: DF=t r )1(1+ Present value: PV=FV*t r )1(1+ PV of multiple cash flowsCt=the cash flows in year tExample: Your auto dealer gives you the choice to pay $15,500 cash now or make threepayments: $8,000 now and $4,000 at the end of the following two years. If your cost of money (discount rate) is 8%, which do you prefer?PerpetuitiesPV of perpetuity: PV=C/rExample: In order to create an endowment, which pays $185,000 per year forever, how much money must be set aside today if the rate of interest is 8%?What if the first payment won’t be received until 3 years from today?PV = 2312,500 / (1 + 0.08)3= 1,835,662.5annuities124,0001(1.08)4,0002(1.08)Initial Payment* 8,000.003,703.703,429.36Total PV $15,133.06PV of C PV of C ++=====185,000.08$2,312,500PV ==Present value of an annuity: PV=C*[r 1-t r r )1(1+] The terms within the brackets are collectively called the “annuity factor ”PV of multiple cash flowsFuture value of annuitiesExample: You plan to save $4,000 every year for 20 years and then retire. Given a 10% rate ofAnnuities due(即付年金)(与普通年金(即后付年金)的区别仅在于付款时间的不同,一个n 期的即付年金相当于一个n-1期的普通年金)(期不等于年)PV annuitydue =PV annuity (1+r) FV annuity due =FV annuity(1+r) Example: Suppose you invest $429.59 annually at the beginning of each year at 10% interest. After 50 years, how much would your investment be worth?EAR & APREffective annual interest rate: The period interest rate that is annualized using compound interest.EAR = (1 + monthly rate)12 - 1Annual Percentage Rate: The period interest rate that is annualized using simple interest APR = monthly rate × 12Example : Given a monthly rate of 1%, what is the Effective Annual Rate(EAR)? What is the Annual Percentage Rate (APR)?Inflation000,550$)10.1()000,500($)1(=⨯=+⨯=AD AD Annuity AD FV FV r FV FV %00.12)12()01.0(%68.121)01.1(12=⨯==-=APR EAR 1+nominal interest rate1+inflation rate 1real interest rate=+Valuing real cash payments♦ Example: You make a loan of $5,000 to Jane who will pay it back in 1 year. The interestrate is 8%, and the inflation rate is 5% now. What is the present value of Jane’s IOU? Show that you get the same answer when (a) discounting the nominal payment at the nominal rate and (b) discounting the real payment at the real rate.♦ (a) 5,000 / (1 + 8%) = $4630(b) 5,000 / (1.05) = $4762 (real dollar)4762 / (1.028) = $4630(2.8% is real interest rate)不能用实际利率去贴现名义现金流Chapter 6bond pricing:example: For a $1000 face value bond with a bid price of 103:05 and an asked price of 103:06, how much would an investor pay for the bond?PV=1)1(r coupon ++2)1(r coupon ++…+t r par coupon )1(++ PV bond =PV coupon +PV parvalue=coupon*(annuity factor)+ par value * (discout factor)Example: What is the value of a 3-year annuity that pays $90 each year and an additional$1,000 at the date of the final repayment? Assume a discount rate of 4%.Warning: bond rate inflation -rate interest nominal rate interest Real ≈()()6103% 103.1875% 321.031875$1,000 $1,031.875of face value ⎛⎫+= ⎪⎝⎭⨯=331(1.04)1$90$1,000.04(1.04)$1,138.75Bond PV --+=⨯+⨯+=()()1(1)where 1and (1)Bond Coupons ParValue Bond t tPV PV PV PV coupon Annuity Factor par value Discount Factor r Annuity Factor rDiscount Factor r -=+=⨯+⨯-+==+The coupon rate IS NOT the discount rate used in the Present Value calculations Example: What is the present value of a 4% coupon bond with face value $1,000 that matures in 3 years? Assume a discount rate of 5%. Bond yields Current yield : annual coupon payments divided by bond priceExample:Suppose you spend $1,150 for a $1,000 face value bond that pays a $60 annual coupon payment for 3 years. What is the bond’s current yield?Yield to maturity:PV=1)1(r coupon ++2)1(r coupon ++…+t r par coupon )1(++ Bond rates of returnRate of return 只算一年的couponYTM vs rate of returnYTM ↑ (↓)(unchange) → the price of bond ↓ (↑) (unchange) → the rate of return for that period less (greater)(equal to) than the yield to maturity.Ytm 通过改变price 去改变p1-p0 从而改变rate of return ,由rate of return 公式得,p1-p0和其成正比,ytm 与change in price 成反比,故ytm 与其成反比Chapter 7Stock marketP/E ratio(本益比): price per share divided by earnings per shareAsk price & bid priceAsk price: the price at which current shareholders are willing to sell their sharesBid price: the price at which investors are willing to buy sharesTerminologyinvestment change price +income Coupon =return of Rate investmentincome total =return of Rate1,market cap. 2.P/E ratio 3.dividend yieldExample: You are considering investing in a firm whose shares are currently selling for $50 per share with 1,000,000 shares outstanding. Expected dividends are $2/share and earnings are $6/share.What is the firm’s Market Cap? P/E Ratio? Dividend Yield?Measure of value1. book value2. liquidation value3.market valueBV= Assets - liabilitiesLV = Assets selling price – LiabilitiesMV = Tangible & intangible assets + Inv. OpportunitiesPrice and intrinsic valueVo 内在价值Example: What is the intrinsic value of a share of stock if expected dividends are $2/shareand the expected price in 1 year is $35/share? Assume a discount rate of 10%.Expected return(ER)Valuing common stocksdividend discount modelconsider three simplying cases1. no growth2. constant growth3. noconstant growth Market Capitalization $501,000,000$50,000,000$50P/E Ratio 8.33$6$2Dividend Yield .044%$50=⨯======HH H r P Div r Div r Div P )1(...)1()1(22110+++++++=1.2.Example: What should the price of a share of stock be if the firm will pay a $4 dividend in 1year that is expected to grow at a constant rate of 5%? Assume a discount rate of 10%.3.Example:A firm is expected to pay $2/share in dividends next year. Those dividends are expected to grow by 8% for the next three years and 6% thereafter. If the discount rate is 10%, what is the current price of this security?Required rates of returnExample: What rate of return should an investor expect on a share of stock with a $2 expected dividend and 8% growth rate that sells today for $60?Sustainable growth rateExample: Suppose a firm that pays out 35% of earnings as dividends and expects its return on equity to be 10%. What is the expected growth rate?Valuing growth stocksWhere: EPS= Earnings per share PVGO = Present Value of Growth OpportunitiesSuppose a stock is selling today for $55/share and there are 10,000,000 shares outstanding. If earnings are projected to be $20,000,000, how much value are investors assigning to growth per share? Assume a discount rate of 10%.Return on Equity Plowback Rate = :g ROE bearnings dividends where b earnings=⨯⨯-=.10(1.35).065 6.5%g =⨯-==Chapter 8(NPV ,EAA,IRR) 第8章( 重点复习单元):净现值及其他投资准则,会算NPV ,计算EAA (P191页),认识其他投评估指标(PP 回流期和 IRR 内含报酬率)及其判断准则(取大或取小),重点关注NPV 与IRR ,注意使用IRR 指标的前提是IRR<r (P199页)有关投资组合,要知道其大前提是资金是有约束的;单个项目的特征(可分/不可分),可分的单个项目之间的比较与排序用PI (收益指数)值来衡量,不可分的用各自的NPV 值来比较衡量,比较的前提是它们的寿命期是一样的,如果不一样的话就用最小共同寿命期法或等价年金法来比较 。

