中级会计实务教学大纲

- 格式:docx

- 大小:20.80 KB

- 文档页数:16

中级会计实务大纲

2023年中级会计实务大纲主要包括以下几个方面的内容:

1. 会计职业道德概述,会计目标、会计要素和会计信息质量要求,会计法规制度体系概述。

2. 金融工具减值的会计处理。

3. “职工薪酬和借款费用”一章内容调整为两章,分别是“第九章职工薪酬”和“第十章借款费用”。

大纲对各章考试内容进行了掌握、熟悉和了解三个层次的划分,掌握的内容要求应试人员对相关知识点能够全面、系统掌握,并能够分析、判断和处理实务中相关的问题;熟悉的内容要求应试人员对相关知识点能够准确理解,并能够解决和处理实务中相关的问题;了解的内容要求应试人员对相关知识点能够一般性理解。

以上信息仅供参考,如需获取2023年中级会计实务大纲的完整内容,可登陆财政部官方网站查阅。

《中级会计实务》教学大纲(Intermediate accounting practiceTeaching Syllabus)Syllabus for intermediate accounting practiceApplicable major: Accounting MajorCategory: correspondenceLevel: UndergraduateClass hours: 52Self-study hours: 200Outline descriptionTeaching aims and requirements"Intermediate accounting practice" is the major course of accounting specialty. It is based on the study of accounting principles. Through this teaching, students can master the basic theory, basic methods and basic skills of "intermediate accounting practice". To understand, operate, analyze, to enable students to have the ability to deal with the accounting business independently, to lay the foundation for the follow-up courses. At the same time, this course is a compulsory subject accounting occupation title examination, from the point of view of the professional courses in the teaching difficulty, difficulty of examination points strive to focus, to explain, to meet the needs of students' examination.Two, the focus and difficulty of the curriculumThe first chapter is general introductionKey points: accounting elements, accounting equation, basic premise of accounting and general principles of accounting.Difficulty: the difference between the accounting subject and the legal subject, and the concrete application of the general principles of accounting.The second chapter: receivables and prepaymentsKey points: accounts receivable, accounts receivable, bad debt losses, prepayments and claims receivableDifficulty: notes receivable discounted and accounting, accounting bills with interest in the final interest, commercial discounts and cash discount conditions should determine the amount of allowance for receivables and bad debt losses accounted for the sale and discount of receivable creditor's rights.Third chapter inventoryKey: valuation method to determine the concept, scope, and inventory accounting value, raw materials pricing according to the actual cost and planned cost accounting, packaging materials and low value consumables amortization method and accounting, accounts office accounting and inventory inventoryprocessing processing inventory.Difficulty: node calculation and inventory cost accounting according to plan the difference between the cost of the inventory, according to the actual cost of the inventory valuation method of cost accounting, inventory overage, shortage or damage of the accounting treatment, the realizable method of determining the net value of the stock.Fourth chapter investmentKey points: the classification of investment, the calculation of short-term investment, the determination of its profit and loss, the accounting treatment of short-term investment impairment, the accounting of long-term bonds, the calculation of long-term bond investment, the cost method and equity method of long-term investment in equity.Difficulties: the short-term investment has determined the cost, determine its gains and losses, impairment of accrual accounting treatment, long-term equity investment, the equity method of long-term equity investment management, long-term bond investment income to determine the overflow, amortization, discount, long-term investment impairment provision and accounting treatment.The fifth chapter, fixed assetsKey points: the characteristics of fixed assets, valuation methods, the scope and methods of carrying out depreciation, the accounting of fixed assets disposal and the accounting ofthe impairment provision.Difficulties: the determination of the value of the financing and the fixed assets, the application of the accelerated method of fixed assets depreciation and the accounting treatment of the provision for the impairment of fixed assets.The sixth chapter: intangible assets and other assetsKey point: intangible assets definition, content, characteristic and account processing, long - term prepaid expenses include contentDifficulty: the particularity of accounting standards for intangible assets, the difference between the transfer of use rights and the transfer of ownership accounting.The seventh chapter is current liabilitiesKey points: the contents of the current liabilities and the accounting of the payable taxes.Difficulties: dealing with bills payable, accounting for taxes payableThe eighth chapter is long-term liabilitiesKey points: the contents of long-term liabilities, the capitalization of long-term borrowing costs and their accounting treatment, the accounting of excess discount bonds, and the determination and calculation of the amount of fixedassets in the financing lease.Difficulties: the capitalization and expense of long-term borrowing costs, the determination of the minimum lease payments for the financing of fixed assets.The ninth chapter owners' equityKey points: composition and accounting of owner's equity, capital surplus and retained earnings.Difficulties: the valuation of capital invested in different ways, and the detailed classification of capital reserves.Tenth chapter feeKey points: the concept and classification of cost, cost, period expenses and contents of non operating expenses.Difficulty: the difference between costs and costs, the method of allocating production costs and their use, the allocation of production costs between finished products and products.The eleventh chapter: income and profitKey points: the concept and classification of income, the recognition principle of various kinds of income, the total profit and the composition of the net profit, and the accounting of the profit and profit distribution of the year.Difficulty: confirm the sales revenue and the specialcircumstances of merchandise sales revenue accounting, tax payable method is built to confirm the confirmation of income, income, contract transactions, income tax accounting and tax effect accounting method.The twelfth chapter, debt restructuringKey points: the definition of bond reorganization, the mode of debt restructuring and accounting treatment.Difficulty: the accounting treatment of non cash assets, debt repayment, accounting, conditional or conditional debt restructuringThe thirteenth chapter deals with non monetary transactionsKey points: the difference between monetary assets and non monetary assets, and the accounting treatment of non monetary transactionsDifficulty: non monetary transactions involve the accounting of the paid price and the accounting treatment without the supplementary price.The fourteenth chapter is about accounting policies, changes in accounting estimates and corrections of accounting errorsKey points: accounting policies, changes in accounting estimates and accounting error correction concepts, the use of methods (that is, when the change of accounting treatment)Difficulties: retrospective adjustment method, future applicable law, cumulative influence number.The fifteenth chapter is the balance sheet daily reportKey: the concept, the date of the balance sheet items after adjusting items, non adjusting events and processing principlesDifficulty: the adjustment principle of adjusting items and non adjusting items.The sixteenth chapter is financial accounting reportKey points: balance sheet, profit statement, cash flow statement and consolidated financial statements.Difficulties: preparation of cash flow statements and consolidated financial statements.The seventeenth chapter is budget accountingKey points: budget accounting structure, budget accounting and enterprise accounting difference.Difficulty: should pay the financial accounts of the detailed classification of accounting.Three, the course content and class assignment(I) course contentThe first chapter is general introductionLearn through this chapter,The students of general principles and specific premise, intermediate financial accounting concepts, accounting object, accounting elements, accounting and business accounting, to provide guarantee for the specific accounting principles after each chapter of content.The second chapter is receivable and advance paymentThis chapter is based on notes receivable, accounts receivable accounting, the confirmation method of bad debts, require students to master notes receivable, accounts receivable, prepayments and other receivables accounting, provision for bad debts, accounts receivable and discounted sale method of accounting treatmentThird chapter inventoryThrough the study of this chapter, the students according to the characteristics of various inventory, master all kinds of accounting methods, especially stock transactions balances accounting, inventory provision is made when determining the net realizable value, raw materials pricing according to plan cost accounting, strengthen the packaging, processing, low value consumable the value of goods such as relatively low inventory managementFourth chapter investmentThrough the study of this chapter, so that students on the concept, classification, investment accounting has a comprehensive understanding, to grasp the investment cost, the final interest valuation and disposal of accounting, especially long-term debt investment, long-term equity investment accounting and final cost method and equity method to use valuation.The fifth chapter is the accounting of fixed assetsThrough the study of this chapter, a clear feature classification, fixed asset recognition criteria, pricing methods and value of depreciation of fixed assets to increase the scope and method, reduction, disposal and impairment accounting.The sixth chapter is the accounting of intangible assets and other assetsThrough the study of this chapter, clear the meaning of intangible assets, long-term prepaid expenses and other assets included in the content, to understand the intangible assets of the book value, to master intangible assets and other assets accounting.The seventh chapter is current liabilitiesThrough the study of this chapter, definition and types of current liabilities, grasp the current liabilities accountingcontent, especially the taxes payable other registration subjects should master and not by the tax payable accounts tax.The eighth chapter is long-term liabilitiesThrough the study of this chapter, understand the long-term liabilities including content, amount and method of accounting for long-term debt, especially to determine the conditions of capital financing costs, rented fixed assets accounted for the amount and long-term bonds at par, premium and discount etc.The ninth chapter owners' equityThrough the study of this chapter, make clear the definition and composition of the owner's equity, understand the way and valuation of the owner's investment, and grasp the accounting of the paid in capital, capital surplus and retained earnings. In particular, the detailed calculation of capital reservesTenth chapter feeThrough the study of this chapter, we define the definition and classification of cost, the difference and relation between cost and expense, the allocation method of auxiliary cost, understand the confirmation principle of cost and the contents of the respective expenses during the period.The eleventh chapter: income and profitThrough the study of this chapter, the definition of income, classification, and the total profit and the composition of thenet profit, to understand the principles of income recognition, the distribution of profits, and grasp the income, profits, profits distribution accounting.The twelfth chapter, debt restructuringThrough the study of this chapter, we can make the trainees clear about the definition of debt restructuring and new features, the ways of debt restructuring and the accounting treatment in various ways.The thirteenth chapter deals with non monetary transactionsThrough the study of this chapter, the students have a clear understanding of monetary assets, non monetary assets and non monetary transactions, and can handle the non monetary transactions without involving the supplement price or the supplementary price.The fourteenth chapter is about accounting policies, changes in accounting estimates and accounting errorsThrough the study of this chapter, to enable students to clearly grasp the accounting policies and accounting estimates, and the change of concept of accounting errors, skilled accounting, especially to determine the cumulative effect and in the accounting statements disclosure.The fifteenth chapter events after the balance sheet dateThrough the study of this chapter, clear the balance sheet dateevents after the concept, covering the period, adjustments to the concept, the concept of non adjusting events, the specific content of the main processing principles and methods, grasp the adjustment of skilled non adjusting events.The sixteenth chapter is financial accounting reportThis chapter through learning, make students clear accounting statements and related schedules, accounting statements and financial situation statement and the meaning of the content, skilled in preparing the balance sheet, income statement, cash flow statement and consolidated accounting statementsThe seventeenth chapter is budget accountingThe introduction of the preceding chapters is mainly based on business accounting. In this chapter, we introduce budget accounting. Through the study of this chapter, students will be able to make clear the composition of budget accounting, the difference between budget accounting and enterprise accounting, and the accounting contents of budget accounting and the accounting statements of institutions.(two) distribution of hourschapterContentClass hoursSelf-study hoursTotalChapter 1GeneralTwoFourSixSecond chapters Receivables and prepayments TwoSixEightThird chaptersStockFourTenFourteenFourth chaptersInvestmentFourTwentyTwenty-fourFifth chaptersfixed assetsTwoSixEightSixth chaptersIntangible assets and other assets TwoFourSixSeventh chapters current liabilities TwoFourSixEighth chaptersLong-term liabilities FourTwentyTwenty-fourNinth chaptersOwner equityTwoSixEightTenth chapters CostThreeTenThirteenEleventh chapters Income and profit FourTwentyTwenty-four Twelfth chapters Debt restructuring FourTwentyTwenty-fourNon monetary transactionFourTwentyTwenty-fourFourteenth chaptersChanges in accounting policies, accounting estimates, and accounting errors are being correctedThreeTwelveFifteenFifteenth chaptersThe date of the balance sheet mattersTwoTwelveFourteenFinancial accounting reportSixTwentyTwenty-sixSeventeenth chaptersbudget accountingTwoSixEightTotalFifty-twoTwo hundredTwo hundred and fifty-twoFour, the use of teaching materials: "intermediate accounting practice", the Ministry of finance accounting qualification evaluation center, "Economic Science Publishing Society",October 2005。

