联交所上市规则第14章

- 格式:pdf

- 大小:318.74 KB

- 文档页数:49

香港联交所信息披露规则摘要简目:一、信息披露的一般规定(一)信息披露的原则(二)信息披露的一般规则二、信息披露的具体规定(一)一般事项(二)须予公布的交易(三)须披露的关联交易(四)财务资料的披露三、《股价敏感资料披露指引》摘要联交所主板上市企业信息披露规则主要规定于《上市规则》及其附录,而《股价敏感资料披露指引》则为部分常见事项的披露提供了指引。

在《上市规则》中,联交所对信息披露规则的规定采用了一般规定结合具体规定的模式(一般披露责任+具体披露责任),一般披露规则规定了信息披露的基本原则和概括要求,而具体披露规定则明确了在特定事项下的信息披露规则。

本摘要亦根据《上市规则》的规定模式,对相关的披露规则进行了简要分类。

一、信息披露的一般规定【基于《上市规则》第13.05条-13.10条】(一)信息披露的原则1、信息披露持续责任的目的及披露的原则。

本章所载涉及信息披露的持续责任,旨在确保发行人在《上市规则》第13.09条所述情况下,实时公布有关数据。

指导性的原则是:凡预期属股价敏感的数据,均须在董事会作出决定后实时公布。

在公布数据之前,发行人及其顾问必须严守秘密。

【第13.05条】2、一般披露责任与具体披露责任的关系。

第十三章所规范的披露责任是在遵循《上市规则》第13.09条的一般性的原则下,为发行人提出的向其证券持有人及公众披露资料的特定要求。

基于此,该章所提出的特定情况并不可取代《上市规则》第13.09条所载的一般披露责任,无论如何也不会减省发行人根据《上市规则》第13.09条所应负的责任。

【第13.06条】3、董事对信息披露的责任。

为遵循第十三章所规定的与信息披露有关的持续责任,发行人的董事必须确保不会在一方没有掌握股价敏感资料而另一方则管有该等资料的情况下进行买卖。

【第13.07条】4、联交所所对信息披露的自由裁量权。

为了使信息披露维持在高水平,交易所可在认为必要时,要求发行人发表进一步的资料及向其施加额外的规定,但在施加任何并非一般对发行人实施的规定前,有关发行人可作出申述。

上市规则附录十第c.14段一、引言在上市规则附录十中,第 c.14段是关于证券上市的具体要求和规定。

该段重点关注了上市公司的信息披露、内幕交易管理、市场操纵等方面的规则和要求。

本文将详细介绍第c.14段的内容,帮助读者更好地了解和理解这一规则的内容和背景。

二、信息披露要求根据第c.14段的规定,上市公司应及时、准确、公平地向投资者提供相关信息。

公司应按照《证券法》和相关法律法规的要求,编制并披露年度报告、中期报告、季度报告,以及其他有关重大事项的及时报告。

同时,公司还应制定并严格执行内幕信息管理制度,以保障投资者的合法权益。

三、内幕交易管理第c.14段明确规定了内幕交易的禁止,要求上市公司的高级管理人员、董事会成员、监事会成员、核心技术人员等相关人员不得利用未公开信息进行交易。

同时,上市公司有责任建立健全的内幕信息管理制度,加强对内幕信息的监控和防范,确保市场公平公正。

四、市场操纵规定第c.14段还涉及到对市场操纵行为的规定。

上市公司及其相关人员不得参与操纵证券市场的行为,不得散布虚假信息或进行不当宣传,确保市场信息的真实性和公正性。

同时,上市公司应配合相关监管部门的调查和核实工作,积极维护市场秩序和投资者利益。

五、处罚措施第c.14段对于违反上市规则的行为也做了相应的处罚措施规定。

一旦发现证券市场的违法违规行为,监管部门将依法采取相应的处罚措施,包括但不限于警告、罚款、停牌、撤销上市等措施,以维护市场秩序和投资者的权益。

六、总结第c.14段是上市规则附录十中关于证券上市的重要规定之一,主要着重于信息披露、内幕交易管理和市场操纵等方面。

上市公司应严格按照该规则的要求,及时披露相关信息,建立健全的内幕信息管理制度,防范市场操纵行为。

同时,监管部门将对违规行为进行严肃处理,以维护市场的公正和投资者的权益。

希望通过本文的介绍,读者对于上市规则附录十第c.14段的内容和要求有更加清晰的了解,为进一步加强证券监管和保护投资者利益提供参考和指导。

联交所上市规则联交所是香港的主要股票交易所,对于想在该交易所上市的企业来说,遵守联交所上市规则是非常重要的。

联交所上市规则涵盖了一系列的准入标准和要求,旨在保护投资者利益、维护市场秩序和促进公司治理的良好运作。

本文将就联交所上市规则展开一系列讨论。

一、准入标准联交所对于上市企业有一定的准入标准。

首先是市值要求,根据联交所的规定,企业在上市时需要满足最低市值的要求。

其次是盈利能力要求,企业需在过去三年中有稳定的盈利能力。

企业还需满足流通性要求、财务指标要求等。

二、公司治理联交所非常重视公司治理,在上市规则中也对公司治理方面有相应要求。

企业需要确保合理、有效且透明的公司治理机制,包括独立董事制度、内部控制和风险管理机制等。

联交所还要求企业建立完善的信息披露制度,及时、准确地向投资者披露相关信息。

三、业务及财务要求为保证上市公司的财务健康和稳定性,联交所对企业的业务及财务状况也有一定要求。

企业需要有合理的业务模式和盈利模式,能够创造稳定的收入。

企业还需满足财务指标要求,如财务报表透明度、财务风险评估等。

四、持续上市要求上市后,企业需要遵守联交所的持续上市要求。

这些要求包括定期报告、信息披露、内幕交易监管等。

企业需要定期向交易所提交财务报告、业绩预告等信息,以便投资者及时了解企业的业务状况。

五、联交所主办人制度联交所还设有主办人制度,主办人是帮助企业上市的机构,负责审核企业的上市申请材料以及监督企业的上市过程。

企业需要选择合适的主办人,并与其建立积极的合作关系。

通过以上几个方面的探讨,我们可以看出联交所上市规则对上市企业有严格的要求,但这些要求也是为了保护投资者利益、维持市场秩序和提高公司治理水平而制定的。

对于想在联交所上市的企业来说,遵守上市规则是非常重要的,可以提高企业的声誉和信任度,提升公司的价值。

总结回顾:联交所上市规则是香港交易所制定的一系列规定,包括准入标准、公司治理、业务及财务要求、持续上市要求等方面。

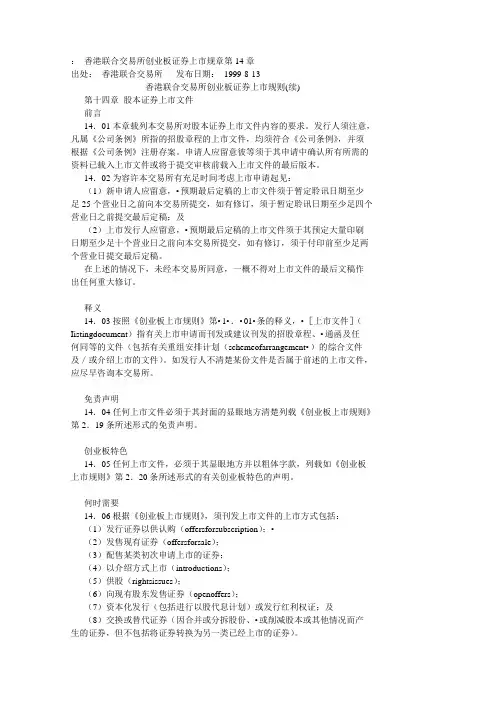

:香港联合交易所创业板证券上市规章第14章出处:香港联合交易所发布日期:1999-8-13香港联合交易所创业板证券上市规则(续)第十四章股本证券上市文件前言14.01本章载列本交易所对股本证券上市文件内容的要求。

