最新版微观经济学精品习题英文版 (with answer) (9)

- 格式:doc

- 大小:128.50 KB

- 文档页数:4

英文微观经济学试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a characteristic of a perfectly competitive market?A. Many buyers and sellersB. Homogeneous productsC. Free entry and exitD. Monopoly powerAnswer: D2. The law of diminishing returns states that:A. The total product of labor increases as more labor is addedB. The marginal product of labor eventually decreases as more labor is addedC. The average product of labor is always higher than the marginal productD. The marginal product of labor is always higher than the average productAnswer: B3. In the short run, a firm in a perfectly competitive market will shut down if:A. Total revenue is greater than total variable costB. Total revenue is less than total costC. Total revenue is less than total variable costD. Total revenue is less than average total costAnswer: C4. The demand for a good is likely to be more elastic when:A. The good has many close substitutesB. The good is a luxury itemC. The good is a necessityD. The good represents a small proportion of consumer's incomeAnswer: A5. The consumer surplus is the difference between:A. The maximum price a consumer is willing to pay and the market priceB. The market price and the minimum price a consumer is willing to payC. The maximum price a consumer is willing to pay and the minimum price a consumer is willing to payD. The minimum price a consumer is willing to pay and the market priceAnswer: A...(此处省略其他选择题)二、简答题(每题10分,共30分)1. Explain the concept of price elasticity of demand and itsdeterminants.Answer: Price elasticity of demand measures the responsiveness of the quantity demanded of a good to a change in its price. It is calculated as the percentage change in quantity demanded divided by the percentage change in price. The determinants of price elasticity include the availability of substitutes, the proportion of income spent on the good, the necessity of the good, and the time period over which the demand is being considered.2. What is the difference between a normal good and aninferior good?Answer: A normal good is a good for which the demand increases as income increases, while the demand for aninferior good decreases as income increases. This is because normal goods are typically considered desirable or of higher quality, while inferior goods are seen as lower quality substitutes that consumers prefer to avoid as their income increases.3. Define the law of supply and give an example.Answer: The law of supply states that, all else being equal, the quantity supplied of a good will increase as the price of the good increases, and decrease as the price of the good decreases. An example of this would be the supply of oil; if the price of oil rises, producers are more likely to increase production and supply more oil to the market.三、计算题(每题25分,共50分)1. A firm has the following total cost function: TC = 0.5Q^2 - 4Q + 100. Calculate the firm's average total cost (ATC) and marginal cost (MC) at the quantity level of Q = 50.Answer:To find the average total cost (ATC), we divide the total cost (TC) by the quantity (Q):\[ ATC = \frac{TC}{Q} = \frac{0.5Q^2 - 4Q + 100}{Q} \]At Q = 50:\[ ATC = \frac{0.5(50)^2 - 4(50) + 100}{50} = \frac{1250}{50} = 25 \]The marginal cost (MC) is the derivative of the total cost function with respect to quantity:\[ MC = \frac{dTC}{dQ} = 0.5 \times 2Q - 4 \]At Q = 50:\[ MC = 0.5 \times 2 \times 50 - 4 = 50 - 4 = 46 \]2. A monopolist faces the demand function P = 100 - 2Q and has a total cost function TC = 10Q. Calculate the profit-maximizing level of output and the corresponding price.Answer:First, calculate the marginal revenue (MR) by taking the derivative of the total revenue (TR) with respect to Q. TR is P*Q, so:\[ TR = (100 -。

Chapter 5 Elasticity and Its Application1. If price elasticity of demand is2.0, this implies that consumers would ( c )a.buy twice as much of the good if price falls by 10 percent.b.require a 2 percent cut in price to raise quantity demanded of the good by 1percent.c.buy 2 percent more of the good in response to a 1 percent cut in price.d.require at least a $2 increase in price before showing any response to the priceincrease.2. If the price elasticity of demand within the price range from $1 and $1.25 for carrots is0.79 and for radishes is 1.6, then within that price range ( b )a.carrots are more price elastic than radishes.b.radishes are more price elastic than carrots.c.carrots and radishes must be substitute goods.d.carrots and radishes must be complementary goods.3. S ue’s Bagel Shop wants to estimate how responsive bagels are to a change in cream cheese prices. To accomplish this task, the following data would NOT be needed? ( a )a.Percentage change in bagel price.b.Original price of cream cheese.c.New quantity of bagels sold.d.Original quantity of bagels sold.4. If Weiskamp T-Shirt Co. lowers its price from $6 to $5 and finds that students increase their quantity demanded from 400 to 600 T-shirts, then the demand for Weiskamp T-shirts within this price range is ( b )a.price inelastic. c. unit elastic.b.price elastic.d. cross elastic.5. The slope of the demand curve is not the same as the price elasticity of demand because the slope of a demand curve ( b )pares percentage changes in quantity demanded and