微软财务报表英文版

- 格式:doc

- 大小:282.00 KB

- 文档页数:6

活期历史明细清单:Current Detailed List of History帐号:Account Number 户名:Customer Name 操作地区:Operation Region 操作网点:Operation Branches 操作柜员:Operation Teller 工作日期:Date of Work 入账日期:Date Recorded 币种:Currency Type 交易代码:Transaction Code 注释:Remark 借贷:Lend or Loan 金额Money 余额Balance 地区Region 网点Branches 操作员Operator 界面Interface 息Interest 税Tax 工资Wage 存deposit 支取Expenditure 汇款remittance 收费fee 批量业务Batch Business 柜面交易Counter transaction 开户:Account 摘要:Abstract 地点:location 打印机构:Print Agencies 现存:Cash deposit 转存:Transfer into 现支:Cash expenses 扣年税:Annual tax deduction 包月费:Monthly fee 中心入账:Center recorded 银行对账单:Bank Reconciliationumbernum&o imprim e de caissier 打印时间print time Temps imprim e 账号account number num e ro de compte 客户名称account name nom et pr e nom de compte 币别currency monnaie 钞汇鉴别cash remittance identification identification d'envoi de fonds / remise de billets起始日期start datedate de d e but终止日期termination date / expirty date date d 'expiration 交易日期trade/transaction date date de l 'op e ration 摘要abstract extrait交易金额transaction amount montant de l'op e ration账号余额account balance solde du compte 对方账号reciprocal account numbernum e ro de compte r e ciproque对方帐户名称reciprocal account name nom de compte r e ciproque 操作员号operator number num e ro de l'op e rateur 自述摘要autobiographical / self-disclosure abstratct extrait autobiographique 现金存入cash deposit d |p?t en esp eces 结息interest settlement r e glement d'int e et现金支取cash withdraw retrait en esp e ces 中国银行的流水清单打印柜员号printed teller sequenceRBS流水查询RBS Transaction inquiry enqu ete de transaction BALANCE SHEETPrinted by For the year(or,quarter,month)endedJULY31,1998ASSETS LIABLITIES AND OWNER'EQUITYLINENO AT BEG OF YEARYEARCURRENT ASSETS EQUICURRENT LIABILITIESCash on handIT 1loansSCash in bankloanpayableansSMarketable securitiesAccounts payabletiesNotes receivableetieAccrued payrolletieAccounts receivableesTaxes payablevablLess:Provision for badDividends payablebadAdvance to suppliersd deAdvances from customersbtsOther receivablesustom 10Other payablesesustAT END OFShort termNotes这些可以搞定工行流水帐的翻译。

