北外1603-国际金融 参考答案

- 格式:doc

- 大小:1.43 MB

- 文档页数:17

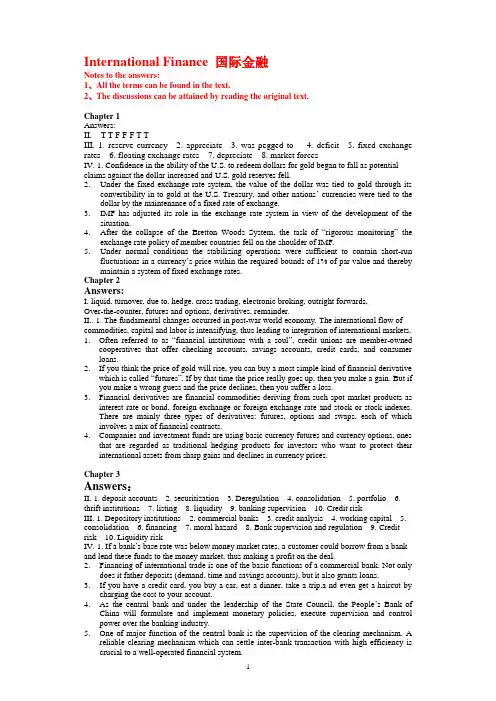

International Finance 国际金融Notes to the ans wers:1、All the terms can be found in the text.2、The discussions can be attained by reading the original text.Chapter 1Answers:II. T T F F F T TIII. 1. reserve currency 2. appreciate 3. was pegged to 4. deficit 5. fixed exchange rates 6. floating exchange rates 7. depreciate 8. market forcesIV. 1. Confidence in the ability of the U.S. to redeem dollars for gold began to fall as potential claims against the dollar increased and U.S. gold reserves fell.2.Under the fixed exchange rate system, the value of the dollar was tied to gold through itsconvertibility in to gold at the U.S. Treasury, and other nations’ currencies were tied to the dollar by the maintenance of a fixed rate of exchange.3.IMF has adjusted its role in the exchange rate system in view of the development of thesituation.4.After the collapse of the Bretton Woods System, the task of ―rigorous monitoring‖theexchange rate policy of member countries fell on the shoulder of IMF.5.Under normal conditions the stabilizing operations were sufficient to contain short-runfluctuations in a currency’s price within the required bounds of 1% of par value and thereby maintain a system of fixed exchange rates.Chapter 2Answers:I. liquid, turnover, due to, hedge, cross trading, electronic broking, outright forwards,Over-the-counter, futures and options, derivatives, remainder.II.. 1. The fundamental changes occurred in post-war world economy. The international flow of commodities, capital and labor is intensifying, thus leading to integration of international markets.1.Often referred to as ―financial institutions with a soul‖, credit unions are member-ownedcooperatives that offer checking accounts, savings accounts, credit cards, and consumer loans.2.If you think the price of gold will rise, you can buy a most simple kind of financial derivativewhich is called ―futures‖. If by that time the price really goes up, then you make a gain. But if you make a wrong guess and the price declines, then you suffer a loss.3.Financial derivatives are financial commodities deriving from such spot market products asinterest rate or bond, foreign exchange or foreign exchange rate and sto ck or stock indexes.There are mainly three types of derivatives: futures, options and swaps, each of which involves a mix of financial contracts.panies and investment funds are using basic currency futures and currency options, onesthat are regarded as traditional hedging products for investors who want to protect their international assets from sharp gains and declines in currency prices.Chapter 3Answers:II. 1. deposit accounts 2. securitization 3. Deregulation 4. consolidation 5. portfolio 6. thrift institutions 7. listing 8. liquidity 9. banking supervision 10. Credit riskIII. 1. Depository institutions 2. commercial banks 3. credit analysis 4. working capital 5. consolidation 6. financing 7. moral hazard 8. Bank supervision and regulation 9. Credit risk 10. Liquidity riskIV. 1. If a bank’s base rate was below money market rates, a customer could borrow from a bank and lend these funds to the money market, thus making a profit on the deal.2.Financing of international trade is one of the basic functions of a commercial bank. Not onlydoes it father deposits (demand, time and savings accounts), but it also grants loans.3.If you have a credit card, you buy a car, eat a dinner, take a trip,a nd even get a haircut bycharging the cost to your account.4.As the central bank and under the leadership of the State Council, the People’s Bank ofChina will formulate and implement monetary policies, execute supervision and control power over the banking industry.5.One of major function of the central bank is the supervision of the clearing mechanis m. Areliable clearing mechanis m which can settle inter-bank transaction with high efficiency is crucial to a well-operated financial system.Chapter 4 Ans wers:II. 1.integrity 2. pretext 3. released 4. produce 5. facilities 6. obliged 7. alleging 8. Claims 9. cleared 10. deliveryIII. 1. in favor of 2. consignment 3. undertaking, terms and conditions 4. cleared 5. regardless of 6. obliged to 7. undervalue arrangement 8. on the pretext of 9. refrain from 10. hinges onIV. 1. The objective of documentary credits is to facilitate international payment by making use of the financial expertise and credit worthiness of one or more banks.2.In compliance with your request, we have effected insurance on your behalf and debited youraccount with the premium in the amount of $1000.3.When an exporter is trading regularly with an importer, he will offer open account terms.4.Exporters usually insist on payment by cash in advance when they are trading with oldcustomers.5.Cash in advance means that the exporter is paid either when the importer places his order orwhen the goods are ready for shipment.Chapter 5.II.1. b 2. c 3. c 4. a 5. b 6. b 7. a 8. cIII. 1. guaranteed 2. without recourse 3. defaults 4. on the buyer’s account 5. is equivalent to 6. in question 7. devaluation 8. validity 9. discrepancy 10. inconsistent withChapter 6Answers:II. 1. open account, creditworthiness 2. demand 3. draw on, creditor 4. protest 5. schedule, discrepancies 6. acceptance 7. drawee 8. guranteedIII. 1. collecting bank 2. tenor 3. the proceeds 4. protest 5. deferred payment 6. presentation 7. the maturity date 8. a document of title 9. the shipping documents 10. transshipmentIV. 1. Documentary collection is a method by which the exporter authorizes the bank to collect money from the importer.2.When a draft is duly presented for acceptance or payment but the acceptance or paymentis refused, the draft is said to be dishonored.3.In the international money market, draft is a circulative and transferable instrument.Endorsement serves to transfer the title of a draft to the transferee.4.A clean bill of lading is favored by the buyer and the banks for financial settlementpurposes.5.Parcel post receipt is issued by the post office for goods sent by parcel post. It is both areceipt and evidence of dispatch and also the basis for claim and adjustment if there is any damage to or loss of parcels.Chapter 7II. financing, discounting, factoring, forfaiting, without recourse, accounts receivable, factor, trade obligations, promissory notes, trade receivables, specialized.III. 1. a cash flow disadvantage 2. without recourse 3. negotiable instruments 4. promissory notes 5. profit margin 6. at a discount, maturity, credit risk 7. A bill of exchange, A promissory noteIV. 1. When a bill is dishonored by non-acceptance or by non-payment, the holder then has an immediate right of recourse against the drawer and the endorsers.2.If a bill of lading is made out to bearer, it can be legally transferred without endorsement.3.The presenting bank should endeavor to ascertain the reasons non-payment ornon-acceptance and advise accordingly to the collecting bank.4.Any charges and expenses incurred by banks in connection with any action for protection o fthe goods will be for the account of the principal.5.Anyone who has a current account at a bank can use a cheque.Chapter EightStructure of the Foreign Exchange Market外汇市场的构成1. Key Terms1)foreign exchange:―Foreign exchange‖ refers t o money denominated in the currency of another nation or group of nations.2)payment“payment”is the transmission of an instruction to transfer value that results from a transaction in the economy.3)settlement―settlement‖ is the final and uncondit ional transfer of the value specified in a payment instruction.2. True or False1) true 2) true 3) true 4) true1)Tell the reasons why the dollar is the market's most widely tradedcurrency?key points: U.S.A economic background; the leadership of USD in the world economy ; the role it plays in investment , trade, etc.2)What kind of market is the foreign exchange market?Make reference to the following parts:(8.7 The Market Is Made Up of An International Network of Dealers)Chapter 9Instruments交易工具1. Key Terms1) spot transactionA spot transaction is a straightforward (or ―outright‖) exchange of one currency for another. The spot rate is the current market price, the benchmark price.Spot transactions do not require immediate settlement, or payment ―on the spot.‖ By convention, the settlement date, or ―value date,‖is the second business day after the ―deal date‖ (or ―trade date‖) on which the transaction is agreed to by the two traders. The two-day period provides ample time for the two parties to confirm the agreement and arrange the clearing and necessary debiting and crediting of bank accounts in various international locations.2) American termsThe phrase ―American terms‖means a direct quote from the point of view of someone located in the United States. For the dollar, that means that the rate is quoted in variable amounts of U.S. dollars and cents per one unit of foreign currency (e.g., $1.2270 per Euro).3) outright forward transactionAn outright forward transaction, like a spot transaction, is a straightforward single purchase/ sale of one currency for another. The only difference is that spot is settled, or delivered, on a value date no later than two business days after the deal date, while outright forward is settled on any pre-agreed date three or more business days after the deal date. Dealers use the term ―outright forward‖ to make clear that it is a single purchase or sale on a future date, and not part of an ―FX swap‖.4) FX swapAn FX swap has two separate legs settling on two different value dates, even though it is arranged as a single transaction and is recorded in the turnover statistics as a single transaction. The two counterparties agree to exchange two currencies at a particular rate on one date (the ―near date‖) and to reverse payments, almost always at a different rate, on a specified sub sequent date (the ―far date‖). Effectively, it is a spot transaction and an outright forward transaction going in opposite directions, or else two outright forwards with different settlement dates, and going in opposite directions. If both dates are less than one month from the deal date, it is a ―short-dated swap‖; if one or both dates are one month or more from the deal date, it is a ―forward swap.‖5) put-call parity―Put-call parity‖says that the price of a European put (or call) option can be deduced from the price of a European call (or put) option on the same currency, with the same strike price and expiration. When the strike price is the same as the forward rate (an ―at-the-money‖forward), the put and the call will be equal in value. When the strike price is not the same as the forward price, the difference between the value of the put and the value of the call will equal the difference in the present values of the two currencies.2. True or False1) true 2) true 3) true3. Cloze1) Traders in the market thus know that for any currency pair, if the basecurrency earns a higher interest rate than the terms currency, the currency will trade at a forward discount, or below the spot rate; and if the base currency earns a lower interest rate than the terms currency, the base currency will trade at a forward premium, or above the spot rate. Whichever side of the transaction the trader is on, the trader won't gain (or lose) from both the interest rate differential and the forward premium/discount. A trader who loses on the interest rate will earn the forward premium, and vice versa.2) A call option is the right, but not the obligation, to buy the underlyingcurrency, and a put option is the right, but not the obligation, to sellthe underlying currency. All currency option trades involve two sides—the purchase of one currency and the sale of another—so that a put to sell pounds sterling for dollars at a certain price is also a call to buy dollars for pounds sterling at that price. The purchased currency is the call side of the trade, and the sold currency is the put side of the trade. The party who purchases the option is the holder or buyer, and the party who creates the option is the seller or writer. The price at which the underlying currency may be bought or sold is the exercise , or strike, price. The option premium is the price of the option that the buyer pays to the writer. In exchange for paying the option premium up front, the buyer gains insurance against adverse movements in the underlying spot exchange rate while retaining the opportunity to benefit from favorable movements. The option writer, on the other hand, is exposed to unbounded risk—although the writer can (and typically does) seek to protect himself through hedging or offsetting transactions.4. Discussions1)What is a derivate financial instrument? Why is traded?2)Discuss the differences between forward and futures markets in foreigncurrency.3)What advantages do foreign currency futures have over foreigncurrency options?4)What is meant if an option is ―in the money‖, ―out of the money‖,or ―atthe money‖?5)What major international contracts are traded on the ChicagoMercantile Exchange ? Philadelphia Stock Exchange?Chapter 10Managing Risk in Foreign Exchange Trading外汇市场交易的风险管理1. Key Terms1) Market riskMarket risk, in simplest terms, is price risk, or ―exposure to (adverse)price change.