2014年铜价记录表

- 格式:xlsx

- 大小:24.18 KB

- 文档页数:3

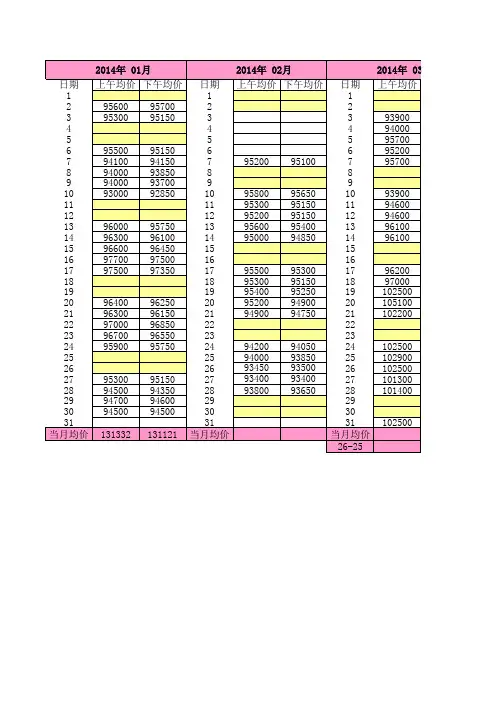

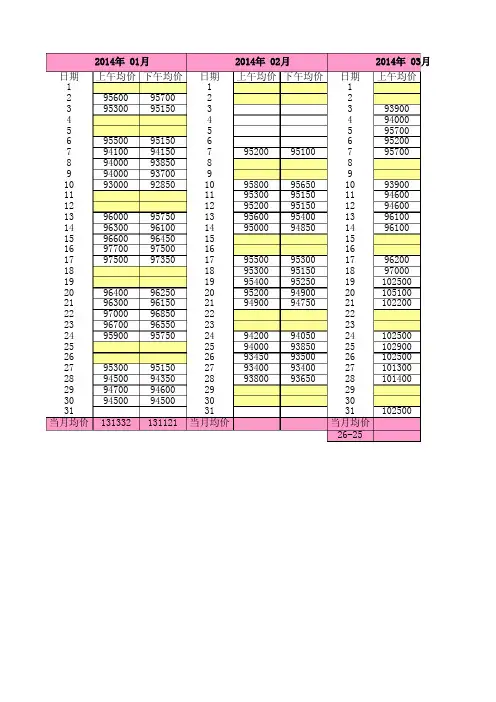

2014年 01月 2014年 02月 2014年 03月日期上午均价下午均价日期上午均价下午均价日期上午均价111295600957002239530095150339390044494000555957006955009515066952007941009415079520095100795700894000938508899400093700991093000928501095800956501093900 111195300951501194600 121295200951501294600 1396000957501395600954001396100 1496300961001495000948501496100 159660096450151516977009750016161797500973501795500953001796200 181895300951501897000 1919954009525019102500 20964009625020952009490020105100 21963009615021949009475021102200 2297000968502222239670096550232324959009575024942009405024102500 2525940009385025102900934509350026262610250093400934002795300951502727101300 28945009435028938009365028101400 29947009460029293094500945003030313131102500当月均价131332131121当月均价当月均价26-2503月下午均价9390093850957509500095500939509470094900959009580096000971001022501047001020001025501028001024001011501014001023002014年 04月 2014年 05月 20日期上午均价下午均价日期上午均价下午均价日期110340*********210480010480022310450010460033410580010590044551258001255005661273001273006771292001287007810850010830081317501328008910920010935091447001447009101160001161001010111180001179001111121214725014730012131315225015075013141212001211001414645014550014151223001198001513320013220015161173001173001613335013315016171220001217001717181201001199501818191913670013705019202014140014075020211208001206502113740013720021221233001232502213900013880022139500139200 231276001274002323241273001270502424251242001242002525138200137950 262626138200138050 272727137850137750 281271001271002828132450131900 291246001239002929133100132600 301247501243003030313131当月均价当月均价当月均价2014年 06月上午均价下午均价135650 133250 133900 134200132450 132200 130050 127250 127300126950 129000 132000 126400 128400 127700 126800 124600 126700 1277501278501355001330001335501340001320001320001297501268501270001267001288501315001260001280001273001262001243501265001275001276502014年 07月 2014年 08月日期上午均价下午均价日期上午均价下午均价1305001303001129250129150 113140013090022135100135100331340001337004128850128750 45129400129250 56129050128900 