发行人须注意,凡属《公司条例》所指的招股章程的上市文件,均须符合《公司条例》,并须根据《公司条例》注册存案。

申请人应留意彼等须于其申请中确认所有所需的资料已载入上市文件或将于提交审核前载入上市文件的最后版本。

14.02为容许本交易所有充足时间考虑上市申请起见:(1)新申请人应留意,•预期最后定稿的上市文件须于暂定聆讯日期至少足25个营业日之前向本交易所提交,如有修订,须于暂定聆讯日期至少足四个营业日之前提交最后定稿;及(2)上市发行人应留意,•预期最后定稿的上市文件须于其预定大量印刷日期至少足十个营业日之前向本交易所提交,如有修订,须于付印前至少足两个营业日提交最后定稿。

在上述的情况下,未经本交易所同意,一概不得对上市文件的最后文稿作出任何重大修订。

释义14.03按照《创业板上市规则》第•1•.•01•条的释义,•[上市文件](Iistingdocument)指有关上市申请而刊发或建议刊发的招股章程、•通函及任何同等的文件(包括有关重组安排计划(schemeofarrangement•)的综合文件及/或介绍上市的文件)。

如发行人不清楚某份文件是否属于前述的上市文件,应尽早咨询本交易所。

免责声明14.04任何上市文件必须于其封面的显眼地方清楚列载《创业板上市规则》第2.19条所述形式的免责声明。

创业板特色14.05任何上市文件,必须于其显眼地方并以粗体字款,列载如《创业板上市规则》第2.20条所述形式的有关创业板特色的声明。

何时需要14.06根据《创业板上市规则》,须刊发上市文件的上市方式包括:(1)发行证券以供认购(offersforsubscription);•(2)发售现有证券(offersforsale);(3)配售某类初次申请上市的证券;(4)以介绍方式上市(introductions);(5)供股(rightsissues);(6)向现有股东发售证券(openoffers);(7)资本化发行(包括进行以股代息计划)或发行红利权证;及(8)交换或替代证券(因合并或分拆股份、•或削减股本或其他情况而产生的证券,但不包括将证券转换为另一类已经上市的证券)。