Chapter8:StrategyandAnalysisinUsingNetPresentValue ConceptQuestions-Chapter88.1 •WhatarethewaysafirmcancreatepositiveNPV.1.Befirsttointroduceanewproduct.2.Furtherdevelopacorecompetencytoproductgoodsorservicesatlowercoststhancompetitors.3.Createabarrierthatmakesitdifficultfortheotherfirmstocompeteeffectively.4.Introducevariationonexistingproductstotakeadvantageofunsatisfieddemand5.Createproductdifferentiationbyaggressiveadvertisingandmarketingnetworks.einnovationinorganizationalprocessestodoalloftheabove. •HowcanmanagersusethemarkettohelpthemscreenoutnegativeNPVprojects?8.2 •Whatisadecisiontree?Itisamethodtohelpcapitalbudgetingdecision-makersevaluatingprojectsinvolvingsequentialdecisions.Ateverypointinthetree,ther earedifferentalternativesthatshouldbeanalyzed. •Whatarepotentialproblemsinusingadecisiontree?Potentialproblems1)thatadifferentdiscountrateshouldbeusedfordifferentbranchesin thetreeand2)itisdifficultfordecisiontreestocapturemanagerialoptions.8.3 •Whatisasensitivityanalysis?Itisatechniqueusedtodeterminehowtheresultofadecisionchangeswhensomeofthepar ametersorassumptionschange. •Whyisitimportanttoperformasensitivityanalysis?Becauseitprovidesananalysisoftheconsequencesofpossiblepredictionorassumption errors.•Whatisabreak-evenanalysis?Itisatechniqueusedtodeterminethevolumeofproductionnecessarytobreakeven,thatis ,tocovernotonlyvariablecostsbutfixedcostsaswell. •Describehowsensitivityanalysisinteractswithbreak-evenanalysis.Sensitivityanalysiscandeterminehowthefinancialbreak-evenpointchangeswhensomefactors(suchasfixedcosts,variablecosts,orrevenue)cha nge.AnswerstoEnd-of-ChapterProblemsQUESTIONSANDPROBLEMSDecisionTrees8.1SonyElectronics,Inc.,hasdevelopedanewtypeofVCR.Ifthefirmdirectlygoestothemarketwiththeproduct,the reisonlya50percentchanceofsuccess.Ontheotherhand,ifthefirmconductstestmarketingoftheVCR,itwilltakeay earandwillcost$2million.Throughthetestmarketing,however,thefirmisabletoimprovetheproductandincreasetheprobabilityofsuccessto7 5percent.Ifthenewproductprovessuccessful,thepresentvalue(atthetimewhenthefirmstartssellingit)ofthepayoff is$20million,whileifitturnsouttobeafailure,thepresentvalueofthepayoffis$5million.Shouldthefirmconducttest marketingorgodirectlytothemarket?Theappropriatediscountrateis15percent.8.1 Godirectly:NPV=0.5⨯$20million+0.5⨯$5million=$12.5millionTestmarketing:NPV=-$2million+(0.75⨯$20million+0.25⨯=$12.13millionGodirectlytothemarket.8.2Themarketingmanagerforagrowingconsumerproductsfirmisconsideringlaunchinganewproduct.Todetermi neconsumers’interestinsuchaproduct,themanagercanconductafocusgroupthatwillcost$120,000andhasa70percentchanceofc orrectlypredictingthesuccessoftheproduct,orhireaconsultingfirmthatwillresearchthemarketatacostof$400,00 0.Theconsultingfirmboastsacorrectassessmentrecordof90percent.Ofcoursegoingdirectlytothemarketwithnop riortestingwillbethecorrectmove50percentofthetime.Ifthefirmlaunchestheproduct,anditisasuccess,thepayoff willbe$1.2million.Whichactionwillresultinthehighestexpectedpayoffforthefirm?8.2 Focusgroup:-$120,000+0.70⨯$1,200,000=$720,000Consultingfirm:-$400,000+0.90⨯$1,200,000=$680,000Directmarketing:0.50⨯$1,200,000=$600,000Themanagershouldconductafocusgroup.8.3TandemBicyclesisnoticingadeclineinsalesduetotheincreaseoflower-pricedimportproductsfromtheFarEast.TheCFOisconsideringanumberofstrategiestomaintainitsmarketshare.T heoptionssheseesarethefollowing:•Pricetheproductsmoreaggressively,resultingina$1.3milliondeclineincashflows. ThelikelihoodthatTandemwilllosenocashflowstotheimportsis55percent;thereisa45percentprobabilitythattheywillloseonly$550,000 incashflowstotheimports.•Hirealobbyisttoconvincetheregulatorsthatthereshouldbeimportanttariffsplaceduponoverseasmanufacturersof bicycles.ThiswillcostTandem$800,000andwillhavea75percentsuccessrate,thatis,nolossincashflowstotheimp orters.Ifthelobbyistsdonotsucceed,TandemBicycleswilllose$2millionincashflows.AstheassistanttotheCFO,w hichstrategywouldyourecommendtoyourboss?AccountingBreak-EvenAnalysis8.3 Pricemoreaggressively:-$1,300,000+(0.55⨯0)+0.45⨯(-$550,000)=-$1,547,500Hirelobbyist:-$800,000+(0.75⨯0)+0.25⨯(-$2,000,000)=-$1,300,000Tandemshouldhirethelobbyist.8.4SamuelsonInc.hasinvestedinafacilitytoproducecalculators.Thepriceofthemachineis$600,000anditsecono miclifeisfiveyears.Themachineisfullydepreciatedbythestraight-linemethodandwillproduce20,000unitsofcalculatorsinthefirstyear.Thevariableproductioncostperunitofthecal culatoris$15,whilefixedcostsare$900,000.Thecorporatetaxrateforthecompanyis30percent.Whatshouldthesal espriceperunitofthecalculatorbeforthefirmtohaveazeroprofit?8.4 Letsalespricebex.Depreciation=$600,000/5=$120,000BEP:($900,000+$120,000)/(x-$15)=20,000x=$668.5Whatistheminimumnumberofunitsthatadistributorofbig-screenTVsmustsellinagivenperiodtobreakeven? Salesprice_$1,500Variablecosts_$1,100Fixedcosts_$120,000Depreciation_$20,000Taxrate_35%8.5 Theaccountingbreak-even=(120,000+20,000)/(1,500-1,100)=350units8.6Youareconsideringinvestinginafledglingcompanythatcultivatesabaloneforsaletolocalrestaurants.Theprop rietorsayshe’llreturnallprofitstoyouaftercoveringoperatingcostsandhissalary.Howmanyabalonemustbeharvestedandsoldin thefirstyearofoperationsforyoutogetanypayback?(Assumenodepreciation.)Fixedcosts_$300,000Salaries_$40,000Taxrate_35%Howmuchprofitwillbereturnedtoyouifhesells300,000abalone?8.6 a. Theaccountingbreak-even=340,000/(2.00-0.72)=265,625abalonesb. [($2.00⨯300,000)-(340,000+0.72⨯300,000)](0.65)=$28,600Thisistheaftertaxprofit.PresentValueBreak-EvenAnalysis8.7Usingtheinformationintheproblemabove,whatisthepresentvaluebreak-evenpointifthediscountrateis15percent,initialinvestmentis$140,000,andthelifeoftheprojectissevenyears?Ass umeastraight-linedepreciationmethodwithazerosalvagevalue.A=$33,6508.7 EAC =$140,000/7.015Depreciation=$140,000/7=$20,000BEP ={$33,650+$340,000⨯0.65-$20,000⨯0.35}/{($2-$0.72)⨯0.65}=297,656.25≈297,657units8.8Kids&ToysInc.haspurchaseda$200,000machinetoproducetoycars.Themachinewillbefullydepreciatedbyt hestraight-linemethodforitseconomiclifeoffiveyearsandwillbeworthlessafteritslife.Thefirmexpectsthatthesalespriceofth etoyis$25whileitsvariablecostis$5.Thefirmshouldalsopay$350,000asfixedcostseachyear.Thecorporatetaxrat eforthecompanyis25percent,andtheappropriatediscountrateis12percent.Whatisthepresentvaluebreak-evenpoint?8.8 Depreciation=$200,000/5=$40,000AEAC =$200,000/5.012=$55,482BEP ={$55,482+$350,000⨯0.75-$40,000⨯0.25}/{($25-$5)⨯0.75}≈20533units8.9TheCornchopperCompanyisconsideringthepurchaseofanewharvester.Thecompanyiscurrentlyinvolvedind eliberationswiththemanufacturerandthepartieshavenotcometosettlementregardingthefinalpurchaseprice.The managementofCornchopperhashiredyoutodeterminethebreak-evenpurchasepriceoftheharvester. ThispriceisthatwhichwillmaketheNPVoftheprojectzero.Baseyouranalysisonthefollowingfacts:•Thenewharvesterisnotexpectedtoaffectrevenues,butoperatingexpenseswillbereducedby$10,000peryearfor10 years.