chapter3-assignment

- 格式:pdf

- 大小:90.27 KB

- 文档页数:2

Assignment 3 outline:According to Lynda Gratton of The Financial Times, workplace loyalty is dead and has been “killed off through shortening contracts, outsourcing, automation and multiple careers.” is extremely right. I agree that there is no place for workplace loyalty today.Professional loyalty means the employees` love and loyalty for their own career. Company loyalty is the loyalty of the staff for the enterprise. There are many reasons for lacking of loyalty in workplace.Why is no place for workplace loyalty today?Some employees can clearly feel the contact between him and work are not close, and there are many reason for this situation, such as when company has recession, it will have a large of layoffs.Company doesn`t care about employee`s loyalty.Employee`s benefits, training and promotion opportunities are greatly reduced.The new employee wants to establish their own brand and have their own expectations when the time is rape.Strong liquidity will lead to the decline in employees` commitment. Communication between employee and boss, between departments, and senior management and management staff is not enough. Many people who have been fired often don't even know why.Another problem is that few companies truly keep their promises to their employees, yet foolishly they expect their employees to remain loyal. Many employees havebecome cynical about management in general, largely because of companies' broken promises concerning raises, promotions, bonuses, incentives, enhanced benefits, and other work related matters.What can we do improve worker loyalty?As an employee, the key is to take responsibility for your own life and professional career and ask your boss what is expected of you.Loyalty is not a quality to be expected; loyalty must be earned. The employer, the one doing the hiring, must earn the respect and loyalty of employees if the company wants loyalty returned.Companies should to provide more opportunities for employees` learning and promotion.Stimulating the ambitions and dreams of employees is also important. Companies should provide glory and good treatment to good employees, and give reflection and elimination to someone, who does nothing.。

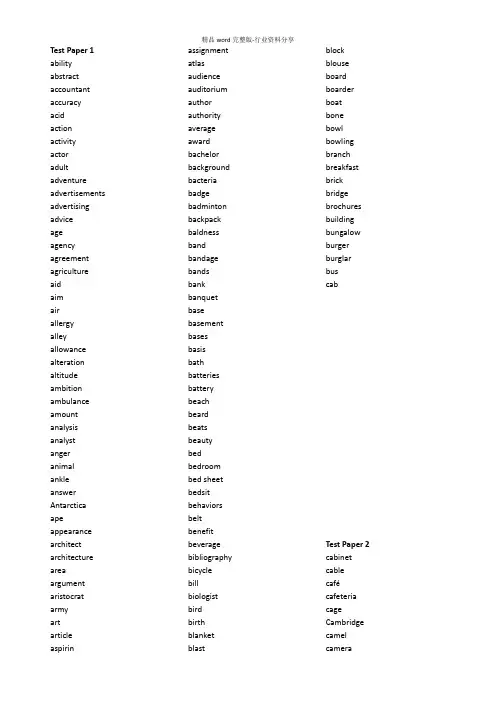

Test Paper 1 ability abstract accountant accuracyacidaction activityactoradult adventure advertisements advertising adviceageagency agreement agricultureaidaimairallergyalley allowance alteration altitude ambition ambulance amount analysis analystangeranimalankleanswer Antarctica ape appearance architect architecture area argument aristocrat armyartarticle aspirin assignmentatlasaudienceauditoriumauthorauthorityaverageawardbachelorbackgroundbacteriabadgebadmintonbackpackbaldnessbandbandagebandsbankbanquetbasebasementbasesbasisbathbatteriesbatterybeachbeardbeatsbeautybedbedroombed sheetbedsitbehaviorsbeltbenefitbeveragebibliographybicyclebillbiologistbirdbirthblanketblastblockblouseboardboarderboatbonebowlbowlingbranchbreakfastbrickbridgebrochuresbuildingbungalowburgerburglarbuscabTest Paper 2cabinetcablecafécafeteriacageCambridgecamelcameracamp campus candidate candle canteen capital capsule carbon care career carpet carving cashier castle category cathedral cause cave cents century certificate chair chance chancellor channel chapter character charge charity chart chat checklist checks cheese chemist’s chest chick chicken child chin chocolate choice church cinema circlecity clarity cleanercleaningclientcliffsclimateclinicclockclothclothingclubcoachcoast codecokecolacolleague collegecomedycommercialscommutercompanioncompanycomplaintcomplexcomputerconcertconclusionconditionconferencesconfidenceconfirmationcongestionconquerorconquestconversationconservationconstructionconsultantconsumptioncontact containercontaminantscontaminationcontentcontinentcontractcontractscontroversyconveniencecooperationcopcopycorporationcorpsecorrespondencecostcostumecotcottagecoughcouncilcountrycoursecrack craftcreamcreditcreekcrimecrisiscrocodilecropcultivationculturecupcupboardcurtaincustomercutlerycyclecyclingdamagedangerdatadatedaydeadlinedebateTest Paper 3debtdecadedecisiondeclinedecorationsdelaydelegatedelight delivery demonstration dentist department deposit depth description desert design designer desiredesks destination detaildiary dictationdietdining dinner dioxide direction director disagreement disaster discipline disco discomfort discos discount discovery diseasedish disposal dispute distance divorce document documentarydonationdonkeydraftdramadrawdrawerdrinkdrinkingdriverdrivingdrugdrumduedurationdustdutyeagleeareasteatingeconomyeditoreducationelbowelderelectricityelementselevatoremotionemperoremployeeemployerencyclopediaendingenergiesengineengineerentranceepidemicequipmentethiceveningeventevidenceexaminationexampleexceptionexchangeexcitementexcursionexcuseexercisesexhibitionexistenceexistingexpansionexpenseexperimentexpertexplanationexplosionexpositionexposureextensionfacilityfactorfactoryTest Paper 4 faculty failure falconfanfarefarm farmer farming fashionfatfeastfeatherfeaturefeedbackfellowshipfemaleferriesfestival fieldfigurefilmfindingfingerfirmsfishfishingflagflashflatflightfloodfloodingflourflourishflowflufly forest forestry form formula fortnight fortune foyer freedom freezer freshman fruitfur furniture future gallery gap garage garbage garden gasoline gender germ gesture glass goal goldgolf grade grades graduate graduates grain grass green ground group growth guest guide gulfguygym habit handhandballhandbookshandlinghandouthatheadacheheadinghealthhearingheartheatinghenherbheroheroesheroinehikehikinghinthintshistorianhithitshobbyholidayhorsehospitalhouseworkhousinghouseholdshourTest Paper 5hotelhotline ]hunthuntingideaidentificationidentityimageimpactimportsinabilityincomingindexindustryinfectioninfluenceinformationinjectioninjuryinlandinsectinsomniainstituteinstitutioninstructioninstructorinstrumentinterestInternetinterviewerintroductioninvestigatorinvestmentirrigationislandisolationitemjacketjamjawjeansjournaljudgejuicejunctionjuniorkeeperkelpkeywordkidkingkioskkitkitchenkitsknifeknowledgekoalalablakelamplandlandmarklandscapelanguagelaptoplaserlavalawyerlayerlecturelecturerleisurelemonlenderlengthlessonletterlevellibraryliftlightlinelionlistsloanlocationlocklossloungeloyaltylucklunchlungmachinemagazine maidmail majority making male manager mane manufacture map margin mark market marketingmarshmastermatmatchingmaterialmaturitymaximummealmeasuremeasurementmeatmediamedicationmedicinemediummethodmicrophonemigrationmilemileagemilkminemineralmillminimumminutemixturemodelmoneymonopolymonthmoodmoralitymosquitomotelmountainTest Paper 6 moustache mouthmovie muscle museum music musical musiciannapnature naught=nought necknet newspaper nightnoisenorth northeast northwestnosenotenoticenurse nursery nursing nutnutrition objectiveoccasionoccupantoceanoculistointmentoption orderordinaryorganizeroriginal outlineoverdraftownerownershipOxfordpackagepagepaintpaintingpairpa;palacepanicpaperparcelparentparkparkingparticipantpassagespassengerpastimepatientpaymentpedestrianpensionpensionerspercentperformerperfumeperiodperiodicalperkpermitpersonpersonalitypetpetrolpetroleumphilosopherphotophotographphysicianphysicspianistpianopicnicpicturepiepillpinkplaceplacementplanplannersplansplantplantingplasticplateplayerplaygroundpleasurepocketpointpolicepollpollutantpollutepollutionportpositionpostpostgraduateparticularsTest Paper 7potteriespower powerpoint precaution precision preference preposition prescription presentation preservation president prevention printing priority privacyprize problem product production professors profit project promotion prone property prospectus protein psychiatrist psychologist psychotherapy publication pump purpose purse quality quantity quarter question radar radiator radio railwayrainrainfall range rankratrateratsrayreaderreadingreasonreceptionreciperecorderrecordingrecreationrecruitrecyclingrefereereferencereflectancereformrefugeregionregulationrelationrelationshiprelaxationreliefreligionremarkremovalrenewalrentrentalrepetitionreplacementreportreproduceresearchreservationreserveresidenceresidentresourcerespondentresponserestaurantresultretirementreturnreviewrevisionriceriderridersriskriverrobotrockrocketroleTest Paper 8roommatesrouterulesafarisafetysailsailingsaladsaladssalarysalesaltsamplesandalsatellitesaucesavingscalescandalscandalsscarscentscheduleschemescholarscholarshipsciencescientistscorescriptsculptureseaseasonseatsecondsecretarysectionsectorselectionselectionsseminarsensesentenceservantservicesewagesewersexshadesheepsheetshelfshellsheltership shoeshopliftersshoppershortageshowersidesightsignsignaturesilencesimulationsinglesitesizeskatingskeleton skillskinskirt slang slave sleep sleeping slip smell smoke smoking snacksoil solution sound source south southeast southwest space speaker speaking speed spending spider sponsor spoons sportsman spot stability stack stage stair standard star starter starting state statement station status steak steam stepstingstockstomachstomachachestonestorestorystrategystrengthstrikestylesubjectsubmitsubsidysuburbsugarsuitsunshieldsupervisorsupportssurfacesurgeonsurnamesurprisesurveysurvivalsweaterswitchswitchessymptomsyndicatesyrupsystemtabletablettapetaxTest Paper 9taxiteateacherteachingteamjargontermtechnologyteethtelephonetelescopetelevisiontempertempletexttexturegalaxythefttheorytherapisttherapythesisthiefthievesthinkingthirdthoughtthreatthrillertickettidetidestiletimbertimetitletoastertoilettomatotonetooltoptopictotaltouchingtourtouringtourismtouristtoweltowertowntracktractortradetramtragedytrailertrainingtrendtraveltravelertreatmenttriptribetributetributesTrinitytrolleytroubletubetunnelstuitiontunetunestutortypeumpireunderstandingutensiluniformunionuniversityusagevacancyvacationvalueparticularsvarietyvegetablevelvetvetvideo view village vinegar visa visitor vitamin vocation volunteer volunteers waist waiter walk walking wall world warming washing wasp waste wasteland water wavewax wealth weapon weather weeds week weekday weekend weight welfare west wetland whale wheel width willows windwing word workforce working wound writing year yoga youth zero。

