第九章会计循环1

- 格式:ppt

- 大小:4.40 MB

- 文档页数:24

第二章 会计循环(一)第一节 交易、事项分析与会计恒等式一、会计工作的简要描述会计作为一个信息系统,是由会计人员通过运用复式薄记系统(包括日记帐或日记帐、会计帐薄和会计报表系统)对经济业务进行记录(记帐)、分类、汇总、计算、整理(算帐),并在此基础上编制和解释财务报告来完成的。

在这个系统中,记帐、算帐是会计人员“生产”信息(加工数据)的过程,财务报告是会计人员“生产”的产品(会计所生成的信息是以财务报告的方式提供给信息使用者的)。

这个过程与一个电子电路比如收音机的负反馈电路非常相似:收集经济业务所反映的数据的日记帐或日记帐相当于收集声波的磁性电棒,分类帐的作用类似于这个电路中的信息载体如二极管、三极管以及电容、电阻等,报表相当于扬声器(喇叭)。

电路设计相当于企业会计制度设计或更具体地说,相当于我国的会计核算形式。

会计信息系统加工乃至生成最终产品的过程,包括许多具体的会计程序,并要依次完成一定的基本步骤。

在会计上,这些依次继起、周而复始的以记录为主的会计处理步骤称为会计循环(Accounting cycle)。

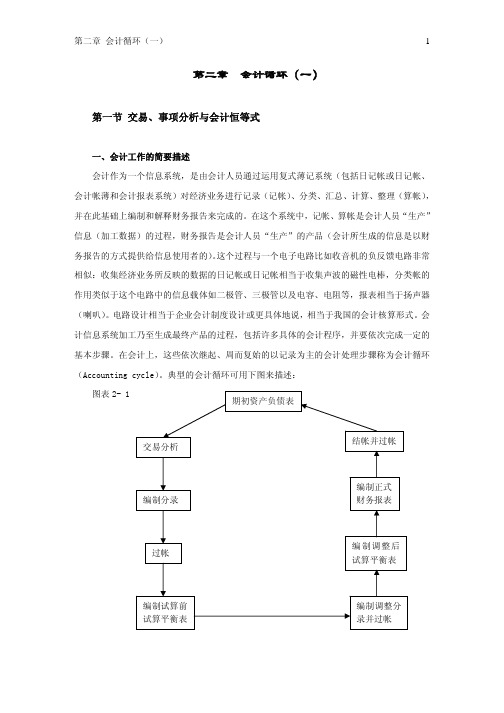

典型的会计循环可用下图来描述:图表2- 1上图说明,会计信息处理是一个周而复始、循环往复的过程,其基本步骤包括:1、交易分析——确定各项交易对资产和权益的影响;``2、编制分录——在原始记录簿(日记帐)中序时记录交易;3、过帐——将交易对各帐户的影响结果分类归集到其所影响的帐户中(把日记帐过帐到相应的分类帐中);4、编制调整前试算平衡表——检验分类帐中的各项借方余额和贷方余额是否相等,并将分类帐中的这些数据资料用编制财务报表所需的适当方式进行汇总;5、编制期末调整分录并过帐——从而使各帐户能反映出最新情况;6、编制调整后试算平衡表——再次检验分类帐中的各项借方余额和贷方余额是否相等,并将分类帐中的这些数据资料用财务报表所需要的方式进行汇总;7、编制正式财务报表——以说明本期会计主体的财务状况、经营成果和现金流动情况;8、结帐——将本期资产负债表的期末余额结转为下一期的期初余额。