‖ For a dealer in foreign exchange, two major elements of market risk are exchange rate risk and interest rate risk—that is, risks of adverse change in a currency rate or in an interest rate.2) VARVAR estimates the potential loss from market risk across an entire portfolio, using probability concepts. It seeks to identify the fundamental risks that the portfolio contains, so that the portfolio can be decomposed into underlying risk factors that can be quantified and managed. Employing standard statistical techniques widely used in other fields, and based in part on past experience, VAR can be used to estimate the daily statistical variance, or standard deviation, or volatility, of the entire portfolio. On the basis of that estimate of variance, it is possible to estimate the expected loss from adverse price movements with a specified probability over a particular period of time (usually a day).3) credit riskCredit risk, inherent in all banking activities, arises from the possibility that the counterparty to a contract cannot or will not make the agreed payment at maturity. When an institution provides credit, whatever the form, it expects to be repaid. When a bank or other dealing institution enters a foreign exchange contract, it faces a risk that the counterparty will not perform according to the provisions of the contract. Between the time of the deal and the time of thesettlement, be it a matter of hours, days, or months, there is an extension of credit by both parties and an acceptance of credit risk by the banks or other financial institutions involved. As in the case of market risk, credit risk is one of the fundamental risks to be monitored and controlled in foreign exchange trading.4) legal risksThere are legal risks, or the risk of loss that a contract cannot be enforced, which may occur, for example, because the counterparty is not legally capable of making the binding agreement, or because of insufficient documentation or a contract in conflict with statutes or regulatory policy.2. True or False1)True 2) true3. Translation1) Broadly speaking, the risks in trading foreign exchange are the same asthose in marketing other financial products. These risks can be categorized and subdivided in any number of ways, depending on the particular focus desired and the degree of detail sought. Here, the focus is on two of the basic categories of risk—market risk and credit risk (including settlement risk and sovereign risk)—as they apply to foreign exchange trading. Note is also taken of some other important risks in foreign exchange trading—liquidity risk, legal risk, and operational risk2) It was noted that foreign exchange trading is subject to a particular form ofcredit risk known as settlement risk or Herstatt risk, which stems in part from the fact that the two legs of a foreign exchange transaction are often settled in two different time zones, with different business hours. Also noted was the fact that market participants and central banks have undertaken considerable initiatives in recent years to reduce Herstatt risk.4. Discussions2)Discuss the way how V AR works in measuring and managing marketrisk?3)Why are banks so interested in political or country risk?4)Discuss other forms of risks which you know in foreign exchange. Chapter 11The Determination of Exchange Rates汇率的决定1. Key Terms1) PPPPurchasing Power Parity (PPP) theory holds that in the long run, exchange rates will adjust to equalize the relative purchasing power of currencies. This concept follows from the law of one price, which holds that in competitive markets, identical goods will sell for identical prices when valued in the same currency.2) the law of one priceThe law of one price relates to an individual product. A generalization of that law is the absolute version of PPP, the proposition that exchange rates will equate nations' overall price levels.3) FEER―fundamental equilibrium exchange rate,‖ or FEER,envisaged as the equilibrium exchange rate that would reconcile a nation's internal and external balance. In that system, each country would commit itself to a macroeconomicstrategy designed to lead, in the medium term, to ―internal balance‖—defined as unemployment at the natural rate and minimal inflation—and to ―external balance‖—defined as achieving the targeted current account balance. Each country would be committed to holding its exchange rate within a band or target zone around the FEER, or the level needed to reconcile internal and external balance during the intervening adjustment period.4) monetary approachThe monetary approach to exchange rate determination is based on the proposition that exchange rates are established through the process of balancing the total supply of, and the total demand for, the national money in each nation. The premise is that the supply of money can be controlled by the nation's monetary authorities, and that the demand for money has a stable and predictable linkage to a few key variables, including an inverse relationship to the interest rate—that is, the higher the interest rate, the smaller the demand for money.5) portfolio balance approachThe portfolio balance approach takes a shorter-term view of exchange rates and broadens the focus from the demand and supply conditions for money to take account of the demand and supply conditions for other financial assets as well. Unlike the monetary approach, the portfolio balance approach assumes that domestic and foreign bonds are not perfect substitutes. According to the portfolio balance theory in its simplest form, firms and individuals balance their portfolios among domestic money, domestic bonds, and foreign currency bonds, and they modify their portfolios as conditions change. It is the process of equilibrating the total demand for, and supply of, financial assets in each country that determines the exchange rate.2. True or False1) true 2) true3. Cloze1)PPP is based in part on some unrealistic assumptions: that goods are identical; that all goods are tradable; that there are no transportationcosts, information gaps, taxes, tariffs, or restrictions of trade; and—implicitly and importantly—that exchange rates are influenced only byrelative inflation rates. But contrary to the implicit PPP assumption,exchange rates also can change for reasons other than differences ininflation rates. Real exchange rates can and do change significantly overtime, because of such things as major shifts in productivitygrowth, advances in technology, shifts in factor supplies, changes inmarket structure, commodity shocks, shortage, and booms.2)Each individual and firm chooses a portfolio to suit its needs, based on a variety of considerations—the holder's wealth and tastes, the level ofdomestic and foreign interest rates, expectations of future inflation,interest rates, and so on. Any significant change in the underlying factorswill cause the holder to adjust his portfolio and seek a new equilibrium.These actions to balance portfolios will influence exchange rates.4. Discussions1)How does the purchasing power parity work?2)Describe and discuss one model for forecasting foreign exchange rates.3)Make commends on how good are the various approaches mentioned in the chapter.4)Central banks occasionally intervene in foreign exchange markets. Discuss the purpose of such intervention. How effective is intervention?Chapter 12The Financial Markets金融市场1. Key Terms1)money marketThe money market is really a market for short-term credit, or the option to use someone else's money for a period of time in return for the payment of interest. The money market helps the participants in the economic process cope with routine financial uncertainties. It assists in bridging the differences in the timing of payments and receipts that arise in a market economy.2)capital marketMarkets dealing in instruments with maturities that exceed one year are often referred to as capital markets.3)primary marketThe term ―primary market‖ applies to the original issuance of a credit market instrument. There are a variety of techniques for such sales, including auctions, posting of rates, direct placement, and active customer contacts by a salesperson specializing in the instrument4) secondary marketOnce a debt instrument has been issued, the purchaser may be able to resell it before maturity in a ―secondary market.‖ Again, a number of techniques are available for bringing together potential buyers and sellers of existing debt instruments. They include various types of formal exchanges, informal telephone dealer markets, and electronic trading through bids and offers on computer screens. Often, the same firms that provide primary marketing services help to create or ―make‖ secondary markets.5)RPsIn addition to making outright purchases and sales in the secondary market, entities with money to invest for a brief period can acquire a security temporarily, and holders of debt instruments can borrow short term by selling securities temporarily. These two types of transactions are repurchase agree-ments (RPs) and reverse RPs,respectively. In the wholesale market, banks and government securities dealers offer RPs at competitive rates of return by selling securities under contracts providing for their repurchase from one day to several months later6)BAs 7)CDs (reference to 13.1)8) EurodollarEurodollars are U.S. dollar deposits at banking offices in a country other than the United States.9) EurobankEurobanks—banks dealing in Eurodollar or some other nonlocal currency deposits, including foreign branches of U.S. banks— originally held deposits almost exclusively in Europe, primarily London. While most such deposits are still held in Europe, they are also held in such places as the Bahamas, Bahrain, Canada, the Cayman Islands, Hong Kong, Singapore, and Tokyo, as well as other parts of the world.10)LIBOR (reference to 13.2.2 Certificates of Deposit)London inter-bank offer rate11)mortgage-backed securities12)Eurobond market (details make reference to13.3.3 )The Eurobond market, centered in London, is an offshore market in intermediate- and long-term debt issues. It serves as a source of capital for multinational corporations and for foreign governments. It developed after the United States instituted the interest equalization tax in 1963 to stem capital outflows inspired by relatively low U.S. interest rates.2. True or False1) true 2) true 3) true3. Discussions1) Describe the characteristics of Interest Rate Swap and the role of it in thebank-related financial market.2) What risks are encountered in the swaps markets?3) Discuss one or two specific examples of derivative products and their use.4. Translations1) Markets dealing in instruments with maturities that exceed one year are often referred to as capital markets, since credit to finance investments in new capital would generally be needed for more than one year. The time division is arbitrary. A long-term project can be started with short-term credit, with additional instruments may need to be renewed before a project is completed. Debt instruments that differ in maturity share other characteristics. Hence, the term ―capital market‖ could be –and occasionally is applied to some shorter maturity transactions.2) The secondary market for Treasure securities consists of a network of dealers, brokers, and investors who effect transactions either by telephone or electronically. Telephone trades are generally between dealers and their customers. Electronics trading is arranged through screen-based systems provided by some of the dealers to their customers. It allows selected trades to take place without a conversation. When dealers trade with each other, they generally use brokers. Brokers provide information on screen, but the final trades are made bytelephone.Chapter 13Concepts of Financial Assets Value金融资产价值的概念1. Key Terms1) absolute measure of valueAn absolute measure of value is used when one must compare it to a nominal amount: purchase price, amount to invest, target sum of money to raise2) relative measure of valueA relative measure of rate of return is more convenient to use when one wishes to compare one financial asset to a set of numerous alternative assets. A rate of return is the most commonly used relative measure of value.3) discountingFuture benefits must be discounted (or converted) to their present (or today's) value, before they are summed. Discounting is part of the study of time value of money, or actuarial mathematics, and a complete treatment of it can be found in specialized textbook.4) time value of moneyTime value of money studies how amounts of money are made equivalent over time. Converting amounts today into their future equivalent consists in adding interest to principal, i.e. compounding. Converting amounts in the future into today's equivalent consists of charging an interest, i.e. discounting. Thus, discounting is the exact inverse of compounding.5) FV 6) PV 7) annuity8) short term securitiesShort term securities (i.e. securities with maturity less than one year) are sold at a discount (i.e. nominal value less the interest to be earned over the remaining number of days to maturity). There is no coupon, and no additional benefits such as conversion right, but there may be a penalty for early redemption in the case of some bank certificates of deposit.9) P/E ratio (make reference to 15.5.3 --Earnings Multiple or P/E Ratio)Another approach which is used as a short-cut by a large number of investors, is the earnings multiple. It is sometimes referred to as earningsmultiplier, and it is most commonly known as price-to-earnings or P/E ratio. In many instances, the approach, rather than being an oversimplification, can be an improvement over the previous format. In its most common presentation, the idea is that the price P of a share should be a multiple m of its earnings per share E. The multiple m is an industry average because it is assumed that all companies in an industry face similar marketing, technological and resource challenges, and thus, should have similar organizational and production patterns.10) intrinsic valueintrinsic value, or difference between market price of the underlying stock and strike price (which is also known as exercise price because it is the price at which an option holder can buy from or sell to the option writer the underlying stock through the options exchange)。

