国际结算双语(票据)

- 格式:ppt

- 大小:1.47 MB

- 文档页数:7

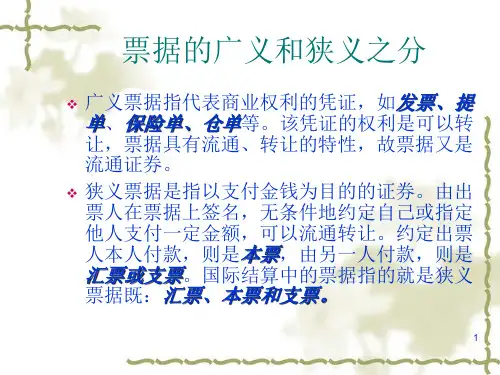

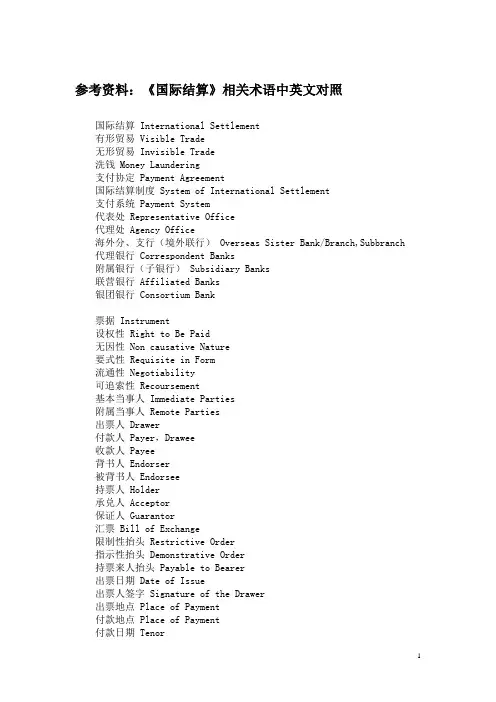

参考资料:《国际结算》相关术语中英文对照国际结算 International Settlement有形贸易 Visible Trade无形贸易 Invisible Trade洗钱 Money Laundering支付协定 Payment Agreement国际结算制度 System of International Settlement支付系统 Payment System代表处 Representative Office代理处 Agency Office海外分、支行(境外联行) Overseas Sister Bank/Branch,Subbranch 代理银行 Correspondent Banks附属银行(子银行) Subsidiary Banks联营银行 Affiliated Banks银团银行 Consortium Bank票据 Instrument设权性 Right to Be Paid无因性 Non causative Nature要式性 Requisite in Form流通性 Negotiability可追索性 Recoursement基本当事人 Immediate Parties附属当事人 Remote Parties出票人 Drawer付款人 Payer,Drawee收款人 Payee背书人 Endorser被背书人 Endorsee持票人 Holder承兑人 Acceptor保证人 Guarantor汇票 Bill of Exchange限制性抬头 Restrictive Order指示性抬头 Demonstrative Order持票来人抬头 Payable to Bearer出票日期 Date of Issue出票人签字 Signature of the Drawer出票地点 Place of Payment付款地点 Place of Payment付款日期 Tenor见票即付 At Sight or on Demand定日付款 At a Fixed Date见票后定期付款 At a Fixed Period after Sight出票后定期付款 At a Fixed Period after Date付一不付二 Pay This First/Second Bill担当付款人 Person Designated as payer预备付款人 Referee in Case of Need必须提示承兑 Presentment for Acceptance Required 不得提示承兑 Acceptance Prohibited付对价持票人 Holder for Value正当持票人Holder in Due Course/Bona Fide Holder 银行汇票 Banker’s Draft商业汇票 Trade Bill承兑汇票Acceptance Bill银行承兑汇票 Banker’s Acceptance Bill商业承兑汇票 Trade’s Acceptance Bill即期汇票 Sight Draft ,Demand Draft远期汇票 Time Bill, Usance Bill光票 Clean Bill跟单汇票 Documentary Bill本票 Promissory Note商业本票Promissory Note银行本票 Cashier’s Order/Check国际汇票 Overseas Money Order支票 Cheque or Check出票 Issue背书 Indorsement承兑 Acceptance保证 Guarantee保付 Certified to Pay提示 Presentation付款 Payment拒付 Dishonour追索 Recourse顺汇 Remittance逆汇 Reverse Remittance汇款人 Remitter汇出行 Remitting Bank汇入行 Paying Bank收款人 Payee电汇 Telegraphic Transfer信汇 Mail Transfer票汇 Remittance by Banker’s Demand Draft预付货款 Payment in Advance货到付款 Payment after Arrival of the Goods托收 Collection委托人 Principal托收行 Remitting Bank代收行 Collecting Bank付款人 Drawee提示行 Presenting Bank托收申请书 Collection Application托收委托书 Collection Advice信用证 Letter of Credit议付行 Negotiating Bank偿付行 Reimbursing Bank开证申请人Applicant开证行 Issuing Bank受益人 Beneficiary通知行 Advising Bank保兑行 Confirming Bank付款行 Paying Bank光票信用证 Clean Credit跟单信用证 Document Credit不可撤销信用证Irrevocable Credit可撤销信用证 Revocable Credit保兑信用证 Confirmed Credit不保兑信用证 Unconfirmed Credit即期付款信用证 Sight Payment Credit延期付款信用证 Deferred Payment Credit承兑信用证 Acceptance Credit转让信用证 Transferable Credit不可转让信用证 Nor-transferable