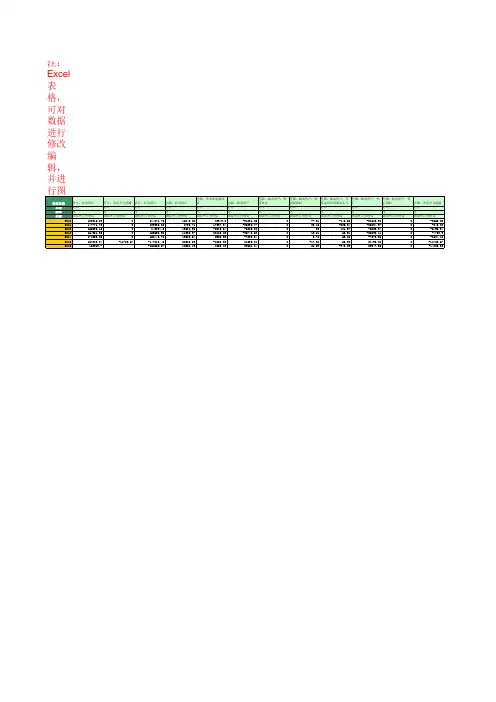

2011—2012年美国国际收支平衡表原版

- 格式:xls

- 大小:37.50 KB

- 文档页数:6

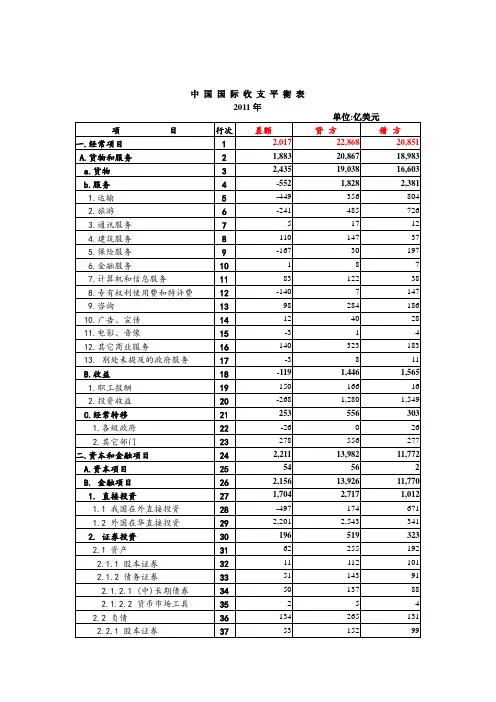

2012年国际收支平衡表分析2012年国际收支平衡表分析第六小组一、国际收支概况根据统计表显示,去年中国国际收支经常项目呈现顺差,而资本和金融项目呈现出逆差,国际储备仍然保持较快地增长。

2012年,中国国际收支经常项目顺差1931亿美元,同比增长41.78%。

按国际收支统计口径计算,货物出口20569亿美元,货物进口17353亿美元,顺差3216亿美元;服务项目收入1914亿美元,支出2812亿美元,逆差898亿美元;收益项目收入1604亿美元,支出2026亿美元,逆差422亿美元;经常转移收入512亿美元,支出477亿美元,顺差35亿美元。

2012年,资本和金融项目逆差168亿美元,而2011年,资本和金融项目顺差2655亿美元。

其中,直接投资净流入1911亿美元,证券投资净流入477亿美元,其它投资净流出2600亿美元。

虽然资本和金融项目出现了小幅的逆差,但是在经常项目存在较大顺差的推动下,2012年中国国际储备也出现了较为快速增长,但是较2011年的增速慢。

其中,特别提款权减少了5亿美元,在基金组织的储备头寸减少16亿美元,外汇储备增加987亿美元,总体上储备资产增量低于去年同期增加3878亿美元的水平,外汇储备的增量也低于去年的3848亿美元的水平。

外汇贮备较多意味着我国中央银行干预外汇市场,稳定汇率的能力增强,对加强外汇市场参与者对其货币的信心十分有利,相应的也有助于本币汇率的上升。

同时也说明了我国的偿债能力也进一步加强。

二、具体分析(一)经常项目差额分析经常项目差额是由经常项目的借方和贷方之差,经常账户由三个子项目构成,分别为货物与服务项目(又称贸易项目)收益项目和经常转移项目,因此经常账户差额就可以写为:经常账户差额=贸易账户差额+收益差额+经常转移差额如果差额为正,则经常账户盈余,如果为负则经常账户赤字,如果为零,则经常账户平衡,经常账户差额的变化受其子项目差额的影响,其子项目和内部结构的变化都将直接影响经常账不足,有待提高,及时找出原因,对其内部组织结构加以调整和优化。