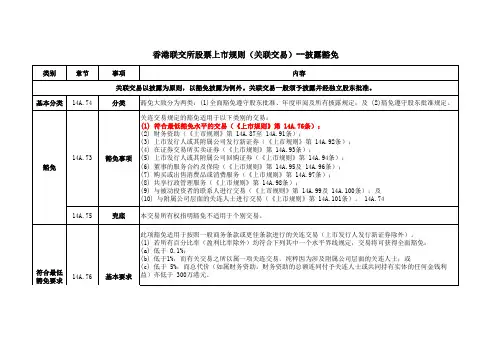

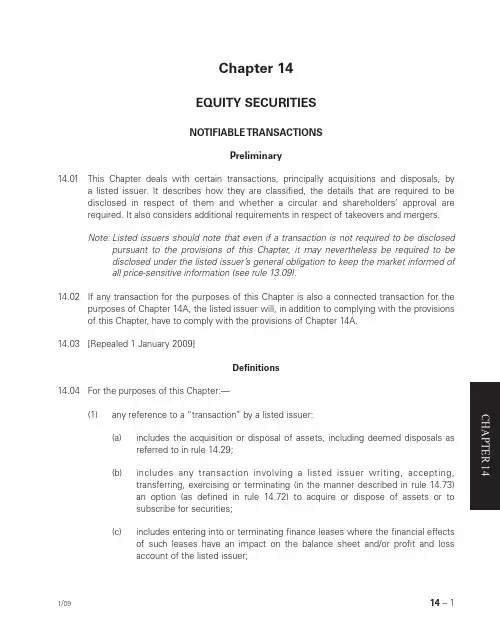

Chapter 14EQUITY SECURITIESNOTIFIABLE TRANSACTIONSPreliminary14.01 This Chapter deals with certain transactions, principally acquisitions and disposals, bya listed issuer. It describes how they are classified, the details that are required to bedisclosed in respect of them and whether a circular and shareholders’ approval are required. It also considers additional requirements in respect of takeovers and mergers.Note: Listed issuers should note that even if a transaction is not required to be disclosed pursuant to the provisions of this Chapter, it may nevertheless be required to bedisclosed under the listed issuer’s general obligation to keep the market informed ofall price-sensitive information (see rule 13.09).14.02 If any transaction for the purposes of this Chapter is also a connected transaction for thepurposes of Chapter 14A, the listed issuer will, in addition to complying with the provisions of this Chapter, have to comply with the provisions of Chapter 14A.14.03 [Repealed 1 January 2009]Defi nitions(1) any reference to a “transaction” by a listed issuer:(a) includes the acquisition or disposal of assets, including deemed disposals asreferred to in rule 14.29;(b) includes any transaction involving a listed issuer writing, accepting,transferring, exercising or terminating (in the manner described in rule 14.73)an option (as defined in rule 14.72) to acquire or dispose of assets or tosubscribe for securities;(c) includes entering into or terminating fi nance leases where the fi nancial effectsof such leases have an impact on the balance sheet and/or profit and lossaccount of the listed issuer;(d) includes entering into or terminating operating leases which, by virtue of theirsize, nature or number, have a signifi cant impact on the operations of the listed issuer. The Exchange will normally consider an operating lease or a transaction involving multiple operating leases to have a “significant impact” if such lease(s), by virtue of its/their total monetary value or the number of leases involved, represent(s) a 200% or more increase in the scale of the listed issuer’s existing operations conducted through lease arrangements of such kind;(e) includes granting an indemnity or a guarantee or providing fi nancial assistanceby a listed issuer, other than by a listed issuer which:(i) is a banking company (as defined in rule 14A.10(1)) and provides thefi nancial assistance (as defi ned in rule 14A.10(4)) in its ordinary and usualcourse of business (as referred to in rule 14.04(8));(ii) grants an indemnity or a guarantee, or provides fi nancial assistance to its subsidiaries; or(iii) is a securities house and provides the fi nancial assistance (as defi ned in rule 14A.10(4)) in its ordinary and usual course of business (as referred toin rule 14.04(8)) and upon normal commercial terms, either:(A) by way of securities margin financing (which means providing afi nancial accommodation in order to facilitate:(aa) the acquisition of securities listed on any stock market,whether a recognized stock market (as defi ned in Schedule1 to the Securities and Futures Ordinance) or any other stockmarket outside Hong Kong; and(bb) (where applicable) the continued holding of those securities,whether or not those or other securities are pledged as securityfor the accommodation); or(B) for the purpose of a proposed acquisition of securities inaccordance with the terms of a prospectus which is registeredin Hong Kong and issued in respect of an initial public offering ofequity securities to be listed in Hong Kong.Note: Such a transaction may nevertheless in some cases constitute a connected transaction under Chapter 14A. In such cases, the listedissuer will have to comply with the provisions of Chapter 14A.(f) includes entering into any arrangement or agreement involving the formationof a joint venture entity in any form, such as a partnership or a company, or any other form of joint arrangement, other than a joint venture where:(i) the joint venture is engaging in a single purpose project/transactionwhich is of a revenue nature in the ordinary and usual course of businessof the issuer (see rule 14.04(1)(g));(ii) the joint venture arrangement is on an arm’s length basis and on normal commercial terms; and(iii) the joint venture agreement contains clause(s) to the effect that the joint venture may not, without its partners’ unanimous consent:(A) change the nature or scope of its business; or(B) enter into any transactions which are not on an arm’s length basis;and(g) to the extent not expressly provided in rules 14.04(1)(a) to (f), excludes anytransaction of a revenue nature in the ordinary and usual course of business (as referred to in rule 14.04(8)) of the listed issuer;Notes: 1 To the extent not expressly provided in rules 14.04(1)(a) to (f), any transaction of a revenue nature in the ordinary and usualcourse of business of a listed issuer will be exempt from therequirements of this Chapter. However, listed issuers shouldnote that any such transaction may nevertheless be required tobe disclosed under the listed issuer’s general obligation to keepthe market informed of all price-sensitive information (see rule13.09).2 Any transaction involving the acquisition and disposal ofproperties will generally not be considered to be of a revenuenature unless such transactions are carried out as one of theprincipal activities and in the ordinary and usual course ofbusiness of the listed issuer.3 Where a listed issuer, for the financial reporting purpose, hastransferred an asset from the fi xed asset account to the currentasset account, a subsequent disposal of the asset by the listedissuer will not be exempt under rule 14.04(1)(g).4 In considering whether or not a transaction is of a revenuenature, a listed issuer must take into account the followingfactors:(a) whether previous transactions or recurring transactionsthat were of the same nature were treated as notifi abletransactions;(b) the historical accounting treatment of its previoustransactions that were of the same nature;(c) whether the accounting treatment is in accordance withgenerally acceptable accounting standards; and(d) whether the transaction is a revenue or capital transactionfor tax purposes.These factors are included for guidance only and are not intendedto be exhaustive. The Exchange may take into account otherfactors relevant to a particular transaction in assessing whetheror not it is of a revenue nature. In cases of doubt, the listedissuer must consult the Exchange at an early stage.(2) “accounts” means:—(a) in respect of a listed issuer, and for the purpose of determining its totalassets, profits or revenue figures pursuant to rule 14.07, the listed issuer’slatest published audited accounts or, where consolidated accounts have beenprepared, the listed issuer’s latest published audited consolidated accounts;and(b) in the case of any other company, legal person, partnership, trust or businessunit, its latest audited accounts or, where consolidated accounts have beenprepared, its latest audited consolidated accounts or, where no auditedaccounts have been prepared, such other accounts as may be permitted by theExchange in its discretion;(3) an “aircraft company” means a company or other entity whose non-cash assetsconsist solely or mainly of aircraft or interests in aircraft or interests in companies or entities whose non-cash assets consist solely or mainly of aircraft and whose income is mainly derived from those aircraft;(4) “assets” means both tangible and intangible assets and includes businesses,companies and securities, whether listed or not (unless otherwise stated);(5) “de minimis ratio” means the ratio determined in accordance with rules 14A.31(2),14A.32, 14A.33(3), 14A.34, 14A.65(2), 14A.66(1) or 14A.66(2) (as the case may be); (6) a “listed issuer” means a company or other legal person whose securitiesare already listed on the Main Board , including a company whose shares are represented by listed depositary receipts, and unless the context otherwise requires, includes its subsidiaries;(7) a “notifiable transaction” means a transaction classified as a share transaction,discloseable transaction, major transaction, very substantial disposal, very substantial acquisition or reverse takeover under rule 14.06;(8) “ordinary and usual course of business” of an entity means the existing principalactivities of the entity or an activity wholly necessary for the principal activities of the entity. In the context of fi nancial assistance provided in the ordinary and usual course of business, this means fi nancial assistance provided by a banking company only or by a securities house pursuant to rule 14.04(1)(e)(iii) only and, in the context of financial assistance not provided in the ordinary and usual course of business, it means fi nancial assistance not provided by a banking company or by a securities house under rule 14.04(1)(e)(iii);(9) “percentage ratios” means the percentage ratios set out in rule 14.07, and “assetsratio”, “profi ts ratio”, “revenue ratio”, “consideration ratio” and “equity capital ratio”shall bear the respective meanings set out in rule 14.07;(10) a “property company” means a company or other entity whose non-cash assetsconsist solely or mainly of properties or interests in properties or interests in companies or entities whose non-cash assets consist solely or mainly of properties and whose income is mainly derived from those properties;(10A) [Repealed 1 February 2011](10B) “Qualified Issuer” means an issuer actively engaged in property development asa principal business activity. For determining whether property development is aprincipal activity of an issuer, consideration will be given to the following factors:(a) clear disclosure of property development activity as a current and continuingprincipal business activity in the Directors’ Report of its latest published annualfi nancial statements;(b) property development activity is reported as a separate and continuingsegment (if not the only segment) in its latest published fi nancial statements;and(c) its format for reporting segmental information and its latest published annualfinancial statements have fully complied with the requirements of relevantaccounting standards adopted for the preparation of its annual financialstatements on reporting of segment revenue and segment expense.