根据下述信用证进行审核相关单据,找出不符点

- 格式:doc

- 大小:67.50 KB

- 文档页数:8

信用证项下付款是以单据相符为条件,单据的准确程度决定了出口货款的顺利收回与否,而在实务中,能以正点单据索回货款在整个信用证交易中仅能占到几成。

前一段时间,国外作过一次调查,结果表示,70%-80%的单据在第一次交单时存在不符点。

笔者在业务中碰到的情况大致与此相同,鲜有信用证项下一交单就可正点出单的。

既然在信用证交易中单据具有无可比拟的作用,从事国际贸易的每一个人也都知道信用证单据的重要性,为什么还有这么多信用证单据存在不符点呢?对于这个问的分析有助于我们在整个信用证业务流程中及时防范,以尽量减少单据中不符点的产生。

信用证案例分析:依据信用证条款、信用证样本分析、信用证交易案例得出在信用证交易中单据的重要性,提出以下四点合理性的建议,可供从事国际贸易人员作为参考。

首先,不符点产生的最直接也是最常见的原因是公司制单员的业务知识局限和操作疏忽。

这一是因为业务范围的限制,一家公司可能与欧洲业务较多,与中东及其他国家的业务量不大,或者情况正好相反,而每个地区的信用证名;有不同特点,如欧洲的信用证较为规范,中东来证大多条款较为复杂,要求的单据多,有些单据要求还较为独特――这就决定了业务员不可能对所有类型的信用证均熟悉。

另外一般公司的客户较稳定,信用证条款相同或相似,单据制作基本也一成不变,这就导致制单员业务知识的局限,一旦有异于先前的信用证出现,业务人员在制作单据时往往就会出现这样那样的问题。

另外制单员的制单疏忽也是产生不符点的一个因素,小则打字错误引起MINORDISCREPANCY,大至一时疏忽造成实质性不符点。

如曾有一案例,信开信用证规定了唛头,由于唛头在信用证的下方,同一页打不开,开证行在最后一行打上了P.T.O.三个字,公司制单员对此也未深究,把P.T.O.三个字也包括在单据的唛头中,导致开证行拒付。

我们知道,P.T.O.是please turnover的缩写,也即是我们汉语的“请见反面”。

该不符点的造成纯粹是因为制单员的大意和不求甚解。

信用证项下如何审证和处理不符点的问题作者:李燕来源:《对外经贸实务》2012年第01期根据(UCP600)的规定,在信用证结算方式下实行的是“单据相符原则”,即“单证一致,单单一致”,只要受益人提交的单据在表面上与信用证规定的条款一致,以及各种单据之间表面一致,银行就必须履行承诺的付款义务。

那么如何严格按信用证程序操作,缮制合格单据,保证安全收汇呢?笔者根据多年从事进出口实务及在高校任教的经验,认为审证与不符点是整个信用证操作环节中两个很重要的问题,下面谈谈自己的一些粗浅的看法。

一、信用证项下应该如何审证的问题(一)银行如何审证1. 政治性风险的审查。

根据对外贸易必须贯彻国家对外政策的原则,主要看信用证内有没有不符合中国对外政策或有歧视性的内容,凡载有上述条款的信用证,一般应予以退回或要求改正。

或由于政策原因不能与之来往的银行开来的信用证,原则上不能接受。

2. 资信情况的审核。

即对开证行、偿付行的政治背景、银行历史、资信情况、经营作风等方面的审核,对它们的名称、地址和资信情况与银行年鉴进行比较分析,发现疑点,立即向开证行或代理行查询,以确保来证的真实性、合法性和开证行的可靠性。

经营作风欠佳,资信情况不好的,原则上不接受。

若因开拓市场、其他政治原因而需接受的,可要求在即期信用证上加列电报索偿条款(T/T Reimbursement Clause),或让其他资信可靠的银行加以保兑。

3. 审核索汇路线、使用货币、付款责任等条款。

还要仔细核对签字、印鉴或密押是否相符,大额来证还应要求开证行加押证实,以确认信用证表面的真实性。

4. 对信用证的效力、有无保留或限制性条款的审核。

只要内容完整而又无“详情后告”等类似词语,并有“适合UCP500或UCP600的条款或文字”,则该信用证是有效的。

若信用证中规定有“单据中包括开证人授权代表副签核验证书”等含有主动权不在自己手中的“软条款”、“陷阱条款”及其它不利条款,一经发现必须尽快与开证人联系修改,或采取相应的防范措施,防患于未然。

