风险术语中英文对照

- 格式:docx

- 大小:14.15 KB

- 文档页数:16

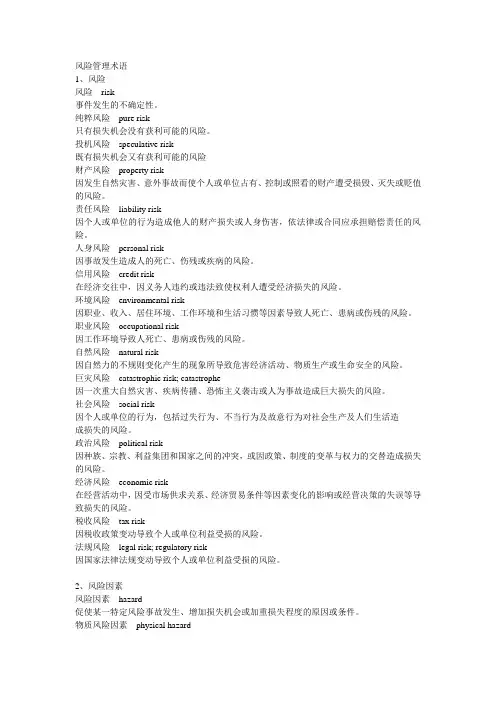

风险管理术语1、风险风险risk事件发生的不确定性。

纯粹风险pure risk只有损失机会没有获利可能的风险。

投机风险speculative risk既有损失机会又有获利可能的风险财产风险property risk因发生自然灾害、意外事故而使个人或单位占有、控制或照看的财产遭受损毁、灭失或贬值的风险。