Credit背对背信用证 Back to Back Credit循环信用证 Revolving Credit预支信用证 Anticipatory Credit银行保函 Letter of Guarantee申请人 Applicant/Principal受益人 Beneficiary担保行 Guarantor Bank通知行 Advising Bank转开行 Reissuing Bank反担保行 Counter Guarantor Bank保兑行 Confirming Bank投标保函 Tender Gurantee履约保函 Performance Gurantee预付款保函 Advanced Payment Gurantee质量保函Quality Gurantee关税保付保函 Customs Gurantee付款保函 Payment Gurantee延期付款保行 Defeerd Payment Gurantee补偿贸易保函 Compensation Gurantee来料加工保函 Processing Gurantee租赁保函 Lease Gurantee借款保函 Loan Gurantee保释金保函 Bail Bond票据保付保函Gurantee For Bill费用保付保函 Payment Gurantee for Commission 备用信用证 Stand-by Letter of Credit单据 Documents商业发票 Commercail Invoice首文 Heading正文Body海关发票 Customs Invoice形式发票 Proforma Invoice领事发票 Consular Invoice样品发票 Sample Invoice广商发票 Manufacturer Invoice证实发票 Certified Invoice货物运输单据 Transport documents海运提单Marine Bill of Loading托运人 Shipper/Consignor承运人 Carrier收货人 Consignee受让人 Transferee or Assignee已装船提单 Shipped on Board待运提单 Received for Shipment直达提单Direct B/L转船提单 Transshipmen B/L联运提单 Through B/L清洁提单 Clean B/L不清洁提单 Unclean B/L记名提单 Straight B/L不记名提单 Open B/L指示性提单 Order B/L简式提单 Short Form B/L全式提单 Long Form B/L班轮提单 Liner B/L租船提单 Charter B/L运输代理行提单 Horse B/L过期提单 Stale B/L倒签提单Anti-dated B/L集装箱运输提单 Container B/L多式运输 Multimodal Transport多是运输单据Multimodal Transport Document不可流通转让的海运单 Non-negotiable Sea Waybill租船合约提单 Charter Party Bill of Lading航空运单 Airway Bill基本险 Chief Risk一般附加险 Additional Risk特殊附加险 Special Additional Risk保险单 Insurance Policy预约保险单Open Policy of Open Cover保险凭证 Insurance Certificate保险声明 Insurance Declaration联合凭证 Combined Certificate暂保单 Cover Note商品验证说明 Inspection Certificate产地证明书 Certificate of Origin包装单据 Packing Document装货箱 Packing List重量单 Weight List打包贷款 Packing Credit/Loan出口押汇 Outward Bill质押书 Letter of Hypothecation出口托收押汇 Advance against Documentary Collection 银行承兑 Bank’s Acceptance票据贴现 Bill Discount出口发票 Invoice Discounting进口开证额度 Limits for Issuing of Credit信托收据 Trust Receipt, T.R, T/R留置权书 Letter of Lien进口押汇 Inward Bills进口信用证押汇 Inward Bill Receivables买房远期信用证 Buyer’s Usance L/C提货担保 Delivery against Bank Guarantee国际保理 International Factoring销售分户账管理 Maintenance of The Sales Ledger债款回收 Collection from Debtors信用销售控制 Credit Control坏账担保 Full Protection Against Bad Debts贸易融资 Trade Financing福费廷 Forfaiting贴现率 Discount Rate承诺费 Commitment Fee利息补贴 Interest Make-up侨汇 Overseas Chinese Remittance外币兑换业务 Exchange of Foreign Currency旅行支票 Traveler’s Cheque信用卡 Credit Card万事达卡 Master Card维萨卡 VISA Card运通卡 American Express Card大莱卡 Diners Club Car国际贸易结算:以票据为基础,单据为条件,银行为中枢,结算与融资相结合的非现金结算体系。