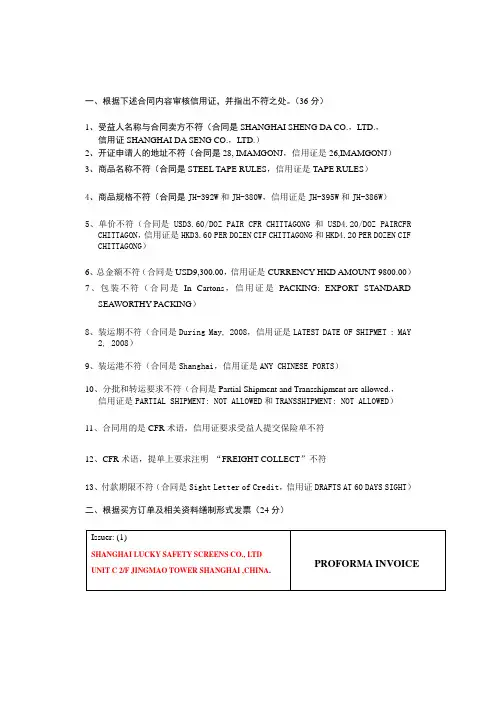

一、根据下述合同内容审核信用证,并指出不符之处。

(36分)1、受益人名称与合同卖方不符(合同是SHANGHAI SHENG DA CO.,LTD.,信用证SHANGHAI DA SENG CO.,LTD.)2、开证申请人的地址不符(合同是28, IMAMGONJ,信用证是26,IMAMGONJ)3、商品名称不符(合同是STEEL TAPE RULES,信用证是TAPE RULES)4、商品规格不符(合同是JH-392W和JH-380W,信用证是JH-395W和JH-386W)5、单价不符(合同是USD3.60/DOZ PAIR CFR CHITTAGONG和USD4.20/DOZ PAIRCFRCHITTAGON,信用证是HKD3.60 PER DOZEN CIF CHITTAGONG和HKD4.20 PER DOZEN CIF CHITTAGONG)6、总金额不符(合同是USD9,300.00,信用证是CURRENCY HKD AMOUNT 9800.00)7、包装不符(合同是In Cartons,信用证是PACKING: EXPORT STANDARDSEAWORTHY PACKING)8、装运期不符(合同是During May, 2008,信用证是LATEST DATE OF SHIPMET : MAY2, 2008)9、装运港不符(合同是Shanghai,信用证是ANY CHINESE PORTS)10、分批和转运要求不符(合同是Partial Shipment and Transshipment are allowed.,信用证是PARTIAL SHIPMENT: NOT ALLOWED和TRANSSHIPMENT: NOT ALLOWED)11、合同用的是CFR术语,信用证要求受益人提交保险单不符12、CFR术语,提单上要求注明“FREIGHT COLLECT”不符13、付款期限不符(合同是Sight Letter of Credit,信用证DRAFTS AT 60 DAYS SIGHT)二、根据买方订单及相关资料缮制形式发票(24分)(12) DETAILS OF OUR BANK:BANK OF CHINA, SHANGHAI BRANCH,NO.4 Zhongshan road, Shanghai ,P.R.CHINASWIFT CODE: BKCHCNBJ530BENEFICIARY: SHANGHAI LUCKY SAFETY SCREENS CO., LTDACCOUNT NO: 1281 2242012 7091 015ADDRESS: UNIT C 2/F JINGMAO TOWER SHANGHAI ,CHINASHANGHAI LUCKY SAFETY SCREENS CO., LTD三、根据合同、信用证及补充资料缮制商业发票、海运提单、汇票及普惠制产地证FORM A(共40分)凭信用证号Drawn under industrial bank of Japan,ltd.,head office L/C NO.LC196107800日期按…. .息…. 付款Dated Oct.15,2007 Payable with interest @… .. % per annum 号码汇票金额上海NO.YL71001Exchange for USD12630.00 Shanghai …DEC.05,2007……………见票…………………日后(本汇票之正本未付)付交At *** sight of this FIRST of Exchange (Second of Exchange being unpaid) Pay to the order of BANK OF CHINA,SHANGHAI BRANCH金额the sum of SAY US DOLLARS TWELVE THOUSAND SIX HUNDRED AND THIRTY ONLY此致To: INDUSTRIAL BANK OF JAPAN,HEAD OFFICESHANGHAI YILONG CO.,LTD.XXXSHANGHAI YILONG CO.,LTD.X X X.Shipper Insert Name, Address and PhoneSHANGHAI YILONG CO.,LTD.NO.91 NANING ROAD SHANGHAI ,CHINA.B/L No.TH14HK07596.Consignee Insert Name, Address and Phone TO ORDER中远集装箱运输有限公司COSCO CONTAINER LINESNotify Party Insert Name, Address and Phone(It is agreed that no responsibility shall attach to the Carrier or his agents for failure to notify)ABC COMPANY1-3 MACHI KU STREET OSAKA,JAPAN Port-to-Port or Combined Transport BILL OF LADINGLADEN ON BOARD THE VESSEL DATE:NOV29,2007BY KAOHSIUNG V.0707SCOSCO CONTAINER LINESCNS01 0108895。

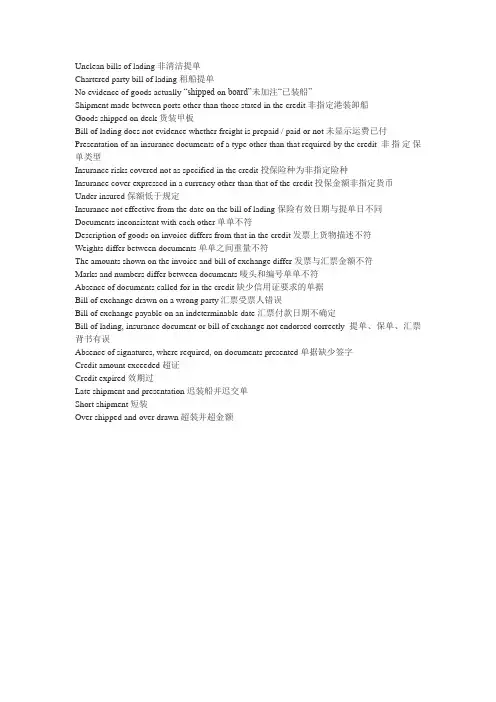

Unclean bills of lading非清洁提单Chartered party bill of lading租船提单No evidence of goods actually “shipped on board”未加注“已装船”Shipment made between ports other than those stated in the credit非指定港装卸船Goods shipped on deck货装甲板Bill of lading does not evidence whether freight is prepaid / paid or not未显示运费已付Presentation of an insurance documents of a type other than that required by the credit 非指定保单类型Insurance risks covered not as specified in the credit投保险种为非指定险种Insurance cover expressed in a currency other than that of the credit投保金额非指定货币Under insured保额低于规定Insurance not effective from the date on the bill of lading保险有效日期与提单日不同Documents inconsistent with each other单单不符Description of goods on invoice differs from that in the credit发票上货物描述不符Weights differ between documents单单之间重量不符The amounts shown on the invoice and bill of exchange differ发票与汇票金额不符Marks and numbers differ between documents唛头和编号单单不符Absence of documents called for in the credit缺少信用证要求的单据Bill of exchange drawn on a wrong party汇票受票人错误Bill of exchange payable on an indeterminable date汇票付款日期不确定Bill of lading, insurance document or bill of exchange not endorsed correctly提单、保单、汇票背书有误Absence of signatures, where required, on documents presented单据缺少签字Credit amount exceeded超证Credit expired效期过Late shipment and presentation迟装船并迟交单Short shipment短装Over shipped and over drawn超装并超金额。

