保险学期末复习题

- 格式:rtf

- 大小:107.68 KB

- 文档页数:4

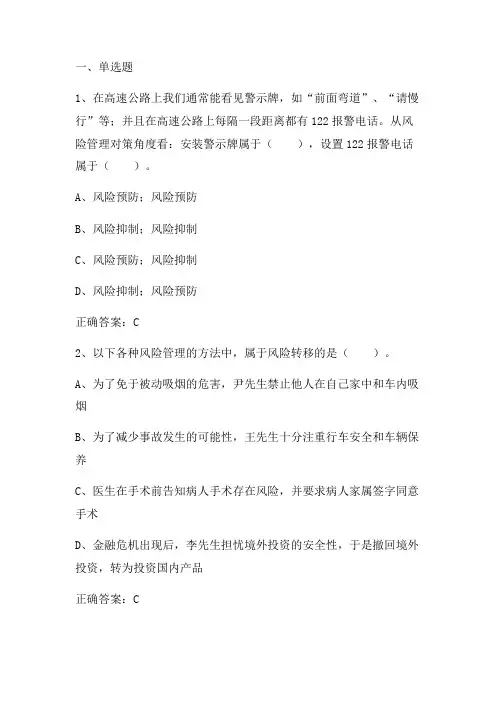

一、单选题1、在高速公路上我们通常能看见警示牌,如“前面弯道”、“请慢行”等;并且在高速公路上每隔一段距离都有122报警电话。

从风险管理对策角度看:安装警示牌属于(),设置122报警电话属于()。

A、风险预防;风险预防B、风险抑制;风险抑制C、风险预防;风险抑制D、风险抑制;风险预防正确答案:C2、以下各种风险管理的方法中,属于风险转移的是()。

A、为了免于被动吸烟的危害,尹先生禁止他人在自己家中和车内吸烟B、为了减少事故发生的可能性,王先生十分注重行车安全和车辆保养C、医生在手术前告知病人手术存在风险,并要求病人家属签字同意手术D、金融危机出现后,李先生担忧境外投资的安全性,于是撤回境外投资,转为投资国内产品正确答案:C3、某运输公司有从事劳动运营的货车,某日因暴雨造成路面积水行车困难,该公司一辆正在路上行驶的货车与迎面驶来的一辆轿车相撞,造成双方车辆损失严重和轿车上人员伤亡,在此次事件中,暴雨是()。

A、风险代价B、风险因素C、风险事故D、风险损失正确答案:B4、为骗取保险赔款而故意纵火,是风险因素中的()。

A、有形风险因素B、道德风险因素C、心理风险因素D、思想风险因素正确答案:B5、下列关于风险管理的说法中,错误的是:()A、风险管理是一个系统的过程,包括风险识别、风险评估、风险处理等步骤B、风险管理的目的在于避免风险C、建立意外损失基金是风险自留的一种措施D、保险是一种财务型的风险转移机制正确答案:B6、房主外出忘记锁门属于()风险因素。

A、道德B、社会C、心理D、物质正确答案:C7、7.按风险的性质分类,风险可分为()。

A、人身风险与财产风险B、纯粹风险与投机风险C、经济风险与技术风险D、自然风险与社会风险正确答案:B8、驾驶机动车不慎撞人而被索赔,属于()。

A、财产风险B、责任风险C、自然风险D、信用风险正确答案:B9、对于损失频率高而损失程度不大的风险应该采用()的风险管理方法。

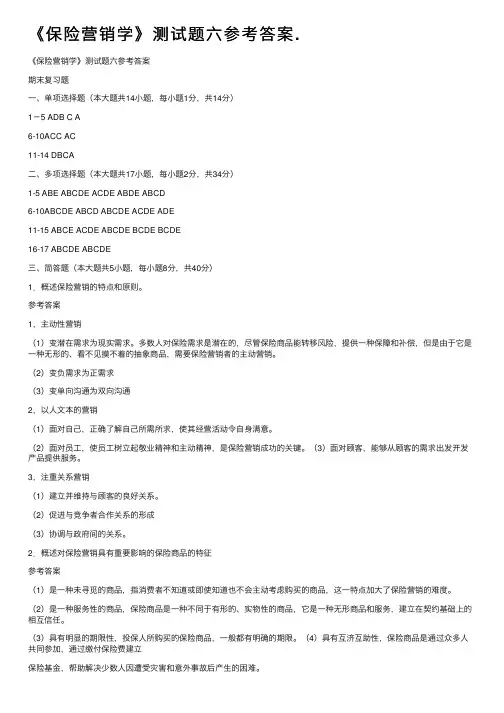

《保险营销学》测试题六参考答案.《保险营销学》测试题六参考答案期末复习题⼀、单项选择题(本⼤题共14⼩题,每⼩题1分,共14分)1-5 ADB C A6-10ACC AC11-14 DBCA⼆、多项选择题(本⼤题共17⼩题,每⼩题2分,共34分)1-5 ABE ABCDE ACDE ABDE ABCD6-10ABCDE ABCD ABCDE ACDE ADE11-15 ABCE ACDE ABCDE BCDE BCDE16-17 ABCDE ABCDE三、简答题(本⼤题共5⼩题,每⼩题8分,共40分)1.概述保险营销的特点和原则。