责任风险liability risk因个人或单位的行为造成他人的财产损失或人身伤害,依法律或合同应承担赔偿责任的风险。

人身风险personal risk因事故发生造成人的死亡、伤残或疾病的风险。

信用风险credit risk在经济交往中,因义务人违约或违法致使权利人遭受经济损失的风险。

环境风险environmental risk因职业、收入、居住环境、工作环境和生活习惯等因素导致人死亡、患病或伤残的风险。

职业风险occupational risk因工作环境导致人死亡、患病或伤残的风险。

自然风险natural risk因自然力的不规则变化产生的现象所导致危害经济活动、物质生产或生命安全的风险。

巨灾风险catastrophic risk; catastrophe因一次重大自然灾害、疾病传播、恐怖主义袭击或人为事故造成巨大损失的风险。

社会风险social risk因个人或单位的行为,包括过失行为、不当行为及故意行为对社会生产及人们生活造成损失的风险。

政治风险political risk因种族、宗教、利益集团和国家之间的冲突,或因政策、制度的变革与权力的交替造成损失的风险。

经济风险economic risk在经营活动中,因受市场供求关系、经济贸易条件等因素变化的影响或经营决策的失误等导致损失的风险。

税收风险tax risk因税收政策变动导致个人或单位利益受损的风险。

法规风险legal risk; regulatory risk因国家法律法规变动导致个人或单位利益受损的风险。

2、风险因素风险因素hazard促使某一特定风险事故发生、增加损失机会或加重损失程度的原因或条件。

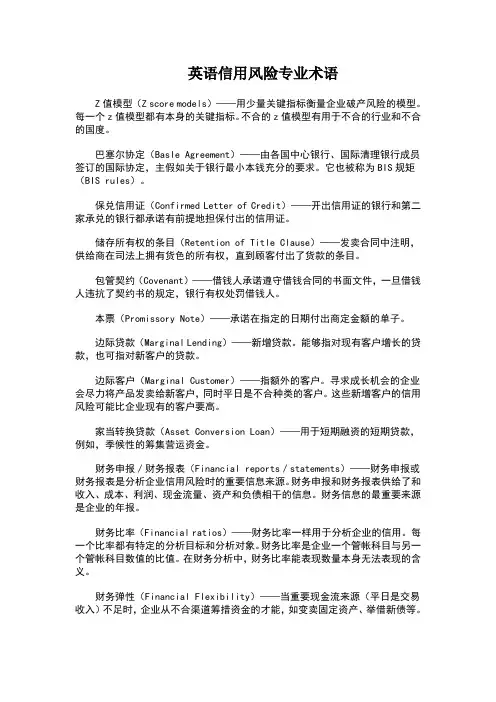

英语信用风险专业术语Z值模型(Z score models)——用少量关键指标衡量企业破产风险的模型。

每一个z值模型都有本身的关键指标。

不合的z值模型有用于不合的行业和不合的国度。

巴塞尔协定(Basle Agreement)——由各国中心银行、国际清理银行成员签订的国际协定,主假如关于银行最小本钱充分的要求。

它也被称为BIS规矩(BIS rules)。

保兑信用证(Confirmed Letter of Credit)——开出信用证的银行和第二家承兑的银行都承诺有前提地担保付出的信用证。

储存所有权的条目(Retention of Title Clause)——发卖合同中注明,供给商在司法上拥有货色的所有权,直到顾客付出了货款的条目。

包管契约(Covenant)——借钱人承诺遵守借钱合同的书面文件,一旦借钱人违抗了契约书的规定,银行有权处罚借钱人。

本票(Promissory Note)——承诺在指定的日期付出商定金额的单子。

边际贷款(Marginal Lending)——新增贷款。

能够指对现有客户增长的贷款,也可指对新客户的贷款。

边际客户(Marginal Customer)——指额外的客户。

寻求成长机会的企业会尽力将产品发卖给新客户,同时平日是不合种类的客户。

这些新增客户的信用风险可能比企业现有的客户要高。

家当转换贷款(Asset Conversion Loan)——用于短期融资的短期贷款,例如,季候性的筹集营运资金。

财务申报/财务报表(Financial reports/statements)——财务申报或财务报表是分析企业信用风险时的重要信息来源。

财务申报和财务报表供给了和收入、成本、利润、现金流量、资产和负债相干的信息。

财务信息的最重要来源是企业的年报。

财务比率(Financial ratios)——财务比率一样用于分析企业的信用。

每一个比率都有特定的分析目标和分析对象。

财务比率是企业一个管帐科目与另一个管帐科目数值的比值。

Narrow-based weighted average ratchet: A type of anti-dilution mechanism. A weighted average ratchet adjusts downward the price per share of the preferred stock of investor A due to the issuance of new preferred shares to new investor B at a price lower than the price investor A originally received. Investor A's preferred stock is repriced to a weighed average of investor A's price and investor B's price. A narrow-based ratchet uses only common stock outstanding in the denominator of the formula for determining the new weighed average price. Compare Broad-Based Weighted Average Ratchet and Chapter 2.9.4.d.ii of the Encyclopedia for specific examples. NASD: The National Association of Securities Dealers. An mandatory association of brokers and dealers in the over the counter securities business. Created by the Maloney Act of 1938, an amendment to the Securities Act of 1934. NASDAQ: An automated information network which provides brokers and dealers with price quotations on securities traded over the counter. NDA (Non-disclosure agreement): An agreement issued by entrepreneurs to potential investors to protect the privacy of their ideas when disclosing those ideas to third parties. Net Asset Value (NAV): NAV is calculated by adding the value of all of the investments in the fund and dividing by the number of shares of the fund that are outstanding. NAV calculations are required for all mutual funds (or open-end funds) and closed-end funds. The price per share of a closed-end fund will trade at either a premium or a discount to the NAV of that fund, based on market demand. Closed-end funds generally trade at a discount to NAV. Net Financing Cost: Also called the cost of carry or, simply, carry, the difference between the cost of financing the purchase of an asset and the asset's cash yield. Positive carry means that the yield earned is greater than the financing cost; negative carry means that the financing cost exceeds the yield earned. Net income: The net earnings of a corporation after deducting all costs of selling, depreciation, interest expense and taxes. Net IRR: IRR if a portfolio or fund taking into account the effect of management fees and carried interest. Net Present Value: An approach used in capital budgeting where the present value of cash inflow is subtracted from the present value of cash outflows. NPV compares the value of a dollar today versus the value of that same dollar in the future after taking inflation and return into account. Net present value (NPV): A firm or project's net contribution to wealth. This is the present value of current and future income streams, minus initial investment. New