《中级会计实务》课程标准课程编码:课程类别:适用专业:会计授课单位:学时:72编写执笔人及编写日期:学分:4审定负责人及审定日期:1、课程定位和课程设计1. 1课程性质与作用本课程为会计专业的主干课程,是必修课程。

通过本课程的教学,让学生对一些复杂的具体业务的核算有基本的认识,让学生基本具备合并报表编制、所得税计算、资产负债表日后事项等职业岗位所需要的最基本技能。

除此以外,将本课程的学习与全国会计专业技术(中级)资格考试相结合,为学生后续提升打下一定的理论基础。

1.2课程设计理念模拟实训、工学结合、学做合一、提升能力。

1.3课程设计思路总体设计思路是:以工作任务为中心组织课程内容,让学生在完成具体项目的工作中学会相应工作任务,并构建相关理论知识,发展职业能力。

课程内容突出对学生职业能力的训练,理论知识的选取紧紧围绕工作任务完成的需要来进行,同时又考虑了高等职业教育对理论知识学习的需要。

课程设计是以工作任务驱动为线索来进行的。

教学过程中,要通过校企合作、校内实训基地建设等多种途径,采取工学结合、顶岗实习等形式,充分开发学习资源,给学生提供丰富的实践机会。

教学效果评价采取过程评价与结果评价相结合的方式,通过理论与实践相结合、重点评价学生的职业能力。

《中级会计实务》教学内容要体现出还要思想性、现实性与前瞻性,达到理论与实践相统一。

在课堂理论教学中让学生不仅学会当下知识,而且具备学习新知识新变化的能力;帮助学生在学习过程中形成健康的世界观、人生观、价值观,养成良好的会计职业素养,具备良好的会计职业道德,践行社会主义核心价值观于日常工作之中,做到“诚信为本,操守为重,坚持准则,不做假账”。