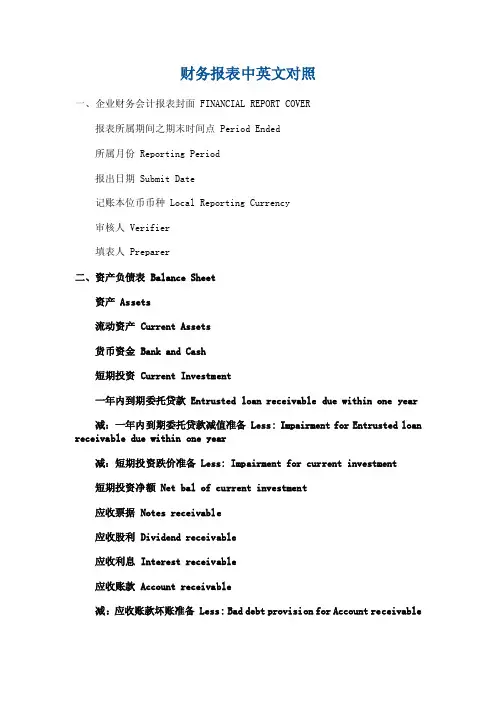

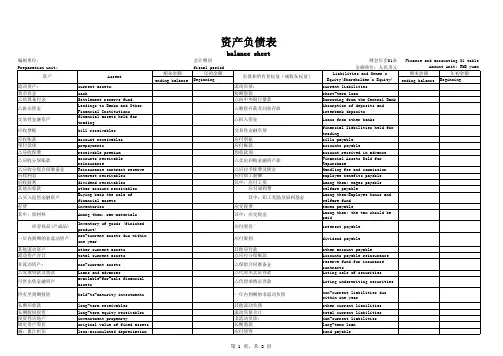

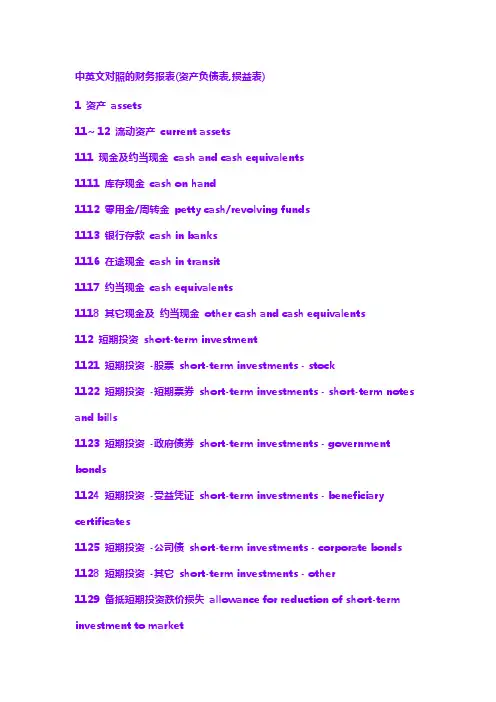

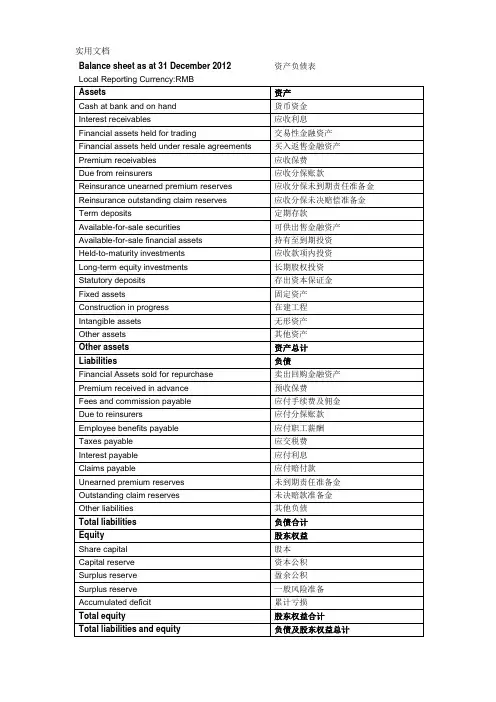

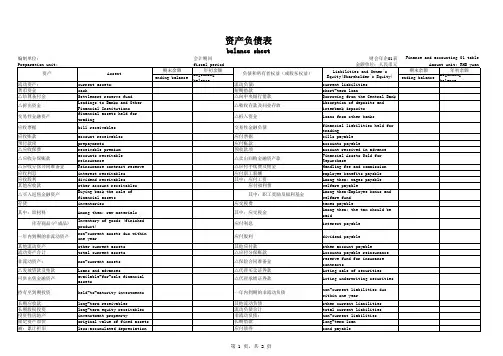

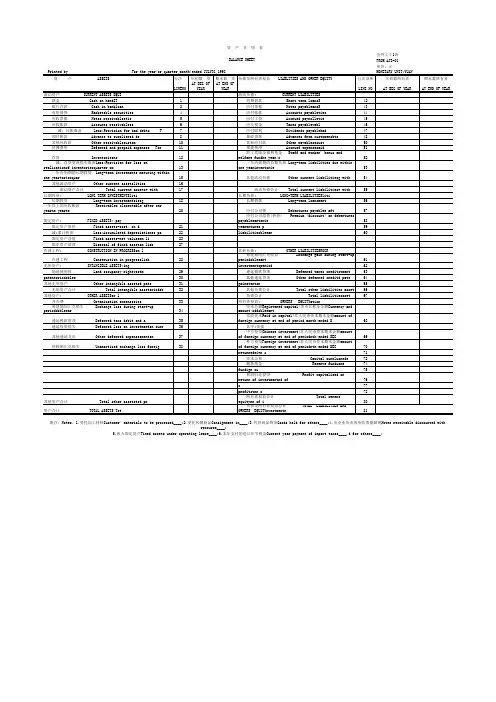

财务报表中英文对照一、企业财务会计报表封面 FINANCIAL REPORT COVER报表所属期间之期末时间点 Period Ended所属月份 Reporting Period报出日期 Submit Date记账本位币币种 Local Reporting Currency审核人 Verifier填表人 Preparer二、资产负债表 Balance Sheet资产 Assets流动资产 Current Assets货币资金 Bank and Cash短期投资 Current Investment一年内到期委托贷款 Entrusted loan receivable due within one year减:一年内到期委托贷款减值准备 Less: Impairment for Entrusted loan receivable due within one year减:短期投资跌价准备 Less: Impairment for current investment短期投资净额 Net bal of current investment应收票据 Notes receivable应收股利 Dividend receivable应收利息 Interest receivable应收账款 Account receivable减:应收账款坏账准备 Less: Bad debt provision for Account receivable应收账款净额 Net bal of Account receivable其他应收款 Other receivable减:其他应收款坏账准备 Less: Bad debt provision for Other receivable其他应收款净额 Net bal of Other receivable预付账款 Prepayment应收补贴款 Subsidy receivable存货 Inventory减:存货跌价准备 Less: Provision for Inventory存货净额 Net bal of Inventory已完工尚未结算款 Amount due from customer for contract work待摊费用 Deferred Expense一年内到期的长期债权投资 Long-term debt investment due within one year一年内到期的应收融资租赁款 Finance lease receivables due within one year其他流动资产 Other current assets流动资产合计 Total current assets长期投资 Long-term investment长期股权投资 Long-term equity investment委托贷款 Entrusted loan receivable长期债权投资 Long-term debt investment长期投资合计 Total for long-term investment减:长期股权投资减值准备 Less: Impairment for long-term equity investment减:长期债权投资减值准备 Less: Impairment for long-term debt investment减:委托贷款减值准备 Less: Provision for entrusted loan receivable长期投资净额 Net bal of long-term investment其中:合并价差 Include: Goodwill (Negative goodwill)固定资产 Fixed assets固定资产原值 Cost减:累计折旧 Less: Accumulated Depreciation固定资产净值 Net bal减:固定资产减值准备 Less: Impairment for fixed assets固定资产净额 NBV of fixed assets工程物资 Material holds for construction of fixed assets在建工程 Construction in progress减:在建工程减值准备 Less: Impairment for construction in progress在建工程净额 Net bal of construction in progress固定资产清理 Fixed assets to be disposed of固定资产合计 Total fixed assets无形资产及其他资产 Other assets & Intangible assets无形资产 Intangible assets减:无形资产减值准备 Less: Impairment for intangible assets无形资产净额 Net bal of intangible assets长期待摊费用 Long-term deferred expense融资租赁——未担保余值 Finance lease – Unguaranteed residual values融资租赁——应收融资租赁款 Finance lease – Receivables其他长期资产 Other non-current assets无形及其他长期资产合计 Total other assets & intangible assets 递延税项 Deferred Tax递延税款借项 Deferred Tax assets资产总计 Total assets负债及所有者(或股东)权益 Liability & Equity流动负债 Current liability短期借款 Short-term loans应付票据 Notes payable应付账款 Accounts payable已结算尚未完工款预收账款 Advance from customers应付工资 Payroll payable应付福利费 Welfare payable应付股利 Dividend payable应交税金 Taxes payable其他应交款 Other fees payable其他应付款 Other payable预提费用 Accrued Expense预计负债 Provision递延收益 Deferred Revenue一年内到期的长期负债 Long-term liability due within one year 其他流动负债 Other current liability流动负债合计 Total current liability长期负债 Long-term liability长期借款 Long-term loans应付债券 Bonds payable长期应付款 Long-term payable专项应付款 Grants & Subsidies received其他长期负债 Other long-term liability长期负债合计 Total long-term liability递延税项 Deferred Tax递延税款贷项 Deferred Tax liabilities负债合计 Total liability少数股东权益 Minority interests所有者权益(或股东权益) Owners’ Equity实收资本(或股本) Paid in capital减;已归还投资 Less: Capital redemption实收资本(或股本)净额 Net bal of Paid in capital 资本公积 Capital Reserves盈余公积 Surplus Reserves其中:法定公益金 Include: Statutory reserves未确认投资损失 Unrealised investment losses未分配利润 Retained profits after appropriation 其中:本年利润 Include: Profits for the year外币报表折算差额 Translation reserve所有者(或股东)权益合计 Total Equity负债及所有者(或股东)权益合计 Total Liability & Equity三、利润及利润分配表 Income statement and profit appropriation一、主营业务收入 Revenue减:主营业务成本 Less: Cost of Sales主营业务税金及附加 Sales Tax二、主营业务利润(亏损以“—”填列) Gross Profit ( - means loss)加:其他业务收入 Add: Other operating income减:其他业务支出 Less: Other operating expense减:营业费用 Selling & Distribution expense管理费用 G&A expense财务费用 Finance expense三、营业利润(亏损以“—”填列) Profit from operation ( - means loss)加:投资收益(亏损以“—”填列) Add: Investment income补贴收入 Subsidy Income营业外收入 Non-operating income减:营业外支出 Less: Non-operating expense四、利润总额(亏损总额以“—”填列) Profit before Tax减:所得税 Less: Income tax少数股东损益 Minority interest加:未确认投资损失 Add: Unrealised investment losses五、净利润(净亏损以“—”填列) Net profit ( - means loss)加:年初未分配利润 Add: Retained profits其他转入 Other transfer-in六、可供分配的利润 Profit available for distribution( - means loss)减:提取法定盈余公积 Less: Appropriation of statutory surplus reserves提取法定公益金 Appropriation of statutory welfare fund提取职工奖励及福利基金 Appropriation of staff incentive and welfare fund提取储备基金 Appropriation of reserve fund提取企业发展基金 Appropriation of enterprise expansion fund利润归还投资 Capital redemption七、可供投资者分配的利润 Profit available for owners distribution减:应付优先股股利 Less: Appropriation of preference shares dividend提取任意盈余公积 Appropriation of discretionary surplus reserve应付普通股股利 Appropriation of ordinary shares dividend转作资本(或股本)的普通股股利 Transfer from ordinary shares dividend to paid in capital八、未分配利润 Retained profit after appropriation补充资料: Supplementary Information:1. 出售、处置部门或被投资单位收益 Gains on disposal of operating divisions or investments2. 自然灾害发生损失 Losses from natural disaster3. 会计政策变更增加(或减少)利润总额 Increase (decrease) in profit due to changes in accounting policies4. 会计估计变更增加(或减少)利润总额 Increase (decrease) in profit due to changes in accounting estimates5. 债务重组损失 Losses from debt restructuring1 资产assets11~ 12 流动资产current assets111 现金及约当现金cash and cash equivalents1111 库存现金cash on hand1112 零用金/周转金petty cash/revolving funds1113 银行存款cash in banks1116 在途现金cash in transit1117 约当现金cash equivalents1118 其它现金及约当现金other cash and cash equivalents112 短期投资short-term investment1121 短期投资-股票short-term investments - stock1122 短期投资-短期票券short-term investments - short-term notes and bills 1123 短期投资-政府债券short-term investments - government bonds1124 短期投资-受益凭证short-term investments - beneficiary certificates1125 短期投资-公司债short-term investments - corporate bonds1128 短期投资-其它short-term investments - other1129 备抵短期投资跌价损失allowance for reduction of short-term investment to market113 应收票据notes receivable1131 应收票据notes receivable1132 应收票据贴现discounted notes receivable1137 应收票据-关系人notes receivable - related parties1138 其它应收票据other notes receivable1139 备抵呆帐-应收票据allowance for uncollec- tible accounts- notes receivable114 应收帐款accounts receivable1141 应收帐款accounts receivable1142 应收分期帐款installment accounts receivable1147 应收帐款-关系人accounts receivable - related parties1149 备抵呆帐-应收帐款allowance for uncollec- tible accounts - accounts receivable118 其它应收款other receivables1181 应收出售远汇款forward exchange contract receivable1182 应收远汇款-外币forward exchange contract receivable - foreign currencies 1183 买卖远汇折价discount on forward ex-change contract1184 应收收益earned revenue receivable1185 应收退税款income tax refund receivable1187 其它应收款- 关系人other receivables - related parties1188 其它应收款- 其它other receivables - other1189 备抵呆帐- 其它应收款allowance for uncollec- tible accounts - other receivables121~122 存货inventories1211 商品存货merchandise inventory1212 寄销商品consigned goods1213 在途商品goods in transit1219 备抵存货跌价损失allowance for reduction of inventory to market 1221 制成品finished goods1222 寄销制成品consigned finished goods1223 副产品by-products1224 在制品work in process1225 委外加工work in process - outsourced1226 原料raw materials1227 物料supplies1228 在途原物料materials and supplies in transit1229 备抵存货跌价损失allowance for reduction of inventory to market 125 预付费用prepaid expenses1251 预付薪资prepaid payroll1252 预付租金prepaid rents1253 预付保险费prepaid insurance1254 用品盘存office supplies1255 预付所得税prepaid income tax1258 其它预付费用other prepaid expenses126 预付款项prepayments1261 预付货款prepayment for