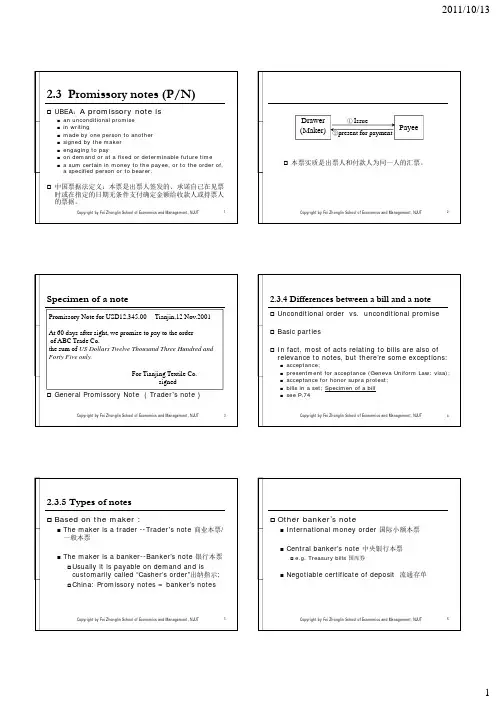

Copyright by Fei Zhonglin School of Economics and Management, NJUT12.3 Promissory notes (P/N)UBEA :A promissory note isan unconditional promise in writingmade by one person to another signed by the maker engaging to payon demand or at a fixed or determinable future timea sum certain in money to the payee, or to the order of, a specified person or to bearer.中国票据法定义:本票是出票人签发的、承诺自己在见票时或在指定的日期无条件支付确定金额给收款人或持票人的票据。

Copyright by Fei Zhonglin School of Economics and Management, NJUT 2本票实质是出票人和付款人为同一人的汇票。

①Issue ②present forpaymentDrawer (Maker)PayeeCopyright by Fei Zhonglin School of Economics and Management, NJUT3Specimen of a noteGeneral Promissory Note ( Trader ’s note )Promissory Note for USD12,345.00 Tianjin,12 Nov.2001At 60 days after sight, we promise to pay to the order of ABC Trade Co.the sum of US Dollars Twelve Thousand Three Hundred and Forty Five only.For Tianjing Textile Co.signedCopyright by Fei Zhonglin School of Economics and Management, NJUT 42.3.4 Differences between a bill and a noteUnconditional order vs. unconditional promise Basic partiesIn fact, most of acts relating to bills are also of relevance to notes, but there ’re some exceptions:acceptance;presentment for acceptance (Geneva Uniform Law: visa); acceptance for honor supra protest; bills in a set; Specimen of a billsee P.74Copyright by Fei Zhonglin School of Economics and Management, NJUT 52.3.5 Types of notesBased on the maker :The maker is a trader --Trader ’s note 商业本票/一般本票The maker is a banker--Banker ’s note 银行本票 Usually it is payable on demand and iscustomarily called “Casher ’s order ”出纳指示; China: Promissory notes = banker ’s notesCopyright by Fei Zhonglin School of Economics and Management, NJUT 6Other banker ’s noteInternational money order 国际小额本票Central banker ’s note 中央银行本票e.g. Treasury bills 国库券Negotiable certificate of deposit 流通存单Copyright by Fei Zhonglin School of Economics and Management, NJUT72.4 ChequesUBEA :A cheque is a bill of exchange drawn on a banker payable on demand.A three-party instrument, the drawee is a bank Payable on demand中国票据法定义:支票是出票人签发的,委托办理支票存款业务的银行在见票时无条件支付确定金额给收款人或持票人的票据。