•Theoldharvesterisnow5yearsold,with10yearsofitsscheduledliferemaining.Itwaspurchasedfor$45,000.Ithasbe endepreciatedonastraight-linebasis.•Theoldharvesterhasacurrentmarketvalueof$20,000. •Thenewharvesterwillbedepreciatedonastraight-linebasisoverits10-yearlife.•Thecorporatetaxrateis34percent.•Thefirm’srequiredrateofreturnis15percent.•Allcashflowsoccuratyear-end.However,theinitialinvestment,theproceedsfromsellingtheoldharvester,andanytaxeffectswilloccurimmed iately.Capitalgainsandlossesaretaxedatthecorporaterateof34percentwhentheyarerealized. •Theexpectedmarketvalueofbothharvestersattheendoftheireconomiclivesiszero.8.9 LetIbethebreak-evenpurchaseprice.IncrementalC0Saleoftheoldmachine $20,000Taxeffect 3,400Total $23,400Depreciationperperiod=$45,000/15=$3,000Bookvalueofthemachine=$45,000-5⨯$3,000=$30,000Lossonsaleofmachine=$30,000-$20,000=$10,000Taxcreditduetoloss=$10,000⨯=$3,400 Incrementalcostsavings:$10,000(1-0.34)=$6,600 Incrementaldepreciationtaxshield:[I/10-$3,000](0.34)Thebreak-evenpurchasepriceistheInvestment(I),whichmakestheNPVbezero.NPV =0=-I+$23,400+$6,6001015.0A+[I/10-$3,000](0.34)1015.0A=-I+$23,400+$6,600(5.0188)+I(0.034)(5.0188)-$3,000(0.34)(5.0188)I=$61,981ScenarioAnalysis8.10Ms.Thompson,astheCFOofaclockmaker,isconsideringaninvestmentofa$420,000machinethathasaseven-yearlifeandnosalvagevalue.Themachineisdepreciatedbyastraight-linemethodwithazerosalvageoverthesevenyears.Theappropriatediscountrateforcashflowsoftheprojectis13per cent,andthecorporatetaxrateofthecompanyis35percent.CalculatetheNPVoftheprojectinthefollowingscenario.Whatisyourconclusionabouttheproject?PessimisticExpectedOptimisticUnitsales23,00025,00027,000Price$38$40$42Variablecosts$21$20$19Fixedcosts$320,000$300,000$280,0008.10Pessimistic:NPV =-$420,000+(){}23,000$38$21$320,0000.65$60,0000.351.13t t 17--⨯+⨯=∑Expected: NPV =-$420,000+(){}25,000$40$20$300,0000.65$60,0000.351.13t 7--⨯+⨯=∑t 1Optimistic:NPV =-$420,000+(){}27,000$42$19$280,0000.65$60,0000.351.13tt 17--⨯+⨯=∑ EventhoughtheNPVofpessimisticcaseisnegative,ifwechangeoneinputwhileallothersareassu medtomeettheirexpectation,wehaveallpositiveNPVsliketheonebefore.Thus,thisprojectisquit eprofitable.Pessimistic NPVUnitsales 23,000Price $38Variablecosts $21Fixedcosts $320,0008.11Youarethefinancialanalystforamanufactureroftennisracketsthathasidentifiedagraphite-likematerialthatitisconsideringusinginitsrackets.Giventhefollowinginformationabouttheresultsoflaunchingan ewracket,willyouundertaketheproject?(Assumptions:Taxrate_40%,Effectivediscountrate_13%,Depreciation_$300,000peryear,andproductionwilloccuroverthenextfiveyearsonly.)PessimisticExpectedOptimisticMarketsize110,000120,000130,000Marketshare22%25%27%Price$115$120$125Variablecosts$72$70$68Fixedcosts$850,000$800,000$750,000Investment$1,500,000$1,500,000$1,500,0008.11 Pessimistic:NPV =-$1,500,000+(){}1100000220000600000401131,.$850,.$300,..⨯--⨯+⨯=∑$115$725ttExpected:NPV =-$1,500,000+(){}1200000250000600000401131,.$800,.$300,..⨯--⨯+⨯=∑$120$705ttOptimistic:NPV =-$1,500,000+(){}130,0000.27$125$68$750,0000.60$300,0000.401.13tt15⨯--⨯+⨯=∑Theexpectedpresentvalueofthenewtennisracketis$428,357.21.(Assumingthereareequalchanc esofthe3scenariosoccurring.)8.12Whatwouldhappentotheanalysisdoneaboveifyourcompetitorintroducesagraphitecompositethatisevenlig hterthanyourproduct?Whatfactorswouldthislikelyaffect?DoanNPVanalysisassumingmarketsizeincreases(du etomoreawarenessofgraphite-basedrackets)tothelevelpredictedbytheoptimisticscenariobutyourmarketsharedecreasestothepessimisticlevel (duetocompetitiveforces).Whatdoesthistellyouabouttherelativeimportanceofmarketsizeversusmarketshare?8.12NPV=(){}-+⨯--⨯+⨯=∑1,500,000130,0000.22$120$70$800,0000.60$300,0000.401.13tt15The3%dropinmarketsharehurtsignificantlymorethanthe10,000increaseinmarketsizehelped.H owever,ifthedropwereonly2%,theeffectswouldbeabouteven.Marketsizeisgoingupbyover8%, thusitseemsmarketshareismoreimportantthanmarketsize.TheOptiontoAbandon8.13YouhavebeenhiredasafinancialanalysttodoafeasibilitystudyofanewvideogameforPassivision.Marketingr esearchsuggestsPassivisioncansell12,000unitsperyearat$62.50netcashflowperunitforthenext10years.Totalan nualoperatingcashflowis_12,000_$750,000.Therelevantdiscountrateis10percent. Therequiredinitialinvestmentis$10million.a.WhatisthebasecaseNPV?b.Afteroneyear,thevideogameprojectcanbeabandonedfor$200,000.Afteroneyear, expectedcashflowswillberevisedupwardto$1.5millionorto$0withequalprobability.Whatistheoptionvalueofabandonment?WhatistherevisedNPV?A8.13 a. NPV=-$10,000,000+($750,000⨯10.10A)b.RevisedNPV =-$10,000,000+$750,000/1.10+[(.5⨯$1,500,000⨯910.+(.5⨯Optionvalueofabandonment =-$5,300,665.58–(-$5,391,574.67)8.14AlliedProductsisthinkingaboutanewproductlaunch.ThevicepresidentofmarketingsuggeststhatAlliedProd uctscansell2millionunitsperyearat$100netcashflowperunitforthenext10years.AlliedProductsusesa20-percentdiscountratefornewproductlaunchesandtherequiredinitialinvestmentis$100million.a.WhatisthebasecaseNPV?b.Afterthefirstyear,theprojectcanbedismantledandsoldforscrapfor$50million.Ifexpectedcashflowscanberevis edbasedonthefirstyear’sexperience,whenwoulditmakesensetoabandontheproject?(Hint:Atwhatlevelofexpectedcashflowsdoesitmak esensetoabandontheproject?)A8.14 a. NPV=-$100M+($100⨯2M⨯1020.Ab.$50M =C920.C =$12.40Million(or1.24Millionunits)。

