企业所得税汇算清缴鉴证报告英文版

- 格式:doc

- 大小:39.00 KB

- 文档页数:3

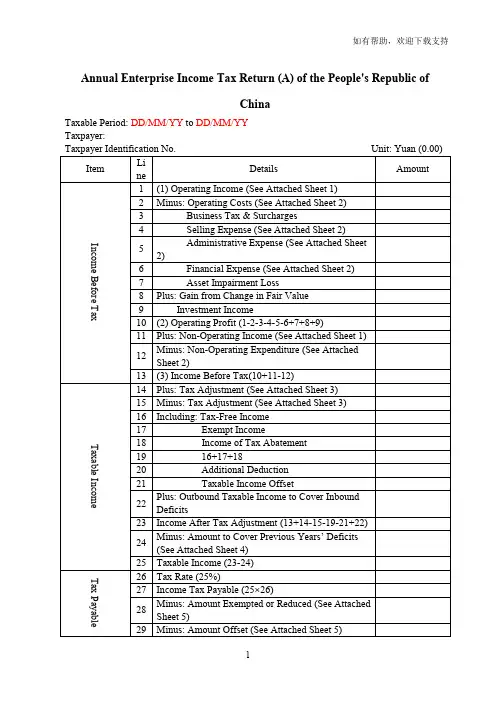

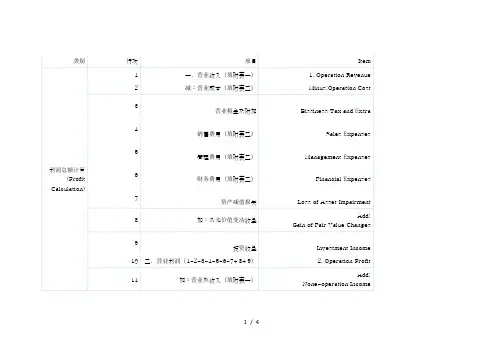

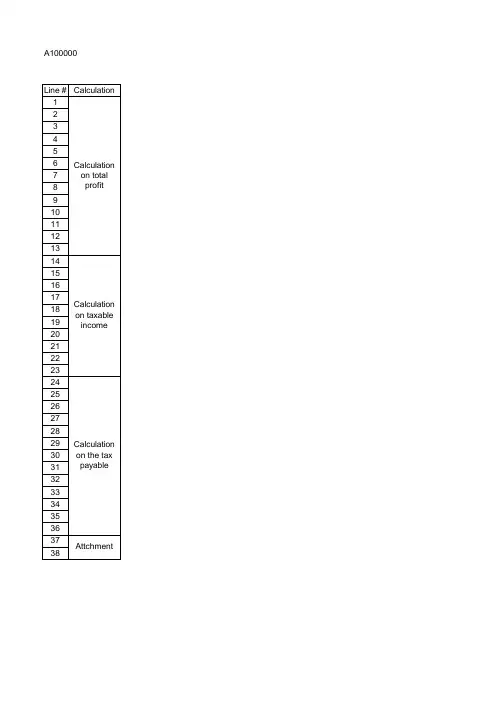

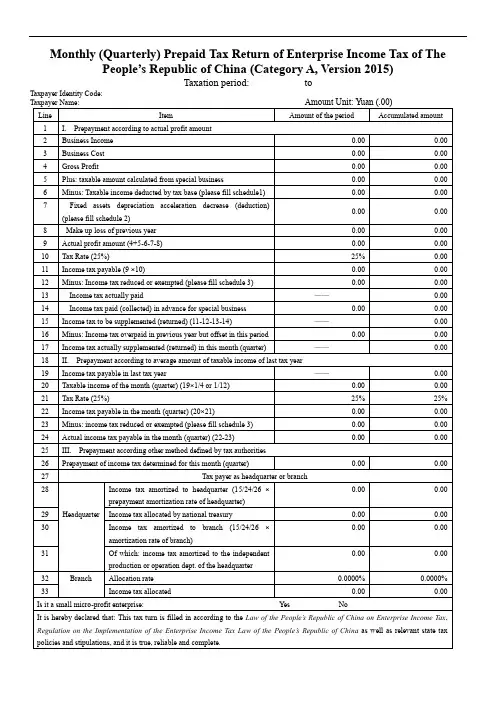

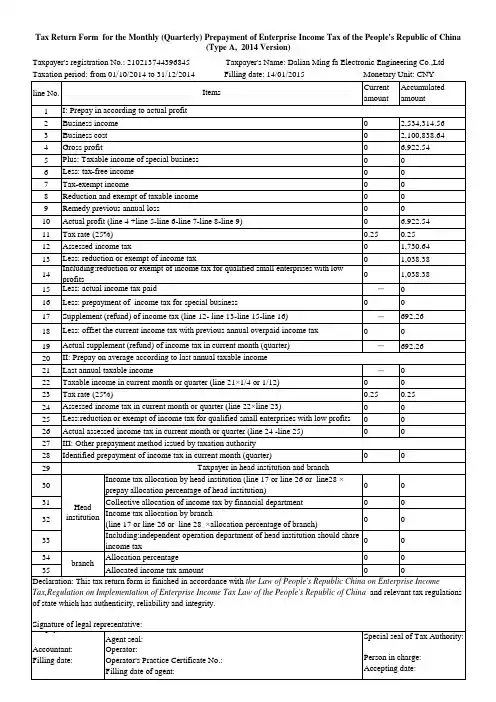

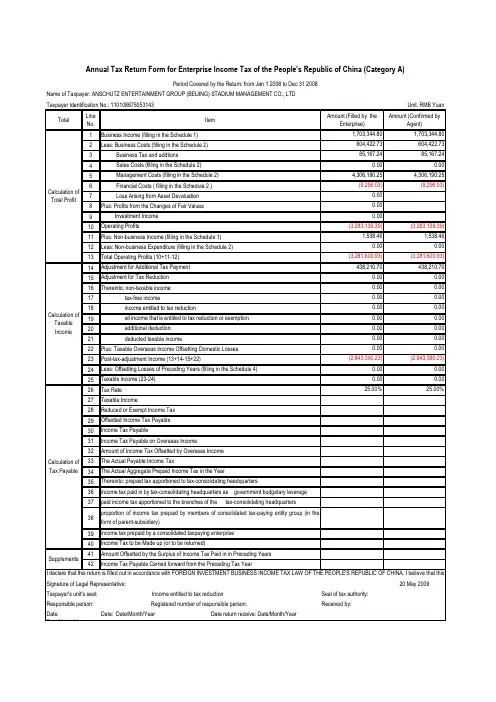

Annual Enterprise Income Tax Return (A) of the People's Republic ofChinaTaxable Period: DD/MM/YY to DD/MM/YYTaxpayer:Monthly(Quarterly)Enterprise Income Tax Return (A) of the People's Republicof ChinaTaxation Period: DD/MM/YY to DD/MM/YYTaxpayer ID:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (signature): Date: Taxpayer’s Official Seal: Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (seal): Date: Taxpayer’s Official Seal:Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (signature): Date: Taxpayer’s Official Seal: Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of Taxation。

汇算清缴英文版指南As a foreign individual or business operating in China, the process of "汇算清缴" (huì suàn qīng jiǎo) or "final settlement and clearance" of taxes can be a complex and daunting task. This guide aims to provide a comprehensive overview of the 汇算清缴 process in English, to help you navigate through the intricacies and ensure compliance with Chinese tax regulations.作为在中国经营的外国个人或企业,“汇算清缴”(huì suàn qīng jiǎo)即“最终结算和清算”税款的过程可能是一个复杂而艰巨的任务。

这份指南旨在全面介绍汇算清缴程序的英文版,帮助您在复杂的税收法规中航行,并确保您遵守中国的税收法规。

The first step in the "final settlement and clearance" process is to gather all relevant financial and tax documents from the previous year. This includes income statements, expense records, tax receipts, and any other documentation related to your financial activities in China.“最终结算和清算”过程的第一步是收集去年所有相关的财务和税务文件。

汇算清缴英文版指南English Response:Reconciliation and Clear Settlement.Reconciliation and clear settlement (RCS) is a process of reconciling and clearing transactions between two or more parties. It is typically used in financial transactions, such as banking, investments, and trade. The purpose of RCS is to ensure that