price.pares absolute changes in quantity demanded and price.c.obeys the law of demand.d.is not constant when the demand curve is linear.6. The cross elasticity of demand for substitute goods must be ( d )a.greater than one. c. zero.b.less than one. d. greater than zero.7. A 5 percent increase in the price of sugar reduces sugar consumption by about 10 percent. The increase causes households to ( b )a.spend more on sugar.b.spend less on sugar.c.spend the same amount on sugar.d.consumer more goods like coffee and tea that are complements of sugar.8. As a result of running high temperature this summer in the south of China, the corn crop declined sharply. If corn growers experienced an increase in sales revenue, the demand for corn must be ( b )a.price elastic. c. unitary elastic.b.price inelastic.d. perfectly inelastic.9. The U.S. Post Office finds that it now has extra costs associated with decontaminating first class mail for anthrax(炭疽病). It is considering a rate hike, but it will only be successful in raising more revenue to pay for these additional costs if ( c )a.there are many substitutes for first class mail service.b.no anthrax is found on the mail.c.the demand for first class mail service is inelastic.d.the rate increase is a very large one.10. Suppose that the elasticity of supply of lawn mowers is 1.5. If the price of lawn mowers rises 5 percent, the quantity supplied of lawn mowers would ( b )a.decline 7.5 percent. c. rise 1.5 percent.b.rise 7.5 percent. d. rise 0.3 percent.11. A decrease in supply will raise the equilibrium price most when demand is ( b )a.relatively elastic. c. unit elastic.b.relatively inelastic.d. perfectly elastic.。

微观经济学试题及答案英文Microeconomics Exam Questions and AnswersQuestion 1: Define the law of demand and explain how itrelates to the concept of price elasticity of demand.Answer 1: The law of demand states that, all else being equal, the quantity demanded of a good or service will decrease asthe price increases. Price elasticity of demand measures the responsiveness of the quantity demanded to a change in price. If the quantity demanded changes significantly in response to a price change, the demand is said to be elastic. Conversely, if the quantity demanded changes very little, the demand is inelastic.Question 2: What is the difference between a firm's total revenue and marginal revenue?Answer 2: Total revenue is the total income received by afirm from selling its product, calculated as the price perunit multiplied by the quantity sold. Marginal revenue, onthe other hand, is the additional revenue generated fromselling one more unit of the product. It is the change intotal revenue divided by the change in quantity sold. In a perfectly competitive market, marginal revenue equals the price, but in a market with some degree of monopoly power, marginal revenue is less than the price.Question 3: Explain the concept of consumer surplus and howit is calculated.Answer 3: Consumer surplus is the difference between what consumers are willing to pay for a good or service and what they actually pay. It is a measure of the welfare gain to consumers from participating in a market. It is calculated by finding the area under the demand curve but above the market price, which represents the total amount consumers would have been willing to pay for each unit up to the quantity they actually purchase.Question 4: What is the marginal cost and how does it relateto a firm's decision to produce?Answer 4: Marginal cost is the cost of producing oneadditional unit of a good or service. It is the change intotal cost resulting from producing one more unit. Firms will continue to produce additional units as long as the marginal cost is less than the marginal revenue. If the marginal cost exceeds the marginal revenue, the firm will reduce production, as producing one more unit would result in a loss.Question 5: Define economies of scale and explain how they affect a firm's cost structure.Answer 5: Economies of scale refer to the cost advantagesthat a firm experiences when it increases its level of output. As the scale of production increases, the average cost perunit of output decreases due to factors such as spreadingfixed costs over more units, specialization of labor, andbulk purchasing discounts. This can lead to lower per-unit costs and potentially higher profits.Question 6: What is the difference between a normal good and an inferior good?Answer 6: A normal good is a good for which the demand increases as consumers' income increases. In contrast, an inferior good is a good for which the demand decreases as consumers' income increases. This is because consumers tend to substitute inferior goods with superior or higher-quality goods when their income rises.End of ExamPlease note that this is a sample set of microeconomics exam questions and answers. The actual content of an exam would depend on the specific topics covered in the course and the level of difficulty desired by the instructor.。

