会计学企业决策的基础 课后习题 答案 chapter11

- 格式:xls

- 大小:26.50 KB

- 文档页数:62

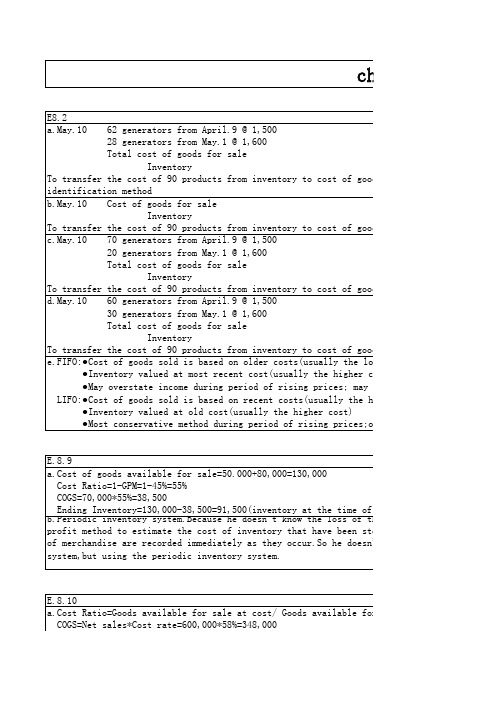

Chapter 6Merchandising Activitie s Ex. 6.41PROBLEM 6.1AClaypool earned a gross profit rate of 32%, which is significantly higher than the industry average. Claypool’s sales were above the industry average, and it earned $77,968 more gross profit than the “average” store of its size. This higher gross profit was earned even though its cost of goods sold was $18,000 to $20,000 higher than the industry average because of the additional transportation charges.To have a higher-than-average cost of goods sold and still earn a much larger-than-average amount of gross profit, Claypool must be able to charge substantially higher sales prices than most hardware stores. Presumably, the company could not charge such prices in a highly competitive environment. Thus, the remote location appears to insulate it from competition and allow it to operate more profitably than hardware stores with nearby competitors.PROBLEM 6.5Ac. Yes. Sole Mates should take advantage of 1/10, n/30 purchase discounts, even if itmust borrow money for a short period of time at an annual rate of 11%. Bytaking advantage of the discount, the company saves 1% by making payment 20 days early. At an interest rate of 11% per year, the bank charges only 0.6%interest over a 20-day period (11% X 20/365 = 0.6%). Thus, the cost of passing up the discount is greater than the cost of short-term borrowing.Chapter 7 Financial assetsChapter 8 Inventories and the cost of goods soldSupplementary ProblemChapter 91617。

第十一章所有者权益习题答案一、名词解释1.所有者权益:是指企业资产扣除负债后,由所有者享有的剩余权益。

公司的所有者权益又称为股东权益。

所有者权益反映了所有者对企业资产的剩余索取权,是企业资产中扣除债权人权益后应由所有者享有的部分。

2.实收资本(或股本):是指企业按照企业章程的规定或合同、协议约定,接受投资者投入企业的资本。

实收资本的构成比例即投资者的出资比例或股东的股权比例,是确定所有者在企业所有者权益中所占的份额和参与企业财务经营决策的基础,也是企业进行利润分配或股利分配的依据,同时还是企业清算时确定所有者对净资产的要求权的依据。