(10C) “Qualified Property Acquisition” means an acquisition of land or property development project in Hong K ong from Government or Government-controlled entities through a public auction or tender; or an acquisition of governmental land in the Mainland from a PRC Governmental Body (as defi ned in rule 19A.04) througha tender ( ), auction ( ), or listing-for-sale ( ) governed by the PRC law (asdefi ned in rule 19A.04);Note: The Exchange may relax this requirement to accept land acquired in other jurisdictions from governmental bodies through public auctions or tenders.Factors which the Exchange will consider include:(i) whether the government land is acquired through a competitive biddingprocess regulated by legislation and/or requirements in the relevantjurisdiction;(ii) whether the bidding process is fairly structured and established, and bidders have no discretion to change pre-established terms;(iii) whether acquiring government land through a bidding process is a common practice in that jurisdiction; and(iv) the problems faced by the issuer in complying with the notifiable transaction Rules for the land acquisition.(10D) [Repealed 1 February 2011](10E) a “securities house” means a corporation which is licensed or registered under the Securities and Futures Ordinance for Type 1 (dealing in securities) or Type 8 (securities margin fi nancing) regulated activity;(11) a “shipping company” means a company or other entity whose non-cash assetsconsist solely or mainly of vessels or interests in vessels or interests in companies or entities whose non-cash assets consist solely or mainly of vessels and whose income is mainly derived from those vessels; and(12) “total assets” means:—(a) in respect of a listed issuer, the total fi xed assets, including intangible assets,plus the total current and non-current assets, as shown in its accounts orlatest published interim report (whichever is more recent), subject to anyadjustments or modifi cations arising by virtue of the provisions of rules 14.16,14.18 and 14.19; and(b) in the case of any other company, legal person, partnership, trust or businessunit, the total fixed assets, including intangible assets, plus the total currentand non-current assets, as shown in its accounts, subject to any adjustmentsor modifi cations arising from any signifi cant changes to its assets subsequentto the date of the balance sheet in the accounts.Note: Listed issuers must demonstrate to the satisfaction of the Exchange that any such adjustments or modifications to the accounts of the relevantcompany, legal person, partnership, trust or business unit are necessaryand appropriate in order to refl ect its latest fi nancial position.Classifi cation and explanation of terms14.05 A listed issuer considering a transaction must, at an early stage, consider whether thetransaction falls into one of the classifi cations set out in rule 14.06. In this regard, the listed issuer must determine whether or not to consult its fi nancial, legal or other professional advisers. Listed issuers or advisers which are in any doubt as to the application of the requirements in this Chapter should consult the Exchange at an early stage.14.06 The transaction classifi cation is made by using the percentage ratios set out in rule 14.07.The classifi cations are:—(1) share transaction — an acquisition of assets (excluding cash) by a listed issuerwhere the consideration includes securities for which listing will be sought andwhere all percentage ratios are less than 5%;(2) discloseable transaction — a transaction or a series of transactions (aggregatedunder rules 14.22 and 14.23) by a listed issuer where any percentage ratio is 5% ormore, but less than 25%;(3) major transaction — a transaction or a series of transactions (aggregated under rules14.22 and 14.23) by a listed issuer where any percentage ratio is 25% or more, butless than 100% for an acquisition or 75% for a disposal;(4) very substantial disposal — a disposal or a series of disposals (aggregated underrules 14.22 and 14.23) of assets (including deemed disposals referred to in rule14.29) by a listed issuer where any percentage ratio is 75% or more;(5) very substantial acquisition — an acquisition or a series of acquisitions (aggregatedunder rules 14.22 and 14.23) of assets by a listed issuer where any percentage ratiois 100% or more; and(6) reverse takeover — an acquisition or a series of acquisitions of assets by a listedissuer which, in the opinion of the Exchange, constitutes, or is part of a transactionor arrangement or series of transactions or arrangements which constitute, anattempt to achieve a listing of the assets to be acquired and a means to circumventthe requirements for new applicants set out in Chapter 8 of the Exchange ListingRules. A “reverse takeover” normally refers to:(a) an acquisition or a series of acquisitions (aggregated under rules 14.22 and14.23) of assets constituting a very substantial acquisition where there is orwhich will result in a change in control (as defi ned in the Takeovers Code) ofthe listed issuer (other than at the level of its subsidiaries); or(b) acquisition(s) of assets from a person or a group of persons or any of his/theirassociates pursuant to an agreement, arrangement or understanding enteredinto by the listed issuer within 24 months of such person or group of personsgaining control (as defined in the Takeovers Code) of the listed issuer (otherthan at the level of its subsidiaries), where such gaining of control had not beenregarded as a reverse takeover, which individually or together constitute(s)a very substantial acquisition. For the purpose of determining whether theacquisition(s) constitute(s) a very substantial acquisition, the lower of:(A) the latest published figures of the asset value, revenue and profi ts asshown in the listed issuer’s accounts and the market value of the listedissuer at the time of the change in control, which must be adjusted inthe manner set out in rules 14.16, 14.17, 14.18 and 14.19, as applicable,up to the time of the change in control; and(B) the latest published figures of the asset value, revenue and profi ts asshown in the listed issuer’s accounts and the market value of the listedissuer at the time of the acquisition(s), which must be adjusted in themanner set out in rules 14.16, 14.17, 14.18 and 14.19, as applicable,is to be used as the denominator of the percentage ratios.Note: Rule 14.06(6) will apply irrespective of whether any general offerobligations under the Takeovers Code have been waived.Percentage ratios14.07 The percentage ratios are the fi gures, expressed as percentages resulting from each of thefollowing calculations:—(1) Assets ratio — the total assets which are the subject of the transaction divided bythe total assets of the listed issuer (see in particular rules 14.09 to 14.12, 14.16,14.18 and 14.19);(2) Profits ratio — the profits attributable to the assets which are the subject of thetransaction divided by the profi ts of the listed issuer (see in particular rules 14.13 and14.17);(3) Revenue ratio — the revenue attributable to the assets which are the subject of thetransaction divided by the revenue of the listed issuer (see in particular rules 14.14and 14.17);(4) Consideration ratio — the consideration divided by the total market capitalisation ofthe listed issuer. The total market capitalisation is the average closing price of thelisted issuer’s securities as stated in the Exchange’s daily quotations sheets for thefi ve business days immediately preceding the date of the transaction (see in particularrule 14.15); and(5) Equity capital ratio — the nominal value of the listed issuer’s equity capital issued asconsideration divided by the nominal value of the listed issuer’s issued equity capitalimmediately before the transaction.Note: The value of the listed issuer’s debt capital (if any), including any preference shares, shall not be included in the calculation of the equity capital ratio.Listed issuers must consider all the percentage ratios to the extent applicable for classifying a