财务会计英语 练习及答案ch03

- 格式:doc

- 大小:308.00 KB

- 文档页数:26

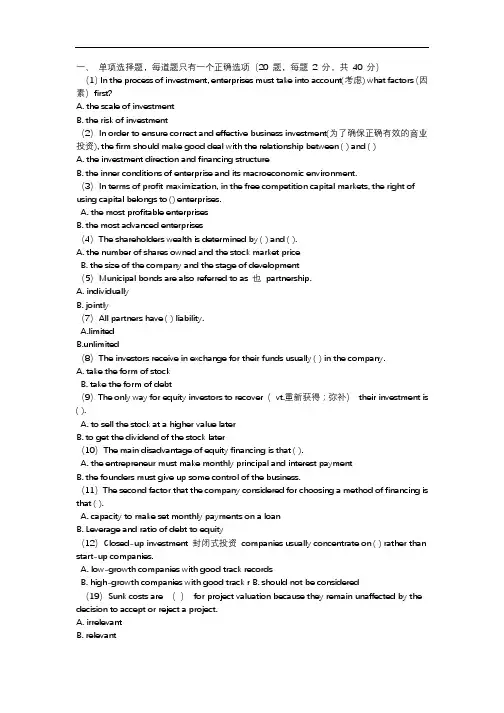

一、单项选择题,每道题只有一个正确选项(20 题,每题2 分,共40 分)(1)In the process of investment, enterprises must take into account(考虑) what factors(因素)first?A. the scale of investmentB. the risk of investment(2)In order to ensure correct and effective business investment(为了确保正确有效的商业投资), the firm should make good deal with the relationship between ( ) and ( )A. the investment direction and financing structureB. the inner conditions of enterprise and its macroeconomic environment.(3)In terms of profit maximization, in the free competition capital markets, the right of using capital belongs to () enterprises.A. the most profitable enterprisesB. the most advanced enterprises(4)The shareholders wealth is determined by ( ) and ( ).A. the number of shares owned and the stock market priceB. the size of the company and the stage of development(5)Municipal bonds are also referred to as 也partnership.A. individuallyB. jointly(7)All partners have ( ) liability.A.limitedB.unlimited(8)The investors receive in exchange for their funds usually ( ) in the company.A. take the form of stockB. take the form of debt(9)The only way for equity investors to recover(vt.重新获得;弥补)their investment is ( ).A. to sell the stock at a higher value laterB. to get the dividend of the stock later(10)The main disadvantage of equity financing is that ( ).A. the entrepreneur must make monthly principal and interest paymentB. the founders must give up some control of the business.(11)The second factor that the company considered for choosing a method of financing is that ( ).A. capacity to make set monthly payments on a loanB. Leverage and ratio of debt to equity(12)Closed-up investment 封闭式投资companies usually concentrate on ( ) rather than start-up companies.A. low-growth companies with good track recordsB. high-growth companies with good track r B. should not be considered(19)Sunk costs are ()for project valuation because they remain unaffected by the decision to accept or reject a project.A. irrelevantB. relevant(20)”The ability to meet credit obligations from existing assets if necessary.” This statement is to describe which “C” within The Five C’s of Credit ?A. CapitalB. Capacity二、单词翻译,英译中(20 题,每题1 分,共20 分)(1)Hedging risk(2)Sunk Cost(3)Securities and Exchange Commission(4)ESOP(5)Initial Public Offerings(6)NPV(7)PP(8)IRR(9)Acid test(10)The current ratio(11)Liquidity(12)Credit-worthy customer(13)Legal filings(14)JIT System(15)EOQ Model(16)Solvency(17)ROCE(18)Inventory Turnover Period(19)ROE(20)Dividend Yield三、判断题,请用T 或F 作答(15 题,每题1 分,共15 分)(1)在Equity Financing 中,“ Equity Investors ”需要每月偿还贷款。

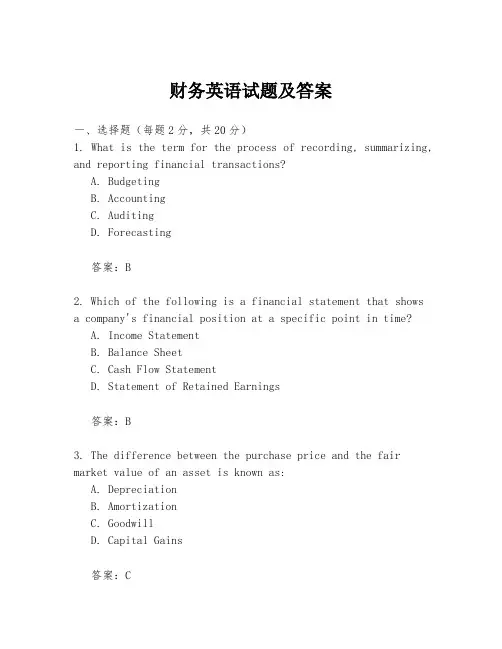

财务英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording, summarizing, and reporting financial transactions?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is a financial statement that showsa company's financial position at a specific point in time?A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Retained Earnings答案:B3. The difference between the purchase price and the fair market value of an asset is known as:A. DepreciationB. AmortizationC. GoodwillD. Capital Gains答案:C4. What is the term for the systematic allocation of the cost of a tangible asset over its useful life?A. DepreciationB. AmortizationC. AccrualD. Provision答案:A5. Which of the following is not a type of revenue recognition?A. Cash basisB. Accrual basisC. Installment methodD. All of the above答案:D6. The process of estimating the cost of completing a project is known as:A. BudgetingB. Cost estimationC. Project managementD. Cost accounting答案:B7. Which of the following is a non-current liability?A. Accounts payableB. Wages payableC. Long-term debtD. Income tax payable答案:C8. The term used to describe the process of adjusting the accounts at the end of an accounting period is:A. Closing the booksB. JournalizingC. PostingD. Adjusting entries答案:D9. What is the term for the financial statement that shows the changes in equity of a company over a period of time?A. Balance SheetB. Income StatementC. Statement of Changes in EquityD. Cash Flow Statement答案:C10. The process of verifying the accuracy of financial records is known as:A. BudgetingB. AuditingC. ForecastingD. Valuation答案:B二、填空题(每空1分,共10分)1. The __________ is the process of determining the value of an asset or liability.答案:valuation2. A __________ is a type of financial instrument that represents a creditor's claim on a company's assets.答案:bond3. The __________ is the difference between the cost of an asset and its depreciation.答案:book value4. __________ is the process of converting non-cash items into cash equivalents.答案:Liquidation5. A __________ is a financial statement that provides information about a company's cash inflows and outflows during a specific period.答案:Cash Flow Statement6. The __________ is the process of estimating the useful life of an asset.答案:depreciation schedule7. __________ is the practice of recording revenues and expenses when they are earned or incurred, not when cash is received or paid.答案:Accrual accounting8. __________ is the process of recording transactions in the order they are received.答案:Journalizing9. __________ is the practice of matching expenses with the revenues they helped to generate.答案:Matching principle10. A __________ is a document that provides evidence of a transaction.答案:voucher三、简答题(每题5分,共20分)1. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity.2. Explain the concept of "double-entry bookkeeping."答案:Double-entry bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to another account, ensuring that the total of debits equals the total of credits.3. What is the purpose of an income statement?答案:The purpose of an income statement is to summarize a company's revenues, expenses, and profits or losses over a specific period of time.4. Describe the role of a financial controller in anorganization.答案:A financial controller is responsible for overseeing the financial operations of an organization, including budgeting, financial reporting, and ensuring compliance with financial regulations and policies.四、论述题(每题15分,共30分)1. Discuss the importance of financial planning in business management.答案:Financial planning is crucial in business management as it helps in setting financial goals。