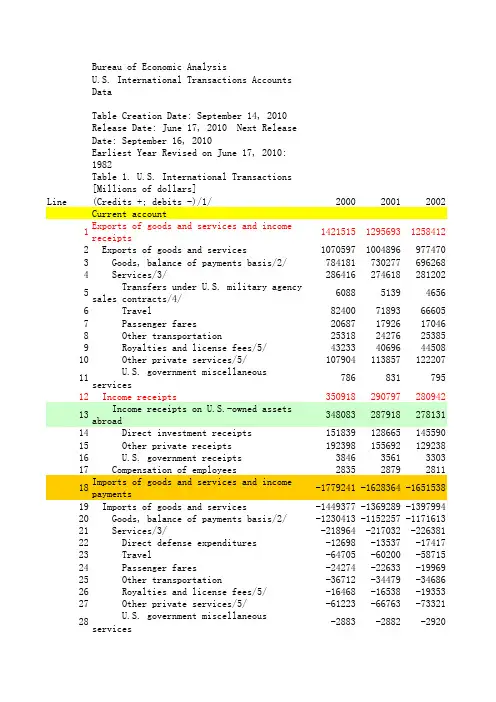

美国国际收支分析近十年美国国际收支平衡表分析近十年来,美国经济从平稳增长到遭遇次贷危机,再到慢慢走出经济危机的阴影,总体而言汇率基本保持稳定,经济发展态势良好。

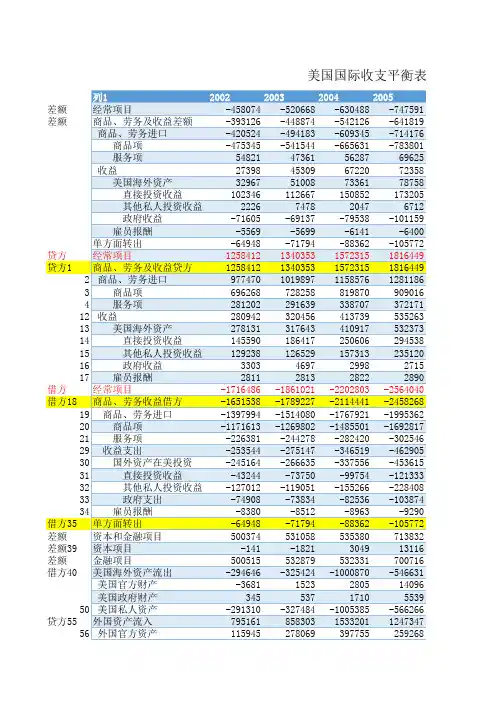

一、国际收支概况美国国际收支结构具有“逆差+顺差”的特点,对外净融资总体呈现扩大之势,基本填补了美国的经常项目赤字,并且,自2002年来,美国不仅要为经常项目赤字融资,还要靠债务为其对外直接投资融资。

1.美国长期保持“经常账户逆差,资本和金融账户顺差”的国际收支结构。

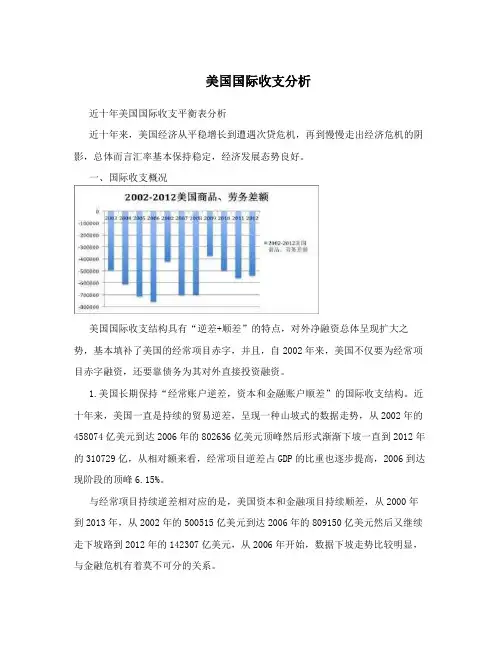

近十年来,美国一直是持续的贸易逆差,呈现一种山坡式的数据走势,从2002年的458074亿美元到达2006年的802636亿美元顶峰然后形式渐渐下坡一直到2012年的310729亿,从相对额来看,经常项目逆差占GDP的比重也逐步提高,2006到达现阶段的顶峰6.15%。

