[政史地]博迪-金融学讲义-北大光华-第二课

- 格式:ppt

- 大小:470.52 KB

- 文档页数:53

金融学讲义课件第一节货币的定义一、货币的经济学定义:在商品、劳务的支付或债务的归还中被普遍接受的任何东西。

本书的定义:货币是人们普遍接受的,可以充任价值尺度、买卖媒介、价值贮藏和支付手腕的物品。

二、货币与通货、财富、支出的区别〔一〕货币不等于现金或通货:通货通常指硬币和现钞,较货币范围小;现金(cash),亦称通货(currency):指由政府授权发行的不兑现的银行券和辅币,是一国的法偿货币。

〔二〕货币不同等于财富:货币和财富是存量,货币是财富的表现方式之一。

〔三〕货币不同等于支出:第二节货币的发生和开展〔三〕马克思的货币来源学说复杂、偶然的价值方式扩展的价值方式普通的价值方式货币的发生二、货币的类型〔一〕实物货币特征:其作为货币用途的价值与其作为非货币用途的价值相等。

〔二〕金属货币:铸币(coins):由国度准许铸造的契合规则重量和成色并具有一定外形的金属货币。

〔三〕代用货币〔大约公元10世纪):由政府和银行发行,替代金属货币流通,往往承诺可随时兑现为金属货币。

特征:其作为货币用途的价值要高于其作为非货币用途的价值,但可以兑换金银。

〔四〕信誉货币(20世纪30年代以后〕: 以信誉活动为基础发生的,可以发扬货币作用的信誉工具。

2、信誉货币的方式〔1〕纸币〔银行券〕:银行券:由银行发行、以信誉和黄金作双重保证的银行票据。

银行券的发生:由银行券到纸币纸币:由国度强迫发行和流通的不可兑换为金银的纸制货币符号。

〔不兑现的银行券〕纸币的优点和缺陷:〔2〕存款货币(deposit money) :可用于转账结算的活期存款〔五〕电子货币(electronic currency )经过电子资金转帐系统贮存和转移的货币资金。

第二节货币职能一、价值尺度:用以权衡和表现一切商品和劳务价值时,货币执行价值尺度职能.▲特点:只需求观念或想象中的货币,不需求理想的货币.▲作用:为各种商品和劳务定价:货币单位:以货币表示的价值计量单位. 价钱:以货币单位表示的价值,即价值的货币表现. △价钱的内在决议要素是价值,而内在的决议要素为供求,市场上的价钱总是围绕价值上下动摇.△价钱的倒数是货币购置力〔对一切商品而言〕,价钱指数与货币购置力成正比.目前存在的争议:第二节货币职能二、流通手腕:货币在商品交流中起媒介作用时,发扬流通手腕职能.▲特点: ①必需运用理想的货币,一手交钱,一手交货.货币需求:流通中需求多少货币取决于3个要素:价钱(P) 、待出售的商品数量(Q) 、货币流通速度(V).在金属货币制度下:M=PQ/V在信誉货币制度下:②作为流通手腕的货币在交流中转眼即逝。

第一章金融概论一、金融的涵义货币资金的融通或货币资金在盈余单位和亏空单位之间调剂余缺的信贷活动。

二、金融的构成、金融主体:谁参与了金融活动;、金融对象:货币和资金;、金融方式:有偿的信用方式;、金融工具:票据和各种有价证券;、金融市场:有形和无形两类;三、金融的特点、可回收性:授信人(债权人)原则上要按等值收回本金;、期限性;、收益性:利息或股息;、风险性:如债务人(受信人)的违约风险;购买力风险;市场风险。

违约风险如政府债券的偿还,其来源是税收,因而本息偿还能力高,违约风险低。

尤其是中央政府发行的债券,违约风险就更低。

而公司债券的偿还能和与经济状况大环境和公司经营的小环境都有密切关系,因而不确定性高,违约风险大。

违约风险低的债券,其利率也低;违约风险高,其债券的利率也就。

债券利率与无风险证券利率之差称为风险溢价。

而无风险证券是指信用风险相对较小的证券,如国库券、政府债券、大银行存单等。

有违约风险的公司债券的风险溢价必须为正,违约风险越大,风险溢价越高。

流动性风险是指因资产变现速度慢而可能遭受的损失。

假定公司债券与公司债券在初始时节利率是相等的,公司因经营亏损致使其公司债券不易变卖,流动性下降,债券需求下降,从而导致该债券的利率上升;而公司债券的流动性溢价。

流动性风险往往与违约风险相伴而生,因此风险溢价是两个风险共同带来的。

巴林银行的破产年月日,世界各地的新闻都以最夺目的标题报道了同一事件:巴林银行破产了。

巴林银行集团是有着年历史的老牌英国银行,在全球拥有雇员多人,总资逾亿美元,所管理的资产高达亿元,在世界家大银行中按核心资本排名位。

巴林银行经历了年伦敦金融市场解除管制的“大爆炸”,仍然屹立不倒,已成为英国金融市场体系的重要支柱。

然而,巴林银行长达两个多世纪的辉煌业绩,却在年月毁于一旦。

巴林银行破产的直接原因是其新加坡的交易员尼克·李森的违规交易。

李森,事发时刚满岁。

年,李森由摩根士丹的衍生工具部转投巴林,被派往新加坡分行。

北京大学金融硕士考研博迪《投资学》辅导讲义考研首先要做到以下几点:可靠正确的信息:这是在北大这类专业课不指定参考书的研究生中最重要的一点,公共课就不说了,因为是大统考,每年基本没有什么变化,复习资料基本也都是一样的。