2、课程目标2.1素质目标(1)培养学生的观察能力、行业敏锐感和时代感;(2)培养学生的良好的信息获取能力、表达能力、自我学习能力;(3)培养学生从事会计职业所应具有的谨慎、稳重的职业素养和良好的职业道德。

2.2知识目标(1)了解中级会计实务的意义及其在财务会计学科中的地位;(2)掌握各特殊业务会计处理方法。

xx大学

会计学专业(成人教育本科)

《中级会计实务》课程教学大纲

第一部分大纲说明

一、课程性质

《中级会计实务》是xx大学成人教育本科(专科起点)会计学专业的一门必修课,属于省开课,4学分,开设一学期。

本课程主要讲授企业基本及特殊经济业务的具体会计核算。

二、文字教材

本课程采用的文字教材为经济科学出版社出版的、由财政部会计资格评价中心编的《中级会计实务》(最新版)。

这本教材也是每年全国中级会计专业技术资格考试指定的辅导用书。

主教材全面系统阐述了各项会计要素的确认、计量、记录、披露等。

学生只有在认真阅读教材并积极进行思考,才能全面掌握这门课程内容的基础。

三、课程资源说明和教学方法建议

近年来,本课程在教学改革和建设方面做了些积极有益的探索,围绕“以学生为中心”,建设有集学习内容、学习资源、学习活动、学习支持服务和学习评价考核于一身的“一体化”的本课程数字学

1。

《中级会计实务》教学大纲一、课程性质与任务《中级会计实务》是会计学专业的一门核心课程,具有较强的综合性和实务性。

本课程旨在使学生掌握中级会计实务的基本理论、方法和技能,为今后从事会计及相关工作打下坚实的基础。

通过本课程的学习,学生应能够熟练处理企业常见的经济业务,具备较强的财务分析和决策能力,能够适应不断变化的会计环境和法规要求。

二、课程目标1、知识目标掌握企业财务会计的基本概念、原则和方法。

熟悉各类资产、负债、所有者权益、收入、费用和利润等会计要素的确认、计量和报告。

了解财务报表的编制和分析方法。

2、能力目标能够正确运用会计原则和方法进行企业日常经济业务的会计处理。

具备编制企业财务报表的能力,并能对财务报表进行初步的分析和解读。

能够运用所学知识解决实际工作中的会计问题,提高职业判断能力。

3、素质目标培养学生严谨的工作态度、良好的职业道德和团队合作精神。

增强学生的法律意识和风险防范意识。

三、课程内容(一)存货1、存货的确认和初始计量存货的定义和分类存货的确认条件不同取得方式下存货的初始计量2、存货的发出计价先进先出法加权平均法个别计价法3、存货的期末计量存货期末计量的原则可变现净值的确定存货跌价准备的计提和转回(二)固定资产1、固定资产的确认和初始计量固定资产的定义和特征固定资产的确认条件不同取得方式下固定资产的初始计量2、固定资产的后续计量固定资产折旧的计提方法固定资产的后续支出3、固定资产的处置固定资产处置的会计处理固定资产清查的会计处理(三)无形资产1、无形资产的确认和初始计量无形资产的定义和分类无形资产的确认条件不同取得方式下无形资产的初始计量2、无形资产的后续计量无形资产使用寿命的确定无形资产的摊销方法3、无形资产的处置无形资产出售的会计处理无形资产报废的会计处理(四)投资性房地产1、投资性房地产的确认和初始计量投资性房地产的定义和范围投资性房地产的确认条件投资性房地产的初始计量2、投资性房地产的后续计量采用成本模式进行后续计量采用公允价值模式进行后续计量投资性房地产后续计量模式的变更3、投资性房地产的转换和处置投资性房地产与非投资性房地产的转换投资性房地产的处置(五)长期股权投资1、长期股权投资的初始计量同一控制下企业合并形成的长期股权投资非同一控制下企业合并形成的长期股权投资以非企业合并方式取得的长期股权投资2、长期股权投资的后续计量成本法权益法长期股权投资核算方法的转换3、长期股权投资的处置(六)资产减值1、资产减值概述资产减值的概念和范围资产减值的迹象和测试2、资产可收回金额的计量估计资产可收回金额的基本方法资产公允价值减去处置费用后的净额的估计资产预计未来现金流量的现值的估计3、资产减值损失的确认和计量资产减值损失的确认和计量原则资产减值损失的账务处理4、资产组的认定及减值处理资产组的认定资产组减值测试总部资产的减值测试(七)金融资产和金融负债1、金融资产的分类和计量以摊余成本计量的金融资产以公允价值计量且其变动计入其他综合收益的金融资产以公允价值计量且其变动计入当期损益的金融资产2、金融负债的分类和计量以摊余成本计量的金融负债以公允价值计量且其变动计入当期损益的金融负债3、金融资产的减值金融资产减值损失的确认和计量金融资产减值的会计处理4、金融资产的转移金融资产转移的类型金融资产转移的会计处理(八)职工薪酬及借款费用1、职工薪酬职工薪酬的范围短期薪酬的确认和计量离职后福利的确认和计量辞退福利的确认和计量其他长期职工福利的确认和计量2、借款费用借款费用的范围借款费用的确认借款费用的计量(九)或有事项1、或有事项的概念和特征或有事项的定义或有事项的特征2、或有负债和或有资产或有负债的概念和特点或有资产的概念和特点3、或有事项的确认和计量预计负债的确认条件预计负债的计量或有事项的会计处理(十)收入1、收入的确认和计量收入确认的原则收入确认的五步法模型特定交易的会计处理2、合同成本合同取得成本合同履约成本(十一)政府补助1、政府补助的概念和特征政府补助的定义政府补助的特征2、政府补助的分类与资产相关的政府补助与收益相关的政府补助3、政府补助的会计处理政府补助的确认和计量政府补助的列报(十二)所得税1、所得税会计概述资产负债表债务法的基本原理所得税会计核算的一般程序2、资产、负债的计税基础及暂时性差异资产的计税基础负债的计税基础暂时性差异3、递延所得税负债和递延所得税资产的确认和计量递延所得税负债的确认和计量递延所得税资产的确认和计量4、所得税费用的确认和计量当期所得税递延所得税所得税费用(十三)外币折算1、外币交易的会计处理记账本位币的确定外币交易的会计处理原则外币交易的账务处理2、外币财务报表折算外币财务报表折算的方法境外经营财务报表的折算(十四)财务报告1、财务报告概述财务报告的构成财务报表列报的基本要求2、资产负债表资产负债表的内容和格式资产负债表的编制方法3、利润表利润表的内容和格式利润表的编制方法4、现金流量表现金流量表的概念和作用现金流量表的编制基础现金流量表的编制方法5、所有者权益变动表所有者权益变动表的内容和格式所有者权益变动表的编制方法6、附注附注的主要内容附注的编制要求(十五)会计政策、会计估计变更和差错更正1、会计政策及其变更会计政策的概念和特点会计政策变更的条件会计政策变更的会计处理2、会计估计及其变更会计估计的概念和特点会计估计变更的原因和会计处理3、前期差错更正前期差错的概念和类型前期差错更正的会计处理(十六)资产负债表日后事项1、资产负债表日后事项概述资产负债表日后事项的概念资产负债表日后事项涵盖的期间资产负债表日后事项的分类2、资产负债表日后调整事项的会计处理调整事项的处理原则常见的调整事项3、资产负债表日后非调整事项的会计处理四、教学方法1、课堂讲授通过教师的系统讲解,使学生掌握中级会计实务的基本理论和方法。