参考答案1,主动性营销(1)变潜在需求为现实需求。

多数⼈对保险需求是潜在的,尽管保险商品能转移风险,提供⼀种保障和补偿,但是由于它是⼀种⽆形的、看不见摸不着的抽象商品,需要保险营销者的主动营销。

(2)变负需求为正需求(3)变单向沟通为双向沟通2,以⼈⽂本的营销(1)⾯对⾃⼰,正确了解⾃⼰所需所求,使其经营活动令⾃⾝满意。

(2)⾯对员⼯,使员⼯树⽴起敬业精神和主动精神,是保险营销成功的关键。

(3)⾯对顾客,能够从顾客的需求出发开发产品提供服务。

3,注重关系营销(1)建⽴并维持与顾客的良好关系。

(2)促进与竞争者合作关系的形成(3)协调与政府间的关系。

2.概述对保险营销具有重要影响的保险商品的特征参考答案(1)是⼀种未寻觅的商品,指消费者不知道或即使知道也不会主动考虑购买的商品,这⼀特点加⼤了保险营销的难度。

(2)是⼀种服务性的商品,保险商品是⼀种不同于有形的、实物性的商品,它是⼀种⽆形商品和服务,建⽴在契约基础上的相互信任。

(3)具有明显的期限性,投保⼈所购买的保险商品,⼀般都有明确的期限。

(4)具有互济互助性,保险商品是通过众多⼈共同参加,通过缴付保险费建⽴保险基⾦,帮助解决少数⼈因遭受灾害和意外事故后产⽣的困难。

(5)具有损失补偿性,保险商品是⼀种避害性商品。

另外还有不可分离性,即购买和⽣产是同时的;不可保存性,即只有投保⼈购买的时候才出现;价格具有固定性,即⼀旦确定便变动的可能性很⼩;不可对⽐性,即保险商品的质量不仅取决于价格,还和保险⼈所能提供的服务、偿付能⼒和财务状况有关。

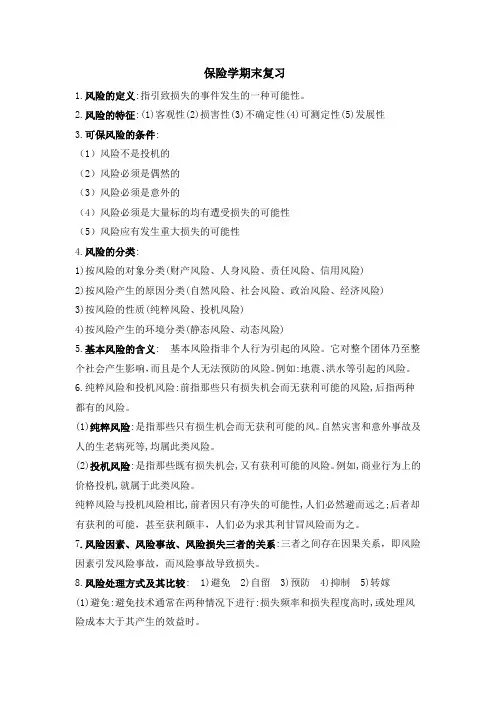

保险学期末复习1.风险的定义:指引致损失的事件发生的一种可能性。

2.风险的特征:(1)客观性(2)损害性(3)不确定性(4)可测定性(5)发展性3.可保风险的条件:(1)风险不是投机的(2)风险必须是偶然的(3)风险必须是意外的(4)风险必须是大量标的均有遭受损失的可能性(5)风险应有发生重大损失的可能性4.风险的分类:1)按风险的对象分类(财产风险、人身风险、责任风险、信用风险)2)按风险产生的原因分类(自然风险、社会风险、政治风险、经济风险)3)按风险的性质(纯粹风险、投机风险)4)按风险产生的环境分类(静态风险、动态风险)5.基本风险的含义: 基本风险指非个人行为引起的风险。

它对整个团体乃至整个社会产生影响,而且是个人无法预防的风险。

例如:地震、洪水等引起的风险。

6.纯粹风险和投机风险:前指那些只有损失机会而无获利可能的风险,后指两种都有的风险。

(1)纯粹风险:是指那些只有损生机会而无获利可能的风。

自然灾害和意外事故及人的生老病死等,均属此类风险。

(2)投机风险:是指那些既有损失机会,又有获利可能的风险。

例如,商业行为上的价格投机,就属于此类风险。

纯粹风险与投机风险相比,前者因只有净失的可能性,人们必然避而远之;后者却有获利的可能,甚至获利颇丰,人们必为求其利甘冒风险而为之。

7.风险因素、风险事故、风险损失三者的关系:三者之间存在因果关系,即风险因素引发风险事故,而风险事故导致损失。

8.风险处理方式及其比较: 1)避免2)自留3)预防4)抑制5)转嫁(1)避免:避免技术通常在两种情况下进行:损失频率和损失程度高时,或处理风险成本大于其产生的效益时。

(2)自留:有主动自留和被动自留之分,通常在风险所致损失程度和频率低、损失短期内可预测以及最大损失不影响企业财务稳定时采用。

(3)预防:通常在损失频率高且损失程度低时采用。

(4)抑制:通常在损失程度高且风险又无法避免和转嫁的情况下采用。

(5)转嫁:转嫁风险的方式主要有两种,即保险转嫁和非保险转嫁(非保险转嫁分为:出让转嫁、合同转嫁)。

《保险学原理》基本知识和原理练习题(附答案)第一章(一)单项选择题1.下列关于保险含义的说法错误的是( A )。

A.保险可以使少数不幸的被保险人的损失由未发生损失的被保险人分摊B.我国《保险法》将保险定义为商业保险行为C.保险是社会保障制度的重要组成部分D.保险是风险管理的一种方法2.纯粹风险是指( C )。

A.既有损失机会,又有获利可能的风险B.只有获利可能而无损失机会的风险C.只有损失可能而无获利机会的风险D.有导致重大损失可能的风险3.厘定财产保险纯费率是用( C )来测算损失概率。

A.保险承保率 B.保险赔付率C.保额损失率 D.保险费用率11.以下说法正确的是( )。

A.重复保险与共同保险并无实质区别B.重复保险与共同保险的惟一区别在于重复保险签发多张保险单而共同保险只签发一张保险单C.重复保险的保险金额总和必定超过保险价值,共同保险的保险金额总和必定小于或等于保险价值D.共同保险和重复保险均属于再保险15.我国《保险法》将保险公司经营的业务分为( )。

A.财产保险与人寿保险 B.财产损失保险与人寿保险C.责任保险与信用保险 D.财产保险与人身保险25.保险人将其承保业务的一部分或全部分给另一个或几个保险人承保,这种保险称作( )。

A.共同保险 B.重复保险 C.再保险 D.原保险26.责任保险的保险标的是( )。

A.造成损害应负的一切责任B.造成损害应负的民事赔偿责任或特别约定的合同责任C.造成损害应负的刑事责任D.造成损害应负的行政责任27.人寿保险的基本职能是( )。