Issue: A stock or bond offered to the public for the first time. New issues may be initial public offerings by previously private companies or additional stock or bond issues by companies already public. New public offerings are registered with the Securities and Exchange Commission. (See Securities and Exchange Commission and Registration). Newco: The typical label for any newly organized company, particularly in the context of a leveraged buyout. No Shop, No Solicitation Clauses: A no shop, no solicitation, or exclusivity, clause requires the company to negotiate exclusively with the investor, and not solicit an investment proposal from anyone else for a set period of time after the term sheet is signed. The key provision is the length of time set for the exclusivity period. No-fault divorce: A "no fault divorce" clause permits investors at a time after the final closing date, to remove the general partner of a fund and either terminate the Partnership or appoint a new general partner. This clause covers situations where the general partner has not defaulted or breached the terms and conditions of the Limited Partnership Agreement. Either an ordinary consent or a special consent may be required to effectuate the removal of the general partner and this clause will usually be subject to the general partner receiving compensation for its removal. Non-Compete Clause: An agreement often signed by employees and management whereby they agree not to work for competitor companies or form a new competitor company within a certain time period after termination of employment. Governed by state law. Nonaccredited: An investor not considered accredited for a Regulation D offering. (Accredited Investor) NYSE: The New York Stock Exchange. Founded in 1792, the largest organized securities market in the United States. The Exchange itself does not buy, sell, own or set prices of stocks traded there. The prices are determined by public supply and demand. Also known as the Big Board.- O - Open-end Fund: An open-end fund, or a mutual fund, generally sells as many shares as investor demand requires. As money flows in, the fund grows. If money flows out of the fund the number of the fund's outstanding shares drops. Open-end funds are sometimes closed to new investors, but existing investors can still continue to invest money in the fund. In order to sell shares an investor generally sells the shares back to the fund. If an investor wishes to buy additional shares in a mutual fund, the investor generally buys newly issued shares directly from the fund. Option Pool: The number of shares set aside for future issuance to employees of a private company. Original Issue Discount: OID. A discount from par value of a bond or debt-like instrument. In structuring a private equity transaction, the use of a preferred stock with liquidation preference or other clauses that guarantee a fixed payment in the future can potentially create adverse tax consequences. The IRS views this cash flow stream as, in essence, a zero coupon bond upon which tax payments are due yearly based on "phantom income" imputed from the difference between the original investment and "guaranteed" eventual payout. Although complex, the solution is to include enough clauses in the investment agreements to create the possibility of a material change in the cash flows of owners of the preferred stock under different scenarios of events such as a buyout, dissolution or IPO. OTC: Over-the-Counter. A market for securities made up of dealers who may or may not be members of a formal securities exchange. The over-the-counter market is conducted over the telephone and is a negotiated market rather than an auction market such as the NYSE. Outstanding Stock: The amount of common shares of a corporation which are in the hands of investors. It is equal to the amount of issued shares less treasury stock. Oversubscription: Occurs when demand for shares exceeds the supply or number of shares offered for sale. As a result, the underwriters or investment bankers must allocate the shares among investors. In private placements, this occurs when a deal is in great demand because of the company's growth prospects. Oversubscription Privilege: In a rights issue, arrangement by which shareholders are given the right to apply for any shares that are not purchased.