中国银行抵押合同英文翻译

- 格式:docx

- 大小:24.11 KB

- 文档页数:15

中信银行个人贷款合同(中英文)CHINA CITIC BANK Personal Loan ContractCode No:借款人(以下简称甲方):Borrower (hereinafter called Party A):身份证件名称及号码:ID name and code No: ID card Number住所:Address of living place:联系电话:Post code: 邮编:Contact number:贷款人(以下简称乙方):Lender (hereinafter called Party B):住所:Address of living place:联系电话:Post code: 邮编:Contact number:抵押人:Mortgager:身份证件名称及号码:ID name and code No: ID card Number住所:Address of living place:联系电话:Post code: 邮编:Contact number:出质人:Pledger:身份证件名称及号码:ID name and code No: ID card Number住所:Address of living place:联系电话:Post code: 邮编:Contact number:保证人:Guarantor:身份证件名称及号码:ID name and code No: ID card Number住所:Address of living place:联系电话:Post code: 邮编:Contact number:根据中华人民共和国合同法和担保法的相关规定,甲方、乙方和担保方经过协商,就乙方向甲方贷款事宜达成如下合同条款。

According to the relevant laws and regulations of the Contract Laws andGuarantee Law of the People’s Republic of China, Party A, Party B and therelevant Guarantor, after reaching agreement through negotiations on the loan to Party B by Party A, hereby enter into this contract.第一条借款金额Article 1 Amount of Loan详见本合同第十四条第一款。

担保合同中英模板This Guarantee Agreement ("Agreement") is made and entered into on this [Effective Date], by and between:[Name of Guarantor], a company duly incorporated under the laws of [Country], with its registered office at [Address] (the "Guarantor"), and[Name of Creditor], a company duly incorporated under the laws of [Country], with its registered office at [Address] (the "Creditor").Whereas, the Creditor and the Debtor [Name of Debtor] have entered into a Loan Agreement dated [Date] (the "Loan Agreement"), pursuant to which the Creditor has agreed to lend a sum of money to the Debtor on the terms and conditions set forth in the Loan Agreement;Whereas, the Creditor requires the Guarantor to provide a guarantee for the obligations of the Debtor under the Loan Agreement, and the Guarantor has agreed to provide such a guarantee on the terms and conditions set forth herein;Now, therefore, in consideration of the mutual covenants and agreements contained herein, the parties hereto agree as follows:1. GuaranteeThe Guarantor hereby irrevocably and unconditionally guarantees the due and punctual payment and performance of all obligations of the Debtor under the Loan Agreement, including but not limited to the payment of the principal amount and interest, fees, costs, expenses, and all other amounts due under the Loan Agreement (the "Obligations").2. Guarantor's Undertakings2.1 The Guarantor undertakes to pay to the Creditor on demand and without any deduction all amounts due and payable by the Debtor under the Loan Agreement, in the event of any default by the Debtor in making any payment or performing any obligation under the Loan Agreement.2.2 The Guarantor's liability under this Agreement shall not be affected by any variation, amendment, or modification of the Loan Agreement, nor by any time, indulgence, or relaxation granted by the Creditor to the Debtor.3. Guarantee is IndependentThis Guarantee is an independent obligation of the Guarantor and shall be irrevocable and unconditional irrespective of:3.1 Any lack of notice to, or knowledge by, the Guarantor of breaches of the Loan Agreement by the Debtor;3.2 Any partial payment, compromise, or release granted by the Creditor to the Debtor;3.3 Any bankruptcy, insolvency, liquidation, winding-up, or other legal proceedings affecting the Debtor;3.4 Any change in the constitution, ownership, or name of the Debtor; and3.5 Any other circumstances which might otherwise discharge, release, or affect the liability of the Guarantor.4. Guarantee Period4.1 The Guarantee shall remain in full force and effect until:(a) The Debtor has fully paid and discharged all of its Obligations under the Loan Agreement; or(b) The Guarantor has received written notice from the Creditor releasing it from the Guarantee.4.2 The Guarantor's liability under this Agreement shall continue to be in force and effect notwithstanding any settlement, compromise, or otherwise extinguishment of the Debt under the Loan Agreement.5. No Waiver5.1 No failure or delay on the part of the Creditor in exercising any right, power, or privilege under this Agreement shall operate as a waiver thereof, nor shall any single or partial exercise of any right, power, or privilege preclude any other or further exercise thereof or the exercise of any other right, power, or privilege.5.2 The rights and remedies of the Creditor under this Agreement are cumulative and not exclusive of any rights or remedies provided by law.6. Governing Law and JurisdictionThis Agreement shall be governed by and construed in accordance with the laws of [Country]. Any dispute arising out of or in connection with this Agreement shall be submitted to the exclusive jurisdiction of the courts of [Country].7. Entire AgreementThis Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral, relating to such subject matter.IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Effective Date first above written.[Guarantor] Name: Title: Date: [Creditor] Name: Title: Date:。

抵押合同英文翻译模板Mortgage Contract Template。

A mortgage contract is a legally binding agreement between a lender and a borrower that outlines the terms and conditions of a loan secured by a property. This document serves as a guide for both parties, ensuring that each understands their rights and responsibilities throughout the duration of the loan. In this article, we will discuss the key components of a mortgage contract and provide a template for creating your own.Key Components of a Mortgage Contract。

1. Parties Involved: The mortgage contract should clearly identify the parties involved, including the lender and the borrower. It should also include the legal names and contact information of both parties.2. Property Description: The contract should include a detailed description of the property being used as collateral for the loan. This may include the property's address, legal description, and any relevant details about the land or building.3. Loan Terms: The contract should outline the specific terms of the loan, including the loan amount, interest rate, and repayment schedule. It should also specify the duration of the loan and any penalties for late payments or early repayment.4. Conditions of the Loan: The contract should detail any conditions that must be met in order for the loan to be approved and maintained. This may include requirements for property insurance, property taxes, and maintenance of the property.5. Rights and Responsibilities: The contract should clearly outline the rights and responsibilities of both the lender and the borrower. This may include the lender's right to foreclose on the property in the event of default, as well as the borrower's responsibility to maintain the property and make timely payments.6. Default and Remedies: The contract should specify the conditions under which the loan will be considered in default, as well as the remedies available to the lender in the event of default. This may include the right to foreclose on the property and sell it to recoup the outstanding debt.7. Signatures: The contract should be signed and dated by both the lender and the borrower, as well as any other relevant parties, such as co-signers or guarantors.Mortgage Contract Template。

Mortgage Contract (Short Version)1. PartiesLender: [Lender's Name]Borrower: [Borrower's Name]2. Loan DetailsLoan Amount: [Loan Amount]Interest Rate: [Interest Rate]%Repayment: [Number of Payments] equal monthly installments of [Monthly Payment Amount], commencing on [First Payment Date].3. Security InterestThe Borrower grants the Lender a security interest in [Description of the Property or Asset Being Mortgaged] to secure the repayment of the Loan.4. Obligations of the BorrowerThe Borrower shall repay the Loan in full, including principal and interest, in accordance with the terms of this Contract.The Borrower shall maintain the mortgaged property in good condition and keep it insured against risks as required by the Lender.5. Obligations of the LenderThe Lender shall provide the Loan to the Borrower in accordance with the terms of this Contract.The Lender shall have the right to enforce its security interest in theevent of default by the Borrower.6. Default and EnforcementIf the Borrower defaults in the repayment of the Loan or breaches any other term of this Contract, the Lender shall have the right to enforce its security interest and take any other actions permitted by law to recover the Loan.7. MiscellaneousThis Contract shall be governed by the laws of [Applicable Jurisdiction].Any dispute arising from or relating to this Contract shall be resolved through [Dispute Resolution Mechanism, e.g., arbitration or litigation].8. SignatureLender: ______________________________Date: ______________________________Borrower: ______________________________Date: ______________________________。

