投资学第6版第2章教案

- 格式:ppt

- 大小:480.50 KB

- 文档页数:31

投资学习题第一篇投资学课后习题与答案乮博迪乯_第6版 由flyesun 从网络下载丆版权归原作者所有。

1. 假设你发现一只装有1 00亿美元的宝箱。

a. 这是实物资产还是金融资产?b. 社会财富会因此而增加吗?c. 你会更富有吗?d. 你能解释你回答b 、c 时的矛盾吗?有没有人因为这个发现而受损呢?2. Lanni Products 是一家新兴的计算机软件开发公司,它现有计算机设备价值30 000美元,以及由L a n n i 的所有者提供的20 000美元现金。

在下面的交易中,指明交易涉及的实物资产或(和)金融资产。

在交易过程中有金融资产的产生或损失吗?a. Lanni 公司向银行贷款。

它共获得50 000美元的现金,并且签发了一张票据保证3年内还款。

b. Lanni 公司使用这笔现金和它自有的20 000美元为其一新的财务计划软件开发提供融资。

c. L a n n i 公司将此软件产品卖给微软公司( M i c r o s o f t ),微软以它的品牌供应给公众,L a n n i 公司获得微软的股票1 500股作为报酬。

d. Lanni 公司以每股80美元的价格卖出微软的股票,并用所获部分资金偿还贷款。

3. 重新考虑第2题中的Lanni Products 公司。

a. 在它刚获得贷款时处理其资产负债表,它的实物资产占总资产的比率为多少?b. 在L a n n i 用70 000美元开发新产品后,处理资产负债表,实物资产占总资产比例又是多少?c. 在收到微软股票后的资产负债表中,实物资产占总资产的比例是多少?4. 检察金融机构的资产负债表,有形资产占总资产的比率为多少?对非金融公司这一比率又如何?为什么会有这样的差异?5. 20世纪6 0年代,美国政府对海外投资者所获得的在美国出售的债券的利息征收 3 0%预扣税(这项税收现已被取消),这项措施和与此同时欧洲债券市场(美国公司在海外发行以美元计值的债券的市场)的成长有何关系?6. 见图1 -7,它显示了美国黄金证券的发行。

第一章一、单项选择题1.下列选项中,()不是投资的特点。

A.投资通常是刚性兑付B.投资的复杂性和系统性C.投资周期相对较长D.投资项目实施的连续性和资金投入的波动性E.投资金融答案:A。

应为"投资具有风险性”。

2.下列选项中,()不是投资对经济增长的影响或作用的表现。

A.从资源配置角度看,投资影响经济结构,从而促进经济增长B.国民收入水平下降的年份,年度投资规模也相应减少,以保证人民生活水平改善的步伐C.从要素投入角度看,投资供给对经济增长有推动作用,增加生产资料供给,为扩大再生产提供物质条件D.从要素投入角度看,投资需求对经济增长有拉动作用,增加一笔投资会带来大于这笔投资额数倍的国民收入增加答案:B。

B为投资的特点之三。

年度投资规模的增长具有波动性。

年度投资规模与国民经济形势和国民收入多少密切相关。

二、多项选择题1.投资的要素包括()。

A.投资主体B.投资客体C.投资目的D.投资方式E.投资金额答案:ABCD。

2.投资学的研究方法包括()。

A.理论与实践相结合B.实证分析与规范分析相结合C.历史分析与比较分析相结合D.系统分析与定量分析相结合E.静态分析与动态分析相结合答案:ABCDE。

三、判断题1.从1992年开始,尽管我国经济体制改革不断深入,但社会各界对投资概念、投资范围的认识并未变化,投资只包括直接投资,即将资金直接投入建设项目形成固定资产和流动资产。

