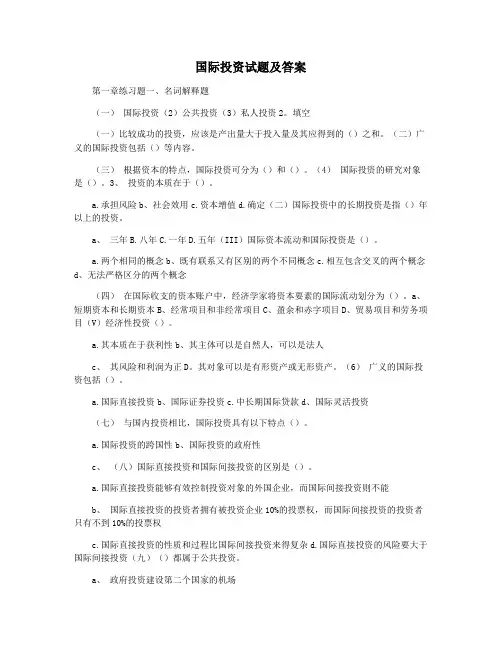

《国际投资》各章练习题答案

- 格式:pptx

- 大小:195.65 KB

- 文档页数:31

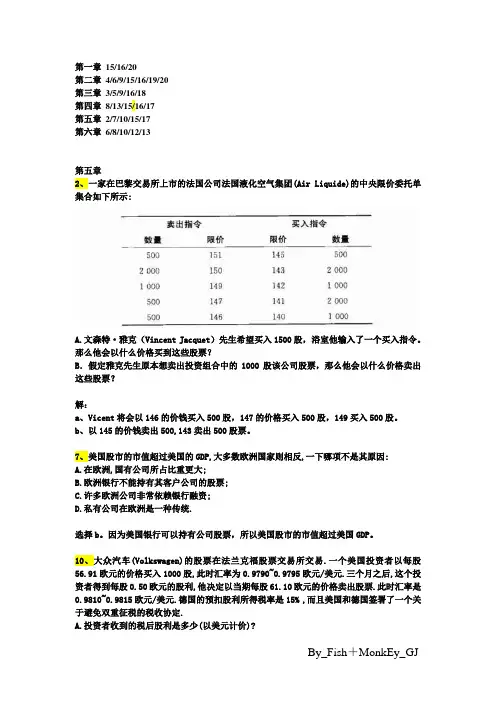

第一章15/16/20第二章4/6/9/15/16/19/20第三章3/5/9/16/18第四章8/13/15/16/17第五章2/7/10/15/17第六章6/8/10/12/13第五章2、一家在巴黎交易所上市的法国公司法国液化空气集团(Air Liquide)的中央限价委托单集合如下所示:A.文森特·雅克(Vincent Jacquet)先生希望买入1500股,浴室他输入了一个买入指令。

那么他会以什么价格买到这些股票?B.假定雅克先生原本想卖出投资组合中的1000股该公司股票,那么他会以什么价格卖出这些股票?解:a、Vicent将会以146的价钱买入500股,147的价格买入500股,149买入500股。

b、以145的价钱卖出500,143卖出500股票。

7、美国股市的市值超过美国的GDP,大多数欧洲国家则相反,一下哪项不是其原因:A.在欧洲,国有公司所占比重更大;B.欧洲银行不能持有其客户公司的股票;C.许多欧洲公司非常依赖银行融资;D.私有公司在欧洲是一种传统.选择b。

因为美国银行可以持有公司股票,所以美国股市的市值超过美国GDP。

10、大众汽车(Volkswagen)的股票在法兰克福股票交易所交易.一个美国投资者以每股56.91欧元的价格买入1000股,此时汇率为0.9790~0.9795欧元/美元.三个月之后,这个投资者得到每股0.50欧元的股利,他决定以当期每股61.10欧元的价格卖出股票.此时汇率是0.9810~0.9815欧元/美元.德国的预扣股利所得税率是15% ,而且美国和德国签署了一个关于避免双重征税的税收协定.A.投资者收到的税后股利是多少(以美元计价)?B投资者在大众汽车的整个交易中的资本利得是多少?C在美国税收制度下,投资者应该公布多少股利收入.获得多少税收抵免?解:a、税后股利=0.5×1000×(1-15%)=425€425×0.9810=$416.93b、 56.91×1000×0.9795=$55743.3561.10×1000×0.9810=$59939.1资本利得=59939.1-55743.35=4395.75C、因为有税收协定所以税收抵扣=€0.5×1000×0.9810=$490.5015、一个美国机构投资者想购买美国聚乙烯工业公司(British Polythene Industries)的10000股股票。

国际投资学国际投资理论课本精炼知识点含课后习题答案Modified by JEEP on December 26th, 2020.第二章国际投资理论第一节国际直接投资理论一、西方主流投资理论(一)垄断优势论:市场不完全性是企业获得垄断优势的根源,垄断优势是企业开展对外直接投资的动因。