A.补偿损失 B.给付保险金 C.防灾防损 D.融通资金28.保险的基本职能是( )。

A.补偿损失和给付保险金 B.补偿损失和分散风险C.补偿损失和防灾防损 D.补偿损失和融通资金29.下列保险中属于商业保险的是( )。

A.互助保险 B.储蓄性保险 C.相互保险 D.社会保险30.社会保险以( )为缴费原则。

A.均一保费制 D.公平保费制 C.趸交保费制 D。

保险学期末考试复习资料(计算与案例)案例分析题示例:1、有一租户向房东租借房屋,租期10个月。

租房合同中写明,租户在租借期内应对房屋损坏负责,租户为此而以所租借房屋投保火险一年。

租期满后,租户按时退房。

(1)退房后半个月,房屋毁于火灾。

于是租户以被保险人身份向保险公司索赔。

问保险人是否承担赔偿责任?为什么?(2)如果租户在退房时,将保单转让给房东,房东是否能以被保险人身份向保险公司索赔?为什么?(保险利益原则的应用)答:(1)保险人不承担赔偿责任。

因为财产保险的保险利益一般要求从保险合同订立时到保险事故发生始终要有可保利益。

本案例中,租户所租借房屋投保火灾一年,租期满后退房,发生保险事故时,因合同失效,保险人不履行赔偿责任。

(2)分情况而定。

若租户退租时,将保单私下转让给户东,并没有征得保险人同意,则保单转让无效。

若租房退租时,将保单转让房东,并征得保险人同意,即保险合同有效,若发生保险事故,房东可以以被保险人身份向保险人索赔。

2、某企业为职工投保团体人身险,在提交的被保险人名单上,已注明张某因肝癌已病休2个月但因保险人未严格审查,办理了承保手续,签发了保单。

日后张某因肝癌死亡,请问保险公司能否拒赔?(最大诚信原则的应用)答:保险人不能因张某不符合投保条件而拒付保险金。

根据保险法,保险人在合同订立时已经知道投保人未如实告知的情况的,保险人不得解除合同,发生保险事故的,保险人应当承担赔偿或者给付保险金的责任。

这是最大诚信原则对保险人的约束。

3、有一艘装载皮革和烟叶的船舶遭遇海难,大量海水浸入船舱,皮革腐烂。

海水虽未直接接触烟叶,但由于腐烂皮革的恶臭,使烟叶完全变质。

当时被保险人以海难为近因要求保险人全部赔付,但保险人却以烟叶包装没有水渍的痕迹为由而拒赔。

请问法院该如何判决此案?答:据上述情况可知,海难中海水侵入是损失的近因,海难与烟草的损失之间存在着必然的不可分割的因果关系,因此,保险人理应也对烟草的损失给予赔偿。

名词解释:1.保险:是指投保人根据合同约定,向保险人支付保险费,保险人对于合同约定的可能发生的事故因其发生而造成的财产损失承担赔偿保险金责任,或者当被保险人死亡、伤残和达到合同约定的年龄、期限时承担给付保险金责任的商业保险行为。

2.人身保险:是指以人的生命和身体为保险标的,当被保险人发生死亡、伤残、疾病、年老等事故或保险期满时给付保险金的保险。

P1123.财产保险:是指投保人根据合同约定,向保险人交付保险费,保险人安保险合同的约定对所承保的财产及其有关利益因自然灾害或意外事故造成的损失承担赔偿责任的保险。

P864.交强险:是由保险公司对被保险机动车发生道路交通事故造成受害人(不包括本车人员和被保险人)的人身伤亡、财产损失,在责任限额内予以赔偿的强制性责任保险。

5.投保人:是与保险人订立保险合同并按照保险合同负有支付保险费义务的人,是保险合同的一方当事人。

P326.投保单:又称要保单,是投保人向保险人申请订立保险合同的书面文件。

7.保险单:是保险人和投保人之间订立的正式保险合同的正式书面文件。

8.保险费率:又称保险价格,是保险费与保险金额的比率,是投保人为取得保险保障而由投保人向保险人所支付的价金,通常以每百元或每千元的保险金额的保险费来表示。

9. 保费:也称保险费,是投保人为取得保险保障,按保险合同约定向保险人支付的费用。

是保险金额与保险费率的乘积。

10.纯保费:保险人用于赔付给被保险人或受益人的保险金,它是保险费的最低界限。

11.附加保险费:是由保险人所支配的费用,由营业费用、营业税和营业利润构成。

12.保险中介:是指依照保险法的规定,并根据保险公司的委托或基于被保险人的利益而代为办理保险业务的单位或个人。

补充:1、第一危险: 保险金额范围内的损失2、被保险人:是其财产或人身受保险合同保障,享有保险金请求权的人。

3、社会保险:是指在既定的社会政策的指导下,由国家通过立法手段对公民强制征收保险费,形成保险基金,用以对其中因年老、疾病、生育、伤残、死亡和失业而导致丧失劳动能力或失去工作机会的成员提供基本生活保障的一种社会保障制度。