名著精读《傲慢与偏见》第三章第3节Mr. Bingley had soon made himself acquainted with all the principal people in the room; he was lively and unreserved danced every dancewas angry that the ball closed so earlyand talked of giving one himself at Netherfield. Such amiable qualities must speak for themselves. What a contrast beeen him and his friend! Mr. Darcy danced only once with Mrs. Hurst and once with Miss BingleyDeclined being introduced to any other ladyand spent the rest of the evening in walking about the room speaking occasionally to one of his own party. His character was decided. He was the proudestmost disagreeable man in the worldand every body hoped that he would never e there again. Amongst the most violent against him was Mrs. Benwhose dislike of his general behaviour was sharpened into particular resentment by his having slighted one of her daughters.彬格莱先生很快就熟悉了全场所有的主要人物。

张美荣2112019094Assignment IIIPassage 1Father Hooper’s breath heaved; it rattled in his throat; but, with a mighty effort, grasping forward with his hands, he caught hold of life, and held it back till he should speak. He even raised himself in bed; and there he sat, shivering with the arms of death around him, while the black veil hung down, awful, at that last moment, in the gathered terrors of a lifetime. And yet the faint, sad smile, so often there, now seemed to glimmer from its obscurity, and linger on Father Hoope r’s lips.胡伯教父奄奄一息,一口气在喉咙里咔咔作响。

但是他用手拼命向前挣扎,才使得命运之神留得片刻,好让他把话说完。

他甚至抬身坐了起来,在死神的怀抱中颤抖。

这时,那可怕的黑色面纱竟垂落而下,在这最后的时刻,凝聚了一生的恐怖。

那时常出现的淡淡的凄楚的微笑,透过黑色面纱闪现出来,在教父的唇边久久不去。

“Why do you tremble at me alone?” cried he, turning his veiled face round the circle of pale spect ators. “Tremble also at each other! Have men avoided me, and women shown no pity, and children screamed and fled, only for my black veil? What, but the mystery which it obscurely typifies, has made this piece of crape so awful? When the friend shows his inmost heart to his friend; the lover to his best beloved; when man does not vainly shrink from the eye of his Creator, loathsomely treasuring up the secret of his sin; then deem me a monster, for the symbol beneath which I have lived, and die! I look around me, and, lo! on every visage a Black Veil!”(Nathaniel Hawthorne, The Minister’s Black Veil)他把他那戴面纱的脸转过来,环顾着四周面色苍白的围观者说道:“为什么在我面前你们就两腿发抖?”“你们彼此见面也该发抖啊!男人躲着我,女人不可怜我,小孩儿(见了我)叫喊着跑开,就因为我的黑色面纱吗?它黑漆漆的颜色却有种神秘感,可是什么使得这块面纱这么恐怖呢?等到有一天,朋友以及爱人之间坦诚相见,人类不再妄想摆脱造物主的目光并且昧着良心地掩藏自己的罪孽时,再把我看作是怪物吧。

CHAPTER 3 Escape第三章逃跑The barn was very large. It was very old. It smelled of hay and it smelled of manure肥料. It smelled of the perspiration汗味of tired horses and the wonderful sweet breath of patient cows温和的奶牛. It often had a sort of peaceful smell - as though nothing bad could happen ever again in the world. It smelled of grain and of harness dressing马具的装饰and of axle grease车轴润滑油and of rubber boots and of new rope. And whenever the cat was given a fish-head to eat, the barn would smell of fish. But mostly it smelled of hay, for there was always hay in the great loft up overhead头顶上方的大阁楼里. And there was always hay being pitched down to the cows and the horses and the sheep.仓库非常大,也非常旧,里面充满了干草和粪肥的气味。

还有疲倦的马身上散发的汗味和温和的奶牛呼出的令人愉快的甜蜜气息。

这常常是一种使人平静的气味——仿佛这世上不会再有什么糟糕的事发生了。

还有谷物、马具的装饰、车轴润滑油、胶靴和新绳子的气味。

而且不论什么时候给猫一个鱼头啃,仓库里都能闻到鱼的气味。

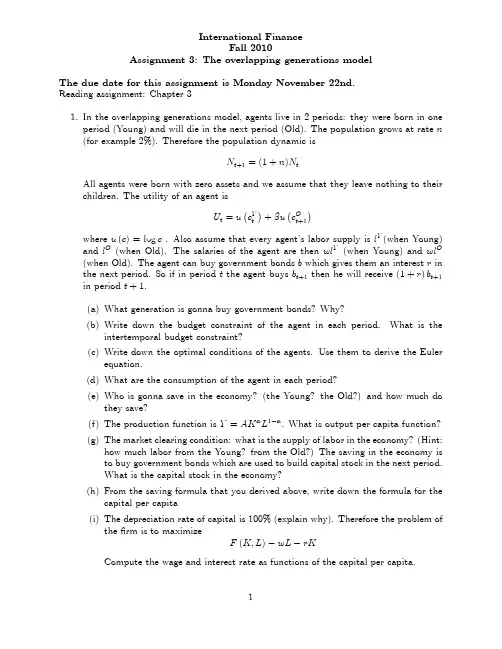

International FinanceFall2010Assignment3:The overlapping generations modelThe due date for this assignment is Monday November22nd.Reading assignment:Chapter31.In the overlapping generations model,agents live in2periods:they were born in oneperiod(Young)and will die in the next period(Old).The population grows at rate n (for example2%).Therefore the population dynamic isN t+1=(1+n)N tAll agents were born with zero assets and we assume that they leave nothing to their children.The utility of an agent isU t=u c Y t + u c O t+1where u(c)=log c.Also assume that every agent’s labor supply is l Y(when Young) and l O(when Old).The salaries of the agent are then wl Y(when Young)and wl O (when Old).The agent can buy government bonds b which gives them an interest r in the next period.So if in period t the agent buys b t+1then he will receive(1+r)b t+1 in period t+1.(a)What generation is gonna buy government bonds?Why?(b)Write down the budget constraint of the agent in each period.What is theintertemporal budget constraint?(c)Write down the optimal conditions of the e them to derive the Eulerequation.(d)What are the consumption of the agent in each period?(e)Who is gonna save in the economy?(the Young?the Old?)and how much dothey save?(f)The production function is Y=AK L1 .What is output per capita function?(g)The market clearing condition:what is the supply of labor in the economy?(Hint:how much labor from the Young?from the Old?)The saving in the economy isto buy government bonds which are used to build capital stock in the next period.What is the capital stock in the economy?(h)From the saving formula that you derived above,write down the formula for thecapital per capita(i)The depreciation rate of capital is100%(explain why).Therefore the problem ofthe…rm is to maximizeF(K;L) wL rKCompute the wage and interest rate as functions of the capital per capita.2.In this exercise we will study the2social security systems using the overlapping gen-erations model.The production function is f(k)=k where k is the capital stock per capita.The utility function isU t c Y t;c O t+1 =log c Y t + log c O t+1Individuals are supposed to work when they are young and retired when they are old.Therefore the individual labor supply isl Y=1;l O=0Population grows at rate n:(a)The…rst system is called Pay as you go:in this system,each young individualspays a lumpt sum tax T,the taxes are used to pay the old generation in that period.1.How much does an old individual receive?2.Write down the budget constraint in each period(Young and Old)of eache those constraints to write down the intertemporal budget con-straint.pute the individual consumptions(how much a person consumes whenYoung and then when Old).pute the aggregate consumption in the…rst period(when the governmentstarts the Pay as you go system).Does the Pay as you go system increase ordecrease aggregate consumption in the…rst period?pute the individual saving.Does this system increase or increase thesaving of each person?Why?pute the capital stock per capita as a function of the capital stock percapita in the previous period(in other words,derive the dynamic of thecapital stock per capita).Calculate the capital stock per capita in the steadystate.(b)The second system is named Fully Funded:Each person has to pay a lumpsum tax T when they are young.The government then uses this tax to invest and repay the taxpayers in the next period(when they are old).1.Redo all the questions as in the Pay as you go system.pare the capital stock per capita in the steady state between the twosystems.。