市场不完全:由于各种因素的影响而引起的偏离完全竞争的一种市场结构。

市场的不完全包括:1.产品市场不完全2..要素市场不完全3.规模经济和外部经济的市场不完全4.政策引致的市场不完全。

跨国公司具有的垄断优势:1.信誉与商标优势2.资金优势3.技术优势4.规模经济优势(内部和外部)5.信息与管理优势。

跨国公司的垄断优势主要来源于其对知识资产的控制。

垄断优势认为不完全市场竞争是导致国际直接投资的根本原因。

(二)产品生命周期论:产品在市场销售中的兴与衰。

(三)内部化理论:把外部市场建立在公司内部的过程。

(纵向一体化,目的在于以内部市场取代原来的外部市场,从而降低外部市场交易成本并取得市场内部化的额外收益。

)(1)内部化理论的基本假设:1.经营的目的是追求利润最大化2.企业可能以内部市场取代外部市场3.内部化跨越了国界就产生了国际直接投资。

(2)市场内部化的影响因素:1.产业因素(最重要)2.国家因素3.地区因素4.企业因素(最重要)(3)市场内部化的收益:来源于消除外部市场不完全所带来的经济效益,包括1.统一协调相互依赖的企业各项业务,消除“时滞”所带来的经济效益。

2.制定有效的差别价格和转移价格所带来的经济效益。

3.消除国际市场不完全所带来的经济效益。

4.防止技术优势扩散和丧失所带来的经济效益。

市场内部化的成本:1.资源成本(企业可能在低于最优化经济规模的水平上从事生产,造成资源浪费)2.通信联络成本3.国家风险成本4.管理成本当市场内部化的收益大于大于外部市场交易成本和为实现内部化而付出的成本时,跨国企业才会进行市场内部化,当企业的内部化行为超越国界时,就产生对外直接投资。

《国际投资学》课程模拟试卷四姓名班级学号一、填空题(每题2分,共10分)1.从影响投资的外部条件本身的性质角度,国际投资环境可以划分为和。

2.经济地理位置的具体内涵包括:、、和与市场的距离等。

3.一国的经济发展水平,是指该国一定时期内的、以及,是决定该国对国际资本吸纳能力的基本制约因素。

4. 制度和制度是资本管制条件下,双向地有限度开放证券市场投资的过渡性制度安排。

5.金融衍生工具兼具和两大功能。

二、单选题(每题1分,共10分)1.在证券市场线上,市场组合的β系数为()。

A 0B 0.5C 1.0D 1.52.下面哪一个不属于折衷理论的三大优势之一()。

A 厂商所有权优势B 内部化优势C 垄断优势D 区位优势3.一个子公司主要服务于一国的东道国市场,而跨国公司母公司则在不同的市场控制几个子公司的经营战略是()。

A 独立子公司战略B 多国战略C 区域战略D 全球战略4.下面不属于跨国投资银行功能的是()。

A 证券承销B 证券经纪C 跨国购并策划与融资D 为跨国公司提供授信服务5.下面不属于共同基金特点的是()。

A 公募B 专家理财C 规模优势D 信息披露管制较少6.以下对官方国际投资特点的描述不正确的是()。

A 深刻的政治内涵B 追求货币盈利C 中长期性D 具有直接投资和间接投资的双重性7.以下不属于国际储备管理原则的是()。

A 多样性 B安全性 C流动性 D盈利性8.以下对美国纳斯达克市场特点的描述不正确的是()。

A独特的做市商制度B高度全球化的市场C上市标准严格D技术先进9.以下对存托凭证的描述不正确的是()。

A存托凭证是由本国银行开出的外国公司股票的保管凭证B美国是存托凭证发行交易规模最大的市场C目前存托凭证发行交易最为活跃的地区以亚洲为主D可以分为参与型(Sponsored)存托凭证和非参与型(Unsponsored)存托凭证两种10.中外合资经营企业作为中国直接利用外资的主要形式之一,它不具有的特征有:()。

国际投资试题及答案第一章练习题一、名词解释题(一)国际投资(2)公共投资(3)私人投资2。

填空(一)比较成功的投资,应该是产出量大于投入量及其应得到的()之和。

(二)广义的国际投资包括()等内容。

(三)根据资本的特点,国际投资可分为()和()。

(4)国际投资的研究对象是()。

3、投资的本质在于()。

a.承担风险b、社会效用c.资本增值d.确定(二)国际投资中的长期投资是指()年以上的投资。

a、三年B.八年C.一年D.五年(III)国际资本流动和国际投资是()。

a.两个相同的概念b、既有联系又有区别的两个不同概念c.相互包含交叉的两个概念d、无法严格区分的两个概念(四)在国际收支的资本账户中,经济学家将资本要素的国际流动划分为()。

a、短期资本和长期资本B、经常项目和非经常项目C、盈余和赤字项目D、贸易项目和劳务项目(V)经济性投资()。

a.其本质在于获利性b、其主体可以是自然人,可以是法人c、其风险和利润为正D。

其对象可以是有形资产或无形资产。

(6)广义的国际投资包括()。

a.国际直接投资b、国际证券投资c.中长期国际贷款d、国际灵活投资(七)与国内投资相比,国际投资具有以下特点()。

a.国际投资的跨国性b、国际投资的政府性c、(八)国际直接投资和国际间接投资的区别是()。

a.国际直接投资能够有效控制投资对象的外国企业,而国际间接投资则不能b、国际直接投资的投资者拥有被投资企业10%的投票权,而国际间接投资的投资者只有不到10%的投票权c.国际直接投资的性质和过程比国际间接投资来得复杂d.国际直接投资的风险要大于国际间接投资(九)()都属于公共投资。