Microeconomics, 10e (Parkin)Chapter 5 Efficiency and Equity1 Resource Allocation Methods1) In the United States, resources are most often allocated byA) market price.B) command system.C) lottery.D) contest.Answer: ATopic: Resource Allocation MethodsSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking2) A contest is a good way to allocate scarce resources whenA) the efforts of the players are hard to monitor directly.B) the lines of responsibility are clear.C) the decision being made affects a large number of people.D) there is no effective way to distinguish among potential users.Answer: ATopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking3) The resource allocation method that is used to allocate scarce resources between private use and government use isA) first-come, first-served.B) personal characteristics.C) majority rule.D) lottery.Answer: CTopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Modified 10th editionAACSB: Reflective Thinking4) Which of the following is true?A) Lotteries work best when a resource can serve just one user at a time in a sequence.B) A market price always allocates resources better than does a command system.C) When the government decides how to allocate tax dollars among competing uses, resources are allocated by majority rule.D) Force has never played an important role in allocating scarce resources.Answer: CTopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking5) Which of the following is true?A) When resources are allocated on the basis of personal characteristics, all people who are willing and able to pay the price get the resource.B) When the range of activities to be monitored is large and complex, a command system allocates resources better than a market price.C) When a market price allocates resources, some people who are willing and able to pay that price don't get the resource.D) Force helps support the legal system on which markets function.Answer: DTopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Modified 10th editionAACSB: Reflective Thinking6) As a method of resource allocation, forceA) is not important.B) plays a crucial negative role.C) plays a crucial positive role.D) plays a crucial role for both good and ill.Answer: DTopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking7) As a method of resource allocation, market priceA) means those who are willing and able to pay get a particular good or service.B) works well when self-interest must be suppressed.C) works best inside firms and government departments.D) is efficient when there is no effective way to distinguish among potential users of a scarce resource.Answer: ATopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Modified 10th editionAACSB: Reflective Thinking8) Which of the following is true?A) When a market price allocates resources, all people who are willing and able to pay that price get the resource.B) A command system works well when the range of activities to be monitored is large and complex.C) When the government decides how to allocate tax dollars among competing uses, resources are allocated by market prices.D) When a manager offers everyone in the company the opportunity to win a prize, resources are allocated by a lottery.Answer: ATopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking9) When allocating resources using market priceA) everyone who is willing and able to pay for a good gets one.B) everyone who wants a good gets one.C) everyone who is willing to pay for a good gets one.D) everyone who is able to pay for a good gets one.Answer: ATopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking10) When scarce resources can serve only one user at a time in sequence, which method works well for allocating the scarce resources?A) first come, first servedB) lotteryC) contestD) command systemAnswer: ATopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking11) Which of the following is true?A) When a market price allocates resources, everyone who is able to pay the price gets the resource.B) A command system works well when the lines of authority and responsibility are clear .C) When the government decides how to allocate tax dollars among competing uses, resources are allocated by command.D) When a manager offers everyone in the company the opportunity to win a prize, resources are allocated by a market price.Answer: BTopic: Resource Allocation MethodsSkill: ConceptualQuestion history: Modified 10th editionAACSB: Reflective Thinking12) Allocating resources by the order of someone in authority is a ________ allocation method.A) first-come, first-servedB) market priceC) majority ruleD) commandAnswer: DTopic: Study Guide Question, Resource Allocation MethodSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking13) Often people trying to withdraw money from their bank must wait in line, which reflects a ________ allocation method.A) first-come, first-servedB) market priceC) contestD) commandAnswer: ATopic: Study Guide Question, Resource Allocation MethodSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking14) If a person will rent an apartment only to married couples over 30 years old, that person is allocating resources using a ________ allocation method.A) first-come, first-servedB) market priceC) personal characteristicsD) commandAnswer: CTopic: Study Guide Question, Resource Allocation MethodSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking2 Benefit, Cost, and Surplus1) The value of one more unit of a good or service is theA) marginal benefit.B) minimum price that people are willing to pay for another unit of the good or service.C) marginal cost.D) opportunity cost of producing one more