让人担心的是专业课,尤其是像北大这种从来不指定任何参考书而且这几年专业课试卷风格改动很大,更需要最新最全最准确的资料信息以及对下一年专业课出题重点侧重的预测。

正确的复习计划:这里最重要的一点就是不要把复习计划落实到几点几分上,也就是不用规定死几点到几点学什么,几点到几点又学什么,即所谓的定时,可以适当地有点弹性,我所有的复习计划,都是按照定量来的,所谓定量就是比如每天数学复习全书看多少内容,专业课看几章,阅读做几篇,按照复习内容的难易长短而有所变化。

效率与时间:要记住效率第一,时间第二,就是说在保证效率的前提下再去延长复习的时间,不要每天十几个小时,基本都是瞌睡昏昏地过去的,那还不如几小时高效率的复习,坚定的意志:考研是个没有硝烟的持久战,在这场战争中,你要时刻警醒,不然随时都会有倒下的可能。

而且,它不像高考那样,每天都有老师催着,每个月都会有模拟考试检验着。

所以你不知道自己究竟是在前进还是在退步、自己的综合水平是在提高还是下降。

而且,和你一起自习的研友基本都没有跟你考同一个学校同一个专业的,你也不知道你的对手是什么水平。

很长一段时间,你可能都感觉不到自己的进步。

可能你某年的数学真题做了130多分,然后你觉得自己的水平很高了,但你要知道,也有很多人做了140多分,甚至满分,所以这是考研期间很大的一个障碍。

第一章1、金融资产分为哪三类?每类包含哪些资产(P4)答:金融资产通常可以分为三类:固定收益型金融资产,权益型金融资产和衍生金融资产。

固定收益型金融资产或称为债务性证券,承诺支付固定的收益流,或按某一特定公式计算的现金流。

固定收益型金融资产,一种极端是货币市场上的债务型证券,这些债券的特点是期限短,流动性强且风险小,如美国国库券和银行存单。

教学内容1.期权简史教学目的1.学习期权的基本属性期权简史圣经与天文学家1.期权合约交易的最早记录出现在《圣经》中。

为了娶期权简史郁金香事件1.17世纪,在荷兰的贵族阶层中,郁金香是身份的象期权简史郁金香事件3.随着郁金香热在其它国家升温,郁金香期权的二级市期权简史大萧条中的期权市场命运1.在经历了1929年10月的股市暴跌以及随之而来的大期权简史大萧条中的期权市场命运3.国会因此举行听证会,著名的期权经纪人Herbert 期权简史CBOE的建立1.20世纪60年代末,CBOT最先提出建立期权交易期权简史CBOE的建立5.CBOE的发起人、第一任总裁Joseph W. Sullivan宣基本概念买权(卖权)赋予持有人在未来某一天或某一天之股票期权交易所与报价1.美国开设股票期权品种的交易所:股票期权到期日与交割月1.从技术的角度来说,美国上市交易的股票期权的到期股票期权执行与交割1.股票期权交易实行“自动执行”原则。