- P - Paid-in Capital: The amount of committed capital a limited partner has actually tranferred to a venture fund. Also known as the cumulative takedown amount. Pari Passu: At an equal rate or pace, without preference. Participating Preferred: A preferred stock in which the holder is entitled to the stated dividend, and also to additional dividends on a specified basis upon payment of dividends to the common stockholders. The preferred stock entitles the owner to receive a predetermined sum of cash (usually the original investment plus accrued dividends) if the company is sold or has an IPO. The common stock represents additional continued ownership in the company. Participation: Describes a right of a holder of Preferred Stock to enjoy both the rights associated with the Preferred Stock and also participate in any benefit available to Common Stock, without converting to Common Stock. This may occur with Liquidation Preferences, for example, a series of Preferred Stock may have the right to receive its Liquidation Preference and then also share in whatever money is left to be distributed to the holders of Common Stock. Dividends may also be "Participating" where after a holder of Preferred Stock receives its Cumulative Dividend it also receives any dividend paid on the Common Stock. Partnership: A nontaxable entity in which each partner shares in the profits, loses and liabilities of the partnership. Each partner is responsible for the taxes on its share of profits and loses. Partnership agreement: The contract that specifies the compensation and conditions governing the relationship between investors (LP's) and the venture capitalists (GP's) for the duration of a private equity fund's life. Pay to Play : A "Pay to Play" provision is a requirement for an existing investor to participate in a subsequent investment round, especially a Down Round. Where Pay to Play provisions exist, an investor's failure to purchase its pro-rata portion of a subsequent investment round will result in conversion of that investor's Preferred Stock into Common Stock or another less valuable series of Preferred Stock. Penny Stocks: Low priced issues, often highly speculative, selling at less than $5/share. Piggyback Registration: A situation when a securities underwriter allows existing holdings of shares in a corporation to be sold in combination with an offering of new public shares. PIK Debt Securities: (Payment in Kind) PIK Debt are bonds that may pay bondholders compensation in a form otherthan cash. PIV: Pooled Investment Vehicle. A legal entity that pools various investor's capital and deploys it according to a specific investment strategy. Placement Agent: A company that specializes in finding institutional investors that are willing and able to invest in a private equity fund or company issuing securities. Sometimes the "issuer" will hire a placement agent so the fund partners can focus on management issues rather than on raising capital. In the U.S., these companies are regulated by the NASD and SEC. Plain English Handbook: The Securities and Exchange Commission online version of Plain English Handbook: How to Create Clear SEC Disclosure Documents Plum: An investment that has a very healthy rate of return. The inverse of an old venture capital adage (see Lemons)claims that "plums ripen later than lemons." Poison Pill: A right issued by a corporation as a preventative antitakeover measure. It allows rightholders to purchase shares in either their company or in the combined target and bidder entity at a s u b s t a n t i a l d i s c o u n t , u s u a l l y 5 0 % . T h i s d i s c o u n t m a y m a k e t h e t a k e o v e r p r o h i b i t i v e l y e x p e n s i v e . / p > p b d s f i d = " 1 0 8 " > 0 0 P o o l e d I R R : A m e t h o d o f c a l c u l a t i n g a n a g g r e g a t e I R R b y s u m m i n g c a s h f l o w s t o g e t h e r t o c r e a t e a p o r t f o l i o c a s h f l o w . T h e I R R i s s u b s e q u e n t l y c a l c u l a t e d o n t h i s p o r t f o l i o c a s h f l o w . / p > p b d s f i d = " 1 0 9 " > 0 0 P o r t f o l i o C o m p a n i e s : C o m p a n i e s i n w h i c h a g i v e n f u n d h a s i n v e s t e d . / p >。

