国际结算练习答案

- 格式:docx

- 大小:52.89 KB

- 文档页数:4

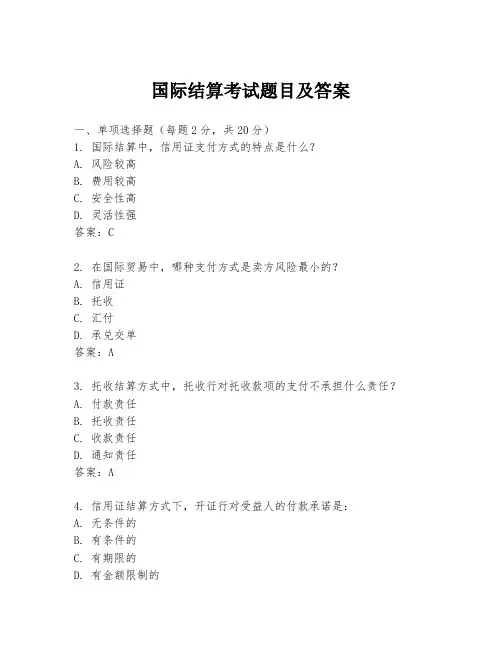

国际结算考试题目及答案一、单项选择题(每题2分,共20分)1. 国际结算中,信用证支付方式的特点是什么?A. 风险较高B. 费用较高C. 安全性高D. 灵活性强答案:C2. 在国际贸易中,哪种支付方式是卖方风险最小的?A. 信用证B. 托收C. 汇付D. 承兑交单答案:A3. 托收结算方式中,托收行对托收款项的支付不承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:A4. 信用证结算方式下,开证行对受益人的付款承诺是:A. 无条件的B. 有条件的C. 有期限的D. 有金额限制的答案:B5. 信用证结算方式中,受益人提交的单据不符合信用证条款,开证行将如何处理?A. 拒绝付款B. 接受单据C. 与申请人协商D. 要求修改信用证答案:A6. 汇付结算方式中,汇入行对汇入款项的支付不承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:A7. 在国际贸易中,哪种支付方式是买方风险最小的?A. 信用证B. 托收C. 汇付D. 承兑交单答案:C8. 信用证结算方式下,开证行对受益人的付款承诺是基于什么条件的?A. 单据相符B. 货物相符C. 合同相符D. 信用相符答案:A9. 托收结算方式中,托收行对托收款项的支付承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:B10. 汇付结算方式中,汇入行对汇入款项的支付承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:C二、多项选择题(每题3分,共15分)1. 信用证结算方式中,受益人需要提交的单据通常包括哪些?A. 发票B. 装运单据C. 保险单D. 信用证副本答案:A B C2. 在国际贸易中,常见的结算方式有哪些?A. 信用证B. 托收C. 汇付D. 承兑交单答案:A B C D3. 信用证结算方式下,开证行对受益人的付款承诺是基于什么条件的?A. 单据相符B. 货物相符C. 合同相符D. 信用相符答案:A4. 托收结算方式中,托收行对托收款项的支付承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:B C5. 汇付结算方式中,汇入行对汇入款项的支付承担什么责任?A. 付款责任B. 托收责任C. 收款责任D. 通知责任答案:A C三、判断题(每题1分,共10分)1. 信用证是一种无条件的付款承诺。

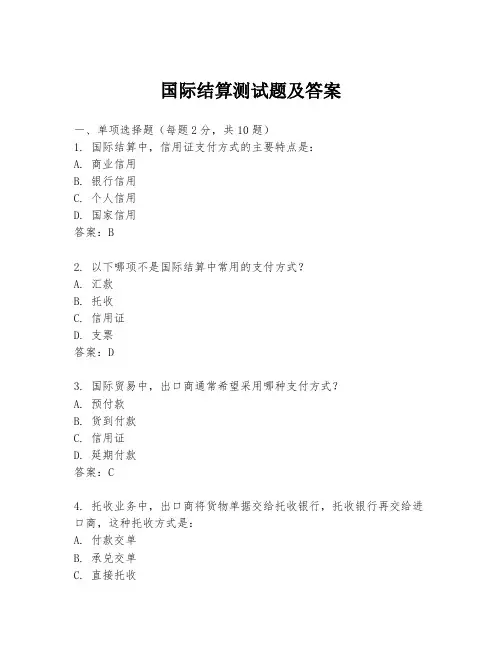

国际结算测试题及答案一、单项选择题(每题2分,共10题)1. 国际结算中,信用证支付方式的主要特点是:A. 商业信用B. 银行信用C. 个人信用D. 国家信用答案:B2. 以下哪项不是国际结算中常用的支付方式?A. 汇款B. 托收C. 信用证D. 支票答案:D3. 国际贸易中,出口商通常希望采用哪种支付方式?A. 预付款B. 货到付款C. 信用证D. 延期付款答案:C4. 托收业务中,出口商将货物单据交给托收银行,托收银行再交给进口商,这种托收方式是:A. 付款交单B. 承兑交单C. 直接托收D. 间接托收答案:A5. 信用证中的“不可撤销”意味着:A. 信用证一经开出,不能更改或撤销B. 信用证可以由开证行随时撤销C. 信用证只能在特定条件下撤销D. 信用证的金额可以随意更改答案:A6. 在国际结算中,汇票的持票人向付款人提示汇票,要求付款的行为称为:A. 提示B. 承兑C. 贴现D. 背书答案:A7. 国际结算中,出口商为了减少汇率风险,可能采用的结算方式是:A. 即期信用证B. 远期信用证C. 汇款D. 托收答案:B8. 国际贸易中,如果出口商希望尽快获得货款,他们可能会选择:A. 信用证B. 托收C. 汇款D. 延期付款答案:C9. 在国际结算中,银行保函是一种:A. 支付承诺B. 信用证C. 担保文件D. 汇票答案:C10. 国际结算中,如果出口商希望减少信用风险,他们可能会要求:A. 提前付款B. 信用证支付C. 托收D. 延期付款答案:B二、多项选择题(每题3分,共5题)1. 国际结算中,以下哪些因素会影响结算方式的选择?A. 交易双方的信用状况B. 货物的性质和价值C. 交易双方的关系D. 汇率波动答案:ABCD2. 信用证结算方式中,以下哪些文件是必须提交的?A. 发票B. 提单C. 装箱单D. 汇票答案:ABCD3. 托收结算方式中,以下哪些是付款交单(D/P)和承兑交单(D/A)的主要区别?A. 付款时间B. 风险承担C. 单据传递方式D. 银行费用答案:AB4. 国际结算中,以下哪些是汇款方式的特点?A. 快速B. 灵活C. 费用较低D. 风险较高答案:ABCD5. 国际结算中,以下哪些是信用证结算方式的优点?A. 降低信用风险B. 提高交易效率C. 增加交易成本D. 保护买卖双方利益答案:ABD结束语:以上是国际结算测试题及答案,希望能够帮助您更好地理解和掌握国际结算的相关知识。

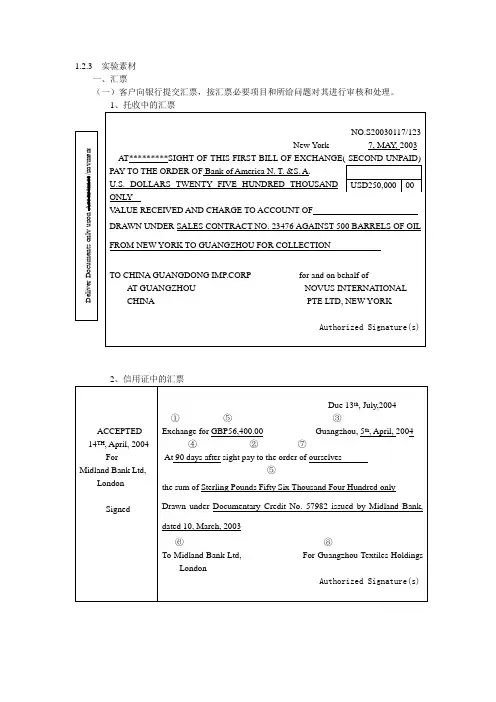

1.2.3 实验素材一、汇票(一)客户向银行提交汇票,按汇票必要项目和所给问题对其进行审核和处理。

(二)客户提交汇票委托银行收款,银行对汇票有效性进行判断并给予客户建议。

GUANGDONG IMP. & EXP. CORPORATION承兑汇票后在票面加盖承兑章。

根据所给汇票和条件在表格中计算并填写汇票到期日。

(五)根据条件进行汇票的转让并加注必要的背书。

1、收款人将汇票记名背书转让给D Company,D Company空白背书转让给E Company,E Company交付转让给F Company,F Company限制背书转让给G Company。

假设收款人公司有权签字人为李华,D Company有权签字人为John,E Company有权签字人为Mary,G2、一笔托收业务中,出口公司为广州市A公司,有权签字人为张品,托收行为中国工商银行广东省分行,有权签字人为李源,代收行为美国花旗银行,进口公司为美国B公司。

⑴开立己收汇票,收款公司空白背书转让给托收行,托收行记名背书给代收行。

汇票背面(六)汇票收款人A Company委托银行向汇票付款人B Company London提示汇票承兑时,付款人根据所给条件在汇票上进行承兑,银行审核承兑汇票。

1、付款人于3月26日在汇票左面作出普通承兑。

6、Standard Chartered Bank Ltd. Hong Kong于2003年11月26日承兑下面汇票后向Bank二、本票(一)客户向银行提交本票,按本票必要项目和所给问题对其进行审核和处理。