如果标的股票在股票期权执行价1.上市交易的股票期权的执行价都是按照一定的规则生股票期权重大事件调整1.如果标的股票的发行公司发生了某些重大事件,那么股票期权重大事件调整4.如果公司分配给股东的红利既不是现金,也不是公司股票期权头寸限制与执行限制1.对股票期权的头寸限制与执行限制依赖于标的股票的流通数量和股票期权长期股票期权1.上市交易的股票期权除了到期时间在一年以内的短期期权交易的机构安排与交易制度一方面因为期权交易所发端于期货交易所,另一方面期权交易的机构安排与交易制度期权清算公司1.在机构设置方面,最大的不同之处在于所有上市交易的期权都在期权交易的机构安排与交易制度交割委派1.在期权持有人下达了交割通知以后,OCC按照既定的前试图平仓因而进行了反向交易,也不能真正平仓期权交易的机构安排与交易制度保证金要求1.在股票市场上,“保证金交易”指投资者凭信用购买股保证金水平期权交易的机构安排与交易制度保证金要求1.期权交易的保证金要求非常复杂,它与标的资产的类期权的风险特征1.在忽略交易费用的条件下,期权的多方和空方的损益期权的风险特征(续)P/期权的风险特征(续)期权价值的决定因素1.实值状态(in-the-money)、两平状态(at-the-期权价值的决定因素期权价值的决定因素1.波动率:波动率越大,标的股票潜在的上涨和下跌幅期权平价关系1.假设标的资产不分红,那么:期权的上下界0c C S £££价值欧式买权的价值及其下界价值欧式卖权的价值及其下界标的资产不分红的美式买权的执行时机1.如果标的资产不分红,投资者不应该在到期之前执行标的资产不分红的美式卖权的执行时机1.极端情形:标的资产的价格等于零,投资者的最优执欧式卖权与美式卖权的价值比较价值美式买权与卖权的价格关系1.如果标的资产不分红,我们可以证明参数相同的美式期权投资策略与交易策略1.期权投资策略的核心是购买、持有或者出售标的资q涉及两个以上期权的策略买进买权策略损益图买进买权策略投机1.购买虚值状态的买权与购买实值状态的买权有什么差分别购买这两种期权,并持有到期买进买权策略投机P/L买进买权策略投机1.相对于购买实值状态的买权而言,购买虚值状态的买买进买权策略投资1.投资者可以通过购买相应头寸的两平股票买权来实现保费比较便宜,但是免赔额较大;实值买权的保费较昂贵,但是没有免赔额买进买权策略投资Herbert Filer在其著作中讲述的一个故事有助于我们出售买权策略出售买权也有两种不同动机投机与保险出售买权策略损益图出售买权策略投机1.如果投资者认为标的资产在一段时间内不会上涨,那出售买权策略投机1.投资者出售实值买权与虚值买权有何差异?加保证金出售买权策略保护性出售买权1.如果投资者已经持有标的股票,并且希望在高出市场出售买权策略保护性出售买权出售买权策略买进-出售策略1.如果投资者预期标的股票价格将缓慢上涨或者趋于稳购买卖权策略1.最大损失等于期权费,最大利润为卖权的执行价减去购买卖权策略损益图购买卖权策略投机1.从投机的角度来看,购买的卖权的执行价格越低,承购买卖权策略投机(200)P/L购买卖权策略保险1.如果投资者持有标的资产,而且担心其价值下跌,那购买卖权策略保险出售卖权策略1.卖权空头的最大利润为卖出卖权获得的期权费收入,出售卖权策略投机1.如果投资者不准备投资于标的资产就出售卖权,那么出售卖权策略投资1.投资者准备投资于标的股票,但是认为其价格偏高,卖权将不会执行,投资者的利润是收取的期权费期权组合策略1.期权组合策略包含两个以上的期权,可以分为两大类垂直套购(vertical spread) 1.垂直套购分为两种类型:垂直牛市套购(Bull 垂直套购(vertical spread)支付函数垂直套购(vertical spread) 损益图垂直套购(vertical spread)1.如果投资者预期标的股票的价格将上涨,但是对上涨直牛市套购策略越激进,风险越大跨式套购(Straddle) 跨式套购(Straddle)支付函数1.跨式套购包含执行价和到期日均相同的一个买权头寸跨式套购(Straddle)损益图跨式套购(Straddle)1.如果投资者认为标的股票价格将出现大幅波动,但是是一种高度投机的策略,使用时要特别慎重勒形组合(Strangles)损益图勒形组合(Strangles)1.勒形套购可以看作是跨式套购的变种,与跨式套购非蝶形套购(Butterfly Spreads)蝶形套购(Butterfly Spreads)损益图1.蝶形套购与反向蝶形套购策略策略既可以用买权又可水平套购(Calendar Spreads)损益图水平套购(Calendar Spreads)1.水平套购利用两种执行价相同、到期日不同的买权期权组合策略特点比较投资期权执行到期初始适用范围。

北大光华管理学院金融硕士毕业就业怎样目标考北大光华管理金融硕士的跨专业的同学来说,对于该校的考试难度的分析以及考研招生人数的多少及招生比例是大家共同所关心的。

在此小编整理这些资料希望对大家能有所帮助。

先了解一下基本情况,比如说毕业就业这个问题。

一、北大光华管理学院金融硕士学费是多少?北大光华管理学院金融硕士学费总额为12.8万元,分两年缴清。

金融硕士考研为什么这么贵,凯程洛老师和清华北大人大的多位教授问了这个问题,他们的回答是一致的,金融硕士是高投入高产出的专业,没有一流的老师就没有一流的学生,请最好的老师培养金融硕士人才,这是行业需要。

确实,金融硕士就业薪水高是事实,一年就赚回来了。

例如五道口金融学院2年12.8万。

二、北大光华管理学院金融硕士就业怎么样?北大光华管理学院本身的学术氛围不错,人脉资源也不错,出国机会也不少。

2014年北大光华管理学院硕士毕业生就业率高达97.38%。

北大光华管理学院金融硕士就业是一等一的好,清华五道口和经管毕业生第一年大约20-30万每年,人大的也是在15-25之间,北大光华管理学院的预计在15-30万之间,金融硕士就业去向一般是金融机构,证券公司,投行,一行三会,国有大企业的投资金融部门,前景一片光明。