风险术语的英文对照1. Risk Assessment - 风险评估2. Risk Management - 风险管理3. Risk Mitigation - 风险缓解4. Risk Identification - 风险识别5. Risk Analysis - 风险分析6. Risk Control - 风险控制7. Risk Response - 风险应对8. Risk Avoidance - 风险避免9. Risk Transfer - 风险转移10. Risk Tolerance - 风险容忍度11. Risk Probability - 风险概率12. Risk Impact - 风险影响13. Risk Assessment Matrix - 风险评估矩阵14. Risk Register - 风险登记册15. Risk Treatment Plan - 风险处理计划16. Risk Exposure - 风险暴露度17. Risk Control Measures - 风险控制措施18. Risk Indicator - 风险指标19. Risk Communication - 风险沟通20. Risk Event - 风险事件请注意,上述术语仅提供参考,具体的风险管理术语可能根据行业和上下文有所不同。

Risk management is an essential component of any organization, as it involves the identification, assessment, and mitigation of potential risks that could impact the achievement of objectives. In order to effectively manage risks, itis crucial to have a clear understanding of various risk terminologies and their corresponding translations in English.Risk assessment, or 风险评估, is the process of identifying and evaluating potential risks to determine their likelihood and potential impact. This involves analyzing the probability of a risk occurring and assessing the potential consequences it could have on the organization. Risk assessments are typically conducted using various tools and techniques such as risk matrices, scenario analysis, and historical data.Once risks have been identified and assessed, the organization can proceed with risk management, or 风险管理. This involves developing strategies and action plans to minimize or eliminate the identified risks. Risk management aims to reduce the likelihood of a risk occurring or its potential impact if it does occur. It includes risk mitigation, or 风险缓解, which involves implementing measures to reduce the probability and/or severity of a risk.Risk identification, or 风险识别, is the process of identifying potential risks that could impact the organization's objectives. This includes analyzing internal and external factors that could lead to risks, such as changes in regulations, market volatility, or operational vulnerabilities. Risk analysis, or 风险分析, is the process of evaluating the identified risks to determine their potential impact and prioritize their treatment.Risk control, or 风险控制, involves implementing measures to reduce or manage the identified risks. This includes developingand implementing risk control measures, such as implementing safety protocols, conducting regular inspections, or implementing redundancy measures. Risk response, or 风险应对, refers to the actions taken by the organization to address identified risks. This could include accepting the risk, avoiding the risk, transferring the risk to a third party, or implementing measures to mitigate the risk.Risk avoidance, or 风险避免, refers to the strategy of completely eliminating the exposure to a particular risk. This could involve making changes to business processes, discontinuing certain activities, or avoiding certain markets or investments. Risk transfer, or 风险转移, involves transferring the responsibility and financial implications of a risk to another party, such as purchasing insurance coverage.Risk tolerance, or 风险容忍度, refers to the level of risk that an organization is willing to accept in order to achieve its objectives. This involves striking a balance between maximizing opportunities and minimizing potential risks. Risk probability, or 风险概率, refers to the likelihood or chance of a risk occurring. Risk impact, or 风险影响, refers to the magnitude of the consequences that would result if a risk were to occur.A risk assessment matrix, or 风险评估矩阵, is a tool used to evaluate and prioritize risks based on their likelihood and impact. It provides a visual representation of risks and helps in determining appropriate risk management strategies. A risk register, or 风险登记册, is a document that records all identified risks, along with their likelihood, potential impact, and mitigation measures.To implement effective risk management, organizations develop risk treatment plans, or 风险处理计划, which outline the specific actions to be taken to manage identified risks. These plans include a clear description of the risk, its potential impact, the desired risk treatment strategy, and the individuals responsible for its implementation.Risk exposure, or 风险暴露度, refers to the level of vulnerability or susceptibility of the organization to a particular risk. It considers the organization's potential financial, operational, and reputational losses resulting from a risk event. Risk control measures, or 风险控制措施, are actions implemented to mitigate or prevent identified risks. These measures may include implementing internal controls, conducting training programs, or investing in technologies to mitigate risks.Risk indicators, or 风险指标, are quantitative or qualitative measures used to monitor and assess risks. These indicators help in identifying early warning signs of emerging risks, enabling timely and proactive risk management. Risk communication, or 风险沟通, refers to the process of sharing information about risks within the organization or with external stakeholders. Effective risk communication is crucial for ensuring that everyone understands the risks, their potential impact, and the organization's strategiesfor managing them.Overall, understanding and utilizing risk terminologies in both English and their native language is vital for effective riskmanagement. It ensures clear communication, facilitates collaboration, and enhances the organization's ability to identify, assess, and mitigate risks. By effectively managing risks, organizations can safeguard their interests, minimize losses, and enhance their overall performance and resilience.。