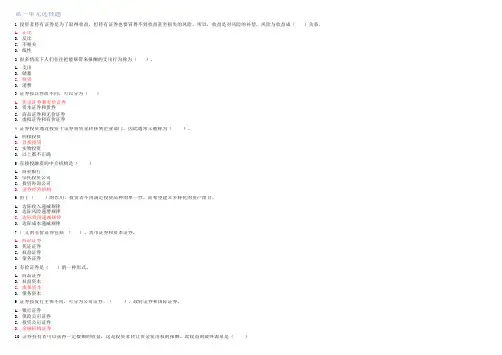

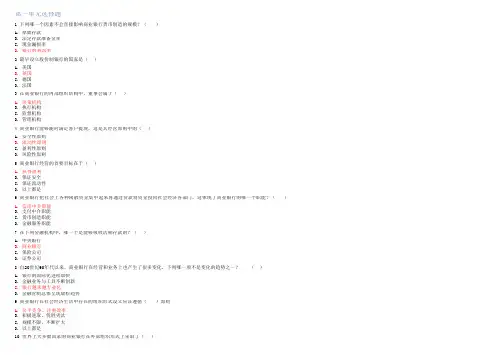

第一单元选择题1 投资者持有证券是为了取得收益,但持有证券也要冒得不到收益甚至损失的风险。

所以,收益是对风险的补偿,风险与收益成()关系。

A. 正比B. 反比C. 不相关D. 线性2 很多情况下人们往往把能够带来报酬的支出行为称为()。

A. 支出B. 储蓄C. 投资D. 消费3 证券按其性质不同,可以分为()A. 凭证证券和有价证券B. 资本证券和货券C. 商品证券和无价证券D. 虚拟证券和有价证券4 证券投资通过投资于证券将资金转移到企业部门,因此通常又被称为()。

A. 间接投资B. 直接投资C. 实物投资D. 以上都不正确5 直接投融资的中介机构是()A. 商业银行B. 信托投资公司C. 投资咨询公司D. 证券经营机构6 由于()的作用,投资者不再满足投资品种的单一性,而希望建立多样化的资产组合。

A. 边际收入递减规律B. 边际风险递增规律C. 边际效用递减规律D. 边际成本递减规律7 广义的有价证券包括()、货币证券和资本证券。

A. 商品证券B. 凭证证券C. 权益证券D. 债务证券8 有价证券是()的一种形式。

A. 商品证券B. 权益资本C. 虚拟资本D. 债务资本9 证券按发行主体不同,可分为公司证券、()、政府证券和国际证券。

A. 银行证券B. 保险公司证券C. 投资公司证券D. 金融机构证券1 0证券持有者可以获得一定数额的收益,这是投资者转让资金使用权的报酬。

此收益的最终源泉是()B. 利息或红利C. 生产经营过程中的价值增值D. 虚拟资本价值第一单元是非题1 证券的最基本特征是法律特征和书面特征。

√2 有价证券是指无票面金额,证明持券人有权按期取得一定收入并可自由转让和买卖的所有权或债权证券货币证券是指本身能使持券人或第三者取得货币索取权的有价证券。

有价证券是虚拟资本的一种形式,能给持有者带来收益。

有价证券本身没有价值,所以没有价格。

×3 √4 √5 ×6 持有有价证券可以获得一定数额的收益,这种收益只有通过转让有价证券才能获得。

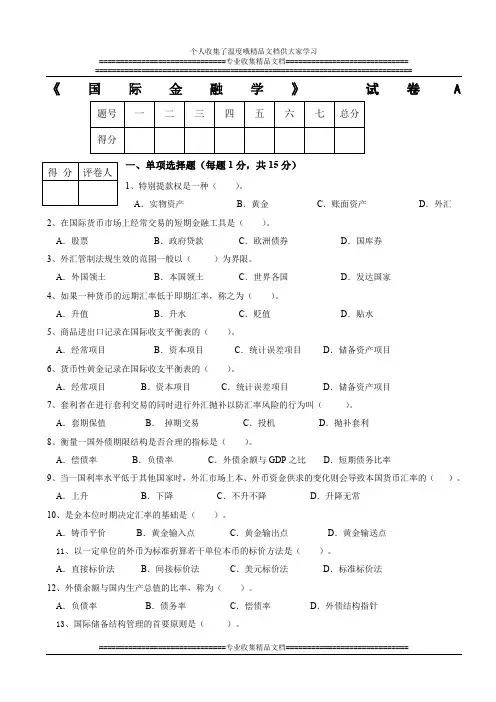

《国际金融学》试卷 A 题号一二三四五六七总分得分一、单项选择题(每题1分,共15分)得分评卷人1、特别提款权是一种()。

A.实物资产B.黄金C.账面资产D.外汇2、在国际货币市场上经常交易的短期金融工具是()。

A.股票B.政府贷款C.欧洲债券D.国库券3、外汇管制法规生效的范围一般以()为界限。

A.外国领土B.本国领土C.世界各国D.发达国家4、如果一种货币的远期汇率低于即期汇率,称之为()。

A.升值B.升水C.贬值D.贴水5、商品进出口记录在国际收支平衡表的()。

A.经常项目B.资本项目C.统计误差项目D.储备资产项目6、货币性黄金记录在国际收支平衡表的()。

A.经常项目B.资本项目C.统计误差项目D.储备资产项目7、套利者在进行套利交易的同时进行外汇抛补以防汇率风险的行为叫()。

A.套期保值B.掉期交易C.投机D.抛补套利8、衡量一国外债期限结构是否合理的指标是()。

A.偿债率B.负债率C.外债余额与GDP之比D.短期债务比率9、当一国利率水平低于其他国家时,外汇市场上本、外币资金供求的变化则会导致本国货币汇率的()。

A.上升B.下降C.不升不降D.升降无常10、是金本位时期决定汇率的基础是()。

A.铸币平价B.黄金输入点C.黄金输出点D.黄金输送点11、以一定单位的外币为标准折算若干单位本币的标价方法是()。

A.直接标价法B.间接标价法C.美元标价法D.标准标价法12、外债余额与国内生产总值的比率,称为()。

A.负债率B.债务率C.偿债率D.外债结构指针13、国际储备结构管理的首要原则是()。

A .流动性B .盈利性C .可得性D .安全性14、布雷顿森林体系的致命弱点是( )。

A .美元双挂钩B .特里芬难题C .权利与义务的不对称D .汇率波动缺乏弹性15、某日纽约的银行报出的英镑买卖价为£1=$1.6783/93,3个月远期贴水为80/70,那么3个月远期汇率为( )。

A .1.6703/23 B .1.6713/1.6723 C .1.6783/93 D .1.6863/63二、多项选择题(每题2分,共10分) 1、记入国际收支平衡表借方的交易有( )A .进口B .出口C . 资本流入D .资本流出2、下列属于直接投资的是( )。

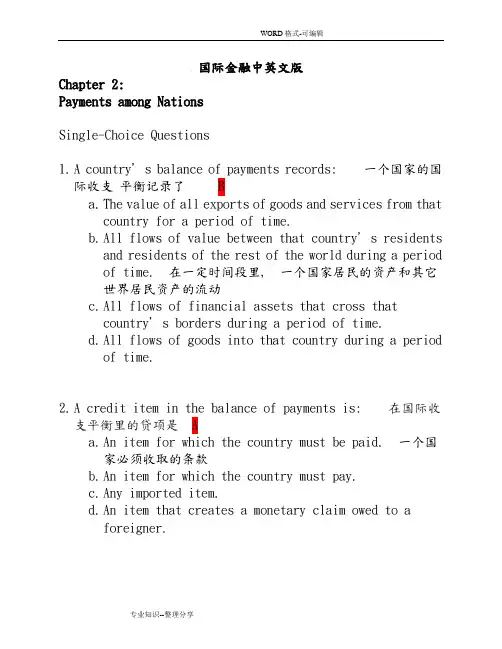

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from thatcountry for a period of time.b.All flows of value between that c ountry’s residentsand residents of the rest of the world during a periodof time. 在一定时间段里, 一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross thatcountry’s borders during a period of time.d.All flows of goods into that country during a periodof time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid. 一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to aforeigner.3.Every international exchange of value is entered into thebalance-of-payments accounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay. 一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the followingitems is always recorded as a positive entry? D 在国际收支中, 下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services.itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments:在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors andomissions.7.Which of the following capital transactions are entered asdebits in the U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba.A U.S. resident transfers $100 from his account atCredit Suisse in Basel (Switzerland) to his account ata San Francisco branch of Wells Fargo Bank.b.A French resident transfers $100 from his account atWells Fargo Bank in San Francisco to his Credit Suisseaccount in Basel. 一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c.A U.S. resident sells his IBM stock to a Frenchresident.d.A U.S. resident sells his Credit Suisse stock to aFrench resident.8.An increase in a nation's financial liabilities to foreignresidents is a: 一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.9.___A_______ are money-like assets that are held bygovernments and that are recognized by governments as fully acceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.Which of the following is considered a capital inflow?下列哪项被视为资本流入 Aa.A sale of U.S. financial assets to a foreign buyer.美国一金融资产卖给一外国买家b.A loan from a U.S. bank to a foreign borrower.c.A purchase of foreign financial assets by a U.S. buyer.d.A U.S. citizen’s repayment of a loan from a foreignbank.11.In a country’s balance of payments, which of thefollowing transactions are debits?一个国家的收支平衡表中,哪个交易属于借项? Aa.Domestic bank balances owned by foreigners aredecreased. 外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residents aredecreased.c.Assets owned by domestic residents are sold tononresidents.d.Securities are sold by domestic residents tononresidents.12.The role of ___D_______ is to direct one nation’ssavings into another nation’s investments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows 资金流13.The net value of flows of goods, services, income, andunilateral transfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.14.The net value of flows of financial assets and similarclaims (excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫 Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.The financial account in the U.S. balance of paymentsincludes: 美国国家收支表中的金融帐包括: Ba.Everything in the current account.b.U.S. government payments to other countries for the useof military bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New U.S. investments in foreign countries.16.A U.S. resident increasing her holdings of a foreignfinancial asset causes a: 一个美国居民增持一外国金融资产会引起Da.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.d.Debit in the U.S. capital account. 美国资本帐的借帐17. A foreign resident increasing her holdings of a U.S.financial asset causes a: 一个美国居民增持本国一金融资产会引起 Ca.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.美国资本帐的贷帐d.Debit in the U.S. capital account.18. A deficit in the current account: 经常帐户中的赤字 Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasingimports.19.In September, 2005, exports of goods from the U.S.decreased $3.3 billion to $73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion. Thisincreased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca.The balance of payments.b.The financial account.c.The current account. 经常帐户d.Unilateral transfers.20.Which of the following would contribute to a U.S. currentaccount surplus? 以下哪项有助于美国现金帐的盈余? Ba.The United States makes a unilateral tariff reductionon imported goods.b.The United States cuts back on American militarypersonnel stationed in Japan.美国削减在日本的军事人员c.U.S. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in theUnited States.21.Which of the following transactions is recorded in thefinancial account?以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b.A Chinese businessman imports Ford automobiles from theUnited States.c.A U.S. tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chineseto play an exhibition game in Beijing, China.22.If a British business buys U.S. government securities,how will this be entered in the balance of payments? 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是? Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increasein U.S. assets held by foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decreasein U.S. assets held by foreigners.23.In the balance of payments, the statistical discrepancyor error term is used to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum ofall credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-paymentsdeficit.d.Obtain an accurate account of a balance-of-paymentssurplus.24.Official reserve assets are: 官方储备资产是Ba.The gold holdings in the nation’s central bank.b.Money like assets that are held by governments and thatare recognized by governments as fully acceptable forpayments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可ernment T-bills and T-bonds.ernment holdings of SDR’s25.Which of the following constitutes the largest componentof the world’s international reserve assets?下列哪项构成了世界国际储备资产的大部份? Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies. 外汇(币)26.The net accumulation of foreign assets minus foreignliabilities is: 海外净资产的积累减去外债等于C official reserves. domestic investment. foreign investment. 国外投资净值 foreign deficit.27. A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and servicetrade, international income payments and receipts andinternational transfers.28.The ___C_______ measures the sum of the current accountbalance plus the private capital account balance. 官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.If the overall balance is in __A________, there is anaccumulation of official reserve assets by the country ora decrease in foreign official reserve holdings of thecountry's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.Which of the following is the current account balance NOTequal to? 以下哪项不等同于现金帐 Da.The difference between domestic product and domesticexpenditure.b.The difference between national saving and domesticinvestment. foreign investment.d.The difference between government saving andgovernment investment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows arecredits. 资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, andgifts is the current account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims isthe private current account balance. 金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets arenow foreign exchange assets, financial assets denominated in a foreign currency that is readily acceptable ininternational transactions. (T) 大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35. A country's financial account balance equals thecountry's net foreign investment.一个国家的金融帐差额相当于一个国家的净国外投资36. A country has a current account deficit if it is savingmore than it is investing domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of thecapital account balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38. A nation's international investment position shows itsstock of international assets and liabilities at a moment in time. (T) 一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39. A nation is a borrower if its current account is indeficit during a time period. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40. A nation is a debtor if its net stock of foreign assetsis positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41. A transaction leading to a foreign resident increasingher holdings of a U.S. financial asset will be recorded asa debit on the U.S. financial account. 如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay.贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often usedin official reserve transactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the differencebetween domestic product and national expenditure.(T) 经常项目余额等于国民生产与国民支出的差额45.In 2007 U.S. households, businesses and government werebuying more goods and services than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