已经有毕业的学生,据统计薪水金额大约第一年在12-20万之间,第二年以后的情况得看个人在单位的发展情况了。

中国金融还是处于初级发展阶段,对高端人才的需求量非常大,有北大光华管理学院这样深厚背景的学生显得特别突出。

三、北大光华管理学院金融硕士考研难不难,跨专业的学生行不行?最近几年金融硕士很火,特别是清华、北大这样的名校,2015年北大光华管理学院金融硕士招生人数45人左右,含推免生35人,招生人数较少,又作为名校,北大光华管理学院金融硕士考研难度可想而知,但是金融硕士考研专业课复习较容易,跨专业考研没有问题。

据凯程从北大光华管理学院内部统计数据得知,北大光华金融硕士的考生中93%是跨专业考生,在录取的学生中,基本都是跨专业考的。

《⾦融学(第⼆版)》讲义⼤纲及课后习题答案详解⼗⼆章CHAPTER 12CHOOSING AN INVESTMENT PORTFOLIOObjectivesTo understand the process of personal investing in theory and in practice.To build a quantitative model of the tradeoff between risk and reward.Outline12.1 The Process of Personal Portfolio Selection12.2 The Trade-off between Expected Return and Risk12.3 Efficient Diversification with Many Risky AssetsSummaryThere is no single portfolio selection strategy that is best for all people.Stage in the life cycle is an imp ortant determinant of the optimal composition of a person’s optimal portfolio of assets and liabilities.Time horizons are important in portfolio selection. We distinguish among three time horizons: the planning horizon, the decision horizon, and the trading horizon.In making portfolio selection decisions, people can in general achieve a higher expected rate of return only by exposing themselves to greater risk.One can sometimes reduce risk without lowering expected return by diversifying more completely either withina given asset class or across asset classes.The power of diversification to reduce the riskiness of an investor’s portfolio depends on the correlations among the assets that make up the portfolio. In practice, the vast majority of assets are positively correlated with each other because they are all affected by common economic factors. Consequently, one’s ability to reduce risk through diversification among risky assets without lowering expected return is limited.Although in principle people have thousands of assets to choose from, in practice they make their choices from a menu of a few final products offered by financial intermediaries such as bank accounts, stock and bond mutual funds, and real estate. In designing and producing the menu of assets to offer to their customers theseintermediaries make use of the latest advances in financial technology.Solutions to Problems at End of Chapter1. Suppose that your 58-year-old father works for the Ruffy Stuffed Toy Company and has contributed regularly to his company-matched savings plan for the past 15 years. Ruffy contributes $0.50 for every $1.00 your father puts into the savings plan, up to the first 6% of his salary. Participants in the savings plan can allocate their contributions among four different investment choices: a fixed-income bond fund, a “blend” option that invests in large companies, small companies, and the fixed-income bond fund, a growth-income mutual fund whose investments do not include other toy companies, and a fund whose sole investment is stock in the Ruffy Stuffed Toy Company. Over Thanksgiving vacation, Dad realizes that you have been majoring in finance and decides to reap some early returns on that tuition money he’s been investing in your education. He shows you the most recent quarterly statement for his savings plan, and you see that 98% of its current value is in the fourth investment option, that of the Ruffy Company stock..a.Assume that your Dad is a typical risk-averse person who is considering retirement in five years. Whenyou ask him why he has made the allocation in this way, he responds that the company stock has continually performed quite well, except for a few declines that were caused by problems in a division that the company has long since sold off. Inaddition, he says, many of his friends at work have done the same. What advice would you give your dad about adjustments to his plan allocations? Why?b.If you consider the fact that your dad works for Ruffy in addition to his 98% allocation to the Ruffy stockfund, does this make his situation more risky, less risky, or does it make no difference? Why? SOLUTION:a.Dad has exposed himself to risk by concentrating almost all of his plan money in the Ruffy Stock fund. This is analogous to taking 100% of the money a family has put aside for investment and investing it in a single stock.First, Dad needs to be shown that just because the company stock has continually performed quite well is no guarantee that it will do so indefinitely. The company may have sold off the divisions which produced price declines in the past, but future problems are unpredictable, and so is the movement of the stock price. “Past performance is no guarantee of future results” is the lesson.Second, Dad needs to hear about diversification. He needs to be counseled that he can reduce his risk by allocating his money among several of the options available to him. Indeed, he can reduce his risk considerably merely by moving all of his money into the “blend” fund because it is diversifi ed by design: it has a fixed-income component, a large companies component, and a small companies component. Diversification isachieved not only via the three differing objectives of these components, but also via the numerous stocks that comprise each of the three components.Finally, Dad’s age and his retirement plans need to be considered. People nearing retirement age typically begin to shift the value of their portfolios into safer investments. “Safer” normally connotes less variability, so that the risk of a large decline in the value of a portfolio is reduced. This decline could come at any time, and it would be very unfortunate if it were to happen the day before Dad retires. In this example, the safest option would be the fixed-income bond fund because of its diversified composition and