与经常项目持续逆差相对应的是,美国资本和金融项目持续顺差,从2000年到2013年,从2002年的500515亿美元到达2006年的809150亿美元然后又继续走下坡路到2012年的142307亿美元,从2006年开始,数据下坡走势比较明显,与金融危机有着莫不可分的关系。

2.货物贸易持续逆差,而服务贸易和投资收益表现为持续顺差。

美国服务贸易近十年来一直表现为顺差,2012年美国该项顺差达到206820亿美元,从2000年开始的趋势是呈现上升趋势,美国经常账户中,投资收益近十年来一直表现为顺差,2012年对外资产的收入达到770079亿美元,而对外支付的投资收益为537815亿美元,顺差额为232264亿美元,从2002年的27398亿美元持续上涨,发展迅速。

值得关注的是,虽然美国已经成为最大的负债国,拥有巨额的对外负债,但是投资收益净额却始终为正。

3.证券投资长期保持净流入,是主要的资本和金融账户顺差来源。

从美国资本和金融账户看,美国资本流入以证券投资为主,2012年证券投资流入314660亿美元,占全部资本流入的86%。

浅析“十二五”期间我国国际收支平衡的状况摘要近年来我国国际收支失衡的情况进一步加剧,长期以来的双顺差格局给我国经济带来了发展的重大机遇。

同时也给我国货币政策的有效实施带来了不良影响,还增加了我国宏观调控的难度,而且很容易使我国在对外贸易中产生贸易摩擦,进而阻碍我国对外经济发展的可持续性,阻碍国民经济的又好又快发展。

"十二五"时期,是我国全面建设小康社会的关键时期,是深化改革开放、加快转变经济发展方式的攻坚时期。

深刻认识并准确把握国内外形势新变化新特点,科学制定"十二五"规划,对于继续抓住和用好我国发展的重要战略机遇期、促进经济长期平稳较快发展,具有十分重要的意义。

而2008年国际金融危机爆发以来,不论从国内层面看,还是从国际层面看,应对危机、刺激经济复苏都始终与国际收支的紧密联系在一起。

因此国家《“十二五”规划纲要》把“国际收支趋向基本平衡”列入十二五经济发展目标。

本文将对“十二五”期间我国国际收支失衡的基本情况进行简要的分析。

关键词:“十二五”、国际收支、“双顺差”、“一顺一逆”一、国际收支和“十二五”的概念国际收支:是指一国在一定时期内(通常为一年)全部对外经济往来的系统的货币记录。

国际收支包括:一个经济体与世界其他经济体之间商品、劳务、和收益交易;一个经济体的货币黄金、特别提款权的所有权变动与其他变动,以及这个经济体对世界上其他经济体的债权、债务的变化;无偿转移以及在会计上需要对上述不能抵消的交易和变化加以平衡的对应记录。