purchases1268 其它预付款项other prepayments128~129 其它流动资产other current assets1281 进项税额VAT paid ( or input tax)1282 留抵税额excess VAT paid (or overpaid VAT)1283 暂付款temporary payments1284 代付款payment on behalf of others1285 员工借支advances to employees1286 存出保证金refundable deposits1287 受限制存款certificate of deposit-restricted1291 递延所得税资产deferred income tax assets1292 递延兑换损失deferred foreign exchange losses1293 业主(股东)往来owners(stockholders) current account1294 同业往来current account with others1298 其它流动资产-其它other current assets - other13 基金及长期投资funds and long-term investments131 基金funds1311 偿债基金redemption fund (or sinking fund)1312 改良及扩充基金fund for improvement and expansion1313 意外损失准备基金contingency fund1314 退休基金pension fund1318 其它基金other funds132 长期投资long-term investments1321 长期股权投资long-term equity investments1322 长期债券投资long-term bond investments1323 长期不动产投资long-term real estate in-vestments1324 人寿保险现金解约价值cash surrender value of life insurance1328 其它长期投资other long-term investments1329 备抵长期投资跌价损失allowance for excess of cost over market value of long-term investments14~ 15 固定资产property , plant, and equipment141 土地land1411 土地land1418 土地-重估增值land - revaluation increments142 土地改良物land improvements1421 土地改良物land improvements1428 土地改良物-重估增值land improvements - revaluation increments1429 累积折旧-土地改良物accumulated depreciation - land improvements143 房屋及建物buildings1431 房屋及建物buildings1438 房屋及建物-重估增值buildings -revaluation increments1439 累积折旧-房屋及建物accumulated depreciation - buildings144~146 机(器)具及设备machinery and equipment1441 机(器)具machinery1448 机(器)具-重估增值machinery - revaluation increments1449 累积折旧-机(器)具accumulated depreciation - machinery151 租赁资产leased assets1511 租赁资产leased assets1519 累积折旧-租赁资产accumulated depreciation - leased assets152 租赁权益改良leasehold improvements1521 租赁权益改良leasehold improvements1529 累积折旧- 租赁权益改良accumulated depreciation - leasehold improvements156 未完工程及预付购置设备款construction in progress and prepayments for equipment1561 未完工程construction in progress1562 预付购置设备款prepayment for equipment158 杂项固定资产miscellaneous property, plant, and equipment1581 杂项固定资产miscellaneous property, plant, and equipment1588 杂项固定资产-重估增值miscellaneous property, plant, and equipment - revaluation increments1589 累积折旧- 杂项固定资产accumulated depreciation - miscellaneous property, plant, and equipment16 递耗资产depletable assets161 递耗资产depletable assets1611 天然资源natural resources1618 天然资源-重估增值natural resources -revaluation increments1619 累积折耗-天然资源accumulated depletion - natural resources17 无形资产intangible assets171 商标权trademarks1711 商标权trademarks172 专利权patents1721 专利权patents173 特许权franchise1731 特许权franchise174 著作权copyright1741 著作权copyright175 计算机软件computer software1751 计算机软件computer software cost176 商誉goodwill1761 商誉goodwill177 开办费organization costs1771 开办费organization costs178 其它无形资产other intangibles1781 递延退休金成本deferred pension costs1782 租赁权益改良leasehold improvements1788 其它无形资产-其它other intangible assets - other18 其它资产other assets181 递延资产deferred assets1811 债券发行成本deferred bond issuance costs1812 长期预付租金long-term prepaid rent1813 长期预付保险费long-term prepaid insurance1814 递延所得税资产deferred income tax assets1815 预付退休金prepaid pension cost1818 其它递延资产other deferred assets182 闲置资产idle assets1821 闲置资产idle assets184 长期应收票据及款项与催收帐款long-term notes , accounts and overdue receivables 1841 长期应收票据long-term notes receivable1842 长期应收帐款long-term accounts receivable1843 催收帐款overdue receivables1847 长期应收票据及款项与催收帐款-关系人long-term notes, accounts and overdue receivables- related parties1848 其它长期应收款项other long-term receivables1849 备抵呆帐-长期应收票据及款项与催收帐款allowance for uncollectible accounts - long-term notes, accounts and overdue receivables185 出租资产assets leased to others1851 出租资产assets leased to others1858 出租资产-重估增值assets leased to others - incremental value from revaluation 1859 累积折旧-出租资产accumulated depreciation - assets leased to others186 存出保证金refundable deposit1861 存出保证金refundable deposits188 杂项资产miscellaneous assets1881 受限制存款certificate of deposit - restricted1888 杂项资产-其它miscellaneous assets - other2 负债liabilities21~ 22 流动负债current liabilities211 短期借款short-term borrowings(debt)2111 银行透支bank overdraft2112 银行借款bank loan2114 短期借款-业主short-term borrowings - owners2115 短期借款-员工short-term borrowings - employees2117 短期借款-关系人short-term borrowings- related parties2118 短期借款-其它short-term borrowings - other212 应付短期票券short-term notes and bills payable2121 应付商业本票commercial paper payable2122 银行承兑汇票bank acceptance2128 其它应付短期票券other short-term notes and bills payable2129 应付短期票券折价discount on short-term notes and bills payable213 应付票据notes payable2131 应付票据notes payable2137 应付票据-关系人notes payable - related parties2138 其它应付票据other notes payable214 应付帐款accounts pay able2141 应付帐款accounts payable2147 应付帐款-关系人accounts payable - related parties216 应付所得税income taxes payable2161 应付所得税income tax payable217 应付费用accrued expenses2171 应付薪工accrued payroll2172 应付租金accrued rent payable2173 应付利息accrued interest payable2174 应付营业税accrued VAT payable2175 应付税捐-其它accrued taxes payable- other2178 其它应付费用other accrued expenses payable218~219 其它应付款other payables2181 应付购入远汇款forward exchange contract payable2182 应付远汇款-外币forward exchange contract payable - foreign currencies 2183 买卖远汇溢价premium on forward exchange contract2184 应付土地房屋款payables on land and building purchased2185 应付设备款Payables on equipment2187 其它应付款-关系人other payables - related parties2191 应付股利dividend payable2192 应付红利bonus payable2193 应付董监事酬劳compensation payable to directors and supervisors2198 其它应付款-其它other payables - other226 预收款项advance receipts2261 预收货款sales revenue received in advance2262 预收收入revenue received in advance2268 其它预收款other advance receipts227 一年或一营业周期内到期长期负债long-term liabilities -current portion 2271 一年或一营业周期内到期公司债corporate bonds payable - current portion 2272 一年或一营业周期内到期长期借款long-term loans payable - current portion 2273 一年或一营业周期内到期长期应付票据及款项long-term notes and accounts payable due within one year or one operating cycle2277 一年或一营业周期内到期长期应付票据及款项-关系人long-term notes and accounts payables to related parties - current portion2278 其它一年或一营业周期内到期长期负债other long-term lia- bilities - current portion228~229 其它流动负债other current liabilities2281 销项税额VAT received(or output tax)2283 暂收款temporary receipts2284 代收款receipts under custody2285 估计售后服务/保固负债estimated warranty liabilities2291 递延所得税负债deferred income tax liabilities2292 递延兑换利益deferred foreign exchange gain2293 业主(股东)往来owners current account2294 同业往来current account with others2298 其它流动负债-其它other current liabilities - others23 长期负债long-term liabilities231 应付公司债corporate bonds payable2311 应付公司债corporate bonds payable2319 应付公司债溢(折)价premium(discount) on corporate bonds payable232 长期借款long-term loans payable2321 长期银行借款long-term loans payable - bank2324 长期借款-业主long-term loans payable - owners2325 长期借款-员工long-term loans payable - employees2327 长期借款-关系人long-term loans payable - related parties2328 长期借款-其它long-term loans payable - other233 长期应付票据及款项long-term notes and accounts payable2331 长期应付票据long-term notes payable2332 长期应付帐款long-term accounts pay-able2333 长期应付租赁负债long-term capital lease liabilities2337 长期应付票据及款项-关系人Long-term notes and accounts payable - related parties2338 其它长期应付款项other long-term payables234 估计应付土地增值税accrued liabilities for land value increment tax 2341 估计应付土地增值税estimated accrued land value incremental tax pay-able 235 应计退休金负债accrued pension liabilities2351 应计退休金负债accrued pension liabilities238 其它长期负债other long-term liabilities2388 其它长期负债-其它other long-term liabilities - other28 其它负债other liabilities281 递延负债deferred liabilities2811 递延收入deferred revenue2814 递延所得税负债deferred income tax liabilities2818 其它递延负债other deferred liabilities286 存入保证金deposits received2861 存入保证金guarantee deposit received288 杂项负债miscellaneous liabilities2888 杂项负债 -其它 miscellaneous liabilities -。