《中级会计实务》教学大纲适用专业:会计学专业类别:函授层次:本科面授学时:52自学学时:200大纲说明一、教学目的和要求《中级会计实务》是会计学专业的主干专业课,它是在学习《会计原理》的基础上开设的。

通过本次教学,使学员明确掌握《中级会计实务》的基本理论、基本方法和基本技能。

达到懂理论、能操作、会分析,使学员具有独立处理会计业务的能力,为后续课程打下基础。

同时这门专业课又是会计职业职称考试的必考科目,从这个角度讲这门专业课难度较大,在教学中力争结合考试点突出重点、难点进行讲解,满足应试学员的需要。

二、课程的重点与难点第一章总论重点:会计要素、会计等式、会计核算的基本前提和会计核算的一般原则。

难点:会计主体与法律主体的区别,会计核算一般原则的具体运用。

第二章应收和预付款项重点:应收票据、应收账款、坏账损失、预付账款、应收债权的核算难点:应收票据贴现及其账务处理,带息票据利息期末的账务处理,在商业折扣和现金折扣条件下应收账款入账金额的确定及坏账损失的备抵法,应收债权的出售和贴现.第三章存货重点:存货的概念、范围、入账价值的确定及计价方法,原材料按实际成本和计划成本计价的核算,包装物、低值易耗品的摊销方法及账务处理,委托加工存货的账务处理及存货清查的账处处理。

难点:存货按计划成本核算其成本差异的计算与结转,存货按实际成本核算发出存货成本的计价方法,存货盘盈、盘亏、毁损的账务处理、存货可变现净值的确定方法。

第四章投资重点:投资的分类,短期投资的核算及其损益的确定,短期投资减值准备的计提及账务处理,长期债券投资的核算,长期投权投资的成本法和权益法。

难点:短期投资取得时成本的确定,其损益的确定,减值准备的计提及账务处理,长期股权投资的权益法、长期股权投资的处置,长期债券投资溢,折价的摊销、收益的确定,长期投资减值准备的计提与账务处理。

第五章固定资产重点:固定资产的特征、计价方法、计提折旧的范围与方法,固定资产处置的核算、减值准备的核算。

中级会计职称考试大纲《中级会计实务》(1)份中级会计职称考试大纲《中级会计实务》 1【基本要求](一)掌握合并财务报表的概念、构成和合并财务报袁合并范围的确定原则(二)掌握合并资产负债表的内容、格式和编制方法(三)掌握合并利润表的内容、格式和编制方法(四)掌握合并现金流量表的内容、格式和编制方法(五)掌握合并所有者权益变动表的内容、格式和编制方法(六)掌握追加投资、处置对子公司投资、因子公司少数股东增资导致母公司股权稀释、交叉持股筝特殊交易在合并财务报袁中的会计处理(七)熟悉编制合并财务报表的编制原则、前期准备事项和程序(八)了解财务报表的构成、分类和列报的基本要求(九)了解财务报表附注的主要披露内容【考试内窖]第一节财务报告概述一、财务报表概述财务报表是会计要素确认、计量的结果和综合性描述,会计准则中对会计要素确认、计量过程中所采用的各项会计__被企业实际应用后将有助于企业可持续发展,反映企业管理层受托责任的履行情况。

(一)财务报表的构成财务报表由报表本身及其附注两部分构成。

一套完整的财务报表至少应当包括“四表一注”,即资产负债表、利润表、现金流量表、所有者权益(或股东权益,下同)变动表以及附注。

(二)财务报表的分类财务报表可以按照不同的标准进行分类。

按财务报表编报期间的不同,可以分为中期财务报表和年度财务报表;按财务报表编报主体的不同,可以分为个别财务报表和合并财务报表。

二、财务报表列报的基本要求(一)依据各项会计准则确认和计量的结果编制财务报表企业应当根据实际发生的交易和事项,遵循基本准则、各项具体会计准则及解释的规定进行确认和计量,并在此基础上编制财务报表。

企业不应以在附注中披露代替对交易和事项的确认和计量。

(二)列报基础持续经营是会计的基本前提,是会计确认、计量及编制财务报表的基础。

企业管理层在对企业持续经营能力进行评估时,应当利用其所有可获得的信息。

评价结果表明对持续经营能力产生重大怀疑的,企业应当在附注中披露导致对持续经营能力产生重大怀疑的影响因素。

2023中级会计实务大纲2023中级会计实务大纲一、会计基础知识1.会计的基本概念和职能2.会计的分类和发展历程3.会计实务的规范和道德准则4.会计信息系统与会计核算方法5.会计要素与会计准则二、会计核算1.会计等式与会计科目2.会计凭证的制作和填制方法3.会计账簿的设置和使用4.会计核算流程和程序5.会计报表的编制和分析三、固定资产和无形资产的会计处理1.固定资产和无形资产的认定和计量2.固定资产和无形资产的购置和清理3.固定资产和无形资产的减值测试4.固定资产和无形资产的摊销和计提四、金融工具的会计处理1.金融资产和金融负债的分类和确认2.金融资产的计量和计提3.金融负债的计量和计提4.其他金融工具会计处理的特殊问题五、财务报告的编制和分析1.财务报表的结构和要素2.财务报表的编制和披露3.财务报表的分析和解读4.财务报表的调整和重新编制六、成本会计与管理会计1.成本的分类和计量方法2.成本核算体系和计算方法3.成本控制和成本分析4.管理会计的基本概念和应用七、预算与财务预测1.预算编制和执行的基本流程2.预算调整和控制3.财务预测和风险管理八、税务会计1.税收法律和税务会计制度2.税务会计核算和纳税申报3.税务稽查与税务风险管理九、审计理论与实务1.审计的基本概念和职能2.审计的分类和发展历程3.审计的业务流程和程序4.审计报告的编制和审计意见以上为2023中级会计实务的大纲内容,旨在帮助学生全面了解和掌握会计实务的相关知识和技能。