三、支票(三)根据所给条件在支票上划线。

出票人在支票上划线“Not Negotiable”;2、收款人在支票上特别划线,委托Bank of East Asia, Guangzhou做光票托收;3、Bank of East Asia,Guangzhou在支票上再特别划线,委托。

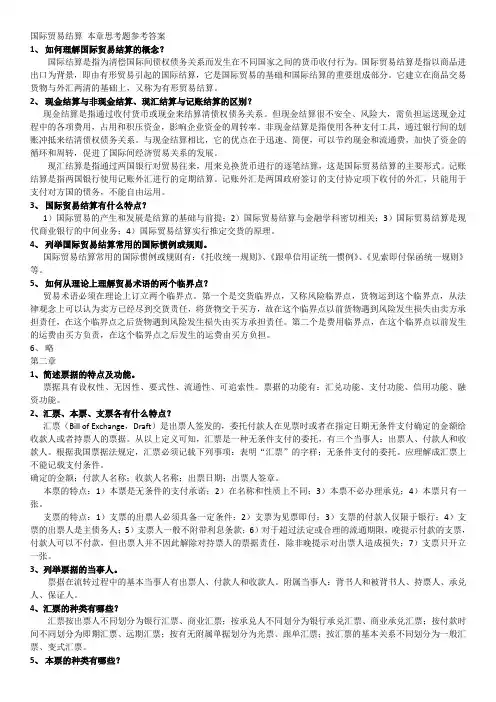

国际贸易结算本章思考题参考答案1、如何理解国际贸易结算的概念?国际结算是指为清偿国际间债权债务关系而发生在不同国家之间的货币收付行为。

国际贸易结算是指以商品进出口为背景,即由有形贸易引起的国际结算,它是国际贸易的基础和国际结算的重要组成部分。

它建立在商品交易货物与外汇两清的基础上,又称为有形贸易结算。

2、现金结算与非现金结算、现汇结算与记账结算的区别?现金结算是指通过收付货币或现金来结算清债权债务关系。

但现金结算很不安全、风险大,需负担运送现金过程中的各项费用,占用和积压资金,影响企业资金的周转率。

非现金结算是指使用各种支付工具,通过银行间的划账冲抵来结清债权债务关系。

与现金结算相比,它的优点在于迅速、简便,可以节约现金和流通费,加快了资金的循环和周转,促进了国际间经济贸易关系的发展。

现汇结算是指通过两国银行对贸易往来,用来兑换货币进行的逐笔结算,这是国际贸易结算的主要形式。

记账结算是指两国银行使用记账外汇进行的定期结算。

记账外汇是两国政府签订的支付协定项下收付的外汇,只能用于支付对方国的债务,不能自由运用。

3、国际贸易结算有什么特点?1)国际贸易的产生和发展是结算的基础与前提;2)国际贸易结算与金融学科密切相关;3)国际贸易结算是现代商业银行的中间业务;4)国际贸易结算实行推定交货的原理。

4、列举国际贸易结算常用的国际惯例或规则。

国际贸易结算常用的国际惯例或规则有:《托收统一规则》、《跟单信用证统一惯例》、《见索即付保函统一规则》等。

5、如何从理论上理解贸易术语的两个临界点?贸易术语必须在理论上订立两个临界点。

第一个是交货临界点,又称风险临界点,货物运到这个临界点,从法律观念上可以认为卖方已经尽到交货责任,将货物交于买方,故在这个临界点以前货物遇到风险发生损失由卖方承担责任,在这个临界点之后货物遇到风险发生损失由买方承担责任。

第二个是费用临界点,在这个临界点以前发生的运费由买方负责,在这个临界点之后发生的运费由买方负担。

一、单项选择题1、在托收方式下,对出口商来说,(C)选择风险最小。

A、D/P90天B、D/A60天C、D/P30天D、D/A40天2、我们说托收业务属于商业信用是因为(C)A、没有银行参与B、出票人开立的汇票是银行汇票C、银行不承担保证付款义务D、以上都不对3、托收方式下的D/P和D/A的主要区别是(B )A、D/P属于跟单托收;D/A属于汇票托收B、D/P是付款后交单;D/A是承兑后交单。

C、D/P属于即期付款;D/A属于远期付款D、D/P属于远期付款;D/A属于即期付款4、以下关于汇款人表述正确的是(A)。

A、汇款人通过银行将款项交付给收款人的方式B、属于银行信用C、一种保证收款人收到款项的方式D、一种逆汇方式5、英文缩写为D /D的是(C)A.信汇B、电汇C、票汇D、汇票6、在下列有关可转让信用证的说明中,错误的说法是(A )。

A.该证的第一受益人可将信用证转让给一个或一个以上的人使用B.该证的第二受益人不得再次转让C.该证转让后由第二受益人对合同履行负责7.保兑信用证的保兑行,其付款责任是(A)。

A.在开证行不履行付款义务时履行付款义务B.在开证申请人不履行付款义务时履行付款义务C.承担第一性付款义务8.托收和信用证两种支付方式使用的汇票都是商业汇票,都是通过银行收款,所以(C)。

A.两者都属于商业信用B.两者都属于银行信用C.托收是属于商业信用;信用证是属于银行信用9.在成套设备和交通工具的交易中,采用延期付款的方式,对买方来说(C )。

A.是利用外资的一种形式B.不是利用外资的一种形式C.是利用出口信贷的一种形式10.使用L/C、D/P和D/A三种支付方式结算货款,就卖方的收汇风险而言,从小到大依次排序为(C)。

A.D/P、D/A和L/CB.D/A、D/P和L/CC.L/C、D/P和D/A11.某外贸公司的工作人员因为在审证过程中粗心大意,未能发现合同发票上的公司名称与公司印章的名称不一致,合同发票上的是ABC Corporation,而印章上的是ABC,仅一词之差,此时又恰逢国际市场价格有变,在这种情况下:(A)A.外商有权拒绝付款B.责任在外商C.外商应该按规定按期付款12. “汇款方式”是基于(B )进行的国际结算A . 国家信用B . 商业信用C . 公司信用D . 银行信用13.以下关于支票的说法,正确的是(A )A.是一种无条件的书面支付承诺B.付款人可以是银行,工商企业或个人C.可以使即期付款或远期付款D.是以银行为付款人的即期汇票14.支票的出票人和付款人的关系是( C )A. 债务人和债权人B.债权人和债务人C.银行的存款人和银行D.供应商和客户15. 客户要求银行使用电汇方式向国外收款人汇款, 则电讯费用由(C )承担A . 汇出行B . 汇入行C . 汇款人D . 收款人16. 银行办理业务时通常无法占用客户资金的汇款方式是(A )A . 电汇B . 票汇C . 信汇D . 以上都是17、在托收业务中,以下关系中不属于委托代理关系的是(C )A.委托人和委托行B.委托行和代收行C.代收行和付款人18、托收出口押汇是(A )A.出口地银行对出口商的资金融通;B.出口地银行对进口商的资金融通;C.进口地银行对出口商的资金融通;D.进口地银行对进口商的资金融通。