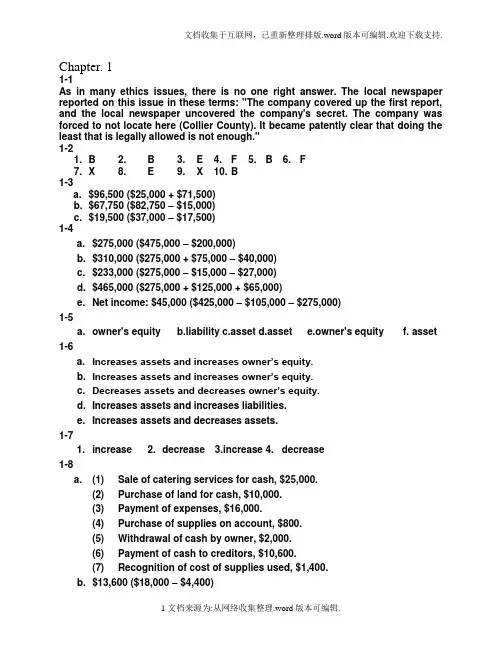

Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000)1-5a. owner's equityb.liabilityc.assetd.assete.owner's equityf. asset 1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4. decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ............................. $297,200 Net income for the month ........................................... $73,000Less withdrawals ........................................................ 12,000Increase in owner’s equity ......................................... 61,000Leo Perkins, capital, April 30, 2006 ........................... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................................................. $232,120 Operating expenses:Wages expense ........................................................ $100,100Rent expense ........................................................... 35,000Supplies expense .................................................... 4,550Miscellaneous expense ........................................... 3,150Total operating expenses ................................... 142,800 Net income ................................................................... $ 89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. T he ratio of liabilities to stockholders’ equity increased from 2002 to 2003,indicating an increase in risk for creditors. However, the assets of The Home Depot are more than sufficient to satisfy creditor claims. Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15 Equipment2. Liabilities21 Accounts Payable22 Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41 Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction Type Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash ...................................................................... 40,000Ira Janke, Capital ............................................ 40,000(2) Supplies ............................................................... 1,800Cash ................................................................ 1,800(3) Equipment ............................................................ 24,000Accounts Payable .......................................... 15,000Cash ................................................................ 9,000(4) Operating Expenses ............................................ 3,050Cash ................................................................ 3,050(5) Accounts Receivable .......................................... 12,000Service Revenue ............................................ 12,000(6) Accounts Payable ................................................ 7,500Cash ................................................................ 7,500(7) Cash ...................................................................... 9,500Accounts Receivable ..................................... 9,500(8) Ira Janke, Drawing ............................................... 5,000Cash ................................................................ 5,000(9) Operating Expenses ............................................ 1,050Supplies .......................................................... 1,050 2-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 – $4,000 – $8,000). Such anega tive balance means that the liabilities of Seth’s busine ssexceed the assets.b. Yes. The balance sheet prepared at December 31 will balance, withSeth Fite, Capital, being reported in the owner’s equity section as anegative $1,500.2-9a. The increase of $28,750 in the cash account does not indicateearnings of that amount. Earnings will represent the net change inall assets and liabilities from operating transactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug. 1 Rent Expense ....................................................... 1,500Cash ................................................................ 1,5002 Advertising Expense (700)Cash (700)4 Supplies ............................................................... 1,050Cash ................................................................ 1,0506 Office Equipment ................................................. 7,500Accounts Payable .......................................... 7,5008 Cash ...................................................................... 3,600Accounts Receivable ..................................... 3,60012 Accounts Payable ................................................ 1,150Cash ................................................................ 1,15020 Gayle McCall, Drawing ........................................ 1,000Cash ................................................................ 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .......................................... 10,150Fees Earned .................................................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct. 27 Supplies .................................................. 15 1,320Accounts Payable .............................. 21 1,320 Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr. Dr. Cr. 2006Oct. 1 Balance ................................. ✓ ........... ........... 585 ...........27 ............................................... 43 1,320 ........... 1,905 ........... Accounts Payable 21 2006Oct. 1 Balance ................................. ✓ ........... ........... ........... 6,15027 ............................................... 43 ........... 1,320 ........... 7,4702-13Inequality of trial balance totals would be caused by errors described in(b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ................................................................... 13,375Accounts Receivable ......................................................... 24,600Prepaid Insurance .............................................................. 8,000Equipment .......................................................................... 75,000Accounts Payable .............................................................. 11,180 Unearned Rent ................................................................... 4,250 Erin Capelli, Capital ........................................................... 82,420 Erin Capelli, Drawing ......................................................... 10,000Service Revenue ................................................................ 83,750 Wages Expense .................................................................. 42,000Advertising Expense ......................................................... 7,200 Miscellaneous Expense ..................................................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ........................................ 15,000Wages Expense .............................................. 15,000b. Prepaid Rent ........................................................ 4,500Cash ................................................................ 4,500 2-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales .................................................. $ 37,028 $ 35,925 $ 1,103 3.1%2. Cost of sales ..................................... (29,658) (28,111) 1,547 5.5%3. Selling, general, and admin.expenses ........................................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes ...................................... $ (45) $ 1,300 $(1,345) (103.5%) b. The horizontal analysis of Kmart Corporation reveals deterioratingoperating results from 1999 to 2000. While sales increased by $1,103million, a 3.1% increase, cost of sales increased by $1,547 million, a5.5% increase. Selling, general, and administrative expenses alsoincreased by $901 million, a 13.8% increase. The end result was thatoperating income decreased by $1,345 million, over a 100%decrease, and created a $45 million loss in 2000. Little over a yearlater, Kmart filed for bankruptcy protection. It has now emerged frombankruptcy, hoping to return to profitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated. Net income willbe overstated.b. Prepaid insurance (or assets) will be overstated. Owner’s equity willbe overstated.3-5a.Insurance Expense ............................................................ 1,215Prepaid Insurance ............................................... 1,215 b.Insurance Expense ............................................................ 1,215Prepaid Insurance ............................................... 1,215 3-6Unearned Fees ...................................................................... 9,570Fees Earned ......................................................... 9,570 3-7a.Salary Expense .................................................................. 9,360Salaries Payable .................................................. 9,360 b.Salary Expense .................................................................. 12,480Salaries Payable .................................................. 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over- Under-stated stated stated stated1. Revenue for the year would be ............... $ 0 $6,900 $ 0 $ 02. Expenses for the year would be ............. 0 0 0 3,7403. Net income for the year would be .......... 0 6,900 3,740 04. Assets at December 31 would be ........... 0 0 0 05. Liabilities at December 31 would be ...... 6,900 0 0 3,7406. Owner’s equity at December 31would be ................................................... 0 6,900 3,740 0 3-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable ......................................................... 11,500Fees Earned ......................................................... 11,500 b. No. If the cash basis of accounting is used, revenues are recognizedonly when the cash is received. Therefore, earned but unbilledrevenues would not be recognized in the accounts, and no adjustingentry would be necessary.3-13a. Fees earned (or revenues) will be understated. Net income will beunderstated.b. Accounts (fees) receivable (or assets) will be understated. Owner’sequity will be understated.3-14Depreciation Expense .......................................................... 5,200Accumulated Depreciation ................................. 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of the equipment to theperiods benefiting from its use. It does not necessarily relate to valueor loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not a valuation method.That is, depreciation allocates the cost of a fixed asset over its usefullife. Depreciation does not attempt to measure market values, whichmay vary significantly from year to year.3-17a.Depreciation Expense ....................................................... 7,500Accumulated Depreciation ................................. 7,500 b. (1) Depreciation expense would be understated. Net income wouldbe overstated.(2) Accumulated depreciation would be understated, and total assetswould be overstated. Owner’s equity would be ove rstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment (5)5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $ 2,844,000 8.0b. Gateway Inc.Amount Percent Net sales $ 4,171,325 100.0Cost of goods sold (3,605,120) 86.4Operating expenses (1,077,447) 25.8Operating income (loss) $ (511,242) (12.2)c. Dell is more profitable than Gateway. Specifically, Dell’s cost ofg oods sold of 82.1% is significantly less (4.3%) than Gateway’s costof goods sold of 86.4%. In addition, Gateway’s operating expensesare over one-fourth of sales, while Dell’s operating expenses are9.9% of sales. The result is that Dell generates an operating incomeof 8.0% of sales, while Gateway generates a loss of 12.2% of sales.Obviously, Gateway must improve its operations if it is to remain inbusiness and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr.1Cash 8 8 1 2Accounts Receivable 50 (a) 7 57 2 3Supplies 8 (b) 5 3 3 4Prepaid Insurance 12 (c) 6 6 4 5Land 50 50 5 6Equipment 32 32 6 7Accum. Depr.—Equip. 2 (d) 5 7 7 8Accounts Payable 26 26 8 9Wages Payable 0 (e) 1 1 9 10Terry Dagley, Capital 112 112 10 11Terry Dagley, Drawing 8 8 11 12Fees Earned 60 (a) 7 67 12 13Wages Expense 16 (e) 1 17 13 14Rent Expense 8 8 1415Insurance Expense 0 (c) 6 6 15 16Utilities Expense 6 6 16 17Depreciation Expense 0 (d) 5 5 17 18Supplies Expense 0 (b) 5 5 18 19Miscellaneous Expense 2 2 19 20Totals 200 200 24 24 213 213 20 ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1Cash 8 8 1 2Accounts Receivable 57 57 2 3Supplies 3 3 3 4Prepaid Insurance 6 6 4 5Land 50 50 5 6Equipment 32 32 6 7Accum. Depr.—Equip. 7 7 7 8Accounts Payable 26 26 8 9Wages Payable 1 1 9 10Terry Dagley, Capital 112 112 10 11Terry Dagley, Drawing 8 8 11 12Fees Earned 67 67 12 13Wages Expense 17 17 13 14Rent Expense 8 8 14 15Insurance Expense 6 6 15 16Utilities Expense 6 6 16 17Depreciation Expense 5 5 17 18Supplies Expense 5 5 18 19Miscellaneous Expense 2 2 19 20Totals 213 213 49 67 164 146 20 21Net income (loss) 18 1821 2267 67 164 164 22 4-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned ........................................................................ $67Expenses:Wages expense ........................................................... $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ........................................................49Net income ......................................................................... $18ITHACA SERVICES CO.Statemen t of Owner’s EquityFor the Year Ended January 31, 2006Terry Dagley, capital, February 1, 2005 ............................ $112Net income for the year ..................................................... $18Less withdrawals (8)Increase in owner’s equity................................................10Terry Dagley, capital, January 31, 2006 ........................... $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities:Cash ............................. $ 8 Accounts payable ....... $26Accounts receivable ... 57 Wages payable (1)Supplies ....................... 3 Total liabilities ......... $ 27 Prepaid insurance . (6)Total current assets . $ 74Property, plant, and Owner’s E quity equipment: Terry Dagley, capital (122)Land ............................. $50Equipment ................... $32Less accum. depr........ 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ..................... $149 owner’s equity.......... $149 4-72006Jan. 31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment (5)31 Wages Expense (1)Wages Payable (1)4-82006Jan. 31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue .................................................................$103,850Operating expenses:Wages expense ........................................................... $56,800Rent expense .............................................................. 21,270Utilities expense ......................................................... 11,500Depreciation expense ................................................. 8,000Insurance expense ..................................................... 4,100Supplies expense ....................................................... 3,100Miscellaneous expense .............................................. 2,250Total operating expenses ............................ 107,020Net loss .............................................................................. $ (3,170)4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006Suzanne Jacob, capital, November 1, 2005 ..................... $173,750Net income for year ........................................................... $44,250Less withdrawals ............................................................... 12,000Increase in owner’s equity................................................32,250Suzanne Jacob, capital, October 31, 2006 ....................... $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000 ($13,750 ×12 months) would be reported as a current liability on the balance sheet. The remainder of $335,000 ($500,000 – $165,000) would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006Assets LiabilitiesCurrent assets Current liabilities:Cash $31,500 Accounts payable $9,500Accounts receivable ....................... 21,850 Salaries payable1,750Supplies................................................. 1,800 Unearned fees1,200Prepaid insurance ................................ 7,200 Total liabilities$12,450Prepaid rent ........................................... 4,800Total current assets $67,150 Owner’s EquityProperty, plant, and equipment: Vernon Posey, capital 114,200 Equipment ......................................... $80,600Less accumulated depreciation 21,100 59,500 Total liabilities andTotal assets $126,650 owner’s equity $126,6504-14Accounts Receivable ............................................................ 4,100Fees Earned .................................................... 4,100 Supplies Expense ................................................ 1,300Supplies .......................................................... 1,300 Insurance Expense .............................................. 2,000Prepaid Insurance .......................................... 2,000 Depreciation Expense ......................................... 2,800Accumulated Depreciation—Equipment ...... 2,800Wages Expense ................................................... 1,000Wages Payable ............................................... 1,000 Unearned Rent ..................................................... 2,500Rent Revenue ................................................. 2,500 4-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detecting and correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ............................................................... 167,550Sue Alewine, Capital ........................................... 167,550 Sue Alewine, Capital ............................................................. 25,000Sue Alewine, Drawing ......................................... 25,000 b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034) ($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December 31, 2002 and2001. In addition, the current ratio is below one at the end of bothyears. While the working capital and current ratios have improvedfrom 2001 to 2002, creditors would likely be concerned about theability of 7 Eleven to meet its short-term credit obligations. Thisconcern would warrant further investigation to determine whetherthis is a temporary issue (for example, an end-of-the-periodphenomenon) and the company’s plans to address its workingcapital shortcomings.4-20a. (1) Sales Salaries Expense ............................................. 6,480Salaries Payable ................................................... 6,480(2) Accounts Receivable ................................................. 10,250Fees Earned .......................................................... 10,250 b. (1) Salaries Payable ......................................................... 6,480Sales Salaries Expense ........................................ 6,480(2) Fees Earned ................................................................ 10,250Accounts Receivable ............................................ 10,250 4-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) Wages Expense .......................................................... 45,000Cash ....................................................................... 45,000(2) Wages Expense .......................................................... 18,000Wages Payable ...................................................... 18,000(3) Income Summary ....................................................... 1,120,800Wages Expense .................................................... 1,120,800(4) Wages Payable ........................................................... 18,000Wages Expense .................................................... 18,000(5) Wages Expense .......................................................... 43,000Cash ....................................................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number of credit salessupported by promissory notes, a notes receivable ledger should bemaintained. Failure to maintain a subsidiary ledger when there are asignificant number of notes receivable transactions violates theinternal control procedure that mandates proofs and security.Maintaining a notes receivable ledger will allow Fridley to operatemore efficiently and will increase the chance that Fridley will detectaccounting errors related to the notes receivable. (The total of theaccounts in the notes receivable ledger must match the balance ofnotes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation of duties isviolated. The accounts receivable clerk is responsible for too many。