全版质押合同英文版Full Version Pledge AgreementThis document serves as a comprehensive pledge agreement between the parties involved. The agreement outlines the terms and conditions of the pledge, including the rights and responsibilities of each party.1. Parties Involved:- Pledger: [Name of Pledger]- Pledgee: [Name of Pledgee]2. Pledged Property:- Description of the property being pledged- Value of the property- Conditions for the release of the pledge3. Duration of Pledge:- Start date of the pledge- End date of the pledge- Renewal options, if any4. Rights and Obligations of the Pledger:- Maintenance of the pledged property- Notification of any changes in the status of the property - Compliance with all legal requirements5. Rights and Obligations of the Pledgee:- Protection of the pledged property- Right to take possession in case of default- Duty to notify the pledger of any actions taken6. Default and Remedies:- Definition of default conditions- Actions to be taken in case of default- Process for the release of the pledge upon fulfillment of obligations7. Governing Law:- Jurisdiction under which the agreement is governed- Applicable laws in case of disputes8. Signatures:- Signatures of both parties to indicate acceptance of the termsThis pledge agreement is a binding contract between the pledger and the pledgee and outlines the terms and conditions of the pledge. Both parties are encouraged to review the agreement carefully before signing to ensure full understanding and compliance with the terms outlined herein.By signing below, both parties acknowledge their acceptance of the terms and conditions of this pledge agreement.[Signature of Pledger] [Signature of Pledgee]Date: _________________ Date:_________________。

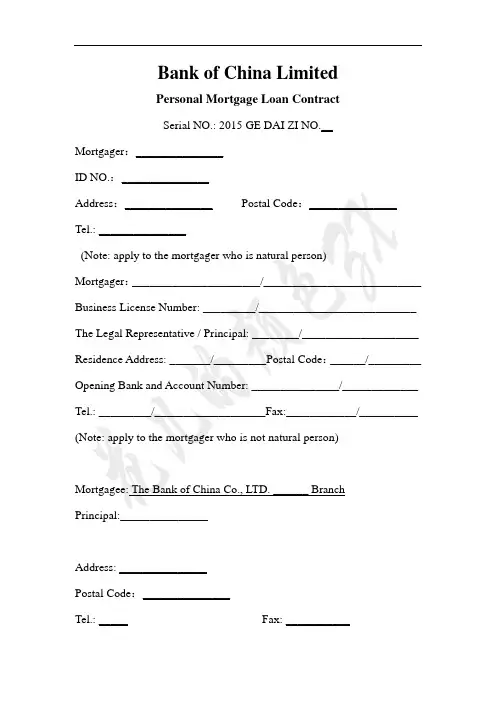

Bank of China LimitedPersonal Mortgage Loan ContractSerial NO.: 2015 GE DAI ZI NO.__Mortgager:_______________ID NO.:_______________Address:_______________ Postal Code:_______________ Tel.: _______________(Note: apply to the mortgager who is natural person)Mortgager:______________________/___________________________ Business License Number: _________/___________________________ The Legal Representative / Principal: ________/____________________ Residence Address: _______/_________Postal Code:______/_________ Opening Bank and Account Number: _______________/_____________ Tel.: _________/___________________Fax:____________/__________ (Note: apply to the mortgager who is not natural person)Mortgagee: The Bank of China Co., LTD. ______ BranchAddress: _______________Postal Code:_______________Tel.: _____ Fax: ___________To guarantee the payment of the debt in the "master contract" which is specified in the article one of this contract, the mortgager set up the mortgage guarantee for the creditor's rights of mortgagee about the property which the mortgager enjoy the right of legal disposal right, and is listed in the attached "collateral list". The two parties make the contract after equal consultation. Except this contract has other agreement, the words explanation in this contract is based on the main contract.Article One the Main ContractThe main contract of this contract is following: the contract signed by the mortgagee and the borrower ________, the revise and the supplement: the ☐“Personal Housing Loan Contract” / ☐“Personal Consumer Car Loan Contract”/ ☐“Individual Operation Car Loan Contract”which’s serials NO. is 2015 GE DAI ZI NO.. / ■Other Loan Contract: ______ “ Personal Loan Contract ”__________________.Article Two the Principal DebtThe debt in the main contract form the principal debt of this contract,default interest), liquidated damages, compensation for damage, the cost of the creditor's rights (including but not limited to legal fee, attorney fees, notarial fee, execution fee, etc.), for the loss caused by the borrower default to the mortgagee and all other accrued expenses.Article Three CollateralCollateral information is in the attachment “collateral list”.During the period of guarantee, collateral damage, loss or be expropriated, etc., the mortgagee can get preferred payments by getting insurance money, damages or indemnities, etc. The period of performance of the secured creditor's right has not expired, the insurance money, damages or indemnities, etc. can be deposited.When collateral is house, when the mortgager is in aware of house will be dismantled, the mortgager should timely inform the mortgagee.During the guarantee period, if the mortgage house is going to be demolished, for the form of house demolished using compensation of property right exchange, the mortgager should negotiate with the borrower, the mortgagee about paying off the debt, or in accordance with the requirements of the mortgagee, to use the house which has property rights exchange or other mortgages to reset mortgage and sign a new mortgage agreement. after the loss of the original mortgage house and before the new mortgage registration is done, the mortgagor should do as the asks, the secured party which has guarantee conditions should provide guarantee; For the demolition house for which to compensate by way of compensation, the mortgagee has the right to get preferred payments about the compensation, or to ask the mortgager to make the demolition compensation as guarantee property by opening adeposit account or certificates of deposit and other form, and sign the relevant compensation collateral agreement or deposit collateral agreement.Article Four Mortgage PatternFor his contract, the mortgager provides:Periodic mortgage guarantee, since the borrower has completed specified the house which loan purchases /cars mortgage registration and the mortgagee has received the original mortgage certificate as described in the article one of this contract under the main contract, in this contract there will no longer occur new guarantee obligations and responsibilities to the mortgager, but before that the debt has happened in the main contract , the principal obligation which formed the contract, the mortgager assume the guarantee liability use the mortgaged property.■The entire mortgage. All of the main contract debt formed this contract’s principal obligation, the mortgager assume the guarantee liability use the mortgaged property.Article Five Mortgage RegistrationWhen manage mortgage registration according to law, within 7 days after signing the contract, the mortgager and the mortgagee should finish the mortgage registration in the relevant registration department. When the mortgage registration items change, and need for alteration registration in accordance with the law, the mortgager and the mortgageeshould finish the mortgage registration in the relevant registration department within 7 days from the date of the change of the mortgage registration items.Mortgage registration fee should be paid in accordance with supervision department requirement.Article Six Possession and Custody of the Mortgage PropertyIn this contract, the mortgage property should be occupied and kept the mortgager, but the mortgage property right document should be kept by the mortgagee.Article Seven Guarantee Responsibility OccursIf the borrower failed to timely pay off debt by agreement in the main contract or other circumstances of agreed mortgagee action, the mortgagee has the right to exercise the mortgage right in accordance with law and this contract..The principle debt not in this contract, and at the same time there are other things’ guarantee or warranty, which does not affect any right and its exercise of mortgagee in this contract.Article the Relationship of This Contract and the Main ContractThe main contract agreement of the two parties change content of the main contract, except involving currencies, interest rates, the amount, time limit, or other changes and lead to increase the amount of theprincipal claim amount or extending the main contract period, regardless of the agreement of the mortgager, the mortgagor still assure guarantee responsibility mortgaged property for the changed main contract about the mortgage property, but as a result of national interest rate policy adjusts, the interest rate changes, the agreement of the mortgager is not required.in the case of mortgager's agreement is required, if without a written agreement of mortgager or mortgager refuse, the mortgager will not assume the guarantee liability for the increased principal claim amount, for the extended main contract performance time limited, the period of the mortgage right performance remain unchanged.If the mortgaged property in this contract has right of other mortgagee, without the written agreement of other mortgagee, the alteration above should has not negative influences to other mortgagee.Article Nine Fault of Signing an AgreementAfter signing the contract, if the mortgager refuses or delay to finish mortgage registration, or other reasons, therefore causes this contract cannot effect, and hypothec cannot be established effectively, this situation will make the contracting fault. Thereby lead to the loss of the mortgagee, and the mortgager should bear the compensation liability for the loss the mortgagee.Article Ten Trust Information Authorization1.The mortgager authorization: of if there occurs the following situations of the mortgagee in related to the mortgager, the mortgagee can query trust report through the financial trust information database.(1)To r eview the mortgage’s loan application;(2)To review the application for which the mortgage providesguarantee.(3)To conduct post-loan supervision for the mortgage’s existing loan or guarantee.(4)The legal person of Acceptance or other organization's loan application or as a guarantee, there need check the mortgager trust conditions when the mortgager is the legal representative or the investor.The mortgager also authorizes: the mortgagee can submit the mortgager’s trust information to the financial trust information basic database.2.The mortgager declares: I fully understand and be clear aboutsubmit the resulting my negative information to the financial trust information database, and reflect in my trust report. if the situation above occurs, the lender can inform the mortgager by means of telephone, SMS, email, etc., the mortgager’s contact information aresubject to this contract’s information or the changed mortgager information in according with the agreement:■SMS■Telephone■Email■Other ways___________(Note: this mortgager declaration does not suit for the mortgager is not natural person)3.The mortgager be aware of and understand the authorization clauses above, the above authorization is made since the date of mortgager sign this contract and be valid until the loan is settled in the main contract settlement. If the mortgagee is beyond the above authorization check, the mortgagee will bear all the consequences and legal responsibility.Article Eleven Default and Handling1.One of the following form or count as the mortgage is in default in this contract:(1)The is in violation of the regulations of this contract, to transfer, to lease, to loan, reconstruction, rebuilding and transform in the form of physical capital without authorization, or in whole or in part dispose of the mortgaged property in any other way;(2)The mortgager hinder the mortgagee according to the relevantprovisions of this contract and dispose the mortgaged property in accordance with the law in any way;(3)In the situation of the value is reduced or the mortgaged property is damaged, the mortgager will not provide the corresponding guarantee as the mortgagee required;(4)Collateral is house, when the mortgager is aware of the house will be dismantled but not timely inform the mortgagee; if mortgage house is to be demolished, the mortgager is in violation of article three of the agreement;(5)Collateral is enterprise, business end or dissolution, revocation or bankruptcy events;(6)A mortgage is in breach of other provisions of the rights and obligations about the parties;(7)the default event between the mortgager and the mortgagee or the bank of China co., LTD. other institutions in the contract;2.In the event of the default specified in the preceding paragraph, the mortgagee has the right to take the following one or more of the measures(1)The mortgager is asked to correct the default within a definite time;(2)Suspend or terminate all or part the acceptance of the mortgager business application in other contract; For the loans not issued and the trade financing not managed, all or part of suspend or terminate the issueand conduct;(3)Announce the mortgager’s outstanding principal loans in other contract / trade financing payments’principal and interest and other payables in whole or in part is due immediately;(4)Terminate or remove this contract, all and part of termination orremove other contract between the mortgager and the mortgagee; (5)The mortgager is asked to compensate for the loss of the mortgageecaused by default, including attorney's fees and other related expenses caused by realize creditor's rights etc. and relevant loss;(6)To perform the mortgage right;(7)Other measures which the mortgagee think necessary.Article Twelve AttachmentThe following attachments and other attachments confirmed by the both sides form integral parts of this contract, and these attachments have the same legal effect as this contract.1. The collateral list (Serial NO.: 2015 GE DAI ZI ___);…Dispute ResolutionAll disputes and dissension arising from the performance of this contract, both sides resolve through consultation first. If consultation fails, the two sides agreed to adopt the same as the contract dispute solution.During the period of dispute resolution, if the dispute does not affect theimplementation of other provisions of this contract, then the other provisions shall continue to perform.Article Fourteen OthersIn the process of performance of this contract, the mortgager provide sources of information on the mortgager which the mortgagee can't obtained from public, all of these information constitute the mortgager confidential information; Except the following situations, the mortgagee shall cannot disclose to any third party:(1) The mortgager written consent or authorization;(2) the mortgagee have the duty to disclosed according to relevant laws and regulations, or according to the requirement of judicial and administrative organs and other authority;(3) the mortgagee disclose to the intermediary institutions which to keep confidential or other third party as tax, auditing, law service requirements or as necessary for performance of this contract;The disclosure of the situation may will make third parties hereby acknowledge the mortgager’s relevant information, and provide service the mortgager according to law or take action may be involved in t the mortgager.Article 15 the Mortgage Contract Comes Into Force and Set Up This contract will take effect when providing all the following conditions: 1.The mortgage r’s signature (the mortgager is natural person) mortgage/ the legal representative of the mortgager / director or the authorized signatories sign and seal (the mortgager is not a natural person);2.Principal of the mortgagee or his authorized signatories sign and seal;3.Need for mortgage registration in accordance with the law, and then begin with the mortgage registration formalities are complete.Attachment the Collateral List Serial NO.: 2015 GE DAI ZI NO._____。