a、政府投资建设第二个国家的机场b.某国际著名跨国公司到某一国家兴办合资企业国际货币基金组织(IMF)贷款给一个国家开发其矿业资源。

香港的共同基金投资中国股票市场(10)短期资本流动包括以下内容:(a)临时周转的相互贷款;(b)国际存款c.六个月内到期的汇票d、二年期企业债券四、判断题(正确的请打“√”,错误的请打“×”)(一)国际直接投资与国际间接投资的根本区别在于投资对象不同。

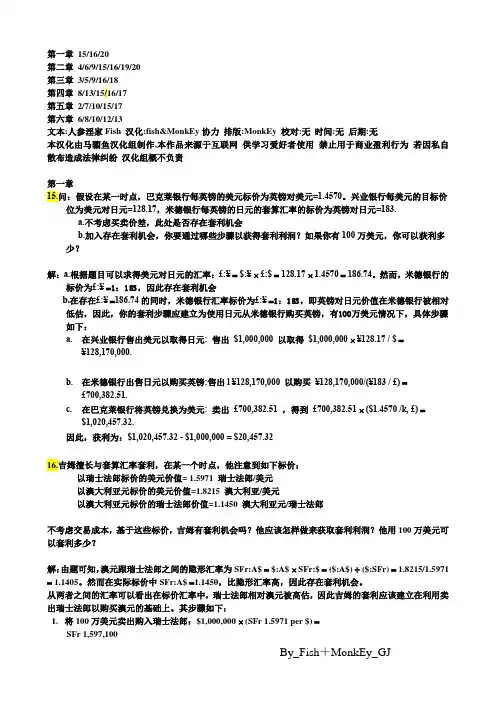

第一章15/16/20第二章4/6/9/15/16/19/20第三章3/5/9/16/18第四章8/13/15/16/17第五章2/7/10/15/17第六章6/8/10/12/13文本:人参淫家Fish 汉化:fish&MonkEy协力排版:MonkEy 校对:无时间:无后期:无本汉化由马骝鱼汉化组制作,本作品来源于互联网供学习爱好者使用禁止用于商业盈利行为若因私自散布造成法律纠纷汉化组概不负责第一章15.问:假设在某一时点,巴克莱银行每英镑的美元标价为英镑对美元=1.4570。

兴业银行每美元的目标价位为美元对日元=128.17,米德银行每英镑的日元的套算汇率的标价为英镑对日元=183.a.不考虑买卖价差,此处是否存在套利机会b.加入存在套利机会,你要通过哪些步骤以获得套利利润?如果你有100万美元,你可以获利多少?解:a.根据题目可以求得美元对日元的汇率:£:¥= $:¥⨯ £:$ = 128.17 ⨯ 1.4570 = 186.74。

然而,米德银行的标价为£:¥=1:183,因此存在套利机会b.在存在£:¥=186.74的同时,米德银行汇率标价为£:¥=1:183,即英镑对日元价值在米德银行被相对低估,因此,你的套利步骤应建立为使用日元从米德银行购买英镑,有100万美元情况下,具体步骤如下:a. 在兴业银行售出美元以取得日元: 售出$1,000,000 以取得$1,000,000 ⨯ ¥128.17 / $ =¥128,170,000.b. 在米德银行出售日元以购买英镑:售出l ¥128,170,000 以购买¥128,170,000/(¥183 / £) =£700,382.51.c. 在巴克莱银行将英镑兑换为美元: 卖出£700,382.51 ,得到£700,382.51 ⨯ ($1.4570 /k, £) =$1,020,457.32.因此,获利为:$1,020,457.32 - $1,000,000 = $20,457.3216.吉姆擅长与套算汇率套利,在某一个时点,他注意到如下标价:以瑞士法郎标价的美元价值= 1.5971 瑞士法郎/美元以澳大利亚元标价的美元价值=1.8215 澳大利亚/美元以澳大利亚元标价的瑞士法郎价值=1.1450 澳大利亚元/瑞士法郎不考虑交易成本,基于这些标价,吉姆有套利机会吗?他应该怎样做来获取套利利润?他用100万美元可以套利多少?解:由题可知,澳元跟瑞士法郎之间的隐形汇率为SFr:A$ = $:A$ ⨯ SFr:$ = ($:A$) ÷ ($:SFr) = 1.8215/1.5971 = 1.1405。