()答案:错。

解释:投资概念、投资范围的认识也不断深化,投资包括直接投资也包括间接投资,即购买有价证券,形成金融资产。

2.无论哪一种方式的金融投资,都是货币资金转化为金融资产,没有直接实现实物资产的增加。

现实生活中实物投资与金融投资具有相互依存和相互促进的关系,金融投资以实物投资为基础,除了某些特殊的金融投资外,并不转化为实物投资。

()答案:对。

3.尽管社会主义市场经济不断发展与完善,但我国原有的以国家投资为主的投融资格局仍未被打破。

《投资学》教学大纲一、课程概述《投资学》是金融学专业的一门重要课程,主要研究投资理论、投资策略和投资工具。

本课程旨在帮助学生了解投资学的基本概念、原理和方法,掌握投资决策的基本技能,为将来从事金融投资及相关领域的工作奠定坚实的基础。

二、课程目标1、掌握投资学的基本概念、原理和方法,了解投资学的学科体系和前沿研究。

2、掌握投资决策的基本技能,包括投资组合的构建、风险评估、投资策略的制定等。

3、熟悉不同类型的投资工具,如股票、债券、基金、衍生品等。

4、了解市场分析和预测的方法,掌握基本的技术分析工具。

5、理解投资学在现实生活中的应用,能够运用所学知识进行实际投资操作。

三、课程内容第一章投资学导论1、投资学的定义与研究对象2、投资学的研究方法3、投资学的学科发展与前沿研究第二章投资组合理论1、投资组合的基本概念2、均值-方差模型3、最优投资组合的求解方法4、投资组合的风险与收益评估第三章风险管理与资产配置1、风险的概念与测量方法2、风险分散与资产配置3、资本资产定价模型(CAPM)4、有效市场假说(EMH)第四章股票投资策略1、股票市场的概述与运行机制2、股票投资的基本分析方法3、股票投资的技术分析方法4、股票投资策略的实际应用第五章债券投资策略1、债券市场的概述与运行机制2、债券的种类与特点3、债券投资的基本分析方法4、债券投资的技术分析方法5、债券投资策略的实际应用第六章基金投资策略1、基金市场的概述与运行机制2、基金的种类与特点3、基金投资的基本分析方法4、基金投资的技术分析方法5、基金投资策略的实际应用第七章期货与期权投资策略1、期货与期权市场的概述与运行机制。

一、课程概述《基础护理学》是护理学专业的一门基础课程,旨在培养学生掌握护理学的基本理论和实践技能,为后续的护理专业课程打下坚实的基础。

本课程主要涵盖了护理学的基本概念、护理伦理与法律、病人评估与记录、常见疾病的护理技能等内容。

二、课程目标通过本课程的学习,学生应达到以下目标:1、掌握护理学的基本概念、原则和方法,了解护理伦理与法律等方面的知识;2、掌握病人评估和记录的方法,能够准确收集病人的病史和体征信息;3、掌握常见疾病的护理技能,能够根据病人的需求和状况进行针对性的护理;4、能够与医生、护士及其他医护人员有效沟通,共同协作完成病人的治疗和护理;5、培养良好的职业道德和人文素养,能够以关怀和尊重的态度对待病人。