61304001299007129800129700 71306501311008130400130250 813325013310099131050131100101013170013175011129650129500 1112130000130000 1213130350130150 1313220013190014130250130000 1413155013140015130150130050 151319501318001616131500131400171713135013090018130350130200 1819129650129500 1920129700129700 2012710012695021130750130600 2112940012930022130750130600 221294001293002323129800129850242413035013070025130100 2513025026130500130350 2627130650130500 2713145013130028130350130250 2812985012970029130050129950 2912980012940030301305501304503131当月均价当月均价26-252014年 09月 2014年 10月 2014年 11月日期上午均价下午均价日期上午均价下午均价日期上午均价113020013005011213020013005022312995012980031062003413130013130041062004513300013300051022505661040006771043507881154001152508913405013390091140501140009101304001302501011410011400010380010 111299501298001110365011 121291001289501210490012 131311355011335010590013 141411360011345010460014 151290501288501511260011245015161272001270001610700010675016171271001269001710690010675010650017 181259001256501810675018 191252001250001910680019 202010740010725011085020 212110410010395011170021 221217501197002210430010410022231166001173002310350010335023241184501185002410355010345011260024 251200001199002511290025 261189001186502611275026 272710115010105011200027 2828999009970011190028 291147501145002910605010610029114650114400301050001046003030311062001066003131当月均价当月均价当月均价26-2526-2526-2511月下午均价1063001060001019501038501043001038001035001048001058001045001063501066501066501106001115001125001128001124001119001117502014年 12月日期上午均价下午均价110900110250 1111600111450 2112100111800 3114800115500 4118400118250 567116100115950 8115700115550 9115700115550 10115200115000 11114200114550 121314117200117050 15115300115100 16113200113000 17110400108750 18109500109300 192021110300110200 22110200110200 23109200109100 2425107600107500108400 261085002728109100109000 29107800107500 30108600108400 31当月均价26-25。

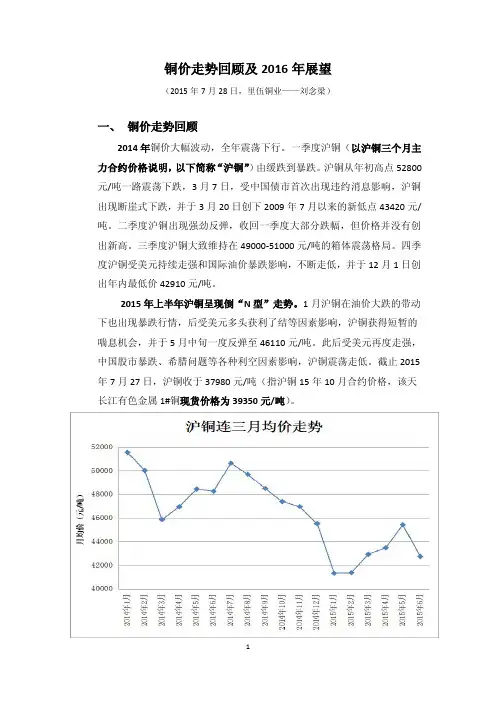

铜价走势回顾及2016年展望(2015年7月28日,里伍铜业——刘念梁)一、铜价走势回顾2014年铜价大幅波动,全年震荡下行。

一季度沪铜(以沪铜三个月主力合约价格说明,以下简称“沪铜”)由缓跌到暴跌。

沪铜从年初高点52800元/吨一路震荡下跌,3月7日,受中国债市首次出现违约消息影响,沪铜出现断崖式下跌,并于3月20日创下2009年7月以来的新低点43420元/吨。