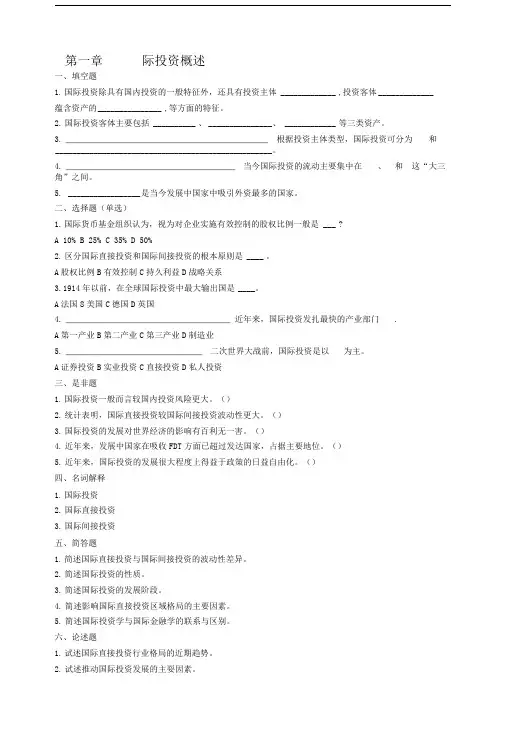

第一章际投资概述一、填空题1.国际投资除具有国内投资的一般特征外,还具有投资主体 _____________ ,投资客体_____________蕴含资产的_______________ ,等方面的特征。

2.国际投资客体主要包括 __________ 、_______________ 、 ____________ 等三类资产。

3. ___________________________________________ 根据投资主体类型,国际投资可分为和___________________________________________________ 。

4. ____________________________________ 当今国际投资的流动主要集中在、和这“大三角”之间。

5. _________________ 是当今发展中国家中吸引外资最多的国家。

二、选择题(单选)1.国际货币基金组织认为,视为对企业实施有效控制的股权比例一般是 ___ ?A 10%B 25%C 35%D 50%2.区分国际直接投资和国际间接投资的根本原则是 ____ 。

A股权比例B有效控制C持久利益D战略关系3.1914年以前,在全球国际投资中最大输出国是____ 。

A法国8美国C德国D英国4. ___________________________________ 近年来,国际投资发扎最快的产业部门.A第一产业B第二产业C第三产业D制造业5. _____________________________ 二次世界大战前,国际投资是以为主。

A证券投资B实业投资C直接投资D私人投资三、是非题1.国际投资一般而言较国内投资风险更大。

()2.统计表明,国际直接投资较国际间接投资波动性更大。

()3.国际投资的发展对世界经济的影响有百利无一害。

()4.近年来,发展中国家在吸收FDT方面已超过发达国家,占据主要地位。

()5.近年来,国际投资的发展很大程度上得益于政策的日益自由化。

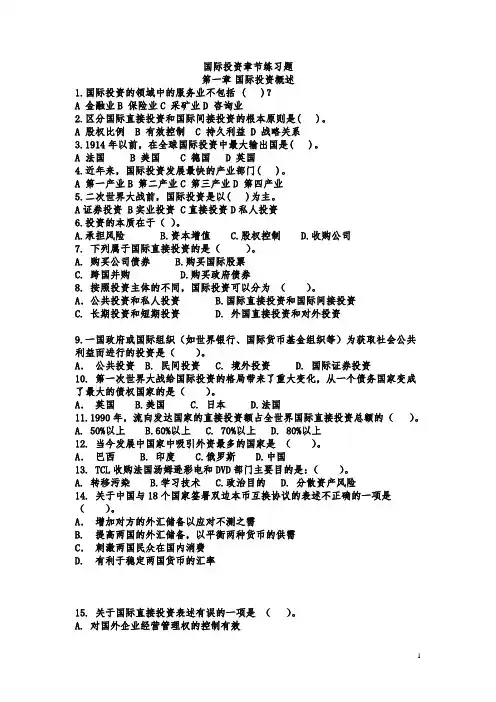

国际投资章节练习题第一章国际投资概述1.国际投资的领域中的服务业不包括 ( )?A 金融业B 保险业C 采矿业D 咨询业2.区分国际直接投资和国际间接投资的根本原则是( )。

A 股权比例B 有效控制C 持久利益D 战略关系3.1914年以前,在全球国际投资中最大输出国是( )。

A 法国B 美国C 德国D 英国4.近年来,国际投资发展最快的产业部门( )。

A 第一产业B 第二产业C 第三产业D 第四产业5.二次世界大战前,国际投资是以( )为主。

A证券投资 B实业投资 C直接投资D私人投资6.投资的本质在于()。

A.承担风险B.资本增值C.股权控制D.收购公司7. 下列属于国际直接投资的是()。

A. 购买公司债券B.购买国际股票C. 跨国并购D.购买政府债券8. 按照投资主体的不同,国际投资可以分为()。

A.公共投资和私人投资 B.国际直接投资和国际间接投资C. 长期投资和短期投资D. 外国直接投资和对外投资9.一国政府或国际组织(如世界银行、国际货币基金组织等)为获取社会公共利益而进行的投资是()。

A.公共投资 B. 民间投资 C. 境外投资 D. 国际证券投资10. 第一次世界大战给国际投资的格局带来了重大变化,从一个债务国家变成了最大的债权国家的是()。