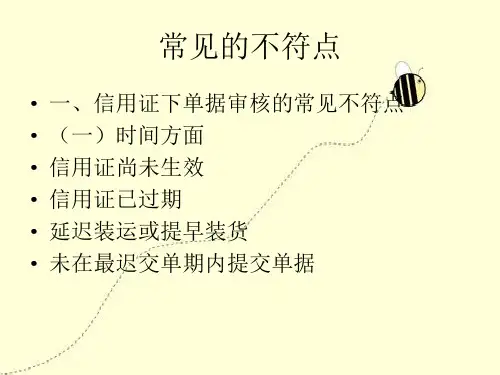

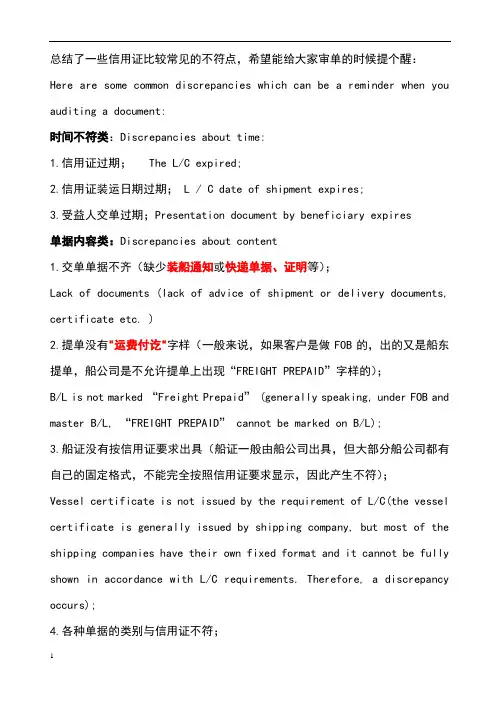

总结了一些信用证比较常见的不符点,希望能给大家审单的时候提个醒:Here are some common discrepancies which can be a reminder when you auditing a document:时间不符类:Discrepancies about time:1.信用证过期; The L/C expired;2.信用证装运日期过期; L / C date of shipment expires;3.受益人交单过期;Presentation document by beneficiary expires单据内容类:Discrepancies about content1.交单单据不齐(缺少装船通知或快递单据、证明等);Lack of documents (lack of advice of shipment or delivery documents, certificate etc. )2.提单没有"运费付讫"字样(一般来说,如果客户是做FOB的,出的又是船东提单,船公司是不允许提单上出现“FREIGHT PREPAID”字样的);B/L is not marked “Freight Prepaid” (generally speaking, under FOB and master B/L, “FREIGHT PREPAID” cannot be marked on B/L);3.船证没有按信用证要求出具(船证一般由船公司出具,但大部分船公司都有自己的固定格式,不能完全按照信用证要求显示,因此产生不符);Vessel certificate is not issued by the requirement of L/C(the vessel certificate is generally issued by shipping company, but most of the shipping companies have their own fixed format and it cannot be fully shown in accordance with L/C requirements. Therefore, a discrepancy occurs);4.各种单据的类别与信用证不符;Discrepancies between each document category and L/C;5.投保的险种与信用证不符;Discrepancies between types of insurance and L/C;6.运输单据和保险单据的背书错误或没有按要求背书;The endorsement error of transport document and insurance document or not according to the requirements of endorsement;7.货物短装或超装(一般信用证都会有±5-10%的数量上落差允许,可以在客户开证之前再做提醒);Cargo short or over loaded (generally, L/C allows a ±5-10% drop, so you can remind your customers before issuing L/C);8.单据没按要求签字盖章;Documents do not be signed and sealed as required;9.单据份数与信用证要求不一致(包括提单,这是可以提前与货代沟通的);Documents copies are not in agreement with L/C (including B/L, which can be confirmed in advance with freight forwarding)在造成不符点的问题中,除了由非受益人出具的单据外(提单、船证、产地证、验货证明等),由受益人出具的证明和文件都是可控的,只要我们足够细心,很多时候,不符点都是可以避免的。

总结了一些信用证比较常见的不符点,希望能给大家审单的时候提个醒:Here are some common discrepancies which can be a reminder when you auditing a document:时间不符类:Discrepancies about time:1.信用证过期; The L/C expired;2.信用证装运日期过期; L / C date of shipment expires;3.受益人交单过期;Presentation document by beneficiary expires单据内容类:Discrepancies about content1.交单单据不齐(缺少装船通知或快递单据、证明等);Lack of documents (lack of advice of shipment or delivery documents, certificate etc. )2.提单没有"运费付讫"字样(一般来说,如果客户是做FOB的,出的又是船东提单,船公司是不允许提单上出现“FREIGHT PREPAID”字样的);B/L is not marked “Freight Prepaid” (generally speaking, under FOB and master B/L, “FREIGHT PREPAID” cannot be marked on B/L);3.船证没有按信用证要求出具(船证一般由船公司出具,但大部分船公司都有自己的固定格式,不能完全按照信用证要求显示,因此产生不符);Vessel certificate is not issued by the requirement of L/C(the vessel certificate is generally issued by shipping company, but most of the shipping companies have their own fixed format and it cannot be fully shown in accordance with L/C requirements. Therefore, a discrepancy occurs);4.各种单据的类别与信用证不符;Discrepancies between each document category and L/C;5.投保的险种与信用证不符;Discrepancies between types of insurance and L/C;6.运输单据和保险单据的背书错误或没有按要求背书;The endorsement error of transport document and insurance document or not according to the requirements of endorsement;7.货物短装或超装(一般信用证都会有±5-10%的数量上落差允许,可以在客户开证之前再做提醒);Cargo short or over loaded (generally, L/C allows a ±5-10% drop, so you can remind your customers before issuing L/C);8.单据没按要求签字盖章;Documents do not be signed and sealed as required;9.单据份数与信用证要求不一致(包括提单,这是可以提前与货代沟通的);Documents copies are not in agreement with L/C (including B/L, which can be confirmed in advance with freight forwarding)在造成不符点的问题中,除了由非受益人出具的单据外(提单、船证、产地证、验货证明等),由受益人出具的证明和文件都是可控的,只要我们足够细心,很多时候,不符点都是可以避免的。