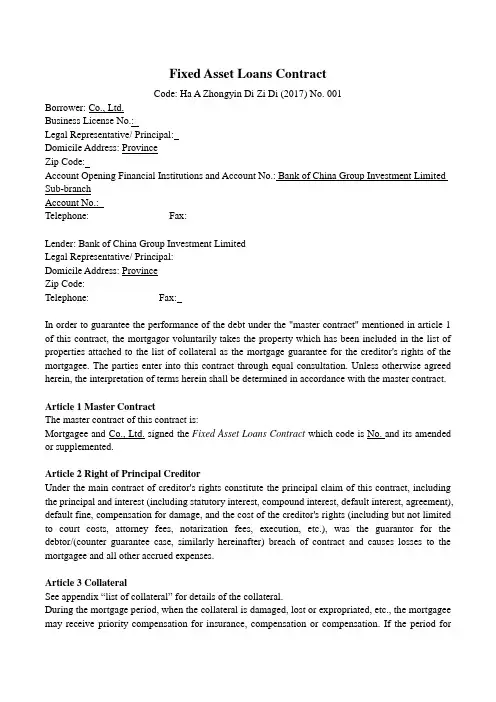

Fixed Asset Loans ContractCode: Ha A Zhongyin Di Zi Di (2017) No. 001Borrower: Co., Ltd.Business License No.:Legal Representative/ Principal:Domicile Address: ProvinceZip Code:Account Opening Financial Institutions and Account No.: Bank of China Group Investment Limited Sub-branchAccount No.:Telephone: Fax:Lender: Bank of China Group Investment LimitedLegal Representative/ Principal:Domicile Address: ProvinceZip Code:Telephone: Fax:In order to guarantee the performance of the debt under the "master contract" mentioned in article 1 of this contract, the mortgagor voluntarily takes the property which has been included in the list of properties attached to the list of collateral as the mortgage guarantee for the creditor's rights of the mortgagee. The parties enter into this contract through equal consultation. Unless otherwise agreed herein, the interpretation of terms herein shall be determined in accordance with the master contract.Article 1 Master ContractThe master contract of this contract is:Mortgagee and Co., Ltd. signed the Fixed Asset Loans Contract which code is No. and its amended or supplemented.Article 2 Right of Principal CreditorUnder the main contract of creditor's rights constitute the principal claim of this contract, including the principal and interest (including statutory interest, compound interest, default interest, agreement), default fine, compensation for damage, and the cost of the creditor's rights (including but not limited to court costs, attorney fees, notarization fees, execution, etc.), was the guarantor for the debtor/(counter guarantee case, similarly hereinafter) breach of contract and causes losses to the mortgagee and all other accrued expenses.Article 3 CollateralSee appendix “list of collateral” for details of the collateral.During the mortgage period, when the collateral is damaged, lost or expropriated, etc., the mortgagee may receive priority compensation for insurance, compensation or compensation. If the period forthe performance of the secured creditor's rights is not expired, such insurance money, compensation or compensation may also be deposited.If the collateral is a house, the mortgagor shall timely notify the mortgagee when he knows the information of the house to be demolished. Houses to be demolished during the period of mortgage, such as mortgages for houses demolished using compensation in the form of property right exchange, the mortgagor shall, in accordance with requirements of the mortgagee and the debtor, the mortgagee shall negotiate the debts, or in accordance with the requirements for the mortgagee to property rights exchange houses or other mortgages resetting mortgage and sign a new mortgage agreement, after the original mortgage property loss and the new mortgage registration has not been dealt with before, the mortgagor shall, in accordance with requirements of the mortgagee and have secured party provide guarantee conditions. If the house is compensated in the form of compensation, the mortgagee shall have the right to receive priority compensation for such compensation, or require the mortgagor to continue to use the compensation as security property by opening a special deposit account or deposit certificate, and sign the corresponding deposit pledge agreement or deposit certificate.Article 4 Mortgage RegistrationMortgage registration is required according to law. Within 15 days after signing this contract, the mortgagor and the mortgagee shall go to the relevant registration department to handle the mortgage registration procedures.Mortgage register item occurrence change, need to carry on change to register according to the law, guarantor and hypothec person should be in the day that register item change 10 days go up to deal with change to register a branch to register.Article 5 Possession and Custody of CollateralThe collateral hereunder shall be owned and kept by the mortgagor, but the ownership certificate of the collateral shall be kept by the mortgagee. The mortgagor agrees to accept and effectively cooperate with the inspection of the collateral by the mortgagee and its designated institutions and individuals at any time.The mortgagor shall properly keep, maintain and maintain the collateral and take effective measures to guarantee the safety and integrity of the collateral. If the collateral needs to be repaired, the mortgagor shall timely carry out and bear the corresponding expenses.Without the written consent of the mortgagee, the mortgagor shall not transfer, lease or lend the collateral in whole or in part, make capital contribution in the form of physical objects, transform, rebuild or dispose of the collateral in any other manner; If the mortgagee agrees in writing, the proceeds from the disposal of the collateral shall be used to pay off the creditor's rights in advance or to put in deposit with a third party designated by the mortgagee.Article 6 Disposal of Reduced Value of CollateralWhere the mortgagor's act is sufficient to reduce the value of the collateral before the principal claims under this contract have been fully paid off, the mortgagee shall have the right to demand that the mortgagor cease the behavior. Where the value of the mortgaged property is reduced, themortgagee has the right to require the mortgagor to restore the value of the collateral, or to provide other guarantees equivalent to the reduced value and recognized as the mortgagee.If the mortgagor does not restore the value of the mortgaged property and does not provide a guarantee, the mortgagee has the right to require the debtor to pay off the debt in advance. If the debtor fails to perform the debt as required, the mortgagee has the right to exercise the mortgage.If the loss or decrease in value of the collateral is caused by natural disaster, accident, infringement or other reasons, the mortgagor shall immediately take measures to prevent further expansion of the loss and immediately notify the mortgagor in writing.Article 7 FruitsThe debtor fails to perform due debts, or other circumstances of the implementation of this contract agreement hypothec, causing the mortgaged property is held in the people's court in accordance with the law, from the date of seizure, the mortgagee has the right to collect the natural fruits of the mortgaged property or legal fruits, but the mortgagee fails to notify the person who has the obligation to pay legal fruits.The fruits specified in the preceding paragraph shall first be used to cover the expenses for collecting fruits.Article 8 Insurance of Collateral (This is an optional article. Choose 1 of the following item: 1. Applicable 2. Not applicable)The amount insured shall not be less than the assessed value of the collateral. The contents of the policy shall conform to the requirements of the mortgagee and shall not be subject to restrictive conditions which are harmful to the rights and interests of the mortgagee.The mortgagor shall not interrupt, terminate, amend or alter the policy for any reason, and shall take all reasonable and necessary measures to ensure that the insurance provided for in this article remains valid, until the principal claims under this contract have been fully paid off. If the mortgagor fails to take out insurance or violates the aforementioned agreement, the mortgagee shall have the right to decide to take out insurance or continue to take out insurance for the collateral, and the insurance expenses shall be borne by the mortgagor, and may be included in the scope of the principal claim together with the losses that may thus be caused to the mortgagee.Within 15 days after the signing of this contract, the mortgagor shall submit the original insurance policy of the collateral to the mortgagee and transfer the right of claim for insurance benefits due to the occurrence of the insurance event to the mortgagee. The original insurance policy shall be held by the mortgagee until the contract is fully paid.Article 9 Occurrence of Guarantee LiabilityIf the debtor/guarantor fails to pay off the mortgagee as agreed upon on any normal or early repayment day, the mortgagee shall have the right to exercise the mortgage according to law and as agreed herein.The date of normal payment referred to in the preceding paragraph shall be the date of principal repayment, interest payment or the date on which the debtor/guarantor shall make any payment to the mortgagee pursuant to the provisions of such contract. The date of advance payment referred to inthe preceding paragraph shall be the date on which the debtor/guarantor agrees to advance payment and the date on which the mortgagee requests the debtor/guarantor to recover the principal and interest of the claim/or any other payment pursuant to the contract or other provisions.Article 10 Period Mortgage ExerciseThe mortgagee shall exercise the mortgage right within the limitation period of the main claim action after the occurrence of the reguarantee responsibility.If the principal claim is paid in installments, the mortgagee shall exercise the right of mortgage before the expiration of the limitation period of action based on the last term of the claim.Article 11 Realization of MortgageAfter guarantee liability occurs, the mortgagee has the right to enter into an agreement with the mortgagor to discount or auction the collateral, and the proceeds from the sale of the collateral are preferred to repay the principal creditor's rights. If no agreement is reached, the mortgagee shall have the right to request the people's court to sell the collateral according to law.The proceeds from the disposal of the collateral shall be used to pay off the principal claims after the priority is given to the disposal expenses of the collateral and the expenses payable to the mortgagee hereunder by the mortgagor.Lord debt outside this contract at the same time there are other things, guarantee or warranty does not affect the right of mortgage of any right under this humanistic and its exercise, the mortgagee has the right to decide the guarantee right to exercise the order, the mortgagor shall guarantee liability in accordance with this contract, shall not exist other defenses creditors guarantee and the exercise of the order.Article 12 Relationship between This Contract and Master ContractWhere both parties of the master contract terminate the master contract or cause the master contract to expire in advance, the mortgagor shall be liable for the security of the claims incurred under the master contract.The parties to the master contract agree to change the contents of the