实收资本在股份有限公司称为股本。

3.资本公积:是企业收到投资者的超出其在企业注册资本(或股本)中所占份额的投资,以及直接计入所有者权益的利得和损失等。

4.盈余公积:是企业按照规定从净利润中提取的各种积累资金。

公司制企业的盈余公积包括法定盈余公积和任意盈余公积。

5.未分配利润:是企业实现的净利润经过弥补亏损、提取盈余公积和向投资者分配利润后留存在企业的、历年结存的利润。

二、单项选择题1.C 2.B 3.D 4.A 5.A 6.C 7.C 8.B 9.C 10.C三、多项选择题1.ABD 2.BCD 3.ABC 4.BC 5.ABD 6.ABD 7.ABCD 8.ACD 9.BC 10.ABD四、判断题1.错2.错3.错4.对5.错6.错7.对8.错9.对10.错五、综合业务题1.答案:借:固定资产126 000贷:实收资本100 000资本公积26 000借:原材料110 000应交税金——应交增值税(进项税额)18 700贷:实收资本100 000资本公积28 700借:银行存款390 000贷:实收资本300 000资本公积90 0002.答案:(1)年末结转本年利润、提取盈余公积并分配现金股利:借:本年利润 1 800 000贷:利润分配——未分配利润 1 800 000借:利润分配——提取法定盈余公积180 000——提取任意盈余公积450 000贷:盈余公积——法定盈余公积180 000——任意盈余公积450 000借:利润分配——应付现金股利500 000贷:应付股利500 000借:利润分配——未分配利润 1 130 000贷:利润分配——提取法定盈余公积180 000——提取任意盈余公积450 000——应付现金股利500 000 (2)以盈余公积转增资本,按股东比例转增:借:盈余公积500 000 贷:实收资本——A公司125 000——B公司150 000——C公司50 000——D公司25 000——其他150 000 (3)盈余公积补亏借:盈余公积100 000 贷:利润分配——盈余公积补亏100 000借:利润分配——盈余公积补亏100 000 贷:利润分配——未分配利润100 000 3.答案:(1)回购股票:借:库存股2400贷:银行存款2400注销股票:借:股本3000贷:库存股2400资本公积——股本溢价600(2)回购股票:借:库存股6000贷:银行存款6000注销股票:借:股本3000资本公积——股本溢价3000贷:库存股6000(3)回购股票:借:库存股9000 贷:银行存款9000 注销股票:借:股本3000 资本公积——股本溢价5000盈余公积1000贷:库存股9000。

管理会计作业(chapter16-20) Chapter 16 P757 16、5AChapter 16 P761 16、4BChapter 17 P802 17、3Aa、Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22、50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17、8Ad、The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line、Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line、If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace、This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline、e、The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality、Chapter 18 P835 18、1B、Ex、a、job costing (each project of a construction company is unique)18、1b、both job and process costing (institutional clients may representunique jobs)c、job costing (each set of equipment is uniquely designed andmanufactured)d、process costing (the dog houses are uniformly manufactured inhigh volumes)e、process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18、3A4,000 EU @ $61、50 = $246,000b4,000 EU @ $13、50 = $54,000Chapter 18 P845 18、2Ba、(1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b、In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a)、Chapter 20 P918 20、1Ad、No、With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even、Chapter 20 P918 20、2AChapter 20 P920 20、6ASales volume required to maintain current operating income:Sales Volume = Fixed Costs + Target OperatingIncomeUnit Contribution Margin= $390,000 + $350,000= $20,000 units $37。

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22.50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line. Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex.18.1a. job costing (each project of a construction company is unique)b . both job and process costing (institutional clients may represent unique jobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d . process costing (the dog houses are uniformly manufactured in high volumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3A4,000 EU @ $61.50 = $246,000 b4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume =Fixed Costs + Target OperatingIncomeUnit Contribution Margin=$390,000 + $350,000= $20,000 units$37。

会计学第十一讲课后练习题一、单选题1.企业购入不需要安装的生产设备一台,所支付的买价和增值税税额分别为20 000元和3 400元,另支付运杂费600元、包装费400元。

该设备的入账价值为()元。

A. 20 000B.23 400C.21 000D. 24 4002. “固定资产”账户用来核算的是企业所持有的固定资产的()。

A. 原价B. 数量C. 折旧D. 现值3.通过“累计折旧”账户对“固定资产”账户的调整,可以反映的内容是( )。

A.固定资产原始价值B.固定资产累计折旧C.固定资产净值D.固定资产重置成本4. 除了()之外,企业购买的固定资产在达到预定可使用状态之前的一切合理必要的开支都列入固定资产初始成本。

A.运杂费B.增值税C.关税D.运输途中的仓储费二、多选题5.下列属于固定资产的有()。

A.土地使用权B.生产设备C.外购商品D.厂房6.增值税一般纳税人企业外购一台生产用设备,其成本应该包括以下( ABD )内容。

A. 增值税专用发票注明的买价500 000元B. 设备运输装卸费3 000元C. 增值税专用发票注明的增值税80 000元D. 设备调试专业人员服务费1 000元7.下列各项中,不应计提折旧的有()。

A.季节性停用的设备B.已提足折旧仍继续使用的设备C.以经营租赁方式租出的设备D.提前报废的设备8.下列固定资产中,应计提折旧的有()。

A.单独计价的土地B.已提足折旧仍继续使用的设备C.以融资租赁方式租入的固定资产D.季节性停用的设备9.下列关于固定资产折旧的表述中,错误的有()。

A.提前报废的固定资产不再补提折旧B.当月增加的固定资产,当月开始计提折旧C.已提足折旧但仍继续使用的固定资产,不再计提折旧D.以经营租赁方式租出的固定资产,不再计提折旧10.下列各项中,影响固定资产年折旧额的主要因素有()。