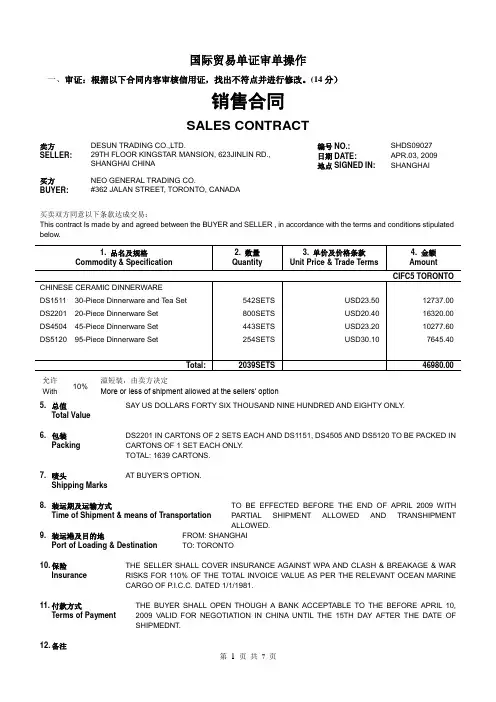

国际贸易单证审单操作一、审证:根据以下合同内容审核信用证,找出不符点并进行修改。

(14分)销售合同SALES CONTRACT卖方SELLER:DESUN TRADING CO.,LTD.29TH FLOOR KINGSTAR MANSION, 623JINLIN RD.,SHANGHAI CHINA编号NO.: SHDS09027日期DATE: APR.03, 2009地点SIGNED IN: SHANGHAI买方BUYER:NEO GENERAL TRADING CO.#362 JALAN STREET, TORONTO, CANADA买卖双方同意以下条款达成交易:This contract Is made by and agreed between the BUYER and SELLER , in accordance with the terms and conditions stipulated below.1. 品名及规格Commodity & Specification2. 数量Quantity3. 单价及价格条款Unit Price & Trade Terms4. 金额AmountCIFC5 TORONTOCHINESE CERAMIC DINNERWAREDS1511 30-Piece Dinnerware and Tea Set DS2201 20-Piece Dinnerware SetDS4504 45-Piece Dinnerware SetDS5120 95-Piece Dinnerware Set 542SETS800SETS443SETS254SETSUSD23.50USD20.40USD23.20USD30.1012737.0016320.0010277.607645.40Total: 2039SETS 46980.00允许With 10%溢短装,由卖方决定More or less of shipment allowed at the sellers’ option5. 总值Total ValueSAY US DOLLARS FORTY SIX THOUSAND NINE HUNDRED AND EIGHTY ONLY.6. 包装Packing DS2201 IN CARTONS OF 2 SETS EACH AND DS1151, DS4505 AND DS5120 TO BE PACKED IN CARTONS OF 1 SET EACH ONLY.TOTAL: 1639 CARTONS.7. 唛头Shipping MarksAT BUYER'S OPTION.8. 装运期及运输方式Time of Shipment & means of Transportation TO BE EFFECTED BEFORE THE END OF APRIL 2009 WITH PARTIAL SHIPMENT ALLOWED AND TRANSHIPMENT ALLOWED.9. 装运港及目的地Port of Loading & Destination FROM: SHANGHAI TO: TORONTO10. 保险Insurance THE SELLER SHALL COVER INSURANCE AGAINST WPA AND CLASH & BREAKAGE & WAR RISKS FOR 110% OF THE TOTAL INVOICE VALUE AS PER THE RELEVANT OCEAN MARINE CARGO OF P.I.C.C. DATED 1/1/1981.11. 付款方式Terms of Payment THE BUYER SHALL OPEN THOUGH A BANK ACCEPTABLE TO THE BEFORE APRIL 10, 2009 VALID FOR NEGOTIATION IN CHINA UNTIL THE 15TH DAY AFTER THE DATE OF SHIPMEDNT.12. 备注RemarksThe Buyer The Seller NEO GENERAL TRADING CO. DESUN TRADING CO.,LTD.(signature) (signature)THE ROYAL BANK OF CANADABRITISH COLUMBIA INTERNATION CENTRE1055 WEST GEORGIA STREET, VANCOUVER, B.C. V6E 3P3CANADA□CONFIRMATION OF TELEX/CABLE PER-ADVISED TELEX NO. 4720688 CA DATE: APR 8, 2009 PLACE: VANCOUVERIRREVOCABLE DOCUMENTARYCREDITCREDIT NUMBER: 09/0501-FCT ADVISING BANK'S REF. NO.ADVISING BANK:SHANGHAI A J FINANCE CORPORATION59 HONGKONG ROADSHANGHAI 200002, CHINA APPLICANT:NEO GENERAL TRADING CO.#362 JALAN STREET, TORONTO, CANADABENEFICIARY:DESUN TRADING CO.,LTD.29TH FLOOR KINGSTAR MANSION, 623JINLIN RD., SHANGHAI CHINA AMOUNT:USD46,980.00(US DOLLARS FORTY SIX THOUSAND NINE HUNDRED AND EIGHTEEN ONLY)EXPIRY DATE: MAY 15, 2009 FOR NEGOTIATION IN APPLICANT COUNTRYGENTLEMEN:WE HEREBY OPEN OUR IRREVOCABLE LETTER OF CREDIT IN YOUR FAVOR WHICH IS AVAILABLE BY YOUR DRAFTS AT SIGHT FOR FULL INVOICE VALUE ON US ACCOMPANIED BY THE FOLLOWING DOCUMENTS:+ SIGNED COMMERCIAL INVOICE AND 3 COPIES.+ PACKING LIST AND 3 COPIES, SHOWING THE INDIVIDUAL WEIGHT AND MEASUREMENT OF EACH ITEM.+ ORIGINAL CERTIFICATE OF ORIGIN AND 3 COPIES ISSUED BY THE CHAMBER OF COMMERCE.+ FULL SET CLEAN ON BOARD OCEAN BILLS OF LADING MARKED “FREIGHT PREPAID” CONSIGNED TO ORDER OF THE ROYAL BANK OF CANADA INDICATING THE ACTUAL DATE OF THE GOODS ON BOARD AND NOTIFY THE APPLICANT WITH FULL ADDRESS AND PHONE NO. 77009910.+ INSURANCE POLICY OR CERTIFICATE FOR 130 PERCENT CIF OF INVOICE VALUE COVERING: INSURANCE CARGO CLAUSES(A) AS PER I.C.C. DATED 1/1/1982.+ BENEFICIARY’S CERTIFICATE CERTIFYING THAT EACH COPY OF SHIPPING DOCUMENTS HAS BEEN FAXED TO THE APPLICANT WITHIN 48 HOURS AFTER SHIPMENT.COVERING SHIPMENT PF:4 ITEMS TERMS OF CHINESE CERAMIC DINNERWARE INCLUDING:DS1511 30-PIECE DINNERWARE AND TEA SET, 544ETSDS2201 20-PIECE DINNERWARE SET, 800SETS,DS4504 45-PIECE DINNERWARE SET, 443SETSDS5120 95-PIECE DINNERWARE SET, 245SETSDETAILS IN ACCORDANCE WITH SALES CONTRACT SHDS09027 DATED APR. 3, 2009.[ ]FOB / [ ]CFR / [X] CIF/ [ ]FAX TORONTO CANADA.SHIPMENT FROM SHANGHAI TOVANCOUVER LATESTAPRIL 30,2009PARTIALSHIPMENTSPROHIBITEDTRANSSHIPMENTPROHIBITEDDRAFTS TO BE PRESENTED FOR NEGOTIATION WITHIN 15 DAYS FROM BILL OF LADING DATE, BUT WITHIN THE VALIDITY根据销售合同的内容审核题中信用证,找出信用证中的不符点,并在下面详细列出:1.2.3.4.5.6.7.OF CREDIT. ALL DOCUMENTS TO BE FORWARDED IN ONE COVER, BY AIRMAIL, UNLESS OTHERWISE STATED UNDER SPECIAL INSTRUCTION.SPECIAL INSTRUCTION: ALL BANKING CHARGES OUTSIDE CANADA ARE FOR ACCOUNT OF BENEFICIARY . + ALL GOODS MUST BE SHIPPED IN FOUR 20'CY TO CY CONTAINER AND B/L SHOWING THE SAME. + THE VALUE OF FREIGHT PREP AID HAS TO BE SHOWN ON BILLS OF LADING.+ DOCUMENTS WHICH FAIL TO COMPLY WITH THE TERMS AND CONDITIONS IN THE LETTER OF CREDIT SUBJECT TO ASPECIAL DISCREPANCY HANDLING FEE OF US$35.00 TO BE DEDUCTED FROM ANY PROCEEDS.DRAFT MUST BE MARKED AS BEING DRAWN UNDER THIS CREDIT AND BEAR ITS NUMBER; THE AMOUNTS ARE TO BE ENDORSED ON THE REVERSE HERE OF BY NEG. BANK. WE HEREBY AGREE WITH THE DRAWERS, ENDORSERS AND FIDE HOLDER THAT ALL DRAFTS DRAWN UNDER AND IN COMPLIANCE WITH THE TERMS OF THIS CREDIT SHALL BE DULY HONORED UPON PRESENTATION.THIS CREDIT IS SUBJECT TO THE UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (2007 REVISION) BY THE INTERNATIONAL CHAMBER OF COMMERCE PUBLICATION NO. 600.David JoneYours Very Truly,Joanne HsanAUTHORIZED SIGNATUREAUTHORIZED SIGNATURE二、审单:根据以下信用证内容审核相关单据,找出不符点并进行修改。