广义的国际收支是指一个经济体(国家或地区)与其它经济体(国家或地区)在一定时期(通常为一年)居民与非居民之间发生的全部对外经济的系统的货币记录。

狭义的国际收支即为人们通常所说的外汇收支。

“十二五”:中国是以五年一个时间段来做国家的中短期规划的,从1953年开始制以五年一个时间段来做国家的中短期规划的,第一个“五年计划”,我们就简称为“一五”。

Table 1. U.S. International Transactions[Millions of dollars, seasonally adjusted]Bureau of Economic AnalysisRelease Date: March 14, 2013 - Next Release Date: June 14, 20131Exports of goods and services and inc6895937134997248007200957279562 Exports of goods and services5088115240005373515332045434713 Goods, balance of payments basis /2/3609173721603821613821673879394 Services /3/1478941518391551901510371555325 Transfers under U.S. military agency 412245454664461544066 Travel27407292603019429254309697 Passenger fares837490809889928797118 Other transportation10520107601095610827108609 Royalties and license fees /5/294053034331055300333043710 Other private services /5/677496758568123667366882111 U.S. government miscellaneous servi31726730928432712 Income receipts18078118949918744918689118448513 Income receipts on U.S.-owned assets17932818804718599418544118300714 Direct investment receipts11862112341711910611909411611615 Other private receipts602626412366361659036614616 U.S. government receipts44550652744474517 Compensation of employees14531452145514501479 18Imports of goods and services and inc-774367-798839-801143-806512-82902119 Imports of goods and services-646036-665549-672173-679489-69206920 Goods, balance of payments basis /2/-542276-559344-562778-571421-58250321 Services /3/-103761-106205-109395-108068-10956722 Direct defense expenditures-7570-7545-7343-7052-683823 Travel-19257-19628-19895-19871-2124424 Passenger fares-7542-7698-7946-7923-893125 Other transportation-13439-13736-13767-13769-1371526 Royalties and license fees /5/-8921-8543-9503-9652-986627 Other private services /5/-45825-47916-49656-48576-4785828 U.S. government miscellaneous servi-1207-1138-1284-1225-111529 Income payments-128330-133290-128971-127022-13695130 Income payments on foreign-owned as-124863-129835-125508-123590-13356131 Direct investment payments-39891-43855-38261-36552-4526132 Other private payments-51501-53193-54157-53655-5539633 U.S. government payments-33471-32787-33090-33383-3290434 Compensation of employees-3467-3455-3463-3433-3390 35Unilateral current transfers, net-35223-33777-31815-32240-3270336 U.S. government grants /4/-11136-13486-11176-11551-1191037 U.S. government pensions and other tra-2202-2227-2250-2269-254138 Private remittances and other transfers /-21884-18064-18389-18419-18253Capital account39Capital account transactions, net-29-829-300-55-1 Financial account40U.S.-owned assets abroad, excluding f-3729447418-91896-26231107001 41 U.S. official reserve assets-3619-6267-4079-1912-123342 Gold /7/0000043 Special drawing rights1961-159-27-23-1144 Reserve position in the International Mo-6428-5974-3909-1768-107845 Foreign currencies848-134-143-121-14446 U.S. government assets, other than offic-547-1358-1137-1006245107647 U.S. credits and other long-term assets-1307-2337-1396-2267-263148 Repayments on U.S. credits and other 610125981265335249 U.S. foreign currency holdings and U.S150-279-553-990105335650 U.S. private assets-36877815042-86679763055715951 Direct investment-104404-133397-70323-111208-11564152 Foreign securities-85472-57195-4011035980360453 U.S. claims on unaffiliated foreigners re-922036147932665122-4918354 U.S. claims reported by U.S. banks an-86699199487144288641121837955Foreign-owned assets in the United St57897298554266397570676050156 Foreign official assets in the United Stat7297412182219889-28596971157 U.S. government securities677199718411249-174178543158 U.S. Treasury securities /9/5627410436328115-175738506859 Other /10/11445-7179-1686615636360 Other U.S. government liabilities /11/2714223622871826283361 U.S. liabilities reported by U.S. banks a-309015764512112215-1930562 Other foreign official assets /12/56316638123251775263 Other foreign assets in the United States505998-2326824650859926-921064 Direct investment333656128163222761202313965 U.S. Treasury securities55054-17613120918825194383466 U.S. securities other than U.S. Treasur4338-5108-20396-35276365467 U.S. currency12576139899614188171805768 U.S. liabilities to unaffiliated foreigners 4068825538-19670-399892421269 U.S. liabilities reported by U.S. banks a359977-10135592820-42265-12210670Financial derivatives, net29277419-394932613-139671Statistical discrepancy (sum of above -889306555-6209455263-3233871a Of which: Seasonal adjustment discrepa17684-11134-267712022318254Memoranda:72Balance on goods (lines 3 and 20)-181358-187184-180617-189254-19456473Balance on services (lines 4 and 21)441334563445795429694596574Balance on goods and services (lines 2 a-137225-141549-134822-146286-14859975Balance on income (lines 12 and 29)524515620958478598694753476Unilateral current transfers, net (line 35)-35223-33777-31815-32240-3270377Balance on current account (lines 1, 18, a-119997-119117-108158-118656-133768 Legend / Footnotes:p Preliminary.r Revised.0 Transactions are possible, but are zero for a given period.