both parties have a complete and accurate record of all transactions, and that all outstanding payments have been settled.The RCS process typically involves the following steps:1. The parties involved agree on the terms of the RCS, including the scope of the reconciliation, the frequency of reconciliation, and the method of settlement.2. The parties exchange data on all transactions thathave occurred during the reconciliation period.3. The data is reconciled to identify any discrepancies or errors.4. The discrepancies or errors are corrected and the data is re-reconciled.5. The parties agree on the final reconciled data and settle any outstanding payments.RCS can be a complex and time-consuming process, but it is essential for ensuring that both parties have a complete and accurate record of all transactions. It can also help to reduce errors and fraud, and improve the efficiency of financial transactions.Here are some of the benefits of RCS:Ensures that both parties have a complete and accurate record of all transactions.Reduces errors and fraud.Improves the efficiency of financial transactions.Helps to resolve disputes.Reconciliation and Clear Settlement in Different Industries.RCS is used in a variety of industries, including:Banking: RCS is used to reconcile and cleartransactions between banks and their customers. This includes transactions such as deposits, withdrawals, checks, and electronic payments.Investments: RCS is used to reconcile and clear transactions between investors and brokers. This includes transactions such as buying and selling stocks, bonds, and mutual funds.Trade: RCS is used to reconcile and clear transactionsbetween buyers and sellers of goods and services. This includes transactions such as purchase orders, invoices,and payments.The specific RCS process used in each industry may vary, but the overall goal is the same: to ensure that bothparties have a complete and accurate record of all transactions, and that all outstanding payments have been settled.中文回答:汇算清缴。