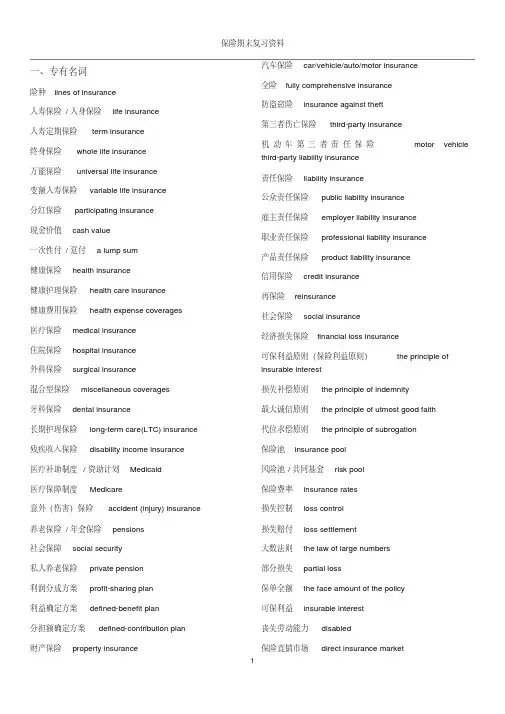

一、专有名词险种 lines of insurance人寿保险/人身保险 life insurance人寿定期保险 term insurance终身保险 whole life insurance万能保险 universal life insurance变额人寿保险 variable life insurance分红保险 participating insurance现金价值 cash value一次性付/趸付 a lump sum健康保险 health insurance健康护理保险 health care insurance健康费用保险 health expense coverages医疗保险 medical insurance住院保险 hospital insurance外科保险 surgical insurance混合型保险 miscellaneous coverages牙科保险 dental insurance长期护理保险 long-term care(LTC) insurance 残疾收入保险 disability income insurance医疗补助制度/资助计划 Medicaid医疗保障制度 Medicare意外(伤害)保险 accident (injury) insurance 养老保险/年金保险 pensions社会保障 social security私人养老保险 private pension利润分成方案 profit-sharing plan利益确定方案 defined-benefit plan分担额确定方案 defined-contribution plan财产保险 property insurance 汽车保险 car/vehicle/auto/motor insurance全险 fully comprehensive insurance防盗窃险 insurance against theft第三者伤亡保险 third-party insurance机动车第三者责任保险motor vehicle third-party liability insurance责任保险 liability insurance公众责任保险 public liability insurance雇主责任保险 employer liability insurance职业责任保险 professional liability insurance产品责任保险 product liability insurance信用保险 credit insurance再保险 reinsurance社会保险 social insurance经济损失保险 financial loss insurance可保利益原则(保险利益原则) the principle of insurable interest损失补偿原则 the principle of indemnity最大诚信原则 the principle of utmost good faith代位求偿原则 the principle of subrogation保险池 insurance pool风险池/共同基金 risk pool保险费率 insurance rates损失控制 loss control损失赔付 loss settlement大数法则 the law of large numbers部分损失 partial loss保单全额 the face amount of the policy可保利益 insurable interest丧失劳动能力 disabled保险直销市场 direct insurance market索赔,理赔 claims风险管理 risk management纯粹风险 pure risk投机风险 speculative risk风险避免 risk avoidance风险承担 risk assumption自保 self-insurance风险预防 loss prevention损失抑制 loss reduction风险转移 risk transfer二、写作范文1、Insurance1.What is insurance and how it worksInsurance is a precaution against a possible unexpected loss; it is a way of risk management.In financial definition, insurance is a financialarrangement that redistributes the costs of unexpected losses. When we buy insurance, we transfer our risk to someone else in exchange fora payment or premium. Then, if we suffer a specified loss, we can make a claim to the insurer according to the insurance policy.It works because insurance companies gather a large number of people who feel exposed to the same possible circumstances to form an insurance pool.The company knows that the total premium collected from the group of people should cover the cost ofthe claims made b y the unfortunate few who actually suffer a loss. That is to say, insurance spreadsthe risk of financial loss among a great many p eople. Here, there are two important factors: (1) Manypeople share the risk. (2)Losses do not happen all at once.Insurance companies invest this pool of funds in the money and capital market to achieve gains andprofits. This is important for insurance companies to grow and develop.2.The types of insuranceThere are many different types of insurance:(1)life insurance;(2)health insurance;(3)accident insurance;(4)property insurance;(5)liability insurance. Every type canalso be divided into several smaller lines of insurance.3.Legal principles of insurance(1)The principle of insurable interest means theinsured person must have an insurable interest in the subject matter of the insurance. That is, hemust stand to lose financially if the event insured against happens. (2)The principle of indemnity means the policyholder must not make aprofit if the event insured against happens.(3)The principle of utmost good faith means a nyone applies for insurance must tell the prospectiveinsurer every fact that he knows or ought to know which would influence the insurer in deciding whether to grant the insurance and, on what terms.(4)Under the principle of subrogation, the insurer who has indemnified the insured’s loss is entitled to recovery from any liable third parties who are responsible.2、Risk managementRisk management is the scientific method of planning to deal with losses. When it comes torisk, it is defined as uncertainty concerningloss. Risks can be divided into two categories:speculative risk and pure risk. Speculativerisks are exposures that can result in gains or losses and usually are not the subject of riskmanagement. On the other hand, pure risks canresult only in losses and usually arise from the following sources: direct losses of property;indirect losses of income; liability losses and losses due to death or disability of keypersonnel. Risk management is the process used to systematically manage e xposures to pure risk. The four steps in the process of risk management are (1) identify risks, (2) evaluate risks, (3) select risk management techniques, and (4) implement and review decisions.1.Identifying and measuring exposuresRecognizing one’s exposure to loss requires organized thinking about the subject. Thereare many sources of risks. One way to classify them is in relation to property, liability,life, health, loss of income and financial exposures. After risks are identified, theyshould be evaluated regarding their expected frequency of occurrence, the probable severityof associated losses and the maximum probableloss. It is well to remember that before a loss occurs, measurement is merely an estimate, which will not necessarily reflect with accuracy the actual amount of damage or exposure to loss.2.Developing and implementing a riskmanagement programIt is the job of the risk manager to developand implement plans to deal with the potential losses, after the identifying and measuringstep has been finished. Accomplishing this task demands a knowledge of the alternativemethods of dealing with risk. In addition to insurance, six other methods are risk avoidance; risk assumption; self-insurance; loss prevention; loss reduction and risk transfer. A thorough risk management programis the result of the consideration of all these alternatives. In every case the risk managerwill carefully weigh the ratio of the costs of an approach with the potential benefits to be produced. So, spending priorities must be established under a limited budget. Also, determining the choice of an appropriate toolshould be based on the measurement of exposures. Once a decision has been made to treat an exposure to loss with a given tool, the decision must be implemented, and reviewed during or after the whole process.3、Life insurance1.What is life insuranceThe standard life insurance provides that upon the insured’s death, the policy face amountwill be paid to the beneficiary. When terminated prior to death, some policies havecash values that can be refunded to the policyholder.2.Some characteristics of life insuranceIt is untimely death that is insured ratherthan the possibility of death itself. So, therisk in life insurance increases from year toyear, until the insured eventually dies. However, the insurance company can promise topay a specified sum to the beneficiary no matter when death comes. Aldo, there is no possibility of partial loss in life insurance. All policies are cash payment policies. As tothe insurable interest, every individual hasan unlimited insurable interest in his/her own life, and may assign that insurable interestto anyone financially related to him/her.3.Types of life insuranceThe three major types of life insurance areterm, whole life and universal life insurance. Term policies usually do not have cash values. The contract terms include the length of timefor which protection is provided, coverage options and the possible changes in the amount of death protection. Whole life insurance maybe kept in force for the insured’s entire lifetime. The premiums can be paid in many forms, and each has a different size of cashvalue. Universal life policies usually provide for flexible premiums and possible changes inthe size of the death benefit. Cash values vary over time, depending on the timing and amountof premiums paid, as well as the insurer’sinvestment earnings, etc. In addition, variable life insurance’s death benefits and cash values vary with the performance of oneor more investment portfolios selected by the policyholder; changes in portfolio selectionusually can be made periodically each year.4.Payment of the benefitMost policies are settled by payment of theface amount in a lump sum upon the insured’s death. Alternative settlement options include payment of the proceeds over a fixedperiod or in a fixed amount, and other arrangements that guarantee payment as long as beneficiaries remain alive.4、Long-term Care (LTC) InsuranceAs more and more people live to advanced ages, there is an increasing risk of loss associated with the need for nursing home care or other assistance with daily living. As a result, long-term care insurance is growing in popularity, and the coverage provisions andoptions are achieving some degree of standardization through federal legislation and actions of NAIC.There may be some differences among differentLTC policies. (1)Some LTC policies cover onlythe named insured, whereas others cover his/her spouse as well. (2)Most policies specify a maximum d aily benefit and an overall maximum limit during the insurance period, while others do not contain these terms. Further, some LTC policies also specify thatthe overall maximum can be restored under various conditions, such as the recovery of the insured and not requiring LTC assistance forsix months. (3)When selecting a policy, insured usually must select an elimination period, which is a form of deductible. (4)Some LTC policies pay only for skilled and intermediate nursing home care and not for custodial care. However, under the NAIC Model Act, insurer must offer almost the same levelof benefits for skilled, intermediate and custodial care. (5)Some early LTC policies require a period of living in hospital beforeentering an LTC facility as a restrictive provision for payment, but most policies nowdo not. (6)Some policies also have options that make benefits available for adult day care,home health care and other forms of assistance that will be needed at advanced ages.In general, LTC insurance can be expected tochange in response to the increasing demand f or this type of protection.。