(*) Transactions are less than $500,000(±).D Suppressed to avoid disclosure of individual companies.n.a. Transactions are possible, but data are not available...... Not applicable, or for data periods 1960-1997, transactions that are 0, “not available,” or “not applicable.”Quarterly estimates are not annualized and are expressed at quarterly rates.1. Credits, +: Exports of goods and services and income receipts; unilateral current transfers to the United Sta2. See Table 2 footnotes for explanations of the various balance of payments adjustments made to convert go3. Includes some goods: Mainly military equipment and supplies in lines 5 and 22 that are commingled in the s4. Includes transfers of goods and services under U.S. military grant programs.5. Beginning in 1982, these lines are presented on a gross basis. The definition of exports is revised to exclud6. Beginning in 1982, the "other transfers" component includes taxes paid by U.S. private residents to foreign g7. At the present time, all U.S.-Treasury-owned gold is held in the United States.8. Includes sales of foreign obligations to foreigners.9. Consists of bills, certificates, marketable bonds and notes, and nonmarketable convertible and nonconvertib10. Consists of U.S. Treasury and Export-Import Bank obligations, not included elsewhere, and of debt securit11. Includes U.S. government liabilities associated with military agency sales contracts, other transactions arra12. Consists of investments in U.S. corporate stocks and in debt securities of private corporations and state an13. Conceptually, the sum of line 77 and line 39 is equal to "net lending or net borrowing" in the national incom14. Beginning with 2003, includes securities brokers' claims on their foreign affiliates. Prior to 2003, they are i15. Beginning with 2003, includes securities brokers' liabilities to their foreign affiliates. Prior to 2003, they are16. Calculated excluding capital account transactions, net (line 39).17. Equals the sum of financial derivatives for the first, second, and third quarters of the year.18. For 1974, includes extraordinary U.S. government transactions with India. See "Special U.S. Government19. For 1978-83, includes foreign currency-denominated notes sold to private residents abroad.20. Break in series. See Technical Notes in the June 1989, June 1990, June 1992, June 1993, June 1995, and21. Seasonally adjusted data for lines 57 and 58 are not available separately through 1972; they are combined734927733290740340 551128550458549435 393530392790389846 157598157668159590 426744614843 323573267132558 1016597879858 109451072110768 300023056130809 695486915470452 314313302 183799182832190905 182317181338189407 111953112463121136 698936840967958 470466313148214941498 -820500-811542-816358 -688781-675302-677853 -579532-566943-570439 -109249-108359-107414 -6726-6349-6205 -21402-20782-20223 -8817-8432-8263 -13807-13841-13807 -10090-10438-9643 -47303-47409-48136 -1104-1107-1137 -131719-136239-138505 -128314-132822-135129 -39005-44662-44170 -56568-55586-58660 -32741-32574-32299 -3404-3417-3376 -32780-34194-34398 -11471-11821-10943 -2574-2622-2617 -18735-19751-20837 -291-4707198 248566-217157-120493 -3289-833895000-10-10-6 -3179-744969-100-79-6816650152042180-2538-1037-2140680844595 18508153973725235206-231528-123568-62967-90927-8191065192142-64783246081582-7642267046-14432530767-142149290599175951797721311119304871093115425759238523910491479560-1414610511-3637266116527412404800710608361460275776 -2219211594888290349476418086025759924782025986-43065475566853671161615615812-27008-4943-17213-21443211091-70475464-51272985 117634460144775-13176-2849623417-186002-174154-180593483494930952176-137653-124845-128417520804659352399-32780-34194-34398-118353-112446-110416ble.”d States; capital accountert goods on a Census-basis tothe source data and cannot bexclude U.S. parents' payments to eign governments and taxes paid vertible bonds and notes. ecurities of U.S. governments arranged with or through foreign ate and local governments.ncome and product accountsare included in the claims ofey are included in the liabilities of ment Transactions," June 19745, and July 1996-2012 issues of the bined with data in line 61.。