TotalLine No.Amount (Filled by theEnterprise)Amount (Confirmed byAgent)11,703,344.801,703,344.802604,422.73604,422.73385,167.2485,167.2440.000.0054,306,190.254,306,190.256(9,296.03)(9,296.03)70.0080.0090.0010(3,283,139.39)(3,283,139.39)111,538.461,538.46120.000.0013(3,281,600.93)(3,281,600.93)14438,210.70438,210.70150.000.00160.000.00170.000.00180.000.00190.000.00200.000.00210.000.00220.000.0023(2,843,390.23)(2,843,390.23)240.000.00250.000.002625.00%25.00%2728293031323334353637383940414220 May 2009Seal of tax authority:Received by:Date: Date/Month/YearBusiness Income (filling in the Schedule 1)Less: Business Costs (filling in the Schedule 2)Amount Offsetted by the Surplus of Income Tax Paid in in Preceding YearsIncome Tax Payable Carried forward from the Preceding Tax YearLoss Arising from Asset Devaluation Plus: Profits from the Changes of Fair Values Investment Income Operating ProfitsBusiness Tax and addtions Sales Costs (filling in the Schedule 2) Management Costs (filling in the Schedule 2) Financial Costs ( filling in the Schedule 2 )Income Tax PayableIncome Tax Payable on Overseas IncomeAmount of Income Tax Offsetted by Overseas Income Plus: Non-business Income (filling in the Schedule 1)Less: Non-business Expenditure (filling in the Schedule 2)Total Operating Profits (10+11-12)Adjustment for Additional Tax Payment Adjustment for Tax Reduction Thereinto: non-taxable income tax-free incomeThe Actual Payable Income TaxThe Actual Aggregate Prepaid Income Tax in the YearThereinto: prepaid tax apportioned to tax-consolidating headquartersincome tax paid in by tax-consolidating headquarters as government budgetary leverage additional deduction deducted taxable incomePlus: Taxable Overseas Income Offsetting Domestic Losses Taxable IncomeReduced or Exempt Income Tax Offsetted Income Tax Payable Date return receive: Date/Month/YearSignature of Legal Representative:Date:Date/Month/Yearpaid income tax apportioned to the branches of the tax-consolidating headquartersproportion of income tax prepaid by members of consolidated tax-paying entity group (in the form of parent-subsidiary)income tax prepaid by a consolidated taxpaying enterprise Income Tax to be Made up (or to be returned)Taxable income (23-24)Tax Rate Calculation of Taxable IncomeTaxpayer Identification No.: 110108675053143Annual Tax Return Form for Enterprise Income Tax of the People's Republic of China (Category A)Period Covered by the Return: from Jan 1 2008 to Dec 31 2008Unit: RMB YuanName of Taxpayer: ANSCHUTZ ENTERTAINMENT GROUP (BEIJING) STADIUM MANAGEMENT CO., LTD income entitled to tax reductionall income that is entitled to tax reduction or exemption Calculation of Tax PayableTaxpayer's unit's seal: Income entitled to tax reduction Responsible person: Registered number of responsible person:SupplementsI declare that this return is filled out in accordance with FOREIGN INVESTMENT BUSINESS INCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA.I believe that this return is true, correct and complete.ItemCalculation of Total ProfitPost-tax-adjustment Income (13+14-15+22)Less: Offsetting Losses of Preceding Years (filling in the Schedule 4)。