信用证项下单据审核标准及不符点分析作者:刘霁来源:《财经界·学术版》2015年第23期摘要:UCP600在UCP500的基础上进行了修订,指导信用证项下的单据审核有了新的规定,本文从相符交单、单据满足其功能、对受益人和开证申请人的地址要求放宽、银行处理单据的时间这几个方面进行了阐述,并对银行审单过程中的常见不符点进行分析,提出出口商应了解UCP600的新规则,掌握审单新标准,制单过程中避免不符点的出现,确保及时、顺利收汇。

关键词:UCP600 单据审核标准不符点一、信用证项下单据审核标准为了适应国际贸易新形势的发展,更好地对信用证业务加以指引,国际商会自 2003年开始对《跟单信用证统一惯例》进行新一轮的修订工作,第600号出版物UCP600于2007年7月1日正式实施。

与1994年1月1日开始实施的UCP500相比,UCP600在单据审核方面有以下新标准:(一)相符交单所谓相符交单(complying presentation),是指受益人所提交的单据必须与信用证条款、UCP600的相关适用条款以及国际标准银行实务一致。

单据必须满足三个文本的要求,同时得考虑三个文本的优先性,即三个文本的条款若有不协调或冲突的地方,优先按照信用证条款制作单据,其次考虑UCP600,最后参照国际标准银行实务的条款。

UCP500对于信用证项下的单据审核标准可以概括为八个字:“单证相符,单单一致”,银行审单时为了避免付款责任,实施“严格相符”原则,以确定单据表面与信用证条款完全一致,产生了单证绝对一致的镜像标准。

任何标点、空格、字母的疏漏或错误都会导致不符点而引起银行拒付。

这种镜像标准过于刻板、僵化,大大提高了实务中交单遭拒付的概率,影响信用证运行机制的效率,使得信用证业务大量萎缩。

经修订,UCP600第十四条d款则规定:“单据中的数据,在与信用证、单据本身以及国际标准银行实务参照解读时,无须与该单据本身中的数据、其他要求的单据或信用证中的数据等同一致,但不得矛盾。

总结了一些信用证比较常见的不符点,希望能给大家审单的时候提个醒:Here are some common discrepancies which can be a reminder when you auditing a document:时间不符类:Discrepancies about time:1.信用证过期; The L/C expired;2.信用证装运日期过期; L / C date of shipment expires;3.受益人交单过期;Presentation document by beneficiary expires单据内容类:Discrepancies about content1.交单单据不齐(缺少装船通知或快递单据、证明等);Lack of documents (lack of advice of shipment or delivery documents, certificate etc. )2.提单没有"运费付讫"字样(一般来说,如果客户是做FOB的,出的又是船东提单,船公司是不允许提单上出现“FREIGHT PREPAID”字样的);B/L is not marked “Freight Prepaid” (generally speaking, under FOB and master B/L, “FREIGHT PREPAID” cannot be marked on B/L);3.船证没有按信用证要求出具(船证一般由船公司出具,但大部分船公司都有自己的固定格式,不能完全按照信用证要求显示,因此产生不符);Vessel certificate is not issued by the requirement of L/C(the vessel certificate is generally issued by shipping company, but most of the shipping companies have their own fixed format and it cannot be fully shown in accordance with L/C requirements. Therefore, a discrepancy occurs);4.各种单据的类别与信用证不符;Discrepancies between each document category and L/C;5.投保的险种与信用证不符;Discrepancies between types of insurance and L/C;6.运输单据和保险单据的背书错误或没有按要求背书;The endorsement error of transport document and insurance document or not according to the requirements of endorsement;7.货物短装或超装(一般信用证都会有±5-10%的数量上落差允许,可以在客户开证之前再做提醒);Cargo short or over loaded (generally, L/C allows a ±5-10% drop, so you can remind your customers before issuing L/C);8.单据没按要求签字盖章;Documents do not be signed and sealed as required;9.单据份数与信用证要求不一致(包括提单,这是可以提前与货代沟通的);Documents copies are not in agreement with L/C (including B/L, which can be confirmed in advance with freight forwarding)在造成不符点的问题中,除了由非受益人出具的单据外(提单、船证、产地证、验货证明等),由受益人出具的证明和文件都是可控的,只要我们足够细心,很多时候,不符点都是可以避免的。

Practice 1:根据信用证和受益人提交的全套单据,审核单据中存在的不符点。

(通知行Bank of China) +LTDTHE PEOPLERIOTS AND CIVIL COMMOTIONS CLAUSE AND I.O.PTO MESSRS.,1995 CHINESE ROYAL JELLY 70 CTNS@JP4510-KG NETBANKING CO., LTD.,TOKYODated 950314At 90 DAYS sight of this FIRST of Exchange (Second of Exchange being unpaid) Pay to the order of BANK OF CHINASEVENTY FIVE ONLYthe same validity.中国人民保险公司中国人民保险公司(以下简称本公司)THIS POLICY ON INSURANCE WITNESSES THAT THE PEOPLECHINA (HEREINAFTER CALLED“THE COMPANY”)根据AT THE REQUEST OF JIANGSU NATIVE PRODUCE IMPORT & EXPORT (GROUP) CORP.(以下简称被保险人)的要求,由被保险人向本公司缴付约定的(HEREINAFTER CALLED“THE INSURED”) AND IN CONSIDERATION OF THE AGREED PREMIUM PAID TO THE COMPANY BY THE保险费,按照本保险单承保险别和背面所载条款与下列INSURED UNDERTAKES TO INSURE THE UNDERMENTIONED GOODS IN TRANSPORTATION SUBJECT TO THE CONDITION OF THIS POLICY特款承保下述货物运输保险,特立本保险单。

信⽤证制单疏漏导致的不符点案例在通过信⽤证作为国际贸易⽀付⽅式情况下,受益⼈制单的严谨性⾄关重要,任何细⼩的疏漏哪怕只是⼀个字母之差都可能导致开证⾏以存在不符点为由拒受,多年前由宁波市中院终审判决的⼀个信⽤证案在今天看来仍然有指导意义,这也是信⽤证不符点认定上的⼀个典型案例。