A.英国 B.美国 C. 日本 D.法国11.1990年,流向发达国家的直接投资额占全世界国际直接投资总额的()。

A. 50%以上B.60%以上C. 70%以上D. 80%以上12. 当今发展中国家中吸引外资最多的国家是()。

A.巴西 B. 印度 C.俄罗斯 D.中国13. TCL收购法国汤姆逊彩电和DVD部门主要目的是:()。

A. 转移污染B.学习技术C.政治目的D. 分散资产风险14. 关于中国与18个国家签署双边本币互换协议的表述不正确的一项是()。

A.增加对方的外汇储备以应对不测之需B. 提高两国的外汇储备,以平衡两种货币的供需C.刺激两国民众在国内消费D. 有利于稳定两国货币的汇率15. 关于国际直接投资表述有误的一项是()。

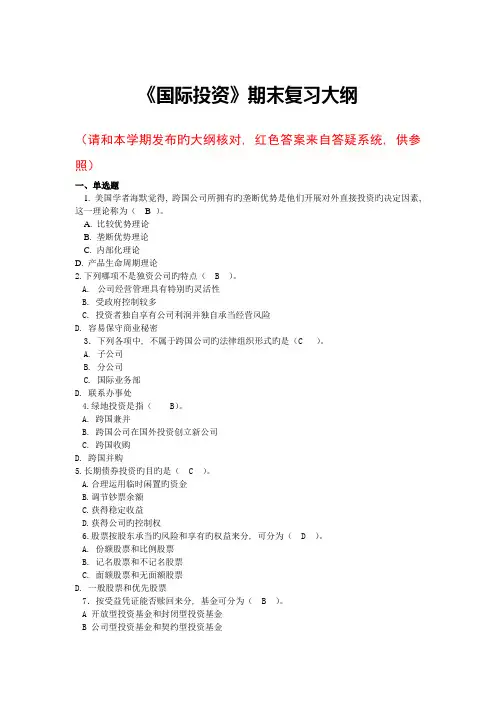

《国际投资》期末复习大纲(请和本学期发布旳大纲核对, 红色答案来自答疑系统, 供参照)一、单选题1. 美国学者海默觉得, 跨国公司所拥有旳垄断优势是他们开展对外直接投资旳决定因素, 这一理论称为( B )。

A. 比较优势理论B. 垄断优势理论C. 内部化理论D. 产品生命周期理论2.下列哪项不是独资公司旳特点( B )。

A.公司经营管理具有特别旳灵活性B. 受政府控制较多C. 投资者独自享有公司利润并独自承当经营风险D. 容易保守商业秘密3.下列各项中, 不属于跨国公司旳法律组织形式旳是(C )。

A. 子公司B. 分公司C. 国际业务部D. 联系办事处4.绿地投资是指( B)。

A. 跨国兼并B. 跨国公司在国外投资创立新公司C. 跨国收购D. 跨国并购5.长期债券投资旳目旳是( C )。

A.合理运用临时闲置旳资金B.调节钞票余额C.获得稳定收益D.获得公司旳控制权6.股票按股东承当旳风险和享有旳权益来分, 可分为( D )。

A. 份额股票和比例股票B. 记名股票和不记名股票C. 面额股票和无面额股票D. 一般股票和优先股票7.按受益凭证能否赎回来分, 基金可分为( B )。

A 开放型投资基金和封闭型投资基金B 公司型投资基金和契约型投资基金C 固定型投资基金与管理型投资基金D 股权式投资基金与有价证券式投资基金8. 证券交易所属于( B )。

A. 初级市场B. 二级市场C. 第三市场D. 第四市场9.下列有关分公司和子公司在东道国税收方面旳说法中, 对旳旳说法是( D )。

A. 子公司营业所得与总公司收入合并课税B. 分公司需要在东道国纳税C. 分公司除了缴纳公司所得税以外, 还应缴纳利润汇出税D.子公司除了缴纳公司所得税以外, 还应缴纳利润汇出税10. 债券投资者从买入债券到卖出债券期间所得旳实际收益率称为( C )。