transaction. In the case of an acquisition where the target entity uses accounting standards different from those of the listed issuer, the listed issuer must, where applicable, perform an appropriate and meaningful reconciliation of the relevant fi gures for the purpose of calculating the percentage ratios.14.08 The table below summarises the classification and percentage ratios resulting from thecalculations set out in rule 14.07. However, listed issuers should refer to the relevant rules for the specifi c requirements.Transaction Assets Consideration Profi ts Revenue Equityratio type ratio ratio ratio ratio capital Share transaction less than 5% less than 5% less than 5% Less than 5% less than 5%Discloseable 5% or more 5% or more 5% or more 5% or more 5% or moretransaction but less than but less than but less than but less than but less than25% 25% 25% 25%25%Major transaction 25% or more 25% or more 25% or more 25% or more Not applicable– disposal but less than but less than but less than but less than75%75% 75%75%Major transaction 25% or more 25% or more 25% or more 25% or more 25% or more– acquisition but less than but less than but less than but less than but less than100% 100% 100% 100% 100% Very substantial 75% or more 75% or more 75% or more 75% or more Not applicabledisposalVery substantial 100% or more 100% or more 100% or more 100% or more 100% or moreacquisitionNote: The equity capital ratio relates only to an acquisition (and not a disposal) by a listed issuer issuing new equity capital.Assets14.09 Where the asset being acquired or disposed of constitutes equity capital, the listed issuermust take into account the matters referred to in rules 14.25 to 14.32 when calculating the amount of total assets which are the subject of the transaction.14.10 Where the equity capital to be acquired or disposed of by the listed issuer is listed on theMain Board or GEM, the total assets which are the subject of the transaction must be adjusted in the manner set out in rules 14.16, 14.18 and 14.19.14.11 Where a listed issuer which is a property company, shipping company or aircraft companyacquires or disposes of properties, vessels or aircraft respectively, the aggregate value (on an unencumbered basis) of the properties, vessels or aircraft (as the case may be) being acquired or realised will be compared with the total assets of the listed issuer which must be adjusted in the manner set out in rules 14.16, 14.18 and 14.19 or the latest published valuation (on an unencumbered basis) of the properties, vessels or aircraft (as the case may be) if such valuation is published after the issue of accounts of the listed issuer, where appropriate.14.12 Where the transaction involves granting an indemnity or guarantee or providing fi nancialassistance by a listed issuer, the assets ratio will be modifi ed such that the total value of the indemnity, guarantee or fi nancial assistance plus in each case any monetary advantage accruing to the entity benefiting from the transaction shall form the numerator of the assets ratio. The “monetary advantage” includes the difference between the actual value of consideration paid by the entity benefiting from the transaction and the fair value of consideration that would be paid by the entity if the indemnity, guarantee or fi nancial assistance were provided by entities other than the listed issuer.Profi ts14.13 Profits mean net profits after deducting all charges except taxation and before minorityinterests and extraordinary items (See also rule 14.17). In the case of an acquisition or disposal of assets (other than equity capital) through a non wholly-owned subsidiary, the profits attributable to the assets acquired or disposed of (and not the listed issuer’s proportionate interest in such profi ts) will form the numerator for the purpose of the profi ts ratio.Revenue14.14 “Revenue” normally means revenue arising from the principal activities of a companyand does not include those items of revenue and gains that arise incidentally. In the case of any acquisition or disposal of assets (other than equity capital) through a non wholly-owned subsidiary, the revenue attributable to the assets being acquired or realised (and not the listed issuer’s proportionate interest in such revenue) will form the numerator for the purpose of the revenue ratio (See also rule 14.17).Consideration14.15 When calculating the consideration ratio:—(1) the value of the consideration shall be the fair value of the consideration determinedat the date of the agreement of the transaction in accordance with applicableaccounting standards adopted for the preparation of the listed issuer’s annual fi nancialstatements. Normally, the fair value of the consideration should be the same asthe fair value of the asset which is the subject of the transaction. Where there is asignifi cant disparity between the fair value of the consideration and the fair value ofthe asset, the listed issuer must use the higher of the fair value of the considerationand the fair value of the asset as the numerator of the consideration ratio;(2) where a transaction involves establishing a joint venture entity or other form of jointarrangement, the Exchange will aggregate:—(a) the listed issuer’s total capital commitment (whether equity, loan orotherwise), including any contractual commitment to subscribe for capital; and(b) any guarantee or indemnity provided in connection with its establishment;Note: Where a joint venture entity or other form of joint arrangement isestablished for a future purpose, for example to develop a property,and the total capital commitment cannot be calculated at the outset,the Exchange will require the listed issuer to recalculate the relevantpercentage ratios at the time when that purpose is carried out. TheExchange will look at the purpose of setting up the arrangement in termsof the initial transaction only. For example, the purpose could be thedevelopment of the property for which the arrangement was established.The Exchange will not look at subsequent transactions entered intounder the arrangement for the purpose of calculating the total capitalcommitment in relation to the establishment of the arrangement.(3) a listed issuer shall add any liabilities of the vendors, whether actual or contingent, tobe discharged or assumed by the purchaser under the terms of the transactions, tothe consideration. The Exchange may require that further amounts be included as itconsiders appropriate;(4) if the listed issuer may pay or receive consideration in the future, the consideration isthe maximum total consideration payable or receivable under the agreement; and(5) in the case of any acquisition or disposal through a non wholly-owned subsidiary, theconsideration (and not, for the avoidance of doubt, the listed issuer’s proportionateinterest in such consideration) will form the numerator for the purpose of theconsideration ratio.Figures used in total assets, profi ts and revenue calculations14.16 A listed issuer must refer to the total assets shown in its accounts or latest publishedinterim report (whichever is more recent) and adjust the fi gures by:(1) the amount of any dividend proposed by the listed issuer in such accounts and anydividend declared by the listed issuer since the publication of such accounts orinterim report; and(2) where appropriate, the latest published valuation of assets (excluding businessesand intangible assets) of the listed issuer if such valuation is published after the issueof such accounts.Note: Rule 14.16(2) will normally apply to a valuation of assets such as properties, vessels and aircraft.14.17 The profits (see rule 14.13) and revenue (see rule 14.14) figures to be used by a listedissuer for the basis of the profi ts ratio and revenue ratio must be the fi gures shown in its accounts. Where a listed issuer has discontinued one or more of its operating activities during the previous financial year and has separately disclosed the profits and revenue from the discontinued operations in its accounts in accordance with applicable accounting standards adopted for the preparation of the listed issuer’s annual fi nancial statements, the Exchange may be prepared to accept the exclusion of such profi ts and revenue for the purpose of the profi ts ratio and revenue ratio respectively.14.18 The value of transactions or issues of securities by the listed issuer in respect of whichadequate information has already been published and made available to shareholders in accordance with the Exchange Listing Rules and which have been completed must be included in the total assets of the listed issuer.14.19 In calculating total assets, the Exchange may require the inclusion of further amountswhere contingent assets are involved.Note: Contingent assets normally refer to assets that will have to be acquired by a listed issuer pursuant to an agreement upon occurrence or non-occurrence of certainevent(s) after the listed issuer has entered into the agreement. Such event(s) is/arenormally beyond the control of the listed issuer and the parties to the transaction.Contingent assets must be determined in accordance with applicable accountingstandards adopted for the preparation of the listed issuer’s annual financialstatements.。