1996年4⽉,开证⾏南洋商业银⾏有限公司开局了⼀份不可撤销跟单信⽤证,⾦额为156750美元,开证申请⼈为--企业公司,受益⼈为--集团,信⽤证约定遵守UCP500规则。

同年5⽉4⽇,--中-⾏收到南洋商业银⾏电传的信⽤证后,通知--集团,--集团开始发运该信⽤证项下货物⼀批男⼠短袖衬衫,同时将相应单据包括提单、商业发票、货物运输保险但等单据递交给--中-⾏,随后--中-⾏将这些单据交南洋商业银⾏有限公司请求付款。

南洋商业银⾏在收到这些单据后通知--中-⾏发现单证两处不符点:1、提单表⾯⽆承运⼈名字2、单据所⽰货物名称中RAYGN,⽽信⽤证上名称中此单词应为RAYON,存在⼀个字母的差异。

此后南洋商业银⾏退回了信⽤证项下所有单据。

--集团收到单据后⾃⾏委托了⽬的港⼀家公司提取了到港货物,后--集团向其所在地宁波某区法院起诉南洋商业银⾏,认为其错误认定不符点,要求其承担损失赔偿责任。

经法院审理查明双⽅发⽣争议的焦点在于1、信⽤证要求提单表⾯必须明⽰承运⼈名称,在--集团提供的提单中签名处签章为中国--⾦陵公司--字样,开证⾏南洋商业银⾏认为此处存在⼀个单位和⼀个⾃然⼈两个签名主体,⽆法确定具体承运⼈,不符合信⽤证要求的明确具体的承运⼈;⽽--集团认为该签章实为⼀个主体不可分割;2、对于货物名称中⼀个字母的差异,开证⾏南洋商业银⾏认为根据UCP500规则,单证相符的要求是严格相符,任何单证表⾯的不匹配都构成不符点,⽽--集团提供证据表明其收到的信⽤证上该字母为RAYGN,双⽅出现差异可能为电传变字导致,但对此银⾏可以免责。

最终,法院经审理认为,南洋商业银⾏作为开证⾏在审单时坚持单证严格相符的原则审核单据并作出拒付决定并⽆不妥,驳回--集团诉请;后--集团上诉⾄宁波市中院,经审理宁波市中院判决驳回上诉请求,维持原判。

信用证结算单据不符如何处理

信用证结算单据不符如何处理以信用证结算,单据的确认首先是议付行和开证行的确认为准,而不是以客户(进口商)确认。

议付行和开证行在接到受益人(出口商)提交的单据之后,确认所交来的单据与信用证规定的要求相符,则接受单据并承担付款的义务。

如果有不符点,则议付行或开证行就可以拒绝付款。

因为信用证的第一付款人是开证行或其指定的付款行,而信用证的开证申请人(进口商)是第二付款责任人。

即只要单证相符,开证行或其指定的付款行要先行支付货款,买下全套单据,再向开证申请人提示,要求开证申请人付款或承兑赎单。

至于单据有不符点,可以有两种方式处理:

1)在议付行交单时辨认出存有相符点,凡是顾得上并可以修正,就轻易修正这些相符点,并使之与信用证吻合,从而确保正常议付货款。

2)在议付行交单时发现有不符点,但已来得及修改,或单据到开证行被发现有不符点,此时已无法修改,则可以通知开证申请人(进口商),说明单据出现的不符点,请他来电确认接受不符点,同时找开证行表示接受单据的不符点,则仍可以收回货款。

但这存有一个前提,即为只是单据上不合乎信用证的规定,而并无货物质量的问题或相符,否则进口商就是有可能不拒绝接受货物质量的相符的。

上述(2)这种交单收汇,实际上已经是由信用证性质变成了托收性质,即由原来信用证的银行承诺的第一付款责任的地位,退为托收银行的地位。

这种变化是因为单证不符而引起的。

所以风险加大了。

3)因此,信用证支付的首要问题就是一定必须努力做到“单证吻合”和“单单是吻合”,这样就可以确保安全收汇!这就是搞信用证支付所必须注重的首要问题,容不得半点模棱两可!。

根据下述信用证进行审核相关单据,找出不符点。

交单日期是:JAN. 28,2006(一)信用证RECEIVED FROM:CHOHKRSECHO HUNG BANKSEOUL100 757 SEOULKOREA,REPUBLIC OFDESTINATION: ABOCCNBJA110AGRICULTURAL BANK OF CHINA,THEHANGZHOU(ZHEJIANG BRANCH)MESSAGE TYPE: 700 ISSUE OF A DOCUMENTARY CREDIT DATE: 7 MAR 2006:27 :SEQUENCE OF TOTAL1/1:40A:FORM OF DOCUMENTARY CREDITIRREVOCABLE:20 :DOCUMENTARY CREDIT NUMBERABC12345:31C:DATE OF ISSUE060605:31D:DATE OF EXPIRY,PLACE OF EXPIRY060615 AT NEGOTIATION BANK:50 :APPLICANTXYZ TRADING CO.,LTDNO.1 KING ROADSEOUL,KOREA.:59 :BENEFICIARYJJJ IMPORT AND EXPORT COMPANYNO.32 DINGHAI ROADHANGZHOU CHINA:32B:CURRENCY CODE :USDAMOUNT :35,500:41D:AVAILABLE WITH … BY …ANY BANKBY NEGOTIATION:42C:DRAFTS AT …AT SIGHT:42D:DRAWEEDRAWN ONCHO HUNG BANK,SEOULFOR FULL INVOICE COST.:43P:PARTIAL SHIPMENTSPROHIBITED:43T:TRANSSHIPMENTPROHIBITED:44A:LOADING ON BOARD/DISPATCH/TAKING IN CHARGESHANGHAI,CHINA:44B:FOR TRANSPORTATION TO …PUSAN,KOREA:44C:LATEST DATE OF SHIPMENT990631:45A:DESCRIPTION OF GOODS AND/OR SERVICESHEFC BLEND-A FIRE EXTINGUISHER 5,000KGSCIF PUSAN PORT AT USD7.10 AGENTCHINA ORIGIN:46A:DOCUMENTS REQUIREDSIGNED COMMERCIAL INVOICE IN QUINTUPLICATEFULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO THE ORDER OF CHO HUNG BANK MARKED “FREIGHT PREPAID”AND NOTIFY ACCOUNTEEINSURANCE POLICY,CERTIFICAT OR DECLARATION IN DUPLICATE,ENDORSED IN BLANK FOR 110PCT OF THEINVOICE COST.INSURANCE POLICY,CERTIFICATE ORDECLARATION MUST EXPRESSLY STIPULATE THAT CLAIMS ARE PAYABLE IN THE CURRENCY OF THE CREDIT AND MUST ALSO INDICATE A CLAIMS SETTLING AGENT IN KOREAINSURANCE MUST INCLUDE:I.C.C.ALL RISKPACKING LIST IN DUPLICATE:47A:ADDITIONAL CONDITIONSUPON RECEIPT OF YOUR DOCUMENTS IN GOOD ORDER,WE WILL REMIT THE PROCEEDS TO THE ACCOUNT DESIGNATED BY NEGOTIATION.:71B:CHARGEALL BANKING COMMISSIONS AND CHARGES,INCLUDINGREIMBURSEMENT CHARGES AND POSTAGE OUTSIDE KOREAARE FOR ACCOUNT OF BENEFICIARY.:48 :PERIOD FOR PRESENTATIONDOCUMENTS MUST BE PRESENTED WITHIN 15 DAYS AFTER THE DATE OF SHIPMENT:49 :CONFIRMATION INSTRUCTIONSWITHOUT:78 :INSTRNS TO PAYING/ACCEPTING/NEGOTIATING BANKTHE AMOUNT OF EACH NEGOTIATION(DRAFT)MUST BEENDORSED ON THE REVERSE OF THIS CREDIT BY THENEGOTIATING BANK.ALL DOCUMENTS MUST BE FORWARDED DIRECTLY BY COURIER SERVICE IN ONE LOT TO CHO HUNG BANK H.O.,(INT’L OPERATIONS DIVISION)14,1-KA,NAMDAMUNRO,CHUNG-KU,SEOUL 100-757,KOREA. IF DOCUMENTS ARE PRESENTED WITH DISRCREPANCIES,A DISCREPANCY FEE OF USD60.00 OR EQUIVALENT SHOULD (WILL)BE DEDUCTED FROM THE REIMBURSMENT CLAIM(THE PROCEEDS).THIS FEE SHOULD BE CHARGED TO THE BENEFICIARY.:57D: “ADVISE THROUGH”BANKPLS ADVISE THRU YR HANGZHOU BRANCHINT’L DEPT.:72 :SENDER TO RECEIVER INFORMATIONTHIS CREDIT IS SUBJECT TO I.C.C.PUBLIC NO 500(1993 REVISION) (二)商业发票 in 4 copies(四)海运提单 3/3(五)保险单 2/2PINGAN INSURANCE COMPANY OF CHINA,LTD. NO.1206007787CARGO TRANSPORTATION INSURANCE POLICY。