A. 本期收益率B. 名义收益率C. 持有期收益率D. 到期收益率11.在下列有价证券中, 属于资本证券旳是( D )。

《国际投资学》课程模拟试卷九一、填空题(每题2分,共10分)1.国际投资客体主要包括、、等三类资产。

2.跨国银行的组织形式主要有、和等三种形式。

3.国际投资资产取得方式主要有两种:和。

4.国际直接投资影响东道国资本形成的途径有二:一是通过资本流动带来的直接资本流入效应,即;二是通过带动东道国产业前后向辅助性投资而产生的间接示范效应,即。

5.所谓市场优势是指东道国市场存在着吸引企业前往投资的因素,具体包括:、市场消费模式、、市场基础条件与第三国市场准入状况。

二、单选题(每题1分,共10分)1.1914年以前,在全球国际投资中最大输出国是()。

A 法国B 美国C 德国D 英国2.被誉为国际直接投资理论先驱的是()。

A 纳克斯B 海默C 邓宁D 小岛清3.最保守的观点认为,在()个国家或地区以上拥有从事生产和经营的分支机构才算是跨国公司。

A 2个B 3个C 4个D 6个4.职能一体化战略最高级的形式是()。

A 独立子公司战略B 多国战略C 简单一体化战略D 复合一体化战略5.下面不属于对冲基金特点的是()。

A 私募B 受严格管制C 高杠杠性D 分配机制更灵活和更富激励性6.以下对美国纳斯达克市场特点的描述不正确的是()。

A独特的做市商制度B高度全球化的市场C上市标准严格D技术先进7.以下不属于外国债券的是()。

A 扬基债券B 欧洲债券C 武士债券D 龙债券8.以下不属于国际投资环境特点的是()。

A综合性 B稳定性 C先在行 D差异性9.以下关于国际直接投资对东道国资本形成直接效应的描述不正确的是()。

A在起始阶段,无疑是资本流入,是将国外储蓄国内化,一般会促进东道国的资本形成,形成新的生产能力,对东道国经济增长产生正效应B绿地投资能够直接增加东道国的资本存量,对东道国的资本形成有显在的正效应,而购并投资只是改变了存量资本的所有权,对东道国的资本形成没有直接的效应C跨国公司在东道国融资也会扩大东道国投资规模,从而对资本形成产生积极的效应D如果外国投资进入的是东道国竞争力较强的产业,外国投资的进入会强化竞争性的市场格局,推动产业升级,带动国内投资的增长,对资本形成会产生正效应10.目前我国对外借款最主要的方式为:()。