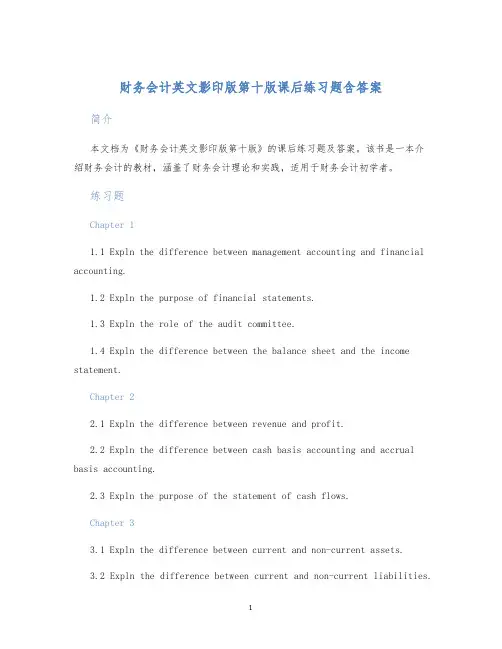

财务会计英文影印版第十版课后练习题含答案简介本文档为《财务会计英文影印版第十版》的课后练习题及答案。

该书是一本介绍财务会计的教材,涵盖了财务会计理论和实践,适用于财务会计初学者。

练习题Chapter 11.1 Expln the difference between management accounting and financial accounting.1.2 Expln the purpose of financial statements.1.3 Expln the role of the audit committee.1.4 Expln the difference between the balance sheet and the income statement.Chapter 22.1 Expln the difference between revenue and profit.2.2 Expln the difference between cash basis accounting and accrual basis accounting.2.3 Expln the purpose of the statement of cash flows.Chapter 33.1 Expln the difference between current and non-current assets.3.2 Expln the difference between current and non-current liabilities.3.3 Expln the difference between financing activities and investing activities.Chapter 44.1 Expln the purpose of the double-entry accounting system.4.2 Expln the difference between debits and credits.4.3 Expln the purpose of the trial balance.Chapter 55.1 Expln the difference between the cost of goods sold and operating expenses.5.2 Expln the purpose of the income statement.5.3 Expln the difference between gross profit and net profit.答案Chapter 11.1 Management accounting is concerned with providing information for internal decision-making, while financial accounting is concerned with providing information to external users.1.2 The purpose of financial statements is to provide information about an entity’s financial performance, financial position, and cash flows.1.3 The audit committee is responsible for overseeing the financial reporting process and ensuring the integrity of financial statements.1.4 The balance sheet shows an entity’s financial position at a specific point in time, while the income statement shows an entity’s financial performance over a period of time.Chapter 22.1 Revenue represents the amounts earned from the sale of goods or services, while profit represents the difference between revenue and expenses.2.2 Cash basis accounting recognizes revenue and expenses when cash is received or pd, while accrual basis accounting recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or pd.2.3 The statement of cash flows is used to show the inflows and outflows of cash from operating, investing, and financing activities.Chapter 33.1 Current assets are expected to be converted to cash within one year, while non-current assets are expected to be held for more than one year.3.2 Current liabilities are expected to be pd within one year, while non-current liabilities are expected to be pd after one year.3.3 Financing activities involve obtning funds from external sources and paying dividends to shareholders, while investing activities involve acquiring and disposing of property, plant, and equipment, and other long-term investments.Chapter 44.1 The double-entry accounting system ensures that everytransaction is recorded in two accounts, with equal debits and credits,in order to mntn the equality of debits and credits in the accounting equation.4.2 Debits are used to record increases in assets and expenses and decreases in liabilities and equity, while credits are used to record increases in liabilities and equity and decreases in assets and expenses.4.3 The trial balance is a list of all the accounts in the ledgerwith their balances, used to ensure that the total of the debits equals the total of the credits.Chapter 55.1 The cost of goods sold represents the cost of the goods or services sold by a company, while operating expenses represent the other costs of running a business.5.2 The income statement shows a company’s revenue, expenses, andnet income or loss for a period of time.5.3 Gross profit represents revenue minus the cost of goods sold, while net profit represents gross profit minus operating expenses.结论本文档为《财务会计英文影印版第十版》课后练习题及答案,涵盖了财务会计的基本理论和实践。

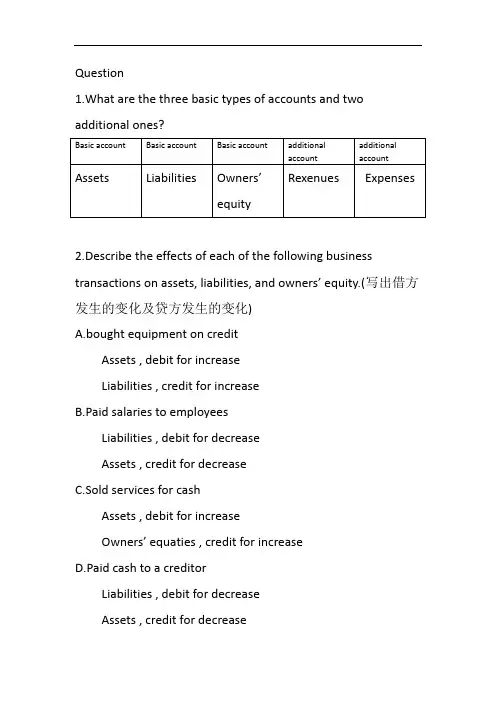

Question1.What are the three basic types of accounts and two additional ones?2.Describe the effects of each of the following business transactions on assets, liabilities, and owners’ equity.(写出借方发生的变化及贷方发生的变化)A.bought equipment on creditAssets , debit for increaseLiabilities , credit for increaseB.Paid salaries to employeesLiabilities , debit for decreaseAssets , credit for decreaseC.Sold services for cashAssets , debit for increaseOwners’ equaties , credit for increaseD.Paid cash to a creditorLiabilities , debit for decreaseAssets , credit for decreaseE.Paid cash for furnitureAssets , debit for increaseAssets , credit for decreaseF.Sold services on creditAssets , debit for increaseOwners’ equaties , credit for increase3.Describe the rules of debit and credit(只需填入debit/credit)Requirement: Complete each of the following statement by using the word debit and credit wherever appropriate.1.Assets accounts normally have debit balances. These accounts increase on the debit side and decrease on the credit side.2.Liabilities accounts normally have credit balances. These accounts increase on the credit side and decrease on the debit side.3.The owners’ capital account normally has credit balance. This account increase on the credit side and decrease on the debit side.。