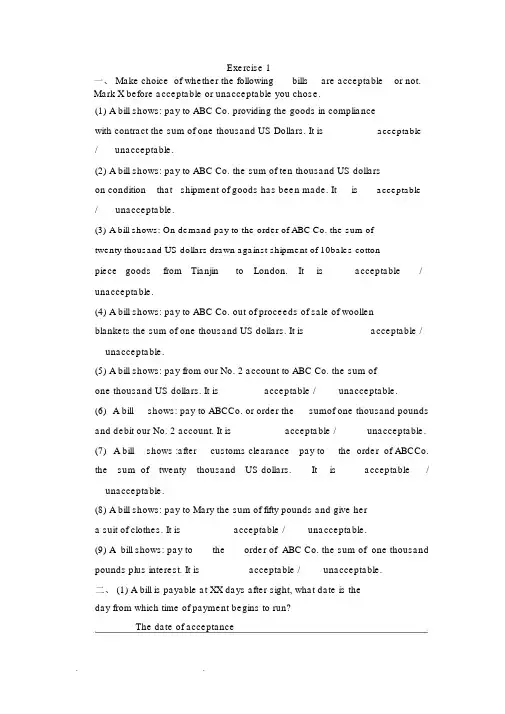

Exercise 1一、 Make choice of whether the following bills are acceptable or not. Mark X before acceptable or unacceptable you chose.(1) A bill shows: pay to ABC Co. providing the goods in compliancewith contract the sum of one thousand US Dollars. It is acceptable /unacceptable.(2) A bill shows: pay to ABC Co. the sum of ten thousand US dollarson condition that shipment of goods has been made. It is acceptable /unacceptable.(3)A bill shows: On demand pay to the order of ABC Co. the sum oftwenty thousand US dollars drawn against shipment of 10bales cottonpiece goods from Tianjin to London.It is acceptable/ unacceptable.(4)A bill shows: pay to ABC Co. out of proceeds of sale of woollenblankets the sum of one thousand US dollars. It is acceptable / unacceptable.(5)A bill shows: pay from our No. 2 account to ABC Co. the sum ofone thousand US dollars. It is acceptable /unacceptable.(6) A bill shows: pay to ABCCo. or order the sumof one thousand pounds and debit our No. 2 account. It is acceptable /unacceptable.(7) A bill shows :after customs clearance pay to the order of ABCCo. the sum of twenty thousand US dollars.It is acceptable/ unacceptable.(8)A bill shows: pay to Mary the sum of fifty pounds and give hera suit of clothes. It is acceptable /unacceptable.(9)A bill shows: pay to the order of ABC Co. the sum of one thousand pounds plus interest. It is acceptable /unacceptable.二、 (1) A bill is payable at XX days after sight, what date is theday from which time of payment begins to run?The date of acceptance(2)A bill is payable at XX days after date,what date is the day fromwhich time of payment begins to run?The date of issuing(3) The maturity of one month after 31 Jan. is28 Feb(4) The maturity of 180 days after 4 April is 1 Oct(5) The maturity of 180 days from 6 Nov.1999 is 3 May. 2000三、 Fill in the following blank forms to draw a bill of exchange. The bill includes the requisite items as follows:(1)date: 22 May,200Xamount: GBP21,787.00tenor: at 90 days after sightdrawer: China National Animal By products Imp.& Exp. Corp, BeijingBranch, Beijingdrawee: Bank of Atlantic, Londonpayee: the Order of China National Animal By product Imp.& Exp.Corp, Beijing Branch(2)date: 23 July,2000amount: USD 35,461.50tenor: on 31 Oct, 2000 fixeddarwer: George Anderson Inc, New Yorkdrawee: Irving Trust Company, New Yorkpayee: Brown and Thomas Inc. or orderdrawn against shipment of cotton form Australia to St. Louis.EXCHANGE forGBP 21787.00Beijing ,22.May200X At90 days after sight pay this first bill ofexchange(Second of same tenor and and date unpaid) to the order of ChinaNational Animal By product Imp.& Exp Corp, Beijing Branch thesum ofSAY GBP TWENTY ONE THOUSAND SEVEN HUNDRED AND EIGHT SEVEN ONLY DrawnTo bank of Atlantic,London For China National Animal By ProductsImp&Exp.Corp Beijing Branch ,BeijingXXX(2)USD 35,461.50New York ,23 July EXCHANGE for200X At31 Oct,2000 fixed pay this first bill of exchange (Second of same tenor and and date unpaid) to the order ofBrown and Thomas Inc.or order the sum of SAYUSDOLLARSTHIRTYFIVE THOUSANDFOURHUNDREDANDSIXTY ONEPOINT FIVE ONLYDrawn against shipment of cotton from Australia St. LouisTo Bank of Atlantic,For George Anderson Inc.New York New YorkXXX四、 Please answer, fill the blank in or made choice of thefollowing question.EXCHANGE for GBP 5,000.00London, 1 Apirl 200XAt60 days after sight pay this first bill of exchange (Second of same tenor and and date unpaid) to the order of Bankof Australiathe sum ofFIVE THOUSAND POUNDS ONLYTo The Import Co.,For The Export Co.,Melbourne LondonSignature(1) Prefer to the above bill, the holder i.e.Bank of Australia has the right transferring it to other person, or the right of presentmentfor acceptance and/or claim for payment to The Import Co. Melbourne.If the latter refuses to pay, the holder has the right of recourse against the Exporting Co. London(2)The payee ’s London Office wishes to transfer the bill to Bank ofNew Zealand, Auckland, please make a restrictive endorsement.Pay to Bank of New Zealand, Auckland onlyFor Bank of Australiasignature(3) Please make a blank endorsement.For Bank of Australiasignature(4) Having made an endorsement in blank, the holder send the bill toBank of New Zealand, Auckland who wishes to convert this blank endorsement into a special endorsement to themselves. Please makethis special endorsement.Pay to the order of Bank of New Zealand, Auckland onlyFor Bank of Australia, LondonSignature(5) If the condition is“on delivery of B/L No. 125”, please makea conditional endorsement.Pay to Bank of Australia or order on delivery of B/L No. 125For Bank of Australia, LondonSignature(6) If payee’s London office wishes to send the bill to their Melbourne officeforcollection, please make an endorsement for collection.Pay to the order of Bank of Australia Melbourne office onlyfor collectionFor Bank of Australia, LondonSignature(7)Refer to the above bill, a banker designated as payer is Bank ofMelbourne, Melbourne. Date of acceptance is 10 April, 200X. Pleasemake acceptance of such bill indicating its maturity.Accepted10 April, 200X9 June, 200XPayable at Bank of Melbourne, MelbourneFor the Importing Co.Signature五、 Choose the best answer to each of the following questionsCCCBCBBAExercise 2P1ease answer.fill the blank in or make choice of the followingquestions .1、There are four parties in aremittance.i.e.(1)remitter(2)payee(3)remitting bank and (4)paying bank2、Remittance through a bank from one country to another may usuallybe made by one of the following methods:(1) Telegraphic Transfer(2)Mail Transfer(3)Banker’s Demand Draft3、(1)Payment in advance which is adopted in international trade isusually effected by remittance.and is advantageous to (× exporter /□ importer).(2)Payment after arrival of goods which is adopted in internationaltrade is usually effected by remittance too .and is advantageousto ( □exporte r /×importer) .(3)Payment after arrival of goods include two types of goods forly①Goods Sold②Consignment.4、Financial documents mean bills of exchange.promissory notes.cheques .Commercial documents mean invoices.transportdocuments.documents of title or other similar documents.5、C1ean collection means collection of financial documents notaccompanied by commercial documents6、Documentary collection means collection of(1)Financial documents accompanied by commercial documents.or(2)commercial documents not accompanied by financialdocuments.7、How many parties are there in a collection ?(1)Principal(or seller)(2)Remitting Bank(3)Collecting bank(4)Drawee(or buyer)8、Terms of delivery of documents are as follows:(1)Delivery of documents against payment .its abbreviationis D/P.