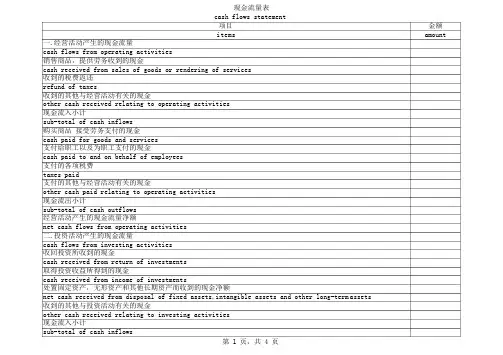

一.经营活动产生的现金流量cash flows from operating activities 销售商品,提供劳务收到的现金现金流量表cash flows statement项目items金额amountcash received from sales of goods or rendering of services收到的税费返还refund of taxes收到的其他与经营活动有关的现金other cash received relating to operating activities现金流入小计sub-total of cash inflows购买商品接受劳务支付的现金cash paid for goods and services支付给职工以及为职工支付的现金cash paid to and on behalf of employees支付的各项税费taxes paid支付的其他与经营活动有关的现金other cash paid relating to operating activities现金流出小计sub-total of cash outflows经营活动产生的现金流量净额net cash flows from operating activities二.投资活动产生的现金流量cash flows from investing activities收回投资所收到的现金cash received from return of investments取得投资收益所得到的现金cash received from income of investments处置固定资产,无形资产和其他长期资产而收到的现金净额net cash received from disposal of fixed assets,intangible assets and other long-term assets 收到的其他与投资活动有关的现金other cash received relating to investing activities现金流入小计sub-total of cash inflows购建固定资产,无形资产和其他长期资产所支付的现金cash paid to acquire fixed assets,intangible assets and other long-term assets 投资所支付的现金cash paid to acquire investments支付的其他与投资活动有关的现金other cash paid relating to investing activities现金流出小计sub-total of cash outflows投资活动产生的现金净额net cash flows from investing activities三.筹资活动产生的现金流量cash flows from finacing activities吸收投资所收到的现金proceeds from invested assets借款所收到的现金proceeds from borrowings收到的其他与筹资活动有关的现金other proceeds relating to financing activities现金流入小计sub-total of cash inflows偿还债务所支付的现金cash repayments of amounts borrowed分配股利,利润或偿付利息所支付的现金cash payments for distribution of dividends,profit or interest expenses支付的其他与筹资活动有关的现金other cash payments relating to finacing activities现金流出小计sub-total of cash outflows筹资活动产生的现金流量净额net cash flows from finacing activities四.汇率变动对现金的影响effect of foreign exchange rate changes on cash五.现金及现金等价物净增加额net increase in cash and cash equivalents补充资料supplemental information1.将净利润调节为经营活动的现金流量reconciliation of net profit to cash flows from operating activities净利润net profit加:计提的资产减值准备add:assets shrink provision固定资产折旧depreciation of fixed assets无形资产摊销amortization of intangible assets长期待摊费用摊销amortization of long term deferred expenses待摊费用的减少(减:增加)decrease in prepaid and deferred expenses(less:increase)预提费用的增加(减:减少)increase in accrued expenses(less:decrease)处置固定资产,无形资产和其他长期资产的损失(减:收益)losses on disposal of fixed assets,intanglble assets and other long-term assets(less:gains)固定资产报废损失losses on scrapping of fixed assets财务费用financial expenses投资损失(减:收益)income on investment(less:losses)递延税款贷项(减:借项)deferred tax credit(less:debit)存货的减少(减:增加)decrease in inventories(less:increase)经营性应收项目的减少(减:增加)decrease in operating receivables (less:increase)经营性应付项目的增加(减:减少)increase in operating payables(less:decrease)其他others经营活动产生的现金流量净额net cash flows from operating activities2.不涉及现金收支的投资和筹资活动investing and financing activities that do not involve in cash receipts and payments:债务转为资本liabilities to be transfer captial一年内到期的可转换公司债券matured convertible bonds within a year融资租入固定资产fixed assets under finacing leasing3.现金及现金等价物净增加情况net increase in cash and cash equivalents现金的期末余额cash at the end of the period减:现金的期初余额less:cash at the beginning of the period加:现金等价物的期末余额plus:cash equivalents at the beginning of the period 减:现金的期初余额less:cash equivalents at the beginning of the period 现金及现金等价物净增加额net increase in cash and cash equivalents。

