——开发框架的使用和推广 of 14

Function and goal

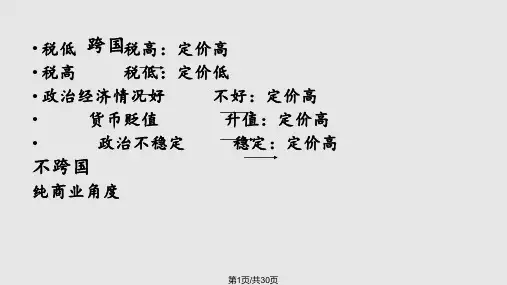

• 1、Evade tariffs • Some countries impose higher tariffs, which increases the cost of the subsidiary to import raw materials and components. This will weaken the subsidiary’s competitiveness in the market. Through transfer pricing, the subsidiary can reduce the tariffs (mainly import tax) burden, therefore the overall tax payment drops.

• According to Ernst & Young Global Surveys(安永全球调查), transfer pricing is the most important international issue MNEs currently face. Tax authorities around the world are implementing and updating their rules and regulations on international transactions as well as increasing their audit activity(审计活动).

——开发框架的使用和推广

of

14

Classification

• 1、Financing transfer pricing (buy and sell products one another) • 2、Tangible assets transfer prices (lease and transfer the internal machinery, equipment and other tangible assets) • 3、Intangible transfer pricing (Internal price to provide management, technical and consulting services, trademarks and other intangible goods)