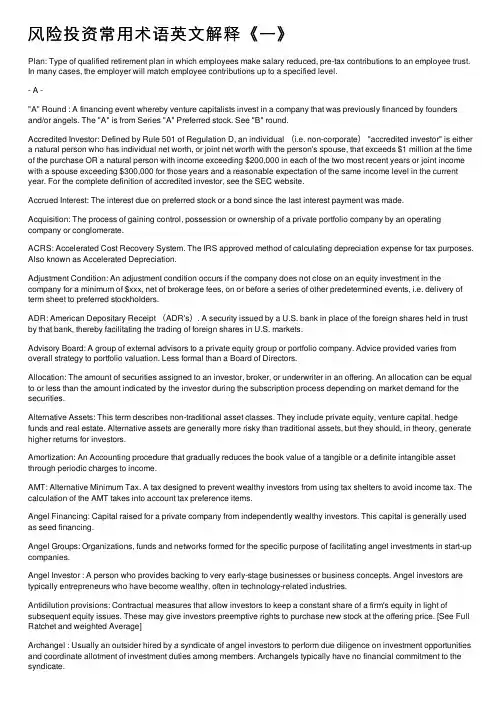

风险投资常⽤术语英⽂解释《⼀》Plan: Type of qualified retirement plan in which employees make salary reduced, pre-tax contributions to an employee trust. In many cases, the employer will match employee contributions up to a specified level.- A -"A" Round : A financing event whereby venture capitalists invest in a company that was previously financed by founders and/or angels. The "A" is from Series "A" Preferred stock. See "B" round.Accredited Investor: Defined by Rule 501 of Regulation D, an individual (i.e. non-corporate) "accredited investor" is either a natural person who has individual net worth, or joint net worth with the person's spouse, that exceeds $1 million at the time of the purchase OR a natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year. For the complete definition of accredited investor, see the SEC website.Accrued Interest: The interest due on preferred stock or a bond since the last interest payment was made.Acquisition: The process of gaining control, possession or ownership of a private portfolio company by an operating company or conglomerate.ACRS: Accelerated Cost Recovery System. The IRS approved method of calculating depreciation expense for tax purposes. Also known as Accelerated Depreciation.Adjustment Condition: An adjustment condition occurs if the company does not close on an equity investment in the company for a minimum of $xxx, net of brokerage fees, on or before a series of other predetermined events, i.e. delivery of term sheet to preferred stockholders.ADR: American Depositary Receipt (ADR's). A security issued by a U.S. bank in place of the foreign shares held in trust by that bank, thereby facilitating the trading of foreign shares in U.S. markets.Advisory Board: A group of external advisors to a private equity group or portfolio company. Advice provided varies from overall strategy to portfolio valuation. Less formal than a Board of Directors.Allocation: The amount of securities assigned to an investor, broker, or underwriter in an offering. An allocation can be equal to or less than the amount indicated by the investor during the subscription process depending on market demand for the securities.Alternative Assets: This term describes non-traditional asset classes. They include private equity, venture capital, hedge funds and real estate. Alternative assets are generally more risky than traditional assets, but they should, in theory, generate higher returns for investors.Amortization: An Accounting procedure that gradually reduces the book value of a tangible or a definite intangible asset through periodic charges to income.AMT: Alternative Minimum Tax. A tax designed to prevent wealthy investors from using tax shelters to avoid income tax. The calculation of the AMT takes into account tax preference items.Angel Financing: Capital raised for a private company from independently wealthy investors. This capital is generally used as seed financing.Angel Groups: Organizations, funds and networks formed for the specific purpose of facilitating angel investments in start-up companies.Angel Investor : A person who provides backing to very early-stage businesses or business concepts. Angel investors are typically entrepreneurs who have become wealthy, often in technology-related industries.Antidilution provisions: Contractual measures that allow investors to keep a constant share of a firm's equity in light of subsequent equity issues. These may give investors preemptive rights to purchase new stock at the offering price. [See Full Ratchet and weighted Average]Archangel : Usually an outsider hired by a syndicate of angel investors to perform due diligence on investment opportunities and coordinate allotment of investment duties among members. Archangels typically have no financial commitment to the syndicate.Asset-backed loan: Loan, typically from a commercial bank, that is backed by asset collateral, often belonging to the entrepreneurial firm or the entrepreneur.Automatic conversion: Immediate conversion of an investor's priority shares to ordinary shares at the time of a company's underwriting before an offering of its stock on an exchange.Average IRR: The arithmetic mean of the internal rate of- B -"B" Round: A