《财务管理》课程编号:CFIN311课程类型:专业必修课总学时: 54 学时学分:3学分适用对象:工商管理专业先修课程:CACC111/MFIN221Learning ObjectivesOn successful completion of this paper candidates should be able to:–Discuss the role and purpose of the financial management function–Assess and discuss the impact of the economic environment on financial management–Discuss and apply working capital management techniques–Carry out effective investment appraisal–Identify and evaluate alternative sources of business finance–Discuss and apply principles of business and asset valuations–Explain and apply risk management techniques in business. Teaching MethodsThis course contains lectures, class discussions, homework assignments, quizzes and exams.Group discussions of the course material are an important part of the learning process in this course. Students are expected to make a meaningful contribution to the class, whether by asking questions, responding to questions, delivering presentations or contributing in other ways to class discussion.Core syllabus areas and teaching guidanceWorking capital management, investment appraisal and business finance are core areas of this course. Lecturing along with past exam problems practicing will be used to demonstrate how to apply key knowledge and techniques.Study TimeTo do well in this course, you need to devote time outside of class for practice and proper preparation. A typical student needs at least20 hours of no-class time each week during a 16-week semester. I would encourage all of you to do all assigned homework and practice extra problems.Homework assignmentsIf you do not attempt to complete the assigned homework, it is likely that your performance in the course will suffer. It is expected that homework assignments will be completed prior to the start of class. The answers need not be correct. Homework will be evaluated as complete if all parts of the assignment have been attempted and all work is shown. Assignments will be collected at the beginning of class and late assignments will not be accepted.Quizzes and ExaminationsThere will be one or two quizzes during the semester. Quizzes may or may not be announced in advance. Quizzes will test your knowledge of both concepts and the application of those concepts. The examination contains a mix of objectives and longer type questionsconsist of questions utilizing the application of critical thinking.Grading schemeA+ (100-97, Superior) A (96-93) A-(92-90)B+ (89-87) B (86-83, Good) B- (82-80)C+ (79-75) C (74-70, competent) C- (69-67)D+ (66-63) D (62-60) F = failure (59and below) Academic dishonestyAny student caught cheating on homework assignments or tests will receive an automatic grade of zero on that assignment. A second violation will result in disciplinary action in accordance with university policy. Any type of cheating on the midterm or final exam will result in a nullification of the exam paper.Classroom PolicyNo cell phones.No textbook no class!No smoking.No drowsing.No chatting and whispering.Participate actively.Course ScheduleCourse outlineChapter 1 Financial management and financial objectivesFinancial management function1 The nature and purpose of financial management(a) Explain the nature and purpose of financial management.(b) Explain the relationship between financial management and financial and management accounting.2 Financial objectives and the relationship with corporate strategy(a) Discuss the relationship between financial objectives, corporate objectivesand corporate strategy.(b) Identify and describe a variety of financial objectives, including:(i) Shareholder wealth maximization(ii) Profit maximization(iii) Earnings per share growth3 Stakeholders and impact on corporate objectives(a) Identify the range of stakeholders and their objectives.(b) Discuss the possible conflict between stakeholder objectives.(c) Discuss the role of management in meeting stakeholder objectives,including the application of agency theory.(d) Describe and apply ways of measuring achievement of corporate objectivesincluding:(i) Ratio analysis, using appropriate ratios such as return on capital employed,return on equity, earnings per share and dividend per share(ii) Changes in dividends and share prices as part of total shareholder return(e) Explain ways to encourage the achievement of stakeholder objectives,including:(i) Managerial reward schemes such as share options and performance-relatedpay(ii) Regulatory requirements such as corporate governance codes of bestpractice and stock exchange listing regulations4 Financial and other objectives in not for profit organizations(a) Discuss the impact of not for profit status on financial and other objectives.(b) Discuss the nature and importance of value for money as an objective in notfor profit organizations.(c) Discuss ways of measuring the achievement of objectives in not for profitorganizations.Key teaching pointsFinancial management functionFinancial and other objectives in not for profit organizationsExam guideThe material in this chapter is examinable as an entire discussion question or as a question involvingcalculations such as ratios and discussion. When doing a ratio analysis question, you must make sure you apply your answer to the organization in the question. The organization will not necessarily be a publicly quoted company with shareholders. AssignmentSee Revision Kit 2016,BPP Learning MediaSection A Questions1-5 MCQ bank – Financial management and financial objectivesSection B Questions 16-20 ABC CoChapter 2 The economic environment for businessThe economic environment for business(a) Identify and explain the main macroeconomic policy targets.(b) Define and discuss the role of fiscal, monetary, interest rate and exchangerate policies in achieving macroeconomic policy targets.(c) Explain how government economic policy interacts with planning anddecision-making in business.(d) Explain the need for, and the interaction with, planning and decision-makingin business of:(i) Competition policy(ii) Government assistance for business(iii) Green policies(iv) Corporate governance regulationKey teaching points(a) Identify and explain the main macroeconomic policy targets.(b) Define and discuss the role of fiscal, monetary, interest rate and exchangerate policies in achieving macroeconomic policy targets.(c) Explain how government economic policy interacts with planning anddecision-making in business.Exam guideThe emphasis in the exam will be on discussing how economic conditions or policies affect particular businesses, for example the impact of a change in interest rates.Assignment21-35 MCQ bank – Financial management environment36-40 CBE style OTQ bank – Financial management environmentChapter 3 Financial markets, money markets and institutions1 The nature and role of financial markets and institutions(a) Identify the nature and role of money and capital markets, both nationallyand internationally.(b) Explain the role of financial intermediaries.(c) Explain the functions of a stock market and a corporate bond market.(d) Explain the nature and features of different securities in relation to therisk/return tradeoff.2 The nature and role of money markets(a) Describe the role of the money markets in:(i) Providing short-term liquidity to the private sector and the public sector(ii) Providing short-term trade finance(b) Explain the role of banks and other financial institutions in the operation ofthe money markets.(c) Explain the characteristics and role of the principal money-marketinstruments:(i) Interest-bearing instruments(ii) Discount instruments(iii) Derivative productsKey teaching pointsExplain the role of financial intermediaries.The nature and role of money marketsExplain the characteristics and role of the principal money-marketInstrumentsExam guideYou are unlikely to be asked a whole longer question on financial markets and institutions. You might,however, be asked a part question or Section A multiple choice question that relates to the circumstances of a particular company, for instance how they could raise funds using a stock market.AssignmentChapter end quick quizChapter 4 Working capital1 The nature, elements and importance of working capital(a) Describe the nature of working capital and identify its elements.(b) Identify the objectives of working capital management in terms of liquidity andprofitability, and discuss the conflict between them.(c) Discuss the central role of working capital management in financial management.2 Management of inventories, accounts receivable, accounts payable and cash(a) Explain the cash operating cycle and the role of accounts payable and accounts receivable.(b) Explain and apply relevant accounting ratios, including:(i) Current ratio and quick ratio(ii) Inventory turnover ratio, average collection period and average payable period (iii) Sales revenue/net working capital ratioKey teaching pointsAll are very importantExam guideWorking capital is highly examinable. Questions are likely to be a mixture of calculations and discussion. Always make sure your discussion and explanations are applied to the specific organization in the question.AssignmentSection A Questions41-45 MCQ bank – Working capital80 Wobnig Co (6/12, amended) (a)Chapter 5 Managing working capital1 Management of inventories, accounts receivable, accounts payable and cash(a) Discuss, apply and evaluate the use of relevant techniques in managing inventory,including the economic order quantity model and Just-in-Time techniques.(b) Discuss, apply and evaluate the use of relevant techniques in managing accountsreceivable, including:(i) Assessing creditworthiness(ii) Managing accounts receivable(iii) Collecting amounts owing(iv) Offering early settlement discounts(v) Using factoring and invoice discounting(vi) Managing foreign accounts receivable(c) Discuss and apply the use of relevant techniques in managing accounts payable, including:(i) Using trade credit effectively(ii) Evaluating the benefits of discounts for early settlement and bulk purchase (iii) Managing foreign accounts payableKey teaching pointsDiscuss, apply and evaluate the use of relevant techniques in managing inventory Discuss and apply the use of relevant techniques in managing accounts payable Exam guideQuestions in this area are likely to be a mixture of calculations and discussion. The material in this chapter is highly examinable.Assignment46-55 CBE style OTQ bank – Managing working capital78 WQZ Co (12/10, amended)79 Bold Co (12/11, amended)Chapter 6 Working capital finance1 Management of inventories, accounts receivable, accounts payable and cash(a) Explain the various reasons for holding cash, and discuss and apply the use ofrelevant techniques in managing cash, including:(i) Preparing cash flow forecasts to determine future cash flows and cash balances(ii) Assessing the benefits of centralized treasury management and cash control (iii) Cash management models, such as the Baumol model and the Miller-Orr model(iv) Investing short-term2 Determining working capital needs and funding strategies(a) Calculate the level of working capital investment in current assets and discuss thekey factors determining this level, including:(i) The length of the working capital cycle and terms of trade(ii) An organization's policy on the level of investment in current assets(iii) The industry in which the organization operates(b) Describe and discuss the key factors in determining working capital funding strategies, including:(i) The distinction between permanent and fluctuating current assets(ii) The relative cost and risk of short-term and long-term finance(iii) The matching principle(iv) The relative costs and benefits of aggressive, conservative and matching funding policies(v) Management attitudes to risk, previous funding decisions and organization size Key teaching points(a) Explain the various reasons for holding cash, and discuss and apply the use ofrelevant techniques in managing cash, including:(i) Preparing cash flow forecasts to determine future cash flows and cash balances(ii) Assessing the benefits of centralized treasury management and cash control (iii) Cash management models, such as the Baumol model and the Miller-Orr modelDescribe and discuss the key factors in determining working capital funding strategies Exam guideThe material covered in this chapter is again highly examinable. Any of the calculations could form part or all of a question and you also need to be able to explain the meaning of your answers.Assignment56-60 CBE style OTQ bank – Working capital finance80 Wobnig Co (6/12, amended) (b)84 Widnor Co (6/15, amended)Chapter 7 Investment decisions1 Investment appraisal techniques(a) Identify and calculate relevant cash flows for investment projects.(b) Calculate payback period and discuss the usefulness of payback as an investmentappraisal method.(c) Calculate return on capital employed (accounting rate of return) and discuss itsusefulness as an investment appraisal method.Key teaching pointsAll are very important as this chapter is a core area of this course.Exam guideYou should be able to use the techniques covered in this chapter, you may be asked to discuss their drawbacks. You must be able to apply your knowledge.Assignment85-94 MCQ bank – Investment decisionsChapter 8 Investment appraisal using DCF methods1 Investment appraisal techniques(a) Calculate net present value and discuss its usefulness as an investment appraisal method.(b) Calculate internal rate of return and discuss its usefulness as an investment appraisal method.(c) Discuss the superiority of DCF methods over non-DCF methods.