master contract, except for cases where currency, interest rate, amount, term or other changes lead to the increase of the amount of principal claims or extend the term of performance of the master contract, without obtaining the consent of the mortgagor, the mortgagor shall throw the collateral under this contract to bear the guarantee responsibility for the changed master contract.If it is necessary to obtain the consent of the mortgagor, without the written consent of the mortgagor or the refusal of the mortgagor, the mortgagor shall not be liable for the increase of the amount of the principal creditor's rights, and the extension of the time limit for the performance of the principal contract, the period for exercising the right of mortgage shall remain the original period.After the mortgagee opens the letter of credit for the debtor/guarantor, the mortgagee shall conduct import bill of exchange financing or other forms of follow-up financing successively with the debtor/guarantor, without the consent of the mortgagor, the mortgagor shall assume the continuous and uninterrupted guarantee responsibility for these financing.The mortgagor and the mortgagee shall sign the import bill of exchange agreement or other follow-up financing agreement ------ withindays to handle the mortgage registration.If any other mortgagee exists on the mortgaged property hereunder, the above changes shall not adversely affect the mortgagee without the written consent of other mortgagees.Article 13 Statements and CommitmentsThe statement and commitments of mortgagor are as follows:1.The mortgagor, who is legally registered and existing, has the full capacity for civil rights andconduct required for the execution and performance of this contract, and has the legal ownership or disposition of the collateral;2.The mortgagor warrants that there is no other co-owner over the mortgaged property, or themortgagor has written permission from all co-owners notwithstanding the co-owner. The mortgagor undertakes to give the written permission to the mortgagee for preservation before signing this contract.3.The mortgagor fully understands the content of the master contract. Signing and performing thiscontract is based on the real intention expressed by the mortgagor, and has obtained legal and effective authorization according to the enterprise articles of association or other internal management documents.The mortgagor is a third party and the company, and the mortgagor provides such guarantee, which has been adopted by the board of directors or the board of shareholders in accordance with the provisions of the articles of association and the resolution of the general meeting of shareholders; Where the total amount of the guarantee and the amount of the single guarantee are limited in the articles of association, the guarantee under this contract shall not exceed the prescribed limit. Signing and performing this contract shall not violate any contract, agreement or other legal documents binding on the mortgagor; The mortgagor has or will obtain all relevant approvals, permits, records or registrations required for the establishment of this mortgage.4.All documents and information provided by the mortgagor to the mortgagee are accurate, true,complete and valid.5.The mortgagor has not concealed from the mortgagee any guarantee property right in thecollateral as of the date of signing this contract.6.If a new guarantee property right is established on the mortgaged property and the mortgagedproperty is sealed up or involved in a major lawsuit or arbitration case, the mortgagor shall promptly notify the mortgagee.7.If the collateral is under construction, the mortgagor promises that there is no right of priority tobe paid by a third party on the collateral; Where there is a third party's prior claim, the mortgagor promises to make the third party issue a written waiver of the prior claim and submit it to the mortgagee for custody.Article 14 Culpa in ContrahendoAfter the conclusion of this contract, if the mortgagor refuses or delays in registering the mortgage or because of other reasons of the mortgagor, the contract cannot take effect and the mortgage right cannot be set up in a small way, it shall constitute the culpa in contrahendo. The mortgagor shall be liable for the losses suffered by the mortgagee.Article 15 Default Event and SolutionsOne of the following shall constitute or be deemed to be the default of the mortgagor under this contract:1.The mortgagor, in violation of the provisions of this contract, arbitrarily transfers, leases, lends,invests in the form of material object, rebuilds, rebuilds or disposes of the collateral in whole or in part in any other manner.2.The mortgagor shall obstruct the mortgagee's lawful disposition of the collateral in accordancewith the relevant provisions of this contract.3.In case of the decrease of the value of the collateral mentioned in article 6 of this contract, themortgagor shall not provide corresponding guarantee as required by the mortgagee.4.The statement made by the mortgagor in this contract is untrue or in breach of the promise madeby the mortgagor in this contract.5.The mortgagor violates other provisions of this contract concerning the rights and obligations ofthe parties.6.The mortgagor terminates business or disbands, revocation or bankruptcy occurs.7.The mortgagor is in default under other contracts with the mortgagee or other institutions ofBank of China Group Investment Limited.In case of the event of default specified in the preceding paragraph, the mortgagee shall have the right to take one or more of the following measures depending on the specific circumstances:1.The mortgagor is required to correct the breach within a time limit.2.To reduce, suspend or terminate the credit line to the mortgagor in whole or in part.3.To suspend or terminate the business application of the mortgagor under other contracts in partor in whole; The issuance and processing of undeveloped loans and unprocessed trade financing shall be suspended or terminated in whole or in part.4.Declare the principal and interest of the mortgage/trade finance and other payables to be fully orpartially due immediately under other contracts.5.This contract shall be terminated or dissolved, and other contracts between the mortgagor andthe mortgagee shall be terminated in whole or in part.6.The mortgagor is required to compensate for the loss caused to the mortgagee due to the default.7.Exercise of mortgage.8.Other measures deemed necessary by the mortgagee.Article 16Reservation of RightThe failure of either party to exercise part or all of its rights hereunder or to require the other party to perform, assume part or all of its obligations and responsibilities shall not constitute a waiver of such rights or a waiver of such obligations and liabilities.Any tolerance of one party to the other party, extension or postponement of the exercise of the rights under this contract shall not affect any rights that it has under the laws and regulations of this contract, nor shall it be deemed as a waiver of such rights.Article 17 Change, Modify and TerminationThis contract may be modified or modified in writing upon mutual agreement of both parties. Any modification or modification shall constitute an integral part of this contract.Except as otherwise provided by laws, regulations or agreed by the parties at the time, this contract shall not be terminated until all the rights and obligations hereunder have been performed.Except as otherwise provided by laws, regulations or agreed by the parties at the time, the invalidity of any provision of this contract shall not affect the legal effect of any other provision.Article 18 Law Applies and Disputes SettlementThe contract shall be governed by the laws of the People's Republic of China.All disputes and disputes arising from the performance of this contract may be settled by both parties through negotiation. If no agreement can be reached through negotiation, both parties agree to adopt the same dispute settlement method as agreed in the master contractDuring the dispute resolution period, if the dispute does not affect the performance of other provisions of this contract, the other provisions shall be performed.Article 19 AttachmentThe following annexes and other annexes confirmed by both parties shall form an integral part of this contract and have the same legal effect as this contract.1.List of CollateralArticle 20 Other Agreements1.Without the written consent of the Lender, the Borrower shall not assign any rights andobligations hereunder to any third party.2.If the lender entrusts other institutions of Bank of China Group Investment Limited to performthe rights and obligations hereunder due to business needs, or the loan business hereunder is transferred to other institutions of Bank of China Group Investment Limited for acceptance and management, and the Borrower acknowledges this.The lender authorizes other institutions of Bank of China Group Investment Limited, or other institutions of Bank of China Group Investment Limited who undertakes the borrowing business under this contract, to exercise all rights under this contract, to file a lawsuit in the name of the institution in the dispute under this contract, and to submit the dispute to the arbitration institution for adjudication or application for enforcement.3.Without prejudice to other provisions of this contract, this contract is legally binding on bothparties and their respective successors and assigns.4.Unless otherwise agreed, both parties shall designate the place of domicile set forth herein as thecommunication and contact address and undertake to notify the other party in writing in case of any change of the communication and contact address.5.The title and business name in this contract shall only be used for convenience and shall not beused to interpret the terms and rights and obligations of the parties.Article 21 Contract Validation and Establishment of Mortgage RightThis contract shall come into force upon being signed and affixed official seal by the legal representative, person in charge or authorized signatory of both parties. However, if mortgage registration is required according to law, it shall take effect from the date of completion of mortgage registration procedures.The mortgage is established when the contract comes into force.This contract is made in triplicate, with both parties debtor/guarantor holding one copy, which has the same legal effect.Authorized signatory: (signature) Authorized signatory: (signature)(seal)Attachment:List of Collateral。