会计循环的内容我呀,跟你说这会计循环的内容,那可真是有点意思又有点麻烦。

你看啊,首先得有这么个交易或者事项发生。

就像我去菜市场买菜,我从兜里掏出钱给菜贩子,这就是个交易,在会计上呢,这就是会计循环的开端。

这时候,就得开始记账了。

记账那得有专门的本子,就像会计有账本一样。

我得把买了啥菜,花了多少钱,明明白白地写下来。

会计呢,他就得把这个交易按照规定的格式,借方写啥,贷方写啥,规规矩矩地记好。

这借方贷方啊,就像是两个人在拉一个锯,你这边多点,我那边就得少点,得平衡着来。

比如说我买了一把青菜,两块钱。

那在会计的账本里,可能就是库存现金减少两块,这是贷方;而食材的成本增加两块,这就是借方。

这账本上的数字啊,得写得清清楚楚的,那些个会计,戴着个眼镜,眼睛死死地盯着账本,那认真的模样,就像在审视世界上最珍贵的宝贝。

那小笔尖在账本上“沙沙沙”地写着,每一笔都像是在刻画一个故事。

记完账了,还不算完呢。

接着就得做分录汇总了。

这就好比把我今天买的所有菜的花销啊,归拢归拢。

会计也是把一段期间里的那些借方贷方的账目,都整理到一块儿,看看总的是个啥情况。

这个过程啊,就像是把散落在地上的珠子,用线串起来,变成一条漂亮的项链,整整齐齐的。

然后就是试算平衡。

这就像走钢丝一样,得两边都平衡了才行。

要是不平衡啊,那会计可就头疼了。

他就像热锅上的蚂蚁,在那账本里翻来覆去地找,到底是哪里出了错呢?那眉头皱得能夹死苍蝇,眼睛里满是疑惑和焦急。

试算平衡之后,就该调整账目了。

有时候啊,有些事儿不是当时就清楚的,就像我买的菜里有个烂叶子,当时没发现,后来才看到,这就得调整菜的成本了。

会计也是,有些费用或者收入可能之前没记对,或者有新的情况出现,就得调整账目。

最后就是编制财务报表了。

这报表就像是一张大地图,把公司的财务状况都清清楚楚地展示出来。

利润多少啊,资产多少啊,负债多少啊,都在这上头。

那些个老板啊,就看着这报表,就像看着自己的家底儿一样,脸上的表情也是随着报表上的数字变来变去的。

True / False Questions1. Accounts that appear in the balance sheet are often called temporary (nominal) accounts.FALSE2. Income Summary is a temporary account only used for the closing process. TRUE3. Revenue accounts should begin each accounting period with zero balances. TRUE4. Closing revenue and expense accounts at the end of the accounting period serves to make the revenue and expense accounts ready for use in the next period.TRUE5. The closing process takes place after financial statements have been prepared. TRUE6. Revenue and expense accounts are permanent (real) accounts and should not be closed at the end of the accounting period.FALSE7. Closing entries result in revenues and expenses being reflected in the owner's capital account.TRUE8. The closing process is a step in the accounting cycle that prepares accounts for the next accounting period.TRUE9. The closing process is a two-step process. First revenue, expense, and withdrawals are set to a zero balance. Second, the process summarizes a period's assets and expenses.FALSE10. Closing entries are required at the end of each accounting period to close all ledger accounts.FALSE11. Closing entries are designed to transfer the end-of-period balances in the revenue accounts, the expense accounts, and the withdrawals account to owner's capital. TRUE12. The Income Summary account is a permanent account that will be carried forward period after period.FALSE13. Closing entries are necessary so that owner's capital will begin each period with a zero balance.FALSE14. Permanent accounts carry their balances into the next accounting period. Moreover, asset, liability and revenue accounts are not closed as long as a company continues in business.FALSE15. The first step in the accounting cycle is to analyze transactions and events to prepare for journalizing.TRUE16. The accounting cycle refers to the sequence of steps in preparing the work sheet. FALSE17. The first five steps in the accounting cycle include analyzing transactions, journalizing, posting, preparing an unadjusted trial balance, and recording adjusting entries.TRUE18. The last four steps in the accounting cycle include preparing the adjusted trial balance, preparing financial statements and recording closing and adjusting entries. FALSE19. A classified balance sheet organizes assets and liabilities into important subgroups that provide more information to decision makers.TRUE20. An unclassified balance sheet provides more information to users than a classified balance sheet.FALSE21. Current assets and current liabilities are expected to be used up or come due within one year or the company's operating cycle whichever is longer.TRUE22. Intangible assets are long-term resources that benefit business operations that usually lack physical form and have uncertain benefits.TRUE23. Assets are often classified into current assets, long-term investments, plant assets, and intangible assets.TRUE24. Current liabilities are cash and other resources that are expected to be sold, collected or used within one year or the company's operating cycle whichever is longer.FALSE25. Long-term investments can include land held for future expansion.TRUE26. Plant assets and intangible assets are usually long-term assets used to produce or sell products and services.TRUE27. Current liabilities include accounts receivable, unearned revenues, and salaries payable.FALSE28. Cash and office supplies are both classified as current assets.TRUE29. Plant assets are also called fixed assets or property, plant, and equipment. TRUE30. The current ratio is used to help assess a company's ability to pay its debts in the near future.TRUEMultiple Choice Questions64. Another name for temporary accounts is:A. Real accounts.B. Contra accounts.C. Accrued accounts.D. Balance column accounts.E. Nominal accounts.65. When closing entries are made:A. All ledger accounts are closed to start the new accounting period.B. All temporary accounts are closed but not the permanent accounts.C. All real accounts are closed but not the nominal accounts.D. All permanent accounts are closed but not the nominal accounts.E. All balance sheet accounts are closed.66. Revenues, expenses, and withdrawals accounts, which are closed at the end of each accounting period are:A. Real accounts.B. Temporary accounts.C. Closing accounts.D. Permanent accounts.E. Balance sheet accounts.67. Which of the following statements is incorrect?A. Permanent accounts is another name for nominal accounts.B. Temporary