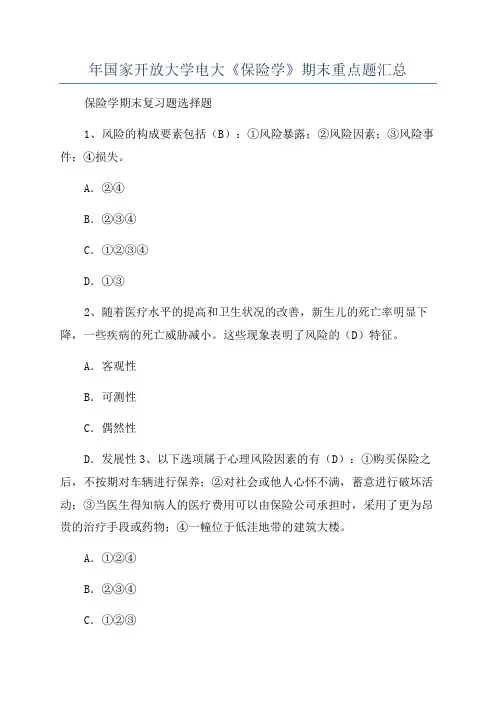

年国家开放大学电大《保险学》期末重点题汇总保险学期末复习题选择题1、风险的构成要素包括(B):①风险暴露;②风险因素;③风险事件;④损失。

A.②④B.②③④C.①②③④D.①③2、随着医疗水平的提高和卫生状况的改善,新生儿的死亡率明显下降,一些疾病的死亡威胁减小。

这些现象表明了风险的(D)特征。

A.客观性B.可测性C.偶然性D.发展性3、以下选项属于心理风险因素的有(D):①购买保险之后,不按期对车辆进行保养;②对社会或他人心怀不满,蓄意进行破坏活动;③当医生得知病人的医疗费用可以由保险公司承担时,采用了更为昂贵的治疗手段或药物;④一幢位于低洼地带的建筑大楼。

A.①②④B.②③④C.①②③4、以下做法属于损失预防的措施有(A):①在厨房安装防火门;②对汽车司机加强安全教育和驾驶技能的培训;③在网吧装设火警警报器、烟雾探测器;④在重大流行病传播时,启动疾病控制预警机制和紧急救助机制。

A.②④B.①④C.①②③④D.①②③5、下列关于纯粹风险的说法,正确的有(D):①纯粹风险是指只有损失或不损失两种可能的风险;②只有纯粹风险才是可保风险;③纯粹风险是风险控制的主要对象;④纯粹风险导致的可能损失对个体而言是一种损失,但从整个社会角度来看,可以在很大程度上相互抵消,甚至完全抵消。

A.①②B.①②④C.②③D.①②③6、下列陈述,正确的有(A):①全家旅游不搭乘同一航班的做法属于风险回避;②如果对某种风险的识别和估计尚无把握,就应该采用风险回避的方法;③风险回避的主要优点是将特定损失的发生概率保持在零水平,简单易行;④风险回避具有消极防御性。

B.③④C.①②③④D.①②7、下列关于近因的陈述,正确的有(B):①近因是指引起保险标的损失最直接、最有效、起主导作用或起支配作用的原因;②如果多个原因连续发生导致损失,并且各原因之间的因果关系没有中断,则时间上最近的原因是近因;③如果造成损失的原因只有一个,那么该原因就是近因;④如果多个原因同时发生,那么这些同时发生的原因都是近因。