Fixed Asset Loans ContractCode:Ha A Zhongyin Di Zi Di(2017)No.001Borrower:Co., Ltd.Business License No.:Legal Representative/Principal:Domicile Address:ProvinceZip Code:Account Opening Financial Institutions and Account No.:Bank of China Group Investment Limited Sub-branchAccount No.:Telephone:Fax:Lender:Bank of China Group Investment LimitedLegal Representative/Principal:Domicile Address:ProvinceZip Code:Telephone:Fax:In order to guarantee the performance of the debt under the"master contract"mentioned in article1 of this contract,the mortgagor voluntarily takes the property which has been included in the list of properties attached to the list of collateral as the mortgage guarantee for the creditor's rights of the mortgagee.The parties enter into this contract through equal consultation.Unless otherwise agreed herein,the interpretation of terms herein shall be determined in accordance with the master contract.Article1Master ContractThe master contract of this contract is:Mortgagee and Co., Ltd.signed the Fixed Asset Loans Contract which code is No.and its amended or supplemented.Article2Right of Principal CreditorUnder the main contract of creditor's rights constitute the principal claim of this contract,including the principal and interest(including statutory interest,compound interest,default interest,agreement), default fine,compensation for damage,and the cost of the creditor's rights(including but not limited to court costs,attorney fees,notarization fees,execution,etc.),was the guarantor for the debtor/(counter guarantee case,similarly hereinafter)breach of contract and causes losses to the mortgagee and all other accrued expenses.Article3CollateralSee appendix“list of collateral”for details of the collateral.During the mortgage period,when the collateral is damaged,lost or expropriated,etc.,the mortgagee may receive priority compensation for insurance,compensation or compensation.If the period forthe performance of the secured creditor's rights is not expired,such insurance money,compensation or compensation may also be deposited.If the collateral is a house,the mortgagor shall timely notify the mortgagee when he knows the information of the house to be demolished.Houses to be demolished during the period of mortgage, such as mortgages for houses demolished using compensation in the form of property right exchange, the mortgagor shall,in accordance with requirements of the mortgagee and the debtor,the mortgagee shall negotiate the debts,or in accordance with the requirements for the mortgagee to property rights exchange houses or other mortgages resetting mortgage and sign a new mortgage agreement,after the original mortgage property loss and the new mortgage registration has not been dealt with before, the mortgagor shall,in accordance with requirements of the mortgagee and have secured party provide guarantee conditions.If the house is compensated in the form of compensation,the mortgagee shall have the right to receive priority compensation for such compensation,or require the mortgagor to continue to use the compensation as security property by opening a special deposit account or deposit certificate,and sign the corresponding deposit pledge agreement or deposit certificate.Article4Mortgage RegistrationMortgage registration is required according to law.Within15days after signing this contract,the mortgagor and the mortgagee shall go to the relevant registration department to handle the mortgage registration procedures.Mortgage register item occurrence change,need to carry on change to register according to the law, guarantor and hypothec person should be in the day that register item change10days go up to deal with change to register a branch to register.Article5Possession and Custody of CollateralThe collateral hereunder shall be owned and kept by the mortgagor,but the ownership certificate of the collateral shall be kept by the mortgagee.The mortgagor agrees to accept and effectively cooperate with the inspection of the collateral by the mortgagee and its designated institutions and individuals at any time.The mortgagor shall properly keep,maintain and maintain the collateral and take effective measures to guarantee the safety and integrity of the collateral.If the collateral needs to be repaired,the mortgagor shall timely carry out and bear the corresponding expenses.Without the written consent of the mortgagee,the mortgagor shall not transfer,lease or lend the collateral in whole or in part,make capital contribution in the form of physical objects,transform, rebuild or dispose of the collateral in any other manner;If the mortgagee agrees in writing,the proceeds from the disposal of the collateral shall be used to pay off the creditor's rights in advance or to put in deposit with a third party designated by the mortgagee.Article6Disposal of Reduced Value of CollateralWhere the mortgagor's act is sufficient to reduce the value of the collateral before the principal claims under this contract have been fully paid off,the mortgagee shall have the right to demand that the mortgagor cease the behavior.Where the value of the mortgaged property is reduced,themortgagee has the right to require the mortgagor to restore the value of the collateral,or to provide other guarantees equivalent to the reduced value and recognized as the mortgagee.If the mortgagor does not restore the value of the mortgaged property and does not provide a guarantee,the mortgagee has the right to require the debtor to pay off the debt in advance.If the debtor fails to perform the debt as required,the mortgagee has the right to exercise the mortgage.If the loss or decrease in value of the collateral is caused by natural disaster,accident,infringement or other reasons,the mortgagor shall immediately take measures to prevent further expansion of the loss and immediately notify the mortgagor in writing.Article7FruitsThe debtor fails to perform due debts,or other circumstances of the implementation of this contract agreement hypothec,causing the mortgaged property is held in the people's court in accordance with the law,from the date of seizure,the mortgagee has the right to collect the natural fruits of the mortgaged property or legal fruits,but the mortgagee fails to notify the person who has the obligation to pay legal fruits.The fruits specified in the preceding paragraph shall first be used to cover the expenses for collecting fruits.Article8Insurance of Collateral(This is an optional article.Choose1of the following item:1. Applicable2.Not applicable)The amount insured shall not be less than the assessed value of the collateral.The contents of the policy shall conform to the requirements of the mortgagee and shall not be subject to restrictive conditions which are harmful to the rights and interests of the mortgagee.The mortgagor shall not interrupt,terminate,amend or alter the policy for any reason,and shall take all reasonable and necessary measures to ensure that the insurance provided for in this article remains valid,until the principal claims under this contract have been fully paid off.If the mortgagor fails to take out insurance or violates the aforementioned agreement,the mortgagee shall have the right to decide to take out insurance or continue to take out insurance for the collateral,and the insurance expenses shall be borne by the mortgagor,and may be included in the scope of the principal claim together with the losses that may thus be caused to the mortgagee.Within15days after the signing of this contract,the mortgagor shall submit the original insurance policy of the collateral to the mortgagee and transfer the right of claim for insurance benefits due to the occurrence of the insurance event to the mortgagee.The original insurance policy shall be held by the mortgagee until the contract is fully paid.Article9Occurrence of Guarantee LiabilityIf the debtor/guarantor fails to pay off the mortgagee as agreed upon on any normal or early repayment day,the mortgagee shall have the right to exercise the mortgage according to law and as agreed herein.The date of normal payment referred to in the preceding paragraph shall be the date of principal repayment,interest payment or the date on which the debtor/guarantor shall make any payment to the mortgagee pursuant to the provisions of such contract.The date of advance payment referred to inthe preceding paragraph shall be the date on which the debtor/guarantor agrees to advance payment and the date on which the mortgagee requests the debtor/guarantor to recover the principal and interest of the claim/or any other payment pursuant to the contract or other provisions.Article10Period Mortgage ExerciseThe mortgagee shall exercise the mortgage right within the limitation period of the main claim action after the occurrence of the reguarantee responsibility.If the principal claim is paid in installments,the mortgagee shall exercise the right of mortgage before the expiration of the limitation period of action based on the last term of the claim.Article11Realization of MortgageAfter guarantee liability occurs,the mortgagee has the right to enter into an agreement with the mortgagor to discount or auction the collateral,and the proceeds from the sale of the collateral are preferred to repay the principal creditor's rights.If no agreement is reached,the mortgagee shall have the right to request the people's court to sell the collateral according to law.The proceeds from the disposal of the collateral shall be used to pay off the principal claims after the priority is given to the disposal expenses of the collateral and the expenses payable to the mortgagee hereunder by the mortgagor.Lord debt outside this contract at the same time there are other things,guarantee or warranty does not affect the right of mortgage of any right under this humanistic and its exercise,the mortgagee has the right to decide the guarantee right to exercise the order,the mortgagor shall guarantee liability in accordance with this contract,shall not exist other defenses creditors guarantee and the exercise of the order.Article12Relationship between This Contract and Master ContractWhere both parties of the master contract terminate the master contract or cause the master contract to expire in advance,the mortgagor shall be liable for the security of the claims incurred under the master contract.The parties to the master contract agree to change the contents of the master contract,except for cases where