美国国际收支平衡2000200120022003经常项目1商品、劳务及收益贷方14215151295693125841213403532 商品、劳务进口1070597100489697747010198973 商品项7841817302776962687282584 服务项28641627461828120229163912 收益35091829079728094232045613 美国海外资产34808328791827813131764314 直接投资收益15183912866514559018641715 其他私人投资收益19239815569212923812652916 政府收益384635613303469717 雇员报酬283528792811281318商品、劳务收益借方-1779241-1628364-1651538-178922719 商品、劳务进口-1449377-1369289-1397994-151408020 商品项-1230413-1152257-1171613-126980221 服务项-218964-217032-226381-24427829 收益支出-329864-259075-253544-27514730 国外资产在美投资-322345-250989-245164-26663531 直接投资收益-56910-12783-43244-7375032 其他私人投资收益-180918-159825-127012-11905133 政府支出-84517-78381-74908-7383434 雇员报酬-7519-8086-8380-851235单方面转出-64487-64948-71794资本项目39资本项目交易-113198-141-1821金融项目40美国海外资产流出-560523-382616-294646-32542450 美国私人资产-559292-377219-291310-32748455外国资产流入103822478287079516185830356 外国官方资产427582805911594527806963 外国在美资产99546675481167921658023471错误遗漏-61329-16294-42300-10391备注72商品贸易差额 -446233-421980-475345-54154473服务贸易差额 6745357586548214736174商品服务差额-378780-364393-420524-49418375收入项差额2105431722273984530976单方面转移差额-58645-64487-64948-7179477经常项目差额-416371-397158-458074-520668单位:百万美元2000200120022003经常账户-416371-397158-458074-520668资本账户-113198-141-1821金融账户477701400254500515532879支平衡表200420052006200720082009 1572315181644921350042478267263554021590001158576128118614527831648665183901215707978198709090161035868116036613048961068499338707372171416916488299534116502298413739535263682221829602796528588203410917532373679338826632793484585256250606294538324816370712403225346073157313235120352122453687385353234458299827152400223349064724282228902883297130442947 -2114441-2458268-2846159-3080813-3182368-2412489-1767921-1995362-2212023-2350763-2537814-1945705-1485501-1692817-1875324-1983558-2139548-1575443-282420-302546-336700-367206-398266-370262-346519-462905-634136-730049-644554-466783-337556-453615-624646-719983-634190-456027-99754-121333-150770-129134-115538-94010-155266-228408-338897-426501-352053-218020-82536-103874-134979-164348-166599-143997-8963-9290-9490-10066-10364-10757-88362-105772-91481-115548-122026-124943304913116-178********-140 -1000870-546631-1285729-1475719156077-140465-1005385-566266-1293449-1453324690540-6295521533201124734720651692107655454722305736397755259268487939481043550770450030113544698807915772301626612-96048-144294 9510733758-47277955284991162497 -665631-783801-839456-823192-834652-506944 562866962580216121093135850132036 -609345-714176-759240-702099-698802-374908 67219723584808599553151974121419-88362-105772-91481-115548-122026-124943-630488-747590-802636-718094-668854-3784322004200520062007200820092010-630488-747591-802636-718094-668854-378432-470242 304913116-178********-140-150 532331700716809150638158577852216075220108。

