债券价格的变动方向与利率的变动方向 相反

(b)L/T bonds more sensitive to interest rate risks

长期债券对利率风险更加敏感

19

可编辑

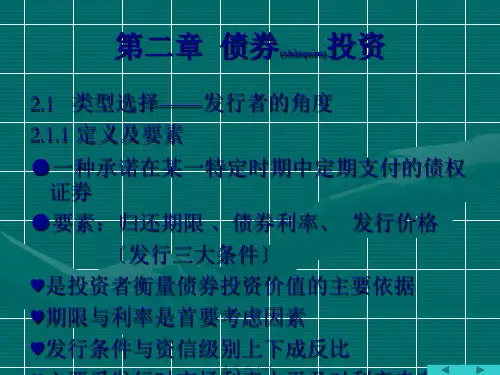

Important Characteristics of Bonds 债券的重要特征

(c) Low coupon bonds are more sensitive to interest rate risks

价格和收益(必要报酬率)呈反比关系

When yields get very high the value of the bond will be very low.

当收益率相当高的时候,债券的价值非常低 When yields approach zero, the value of

the bond approaches the sum of the cash flows. 当收益率接近于零的时候,债券的价值接近于现金流 的总和

11

可编辑

Equation in Action... 方程式的Байду номын сангаас际操作…

if risk-free Government bond yields 2%

如果无风险政府债券的收益率为2% inflation premium is 4% 通货膨胀溢价为4% other risk-premium is 2% 其它风险溢价为2%

求r

PB

T t 1

Ct (1 r)t

ParValueT (1 r)T

22

可编辑

Bond Prices and Yields 债券价格与收益

Prices and Yields (required rates of return) have an inverse relationship