accounts carry a zero balance at the beginning of each accounting period.C. The Income Summary account is a temporary account.D. Real accounts remain open as long as the asset, liability, or equity items recorded in the accounts continue in existence.E. The closing process applies only to temporary accounts.68. Assets, liabilities, and equity accounts are not closed; these accounts are called:A. Nominal accounts.B. Temporary accounts.C. Permanent accounts.D. Contra accounts.E. Accrued accounts.69. Closing the temporary accounts at the end of each accounting period:A. Serves to transfer the effects of these accounts to the owner's capital account on the balance sheet.B. Prepares the withdrawals account for use in the next period.C. Gives the revenue and expense accounts zero balances.D. Causes owner's capital to reflect increases from revenues and decreases from expenses and withdrawals.E. All of these.70. Journal entries recorded at the end of each accounting period to prepare the revenue, expense, and withdrawals accounts for the upcoming period and to update the owner's capital account for the events of the period just finished are referred to as:A. Adjusting entries.B. Closing entries.C. Final entries.D. Work sheet entries.E. Updating entries.71. The closing process is necessary in order to:A. calculate net income or net loss for an accounting period.B. ensure that all permanent accounts are closed to zero at the end of each accounting period.C. ensure that the company complies with state laws.D. ensure that net income or net loss and owner withdrawals for the period are closed into the owner's capital account.E. ensure that management is aware of how well the company is operating.72. Closing entries are required:A. if management has decided to cease operating the business.B. only if the company adheres to the accrual method of accounting.C. if a company's bookkeeper forgets to prepare reversing entries.D. if the temporary accounts are to reflect correct amounts for each accounting period.E. in order to satisfy the Internal Revenue Service.73. The recurring steps performed each reporting period, starting with analyzing and recording transactions in the journal and continuing through the post-closing trial balance, is referred to as the:A. Accounting period.B. Operating cycle.C. Accounting cycle.D. Closing cycle.E. Natural business year.74. Which of the following is the usual final step in the accounting cycle?A. Journalizing transactions.B. Preparing an adjusted trial balance.C. Preparing a post-closing trial balance.D. Preparing the financial statements.E. Preparing a work sheet.75. A classified balance sheet:A. Measures a company's ability to pay its bills on time.B. Organizes assets and liabilities into important subgroups.C. Presents revenues, expenses, and net income.D. Reports operating, investing, and financing activities.E. Reports the effect of profit and withdrawals on owner's capital.76. The assets section of a classified balance sheet usually includes:A. Current assets, long-term investments, plant assets, and intangible assets.B. Current assets, long-term assets, revenues, and intangible assets.C. Current assets, long-term investments, plant assets, and equity.D. Current liabilities, long-term investments, plant assets, and intangible assets.E. Current assets, liabilities, plant assets, and intangible assets.77. The usual order for the asset section of a classified balance sheet is:A. Current assets, prepaid expenses, long-term investments, intangible assets.B. Long-term investments, current assets, plant assets, intangible assets.C. Current assets, long-term investments, plant assets, intangible assets.D. Intangible assets, current assets, long-term investments, plant assets.E. Plant assets, intangible assets, long-term investments, current assets.78. A classified balance sheet differs from an unclassified balance sheet in thatA. a unclassified balance sheet is never used by large companies.B. a classified balance sheet normally includes only three subgroups.C. a classified balance sheet presents information in a manner that makes it easier to calculate a company's current ratio.D. a classified balance sheet will include more accounts than an unclassified balance sheet for the same company on the same date.E. a classified balance sheet cannot be provided to outside parties.79. Two common subgroups for liabilities on a classified balance sheet are:A. current liabilities and intangible liabilities.B. present liabilities and operating liabilities.C. general liabilities and specific liabilities.D. intangible liabilities and long-term liabilities.E. current liabilities and long-term liabilities.80. The current ratio:A. Is used to measure a company's profitability.B. Is used to measure the relation between assets and long-term debt.C. Measures the effect of operating income on profit.D. Is used to help evaluate a company's ability to pay its debts in the near future.E. Is calculated by dividing current assets by equity.81. The current ratio:A. Is calculated by dividing current assets by current liabilities.B. Helps to assess a company's ability to pay its debts in the near future.C. Can reveal problems in a company if it is less than 1.D. Can affect a creditor's decision about whether to lend money to a company.E. All of these.AACSB: CommunicationsAICPA BB: IndustryAICPA FN: Risk