(d) Discuss the relative merits of NPV and IRR.Key teaching pointsAll are very important as this chapter is a core area of this course.Exam guideYou may be asked to discuss the relative merits of the various investment appraisal techniques as well as to demonstrate your ability to apply the techniques themselves. Assignment95-104 MCQ bank – Investment appraisal using DCFChapter 9 Allowing for inflation and taxation1 Allowing for inflation and taxation in investment appraisal(a) Apply and discuss the real terms and nominal terms approaches to investment appraisal.(b) Calculate the taxation effects of relevant cash flows, including the tax benefits ofcapital allowances and the tax liabilities of taxable profit.(c) Calculate and apply before- and after-tax discount rates.Key teaching pointsAll are very important as this chapter is a core area of this course.Exam guideAs well as bringing inflation into your DCF calculations, you may be asked to explain the differences between real and nominal rates. In a long question, you can expect to have to deal with inflation, tax and working capital in an NPV question. Assignment105-114 MCQ bank – Allowing for tax and inflation146 Project E (6/14, amended)152 Uftin Co (12/14, amended)Chapter 10 Project appraisal and risk1 Investment appraisal process techniques(a) Calculate discounted payback and discuss its usefulness as an investment appraisal method.2 Adjusting for risk and uncertainty in investment appraisal(a) Describe and discuss the difference between risk and uncertainty in relation toprobabilities and increasing project life.(b) Apply sensitivity analysis to investment projects and discuss the usefulness ofsensitivity analysis in assisting investment decisions.(c) Apply probability analysis to investment projects and discuss the usefulness ofprobability analysis in assisting investment decisions.(d) Apply and discuss other techniques of adjusting for risk and uncertainty ininvestment appraisal, including:(i) Simulation(ii) Adjusted paybackKey teaching pointsCalculate discounted payback and discuss its usefulness as an investment appraisal method.Apply sensitivity analysis to investment projects and discuss the usefulness of sensitivity analysis in assisting investment decisions.Apply probability analysis to investment projects and discuss the usefulness of probability analysis in assisting investment decisions.Exam guideRisk and uncertainty are increasingly examinable in financial management exams andsensitivity calculations are particularly important. You will need to be able to explain these techniques as well as be confident and competent with the calculations. Assignment115-119 CBE style OTQ bank – Project appraisal and risk130-134 Sensitivity analysisChapter 11 Specific investment decisionsSpecific investment decisions (lease or buy; asset replacement; capital rationing) (a) Evaluate leasing and borrowing to buy using the before- and after-tax costs of debt.(b) Evaluate asset replacement decisions using equivalent annual cost and equivalent annual benefit.(c) Evaluate investment decisions under single period capital rationing, including: (i) The calculation of profitability indexes for divisible investment projects(ii) The calculation of the NPV of combinations of non-divisible investment projects Key teaching pointsAll are very important as this chapter is a core area of this course.Exam guideYou may be asked to calculate the results of different options and careful, methodical workings will be essential. These calculations can be quite difficult and will need lots of practice.Assignment120-129 CBE style OTQ bank – Specific investment decisions145 Calvic Co147 AGD Co (FMC, 12/05, amended)Chapter 12 Sources of finance1 Sources of and raising business finance(a) Identify and discuss the range of short-term sources of finance available to businesses, including:(i) Overdraft(ii) Short-term loan(iii) Trade credit(iv) Lease finance(b) Identify and discuss the range of long-term sources of finance available tobusinesses, including:(i) Equity finance(ii) Debt finance(iii) Lease finance(iv) Venture capital(c) Identify and discuss methods of raising equity finance, including:(i) Rights issue(ii) Placing(iii) Public offer(iv) Stock exchange listing(d) Identify and discuss methods of raising short- and long-term Islamic finance, including:(i) Major difference between Islamic finance and the other forms of business finance(ii) The concept of riba (interest) and how returns are made by Islamic financial securities(iii) Islamic financial instruments available to businesses, including:(i) Murabaha (trade credit)(ii) Ijara (lease finance)(iii) Mudaraba (equity finance)(iv) Sukuk (debt finance)(v) Musharaka (venture capital)Key teaching pointsIdentify and discuss methods of raising equity financeIdentify and discuss methods of raising short- and long-term Islamic financeExam guideSources of finance are a major topic. You may be asked to describe appropriate sources of finance for a particular company, and also discuss in general terms when different sources of finance should be utilized and when they are likely to be available.Assignment154-158 MCQ bank – Sources of finance147 AGD Co (FMC, 12/05, amended)199 Bar Co (12/11, amended)Chapter 13 Dividend policy1 Sources of and raising business finance(a) Identify and discuss internal sources of finance, including:(i) Retained earnings(ii) Increasing working capital management efficiency(iii) The relationship between dividend policy and the financing decision(iv) The theoretical approaches to, and the practical influences on, the dividend decisions, including legal constraints, liquidity, shareholding expectations andalternatives to cash dividendsKey teaching pointsIdentify and discuss internal sources of finance(i) Retained earnings(ii) Increasing working capital management efficiencyExam guideThis chapter is likely to be examined as a discussion question, perhaps combined with ratio analysisAssignment159-163 MCQ bank – Dividend policyChapter 14 Gearing and capital structure1 Sources of finance and their relative costs(c) Identify and discuss the problem of high levels of gearing.(d) Assess the impact of sources of finance on financial position, financial risk and shareholder wealth using appropriate measures, including:(i) Ratio analysis using statement of financial position gearing, operational and financial gearing, interest coverage ratio and other relevant ratios(ii) Cash flow forecasting(iii) Leasing or borrowing to buy2 Finance for small and medium-sized entities (SMEs)(a) Describe the financing needs of small businesses.(b) Describe the nature of the financing problem for small businesses in terms of the funding gap, the maturity gap and inadequate security.(c) Explain measures that may be taken to ease the financing problems of SMEs, including the responses of government departments and financial institutions.(d) Identify and evaluate the financial impact of different sources of finance for SMEs, including sources already referred to in syllabus section E1, and also:(i) Business angel financing(ii) Government assistance(iii) Supply chain financing(iv) Crowdfunding/peer to peer fundingKey teaching pointsRatio analysis using statement of financial position gearing, operational and financial gearing, interest coverage ratio and other relevant ratiosFinance for small and medium-sized entities (SMEs)Exam guideYou may be asked to explain the implications of different financing decisions on investment opportunities and the company's continued health. Capital structure is a significant topic in this exam and can be examined in conjunction with a number of other areas.Assignment164-173 MCQ bank – Gearing and capital structureChapter 15 The cost of capital1 Estimating the cost of capital(a) Estimate the cost of equity including:(i) Application of the dividend growth model and discussion of its weaknesses(ii) Explanation and discussion of systematic and unsystematic risk(iii) Relationship between portfolio theory and the capital asset pricing model(CAPM)(iv) Application of the CAPM, its assumptions, advantages and disadvantages (b) Estimating the cost of debt:(i) Irredeemable debt(ii) Redeemable debt(iii) Convertible debt(iv) Preference shares(v) Bank debt(c) Estimating the overall cost of capital including: 2(i) Distinguishing between average and marginal cost of capital(ii) Calculating the weighted average cost of capital (WACC) using book value and market value weightings2 Sources of finance and their relative costs(a) Describe the relative risk-return relationship and describe the relative costs of equity and debt.(b) Describe the creditor hierarchy and its connection with the relative costs of sources of finance.Key teaching pointsAll are very important as this chapter is a core area of this course.Exam guideIn the exam you may be asked to calculate the weighted average cost of capital and its component costs, either as a separate sub-question, or as part of a larger question, most likely an investment appraisal. Remember that questions won't just involve calculations; you may be asked to discuss the problems with the methods of calculation you've used or the relevance of the costs of capital to investment decisions.Assignment174 -183 CBE style OTQ bank – The cost of capital201 NN Co (12/10, amended)202 AQR Co (6/11, amended)203 BKB Co (12/12, amended)Chapter 16 Capital structure1 Sources of finance and their relative costs(a) Impact of cost of capital on investments including:(i) The relationship between company value and cost of capital(ii) The circumstances under which WACC can be used in investment appraisal (iii) The advantages of the CAPM over WACC in determining a project-specific cost of capital(iv) Application of CAPM in calculating a project-specific discount rate2 Capital structure theories and practical considerations(a) Describe the traditional view of capital structure and its assumptions.(b) Describe the views of Miller and Modigliani on capital structure, both without andwith corporate taxation, and their assumptions.(c) Identify a range of capital market imperfections and describe their impact on theviews of Miller and Modigliani on capital structure.(d) Explain the relevance of pecking order theory to the selection of sources of finance.Key teaching pointsAll are very important as this chapter is a core area of this course.Exam guideThe theories covered in this chapter could be needed in a discussion part of a question. Gearing andungearing a beta is an essential technique to master using the formula which will be given to you in the exam.Assignment184- 193 CBE style OTQ bank – Capital structure204 Fence Co (6/14, amended)205 Tinep Co (12/14, amended)Chapter 17 Business valuations1 Nature and purpose of the valuation of business and financial assets(a) Identify and discuss reasons for valuing businesses and financial assets.(b) Identify information requirements for valuation and discuss the limitations ofdifferent types of information.2 Models for the valuation of shares(a) Asset-based valuation models, including:(i) Net book value (statement of financial position basis)(ii) Net realisable value basis(iii) Net replacement cost basis(b) Income-based valuation models, including:(i) Price/earnings ratio method(ii) Earnings yield method(c) Cash flow based valuation models, including:(i) Dividend valuation model and the dividend growth model(ii) Discounted cash flow basis3 The valuation of debt and other financial assets(a) Apply appropriate valuation methods to:(i) Irredeemable debt(ii) Redeemable debt(iii) Convertible debt(iv) Preference sharesKey teaching pointsModels for the valuation of sharesThe valuation of debt and other financial assetsAssignment207-216 MCQ bank – Business valuations222-226 Phobis Co (12/07, amended)Chapter 18 Market efficiency1 Efficient market hypothesis (EMH) and practical considerations in the valuation of shares(a) Distinguish between and discuss weak form efficiency, semi-strong formefficiency and strong form efficiency.(b) Discuss practical considerations in the valuation of shares and businesses, including:(i) Marketability and liquidity of shares(ii) Availability and sources of information(iii) Market imperfections and pricing anomalies(iv) Market capitalization(c) Describe the significance of investor speculation and the explanations of investor decisions offered by behavioral finance.Key teaching pointsDistinguish between and discuss weak form efficiency, semi-strong form efficiency and strong form efficiency.Discuss practical considerations in the valuation of shares and businessesExam guideMarket efficiency may need to be discussed as part of a business valuation question. Assignment217-221 CBE style OTQ bank – Market efficiencyChapter 19 Foreign currency risk1 The nature and role of money market(a) Describe the role of money markets in:(i) Allowing an organization to manage its exposure to foreign currency risk and interest rate risk2 The nature and types of risk and approaches to risk management(a) Describe and discuss different types of foreign currency risk:(i) Translation risk(ii) Transaction risk(iii) Economic risk3 Causes of exchange rate differences and interest rate fluctuations(a) Describe the causes of exchange rate fluctuations, including:(i) Balance of payments(ii) Purchasing power parity theory(iii) Interest rate parity theory(iv) Four-way equivalence(b) Forecast exchange rates using:(i) Purchasing power parity(ii) Interest rate parity4 Hedging techniques for foreign currency risk(a) Discuss and apply traditional and basic methods of foreign currency risk management, including:(i) Currency of invoice(ii) Netting and matching。