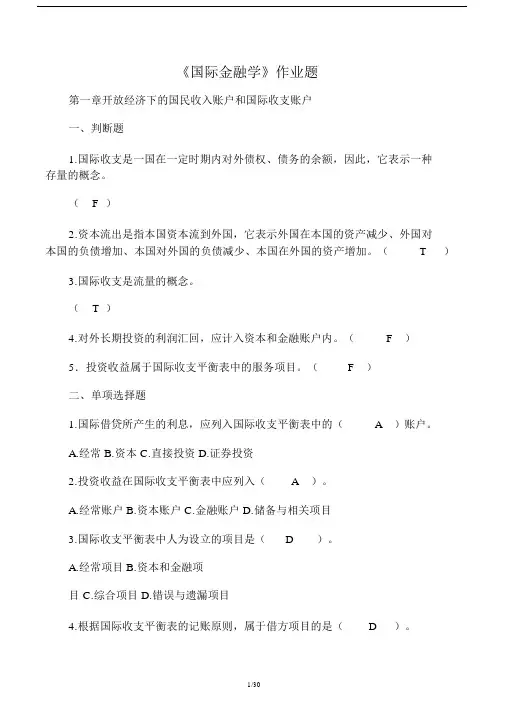

《国际金融学》作业题第一章开放经济下的国民收入账户和国际收支账户一、判断题1.国际收支是一国在一定时期内对外债权、债务的余额,因此,它表示一种存量的概念。

( F )2.资本流出是指本国资本流到外国,它表示外国在本国的资产减少、外国对本国的负债增加、本国对外国的负债减少、本国在外国的资产增加。

(T)3.国际收支是流量的概念。

(T )4.对外长期投资的利润汇回,应计入资本和金融账户内。

(F)5.投资收益属于国际收支平衡表中的服务项目。

(F)二、单项选择题1.国际借贷所产生的利息,应列入国际收支平衡表中的(A)账户。

A.经常B.资本C.直接投资D.证券投资2.投资收益在国际收支平衡表中应列入(A)。

A.经常账户B.资本账户C.金融账户D.储备与相关项目3.国际收支平衡表中人为设立的项目是(D)。

A.经常项目B.资本和金融项目 C.综合项目 D.错误与遗漏项目4.根据国际收支平衡表的记账原则,属于借方项目的是(D)。

A.出口商品B.官方储备的减少C.本国居民收到国外的单方向转移 D.本国居民偿还非居民债务。

5.根据国际收入平衡表的记账原则,属于贷方项目的是(B)。

A.进口劳务B.本国居民获得 xx 资产C.官方储备增加D.非居民偿还本国居民债务三、多项选择题1.属于我国居民的机构是(ABC)。

A.在我国建立的外商独资企业B.我国的国有企业C.我国驻外使领馆D. IMF等驻华机构2.国际收支平衡表中的经常账户包括( ABCD )子项目。

A.货物 B.服务C.收益 D.经常转移3.国际收支平衡表中的资本与金融账户包括(AB)子项目。

A.资本账户B.金融账户C.服务D.收益4.下列(AD)交易应记入国际收支平衡表的贷方。

A.出口B.进口C.本国对外国的直接投资D.本国居民收到外国侨民汇款5.下列属于直接投资的是(BCD )。

A.美国一家公司拥有一日本企业8%的股权B.青岛海尔在海外设立子公司C.天津摩托罗拉将在中国进行再投资D.麦当劳在中国开连锁店四、名词解释国内吸收、国际投资头寸、国际收支、经常账户、资本与金融账户五、论述题试根据本章的基本原理,对2010 年中国国际收支账户进行简要分析。

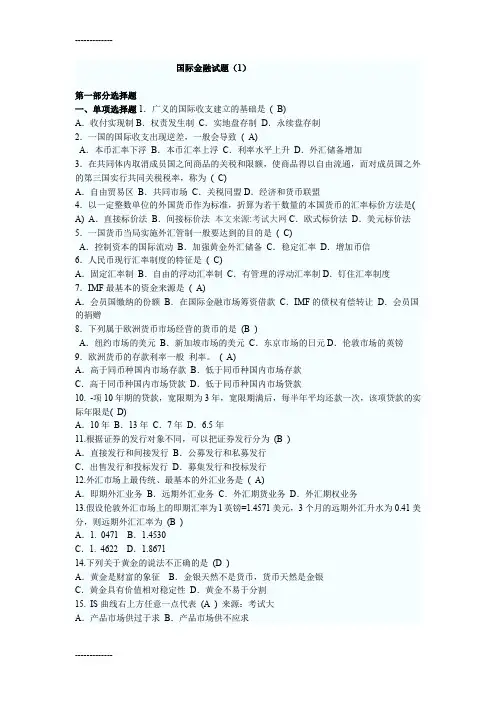

国际金融试题(1)第一部分选择题一、单项选择题1.广义的国际收支建立的基础是( B)A.收付实现制B.权责发生制C.实地盘存制D.永续盘存制2.一国的国际收支出现逆差,一般会导致( A)A.本币汇率下浮B.本币汇率上浮C.利率水平上升D.外汇储备增加3.在共同体内取消成员国之间商品的关税和限额,使商品得以自由流通,而对成员国之外的第三国实行共同关税税率,称为( C)A.自由贸易区B.共同市场C.关税同盟D.经济和货币联盟4.以一定整数单位的外国货币作为标准,折算为若干数量的本国货币的汇率标价方法是( A) A.直接标价法B.间接标价法本文来源:考试大网C.欧式标价法D.美元标价法5.一国货币当局实施外汇管制一般要达到的目的是( C)A.控制资本的国际流动B.加强黄金外汇储备C.稳定汇率D.增加币信6.人民币现行汇率制度的特征是( C)A.固定汇率制B.自由的浮动汇率制C.有管理的浮动汇率制D.钉住汇率制度7.IMF最基本的资金来源是( A)A.会员国缴纳的份额B.在国际金融市场筹资借款C.IMF的债权有偿转让D.会员国的捐赠8.下列属于欧洲货币市场经营的货币的是(B )A.纽约市场的美元B.新加坡市场的美元C.东京市场的日元D.伦敦市场的英镑9.欧洲货币的存款利率一般利率。

( A)A.高于同币种国内市场存款B.低于同币种国内市场存款C.高于同币种国内市场贷款D.低于同币种国内市场贷款10. -项10年期的贷款,宽限期为3年,宽限期满后,每半年平均还款一次,该项贷款的实际年限是( D)A.10年B.13年C.7年D.6.5年11.根据证券的发行对象不同,可以把证券发行分为(B )A.直接发行和间接发行B.公募发行和私募发行C.出售发行和投标发行D.募集发行和投标发行12.外汇市场上最传统、最基本的外汇业务是( A)A.即期外汇业务B.远期外汇业务C.外汇期货业务D.外汇期权业务13.假设伦敦外汇市场上的即期汇率为l英镑=1.4571美元,3个月的远期外汇升水为0.41美分,则远期外汇汇率为(B )A.1. 0471 B.1.4530C.1. 4622 D.1.867114.下列关于黄金的说法不正确的是(D )A.黄金是财富的象征B.金银天然不是货币,货币天然是金银C.黄金具有价值相对稳定性D.黄金不易于分割15. IS曲线右上方任意一点代表(A ) 来源:考试大A.产品市场供过于求B.产品市场供不应求C.货币市场供过于求D.货币市场供不应求16.特里芬在《黄金与美元危机》一书中指出:一国的国际储备额应同其进口额保持一定的比例关系,这个比例关系的最高限与最低限应该分别是(A )A.40%和20% B..30%和25% C.25%和30% D.20%和40%二、多项选择题17.资本与金融账户记录的项目有( ABCE)A.资本转移B.直接投资C.证券投资D.投资收入E.国际商业银行贷款18. -国货币满足以下哪些条件,即为可自由兑换货币?( ABEA.是全面可兑换货币B.在国际支付中被广泛采用C.是各个国家必持有的储备资产D.资本项目下可兑换的货币E.是世界外汇市场上的主要交易对象19.下列实行单独浮动汇率的货币是(ABDF )A.美元B.欧元C.港元D.日元E.英镑20.下列属于国际货币市场的是( ACD)A.短期信贷市场B.国际债券市场C.短期票据市场D.贴现市场E.国际股票市场21.外汇市场的交易主体有( ABCDE)A.一般工商客户B.外汇银行C.外汇经纪人D.中央银行E.个人客户三、名词解释题(本大题共3小题,每小题2分,共6分)22.期货交易: 在有形的交易所内,通过结算所的下属成员清算公司或经纪人,根据成交单位、交割时间等标准化的原则,按固定价格购买与卖出各种期货合约的一种交易。