企业年度报告证明英文*Introduction*In this annual report, we aim to provide a comprehensive overview and assessment of our company's performance during the past year. Our company has strived to remain competitive in an ever-evolving market, and this report serves as evidence of our success and dedication.*Financial Performance*Our company has achieved remarkable growth in terms of revenue and profitability. The total revenue for the year has increased by 20% compared to the previous year, reaching an all-time high of 100 million. This growth can be attributed to our efforts in expanding our customer base, improving customer satisfaction, and introducing innovative products.Notably, our profit margin has also witnessed a significant improvement, increasing by 15% compared to the previous year. This improvement can be attributed to cost management strategies and increased productivity. Cash flow management has been another key focus for our company. We have successfully increased our operating cash flow by streamlining our operations and implementing effective accounting practices. This has allowed us to invest in research and development, expand our production capacity, and fund strategic acquisitions in line with our long-term growth plans.*Market Analysis*Our company operates in a highly competitive market where constant innovation and adaptation are essential. Despite these challenges, we have successfully maintained our market share and even gained new ones, thanks to the implementation of effective marketing strategies.In terms of market growth, our company has consistently outperformed the industry average. This can be attributed to our ability to identify emerging market trends and respond swiftly with appropriate products and services. Additionally, our strong brand reputation has allowed us to attract new customers and retain existing ones.*Corporate Social Responsibility*As a responsible corporate citizen, our company is committed to making a positive impact on society and the environment. In the past year, we have actively participated in various social and environmental initiatives. We have implemented sustainable practices throughout our supply chain, reducing our carbon footprint and waste production. We have also supported local communities by volunteering our time and resources in education and healthcare projects.*Future Outlook*Looking ahead, we are confident in our ability to sustain and build upon our success. With a solid financial foundation, a strong market presence, and a dedicated workforce, our company is well-positioned for futuregrowth.To further drive growth, we will continue to invest in research and development to bring innovative and advanced products to the market. Additionally, we will focus on expanding our global reach by exploring new market opportunities and building strategic partnerships.*Conclusion*In conclusion, this annual report provides a comprehensive overview of our company's performance and achievements for the past year. Our strong financial performance, market growth, and commitment to corporate social responsibility are evidence of our dedication to success. We look forward to another year of growth and continued success.。

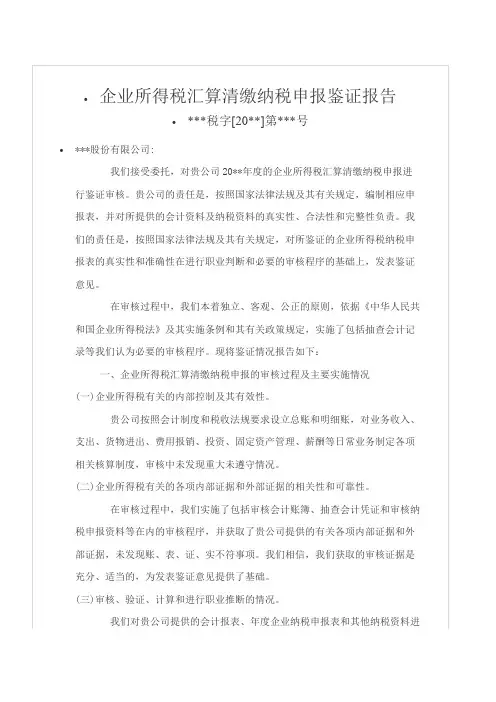

企业所得税汇算清缴纳税申报鉴证报告(参考文本)编号:ⅩⅩⅩⅩⅩⅩⅩⅩ公司:我公司接受委托,对贵公司ⅩⅩⅩⅩ年度/期间的企业所得税汇算清缴纳税申报进行了审核鉴证。

贵公司的责任是:对所提供的会计资料及纳税资料的真实性和完整性负责。

我公司的责任是:本着独立、客观、公正的原则,按照国家法律法规及其有关规定,在通过必要的程序对企业所得税纳税申报表及其有关资料的真实性和准确性实施审核的基础上,进行职业判断,并出具真实、合法的鉴证报告。

我们认为,本报告后附的《企业所得税汇算清缴纳税申报审核事项说明》、《企业所得税年度纳税申报审核鉴证表》及其他鉴证表已经按照《中华人民共和国企业所得税法》及其《实施条例》和相关规范性文件的规定编制,在所有重大方面真实反映了贵公司ⅩⅩⅩⅩ年度/期间的企业所得税纳税情况,现将鉴证结果报告如下:一、贵公司存在与企业所得税有关的内部控制制度,并一贯遵循,未发现与企业所得税相关的内部控制制度存在重大缺陷。

(或贵公司与企业所得税有关的内部控制制度尚未建立;与企业所得税相关的内部控制制度存在缺陷。

)二、贵公司提供的与企业所得税有关的内部证据和外部证据相关、可靠。

(或贵公司提供的与企业所得税有关的内部证据和外部证据缺乏相关性和可靠性。

)三、鉴证结论。

我们对贵公司提供的相关会计资料及纳税资料等进行了审核、验证、计算和必要的职业推断。

现就贵公司ⅩⅩⅩⅩ年度/期间企业所得税汇算清缴纳税申报审核鉴证事项确认如下:1、营业收入:元;其中:主营业务收入:元;其他业务收入:元;2、营业成本:元;其中:主营业务成本:元;其他业务成本:元;3、营业税金及附加:元;4、*利润总额:元;5、*纳税调整增加额:元;6、*纳税调整减少额:元;境外应税所得弥补境内亏损:元;7、*纳税调整后所得:元;*弥补以前年度亏损额:元;8、*应纳税所得额:元;9、*税率:25%;10、*应纳所得税额:元;*减免所得税额:元;*抵免所得税额:元;11、*应纳税额:元;境外所得应纳所得税额:元;境外所得抵免所得税额:元;12、*实际应纳所得税额:元;13、*本年累计实际已预缴所得税:元;14、*本期应补(退)的所得税额:元。