二季度沪铜出现强劲反弹,收回一季度大部分跌幅,但价格并没有创出新高。

三季度沪铜大致维持在49000-51000元/吨的箱体震荡格局。

四季度沪铜受美元持续走强和国际油价暴跌影响,不断走低,并于12月1日创出年内最低价42910元/吨。

2015年上半年沪铜呈现倒“N型”走势。

1月沪铜在油价大跌的带动下也出现暴跌行情,后受美元多头获利了结等因素影响,沪铜获得短暂的喘息机会,并于5月中旬一度反弹至46110元/吨。

此后受美元再度走强,中国股市暴跌、希腊问题等各种利空因素影响,沪铜震荡走低。

截止2015年7月27日,沪铜收于37980元/吨(指沪铜15年10月合约价格,该天长江有色金属1#铜现货价格为39350元/吨)。

二、后期铜价展望1、宏观经济形势分析2014年全球经济增速为3.4%,中国经济增速为7.4%,2015年上半年中国经济增速为7%。

根据国际货币基金组织(IMF)在2015年7月9日发布的全球经济展望报告预测,2015年全球经济增速预计为3.3%,中国经济增速预计为7.1%。

预计2016年全球增速将提至3.8%,但新兴市场及发展中经济体的增速将继续放缓,预计中国2016年的GDP增速为6.3-7%。

由于大宗商品的消费需求主要取决于新兴经济体,故根据2015年新兴经济体经济形势分析及美元下半年加息预期的影响,料大宗商品下半年仍有二次探底的可能,但随着美元加息的靴子落地及美元多头的获利了结,大宗商品有望在2016年走出阶段性的筑底反弹行情。

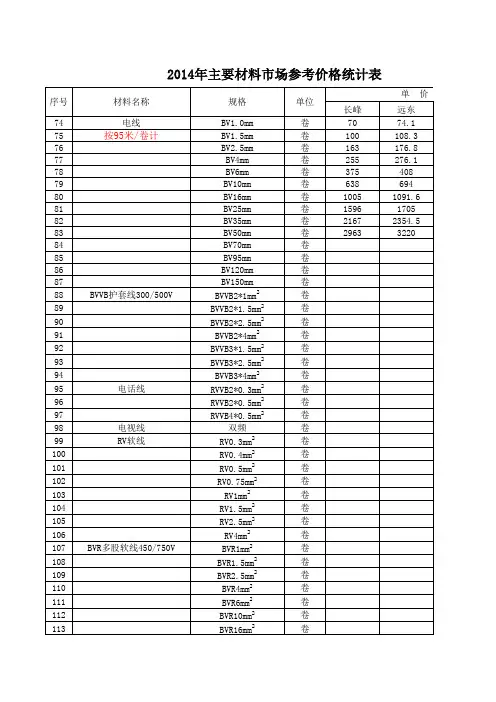

2014年主要材料市场参考价格统计表型号截面积计算式面积#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?价2#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME? #NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME?#NAME?#NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME?#NAME?#NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME? #NAME?#NAME?#NAME?#NAME? #NAME?#NAME? #NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME?#NAME? #NAME? #NAME?。