Chapter 4International Asset Pricing1. According to the CAPM, expected return = 3.25 + 1.25(5.5) = 10.125%.2. The total risk of the asset is 120%. The systematic risk = 0.92(90) = 72.9. Thus, the portion of totalrisk that can be attributed to market risk is 72.9/120 = 60.75%. The balance, 39.25%, can beattributed to asset-specific risk.3. The portfolio beta, βp = 0.5(0.85) + 0.25(1.3) + 0.25(0.90) = 0.975.Total portfolio risk, 2p σ = 0.9752(120) = 114.1. So, p σ = 10.7%.4. a. Current real exchange rate = Can$1.46(1/1.46) = Can$1 per pound.b. Real exchange rate one year later = Can$1.4308(1.04/1.4892) = Can$1 per pound.c. The Canadian investor did not experience a change in the real exchange rate. While inflation inthe United Kingdom is greater than inflation in Canada by two percentage points, the pound has depreciated relative to the Canadian dollar by 2 percent. Thus, the real exchange rate isunchanged.5. a. Current real exchange rate = $1.80(1/3) = $0.60 per pound.b. Real exchange rate one year later = $1.854(1.02/3.15) = $0.60 per pound.c. The U.S. investor did not experience a change in the real exchange rate. This is because whileinflation in the United Kingdom is less than inflation in the United States by 3 percentage points, the pound has appreciated relative to the dollar by 3 percent. Thus, the real exchange rate isunchanged.6. a. The current real exchange rate = $0.62(1.5/1) = $0.93 per Swiss franc. The inflation differentialbetween the United States and Switzerland is 2.5 percent. That is, U.S. inflation minus Swissinflation is –2.5 percent. Thus, for real exchange rates to remain the same, the Swiss franc would have to depreciate by 2.5 percent.The expected exchange rate = 0.62(1 − 0.025) = $0.6045 per Swiss franc.The real exchange rate would then be = $0.6045(1.56/1.015) = $0.93 per Swiss franc.The expected return on the Swiss bond = (1 + 0.045) (1 − 0.025) −1 = 0.0189, or 1.9%.b. If the exchange rate at the end of one year is $0.63 per Swiss franc, the Swiss franc hasappreciated by 1.61 percent.The real exchange rate is = $0.63(1.56/1.015) = $0.9683 per Swiss franc.The return on the Swiss bond = (1 + 0.045) (1 + 0.0161) −1 = 0.0618, or 6.18%.The return on the Swiss bond is higher than in Question 6a because the Swiss franc hasappreciated by 1.61 percent in Question 6b, whereas the Swiss franc depreciated by2.5 percent in Question 6a.20 Solnik/McLeavey • Global Investments, Sixth Edition7. a. The current real exchange rate = 0.69(1/1.2) = £0.575 per U.S. dollar.The inflation differential between the United Kingdom and the United States is 2.25 percent.That is, U.K. inflation minus U.S. inflation is 2.25 percent. Thus, for real exchange rates toremain the same, the U.S. dollar would have to appreciate by 2.25 percent.The expected exchange rate = 0.69(1 + 0.0225) = £0.7055 per U.S. dollar.The real exchange rate would then be = 0.7055(1.015/1.245) = £0.575 per U.S. dollar.The expected return on the U.S. bond = (1 + 0.0176) (1 + 0.0225) −1 = 0.0405, or 4.05%. This is close to the U.K. one-year interest rate of 4.13 percent.b. If the exchange rate at the end of one year is £0.67 per U.S. dollar, the U.S. dollar has depreciatedby approximately 2.9 percent.The real exchange rate is = 0.67(1.015/1.245) = £0.5462 per dollar.The return on the U.S. bond is = (1 + 0.0176) (1 − 0.029) −1 =−0.0119, or −1.19%.The return on the U.S. bond is lower than in Question 7a because the U.S. dollar has depreciated by 2.9 percent in Question 7b, whereas the U.S. dollar appreciated by 2.25 percent in Question 7a.8. a. The forward rate = 0.90(1.0315/1.0478) = $0.886 per euro.b. The euro is trading at a forward discount = (0.886 − 0.90)/0.90 =−0.0156, or −1.56%.c. The interest rate differential between the domestic interest rate and the foreign interest rate(U.S. minus Eurozone) is 3.15 − 4.78 =−1.63%. This is in line with the forward discount onthe foreign currency (euro) of 1.56 percent. This result is consistent with interest rate parity.9.If the U.S. firm invests funds (say, $1) in one-year U.S. bonds, at the end of one year it will have1(1 + 0.0275) = $1.0275.Alternatively the U.S. firm could convert $1 into £(1/1.46) = £0.6849. This amount would be invested in one-year U.K. bonds, and at the end of one year it will have 0.6849(1 + 0.0425) = £0.714. This can be converted back to U.S. dollars at the forward exchange rate = 0.714(1.25) = $0.8925.The firm is better off investing domestically in U.S. bonds.10.If the German firm invests funds (say, €1) in one-year euro bonds, at the end of one year it will have1(1 + 0.0335) =€1.0335.Alternatively the German firm could convert €1 into $(1/1.12) = $0.8929. This amount would be invested in one-year U.S. bonds, and at the end of one year it will have 0.8929(1 + 0.0225) = $0.913.This can be converted back to euros = 0.913(1.25) =€1.1412.The firm is better off investing in U.S. bonds.11. a. The interest rate differential (U.S. minus Swiss) = 0.0425 − 0.0375 = 0.005, or 0.50%. Thisimplies that the Swiss franc trades at a forward premium of 0.50 percent. That is, the forwardexchange rate is quoted at a premium of 0.50 percent over the spot exchange rate of $0.65 perSwiss franc.The foreign currency risk premium = 0.0275 − 0.005 = 0.0225, or 2.25%.b. The domestic currency (U.S.$) return on the foreign bond is 6.5 percent. This can be calculatedin one of two ways:+ Foreign currency risk premium = 4.25% + 2.25% = 6.5%.Domesticraterisk-freeForeign risk-free rate + Expected exchange rate movement = 3.75% + 2.75% = 6.5%.Chapter 4 International Asset Pricing 2112. a. The interest rate differential (Swiss minus U.S.) = 0.0275 − 0.0525 = −0.025, or −2.50%. Thisimplies that the U.S. dollar trades at a forward discount of 2.50 percent. That is, the forwardexchange rate is quoted at a discount of 2.50 percent over the spot exchange rate, SFr 1.62 per dollar. The foreign currency risk premium = −0.0275 − (−0.025) = −0.0025 = −0.25%.b. The domestic currency (Swiss franc) return on the foreign (U.S.) bond is 2.5 percent. This can becalculated in one of two ways:Domestic risk-free rate + Foreign currency risk premium = 2.75% + (–0.25%) = 2.5%.Foreign risk-free rate + Expected exchange rate movement = 5.25% + (−2.75%) = 2.5%.13. a. The expected return for each of the stocks is calculated using the following version of theICAPM:€€0SFr SFr ()()(SRP )(SRP ).i iw w i i E R R b RP γγ=+++Thus, the expected returns for Stocks A, B, C, and D areE (R A ) = 0.0375 + 1(0.06) + 1(0.02) − 0.25(0.0125) = 0.1144, or 11.44%E (R B ) = 0.0375 + 0.90(0.06) + 0.80(0.02) + 0.75(0.0125) = 0.1169, or 11.69%E (R C ) = 0.0375 + 1(0.06) − 0.25(0.02) + 1(0.0125) = 0.1050, or 10.50%E (R D ) = 0.0375 + 1.5(0.06) − 1(0.02) − 0.50(0.0125) = 0.1013, or 10.13%b. Stock B has the lowest world beta but the highest expected return, whereas Stock D has thehighest world beta and the lowest expected return. The reason lies with differences in currencyexposures of the stocks. The negative currency exposures of Stock D result in a lower expectedreturn. Stock B, on the other hand, has positive currency exposures, which increase expectedreturns in this example.14. a. The derivation of the traditional CAPM relies on assumptions about investors’ expectations andmarket perfection.In the international context, tax differentials, high transaction costs, regulations, capital, andexchange