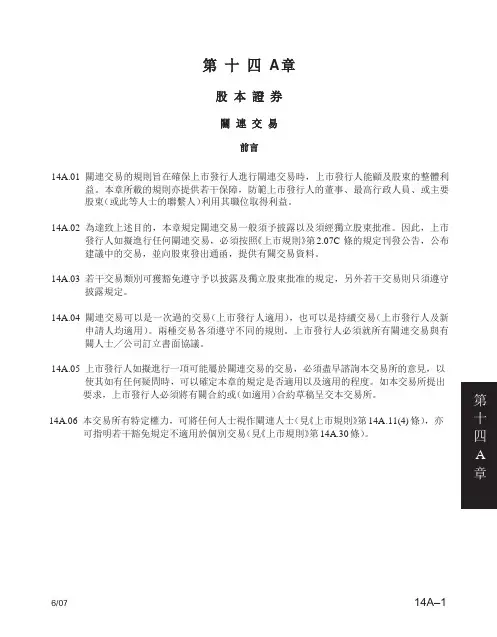

第十四A章股本證券關連交易前言14A.01 關連交易的規則旨在確保上市發行人進行關連交易時,上市發行人能顧及股東的整體利益。

本章所載的規則亦提供若干保障,防範上市發行人的董事、最高行政人員、或主要股東(或此等人士的聯繫人)利用其職位取得利益。

14A.02 為達致上述目的,本章規定關連交易一般須予披露以及須經獨立股東批准。

因此,上市發行人如擬進行任何關連交易,必須按照《上市規則》第2.07C 條的規定刊發公告,公布建議中的交易,並向股東發出通函,提供有關交易資料。

14A.03 若干交易類別可獲豁免遵守予以披露及獨立股東批准的規定,另外若干交易則只須遵守披露規定。

14A.04 關連交易可以是一次過的交易(上市發行人適用),也可以是持續交易(上市發行人及新申請人均適用)。

兩種交易各須遵守不同的規則。

上市發行人必須就所有關連交易與有關人士╱公司訂立書面協議。

14A.05 上市發行人如擬進行一項可能屬於關連交易的交易,必須盡早諮詢本交易所的意見,以使其如有任何疑問時,可以確定本章的規定是否適用以及適用的程度。

如本交易所提出要求,上市發行人必須將有關合約或(如適用)合約草稿呈交本交易所。

第14A.06 本交易所有特定權力,可將任何人士視作關連人士(見《上市規則》第14A.11(4) 條),亦十可指明若干豁免規定不適用於個別交易(見《上市規則》第14A.30 條)。

四A章14A.07 本交易所若認為恰當,可按其所決定的條款及條件豁免本章所有或任何規定(見《上市規則》第14A.42 條)。

14A.08 關連交易可以同時是反收購行動、非常重大的收購事項、非常重大的出售事項、主要交易、須予披露的交易或股份交易,因此上市發行人應同時參閱《上市規則》第十四章。

14A.09 上市發行人須向本交易所填報任何涉及關連交易或持續關連交易的清單;有關清單須按本交易所不時指定的形式填報。

有關定義及釋義的一般事項14A.10 就本章而言:(1) 「經營銀行業務的公司」指《銀行條例》所界定的銀行、有限制牌照銀行或接受存款公司,又或根據適當的海外法例或權力成立的銀行;(2) 「代價」乃按《上市規則》第14.15 條所載的方法計算;(3) 「控權人」指上市發行人的董事、最高行政人員或控股股東;(4) 「財務資助」包括授予信貸、借出款項、就貸款提供保證或作出擔保;註:同時參閱《上市規則》第14A.10(9) 條關於「日常業務」的釋義。

香港联交所上市规则香港联合交易所有限公司(Hong Kong Exchanges and Clearing Limited,简称HKEX)是香港主要的证券交易所,负责监管和管理香港的股票市场。

以下是关于香港联交所上市的一般规则:1. 资格要求:公司必须满足一定的资格要求才能在香港联交所上市。

这些要求包括公司的财务状况、业务规模、股本结构、管理层经验和公司治理标准等。

2. 上市申请程序:公司必须提交上市申请,包括提供详细的上市文件和相关资料。

申请文件将由香港联交所审核,以确定公司是否符合上市要求。

3. 发行股份:公司可以通过公开发行股份的方式筹集资金。

在发行股份时,公司必须遵守香港联交所的发行规则和披露要求。

4. 保荐人和律师:公司在上市过程中需要聘请保荐人和律师,以协助处理上市申请和相关事宜。

保荐人是一家具有资格的金融机构,负责对公司进行审核和发行股份的安排。

5. 上市监管:一旦公司成功上市,香港联交所将对上市公司进行监管,包括要求定期披露财务和业务信息,确保公司遵守上市规则和法规。

6. 信息披露:上市公司必须及时向投资者公开披露重要信息,以确保公平、公正和透明的市场交易环境。

公司需要定期发布财务报表和公告,并及时披露任何对股价和业务前景有重大影响的信息。

7. 挂牌规则:香港联交所有一套详细的挂牌规则,涵盖了上市公司的行为准则、交易规则、市场行为规范等方面的要求。

公司必须遵守这些规则,并按照规定的程序进行交易。

需要注意的是,香港联交所上市规则可能会根据市场需求和监管要求进行更新和修改。

对于具体的上市要求和程序,建议您咨询专业的金融机构、律师或香港联交所官方网站上的相关信息。

香港联合交易所有限公司证券上市规则目录前言章数一释义章数二导言章数二A 上市委员会、上市上诉委员会及上市科的组织、职权、职务及议事程序章数二B 复核程序章数三保荐人、授权代表及董事章数四会计师报告章数五物业的估值及资料章数六停牌、除牌及撤回上市股本证券章数七上市方式章数八上市资格章数九申请程序及规定章数十对购买及认购的限制章数十一上市文件章数十一A 招股章程章数十二公布规定章数十三上市协议章数十四须予公布的交易章数十五期权、认股权证及类似权利章数十五A 衍生认股权证章数十六可转换股本证券章数十七股份计划章数十八矿务公司章数十九海外发行人章数十九A 在中华人民共和国注册成立的发行人投资工具章数二十认可单位信托、互惠基金及其它集体投资计划章数二十一投资公司债务证券章数二十二上市方式(选择性销售的证券除外)章数二十三上市资格(选择性销售的证券除外)章数二十四申请程序及规定(选择性销售的证券除外)章数二十五上市文件(选择性销售的证券除外)章数二十六上市协议(选择性销售的证券除外)章数二十七期权、认股权证及类似权利章数二十八可转换债务证券章数二十九不限量发行、债务证券发行计划及有资产支持的证券章数三十矿务公司章数三十一国家机构(选择性销售的证券除外)章数三十二超国家机构(选择性销售的发行除外)章数三十三国营机构(选择性销售的发行除外)章数三十四银行(选择性销售的发行除外)章数三十五担保人及担保发行(选择性销售的发行除外)章数三十六海外发行人(选择性销售的发行除外)章数三十七选择性销售的证券章数三十八香港交易及结算所有限公司上市指引摘要∕应用指引第1项指引摘要停牌及复牌(已于一九九五年十月十六日删除)第2项指引摘要有关供股及公开售股须获全数包销的规定(已于一九九五年十月十六日删除)第3项指引摘要未缴足股款的证券(已于一九九五年十月十六日删除)第4项指引摘要新申请人管理阶层的营业记录(已于一九九五年十月十六日删除)第5项指引摘要有关发展中物业市场的物业估值(已于一九九五年十月十六日删除)第6项指引摘要年度业绩的评论(已于一九九五年十月十六日删除)第1项应用指引有关呈交数据及文件的程序第2项应用指引股份购回规则某些重要条款的豁免(已于一九九一年十二月三十一日删除)第3项应用指引新申请人管理阶层的营业记录第4项应用指引向现有认股权证持有人发行新认股权证第5项应用指引公开权益数据第6项应用指引确定发售期间第7项应用指引另类认股权证的上市事项(已于一九九三年七月一日删除)第8项应用指引有关中央结算及交收系统的简介及在台风及∕或黑色暴雨警告讯号期间的紧急股票过户登记安排第9项应用指引另类认股权证 _ 附加规定(已于一九九三年七月一日删除)第10项应用指引有关新发行人报告中期业绩规定第11项应用指引停牌及复牌第12项应用指引有关发展中物业市场的物业估值第13项应用指引如何决定某项交易是否须予公布的交易,以及发行人在附属公司及主要附属公司之权益摊薄第14项应用指引进一步发行权证与现有权证成单一系列第15项应用指引本交易所在考虑分拆上市申请时所采用的原则第16项应用指引上市文件及通函无需刊载有关以营运租约租赁的物业之估值报告第17项应用指引足够的业务运作及除牌程序第18项应用指引证券的首次公开招股第19项应用指引有关根据《上市协议》第2段的规定而可能须及时作出公开披露的特定情况之指引第20项应用指引发行人首次售股时雇员所认购股份的分配("粉红色表格的分配")第一章总则释义为释疑起见,《香港联合交易所有限公司证券上市规则》只适用于那些与证券和其发行人有关的事宜,而该等证券是在由本交易所营运的证券市场(除创业板以外)上市的;这个证券市场,在《香港联合交易所有限公司创业板证券上市规则》("《创业板上市规则》")中,是被界定为 "主板"。