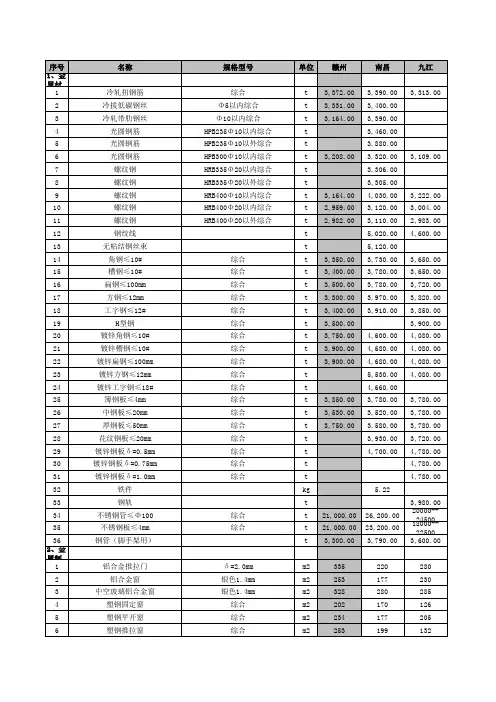

江西2014年11月工程材料信息价格序号名称规格型号单位南昌九江萍乡新余1、金属材料1冷轧扭钢筋综合t336033542冷拔低碳钢丝Φ5以内综合t33703275.753冷轧带肋钢丝Φ10以内综合t33604光圆钢筋HPB235Φ10以内综合t34603173.2530555光圆钢筋HPB235Φ10以外综合t38803203.2529556光圆钢筋HPB300Φ10以内综合t328031503224.530807螺纹钢HRB335Φ20以内综合t33063243.258螺纹钢HRB335Φ20以外综合t33053190.59螺纹钢HRB400Φ10以内综合t403032513306.5317810螺纹钢HRB400Φ20以内综合t322031713376.5305011螺纹钢HRB400Φ20以外综合t321031503323.75303912钢绞线t502013无粘结钢丝束t512014角钢≤10#综合t368036003472.43350015槽钢≤10#综合t373036203516.15350016扁钢≤100mm综合t371036803498.05365017方钢≤12mm综合t397037503605.11365018工字钢≤12#综合t386037503524.97350019H型钢综合t3850350020镀锌角钢≤10#综合t46004300385021镀锌槽钢≤10#综合t46804300420022镀锌扁钢≤100mm综合t46804300420023镀锌方钢≤12mm综合t55304300420024镀锌工字钢≤18#综合t4660420025簿钢板≤4mm综合t359038003623.65331226中钢板≤20mm综合t329037003581.18339027厚钢板≤50mm综合t335038403446.49313528花纹钢板≤20mm综合t388037003762.69350029镀锌钢板δ=0.5mm综合t46704800465030镀锌钢板δ=0.75mm综合t4800455031镀锌钢板δ=1.0mm综合t4800455032铁件kg 5.15 6.233钢轨t4140420034不锈钢管≤Φ100综合t2620020000--2200024361.022100035不锈钢板≤4mm综合t2320018000-20000225691900036钢管(脚手架用)t375037003710.623550 2、金属制品1铝合金推拉门δ=2.0mm m2220268200180 2铝合金窗银色1.4mm m2177219180175 3中空玻璃铝合金窗银色1.4mm m2280278280320 4塑钢固定窗综合m2170125150155 5塑钢平开窗综合m2177200150150 6塑钢推拉窗综合m2199131150155 7塑钢推拉门综合m2185125150150 8铝合金地弹门δ=2.0mm m22803452809铝合金卷帘门δ=0.6mm m212211010铝合金卷帘门δ=0.8mm m213613511铝合金推拉窗5+6+5普玻m235526028012塑钢推拉窗5+6+5普玻m217528013彩钢板卷帘门δ=0.5mm m210514轻钢龙骨主h45、付h19主龙骨间距为1米付龙骨400*600m22215静电喷涂铝型材kg272516阳极氧化幕墙铝型材kg2628.117外墙铝塑板3mm m2807065 18外墙铝塑板4mm m215614013819内墙铝塑板3mm m270504550 20内墙铝塑板4mm m260603、水泥1普通水泥PO42.5(散装)t410-430350384 2普通水泥PO42.5(袋装)t420-440417425 3普通水泥PO52.5(散装)t451 4普通水泥PO52.5(袋装)t525-535513 5普通水泥PC32.5(散装)t345-365330359 6普通水泥PC32.5(袋装)t350-370366384 7普通水泥PS32.5(散装)t330-3508普通水泥PS32.5(袋装)t340-3609白水泥t5575005504、砖、灰、砂、石1红机砖100#240*115*53千块480340269.88300 2粉煤灰砖240*115*53千块270290 3粘土多孔砖240*115*90千块680590 4混凝土多孔砖190*190*90千块7805混凝土多孔砖240*190*90千块6煤矸石烧结多孔砖240*115*90(150#)千块6007煤矸石烧结多孔砖190*190*90千块720 8煤矸石烧结空心砖180*200*115千块9页岩实心砖240*115*53千块35010页岩多孔砖240*115*53千块11蒸压灰砂砖240*115*53千块41026012混凝土空心砌块240*115*90m3220 13混凝土空心砌块90*390*90m314014混凝土空心砌块120*390*190m315015混凝土空心砌块190*390*190m3150200170 16加气混凝土砌块600*240*240m325625524617加气混凝土砌块600*240*200m325625524618加气混凝土砌块600*240*180m325626024619加气混凝土砌块600*240*120m326626524620加气混凝土砌块600*240*100m326626524621加气混凝土砌块240*200*90m326626024622天然砂m36023细砂m363.824中砂m36769.425中(粗)砂m36788115.8365 26片(毛)石m3956059.851 27碎石(综合)m31167566.6668 28卵石(综合)m37555 29料石m330矿渣m331天然砂砾m36642 5、竹、木材及竹木制品1松圆木综合Φ200~280m31280889.67870 2松木板、枋料综合m31200180011003杉圆木综合Φ200~280m3148010601030 4杉木板、枋料综合m31200180012605杉条木Φ8-20综合m3161012708606硬木板、枋料综合m3150012807实木地板δ=18mm m21921851808复合地板δ=12mm