financing event whereby professional investors such as venture capitalists are sufficiently interested in a company to provide additional funds after the "A" round of financing. Subsequent rounds are called "C", "D", and so on.Balance Sheet: A condensed financial statement showing the nature and amount of a company's assets, liabilities, and capital on a given date.Bankruptcy: An inability to pay debts. Chapter 11 of the bankruptcy code deals with reorganization, which allows the debtor to remain in business and negotiate for a restructuring of debt.Barbell Strategy: Investment strategy by limited partners that primarily make commitments to buyout firms on (1) the micro/small and (2) the large/mega ends of the market; while mostly eschewing the vast array of middle-market opportunities.BATNA (best alternative to a negotiated agreement): A no-agreement alternative reflecting the course of action a party to a negotiation will take if the proposed deal is not possible.Bear Hug: An offer made directly to the Board of Directors of a target company. Usually made to increase the pressure on the target with the threat that a tender offer may follow.Benchmarking: Comparing returns of a portfolio to the returns of its peers; in private equity, fund performance is benchmarked against a sample of funds formed in the same vintage year with the same investment focus.Best Efforts: An offering in which the investment banker agrees to distribute as much of the offering as possible, and return any unsold shares to the issuer.Blue Sky Laws: A common term that refers to laws passed by various states to protect the public against securities fraud. The term originated when a judge ruled that a stock had as much value as a patch of blue sky.Book Value: Book value of a stock is determined from a company's balance sheet by adding all current and fixed assets and then deducting all debts, other liabilities and the liquidation price of any preferred issues. The sum arrived at is divided by the number of common shares outstanding and the result is book value per common share.Bootstrapping: Means of financing a small firm by employing highly creative ways of using and acquiring resources without raising equity from traditional sources or borrowing money from the bank.Bridge Financing: A limited amount of equity or short-term debt financing typically raised within 6-18 months of an anticipated public offering or private placement meant to "bridge" a company to the next round of financing.Broad-Based Weighted Average Ratchet: A type of anti-dilution mechanism. A weighted average ratchet adjusts downward the price per share of the preferred stock of investor A due to the issuance of new preferred shares to new investor B at a price lower than the price investor A originally received. Investor A's preferred stock is repriced to a weighed average of investor A's price and investor B's price. A broad-based ratchet uses all common stock outstanding on a fully diluted basis (including all convertible securities, warrants and options) in the denominator of the formula for determining the new weighed average price. Compare Narrow-Based Weighted Average ratchet and Chapter 2.9.4.d.ii of the Encyclopedia. Brokers: Private individuals or firms retained by early-stage companies to raise funds for a finder's fee. (compare, broker-dealer)Burn Out / Cram Down: Extraordinary dilution, by reason of a round of financing, of a non-participating investor's percentage ownership in the issuer.Burn Rate: The rate at which a company expends net cash over a certain period, usually a month.Business Development Company (BDC): A vehicle established by Congress to allow smaller, retail investors to participate in and benefit from investing in small private businesses as well as the revitalization of larger private companies. Business Plan: A document that describes the entrepreneur's idea, the market problem, proposed solution, business andrevenue models, marketing strategy, technology, company profile, competitive landscape, as well as financial data for coming years. The businessplan opens with a brief executive summary, most probably the most important element of the document due to the time constraints of venture capital funds and angels.。