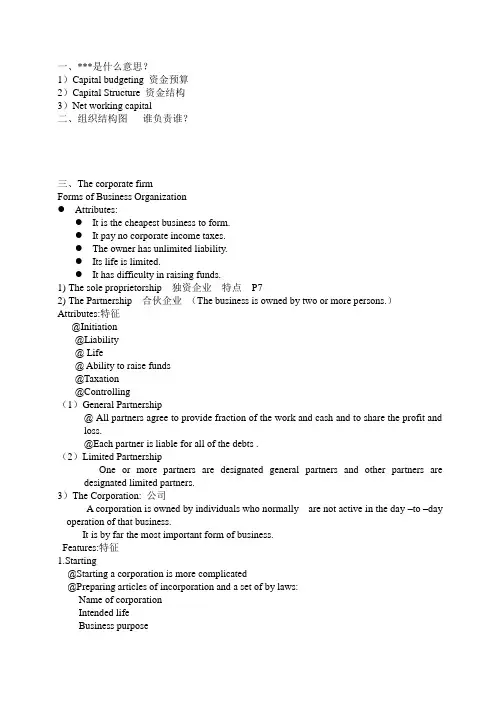

一、***是什么意思?1)Capital budgeting 资金预算2)Capital Structure 资金结构3)Net working capital二、组织结构图谁负责谁?三、The corporate firmForms of Business Organization●Attributes:●It is the cheapest business to form.●It pay no corporate income taxes.●The owner has unlimited liability.●Its life is limited.●It has difficulty in raising funds.1)The sole proprietorship 独资企业特点P72)The Partnership 合伙企业(The business is owned by two or more persons.)Attributes:特征@Initiation@Liability@ Life@ Ability to raise funds@Taxation@Controlling(1)General Partnership@ All partners agree to provide fraction of the work and cash and to share the profit and loss.@Each partner is liable for all of the debts .(2)Limited PartnershipOne or more partners are designated general partners and other partners are designated limited partners.3)The Corporation: 公司A corporation is owned by individuals who normally are not active in the day –to –day operation of that business.It is by far the most important form of business.Features:特征1.Starting@Starting a corporation is more complicated@Preparing articles of incorporation and a set of by laws:Name of corporationIntended lifeBusiness purposeNumber of shares of stockNature of the right granted to shareholdersNumber of members of the initial board of directors2. Three sets of distinct interests:ShareholdersDirectorsCorporation officer3.It is a legal entity.4.OwnershipOwnership is represented by shares of stock, it is easy to transfer ownership.5.Life6.The corporation has unlimited life7.LiabilityLiability is limited to the amounted invested in the ownership .8.Taxation: double taxation9.Raising funds: easyThe goal of financial management:Maximize the current value per share of the existing stock.1.5 Financial MarketsClassification of financial markets市场分类1.Money market vs capital market1) Money MarketThe market for debt securities that will pay off in the short term2) Capital MarketThe market for long-term debt and for equity shares (common stock, preferred stock, corporate and government bonds2.Primary Market vs Secondary Markets1) Primary Market一级市场Issuance of a security for the first time2)Secondary Markets二级市场Buying and selling of previously issued securitiesanized security exchanges vs over-the counter market (Securities may be traded in either a dealer or auction market1) Organized security exchanges are tangible entitiesNYSE2)OCT include all security markets eccept the organized exchanges.NASDAQ2.3 TaxesThe one thing we can rely on with taxes is that they are always changingMarginal vs. average tax ratesMarginal – the percentage paid on the next dollar earnedAverage – the tax bill / taxable income1) Average tax rate is tax bill divided your taxable income.2) Marginal tax rate is the tax you would pay (in percent) if you earned one more dollar.例题:Taxable Income Tax Rate$ 0 - 50,000 15%50,001-75,000 25%75,001-100,000 34%100,001-335,000 39%335,001-10,000,000 34%--------------------------------The tax rates apply to the part of income in the indicated range only, not all income.Suppose your firm earns $4 million in taxable income. Use table2.1,we can figure out tax bill as:.15($50,000)=$7,500.25(75,00-50,000)=6250.34(100,000-75,000)=8500.39(335,000-100,000)=91,650.34(4,000,000-335,000)=1246,100Total tax bill 1,360,000Average tax rate= 1,360,000/4,000,000 =34%EquationCash flows from the assets= Operating cash flow –Investment in NWC –Investment in fixed assets1.Operating cash flowDefinition: Operating cash flow refers to the cash generated from operations.Calculation:Method 1:OCF= Sales – Costs – TaxesMethod 2:OCF = EBIT + Depreciation – TaxesEgNabors, corporation.2005 Income Statement ($ in millions)Net sales $9,610Less: Cost of goods sold 6,310Less: Depreciation 1,370Earnings before interest and taxes 1,930Less: Interest paid 630Taxable Income $1,300Less: Taxes 455Net income $ 845Method1:Sales $9,610Less: cost 6,310Taxes 455Operating cash flow $ 2845Nabors, corporation2005 Income Statement ($ in millions)Net sales $9,610Less: Cost of goods sold 6,310Less: Depreciation 1,370Earnings before interest and taxes 1,930Less: Interest paid 630Taxable Income $1,300Less: Taxes 455Net income $ 845Method2:Earnings before interest and taxes $1,930Plus depreciation 1,370Less taxes 455Operating cash flow $ 2845Positive cash flows were generated from operations of $2845.2.Change in NWCDefinition:Net Working Capital =current assets – current liabilitiesNWC usually grows with the firmChange in NWC= ending net working capital – beginning net working capital3.Change in fixed assetsMethod 1:Ending gross fixed assets- Beginning gross fixed assets = Change in fixed assets Method 2:Ending net fixed assts - Beginning net fixed assets+ Depreciation= Change in fixed assets .Free cash flowCommon-Size Balance SheetsCompute all accounts as a percent of total assets(express each item as percentage of total assetsCommon-Size Income StatementsCompute all line items as a percent of sales(express each item as a percentage of total sales)Categories of Financial RatiosShort-term solvency or liquidity ratiosLong-term solvency, or financial leverage, ratiosAsset management or turnover ratiosProfitability ratiosMarket value ratiosComputing Liquidity RatiosMeaningLiquidity ratios are intended to provide information about a firm’s liquidity.Who are interested in liquidity ratiosshort-term creditorFeaturesTheir book value and market value are likely to be similar.CalculationCurrent Ratio = CA / CL (dollar or times)708 / 540 = 1.31 timesQuick Ratio (acid-test)= (CA – Inventory) / CL(708 - 422) / 540 = .53 timesCash Ratio = Cash / CL98 / 540 = .18 times3.3 The Du Pont IdentityIt is an integrative approach to ratio analysis.It evaluates firm’s return on equity (ROE)Definition of ROEROE = Net income / Total equityMultiply by 1(TA / TA) and then rearrange:ROE = (NI / TE) (TA / TA)ROE = (NI / TA) (TA / TE) = ROA * EMMultiply by 1 again and then rearrange:ROE = (NI / TA) (TA / TE) (Sales / Sales)ROE = (NI / Sales) (Sales / TA) (TA / TE)ROE = PM * TAT * EMROE = PM * TAT * EMProfit margin is a measure of the firm’s operating efficiency – how well it controls costs.Total asset turnover is a measure of the firm’s asset use efficiency – how well it manages its assets.Equity multipli er is a measure of the firm’s financial leverage.3.5 Long-Term Financial PlanningAnother use of financial statementsThe most comprehensive means of financial planning is to develop a series of pro forma, or projected, financial statements.External Financing Needed (EFN)The difference between the forecasted increase in assets and the forecasted increase in liabilities and equity.Formula: EFN=Assets×g- Spontaneous liabilities×g-PM×Projected sales×(1-d)External Financing Needed (EFN) can also be calculated as:The Internal Growth RateThe internal growth rate tells us how much the firm can grow assets using retained earnings as the only source of financing.The Sustainable Growth RateThe sustainable growth rate tells us how much the firm can grow by using internally generated funds and issuing debt to maintain a constant debt ratio.4.4 SimplificationsPerpetuityA constant stream of cash flows that lasts foreverGrowing perpetuityA stream of cash flows that grows at a constant rate foreverAnnuityA stream of constant cash flows that lasts for a fixed number of periodsGrowing annuityA stream of cash flows that grows at a constant rate for a fixed number of periodsZero Coupon BondsMake no periodic interest payments (coupon rate = 0%)The entire yield to maturity comes from the difference between the purchase price and the par valueCannot sell for more than par valueSometimes called zeroes, deep discount bonds, or original issue discount bonds (OIDs) Treasury Bills and principal-only Treasury strips are good examples of zeroesThe Fisher EffectThe Fisher Effect defines the relationship between real rates, nominal rates, and inflation.(1 + R) = (1 + r)(1 + h), whereR = nominal rater = real rateh = expected inflation rateApproximationR = r + h例子If we require a 10% real return and we expect inflation to be 8%, what is the nominal rate? R = (1.1)(1.08) – 1 = .188 = 18.8%Approximation: R = 10% + 8% = 18%Because the real return and expected inflation are relatively high, there is a significant difference between the actual Fisher Effect and the approximation.。