英文企业认证报告范文模板IntroductionThis business certification report aims to provide a detailed analysis of our organization's performance and compliance with recognized industry standards. The report assesses various aspects of our business operations, including financial stability, ethical practices, environmental responsibility, and commitment to social causes.Certification CriteriaThe certification criteria used for this report are based on internationally recognized standards, such as ISO 9001 for quality management systems, ISO 14001 for environmental management systems, ISO 26000 for social responsibility, and SA8000 for labor practices. These criteria are widely accepted and help assess our performance against industry benchmarks.Financial StabilityOur organization has maintained a strong financial standing throughout the evaluation period. We have consistently met orexceeded the financial targets set by the industry. Our financial stability is a result of effective management, prudent financial decision-making, and a focus on long-term growth.Ethical PracticesWe prioritize ethical practices in every aspect of our business operations. Our employees undergo regular training sessions to understand and adhere to our ethical code of conduct. We have implemented robust systems to prevent corruption, bribery, and any unethical behavior within our organization. We promote transparency and fairness in all business dealings. Environmental ResponsibilityEnvironmental responsibility is a crucial component of our business strategy. We have implemented an environmental management system that identifies and mitigates our environmental impact. Our organization actively seeks ways to reduce waste, conserve energy, and promote sustainable practices. We comply with all applicable environmental laws and regulations and strive to exceed the requirements whenever possible.Social ResponsibilityAs a socially responsible organization, we actively contribute to the communities in which we operate. We have implemented initiatives to support education, healthcare, and social welfare programs. Our corporate social responsibility activities are aligned with the United Nations Sustainable Development Goals to ensure we make a significant positive impact on society.Labor PracticesWe believe in providing a safe, inclusive, and fair working environment for our employees. Our organization strictly adheres to labor laws and regulations, including minimum wage requirements, maximum working hours, and workplace safety standards. We value diversity and equal opportunities, and we actively promote the well-being and professional development of our workforce.ConclusionThis business certification report demonstrates our organization's commitment to excellence in various areas, includingfinancial stability, ethical practices, environmental responsibility, social causes, and labor practices. We maintain a strong focus on meeting and exceeding internationally recognized standards, ensuring the long-term sustainability and success of our business. Our efforts reflect our dedication to being a responsible corporate citizen and contributing positively to society as a whole.。