中级会计实务教学大纲中级会计实务教学大纲是中级会计职称考试的重要参考资料,它规定了中级会计实务课程的教学内容、教学目标和教学方法。

本文将从教学大纲的编制背景、教学内容的重点和难点以及教学方法的创新等方面进行探讨。

一、编制背景中级会计实务教学大纲的编制是为了适应中级会计职称考试的要求,提高学员的综合素质和实际操作能力。

随着经济的发展和会计职业的不断壮大,中级会计人才的需求也越来越大。

因此,教学大纲的编制需要紧密结合实际需求,注重培养学员的实际操作能力和解决问题的能力。

二、教学内容的重点和难点中级会计实务教学大纲的教学内容主要包括会计核算、会计报表、财务管理、财务会计、成本会计、审计与审计报告等方面。

其中,会计核算是整个教学内容的基础,也是学员掌握的重点和难点。

会计核算包括会计科目的设置、会计凭证的填制、账簿的建立和账务处理等方面,要求学员具备良好的会计基础知识和操作技能。

另外,会计报表也是学员需要重点掌握的内容之一。

会计报表是企业财务状况和经营成果的重要反映,对于学员来说,理解和分析会计报表是提高会计实务能力的关键。

财务管理和财务会计则是学员需要进一步学习和掌握的内容,包括资金管理、投资决策、筹资决策、成本管理、财务分析等方面。

三、教学方法的创新为了提高中级会计实务教学的效果,教学大纲还提出了创新的教学方法。

传统的教学方法主要以讲授为主,学员被动接受知识。

而现代教学方法强调学生参与和实践,注重培养学生的自主学习能力和解决问题的能力。

在中级会计实务教学中,可以采用案例教学的方法。

通过真实的案例,引导学员分析和解决问题,培养学员的实际操作能力和综合分析能力。

此外,还可以采用小组讨论、角色扮演等互动形式,激发学员的学习兴趣和积极性。

同时,教学大纲还鼓励教师运用现代教育技术手段,如多媒体教学、网络教学等,提高教学效果。

通过多媒体教学,可以将抽象的概念和理论变得具体和形象,帮助学员更好地理解和记忆知识。

而网络教学则可以为学员提供更加灵活和自主的学习环境,实现随时随地的学习。

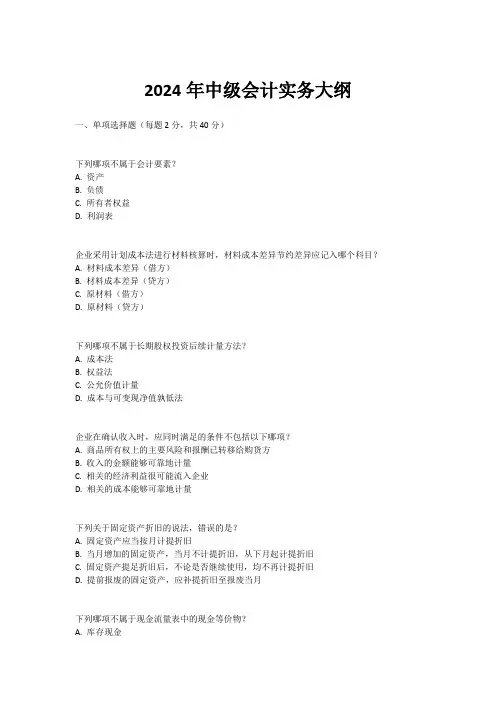

2024年中级会计实务大纲一、单项选择题(每题2分,共40分)下列哪项不属于会计要素?A. 资产B. 负债C. 所有者权益D. 利润表企业采用计划成本法进行材料核算时,材料成本差异节约差异应记入哪个科目?A. 材料成本差异(借方)B. 材料成本差异(贷方)C. 原材料(借方)D. 原材料(贷方)下列哪项不属于长期股权投资后续计量方法?A. 成本法B. 权益法C. 公允价值计量D. 成本与可变现净值孰低法企业在确认收入时,应同时满足的条件不包括以下哪项?A. 商品所有权上的主要风险和报酬已转移给购货方B. 收入的金额能够可靠地计量C. 相关的经济利益很可能流入企业D. 相关的成本能够可靠地计量下列关于固定资产折旧的说法,错误的是?A. 固定资产应当按月计提折旧B. 当月增加的固定资产,当月不计提折旧,从下月起计提折旧C. 固定资产提足折旧后,不论是否继续使用,均不再计提折旧D. 提前报废的固定资产,应补提折旧至报废当月下列哪项不属于现金流量表中的现金等价物?A. 库存现金B. 银行存款C. 三个月内到期的国债D. 存货企业所得税法规定,企业的下列收入为免税收入的是?A. 利息收入B. 转让财产收入C. 财政拨款D. 从事农、林、牧、渔业项目的所得(符合免税条件)下列关于会计政策变更的说法,正确的是?A. 会计政策变更能够影响会计确认、计量基础或列报项目B. 会计政策变更仅影响变更当期的会计信息和财务报告C. 会计政策变更应采用追溯调整法进行处理D. 会计政策变更无需在财务报表附注中披露(以此类推,共20题,覆盖中级会计实务、财务管理、经济法等多个方面)二、多项选择题(每题2分,共20分)下列哪些属于会计政策变更的情形?A. 存货计价方法由先进先出法改为加权平均法B. 固定资产折旧年限由10年改为5年C. 投资性房地产后续计量由成本模式改为公允价值模式D. 坏账准备计提比例由5%改为10%下列哪些属于财务报表附注应披露的内容?A. 重要会计政策和会计估计B. 会计政策和会计估计变更以及差错更正的说明C. 报表重要项目的说明D. 企业基本情况、财务报表的编制基础三、判断题(每题1分,共10分)企业在确认商品销售收入时,必须同时满足五个条件。