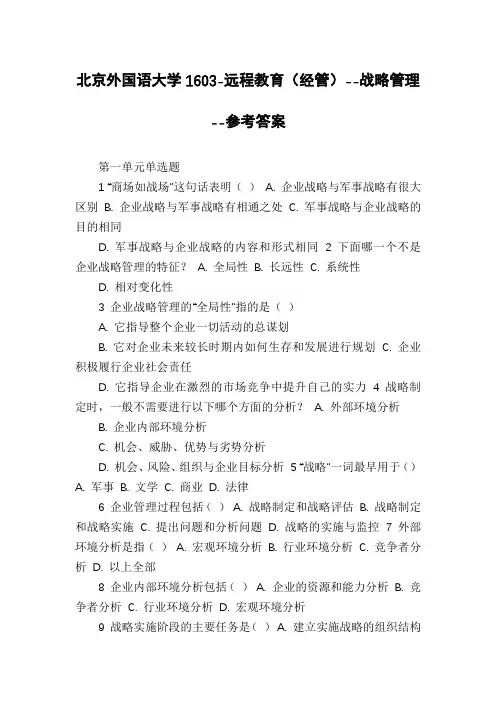

北京外国语大学1603-远程教育(经管)--战略管理--参考答案第一单元单选题1 “商场如战场”这句话表明()A. 企业战略与军事战略有很大区别B. 企业战略与军事战略有相通之处C. 军事战略与企业战略的目的相同D. 军事战略与企业战略的内容和形式相同 2 下面哪一个不是企业战略管理的特征?A. 全局性B. 长远性C. 系统性D. 相对变化性3 企业战略管理的“全局性”指的是()A. 它指导整个企业一切活动的总谋划B. 它对企业未来较长时期内如何生存和发展进行规划C. 企业积极履行企业社会责任D. 它指导企业在激烈的市场竞争中提升自己的实力 4 战略制定时,一般不需要进行以下哪个方面的分析? A. 外部环境分析B. 企业内部环境分析C. 机会、威胁、优势与劣势分析D. 机会、风险、组织与企业目标分析5 “战略”一词最早用于()A. 军事B. 文学C. 商业D. 法律6 企业管理过程包括()A. 战略制定和战略评估B. 战略制定和战略实施 C. 提出问题和分析问题 D. 战略的实施与监控7 外部环境分析是指()A. 宏观环境分析B. 行业环境分析C. 竞争者分析D. 以上全部8 企业内部环境分析包括()A. 企业的资源和能力分析B. 竞争者分析C. 行业环境分析D. 宏观环境分析9 战略实施阶段的主要任务是()A. 建立实施战略的组织结构B. 明确组织使命C. 如何贯彻执行设计的战略D. 确定企业的经营范围1 0 战略管理的基本类型包括()A. 发展型战略B. 稳定型战略C. 紧缩型战略D. 以上全部第一单元判断题1 战略的有效性不仅取决于战略的制定,而且还取决于战略的有效执行√2 明确了企业制定战略所面临的主要问题之后,就进入战略实施阶段×3 战略的制定和实施主要是企业高层管理者的责任×4 战略制定一般先由企业总部的高层管理人员制定企业的总体战略,然后各部门再根据自己的实际情况以及总部的战略要求来充实和完善这一战略。

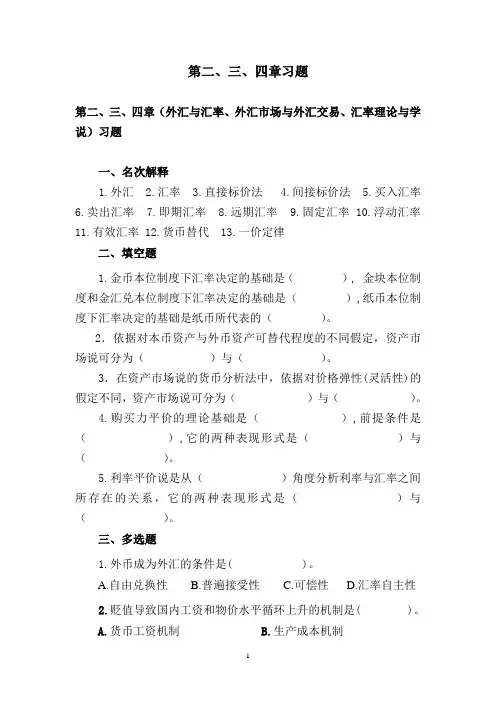

第二、三、四章习题第二、三、四章(外汇与汇率、外汇市场与外汇交易、汇率理论与学说)习题一、名次解释1.外汇2.汇率3.直接标价法4.间接标价法5.买入汇率6.卖出汇率7.即期汇率8.远期汇率9.固定汇率 10.浮动汇率11.有效汇率 12.货币替代 13.一价定律二、填空题1.金币本位制度下汇率决定的基础是(), 金块本位制度和金汇兑本位制度下汇率决定的基础是(),纸币本位制度下汇率决定的基础是纸币所代表的()。

2.依据对本币资产与外币资产可替代程度的不同假定,资产市场说可分为()与()。

3.在资产市场说的货币分析法中,依据对价格弹性(灵活性)的假定不同,资产市场说可分为()与()。

4.购买力平价的理论基础是(),前提条件是(),它的两种表现形式是()与()。

5.利率平价说是从()角度分析利率与汇率之间所存在的关系,它的两种表现形式是()与()。

三、多选题1.外币成为外汇的条件是( )。

A.自由兑换性B.普遍接受性C.可偿性D.汇率自主性2.贬值导致国内工资和物价水平循环上升的机制是( )。

A.货币工资机制B.生产成本机制C.货币供应机制D.收入机制3.货币替代和资金外逃的经济后果是( )。

A.国内金融秩序的不稳定B.削弱政府运用货币政策的能力C.破坏国内的积累基础D.限制货币的自由兑换4.贬值对经济产生紧缩性影响的效应是( )。

A.贬值税效应B.收入再分配效应C.货币资产效应D.债务效应5.如果人们预期本币在未来将贬值,那么人们就会在外汇市场上抛出本国货币,抢购外国货币,由此造成的后果是( )。

A.外币现汇价格的上涨B.本币现汇价格的下跌C.外币现汇价格的下跌D.本币现汇价格的上涨四、判断题1.直接标价法下,汇率的高低与本币币值的高低反比例变化。

()2.间接标价法下,汇率的高低与本币币值的高低正比例变化。

()3.货币学派认为,急于发展经济而过度发行货币,是导致外汇收支失衡和外汇短缺的主要原因。

You are given the following information about a country’s international transactions during a year: a.Calculate the values of the country’s goods and services balance,current account balance,and official settlements balance?a.Merchandise trade balance: $330 - 198 = $132Goods and services balance: $330 - 198 + 196 - 204 = $124Current account balance: $330 - 198 + 196 - 204 + 3 - 8 = $119Official settlements balance: $330 - 198 + 196 - 204 + 3 - 8 + 102 - 202 + 4 = $23b.What are the value of the change in official reserve assets(net)?Is the country increasing or decreasing its net holdings of official reserve assets?b.Change in official reserve assets (net) = - official settlements balance = -$23The country is increasing its net holdings of official reserve assets.What are the major types of transactions or activities that result in supply of foreign currency in the spct foreign exchange market?Exports of merchandise and services result in supply of foreign currency in the foreignexchange market. Domestic sellers often want to be paid using domestic currency, whilethe foreign buyers want to pay in their currency. In the process of paying for these exports,foreign currency is exchanged for domestic currency, creating supply of foreign currency.International capital inflows result in a supply of foreign currency in the foreign exchangemarket. In making investments in domestic financial assets, foreign investors often startwith foreign currency and must exchange it for domestic currency before they can buy thedomestic assets. The exchange creates a supply of foreign currency. Sales of foreignfinancial assets that the country's residents had previously acquired, and borrowing fromforeigners by this country's residents are other forms of capital inflow that can createsupply of foreign currency.You have access to the following three spot exchange rates:$0.01/YEN$0.20/KRONE25YEN/KRONEYou strat with dollars and want to end up with dollarsa.hoe would you engage in arbitrage to profit from these three rates?what is the profit for each dollar used initially?a.The cross rate between the yen and the krone is too high (the yen value of the krone is toohigh) relative to the dollar-foreign currency exchange rates. Thus, in a profitabletriangular arbitrage, you want to sell kroner at the high cross rate. The arbitrage will be:Use dollars to buy kroner at $0.20/krone, use these kroner to buy yen at 25 yen/krone, anduse the yen to buy dollars at $0.01/yen. For each dollar that you sell initially, you canobtain 5 kroner, these 5 kroner can obtain 125 yen, and the 125 yen can obtain $1.25. Thearbitrage profit for each dollar is therefore 25 cents.b.As a result of this arbitrage,what is the pressure on the cross-rate between yen and krone?what must the value of the cross-rate be to eliminate the opportunity for triangular arbitrage?b.Selling kroner to buy yen puts downward pressure on the cross rate (the yen price ofkrone). The value of the cross rate must fall to 20 (=0.20/0.01) yen/krone to eliminate theopportunity for triangular arbitrage, assuming that the dollar exchange rates areunchanged.Explain the nature of the exchange rate risk for each of the following,from the perspective of the U.S frim or person.in your answer,include whether each is a long or short position in foreign currency.a.a small U.S firm sold experimental computer computer compoments to a Japanese firm,and it will receive payment of 1 million yen in 60 days.a.The U.S. firm has an asset position in yen—it has a long position in yen. To hedge itsexposure to exchange rate risk, the firm should enter into a forward exchange contractnow in which the firm commits to sell yen and receive dollars at the current forward rate.The contract amounts are to sell 1 million yen and receive $9,000, both in 60 days.The current spot exchange rate is $1.20/euro.the current 90-day forward exchange rate is$1.18/euro.you expect the spot rate to be $1.22/euro in 90 days.how would you speculate using a forward contract?if many people speculate in this way,what pressure is placed on the walue of the current forward exchange rate?Relative to your expected spot value of the euro in 90 days ($1.22/euro), the currentforward rate of the euro ($1.18/euro) is low—the forward value of the euro is relativelylow. Using the principle of "buy low, sell high," you can speculate by entering into aforward contract now to buy euros at $1.18/euro. If you are correct in your expectation,then in 90 days you will be able to immediately resell those euros for $1.22/euro,pocketing a profit of $0.04 for each euro that you bought forward. If many peoplespeculate in this way, then massive purchases now of euros forward (increasing thedemand for euros forward) will tend to drive up the forward value of the euro, toward acurrent forward rate of $1.22/euro.The following rates are available in the markets:Current spot exchange rate:$0.500/SFrCurrent 30-day forward exchange rate:$0.505/SFrAnnualized interest rate on 30-day dollar-denominated bonds:12%(1.0% for 30 days)Annualized interest rate on 30-day Swiss franc-denominated bonds:6%(0.5% for 30 days)a.Is the swiss franc at a forward premium or discount?a.The Swiss franc is at a forward premium. Its current forward value ($0.505/SFr) is greaterthan its current spot value ($0.500/SFr).b.should a U.S-based investor make a covered investment in swiss franc-denominated 30-day bonds,rather than investing 30-day dollar-denominated bonds?Explain.b.The covered interest differential "in favor of Switzerland" is ((1 + 0.005) (0.505) / 0.500)- (1 + 0.01) = 0.005. (Note that the interest rate used must match the time period of theinvestment.) There is a covered interest differential of 0.5% for 30 days (6 percent at anannual rate). The U.S. investor can make a higher return, covered against exchange raterisk, by investing in SFr-denominated bonds, so presumably the investor should make thiscovered investment. Although the interest rate on SFr-denominated bonds is lower thanthe interest rate on dollar-denominated bonds, the forward premium on the franc is largerthan this difference, so that the covered investment is a good idea.c.Because of covered interest arbitrage,what pressures are placed on the various rates?if the only rate that actually changes is forward exchange rate,to what value will it bu driven?c.The lack of demand for dollar-denominated bonds (or the supply of these bonds asinvestors sell them in order to shift into SFr-denominated bonds) puts downward pressureon the prices of U.S. bonds—upward pressure on U.S. interest rates. The extra demandfor the franc in the spot exchange market (as investors buy SFr in order to buySFr-denominated bonds) puts upward pressure on the spot exchange rate. The extrademand for SFr-denominated bonds puts upward pressure on the prices of Swissbonds—downward pressure on Swiss interest rates. The extra supply of francs in theforward market (as U.S. investors cover their SFr investments back into dollars) putsdownward pressure on the forward exchange rate. If the only rate that changes is theforward exchange rate, this rate must fall to about $0.5025/SFr. With this forward rate andthe other initial rates, the covered interest differential is close to zero.Why is testing whether uncovered interest parity holds for actual rates more difficult than testing whether covered interest parity holds?In testing covered interest parity, all of the interest rates and exchange rates that areneeded to calculate the covered interest differential are rates that can observed in the bondand foreign exchange markets. Determining whether the covered interest differential isabout zero (covered interest parity) is then straightforward (although some more subtleissues regarding timing of transactions may also need to be addressed). In order to testuncovered interest parity, we need to know not only three rates—two interest rates and thecurrent spot exchange rate—that can be observed in the market, but also one rate—theexpected future spot exchange rate—that is not observed in any market. The tester thenneeds a way to find out about investors' expectations. One way is to ask them, using asurvey, but they may not say exactly what they really think. Another way is to examinethe actual uncovered interest differential after we know what the future spot exchange rateactually turns out to be, and see whether the statistical characteristics of the actualuncovered differential are consistent with an expected uncovered differential of aboutzero (uncovered interest parity)the following rates currently exist:spot exchange rate:$1.000/euro.Annual interest rate on 180-day euro-denominated bonds:3%Annual interest rate on 180-day U.S dollar-denominated bonds:4%Ibvestors currently expect the spot exchange rate to be about$1.005/euro in180 days.a.show that uncovered interest parity holds(approximately)at these ratesa.The euro is expected to appreciate at an annual rate of approximately ((1.005 -1.000)/1.000)⊕(360/180)⊕100 = 1%. The expected uncovered interest differential isapproximately 3% + 1% - 4% = 0, so uncovered interest parity holds (approximately).What is likely to be the effect on the spot eschange rate if the interest rate on 180-day dollar-denominated bonds declines to 3%? If the euro interest rate and the expected future spot rate are unchanged,and if uncovered interest parity is reestablished,what will the new current spot exchange rate be?has the dollar appreciated or depreciated?b.If the interest rate on 180-day dollar-denominated bonds declines to 3%, then the spotexchange rate is likely to increase—the euro will appreciate, the dollar depreciate. At theinitial current spot exchange rate, the initial expected future spot exchange rate, and theinitial euro interest rate, the expected uncovered interest differential shifts in favor ofinvesting in euro-denominated bonds (the expected uncovered differential is now positive,3% + 1% - 3% = 1%, favoring uncovered investment in euro-denominated bonds. Theincreased demand for euros in the spot exchange market tends to appreciate the euro. Ifthe euro interest rate and the expected future spot exchange rate remain unchanged, thenthe current spot rate must change immediately to be $1.005/euro, to reestablish uncoveredinterest parity. When the current spot rate jumps to this value, the euro's exchange ratevalue is not expected to change in value subsequently during the next 180 days. Thedollar has depreciated immediately, and the uncovered differential then again is zero (3%+ 0% - 3% = 0)You observe the following current rates:Spot exchange rate:$0.01/yenAnnual interest rate on 90-day U.S dollar-denominated bonds:4%Annual interest rate on 90-day yen-denominated bonds:4%a.if uncovered interest parity holds,what spot exchange rate do investors expect to exist in 90 days?a.For uncovered interest parity to hold, investors must expect that the rate of change in thespot exchange-rate value of the yen equals the interest rate differential, which is zero.Investors must expect that the future spot value is the same as the current spot value,$0.01/yen.b.a close U.S presidential has just been decided.the candidate whom international investors view as the stronger and more probusiness person won.because of this,investors expect the exchange rate to be$0.0095/yen in 90 days.what will happen in the foreign exchange market?b.If investors expect that the exchange rate will be $0.0095/yen, then they expect the yen todepreciate from its initial spot value during the next 90 days. Given the other rates,investors tend to shift their investments toward dollar-denominated investments. Theextra supply of yen (and demand for dollars) in the spot exchange market results in adecrease in the current spot value of the yen (the dollar appreciates). The shift toexpecting that the yen will depreciate (the dollar appreciate) sometime during the next 90days tends to cause the yen to depreciate (the dollar to appreciate) immediately in thecurrent spot market.To aid in its efforts to get reelected,the current government of o country decides to increase the growth rate of the domestic money supply by two percentage points.the increased growth rate becomes”permanene”because once started it is difficult to reverse.a.according to the monetary approach,how will this affect the long-run trend for the exchange rate value of the country’s currency?a.Because the growth rate of the domestic money supply (M s ) is two percentage pointshigher than it was previously, the monetary approach indicates that the exchange ratevalue (e) of the foreign currency will be higher than it otherwise would be—that is, theexchange rate value of the country's currency will be lower. Specifically, the foreigncurrency will appreciate by two percentage points more per year, or depreciate by twopercentage points less. That is, the domestic currency will depreciate by two percentagepoints more per year, or appreciate by two percentage points less.b.explain why the nominal exchange rate trend is affected,referring to PPPb.The faster growth of the country's money supply eventually leads to a faster rate ofinflation of the domestic price level (P). Specifically, the inflation rate will be twopercentage points higher than it otherwise would be. According to relative PPP, a fasterrate of increase in the domestic price level (P) leads to a higher rate of appreciation of theforeign currency.A country has a marginal propensity to save of 0.15 and a marginal propensity to import of 0.4 real domestic spending now decreases by$2 billiona.according to the spending multiplier(for a small open economy),,by how much will domestic product and income change?a.The spending multiplier in this small open economy is about 1.82 (= 1/(0.15 + 0.4)). Ifreal spending initially declines by $2 billion, then domestic product and income willdecline by about $3.64 billion (= 1.82⋅$2 billion)b.what is the change in the country’s imports?b. If domestic product and income decline by $3.64 billion, then the country's imports willdecline by about $1.46 billion (= $3.64 billion⋅0.4).c.if this country is large,what effect will this have on foreign product and income?explainc. The decrease in this country's imports reduces other countries' exports, so foreign productand income decline.d.will the change in foreign product and income tend to counteract or reinforce the change in the first country’s domestic product and income?explaind. The decline in foreign product and income reduce foreign imports, so the first country'sexports decrease. This reinforces the change (decline) in the first country's domesticproduct and income—an example of foreign-income repercussions.。

第一单元选择题1 下列哪一个因素不会直接影响商业银行货币创造的规模?()A. 原始存款B. 法定存款准备金率C. 现金漏损率D. 银行的利润率2 最早设立股份制银行的国家是()A. 美国B. 英国C. 德国D. 法国3 在商业银行的内部组织结构中,董事会属于()A. 决策机构B. 执行机构C. 监督机构D. 管理机构4 商业银行能够随时满足客户提现,这是其经营原则中的()A. 安全性原则B. 流动性原则C. 盈利性原则D. 风险性原则5 商业银行经营的首要目标在于()A. 获得盈利B. 保证安全C. 保证流动性D. 以上都是6 商业银行把社会上各种闲散资金集中起来再通过贷款将资金投向社会经济各部门,这体现了商业银行的哪一个职能?()A. 信用中介职能B. 支付中介职能C. 货币创造职能D. 金融服务职能7 在下列金融机构中,哪一个是能够吸收活期存款的?()A. 中央银行B. 商业银行C. 保险公司D. 证券公司8 自20世纪90年代以来,商业银行在经营和业务上也产生了很多变化,下列哪一项不是变化的趋势之一?()A. 银行的国际化进程加快B. 金融业务与工具不断创新C. 银行越来越专业化D. 金融管制总体呈现放松趋势9 商业银行在社会经济生活中存在的组织形式设立应该遵循()原则A. 公平竞争、注重效率B. 积极进取、优胜劣汰C. 规模不限、不断扩大D. 以上都是1 0世界上大多数国家的商业银行在外部组织形式上采取了()A. 单一银行制B. 多元银行制C. 总分行制D. 全能银行制第一单元是非题1 商业银行的行政首脑是总经理(行长),是商业银行决策机构的构成部分。

商业银行通过支付中介职能可以称为工商企业、社会团体和个人的货币保管者、出纳者和支付代理人。

在各类金融机构中,商业银行的历史最为悠久×2 √3 √4 现代商业银行都是根据资本主义经济发展、按照资本主义原则,以股份公司形式组建而成的。

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

国际金融习题答案全 The pony was revised in January 2021第一章三、名词解释1、国际收支:在一定时期内,一国居民与非居民之间经济交易的系统记录。

2、国际收支平衡表:一国将其一定时期内的全部国际经济交易,根据交易的内容与范围,按照经济分析的需要设置账户或项目编制出来的统计报表。

3、居民是指一个国家的经济领土内具有经济利益的经济单位。

在国际收支统计中判断一项交易是否应当包括在国际收支的范围内,所依据的不是交易双方的国籍,而是依据交易双方是否有一方是该国居民。

4、一国的经济领土:一般包括一个政府所管辖的地理领土,还包括该国天空、水域和邻近水域下的大陆架,以及该国在世界其他地方的飞地。

依照这一标准,一国的大使馆等驻外机构是所在国的非居民,而国际组织是任何国家的非居民。

5、经常账户:是指对实际资源在国际间的流动行为进行记录的账户,它包括以下项目:货物、服务、收入和经常转移。

反映进口实际资源的记人经常项目借方;反映出口实际资源的记人经常项目贷方。

6、经常转移包括各级政府的转移(如政府间经常性的国际合作、对收入和财政支付的经常性税收等)和其他转移(如工人汇款)。

当一个经济体的居民实体向另一个非居民实体无偿提供了实际资源或金融产品时,按照复式记账法原理,需要在另一方进行抵消性记录以达到平衡,也就是需要建立转移账户作为平衡项目。

7、贸易收支:又称有形贸易收支,是国际收支中的一个项目,指由商品输出入所引起的收支。

出口记为贷方,进口记为借方。

IMF规定,在国际收支的统计工作中,进出口商品都以离岸价格(FOB)计算。

若进口商品以到岸价格(CIF)计算时,应把货价中的运费、保险费等贸易的从属费用减除,然后列入劳务收支项目中。

8、服务交易:是经常账户的第二个大项目,它包括运输、旅游以及在国际贸易中的地位越来越重要的其他项目,如通讯、金融、计算机服务、专有权征用和特许以及其他商业服务。

将服务交易同收入交易明确区分开来是《国际收支手册》第五版的重要特征。

【北语】21春《国际金融》作业1试卷总分:100 得分:100一、单选题 (共 20 道试题,共 100 分)1.福费廷与一般贴现的区别中错误的是:[A.]贴现票据遭拒付时银行可行使出票人行使追索权而福费廷不可以[B.]贴现的票据可以是国内和国际贸易中的票据,福费廷多为与进出口设备相联系的有关票据[C.]贴现不需银行担保,福费廷也不需要[D.]贴现的办理手续较简单而福费廷较复杂[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:C2.某公司因业务需要,在瑞士法郎和美元之间做掉期买卖。

该公司卖出即期瑞士法郎,买进();买回远期瑞士法郎,卖出()。

[A.]远期美元,即期美元[B.]即期美元,远期美元[C.]即期美元,即期美元[D.]远期美元,远期美元[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:B3.商业银行等金融机构之间相互买卖外汇,应用的是:[A.]金融汇率[B.]中间汇率[C.]电汇汇率[D.]信汇汇率[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:B4.择期外汇业务的购买者在()有权要求银行按购买汇实行交割。

[A.]合约到期日当天[B.]合约有效期内任何一天[C.]合约到期日以后[D.]以上均不对[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:B5.政府利用公开市场业务调节国际收支逆差所需的条件是:[A.]政府有充足的外汇储备[B.]国内物价稳定,不存在通货膨胀现象[C.]政府有较强的宏观调控能力[D.]该国实行的是自由市场经济[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:A6.增加外汇储备的途径有()。

[A.]中央银行抛售本币收购其他储备货币[B.]中央银行对外借款[C.]国际收支顺差[D.]A+B+C[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:D7.金本位制下,汇率的波动的原因是:[A.]各国政策因素[B.]不同国家货币成色不同[C.]外汇市场供求[D.]金价波动[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:C8.以下是有关国民收入的迅速增长引发国际收支逆差的途径的描述,不正确的是:[A.]国民收入的增加,使得本国居民对外国商品的需求增加,使得进口快速增长[B.]国民收入的增加,使得本国居民的非贸易支出大幅度增长[C.]国民收入的增加,对外国的投资支出也会相应增大[D.]国民收入的增加,会吸引外国资本的流入[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:D9.哪项为布雷顿森林体系崩溃的本质原因?[A.]特里芬难题的存在[B.]发达国家国际收支极端不平衡[C.]发达国家通货膨胀程度差异[D.]国际协调能力有限[解析提示]本题请参考课本相关知识,并完成课程作业本题参考选项是:A10.我国外债管理实行"分工负责"的原则,其中,负责世界银行贷款的部门是____。

北外1603-远程教育--服务贸易与技术贸易(经管专升本选修)--参考答案教材第⼀单元单选题1 下列哪项不属于国际技术贸易的⽅式:( )A. 甲国某公司许可中国某企业使⽤其专利B. ⼴州某公司从丹麦进⼝⼀套环保塑料⽣产设备C. KFC在青岛⼜开⼀家加盟店D. 中国中铁委托某国际知名公司提供京沪⾼速磁悬浮铁路的可⾏性报告2 有关技术特点的论述正确的是( )A. 技术不属于知识范畴,但它是⽤于⽣产或有助于⽣产活动的知识B. 技术是不可转移的C. 技术是商品D. 技术不是⽣产⼒,但技术是间接的⽣产⼒3 技术贸易的⽅式不包括()A. 许可贸易B. 设备进⼝C. 特许经营D. 技术服务和咨询4 许可⽅和被许可⽅,这种提法多适⽤于( )A. 专有技术转让合同B. 技术与咨询服务及相关合同C. 权利的转让D. ⼯业产权技术的许可合同5 《巴黎公约》的全称是()A. 《保护财产权巴黎公约》B. 《保护⼯业产权巴黎公约》《保护财产权巴黎公约》《保护⼯业产权巴黎公约》C. 《保护著作权巴黎公约》D. 《保护版权巴黎公约》6 技术按照所有权状况可以分为:公有技术和()A. 硬件技术B. 软件技术C. 私有技术D. ⼯业产权技术7 国际技术贸易和国际商品贸易的不同点不包括()A. 交易标的不同B. 所有权转移不同C. 政府⼲预程度不同D. 交货条件不同8 国际技术贸易是指()A. ⽆偿的技术援助B. 有偿的技术转让C. 国家间的技术交流D. 专题研讨会的合作交流9 关于国际技术贸易的特点,下列陈述正确的是( )A. 其标的⼀般是⽆形的技术知识和经验的所有权B. 通常受让⽅取得的是技术知识的所有权C. 国际技术贸易⼀般期限较长,且交易过程复杂1 0 下列关于技术转让的叙述正确的是()A. 是技术地理位置的变化B. 是⼈为有意识的变化C. 可分为有偿和⽆偿两种⽅式D. 也可称为技术贸易第⼀单元判断题1 国际技术贸易的划分标准是以当事⼈的国籍来划分的×2 国内技术贸易与国际技术贸易的法律适⽤不同√3 ⼯业产权技术和⾮⼯业产权技术是按照技术的法律状态来划分的国际商品贸易的当事⼈之间的关系与国际技术贸易相同√4 ×5 KFC 是⾃由连锁经营×6 国内技术贸易,是指⼀个国境内的不同当事⼈之间按⼀般商业条件进⾏的技术转让或技术使⽤权许可⾏为许可贸易是国际技术贸易中最常见的贸易类型√7 √8 国际技术贸易领域适⽤的专门的国际公约就是联合国贸发会拟订的《国际技术转让⾏动守则》在国际技术贸易领域存在的国际惯例就是在国际技术合同中存在限制性商业条款×9 √1 0 国内法是⽬前国际技术贸易领域的主要法律渊源√第⼆单元单选题1 我国专利法所称发明是指对产品、⽅法或者改进所提出的新的技术⽅案,包括产品发明和()A. 管理模式发明B. 技术发明C. ⽅法发明D. 外观设计发明2 我国《专利法》规定,专利权的有效期为() A. 15年B. 20年C. 7年D. 10年3 知识产权的类型不包括()A. 传统⽂化B. 专有技术C. 商标D. 地理标志4 专有技术在什么条件下可以转变为专利技术?( )A. 不可能转变B. 由秘密变为公开时C. 在符合专利法条件下提出专利申请D. 符合《发展中国家保护发明⽰范法》5 下列不属于国际技术贸易客体的是( )A. 专利权B. 商标权C. 著作权D. 专有技术6 实⽤新型专利的保护对象是( )A. ⽅法发明B. 技术和产品的功能C. 没有固定形状的产品D. 有固定形状的产品技术性外表7 下列不属于技术贸易对象的是()A. ⽤于⽣产领域内的发明B. 外观设计C. 科学发现D. 商标8 下列哪项属于保护专有技术的法律依据( )A. 《商标法》B. 《计算机软件保护条例》C. 《反不正当竞争法》D. 《版权法》9 按照我国《商标法》的规定,下列能作为商标使⽤的是( )A. 图形B. 国徽C. 红⼗字标志D. 中国⼈民共和国字样1 0“海尔”是()商标A. 商品商标B. 服务商标C. 销售商标D. 防御商标第⼆单元判断题1 知识产权是指法律所赋予的权利⼈对其创造性的智⼒成果所享有的专有权利√2 中国建设银⾏股份公司是商品商标×√4 地理标志是知识产权的⼀个新客体新颖性是考察专利的授权的唯⼀条件商标是其所有者的重要⽆形财产我国的商标注册采⽤使⽤在先的原则计算机软件具有⽂字作品的性质集成电路的布图设计的保护期为15年√5 ×6 √7 √8 √9 ×1 0 国际技术贸易是知识产权价值体现的重要形式之⼀√第三单元单选题1 在技术贸易合同中,与合同正⽂具有相同的法律地位的是( )A. 合同尾部B. 鉴于条款C. 合同附件D. 合同序⽂2 如合同中规定:“本合同适⽤于德国法。

国际⾦融习题答案(全)第⼀章三、名词解释1、国际收⽀:在⼀定时期内,⼀国居民与⾮居民之间经济交易的系统记录。

2、国际收⽀平衡表:⼀国将其⼀定时期内的全部国际经济交易,根据交易的内容与范围,按照经济分析的需要设置账户或项⽬编制出来的统计报表。

3、居民是指⼀个国家的经济领⼟内具有经济利益的经济单位。

在国际收⽀统计中判断⼀项交易是否应当包括在国际收⽀的范围内,所依据的不是交易双⽅的国籍,⽽是依据交易双⽅是否有⼀⽅是该国居民。

4、⼀国的经济领⼟:⼀般包括⼀个政府所管辖的地理领⼟,还包括该国天空、⽔域和邻近⽔域下的⼤陆架,以及该国在世界其他地⽅的飞地。

依照这⼀标准,⼀国的⼤使馆等驻外机构是所在国的⾮居民,⽽国际组织是任何国家的⾮居民。

5、经常账户:是指对实际资源在国际间的流动⾏为进⾏记录的账户,它包括以下项⽬:货物、服务、收⼊和经常转移。

反映进⼝实际资源的记⼈经常项⽬借⽅;反映出⼝实际资源的记⼈经常项⽬贷⽅。

6、经常转移包括各级政府的转移(如政府间经常性的国际合作、对收⼊和财政⽀付的经常性税收等)和其他转移(如⼯⼈汇款)。

当⼀个经济体的居民实体向另⼀个⾮居民实体⽆偿提供了实际资源或⾦融产品时,按照复式记账法原理,需要在另⼀⽅进⾏抵消性记录以达到平衡,也就是需要建⽴转移账户作为平衡项⽬。

7、贸易收⽀:⼜称有形贸易收⽀,是国际收⽀中的⼀个项⽬,指由商品输出⼊所引起的收⽀。

出⼝记为贷⽅,进⼝记为借⽅。

IMF规定,在国际收⽀的统计⼯作中,进出⼝商品都以离岸价格(FOB)计算。

若进⼝商品以到岸价格(CIF)计算时,应把货价中的运费、保险费等贸易的从属费⽤减除,然后列⼊劳务收⽀项⽬中。

8、服务交易:是经常账户的第⼆个⼤项⽬,它包括运输、旅游以及在国际贸易中的地位越来越重要的其他项⽬,如通讯、⾦融、计算机服务、专有权征⽤和特许以及其他商业服务。

将服务交易同收⼊交易明确区分开来是《国际收⽀⼿册》第五版的重要特征。

9、收⼊交易:包括居民和⾮居民之间的两⼤类交易:①⽀付给⾮居民⼯⼈(例如季节性的短期⼯⼈)的职⼯报酬;②投资收⼊项下有关对外⾦融资产和负债的收⼊和⽀出。

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from that countryfor a period of time.b.All flows of value between that country's residents and residentsof the rest of the world during a period of time.在一定时间段里,一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country’s bordersduring a period of time.d.All flows of goods into that country during a period of time。

2.A credit item in the balance of payments is:在国际收支平衡里的贷项是 Aa.An item for which the country must be paid.一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to a foreigner。

3.Every international exchange of value is entered into thebalance-of-payments accounts __________ time(s)。

第一单元单选题1 在国际收支失衡后一国可以采取一些政策措施来加以调节,以下哪一项不属于货币政策的调节方式。

A. 调整出口退税政策B. 改变准备金比率C. 调整再贴现率D. 进行公开市场操作2 国际收支的弹性理论分析中提出的马歇尔-勒纳条件是货币贬值改善贸易收支的必要条件,是指下列哪一组弹性之和大于1?A. 出口商品的供给弹性和进口商品的供给弹性B. 出口商品的需求弹性和进口商品的需求弹性C. 出口商品的需求弹性和进口商品的供给弹性D. 出口商品的供给弹性和进口商品的需求弹性3 根据“蒙代尔分配法则”,在国内经济出现通货膨胀、国际收支出现顺差时,应该采取的政策组合是A. 扩张性的货币政策和紧缩性的财政政策B. 紧缩性的货币政策和紧缩性的财政政策C. 扩张性的货币政策和扩张性的财政政策D. 紧缩性的货币政策和扩张性的财政政策4 判断一项交易是否应列入国际收支的依据指A. 交易双方的国籍B. 交易的币种C. 交易发生地D. 交易双方的居住地5 国际收支平衡表中的一个人为设立的项目是A. 经常项目B. 资本项目C. 净错误与遗漏D. 金融项目6 下面哪一项交易最有可能是调节性交易A. 日本一家公司从中国进口1000万日元的玩具B. 美国的高利率吸引了很多国家的资本流入C. 旅居英国的李小姐每年向留在中国的双亲汇去一笔赡养费D. 随着中国贸易顺差的不断增长,我国货币当局大幅度增加外汇储备7 在国际收支平衡表的金融项目中,通常最具稳定性的是A. 直接投资B. 证券投资C. 其他投资D. 以上都不是8 由于国民收入的增减变化而引起的国际收支不平衡被称为A. 周期性不平衡B. 收入性不平衡C. 结构性不平衡D. 货币性不平衡9 针对不同国家在相同时期内的国际收支平衡表进行分析,是国际收支平衡表的哪种分析方法A. 静态分析法B. 动态分析法C. 比较分析法D. 差额分析法1 0 国际收支顺差可能会带来的潜在不利后果是A. 外汇储备增加B. 本币坚挺,经济环境稳定C. 本国货币供应量增加,通货膨胀压力增大D. 贸易伙伴更加友好第一单元是非题1 国际收支是一个存量的概念。

×2 国际收支平衡表的记账规则是复试记账法,即有借必有贷,借贷必相等。

√3 在一国的国际收支统计中,如果商品进口大于商品出口,则其贸易差额为顺差。

×4 线上项目总差额为负数,则表示该国在这段时期内国际收支是逆差,官方储备就会增加。

国际投资头寸表是反映特定时点上一个国家或地区对世界其他国家或地区的金融资产和负债存量的统计报表。

经济结构和经济增长变化所引起的国际收支不平衡往往被称为暂时性不平衡,货币因素和偶发事件引起的国际收支不平衡往往被称为持久性不平衡。

英国经济学家大卫-休谟提出的物价现金流动机制理论是金本位制下国际收支的自动调节理论。

一个国家政府的政策目标有很多个,内部平衡目标包括经济增长和物价稳定,外部平衡目标包括充分就业和国际收支平衡。

新中国成立后,我国也一直编制国际收支平衡表。

×5 √6 ×7 √8 ×9 ×1 0 经常项目差额是判断一个国家国际收支地位的重要指标。

√第二单元单选题1 国际储备的主要功能不包括下列哪一点?A. 弥补国际收支赤字B. 维持本国汇率稳定C. 政府采购外国商品D. 提供对外信用保证2 目前,世界各国的国际储备中,最重要的组成部分是A. 黄金储备B. 外汇储备C. 在国际货币基金组织(IMF )的储备头寸D. 特别提款权3 普通提款权是指国际储备中的A. 黄金储备B. 外汇储备C. 特别提款权D. 在国际货币基金组织的储备头寸4 以下哪一项不属于借入性储备?A. 特别提款权B. 备用信贷C. 借款总安排D. 互惠信贷协议5A. 经常项目收支顺差B. 资本项目收支顺差C. 长期资本项目收支顺差D. 短期资本项目收支顺差6 美国耶鲁大学教授特里芬在《黄金与美元危机》一书中指出:一国的国际储备额应同其年进口额保持一定的比例关系;对大多数国家来说,比较合理的储备额占年进口额的比重应该是A. 20%~30%B. 30%~40%C. 40%~50%D. 50%~60%7 第二次世界大战后,世界上最重要的储备货币是A. 美元B. 日元C. 欧元D. 英镑8 国际储备结构管理的基本原则——三性原则是指A. 安全性、固定性、保值性B. 安全性、固定性、收益性C. 流动性、安全性、收益性D. 流动性、保值性、增值性9 自改革开放以来,我国外汇储备数量的增长既迅猛又曲折,下列哪一个阶段是外汇储备的迅速巨额增长阶段?A. 1981-1993年间B. 1994-2000年间C. 2001-2007年间D. 以上所有时期1 0近年来我国外汇储备迅速增加带来了流动性过剩,中国人民银行除了利用传统的货币政策工具应对之外,还进行了创新性操作A. 公开市场操作B. 发行央行票据C. 提高准备金率D. 收缩再贷款和再贴现第二单元是非题1 一国国际储备的供给可以来自于特别提款权、黄金储备和外汇储备。

×2 持有国际储备有机会成本,因此不是越多越好。

√3 影响储备货币外汇资产收益率的主要因素是汇率和利息率。

√4 目前,我国的外汇储备是由国家外汇库存和中国银行外汇结存两部分构成。

×5 中央汇金投资公司和中国投资公司都是我国在外汇储备管理上的探索和拓展。

√6 近年来由于频频发生美元的信用危机,目前它已经不是世界上最主要的储备货币了。

若一国的对外贸易条件良好,其出口产品具有较强的国际市场竞争力,则该国对国际储备的需求相对较少。

黄金储备是一国国际储备中的重要组成部分,可以直接用它进行对外支付。

×7 √8 ×9 特别提款权作为一种国际储备资产,其价值是由包括美元、欧元、日元和英镑的一篮子货币为基础来确定的。

√1 0 “国际清偿能力”与“国际储备”是同一个概念的不同称呼方法。

×第三单元单选题1 金本位制度包括不同的形式,以下哪一种形式不在其中A. 金币本位制B. 金条本位制C. 金块本位制D. 金汇兑本位制2 在纸币制度下,长期来看,影响一国货币对外比价的基本因素是A. 一国的财政经济状况B. 一国的国际收支状况C. 一国的利率水平D. 重大的国际政治因素3 一国货币对外升值通常会对其进出口贸易产生何种影响A. 出口增加,进口减少B. 出口减少,进口增加C. 出口增加,进口增加D. 出口减少,进口减少4 以两国物价水平为基础形成汇率属于哪一个汇率理论A. 国际借贷理论B. 利率平价理论C. 购买力平价理论D. 换汇成本理论5 根据利率平价理论,利率差会带来远期汇率的如下变化A. 高利率国家的货币远期汇率会下跌,低利率国家的货币远期汇率会上升B. 高利率国家的货币远期汇率会上升,低利率国家的货币远期汇率会下跌C. 高利率国家的货币远期汇率会上升,低利率国家的货币远期汇率会上升D. 高利率国家的货币远期汇率会下跌,低利率国家的货币远期汇率会下跌6 以下哪一项不属于广义的外汇A. 外国纸币和铸币B. 外币有价证券C. 外币支付凭证D. 外国的黄金和珠宝7 在直接标价法下,银行报出的某一外汇的几种汇率由小到大应该是A. 现汇买入价、现钞买入价、卖出价B. 现钞买入价、现汇买入价、卖出价C. 卖出价、现汇买入家、现钞买入价D. 现汇买入家、卖出价、现钞买入价8 你在国际金融市场上看到外汇报价,1美元=1.5080瑞士法郎,1美元=3.1020林吉特,那么你可以算出瑞士法郎与林吉特之间的比价是A. 1瑞士法郎=2.0570林吉特B. 1瑞士法郎=0.4861林吉特C. 1林吉特=4.6778瑞士法郎D. 以上都不对9 剔出掉通货膨胀对名义汇率的影响,得到A. 有效汇率B. 实际汇率C. 铸币平价D. 信汇汇率1 0 换汇成本理论也是利用两国商品价格对比来考察汇率决定,但不包括购买力平价理论中的A. 贸易商品B. 农产品C. 非贸易商品D. 以上都是第三单元是非题1 外汇就是指外国货币。

×2 国际借贷是指国际间各种经济往来所产生的债权债务关系。

√3 如果英国规定1英镑的含金量是113.0016格令,美国规定1美元的含金量是23.22格令,则美元与英镑之间的铸币平价是4.8665。

中国的GDP 国际排名可以基于用市场汇率折算的值,也可以基于用购买力平价(PPP )折算的值,一般前者要高于后者。

外汇远期汇率就是指外汇远期交易的交割日的即期汇率。

×4 ×5 ×6 外汇倾销是指一国有意加大本币汇率下降的幅度,使其高于本国物价上涨的幅度,以便以低于世界市场的价格输出商品。

在直接标价法下,外汇汇率上升意味着外币升值、本币贬值。

√7 √8 一国货币对某一外币可能因性质与用途不同而存在两种或两种以上的汇率。

有效汇率是反映两国之间贸易状况的汇率。

√9×1 0汇率变动对商品生产多样化的国家影响较大,而对商品生产单一的国家影响较小。

×第四单元单选题1 1994年4月,全国统一的外汇市场——中国外汇交易的中心在()正式运营。

A. 深圳B. 北京C. 上海D. 天津2 2005年7月21日,下面哪一项不属于中国人民银行的人民币汇率改革的内容?A. 由钉住单一美元转向钉住美元、欧元和日元三大货币B. 扩大汇率浮动幅度C. 发展完善外汇市场D. 改进人民币汇率形成机制3 在固定汇率制度下,各国央行维持汇率稳定的手段有A. 利率手段B. 外汇储备支持C. 外汇管制D. 以上都是4 尽管IMF将世界各国的汇率制度划分为八大类,但从本质上说,可以基本的分为固定和浮动,下面可以归类到浮动汇率制度的是A. 放弃独立法定货币B. 货币局制度C. 管理浮动D. 以上都是5 下列哪一项是固定汇率制度的优点A. 降低对外经济交往中的汇率风险B. 使汇率可以发挥调节国际收支的杠杆作用C. 有利于促进一国国内经济的平衡D. 有助于抑制货币投机6 我国经过了多年的改革开放、经济发展,目前在外汇管制上属于A. 名义上取消了外汇管制B. 实际上取消了外汇管制C. 实行严格的外汇管制D. 实行部分的外汇管制7 我国在()正式宣布接受国际货币基金组织第8条款,实现人民币经常项目完全兑换。

A. 1994、1、1B. 1996、4、4C. 1996、7、1D. 1996、12、18 一国经济倾向于选择浮动汇率制度,如果A. 经济规模较小B. 经济结构较为多样C. 金融市场发展程度较低D. 对外开放程度较大9 克鲁格曼提出的“三元悖论”是三个不可兼得的目标,不包括A. 固定汇率B. 货币政策独立性C. 财政赤字减少D. 资本自由流动1 0 外汇管制有很多手段,下面属于价格管制的是A. 进口许可证制度B. 差别汇率制度C. 进口预交存款制D. 资本输出限制第四单元是非题1 我国已实行了资本项目下的自由兑换。