A.固定资产原价B.固定资产的使用年限C.固定资产的预计净残值D.固定资产的使用部门三、判断题11.计提固定资产折旧时贷记的科目为“固定资产”。

Ex. 1.7i. Financial accountingh. Management accountingb. Financial reportingf. Financial statementsg. General-purpose assumptionc. Integritye. Internal controld. Public accountinga. BookkeepingCASE 1.1FANNIE MAESeveral factors prevent a large publicly owned corporation such as Fannie Mae from issuing misleading financial statements, no matter how desperately the company needs investors’ capital. To begin with, there is the basic honesty and integrity of the company’s management and its accounting personnel. Many people participate in the preparation of the financial statements of a large corporation. For these statements to be prepared in a grossly misleading manner, all of these people would have to knowingly participate in an act of criminal fraud.Next, there is the audit of Fannie Mae's financial statements by a firm of independent CPAs. These CPAs, too, would have to participate in a criminal conspiracy if the company were to supply creditors and investors with grossly misleading financial statements.If personal integrity is not sufficient to deter such an act of fraud, the federal securities laws provide for criminal penalties as well as financial liability for all persons engaged in the preparation and distribution of fraudulent financial statements. All that would be necessary for the SEC to launch an investigation would be a “tip” from but one individual within the company’s organization or its auditing firm. An investigation also would be launched automatically if the company declared bankruptcy or became insolvent shortly after issuing financial statements that did not indicate a shaky financial position.Problem 2.1 AProblem 3.8AExercise 4.2Exercise 4.14Problem 4.5AProblem 5.2AProblem 5.5A。

企业会计学总论课后习题参考答案(1-11章)第一章一、简答题1.答:(1)会计主体:会计主体是指会计工作为其服务的特定单位或组织。

具体是指运用会计核算方法体系进行反应和监督活动,具有独立的生产经营活动资金,进行独立的生产经营活动,实行独立的财务报告的单位。

(2)持续经营:持续经营是指会计主体的生产经营活动将无限期地持续下去,在可以预见的未来,会计主体不会面临破产,解散,倒闭而进行清算。

(3)会计分期:会计分期是指为了定期反映企业的生产经营活动,便于清算账目、编制会计报表.及时提供有关的财务状况及经营成果而人为地将一个企业持续不断的生产经营期间划分为若干个均等的会计期间。

(4)货币计量:货币计量是指会计主体在会计核算过程中采用货币作为计量单位,记录、反映会计主体的生产经营活动。

2.答:(1)可靠性:可靠性要求企业应当以实际发生的交易或者事项为依据进行会计确认、计量和报告,如实反映符合确认和计量要求的各项会计要素及其他相关信息,保证会计信息真实可靠、内容完整。

(2)相关性:相关性要求企业提供的会计信息应当与财务报告使用者的经济决策需要相关,有助于财务报告使用者对企业过去、现在或未来的情况做出评价或预测。

(3)可理解性:可理解性要求企业提供的会计信息应当清晰明了,便于财务报告使用者理解和使用。

(4)可比性:可比性要求企业提供的会计信息应当相互可比,具体包括以下两个方面:1)同企业不同时期可比。

为了便于会计信息使用者了解企业财务状况和经营成果的变化趋势,从而全面、客观地评价过去、预测未来、做出决策,会计信息质量的可比性要求同一企业不同时期发生的相同或相似的交易或事项应当采用致的会计政策,不得随意变更,如确需变更的,应当在附注中说明。

2)不同企业相同会计期间可比。

不同企业同一会计期间发生的相同或相似的交易或事项应当采用规定的会计政策,确保会计信息口径一致、相互可比,以使不同企业按照一致的确认、计量和报告要求提供有关会计信息。