企业所得税年度纳税申报表中英文对照表今夜偏知春气暖,虫声新透绿窗纱。

仓廪实而知礼节,衣食足而知荣辱。

僵卧孤村不自哀,尚思为国戍轮台。

知之者不如好之者,好之者不如乐之者。

露从今夜白,月是故乡明。

Income Tax on Enterprises Annual Tax Return企业所得税年度纳税申报表Taxation period税款所属时间Monetary Unit金额单位Taxpayer's registration number纳税人识别号Taxpayer's Name纳税人名称Taxpayer's Address纳税人地址Zip code(postcode)邮政编码Type of business登记注册类型Industry type行业Taxpayer's bank纳税人开户银行Bank account number账号Gross revenue收入总额Line No.行次Items项目Business income销售(营业)收入Less:Sales return减:销售退回Depreciation allowance折扣与折让Net operating revenue销售(营业)收入净额Amount of exempt income included其中:免税的销售(营业)收入Income from royalties特许权使用费收益Investment income投资收益Net income in investment transfer投资转让净收益Rental net income租赁净收益Exchange net income汇兑净收益Net income from asset/inventory surplus资产盘盈净收益Subsidy income补贴收入Other income其他收入Final.total income收入总额合计Operating expenses销售(营业)成本Sales tax销售税金及附加Total period expenses期间费用合计Deduction items扣除项目Including salary bonus Employee benefits.Employee labor union dues.Employee education expenses其中:工资薪金职工福利费、职工工会经费、职工教育经费Depreciation of fixed assets固定资产折旧Amortisation on intangible assets and deferred assets无形资产、递延资产摊销Research and development expenses研究开发费用Net interest expense利息净支出Exchange net loss汇兑净损失Rental net expense租金净支出Head office administrative expense上缴总机构管理费Entertainment expenses业务招待费Taxation expense税金Loss on bad debts坏账损失Additional bad debts provision for prior year增提的坏账准备金Net loss due to inventory shortage,spoilage and obsolescence资产盘亏、毁损和报废净损失Net loss in investment transfer投资转让净损失National insurance payment社会保险缴款Workers insurance expense劳动保护费Advertising expenditure广告支出Donations Contributed捐赠支出Auditing,consulting and litigation expenses审计、咨询、诉讼费Travelling expenses差旅费Conference expenses会议费Transportation,packing,handling and insurance exhibitionexpense on sales运输、装卸、包装、保险展览等销售费用Bankruptcy compensation cost矿产资源补偿费Other deductible expense items其他扣除费用项目Taxable income calculation应纳税所得额的计算Income before tax adjustment纳税调整前所得Plus:Adjustment for additional tax payment加:纳税调整增加额Including salary bonus tax adjustmentAdjustment to tax payment for employee benefits,employee labor union dues,employee education expense.其中:工资薪金纳税调整额职工福利费、职工工会经费和职工教育经费的纳税调整额Interest expense tax payment adjustment amount利息支出纳税调整额Entertainment expenses tax adjustment amount业务招待费纳税调整额Advertising expenditure tax payment adjustment amount广告支出纳税调整额Tax adjustment for contribution expenditure赞助支出纳税调整额Donations Contributed Tax Adjustment捐赠支出纳税调整额Tax adjustment for depreciation and amortisation expenditure折旧、摊销支出纳税调整额Loss on bad debts tax payment adjustment amount坏账损失纳税调整额Provision for bad debts tax payment adjustment amount坏账准备纳税调整额Penalties paid for late late tax payment罚款、罚金或滞纳金Inventory revaluation reserve存货跌价准备Short term investments depreciation reserve短期投资跌价准备Long term investments depreciation reserve长期投资减值准备Plus other taxable items adjustment其他纳税调整增加项目Less:Deduction for tax adjustment减:纳税调整减少额Including research and development expenses其中:研究开发费用附加扣除额Other tax deductible items其他纳税调整减少项目After tax adjusted income纳税调整后所得Less:Prior year deficiency减:弥补以前年度亏损Less:tax-exempt income减:免税所得Including government loan interest income其中:国债利息所得Tax free income subsidy免税的补贴收入Tax free investment income免于补税的投资收益Tax free technology transfer income免税的技术转让收益Other tax free income其他免税所得Taxable Income应纳税所得额Applicable tax rate适用税率Income tax payable应缴所得税额Less:amount overpaid at beginning of period减:期初多缴所得税额Prepaid income tax已预缴的所得税额Tax allowance for domestic investment应补税的境内投资收益的抵免税额Tax allowance for foreign investment应补税的境外投资收益的抵免税额Approved income tax reduction经批准减免的所得税额Taxpayer's representative's seal纳税人代表签章Taxpayer's unit's seal纳税人单位公章Date日期Agent's company seal代理申报中介机构签章Responsible person经办人Registered number of responsible person经办人执业证件号码Completed by tax authority以下由税务机关填写Date return receive受理申报日期Person approving审核人Date of approval审核日期Tax Authority's Seal受理申报税务机关公章Excise tax,tax return营业税纳税申报表Date of filing填表日期Taxpayer's registration number纳税人识别号Renminbi(yuan,jiao,fen)元(列至角分)Taxpayer's Name纳税人名称Taxation period税款所属时间Tax Items税目Operating items经营项目Turnover营业额Total Income全部收入Tax exempt items不征税项目Abatement item减除项目Tax reduced items减免税项目Turnover tax payable应税营业额Current Period本期Tax amount payable应纳税额Less tax paid减免税额If this return is filled by tax payer,the following should be completed by that tax payer.如纳税人填报,由纳税人填写以下各栏General Accountant(seal)会计主管(签章)Tax payer(seal)纳税人(公章)If this return is filled by an authorized agent,following should be completed by that agent.如委托代理人填报,由代理人填写以下各栏Agent's Name代理人名称Address地址Agent's seal代理人(公章)Completed by tax authority以下由税务机关填写Received by tax authority收到申报表日期Received by接收人精诚所至,金石为开。