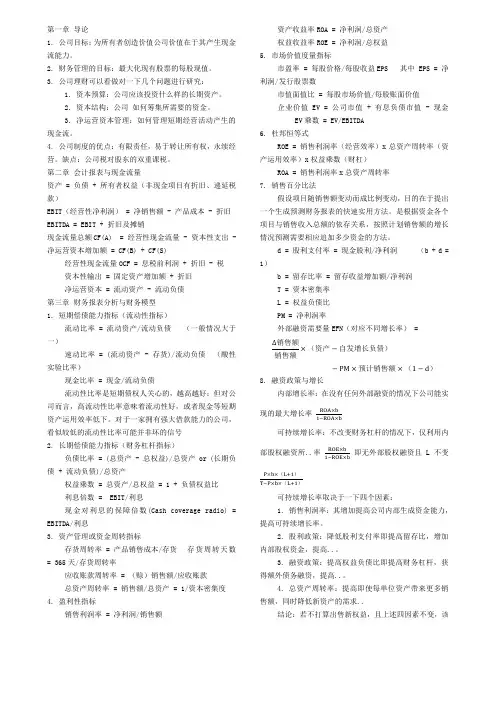

第一章导论1. 公司目标:为所有者创造价值公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财可以看做对一下几个问题进行研究:1. 资本预算:公司应该投资什么样的长期资产。

2. 资本结构:公司如何筹集所需要的资金。

3. 净运营资本管理:如何管理短期经营活动产生的现金流。

4. 公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产 = 负债 + 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润) = 净销售额 - 产品成本 - 折旧EBITDA = EBIT + 折旧及摊销现金流量总额CF(A) = 经营性现金流量 - 资本性支出 - 净运营资本增加额 = CF(B) + CF(S)经营性现金流量OCF = 息税前利润 + 折旧 - 税资本性输出 = 固定资产增加额 + 折旧净运营资本 = 流动资产 - 流动负债第三章财务报表分析与财务模型1. 短期偿债能力指标(流动性指标)流动比率 = 流动资产/流动负债(一般情况大于一)速动比率 = (流动资产 - 存货)/流动负债(酸性实验比率)现金比率 = 现金/流动负债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,或者现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司,看似较低的流动性比率可能并非坏的信号2. 长期偿债能力指标(财务杠杆指标)负债比率 = (总资产 - 总权益)/总资产 or (长期负债 + 流动负债)/总资产权益乘数 = 总资产/总权益 = 1 + 负债权益比利息倍数 = EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 资产管理或资金周转指标存货周转率 = 产品销售成本/存货存货周转天数= 365天/存货周转率应收账款周转率 = (赊)销售额/应收账款总资产周转率 = 销售额/总资产 = 1/资本密集度4. 盈利性指标销售利润率 = 净利润/销售额资产收益率ROA = 净利润/总资产权益收益率ROE = 净利润/总权益5. 市场价值度量指标市盈率 = 每股价格/每股收益EPS 其中EPS = 净利润/发行股票数市值面值比 = 每股市场价值/每股账面价值企业价值EV = 公司市值 + 有息负债市值 - 现金EV乘数 = EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总资产周转率(资产运用效率)x权益乘数(财杠)ROA = 销售利润率x总资产周转率7. 销售百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