(2)Delivery of documents against acceptance.its abbreviationis D/A.9、(1)The remitting bank has maintained an account with the collectingbank.how do you write collecting proceeds instructions in the collection instruction.Whencollected please credit our account with you under your cable/airmail advice to us(2)The Collecting bank has maintained an account with theremitting bank.how do you write co11ecting proceeds instructions inthe collection instruction?Please collect the proceeds and authorize us by cable/airmail debit your accountwith us10、Remitting bank:Bank of China.TianjinPaying bank : Bank of China.LuxemburgDate of cable:9 JuneTest :2563Ref No .208TT0219Amount:USD l.660.00Payee: Marie Clauda Dumont.LuxemburgAccount No .0—164/7295/550withBanque International du LuxemburgMessage:PayrollRemitter : Crystal Palace Hotel.TianjinCover : Debit our H.O. accountFM:BANK OFCHINA ,TIANJINTO:BANK OFCHINA ,LUXEMBURGDATE:9JUNETEST 2563.208TTOUR REF0219NOT ANY CHARGES FOR USPAY USD 1660.00TO BANQUE INTERNATIONAL DU LUXEMBURGFOR CREDITING ACCOUTNO.0-164/7295/550OF MARIE CLAUDADUMONT ,LUXEMBURGMESSAGE PAYROLLORDER CRYSTAL PALACEHOTEL ,TIANJINCOVER DEBIT OUR H.O.ACCOUNT11、MT100CUSTOMER TRANSFERDATE: 031206SENT TO: BKCHCNBJ200BANK OF CHINA.TIANJIN:FM: 04HSBCHK25264HONG KONG AND SHANGHAI BANKINGCORPORATION.HONGKONG :20: TRN:TT-HKH315064BACP:32A:VALUE DATE/CUR CODE/AMTDATE:031206 CURRENCY CODE:CNY AMDUNT:6.859.58:50: ORDERING CUSTOMER:ARTHUR ANDERSEN AND CO.:57s:“ ACOOUNT WITH”BANK:BANK OF CHINA.TIANJIN BR. TIANJIN.CHINA:59: BENEFICIARY CUSTOMERTIANJIN INTERNATIONAL TAXATION CONSULT1NG BUREAU :70: DETAILS OF PAYMENT:PAYMENT TO RENT AND TAX FOR NOV.2003:71A:DETAILS OF CHARGES:BENEFICIARY:72: BANK TO BANK INFORMATION:IN COVER SETTLE THRU OUR CNY/AC 111— 01081WITHYOUR BEIJING HEAD OFFICEIn accordance with above SWIFTMessage Type l00 please write a cable text of remittance.DATE; 6TH DEC,2003TO:BANK OF CHINA, TIANJIN BR TIANJIN CHINAFM: HONGKONG AND SHANGHAI BANKINGCORPORATION,HONGKONG TION,HONGKONGOUR.REF: TT-HKH315064BACP VALUE DATE 6 DEC1998 CNY 6859.58ORDERING ARTHUR ANDERSEN AND CO.ACCOUNT WITH BANK BANK OFCHINA, TIANJIN BRANCH TIANJIN BENEFICIARY TIANJIN INTERNATIONALTAXATION CONSULTING, BUREAU DETAILS OF PAYMENT PAYMENT OFRENT AND TAX FOR NOV.1998 DETAILS OF CHARGESBENEFICIARY IN COVER SETELE THRU OUR CNY A/C 111-01081WITH YOU BEIJING HEAD OFFIC12、Draft NO .20060613Amount:HKD32.150.00Place and date of draft:Tianjin.8 May.200XPaying bank :Bank of China.HongKongPayee :the order of United Trading Company.HongKongPay against this draft to the debit of our accountRemitting bank:Bank of China.TianjinRemitter:China-National Light Industrial Products Imp .& Exp .Corp..Tianjin Branch.TianjinP1ease draw a demand draft to make remittance by D/D .13、(1)China National Instruments Imp.&Exp.Corp.. TianjinBranch.Tianjin (principa1) wishes to issue a draft dated 14 Ju1y.200Xdrawn on Continental Co. , 46 Rue de Ancient.Paris (drawee) at sight for USDl.200.00 payable to the order of Bank of China.Tianjin(remitting bank) which will make a special endorsement to Banque ofParis .Paris.marked “Drawn against shipment of 20 sets oftransistors shipped per s.s.Chenghau from Tianjin to Le Harve for collection.”P1ease draw a draft to meet the above requirements.(2)The principa1 presents an application for collection accompanied bydraft and documents to the remitting bank for collection.An application for collection shows as follows:Commercial documents surrendered are below:B /L in triplicateInvoice in triplicateInsurance policy in duplicatecertificate of origin in duplicatepacking list induplicateCo11ection instructions are given below:deliver documents against paymentremit the proceeds by airmailairmail advice of paymentcollection charges outside China from drawee.waive if refused by him.airmail advice of non-payment with reasonsprotest waivedWhen collected. please credit proceeds to principal’s account with remitting bank.Remitting bank complete a collection instruction in accordancewith principal ’s application to add other requirements as follows:Ref .No.OC2576459Date:15 July.200XPlease co11ect and remit proceeds to Bank of China.New York for credit of our account with them under their advice to us.Please produce a collection instructionattaching draft and documents to be forwarded to the co11ectingbank.Banque of Paris.Paris.(COLLECTION INSTRUCTION)Exercise 3Please answer.fill the blank in or make choice of the fo1lowing questions .1、Here is the simple definition of letter of credit:In simple terms.a letter of credit is a conditional bank promise /undertakingof payment.2、There exists a triangular contractual arrangement under a documentary credit operation:(1) Firstly.the sales contract between beneficiary and applicant.(2) Secondly.the applicant between applicant and issuing bank.(3)Thirdly.the documentary credit between issuing bank and beneficiary.3、 A credit stipulated that quantity of goods.grade A 60%.quantity ofgoods.grade B 40% . Beneficiary presented invoices being evidenced gradeA 40%.gradeB 60% which were in accordance with sales contract as he saidthat the credit has stipulated erroneously.(1)□ The above invoice is acceptable.(2)The above invoice is not acceptable.4、How many parties are there in a documentary credit?(1) the issuing bank(2 ) the applicant if any(3) the beneficiary5、The advising bank’s liability is to check the apparent authenticityof the credit.6、 All credit must stipulated an expiry date for presentation for payment .7、If the amount is preceded by “about ”,“ approximately”or“ circa”, the credit will allow the10% tolerance.8、In the absence of indicating the nature of a credit.it shall be deemed to be irrevocable9、Under an irrevocable credit.the issuing bank must undertake primary liability for payment .10、What is the essence of an irrevocable documentary credit?The essence of an irrevocable documentary credit is that“ an irrevocable credit can neither be amended nor cancelled without the agreement of the issuing bank.the confirming bank (if any)and the beneficiary”.11、A credit should not be issued available by draft(s) on the applicant.If the credit nevertheless calls for draft on the applicant, banks willconsider such draft(s) as an additional documents12、An issuing bank’s undertaking clause is as follows:We hereby undertake to pay at sight against draft and/or documents presented to our office in conformity with terms of credit.Who undertakes the primary liability?Issuing bank13、A bank confirms a credit.it will usually write a clause as follows:We hereby add our confirmation to the credit and undertake to honourdrafts and documents inconformity with the terms of the credit uponpresentation themto us14、A credit is issued by Bank of China.Tianjin and confirmed by Bank ofChina.London . It constitutes the payment undertaking of(1) 口 one bank only .(2)above two banks .15、Put ╳ in relative check box of the following sentences or fill the blanksto issue an irrevocable unconfirmed documentary credit which is to expireon or before 30 June.200X and is available with the advising bank.theIndustrial and Commercial Bank of China , Shanghai by deferredpayment at30 days after presentation of documents against the documents .(1) In Irrevocable Documentary Credit Form(Advice for the advising bank)We request you to advice beneficiary:①without adding your confirmation.②口 adding your confirmation.③口 adding your confirmation if requested by the beneficiary.(2) In Notification of Irrevocable Documentary Credit Form①This notification and the enclosed advice are sent to you withoutany engagement on our part.②口 As requested by the issuing bank.we hereby add our confirmationto this credit in accordance with the stipulations under UCP500.