unit of a good or service.Answer: ATopic: Value, Willingness to Pay, and DemandSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking2) The value of a good is equal to theA) maximum price you are willing to pay for it.B) price that you actually pay for it.C) price you actually pay for it minus the maximum you are willing to pay for it.D) maximum you are willing to pay for it minus the price you actually pay for it.Answer: ATopic: Value, Willingness to Pay, and DemandSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking3) Marginal benefit is the benefit received from ________.A) consuming more goods or servicesB) producing the efficient quantityC) consuming the efficient quantityD) consuming one more unit of a good or serviceAnswer: DTopic: Marginal BenefitSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking4) All of the following statements about marginal benefit are correct EXCEPT the marginal benefit of a goodA) is the benefit a person receives from consuming one more unit of the good or service.B) is measured as the maximum amount that a person is willing to pay for one more unit of the good.C) is equal to zero when resource use is efficient.D) decreases as the quantity consumed of the good increases.Answer: CTopic: Marginal BenefitSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking5) Sal likes to eat pizza. The ________ is the maximum amount that Sal is willing to pay for one more piece of pizza.A) efficient priceB) efficient amountC) marginal benefitD) marginal costAnswer: CTopic: Marginal BenefitSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking6) Marginal benefitA) is the same as the total benefit received from consuming a good.B) is the maximum amount a person is willing to pay for one more unit of a good.C) increases as consumption increases.D) is the difference between total benefit and total cost.Answer: BTopic: Marginal BenefitSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking7) Jane is willing to pay $50 for a pair of shoes. The actual price of the shoes is $30. Her marginal benefit isA) $50.B) $30.C) $20.D) $80.Answer: ATopic: Marginal BenefitSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Reflective ThinkingThe table below shows the demand schedules for pizza for Abby and Barry who are the only buyers in the market.8) Based on the table, what is Abby's marginal benefit from the 10th slice of pizza?A) $4B) $13C) $0.50D) $40Answer: ATopic: Marginal BenefitSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills9) Based on the table, what is Barry's marginal benefit from the 40th slice of pizza?A) $3B) $5.50C) $0.50D) $12Answer: ATopic: Marginal BenefitSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills10) Based on the table, what is the marginal social benefit from the 45th slice of pizza?A) $3.50B) $3.25C) $0.50D) $9Answer: ATopic: Marginal Social BenefitSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills11) If you increase your consumption of soda by one additional can a week, your marginal benefit of this last can is $1.00. The ________ of this last can of soda is $1.00.A) valueB) priceC) opportunity costD) marginal costAnswer: ATopic: Value, Willingness to Pay, and DemandSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills12) A person will choose to buy a good as long asA) marginal benefit is at least as great as price.B) consumer surplus is positive.C) marginal benefit is positive.D) consumer surplus is at least as great as price.Answer: ATopic: Value, Willingness to Pay, and DemandSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking13) Sam's demand curve for pizzaA) lies above her marginal benefit curve for pizza.B) lies below her marginal benefit curve for pizza.C) is the same as her marginal benefit curve for pizza.D) has one point in common with her marginal benefit curve for pizza.Answer: CTopic: Value, Willingness to Pay, and DemandSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking14) The market demand curveA) can also be the marginal social cost curve.B) shows the value of a good that consumers must give up to get another unit of a different good.C) by itself determines equilibrium prices.D) can also be the marginal social benefit curve.Answer: DTopic: Marginal Benefit and DemandSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking15) The market demand curve also isA) a marginal social cost curve.B) a marginal social benefit curve.C) an opportunity cost curve.D) a consumer surplus curve.Answer: BTopic: Marginal Benefit and DemandSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking16) The market demand curve for coffee is the same as theA) marginal social cost curve of coffee.B) marginal social benefit curve of coffee.C) opportunity cost curve of coffee.D) marginal social benefit curve minus the marginal social cost curve of coffee.Answer: BTopic: Marginal Benefit and DemandSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking17) A market demand curve measuresA) how much a consumer is willing to pay for an additional unit of the good.B) the marginal social benefit of an additional unit of the good.C) the marginal social cost of an additional unit of the good.D) Both answers A and B are correct.Answer: DTopic: Value, Willingness to Pay, and DemandSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking18) Moving down