Chapter 8: Strategy and Analysis in Using Net Present Value Concept Questions - Chapter 88.1 •What are the ways a firm can create positive NPV.1.Be first to introduce a new product.2.Further develop a core competency to product goods or services at lower coststhan competitors.3.Create a barrier that makes it difficult for the other firms to competeeffectively.4.Introduce variation on existing products to take advantage of unsatisfieddemand5.Create product differentiation by aggressive advertising and marketingnetworks.e innovation in organizational processes to do all of the above.•How can managers use the market to help them screen out negative NPV projects?8.2 •What is a decision tree?It is a method to help capital budgeting decision-makers evaluating projectsinvolving sequential decisions. At every point in the tree, there are differentalternatives that should be analyzed.•What are potential problems in using a decision tree?Potential problems 1) that a different discount rate should be used for differentbranches in the tree and 2) it is difficult for decision trees to capture managerialoptions.8.3 •What is a sensitivity analysis?It is a technique used to determine how the result of a decision changes whensome of the parameters or assumptions change.•Why is it important to perform a sensitivity analysis?Because it provides an analysis of the consequences of possible prediction orassumption errors.•What is a break-even analysis?It is a technique used to determine the volume of production necessary to breakeven, that is, to cover not only variable costs but fixed costs as well.•Describe how sensitivity analysis interacts with break-even analysis.Sensitivity analysis can determine how the financial break-even point changeswhen some factors (such as fixed costs, variable costs, or revenue) change. Answers to End-of-Chapter ProblemsQUESTIONS AND PROBLEMSDecision Trees8.1 Sony Electronics, Inc., has developed a new type of VCR. If the firm directly goes to the market with the product, there is only a 50 percent chance of success. On the other hand, if the firm conducts test marketing of the VCR, it will take a year and will cost $2 million.Through the test marketing, however, the firm is able to improve the product and increase the probability of success to 75 percent. If the new product proves successful, the present value (at the time when the firm starts selling it) of the payoff is $20 million, while if it turns out to be a failure, the present value of the payoff is $5 million. Should the firm conduct test marketing or go directly to the market? The appropriate discount rate is 15 percent.8.1 Go directly:NPV = 0.5 ⨯ $20 million + 0.5 ⨯ $5 million= $12.5 millionTest marketing:NPV = -$2 million + (0.75 ⨯ $20 million + 0.25 ⨯ $5 million) / 1.15= $12.13 millionGo directly to the market.8.2 The marketing manager for a growing consumer products firm is considering launching a new product. To determine consumers’ interest in such a product, the manager can conduct a focus group that will cost $120,000 and has a 70 percent chance of correctly predicting the success of the product, or hire a consulting firm that will research the market at a cost of $400,000. The consulting firm boasts a correct assessment record of 90 percent. Of course going directly to the market with no prior testing will be the correct move 50 percent of the time. If the firm launches the product, and it is a success, the payoff will be $1.2 million.Which action will result in the highest expected payoff for the firm?8.2 Focus group: -$120,000 + 0.70 ⨯ $1,200,000 = $720,000Consulting firm: -$400,000 + 0.90 ⨯ $1,200,000 = $680,000Direct marketing: 0.50 ⨯ $1,200,000 = $600,000The manager should conduct a focus group.8.3 Tandem Bicycles is noticing a decline in sales due to the increase of lower-priced import products from the Far East. The CFO is considering a number of strategies to maintain its market share. The options she sees are the following:• Price the products more aggressively, resulting in a $1.3 million decline in cash flows.The likelihood that Tandem will lose no cash flows to the imports is 55 percent; there is a45 percent probability that they will lose only $550,000 in cash flows to the imports.• Hire a lobbyist to convince the regulators that there should be important tariffs placed upon overseas manufacturers of bicycles. This will cost Tandem $800,000 and will have a 75 percent success rate, that is, no loss in cash flows to the importers. If the lobbyists do not succeed, Tandem Bicycles will lose $2 million in cash flows. As the assistant to the CFO, which strategy would you recommend to your boss? Accounting Break-Even Analysis8.3 Price more aggressively:-$1,300,000 + (0.55 ⨯ 0) + 0.45 ⨯ (-$550,000)= -$1,547,500Hire lobbyist:-$800,000 + (0.75 ⨯ 0) + 0.25 ⨯ (-$2,000,000)= -$1,300,000Tandem should hire the lobbyist.8.4 Samuelson Inc. has invested in a facility to produce calculators. The price of the machine is $600,000 and its economic life is five years. The machine is fully depreciated by the straight-line method and will produce 20,000 units of calculators in the first year. The variable production cost per unit of the calculator is $15, while fixed costs are $900,000. The corporate tax rate for the company is 30 percent. What should the sales price per unit of the calculator be for the firm to have a zero profit?8.4 Let sales price be x.Depreciation = $600,000 / 5 = $120,000BEP: ($900,000 + $120,000) / (x - $15) = 20,000x = $668.5 What is the minimum number of units that a distributor of big-screen TVs must sell in a given period to break even?Sales price _ $1,500Variable costs _ $1,100Fixed costs _ $120,000Depreciation _ $20,000Tax rate _ 35%8.5 The accounting break-even= (120,000 + 20,000) / (1,500 - 1,100)= 350 units8.6 You are considering investing in a fledgling company that cultivates abalone for sale to local restaurants. The proprietor says he’ll return all profits to you after covering operating costs and his salary. How many abalone must be harvested and sold in the first year of operations for you to get any payback? (Assume no depreciation.)Price per adult abalone _ $2.00Variable costs _ $0.72Fixed costs _ $300,000Salaries _ $40,000Tax rate _ 35%How much profit will be returned to you if he sells 300,000 abalone?8.6 a. The accounting break-even= 340,000 / (2.00 - 0.72)= 265,625 abalonesb. [($2.00 ⨯ 300,000) - (340,000 + 0.72 ⨯ 300,000)] (0.65)= $28,600This is the after tax profit.Present Value Break-Even Analysis8.7 Using the information in the problem above, what is the present value break-even point if the discount rate is 15 percent, initial investment is $140,000, and the life of the project is seven years? Assume a straight-line depreciation method with a zero salvage value.A = $33,6508.7 EAC = $140,000 / 715.0Depreciation = $140,000 / 7 = $20,000BEP = {$33,650 + $340,000 ⨯ 0.65 - $20,000 ⨯ 0.35} / {($2 - $0.72) ⨯ 0.65}= 297,656.25≈ 297,657 units8.8 Kids & Toys Inc. has purchased a $200,000 machine to produce toy cars. The machine will be fully depreciated by the straight-line method for its economic life of five years and will be worthless after its life. The firm expects that the sales price of the toy is $25 while its variable cost is $5. The firm should also pay $350,000 as fixed costs each year. The corporate tax rate for the company is 25 percent, and the appropriate discount rate is 12 percent. What is the present value break-even point?8.8 Depreciation = $200,000 / 5 = $40,000A = $200,000 / 3.60478EAC = $200,000 / 512.0= $55,482BEP = {$55,482 + $350,000 ⨯ 0.75 - $40,000 ⨯ 0.25} / {($25 - $5) ⨯ 0.75}= 20,532.13≈ 20533 units8.9 The Cornchopper Company is considering the purchase of a new harvester. The company is currently involved in deliberations with the manufacturer and the parties have not come to settlement regarding the final purchase price. The management of Cornchopper has hired you to determine the break-even purchase price of the harvester.This price is that which will make the NPV of the project zero. Base your analysis on the following facts: • The new harvester is not expected to affect revenues, but operating expenses will be reduced by $10,000 per year for 10 years.• The old harvester is now 5 years old, with 10 years of its scheduled life remaining. It was purchased for $45,000. It has been depreciated on a straight-line basis.• The old harvester has a current market value of $20,000.• The new harvester will be depreciated on a straight-line basis over its 10-year life.• The corporate tax rate is 34 percent.• The firm’s required rate of return is 15 percent.• All cash flows occur at year-end. However, the initial investment, the proceeds from selling the old harvester, and any tax effects will occur immediately. Capital gains and losses are taxed at the corporate rate of 34 percent when they are realized.• The expected market value of both harvesters at the end of their economic lives is zero.8.9 Let I be the break-even purchase price.Incremental C0Sale of the old machine $20,000Tax effect 3,400Total $23,400Depreciation per period= $45,000 / 15= $3,000Book value of the machine= $45,000 - 5 ⨯ $3,000= $30,000Loss on sale of machine= $30,000 - $20,000= $10,000Tax credit due to loss= $10,000 ⨯ 0.34= $3,400Incremental cost savings:$10,000 (1 - 0.34) = $6,600Incremental depreciation tax shield:[I / 10 - $3,000] (0.34)The break-even purchase price is the Investment (I), which makes the NPV be zero.NPV = 0= -I + $23,400 + $6,600 1015.0A+ [I / 10 - $3,000] (0.34) 1015.0A= -I + $23,400 + $6,600 (5.0188)+ I (0.034) (5.0188) - $3,000 (0.34) (5.0188)I = $61,981Scenario Analysis8.10 Ms. Thompson, as the CFO of a clock maker, is considering an investment of a $420,000 machine that has a seven-year life and no salvage value. The machine is depreciated by a straight-line method with a zero salvage over the seven years. The appropriate discount rate for cash flows of the project is 13 percent, and the corporate tax rate of the company is 35 percent. Calculate the NPV of the project in the following scenario. What is your conclusion about the project?Pessimistic Expected OptimisticUnit sales 23,000 25,000 27,000Price $ 38 $ 40 $ 42Variable costs $ 21 $ 20 $ 19Fixed costs $320,000 $300,000 $280,0008.10 Pessimistic:NPV = -$420,000 +(){}23,000$38$21$320,0000.65$60,0000.351.13tt17--⨯+⨯=∑= -$123,021.71 Expected:NPV = -$420,000 +(){}25,000$40$20$300,0000.65$60,0000.351.13t7--⨯+⨯=∑t1= $247,814.17 Optimistic:NPV = -$420,000 +(){}27,000$42$19$280,0000.65$60,0000.351.13tt17--⨯+⨯=∑= $653,146.42Even though the NPV of pessimistic case is negative, if we change one input while all others are assumed to meet their expectation, we have all positive NPVs like the one before. Thus, this project is quite profitable.Pessimistic NPVUnit sales 23,000 $132,826.30Price $38 $104,079.33Variable costs $21 $175,946.75Fixed costs $320,000 $190,320.248.11 You are the financial analyst for a manufacturer of tennis rackets that has identified a graphite-like material that it is considering using in its rackets. Given the following information about the results of launching a new racket, will you undertake the project?(Assumptions: Tax rate _ 40%, Effective discount rate _ 13%, Depreciation _ $300,000per year, and production will occur over the next five years only.)Pessimistic Expected OptimisticMarket size 110,000 120,000 130,000Market share 22% 25% 27%Price $ 115 $ 120 $ 125Variable costs $ 72 $ 70 $ 68Fixed costs $ 850,000 $ 800,000 $ 750,000Investment $1,500,000 $1,500,000 $1,500,0008.11 Pessimistic:NPV = -$1,500,000+(){}1100000220000600000401131,.$850,.$300,..⨯--⨯+⨯=∑$115$725tt= -$675,701.68Expected:NPV = -$1,500,000+(){}1200000250000600000401131,.$800,.$300,..⨯--⨯+⨯=∑$120$705tt= $399,304.88Optimistic:NPV = -$1,500,000+(){}130,0000.27$125$68$750,0000.60$300,0000.401.13tt15⨯--⨯+⨯=∑= $1,561,468.43The expected present value of the new tennis racket is $428,357.21. (Assuming there are equal chances of the 3 scenarios occurring.)8.12 What would happen to the analysis done above if your competitor introduces a graphite composite that is even lighter than your product? What factors would this likely affect? Do an NPV analysis assuming market size increases (due to more awareness of graphite-based rackets) to the level predicted by the optimistic scenario but your market share decreases to the pessimistic level (due to competitive forces). What does this tell you about the relative importance of market size versus market share?8.12 NPV =(){}-+⨯--⨯+⨯=∑1,500,000130,0000.22$120$70$800,0000.60$300,0000.401.13tt15= $251,581.17The 3% drop in market share hurt significantly more than the 10,000 increase in marketsize helped. However, if the drop were only 2%, the effects would be about even. Market size is going up by over 8%, thus it seems market share is more important than market size. The Option to Abandon8.13 You have been hired as a financial analyst to do a feasibility study of a new video game for Passivision. Marketing research suggests Passivision can sell 12,000 units per year at $62.50 net cash flowper unit for the next 10 years. Total annual operating cash flow is forecasted to be $62.50 _ 12,000 _ $750,000. The relevant discount rate is 10 percent.The required initial investment is $10 million.a. What is the base case NPV?b. After one year, the video game project can be abandoned for $200,000. After one year,expected cash flows will be revised upward to $1.5 million or to $0 with equalprobability. What is the option value of abandonment? What is the revised NPV?A) = -$5,391,574.678.13 a. NPV = -$10,000,000 + ( $750, 000 ⨯1010.A)b.Revised NPV = -$10,000,000 + $750,000 / 1.10 + [(.5 ⨯ $1,500,000 ⨯9.10+ (.5 ⨯ $200,000 )] / 1.10= -$5,300,665.58Option value of abandonment = -$5,300,665.58 – ( -$5,391,574.67 )= $90,909.098.14 Allied Products is thinking about a new product launch. The vice president of marketing suggests that Allied Products can sell 2 million units per year at $100 net cash flow per unit for the next 10 years. Allied Products uses a 20-percent discount rate for new product launches and the required initial investment is $100 million.a. What is the base case NPV?b. After the first year, the project can be dismantled and sold for scrap for $50 million. If expected cash flows can be revised based on the first year’s experience, when would it make sense to abandon the project? (Hint: At what level of expected cash flows does it make sense to abandon the project?)A) = $738.49Million8.14 a. NPV = -$100M + ( $100 ⨯ 2M ⨯10.20Ab.$50M = C9.20C = $12.40 Million (or 1.24 Million units )。