INTERNATIONAL FINANCEAssignment Problems (3) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (2 credits for each question, total credits 2 x 25 = 50)1. Interbank quotations that include the United States dollars are conventionally given in __________, which state the foreign currency price of one U.S. dollar, such as a bid price of SFr 0.85/$.A. indirect quoteB. direct quoteC. American quoteD. European quote2. The spot exchange rate published in financial newspapers is usually the __________.A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate3. The foreign exchange refers to the __________.A. foreign bank notes and coinsB. demand deposits in foreign banksC. foreign securities that can be easily cashedD. all of the above4. The functions of the foreign exchange market come down to __________.A. converting the currency of one country into the currency of anotherB. providing some insurance against the foreign exchange riskC. making the foreign exchange speculation easyD. Only A and B are true.5. Which of the following is NOT true regarding the foreign exchange market?A. It is the place through which people exchange one currency for another.B. The exchange rate nowadays is mainly determined by the market forces.C. Most foreign exchange transactions are physically completed in this market.D. All of the above are true.6. The world largest foreign exchange markets are __________ respectively.A. London, New York and TokyoB. London, Paris and FrankfurtC. London, Hong Kong and SingaporeD. London, Zurich and Bahrain7. The foreign exchange market is NOT efficient because __________.A. monetary authorities dominate the foreign exchange market and everybody knows that by definition, central banks are inefficientB. commercial banks and other participants of the market do not compete with one another due to the fact that transaction takes place around the world and not in a single centralized locationC. foreign exchange dealers have different prices such as bid and ask pricesD. None of the reasons listed are correct because the foreign exchange market is an efficient market8. __________ earn a profit by a bid-ask spread on currencies they buy and sell. __________ on the other hand, earn a profit by bringing together buyers and sellers of foreign exchanges and earning a commission on each sale and purchase.A. Foreign exchange brokers; foreign exchange dealersB. Foreign exchange dealers; foreign exchange brokersC. arbitragers; speculatorsD. commercial banks; central banks9. Most foreign exchange transactions are through the U.S. dollars. If the transaction is expressed as the currencies per dollar, this is known as __________ whereas __________ are expressed as dollars per currency.A. direct quote; indirect quoteB. indirect quote; direct quoteC. European quote; American quoteD. American quote, European quote10. From the viewpoint of a Japanese investor, which of the following would be a direct quote?A. SFr 1.25/€B. $1.55/₤C. ¥ 110/€D. €0.0091/ ¥11. Which of the following is true about the foreign exchange market?A. It is a global network of banks, brokers, and foreign exchange dealers connected by electronic communications system.B. The foreign exchange market is usually located in a particular place.C. The foreign exchange rates are usually determined by the related monetary authorities.D. The main participants in this market are currency speculators from different countries.12. The extent to which the income from individual transactions is affected by fluctuations in foreign exchange values is considered to be _________.A. Translation exposureB. economic exposureC. transaction exposureD. accounting exposure13. Which of the following exchange rates is adjusted for price changes?A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate14. Suppose the exchange rate of the RMB versus U.S. dollar is ¥6.8523/$ now. If the RMB were to undergo a 10% depreciation, the new exchange rate in terms of ¥/$ would be:A. 6.1671B. 7.5375C. 6.9238D. 7.613515. At least in a U.S. MNC’s financial accounting statement, if the value of the euro depreciates rapidly against that of the dollar over a year, this would reduce the dollar value of the euro profit made by the European subsidiary. This is a typical __________.A. transaction exposureB. translation exposureC. economic exposureD. operating exposure16. A Japanese-based firm expects to receive pound-payment in 6 months. The company has a (an) __________.A. economic exposureB. accounting exposureC. long position in sterlingD. short position in sterling17 The exposure to foreign exchange risk known as Translation Exposure may be defined as __________.A. change in reported owner’s equity in consolidated financial statements caused by a change in exchange ratesB. the impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange ratesC. the change in expected future cash flows arising from an unexpected change in exchange ratesD. All of the above18 When a firm deals with foreign trade or investment, it usually has foreign exchange risk exposure. So if an American firm expects to receive a dollar-paymentfrom a Chinese company in the next 30 days, the U.S. firm has the possible __________.A. economic exposureB. transaction exposureC. translation exposureD. none of the above19. In order to avoid the possible loss because of the exchange rate fluctuations, a firm that has a __________ position in foreign exchanges can __________ that position in the forward market.A. short; sellB. long; sellC. long; buyD. none of the above20. A forward contract to deliver Japanese yens for Swiss francs could be described either as __________ or __________,A. selling yens forward; buying francs forwardB. buying francs forward; buying yens forwardC. selling yens forward; selling francs forwardD. selling francs forward; buying yens forward21. Dollars are trading at S0SFr/$=SFr0.7465/$ in the spot market. The 90-day forward rate is F1SFr/$=SFr0.7432/$. So the forward __________ on the dollar in basis points is __________:A. discount, 0.0033B. discount, 33C. premium, 0.0033D. premium, 3322. If the spot rate is $1.35/€, 3-month forward rate is $1.36/€, which of the following is NOT true?A. euro is at forward premium by 100 points.B. dollar is at forward discount by 100 points.C. dollar is at forward discount by 55 points.D. euro is at forward premium by 2.96% p.a.23. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the outright forward quote in American term should be __________.A. 1.0330 – 1.0345B. 1.0280 – 1.0285C. 0.9681 – 0.9667D. 0.9728 – 0.972324. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the $/C$ forward quote in terms of points should be __________.A. 30/25B. 25/30C. – (23/28)D. – (28/23)25. The current U.S. dollar exchange rate is ¥85/$. If the 90-day forward dollar rate is ¥90/$, then the yen is selling at a per annum __________ of __________.A. premium; 5.88%B. discount; 5.56%C. premium; 23.52%D. discount; 22.23%II. ProblemsQuestions 1 through 10 are based on the information presented in Table 3.1. (2 credits for each question, total credits 2 x 10 = 20)Table 3.1Country Exchange rate Exchange rate CPI V olume of Volume of (2008) (2009) (2008) exports to U.S imports from U.S. Germany €0.75/$ €0.70/$ 102.5 $200m $350m Mexico Mex$11.8/$ Mex$12.20/$ 110.5 $120m $240mU.S. 105.31. The real exchange rate of the dollar against the euro in 2009 was __________.2. The real exchange rate of the dollar against the peso in 2009 was __________.3. The dollar was __________ against the euro in nominal term by __________.A. appreciated; 6.67%B. depreciated; 6.67%C. appreciated; 7.14%D depreciated; 7.14%4. The Mexican peso was __________ against the dollar in nominal term by __________.A. appreciated; 3.39%B. depreciated; 3.39%C. appreciated; 3.28%D. depreciated; 3.28%5. The volume of the German foreign trade with the U.S. was __________.6. The volume of the Mexican foreign trade with the U.S. was __________.7. Assume the U.S. trades only with the Germany and Mexico. Now if we want to calculate the dollar effective exchange rate in 2009 against a basket of currencies of euro and Mexican peso, the weight assigned to the euro should be __________.8. The weight assigned to the peso should be __________.9. Assume the 2008 is the base year. The dollar effective exchange rate in 2009 was __________.10. Was the dollar generally stronger or weaker in 2009 according to your calculation?11. The following exchange rates are available to you.Fuji Bank ¥80.00/$United Bank of Switzerland SFr0.8900/$Deutsche Bank ¥95.00/SFrAssume you have an initial SFr10 million. Can you make a profit via triangular arbitrage? If so, show steps and calculate the amount of profit in Swiss francs. (8 credits)12. If the dollar appreciates 1000% against the ruble, by what percentage does the ruble depreciate against the dollar? (5 credits)13. As a percentage of an arbitrary starting amount, about how large would transactions costs have to be to make arbitrage between the exchange rates S SFr/$= SFr1.7223/$, S$/¥= $0.009711/¥, and S¥/SFr = ¥61.740/SFr unprofitable? Explain. (7 credits14. You are given the following exchange rates:S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670Calculate the bid and ask rate of S¥/£: (5 credits)15. Suppose the spot quotation on the Swiss franc (CHF) in New York is USD0.9442 –52 and the spot quotation on the Euro (EUR) is USD1.3460 –68. Compute the percentage bid-ask spreads on the CHF/EUR quote. ( 5 credits)Answers to Assignment Problems (3)Part II1. 0.70 x (105.3/102.5) = 0.7 x 1.0273 = 0.71912. 12.2 x (105.3/110.5) = 12.2 x .9529 = 11.62593. B (0.7 /.75) – 1 = -6.67%4. D (1/12.2)/(1/11.8) – 1 = -3.28%5. 5506. 3607. 550/910 = 60.44%8. 360/910 = 39.569. (0.70/0.75)(60.44%) + (12.2/11.8)(39.56%) = .5641 + 0.4090 = .9731 = 97.31%10. weaker, because dollar depreciated by 2.69%.11. Since S¥/$S$/SFr S SFr/¥= 80 x 1/0.8900 x 1/95.00 = 0.946186 < 1, there is an arbitrage opportunity.Steps:①Buy ¥ from Deutsche Bank, SFr10 million x 95.00 = ¥950 million②Buy $from Fuji Bank, $950 m / 80.00 = $11.875 m③Buy SFr from UBS, $11.875 x 0.8900 = SFr10.56875 mProfit (ignoring transaction fees):SFr10.56875 – SFr10 = 0.56875 million = 568,75012. (x – 1) = 1000%; 1/11 – 1 = 90.9%13. S SFr/$ S$/¥S¥/SFr = SFr1.7223/$ x $0.009711/¥ x ¥61.740/SFr = 1.0326If transaction costs exceed $0.0326 (3.26%), the arbitrage is unprofitable.14. Given: S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670So, S¥/₤ = 67.05/0.3670 = 182.70 (bid)S£/₤ = 68.75/0.3590 = 191.50 (ask)15. Given: USD0.9442 – 52/SFrUSD1.3460 – 68/SFrSo, S SRr/€ = 1.3460/0.9452 =1.424 (bid)S SFr/€ = 1.3468/0.9442 = 1.4264 (ask)。