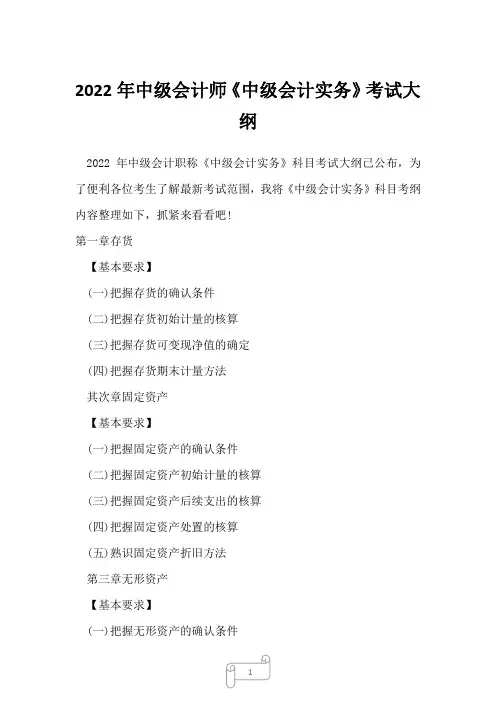

2022年中级会计师《中级会计实务》考试大纲2022年中级会计职称《中级会计实务》科目考试大纲已公布,为了便利各位考生了解最新考试范围,我将《中级会计实务》科目考纲内容整理如下,抓紧来看看吧!第一章存货【基本要求】(一)把握存货的确认条件(二)把握存货初始计量的核算(三)把握存货可变现净值的确定(四)把握存货期末计量方法其次章固定资产【基本要求】(一)把握固定资产的确认条件(二)把握固定资产初始计量的核算(三)把握固定资产后续支出的核算(四)把握固定资产处置的核算(五)熟识固定资产折旧方法第三章无形资产【基本要求】(一)把握无形资产的确认条件(二)把握无形资产初始计量的核算(三)把握内部讨论开发项目阶段支出资本化条件和内部开发无形资产的成本构成(四)把握内部讨论开发支出的会计处理(五)把握无形资产后续计量的核算(六)把握无形资产处置的会计处理(七)熟识内部讨论开发项目的讨论阶段和开发阶段的区分标准第四章长期股权投资和合营支配【基本要求】(一)把握同一掌握下企业合并形成的长期股权投资初始投资成本的确定方法(二)把握非同一掌握下企业合并形成的长期股权投资初始投资成本的确定方法(三)把握非企业合并方式取得的长期股权投资初始投资成本的确定方法(四)把握长期股权投资成本法核算(五)把握长期股权投资权益法核算(六)把握长期股权投资核算方法转换的核算(七)把握合营支配的认定及分类(八)把握共同经营中合营方的核算(九)熟识长期股权投资处置的核算(十)熟识对共同经营不享有共同掌握的参加方的核算第五章投资性房地产【基本要求】(一)把握投资性房地产的特征和范围(二)把握投资性房地产的确认条件(三)把握投资性房地产初始计量的核算(四)把握与投资性房地产有关的后续支出的核算(五)把握投资性房地产后续计量的核算(六)把握投资性房地产转换的核算(七)熟识投资性房地产处置的核算第六章资产减值【基本要求】(一)把握认定资产可能发生减值的迹象(二)把握资产可收回金额的计量方法(三)把握资产减值损失的确定原则(四)把握资产组的认定方法及其减值的处理第七章金融资产和金融负债【基本要求】(一)把握金融资产和金融负债的特征和分类(二)把握金融资产和金融负债初始计量的核算(三)把握采纳实际利率确定金融资产和金融负债摊余成本的方法(四)把握各类金融资产和金融负债后续计量的核算(五)熟识金融资产之间重分类的核算(六)熟识金融资产和金融负债的确认和终止确认第八章职工薪酬及借款费用【基本要求】(一)把握职工薪酬的定义和内容(二)把握职工薪酬的确认和计量(三)把握借款费用的范围和确认原则(四)把握借款费用资本化期间和资本化金额的确定(五)熟识借款费用应予资本化的借款范围第九章或有事项【基本要求】(一)把握估计负债的确认条件(二)把握估计负债的计量原则(三)把握未决诉讼、未决仲裁、产品质量保证和亏损合同形成的或有事项的处理(四)熟识或有事项的概念及其特征和常见的或有事项(五)熟识或有负债和或有资产的概念(六)熟识债务担保和重组形成的或有事项的处理第十章收入【基本要求】(一)把握单项履约义务的识别(二)把握交易价格的确定及分摊(三)把握属于在某一时段内履行的履约义务的条件及其收入确认(四)把握在某一时点履行的履约义务的收入确认(五)把握附有销售退回及保证条款的销售、附有客户额外购买选择权的销售以及授予学问产权许可、售后回购及客户未行使的权利的会计处理(六)把握主要责任人和代理人区分(七)熟识与客户之间的合同的识别(八)熟识合同履约成本、合同取得成本及其相关资产的摊销和减值(九)熟识无需退回的初始费的会计处理第十一章政府补助【基本要求】(一)把握政府补助的定义、特征和分类(二)把握政府补助的会计处理方法(三)把握与资产相关的政府补助和与收益相关的政府补助的会计处理(四)把握综合性项目政府补助的会计处理(五)把握政府补助退回的会计处理第十二章非货币性资产交换【基本要求】(一)把握非货币性资产交换的概念和认定(二)把握非货币性资产交换具有商业实质的条件(三)把握不涉及补价状况下的非货币性资产交换的会计处理(四)把握涉及补价状况下的非货币性资产交换的会计处理(五)熟识涉及多项资产的非货币性资产交换的会计处理第十三章债务重组【基本要求】(一)把握债务重组的方式(二)把握债务重组中债权和债务终止确认的条件(三)把握债权人的会计处理(四)把握债务人的会计处理(五)把握构成权益性交易的债务重组的推断第十四章所得税【基本要求】(一)把握所得税核算的基本原理和程序(二)把握资产计税基础和负债计算基础的计算(三)把握临时性差异的分类和详细情形(四)把握递延所得税负债和递延所得税资产的确认和计量(五)把握所得税费用的确认和计量(六)熟识特定交易或事项涉及递延所得税的确认(七)熟识合并财务报表中因抵销未实现内部交易损益产生的递延所得税(八)了解所得税税率变化对递延所得税资产和递延所得税负债影响的确认与计量第十五章外币折算【基本要求】(一)把握外币交易的会计处理(二)把握外币财务报表的折算方法(三)把握境外经营处置的会计处理(四)熟识记账本位币的确定第十六章租赁【基本要求】(一)把握租赁的定义和识别(二)把握承租人的会计处理(三)把握出租人的会计处理(四)熟识租赁的分拆和合并(五)熟识特别租赁业务的会计处理第十七章持有待售的非流淌资产、处置组和终止经营【基本要求】(一)把握划分为持有待售类别的基本原则和详细条件(二)把握延长一年期限的例外条款(三)把握持有待售的长期股权投资的会计处理原则(四)把握持有待售类别的计量(五)把握终止经营的定义(六)熟识持有待售类别和终止经营的列报要求第十八章企业合并【基本要求】(一)把握企业合并的界定条件、企业合并类型的划分(二)把握同一掌握下企业合并的会计处理,非同一掌握下企业合并的会计处理(三)把握购买子公司少数股权的会计处理(四)熟识企业合并的三种方式(五)熟识构成业务的要素和推断条件、集中度测试(六)熟识反向购买的会计处理第十九章财务报告【基本要求】(一)把握财务报表的概念、构成、分类和列报的基本要求(二)把握合并财务报表的概念、构成和合并范围的确定原则(三)把握合并资产负债表的内容、格式和编制方法(四)把握合并利润表的内容、格式和编制方法(五)把握合并全部者权益变动表的内容、格式和编制方法(六)把握合并现金流量表的内容、格式和编制方法(七)熟识编制合并财务报表的原则、前期预备事项和一般程序(九)了解合并财务报表附注的主要披露内容其次十章会计政策、会计估量变更和差错更正【基本要求】(一)把握会计政策变更的条件(二)把握会计政策变更的会计处理(三)把握会计估量变更的会计处理(四)把握前期差错更正的会计处理其次十一章资产负债表日后事项【基本要求】(一)把握资产负债表日后事项的概念(二)把握资产负债表日后事项涵盖的期间(三)把握资产负债表日后事项的内容(四)把握资产负债表日后调整事项的处理方法(五)把握资产负债表日后非调整事项的处理方法其次十二章公允价值【基本要求】(一)把握公允价值的定义和公允价值计量的总体要求(二)把握相关资产或负债、有序交易、主要市场或最有利市场、市场参加者、公允价值初始计量、估值技术、输入值、公允价值层次等与公允价值相关的基本概念及一般应用(三)熟识非金融资产、负债以及企业自身权益工具的公允价值计量其次十三章政府会计【基本要求】(一)把握政府会计核算模式、政府会计要素及其确认和计量(二)把握政府单位会计核算的基本特点及政府单位特定业务的核算(三)熟识政府会计准则制度体系及其适用范围(四)熟识政府决算报告及财务报告其次十四章民间非营利组织会计【基本要求】(一)把握民间非营利组织会计的概念和特点、会计核算基本原则、会计要素和财务会计报告构成(二)把握民间非营利组织特定业务的核算(三)熟识民间非营利组织的概念和特征。