上市规则第14.54条一、概述上市规则第14.54条是指股票市场中的一项重要规定,它对于上市公司的运作和市场秩序具有重要影响。

本文将全面解析上市规则第14.54条的内容及其应用,以帮助读者更好地了解并应对这一规则。

二、上市规则第14.54条的内容上市规则第14.54条主要内容包括:对上市公司进行内幕交易的监管、信息披露的要求、市场交易行为的规定等。

这些规定旨在维护市场秩序,保护投资者权益,促进市场的公平公正。

具体而言,根据上市规则第14.54条的规定,以下行为将被视为违规:1.未经批准进行内幕交易;2.不按时、不按规定披露信息;3.操纵市场价格或造成市场异常波动;4.虚假宣传或误导投资者;5.违规使用他人账户进行交易等。

对于违反上市规则第14.54条的行为,相关监管机构将依法追究责任,并可能对涉事公司或个人处以罚款、停牌、退市等相应的行政处罚。

三、上市规则第14.54条的应用上市规则第14.54条的应用范畴涵盖了所有已上市的公司,无论其规模大小和行业类型。

这意味着所有上市公司都应遵守该规则的各项要求,确保自身的合规经营。

为了有效应用上市规则第14.54条,各上市公司应加强内部风控管理,确保内幕信息不被泄露,及时披露相关信息,并明确公司的交易行为准则。

同时,监管机构也应加大对市场的监管力度,及时发现并处理违规行为,确保市场的公平交易。

四、上市规则第14.54条的意义上市规则第14.54条的实施对于股票市场的健康发展具有重要意义。

它有助于维护市场秩序,提高市场的透明度和公信力,为投资者提供更加可靠的投资环境。

此外,上市规则第14.54条的意义还表现在以下几个方面:1.保护投资者利益:规范市场交易行为,防止信息不对称和操纵行为,减少投资者的风险和损失。

2.提升市场信心:加强信息披露,提高上市公司的透明度,增加投资者对市场的信心和信任。

3.维护市场稳定:防范市场异常波动和操纵行为,维持市场的平稳运行和健康发展。

香港聯合交易所有限公司證券上市規則目錄第一冊前言章數七上市方式章數八上市資格章數九申請程序及規定章數十對購買及認購的限制章數十一上市文件章數十一A 招股章程章數十二公佈規定章數十三上市協議章數十四須予公佈的交易章數十五期權、認股權證及類似權利章數二十二上市方式(選擇性銷售的證券除外)章數二十三上市資格(選擇性銷售的證券除外)章數二十四申請程序及規定(選擇性銷售的證券除外)章數二十五上市文件(選擇性銷售的證券除外)章數二十六上市協議(選擇性銷售的證券除外)章數二十七期權、認股權證及類似權利章數二十八可轉換債務證券章數二十九不限量發行、債務證券發行計劃及有資產支章數三十八香港交易及結算所有限公司上市指引摘要∕應用指引第1項指引摘要停牌及復牌(已於一九九五年十月十六日刪除)第2項指引摘要有關供股及公開售股須獲全數包銷的規定(已於一九九五年十月十六日刪除)第3項指引摘要未繳足股款的證券(已於一九九五年十月十六日刪除)第4項指引摘要新申請人管理階層的營業記錄(已於一第5項應用指引公開權益資料第6項應用指引確定發售期間第7項應用指引另類認股權證的上市事項(已於一九九三年七月一日刪除)第8項應用指引有關中央結算及交收系統的簡介及在颱風及∕或黑色暴雨警告訊號期間的緊急股票過戶登記安排第9項應用指引另類認股權證 _ 附加規定(已於一九九三年七月一日刪除)第10項應用指引有關新發行人報告中期業績規定第17項應用指引足夠的業務運作及除牌程序第18項應用指引證券的首次公開招股第19項應用指引有關根據《上市協議》第2段的規定而可能須及時作出公開披露的特定情況之指引第20項應用指引發行人首次售股時僱員所認購股份的分配("粉紅色表格的分配")第一章總則券(在證券交易所上市)(核過戶登記處”准股票註冊商)規則》第3條獲批准成立的法人組織的屬下成員(approvedshare registrar)"章程" 指本交易所的組織章程(Articles)“有資產支持的指由金融資產支持的債務證券,而該等債務證券在發行時,在要股東或其配偶未滿18歲的子女或繼子女(“家屬權益”(familyinterests));(ii) 在以其本人或其任何家屬權益為受益人(或如屬全權信託,則指全權託管的對象)的任何信託中,具有受託人身份的受託人;及(iii) 其本人及/或其家屬權益直接或間接擁有股本權益的任何公司,公司或控股公司或其控股公司的附屬公司,或主要股東及/或上文所指的其他公司(一家或多家)直接或間接擁有股本權益的公司,而他們所合共擁有的股本權益足以讓他們在股東大會上行使或控制行使35%或以上(或《收購守則》不時規定會觸發強制性公開要約所需的較低¦分比)的投票權,或足以讓他們控制董事會大部份成員條所委任為授權代表的人士(authorisedrepresentative)“銀行”(bank) 指根據《銀行業條例》領有牌照的銀行,或在香港以外地區註冊或成立的銀行,而銀行監理專員認為該銀行在其註冊或成立的地方,已受到當地認可的銀行監管機關充份監管“不記名證券” 指可轉讓予持票人的證券(CCASS) “行政總裁” 指一名單獨或聯同另外一人或多人獲董事會直接授權負責上市(chief發行人業務的人士executive)“《基金守則》”指獲證監會核准(不時予以修訂)的《單位信託及互惠基金守則》(Code)“《股份購回守則》”指獲證監會核准(不時予以修(CompanyLaw)“關連人士”(a) 就中國發行人以外的或中國發行人附屬公司以外的公司而(connected 言,指該公司或其附屬公司的董事、行政總裁或主要股person) 東,或任何該等人士的聯繫人;及(b) 就中國發行人而言,指中國發行人或其附屬公司的發起人、董事、º事、行shareholder) 比)投票權的人士或一組人士,或有能力控制組成發行人董事會的大部分成員的任何一名或一組人士;如屬中國發行人,則具有《上市規則》第19A.16條給予該詞的涵義“可轉換債務證券”指可轉換或可交換股本證券或其他資產的債務證券,以及附有(convertible 可認購或購買股本證券或其他資產的不可分離期權、認股權證(debt issuance 於餘上部份的發行,則可在其後分一批或數批進行programmes)“債務證券”指債權股證或貸款股額、債權證、債券、票據,以及其他承(debt 認、證明或設定債務(無論有抵押與否)的證券或契據;可認購securities) 或購買任何該等證券或契據的期權、認股權證及類似權利;及可轉換債務證券Security) 所指的情況下包括該項發行的任何類別的證券;“股本證券”包括股份(包括優先股)、可轉換股本證券、及可認購或購買股(equity 份或可轉換股本證券的期權、認股權證或類似權利,但不包括securities) 互惠基金所發行的可贖回股份“上市科執行總º”指不論以任何職稱不時擔任上市科總º一職的人士過本交易所進行買賣的人的列表、登記冊或名冊內“本交易所的上市指本交易所不時制訂的證券上市規則、其附錄、根據上述規則規則”與任何一方訂立的任何上市協議或其他合約安排,以及本交易(Exchange 所根據上述規則而作出的裁決。