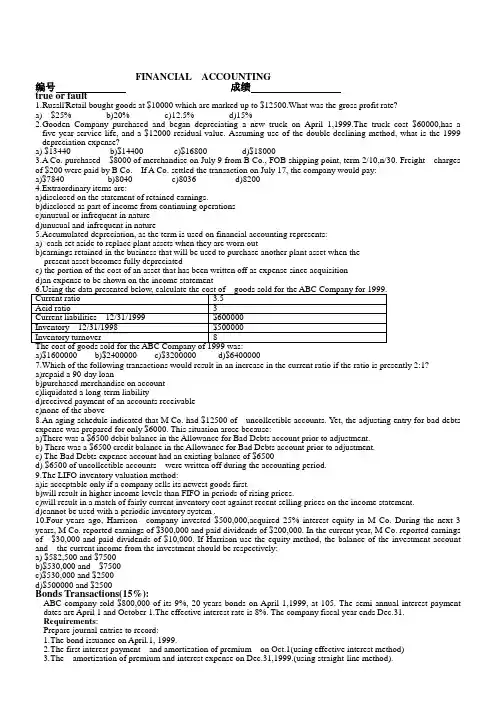

FINANCIAL ACCOUNTING编号成绩true or fault1.R ussll'Retail bought goods at $10000 which are marked up to $12500.What was the gross profit rate?a) $25% b)20% c)12.5% d)15%2.G ooden Company purchased and began depreciating a new truck on April 1,1999.The truck cost $60000,has a five-year service life, and a $12000 residual value. Assuming use of the double-declining method, what is the 1999 depreciation expense?a) $13440 b)$14400 c)$16800 d)$180003.A Co. purchased $8000 of merchandise on July 9 from B Co., FOB shipping point, term 2/10,n/30. Freight charges of $200 were paid by B Co. If A Co. settled the transaction on July 17, the company would pay:a)$7840 b)8040 c)8036 d)82004.Extraordinary items are:a)d isclosed on the statement of retained earnings.b)disclosed as part of income from continuing operationsc)unusual or infrequent in natured)unusual and infrequent in nature5.Accumulated depreciation, as the term is used on financial accounting represents:a)cash set aside to replace plant assets when they are worn outb)earnings retained in the business that will be used to purchase another plant asset when thepresent asset becomes fully depreciatedc) the portion of the cost of an asset that has been written off as expense since acquisitiond)an expense to be shown on the income statementing the data presented below, calculate the cost of goods sold for the ABC Company for 1999.Current ratio 3.5Acid ratio 3Current liabilities 12/31/1999 $600000Inventory 12/31/1998 $500000Inventory turnover 8The cost of goods sold for the ABC Company of 1999 was:a)$1600000 b)$2400000 c)$3200000 d)$64000007.Which of the following transactions would result in an increase in the current ratio if the ratio is presently 2:1?a)r epaid a 90-day loanb)purchased merchandise on accountc)liquidated a long-term liabilityd)received payment of an accounts receivablee)none of the above8.An aging schedule indicated that M Co. had $12500 of uncollectible accounts. Yet, the adjusting entry for bad debts expense was prepared for only $6000. This situation arose because:a)T here was a $6500 debit balance in the Allowance for Bad Debts account prior to adjustment.b) There was a $6500 credit balance in the Allowance for Bad Debts account prior to adjustment.c) The Bad Debts expense account had an existing balance of $6500d) $6500 of uncollectible accounts were written off during the accounting period.9.The LIFO inventory valuation method:a)i s acceptable only if a company sells its newest goods first.b)will result in higher income levels than FIFO in periods of rising prices.c)will result in a match of fairly current inventory cost against recent selling prices on the income statement.d)cannot be used with a periodic inventory system .10.Four years ago, Harrison company invested $500,000,acquired 25% interest equity in M Co. During the next 3 years, M Co. reported earnings of $300,000 and paid dividends of $200,000. In the current year, M Co. reported earnings of $30,000 and paid dividends of $10,000. If Harrison use the equity method, the balance of the investment account and the current income from the investment should be respectively:a) $582,500 and $7500b)$530,000 and $7500c)$530,000 and $2500d)$500000 and $2500Bonds Transactions(15%):ABC company sold $800,000 of its 9%, 20 years bonds on April 1,1999, at 105. The semi-annual interest payment dates are April 1 and October 1.The effective interest rate is 8%. The company fiscal year ends Dec.31. Requirements:Prepare journal entries to record:1.T he bond issuance on April.1, 1999.2.T he first interest payment and amortization of premium on Oct.1(using effective interest method)3.T he amortization of premium and interest expense on Dec.31,1999.(using straight-line method).XYZ Co. was formed on Jan.1999. The company is authorized to issue 100000 shares of $20 par-value common stock and 30000 shares of 6%, $10 par-value preferred stock. The following selected transactions occurred during the year(15%):1.I ssued 80000 shares of common stock at $35 per share.2.I ssued 14000 shares of preferred stock at $12 per share.3.R equired 5000 shares of treasury stock for $40 per share.4.S old 500 shares of treasury stock at $25 per share.5.D eclared cash dividend for $15000.Requirement:Make journal entries based on the information given above(compute the cash dividend for common stock and preferred stock respectively)Statement of cash flow(30%)Paper 1 Accounting ReportsInformation One:Colwell CorporationIncome StatementFor 2003Sales $ 3,000,000Cost of goods sold 1,200,000$ 1,800,000ExpensesSelling &administrative $ 1,455,000Building depreciation 25,000Equipment depreciation 70,000 $ 1,550,000$ 250,000Other revenue (expense)Interest expense $ (200,000)Loss on sale of equipment (5,000)Gains on sale of L-T investment 15,000 (190,000 )Income before income taxes $ 60,000Income taxes 20,000Net income $ 40,000Information Two:Statement of Retained earningFor 2003Retained earnings, 1/1/2003 $ 450,000Add: Net income 40,000$ 490,000Less: Cash dividends 15,000Retained earnings,12/31/2003 $ 475,000Information Three:Colwell CorporationComparative Balance SheetDec.31,2002 and 2003Assets 2003 2002Current assetsCash $ 100,000 $ 50,000Accounts receivable (net) 400,000 375,000Inventory 425,000 450,000Prepaid selling expenses 5,000 4,000Total current assets $ 930,000 $ 879,000Property, plant & equipmentLand $ 200,000 $ 115,000Building 1,450,000 1,250,000Accumulated depreciation: building (50,000) (25,000)Equipment 725,000 800,000Accumulated depreciation: equipment (250,000) (260,000)Total property, plant & equipment $2,075,000 $ 1,880,000Other assetsL--T investment $ 880,000 $ 1,000,000Total assets $ 3,885,000 $ 3,759,000Liabilities & Stockholders' EquityCurrent liabilitiesAccounts payable $ 470,000 $ 340,000Notes payable --- 300,000Income taxes payable 40,000 39,000Total current liabilities $ 510,000 $ 679,000L-T liabilitiesBonds payable $ 2,070,000 $ 2,000,000Stockholders' equityCommon stock, par value $ 1 $ 195,000 $ 130,000Paid-in capital in excess of par 635,000 500,000Retained earnings 475,000 450,000Total stockholders' equity $ 1,305,000 $ 1,080,000Total liabilities &stockholders' equity $ 3,885,000 $ 3,759,000Additional Information extracted from Colwell's accounting records:1.A parcel of land which cost $85,000 was purchased for cash on Oct.19.2.A building having a fair market value of $200,000 was acquired on the last day of the year inexchange for 65,000 shares of the company's $1 par-value common stock.3.Equipment of $100,000 was disposed of for cash on May 1.4.E quipment of $25,000 was purchased on Nov.1.5.T he notes payable relate to money borrowed from First Pacific Trust in late 1998.6.$120,000 of long-term investments was sold for $135,000, generated a gain of $15,000.7.B onds of $70,000 were issued at face value on Feb.14.Requirements:Prepare the Statement of Cash Flow in good form for Colwell Corporation under indirect approach.。