m28070809木踢脚线h=80mm m161010胶合板δ=3mm m2108.611 11胶合板δ=5mm m27.516.812.512 12胶合板δ=9mm m2152018.914 13石膏板600*600m22010.514吸音石膏板600*600m21315纸面石膏板1220*2440m28.97.58.57 16耐火纸面石膏板1200*3000*12m229.5291817耐火纸面石膏板1200*3000*9.5m224201518胶合饰面白榉木板1220*2440(天然)m217.92021 19胶合饰面白榉木板1220*2440(人造)m21513.512 20胶合饰面红榉木板1220*2440(天然)m218.91521胶合饰面红榉木板1220*2440(人造)m212.981212.322胶合饰面水曲柳板1220*2440m216.11815.2123松木模板m312001088.1224九夹板模板15mm m232.84134.9435 25九夹板模板18mm m245463826竹夹板模板m2465436.527细木工板12mm(1220*2440)m23724.3628细木工板15mm(1220*2440)m24230.1829细木工板18mm(1220*2440)m25036.7930竹脚手板(侧)m217.181921.514 31竹脚手板(平)m2 4.878.58.56 32毛竹Φ100~200根2018.520.56、玻璃1白玻4mm m22018.82021 2白玻5mm m22625.43532 3白玻10mm m266.563.855 4白玻12mm m278.47565 5白玻15mm m2140.61386绿色玻璃4mm m221.9307镀膜玻璃5mm m24256.6558镀膜玻璃6mm m25368.17068 9钢化玻璃8mm m26563.59081 10钢化玻璃10mm m27111089 11钢化玻璃12mm m29082120110 12钢化玻璃15mm m2180160.4170160 13中空钢化镀膜玻璃5+6A+5m211012516014单片钢化镀膜玻璃6mm m283.880110 15中空玻璃(普白)5+6+5m29571.910080 16中空玻璃(双钢)5+6+5m296.713517中空玻璃low-E+9A+5mm m216722518中空玻璃low-E+9A+6mm m223019826019磨砂玻璃3mm m24020磨砂玻璃5mm m228415549 21有机玻璃6mm m2687、墙、地面砖1抛光地面砖300*300m242423650 2抛光地面砖600*600m242525560 3抛光地面砖800*800m2597595 4釉面墙面砖250*400m221345釉面墙面砖100*100m220.5286釉面墙面砖100*200m218.5257釉面墙面砖60*200m2162224 8釉面墙面砖60*235m216209釉面墙面砖50*235m21617.510釉面踢脚线米 5.5511内墙瓷砖300*450m2534212瓷质文化砖150*300m225.53813瓷质文化砖100*200m225.53214瓷质文化砖200*400m2323515石质文化砖200*400m2375016石质文化砖150*300m231458、防水、保温1石油沥青30#t365038003750 2石油沥青(国产)60#-100#t560053505091.255281 3石油沥青(进口)60#-100#t55005600 4乳化沥青(国产)t3700390035803820 5乳化沥青(进口)t41904570 6改性石油沥青(国产)t6500590058805880 7改性石油沥青(进口)t665064008油毡m2 3.3 2.65 2.59三元乙丙防水卷材 1.2mm m216.81819.821 10三元乙丙防水卷材 1.5mm m218.52222.9523 11三元乙丙防水卷材2mm m221.42428.7327 12三元乙丙防水卷材3mm m2333213APP改性沥青防水卷材3mm m2262426.514APP改性沥青防水卷材4mm m231.32730.815SBS改性沥青防水卷材3mm m229252420 16SBS改性沥青防水卷材4mm m234283022 17PVC防水卷材(加筋) 1.2mm m230273618PVC防水卷材(复合) 1.2mm m228233233 19PVC防水卷材(单层) 1.2mm m226202620PVC防水卷材(加筋) 1.5mm m235304121PVC防水卷材(复合) 1.5mm m232283835 22PVC防水卷材(单层) 1.5mm m230263023膨胀珍珠岩m3180160 24聚苯外墙保温颗粒m325玻化微珠m37007009、油漆及其他1聚氨酯漆kg1518.062聚酯漆kg3525323亚光漆kg26.517.334调和漆kg10.288.385地板漆kg2822.646防锈漆kg888.367油漆溶剂油kg 4.577.58醇酸清漆kg121013.869醇酸稀酸清漆kg88.610乳胶漆外墙防水kg24.5202523 11乳胶漆外墙普通kg17.41618.9617 12乳胶漆内墙防水kg12.5121320 13乳胶漆内墙普通kg8.589.614硅炳金属外墙涂料kg60585815氟碳金属外墙涂料kg80809216油性外墙涂料kg40394517水性外墙涂料kg30243618弹性外墙涂料平涂kg28282219丙稀酸清漆kg15.91413.620防火涂料kg20.8131321丙烯酸释剂kg18.2121422水m3 2.35 2.66 3.8 2.9 23电kw/h 1.020.8 1.020.81 24汽油93#kg10.269.19.739.81 25汽油97#kg10.869.6110.4510.36 26柴油0#kg8.487.428.158.15 