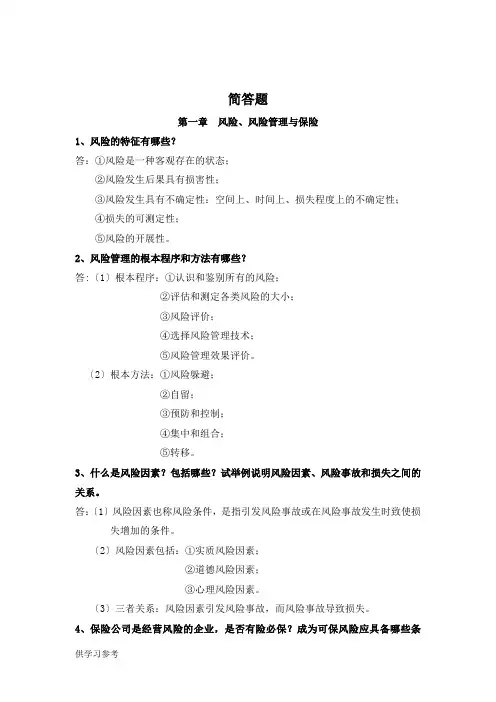

简答题第一章风险、风险管理与保险1、风险的特征有哪些?答:①风险是一种客观存在的状态;②风险发生后果具有损害性;③风险发生具有不确定性:空间上、时间上、损失程度上的不确定性;④损失的可测定性;⑤风险的开展性。

2、风险管理的根本程序和方法有哪些?答:〔1〕根本程序:①认识和鉴别所有的风险;②评估和测定各类风险的大小;③风险评价;④选择风险管理技术;⑤风险管理效果评价。

〔2〕根本方法:①风险躲避;②自留;③预防和控制;④集中和组合;⑤转移。

3、什么是风险因素?包括哪些?试举例说明风险因素、风险事故和损失之间的关系。

答:〔1〕风险因素也称风险条件,是指引发风险事故或在风险事故发生时致使损失增加的条件。

〔2〕风险因素包括:①实质风险因素;②道德风险因素;③心理风险因素。

〔3〕三者关系:风险因素引发风险事故,而风险事故导致损失。

4、保险公司是经营风险的企业,是否有险必保?成为可保风险应具备哪些条件?答:保险公司不是有险必保。

可保风险即可保危险,是指可被保险公司接受的风险,或可以被保险公司转嫁的风险可保风险必须是纯粹风险即危险但也不是任何危险均可向保险公司转嫁,也就是说保险公司所承担的危险是有条件的。

必备条件:①风险不是投机的〔投机性〕;②风险必须是偶然的〔偶然性〕;③风险必须是意外的;④风险必须是大量标的均有遭受损失的可能性;⑤风险应有发生重大损失的可能性;⑥承保的风险必须有利于维护公德。

5、保险的特点有哪些?试比较保险与储蓄及救济、赌博的异同点。

答:〔1〕特点:①合同行为;②带有互助性;③经济补偿;④保险费率的厘定具有科学性。

〔2〕异同点:A.保险与储蓄:共同点:都是以现在的剩余对付将来的缺乏;都表达了有备无患的思想。

区别:①储蓄是一种自助行为,保险是一种自助与他助相结合的行为;②储蓄的本利给付是确定的,保险的保险金给付是不确定的。

B.保险与救济:共同点:都是补偿灾害事故损失的经济制度。

区别:①保险是一种合同行为,救济不是合同行为;②保险是以投保人缴费为前提,是对价交易;救济是单方行为,没有对价作根底。

保险学概论期末复习重点一、解释名词1、风险2、保险3、纯粹风险4投机风险5、社会保险6、保险密度7、保险深度8、原保险9、再保险10、共同保险11、财产保险12、人身保险13、重复保险14、保险利益15、保证16、弃权与禁止反言17、保险合同18、射幸合同19、保险人20、保险金额21、保险凭证22、保险法24、保险资金25、分业经营26、未到期责任准备金27、保证金28、保险保障基金29、自留保险费30、第一损失保险 31、责任保险 32、人寿保险 33、年金保险 34、健康保险 35、意外伤害保险 36、宽限期条款 37、人身保险 38、医疗保险 39、不可争条款二、单项选择题1、保险基金的来源是()。

A、保险费率B、保险金额C、保险费D、营业收入2、风险管理中最为重要的环节是()。

A、风险识别B、风险评价C、风险估测D、选择风险管理技术3、保险市场的保险人提供保障的基础是()。

A、保险基金B、保险标的C、保险价值D、保险费率4、某房东外出时忘记锁门,结果小偷进屋、家具被偷。

则导致该失窃事件的风险因素是()。

A、道德风险因素B、经济风险因素C、物质风险因素D、心理风险因素5、某厂对早已发现的老化电路未及时进行维修,结果引起火灾事故并致使财产损失。

则导致该事故的风险因素是()。

A、道德风险因素B、经济风险因素C、物质风险因素D、心理风险因素6、下列风险中,只有()属于可保的纯粹风险。

A、技术革新B、货物出口C、地震D、车祸7、被保险人缴付的用于赔偿损失或给付保险金的费用叫()。

A、纯保费B、毛保费C、毛费率D、附加保费8、有关劳合社的性质,下列说法中除了()以外,都是正确的。

A、保险交易所B、保险社团C、保险公司D、保险市场9、人身保险属于()。

A、定值保险B、定额保险C、重置价值保险D、不定值保险10、某企业投保企业财产险,保险金额为100万元,出险时保险财产的价值为80万元;当发生全损时,保险人应赔偿()。

保险学概论习题及答案《保险学概论》期末总复习⼀、填空题:10分(1*10空)1、《保险法》规定:设⽴区域性保险公司,其注册资本的最低限额为⼈民币2亿元;全国性保险公司注册资本的最低限额为⼈民币5亿元。