财务会计英语练习及答案ch个人收集整理勿做商业用途CHAPTER 16 STATEMENT OF CASH FLOWS个人收集整理勿做商业用途Chapter 16—Statement of Cash FlowsTRUE/FALSE1. The statement of cash flows is not one of the basic financial statements.ANS: F DIF: 1 OBJ: 012. Cash, as the term is used for the statement of cash flows, could indicate either cash or cashequivalents.ANS: T DIF: 1 OBJ: 013. The statement of cash flows is an optional financial statement.ANS: F DIF: 1 OBJ: 014. The statement of cash flows shows the effects on cash ofa company's operating, investing,and financing activities.ANS: T DIF: 1 OBJ: 015. The statement of cash flows reports a firm's major sources of cash receipts and major uses ofcash payments for a period.ANS: T DIF: 1 OBJ: 016. Cash flows from operating activities, as part of the statement of cash flows, include cashtransactions that enter into the determination of net income.ANS: T DIF: 1 OBJ: 017. To arrive at cash flows from operations, it is necessary toconvert the income statement froman accrual basis to the cash basis of accounting.ANS: T DIF: 2 OBJ: 018. Cash flows from investing activities, as part of the statement of cash flows, include receiptsfrom the sale of land.ANS: T DIF: 2 OBJ: 019. Cash flows from financing activities, as part of the statement of cash flows, include paymentsfor dividends.ANS: T DIF: 2 OBJ: 0110. Cash flows from investing activities, as part of the statement of cash flows, include paymentsfor the purchase of treasury stock.ANS: F DIF: 2 OBJ: 0111. Cash flows from investing activities, as part of the statement of cash flows, include receiptsfrom the issuance of bonds payable.ANS: F DIF: 2 OBJ: 0112. There are two alternatives to reporting cash flows from operating activities in the statement ofcash flows: (1) the direct method and (2) the indirect method.ANS: T DIF: 1 OBJ: 0113. The direct method of preparing the operating activities section of the statement of cash flowsreports major classes of gross cash receipts and gross cash payments.ANS: T DIF: 1 OBJ: 0114. Under the direct method of reporting cash flows from operations, the major source of cash iscash received from customers.ANS: T DIF: 1 OBJ: 0115. The main disadvantage of the direct method of reporting cash flows from operating activitiesis that the necessary data are often costly to accumulate.ANS: T DIF: 2 OBJ: 0116. A major disadvantage of the indirect method of reporting cash flows from operating activitiesis that the difference between the net amount of cash flows from operating activities and net income is not emphasized.ANS: F DIF: 2 OBJ: 01个人收集整理勿做商业用途17. Cash outflows from financing activities include the payment of cash dividends, theacquisition of treasury stock, and the repayment of amounts borrowed.ANS: T DIF: 2 OBJ: 0118. Cash flows from investing activities, as part of the statement of cash flows, include paymentsfor the acquisition of fixed assets.ANS: T DIF: 2 OBJ: 0119. The acquisition of land in exchange for common stock is an example of noncash investing andfinancing activity.ANS: T DIF: 2 OBJ: 0120. If a business issued bonds payable in exchange for land, the transaction would be reported in aseparate schedule on the statement of cash flows.ANS: T DIF: 2 OBJ: 0121. A cash flow per share amount should be reported on thestatement of cash flows.ANS: F DIF: 1 OBJ: 0122. Although there is no order in which the noncash balance sheet accounts must be analyzed indetermining data for preparing the statement of cash flows by the indirect method, time can be saved and greater accuracy can be achieved by selecting the accounts in the reverse order in which they appear on the balance sheet.ANS: T DIF: 1 OBJ: 0223. The 2002 edition of Accounting Trends and Techniques reported that 90% of the companiessurveyed used the indirect method to report changes in cash flows from operations.ANS: F DIF: 2 OBJ: 0224. Rarely would the cash flows from operating activities, as reported on the statement of cashflows, be the same as the net income reported on the income statement.ANS: T DIF: 2 OBJ: 0225. If land costing $75,000 was sold for $135,000, the amount reported in the investing activitiessection of the statement of cash flows would be $75,000.ANS: F DIF: 2 OBJ: 0226. If land costing $150,000 was sold for $205,000, the $55,000 gain on the sale would be addedto net income in converting the net income reported on the income statement to cash flows from operating activities for the statement of cash flows prepared by the indirect method.ANS: F DIF: 2 OBJ: 0227. In preparing the cash flows from operating activitiessection of the statement of cash flows bythe indirect method, the net decrease in inventories from the beginning to the end of the period is added to net income for the period.ANS: T DIF: 2 OBJ: 0228. In determining the cash flows from operating activities for the statement of cash flows by theindirect method, the depreciation expense for the period is added to the net income for the period.ANS: T DIF: 2 OBJ: 0229. In preparing the cash flows from operating activities section of the statement of cash flows bythe indirect method, the amortization of bond discount for the period is deducted from the net income for the period.ANS: F DIF: 2 OBJ: 02个人收集整理勿做商业用途30. If cash dividends of $145,000 were declared during the year and the decrease in dividendspayable from the beginning to the end of the year was $7,000, the statement of cash flows would report $152,000 in the financing activities section.ANS: T DIF: 2 OBJ: 0231. The declaration and issuance of a stock dividend would be reported on the statement of cashflows.ANS: F DIF: 2 OBJ: 0232. If 900 shares of $40 par common stock are sold for $48,000, the $48,000 would be reported inthe cash flows from financing activities section of the statement of cash flows.ANS: T DIF: 2 OBJ: 0233. If $500,000 of bonds payable are sold at 101, $500,000 would be reported in the cash flowsfrom financing activities section of the statement of cash flows.ANS: F DIF: 2 OBJ: 0234. Net income was $ 52,000 for the year. The accumulated depreciation balance increased by$17,000 over the year. There were no sales of fixed assets or changes in noncash current assets or liabilities. The cash flow from operations is $35,000ANS: F DIF: 2 OBJ: 0235. Net income for the year was $29,000. Accounts receivable increased $2,500, and accountspayable increased $5,100. The cash flow from operations is $31,600.ANS: T DIF: 2 OBJ: 0236. A building with a cost of $153,000 and accumulated depreciation of $42,000 was sold for an$11,000 gain. The cash generated from this investing activity was $121,000.ANS: F DIF: 2 OBJ: 0237. The indirect method reports cash received from customers in the cash flows from operatingactivities section of the statement of cash flows.ANS: F DIF: 2 OBJ: 0238. Cash paid to acquire treasury stock should be shown on the statement of cash flows frominvesting activities.ANS: F DIF: 2 OBJ: 0239. Repayments of bonds would be shown as a cash outflow in the investing section of thestatement of cash flows.ANS: F DIF: 2 OBJ: 0240. Acquiring equipment by issuing a six-month note should be shown on the statement of cashflows under the investing activities section.ANS: F DIF: 2 OBJ: 0241. In reporting cash flows from investing activities on the statement of cash flows, the cashinflows are usually reported first, followed by the cash outflows.ANS: T DIF: 1 OBJ: 0242.Cash inflows and outflows are not netted in any activity section of the statement of cash flows but are separately disclosed to give the reader full information.ANS: T DIF: 1 OBJ: 0243. The manner of reporting cash flows from investing and financing activities will be differentunder the direct method as compared to the indirect method.ANS: F DIF: 1 OBJ: 0344. Sales reported on the income statement were $375,000. The accounts receivable balancedeclined $6,500 over the year. The amount of cash received from customers was $368,500.