10、市政排水管及其它1承插混凝土排水管Φ300Ⅱ级m6858.7452承插混凝土排水管Φ400Ⅱ级m7976.8683承插混凝土排水管Φ500Ⅱ级m11896.7954承插混凝土排水管Φ600Ⅱ级m166118.61355承插混凝土排水管Φ800Ⅱ级m273226.62306承插混凝土排水管Φ1000Ⅱ级m431332.83507承插混凝土排水管Φ1200Ⅱ级m650570.95508承插混凝土排水管Φ1500Ⅱ级m910975.68719承插混凝土排水管Φ1800Ⅱ级m1499.610承插混凝土排水管Φ2000Ⅱ级m15302197.211平口混凝土排水管Φ300m36.93512平口混凝土排水管Φ400m47.54513平口混凝土排水管Φ500m61.15814平口混凝土排水管Φ600m73.77215平口混凝土排水管Φ700m106.710516平口混凝土排水管Φ800m138.514517平口混凝土排水管Φ1000m209.323018平口混凝土排水管Φ1200m394.339019平口混凝土排水管Φ1500m658.861020双壁波纹管Φ300环刚度≥4KN/m2m70.0980.780101 21双壁波纹管Φ400环刚度≥4KN/m2m105.29120120164 22双壁波纹管Φ500环刚度≥4KN/m2m166.57199.8210252 23双壁波纹管Φ600环刚度≥4KN/m2m293282.7300382 24双壁波纹管Φ700环刚度≥4KN/m2m377422.425双壁波纹管Φ800环刚度≥4KN/m2m524565.7689 26双壁波纹管Φ300环刚度≥8KN/m2m118.7107 27双壁波纹管Φ400环刚度≥8KN/m2m177.6177 28双壁波纹管Φ500环刚度≥8KN/m2m267.8274 29双壁波纹管Φ600环刚度≥8KN/m2m420.6412 30双壁波纹管Φ700环刚度≥8KN/m2m560577 31双壁波纹管Φ800环刚度≥8KN/m2m756.7795 32铸铁窨井盖井座圆700mm(重型)套360380 33铸铁窨井盖井座圆700mm(轻型)套285290 34铸铁雨水井盖井座方750*450mm(重型)套305310 35铸铁雨水井盖井座方750*450mm(轻型)套260260 36铸铁雨水井盖井座方600*400mm(重型)套26537铸铁雨水井盖井座方600*400mm(轻型)套21038铸铁雨水井盖井座方500*300mm(重型)套18039铸铁雨水井盖井座方500*300mm(轻型)套15040铸铁井盖井座(三盖)方1800*900mm(重型)套41铸铁井盖井座(三盖)方1800*900mm(轻型)套42铸铁井盖井座(双盖)方1200*800mm(重型)套43铸铁井盖井座(双盖)方1200*800mm(轻型)套44铸铁井盖井座(单盖)方800*600mm(重型)套53045铸铁井盖井座(单盖)方800*600mm(轻型)套43046复合钢纤维井盖板方380*680mm套21018047复合钢纤维井盖板圆700mm套21527048花岗岩路沿石1000*220*80m324849花岗岩路沿石1000*200-220*150m607850花岗岩路沿石1000*300*80-100m43--556051花岗岩路沿石1000*420*150m94.511052花岗岩路沿石1000*300*120m546853花岗岩人行道板600*600*30m2606554花岗岩盲道板600*600*30m2808055砼侧石1000*400*200m2417.556彩色人行道板250*250*40-50m23522---253057彩色人行道板六边形对角210*210*40-50m222---252858彩色植草砖m222.2303259混凝土盲道板250*250*50m22627.560透水砖200*100*60m232323061土工布m291011、商品混凝土1非泵送砼C15普通碎石砼m3319315292.1368(5-31.5mm碎石2非泵送砼C20普通碎石砼m3333324302.3885(5-31.5mm碎石3非泵送砼C25普通碎石砼m3353332312.6398(5-31.5mm碎石4非泵送砼C30普通碎石砼m3374340322.8812(5-31.5mm碎石5非泵送砼C35普通碎石砼m3393351333.1323(5-31.5mm碎石6非泵送砼C40普通碎石砼m3415361348.5136(5-31.5mm碎石7非泵送砼C45普通碎石砼m3437372363.8947(5-31.5mm碎石8非泵送砼C50普通碎石砼m3458385379.279非泵送砼C15普通卵石砼m329310非泵送砼C20普通卵石砼m330511非泵送砼C25普通卵石砼m331712非泵送砼C30普通卵石砼m333413非泵送砼C35普通卵石砼m335614非泵送砼C40普通卵石砼m337915非泵送砼C45普通卵石砼m339016非泵送砼C50普通卵石砼m317商品混凝土泵送费(市内)m320221518商品混凝土抗渗费m32012、石材1花岗岩板芝麻灰(2cm)m26055752花岗岩板桃花红(2cm)m2667560533花岗岩板映山红(2cm)m279807880 4花岗岩板太阳红(2cm)m284879586 5花岗岩板夕阳红(2cm)m2921001106花岗岩板杜鹃红(2cm)m28390907花岗岩板樱桃红(2cm)m270706872 8花岗岩板罗源红(2cm)m270607595 9花岗岩板安溪红(2cm)m2787585105 10花岗岩板枫叶红(2cm)m213214012085 11花岗岩板将军红(2cm)m211912411012花岗岩板中国红(2cm)m2159165180160 13花岗岩板中国绿(2cm)m2168175165155 14花岗岩板天山红(2cm)m293140170160 15花岗岩板天山绿(2cm)m214217016816花岗岩板孔雀绿(2cm)m212212511817花岗岩板多彩绿(2cm)m211213013018花岗岩板济南青(2cm)m212212512019花岗岩板蒙古黑(2cm)m213012812020花岗岩板珍珠黑(2cm)m212914012521花岗岩板芝麻灰(3cm)m294807522花岗岩板芝麻灰(4cm)m211710511823花岗石普通麻面(2cm)m270555585 