根据下述合同内容审核信用证,指出不符之处,并提出修改意见。

SHANGHAI ANDYS TRADING CO., LTD.SALES CONTRACTTHE SELLER: SHANGHAI ANDYS TRADING CO., LTD. NO. AD13007NO. 126 Wenhua Road, Shanghai,China DATE: MAR. 16, 2013SIGNED AT: SHANGHAI, CHINA THE BUYER: HAZZE AB HOLDINGBOX 1237, S-111 21HUDDINGE, SWEDENThis contract is made by and between the Seller and Buyer, whereby the Seller agree to sell and the Buyer agree to buy the under-mentioned commodity according to the terms and conditionsPACKING: In Carton. SHIPPING MARKS: TIME OF SHIPMENT:During July,2013. HAZZEPLACE OF LOADING AND DESTINATION: AD2013007From Shanghai, China to Stockholm, Sweden STOCKHOLM, SWEDEN Partial shipment and transshipment are allowed. NOS.1- UP INSURANCE: To be effected by the Buyer.TERMS OF PAYMENT: By irrevocable L/C at sight which should be issued before May31,2013, valid for negotiation in China for further 15 days after timeof shipment.INSPECTION: In the factory.This contract is made in two original copies and become valid after signature, one copy to be held by each party.Signed by:THE SELLER THE BUYERSHANGHAI ANDYS TRADING CO., LTD. HAZZE AB HOLDINGHazze信用证:MT 700 ISSUE OF A DOCUMENTARY CREDIT SENDER SWEDBANKRECEIVER BANK OF CHINA, SHANGHAI, CHINASEQUENCE OF TOTAL27: 1 / 1FORM OF DOC.CREDIT40A:IRREVOCABLEDOC. CREDIT NUMBER20:BCN1008675DA TE OF ISSUE31C:130612APPLICABLE RULES40E:UCP LATEST VERSION31D:DA TE 130630 PLACE IN SWEDENDA TE AND PLACE OFEXPIRY.APPLICANT50:HAZZE ABC HOLDINGBOX 1237, S-111 21HUDDINGE, SWEDEN BENEFICIARY59:SHANGHAI ANDY TRADING CO., LTD.NO. 126 WENHUAROAD,SHANGHAI, CHINA. AMOUNT32B:CURRENCY EUR AMOUNT 27,000.00A V AILABLE WITH/BY41D:ANY BANK IN CHINA,BY NEGOTIATIONDRAFTS AT ...42C:30 DAYS AFTER SIGHTDRAWEE42A:HAZZE AB HOLDING 改为开证行PARTIAL SHIPMTS44P:NOT ALLOWEDTRANSSHIPMENT44T:NOT ALLOWEDPORT OF LOADING44E:TIANJIN, CHINAPORT OF DISCHARGE44F:STOCKHOLM, SWEDENLATEST SHIPMENT44C:130615DESCRIPTION OF GOODS 45A:1000 PCS OF GAS DETECTORS AS PER S/CNO.AD13007CIF STOCKHOLMPACKED IN CARTONSDOCUMENTS REQUIRED46A:+ COMMERCIAL INVOICE SIGNED MANUALL Y INMT 700 ISSUE OF A DOCUMENTARY CREDITTRIPLICATE.+ PACKING LIST IN TRIPLICATE.+ CERTIFICATE OF CHINESE ORIGIN CERTIFIEDBY CHAMBER OF COMMERCE.+ INSURANCE POLICY/CERTIFICATE INDUPLICATE ENDORSED IN BLANK FOR 110%INVOICE V ALUE, COVERING ALL RISKS AND WARRISK OF CIC OF PICC (1/1/1981).删+ FULL SET OF CLEAN ‘ON BOARD’ OCEAN BILLSOF LADING MADE OUT TO ORDER MARKEDFREIGHT PREPAID AND NOTIFY APPLICANT. ADDITIONAL CONDITION47A:+ ALL PRESENTATIONS CONTAININGDISCREPANCIES WILL ATTRACT A DISCREPANCYFEE OF USD50.00. THIS CHARGE WILL BEDEDUCTED FROM THE BILL AMOUNT WHETHEROR NOT WE ELECT TO CONSULT THE APPLICANTFOR A WAIVER.CHARGES71B:ALL CHARGES AND COMMISSIONS OUTSIDESWEDEN ARE FOR ACCOUNT OF BENEFICIARY.49:WITHOUTCONFIRMATIONINSTRUCTION答案:1. 31C 开证日期与合同不符,应为:2013年5月31日之前2. 31D有效期与合同不符,应为:2013年8月15日及该日之后3. 31D到期地点与合同不符,应为:CHINA4. 50开证申请人名称与合同不符,不是HAZZE ABC HOLDING,应为:HAZZE AB HOLDING5. 59受益人名称与与合同不符,不是SHANGHAI ANDY TRADING CO., LTD.,应为:SHANGHAI ANDYS TRADING CO., LTD.6. 32B货币名称与合同不符,应为:USD7. 32B信用证金额与合同不符,应为:275008. 42C付款期限与合同不符,应为:即期(写成AT SIGHT也得分)9. 42A受票人(写“付款人”也可)不应为开证申请人,应为:SWEDBANK(写“开证行”或“ISSUING BANK”也可)10. 44P不允许分批与合同不符,应为:允许(ALLOWED)11. 44T不允许转运与合同不符,应为:允许(ALLOWED)12. 44E装运港与合同不符,应为:SHANGHAI13.44C最迟装运期与合同不符,应为:13073114. 45A数量与合同不符,不是1000PCS,应为:100PCS15. 45A贸易术语与合同不符,I不是CIF STOCKHOLM,应为:FOB SHANGHAI16. 合同采用的贸易术语为FOB,46A不应该要求受益人提交保险单,应为:删除此条17. 46A海运提单要求注明“FREIGHT PREPAID ”,与FOB术语不符,应为:FREIGHT COLLECT18. 71B所有的费用和佣金由受益人负担不妥,应为:ALL CHARGES AND COMMISSIONS OUTSIDE SWEDEN ARE FOR ACCOUNT OF BENEFICIARY.。