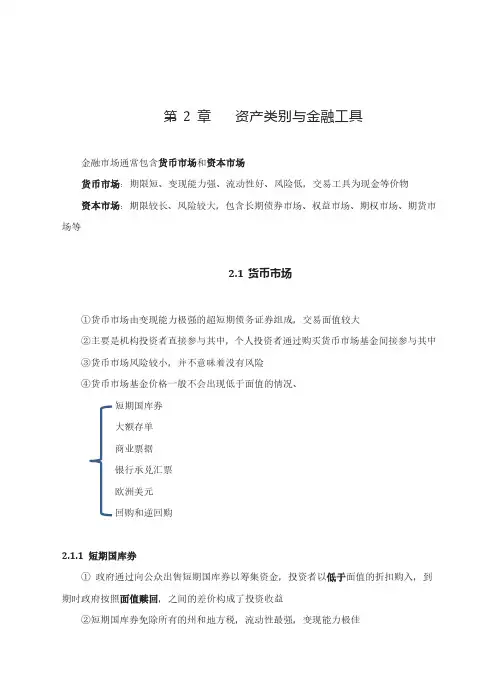

第2章资产类别与金融工具金融市场通常包含货币市场和资本市场货币市场:期限短、变现能力强、流动性好、风险低,交易工具为现金等价物资本市场:期限较长、风险较大,包含长期债券市场、权益市场、期权市场、期货市场等2.1货币市场①货币市场由变现能力极强的超短期债务证券组成,交易面值较大②主要是机构投资者直接参与其中,个人投资者通过购买货币市场基金间接参与其中③货币市场风险较小,并不意味着没有风险④货币市场基金价格一般不会出现低于面值的情况、短期国库券大额存单商业票据银行承兑汇票欧洲美元回购和逆回购2.1.1 短期国库券①政府通过向公众出售短期国库券以筹集资金,投资者以低于面值的折扣购入,到期时政府按照面值赎回,之间的差价构成了投资收益②短期国库券免除所有的州和地方税,流动性最强,变现能力极佳③短期国库券报价并不提供具体价格,而是提供基于贴现的收益率例:某日距到期日还有156天的国库券,卖方报价收益率0.125%,则对应时间的折扣水平为0.125%×(156/360)=0.0542%,面值为10000美元的国库券的出售价格为(1-0.0542%)×10000=9994.58美元,基于卖方报价的年化收益率为0.0542%×365/156=0.127%,称为债券的等值收益率2.1.2 大额存单(CD)①不记名、不能随时提取,银行到期才支付本金和利息②可以将未到期的大额存单转让给他人,变现能力较强2.1.3 商业票据①知名大公司发行的短期无担保债务凭证②商业票据由一定的银行信用额度支持,提高其信用水平③商业票据分为本票、汇票,本票是一种支付保证书,汇票是一种支付命令书,本票的付款方是出票人,汇票的付款方是第三方,通常是银行④商业票据的背书和承兑,背书是一种背面签章行为,作为进行追索的依据,承兑是一种保证行为,保证票据到期进行支付。

2.1.4 银行承兑汇票①是指银行客户向银行发出在未来某一日期支付一笔款项的指令,期限通常为6个月②当银行背书承兑后,银行开始负有向汇票持有人最终付款的责任③银行承兑汇票可以在二级市场转让,像短期国库券一样,在面值的基础上折价销售2.1.5 欧洲美元①是指美国国外银行或美国银行的国外分支机构中以美元计价的存款,这些银行位于美国以外,不受美联储的监管。

![《投资学 》( Investments,(6th Edition))第六版[PDF]](https://uimg.taocdn.com/de7bdf868762caaedd33d4f1.webp)

《投资学》( Investments,(6th Edition))第六版[PDF]状态: 精华资源摘要: 发行时间: 2005年08月01日语言: 简体中文时间: 3月21日发布| 3月21日更新分类: 资料电子图书统计: 27000次浏览| 18次收藏相关:请登录举报: 举报资源•详细内容•相关资源•补充资源•用户评论eMule资源下面是用户共享的文件列表,安装eMule后,您可以点击这些文件名进行下载投资学.(第6版.).pdf 详情97.5MB全选97.5MB中文名: 投资学英文名: Investments,(6th Edition)资源格式: PDF版本: 第六版发行时间: 2005年08月01日地区: 大陆语言: 简体中文简介:资源介绍:《投资学》是由三名美国知名学府的著名金融学教授撰写的优秀著作,是美国最好的商学院和管理学院的首选教材,在世界各国都有很大的影响,被广泛使用。

自1999年《投资学》第4版以及2002年的第5版翻译介绍进中国以后,在国内的大学里,本书同样得到广泛运用和热烈反响。

此为本书的第6版,作者在前5版的基础上根据近年来金融市场、投资环境的变化和投资理论的最新进展做了大幅度的内容更新和补充,还亢分利用了网络资源为使用者提供了大量网上资料。

全书共分7大部分,27章。

详细讲解了投资领域中的风险组合理论、资本资产定价模型、套利定价理论、市场有效性、证券评估、衍生证券、资产组合管理等重要内容。

本书观点权威,阐述详尽,结构清楚,设计独特,语言生动活泼,学生易于理解,内容上注重理论与实践的结合。

本书适用于金融专业高年级本科生、研究生及MBA学生,金融领域的研究人员、从业者。

目录:第一部分引论第1章投资环境第2章金融工具第3章证券是如何交易的第4章共同基金和其他投资公司第二部分投资组合理论第5章利率史与风险溢价第6章风险与风险厌恶第7章风险资产与无风险资产之间的资本配置第8章最优风险资产组合第三部分资本市场均衡第9章资本资产定价模型第10章指数模型第11章套利定价理论与风险收益多因素模型第12章市场有效性和行为金融学第13章证券收益的经验根据第四部分固定收益证券第14章债券的价格与收益第15章利率的期限结构第16章债券资产组合的管理第五部分证券分析第17章宏观经济分析与行业分析第18章股权估价模型第19章财务报表分析第六部分期权、期货及其他衍生证券第20章期权市场介绍第21章期权定价第22章期货市场第23章期货与互换的详细分析第七部分积极的资产组合管理第24章资产组合业绩评估第25章投资国际分散化第26章资产组合的管理过程第27章积极的资产组合管理理论附录术语表。