AnalysisDifficulty: HardLearning Objective: A182. The Unadjusted Trial Balance columns of a company's work sheet show the balance in the Office Supplies account as $750. The Adjustments columns show that $425 of these supplies were used during the period. The amount shown as Office Supplies in the Balance Sheet columns of the work sheet is:A. $325 debit.B. $325 credit.C. $425 debit.D. $750 debit.E. $750 credit.83. A 10-column spreadsheet used to draft a company's unadjusted trial balance, adjusting entries, adjusted trial balance, and financial statements, and which is an optional tool in the accounting process is a(n) :A. Adjusted trial balance.B. Work sheet.C. Post-closing trial balance.D. Unadjusted trial balance.E. General ledger.84. Accumulated Depreciation, Accounts Receivable, and Service Fees Earned would be sorted to which respective columns in completing a work sheet?A. Balance Sheet or Statement of Owner's Equity-Credit; Balance Sheet or Statement of Owner's Equity Debit; and Income Statement-Credit.B. Balance Sheet or Statement of Owner's Equity-Debit; Balance Sheet or Statement of Owner's Equity-Credit; and Income Statement-Credit.C. Income Statement-Debit; Balance Sheet or Statement of Owner's Equity-Debit; and Income Statement-Credit.D. Income Statement-Debit; Income Statement-Debit; and Balance Sheet or Statement of Owner's Equity-Credit.E. Balance Sheet or Statement of Owner's Equity-Credit; Income Statement-Debit; and Income Statement-Credit.85. Which of the following statements is incorrect?A. Working papers are useful aids in the accounting process.B. On the work sheet, the effects of the accounting adjustments are shown on the account balances.C. After the work sheet is completed, it can be used to help prepare the financial statements.D. On the work sheet, the adjusted amounts are sorted into columns according to whether the accounts are used in preparing the unadjusted trial balance or the adjusted trial balance.E. A worksheet is not a substitute for financial statements86. A company shows a $600 balance in Prepaid Insurance in the Unadjusted Trial Balance columns of the work sheet. The Adjustments columns show expired insurance of $200. This adjusting entry results in:A. $200 decrease in net income.B. $200 increase in net income.C. $200 difference between the debit and credit columns of the Unadjusted Trial Balance.D. $200 of prepaid insurance.E. An error in the financial statements.87. Statements that show the effects of proposed transactions as if the transactions had already occurred are called:A. Pro forma statements.B. Professional statements.C. Simplified statements.D. Temporary statements.E. Interim statements.88. If in preparing a work sheet an adjusted trial balance amount is mistakenly sorted to the wrong work sheet column. The Balance Sheet columns will balance on completing the work sheet but with the wrong net income, if the amount sorted in error is:A. An expense amount placed in the Balance Sheet Credit column.B. A revenue amount placed in the Balance Sheet Debit column.C. A liability amount placed in the Income Statement Credit column.D. An asset amount placed in the Balance Sheet Credit column.E. A liability amount placed in the Balance Sheet Debit column.89. If the Balance Sheet and Statement of Owner's Equity columns of a work sheet fail to balance when the amount of the net income is added to the Balance Sheet and Statement of Owner's Equity Credit column, the cause could be:A. An expense amount entered in the Balance Sheet and Statement of Owner's Equity Debit column.B. A revenue amount entered in the Balance Sheet and Statement of Owner's Equity Credit column.C. An asset amount entered in the Income Statement and Statement of Owner's Equity Debit column.D. A liability amount entered in the Income Statement and Statement of Owner's Equity Credit column.E. An expense amount entered in the Balance Sheet and Statement of Owner's Equity Credit column.Problems129. In the table below, indicate with an "X" in the proper column whether the account is a (nominal) temporary account or a (real) permanent account.132. Based on the adjusted trial balance shown below, prepare a classified balance sheet for Focus Package Delivery.* $2,000 of the long-term note payable is due during the next year.135. Use the following partial work sheet from Matthews Lanes to prepare its income statement, statement of owner's equity and a balance sheet (Assume the owner did not make any investments in the business this year.)137. A partially completed work sheet is shown below. The unadjusted trial balance columns are complete. Complete the adjustments, adjusted trial balance, income statement, and balance sheet and statement of owner's equity columns.140. The adjusted trial balance of Sara's Web Services follows:(a) Prepare the closing entries for Sara's Web Services.(b) What is the balance of Sara's capital account after the closing entries are posted?Problems159. The unadjusted trial balance of Quick Delivery is entered on the partial work sheet below. Complete the work sheet using the following information:(a) Salaries earned by employees that are unpaid and unrecorded, $5,000.(b) An inventory of supplies showed $1,000 of unused supplies still on hand.(c) Depreciation on delivery vans, $24,000.(d) Services paid in advance by customers of $10,000 have now been provided tocustomers.。