公司理财(双语)-知识重点————————————————————————————————作者:————————————————————————————————日期:第一篇价值第一章公司理财导论1.公司理财是对以下三个问题的研究:1) 资本预算(Capital Budgeting):长期资产的投资和管理2) 资本结构(Capital Structure):公司短期及长期负债与所有者权益的比例3) 净营运资本(Net Working Capital):现金流量的短期管理(流动资产–流动负债)2.财务管理目标:最大化现有股票的每股价值(最大化现有所有者权益的市场价值)。

因此,可以把公司理财定义为研究企业决策和企业股票价值的关系。

第二章会计报表与现金流量1.财务现金流量(FCFF 企业自由现金流、资产的现金流)= 经营性现金流量–资本性支出–净营运资本的增加= EBIT(1−t c)+折旧−资本性支出−净营运资本的增加其中:经营性现金流量= EBIT(1−t c)+折旧= (营业收入−营业支出)×(1−t c)+折旧×t c资本性支出= 购入的固定资产–卖出的规定资产= 期末固定资产净额–期初固定资产净额+ 折旧净营运资本的增加= 期末净营运资本–期初净营运资本(用current asset)注:EBIT = 销售收入–销售成本–销售费用、一般费用及管理费用–折旧+ 其他利润这里,可以看出NOPAT = NOPLAT2.计算项目的现金流:看第六章。