2、近因是造成保险标的损失最直接、最有效、起决定性作⽤的原因。

3、健康保险包括医疗保险、残疾收⼊补偿保险、住院医疗保险、疾病保险和⽣育保险。

4、保险费率由纯费率和附加费率组成。

两保费合称为总保费。

5、风险的基本要素包括风险因素、风险事故和损失。

6、保险赔偿⽅式主要有现⾦赔付、修复、重置三种。

7、投保⼈对保险标的不具有保险利益的,保险合同⽆效。

8、保证按保证存在形式分为明⽰保证和默⽰保证。

9、风险因素可分为实质风险因素、道德风险因素和⼼理风险因素。

10、保险公司的组织形式有国有独资保险公司和股份保险公司两种。

11、保险具有经济性、互助性、契约性和科学性的特点。

12、保险⼈把其原保险业务转让给其它保险⼈的⽅式叫再保险。

13、保险的基本职能是补偿损失和给付保险⾦。

保险的派⽣职能是融资和防灾防损。

14、风险是损失的不确定性。

它有两层含义,⼀是可能存在损失;⼆是这种损失是不确定的。

15、保险合同的当事⼈包括保险⼈和投保⼈,保险合同的关系⼈包括被保险⼈和受益⼈。

16、保险合同的辅助⼈包括保险代理⼈、保险经纪⼈和保险公估⼈。

17、哈雷⽣命表的编制和运⽤,奠定了现代⼈寿保险的数理基础。

18、纯粹风险导致两种结果,即损失和⽆损失;投机风险导致三种结果,即损失、⽆损失和获利。

⼆、单项选择题:10分(1*10题)1、当损失频率=( C )时风险最⼤。

A、0;B、0.3;C、0.5;D、12、权利⼈因义务⼈⽽遭受经济损失的风险是( D )。

A、财产风险;B、⼈⾝风险;C、责任风险;D、信⽤风险3、两个或两个以上的保险⼈共同承保同⼀保险责任,同⼀保险利益,同⼀保险事故的保险称为( C )。

A、重复保险;B、再保险;C、共同保险;D、综合保险4、保费收⼊总额占国内⽣产总值的⽐重是指( B )。

对外经济贸易大学远程教育学院2007--2008学年第一学期《人寿与健康保险》期末考试大纲(请和本学期公布的大纲核对,答案供参考)本复习大纲适用于本学期的期末考试,所列题目为期末试卷试题的出题范围。

本次期末考试题型分为三种:单项选择题;多项选择题;判断题。

单项选择占30% 多项选择占60% 判断题占10%期末复习思考题(一)单项选择题1.不确定性是指基于某一事件发生的结果的概率为(D)。

A.0 B.1C.0或1 D.介于0和1之间2.风险的一般定义是指某一事件发生的( C )。

A.必然性 B.客观性C.不确定性 D.损害性3.根据风险的一般定义,下列说法错误的是( C )。

A.风险可以是盈利的不确定性B.风险可以是损失的不确定性C.风险只能是损失的不确定性D.风险既可以是盈利的不确定性,也可以是损失的不确定性4.通常人身保险中所指风险的结果(B)。

A.只能是盈利的不确定性 B.只能是损失的不确定性C.只能是盈利的确定性 D.只能是损失的确定性5.人身风险的存在都是不以人的意志为转移的,这表明风险具有( A )特征。

A.客观性 B.偶然性C.普遍性 D.意外性6.新的人身风险不断产生体现了人身风险的(D )。

A.客观性 B.普遍性C.损失性 D.可变性7.构成人身可保风险的条件之一要求损失不能是巨灾损失,这一条件是指( B )。

A.可以有大比例的保险标的同时出险B.不能有大比例的同质风险单位同时遭受损失C.同一地点只能一个保险标的受损D.一次事故只能一个保险标的受损8.可保人身风险必须具备的条件之一是(D )。

A.大量标的均有遭受损失的可能B.大量标的均有遭受损失的必然C.少量标的均有遭受损失的必然D.少量标的均有遭受损失的可能9.若一个个体损失确定发生,则损失机会为(C)。

A.0 B.1/2C.1 D.0-1之间10.下列导致人身伤害及疾病的风险属于可保风险的是( D)。

A.战争 B.核爆炸C.地震 D.火车倾覆11.关于人身风险的保费经济可行阐述错误的是(C)。

《保险学原理》期末复习题及答案第一章风险与风险管理一.单选1.股市波动风险属于()。

A.自然风险B.投机风险C.政治风险D.纯粹风险2.某建筑队在施工时偷工减料导致建筑物塌陷,则造成损失事故发生的风险因素是()。

A.物质风险因素B.心理风险因素C.道德风险因素D.思想风险因素3.某房东外出时忘记锁门,结果小偷进屋家里被偷。

则风险因素是()。

A.小偷进屋B.家具被偷C.外出时忘记锁门D.房东外出4.属于控制型风险管理技术的有()。

A.抑制与避免B.抑制与自留C.转移与分散D.保险与自留5.保险可以从不同的角度进行定义,从经济角度看,保险属于()。

A.合同行为B.财务安排C.精巧的稳定器D.风险管理的方法6.风险是保险产生和存在的()。

A.前提B.环境C.可能D.证明7.可保风险必须是只有损失机会没有获利可能的风险,这说明保险人承保的风险是()。

A.投资风险B.投机风险C.纯粹风险D.自然风险8.保险经营的费率计算是依据风险发生的概率,这说明可保风险必须具有()。

A.不确定性B.现实可测性C.损失大量性D.损失集中性9.在保险中,人们以不诚实或故意欺诈行为促使保险事故发生,以便从保险中获取额外利益的风险因素属于()。

A.逆选择B.道德风险C.心理风险D.法律风险10.()使风险的可能性转化为现实性。

A.风险因素B.风险事故C.风险增加D.风险11.疾病传染属于()。

A.物质风险因素B.道德风险因素C.心理风险因素D.社会风险因素12.带病投保属于()。

A.物质风险因素B.道德风险因素C.心理风险因素D.社会风险因素13.制造交通事故杀人骗保属于()。

A.物质风险因素B.道德风险因素C.心理风险因素D.社会风险因素14.下面说法正确的是()。

A.风险按原因分为纯粹风险和投机风险B.风险事故、风险因素和损失三者之间存在着一因果关系,风险事故增加或产生风险因素,风险因素引起损失C.风险按照性质分可以分为静态风险和动态风险D.风险是指在特定的客观情况下,在特定的期间内,某种损失发生的可能性15.风险存在具有()。