currency,interest rate,amount,term or other changes lead to the increase of the amount of principal claims or extend the term of performance of the master contract,without obtaining the consent of the mortgagor,the mortgagor shall throw the collateral under this contract to bear the guarantee responsibility for the changed master contract.If it is necessary to obtain the consent of the mortgagor,without the written consent of the mortgagor or the refusal of the mortgagor,the mortgagor shall not be liable for the increase of the amount of the principal creditor's rights,and the extension of the time limit for the performance of the principal contract,the period for exercising the right of mortgage shall remain the original period.After the mortgagee opens the letter of credit for the debtor/guarantor,the mortgagee shall conduct import bill of exchange financing or other forms of follow-up financing successively with the debtor/guarantor,without the consent of the mortgagor,the mortgagor shall assume the continuous and uninterrupted guarantee responsibility for these financing.The mortgagor and the mortgagee shall sign the import bill of exchange agreement or other follow-up financing agreement------withindays to handle the mortgage registration.If any other mortgagee exists on the mortgaged property hereunder,the above changes shall not adversely affect the mortgagee without the written consent of other mortgagees.Article13Statements and CommitmentsThe statement and commitments of mortgagor are as follows:1.The mortgagor,who is legally registered and existing,has the full capacity for civil rights andconduct required for the execution and performance of this contract,and has the legal ownership or disposition of the collateral;2.The mortgagor warrants that there is no other co-owner over the mortgaged property,or themortgagor has written permission from all co-owners notwithstanding the co-owner.The mortgagor undertakes to give the written permission to the mortgagee for preservation before signing this contract.3.The mortgagor fully understands the content of the master contract.Signing and performing thiscontract is based on the real intention expressed by the mortgagor,and has obtained legal and effective authorization according to the enterprise articles of association or other internal management documents.The mortgagor is a third party and the company,and the mortgagor provides such guarantee,which has been adopted by the board of directors or the board of shareholders in accordance with the provisions of the articles of association and the resolution of the general meeting of shareholders; Where the total amount of the guarantee and the amount of the single guarantee are limited in the articles of association,the guarantee under this contract shall not exceed the prescribed limit. Signing and performing this contract shall not violate any contract,agreement or other legal documents binding on the mortgagor;The mortgagor has or will obtain all relevant approvals, permits,records or registrations required for the establishment of this mortgage.4.All documents and information provided by the mortgagor to the mortgagee are accurate,true,complete and valid.5.The mortgagor has not concealed from the mortgagee any guarantee property right in thecollateral as of the date of signing this contract.6.If a new guarantee property right is established on the mortgaged property and the mortgagedproperty is sealed up or involved in a major lawsuit or arbitration case,the mortgagor shall promptly notify the mortgagee.7.If the collateral is under construction,the mortgagor promises that there is no right of priority tobe paid by a third party on the collateral;Where there is a third party's prior claim,the mortgagor promises to make the third party issue a written waiver of the prior claim and submit it to the mortgagee for custody.Article14Culpa in ContrahendoAfter the conclusion of this contract,if the mortgagor refuses or delays in registering the mortgage or because of other reasons of the mortgagor,the contract cannot take effect and the mortgage right cannot be set up in a small way,it shall constitute the culpa in contrahendo.The mortgagor shall be liable for the losses suffered by the mortgagee.Article15Default Event and SolutionsOne of the following shall constitute or be deemed to be the default of the mortgagor under this contract:1.The mortgagor,in violation of the provisions of this contract,arbitrarily transfers,leases,lends,invests in the form of material object,rebuilds,rebuilds or disposes of the collateral in whole or in part in any other manner.2.The mortgagor shall obstruct the mortgagee's lawful disposition of the collateral in accordancewith the relevant provisions of this contract.3.In case of the decrease of the value of the collateral mentioned in article6of this contract,themortgagor shall not provide corresponding guarantee as required by the mortgagee.4.The statement made by the mortgagor in this contract is untrue or in breach of the promise madeby the mortgagor in this contract.5.The mortgagor violates other provisions of this contract concerning the rights and obligations ofthe parties.6.The mortgagor terminates business or disbands,revocation or bankruptcy occurs.7.The mortgagor is in default under other contracts with the mortgagee or other institutions ofBank of China Group Investment Limited.In case of the event of default specified in the preceding paragraph,the mortgagee shall have the right to take one or more of the following measures depending on the specific circumstances:1.The mortgagor is required to correct the breach within a time limit.2.To reduce,suspend or terminate the credit line to the mortgagor in whole or in part.3.To suspend or terminate the business application of the mortgagor under other contracts in partor in whole;The issuance and processing of undeveloped loans and unprocessed trade financing shall be suspended or terminated in whole or in part.4.Declare the principal and interest of the mortgage/trade finance and other payables to be fully orpartially due immediately under other contracts.5.This contract shall be terminated or dissolved,and other contracts between the mortgagor andthe mortgagee shall be terminated in whole or in part.6.The mortgagor is required to compensate for the loss caused to the mortgagee due to the default.7.Exercise of mortgage.8.Other measures deemed necessary by the mortgagee.Article16Reservation of RightThe failure of either party to exercise part or all of its rights hereunder or to require the other party to perform,assume part or all of its obligations and responsibilities shall not constitute a waiver of such rights or a waiver of such obligations and liabilities.Any tolerance of one party to the other party,extension or postponement of the exercise of the rights under this contract shall not affect any rights that it has under the laws and regulations of this contract,nor shall it be deemed as a waiver of such rights.Article17Change,Modify and TerminationThis contract may be modified or modified in writing upon mutual agreement of both parties.Any modification or modification shall constitute an integral part of this contract.Except as otherwise provided by laws,regulations or agreed by the parties at the time,this contract shall not be terminated until all the rights and obligations hereunder have been performed.Except as otherwise provided by laws,regulations or agreed by the parties at the time,the invalidity of any provision of this contract shall not affect the legal effect of any other provision.Article18Law Applies and Disputes SettlementThe contract shall be governed by the laws of the People's Republic of China.All disputes and disputes arising from the performance of this contract may be settled by both parties through negotiation.If no agreement can be reached through negotiation,both parties agree to adopt the same dispute settlement method as agreed in the master contractDuring the dispute resolution period,if the dispute does not affect the performance of other provisions of this contract,the other provisions shall be performed.Article19AttachmentThe following annexes and other annexes confirmed by both parties shall form an integral part of this contract and have the same legal effect as this contract.1.List of CollateralArticle20Other Agreements1.Without the written consent of the Lender,the Borrower shall not assign any rights andobligations hereunder to any third party.2.If the lender entrusts other institutions of Bank of China Group Investment Limited to performthe rights and obligations hereunder due to business needs,or the loan business hereunder is transferred to other institutions of Bank of China Group Investment Limited for acceptance and management,and the Borrower acknowledges this.The lender authorizes other institutions of Bank of China Group Investment Limited,or other institutions of Bank of China Group Investment Limited who undertakes the borrowing business under this contract,to exercise all rights under this contract,to file a lawsuit in the name of the institution in the dispute under this contract,and to submit the dispute to the arbitration institution for adjudication or application for enforcement.3.Without prejudice to other provisions of this contract,this contract is legally binding on bothparties and their respective successors and assigns.4.Unless otherwise agreed,both parties shall designate the place of domicile set forth herein as thecommunication and contact address and undertake to notify the other party in writing in case of any change of the communication and contact address.5.The title and business name in this contract shall only be used for convenience and shall not beused to interpret the terms and rights and obligations of the parties.Article21Contract Validation and Establishment of Mortgage RightThis contract shall come into force upon being signed and affixed official seal by the legal representative,person in charge or authorized signatory of both parties.However,if mortgage registration is required according to law,it shall take effect from the date of completion of mortgage registration procedures.The mortgage is established when the contract comes into force.This contract is made in triplicate,with both parties debtor/guarantor holding one copy,which has the same legal effect.Authorized signatory:(signature)Authorized signatory:(signature)(seal)Attachment:List of Collateral。