3.会计现金流量表= 经营活动产生的现金流量+ 投资活动产生的现金流量+ 筹资活动产生的现金流量第三章 财务报表分析与财务模型1. 盈余的度量指标:1 ) Net Income: 净利润 = 总收入 – 总支出 2) EPS: 每股收益 = 净利润/发行在外的总股份数3) EBIT: 息税前利润 = 经营活动总收入 – 经营活动总成本= 净利润 + 财务费用 + 所得税(可排除资本结构(利息支出)和税收的影响) 4) EBITDA: 息税及折旧和摊销前利润 = EBIT + 折旧和摊销 2. 财务比率分析 看Excel 表格总结3. 偿债能力比率分析 a)短期偿债能力分析 i. 流动比率ii. 速动比率iii. 现金比率b)长期偿债能力分析 i. 资产负债率ii. 利息保障倍数(TIE )iii. 产权比率iv. 强制性现金支付比率4. 如果ROE 不太令人满意,可以从杜邦恒等式(Du Pont Identity )中看出要从哪里寻找原因。

ROE=profit margin (利润率) * total asset turnover (总资产周转率) * equity multiplier (权益乘数)流动比率=流动资产流动负债速动比率=速动资产流动负债现金比率=现金+可变现有价证券流动负债资产负债率=负债总额资产总额 ×100%利息保障倍数=息税前利润利息费用产权比率=负债总额所有者权益总额强制性现金支付比率=现金流入总量经营现金流出量+偿还到期本息付现×100% 利润总额权益乘数=总资产总负债⏹ 杜邦分析图为我们提供了以下信息:● 权益利润率是综合性最强,最具有代表性的一个指标,也是杜邦分析体系的核心● 权益乘数主要受资产负债比率的影响,负债比例越大,权益乘数越大,财务杠杆的效应也越大● 总资产净利润率也是一项综合性较强的指标,总资产净利润率的高低要受销售获利能力和总资产营运效率的影响ROE 受三个因素的影响: ● 经营效率(利润率)● 资产使用效率(总资产周转率) ● 财务杠杆(权益乘数)经营效率(operating efficiency )和资产使用效率的缺陷都将表现为资产报酬率(ROA )的降低最终导致较低的ROE5. 股利支付率 = 现金股利/净利润 = 1 – 留存收益增加额/净利润 = 1 – 留存比率6. 内部增长率:没有任何外部融资的情况下公司能实现的最大增长率内部增长率 =ROA ×b 1−ROA ×bROA =NET INCOMEAverage total asset=profit margin ×assets turnoverb: plowback ratio, retention ratio 提存率,再投资率b =addition to retained earningsnet income=1−dividend payout ratio股利支付率(dividend payout ratio )=casℎ dividend net income7. 可持续增长率(sustainable growth) :在没有外部股权融资且保持负债权益比不变的情况下可能实现的最高增长率可持续增长率 = g =ROE ×b1−ROE ×b实际中,g =ROE ×b ,,其中Equity 用的是期初数。

因此,一个企业的增长来自追加的投资量b 和投资的效果ROE 。

总结:一家公司的增长率取决于四个因素(与b 相关的一个和与ROE 相关的三个) 1) 股利政策:支付的股利占净利润的比率的降低,会提高提存率(retention rate ),这样会总资产周转率=营业收入净额总资产平均余额式中:总资产平均余额=期初总资产+期末总资产2增加内部产生的权益(internally generated equity),从而提高可持续增长率。

2) 销售利润率:利润率的提高将会增强企业从内部产生现金的能力(generated fundsinternally),从而提高它的持续增长率。

3) 融资政策(是否提高公司的财务杠杆):债务权益率(debt-equity ratio)的提高将会大大加大企业的财务杠杆(financial leverage),因为这会是额外的债务筹资(additional debt financing available) 成为可能,所以它会提高可持续增长率。

4) 总资产周转率:企业总资产周转率的提高会增加每一美元资产所产生的销售收入。

8、所需的外部筹资(EFN)外部筹资需求量的预测所需的外部筹资(EFN)=资产增加-负债增加-内部筹资增加-折旧=第二篇估值与资本预算第四章折现现金流量估价1.APR – Annual Percentage Rate 名义年利率= 每期利息X 一年中的期数市场中公布的利率都是APR2.EAR – Effective Annual Rate 实际年利率=(1+rm)m−1,其中r=APR连续复利:limm→∞(1+rm)m−1=e r−1,若多年:e rT−1,T为年数3.货币的时间价值First basic principle of finance: A dollar today is worth more than a dollar in the futureSecond basic principle of finance: A safe dollar is worth more than a risky dollar If future cash flows are not certain:Use expected future cash flowsAnd use higher discount rate (expected rate of return on other investments of comparable risk)4. A bank will lend you money at 8% for the project. Is 8% the cost of capital for the project?No. The bank is offering you at 8% loan based on the overall financial condition of your firm.5.现金流折现的简化(最好看一遍课件第三讲)1) 永续年金(Perpetuity)PV=Cr2) 永续增长年金PV=Cr−g注意:分子C是现在起一期后收到的现金流,而非当前的现金流2)后付年金:每期期末有等额现金收付的年金。

PV=C(1r −1r (1+r)T)=Cr(1−1(1+r)T)3)普通年金(annuities)可以用来计算贷款的每月payment第六章投资决策(NPV)1.关键:决定要不要投资于某个项目时,对项目产生的增量现金流进行折现是关键。

从整体评价一家公司时,对股利进行折现,因为股利是投资者收到的现金流。

2.在计算项目现金流时,不考虑其若采用债务融资而产生的利息费用,即公司通常在项目中依据全权益融资的假设计算项目的现金流,对债务融资的任何调整都反映在折现率中。

3.在计算项目NPV中,采用名义现金流或实际现金流计算得出的结果是一致的。

因为若分子用名义现金流,分母就要用名义折现率;若分子用实际现金流,分母就用实际折现率。

折回当期计算的NPV与未来通胀无关。

4.项目的现金流(NPV中的分子)= 投资性现金流+ 经营性现金流+ 净营运资本的变化其中:投资性现金流包括固定资产投资(与残值)、机会成本经营性现金流= EBIT(1−t c)+折旧第八章利率和债券估值1.债券现值公式:1) Discount Bonds零息债券:PV=F/(1+r)T2) Coupon Bonds 平息债券:PV=Cr (1−1(1+r)T)+F/(1+r)T=C[1− 1(1+r)tr]+F(1+r)t⁄•If YTM = coupon rate, then par value = bond price•If YTM > coupon rate, then par value > bond price–Why? The discount provides yield above coupon rate–Price below par value, called a discount bond•If YTM < coupon rate, then par value < bond price–Why? Higher coupon rate causes value above par–Price above par value, called a premium bond2.上式中,r = YTM = Yield to Maturity,为到期承诺收益率,指持有到期,且不考虑利率风险、违约风险的收益率。

3.利率风险:利率浮动带来的风险1)在其他条件相同的情况下,距离到期日时间越长,利率风险越大;2)在其他条件相同的情况下,票面利率越低,利率风险越大。