(3) In Irrevocable Documentary Credit Form(Advice for the beneficiary)Expiry date and place for presentation of documentsexpiry date:30 June.200Xplace for presentation:Shanghaicredit available with the Industrial andCommercial Bank of China①口 by payment at sight② by deferred payment at30 days after presentation of documents③口 by acceptance of draft(s) at④口 by negotiationagainst the documents detailed herein⑤and beneficiary's draft(s) drawn onthe Industrial and Commercial Bank of China16、Put X in relative check box of the following sentences or fill theblanks to issue an irrevocable credit which is to expire on or before 30June.200X and is available with the issuing bank.Dresdner Bank, Hamburgby acceptance of draft(s) at 90 days sight.In Irrevocable Documentary Credit Form (Advice for the beneficiary)Expiry date and place for presentation of documentsexpiry date:30 June.200Xplace for presentation:Hamburgcredit available with Hamburg①口 by payment at sight②口 by deferred payment at③by acceptance of draft(s) at90 days sight.④口 by negotiationagainst the documents detailed herein⑤and beneficiary’s draft(s) drawn on Dresdner Bank17、An irrevocable negotiation (with the advising bank)documentary creditwill expire on 29 May.200X.at:①口(place of issuing bank)/②(place of advising bank)/③口(place of other bank)available with:name and place of/④口(issuing bark)/⑤(advisingbank) /⑥口 (other bank)by :⑦口 (sight payment) /⑧口 (deferred payment at) /⑨口 (acceptance of draft at)/⑩negotiationagainst the documents detailed hereinand beneficiary's draft(s) drawn on name and place of/口(issuing bank) /口(advising bank)18、A new transferable credit maybe opened at the request of the first beneficiary by the transferring bank in accordance with all terms and conditions of original credit except that① the applicant may be changed by the first beneficiary② the credit amount and unit price maybe reduced③the shipment and expiry dates and latest date for presentation ofdocuments maybe shortened④ the percentage of insurance cover maybe increase⑤ the original transferable credit allows the first beneficiary to substitute hisinvoice and draft for those presented by the second beneficiary19、Whomakes first presentation of documents to the nominated bank undera transferable credit?①口 The first beneficiary.② The second beneficiary.③口 The middleman .20、SWIFTMT700 and MT 701 are used for issue of a documentary credit.SWIFT MT 707issued for amendment to a documentary credit.21~30 BBCBC CCDAD31、Please fill with the following terms into a SWIFTMT700form to issuea documentary credit:ADVISING BANK: BANKOF ASIA.SHENZHEN BRANCHNO.68 SHEN NNAN ROAD.CENTRAL.SHENZHEN 518043.GUANGDONGDOCUMENARY CREDIT NUMBERE-0l-N-04939ISSUING BANK: BANKOF ASIA.HKBENEFICIARY:SHENZHEN BUILDING MATERIALSINDUSTRY (GROUP) CO STONEDEPARTMENT l0/F BUILDING MATERIALSBLDG.28 SHENNAN ZHONG .RDSHENZHEN .CHINAACCOUNT NO.6251420110002APPLICANT:NEWTOWER DEVELOPMENT LIMITEDROOM 2504-5 CAUSEWAY BAY PLAZA489 HENNESSY ROAD.CAUSEWAY BAY.HONGKONGCUR AMOUNT:USD34.800.00DRAFTS AT SIGHTQUOTING NO.AND DATE OF THIS LC ANDNAME OF LC ISSUING BANKDRAWEE:ISSUING BANK FOR FULL INVOICE VALUE+FULL SET OF CLEAN ON BOARDOCEAN BILLS OF LADINGMADE OUT TO ORDER OF BANK OFASIA.HO.HONGKONG MARKED FREIGHT PREEPAID ANDNOTIFY NEWTOWER DEVELOPMENT LIMITEDROOM2504-5 CAUSEWAY BAY PLAZA 489 HENNESSY ROAD.+SIGNED COMERRCIAL INVOICE+MARINE INSURANCE POLICY OR CERTIFICATE ENDORSEDIN BLANKBY THE ASSURED FOR AT LEAST 110% OF THE CIFVALUE COVERING F. P. A. AS PER OCEAN MARINECARGO CLAUSES (1/1/1981) OF PICC SHOWINGCLAIMS PAYABLE ATDESTINATION IN THE SAME CURRENCY AS.DNINSURANCE TOINCLUDE THE RISKS OF JETTISION AND WASHING OVER BOARD IN CASE OF SHIPMENT BY CONTAINER+PANKING LIST+BENEFICIARY’ S CERTIFICATE ADDRESSED TOISSUING BANKCONFIRMING THEIR ACCEPTANCEAND/ OR NON-ACCEPTANCEOF ALL THEAMENNDMENTMADEUNDERTHIS CREDIT QUOTINGTHEREVALENTAMENDMENT NUMBER.IF THIS CREDIT HAS NOT BEEN AMENDED.SUCH CERTIFICATE IS NOT REQUIED.INSTRUCTIONS TO THE PAYING /ACCEPTING /NEGOTIATING BANK:+EACH DRAWING BE ENDORSED ON THERERSE BY PRESENTING BANK+ALL DOCUMENTS TO BE DESPACHEDTO ISSUING BANKIN ONE LOT BY FIRST AVAILABLE AIRMAIL+ON RECEIPT OF DOCUMENTS CONFORMlNG TOTHE TERMS OF THIS DOCUMENTARY CREDIT WESHALL REIMBURS YOU INACCORDANCE WITH YOUR INSTRUCTIONSSWIFT MT 700 FORMDATE:X X/04/20FORM:(1)BANKOF ASIA ,HKTO:(2)BANKOF ASIA.SHENZHEN BRANCHNO.68 SHEN NNAN ROADCENTRAL.SHENZHEN 518043.GUANGDONGTEST 71-3315MT 700/ISSUE OF A DOCUMENTARY CREDIT:27/SEQUENCE OF TOTAL:1/1:40A/ FORM OF DOCUMENTARY CREDIT:IRREVOCABLE:20/(3) DOCUMENARY CREDIT NUMBERE-0l-N-04939:31C/ DATE OF ISSURE (YYMMDD) X X/04/20:31D/ DATE AND PLACE OF EXPIRE (DATE IN YYMMDD):XX0615 IN BENEFICIARY ’ S COUNTARY:50/(4) APPLICANT:NEWTOWER DEVELOPMENT LIMITEDROOM 2504-5 CAUSEWAY BAY PLAZA489 HENNESSY ROAD.CAUSEWAY BAY.HONGKONG:59/(5) BENEFICIARYSHENZHEN BUILDING MATERIALSINDUSTRY (GROUP) CO STONEDEPARTMENT l0/F BUILDING MATERIALSBLDG.28 SHENNAN ZHONG RDSHENZHEN .CHINA:32B/ (6) CUR AMOUNTUSD34.800.00:41A/ AVAILABLE WTIHBANKOFASIASHENZHEN BRANCHBY NEGOTIATION:42C/ (7) DRAFTS AT SIGHTQUOTING NO.AND DATE OF THIS LC ANDNAME OF LC ISSUING BANK:42D (8)DRAWEEISSUING BANK FOR FULL INVOICE VALUE:43T/ PARTIAL SHIPEMTS:ALLOWED:43T/ TRANSHIPMENT: ALLOWED:44A/ LOADING ON BOARD/DISPATCH/TAKING IN CHARGE AT/ FROM:CHINESE PORT:44B/ FOR TRANSPORTATION:TOHONGKONG:44C/ LATEST DATE OF SHIPMENT(YYMMDD):XX0531:45A/ DESCRIPION OF GOOS AND/OR SERVICES:1200 SQ.M.OF PINK POLISHED GRANITE TILESAT USD29.00/SQ.M.CIF HONGKONG:46A/ DOCUMENTS REQUIRED:(AT LEAST IN DUPLICATE卫UNLESS OTHERWISE SPECIFIED)(9)+ SIGNED COMERRCIAL INVOICE+ FULL SET OF CLEAN ON BOARDOCEAN BILLS OF LADINGMADE OUT TO ORDER OF BANK OF ASIA.HO.HONGKONGMARKED FREIGHT PREEPAID AND NOTIFYNEWTOWER DEVELOPMENT LIMITEDROOM 2504-5CAUSEWAY BAY PLAZA 489 HENNESSY ROAD+ MARINE INSURANCE POLICY OR CERTIFICATE ENDORSEDIN BLANKBY THE ASSURED FOR AT LEAST 110% OF THE CIF VALUECOVERING F.P.A.AS PER OCEAN MARINE CARGOCLAUSES (1 / 1/ 1981) OF PICC SHOWING CLAIMSPAYABLE ATDESTINATION IN THE SAME CURRENCY AS DN.INSURANCE TOINCLUDE THE RISKS OF JETTISION AND WASHING OVER BOARD INCASE OF SHIPMENT BY CONTAINER+PANKING LIST+BENEFICIARY ’S CERTIFICATE ADDRESSED TOISSUING BANKCONFIRMING THEIRACCEPTANCE AND /OR NON-ACCEPTANCEOF ALL THE AMENNDMENTMADE UNDERTHIS CREDIT QUOTING THEREVALENT AMENDMENT NUMBERIF THIS CREDIT HAS NOT BEEN AMENDED.SUCH CERTIFICATE IS NOT REQUIED.INSTRUCTIONS TO THE PAYING /ACCEPTING / NEGOTIATING:47A/ ADDITIONAL CONDITIONS:+CREDIT AMOUNT AND SHIPMENT QUANTITY%5MORE OR LESS+DOCUMENTS MUST BE PRESENTED WITHIN 15 DAYS AFTER THE DATE OF SHIPMENT BUT WITHIN THE VALIDITY OF THE CREDIT+DOCUMENTS MUST BE PRESEVTED TO CREDIT ISSUING BANK (ADDRESS-20 PEDDER ST CENTRAL.HK.ATTN.INWARD BIILS DEPARTMENT)THOUGH BANK OF ASIA.SHENZHEN BRANCH+A DISCREPANCY FEE OF USD30.00 (OR EQUIVA LENT) AND THERELATIVE CABLE CHARGES FOR ADVISING DISCREPANCY TONEGOTIATING / PRESENTING BANK ARE PAYABLE BY BENEFICIARY ANDSHALL BE DEDUCTED FROM THE PROCEEDS FOR EACH PRESENTATION OF DISCREPANT DOCUMNTS UNDER THIS DOCUMENTARY CREDIT :71B/ CHARGES:ALL BANKING CHARGES OUTSIDE HONGKONGINCLUDING REIMBURSING CHARGESARE FOR ACOOUNT OF BENEFICIARY:49/CONFIRMATION INSTRUCTIONS:WITHOUT:78/(10)INSTRUCTIONS TO THE PAYING /ACCEPTING / NEGOTIATING BANK +EACH DRAWING BE ENDORSED ON THERERSE BY PRESENTING BANK+ALL DOCUMENTS TO BE DESPACHEDTO ISSUING BANK IN ONE LOT BY FIRST AVAILABLE AIRMAIL+ON RECEIPT OF DOCUMENTS CONFORMlNG TOTHE TERMS OF THIS DOCUMENTARY CREDIT WE SHALLREIMBURS YOU INACCORDANCE WITH YOUR INSTRUCTIONS:72/SENDER TO RECEIVER INFORMATION:SUBJECT TO UCP (1993 REVISION) ICC PUBLICATION NO.500THIS IS THE OPERATIVE INSTRUMENTNO MAIL CONFIRMATION WILL FOLLOWNNNN二、 Decide whether the following statements are true or false.TFTFF。