《中级会计实务》课程标准一、教学对象:《中级会计实务》适用于会计与统计核算专业学生,也包括二年制和三年制的高中生及三校生。

二、建议课时及学分建议课时:96学时学分:6.5学分三、先修和后续课程先修课程:《会计基础》《初级会计实务》后续课程:《中级会计实务》四、课程性质本课程是基于会计实务岗位的课程,是会计与统计核算专业的核心课程。

本课程在专业人才培养过程中意义重大,具有综合性、法律性、实用性等特点,与会计、税收等相关课程联系紧密。

通过本课程的理论学习和配套实训,学生具备企业会计岗位应有的能力;通过加强学生手工实训和模拟操作,达到理论与实践相统一,使得会计各环节所需技能能够融会贯通。

五、教学目标项目一:总论阐述会计学科的重要性,历史发展变化及在企业中的作用。

除此之外,介绍会计的基本假设、信息质量要求以及会计人员的职业操守与道德水平。

本课程应按照企业会计业务流程岗位的分配进行讲解与实训。

项目二:出纳岗位会计货币资金的概念、货币资金的内容(库存现金、银行存款、其他货币资金)、货币资金的内部控制及具体结算业务。

能填写现金存款单;能规范登记日记账;能规范填写支票、银行汇票委托书等各种单据;能编制银行存款余额调节表;能进行货币资金相关业务的账务处理并填制相关凭证。

项目三:往来款项核算业务能够制定有关往来款项清算手续制度;办理往来款项结算业务;负责往来结算的明细核算业务;应收账款减值的处理。

重点掌握应付账款、应付职工薪酬、应交税费、银行借款、应付债券的核算。

能规范填写商业汇票;能登记应收应付票据备查簿;能办理商业汇票背书、贴现的手续;能准确计算商业折扣、现金折扣金额;能准确计算当期应计提的坏账准备;能编制坏账损失表;能在购进材料时,如果存在商业折扣或现金折扣,确定应付账款、应付票据的入账价值;对于带息票据,能准确计算期末应计提的利息。

能根据职工薪酬的用途,判断计入不同的成本、费用账户;能编制“职工工资结算表”、“职工工资费用分配汇总表”,并据以填制相关记账凭证。

《中级会计实务》教学大纲一、课程基本情况课程编号:30331245课程名称:中级会计实务课程类别:专业选修课学时/学分:68学时/4学分先修课程:基础会计、基础会计实训、财务会计、财务会计实训等适用专业:会计电算化专业开课系或教研室:数理系会计电算化教研室二、课程教学目标1、任务和地位:本课程是高职高专经济类各会计专业的一门专业选修课程,是构成本学科、本层次学生会计知识结构的主体部分。

通过本课程的学习,使学生了解财务会计中未涉及的特殊、复杂经济业务核算的基本理论和基本方法,培养学生特殊业务会计核算的能力。

2、知识目标:理解会计计量属性;掌握企业投资性房地产、金融资产、非货币性资产交换、债务重组、借款费用的核算,会计政策、会计估计变更和差错更正,资产负债表日后事项调整,合并会计报表编制等各类特殊经济业务的核算。

本课程的目标是培养学生实际特殊的、复杂经济业务会计工作的能力,同时,能运用所学的会计理论和实务进行客观经济业务的分析,创造性的解决工作中的实际问题,综合平衡和协调本岗位的各项工作,提供可靠的会计成果。

3、能力目标:具有分析企业特殊、复杂经济业务的能力,能判断经济业务的类型,并依据经济业务的性质予以会计处理。

本课程要求学生掌握现代会计理论在实际工作的运用方法;要求学生能够独立、熟练运用现代会计处理技术进行实际经济业务的会计处理,三、课程教学内容(一)教学内容第一章总论【学习目标】1、理解会计要素计量时可供选择的计量属性。

2、熟悉会计计量的各计量属性,为以后各章的学习奠定基础。

【教学重点和难点】1、重点:会计要素可供选择的计量属性的理解与选用。

2、难点:货币的时间价值在中级会计实务中的运用。

第二章投资性房地产【学习目标】1、了解投资性房地产的范围。

2、熟悉投资性房地产的计量模式。

3、掌握投资性房地产的成本计量模式会计处理。

4、掌握投资性房地产的转换与处置的会计处理。

5、掌握用成本计量模式对投资性房地产进行会计处理。

中级会计实务教材目录第一章总论1.1 会计的基本概念与职能1.2 会计基本假设和会计信息质量要求1.3 会计要素及其确认与计量1.4 会计科目与账户1.5 会计凭证与账簿1.6 财务报告第二章存货2.1 存货的概念与分类2.2 存货的初始计量2.3 存货的后续计量2.4 存货的期末计量与账务处理2.5 存货的清查与盘点第三章固定资产3.1 固定资产的概念与分类3.2 固定资产的初始计量3.3 固定资产的折旧3.4 固定资产的后续支出3.5 固定资产的处置与期末计量第四章无形资产4.1 无形资产的概念与分类4.2 无形资产的初始计量4.3 无形资产的后续计量4.4 无形资产的处置与期末计量第五章投资性房地产5.1 投资性房地产的概念与分类5.2 投资性房地产的初始计量5.3 投资性房地产的后续计量5.4 投资性房地产的转换与处置第六章长期股权投资6.1 长期股权投资的概念与分类6.2 长期股权投资的初始计量6.3 长期股权投资的后续计量(成本法与权益法)6.4 长期股权投资的处置与期末计量第七章资产减值7.1 资产减值的概念与原因7.2 资产可回收金额的计量7.3 资产减值损失的确认与计量7.4 资产减值准备的计提与转回第八章金融资产8.1 金融资产的概念与分类8.2 金融资产的初始计量8.3 金融资产的后续计量8.4 金融资产的处置与期末计量第九章职工薪酬9.1 职工薪酬的概念与分类9.2 职工薪酬的计量与账务处理9.3 社会保险与住房公积金的处理9.4 福利与非货币性福利的处理第十章借款费用10.1 借款费用的概念与范围10.2 借款费用的确认与计量10.3 借款费用资本化的条件10.4 借款费用的会计处理以上即为中级会计实务教材的目录内容。

本书旨在帮助读者全面理解和掌握中级会计实务的基本理论和方法,通过实际操作和案例分析,提高会计实务的处理能力。

《中级会计学》教学大纲一、基本信息二、教学目标及任务《中级会计学》是会计学专业的核心专业课程,通过本课程的教学,学生应当能够全面系统地掌握工业企业会计要素确认、计量、记录与报告的基本理论、基本方法和基本技能。