24普通大理石综合(2cm)m2706025大理石400*400(2cm)m2928526大理石500*500(2cm)m2948527大理石工程板广西白(2cm)m212613511528大理石工程板汉白玉(2cm)m226128027529大理石工程板汉中白(2cm)m222124021030花岗岩大花绿(2cm)m225526022031花岗岩黑金砂(2cm)m228031030032花岗岩西班牙米黄(2cm)m2323300280息价格汇总表(精简)鹰潭赣州宜春上饶吉安抚州景德镇备注327034513500323034513250345134003130332134003210332132153186322031983321326531603220322931083240322936603311329032403300.53348342932803203316832403187.7533483223324031943150324031573348321330603752346232703577.253639344031803803346232703587.53639344031803752346233203792.53639374033803752346233603741.253639374030803957346234003669.536393740405934623370340336394336368835204171.75374839404367368835704233.25374839404336368838504202.537484240370538504151.25374842403705426437484290 30604418357634703290.253977364033104059357634903290.253967354034104367357632303239396734404418361635703720.7539673740 4260477741504438.25430246404260436742004366.5430245404260441842504284.5430244906.17 5.84 5.024240396521525231252450024600236502400021013217752200022960221502200030603649374035003751.538603440245334180190189.63176240注明是否含安装价190252177170179.38170190 345328272310317.75305300150201154160158.88164150 220234160180179.38160200 160252154180169.13160160 160225160180169.13160170 330453242260307.5280300 1001041108277100 120123*********.51051202662603202662602801101128610592.25232320.5镀锌23252526.65292724252632.82927.57084606046.1372709511011513056.3815015040634536.93648555546.136660460-490495-526427430440360-410500-530506-536437460450450385-435540-570550-581500520490505560-580560-591510550550500525400-435448-478368390410310-350420-450458-489380400400420335-375368400380410550679504580563.75560470463322310374.13351410410387360360 6107765285005096504807209201180428370353.63360310358.75533371350425145145145295290243270240.88270268290243280240.88270268290243240.8827026831624324627026831624324627026831624524627026845402978回填用59509051100100454887 465110085454882 7058565756.385565 7570707069.295577 4266586047545880180(条石)77454436 42503852578809518659009009001200 160011351090102013801050180012849881100110011151300 1660117011801200142011002000 900953793860910960130014711275125013501550 160145152180185180180 75607775856580 1520101014121178.6111110141110121513261513.5201917 12181112.5141411122116161816 10810139.2139 202019183025 181416142120 17261717231915 12121213151411 17201716231915 12131213151411 15171516201614 11001050103010509751050 3942323334.853038 4445343936.93243 403535.884038 25262525322328 30343030402634 36423536483648 20161316.418109797.78 181512131428252019192625 31332625273431 70656360627562 82787675788776 140138113112138112124 30302222302425 55735857655956 70827069757169 90677283709180 967389907510195 9010410090118110 168157170140115169165 