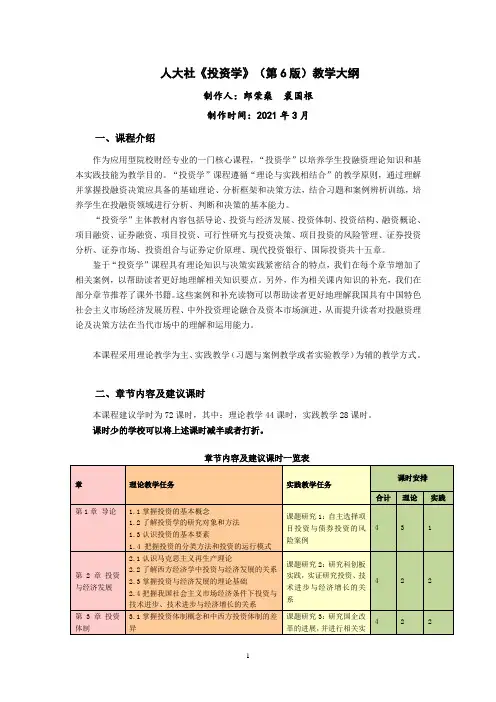

人大社《投资学》(第6版)教学大纲制作人:郎荣燊裘国根制作时间:2021年3月一、课程介绍作为应用型院校财经专业的一门核心课程,“投资学”以培养学生投融资理论知识和基本实践技能为教学目的。

“投资学”课程遵循“理论与实践相结合”的教学原则,通过理解并掌握投融资决策应具备的基础理论、分析框架和决策方法,结合习题和案例辨析训练,培养学生在投融资领域进行分析、判断和决策的基本能力。

“投资学”主体教材内容包括导论、投资与经济发展、投资体制、投资结构、融资概论、项目融资、证券融资、项目投资、可行性研究与投资决策、项目投资的风险管理、证券投资分析、证券市场、投资组合与证券定价原理、现代投资银行、国际投资共十五章。

鉴于“投资学”课程具有理论知识与决策实践紧密结合的特点,我们在每个章节增加了相关案例,以帮助读者更好地理解相关知识要点。

另外,作为相关课内知识的补充,我们在部分章节推荐了课外书籍。

这些案例和补充读物可以帮助读者更好地理解我国具有中国特色社会主义市场经济发展历程、中外投资理论融合及资本市场演进,从而提升读者对投融资理论及决策方法在当代市场中的理解和运用能力。