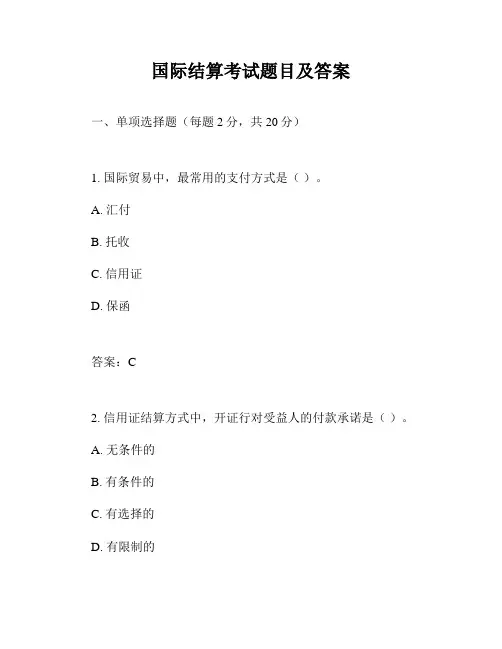

国际结算考试题目及答案一、单项选择题(每题2分,共20分)1. 国际贸易中,最常用的支付方式是()。

A. 汇付B. 托收C. 信用证D. 保函答案:C2. 信用证结算方式中,开证行对受益人的付款承诺是()。

A. 无条件的B. 有条件的C. 有选择的D. 有限制的答案:B3. 在托收结算方式中,代收行对托收款项的收取()。

A. 承担付款责任B. 不承担付款责任C. 承担部分付款责任D. 承担全部付款责任答案:B4. 出口商在信用证结算方式下,通常需要提交的单据是()。

A. 发票B. 装箱单C. 运输单据D. 所有以上选项答案:D5. 国际保理业务中,保理商提供的服务不包括()。

A. 贸易融资B. 销售分户账管理C. 信用风险控制D. 货物运输答案:D6. 在汇付结算方式中,预付款属于()。

A. 电汇B. 信汇C. 票汇D. 托收答案:A7. 信用证结算方式中,受益人提交的单据与信用证条款不符时,开证行()。

A. 必须付款B. 可以拒付C. 必须拒付D. 可以付款答案:B8. 国际结算中,银行保函通常用于()。

A. 贸易融资B. 预付款保证C. 履约保证D. 所有以上选项答案:D9. 在信用证结算方式中,开证行对受益人的付款责任是在()。

A. 收到符合信用证条款的单据后B. 收到开证申请后C. 收到开证保证金后D. 信用证生效后答案:A10. 国际结算中,远期信用证的有效期通常为()。

A. 30天B. 60天C. 90天D. 120天答案:C二、多项选择题(每题3分,共15分)1. 信用证结算方式中,以下哪些单据是必须提交的()。

A. 发票B. 装箱单C. 运输单据D. 保险单答案:A、B、C2. 国际结算中,以下哪些属于支付方式()。

A. 汇付B. 托收C. 信用证D. 保函答案:A、B、C3. 托收结算方式中,以下哪些是代收行的职责()。

A. 审核单据B. 代为收款C. 承担付款责任D. 提供资金融通答案:A、B4. 国际保理业务中,以下哪些是保理商提供的服务()。

国际贸易结算本章思考题参考答案1、如何理解国际贸易结算的概念?国际结算是指为清偿国际间债权债务关系而发生在不同国家之间的货币收付行为。

国际贸易结算是指以商品进出口为背景,即由有形贸易引起的国际结算,它是国际贸易的基础和国际结算的重要组成部分。

它建立在商品交易货物与外汇两清的基础上,又称为有形贸易结算。

2、现金结算与非现金结算、现汇结算与记账结算的区别?现金结算是指通过收付货币或现金来结算清债权债务关系。

但现金结算很不安全、风险大,需负担运送现金过程中的各项费用,占用和积压资金,影响企业资金的周转率。

非现金结算是指使用各种支付工具,通过银行间的划账冲抵来结清债权债务关系。

与现金结算相比,它的优点在于迅速、简便,可以节约现金和流通费,加快了资金的循环和周转,促进了国际间经济贸易关系的发展。

现汇结算是指通过两国银行对贸易往来,用来兑换货币进行的逐笔结算,这是国际贸易结算的主要形式。

记账结算是指两国银行使用记账外汇进行的定期结算。

记账外汇是两国政府签订的支付协定项下收付的外汇,只能用于支付对方国的债务,不能自由运用。

3、国际贸易结算有什么特点?1)国际贸易的产生和发展是结算的基础与前提;2)国际贸易结算与金融学科密切相关;3)国际贸易结算是现代商业银行的中间业务;4)国际贸易结算实行推定交货的原理。

4、列举国际贸易结算常用的国际惯例或规则。

国际贸易结算常用的国际惯例或规则有:《托收统一规则》、《跟单信用证统一惯例》、《见索即付保函统一规则》等。

5、如何从理论上理解贸易术语的两个临界点?贸易术语必须在理论上订立两个临界点。

第一个是交货临界点,又称风险临界点,货物运到这个临界点,从法律观念上可以认为卖方已经尽到交货责任,将货物交于买方,故在这个临界点以前货物遇到风险发生损失由卖方承担责任,在这个临界点之后货物遇到风险发生损失由买方承担责任。

第二个是费用临界点,在这个临界点以前发生的运费由买方负责,在这个临界点之后发生的运费由买方负担。

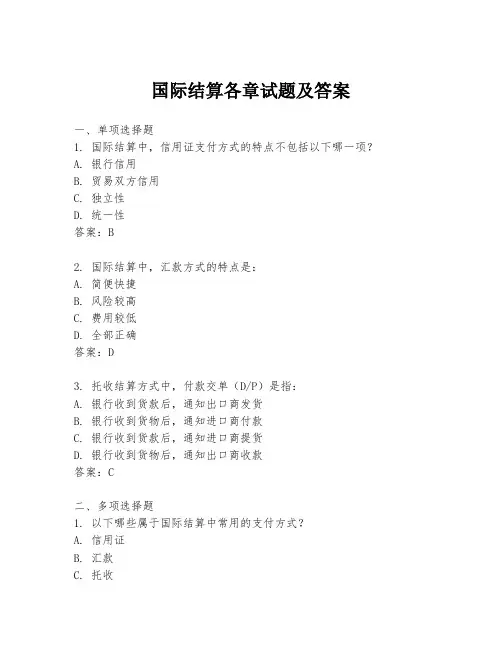

国际结算各章试题及答案一、单项选择题1. 国际结算中,信用证支付方式的特点不包括以下哪一项?A. 银行信用B. 贸易双方信用C. 独立性D. 统一性答案:B2. 国际结算中,汇款方式的特点是:A. 简便快捷B. 风险较高C. 费用较低D. 全部正确答案:D3. 托收结算方式中,付款交单(D/P)是指:A. 银行收到货款后,通知出口商发货B. 银行收到货物后,通知进口商付款C. 银行收到货款后,通知进口商提货D. 银行收到货物后,通知出口商收款答案:C二、多项选择题1. 以下哪些属于国际结算中常用的支付方式?A. 信用证B. 汇款C. 托收D. 现金交易答案:A、B、C2. 信用证结算方式中,常见的类型包括:A. 即期信用证B. 远期信用证C. 可转让信用证D. 保兑信用证答案:A、B、C、D三、判断题1. 信用证结算方式下,银行只负责审核单据,不负责审核货物的质量。

答案:正确2. 汇款结算方式下,出口商承担的风险较小。

答案:错误四、简答题1. 简述信用证结算方式的优点。

答案:信用证结算方式的优点包括:(1)银行信用担保,降低了贸易双方的风险;(2)单据审核独立于货物,简化了结算流程;(3)提供了标准化的结算程序,便于国际贸易的进行。

2. 汇款结算方式下,汇款人需要注意哪些事项?答案:汇款人需要注意以下事项:(1)选择可靠的汇款渠道;(2)了解汇款费用及汇率;(3)确保收款人信息的准确性;(4)注意汇款的安全性和及时性。

五、案例分析题某公司通过信用证方式向国外出口一批货物,信用证要求提供商业发票、提单、装箱单等单据。

货物装船后,公司发现提单上的货物数量与实际不符,但货物已经发运。

问:该公司应如何处理?答案:该公司应立即通知银行和进口商,说明情况并请求修改提单。

同时,应与船运公司协调,确保提单信息的准确性。

如果进口商同意接受不符点,可以提供不符点说明和相应的证明文件,以便银行接受不符点并支付货款。

如果进口商不同意接受不符点,公司可能需要承担货物退回或重新发运的风险和费用。

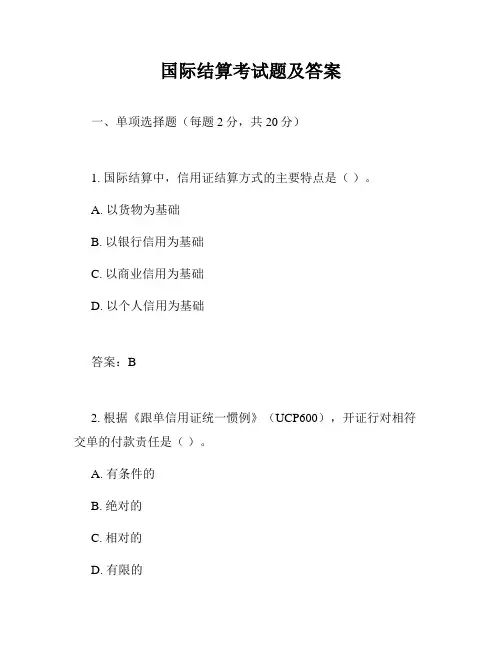

国际结算考试题及答案一、单项选择题(每题2分,共20分)1. 国际结算中,信用证结算方式的主要特点是()。

A. 以货物为基础B. 以银行信用为基础C. 以商业信用为基础D. 以个人信用为基础答案:B2. 根据《跟单信用证统一惯例》(UCP600),开证行对相符交单的付款责任是()。

A. 有条件的B. 绝对的C. 相对的D. 有限的答案:B3. 在国际贸易中,托收结算方式下,出口商将单据交给()。

A. 进口商B. 托收银行C. 议付银行D. 开证行答案:B4. 国际结算中,汇票的出票人是()。

A. 付款人B. 收款人C. 承兑人D. 持票人答案:A5. 根据《国际贸易术语解释通则》(Incoterms),FOB、CIF 和CFR三种贸易术语中,卖方责任最大的是()。

A. FOBB. CIFC. CFRD. 相同答案:B6. 国际结算中,汇款结算方式的主要特点是()。

A. 以银行信用为基础B. 以商业信用为基础C. 以个人信用为基础D. 以货物为基础答案:B7. 在国际结算中,信用证结算方式下,银行对单据的审核标准是()。

A. 严格相符B. 基本相符C. 近似相符D. 完全相符答案:A8. 根据《跟单信用证统一惯例》(UCP600),信用证到期地点通常在()。

A. 开证行所在地B. 受益人所在地C. 议付行所在地D. 申请人所在地答案:A9. 国际结算中,汇票的承兑人是()。

A. 付款人B. 收款人C. 出票人D. 持票人答案:A10. 在国际贸易中,托收结算方式下,出口商将单据交给托收银行后,托收银行将单据交给()。

A. 进口商B. 托收银行C. 议付银行D. 开证行答案:A二、多项选择题(每题3分,共15分)11. 国际结算中,以下哪些因素可能影响汇率的变动?()A. 国际收支状况B. 通货膨胀率C. 利率水平D. 政治稳定性答案:ABCD12. 根据《跟单信用证统一惯例》(UCP600),以下哪些单据是信用证结算中常见的单据?()A. 商业发票B. 运输单据C. 保险单据D. 原产地证明答案:ABCD13. 国际结算中,以下哪些贸易术语属于E组术语?()A. EXWB. FCAC. DAPD. DDP答案:AD14. 在国际贸易中,以下哪些因素可能影响托收结算方式的风险?()A. 进口商的信用状况B. 出口商的信用状况C. 托收银行的信用状况D. 国际市场的政治经济状况答案:ACD15. 国际结算中,以下哪些结算方式属于商业信用?()A. 汇款B. 托收C. 信用证D. 保函答案:AB三、判断题(每题2分,共10分)16. 信用证结算方式下,银行对单据的审核是实质性审核。