英语信用风险专业术语 Revised by Jack on December 14,2020SWOT分析(SWOT analysis)——分析经营风险的方法。

即对企业的优势(strengths)、弱点(weaknesses)、机会(opportunities)、威胁(threats)列表分析。

Z值(Z Score)——指对企业财务状况、破产可能性的量化评估。

Z值主要利用核心的财务指标进行评估,它是由企业破产预测模型得出。

Z值模型(Z score models)——用少量关键指标衡量企业破产风险的模型。

每一个z值模型都有自己的关键指标。

不同的z值模型适用于不同的行业和不同的国家。

巴塞尔协议(Basle Agreement)——由各国中央银行、国际清算银行成员签订的国际协议,主要是关于银行最小资本充足的要求。

它也被称为BIS规则(BIS rules)。

保兑信用证(Confirmed Letter of Credit)——开出信用证的银行和第二家承兑的银行都承诺有条件地担保支付的信用证。

保留所有权的条款(Retention of Title Clause)——销售合同中注明,供应商在法律上拥有货物的所有权,直到顾客支付了货款的条款。

保证契约(Covenant)——借款人承诺遵循借款条约的书面文件,一旦借款人违背了契约书的规定,银行有权惩罚借款人。

本票(Promissory Note)——承诺在指定的日期支付约定金额的票据。

边际贷款(Marginal Lending)——新增贷款。

可以指对现有客户增加的贷款,也可指对新客户的贷款。

边际客户(Marginal Customer)——指额外的客户。

寻求成长机会的企业会尽力将产品销售给新客户,而且通常是不同种类的客户。

这些新增客户的信用风险可能比企业现有的客户要高。

财产转换贷款(Asset Conversion Loan)——用于短期融资的短期贷款,例如,季节性的筹集营运资金。

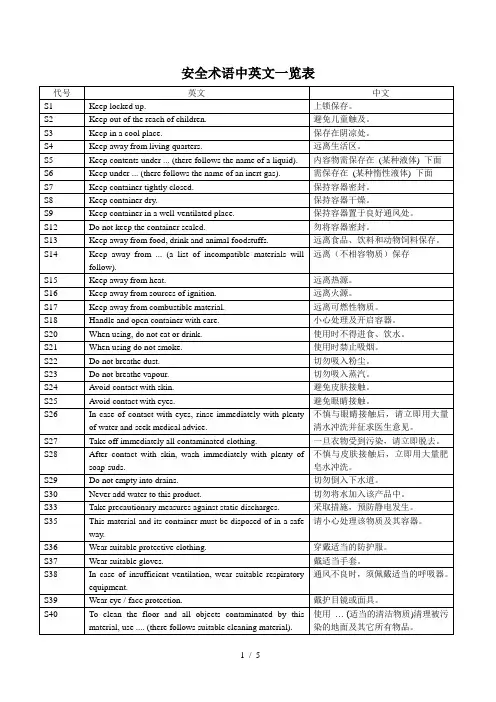

安全术语Chemical data sheets available in many countries now contain codes for certain "risk phrases", shown as R23, R45 etc. These risk phrase codes have the following meanings:R1Explosive when dry. 干燥时易爆。

R2Risk of explosion by shock, friction, fire or other source of ignition. 受冲击、摩擦、着火或其他引燃源有爆炸危险。

R3Extreme risk of explosion by shock, friction, fire or other sources of ignition.受冲击、摩擦、着火或其他引燃源有极高爆炸危险。

R4Forms very sensitive explosive metallic compounds. 生成极敏感的爆炸性金属化合物。

R5Heating may cause an explosion. 受热可能引起爆炸。

R6Explosive with or without contact with air. 极容易爆炸。

R7May cause fire. 可能引起火灾。

R8Contact with combustible material may cause fire. 与可燃物料接触可能引起火灾。

R9Explosive when mixed with combustible material. 与可燃物料混合有爆炸性。

R10Flammable. 易燃。

R11Highly flammable. 高度易燃。

R12Extremely flammable. 极度易燃。

R13Extremely flammable liquefied gas 极度易燃的液化气体。

安全术语Chemical data sheets available in many countries now contain codes for certain "risk phrases", show n as R23, R45 etc. These risk phrase codes have the follow ing meanin gs:R1Explosive when dry. 干燥时易爆。

R2Risk of explosi on by shock, friction, fire or other source of ign iti on. 受冲击、摩擦、着火或其他引燃源有爆炸危险。

R3Extreme risk of explosi on by shock, friction, fire or other sources of ign iti on. 受冲击、摩擦、着火或其他引燃源有极高爆炸危险。

R4Forms very sen sitive explosive metallic compou nds. 生成极敏感的爆炸性金属化合物。

R5Heating may cause an explosion. 受热可能弓丨起爆炸。

R6Explosive with or without con tact with air. 极容易爆炸。

R7May cause fire.可能引起火灾。

R8Con tact with combustible material may cause fire. 与可燃物料接触可能引起火灾。

R9Explosive whe n mixed with combustible material. 与可燃物料混合有爆炸性。

R10Flammable.易燃。

R11Highly flammable.高度易燃。

R12Extremely flammable.极度易燃。