Because I wanted to see you sooner. 因为我想快一点看到你。

Why are you so late? I've been waiting for you. 你为什么这样晚?我正等着你。

I had lunch late. 我午餐吃晚了。

If Mommy were late, we could have missed each other. 如果妈妈晚到,我们可能就错过彼此了。

Give me your bookbag. I'll carry it for you. 把书包给我,我来拿。

When it's raining, wait for me to bring an 下雨的时候,等我拿雨伞给你。

The bus is late today. 今天公车晚了。

Are you happy that Mommy came? 妈妈来接你,高兴吗?I'm really happy that you came for me. 我真的很高兴你能来接我。

Mommy feels happy to come here, too. 妈妈也很高兴能来。

Can you pick me up again tomorrow? 明天你也能来接我吗?I'll be waiting here tomorrow. 明天,我在这里等你。

Sorry I was a little late. 抱歉,我晚了一点。

I'll come and pick you up every Monday. 每周,我都会来接你。

Were you waiting for me for a while? 你等我一会了吗?Even if Mommy's late, wait here. 即使妈妈晚到,也一定要在这等。

CHAPTER03-03洗手Look at your hands! They're dirty. 看看你的手!好脏。

Assignment 2 (Chapter 3/4/5)1. Translate the following sentences into English.1)我们确定搞两个开放:一个是对内开放,一个是对外开放。

2)汉字在历史上有过不可磨灭的功绩。

3)姑娘有点不好意思了,脸上泛着红潮。

4)多年来那个地区一直有严重的失业现象。

5)他挣的钱几乎难以维持生活。

6)我昨天没上学,一来是因为天气不好,二来是因为我不舒服。

7)他把事情一五一十地都给老师讲了。

8)他每天要处理许多棘手的问题9)他就知道脚踩两只船。

10)学生们急得像热锅上的蚂蚁一样。

11)人们利用科学去了解自然,改造自然。

12)老年人如夕阳,少年人如朝阳。

老年人如秋后之柳,少年人如春间之草。

13)机械能可以变成电能,电能也可以变成机械能。

2. Translate the following sentences into English!1)杨宪益长年生活学习在国外,大学毕业后,他的生活习惯和内在气质,都已与中国同胞截然不同。

2)就在这时,他为了兴办学校,广泛招聘人才,向我发出了邀请。

3. Translate the following sentences into Chinese!1)Nevertheless, they all emphasize that pollution of air and water, noise and congestion, and themechanization of the work process are very real and very serious problems.然而,他们都强调:水和空气污染,噪音和交通拥挤,机械性的工作等问题的确是很严重的问题。