along the market demand curve for hot dogs, theA) maximum price that people are willing to pay for hot dogs increases.B) marginal social benefit of hot dogs decreases.C) marginal social cost of hot dogs increases.D) consumer surplus of the last hot dog consumed increases.Answer: BTopic: Value, Willingness to Pay, and DemandSkill: ConceptualQuestion history: Modified 10th editionAACSB: Reflective Thinking19) The market demand curve is constructed by adding theA) quantities demanded by each individual at each price.B) prices that each individual is willing to pay at each quantity.C) Neither answer A nor answer B is correct.D) Both answer A and answer B are correct.Answer: ATopic: Individual Demand and Market DemandSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking20) A market demand curve is constructed byA) a horizontal summation of each individual demand curve.B) averaging each individual demand curve.C) dividing one individual demand curve by the number of consumers in the market.D) a vertical summation of each individual demand curve.Answer: ATopic: Individual Demand and Market DemandSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking21) A market demand curve can be constructed byA) adding the prices all consumers will pay for any given quantity.B) adding the quantities that all consumers buy at each price.C) adding the quantities that a consumer buys at the highest price.D) None of the above answers is correct.Answer: BTopic: Individual Demand and Market DemandSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking22) The market demand curve for iPads is the ________ of all the individual demand curves for iPads.A) horizontal productB) horizontal sumC) vertical sumD) vertical productAnswer: BTopic: Individual Demand and Market DemandSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking23) Given the individual demands for video downloads in the above table, and assuming that these three people are the only ones in the market, which of the following statements is NOT true about market demand for video downloads?A) The market quantity demanded at a price of $5 is 10.B) The height of the market demand curve at a quantity demanded of 22 is $3.C) The height of the market demand curve at a quantity demanded of 16 is $5.D) The market quantity demanded at a price of $2 is 28.Answer: CTopic: Individual Demand and Market DemandSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical SkillsQuantity of tennis24) Jill and Jed have individual demand curves for tennis rackets given in the table above and are the only two demanders in the market. What is the market quantity demanded at the price of $30?A) 2B) 5C) 11D) 18Answer: BTopic: Individual Demand and Market DemandSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills25) Homer, Bart, and Lisa are the only consumers in the market. Using the information in the above table, what is the market demand for chocolate chip cookies at $4.00 per pound?A) 21 poundsB) 17 poundsC) 11 poundsD) 4 poundsAnswer: CTopic: Individual Demand and Market DemandSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills26) Consumer surplus is the ________ summed over the quantity bought.A) marginal social benefit minus the marginal social costB) number of dollars' worth of other goods and services forgone to obtain one more unit of a good or serviceC) value of a good or service minus the price paid for the good or serviceD) value of a good or service plus the price paid for the good or serviceAnswer: CTopic: Consumer SurplusSkill: RecognitionQuestion history: Modified 10th editionAACSB: Reflective Thinking27) ________ is the value of a good minus the price paid for it summed over the quantity bought.A) Producer surplusB) Consumer surplusC) SurplusD) ShortageAnswer: BTopic: Consumer SurplusSkill: RecognitionQuestion history: Modified 10th editionAACSB: Reflective Thinking28) Consumer surplus is theA) value of a good expressed in dollars.B) price of a good expressed in dollars.C) value of a good minus the price paid for it summed over the quantity bought.D) value of a good plus the price paid for it summed over the quantity bought.Answer: CTopic: Consumer SurplusSkill: RecognitionQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking29) Consider the market for hot dogs. As long as the marginal benefit of consuming hot dogs is greater than the price of hot dogs,A) people receive consumer surplus from eating hot dogs.B) the price of hot dogs will rise.C) the value of hot dogs will rise.D) there is no decreasing marginal benefit of eating hot dogs.Answer: ATopic: Consumer SurplusSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking30) If the price of a pizza increases and the demand curve for pizza does not shift, then the consumer surplus from pizza will ________.A) increaseB) decreaseC) equal the producer surplus if the market produces the efficient quantity of pizzaD) remain the sameAnswer: BTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking31) Nick can purchase each milkshake for $2. For the first milkshake purchased Nick is willing to pay $4, for the second milkshake $3, for the third milkshake $2 and for the fourth milkshake $1. What is the value of Nick's consumer surplus for the milkshakes he buys?A) $2B) $9C) $3D) $10Answer: CTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills32) A