中英文对照的财务报表(资产负债表,损益表)1 资产 assets11~ 12 流动资产 current assets111 现金及约当现金 cash and cash equivalents1111 库存现金 cash on hand1112 零用金/周转金 petty cash/revolving funds1113 银行存款 cash in banks1116 在途现金 cash in transit1117 约当现金 cash equivalents1118 其它现金及约当现金 other cash and cash equivalents112 短期投资 short-term investment1121 短期投资 -股票 short-term investments - stock1122 短期投资 -短期票券 short-term investments - short-term notes and bills1123 短期投资 -政府债券 short-term investments - government bonds 1124 短期投资 -受益凭证 short-term investments - beneficiary certificates1125 短期投资 -公司债 short-term investments - corporate bonds1128 短期投资 -其它 short-term investments - other1129 备抵短期投资跌价损失 allowance for reduction of short-term investment to market113 应收票据 notes receivable1131 应收票据 notes receivable1132 应收票据贴现 discounted notes receivable1137 应收票据 -关系人 notes receivable - related parties1138 其它应收票据 other notes receivable1139 备抵呆帐-应收票据 allowance for uncollec- tible accounts- notes receivable114 应收帐款 accounts receivable1141 应收帐款 accounts receivable1142 应收分期帐款 installment accounts receivable1147 应收帐款 -关系人 accounts receivable - related parties1149 备抵呆帐-应收帐款 allowance for uncollec- tible accounts - accounts receivable118 其它应收款 other receivables1181 应收出售远汇款 forward exchange contract receivable1182 应收远汇款 -外币 forward exchange contract receivable - foreign currencies1183 买卖远汇折价 discount on forward ex-change contract1184 应收收益 earned revenue receivable1185 应收退税款 income tax refund receivable1187 其它应收款 - 关系人 other receivables - related parties1188 其它应收款 - 其它 other receivables - other1189 备抵呆帐 - 其它应收款 allowance for uncollec- tible accounts -other receivables121~122 存货 inventories1211 商品存货 merchandise inventory1212 寄销商品 consigned goods1213 在途商品 goods in transit1219 备抵存货跌价损失 allowance for reduction of inventory to market 1221 制成品 finished goods1222 寄销制成品 consigned finished goods1223 副产品 by-products1224 在制品 work in process1225 委外加工 work in process - outsourced1226 原料 raw materials1227 物料 supplies1228 在途原物料 materials and supplies in transit1229 备抵存货跌价损失 allowance for reduction of inventory to market 125 预付费用 prepaid expenses1251 预付薪资 prepaid payroll1252 预付租金 prepaid rents1253 预付保险费 prepaid insurance1254 用品盘存 office supplies1255 预付所得税 prepaid income tax1258 其它预付费用 other prepaid expenses126 预付款项 prepayments1261 预付货款 prepayment for purchases1268 其它预付款项 other prepayments128~129 其它流动资产 other current assets1281 进项税额 VAT paid ( or input tax)1282 留抵税额 excess VAT paid (or overpaid VAT)1283 暂付款 temporary payments1284 代付款 payment on behalf of others1285 员工借支 advances to employees1286 存出保证金 refundable deposits1287 受限制存款 certificate of deposit-restricted1291 递延所得税资产 deferred income tax assets1292 递延兑换损失 deferred foreign exchange losses1293 业主(股东)往来 owners(stockholders) current account1294 同业往来 current account with others1298 其它流动资产-其它 other current assets - other13 基金及长期投资 funds and long-term investments131 基金 funds1311 偿债基金 redemption fund (or sinking fund)1312 改良及扩充基金 fund for improvement and expansion1313 意外损失准备基金 contingency fund1314 退休基金 pension fund1318 其它基金 other funds132 长期投资 long-term investments1321 长期股权投资 long-term equity investments1322 长期债券投资 long-term bond investments1323 长期不动产投资 long-term real estate in-vestments1324 人寿保险现金解约价值 cash surrender value of life insurance 1328 其它长期投资 other long-term investments1329 备抵长期投资跌价损失 allowance for excess of cost over market value of long-term investments14~ 15 固定资产 property , plant, and equipment141 土地 land1411 土地 land1418 土地-重估增值 land - revaluation increments142 土地改良物 land improvements1421 土地改良物 land improvements1428 土地改良物 -重估增值 land improvements - revaluation increments 1429 累积折旧 -土地改良物 accumulated depreciation - land improvements 143 房屋及建物 buildings1431 房屋及建物 buildings1438 房屋及建物 -重估增值 buildings -revaluation increments1439 累积折旧 -房屋及建物 accumulated depreciation - buildings144~146 机(器)具及设备 machinery and equipment1441 机(器)具 machinery1448 机(器)具 -重估增值 machinery - revaluation increments1449 累积折旧 -机(器)具 accumulated depreciation - machinery151 租赁资产 leased assets1511 租赁资产 leased assets1519 累积折旧 -租赁资产 accumulated depreciation - leased assets152 租赁权益改良 leasehold improvements1521 租赁权益改良 leasehold improvements1529 累积折旧- 租赁权益改良 accumulated depreciation - leasehold improvements156 未完工程及预付购置设备款 construction in progress and prepayments for equipment1561 未完工程 construction in progress1562 预付购置设备款 prepayment for equipment158 杂项固定资产 miscellaneous property, plant, and equipment1581 杂项固定资产 miscellaneous property, plant, and equipment1588 杂项固定资产-重估增值 miscellaneous property, plant, and equipment - revaluation increments1589 累积折旧- 杂项固定资产 accumulated depreciation - miscellaneous property, plant, and equipment16 递耗资产 depletable assets161 递耗资产 depletable assets1611 天然资源 natural resources1618 天然资源 -重估增值 natural resources -revaluation increments 1619 累积折耗 -天然资源 accumulated depletion - natural resources17 无形资产 intangible assets171 商标权 trademarks1711 商标权 trademarks172 专利权 patents1721 专利权 patents173 特许权 franchise1731 特许权 franchise174 著作权 copyright1741 著作权 copyright175 计算机软件 computer software1751 计算机软件 computer software cost176 商誉 goodwill1761 商誉 goodwill177 开办费 organization costs1771 开办费 organization costs178 其它无形资产 other intangibles1781 递延退休金成本 deferred pension costs1782 租赁权益改良 leasehold improvements1788 其它无形资产-其它 other intangible assets - other18 其它资产 other assets181 递延资产 deferred assets1811 债券发行成本 deferred bond issuance costs1812 长期预付租金 long-term prepaid rent1813 长期预付保险费 long-term prepaid insurance1814 递延所得税资产 deferred income tax assets1815 预付退休金 prepaid pension cost1818 其它递延资产 other deferred assets182 闲置资产 idle assets1821 闲置资产 idle assets184 长期应收票据及款项与催收帐款 long-term notes , accounts and overdue receivables1841 长期应收票据 long-term notes receivable1842 长期应收帐款 long-term accounts receivable1843 催收帐款 overdue receivables1847 长期应收票据及款项与催收帐款-关系人 long-term notes, accounts and overdue receivables- related parties1848 其它长期应收款项 other long-term receivables1849 备抵呆帐-长期应收票据及款项与催收帐款 allowance foruncollectible accounts - long-term notes, accounts and overduereceivables185 出租资产 assets leased to others1851 出租资产 assets leased to others1858 出租资产 -重估增值 assets leased to others - incremental value from revaluation1859 累积折旧 -出租资产 accumulated depreciation - assets leased to others186 存出保证金 refundable deposit1861 存出保证金 refundable deposits188 杂项资产 miscellaneous assets1881 受限制存款 certificate of deposit - restricted1888 杂项资产 -其它 miscellaneous assets - other2 负债 liabilities21~ 22 流动负债 current liabilities211 短期借款 short-term borrowings(debt)2111 银行透支 bank overdraft2112 银行借款 bank loan2114 短期借款 -业主 short-term borrowings - owners2115 短期借款 -员工 short-term borrowings - employees2117 短期借款 -关系人 short-term borrowings- related parties2118 短期借款 -其它 short-term borrowings - other212 应付短期票券 short-term notes and bills payable2121 应付商业本票 commercial paper payable2122 银行承兑汇票 bank acceptance2128 其它应付短期票券 other short-term notes and bills payable2129 应付短期票券折价 discount on short-term notes and bills payable 213 应付票据 notes payable2131 应付票据 notes payable2137 应付票据 -关系人 notes payable - related parties2138 其它应付票据 other notes payable214 应付帐款 accounts pay able2141 应付帐款 accounts payable2147 应付帐款 -关系人 accounts payable - related parties216 应付所得税 income taxes payable2161 应付所得税 income tax payable217 应付费用 accrued expenses2171 应付薪工 accrued payroll2172 应付租金 accrued rent payable2173 应付利息 accrued interest payable2174 应付营业税 accrued VAT payable2175 应付税捐 -其它 accrued taxes payable- other2178 其它应付费用 other accrued expenses payable218~219 其它应付款 other payables2181 应付购入远汇款 forward exchange contract payable2182 应付远汇款 -外币 forward exchange contract payable - foreign currencies2183 买卖远汇溢价 premium on forward exchange contract2184 应付土地房屋款 payables on land and building purchased2185 应付设备款 Payables on equipment2187 其它应付款 -关系人 other payables - related parties2191 应付股利 dividend payable2192 应付红利 bonus payable2193 应付董监事酬劳 compensation payable to directors and supervisors 2198 其它应付款 -其它 other payables - other226 预收款项advance receipts2261 预收货款 sales revenue received in advance2262 预收收入 revenue received in advance2268 其它预收款 other advance receipts227 一年或一营业周期内到期长期负债 long-term liabilities -current portion2271 一年或一营业周期内到期公司债 corporate bonds payable - current portion2272 一年或一营业周期内到期长期借款 long-term loans payable - current portion2273 一年或一营业周期内到期长期应付票据及款项 long-term notes and accounts payable due within one year or one operating cycle2277 一年或一营业周期内到期长期应付票据及款项-关系人 long-term notes and accounts payables to related parties - current portion2278 其它一年或一营业周期内到期长期负债 other long-term lia- bilities - current portion228~229 其它流动负债 other current liabilities2281 销项税额 VAT received(or output tax)2283 暂收款 temporary receipts2284 代收款 receipts under custody2285 估计售后服务/保固负债 estimated warranty liabilities2291 递延所得税负债 deferred income tax liabilities2292 递延兑换利益 deferred foreign exchange gain2293 业主(股东)往来 owners current account2294 同业往来 current account with others2298 其它流动负债-其它 other current liabilities - others23 长期负债 long-term liabilities231 应付公司债 corporate bonds payable2311 应付公司债 corporate bonds payable2319 应付公司债溢(折)价 premium(discount) on corporate bonds payable 232 长期借款 long-term loans payable2321 长期银行借款 long-term loans payable - bank2324 长期借款 -业主 long-term loans payable - owners2325 长期借款 -员工 long-term loans payable - employees2327 长期借款 -关系人 long-term loans payable - related parties2328 长期借款 -其它 long-term loans payable - other233 长期应付票据及款项 long-term notes and accounts payable2331 长期应付票据 long-term notes payable2332 长期应付帐款 long-term accounts pay-able2333 长期应付租赁负债 long-term capital lease liabilities2337 长期应付票据及款项 -关系人 Long-term notes and accounts payable - related parties2338 其它长期应付款项 other long-term payables234 估计应付土地增值税 accrued liabilities for land value increment tax 2341 估计应付土地增值税 estimated accrued land value incremental tax pay-able235 应计退休金负债 accrued pension liabilities2351 应计退休金负债 accrued pension liabilities238 其它长期负债 other long-term liabilities2388 其它长期负债-其它 other long-term liabilities - other28 其它负债 other liabilities281 递延负债 deferred liabilities2811 递延收入 deferred revenue2814 递延所得税负债 deferred income tax liabilities2818 其它递延负债 other deferred liabilities286 存入保证金 deposits received2861 存入保证金 guarantee deposit received288 杂项负债 miscellaneous liabilities2888 杂项负债 -其它 miscellaneous liabilities -资产负债表 Balance Sheet资产 ASSETS流动资产: Current asset货币资金 Cash(currency fund)Bank短期投资 Short-term investment应收票据 Notes receivable应收股利 Dividends receivable应收利息 Interests receivable应收账款 Accounts receivable其他应收款 Other receivable预付账款 Advances to suppliers应收补贴款 Subsidies receivable存货 Inventories待摊费用 Prepaid expenses一年内到期的长期债券投资 Long-term investments maturing within one year 其他流动资产 Other current assets流动资产合计 Total current assets长期投资: LONG TERM INVESTMENTS长期股权投资 Long-term equity investment长期债权投资 Long-term debt investment长期投资合计 Total long term investment固定资产: FIXED ASSETS:固定资产原值 Fixed assets-cost减:累计折旧 Less:Accumulated depreciation固定资产净值 Fixed assets-net value减:固定资产减值准备 Less: Impairment of fixed assets固定资产净额 Fixed assets-book value工程物资 Materials for projects在建工程 Construction in progress固定资产清理 Disposal of fixed assets固定资产合计 Total Fixed Assets无形资产及其它资产 INTANGIBLE ASSETS AND OTHER ASSETS:无形资产 Intangible assets长期待摊费用 Long-term deferred expenses其他长期资产 Other long-term assets无形资产及其他资产合计 Total intangible assets and other assets 递延税项 Deferred tax递延税款借项 Deferred tax debit资产总计 TOTAL ASSETS负债及所有者权益(或股东权益) LIABILITIES AND OWNER`S EQUITY 流动负债: CURRENT LIABILITIES短期借款 Short-term loans应付票据 Notes payable应付账款 Accounts payable预收账款 Advances from customers应付工资 Accrued payroll应付福利费 Accrued Employee’s welfare expenses应付股利 Dividends payable未交税金 Taxes payable其他应交款 Other taxes and expenses payable其他应付款 Other payables预提费用 Accrued expenses预提负债 Provisions一年内到期的长期负债 Long-term liabilities due within one year 其他流动负债 Other current liabilities流动负债合计 Total current liabilities长期负债: LONG-TERM LIABILITIES:长期借款 Long-term loans应付债券 Bonds payable长期应付款 Long-term accounts payable专项应付款 Specific accounts payable其他长期负债 Other long-term liabilities长期负债合计 Total long-term liabilities递延税项: Deferred tax递延税款贷项 Deferred tax credit负债合计 Total other liabilities所有者权益:(或股东权益) OWNER`S EQUITY实收资本(或股本) Paid-in capital减:已归还投资 Less:Investments returned实收资本(或股本)净额 Paid-in capital-net资本公积 Capital surplus盈余公积 Surplus from profits其中:法定公益金 Including:statutory public welfare fund未分配利润 Undistributed profit所有者权益(或股东权益)合计 Total owner`s equity负债及所有者权益(或股东权益)合计 TOTAL LIABILITIES AND OWNER`S EQUITY 损益表 Profit and Loss Statement项目 ITEMS一、营业收入 Income from main减:营业成本 Less:Cost of main operation营业税金及附加 Tax and additional expense二、经营利润 Income from main operation加:其他业务利润 Add:Income from other operation减:营业费用 Less:Operating expense管理费用 General and administrative expense财务费用 Financial expense三、营业利润 Operating Income加:投资收益 Add:Investment income补贴收入 Income from subsidies营业外收入 Non-operating income减:营业外支出 Less:Non-operating expense四、利润总额 Income before tax减:所得税 Less:Income tax五、净利润 NET INCOME--------------------------------------------------------------------------------1 资产 assets11~ 12 流动资产 current assets111 现金及约当现金 cash and cash equivalents1111 库存现金 cash on hand1112 零用金/周转金 petty cash/revolving funds1113 银行存款 cash in banks1116 在途现金 cash in transit1117 约当现金 cash equivalents1118 其它现金及约当现金 other cash and cash equivalents112 短期投资 short-term investment1121 短期投资 -股票 short-term investments - stock1122 短期投资 -短期票券 short-term investments - short-term notes and bills1123 短期投资 -政府债券 short-term investments - government bonds 1124 短期投资 -受益凭证 short-term investments - beneficiary certificates1125 短期投资 -公司债 short-term investments - corporate bonds1128 短期投资 -其它 short-term investments - other1129 备抵短期投资跌价损失 allowance for reduction of short-term investment to market113 应收票据 notes receivable1131 应收票据 notes receivable1132 应收票据贴现 discounted notes receivable1137 应收票据 -关系人 notes receivable - related parties1138 其它应收票据 other notes receivable1139 备抵呆帐-应收票据 allowance for uncollec- tible accounts- notes receivable114 应收帐款 accounts receivable1141 应收帐款 accounts receivable1142 应收分期帐款 installment accounts receivable1147 应收帐款 -关系人 accounts receivable - related parties1149 备抵呆帐-应收帐款 allowance for uncollec- tible accounts - accounts receivable118 其它应收款 other receivables1181 应收出售远汇款 forward exchange contract receivable1182 应收远汇款 -外币 forward exchange contract receivable - foreign currencies1183 买卖远汇折价 discount on forward ex-change contract1184 应收收益 earned revenue receivable1185 应收退税款 income tax refund receivable1187 其它应收款 - 关系人 other receivables - related parties1188 其它应收款 - 其它 other receivables - other1189 备抵呆帐 - 其它应收款 allowance for uncollec- tible accounts - other receivables121~122 存货 inventories1211 商品存货 merchandise inventory1212 寄销商品 consigned goods1213 在途商品 goods in transit1219 备抵存货跌价损失 allowance for reduction of inventory to market 1221 制成品 finished goods1222 寄销制成品 consigned finished goods1223 副产品 by-products1224 在制品 work in process1225 委外加工 work in process - outsourced1226 原料 raw materials1227 物料 supplies1228 在途原物料 materials and supplies in transit1229 备抵存货跌价损失 allowance for reduction of inventory to market 125 预付费用 prepaid expenses1251 预付薪资 prepaid payroll1252 预付租金 prepaid rents1253 预付保险费 prepaid insurance1254 用品盘存 office supplies1255 预付所得税 prepaid income tax1258 其它预付费用 other prepaid expenses126 预付款项 prepayments1261 预付货款 prepayment for purchases1268 其它预付款项 other prepayments128~129 其它流动资产 other current assets1281 进项税额 VAT paid ( or input tax)1282 留抵税额 excess VAT paid (or overpaid VAT)1283 暂付款 temporary payments1284 代付款 payment on behalf of others1285 员工借支 advances to employees1286 存出保证金 refundable deposits1287 受限制存款 certificate of deposit-restricted1291 递延所得税资产 deferred income tax assets1292 递延兑换损失 deferred foreign exchange losses1293 业主(股东)往来 owners(stockholders) current account1294 同业往来 current account with others1298 其它流动资产-其它 other current assets - other13 基金及长期投资 funds and long-term investments131 基金 funds1311 偿债基金 redemption fund (or sinking fund)1312 改良及扩充基金 fund for improvement and expansion1313 意外损失准备基金 contingency fund1314 退休基金 pension fundAccount 帐户Accounting equation 会计等式Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Articulation 勾稽关系Assets 资产Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Business entity 企业个体Capital stock 股本Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant 注册会计师Corporation 公司Cost accounting 成本会计Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure 批露Expenses 费用External users 外部使用者Financial activities 筹资活动Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Financial statement 财务报表Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Going-concern assumption 持续经营假设Government Accounting Office 政府会计办公室Income statement 损益表Inflation 通货膨涨Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Investing activities 投资活动Liabilities 负债Management accounting 管理会计Negative cash flow 负现金流量Operating activities 经营活动Owner's equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Return of investment 投资回报Return on investment 投资报酬Revenue 收入Securities and Exchange Commission 证券交易委员会Sole proprietorship 独资企业Solvency 清偿能力Stable-dollar assumption 稳定货币假设Statement of cash flow 现金流量表Statement of financial position 财务状况表Stockholders 股东Stockholders' equity 股东权益Tax accounting 税务会计Window dressing 门面粉。