157159159145160131155 86758380808585 109938990131110 125107124110120130 210189219210210251205 240215255230230272235 413139353039584951486742 84681188135263545505036 50564349737148 65665664908165 332329322121191920241821221918201916171822181922161820161624141855757 40563340556830 32302519333327302226312432242845433736364440352936328037503980340038183200 5400485950385150540052795200 5650519353505550580056895300 3314395036004400340044014950420047004300571359006050550060206400605060003.53 20162020211919 22182323242322 282127293127262933423030 25.1302626302427 28383130362936 26222123321921 29282327362327 32253337282823292234242621281831203429293944303027332439352825302035312462301504407807857007207201828171516153027283436353424203012.5361712101212.530222630223014101010.512.513755461713121312.51298.511918222324232114151718161818181312.518.51217 13121091481160626260378990579524375538605821334333.2462628273028271215151315201518162117.5171618102.753.06 3.13 2.36 2.50.79 1.2 1.8 1.40.98110.169.189.148.759.110.158.8510.929.869.739.49.6110.919.518.517.67.827.787.88.517.325247485658按标准图706372708091709885105131144120125226234210205360327330320555530510550830829800760113811001100 19302045156717001450 283432352142 504746483754 62.56255585866 757974758380 102107106110136110 135149152150190150 195218260210215210 330400464410450400 600600668600630600 95646490657875 140105105134120118120 210165194210197178190 305270290280310275 370416*********495542520586495116105116192170208290255304420400464606550600804750800 400355418410384360 360312408320305280 340306288280348 258254240243 280225266255310 160230210216 230185184190230 150160160160 1330133096111001002110810501100 7159068005705505705205904335394301591982001482442882602403836384836757752581508256495556589676801151106850658085706564657575858870859898211715252824221831232822183836283228282836262732253230363032366.58 6.8714m碎石)317321270312.22m碎石)342310339290328.84m碎石)373330359315349.07m碎石)393350379335365.04 403.77416370401350383.3m碎石)455390421375398.6m碎石)480410441395423.76507430461415434.02 288.22301245313.24319255332.86339280357.933593003813154013404214412225202025加高费自行定352020556862607055656070656560656078837373807580 7883757580 7592781008585 70926780907070 70787065757565 65736768626570 77878265806872 9010311085120105125 801031209512090125 160110153105125150150 120182153130170112155 100153148120155106145 100167159120150108155 10013012013011098125 100127105115100 10511011512098125 135140126120140135118 120133130135120122 798585888075 120120118110110150 60806880706068 609070708060 95908785859795 90909690809095 135143108110135130120 320246160260278280 210227*********252240260320 320320304310280380 280275330360480。