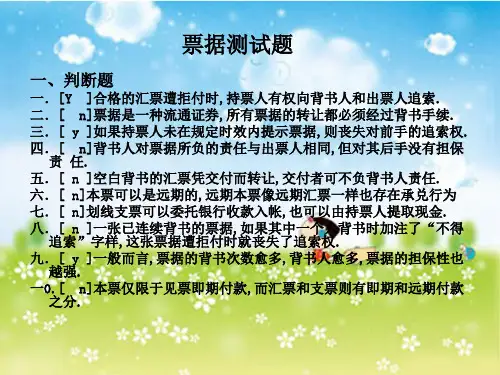

《国际结算》章后习题答案1.简述票据的定义及特性答:票据是由出票人签发,具有法定格式,约定由自己或指定他人无条件支付一定金额的可以转让流通的有价证券,包括汇票、本票和支票。

票据具有8个特性:设权性;无因性;要式性;文义性;金钱性;返还性;提示性;流通转让性。

2.简述汇票的必要项目答:汇票是一种要式凭证,注重在形式上应具备必要项目。

一张汇票的必要项目是否齐全和合格,决定了该汇票是否具有法律效力。

汇票的必要项目包括:①“汇票”字样;②无条件支付命令;③收款人名称;④确定的金额;⑤付款人名称;⑥出票人名称和签字;⑦出票日期和出票地点;⑧付款地点;⑨付款期限3.什么是汇款?汇款可分哪几种?答:汇款又称汇付,是指交易双方订立商务合同后,进口商将货款交给进口银行,要求银行通过一定的方式,委托在出口地的代理行或联行,将款项交给出口商的一种结算方式。

按照所采用的支付工具的不同,汇款可分为电汇、信汇和票汇三种不同的方法。

4. 托收的含义和特点是什么?答:国际商会《托收统一规则》(URC522)第二条规定:托收是指由接受托收指示的银行依据所收到的指示处理金融单据或商业单据以便取得付款或承兑,或凭付款或承兑交出商业单据或凭其他条款或条件交出单据。

托收的特点:(1)以商业信用为基础,出口商承担了较大的风险(2)资金负担仍不平衡(3)手续比较繁琐,费用较高5. 简述托收方式下的当事人及其关系。

答:在托收业务中,主要涉及四个当事人,即委托人、托收行、代银行和付款人。

(1)委托人通常是指委托银行办理托收业务的一方。

(2)托收行是指接受委托人的委托办理托收的银行。

(3)代收行是指接受托收行的委托,依照托收行指示,向进口商或债务人收款的银行。

(4)付款人是指依照托收指示,由代收行向其提示单据并要求其付款的人。

托收下四大当事人之间存在三个合同关系,一是委托人与付款人之间的买卖合同关系,双方按买卖合同履行各自的义务;二是委托人与托收行之间的委托代理合同,即委托人填写的托收申请书,托收行应按委托人的指示办理相关业务;三是托收行与代收行之间的委托代理合同,即托收委托书,代收行作为代理人应严格执行托收行的指示办理代收业务。

国际结算试题及答案解析一、单项选择题1. 国际结算中,信用证是一种()。

A. 银行信用B. 商业信用C. 个人信用D. 政府信用答案:A解析:信用证是一种银行信用,由银行出具,保证在符合信用证条款的情况下支付款项。

2. 托收结算方式中,出口商将汇票连同货运单据交给()。

A. 开证行B. 托收行C. 议付行D. 代收行解析:在托收结算方式中,出口商将汇票连同货运单据交给托收行,由托收行代为向进口商收取款项。

3. 根据《跟单信用证统一惯例》(UCP600),信用证到期地点通常为()。

A. 开证行所在地B. 受益人所在地C. 议付行所在地D. 申请人所在地答案:A解析:根据UCP600的规定,信用证到期地点通常为开证行所在地。

4. 国际结算中,汇票的出票人是()。

A. 付款人B. 收款人C. 承兑人答案:A解析:汇票的出票人是付款人,即承诺在汇票到期时支付款项的人。

5. 国际结算中,银行保函是一种()。

A. 银行信用B. 商业信用C. 个人信用D. 政府信用答案:A解析:银行保函是一种银行信用,由银行出具,保证在符合保函条款的情况下支付款项。

二、多项选择题6. 国际结算中,以下哪些属于支付方式?()A. 汇款B. 托收C. 信用证D. 银行保函答案:ABCD解析:汇款、托收、信用证和银行保函都是国际结算中常见的支付方式。

7. 信用证结算方式中,以下哪些是开证行的责任?()A. 审核单据B. 支付款项C. 审核信用证条款D. 审核货物质量答案:ABC解析:开证行在信用证结算方式中负责审核单据、支付款项和审核信用证条款,但不负责审核货物质量。

8. 托收结算方式中,以下哪些是托收行的责任?()A. 审核单据B. 代为收款C. 审核信用证条款D. 审核货物质量答案:AB解析:托收行在托收结算方式中负责审核单据和代为收款,但不负责审核信用证条款和货物质量。

9. 国际结算中,以下哪些属于汇票的当事人?()A. 出票人B. 付款人C. 收款人D. 持票人答案:ABCD解析:汇票的当事人包括出票人、付款人、收款人和持票人。

国际结算业务试题(附答案)一、单选题(共31题,每题1分,共31分)1.对金额在()美元以下的对私涉外收付款,实行限额下免申报A、等值3000美元以下(含3000美元)B、等值5000美元以下(含5000美元)C、等值1000美元以下(含1000美元)D、等值10000美元以下(含10000美元)正确答案:B2.汇款业务中对公单位的购汇凭《购汇工作单》加盖人民币账户的()。

A、财务章加公章B、授信印鉴C、预留印鉴D、公章正确答案:C3.平仓是指交易者买入或者卖出与其所持合约的品种、数量及交割月份相同且()的合约,了结交易的行为。

A、视当前汇率波动方向决定方向B、方向相反C、方向相同D、视当前客户损益方向决定方向正确答案:B4.INCOTERMS2020几种贸易术语()A、10B、11C、12D、13正确答案:B5.汇入款中,客户授权结汇成人民币,此笔要求保留现汇的,需提交加盖企业公章的()。

A、《出口收汇保留现汇的说明》B、《补制回单申请书》C、《套汇保函》D、《自动划转及结汇授权委托书》正确答案:A6.开户材料中,需提供股东名册或其他能体现占股()以上股东情况的说明,并提供股东的相关材料。

A、20B、10C、40D、30正确答案:A7.下列不属于开立NRA外汇账户需要提供的材料的是()A、境外机构在境外合法注册成立的证明文件原件及复印件;B、公司章程C、董事会或公司内部其他有权机构同意开户的决议D、供在境内开展相关活动所依据的法规制度或政府主管部门的批准文件正确答案:D8.境内银行可为香港、澳门居民开立个人人民币银行结算账户,用于接收香港、澳门居民每人每日( )元额度内的同名账户汇入资金。

A、10万B、8万C、5万正确答案:B9.若收到的代理行的汇入汇款电/函存在印/押不符、收款人名址不详、收款人户名与账号不符等问题,我行应()。

A、根据代理行的邮件指示做修改B、根据付款人的邮件指示做修改C、向代理行发查询D、根据收款人的书面申请做修改正确答案:C10.按CIF价格术语成交的合同一般应由A、卖方办理保险B、买方办理保险C、承运人办理保险D、保险人办理保险正确答案:A11.具有关联关系的境内外机构代垫或分摊的服务贸易费用,代垫或分摊期限不得超过()个月;A、12B、3C、36D、6正确答案:A12.外国投资者境内直接投资实行()管理。

一、单选1.不可撤销保兑信用证的鲜明特点是(A). 第7章A。

给予受益人双重的付款承诺B。

有开证行确定的付款承诺C。

给予买方最大的灵活性D。

给予卖方以最大的安全性2。

国际贸易结算是指由(C)带来的结算。

第1章A.一切国际交易B。

服务贸易C。

有形贸易D. 票据交易3。

信用证被广泛使用到,其中有一个重要原因在于信用证对于出口商和进口商来说有资金融通的作用,以下选项不一定是信用证对于出口商的融资方式的是(C)。

第6章A. 打包放款B. 汇票贴现C. 押汇D. 红条款信用证4。

信用证能否转让给二个以上的第二受益人取决于(C)。

第8章A. 信用证上面是否标明“transferable"字样B。

受益人与转让行之间的协议是否规定C。

信用证是否规定了分批转运D. 第一受益人与第二受益人商议决定5 . 一份信用证如果未注明是否可以撤销,则是(B)的.第6章A. 可以撤销的B。

不可撤销的 C. 由开证行说了算 D. 由申请人说了算6。

信用证业务中,三角契约安排规定了开证行与受益人之间权责义务受(A)约束.第6章A。

销售合同B。

开证申请书 C. 担保文件D。

跟单信用证7 . 以下属于顺汇方法的支付方式是(A).第3章A. 汇付B。

托收C。

信用证D。

银行保函8 . 以下关于海运提单的说法不正确的是(C)。

第9章A。

是货物收据B. 是运输合约证据C. 是无条件支付命令D。

是物权凭证9 。

背书人在汇票背面只有签字,不写被背书人名称,这是(D)。

第2章A。

限定性背书B。

特别背书C. 记名背书D。

空白背书10 。

信用证业务特点之一是:银行付款依据(A)。

第6章A。

信用证B。

单据C. 货物D。

合同11 . 对于出口商而言,承担风险最大的交单条件是(C).第4章A. D/P at sight B。

D/P after at sight C。

D/A after at sight D。

T/R12 . 远期信用证中开证行会指定一家银行作为受票行,由它对远期汇票做出承兑,这家银行应该是(C).第6章A。

《国际结算实务》试题库参考答案第一章国际结算导论一、填空题1.支付工具、划账冲抵2.联行、代理行3.票据、单据、银行4.习惯、普遍二、是非判断题(用“T”表示正确,“F”表示错误)1.F;2.F;3.T;4.T;5.F;6.F;7.T;8.T;三、单项选择题1.C;2.D;3.C;4.D四、多项选择题1.ABDE;2.ABCD;3.BC;4.ACDEF;5.ABD五、名词解释1.国际结算国际结算是指为清偿国际间债权债务关系,而发生在不同国家之间的货币收付活动。