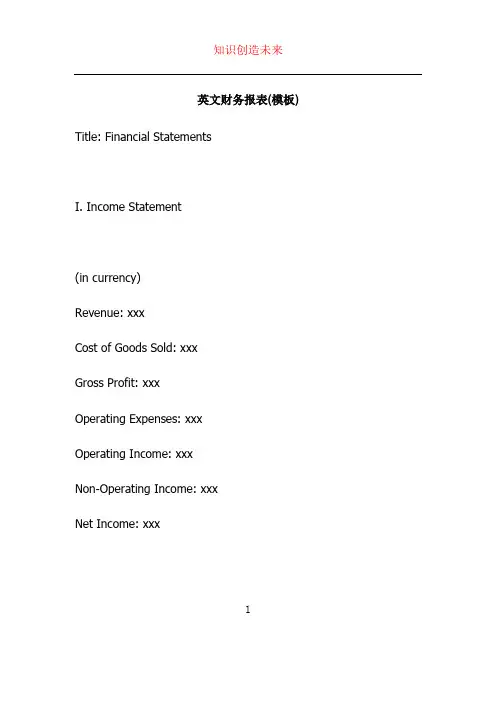

英文财务报表(模板) Title: Financial StatementsI. Income Statement(in currency)Revenue: xxxCost of Goods Sold: xxxGross Profit: xxxOperating Expenses: xxxOperating Income: xxxNon-Operating Income: xxxNet Income: xxx1II. Balance Sheet(in currency)Assets:Current Assets:Cash: xxxAccounts Receivable: xxxInventory: xxxLong-term Assets:Property, Plant, and Equipment: xxx Intangible Assets: xxxTotal Assets: xxxLiabilities:Current Liabilities:2Accounts Payable: xxxShort-term Debt: xxxLong-term Liabilities:Long-term Debt: xxxTotal Liabilities: xxxEquity:Shareholder's Equity: xxxRetained Earnings: xxxTotal Equity: xxxIII. Cash Flow StatementOperating Activities:Cash Inflows:3Cash collections from customers: xxxInterest received: xxxCash Outflows:Payment to suppliers: xxxSalary and wages payments: xxxUtility and overhead payments: xxxNet Cash from Operating Activities: xxxInvesting Activities:Cash Inflows:Proceeds from sale of property, plant, and equipment: xxx Cash Outflows:Purchase of property, plant, and equipment: xxxNet Cash used in Investing Activities: xxx4Financing Activities:Cash Inflows:Proceeds from issuance of long-term debt: xxx Cash Outflows:Repayment of long-term debt: xxxNet Cash used in Financing Activities: xxxNet increase/(decrease) in Cash: xxxIV. Notes to financial statements- Explanation of significant accounting policies- Breakdown of revenue by product/service- Detailed list of property, plant, and equipment- Summary of long-term debt obligations5Note: This template serves as a starting point and can be customized based on the specific requirements and format preferences of your organization.6。

信用减值损失英文版财务报表模板全文共3篇示例,供读者参考篇1Title: Financial Statement Template for Credit Impairment LossIntroduction:Credit impairment loss is an important aspect of financial reporting that reflects the potential losses that a company may face due to the non-repayment of loans and other credit assets. This article provides a template for a financial statement that includes a detailed analysis of credit impairment loss.Financial Statement Template:Company Name: ________________ Date: ________________Financial Statement for the year ended ________________Balance Sheet:AssetsCash and cash equivalents $___________Accounts Receivable $___________Less: Credit Impairment Loss $(__________) Net Accounts Receivable $___________ Inventory $_____________Total Assets $__________LiabilitiesAccounts Payable $____________Total Liabilities $____________Income Statement:Net Sales $___________Cost of Goods Sold $___________Gross Profit $___________Operating Expenses $___________Net Income before Tax $___________ Credit Impairment Loss $(__________)Net Income after Tax $___________ Statement of Cash Flows:Cash from Operating Activities $___________Cash from Investing Activities $___________Cash from Financing Activities $___________Net Increase (Decrease) in Cash $___________Analysis of Credit Impairment Loss:The company incurred a credit impairment loss of$___________ during the year ended ________________. This loss was primarily due to the non-repayment of loans by customers and the decline in the value of certain credit assets. The company has implemented credit risk management strategies to minimize such losses in the future.Conclusion:This financial statement template provides a comprehensive analysis of credit impairment loss and its impact on the company's financial performance. It is important for companies to regularly assess and report their credit impairment loss to investors and stakeholders to maintain transparency and credibility in financial reporting.Note: This template is for illustrative purposes only and should be customized according to the specific requirements of the company.End of Document.篇2Credit Impairment Loss Financial Statement TemplateIntroductionA credit impairment loss is a provision that a company sets aside to cover potential losses on loans or investments that have become impaired. When an asset's value is impaired, it means that the fair value of the asset is less than its carrying amount on the balance sheet. In financial reporting, companies are required to disclose their credit impairment losses on their financial statements to provide investors and stakeholders with a clear picture of the company's financial health.The following is a template for a financial statement showing credit impairment losses:Example CompanyIncome Statement for the Year Ended December 31, 20XXRevenue:- Sales Revenue: $XXX- Other Income: $XXXTotal Revenue: $XXXExpenses:- Cost of Goods Sold: $XXX- Selling and Administrative Expenses: $XXX - Depreciation: $XXX- Interest Expense: $XXX- Credit Impairment Loss: $XXXTotal Expenses: $XXXNet Income: $XXXBalance Sheet as of December 31, 20XX Assets:- Cash: $XXX- Accounts Receivable: $XXX- Inventory: $XXX- Equipment: $XXX- Investment: $XXXTotal Assets: $XXXLiabilities:- Accounts Payable: $XXX- Loans Payable: $XXXTotal Liabilities: $XXXEquity:- Common Stock: $XXX- Retained Earnings: $XXXTotal Equity: $XXXTotal Liabilities and Equity: $XXXNotes to the Financial Statements:1. Credit Impairment Loss: The company has recognized a credit impairment loss of $XXX during the year. This provision is based on an assessment of the company's loans and investments that have become impaired.2. Measurement of Credit Impairment Losses: The credit impairment losses are determined based on the expected credit losses model as per the requirements of the accounting standards.3. Risks and Uncertainties: The company faces risks and uncertainties in its credit portfolio, which could result in further credit impairment losses in the future. The management regularly assesses these risks and updates its provisions accordingly.4. Going Concern: The company's financial statements have been prepared on a going concern basis, assuming that the company will continue its operations in the foreseeable future and will be able to meet its financial obligations.This template provides a basic format for disclosing credit impairment losses on financial statements. Companies should customize the template to suit their specific requirements and ensure that all relevant disclosures are made in accordance with the applicable accounting standards. Investors and stakeholders rely on these disclosures to make informed decisions about the company's financial performance and outlook.篇3Impairment loss on financial assets is a significant issue for organizations, as it can impact the financial stability and performance of a company. The recognition and measurement of impairment loss on financial assets are critical aspects offinancial reporting, and companies must adhere to relevant accounting standards and regulations when reporting on such losses.When a company estimates that the recoverable amount of a financial asset is less than its carrying amount, it is required to recognize an impairment loss on the asset. Impairment losses are recognized in the income statement and reduce the carrying amount of the impaired financial asset. The impairment loss is calculated as the difference between the carrying amount of the asset and its recoverable amount.The recoverable amount of a financial asset is the higher of the asset's fair value less costs to sell and its value in use. Fair value is determined based on observable market prices, while value in use is the present value of expected cash flows from the asset. Companies must conduct regular assessments to determine whether impairment losses are required for their financial assets.The financial statements of a company must disclose information on impairment losses recognized during a reporting period. This includes details on the nature and amount of the impairment loss, the financial assets impaired, and the reasons for the impairment. Additionally, companies must provideinformation on the methodology used to determine the recoverable amount of impaired assets.The following is a template for reporting impairment losses on financial assets in a company's financial statements:[Company Name]Notes to the Financial StatementsFor the Year Ended [Date]Impairment Loss on Financial AssetsDuring the year, the Company recognized impairment losses on financial assets as follows:| Financial Asset | Carrying Amount | Recoverable Amount | Impairment Loss ||-------------------------------|-----------------|--------------------| -----------------|| [Asset 1] | [$Amount] | [$Amount] | [$Amount] || [Asset 2] | [$Amount] | [$Amount] | [$Amount] || [Asset 3] | [$Amount] | [$Amount] | [$Amount] |The Company conducted impairment assessments in accordance with relevant accounting standards. The recoverable amounts of the impaired assets were determined based on [insert methodology]. The impairment losses recognized in the income statement for the year ended [Date] totaled [$Amount].Management believes that the impairment losses recognized accurately reflect the recoverable amounts of the impaired financial assets. The Company will continue to monitor the carrying amounts and recoverable amounts of its financial assets to ensure the proper recognition of impairment losses in future periods.[Signature][Name][Title][Date]This template provides a structured format for reporting impairment losses on financial assets in a company's financial statements. Companies should adapt the template to their specific circumstances and provide additional information asnecessary to comply with reporting requirements. Proper disclosure of impairment losses is essential for transparent and accurate financial reporting.。