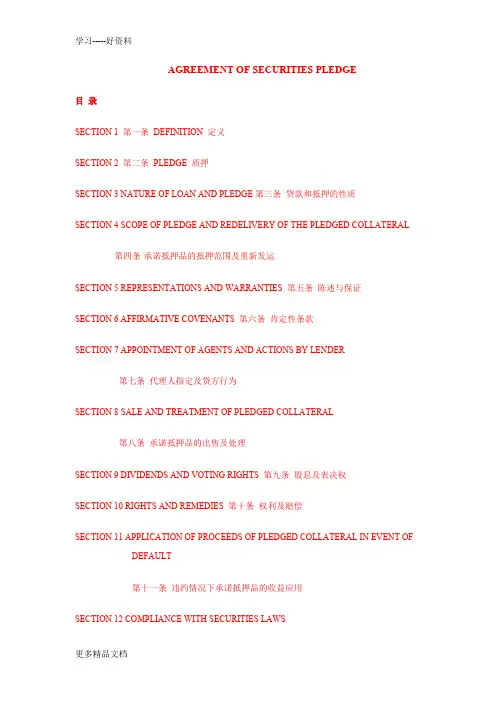

AGREEMENT OF SECURITIES PLEDGE目录SECTION 1第一条DEFINITION定义SECTION 2第二条PLEDGE质押SECTION 3 NATURE OF LOAN AND PLEDGE第三条贷款和抵押的性质SECTION 4 SCOPE OF PLEDGE AND REDELIVERY OF THE PLEDGED COLLATERAL第四条承诺抵押品的抵押范围及重新发运SECTION 5 REPRESENTATIONS AND WARRANTIES 第五条陈述与保证SECTION 6 AFFIRMATIVE COVENANTS 第六条肯定性条款SECTION 7 APPOINTMENT OF AGENTS AND ACTIONS BY LENDER第七条代理人指定及贷方行为SECTION 8 SALE AND TREATMENT OF PLEDGED COLLATERAL第八条承诺抵押品的出售及处理SECTION 9 DIVIDENDS AND VOTING RIGHTS 第九条股息及表决权SECTION 10 RIGHTS AND REMEDIES第十条权利及赔偿SECTION 11 APPLICATION OF PROCEEDS OF PLEDGED COLLATERAL IN EVENT OF DEFAULT第十一条违约情况下承诺抵押品的收益应用SECTION 12 COMPLIANCE WITH SECURITIES LAWS第十二条有价证券法律的遵守SECTION 13 MONETARY RELIEF 第十三条货币补偿SECTION 14 MISCELLANEOUS 第十四条其他款项SECTION 1第一条DEFINITION定义1.1 Use of Defined Terms. Unless otherwise expressly specified herein, defined terms denoting the singular number shall, when in the plural form, denote the plural number of the matter or item to which such defined terms refer, and vice-versa. The Section, Schedule and Exhibit headings used in this Pledge Agreement are descriptive only and shall not affect the construction or meaning of any provision of this Agreement. Unless otherwise specified, the words “hereof,” “herein,” “hereunder” and other similar words refer to this Pledge Agreement as a whole and not just to the Section, subsection or clause in which they are used; and the words “this Agreement” refer to this Pledge Agreement. Unless otherwise specified, references to Sections, Recitals, Schedules and Exhibits are references to Sections of, and Recitals, Schedules and Exhibits to this Agreement.定义术语的使用。