本课程采用理论教学为主、实践教学(习题与案例教学或者实验教学)为辅的教学方式。

二、章节内容及建议课时本课程建议学时为72课时,其中:理论教学44课时,实践教学28课时。

课时少的学校可以将上述课时减半或者打折。

三、教学目标1.基本知识教学目标(1)掌握投资学基本理论、投资与经济增长、投资体制比较以及投资结构等要点。

(2)掌握融资的主要概念、融资方法和方式比较,特别是项目融资与证券融资。

(3)掌握投资的主要方法、分析工具、决策方法、相关市场及中介机构。

2.职业能力培养目标(1)学会运用所学的专业知识和分析方法来解决投融资实践过程中的疑难问题。

(2)独立操作、正确处理在实际工作当中经常涉及到的投融资决策问题。

3.思想素质教育目标(1)具有团队精神和协作精神。

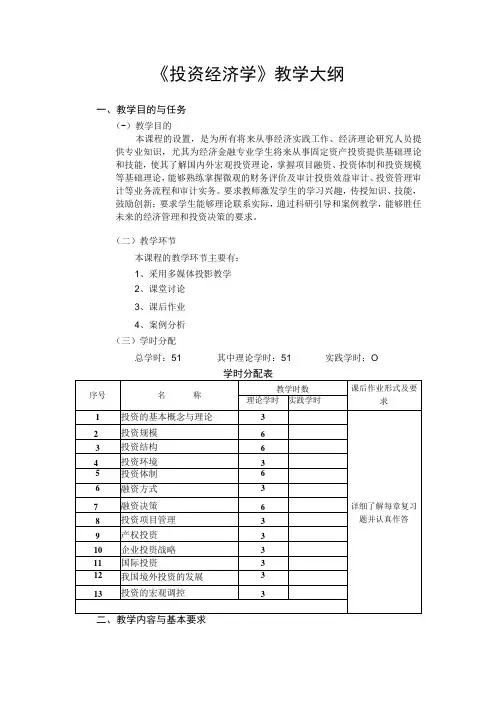

《投资经济学》教学大纲一、教学目的与任务(-)教学目的本课程的设置,是为所有将来从事经济实践工作、经济理论研究人员提供专业知识,尤其为经济金融专业学生将来从事固定资产投资提供基础理论和技能,使其了解国内外宏观投资理论,掌握项目融资、投资体制和投资规模等基础理论,能够熟练掌握微观的财务评价及审计投资效益审计、投资管理审计等业务流程和审计实务。