个人收集整理勿做商业用途ANS: F DIF: 2 OBJ: 0345. To determine cash payments for merchandise for the cash flow statement using the directmethod, a decrease in accounts payable is added to the cost of merchandise sold.ANS: T DIF: 2 OBJ: 0346. To determine cash payments for operating expenses for the cash flow statement using thedirect method, a decrease in prepaid expenses is added to operating expenses other thandepreciation.ANS: F DIF: 2 OBJ: 0347. To determine cash payments for operating expenses for the cash flow statement using thedirect method, a decrease in accrued expenses is added to operating expenses other thandepreciation.ANS: T DIF: 2 OBJ: 0348. To determine cash payments for income tax for the cash flow statement using the directmethod, an increase in income taxes payable is added to the income tax expense.ANS: F DIF: 2 OBJ: 0349. Free cash flow is cash flow from operations, less cash used to purchase fixed assets tomaintain productive capacity and cash used for dividends.ANS: T DIF: 1 OBJ: 0450. Free cash flow is the measure of operating cash flow available for corporate purposes afterproviding sufficient fixed asset additions to maintain current productive capacity anddividends.ANS: T DIF: 1 OBJ: 04MULTIPLE CHOICE1. Which of the following is not one of the four basic financial statements?a. balance sheetb. statement of cash flowsc. statement of changes in financial positiond. income statementANS: C DIF: 1 OBJ: 012. Which of the following concepts of cash is not appropriate to use in preparing the statementof cash flows?a. cashb. cash and money market fundsc. cash and cash equivalentsd. cash and U.S. treasury bondsANS: D DIF: 2 OBJ: 013. The statement of cash flows reportsa. cash flows from operating activitiesb. total assetsc. total changes in stockholders' equityd. changes in retained earningsANS: A DIF: 1 OBJ: 014. On the statement of cash flows, the cash flows from operating activities section would includea. receipts from the issuance of capital stockb. receipts from the sale of investmentsc. payments for the acquisition of investments个人收集整理勿做商业用途d. cash receipts from sales activitiesANS: D DIF: 2 OBJ: 015. Preferred stock issued in exchange for land would be reported in the statement of cash flowsina. the cash flows from financing activities sectionb. the cash flows from investing activities sectionc. a separate scheduled. the cash flows from operating activities sectionANS: C DIF: 2 OBJ: 016. Cash paid to purchase long-term investments would be reported in the statement of cash flowsina. the cash flows from operating activities sectionb. the cash flows from financing activities sectionc. the cash flows from investing activities sectiond. a separate scheduleANS: C DIF: 2 OBJ: 017. A statement of cash flows would not disclose the effects of which of the followingtransactions?a. stock dividends declaredb. bonds payable exchanged for capital stockc. purchase of treasury stockd. capital stock issued to acquire fixed assetsANS: A DIF: 2 OBJ: 018. Which of the following does not represent an outflow of cash and therefore would not bereported on the statement of cash flows as a use of cash?a. purchase of noncurrent assetsb. purchase of treasury stockc. discarding an asset that had been fully depreciatedd. payment of cash dividendsANS: C DIF: 2 OBJ: 019. Which of the following represents an inflow of cash and therefore would be reported on thestatement of cash flows?a. appropriation of retained earningsb. acquisition of treasury stockc. declaration of stock dividendsd. issuance of long-term debtANS: D DIF: 2 OBJ: 0110. A ten-year bond was issued at par for $150,000 cash. This transaction should be shown on astatement of cash flows undera. investing activitiesb. financing activitiesc. noncash investing and financing activitiesd. operating activitiesANS: B DIF: 1 OBJ: 0111. Cash paid for preferred stock dividends should be shown on the statement of cash flows undera. investing activitiesb. financing activitiesc. noncash investing and financing activities个人收集整理勿做商业用途d. operating activitiesANS: B DIF: 2 OBJ: 0112. The last item on the statement of cash flows prior to the schedule of noncash investing andfinancing activities reportsa. the increase or decrease in cashb. cash at the end of the yearc. net cash flow from investing activitiesd. net cash flow from financing activitiesANS: B DIF: 2 OBJ: 0113. Which of the following is a noncash investing and financing activity?a. payment of a cash dividendb. payment of a six-month note payablec. purchase of merchandise inventory on accountd. issuance of common stock to acquire landANS: D DIF: 2 OBJ: 0114. Which of the following should be shown on a statement of cash flows under the financingactivity section?a. the purchase of a long-term investment in the common stock of another companyb. the payment of cash to retire a long-term notec. the proceeds from the sale of a buildingd. the issuance of a long-term note to acquire landANS: B DIF: 2 OBJ: 0115. A company purchases equipment for $29,000 cash. This transaction should be shown on thestatement of cash flows undera. investing activitiesb. financing activitiesc. noncash investing and financing activitiesd. operating activitiesANS: A DIF: 2 OBJ: 0116. Cash flow per share isa. required to be reported on the balance sheetb. required to be reported on the income statementc. required to be reported on the statement of cash flowsd. not required to be reported on any statementANS: D DIF: 1 OBJ: 0117. On the statement of cash flows prepared by the indirect method, the cash flows from operatingactivities section would includea. receipts from the sale of investmentsb. amortization of premium on bonds payablec. payments for cash dividendsd. receipts from the issuance of capital stockANS: B DIF: 2 OBJ: 0118. The statement of cash flows may be used by management toa. assess the liquidity of the businessb. assess the major policy decisions involving investments and financingc. determine dividend policyd. do all of the aboveANS: D DIF: 1 OBJ: 01个人收集整理勿做商业用途19. Depreciation on factory equipment would be reported in the statement of cash flows preparedby the indirect method ina. the cash flows from financing activities sectionb. the cash flows from investing activities sectionc. a separate scheduled. the cash flows from operating activities sectionANS: D DIF: 2 OBJ: 0220. Which of the following should be added to net income incalculating net cash flow fromoperating activities using the indirect method?a. an increase in inventoryb. a decrease in accounts payablec. preferred dividends declared and paidd. a decrease in accounts receivableANS: D DIF: 2 OBJ: 0221. Which of the following should be deducted from net income in calculating net cash flow fromoperating activities using the indirect method?a. depreciation expenseb. amortization of premium on bonds payablec. a loss on the sale of equipmentd. dividends declared and paidANS: B DIF: 2 OBJ: 0222. Which of the following below increases cash?a. depreciation expenseb. acquisition of treasury stockc. borrowing money by issuing a six-month noted. the declaration of a cash dividendANS: C DIF: 2 OBJ: 0223. Which one of the following below would not be classified as an operating activity?a. interest expenseb. income taxesc. payment of dividendsd. selling expensesANS: C DIF: 2 OBJ: 0224. Which one of the following below should be added to net income in calculating net cash flowfrom operating activities using the indirect method?a. a gain on the sale of landb. a decrease in accounts payablec. an increase in accrued liabilitiesd. dividends paid on common stockANS: C DIF: 2 OBJ: 0225. On the statement of cash flows prepared by the indirect method, a $50,000 gain on the sale ofinvestments would bea. deducted from net income in converting the net income reported on the incomestatement to cash flows from operating activitiesb. added to net income in converting the net income reported on the income statementto cash flows from operating activitiesc. added to dividends declared in converting the dividends declared to the cash flowsfrom financing activities related to dividends个人收集整理勿做商业用途d. deducted from dividends declared in converting the dividends declared to the cashflows from financing activities related to dividendsANS: A DIF: 2 OBJ: 0226. Accounts receivable arising from trade transactions amounted to $45,000 and $52,000 at thebeginning and end of the year, respectively. Net income reported on the income statement for the year was $105,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method isb. $112,000c. $98,000d. $140,000ANS: C DIF: 2 OBJ: 0227. The net income reported on the income statement for the current year was $275,000.Depreciation recorded on fixed assets and amortization of patents for the year were $40,000 and $9,000, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:End Beginning Cash $ 50,000 $ 60,000 Accounts receivable 112,000 108,000 Inventories 105,000 93,000 Prepaid expenses 4,500 6,500 Accounts payable (merchandise creditors) 75,000 89,000 What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?a. $198,000b. $324,000c. $352,000d. $296,000ANS: D DIF: 3 OBJ: 0228. The following information is available from the current period financial statements:Net income .................................... $140,000Depreciation expense ..................... 