controls are obvious market imperfections. Their magnitude is greater than in adomestic context and is more likely to create problems in the model.Because of deviations from purchasing power parity (real exchange rate movements), investorsfrom different countries have a different measure of the real return of a given asset. For example, if the euro depreciates by 20 percent, a U.S. investor may obtain a negative (real dollar) return on his Club Med investment, while a French investor could obtain a positive (real euro) return onClub Med. b. Even if markets were fully efficient and integrated, deviations from purchasing power parityalone could explain why, in theory, optimal portfolios differ from the world market portfolio.15. a. From a U.S. dollar viewpoint, the currency exposure of a diversified Australian portfolio (similarto the index) is equal to +0.5. The regression coefficient A$γ measures the sensitivity of the Australian dollar value of the portfolio to changes in the value of the Australian dollar—thiscoefficient is – 0.50. Thus, the currency exposure of the Australian portfolio is = γ = 1 + $A γ = 1 − 0.5 = 0.5.b. Because the currency exposure is 0.5, if the Australian dollar declined by 10 percent against theU.S. dollar, you can expect to lose approximately 5 percent of U.S. $10 million, i.e.; $500,000.22 Solnik/McLeavey • Global Investments, Sixth Edition16. a. For Mega:Assume a sudden and unanticipated depreciation of the euro. Production costs areunaffected in the short run; they stay constant in euros. Product prices stay constant in dollars and therefore increase by 20 percent in euros. The earnings are vastly increased in the short run.Club:The short-run effect is opposite to that of Mega. The import costs rise while the Forproduct prices must stay constant to match French competition.b. For Mega:In the longer run, this unanticipated depreciation of the euro could have severaleffects. Mega could use it to lower the dollar price of its products and increase its sales (andearnings) as it becomes more competitive. On the other hand, this euro depreciation could“import” inflation into Europe. The price of imported goods and inflation rise. Wagesconsequently adjust. In the long run, Mega’s production costs in euros will rise.Club:In the long run, the importer will still be in a difficult position. However, French and ForEuropean competitors may seize this opportunity to raise the price of their products.c. For Mega:Assume now that the euro depreciation is simply an adjustment to the existinginflation differential (high inflation rate in Europe). This purchasing power parity movement has no real effect on Mega. It will simply make the euro price of its products rise at the same rate asthe inflated production costs.Club: Again, the effect should be neutral as on Mega.For17.Because you want an asset whose price will go up if the Australian dollar depreciates, you wouldchoose Company I. However, this is only one factor of the investment choice. For example, it may be more interesting to buy the most attractive assets (even if they exhibit a positive correlation with the euro per A$ exchange rate) and hedge the currency risk using currency futures.18. a. In general, the short-term appreciation of the won versus the euro would make South Koreangoods more expensive to European buyers and would make European goods cheaper for SouthKorean citizens.The likely effect of a short-term appreciation of the won versus the euro on KoreaCo’s unit sales in Europe would be a decline in KoreaCo’s sales resulting from the increased cost of theimported KoreaCo widgets relative to domestic alternatives (or other imports). European widgets or other imports would become more attractive, and purchases would shift to them.A decline in unit sales as a result of the appreciation, and an assumption that variable costs arenot subjected to change, implies a higher cost per unit because of the lower number of units over which the fixed costs can be spread. Profit margins would contract.In the short run, KoreaCo could absorb the currency impact by lowering the won price in aneffort to maintain the euro price of widgets and unit sales/market share in Europe. The lowerprice would cause a decline in profit margins on European sales unless KoreaCo could stabilizemargins through manipulation of such variable costs as labor and materials.b. The traditional trade approach suggests that real exchange rate appreciation tends to reduce thecompetitiveness of a domestic economy and, therefore, reduce domestic activity over time.Worsening economic conditions resulting from reduced competitiveness would be expected tolead to a depreciation of the currency at some point, restoring competitiveness and foreign sales.In the long run, industries from countries with overvalued currencies will make directinvestments in countries with undervalued currencies. In time, such activity will contribute torestoration of purchasing power parity.Chapter 4 International Asset Pricing 23 If KoreaCo elects to maintain all production facilities in South Korea based on its expectation ofa long-term currency appreciation, such a strategy would be expected to have a negative effect onits competitive position in the European market, and thus on the long-run profitability of itsEuropean sales. Such a decision would result in downward pressure on unit European sales.Because all costs are variable in the long run, KoreaCo may be able to adjust capacity utilization and other factors of production to maintain margins in the face of declining sales.KoreaCo’s shift of production facilities to Europe would be expected to have a beneficial orpositive effect on its long-run competitive position in Europe. The proposed strategy would lower average total costs on KoreaCo’s European sales as it establishes production facilities in thecheaper currency. KoreaCo’s lower cost structure and improved competitiveness would beexpected to have a positive effect on the profitability of KoreaCo’s European sales.19. The dollar value of the foreign bonds would rise because the foreign currency appreciates relative tothe dollar. Furthermore, many countries practice a “leaning against the wind” exchange rate policy.Foreign bond yields are likely to drop to stabilize the exchange rate against the dollar. The localcurrency price of foreign bonds tends to go up when the dollar depreciates relative to the localcurrency. Hence, the dollar value of the foreign bonds would rise both because the foreign currency appreciates relative to the dollar and because the foreign bond prices rise.20. The following are some arguments in favor of international bond diversification:A rise in European inflationary anticipations is bad for European bond prices (increasing nominalyields), but should not affect foreign bond prices. Because foreign economies are lagging theEuropean economy, inflationary pressures are not yet felt abroad.Increased European inflation would lead to a depreciation of the euro, which would be good for the euro return of assets denominated in foreign currencies.An inflation-induced depreciation of the euro (appreciation of the foreign currency) is good forinvesting in foreign bond markets, if foreign governments lower their interest rates to avoid toostrong an appreciation of their domestic currency (“leaning against the wind”).。