具体而言,应当使学生掌握、熟悉与了解以下财务会计的基本理论、基本方法与基本技能。

(一)对基本理论与基本方法的要求1.掌握会计核算的基本假设、会计要素的基本特征和会计信息质量特征2.掌握银行存款余额调节表的编制方法3.掌握资产减值的理论基础和减值测试方法4.掌握实际利率法5.掌握财务报表编报的基础6.熟悉美国FASB和IASB的概念框架7.熟悉非货币性资产交换的判断8.了解财务会计涵义与特征9.了解附注编制的基本方法(二)对基本技能的要求1.掌握货币资金的收支核算2.掌握金融资产的会计核算3.掌握存货、长期股权投资、固定资产和无形资产的会计核算4.掌握非货币性资产交换的会计核算5.掌握流动负债和长期负债的会计核算6.掌握所有者权益的会计核算7.掌握经营成果形成的会计核算8.掌握财务会计报告的编制方法三、学时分配本课程教学内容共计13章,64学时,其中教师讲授53学时,11学时为单项手工实验,学时在各章的分配情况如下表所示。

教学课时分配四、教学内容及教学要求第一章总论本章教学目的通过本章的教学,学生应当:(1)了解企业财务会计涵义与特征;(2)熟悉美国FASB和IASB的财务会计概念框架以及我国《企业会计准则——基本准则》的主要内容;(3)掌握企业财务会计的基本假设、会计要素的基本特征和会计计量属性,以及会计信息质量要求。

本章重点、难点本章教学的重点在于对资产、负债、所有者权益、收入、费用和利润六大会计要素概念与特征的理解;难点在于对会计信息质量特征的应用,教学时可以结合后面章节的内容,通过具体经济业务的会计处理来加深理解和掌握。

本章主要内容第一节财务会计的涵义与特征1.财务会计的概念与内涵2.财务会计的基本特征第二节财务会计概念框架1.财务会计概念框架的总体结构2.财务会计的环境和目标3.财务会计的基本假设4.财务会计的要素5.财务会计的系统结构第三节财务会计信息及质量特征1.财务会计信息的内容和形式2.财务会计信息的使用者3.财务会计信息的提供者4.财务会计信息的质量特征本章思考题1.什么是财务会计?其本质是什么?2.财务会计的基本特征有哪些?3.什么是财务会计概念框架?其作用是什么?4.美国的财务会计概念框架有什么特点?5.什么是财务会计的目标?我国财务会计的目标是什么?6.什么是财务会计的基本假设?有哪几项基本假设?7.简述资产的涵义、特征和主要分类。

一、概述2023年中级会计实务教材大纲的制定是贯彻国家教育政策,适应社会经济发展需要的重要举措。

本次大纲的制定严格遵循教育部相关规定,立足于培养高素质会计人才,促进中级会计实务教学的深入发展。

本文将就2023年中级会计实务教材大纲的主要内容进行阐述。

二、教材编写要求1. 强调理论与实践相结合中级会计实务教材要求注重理论通联实际,引导学生理论通联实际,增强学生的实际操作能力。

教材内容要贴近会计实务工作,突出实用性和操作性。

2. 强调国际化随着我国经济的全球化发展,中级会计实务教材要求增加国际化内容,强调国际会计准则和国际财务报告准则,提升学生的国际化视野和竞争力。

3. 强调适应性中级会计实务教材大纲要求教材内容要适应不同行业、不同企业规模和不同地区的需求,实现个性化教学,满足不同学生的学习需求。

三、教材大纲主要内容1. 教学目标本次中级会计实务教材大纲的教学目标是培养学生掌握中级会计实务理论与技能,具备较强的会计实务操作能力和创新精神,能够适应现代企业会计实务工作的要求。

2. 教学内容(1)会计基础知识:包括会计概论、会计准则、会计职业道德等;(2)会计信息系统:包括会计核算、内部控制、财务管理等;(3)财务会计:包括资产、负债、所有者权益、成本与费用、利润分配等;(4)管理会计:包括成本核算、预算管理、业绩评价等;(5)财务管理:包括资金管理、投资决策、融资决策等;(6)风险管理与内部控制:包括企业风险管理、内部控制原则等;(7)注重国际化教学内容,包括国际财务报告、国际会计准则等。

3. 教学方法注重理论与实践相结合的教学方法,采用案例教学、实践操作和模拟实验的教学方式,培养学生的实际操作能力和团队协作精神。

四、教材编写标准1. 教材内容科学教材内容要求科学、准确、贴近现实,符合国家政策法规和会计职业的规范要求。

2. 教材体例规范教材要求体例规范,文字简练明了,结构清晰,便于学生理解和复习。

3. 教材语言规范教材要求语言规范、通俗易懂,符合学生的认知水平,有效提高学生学习效果。

2023中级会计课程大纲一、课程概述中级会计课程旨在培养学生掌握会计理论和实务知识,提升其会计专业能力和实践能力。

本课程大纲旨在规范教学内容和教学方式,确保学生能够系统地学习和应用中级会计知识。

二、课程目标1. 掌握中级会计的基本理论和原则;2. 熟悉会计准则和法规,了解其应用;3. 学习财务报表的编制和分析方法;4. 掌握成本会计和管理会计的基本概念和方法;5. 培养会计信息系统应用能力。

三、课程内容与学时安排1. 会计理论基础(20学时)1.1 会计的发展和演变1.2 会计基本假设和原则1.3 会计同一性原则与会计伦理1.4 会计信息的定性与定量特征2. 会计准则与法规(30学时)2.1 企业会计准则体系2.2 会计政策和会计估计2.3 企业会计报告制度2.4 会计信息披露与财务分析3. 财务报表编制与分析(40学时)3.1 资产负债表和利润表的编制3.2 经营性资产和非经营性资产的识别和计量 3.3 财务报表分析的基本方法和工具3.4 财务报表的报告和解读4. 成本会计(30学时)4.1 成本会计的基本概念和分类4.2 成本的计算和分配方法4.3 生产成本核算和作业成本法4.4 辅助成本核算和管理决策5. 管理会计(30学时)5.1 管理会计的基本概念和任务5.2 预算管理与控制5.3 经营决策与绩效评估5.4 现代成本管理方法与效益分析6. 会计信息系统应用(20学时)6.1 会计信息系统的基本框架和流程6.2 会计软件的应用与操作6.3 信息系统的安全与风险管理6.4 数据质量控制和信息披露四、教学方法本课程采用多种教学方式:1. 理论课讲授:教师讲解中级会计的基本概念、理论和应用;2. 实践操作:针对财务报表编制、成本计算和信息系统应用等内容,进行实际案例演练;3. 小组讨论:鼓励学生参与课堂讨论,分享经验和理解,提高学习效果;4. 课堂练习:安排课外练习题,巩固学生对知识点的掌握程度;5. 实习实训:组织学生进行实习实训活动,加深对实务操作的理解。