28,000Increase in accounts receivable ....... 16,000Decrease in accounts payable ......... 21,000The net cash flow from operating activities using the indirect method isb. $163,000c. $107,000d. $205,000ANS: A DIF: 3 OBJ: 0229. On the statement of cash flows, the cash flows from investing activities section would includea. receipts from the issuance of capital stockb. payments for dividendsc. payments for retirement of bonds payabled. receipts from the sale of investmentsANS: D DIF: 2 OBJ: 02个人收集整理勿做商业用途30. A building with a book value of $ 45,000 is sold for $50,000 cash. Using the indirect method,this transaction should be shown on the statement of cash flows as follows:a. an increase of $45,000 from investing activitiesb. an increase of $50,000 from investing activities and a deduction from net income of$5,000c. an increase of $50,000 from investing activitiesd. an increase of $45,000 from investing activities and an addition to net income of$5,000ANS: B DIF: 2 OBJ: 0231. Cash paid for equipment would be reported in the statement of cash flows ina. the cash flows from operating activities sectionb. the cash flows from financing activities sectionc. the cash flows from investing activities sectiond. a separate scheduleANS: C DIF: 2 OBJ: 0232. If a gain of $9,000 is incurred in selling (for cash) office equipment having a book value of$55,000, the total amount reported in the cash flows from investing activities section of the statement of cash flows isa. $46,000b. $9,000c. $55,000d. $64,000ANS: D DIF: 2 OBJ: 0233. Which of the following types of transactions would be reported as a cash flow from investingactivity on the statement of cash flows?a. issuance of bonds payableb. issuance of capital stockc. purchase of treasury stockd. purchase of noncurrent assetsANS: D DIF: 2 OBJ: 0234. Land costing $47,000 was sold for $78,000 cash. The gain on the sale was reported on theincome statement as other income. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?a. $78,000b. $47,000c. $109,000d. $31,000ANS: A DIF: 2 OBJ: 0235. Equipment with an original cost of $50,000 and accumulated depreciation of $20,000 wassold at a loss of $7,000. As a result of this transaction, cash woulda. increase by $23,000b. decrease by $7,000c. increase by $43,000d. decrease by $30,000ANS: A DIF: 2 OBJ: 0236. On the statement of cash flows, the cash flows from financing activities section would includea. receipts from the sale of investmentsb. payments for the acquisition of investmentsc. receipts from a note receivabled. receipts from the issuance of capital stockANS: D DIF: 2 OBJ: 0237. On the statement of cash flows, the cash flows from financing activities section would includeall of the following excepta. receipts from the sale of bonds payableb. payments for dividendsc. payments for purchase of treasury stockd. payments of interest on bonds payableANS: D DIF: 2 OBJ: 0238. Cash dividends paid on capital stock would be reported in the statement of cash flows ina. the cash flows from financing activities sectionb. the cash flows from investing activities sectionc. a separate scheduled. the cash flows from operating activities sectionANS: A DIF: 2 OBJ: 0239. Cash dividends of $80,000 were declared during the year. Cash dividends payable were$10,000 and $15,000 at the beginning and end of the year, respectively. The amount of cash for the payment of dividends during the year isa. $85,000b. $80,000c. $95,000d. $75,000ANS: D DIF: 2 OBJ: 0240. On the statement of cash flows, a $20,000 gain on the sale of fixed assets would bea. added to net income in converting the net income reported on the income statementto cash flows from operating activitiesb. deducted from net income in converting the net income reported on the incomestatement to cash flows from operating activitiesc. added to dividends declared in converting the dividends declared to the cash flowsfrom financing activities related to dividendsd. deducted from dividends declared in converting the dividends declared to the cashflows from financing activities related to dividendsANS: B DIF: 2 OBJ: 0241. A business issues 20-year bonds payable in exchange for preferred stock. This transactionwould be reported on the statement of cash flows ina. a separate scheduleb. the cash flows from financing activities sectionc. the cash flows from investing activities sectiond. the cash flows from operating activities sectionANS: A DIF: 2 OBJ: 0242. Land costing $68,000 was sold for $50,000 cash. The loss on the sale was reported on theincome statement as other expense. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?a. $50,000b. $78,000c. $118,000d. $68,000ANS: A DIF: 2 OBJ: 0243. The current period statement of cash flows includes the flowing:Cash balance at the beginning of the period................... $410,000Cash provided by operating activities ............................ 185,000 Cash used in investing activities .................................... 43,000Cash used in financing activities .................................... 97,000 The cash balance at the end of the period isa. $45,000b. $735,000c. $455,000d. $85,000ANS: C DIF: 2 OBJ: 0244. On the statement of cash flows, the cash flows from operating activities section would includea. receipts from the issuance of capital stockb. payment for interest on short-term notes payablec. payments for the acquisition of investmentsd. payments for cash dividendsANS: B DIF: 2 OBJ: 0345. The cost of merchandise sold during the year was $50,000. Merchandise inventories were$12,500 and $10,500 at the beginning and end of the year, respectively. Accounts payable were $6,000 and $5,000 at the beginning and end of the year, respectively. Using the direct method of reporting cash flows from operating activities, cash payments for merchandise totala. $49,000b. $47,000c. $51,000d. $53,000ANS: A DIF: 2 OBJ: 0346. Sales for the year were $600,000. Accounts receivable were $100,000 and $80,000 at thebeginning and end of the year. Cash received from customers to be reported on the cash flow statement using the direct method isa. $700,000b. $600,000c. $580,000d. $620,000ANS: D DIF: 2 OBJ: 0347. Operating expenses other than depreciation for the year were $400,000. Prepaid expensesincreased by $17,000 and accrued expenses decreased by $30,000 during the year. Cash payments for operating expensesto be reported on the cash flow statement using the direct method would bea. $353,000b. $413,000c. $447,000d. $383,000ANS: C DIF: 2 OBJ: 0348. The following selected account balances appeared on the financial statements of the FranklinCompany:Accounts Receivable, Jan. 1 ........... $13,000Accounts Receivable, Dec. 31 ........ 9,000Accounts Payable, Jan 1 ................ 4,000Accounts payable Dec. 31 .............. 7,000Merchandise Inventory, Jan 1 ......... 10,000Merchandise Inventory, Dec 31 ...... 15,000Sales ............................................. 56,000Cost of Goods Sold ........................ 31,000The Franklin Company uses the direct method to calculate net cash flow from operatingactivities. Cash collections from customers area. $56,000b. $52,000c. $60,000d. $45,000ANS: C DIF: 3 OBJ: 0349. The following selected account balances appeared on the financial statements of the FranklinCompany:Accounts Receivable, Jan. 1 ......... $13,000Accounts Receivable, Dec. 31 ...... 9,000Accounts Payable, Jan 1 .............. 4,000Accounts payable Dec. 31 ............ 7,000Merchandise Inventory, Jan 1 ....... 10,000Merchandise Inventory, Dec 31 .... 15,000Sales ........................................... 56,000Cost of Goods Sold ....................... 31,000The Franklin Company uses the direct method to calculate net cash flow from operatingactivities. Cash paid to suppliers isa. $39,000b. $33,000c. $29,000d. $23,000ANS: B DIF: 3 OBJ: 0350. Income tax was $400,000 for the year. Income tax payable was $30,000 and $40,000 at thebeginning and end of the year. Cash payments for income tax reported on the cash flow statement using the direct method isa. $400,000b. $390,000c. $430,000d. $440,000ANS: B DIF: 2 OBJ: 0351. Free cash flow isa. all cash in the bankb. cash from operationsc. cash from financing, less cash used to purchase fixed assets to maintain productive。