美国国际收支分析This model paper was revised by the Standardization Office on December 10, 2020近十年美国国际收支平衡表分析近十年来,美国经济从平稳增长到遭遇次贷危机,再到慢慢走出经济危机的阴影,总体而言汇率基本保持稳定,经济发展态势良好。

一、国际收支概况美国国际收支结构具有“逆差+顺差”的特点,对外净融资总体呈现扩大之势,基本填补了美国的经常项目赤字,并且,自2002年来,美国不仅要为经常项目赤字融资,还要靠债务为其对外直接投资融资。

1.美国长期保持“经常账户逆差,资本和金融账户顺差”的国际收支结构。

近十年来,美国一直是持续的贸易逆差,呈现一种山坡式的数据走势,从2002年的458074亿美元到达2006年的802636亿美元顶峰然后形式渐渐下坡一直到2012年的310729亿,从相对额来看,经常项目逆差占GDP的比重也逐步提高,2006到达现阶段的顶峰%。

与经常项目持续逆差相对应的是,美国资本和金融项目持续顺差,从2000年到2013年,从2002年的500515亿美元到达2006年的809150亿美元然后又继续走下坡路到2012年的142307亿美元,从2006年开始,数据下坡走势比较明显,与金融危机有着莫不可分的关系。

2.货物贸易持续逆差,而服务贸易和投资收益表现为持续顺差。

美国服务贸易近十年来一直表现为顺差,2012年美国该项顺差达到206820亿美元,从2000年开始的趋势是呈现上升趋势,美国经常账户中,投资收益近十年来一直表现为顺差,2012年对外资产的收入达到770079亿美元,而对外支付的投资收益为537815亿美元,顺差额为232264亿美元,从2002年的27398亿美元持续上涨,发展迅速。