interest-bearing design, but there is still risk exposure to inflation and the level of interest rates. Note that the tax-deferred nature of the savings plan encourages allocation to something that produces interest or dividends. As it stands now, Dad is very exposed to a large decline in the value of his savings plan because it is dependent on the value of one stock.Individual equities over time have proven to produce the most variable of returns, so Dad should definitely move some, probably at least half, of his money out of the Ruffy stock fund. In fact, a good recommendation given his retirement horizon of five years would be to re-align the portfolio so that it has 50% in the fixed- income fund and the remaining 50% split between the Ruffy stock fund (since Dad insists) and the “blend” fund.Or, maybe 40% fixed-income, 25% Ruffy, 15% growth-income fund, and 20% “blend” fund. This latterallocation has the advantage of introducing another income-producing component that can be shielded by the tax-deferred status of the plan.b.The fact that Dad is employed by the Ruffy Company makes his situation more risky. Let’s say that the companyhits a period of slowed business activities. If the stock price declines, so will th e value of Dad’s savings plan. If the company encounters enough trouble, it may consider layoffs. Dad’s job may be in jeopardy. At the same time that his savings plan may be declining in value, Dad may also need to look for a job or go onunemployment. Thus, Dad is exposed on two fronts to the same risk. He has invested both his human capital and his wealth almost exclusively in one company.2. Refer to Table 12.1.a.Perform the calculations to verify that the expected returns of each of the portfolios (F, G, H, J, S) in thetable (column 4) are correct.b.Do the same for the standard deviations in column 5 of the table.c.Assume that you have $1million to invest. Allocate the money as indicated in the table for each of the fiveportfolios and calculate the expected dollar return of each of the portfolios.d.Which of the portfolios would someone who is extremely risk tolerant be most likely to select? SOLUTION:d.An extremely risk tolerant person would select portfolio S, which has the largest standard deviation but also thelargest expected return.3. A mutual fund company offers a safe money market fund whose current rate is4.50% (.045). The same company also offers an equity fund with an aggressive growth objective which historically has exhibited an expected return of 20% (.20) and a standard deviation of .25.a.Derive the equation for the risk-reward trade-off line.b.How much extra expected return would be available to an investor for each unit of extra risk that shebears?c.What allocation should be placed in the money market fund if an investor desires an expected return of15% (.15)?SOLUTION:a.E[r] = .045 + .62b.0.62c.32.3% [.15 = w*(.045) + (1-w)*(.020) ]4. If the risk-reward trade-off line for a riskless asset and a risky asset results in a negative slope, what does that imply about the risky asset vis-a-vis the riskless asset?SOLUTION:A trade-off line wit h a negative slope indicates that the investor is “rewarded” with less expected return for taking on additional risk via allocation to the risky asset.5. Suppose that you have the opportunity to buy stock in AT&T and Microsoft.a.stocks is 0? .5? 1? -1? What do you notice about the change in the allocations between AT&T andMicrosoft as their correlation moves from -1 to 0? to .5? to +1? Why might this be?b.What is the variance of each of the minimum-variance portfolios in part a?c.What is the optimal combination of these two securities in a portfolio for each value of the correlation,assuming the existence of a money market fund that currently pays 4.5% (.045)? Do you notice any relation between these weights and the weights for the minimum variance portfolios?d.What is the variance of each of the optimal portfolios?e.What is the expected return of each of the optimal portfolios?f.Derive the risk-reward trade-off line for the optimal portfolio when the correlation is .5. How much extraexpected return can you anticipate if you take on an extra unit of risk?SOLUTION:a.Minimum risk portfolios if correlation is:-1: 62.5% AT&T, 37.5% Microsoft0: 73.5% AT&T, 26.5% Microsoft.5: 92.1% AT&T, 7.9% Microsoft1: 250% AT&T, short sell 150% MicrosoftAs the correlation moves from -1 to +1, the allocation to AT&T increases. When two stocks have negativec orrelation, standard deviation can be reduced dramatically by mixing them in a portfolio. It is to the investors’benefit to weight more heavily the stock with the higher expected return since this will produce a high portfolio expected return while the standard deviation of the portfolio is decreased. This is why the highest allocation to Microsoft is observed for a correlation of -1, and the allocation to Microsoft decreases as the correlationbecomes positive and moves to +1. With correlation of +1, the returns of the two stocks will move closely together, so you want to weight most heavily the stock with the lower individual standard deviation.b. Variances of each of the minimum variance portfolios:62.5% AT&T, 37.5% Microsoft Var = 073.5% AT&T, 26.5% Microsoft Var = .016592.1% AT&T, 7.9% Microsoft Var = .0222250% AT&T, short 150% Microsoft Var = 0c. Optimal portfolios if correlation is:-1: 62.5% AT&T, 37.5% Microsoft0: 48.1% AT&T, 51.9% Microsoft.5: 11.4% AT&T, 88.6% Microsoft1: 250% AT&T, short 150% Microsoftd. Variances of the optimal portfolios:62.5% AT&T, 37.5% Microsoft Var = 048.1% AT&T, 51.9% Microsoft Var = .022011.4% AT&T, 88.6% Microsoft Var = .0531250% AT&T, short 150% Microsoft Var = 0e. Expected