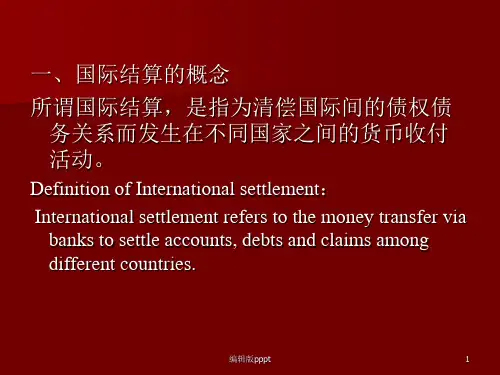

1.1 The Concept of International Trade国际贸易的观念International trade is the exchange of goods and services produced in one country for those produced in another country. In most cases countries do not trade the actual the goods and services. Rather they use the income or money from the sale of their products to buy the products of another country.1.2 Introduction to International Payments and SettlementsInternational payments and settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to clear relations of debts.国际支付与结算是指为清偿国际间的债权债务关系或跨国转移资金而发生在不同国家之间的货币收付活动。

1.2 categories(分类)(1)、According to the cause of international settlementInternational trade settlement(国际贸易结算)International trade settlement is created on the basis of sales of commodities.国际贸易结算是指有形贸易活动(即由商品的进出口)引起的货币收付活动.(主要形式)International non-trade settlement (国际非贸易结算)invisible trade无形交易financial transaction金融业务payment between governments政府间的款项others 其他业务(2)、According to whether cash is usedCash settlement(现金结算)International payments is effected by shipping precious metals taking the form of coins, bars or bullions to or from the trading countries.Non-cash settlement(非现金结算)International payment is settled by way of transferring funds through the accounts opened in these banks.Four major clearing systems in the world(四大清算系统)2.1 SWIFT(Society for Worldwide Interbank Financial Telecommunication)SWIFT is a service organization established to meet a number of specialized service needs relating to interbank financial communications through a dedicated data processing and telecommunication system.Membership 会员制Low expenses 低费用Security 安全性Standardised 标准化2.2 CHIPS(The Clearing House Interbank Payment System).纽约清算所同业支付系统2.3 CHAPS(Clearing House Automated Payment System)伦敦银行同业自动支付系统2.4 TATGET(Trans-European Automated Real-Time Gross-Settlement Express Transfer)泛欧实时全额自动清算系统3.1 Correspondent Bank代理银行Correspondent banking is an arrangement under which one bank (correspondent) holds deposits owned by other banks (respondents) and provides payment and other services to those respondent banks. Such arrangements may also be known as agency relationships in some domestic contexts.是接受其他国家或地区的银行委托,代办国际结算业务或提供其他服务,并建立相互代理业务关系的银行。

实验素材一——票据一、汇票(一)客户向银行提交汇票,按汇票必要项目和所给问题对其进行审核和处理。

(二)客户提交汇票委托银行收款,银行对汇票有效性进行判断并给客户提出建议。

(三)根据所给条件填写汇票。

1.汇票一:Due 10,Jan,2004Exchange for GBP21,350.00 Changsha,10,Jan, 2004At one month after date sight of this First Bill of Exchange (Second unpaid) pay to Agricultural Bank of China, Hunan or orderthe sum of GBP Twenty One Thousand Three Hundred and Fifty onlyDrawn against 1 000 boxes of glass bricks from Changsha to LondonTo AAA Group Co.,Ltd., London For Hunan Arts & CraftsImp.& Exp. CompanyAuthorized Signature(s)2.汇票二:Exchange for J¥7,082,000.00Tokyo, 17th,Nov,2004At 90 days after sight of this First Bill of Exchange(Second unpaid)pay to CREDIT SUISSE,TOKYO, BRANCH or orderthe sum of Japanese Yen Seven Million Eighty Two Thousand onlyDrawn under LC No. 235GD201 issued by Bank of China, Guangdong Branch, dated 20/Oct., 2004To Bank of China,Guangdong Branch For TOYOTA TSUSHOCORPORATIONAuthorized Signature(s)3.汇票三:Exchange for USD34,486.78 Guangzhou ,25th,February,2003At***sight of this Second Bill of Exchange (First unpaid)pay to China National Animal By-products Imp.& Exp. Corp.,Guangzhou or orderthe sum of U.S dollar thirty four thousand four hundred and eighty six point seven eightDrawn under LC No. 2431/221 issued by First National Bank of Chicago, dated20/Dec.,2002To First National Bank,Chicago For Guangzhou, China National AnimalBy-products Imp.& Exp. Corp., BranchAuthorized Signature(s)(四)GUANGDONG IMP. & EXP. CORPORATION提交一张远期汇票委托银行收款,付款人承兑汇票后在票面加盖承兑章。