企业所得税汇算清缴鉴证报告英文版XXX Authentication Report of Income Tax (2011)jianzi[2012]No.16XXX:We examined and verified your settlement and payment of Enterprise Income Tax for the year of 2011 upon your entrustment in accordance with stipulations of Enterprise Income Tax Lawof the People's Republic of China and Detailed Rules for implementation of Enterprise Income TaxLaw of the People's Republic of China, and conducted necessary inspection proceeding on your vouchers, account books and relevant financial statements in the light of Business Rules ofSettlement and Payment of Enterprise Income Tax on a Trial Basis and Business Guidance torSettlement and Payment of Enterprise Income Tax.Your company is responsible for the legitimacy, reasonability, and completeness of relevant documents upon which we issue ourauthentication report independently, objectively and fairly. You shall make use of the authentication report pursuant to the Authentication Engagement. Consequences caused by the principal or any other third party’s misuse of authentication reportshall be undertaken by the Certified Tax Agent and Tax Agent Office.I. Authentication Process and Main EnforcementA. Comment on the Effectiveness and Reasonability of the Internal ControlThere’s no ev idence against the reasonability of the certifiedunits shown in our process ofAuthentication. We trust the internal control system completely.B. Comment on the Interdependency and Dependability of Both Internal and ExternalEvidences1. InterdependencyWe examined the internal and external evidences such as relevant accounting materialand tax filling documents in accordance with Business Rules of Settlement and Paymentof Enterprise Income Tax on a Trial Basis, which supports our authentication resultsoundly.2. dependabilityAfter making proper judgment and certification of relevant documents according tostatutory proceeding and certifying standard, we didn’t find illegitimate evidence and recognize the authentic of annual tax filling prepared by the certified unit.C. Authentication, Verification, Calculation and Inference on Relevant Accounting Material and Taxation DocumentsDue to the following conditions, we determine to issue this authentication report: 1. All the authenticated items correspond to the statutory criterion, and thepreparation of related accounting material and tax filling documents complies withrelevant regulations.2. Certified Public Tax Agent conducted necessary authentication procedures withoutany challenge from the certified company in accordance with regulations of theBusiness Rules of Settlement and Payment of Enterprise Income Tax on a TrialBasis.3. Certified Public Tax Agent collected proper and adequate evidence on theauthenticated items, which fully supports our recognition of tax payment.II. Authentication ConclusionAudit results on your company’s expenditure for the year of 2011 are as below:1. Gross Profit: ,4,718,887.612. Adjustment for Additional ax Payment: ,4,955,091.623. Adjustment for Tax Payment Deductible: ,2,330,753.464. Overseas Taxable Income Offset Assets Loss for Domestic Losses ,0.004. Income after Tax Adjustment: ,7,343,225.775. Offset Assets Loss for Prior Years ,0.006.Taxable Income: ,7,343,225.777. Tax Rate: 25%8. Tax Payable ,1,835,806.449. Tax Exempted: ,0.0010. Tax Paid: ,1,181,002.5011.Tax in Arrears , 654,803.94The above information is dependable for tax filling.。

企业所得税汇算清缴申报自查报告表年度纳税人编码:纳税人名称:“自查情况”栏,应分收入、成本费用、资产损失、税收优惠和其他五个方面详细说明自查过程中发现的问题; 3.如需填报内容较多,可另附纸张.企业所得税汇算清缴报告一、企业所得税汇算清缴报告编制原理(一)企业所得税汇算清缴的含义企业所得税汇算清缴,是指纳税人在纳税年度终了后4个月内(现在改为每年5月底前),依照税收法律、法规、规章及其他有关企业所得税的规定,自行计算全年应纳税所得额和应纳所得税额,根据月度或季度预缴所得税的数额,确定该年度应补或者应退税额,并填写年度企业所得税纳税申报表,向主管税务机关办理年度企业所得税纳税申报、提供税务机关要求提供的有关资料、结清全年企业所得税税款的行为.实行查账征收的企业(A类)适用汇算清缴办法,核定定额征收企业所得税的纳税人(B 类),不进行汇算清缴。

A类企业做汇算清缴要从几个方面考虑:1。

1、收入:核查企业收入是否全部入帐,特别是往来款项是否还存在该确认为收入而没有入帐;1。

2、成本:核查企业成本结转与收入是否匹配,是否真实反映企业成本水平;1。

3、费用:核查企业费用支出是否符合相关税法规定,计提费用项目和税前列支项目是否超过税法规定标准;1.4、税收:核查企业各项税款是否争取提取并缴纳;1。

5、调整:对以上项目按税法规定分别进行调增和调减后,依法计算本企业年度应纳税所得额,从而计算并缴纳本年度实际应当缴纳的所得税税额;1.6、补亏:用企业当年实现的利润对以前年度发生亏损的合法弥补(5年内);1.7所得税:计算出企业应补缴的所得税或者应退税额.特别注意:所得税汇算清缴所说的纳税调整,是调表不调账的,在会计方面不做任何业务处理,只是在申报表上进行调整,影响的也只是企业应纳所得税,不影响企业的税前利润。