returns of the optimal portfolios:62.5% AT&T, 37.5% Microsoft E[r] = 14.13%48.1% AT&T, 51.9% Microsoft E[r] = 15.71%11.4% AT&T, 88.6% Microsoft E[r] = 19.75%250% AT&T, short 150% Microsoft E[r] = -6.5%f.Risk-reward trade-off line for optimal portfolio with correlation = .5:E[r] = .045 + .66/doc/31dbf23b580216fc700afd59.html ing the optimal portfolio of AT&T and Microsoft stock when the correlation of their price movements is 0.5, along with the results in part f of question 12-5, determine:a.the expected return and standard deviation of a portfolio which invests 100% in a money market fundreturning a current rate of 4.5%. Where is this point on the risk-reward trade-off line?b.the expected return and standard deviation of a portfolio which invests 90% in the money market fundand 10% in the portfolio of AT&T and Microsoft stock.c.the expected return and standard deviation of a portfolio which invests 25% in the money market fundand 75% in the portfolio of AT&T and Microsoft stock.d.the expected return and standard deviation of a portfolio which invests 0% in the money market fundand 100% in the portfolio of AT&T and Microsoft stock. What point is this?SOLUTION:a.E[r] = 4.5%, standard deviation = 0. This point is the intercept of the y (expected return) axis by the risk-rewardtrade-off line.b.E[r] = 6.03%, standard deviation = .0231c.E[r] = 15.9%, standard deviation = .173d.E[r] = 19.75%, standard deviation = .2306. This point is the tangency between the risk-reward line from 12-5part f and the risky asset risk-reward curve (frontier) for AT&T and Microsoft.7. Again using the optimal portfolio of AT&T and Microsoft stock when the correlation of their price movements is 0.5, take $ 10,000 and determine the allocations among the riskless asset, AT&T stock, and Microsoft stock for:a. a portfolio which invests 75% in a money market fund and 25% in the portfolio of AT&T and Microsoftstock. What is this portfolio’s expected return?b. a portfolio which invests 25% in a money market fund and 75% in the portfolio of AT&T and Microsoftstock. What is this portfolio’s expect ed return?c. a portfolio which invests nothing in a money market fund and 100% in the portfolio of AT&T andMicrosoft stock. What is this portfolio’s expected return?SOLUTION:a.$7,500 in the money-market fund, $285 in AT&T (11.4% of $2500), $2215 in Microsoft. E[r] = 8.31%, $831.b.$2,500 in the money-market fund, $855 in AT&T (11.4% of $7500), $6645 in Microsoft. E[r] = 15.94%, $1,594.c.$1140 in AT&T, $8860 in Microsoft. E[r] = 19.75%, $1,975.8. What strategy is implied by moving further out to the right on a risk-reward trade-off line beyond the tangency point between the line and the risky asset risk-reward curve? What type of an investor would be most likely to embark on this strategy? Why?SOLUTION:This strategy calls for borrowing additional funds and investing them in the optimal portfolio of AT&T and Microsoft stock. A risk-tolerant, aggressive investor would embark on this strategy. This person would be assuming the risk of the stock portfolio with no risk-free component; the money at risk is not onl y from this person’s own wealth but also represents a sum that isowed to some creditor (such as a margin account extended by the investor’s broker).9. Determine the correlation between price movements of stock A and B using the forecasts of their rate of return and the assessments of the possible states of the world in the following table. The standard deviations for stock A and stock B are0.065 and 0.1392, respectively. Before doing the calculation, form an expectation of whether that correlation will be closer to1 or -1 by merely inspecting the numbers.SOLUTION:Expectation: correlation will be closer to +1.E[r A] = .05*(-.02) + .15*(-.01) + .60*(.15) + .20*(.15) = .1175, or, 11.75%E[r B] = .05*(-.20) + .15*(-.10) + .60*(.15) + .20*(.30) = .1250, or, 12.50%Covariance = .05*(-.02-.1175)*(-.20-.125) + .15*(-.01-.1175)*(-.10-.125) +.60*(.15-.1175)*(.15-.125) + .20*(.15-.1175)*(.30-.125) =.008163Correlation = .008163/(.065)*(.1392) = .90210.Analyze the “expert’s” answers to the following questions:a.Question:I have approx. 1/3 of my investments in stocks, and the rest in a money market. What do you suggestas a somewhat “safer” place to invest another 1/3? I like to keep 1/3 accessible for emergencies.Expert’s answer:Well, you could try 1 or 2 year Treasury bonds. You’d get a little bit more yie ld with no risk.b.Question:Where would you invest if you were to start today?Expert’s answer:That depends on your age and short-term goals. If you are very young – say under 40 –and don’tneed the money you’re investing for a home or college tuition or such, you would put it in a stockfund. Even if the market tanks, you have time to recoup. And, so far, nothing has beaten stocks overa period of 10 years or more. But if you are going to need money fairly soon, for a home or for yourretirement, you need to play it safer.SOLUTION:a.You are not getting a little bit more yield with no risk. The real value of the bond payoff is subject to inflationrisk. In addition, if you ever need to sell the Treasury bonds before expiration, you are subject to the fluctuation of selling price caused by interest risk.b.The expert is right in pointing out that your investment decision depends on your age and short-term goals. In addition, the investment decision also depends on other characteristics of the investor, such as the special character of the labor income (whether it is highly correlated with the stock market or not), and risk tolerance.Also, the fact that over any period of 10 years or more the stock beats everything else cannot be used to predict the future.。