财务会计题库英文及答案1. Question: What is the purpose of the statement of cash flows in financial accounting?Answer: The purpose of the statement of cash flows is to provide information about the cash receipts and cash payments of an entity, showing how the changes in balance sheet accounts and income affect cash and cash equivalents, and to reveal the entity's financing and investing activities.2. Question: Explain the difference between a debit and a credit in double-entry bookkeeping.Answer: In double-entry bookkeeping, a debit is an entry on the left side of an account that either increases an asset or expense, or decreases a liability, equity, or revenue. A credit is an entry on the right side of an account that increases a liability, equity, or revenue, or decreases an asset or expense.3. Question: What is the accrual basis of accounting?Answer: The accrual basis of accounting is a method of accounting in which revenues and expenses are recognized when they are earned or incurred, not when cash is received or paid. This method provides a more accurate picture of a company's financial performance over a period of time.4. Question: How does depreciation affect a company's financial statements?Answer: Depreciation is a non-cash expense that allocates the cost of a tangible asset over its useful life. It affects the company's financial statements by reducing the asset's carrying value on the balance sheet and decreasing the net income on the income statement, which in turn can affect the retained earnings.5. Question: What is the primary goal of financial statement analysis?Answer: The primary goal of financial statement analysis is to assess the performance and financial condition of a company. It helps investors, creditors, and other stakeholders make informed decisions by evaluating the company's profitability, liquidity, solvency, and overall financial health.6. Question: What is the difference between a journal entry and a ledger entry?Answer: A journal entry records the initial transaction in the general journal, showing the date, accounts affected, and the amounts debited and credited. A ledger entry, on the other hand, is the posting of the journal entry to the appropriate accounts in the general ledger, which summarizes the transactions for each account.7. Question: Explain the matching principle in financialaccounting.Answer: The matching principle in financial accounting requires that expenses be recognized in the same period asthe revenues they helped to generate. This principle ensures that the income statement reflects the actual economic performance of the period and avoids distortions that could arise from recognizing revenues and expenses in different periods.8. Question: What is the purpose of adjusting entries?Answer: Adjusting entries are made at the end of an accounting period to ensure that the financial statements reflect the current financial position and performance of the company. They adjust for revenues and expenses that have been incurred but not yet recorded, or cash received or paid butnot yet recognized.9. Question: What is the difference between a budget and a forecast?Answer: A budget is a detailed financial plan thatoutlines expected revenues and expenses for a specific period, often used for internal management and control. A forecast,on the other hand, is a projection of future financial performance based on assumptions and trends, and is typically used for strategic planning and decision-making.10. Question: What is the role of the balance sheet infinancial accounting?Answer: The balance sheet is a financial statement that presents a company's financial position at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess the company's liquidity, solvency, and overall financial stability. The balance sheet must always balance, with total assets equaling the sum of liabilities and equity.。

会计英语试题及答案精品文档会计英语试题及答案会计专业英语是会计专业人员职业发展的必要工具。

学习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。

以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。