(单选题)1.投保人向保险人提出保险要约的书面形式是()。

A: 保险单B: 投保单C: 暂保单D: 保险凭证正确答案: B(单选题)2.两全保险有多种形式,常见的有普通两全保险、联合两全保险及()。

A: 特殊两全保险B: 健体两全保险C: 次健体两全保险D: 期满双倍两全保险正确答案: D(单选题)3.比例再保险确定自留额和分出额的基础是()。

A: 赔付率B: 赔款C: 责任限额D: 保额正确答案: D(单选题)4.最终必定要给付一笔保险金额的人身保险险种为()。

A: 定期死亡保险B: 终身保险C: 生存保险D: 人身意外伤害保险正确答案: B(单选题)5.人身保险合同是( )A: 收益性的B补偿性的B: 投资性的C: 积累性的正确答案: A(单选题)6.以下不属于再保险合同起始与终止情况的是()。

A: 期满终止B: 特殊终止C: 给付终止D: 通知终止正确答案: C(单选题)7.下列不属于养殖业保险标的的是()。

A: 肉用畜B: 家禽C: 商品性养殖的各水产品D: 宠物正确答案: D(单选题)8.在损失发生后对损失事故进行调查,以确定保险责任归属、赔偿金额等事项的中间人是()。

A: 保险经纪人B: 保险公估人C: 独立代理人D: 专用代理人正确答案: B(单选题)9.下列不属于水产养殖死亡责任的是()。

A: 缺氧死亡B: 他人投毒C: 疾病D: 放养过程的自然死亡正确答案: D(单选题)10.财产保险的职能是()。

A: 积累B: 经济补偿C: 消费D: 投资正确答案: B(单选题)11.下列属于按照风险形式分类的是()。

A: 特定风险B: 基本风险C: 投机风险D: 责任风险正确答案: C(单选题)12.属于企业财产保险可保财产的是()。

A: 土地B: 账外或已摊销财产C: 矿藏D: 道路正确答案: B(单选题)13.团体人身保险是通过一张保险单承保一个团体的全部或部分人员的人身保险,为了防止道德风险,一般要求至少投保团体总人数的()。

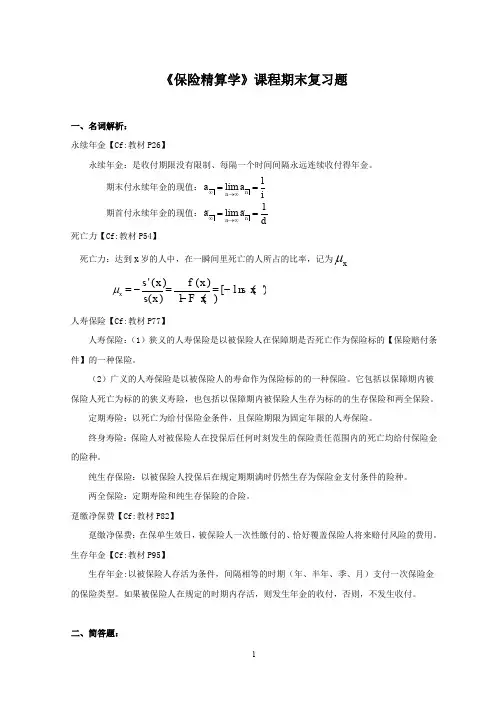

1.李华1990年1月1日在银行帐户上有5000元存款,(1)在每年10%的单利下,求1994年1月1日的存款额。

(2)在年利率8%的复利下,求1994年5月1日的存款额。

解:(1)5000×(1+4×10%)=7000(元)(2)5000×(1+10%)4.33=7556.8(元)2.把5000元存入银行,前5年的银行利率为8%,后5年年利率为11%,求10年末的存款累计额。

解:5000(1+8%)5×(1+11%)5=12385(元)3.李美1994年1月1日在银行帐户上有10000元存款。

(1)求在复利11%下1990年1月1日的现值。

(2)在11%的折现率下计算1990年1月1日的现值。

解:(1)10000×(1+11%)-4=5934.51(元)(2)10000×(1-11%)4=6274.22(元)4.假设1000元在半年后成为1200元,求⑴ )2(i ,⑵ i, ⑶ )3(d 。

解:⑴ 1200)21(1000)2(=+⨯i ;所以4.0)2(==i ⑵2)2()21(1i i +=+;所以44.0=i ⑶n n m m nd d i m i ---=-=+=+)1()1(1)1()(1)(;所以, 13)3()1()31(-+=-i d ;34335.0)3(=d5.当1>n 时,证明:i idd n n <<<<)()(δ。

证明:①)(n d d <因为,+⋅-⋅+⋅-⋅=-=-3)(32)(2)(10)()()(1)1(1nd C n d C n d C C n d d n n n n n n n n n)(1n d->所以得到,)(n dd <;②δ<)(n d)1()(mn em dδ--=;mm C m C m C m ennnmδδδδδδ->-⋅+⋅-⋅+-=-1)()()(1443322所以,δδ=--<)]1(1[)(mm dn③)(n i <δi n in n +=+1]1[)(, 即,δ=+=+⋅)1ln()1ln()(i nin n所以,)1()(-⋅=n n e n i δm m C m C m C m e nnnnδδδδδδ+>+⋅+⋅+⋅++=1)()()(1443322δδ=-+>]1)1[()(nn in④i in <)(i ni nn +=+1]1[)(,)(2)(2)(10)(1)(1]1[n n n n n n n n i n i C n i C C n i +>+⋅+⋅+⋅=+所以,i in <)(6.证明下列等式成立,并进行直观解释:⑴nmm n m a v a a +=+;解:iv a nm n m ++-=1,iv a mm -=1,ivv i v v a v nm m n mn m +-=-=1所以,n m nm m m n mma iv v v a v a ++=-+-=+1⑵n mm n m s v a a -=-;解:iva nm nm ---=1,iv a mm-=1,iv v s v n m m n m--=-所以,n m nm m m n mma iv v v s v a --=-+-=-1⑶nmm n m a i s s )1(++=+;解:i i s m m 1)1(-+=,ii i i i i s i m n m n mnm )1()1(1)1()1()1(+-+=-++=++所以,n m mnm m nmm s ii i i a i s ++=+-++-+=++)1()1(1)1()1(⑷nmm n m a i s s )1(+-=-。