2)He was one of 15 children in the family.。

Assignment for Unit 3T opics: Chinese and Western WeddingsDirections:1.Each group focuses on one topic: Chinese weddings or Western weddings2.Collect information about the procedure and arrangements of the Chinese weddings or thewestern wedding,3.Prepare a presentation or role-playIf your group chooses to do the presentation, please work out an outline of the procedures and arrangements of Chinese weddings or the western wedding. Y ou can have one or two speakers.If your group chooses to do the role-play, please assign each member of your group a role. The roles are, for example, bride, groom, pastor/minister/host/spokesperson, groomsman/best man, bridesmaid, parents, relatives, friends, etc. group act out their wedding in class.4.The followings are the useful word and expressions which you can refer to, and you are alsowelcome to add more information about the weddings.Reference:Traditional Chinese Wedding Ceremony●The groom's family sends out a procession of servants, musicians and a carriage which iscarried by four servants to the bride's family to bring the bride back to the groom’s house to perform the marriage ceremony witnessed by all the relatives and friends.●The bride and groom worship the heavens and the earth, the groom's ancestors.●The bride and groom serve tea to all of their superiors in the family.●The superiors give the couple red packages with monetary gifts and wish them well.●The wedding host oversees the whole process and keeps toasting the couple.●After the meal, the newly wed couple returns to the bridal room and some naughty friendsmay tag along and play tricks on the groom.●The couple drinks and toasts and the host offers sweets and fruits to the couple to wish themlong life and lots of kids.●The couple is finally left with themselves and the groom can take off the red cloth that coversthe bride's face.Traditional Western Wedding Ceremony●Entrance of the bride and groom and wedding party.(The bride is accompanied by her father and the father gives the bride to her future husband.)●Music, literature and poetry or wedding reading from the Bible.●Exchange of Wedding V ows.For example: I, (Bride/Groom), take you (Groom/Bride), to be my (wife/husband), to have and to hold from this day forward, for better or for worse, for richer, for poorer, in sickness and in health, to love and to cherish; from this day forward until death do us part.●Exchange of wedding rings or gifts.●Pastor prays for the couple and declares them husband and wife.●A first kiss as a married couple.●The bride throws her bouquet to the unmarried female guests.●A reception (cutting wedding cake and toasting each other).。

GL827LUSB 2.0 Single Slot SD/MMC/MSCard Reader ControllerDatasheetRevision 1.04 Nov. 5, 2009Copyright:Copyright © 2009 Genesys Logic, Inc. All rights reserved. No part of the materials shall be reproduced in any form or by any means without prior written consent of Genesys Logic, Inc.Ownership and TitleGenesys Logic, Inc. owns and retains of its right, title and interest in and to all materials provided herein. Genesys Logic, Inc. reserves all rights, including, but not limited to, all patent rights, trademarks, copyrights and any other propriety rights. No license is granted hereunder.DisclaimerAll Materials are provided “as is”. Genesys Logic, Inc. makes no warranties, express, implied or otherwise, regarding their accuracy, merchantability, fitness for any particular purpose, and non-infringement of intellectual property. In no event shall Genesys Logic, Inc. be liable for any damages, including, without limitation, any direct, indirect, consequential, or incidental damages. The materials may contain errors or omissions. Genesys Logic, Inc. may make changes to the materials or to the products described herein at anytime without notice.Genesys Logic, Inc.12F, No. 205, Sec. 3, Beishin Rd., Shindian City,Taipei, TaiwanTel : (886-2) 8913-1888Fax : (886-2) 6629-6168http ://Revision HistoryRevision Date Description 1.00 11/06/2007 First formal release1.01 12/14/2007 Add QFN 24 package, p.9, p.18Update absolute maximum rating and DC characteristics, p.141.02 07/11/2008 Remove Ambient Temperature in Table 6.1, p.14 Update QFN 24 package, p.18, p.191.03 10/17/2008 Add QFN 24 package (B), p.10, p.11 1.04 11/05/2009 Add “Compatible with SDXC…”, p.7Table of ContentsCHAPTER 1 GENERAL DESCRIPTION (6)CHAPTER 2 FEATURES (7)CHAPTER 3 PIN ASSIGNMENT (8)3.1 Pinout (8)3.2 Pin Descriptions (11)CHAPTER 4 BLOCK DIAGRAM (13)CHAPTER 5 FUNCTION DESCRIPTION (14)5.1 UTM (14)5.2 SIE (14)5.3 EPFIFO (14)5.4 MHE (14)CHAPTER 6 ELECTRICAL CHARACTERISTICS (15)6.1 Absolute Maximum Ratings (15)6.2 Operating Conditions (15)6.3 DC Characteristics (15)6.4 5V to 3.3V Regulator Characteristics (16)6.5 PMOS Characteristics (16)6.6 AC Characteristics (17)6.6.1 UTMI Transceiver (17)6.6.2 Reset Timing (17)CHAPTER 7 PACKAGE DIMENSION (18)CHAPTER 8 ORDERING INFORMATION (21)List of FiguresFigure 3.1 - 28 Pin SSOP Pinout Diagram (8)Figure 3.2 - (A) 24 Pin QFN Pinout Diagram (9)Figure 3.3 - (B) 24 Pin QFN Pinout Diagram (10)Figure 4.1 - Block Diagram (13)Figure 6.1 - 5V to 3.3V Regulator Architecture (16)Figure 6.2 - Embedded PMOS Switch Architecture (16)Figure 6.3 - Timing Diagram of Reset Width (17)Figure 6.4 - Timing Diagram of Power Good to USB Command Receive Ready (17)Figure 7.1 - GL827L 28 Pin SSOP Package (18)Figure 7.2 - GL827L 24 Pin QFN Package (For 827L-01 and 827L-02 version only) (19)Figure 7.3 - GL827L 24 Pin QFN Package (For 827L-03 and later version) (20)List of TablesTable 3.3 - Pin Descriptions (11)Table 6.1 - Absolute Maximum Ratings (15)Table 6.2 - Operating Conditions (15)Table 6.3 - DC Characteristics (15)Table 6.4 - Regulator Output Current (16)Table 6.5 - PMOS I-V table (16)Table 8.1 - Ordering Information (21)CHAPTER 1 GENERAL DESCRIPTIONThe GL827L is USB 2.0 SD/MMC/MS Flash Card Reader single chip. It supports USB 2.0 high-speed transmission to Secure Digital TM(SD), SDHC, SDXC, miniSD TM, microSD TM, T-Flash , MultiMediaCard TM (MMC), RS MultiMediaCard TM(RS MMC), MMCmicro , HS-MMC, MMC-mobile , Memory Stick TM(MS), Memory Stick Duo TM(MS Duo), High Speed Memory Stick TM(HS MS), Memory Stick PRO TM(MS PRO), Memory Stick PRO TM Duo (MS PRO Duo), Memory Stick PRO-HG (MS PRO-HG), Memory Stick ROM, MS PRO Micro (M2) on one chip. As a single chip solution for USB 2.0 flash card reader, the GL827L complies with Universal Serial Bus specification rev. 2.0, USB Storage Class specification ver.1.0, and each flash card interface specification.The GL827L integrates a high speed 8051 microprocessor and a high efficiency hardware engine for the best data transfer performance between USB and flash card interfaces. Its’ pin assignment design fits to card sockets to provide easier PCB layout.The GL827L is packaged with 28 pin SSOP (150mil) and 24 pin QFN for up to 1 LUN (SD/MMC, MS).CHAPTER 2 FEATURESUSB specification compliance-Comply with 480Mbps Universal Serial Bus specification rev. 2.0.-Comply with USB Storage Class specification rev. 1.0.-Support 1 device address and up to 4 endpoints: Control (0)/ Bulk Read (1)/ Bulk Write (2)/Interrupt (3).Integrated USB building blocks-USB2.0 transceiver macro (UTM), Serial Interface Engine (SIE), Build-in power-on reset (POR) and low-voltage detector (LVD)Embedded 8051 micro-controller-Operate @ 60 MHz clock, 12 clocks per instruction cycle-Embedded 32K Byte mask ROM and internal 256 byte SRAM-Embedded 2K Byte external SRAMSecure Digital TM and MultiMediaCard TM-Supports SD specification v1.0 / v1.1 / v2.0/ SDHC (Up to 32GB)-Compatible with SDXC (Up to 2TB)-Supports MMC specification v3.X / v4.0 / v4.1 / v4.2.-x1 / x4 / x8 data transmission. (For QFN24 up to x4)-Automatic CRC7 generation for command and CRC7 verification for response on CMD-Support automatic CRC16 generation and verification on DAT0:7-In addition to full packet transaction, optional single byte / bit operation on both CMD and DAT line / lines-Process data in block or byteMemory Stick TM/ Memory Stick PRO TM / Memory Stick PRO Duo TM / Memory Stick PRO-HG/ Memory Stick Micro-Comply with Memory Stick specification: MS 1.43, MS PRO 1.02, MS PRO-HG 1.01 with 4-bit data bus-Support INS signal-Support automatic CRC16 generation and verificationOn board 12 MHz Crystal driver circuit or 12 MHz Clock input.On-Chip 5V to 3.3V regulator. No external regulator required.On-Chip power MOSFETs for supplying flash media card power.Available in 28 pin SSOP (150mil) package.Available in 24 pin QFN package.CHAPTER 3 PIN ASSIGNMENT3.1 PinoutGL827LGL827L3.2 Pin DescriptionsTable 3.3 - Pin DescriptionsPin name SSOP28QFN 24 (A) QFN 24 (B) Type DescriptionGND 6 3 3 P groundAVDD 7 4 4 P Analog power 3.3v DM 9 6 6 A USB D- DP 8 5 5 A USB D+ RREF 10 7 7 A Reference resistorX1 4 1 1 I 12MHz XTAL input. It can be connected to external 12MHz clock input. X2 5 2 2 B 12MHz output. DVDD 3,,11 24,,8 24,,8 P Digital power 3.3V VP5 12 9 9 P Regulator 5V Input PMOSO 2 23 23 PCard powerEXTRSTZ 13 10 10 I, pu System reset, active low MS_INS261919I, pu Memory Stick insertion detect 0: card insert1: no cardSD_CDZ 15 12 12I, pu SD Card detect 0: card insert1: no card D0~D3 17,16,25, 24 14,13,18, 1714,13,18, 17B MS data 0~3 SD data 0~3MMC data 0~3 D4~D7 23,21, 19,18- - B MMC Data4~7 (Only for SSOP28) SD_CLK /MS_SCLK 201515OSD/MMC CLK/ MemoryStick SCLKSD_WP 14 11 11I, pd SD Write Protect 0: write enable1: write protect SD_CMD/ MS_BS 22 16 16I, pd SD/MMC CMD/ Memory Stick BS GPIO0 28 21 20 B Access LEDGPIO1 1 22 21 B SSOP28/ QFN24(A) GPIO1: NC QFN24(B) GPIO1: I2C_SCL GPIO3 27 20 B Power LED GPIO222BI2C_SDANotation:Type A AnalogB Bi-directionalI InputO OutputP Power / Groundpd Internal pull downpu Internal pull upCHAPTER 4 BLOCK DIAGRAMFigure 4.1 - Block DiagramCHAPTER 5 FUNCTION DESCRIPTION5.1 UTMThe USB 2.0 Transceiver Macrocell is the analog circuitry that handles the low level USB protocol and signaling, and shifts the clock domain of the data from the USB 2.0 rate to one that is compatible with the general logic.5.2 SIEThe Serial Interface Engine, which contains the USB PID and address recognition logic, and other sequencing and state machine logic to handle USB packets and transactions.5.3 EPFIFOEndpoint FIFO includes Control FIFO (FIFO0), interrupt FIFO (FIFO3), Bulk In/Out FIFO (BULKFIFO)Control FIFO FIFO of control endpoint 0.It is 64-byte FIFO, and it is used for endpoint 0 data transfer.Interrupt FIFO 64-byte depth FIFO of endpoint 3 for status interruptBulk In/Out FIFO It can be in the TX mode or RX mode:1. It contains ping-pong FIFO (512 bytes each bank) for transmit/receive data continuously.2. It can be directly accessed by Uc3. Automatic hardware SmartMedia ECC error correction support5.4 MHEIt contains 2 MIFs (Media Interface)MIFs1. SD / MMC2. MemoryStick/ MemoryStick PROExternal reset circuitNon-inverting, Schmitt input with weak pull-up using DVDD power.CHAPTER 6 ELECTRICAL CHARACTERISTICS6.1 Absolute Maximum RatingsTable 6.1 - Absolute Maximum RatingsParameter ValueStorage Temperature -65°C to +150 °C DC Input V oltage to Any Pin -0.5V to +5.8V6.2 Operating ConditionsTable 6.2 - Operating ConditionsParameter Value Ta (Ambient Temperature Under Bias) 0°C to 70°CSupply V oltage +4.75V to +5.25VGround V oltage 0VF OSC (Oscillator or Crystal Frequency)12 MHz ± 0.05%12 MHz ± 0.25% (for USB full-speed only)6.3 DC CharacteristicsTable 6.3 - DC CharacteristicsSymbol Parameter Condition Min. Typ. Max. Unit Vcc Supply V oltage 4.75 - 5.25 V V IH Input High V oltage 2.0 - - V V IL Input Low V oltage - - 0.8 VI I Input Leakage current 0 < V IN < 3.3v -10 - 10 µAV OH Output High V oltage 2.4 - - V V OL Output Low V oltage - - 0.4 VI OH Output Current High - 8 - mAI OL Output Current Low 8 - mAC IN Input Pin Capacitance - 5 - pFI SUSP Suspend current 1.5K external pull-upincluded- - 450 µAI CC Power consumption Connect to USB with 8051operating without Cardpower consumption- - 60 mA6.4 5V to 3.3V Regulator CharacteristicsTable 6.4 - Regulator Output CurrentParameters Description Test Conditions Typ. Units Iq Quiescent current no loading 18 uA Io_max Output driving capability V o > 2.9V 400 mAVo_0mA V o voltage without loading 3.38 VFigure 6.1 - 5V to 3.3V Regulator Architecture6.5 PMOS CharacteristicsTable 6.5 - PMOS I-V table( IO Power=3.3V, Temperature 25 °C)Driving Loading (mA) Vd output voltage(V)100mA 3.12200mA 2.94Note:1.Driving strength is defined as the PMOS sinking current when Vio=3.3VFigure 6.2 - Embedded PMOS Switch Architecture6.6 AC Characteristics 6.6.1 UTMI TransceiverThe GL827L is fully compatible with Universal Serial Bus specification rev. 2.0 and USB 2.0 Transceiver Macercell Interface (UTMI) specification rev. 1.01. Please refer to the specification for more information.6.6.2 Reset TimingEXTRSTZFigure 6.3 - Timing Diagram of Reset Width500us 72msFigure 6.4 - Timing Diagram of Power Good to USB Command Receive ReadyParameter DescriptionMin Unit Trst Chip reset sense timing width2 us T1 External reset valid from power up to high 500 us T2Reset deassertion to respond USB command ready72msCHAPTER 7 PACKAGE DIMENSIONGL827L YWWXXXXXXXXFigure 7.1 - GL827L 28 Pin SSOP PackageGL827LNo.No.Figure 7.2 - GL827L 24 Pin QFN Package (For 827L-01 and 827L-02 version only)GL827L YWWXXXXInternal Version No.Date Code Lot CodeFigure 7.3 - GL827L 24 Pin QFN Package (For 827L-03 and later version)GL827L Datasheet©2009 Genesys Logic, Inc. - All rights reserved. Page 21 CHAPTER 8 ORDERING INFORMATION Table 8.1 - Ordering InformationPart NumberPackage Normal/Green Version Status GL827L-HHGXXSSOP 28 Green Package XX Available GL827L-OGG*XXQFN 24 Green Package XX Available*The marking of "OGG" will not be shown on the IC due to QFN 24 package size limitation.。