上市公司季度财务报告英文版(模板)IntroductionFinancial Highlights- Expenses: Operating expenses amounted to [Amount], including [Breakdown of Expenses].Expenses: Operating expenses amounted to [Amount], including [Breakdown of Expenses].Financial AnalysisRevenue Analysis1. Product/Service Sales: Higher sales volumes and increased demand for our products/services contributed to the revenue growth.Product/Service Sales: Higher sales volumes and increased demand for our products/services contributed to the revenue growth.2. Market Expansion: Successful market expansion strategies and new customer acquisitions resulted in additional revenuestreams.Market Expansion: Successful market expansion strategies and new customer acquisitions resulted in additional revenue streams.Profitability Analysis1. Cost Management: Strict cost control measures and optimization of operational efficiency helped in reducing expenses and improving profit margins.Cost Management: Strict cost control measures and optimization of operational efficiency helped in reducing expenses and improving profit margins.2. Productivity Gains: Enhanced productivity through process improvements and workforce efficiency positively impacted profitability.Productivity Gains: Enhanced productivity through process improvements and workforce efficiency positively impacted profitability.Expenses AnalysisOperating expenses were primarily driven by:1. Personnel Costs: Increased personnel costs, which include salaries, benefits, and bonuses.Personnel Costs: Increased personnel costs, which include salaries, benefits, and bonuses.2. Marketing and Sales: Investments in marketing and sales activities to drive customer acquisition and brand awareness.Marketing and Sales: Investments in marketing and sales activities to drive customer acquisition and brand awareness.Financial Position- Liabilities: Total liabilities stood at [Amount], including [Breakdown of Liabilities].Liabilities: Total liabilities stood at [Amount], including [Breakdown of Liabilities].- Equity: Shareholders' equity totaled [Amount], indicating a healthy financial position.Equity: Shareholders' equity totaled [Amount], indicating a healthy financial position.Conclusion。

XX Co., Ltd. Annual Audit Report YZXXZ () No. 2XX56XX Certified Public Accountants Co., Ltd.ContentI. Audit report Page 1-2II. Financial statements Page 3-6 (i) Balance Sheet Page 3 (ii) Income Statement Page 4 (iii) Cash Flow Statement Page 5 (iv) Change Statement of Owners’ Equity Page 6III. Explanatory notes of financial statements Page 7-23XX CERTIFIED PUBLIC ACCOUNTANTS CO., LTDAudit ReportYZXXZ () No. 2XX56XX Co., Ltd.,We have audited the accompanying financial statements of XX Co., Ltd. (hereinafter referred to as “your company”), including the balance sheet as at December 31, , the income statement, cash flow statement and change statement of owners’ equity of as well as explanatory notes of financial statements.I. Management’s responsibility for the financial statementsManagement of your company is responsible for the preparation and fair presentation of financial statements. This responsibility includes: (1) preparing the financial statements and reflecting fair representation in accordance with provisions of the Accounting Standards for Business Enterprises; (2) designing, implementing andmaintaining the necessary internal control in order to free financial statements from material misstatement, whether due to fraud or error.II. Auditor’s responsibilityOur responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with provisions of the Chinese Certified Public Accountants Auditing Standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the certified public accountants consider the internal control relevant to the preparation and fair presentation of the financial statements in order to design audit procedures that area appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.III. Audit opinionIn our opinion, the financial statements of your company have been prepared in accordance with provisions of the Accounting Standards for Business Enterprises in all material aspects, and present fairly the financial position of your company as of December 31, and the results of its operations and cash flows of .XX Certified Public Accountants Co., Ltd. Chinese Certified Public Accountant: Guangdong, China Chinese Certified Public Accountant:February 29,Balance SheetDecember 31,KQ 01 Enterprise name: XX Co., Ltd.Unit: RMB YuanInterest receivable Employees’ compensationpayableDividend receivable Tax payableOther accounts receivable Interest payable Inventory Dividend payableAssets divided as availableassets for saleOther accounts payableNon-current assets due within 1 year Liabilities divided as available liabilities for saleOther current assets Non-current liabilities duewithin 1 yearTotal current assets Other current liabilitiesTotal current liabilitiesNon-current liabilities:Long-term borrowingsBonds payableIncluding: Preferred sharesPerpetual capital securitiesLong-term account payableLong-term employees’compensation payableNon-current assets: Special payablesAvailable for sale financialAccrued liabilitiesassetsHeld-to-maturity investments Deferred incomeLong-term account receivable Deferred tax liabilitiesLong-term equity investment Other non-current liabilities Investing real estate Total non-current liabilitiesFixed asset7Total liabilitiesProject in construction Owners’ equity (orshareholders’ equity)16 Engineering material Paid-in capital (or sharecapital)Fixed asset disposal Other equity instruments Production biological assets Including: Preferred sharesOil and gas assets Perpetual capital securities2Income StatementYear ofKQ 02 Enterprise name: XX Co., Ltd.Unit: RMB YuanPlus: Non-business income5 Including: Gain from non-current asset disposalMinus: Non-business expenditure6 Including: Loss from non-current asset disposalIII. Total profit (total loss with “-”)Minus: Income tax expense7 IV. Net profit (net loss with “-”)V. Net after-tax amount of other comprehensive incomes(i) Other comprehensive incomes not reclassified into profit andloss in future1. Changes for net liability or net asset of remeasured and resetbenefit plan2. Shares enjoyed in other comprehensive incomes not reclassifiedinto profit and loss by the invested unit(ii) Other comprehensive incomes reclassified into profit and lossin future1. Shares enjoyed in other comprehensive incomes reclassifiedinto profit and loss by the invested unit in future4Cash Flow StatementYear ofKQ 03 Enterprise name: XX Co., Ltd.Unit: RMB YuanII. Cash flow from investing activities:Cash flow from disposal of investmentsCash received from returns of investmentsCash received from incomes on investmentsNet cash received from disposal of fixed assets, intangible assets and other long-term assetsOther cash received relating to investing activitiesSub-total of cash inflows from investing activitiesCash paid to acquire fixed assets, intangible assets and other long-term assetsCash paid to acquire investmentsNet cash received from the subsidiary company and other business unitsOther cash payments relating to investing activitiesSub-total of cash outflows from investing activitiesNet cash flows from investing activitiesIII. Cash flows from financing activities:5。

美的2023年财务报告英文版As of December 31, 2023, we are pleased to present the financial report for the year. Despite the challenges posed by the global economic landscape, we are proud to report a strong performance in 2023.Revenue for the year reached $10.5 billion, representing a 8% increase from the previous year. This growth can be attributed to our continued focus on innovation and customer satisfaction. Our investment in new product development and marketing initiatives has paid off, as we have seen increased demand for our products across all regions.Operating income for the year was $2.1 billion, a 10% increase from the previous year. This increase is a result of our efforts to streamline operations and improve efficiency across the organization. We have also been successful in managing our costs, which has contributed to the overall improvement in operating income.Net income for the year was $1.5 billion, a 12% increase from the previous year. This growth is a testament to our commitment to delivering value to our shareholders. We have focused on maximizing profitability while also investing in the future growth of the company.In terms of our balance sheet, we have maintained a strong financial position. Our total assets stand at $25 billion, with a healthy mix of cash, investments, and property. Our liabilities are well-managed, with a manageable level of debt and adequate provisions for future obligations.Looking ahead, we remain cautiously optimistic about the future. While the global economic environment remains uncertain, we are confident in our ability to navigate any challenges that may arise. We will continue to focus on innovation, customer satisfaction, and operational excellence to drive future growth and success.In conclusion, we are pleased with the strong performance in 2023. Our focus on delivering value to our customers and shareholders has paid off, and we are well-positioned for continued success in the future. We would like to express our gratitude to our employees, customers, and shareholders for their continued support, and we look forward to the opportunities and challenges that lie ahead.。