要求教师激发学生的学习兴趣,传授知识、技能,鼓励创新;要求学生能够理论联系实际,通过科研引导和案例教学,能够胜任未来的经济管理和投资决策的要求。

(二)教学环节本课程的教学环节主要有:1、采用多媒体投影教学2、课堂讨论3、课后作业4、案例分析(三)学时分配总学时:51 其中理论学时:51 实践学时:O第一章投资的基本概念与理论1 .教学内容(1)投资的基本概念(2)投资的理论2 .基本要求(1)理解并掌握投资的基本含义(2)了解投资的形式与作用(3)重点理解投资对于经济增长的影响途径(4)认识西方投资理论的形成与发展历程(5) 了解中国投资理论的发展历程3 .重点与难点(1)重点投资的基本含义,实质与分类,作用(2)难点中国与西方投资理论的形成与发展及对比第二章投资规模4 .教学内容(1)投资规模概述(2)投资规模的确定(3)投资规模的调控5 .基本要求(1)理解年度投资规模、在建投资规模的含义及相互关系(2)了解投资规模的衡量方法和变动规律(3)理解投资规模对于宏观经济的影响方式(4)了解我国历史上投资规模的变化情况及相应的经济背景6 .重点与难点(1)重点投资规模的概念(2)难点投资规模的确定原则和确定方法第三章投资结构1 .教学内容(1)投资结构概述(2)产业投资结构(3)投资结构调控2 .基本要求(1)掌握投资结构的含义及分类(2)了解投资结构优化的标准和原则(3)掌握我国产业投资结构的含义及优化措施(4)了解我国投资结构的历史演变(5)掌握我国投资结构调控的目标和对策3 .重点与难点(1)重点投资结构的含义及分类(2)难点产业投资结构优化产业结构调控第四章投资环境1 .教学内容(1)投资环境概述(2)投资环境评价(3)投资环境优化2 .基本要求(1)明确投资环境的含义和特点(2)了解投资环境的具体内容(3)熟悉投资环境评价的原则和标准(4)掌握投资环境评价的方法(5)了解我国投资环境现状和优化的主要方向3.重点与难点(1)重点资环境的涵义和特点(2)难点“冷热”因素分析法、等级尺度评分法、多因素评估法第五章投资体制4.教学内容(1)投资体制概述(2)我国投资体制的沿革(3)我国投资体制的改革(4)中外投资体制比较5.基本要求(1)掌握投资体制的含义(2)掌握投资体制的构成和类型63)了解我国投资体制的沿革和发展74)掌握我国投资体制改革的目标和措施85)了解我国投资体制改革的主要成就3.重点与难点(1)重点投资体制的相关概念及其构成(2)难点中外投资体制比较第六章融资方式1 .教学内容(1)融资概述(2)融资方式2 .基本要求(1)理解融资的含义(2)掌握融资的四种分类方法(3)了解直接融资和间接融资的概念(4)了解各种融资方式及相关知识3.重点与难点(1)重点融资方式的相关基础知识(2)难点如何选择融资方式,怎样把握融资规模以及种融资方式的利用时机、条件第七章融资决策1 .教学内容(1)资本成本概述、影响因素及原则(2)资本成本(3)财务风险的衡量(4)资本结构与融资决策2 .基本要求(1) 了解融资决策的影响因素(2)理解融资决策应遵循的原则(3)掌握资本成本的概念及相关计算方法(4)掌握财务风险中各种杠杆的概念及计算方法(5)理解资本结构对于融资决策的影响3 .重点与难点(1)重点资本成本的定义及作用(2)难点融资风险的衡量,最佳资本结构的确定和追加融资方案的选择第八章投资项目管理1 .教学内容(1)项目及投资(2)投资项目周期(3)投资项目决策(4)阶段的分析(5)投资项目知识体系2 .基本要求(1)了解投资项目的特征、分类以及投资项目周期的含义(2)掌握投资建设项目周期的工作类型、阶段划分及其影响因(3)掌握投资项目决策阶段的主要工作(4) 了解项目管理知识体系的主要内容及其发展3 .重点与难点(1)重点投资项目界定与分类(2)难点决策阶段的分析与管理投资建设项目周期阶段划分与投资影响因素第九章产权投资1 .教学内容(1)产权投资的基本概念(2)产权投资的决策分析(3)产权投资的程序2 .基本要求(1)掌握产权投资的概念和意义(2)了解产权投资的主要实现形式(3)掌握产权投资的决策分析(4)了解产权投资的程序3 .重点与难点(1)重点产权投资的基本概念(2)难点产权投资的决策分析第十章企业投资战略1 .教学内容(1)企业投资战略的基本概念(2)企业投资战略的类型(3)企业投资战略的制定2 .基本要求(1)了解企业投资战略的含义及特点(2)掌握企业投资战略的各种类型及其优缺点(3)掌握企业投资战略制定的步骤3 .重点与难点(1)重点投资战略的四种类型及其特点(2)难点投资战略的制定过程第十一章国际投资1 .教学内容(1)国际投资的产生与发展(2)国际直接投资(3)国际间接投资(4)其他类型的国际投资方式2 .基本要求(1)了解国际投资的作用与发展过程,掌握国际投资相关理论(2)掌握国际直接投资的分类及影响因素(3)掌握国际间接投资的主要种类(4)了解补偿贸易、国际加工装配、国际租赁等国际投资方式3 .重点与难点(1)重点投资的基本阐述(2)难点直接投资和国际间接投资第十二章我国境外投资的发展4 .教学内容(1)我国境外投资发展概述(2)境外投资发展战略(3)我国政府对境外投资的管理5 .基本要求(1)了解我国境外投资的发展阶段(2)掌握境外投资发展战略的主要模式(3)掌握我国境外投资的管理制度6 .重点与难点(1)重点境外投资的涵义、方式(2)难点我国境外投资管理机构、管理制度第十三章投资的宏观调控1 .教学内容(1)投资宏观调控的目标(2)投资宏观调控的意义、原则和手段2 .基本要求(1)了解投资宏观调控的目标及意义(2)掌握投资宏观调控的原则和手段(3)了解近年来我国投资宏观调控的进程以及目前面临的问题3.重点与难点(1)重点投资宏观调控的概述(2)难点投资宏观调控的原则和手段。