第三章 线性分组码 习题

1.证明[n ,k ]线性分组码的最大距离为n -k +1。

2.设一个[7,4]码的生成矩阵为

1000111010010100100110

00111

0G ⎡⎤⎢⎥⎢

⎥=⎢⎥⎢⎥⎣⎦

(1)求出该码的全部码矢; (2)求出该码的一致校验矩阵; (3)作出该码的标准阵译码表。

3.证明定理3.1.3。

4.一个[8,4]系统码,它的一致校验方程为:

c 0=m 1+m 2+m 3c 1=m 0+m 1+m 2c 2=m 0+m 1+m 2c 3=m 0+m 2+m 3

式中,m 0,m 1,m 2,m 3是信息位,c 0,c 1,c 2,c 3是校验位。

找出该码的G 和H ,并证明该码的最小距离为4。

5.构造第4题中码的对偶码。

6.设H 1是[n ,k ]线性分组码C 1的校验矩阵,且有奇数最小距离为d 。

作一个新的码C 2,它的校

验矩阵为

12000111

1H H ⎡⎤

⎢⎥⎢⎥⎢

⎥=⎢⎥⎢⎥⎢⎥⎣⎦

M L (1)证明C 2是一个(n +1,k )分组码; (2)证明C 2中每一码字的重量为偶数; (3)证明C 2码的最小重量为d +1。

7.设C 1是一个有最小距离为d 1的[n 1,k ]线性系统码,生成矩阵为G 1=[P 1I k ]。

C 2是一个有最小距离为d 2的[n ,k ]线性系统码,它的生成矩阵G 2=[P 2I k ]。

对满足下述一致校验矩阵

212T

k n n k

T p H I P I −−⎤⎡

⎥

⎢=⎥⎢⎥⎢⎣⎦

的[n 1+n 2,k]线性码,证明它有最小距离至少为d 1+d 2。

8.设一个二进制[n ,k ]码C 的G 矩阵不含全零列,将C 的所有码字排成2k ×n 的阵。

证明:

(a )阵中不含有全零列;

(b )阵中的每一列由2k -1个零和2k -1个1组成;

(c )在一特定分量上为0的所有码字构成C 的一个子空间,问该子空间的维数是多少? 9.令是所有二进制[n ,k ]线性系统码的集合。

证明非零二进制n 重V 或者恰巧含于的

ΓΓ(1)()2k n k −−个码中,或者不在的任一码中。

Γ10.证明二进制[23,12,7]Golay 码和三进制的[11,6,5]Golay 码是完备码。

11.若d 是码C 的最小重量,且为偶数,(1)/2t d =−⎢⎥⎣⎦。

证明有两个重量均为t +1的矢量必在C 码的同一陪集中。

12.求出d =3,至多只有3个校验元的二进制码的码长n ;和d =5,至多只有8个校验元的二进

制码的码长n 。

13.计算二进制[24,12,8]扩张Golay 码的覆盖半径,及[8,4]RM 码的覆盖半径。

14.证明定理3.9.3。

15.构造三个二进制的[10,3,5]LUEP 码,其分离矢量分别为(8,2,2),(7,4,4),

(6,4,4)。

写出它们标准形式的G 和系统码形式的G 。

16.证明定理3.10.3。

17.构造一个具有最高码率的k =10,t =2的2-EC/AUED 码。

18.证明定理3.10.6。