根据下述信用证进行审核相关单据,找出不符点。

交单日期是:JAN. 28,2006

(一)信用证

RECEIVED FROM:CHOHKRSE

CHO HUNG BANK

SEOUL

100 757 SEOUL

KOREA,REPUBLIC OF

DESTINATION: ABOCCNBJA110

AGRICULTURAL BANK OF CHINA,THE

HANGZHOU(ZHEJIANG BRANCH)

MESSAGE TYPE: 700 ISSUE OF A DOCUMENTARY CREDIT DATE: 7 MAR 2006

:27 :SEQUENCE OF TOTAL

1/1

:40A:FORM OF DOCUMENTARY CREDIT

IRREVOCABLE

:20 :DOCUMENTARY CREDIT NUMBER

ABC12345

:31C:DATE OF ISSUE

060605

:31D:DATE OF EXPIRY,PLACE OF EXPIRY

060615 AT NEGOTIATION BANK

:50 :APPLICANT

XYZ TRADING CO.,LTD

NO.1 KING ROAD

SEOUL,KOREA.

:59 :BENEFICIARY

JJJ IMPORT AND EXPORT COMPANY

NO.32 DINGHAI ROAD

HANGZHOU CHINA

:32B:CURRENCY CODE :USD

AMOUNT :35,500

:41D:AVAILABLE WITH … BY …

ANY BANK

BY NEGOTIATION

:42C:DRAFTS AT …

AT SIGHT

:42D:DRAWEE

DRAWN ON

CHO HUNG BANK,SEOUL

FOR FULL INVOICE COST.

:43P:PARTIAL SHIPMENTS

PROHIBITED

:43T:TRANSSHIPMENT

PROHIBITED

:44A:LOADING ON BOARD/DISPATCH/TAKING IN CHARGE SHANGHAI,CHINA

:44B:FOR TRANSPORTATION TO …

PUSAN,KOREA

:44C:LATEST DATE OF SHIPMENT

990631

:45A:DESCRIPTION OF GOODS AND/OR SERVICES

HEFC BLEND-A FIRE EXTINGUISHER 5,000KGS

CIF PUSAN PORT AT USD7.10 AGENT

CHINA ORIGIN

:46A:DOCUMENTS REQUIRED

SIGNED COMMERCIAL INVOICE IN QUINTUPLICATE

FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO THE ORDER OF CHO HUNG BANK MARKED “FREIGHT PREPAID”AND NOTIFY ACCOUNTEE

INSURANCE POLICY,CERTIFICAT OR DECLARATION IN

DUPLICATE,ENDORSED IN BLANK FOR 110PCT OF THE

INVOICE COST.INSURANCE POLICY,CERTIFICATE OR

DECLARATION MUST EXPRESSLY STIPULATE THAT CLAIMS ARE PAYABLE IN THE CURRENCY OF THE CREDIT AND MUST ALSO INDICATE A CLAIMS SETTLING AGENT IN KOREA

INSURANCE MUST INCLUDE:I.C.C.ALL RISK

PACKING LIST IN DUPLICATE

:47A:ADDITIONAL CONDITIONS

UPON RECEIPT OF YOUR DOCUMENTS IN GOOD ORDER,WE WILL REMIT THE PROCEEDS TO THE ACCOUNT DESIGNATED BY NEGOTIATION.

:71B:CHARGE

ALL BANKING COMMISSIONS AND CHARGES,INCLUDING

REIMBURSEMENT CHARGES AND POSTAGE OUTSIDE KOREA

ARE FOR ACCOUNT OF BENEFICIARY.

:48 :PERIOD FOR PRESENTATION

DOCUMENTS MUST BE PRESENTED WITHIN 15 DAYS AFTER THE DATE OF SHIPMENT

:49 :CONFIRMATION INSTRUCTIONS

WITHOUT

:78 :INSTRNS TO PAYING/ACCEPTING/NEGOTIATING BANK

THE AMOUNT OF EACH NEGOTIATION(DRAFT)MUST BE

ENDORSED ON THE REVERSE OF THIS CREDIT BY THE

NEGOTIATING BANK.ALL DOCUMENTS MUST BE FORWARDED

DIRECTLY BY COURIER SERVICE IN ONE LOT TO

CHO HUNG BANK H.O.,(INT’L OPERATIONS DIVISION)

14,1-KA,NAMDAMUNRO,CHUNG-KU,SEOUL 100-757,KOREA.

IF DOCUMENTS ARE PRESENTED WITH DISRCREPANCIES,

A DISCREPANCY FEE OF USD60.00 OR EQUIVALENT SHOULD

(WILL)BE DEDUCTED FROM THE REIMBURSMENT CLAIM

(THE PROCEEDS).THIS FEE SHOULD BE CHARGED TO THE

BENEFICIARY.

:57D: “ADVISE THROUGH”BANK

PLS ADVISE THRU YR HANGZHOU BRANCH

INT’L DEPT.

:72 :SENDER TO RECEIVER INFORMATION

THIS CREDIT IS SUBJECT TO I.C.C.PUBLIC NO 500(1993 REVISION) (二)商业发票 in 4 copies

(四)海运提单 3/3

(五)保险单 2/2

PINGAN INSURANCE COMPANY OF CHINA,LTD. NO.1206007787

CARGO TRANSPORTATION INSURANCE POLICY。