(二)对象与方式企业所得税汇算清缴的对象为国家税务局负责征收管理的企业所得税纳税人。

企业可自愿委托中介机构代理纳税申报,提高汇缴质量。

企业所得税汇算清缴英语Corporate Income Tax Final Settlement and Payment refers to the annual tax settlement and payment made by companies to the tax authorities after calculating their final tax liabilities for the year. This process is mandatory for all companies in China, both domestic and foreign invested.The Corporate Income Tax Final Settlement and Payment process typically covers the following steps:1. Annual tax return filing: Companies must file an annual tax return to the tax authorities by June 30th of the following year. This return must include all relevant company financial information and tax calculations for the previous year.2. Tax calculation: After filing the annual tax return, companies must calculate their final tax liabilities based on their financial data and applicable tax rates. Taxliabilities may be adjusted based on factors such as non-deductible expenses and tax incentives.3. Tax payment: Companies must make a payment for their final tax liabilities by the end of the tax filing period. This payment can be made in a lump sum or in installments.4. Tax clearance: Once the final tax liabilities have been paid, companies must obtain a tax clearance certificate from the tax authorities. This certificate certifies that the company has fulfilled its tax obligations for the year.It is important for companies to accurately calculate their final tax liabilities and make timely payments to avoid penalties and other legal consequences. In addition,companies can consult with tax professionals to better understand relevant tax regulations and ensure compliance with applicable laws and regulations.In conclusion, Corporate Income Tax Final Settlement and Payment is an important process for companies operating in China. Through careful tax planning and compliance, companies can effectively manage their tax liabilities and contributeto the overall development of the economy.。

XXX Authentication Report of Income Tax (2011)

jianzi[2012]No.16

XXX:

We examined and verified your settlement and payment of Enterprise Income Tax for the year of 2011 upon your entrustment in accordance with stipulations of Enterprise Income Tax Law of the People's Republic of China and Detailed Rules for implementation of Enterprise Income Tax Law of the People's Republic of China, and conducted necessary inspection proceeding on your vouchers, account books and relevant financial statements in the light of Business Rules of Settlement and Payment of Enterprise Income Tax on a Trial Basis and Business Guidance tor Settlement and Payment of Enterprise Income Tax.

Your company is responsible for the legitimacy, reasonability, and completeness of relevant documents upon which we issue our authentication report independently, objectively and fairly. You shall make use of the authentication report pursuant to the Authentication Engagement. Consequences caused by the principal or any other third party’s misuse of authentication report shall be undertaken by the Certified Tax Agent and Tax Agent Office.

I.Authentication Process and Main Enforcement

ment on the Effectiveness and Reasonability of the Internal Control

There’s no evidence against the reasonability of the certified units shown in our process of Authentication. We trust the internal control system completely.

ment on the Interdependency and Dependability of Both Internal and External

Evidences

1.Interdependency

We examined the internal and external evidences such as relevant accounting material

and tax filling documents in accordance with Business Rules of Settlement and Payment

of Enterprise Income Tax on a Trial Basis, which supports our authentication result

soundly.

2.dependability

After making proper judgment and certification of relevant documents according to

statutory proceeding and certifying standard, we didn’t find illegitimate evidence and

recognize the authentic of annual tax filling prepared by the certified unit.

C.Authentication, V erification, Calculation and Inference on Relevant Accounting

Material and Taxation Documents

Due to the following conditions, we determine to issue this authentication report:

1.All the authenticated items correspond to the statutory criterion, and the

preparation of related accounting material and tax filling documents complies with

relevant regulations.

2.Certified Public Tax Agent conducted necessary authentication procedures without

any challenge from the certified company in accordance with regulations of the

Business Rules of Settlement and Payment of Enterprise Income Tax on a Trial

Basis.

3.Certified Public Tax Agent collected proper and adequate evidence on the

authenticated items, which fully supports our recognition of tax payment.

II.Authentication Conclusion

Audit results on your company’s expenditure for the year of 2011 are as below:

1. Gross Profit: ¥4,718,887.61

2. Adjustment for Additional ax Payment:¥4,955,091.62

3. Adjustment for Tax Payment Deductible:¥2,330,753.46

4. Overseas Taxable Income Offset Assets Loss for Domestic Losses ¥0.00

4. Income after Tax Adjustment:¥7,343,22

5.77

5. Offset Assets Loss for Prior Years ¥0.00

6.Taxable Income: ¥7,343,225.77

7. Tax Rate:25%

8. Tax Payable ¥1,835,806.44

9. Tax Exempted: ¥0.00

10. Tax Paid:¥1,181,002.50

11.Tax in Arrears ¥654,803.94

The above information is dependable for tax filling.。