光华金融——北大光华管理学院金融学考研课程讲义解读各位考研的同学们,大家好!我是才思的一名学员,现在已经顺利的考上北大管理学院,今天和大家分享一下这个专业的真题,方便大家准备考研,希望给大家一定的帮助。

425、GDP deflator GDP紧缩指数GDP的"价格"。

该价格指数用于衡量GDP各组成部分相对于基年的平均价格。

426、GDP gap GDP缺口潜在GDP与实际GDP的差额或缺口。

427、GNP 国民生产总值见国民生产总值(gloss national product)428、Gold standard 全本位制指这样一种制度:一国(1)宣布其货币单位与一定重量的黄金等价;(2)持有黄金储备,并根据所宣布的价格自由买卖黄金;(3)对黄金的进出口不加任何限制。

429、Government debt 政府债务以债券和短期借款形式存在的政府债务总额。

除由准政府机构(如中央银行)持有的债券以外,政府债务一般由公众持有。

430、Goverment expenditure multiplier 政府支出乘数政府采购等支出每增加一美元所引起的GDP的增量。

431、Graduated income tax 累进所得税见个人所得税(income tax, personal)。

432、Gresham`s Law 格雷欣法则由托马斯•格雷欣爵士(Sir ThomasGresham,英国伊莉莎白女王一世的顾问)首次提出,他在1558年发表的"劣币驱逐良币"这一见解认为:当公众对货币供给的某一部分怀有疑虑时,他们会将"良币"(good money)窖藏起来,并试图将"劣币"(bad money)转让给他人。

433、Gross domestic product, nominal(or nominal GDP)名义国内生产总值(或名义GDP)按当前市场价格计算的一国一年内所生产的全部最终产出的价值。

北大经院博迪《投资学》考研辅导讲义考研首先要做到以下几点:可靠正确的信息:这是在北大这类专业课不指定参考书的研究生中最重要的一点,公共课就不说了,因为是大统考,每年基本没有什么变化,复习资料基本也都是一样的。

让人担心的是专业课,尤其是像北大这种从来不指定任何参考书而且这几年专业课试卷风格改动很大,更需要最新最全最准确的资料信息以及对下一年专业课出题重点侧重的预测。

正确的复习计划:这里最重要的一点就是不要把复习计划落实到几点几分上,也就是不用规定死几点到几点学什么,几点到几点又学什么,即所谓的定时,可以适当地有点弹性,我所有的复习计划,都是按照定量来的,所谓定量就是比如每天数学复习全书看多少内容,专业课看几章,阅读做几篇,按照复习内容的难易长短而有所变化。

效率与时间:要记住效率第一,时间第二,就是说在保证效率的前提下再去延长复习的时间,不要每天十几个小时,基本都是瞌睡昏昏地过去的,那还不如几小时高效率的复习,坚定的意志:考研是个没有硝烟的持久战,在这场战争中,你要时刻警醒,不然随时都会有倒下的可能。