英文抵押合同英文抵押合同篇一:质押合同英语中英文对照AGREEMENT OF SECURITIES PLEDGE目录SECTION 1 第一条 DEFINITION 定义SECTION 2 第二条 PLEDGE 质押SECTION 3 NATURE OF LOAN AND PLEDGE第三条贷款和抵押的性质SECTION 4 SCOPE OF PLEDGE AND REDELIVERY OF THE PLEDGED COLLATERAL第四条承诺抵押品的抵押范围及重新发运SECTION 5 REPRESENTATIONS AND WARRANTIES 第五条陈述与保证SECTION 6 AFFIRMATIVE COVENANTS 第六条肯定性条款SECTION 7 APPOINTMENT OF AGENTS AND ACTIONS BY LENDER第七条代理人指定及贷方行为SECTION 8 SALE AND TREATMENT OF PLEDGED COLLATERAL第八条承诺抵押品的出售及处理SECTION 9 DIVIDENDS AND VOTING RIGHTS 第九条股息及表决权SECTION 10 RIGHTS AND REMEDIES 第十条权利及赔偿SECTION 11 APPLICATION OF PROCEEDS OF PLEDGED COLLATERAL IN EVENT OFDEFAULT第十一条违约情况下承诺抵押品的收益应用SECTION 12 COMPLIANCE WITH SECURITIES LAWS第十二条有价证券法律的遵守SECTION 13 MONETARY RELIEF 第十三条货币补偿SECTION 14 MISCELLANEOUS 第十四条其他款项SECTION 1 第一条 DEFINITION 定义1.1 Use of Defined Terms. Unless otherwise expressly specified herein, defined terms denoting the singular number shall, when in the plural form, denote the plural number of the matter or item to which such defined terms refer, and vice-versa. The Section, Schedule and Exhibit headings used in this Pledge Agreement are descriptive only and shall not affect the construction or meaning of any provision of this Agreement. Unless otherwise specified, the words “hereof,” “herein,” “hereunder” and other similar words refer to this Pledge Agreement as a whole and not just to the Section, subsection or clause in which they are used; and the words “this Agreement” refer to this Pledge Agreement. Unless otherwise specified, references to Sections, Recitals,Schedules and Exhibits are references to Sections of, and Recitals, Schedules and Exhibits to this Agreement.定义术语的使用。

Bank of China Beijing Sub-BranchPersonal Loan ContractContract No. No.Borrower XXXX (hereafter referred to as Party A) applies a loan from Creditor Bank of China Beijing XXX Sub-Branch (hereafter referred to as Party B). Both parties agree to sign this contract for both parties to abide by via consultationsArticle 1 The Amount, Term and Interest rate of the loan1.The term of the loan: XX months, from the starting date of the issuing loan.2.The amount of the loan: RMB XXXX3.The interest rate of the loan: the interest rate should be executed in accordancewith the interest rate notified by Bank of China when the loan issued. The loan in the contract has been transfer into the deposit account XXXXXX in the creditor’s placeArticle 2 Pledge Guarantee and Pledge Occupancy1.The pledge guarantee in this contract is the personal time deposit receipt. Thescope of the pledge guarantee: The principal of the loan, the interest, and the possible penalty when Party A breaks the contract.2.Party A agrees to use the time deposit receipt as the pledge in this contract andcommit that in the pledge term, there would be no loss report or withdrawal in advance.3.Party B can implement pledge right, and should provide Party A with ownershipcertificate. When all the principal and interest were paid back, Party A can redeem the deposit receipt with the ownership certificate.Article 3 Issue and Pay back the loan1.As soon as the loan is approved, Party B should transfer the loan into the timedeposit account of Party A in creditor’s place within one working day, and call to inform Party A. Party A can withdraw in any savings bank.2.Party A should pay back the principal and interest to Party B on time in terms ofthe “Approval form of personal loan application”. The loan s hould be pay off at term at one time.3.Approved by Party B, Party A can pay off the loan in advance, and the interest ofthe loan should be calculated in terms of the actual term of the loan.Article 4 Modify and Terminate the contract1.Any Party who want to modify the articles in the contract should serve writtennotice to the other Party on time. And written agreement should be made via consultation. This contract is still valid before any new agreement is made.2.Any Party who want to terminate the contract should serve written notice to theother Party on time. All matters concerned after the termination of the contract should be listed in a written agreement. At that time, Party A should pay back the principal and interest to Party B in terms of this contract, and Party B should return the pledge to Party A.Article 5 Obligation of breaking the contract and Solution of disputes1.If Party A can not pay back the principal and interest on time, Party B would addanother 50% interest charge in terms of the regulation listed on this loan contract by Bank of China. After 30 days overdue, Party A still can not pay off the principal and interest in this contract, Party A authorize Party B the right to handle the pledge to repay the principal and the interest of the loan. All interest loss should be taken by Party A. After the repayment of the principal and interest, the left should be returned to Party A.2.Any Party break the contract should pay 5‰ penalty to the other Party in terms ofthe contract. The contract should be kept on implementing if the other party requests.3.Within the term of the contract, any dispute should be handled by consultation, ifno agreement can be achieved, the parties can bring a suit in the people’s courts of Party B.Article 6 Effect of the Contract1.The contract can be made from the date of signing by both sides, and go intoeffect when Party A hands in the pledge deposit receipt to Party B. The contract terminates when all the principal and interest are paid off, the pledge right terminate and Party B should return the pledge to Party A.2.The “Approval form of personal loan application” and other materials are all partsof this contract.3.This contract is in duplicate, one copy for Party A and one copy for Party B. Party A: XXXXXX Party B: Bank of China Beijing XXXXX Sub-Branch(seal)2007-XX-XX 2007-XX-XX。

Pledge and Security Agreement抵押担保协议-In consideration of the Company’s acceptance of the Note as full or partialpayment of the exercise price of the Shares, and for other good and valuableconsideration, the receipt of which is hereby acknowledged, the parties heretoagree as follows:1. The Note shall become payable in full upon the voluntary orinvoluntary termination or cessation of employment of Borrower with the Company,for any reason, with or without cause (including death or disability).2. Borrower shall deliver to the Secretary of the Company, or his or herdesignee (hereinafter referred to as the Pledge Holder ), all certificatesrepresenting the Shares, together with an Assignment Separate from Certificatein the form attached to this Agreement as Attachment A executed by Borrower andby Borrower’s spouse (if required for transfer), in blank, for use intransferring all or a portion of the Shares to the Company if, as and whenrequired pursuant to this Agreement. In addition, if Borrower is marrie d,Borrower’s spouse shall execute the signature page attached to this Agreement.3. As security for the payment of the Note and any renewal, extension ormodification of the Note, Borrower hereby grants to the Company a securityinterest in and pledges with and delivers to the Company Borrower’s Shares(sometimes referred to herein as the Collateral ).4. In the event that Borrower prepays all or a portion of the Note, inaccordance with the provisions thereof, Borrower intends, unless written noticeto the contrary is delivered to the Pledge Holder, that the Shares representedby the portion of the Note so repaid, including annual interest thereon, shallcontinue to be so held by the Pledge Holder, to serve as independent collateralfor the outstanding portion of the Note for the purpose of commencing theholding period set forth in Rule 144(d) promulgated under the Securities Act of 1933, as amended (the Securities Act ).5. In the event of any foreclosure of the security interest created bythis Agreement, the Company may sell the Shares at a private sale or mayrepurchase the Shares itself. The parties agree that, prior to the establishmentof a public market for the Shares of the Company, the securities laws affectingsale of the Shares make a public sale of the Shares commercially unreasonable.The parties further agree that the repurchasing of such Shares by the Company,or by any person towhom the Company may have assigned its rights under thisAgreement, is commercially reasonable if made at a price determined by the Boardof Directors in its discretion, fairly exercised, representing what would be theFair Market Value of the Shares reduced by any limitation on transferability,whether due to the size of the block of shares or the restrictions of applicablesecurities laws.6. In the event of default in payment when due of any indebtedness underthe Note, the Company may elect then, or at any time thereafter, to exercise allrights available to a secured party under the California Commercial Codeincluding the right to sell the Collateral at a private or public sale orrepurchase the Shares as provided above. The proceeds of any sale shall beapplied in the following order:(a) To the extent necessary, proceeds shall be used to pay allreasonable expenses of the Company in enforcing this Agreement and the Note,including, without limitation, reasonable attorney’s fees and legal expensesincurred by the Company.(b) To the extent necessary, proceeds shall be used to satisfy anyremaining indebtedness under Bor rower’s Note.(c) Any remaining proceeds shall be delivered to Borrower.7. Upon full payment by Borrower of all amounts due under the Note,Pledge Holder shall deliver to Borrower all Shares in Pledge Holder’s possessionbelonging to Borrower, and P ledge Holder shall thereupon be discharged of allfurther obligations under this Agreement; provided, however, that Pledge Holdershall nevertheless retain the Shares as escrow agent if at the time of fullpayment by Borrower said Shares are still subject to a Repurchase Option infavor of the Company.The parties have executed this Pledge and Security Agreement as of the datefirst set forth above.。