香港联交所信息披露规则摘要简目:一、信息披露的一般规定(一)信息披露的原则(二)信息披露的一般规则二、信息披露的具体规定(一)一般事项(二)须予公布的交易(三)须披露的关联交易(四)财务资料的披露三、《股价敏感资料披露指引》摘要联交所主板上市企业信息披露规则主要规定于《上市规则》及其附录,而《股价敏感资料披露指引》则为部分常见事项的披露提供了指引。

在《上市规则》中,联交所对信息披露规则的规定采用了一般规定结合具体规定的模式(一般披露责任+具体披露责任),一般披露规则规定了信息披露的基本原则和概括要求,而具体披露规定则明确了在特定事项下的信息披露规则。

本摘要亦根据《上市规则》的规定模式,对相关的披露规则进行了简要分类。

一、信息披露的一般规定【基于《上市规则》第13.05条-13.10条】(一)信息披露的原则1、信息披露持续责任的目的及披露的原则。

本章所载涉及信息披露的持续责任,旨在确保发行人在《上市规则》第13.09条所述情况下,实时公布有关数据。

指导性的原则是:凡预期属股价敏感的数据,均须在董事会作出决定后实时公布。

在公布数据之前,发行人及其顾问必须严守秘密。

【第13.05条】2、一般披露责任与具体披露责任的关系。

第十三章所规范的披露责任是在遵循《上市规则》第13.09条的一般性的原则下,为发行人提出的向其证券持有人及公众披露资料的特定要求。

基于此,该章所提出的特定情况并不可取代《上市规则》第13.09条所载的一般披露责任,无论如何也不会减省发行人根据《上市规则》第13.09条所应负的责任。

【第13.06条】3、董事对信息披露的责任。

为遵循第十三章所规定的与信息披露有关的持续责任,发行人的董事必须确保不会在一方没有掌握股价敏感资料而另一方则管有该等资料的情况下进行买卖。

【第13.07条】4、联交所所对信息披露的自由裁量权。

为了使信息披露维持在高水平,交易所可在认为必要时,要求发行人发表进一步的资料及向其施加额外的规定,但在施加任何并非一般对发行人实施的规定前,有关发行人可作出申述。

香港交易所上市決策HKEx-LD75-3 (2009 年 10 月 )摘要涉及人士X 公司──主板上市公司,及 Y 公司的控股股東Y 公司──另一主板上市公司事宜 1.X 公司應否使用百分比率同時計算有關配售及先舊後新的認購,以根據《上市規則》第十四章界定交易類別2.就有關配售及先舊後新的認購,聯交所會否豁免X 公司不用符合主要交易的規定上市規則《主板上市規則》第 14.04(1)(a) 、14A.31(3)(d) 條議決 1.有關配售及先舊後新的認購各為X 公司的一項交易。

X公司應使用百分比率獨立計算各項交易,以根據《上市規則》第十四章界定交易類別2.聯交所就有關配售及先舊後新的認購豁免 X 公司不用符合主要交易的規定資料摘要1.X 公司、 Y 公司與配售代理訂立配售及認購協議 (「有關協議」) ,X 公司同意:將其若干數量於Y 公司的現有股份以固定價格配售予獨立投資者(「有關配售」 ),及以配售價認購同等數量由 Y 公司發行的新股 (「先舊後新的認購」)。

2.有關配售是無條件進行的,並將於有關協議執行數日後完成。

3.先舊後新的認購能否完成取決於多項條件,即包括有關配售的完成、 Y 公司根據先舊後新的認購發行的新股獲聯交所批准上市,及證監會企業融資部執行董事根據《收購守則》向X 公司發給清洗豁免。

4.根據《上市規則》第十四 A 章,先舊後新的認購構成 Y 公司的一項關連交易。

先舊後新的認購如可於有關協議執行後14 日內完成,其將獲豁免遵守《上市規則》第14A.33 條有關關連交易的所有規定。

5.X 公司於 Y 公司的持股量將因有關配售而由 46%降至 36%,但先舊後新的認購完成後將增加至42%。

若使用百分比率分別計算有關配售及先舊後新的認購,根據《上市規則》第十四章,有關交易將構成X 公司的一項主要交易。

6.X 公司表示,有關配售的目的在便利 Y 公司集資,而 Y 公司將於有關配售之後不久向 X 公司發行新股。

一、交易五项测试的基本概念。

根据香港联合交易所上市规则第14章《必须发表的交易》的要求,香港股票上市公司在开展资产收购和剥离等交易时,相对规模的交易分为等级不同的交易分类,面临不同的信息公开和审查要求。

在判断交易类型时,规则提供了五个维度的比作为判断标准,即常说的交易规模五项测试。

五个比例本质上反映了交易目标对交易上市公司的重要性,目标对上市公司规模越大,重要性越高,面临的信息披露要求和监督要求越高,反之亦然。

如果五个维度计算的比例落在不同的区间,则有利于保护投资者的知情权,合理判断上市公司的交易行为。

具体来说,比率主要有几个临界值:5%、25%、75%、100%,这分为:股票交易(Sharetransaction)必须公开的交易(Discloseabletransaction)主要交易-销售事项(Majortransaction-disposal)主要交易-收购交易(Majortransaction-acquisition)非常重要的销售事项(Verysubstantialdisposal)非常重要的收购事项(Very.substantial.acquisition)五个维度主要涉及:资产比率(Assetsratio)收益率(Profitsratio)收入比率(Revenueratio)成本比率(Considerationratio)股东比率(Equitycapitalratio)香港股票上市公司涉及资产交易时,首先要以五个比例计算交易目标的相对规模在哪个水平,选择高者来决定交易类型。

简单举个例子,假设a公司的资产规模为100亿美元,年收入为10亿美元,收购目标b公司的资产规模为4.9亿美元,年收入为1亿美元,根据资产比例,4.9/100=4.9%,收入比例为1/10=10%,这里暂时不考虑其他比例因素的影响。

该交易类型应以10%的收入比率进入必须公开的交易,履行公开义务,遵守监督要求。

二、交易五项测试的其他规定。