而且,它不像高考那样,每天都有老师催着,每个月都会有模拟考试检验着。

所以你不知道自己究竟是在前进还是在退步、自己的综合水平是在提高还是下降。

而且,和你一起自习的研友基本都没有跟你考同一个学校同一个专业的,你也不知道你的对手是什么水平。

很长一段时间,你可能都感觉不到自己的进步。

可能你某年的数学真题做了130多分,然后你觉得自己的水平很高了,但你要知道,也有很多人做了140多分,甚至满分,所以这是考研期间很大的一个障碍。

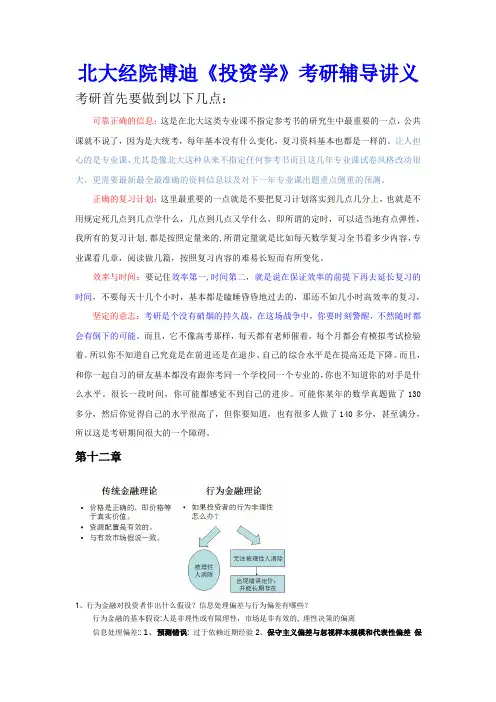

第十二章1、行为金融对投资者作出什么假设?信息处理偏差与行为偏差有哪些?行为金融的基本假设:人是非理性或有限理性,市场是非有效的,理性决策的偏离信息处理偏差::1、预测错误:过于依赖近期经验2、保守主义偏差与忽视样本规模和代表性偏差保守主义偏差:对最近出现的事件反应太慢。

忽视样本规模和代表性偏差:投资者基于小样本过快地推出一种模式,并推断出未来的趋势。

北大光华金融硕士2012考研资料汇总(概率+微观+宏观;参考书目+真题+讲义+笔记)【纸质资料部分】光华金融考研历年真题(1995-2011)光华金融历年真题详尽参考答案(1995-2010)2000-2006,2010光华统计考研真题(无电子版)范里安《现代观点》中级微观中文课件光华本科微观期末试题及期末复习题光华金融培训班内部讲义(某辅导班上课的讲义,无电子版!)范里安《高微经济学》习题答案范里安《微观经济学:现代观点》考研复习读书笔记(2011年新版,无电子版)共200多页范里安《微观经济学:现代观点》考研复习读书笔记浓缩精华版(2011年新版,无电子版)共200多页范里安《微观经济学:现代观点》笔记和课后习题详解共200多页【电子版的内容包括】(纸质部分如有不清晰的,电子版的都有清晰的)一、超全真题,试题和答案1.光华金融考研历年真题(1995-2011)独家更新2011年北大光华金融题2.光华金融历年真题详尽参考答案(1995-2010)3.2000-2006,2010光华统计考研真题4.光华金融硕士招生复试题目6.2009年光华金融复试听力(对复试有极大的帮助!)7.北京大学经济学院历年硕士研究生入学专业考试试题(1999-2010)8.CCER、五道口、GSM部分考试题目(参考)9.1996-2010人行历年考研真题10.2004-2010年人行历年复试试题11.《金融学概论》本科生课堂5次作业题及详细答案,这是光华本科的5次作业题,有一定的难度,但有详细的完整的习题及标准答案。

属于内部资料,很贴近光华金融的考研题,很有价值!12.罗斯-SolutionManual13.刘力财务管理学习题答案14.北大光华,金融学概论,公式表15.光华内部数理统计资料16.光华《公司财务》复习题及答案17.光华硕士金融学概论期末考试题18.光华硕士金融学概论习题及答案19.于鸿君习题&微观期末复习题20.证券投资学习题和答案200321.00-04Principles of Finance, Final Exams Series solutions22.光华高微期末考试题(2001-2004)23..光华统计学真题统计作业24.北大经济学资料包(真题版)25.北大经院刘文忻高微北大经院刘文忻中微26.40页ccer96-05试题及解答(ccer重要参考)27.50页微观考试试题28.63页经济中心微观习题(ccer重要参考)29.中心试题经济学考卷ccer真题答案北大CCER96-08年历年试题.ccer产业组织习题30.10秋ccer双学位中微作业ccer双学位作业集ccer真题(ccer重要参考)ER 08年平新乔中微期末题和答案(ccer重要参考)er微观经济学20次作业(全)(ccer重要参考)33.经济学各名校考研真题含北大(重要参考)34.西方经济学考研真题与典型题详解(宏观)35.西方经济学(微观部分)考研真题与典型题详解36.光华复试资料集37.春中微作业mit习题38.计量部分课件作业计量考试试卷39.罗斯-SolutionManual 金融学work 博弈论习题40.企业管理历年试题及答案电子版(1999-2009)(附赠,同样对企业管理有兴趣的同学可以看一下,对金融没用)41.秋计量部分课件作业42.张俊妮统计作业二、金融全套电子版及课件complete electronic version of the financial and courseware of guanghua43.现代观点课件44.《金融学概论》(莫顿版)。