2.国际贸易结算国际贸易结算是指以商品进出口为背景,即由有形贸易引起的国际结算。

3.国际惯例国际惯例是指在长期的国际贸易和结算实践中,逐渐形成的一些通用的习惯做法和普遍规则。

4.代理行代理行是指接受其他国家或地区的银行委托,代办国际结算业务或提供其他服务,并建立相互代理业务关系的银行。

5.密押密押是银行之间事先约定的,在以电讯方式传递文件时,由发电行在电文中加注的密码,以判定电报、电传的真伪。

6.签字样本签字样本是银行有权签字人的签字式样,用以确认银行之间的信函、凭证、票据等的真实性。

六、将下列英文译成中文1.International Settlement 国际结算2.International Customs 国际惯例3.booklet of authorized signatures 签字样本4.test key 密押5.Correspondent Bank代理行6.SWIFT 环球银行金融电讯协会七、简答题1.答:国际结算的性质表现为它是一门实践性很强的交叉学科,特点有四:1)国际金融与国际结算密切相关;2)国际贸易是国际结算的前提;3)国际结算是一项银行中间业务;4)国际结算比国内结算复杂。

2.答:产生国际结算的原因大体有:①国际旅游、②亲友赠款、③留学、④国际捐助、⑤劳务输出入、⑥国际工程承包、⑦国际技术转让、⑧商品贸易、⑨外汇交易、⑩国际筹资与国际投资等等。

《国际结算》答案第一套试题一、简答题(10分/题)1.答案:风险最小、成本最低,结合各种结算方式来具体说明2.答案:汇款、托收、信用证、银行保函、备用信用证、国际保理3.答案:票据的特征(一)流通性(negotiability)指在法定的合理时限内,票据经过背书、交付而可以将票据权利转让给后手,手续简便但效力明确。

⏹持票人可经交付或背书后交付将票据转让他人,而不必通知原债务人。

⏹票据的受让人接受票据即获得了票据上的全部权利,若票据被拒付或出现其他问题,受让人有权以自己的名义提出诉讼。

⏹善意而付过对价的票据受让人不因其前手票据权利的缺陷而影响其票据权利。

⏹(二)无因性(non-causative nature)原因:产生票据上的权利义务关系的原因。

票据是一种不要过问原因的证券。

票据原因是票据的基本关系,包括两方面的内容:出票人与付款人之间的资金关系出票人与收款人,以及票据的背书人与被背书人之间的对价关系。

(三)要式性(requisite in form):要式不要因票据的存在不重视其原因,但却非常强调其形式和内容。

要式性:票据的形式必须符合法律规定,票据上的必要记载项目必须齐全且符合规定。

(四)设权性票据一经设立并交付出去,票据的权利和义务便随之而确立。

票据做成后经过交付,就创设了对于给付一定金额的请求权,并由此派生出一系列的相关权利。

付款请求权和追索权票据的权利人依法享有这种权利,直到票据所代表的债权债务关系完全了结,票据退出流通。

⏹(五)可追索性票据的付款人或承兑人如果对合格票据拒绝承兑或拒绝付款,正当持票人为维护其票据权利,有权通过法定程序向所有票据债务人起诉、追索,要求得到票据权利。

4.答案:(一)按照国际惯例进行国际结算1.与票据有关的法律和国际惯例(1)《英国票据法》(2)《日内瓦统一票据法》2.与结算方式相关的国际惯例⏹跟单信息证统一惯例⏹托收统一规则⏹见索即付保函统一规则⏹银行间偿付办法⏹合约保函统一规则⏹1998年的国际备用信用证惯例(ISP98)⏹2000年国际保理商联合会制定的国际保理业务惯例规则3.与单据相关的国际公约与国际惯例海牙规则、汉堡规则、联合运输单证统一规则、伦敦保险协会货物保险条款Incoterms 2000:贸易术语E:卖方在自己的地点为买方备妥货物F:卖方要将货物交给买方指定的承运人C:D:卖方承担把货物交至目的地国所需的全部费用和风险⏹(二)使用可兑换货币进行结算⏹一种货币只要不受限制可以自由兑换成其他货币,即为可兑换货币。

国际结算练习答案

Company number:【0089WT-8898YT-W8CCB-BUUT-202108】

国际结算汇款托收实践操作练习

1、上海长城电器公司(Shanghai Great Wall Electrical Equipment Co. Ltd)出口一批电冰

箱到香港凤凰贸易公司(Hongkong Phoenix Trading Co.),金额为100万港元。合同规定

用托收方法结算,交单条件为D/P90天。长城公司将通过建行上海分行(The

Construction Bank of China,Shanghai)办理托收业务,托收行又通过香港汇丰银行

(The Hongkong and Shanghai Banking Corporation Limited)代收此笔货款。请你:

(1) 开出一张以出口商自己为收款人的跟单汇票(Drawn against shipment of L-120

refrigerator at HKD 500 per set from Shanghai to HongKong)

Bill of exchange

Exchange for HKD 1,000, Shanghai Mach 10th 2002

At 10 days after date of this draft, pay to the order of ourselves the sum of one million Hong

Kong Dollars.

Drawn against shipment of L-120 refrigerator at HKD 500 per set from Shanghai to Hong

Kong.

To: Hong Kong Phoenix Trading Co. For: Shanghai Great Wall Electrical Equipment

Co. Ltd

signature

(2) 通过两次背书将此汇票的代理收款权授予代收行。

第一次背书:

For collection

Pay to the order of the Construction Bank of China, Shanghai

For: Shanghai Great Wall Electrical Equipment Co. Ltd

Signature

第二次背书:

For collection

Pay to the order of the Hong Kong and Shanghai Banking Corporation Limited.

For: the Construction Bank of China, Shanghai.

Signature

(3)作出此托收业务流程图。

(4)假如进口商想要做成一笔无本买卖,他可以怎样做

答:该进口商可以利用自己在代收行的信用,开立一份信托收据从代收行处借来单据,

向承运人提货,同时承认货物的所有权仍归银行。待货物出售后,再在远期汇票到期

时,将货款归还给代收行。

(5)请改写此业务流程。

答:①当代收行通知托收行并向进口商提示跟单汇票;

②进口商根据贸易合同审单;无误后在汇票上作好承兑,同时,用自己的信托收据向代

收行借取商业单据;

③代收行收好经进口商承兑的汇票以及信托收据,在风险承受范围内,并以自己的名

义,将提单等放给进口商。该放单行为与托收行以及出口商无关,由代收行独自承担到

期不能收回货款的风险。

④代收行在票据到期前向进口商提示票据及信托收据要求付款。

⑤进口商付款。

2、上海纺织品进出口公司向纽约服装公司出口整套机电设备,贸易合同规定,纽约公

司应预付25%的货款。假如:

(1)纽约公司用信汇方式支付预付款,汇出行是中国银行纽约分行,汇入行是中国银

行上海分行,请写出该笔信汇业务的流程图。

(2)纽约公司用票汇方式支付预付款,汇出行是中国银行纽约分行,汇入行是中国银

行上海分行,请写出该笔票汇业务的流程图。

(3)纽约公司用电汇方式支付预付款,汇出行是中国银行纽约分行,汇入行是中国银

行上海分行,请写出该笔电汇业务的流程图。

在上述业务中,假如:

(1)中国银行上海分行在中国银行纽约有账户,中行纽约分行在给中国银行上海分行

的交款指示中可以怎样写

上海分行可以写成“In cover, we have credited you're a/c with us.”(作为偿付,我行已经贷记

你行在我行开立的账号),并在寄给汇入行的贷记报单(Credit Advice)上注明“your a/c

credited”字样。

(2)中行纽约分行在中国银行上海分行有账户,中行纽约分行在给中国银行上海分行

的交款指示中可以怎样写

纽约分行应注明偿付指示“In cover, please debit our a/c with you”(作为偿付,请借记我行

在你行开立的账户),并在寄给汇入行的贷记报单(Debit Advice)上注明“your a/c debited”

字样。

(3)如果两家银行之间并没有账户关系,但两家银行在花旗银行纽约银行都存有账

户,中行纽约分行在给中国银行上海分行的交款指示中可以怎样写

纽约分行可以在支付委托书上作偿付指示“In cover, we have authorized Citibank to debit

our a/c and credit your a/c with them.”(作为偿付,我行已授权花旗银行在借记我行帐户的同

时贷记你行在花旗银行的帐户)。