Questions & problems3. a. A market order instructs the broker to buy or sell immediately at the bestavailable price. The investor is virtually assured that the order will be filled.However, the actual trade price could differ from the price existing when theorder was placed.b. A limit order instructs the broker to buy or sell at a specified price (or better).The investor is assured that, if the trade takes place, then it will be done at aprice at least as good as his or her limit price. However, the investor cannotbe certain when, or even if, the order will eventually be filled.c. A stop order instructs the broker to buy or sell at the best available price oncea stop price is reached. The investor can be fairly certain that his or herorder will be filled if the stop price is reached. However, the actual tradeprice could differ from the stop price.8. The minimum collateral required to avoid a margin call in the case of a marginpurchase is given by:Minimum collateral = Loan/(1 – maintenance margin requirement)In Snooker's case:Min collateral= [(1,000 shrs ⨯$60/shr) ⨯ (1 - .50)]/(1 – .30)= $42,857.14With the decline in price to $50/share, Snooker’s actual collateral is now:Collateral = 1,000 shrs ⨯ $50/shr = $50,000Snooker’s actual collateral is therefore above the minimum level necessary to avoid a margin call. No margin call will occur.10. The maximum amount that Lizzie can purchase is found by solving:Initial Equity = Initial Margin Requirement⨯Purchase AmountorMax Purchase Amount= Initial Equity/Initial Margin Requirement= $15,000/.50 = $30,00011. The maintenance margin requirement ensures that an investor maintains sufficientequity in his or her account to protect the broker against sudden shifts in the value of the investor's securities purchased on margin. Margin in the investor’s account represents the excess of asset values over the value of the investor’s loan.Therefore the greater the maintenance margin requirement, the greater is the broker's "cushion" against declines in the value of the investor's portfolio.12. Penny's initial investment in South Beloit is $17,500 ($35 ⨯ 500) of which Penny putdown $7,875 (.45 ⨯ $17,500). Over the course of the year Penny must pay interest of $1,155 (.12 ⨯ $9,625). At year-end Penny's investment is worth $20,000 ($40 ⨯500). Thus Penny's return on investment for the year is:ROR = [($20,000 - $17,500) - $1,155]/$7,875=.171 = 17.1%14. Note that the return on an investor's margin purchase can be expressed on a totaldollar basis or on a per share basis. In the latter case:RORP P D r im Pim Pt t t tt=-+-⨯-⨯⨯+11[()]()In Ed Delahanty's case:a. ROR = {($40 - $30 + $1) - [.13 ⨯ (1 - .55) ⨯ $30]}/(.55 ⨯ $30)= ($11 - $1.755)/$16.50 = .560 = 56.0%b. ROR = {($20 - $30 + $1) - [.13 ⨯ (1 - .55) ⨯ $30]}/(.55 ⨯ $30)= ($-9 - $1.755)/$16.50 = -.652 = -65.2%c. ROR = ($40 - $30 + $1)/$30= $11/$30 = .367 = 36.7%ROR = ($20 - $30 + $1)/$30= $-9/$30 = -.300 = -30.0%16. Beauty's balance sheet at the time of the short sale would appear as follows:17. The equity (or net worth) in an investor’s account who engages in short selling isgiven by:Equity = (short sale proceeds + initial margin) - loanThus for Candy:a. [(200 shrs ⨯ $50/shr) ⨯ (1 + .45)] – (200 shrs ⨯ $58/shr)= $14,500 - $11,600 = $2,900b.[(200 shrs ⨯ $50/shr) ⨯ (1 + .45)] – (200 shrs ⨯ $42/shr)= $14,500 - $8,400 = $6,10018.The collateral required to avoid a margin call in the case of a short sale is given by:collateral =(short sale proceeds+initial margin) / (1 + maintenance margin requirement)In Dinty’s case, the minimum collateral is:collateral= (500 shrs ⨯ $45/shr) ⨯ (1+ .55) /(1+.35)= $25,833Dinty’s actual loan equals:500 shrs ⨯ $50/shr = $25000Because the collateral exceeds the actual loan, Dinty will not receive a margin call at this time.21.Calculated on a total dollar basis, Deerfoot's initial investment in the short sale ofDeForest stock is $35,000 (.50 ⨯$70 ⨯1,000). At year-end, Deerfoot had to reimburse the owner of the DeForest stock with $2,000 ($2 ⨯ 1,000) for dividends paid on the stock. Further, at year-end, if Deerfoot purchased the stock and repaid the owner, then the excess proceeds over the amount which Deerfoot originally received when the stock was sold short would equal -$5,000 ($70 - $75 ⨯ 1000). Thus Deerfoot's return on investment during the year was:ROR = [($70,000 - $75,000) - $2,000]/$35,000=-.200 = -20.0%22.Expressing the return on a short sold security on a per share basis (includinginterest on the initial margin deposit) given:) ()( 1t ttttPimr PimDPPROR⨯⨯⨯+--=+a. If the Madison stock, which was originally sold short at $50 per share, risesto $58 then:ROR = [($50 - $58 - $0) + (.45 ⨯ $50 ⨯ .08)]/(.45 ⨯ $50)= -.276 = -27.6%b. If the Madison stock, which was originally sold short at $50 per share, fallsto $42 then:ROR = [($50 - $42 - $0)] + (.45 ⨯ $50 ⨯ .08)]/(.45 ⨯ 50)= .436 = 43.6。