本文档如对你有帮助,请帮忙下载支持!财务报表各项目中英文对照一、损益表INCOME STATEMENTAggregate income statement 合并损益表Operating Results 经营业绩FINANCIAL HIGHLIGHTS 财务摘要Gross revenues 总收入/毛收入Net revenues 销售收入/净收入Sales 销售额Turnover 营业额Cost of revenues 销售成本Gross profit 毛利润Gross margin 毛利率Other income and gain 其他收入及利得EBITDA 息、税、折旧、摊销前利润(息、税、折旧、摊销前利润(EBITDA)EBITDA margin EBITDA率EBITA 息、税、摊销前利润EBIT 息税前利润/营业利润Operating income(loss)营业利润/(亏损)Operating profit 营业利润Operating margin 营业利润率营业利润率EBIT margin EBIT率(营业利润率)率(营业利润率)Profit before disposal of investments 出售投资前利润出售投资前利润Operating expenses: 营业费用:Research and development costs (R&D)研发费用marketing expensesSelling expenses 销售费用Cost of revenues 营业成本Selling Cost 销售成本Sales and marketing expenses Selling and marketing expenses 销售费用、或销售及市场推广费用Selling and distribution costs 营销费用/行销费用General and administrative expenses 管理费用/一般及管理费用Administrative expenses 管理费用Operating income(loss)营业利润/(亏损)Profit from operating activities 营业利润/经营活动之利润Finance costs 财务费用/财务成本Financial result 财务费用Finance income 财务收益Change in fair value of derivative liability associated with Series B convertible redeemable preference shares 可转换可赎回优先股B相关衍生负债公允值变动Loss on the derivative component of convertible bonds 可換股債券衍生工具之損失Equity loss of affiliates 子公司权益损失Government grant income 政府补助Other (expense) / income 其他收入其他收入/(费用)Loss before income taxes 税前损失Income before taxes 税前利润Profit before tax 税前利润Income taxes 所得税taxes 税项Current Income tax 当期所得税Deferred Income tax 递延所得税递延所得税Interest income 利息收入Interest income net 利息收入净额Profit for the period 本期利润Ordinary income 普通所得、普通收益、通常收入普通所得、普通收益、通常收入Comprehensive income 综合收益、全面收益Net income 净利润净利润Net loss 净损失Net Margin 净利率净利率Income from continuing operations 持续经营收益或连续经营部门营业收益Income from discontinued operations 非持续经营收益或停业部门经营收益非持续经营收益或停业部门经营收益extraordinary gain and loss 特别损益、非常损益Gain on trading securities 交易证券收益Net Profit attributable to Equity Holders of the Company 归属于本公司股东所有者的净利润Net income attributed to shareholders 归属于母公司股东的净利润或股东应占溢利(香港译法)Profit attributable to shareholders 归属于股东所有者(持有者)的利润或股东应占溢利(香港译法)Minority interests 少数股东权益少数股东权益/少数股东损益Change in fair value of exchangeable securities 可交换证券公允值变动Other comprehensive income — Foreign currency translation adjustment 其他综合利润—外汇折算差异Comprehensive (loss) / income 综合利润(亏损) Gain on disposal of assets 处分资产溢价收入Loss on disposal of assets 处分资产损失Asset impairments 资产减值资产减值Gain on sale of assets 出售资产利得Intersegment eliminations 公司内部冲销Dividends 股息/股利/分红Deferred dividends 延派股利Net loss per share: 每股亏损Earnings per share(EPS)每股收益Earnings per share attributable to ordinaryequity holders of the parent 归属于母公司股东持有者的每股收益-Basic -基本基本-Diluted -稀释/摊薄(每股收益一般用稀释,净资产用摊薄)Diluted EPS 稀释每股收益Basic EPS 基本每股收益Weighted average number of ordinary shares: 加权平均股数:-Basic -基本基本-Diluted -稀释/摊薄Derivative financial instruments 衍生金融工具Borrowings 借貸借貸Earnings Per Share, excluding the (loss)gain on the derivative component of convertible bonds and exchange difference 扣除可换股债券之衍生工具评估损益及汇兑损失后每股盈Historical Cost 历史成本历史成本Capital expenditures 资本支出revenues expenditure 收益支出Equity in earnings of affiliatesequity earnings of affiliates 子公司股权收益附属公司股权收益联营公司股权收益equity in affiliates 附属公司权益Equity Earning 股权收益、股本盈利Non-operating income 营业外收入Income taxes-current 当期所得税或法人税、住民税及事业税等(日本公司用法)Income taxes-deferred 递延所得税或法人税等调整项(日本公司用法)Income (loss) before income taxes and minority interest 所得税及少数股东权益前利润(亏损)Equity in the income of investees 采权益法认列之投资收益Equity Compensation 权益报酬Weighted average number of shares outstanding 加权平均流通股treasury shares 库存股票Number of shares outstanding at the end of the period 期末流通股数目Equity per share, attributable to equity holders of the Parent 归属于母公司所有者的每股净资产Dividends per share 每股股息、每股分红Cash flow from operations (CFFO)经营活动产生的现金流量Weighted average number of common and common equivalent shares outstanding:加权平均普通流通股及等同普通流通股Equity Compensation 权益报酬Weighted Average Diluted Shares 稀释每股收益加权平均值Gain on disposition of discontinued operations 非持续经营业务处置利得(收益)Loss on disposition of discontinued operations 非持续经营业务处置损失非持续经营业务处置损失participation in profit 分红profit participation capital 资本红利、资本分红profit sharing 分红分红Employee Profit Sharing 员工分红(红利)员工分红(红利)Dividends to shareholders 股东分红(红利)Average basic common shares outstanding 普通股基本平均数Average diluted common shares outstanding 普通股稀释平均数Securities litigation expenses, net 证券诉讼净支出Intersegment eliminations 部门间消减ROA(Return on assets)资产回报率/资产收益率ROE(Return on Equit) 股东回报率/股本收益率(回报率)净资产收益率Equit ratio 产权比率Current ration (times) 流动比率ROCE(Return on Capital Employed)资本报酬率(回报率)或运营资本回报率或权益资本收益率或股权收益率RNOA(Return on Net Operating Assets)净经营资产收益率(回报率)ROI(Return on Investment)投资回报率OA(Operating Assets)经营性资产OL(Operating Liabilites)经营性负债NBC(Net Borrow Cost) 净借债费用净借债费用OI(Operating Income) 经营收益经营收益NOA(Net Operating Assets) 净经营性资产NFE(Net Financial Earnings) 净金融收益净金融收益NFO(Net Financial Owners) 净金融负债净金融负债FLEV(Financial leverage) 财务杠杆OLLEV(Operating Liabilites leverage) 经营负债杠杆CSE(Common Stock Equity) 普通股权益普通股权益SPREAD 差价RE(Residual Earning) 剩余收益二、资产负债表balance sheet 资产负债表aggregate balance sheet 合并资产负债表Assets 资产Current assets 流动资产Non-current assets 非流动资产Interests in subsidiaries 附属公司权益Cash and cash equivalents 现金及现金等价物Hong Kong listed investments, at fair value 于香港上市的投资,以公允价值列示Investment deposits 投资存款Designated loan 委托贷款Financial assets 金融资产Pledged deposits 银行保证金 /抵押存款抵押存款Trade accounts receivable 应收账款Trade and bills receivables 应收账款及应收票据应收账款及应收票据Inventories 存货/库存Prepayments and other receivables 预付款及其他应收款Prepayments, deposits and other receivables 预付账款、按金及其它应收款Total current assets 流动资产合计流动资产合计Tangible assets 有形资产Intangible assets 无形资产Investment properties 投资物业投资物业Goodwill 商誉商誉Other intangible assets 其他无形资产其他无形资产Available-for-sale investments 可供出售投资Prepayments for acquisition of properties 收购物业预付款项fair value 公允价值公允价值Property, plant and equipment 物业、厂房及设备或财产、厂房及设备或固定资产Fixed Assets 固定资产Plant Assets 厂房资产Lease prepayments 预付租金Intangible assets 无形资产Deferred tax assets 递延税/递延税项资产Total assets 资产合计Liabilities 负债Current liabilities 流动负债Short-term bank loans 短期银行借款短期银行借款Current maturities of long-term bank loans 一年内到期的长期银行借款Accounts and bills payable 应付账款及应付票据应付账款及应付票据Accrued expenses and other payables 预提费用及其他应付款Total current liabilities 流动负债合计Long-term bank loans, less current maturities Deferred income Deferred tax liabilities 长期银行借款,减一年内到期的长期银行贷款Deferred income 递延收入Deferred tax liabilities 递延税Financial Net Debt 净金融负债净金融负债Total liabilities 负债合计负债合计Commitments and contingencies 资本承诺及或有负债三、股东权益Donated shares 捐赠股票Additional paid-in capital 资本公积Statutory reserves 法定公积Retained earnings 未分配利润Accumulated other comprehensiveincome 累积其他综合所得Treasury shares 库存股票Total shareholders’ equity equity 股东权益合计股东权益合计Equity 股东权益、所有者权益、净资产Sharehold er’s EquityStockholder's EquityOwner&# 39;s Equity 股东权益、所有者权股东权益、所有者权益Total liabilities and shareholders’ equity 负债和股东权益合计负债和股东权益合计Capital and reserves attributable to the Company’s equity holders 本公司权益持有人应占资本及储备Issued capital 已发行股本Share capital 股本Reserves 储备Cash reserves 现金储备Inerim dividend 中期股息中期股息Proposed dividend 拟派股息Proposed special dividend 拟派末期股息Proposed special dividend 拟派特别股息Proposed final special dividend 拟派末期特别股息拟派末期特别股息Convertible bonds 可换股债券Shareholders’ fund 股东资金股东资金四、现金流量表STATEMENTS OF CASH FLOWSCash flow from operating activities 经营活动产生的现金流Net cash provided by / (used in) operating activities 经营活动产生的现金流量净额 Net income /loss 净利润或损失净利润或损失Adjustments to reconcile net loss to net cash provided by/(used in) operating activities: 净利润之现金调整项:净利润之现金调整项:Depreciation and amortization 折旧及摊销Addition of bad debt expense 坏账增加数/(冲回数)Provision for obsolete inventories 存货准备Share-based compensation 股票薪酬Deferred income taxes 递延所得税Exchange loss 汇兑损失Loss of disposal of property,plant and equipment 处置固定资产损失Changes in operating assets and liabilities: 经营资产及负债的变化Trade accounts receivable 应收账款Inventories 存货Prepayments and other receivables 预付款及其他应收款Accounts and bills payable 应付账款及应付票据Accrued expenses and other payables 预提费用及其他应付款Net cash provided by / (used in) operating activities 经营活动产生/(使用)的现金Free cash flow 自由现金流Cash flow from investing activities 投资活动产生的现金流Net cash used in investing activities 投资活动产生的现金流量净额Purchases of property, plant and equipment 购买固定资产Payment of lease prepayment 支付预付租金支付预付租金Purchases of intangible assets 购买无形资产Proceeds from disposal of property, plant and equipment 处置固定资产所得Government grants received 政府补助政府补助Equity in the income of investees 采权益法认列之投资收益Cash flow from financing activities 筹资活动产生的现金流Net cash provided by financing activities 筹资活动产生的现金流量净额Proceeds from borrowings 借款所得借款所得Repayment of borrowings 还款Decrease / (increase) in pledged deposits 银行保证金(增加)/ 减少Proceeds from issuance of capital stock 股本发行所得股本发行所得Net cash provided by financing activities 筹资活动产生的现金Effect of exchange rate changes on cash and cash equivalents 现金及现金等价物的汇率变更的影响Net decrease in cash and cash equivalents 现金及现金等价物的净(减少)现金及现金等价物的净(减少)/ 增加Cash and cash equivalents at the beginning of period 期初现金及现金等价物Cash and cash equivalents at the end of period 期末现金及现金等价物本文档如对你有帮助,请帮忙下载支持!Investments (incl. financial assets)金融资产投资Investments in acquisitions 并购投资Net cash flow 现金流量净额现金流量净额。

项目 ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款 Other receivables预付帐款 Accounts prepaid期货保证金 Future guarantee应收补贴款 Allowance receivable应收出口退税 Export drawback receivable存货Inventories其中:原材料 Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资 Long-term debenture investment falling due in a yaear 其他流动资产Other current assets流动资产合计Total current assets长期投资: Long-term investment:其中:长期股权投资 Including long term equity investment长期债权投资 Long term securities investment*合并价差 Incorporating price difference长期投资合计Total long-term investment固定资产原价 Fixed assets-cost减:累计折旧 Less:Accumulated Dpreciation固定资产净值 Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计 Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出 Improvement expenditure of fixed assets其他长期资产 Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets递延税款借项 Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目 ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费 Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款 Other payable to government其他应付款 Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债Other current liabilities流动负债合计 Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款 long-term accounts payable专项应付款 Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金 Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金 public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列) Unaffirmed investment loss未分配利润 Retained earnings外币报表折算差额 Converted difference in Foreign Currency Statements 所有者权益合计 Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表 INCOME STATEMENT项目 ITEMS产品销售收入Sales of products其中:出口产品销售收入 Including:Export sales减:销售折扣与折让 Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本 Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利 Gross profit on sales减:销售费用 Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益) Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额 Total profit减:所得税 Less:Income tax净利润 Net profit现金流量表Cash Flows StatementPrepared by: Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve inCash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents。