外贸单证操作中行香港分行信用证申请书

- 格式:doc

- 大小:93.50 KB

- 文档页数:3

开信用证申请书尊敬的负责人,我代表(您的公司名称)向贵公司申请开立一份信用证,以确保我们的交易安全、快速和顺利进行。

首先,我在此向贵公司简要介绍一下我们的公司背景和业务模式。

我司成立于XX年,是一家专注于(描述您的业务领域)的公司。

多年来,我们致力于为客户提供高品质的产品和优质的服务,获得了良好的声誉和多个合作伙伴。

随着我们业务的扩大和市场需求的增长,我们需要与供应商建立长期的合作关系,并保证供应链的顺畅运作。

因此,我们希望通过开立信用证来确保交易的可靠性和及时性。

以下是我们的信用证申请的详细信息:1. 贸易术语:(描述贸易术语,如CIF、FOB等)2. 货物描述:(具体描述货物,有关规格、数量、品质等详细信息)3. 发货地点和时间:(发货地点和时间的具体要求)4. 支付条件:(描述支付条件,如付款的方式、时间等)我们需要的信用证金额为(具体金额),信用证期限为(具体天数)。

希望贵公司能够在(具体日期)之前开立信用证,并将信用证发送到我司指定的银行。

除了以上所列的基本要求外,我们还希望贵公司能够提供以下额外的服务:1. 在货物发运前,向我司提供发货通知和相关文件的复印件;2. 提供货物的跟踪信息,以保证我司能够及时了解货物的到达状态;3. 在我司提供所需文件的情况下,确保支付条件能够按时履行。

希望贵公司能够认真考虑我们的信用证申请,并尽快回复我们的请求。

我们相信通过信用证的开立,我们之间的合作将更加稳固和可靠。

如果贵公司对信用证的具体细节有任何疑问或需要进一步商讨,请随时与我们联系。

再次感谢贵公司对我们合作的支持与信任,期待与贵公司的进一步合作。

此致敬礼(您的姓名)(您的职位)(公司名称)(联系方式)。

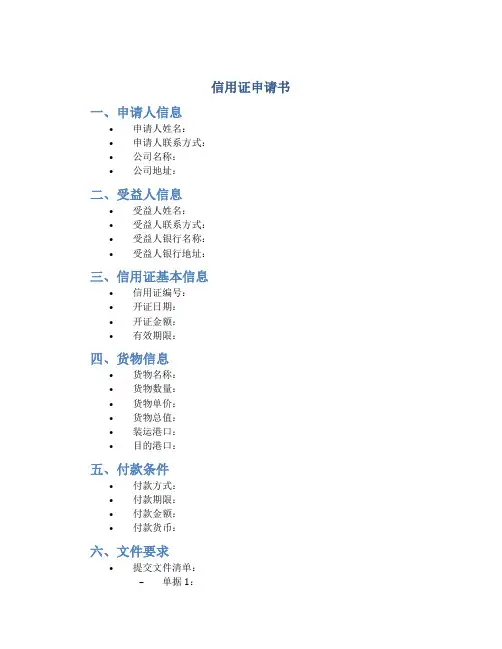

信用证申请书

一、申请人信息

•申请人姓名:

•申请人联系方式:

•公司名称:

•公司地址:

二、受益人信息

•受益人姓名:

•受益人联系方式:

•受益人银行名称:

•受益人银行地址:

三、信用证基本信息

•信用证编号:

•开证日期:

•开证金额:

•有效期限:

四、货物信息

•货物名称:

•货物数量:

•货物单价:

•货物总值:

•装运港口:

•目的港口:

五、付款条件

•付款方式:

•付款期限:

•付款金额:

•付款货币:

六、文件要求

•提交文件清单:

–单据1:

–单据2:

–单据3:

七、其他条款

•运输方式:

•保险要求:

•合同条款:

•其他特殊要求:

八、申请人声明

本人保证以上所填写的信息真实有效,并承担由于信息不准确或不完整所引起的任何责任。

如有任何问题,请及时与我联系。

申请人签名: ______________________

日期: ______________________。

尊敬的银行:我方(以下简称“申请人”)为[申请人名称],注册地为[申请人注册地],现因[具体交易背景,如:进口货物、出口货物、技术服务等],特向贵行申请开立国际信用证,具体如下:一、信用证基本信息1. 信用证类型:[可选用以下类型之一:不可撤销信用证、可撤销信用证、备用信用证等]2. 信用证金额:[货币种类][金额],[可否加证][可否部分支款][可否溢装][溢装百分比]3. 信用证有效期:[起止日期],逾期无效。

4. 信用证受益人:[受益人名称],注册地为[受益人注册地]。

5. 信用证通知行:[通知行名称],注册地为[通知行注册地]。

二、货物/服务信息1. 货物/服务名称:[具体货物/服务名称]2. 货物/服务数量:[数量]3. 货物/服务单价:[单价]4. 货物/服务总价:[总价]5. 货物/服务规格型号:[规格型号]6. 货物/服务质量标准:[质量标准]7. 货物/服务产地:[产地]8. 货物/服务出口日期:[出口日期]三、支付方式1. 付款方式:[可选用以下方式之一:即期付款、远期付款、分期付款等]2. 付款期限:[期限]3. 付款地点:[地点]四、单据要求1. 货物/服务发票:[发票名称],[发票数量],[发票金额]2. 装箱单:[装箱单名称],[装箱单数量],[装箱单金额]3. 运输单据:[运输单据名称],[运输单据数量],[运输单据金额]4. 保险单:[保险单名称],[保险单数量],[保险单金额]5. 其他单据:[其他单据名称],[其他单据数量],[其他单据金额]五、其他事项1. 申请人保证所提供的信息真实、准确、完整。

2. 申请人同意遵守贵行的相关规定和操作流程。

3. 申请人同意按照贵行的要求提供相关资料和文件。

4. 申请人同意承担因信用证开立、使用、撤销等产生的所有费用。

5. 申请人同意接受贵行的监督和管理。

特此申请,请贵行予以审核并办理。

申请人:[申请人名称]法定代表人:[法定代表人姓名]联系电话:[联系电话]电子邮箱:[电子邮箱]申请日期:[申请日期]附件:1. 申请人营业执照复印件2. 申请人法定代表人身份证明复印件3. 申请人授权委托书(如有)注:以上申请书仅供参考,具体内容请根据实际情况进行修改。

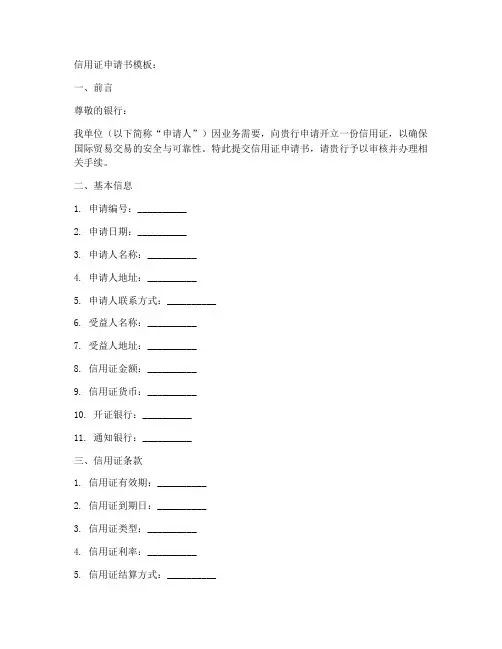

信用证申请书模板:一、前言尊敬的银行:我单位(以下简称“申请人”)因业务需要,向贵行申请开立一份信用证,以确保国际贸易交易的安全与可靠性。

特此提交信用证申请书,请贵行予以审核并办理相关手续。

二、基本信息1. 申请编号:__________2. 申请日期:__________3. 申请人名称:__________4. 申请人地址:__________5. 申请人联系方式:__________6. 受益人名称:__________7. 受益人地址:__________8. 信用证金额:__________9. 信用证货币:__________10. 开证银行:__________11. 通知银行:__________三、信用证条款1. 信用证有效期:__________2. 信用证到期日:__________3. 信用证类型:__________4. 信用证利率:__________5. 信用证结算方式:__________6. 信用证付款方式:__________7. 信用证附加条款:__________四、货物及服务描述1. 商品名称:__________2. 商品数量:__________3. 商品单价:__________4. 商品总价:__________5. 商品规格:__________6. 服务内容:__________五、付款条件1. 预付款比例:__________2. 付款期限:__________3. 付款方式:__________六、申请人与受益人之间的合同编号及名称1. 合同编号:__________2. 合同名称:__________七、其他事项1. 申请人在信用证有效期内,如需修改信用证条款,应向贵行提交书面修改申请,并说明修改原因及内容。

2. 申请人保证提交的信用证申请材料真实、完整、有效,如有虚假陈述,申请人愿承担相应法律责任。

3. 申请人与受益人之间的纠纷,应通过友好协商解决;如协商无果,可通过仲裁或诉讼方式解决。

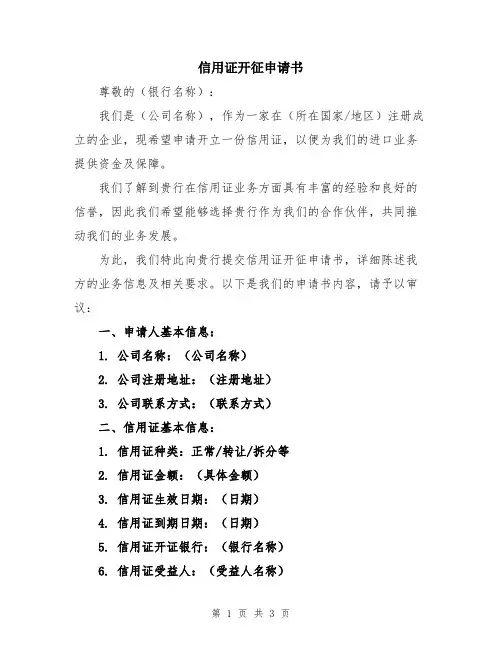

信用证开征申请书尊敬的(银行名称):我们是(公司名称),作为一家在(所在国家/地区)注册成立的企业,现希望申请开立一份信用证,以便为我们的进口业务提供资金及保障。

我们了解到贵行在信用证业务方面具有丰富的经验和良好的信誉,因此我们希望能够选择贵行作为我们的合作伙伴,共同推动我们的业务发展。

为此,我们特此向贵行提交信用证开征申请书,详细陈述我方的业务信息及相关要求。

以下是我们的申请书内容,请予以审议:一、申请人基本信息:1. 公司名称:(公司名称)2. 公司注册地址:(注册地址)3. 公司联系方式:(联系方式)二、信用证基本信息:1. 信用证种类:正常/转让/拆分等2. 信用证金额:(具体金额)3. 信用证生效日期:(日期)4. 信用证到期日期:(日期)5. 信用证开证银行:(银行名称)6. 信用证受益人:(受益人名称)7. 信用证编号:(如已生成)8. 转运期限:(具体期限)9. 付款方式:见即期汇票、托收、电汇等三、货物信息及要求:1. 货物名称及规格:(货物名称及详细规格)2. 数量及单位:(具体数量及单位)3. 价格及货币单位:(具体价格及货币单位)4. 装运港口:(装运港口名称)5. 目的港口:(目的港口名称)6. 装运期限:(具体期限)7. 保险要求:由出口方/进口方承担四、付款及交单要求:1. 付款方式:(具体方式)2. 付款条件:(具体条件)3. 交单期限:(具体期限)4. 提单要求:全套正本提单,注明“到付”五、其他特殊要求:(如有其他特殊要求,例如质检证书、检疫证书、装箱清单等,请在此部分详细叙述)六、附件:1. (根据需要提供的附件,例如合同、发票、装箱单等)请注意,我们将遵守信用证开立所需的一切规定、条款和细节,并且对信用证的使用及交单等工作负责。

我们愿意承担因本信用证起的一切风险,并且将及时支付本信用证项下的所有费用。

最后,我们真诚希望(银行名称)能够审核通过本申请,并为我们开立信用证。

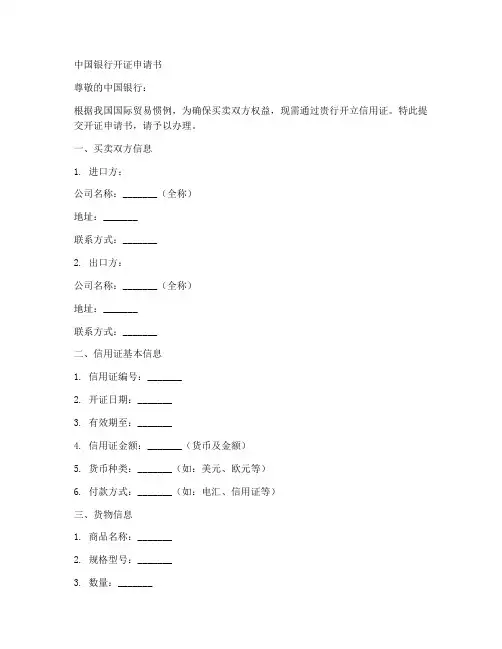

中国银行开证申请书尊敬的中国银行:根据我国国际贸易惯例,为确保买卖双方权益,现需通过贵行开立信用证。

特此提交开证申请书,请予以办理。

一、买卖双方信息1. 进口方:公司名称:_______(全称)地址:_______联系方式:_______2. 出口方:公司名称:_______(全称)地址:_______联系方式:_______二、信用证基本信息1. 信用证编号:_______2. 开证日期:_______3. 有效期至:_______4. 信用证金额:_______(货币及金额)5. 货币种类:_______(如:美元、欧元等)6. 付款方式:_______(如:电汇、信用证等)三、货物信息1. 商品名称:_______2. 规格型号:_______3. 数量:_______4. 单价:_______5. 总价:_______(货币及金额)四、运输信息1. 运输方式:_______(如:海运、空运等)2. 装运港:_______3. 目的港:_______4. 装运日期:_______五、单据要求1. 商业发票:_______份2. 装箱单:_______份3. 重量单:_______份4. 出口许可证:_______份5. 其他单据:_______份(如:原产地证明、质量证明等)六、其他条款1. 保险:_______(如:买方负责、卖方负责等)2. 关税:_______(如:买方负责、卖方负责等)3. 争议解决:_______(如:仲裁、诉讼等)七、申请人与受益人签字申请人(进口方):_______受益人(出口方):_______特此申请,敬请予以办理。

申请人(进口方):_______(盖章)日期:_______年_______月_______日受益人(出口方):_______(盖章)日期:_______年_______月_______日注:以上内容仅供参考,具体开证申请书以中国银行实际要求为准。

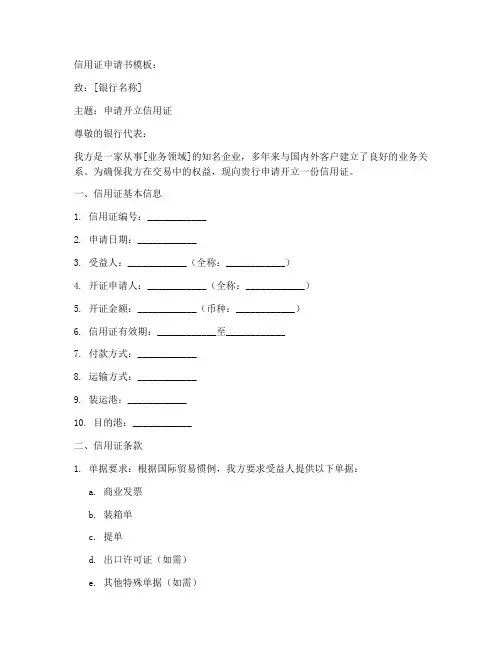

信用证申请书模板:致:[银行名称]主题:申请开立信用证尊敬的银行代表:我方是一家从事[业务领域]的知名企业,多年来与国内外客户建立了良好的业务关系。

为确保我方在交易中的权益,现向贵行申请开立一份信用证。

一、信用证基本信息1. 信用证编号:____________2. 申请日期:____________3. 受益人:____________(全称:____________)4. 开证申请人:____________(全称:____________)5. 开证金额:____________(币种:____________)6. 信用证有效期:____________至____________7. 付款方式:____________8. 运输方式:____________9. 装运港:____________10. 目的港:____________二、信用证条款1. 单据要求:根据国际贸易惯例,我方要求受益人提供以下单据:a. 商业发票b. 装箱单c. 提单d. 出口许可证(如需)e. 其他特殊单据(如需)2. 货物描述:请参照我方与受益人签订的购销合同中的货物描述。

3. 质量与数量:货物质量与数量以购销合同为准。

4. 价格条款:货物价格为[价格类型],具体金额请参照购销合同。

5. 交货期限:货物应在信用证有效期内送达目的港。

6. 保险:货物运输保险由我方负责办理。

7. 争议解决:双方同意通过协商解决任何争议,如协商无果,则提交[仲裁机构]进行仲裁。

三、申请原因及担保1. 我方与受益人之间的交易历史悠久,双方信誉良好。

2. 受益人已向我方提供充足的担保,包括:[担保方式],确保货物质量及信用证履行。

3. 开证申请人与受益人之间的交易均遵循国际贸易惯例和法律法规。

四、申请人的声明1. 我方保证上述申请信息真实、准确、完整。

2. 我方承诺在信用证有效期内履行付款义务。

3. 我方同意承担信用证开立过程中产生的相关费用。

外贸信用证申请书模板如下:致:[进口商银行名称]主题:申请开立信用证尊敬的先生/女士:您好!我方是一家专业从事国际贸易的公司,与贵行有着长期且良好的合作关系。

现根据我方与[进口商名称]签订的销售合同(合同编号:[合同编号]),我方在此向贵行申请开立一份信用证,具体事项如下:一、信用证信息1. 信用证编号:[信用证编号]2. 受益人名称:[受益人名称]3. 申请开证金额:[申请开证金额]4. 申请开证期限:[申请开证期限]5. 信用证有效期:[信用证有效期]6. 开证银行:[开证银行名称]7. 付款方式:根据信用证条款规定二、货物描述1. 商品名称:[商品名称]2. 商品规格:[商品规格]3. 数量:[数量]4. 单价:[单价]5. 总价:[总价]6. 交货期限:[交货期限]三、信用证条款1. 信用证依据的合同:[合同编号]2. 货物运输方式:[运输方式]3. 货物运输保险:[保险条款]4. 付款方式:[付款方式]5. 质量保证:[质量保证]6. 售后服务:[售后服务]7. 其他条款:[其他条款]四、申请开证理由鉴于我方与[进口商名称]长期保持良好的合作关系,且对其信用状况有充分了解,为确保合同的顺利履行,特向贵行申请开立信用证。

开立信用证将有助于我方按照合同约定按时、按质、按量交付货物,同时也有利于保障我方的合法权益。

五、申请开证所需文件1. 销售合同副本:[合同编号]2. 商业发票3. 装箱单4. 运输合同副本5. 保险单副本6. 其他相关文件六、保证金及费用1. 我方愿意向贵行提供[保证金金额]作为信用证开立的保证金。

2. 信用证开立及执行过程中产生的所有费用,包括但不限于手续费、电报费等,均由我方承担。

七、联系方式1. 申请人:[申请人名称]2. 联系人:[联系人姓名]3. 电话:[联系电话]4. 邮箱:[联系邮箱]敬请贵行审慎考虑我方的申请,并尽快办理。

如有任何疑问,请随时与我方联系。

在此预感谢贵行对我方工作的支持与帮助!此致敬礼![申请人名称][申请人签名][申请日期]。

尊敬的中国银行:我方(申请人名称)在此向您申请开具信用证,以便与(受益人名称)进行(交易类型,如购销、服务等)交易。

以下是信用证申请的具体内容:一、信用证金额:本次信用证申请的金额为(金额),以(货币类型,如美元、欧元等)计价。

二、信用证期限:信用证的有效期为(期限),自信用证开证之日起计算。

三、信用证类型:根据我方与受益人的交易特点,我们申请开立(信用证类型,如跟单信用证、光票信用证等)。

四、信用证条件:信用证的支付条件为(支付条件,如付款交单、承兑交单等)。

五、单据要求:受益人应提交以下单据,以满足信用证的支付条件:(列明所需单据,如商业发票、装箱单、运输单据等)。

六、付款方式:信用证项下的付款将通过(付款方式,如电汇、承兑汇票等)进行。

七、其他条款:根据双方协商,其他条款如下:(列明其他特殊条款,如保险、关税等)。

八、申请人与受益人的关系:我方与受益人之间存在(关系,如长期合作关系、首次合作等)。

九、申请人的信用状况:我方具有良好的信用状况,具备履行合同的能力。

十、申请人的法律责任:我方承认,如受益人提交符合信用证条款的单据,银行有权向我方付款。

若我方未能履行付款义务,则应承担相应的法律责任。

十一、申请人的声明:我方声明,所提供的信息真实可靠,并无任何欺诈行为。

十二、申请人的签名:申请人的授权代表已在本信用证申请书上签字,以示确认。

请中国银行审核我方的信用证申请,并在符合条件的情况下开具信用证。

我们将按照信用证的条款履行付款义务,并保证受益人提交符合信用证条款的单据。

特此申请!申请人:(申请人名称)申请人地址:(申请人地址)申请人联系方式:(申请人联系方式)申请日期:(申请日期)注:以上内容仅为信用证申请书模板,实际申请时请根据具体交易情况予以修改。

如有需要,请咨询专业律师或银行工作人员。

信用证开立申请书尊敬的信用证开立申请委员会:我兹奉命代表本公司向贵行提交信用证开立申请书,就以下几个方面做一详细说明:1. 申请人介绍:本公司是一家拥有多年经验的贸易公司,主营业务涉及进出口贸易、国际投资等行业。

我们在业界具有良好的信誉和声誉,并积累了广泛的合作伙伴网络。

鉴于我们对贸易讯息的深入了解和独特的分析能力,我们时刻关注市场走势,以确保我们的客户获得最佳的贸易机会。

2. 信用证用途:本申请书为了支持我们与供应商之间的国际贸易合作。

我公司计划进口大量的商品,以满足国内市场的需求。

为了确保交易双方的权益,我们希望通过信用证机制来确保支付的安全和准时。

3. 信用证金额和期限:我们计划开立信用证金额为XXX美元,期限为X个月。

基于以往的经验和市场预测,我们相信该金额能够满足我们与供应商的贸易需求,同时给予我们足够的灵活性以应对市场的变化。

4. 信用证开立行:鉴于贵行在国际贸易领域的专业经验和优秀声誉,我们选择贵行作为我们信用证的开立行。

我们相信贵行具备足够的实力和专业知识,能够为我们提供高质量的服务,并确保我们的款项得到安全支付。

5. 信用证条款和条件:我们的信用证开立申请书附有详细的信用证条款和条件,其中包括商品的描述、装运细节、支付条款、验收程序等。

我们建议贵行仔细审查申请书,并确保信用证条款和条件符合我们的需求和预期。

6. 付款保证:为了确保我们的供应商能够与我们建立信任关系并保证按时交付商品,我们将提供相应的款项作为付款保证。

我们会将该款项存入信用证中,并授权贵行按照信用证条款和条件进行支付。

7. 其他文件与要求:我们的信用证申请书附有相关文件,包括供应商的合同、发票、装运单据等。

除此之外,我们还要求贵行在信用证开立后,按照我们的要求提供相应的文件跟踪服务,并确保信用证的及时有效。

8. 结论:基于我们的专业经验和市场调研,我们对本次信用证申请书非常有信心。

我们相信通过我们与贵行的合作,我们能够顺利地完成这次贸易交易,并确保双方的权益得到保障。

信用证申请书样本1. 引言信用证是国际贸易中常见的支付方式之一,它为买卖双方提供了一种安全可靠的支付保障。

本文档旨在提供信用证申请书的样本,以帮助申请人编写符合国际惯例和要求的信用证申请书。

2. 申请人信息申请人信息是信用证申请书中的重要部分,以下是申请人信息的示例:申请人名称:[申请人公司全称]联系地址:[申请人公司地址]电话:[申请人联系电话]传真:[申请人传真号码]电子邮件:[申请人电子邮件]3. 受益人信息受益人是信用证的收款人,以下是受益人信息的示例:受益人名称:[受益人公司全称]联系地址:[受益人公司地址]电话:[受益人联系电话]传真:[受益人传真号码]电子邮件:[受益人电子邮件]4. 信用证条款信用证条款是信用证申请书中的核心内容,以下是信用证条款的示例:1. 信用证编号:[信用证编号]2. 开证行名称:[开证行名称]3. 开证行地址:[开证行地址]4. 接单行名称:[接单行名称]5. 接单行地址:[接单行地址]6. 信用证金额:[信用证金额]7. 付款期限:[付款期限]8. 装运期限:[装运期限]9. 有效期限:[有效期限]10. 单据要求:[单据要求]11. 运输方式:[运输方式]12. 装运口岸:[装运口岸]13. 保险要求:[保险要求]14. 其他特殊要求:[其他特殊要求]5. 申请人声明申请人在信用证申请书中需做出一系列声明,以保证申请人的合法性和信用性,以下是申请人声明的示例:1. 本人申请开立以上信用证,保证所提供的信息真实有效。

2. 本人自愿承担因信息不真实或不完整所产生的一切法律责任和经济损失。

3. 本人同意并接受信用证的所有条款和条件,并愿意履行相关的责任和义务。

4. 本人保证所开具的提单、发票、装箱单等单据真实有效。

5. 本人保证货物的质量和数量符合合同要求。

6. 附件附件是信用证申请书的补充材料,可以包括合同、发票、装箱单等相关文件的复印件,以下是附件的示例:1. 合同复印件:[合同复印件的文件名及路径]2. 发票复印件:[发票复印件的文件名及路径]3. 装箱单复印件:[装箱单复印件的文件名及路径]7. 结论信用证申请书是国际贸易中非常重要的文件之一,它为买卖双方提供了支付保障。

信用证申请书模板尊敬的银行:我司因业务需要,依据我司与贵行签署的《授信额度协议》及其附件,向贵行申请开立一份信用证。

具体申请事项如下:一、信用证基本信息1. 信用证编号:_______2. 开证申请人:_______(我司全称)3. 受益人:_______(出口商全称)4. 信用证金额:_______(币种:美元/人民币等)5. 信用证有效期:_______(起始日期至结束日期)6. 装运期限:_______(起始日期至结束日期)7. 装运地点:_______8. 目的地:_______9. 货物描述:_______(详细描述货物名称、规格、数量等)二、信用证条款1. 信用证付款方式:_______(电汇、信用证转账等)2. 议付行:_______3. 付款行:_______4. 开证行:_______5. 信用证类型:_______(即期信用证、远期信用证等)6. 信用证状态:_______(可撤销信用证、不可撤销信用证等)7. 其他条款:_______(如运输保险、品质保证等)三、申请开证押金及保证1. 我司同意向贵行交纳开证押金,金额为信用证金额的_______%。

2. 开证押金支付方式:_______(现金、转账等)3. 开证押金退还条件:_______(根据信用证到期是否议付及付款情况进行退还)四、申请人与贵行之间的其他约定1. 我司承诺在信用证有效期内,按照信用证条款履行付款义务。

2. 贵行承诺在符合信用证条款的情况下,向我司支付货物款项。

3. 如发生信用证争议,双方应友好协商解决;如协商无果,应提交_______(仲裁机构)进行仲裁。

五、申请开证所需文件1. 买卖合同副本2. 出口商提供的货物报价单3. 出口商提供的装箱单4. 出口商提供的商业发票5. 其他必要的单证六、申请人与受益人的关系1. 我司与受益人系长期合作伙伴,双方具有良好的商业信誉。

2. 受益人具备履行合同的能力,其货物质量、服务均符合我司要求。

编号:HT-ZGGXzKoKXN信用证开证申请书中英All legal explanation, the more simple, is also fair law.甲方:_____________________乙方:_____________________签订日期:_____________________WORD文档/ A4打印/ 可编辑中国银行:我公司已办妥一切进口手续,现请贵行按我公司开证申请书内容开出不可撤销跟单信用证,为此我公司愿不可撤销地承担有关责任如下:一、我公司同意贵行依照国际商会第500号出版物《跟单信用证统一惯例》办理该信用证项下一切事宜,并同意承担由此产生的一切责任。

二、我公司保证按时向贵行支付该证项下的货款、手续费、利息及一切费用等(包括国外受益人拒绝承担的有关银行费用)所需的外汇和人民币资金。

三、我公司保证在贵行单到通知书中规定的期限之内通知贵行办理对外付款/承兑,否则贵行可认为我公司已接受单据,同意付款/承兑。

四、我公司保证在单证表面相符的条件下办理有关付款/承兑手续。

如因单证有不符之处而拒绝付款/承兑,我公司保证在贵行单到通知书中规定的日期之前将全套单据如数退还贵行并附书面拒付理由,由贵行按国际惯例确定能否对外拒付。

如贵行确定我公司所提拒付理由不成立,或虽然拒付理由成立,但我公司未能退回全套单据,或拒付单据退到贵行已超过单到通知书中规定的期限,贵行有权主动办理对外付款/承兑,并从我公司帐户中扣款。

五、该信用证及其项下业务往来函电及单据如因邮、电或其它方式传递过程中发生遗失、延误、错漏,贵行当不负责。

六、该信用证如需修改、由我公司向贵行提出书面申请,由贵行根据具体情况确定能否办理修改。

我公司确认所有修改当由信用证受益人接受时才能生效。

七、我公司在收到贵行开出的信用证、修改书副本后,保证及时与原申请书核对,如有不符之处,保证在接到副本之日起,两个工作日内通知贵行。

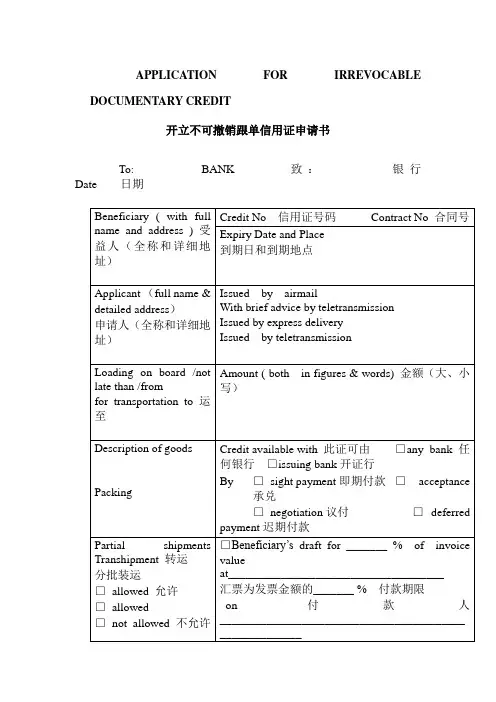

APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDITTO: BANK OF CHINA (HONG KONG) LIMITEDDate :Terms and Conditions of Application For Documentary Credit ("Credit")In consideration of the issuance of the Credit by Bank of China (Hong Kong) Limited (the "Bank"), the applicant of this application (the "Applicant") agrees to the following conditions :-1.This application and the Credit to be issued are subject to the Uniform Customs and Practice for Documentary Credits of the InternationalChamber of Commerce as are in effect from time to time (the "UCP"), the Master Agreement for Bills Transactions and Trade Finance and any other agreement(s) previously signed and delivered to the Bank by the Applicant, if any. In case of conflict, terms of this application shall prevail to the extent of conflict.2.The Applicant undertakes to pay and reimburse the Bank any sum in connection with the Credit upon the Bank's demand and irrevocablyauthorises the Bank to debit the Applicant's account(s) for any such sum at any time the Bank thinks appropriate. Such sum includes interest, costs, expenses, commissions, reimbursement claims from any nominated bank or confirming bank and any payment, prepayment or purchase effected by the Bank in connection with the Credit, all irrespective of any alleged discrepancies in the presented documents and/or any fraud that may be alleged at any time or discovered subsequent to such payment, negotiation, prepayment or purchase by any nominated bank, confirming bank or the Bank.3.The Applicant acknowledges and agrees that upon issuance of the Credit, the Bank may, in its sole and absolute discretion, earmark both thedocumentary credit issuance and trust receipt credit facilities extended by the Bank.4.All documents presented under the Credit and the relevant goods will be automatically pledged to the Bank as security for the Applicant'sliabilities and obligations owing to the Bank but the risk of the goods shall be with the Applicant at all times.5.All the terms and conditions of the Credit must be identical to that of the master credit detailed overleaf ("Master Credit"), if any, except asotherwise agreed by the Bank.6.The Applicant undertakes to present all export documents under the Master Credit to the Bank for issuing bank's payment or the Bank'snegotiation, purchase or prepayment under the Credit.7.The Bank is irrevocably authorized (but is not obliged) to (i) utilize documents presented under the Credit for the drawing of the Master Credit;(ii) negotiate the presented documents, prepay the deferred payment undertaking incurred by the Bank or purchase the draft accepted by the Bank (the "Financing") under the Master Credit; and (iii) directly apply the Financing proceeds of the Master Credit to settle the corresponding drawing(s) under the Credit without first crediting such proceeds to the Applicant's account with the Bank, irrespective of discrepancies that may appear on the documents presented under the Credit (all of which, if any, are hereby waived).8.The Applicant agrees that the Bank may, at its sole discretion and without consent from the Applicant, amend the terms and conditions of theCredit stated in this application and/or insert additional terms and conditions into the Credit as the Bank thinks appropriate. The Bank may, subject to the beneficiary's consent, cancel the whole or any unused balance of the Credit.9.The Applicant agrees and acknowledges that it is the sole responsibility of the Applicant to (i) ensure the clarity, enforceability or effectivenessof any terms or requirements incorporated in the Credit; and (ii) comply with all applicable laws and regulations regarding the underlying transaction to which the Credit relates and obtain any necessary documents and approvals from any governmental or regulatory bodies and produce such documents or approvals to the Bank upon request. The Bank is not responsible for advising and has no duty whatsoever to advise the Applicant on such issues. The Bank shall not be liable to the Applicant for any direct, indirect, special or consequential loss or damage, costs, expenses or other claims for compensation whatsoever which arise out of such issues.10.Notwithstanding any instruction(s) stipulated in this application, the Bank may, at its sole discretion, restrict, name or instruct any correspondentto be the advising, confirming or nominated bank in respect of the Credit.11.The Applicant agrees that the Bank is fully entitled to reject any discrepant documents presented under the Credit notwithstanding that theApplicant may have waived such discrepancy.12.If the Applicant instructs the Bank to permit T/T reimbursement in the Credit, the Bank is irrevocably authorised to pay and/or reimburse therelevant claiming bank or reimbursing bank upon receipt of a claim from such bank even prior to the Bank's receipt of the presented documents.The Applicant shall bear all relevant risks (including non-receipt and non-compliance risks of the presented documents) and shall reimburse and indemnify the Bank for any payment made under the Credit.13.Any action taken or omitted by the Bank or by any of its correspondents or agents under or in connection with the Credit shall be binding on theApplicant and shall not place the Bank or its correspondents or agents under any liability to the Applicant.14.The Applicant agrees and undertakes to examine the customer copy of the Credit issued by the Bank and irrevocably agrees that failure to give anotice of objection about the contents of the Credit within 5 calendar days after the customer copy of the Credit is sent to the Applicant shall be deemed to be its waiver of any rights to raise objections or pursue any remedies against the Bank in respect of the Credit.15.Each of the persons signing this application (in his own personal capacity and as authorized representative(s) of the Applicant) warrants andrepresents to the Bank that this application is made for the purpose of facilitating the acquisition of the goods mentioned overleaf and for no other purpose and acknowledges that the Bank will rely on such warranty and representation when assessing this application.16.The Bank may, at any time and at its absolute discretion without giving any reason therefor, by giving 3 ca lendar days’ prior written notice tothe Applicant, convert all or any outstanding indebtedness, liabilities and/or obligations (actual or contingent) owing by the Applicant as a result of the issuance of the Credit into (i) Hong Kong dollars; or (ii) the currency stipulated in the Bank's credit facilities agreement(s) in respect of documentary credit issuance. The conversion shall be made at the prevailing rate of exchange as the Bank may determine conclusively. The Bank may, after such conversion, adjust the applicable interest rate in accordance with the market condition but in any event not less than the interest margin charged by the Bank before conversion.17.The Applicant further undertakes that it shall indemnify the Bank and the Bank's delegate(s) on demand (on a full indemnity basis) against allliabilities, losses, payments, damages, demands, claims, expenses and costs (including legal fees), proceedings or actions which the Bank or the Bank's delegate(s) may incur or suffer under or in connection with this application and the Credit.18.If this application is executed by more than one party, the obligations and liabilities of each of the parties are primary as well as joint and severaland the Bank will be at liberty to release, compound with or otherwise vary or agree to vary the liability of any one without prejudicing or affecting the Bank's rights and remedies against the others.19.This application is governed by and shall be construed in accordance with the laws of the Hong Kong Special Administrative Region and theApplicant agrees to submit to the non-exclusive jurisdiction of the Hong Kong Courts.SUPPLEMENTAL SHEET。

信用证开证申请书02

中国银行:

我公司已办妥一切进口手续,现请贵行按我公司开证申请书内容开出不可撤销跟单信用证,为此我公司愿不可撤销地承担有关责任如下:

一、我公司同意贵行依照国际商会第号出版物《跟单信用证统一惯例》办理该信用证项下一切事宜,并同意承担由此产生的一切责任。

二、我公司保证按时向贵行支付该证项下的货款、手续费、利息及一切费用等(包括国外受益人拒绝承担的有关银行费用)所需的外汇和人民币资金。

三、我公司保证在贵行单到通知书中规定的期限之内通知贵行办理对外付款/承兑,否则贵行可认为我公司已接受单据,同意付款/承兑。

四、我公司保证在单证表面相符的条件下办理有关付款/承兑手续。

如因单证有不符之处而拒绝付款/承兑,我公司保证在贵行单到通知书中规定的日期之前将全套单据如数退还贵行并附书面拒付理由,由贵行按国际惯例确定能否对外拒付。

如贵行确定我公司所提拒付理由不成立,或虽然拒付理由成立,但我公司未能退回全套单据,或拒付单据退到贵行已超过单到通知书中规定的期限,贵行有权主动办理对外付款/承兑,并从我公司帐户中扣款。

五、该信用证及其项下业务往来函电及单据如因邮、电或其它方式传递过程中发生遗失、延误、错漏,贵行当不负责。

六、该信用证如需修改、由我公司向贵行提出书面申请,由贵行根据具体情况确定能否办理修改。

我公司确认所有修改当由信用证受益人接受时才能生效。

七、我公司在收到贵行开出的信用证、修改书副本后,保证及时与原申请书核对,如有不符之处,保证在接到副本之日起,两个工作日内通知贵行。

如未通知,当视为正确无误。

八、如因申请书字迹不清或词意含混而引起的一切后果由我公司负责。

开证申请人(签字盖章)。

APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDITTO: BANK OF CHINA (HONG KONG) LIMITEDDate :Terms and Conditions of Application For Documentary Credit ("Credit")In consideration of the issuance of the Credit by Bank of China (Hong Kong) Limited (the "Bank"), the applicant of this application (the "Applicant") agrees to the following conditions :-1.This application and the Credit to be issued are subject to the Uniform Customs and Practice for Documentary Credits of the InternationalChamber of Commerce as are in effect from time to time (the "UCP"), the Master Agreement for Bills Transactions and Trade Finance and any other agreement(s) previously signed and delivered to the Bank by the Applicant, if any. In case of conflict, terms of this application shall prevail to the extent of conflict.2.The Applicant undertakes to pay and reimburse the Bank any sum in connection with the Credit upon the Bank's demand and irrevocablyauthorises the Bank to debit the Applicant's account(s) for any such sum at any time the Bank thinks appropriate. Such sum includes interest, costs, expenses, commissions, reimbursement claims from any nominated bank or confirming bank and any payment, prepayment or purchase effected by the Bank in connection with the Credit, all irrespective of any alleged discrepancies in the presented documents and/or any fraud that may be alleged at any time or discovered subsequent to such payment, negotiation, prepayment or purchase by any nominated bank, confirming bank or the Bank.3.The Applicant acknowledges and agrees that upon issuance of the Credit, the Bank may, in its sole and absolute discretion, earmark both thedocumentary credit issuance and trust receipt credit facilities extended by the Bank.4.All documents presented under the Credit and the relevant goods will be automatically pledged to the Bank as security for the Applicant'sliabilities and obligations owing to the Bank but the risk of the goods shall be with the Applicant at all times.5.All the terms and conditions of the Credit must be identical to that of the master credit detailed overleaf ("Master Credit"), if any, except asotherwise agreed by the Bank.6.The Applicant undertakes to present all export documents under the Master Credit to the Bank for issuing bank's payment or the Bank'snegotiation, purchase or prepayment under the Credit.7.The Bank is irrevocably authorized (but is not obliged) to (i) utilize documents presented under the Credit for the drawing of the Master Credit;(ii) negotiate the presented documents, prepay the deferred payment undertaking incurred by the Bank or purchase the draft accepted by the Bank (the "Financing") under the Master Credit; and (iii) directly apply the Financing proceeds of the Master Credit to settle the corresponding drawing(s) under the Credit without first crediting such proceeds to the Applicant's account with the Bank, irrespective of discrepancies that may appear on the documents presented under the Credit (all of which, if any, are hereby waived).8.The Applicant agrees that the Bank may, at its sole discretion and without consent from the Applicant, amend the terms and conditions of theCredit stated in this application and/or insert additional terms and conditions into the Credit as the Bank thinks appropriate. The Bank may, subject to the beneficiary's consent, cancel the whole or any unused balance of the Credit.9.The Applicant agrees and acknowledges that it is the sole responsibility of the Applicant to (i) ensure the clarity, enforceability or effectivenessof any terms or requirements incorporated in the Credit; and (ii) comply with all applicable laws and regulations regarding the underlying transaction to which the Credit relates and obtain any necessary documents and approvals from any governmental or regulatory bodies and produce such documents or approvals to the Bank upon request. The Bank is not responsible for advising and has no duty whatsoever to advise the Applicant on such issues. The Bank shall not be liable to the Applicant for any direct, indirect, special or consequential loss or damage, costs, expenses or other claims for compensation whatsoever which arise out of such issues.10.Notwithstanding any instruction(s) stipulated in this application, the Bank may, at its sole discretion, restrict, name or instruct any correspondentto be the advising, confirming or nominated bank in respect of the Credit.11.The Applicant agrees that the Bank is fully entitled to reject any discrepant documents presented under the Credit notwithstanding that theApplicant may have waived such discrepancy.12.If the Applicant instructs the Bank to permit T/T reimbursement in the Credit, the Bank is irrevocably authorised to pay and/or reimburse therelevant claiming bank or reimbursing bank upon receipt of a claim from such bank even prior to the Bank's receipt of the presented documents.The Applicant shall bear all relevant risks (including non-receipt and non-compliance risks of the presented documents) and shall reimburse and indemnify the Bank for any payment made under the Credit.13.Any action taken or omitted by the Bank or by any of its correspondents or agents under or in connection with the Credit shall be binding on theApplicant and shall not place the Bank or its correspondents or agents under any liability to the Applicant.14.The Applicant agrees and undertakes to examine the customer copy of the Credit issued by the Bank and irrevocably agrees that failure to give anotice of objection about the contents of the Credit within 5 calendar days after the customer copy of the Credit is sent to the Applicant shall be deemed to be its waiver of any rights to raise objections or pursue any remedies against the Bank in respect of the Credit.15.Each of the persons signing this application (in his own personal capacity and as authorized representative(s) of the Applicant) warrants andrepresents to the Bank that this application is made for the purpose of facilitating the acquisition of the goods mentioned overleaf and for no other purpose and acknowledges that the Bank will rely on such warranty and representation when assessing this application.16.The Bank may, at any time and at its absolute discretion without giving any reason therefor, by giving 3 ca lendar days’ prior written notice tothe Applicant, convert all or any outstanding indebtedness, liabilities and/or obligations (actual or contingent) owing by the Applicant as a result of the issuance of the Credit into (i) Hong Kong dollars; or (ii) the currency stipulated in the Bank's credit facilities agreement(s) in respect of documentary credit issuance. The conversion shall be made at the prevailing rate of exchange as the Bank may determine conclusively. The Bank may, after such conversion, adjust the applicable interest rate in accordance with the market condition but in any event not less than the interest margin charged by the Bank before conversion.17.The Applicant further undertakes that it shall indemnify the Bank and the Bank's delegate(s) on demand (on a full indemnity basis) against allliabilities, losses, payments, damages, demands, claims, expenses and costs (including legal fees), proceedings or actions which the Bank or the Bank's delegate(s) may incur or suffer under or in connection with this application and the Credit.18.If this application is executed by more than one party, the obligations and liabilities of each of the parties are primary as well as joint and severaland the Bank will be at liberty to release, compound with or otherwise vary or agree to vary the liability of any one without prejudicing or affecting the Bank's rights and remedies against the others.19.This application is governed by and shall be construed in accordance with the laws of the Hong Kong Special Administrative Region and theApplicant agrees to submit to the non-exclusive jurisdiction of the Hong Kong Courts.SUPPLEMENTAL SHEET。