值得关注的是,虽然美国已经成为最大的负债国,拥有巨额的对外负债,但是投资收益净额却始终为正。

3.证券投资长期保持净流入,是主要的资本和金融账户顺差来源。

Table 1. U.S. International Transactions[Millions of dollars, seasonally adjusted]Bureau of Economic AnalysisRelease Date: March 14, 2013 - Next Release Date: June 14, 20131Exports of goods and services and inc6895937134997248007200957279562 Exports of goods and services5088115240005373515332045434713 Goods, balance of payments basis /2/3609173721603821613821673879394 Services /3/1478941518391551901510371555325 Transfers under U.S. military agency 412245454664461544066 Travel27407292603019429254309697 Passenger fares837490809889928797118 Other transportation10520107601095610827108609 Royalties and license fees /5/294053034331055300333043710 Other private services /5/677496758568123667366882111 U.S. government miscellaneous servi31726730928432712 Income receipts18078118949918744918689118448513 Income receipts on U.S.-owned assets17932818804718599418544118300714 Direct investment receipts11862112341711910611909411611615 Other private receipts602626412366361659036614616 U.S. government receipts44550652744474517 Compensation of employees14531452145514501479 18Imports of goods and services and inc-774367-798839-801143-806512-82902119 Imports of goods and services-646036-665549-672173-679489-69206920 Goods, balance of payments basis /2/-542276-559344-562778-571421-58250321 Services /3/-103761-106205-109395-108068-10956722 Direct defense expenditures-7570-7545-7343-7052-683823 Travel-19257-19628-19895-19871-2124424 Passenger fares-7542-7698-7946-7923-893125 Other transportation-13439-13736-13767-13769-1371526 Royalties and license fees /5/-8921-8543-9503-9652-986627 Other private services /5/-45825-47916-49656-48576-4785828 U.S. government miscellaneous servi-1207-1138-1284-1225-111529 Income payments-128330-133290-128971-127022-13695130 Income payments on foreign-owned as-124863-129835-125508-123590-13356131 Direct investment payments-39891-43855-38261-36552-4526132 Other private payments-51501-53193-54157-53655-5539633 U.S. government payments-33471-32787-33090-33383-3290434 Compensation of employees-3467-3455-3463-3433-3390 35Unilateral current transfers, net-35223-33777-31815-32240-3270336 U.S. government grants /4/-11136-13486-11176-11551-1191037 U.S. government pensions and other tra-2202-2227-2250-2269-254138 Private remittances and other transfers /-21884-18064-18389-18419-18253Capital account39Capital account transactions, net-29-829-300-55-1 Financial account40U.S.-owned assets abroad, excluding f-3729447418-91896-26231107001 41 U.S. official reserve assets-3619-6267-4079-1912-123342 Gold /7/0000043 Special drawing rights1961-159-27-23-1144 Reserve position in the International Mo-6428-5974-3909-1768-107845 Foreign currencies848-134-143-121-14446 U.S. government assets, other than offic-547-1358-1137-1006245107647 U.S. credits and other long-term assets-1307-2337-1396-2267-263148 Repayments on U.S. credits and other 610125981265335249 U.S. foreign currency holdings and U.S150-279-553-990105335650 U.S. private assets-36877815042-86679763055715951 Direct investment-104404-133397-70323-111208-11564152 Foreign securities-85472-57195-4011035980360453 U.S. claims on unaffiliated foreigners re-922036147932665122-4918354 U.S. claims reported by U.S. banks an-86699199487144288641121837955Foreign-owned assets in the United St57897298554266397570676050156 Foreign official assets in the United Stat7297412182219889-28596971157 U.S. government securities677199718411249-174178543158 U.S. Treasury securities /9/5627410436328115-175738506859 Other /10/11445-7179-1686615636360 Other U.S. government liabilities /11/2714223622871826283361 U.S. liabilities reported by U.S. banks a-309015764512112215-1930562 Other foreign official assets /12/56316638123251775263 Other foreign assets in the United States505998-2326824650859926-921064 Direct investment333656128163222761202313965 U.S. Treasury securities55054-17613120918825194383466 U.S. securities other than U.S. Treasur4338-5108-20396-35276365467 U.S. currency12576139899614188171805768 U.S. liabilities to unaffiliated foreigners 4068825538-19670-399892421269 U.S. liabilities reported by U.S. banks a359977-10135592820-42265-12210670Financial derivatives, net29277419-394932613-139671Statistical discrepancy (sum of above -889306555-6209455263-3233871a Of which: Seasonal adjustment discrepa17684-11134-267712022318254Memoranda:72Balance on goods (lines 3 and 20)-181358-187184-180617-189254-19456473Balance on services (lines 4 and 21)441334563445795429694596574Balance on goods and services (lines 2 a-137225-141549-134822-146286-14859975Balance on income (lines 12 and 29)524515620958478598694753476Unilateral current transfers, net (line 35)-35223-33777-31815-32240-3270377Balance on current account (lines 1, 18, a-119997-119117-108158-118656-133768 Legend / Footnotes:p Preliminary.r Revised.0 Transactions are possible, but are zero for a given period.(*) Transactions are less than $500,000(±).D Suppressed to avoid disclosure of individual companies.n.a. Transactions are possible, but data are not available...... Not applicable, or for data periods 1960-1997, transactions that are 0, “not available,” or “not applicable.”Quarterly estimates are not annualized and are expressed at quarterly rates.1. Credits, +: Exports of goods and services and income receipts; unilateral current transfers to the United Sta2. See Table 2 footnotes for explanations of the various balance of payments adjustments made to convert go3. Includes some goods: Mainly military equipment and supplies in lines 5 and 22 that are commingled in the s4. Includes transfers of goods and services under U.S. military grant programs.5. Beginning in 1982, these lines are presented on a gross basis. The definition of exports is revised to exclud6. Beginning in 1982, the "other transfers" component includes taxes paid by U.S. private residents to foreign g7. At the present time, all U.S.-Treasury-owned gold is held in the United States.8. Includes sales of foreign obligations to foreigners.9. Consists of bills, certificates, marketable bonds and notes, and nonmarketable convertible and nonconvertib10. Consists of U.S. Treasury and Export-Import Bank obligations, not included elsewhere, and of debt securit11. Includes U.S. government liabilities associated with military agency sales contracts, other transactions arra12. Consists of investments in U.S. corporate stocks and in debt securities of private corporations and state an13. Conceptually, the sum of line 77 and line 39 is equal to "net lending or net borrowing" in the national incom14. Beginning with 2003, includes securities brokers' claims on their foreign affiliates. Prior to 2003, they are i15. Beginning with 2003, includes securities brokers' liabilities to their foreign affiliates. Prior to 2003, they are16. Calculated excluding capital account transactions, net (line 39).17. Equals the sum of financial derivatives for the first, second, and third quarters of the year.18. For 1974, includes extraordinary U.S. government transactions with India. See "Special U.S. Government19. For 1978-83, includes foreign currency-denominated notes sold to private residents abroad.20. Break in series. See Technical Notes in the June 1989, June 1990, June 1992, June 1993, June 1995, and21. Seasonally adjusted data for lines 57 and 58 are not available separately through 1972; they are combined734927733290740340 551128550458549435 393530392790389846 157598157668159590 426744614843 323573267132558 1016597879858 109451072110768 300023056130809 695486915470452 314313302 183799182832190905 182317181338189407 111953112463121136 698936840967958 470466313148214941498 -820500-811542-816358 -688781-675302-677853 -579532-566943-570439 -109249-108359-107414 -6726-6349-6205 -21402-20782-20223 -8817-8432-8263 -13807-13841-13807 -10090-10438-9643 -47303-47409-48136 -1104-1107-1137 -131719-136239-138505 -128314-132822-135129 -39005-44662-44170 -56568-55586-58660 -32741-32574-32299 -3404-3417-3376 -32780-34194-34398 -11471-11821-10943 -2574-2622-2617 -18735-19751-20837 -291-4707198 248566-217157-120493 -3289-833895000-10-10-6 -3179-744969-100-79-6816650152042180-2538-1037-2140680844595 18508153973725235206-231528-123568-62967-90927-8191065192142-64783246081582-7642267046-14432530767-142149290599175951797721311119304871093115425759238523910491479560-1414610511-3637266116527412404800710608361460275776 -2219211594888290349476418086025759924782025986-43065475566853671161615615812-27008-4943-17213-21443211091-70475464-51272985 117634460144775-13176-2849623417-186002-174154-180593483494930952176-137653-124845-128417520804659352399-32780-34194-34398-118353-112446-110416ble.”d States; capital accountert goods on a Census-basis tothe source data and cannot bexclude U.S. parents' payments to eign governments and taxes paid vertible bonds and notes. ecurities of U.S. governments arranged with or through foreign ate and local governments.ncome and product accountsare included in the claims ofey are included in the liabilities of ment Transactions," June 19745, and July 1996-2012 issues of the bined with data in line 61.。