used car was recently priced at $20,000.00. Seeing the car, Bobby thought, "It's nice, but ifI have to pay more than $19,500 for this car, then I would rather do without it." After negotiations, Bobby purchased the car for $19,250.00. His consumer surplus was equal toA) $19,500.00.B) $1,750.00.C) $250.00.D) $0.00.Answer: CTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills33) When the Smith's were shopping for their present home, the asking price from the previous owner was $250,000.00. The Smith's had decided they would pay no more than $245,000.00 for the house. After negotiations, the Smith's actually purchased the house for $239,000.00. They, therefore, enjoyed a consumer surplus ofA) $239,000.00.B) $5,000.00.C) $6,000.00.D) $11,000.00.Answer: CTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills34) The latest model car in the dealer's showroom has a sticker price of $35,000.00. Fred, the shopper, has decided that he would pay no more than $32,000.00 for the car. After two hours of bargaining with the saleswoman, Fred actually purchases the car for $31,000.00. Fred, therefore, has obtained a consumer surplus ofA) $35,000.00.B) $32,000.00.C) $4,000.00.D) $1,000.00.Answer: DTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills35) Jane is willing to pay $50 for a pair of shoes. The actual price of the shoes is $30. Her consumer surplus on this pair of shoes isA) $20.B) $50.C) $30.D) $80.Answer: ATopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills36) Charlene is willing to pay $5.00 for a sandwich. If Charlene must pay ________ for a sandwich, she ________.A) $4.00; does not receive consumer surplusB) $4.00; receives consumer surplusC) $6.00; receives consumer surplusD) $6.00; receives a marginal costAnswer: BTopic: Consumer SurplusSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills37) Joe is willing to pay $4 for his first slice of pizza and $3 for his second slice of pizza. If the price is $2, on his two slices of pizza Joe receives a total consumer surplus ofA) $4.B) $3.C) $2.D) $1.Answer: BTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills38) Jane is willing to pay $4 for the first cup of coffee a day, $2.50 for the second cup, and $1 for the third cup, after which she won't buy any coffee. The price of a cup of coffee is $2.40. How many cups of coffee per day will Jane buy?A) 1B) 2C) 3D) NoneAnswer: BTopic: Demand and Marginal BenefitSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills39) Jane is willing to pay $4 for the first cup of coffee a day, $2.50 for the second cup, and $1 for the third cup, after which she won't buy any coffee. The price of a cup of coffee is $2.40. Jane's consumer surplus from the coffee she buys is $________ per day.A) $1.60B) $1.70C) $4.80D) $6.50Answer: BTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills40) Consider a market that has linear supply and demand curves, and is in equilibrium. The area above the price line and below the demand curve isA) consumer surplus.B) producer surplus.C) marginal cost.D) marginal benefit.Answer: ATopic: Consumer SurplusSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Reflective Thinking41) Four people each have a different willingness to pay for one unit of a good: George will pay $15, Glen will pay $12, Tom will pay $10, and Peter will pay $8. If price is equal to $9 per unit then the quantity demanded in the market will be ________ and the consumer surplus for this unit will be ________.A) 3; $10B) 3; $37C) 3; $36D) 4; $8Answer: ATopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills42) Four people each have a different willingness to pay for one unit of a good: George will pay $15, Glen will pay $12, Tom will pay $10, and Peter will pay $8. If price decreases from $9 to $8 then the consumer surplus from this unit will increase byA) $3.B) $4.C) $2.D) $1.Answer: ATopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills43) The figure above shows Clara's demand for CDs. If the price for a CD is $15, then ClaraA) receives no consumer surplus on the 6th CD she buys.B) receives a total of $10 of consumer surplus.C) will buy no CDs.D) receives a total of $40 of consumer surplus.Answer: ATopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills44) The figure above shows Clara's demand for CDs. The price for a CD is $15. Which statement is true?A) When Clara buys 6 CDs, she receives $15 of consumer surplus on her 6th CD.B) When Clara buys 6 CDs, she receives a total of $15 of consumer surplus.C) When Clara buys 6 CDs, she receives a total of $30 of consumer surplus.D) When Clara buys 6 CDs, she receives a total of $45 of consumer surplus.Answer: DTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills45) The figure above shows Clara's demand for CDs. At a price of $20 for a CD, the value of Clara's total consumer surplus for all the CDs she buys isA) $40.B) $30.C) $20.D) $4.Answer: CTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills46) The figure above shows Clara's demand for CDs. At a price of $5 for a CD, the value of Clara's total consumer surplus for all the CDs she buys isA) $5.B) $10.C) $25.D) $125.Answer: DTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills47) The figure above shows Clara's demand for CDs. If the price of a CD were to increase from $15 to $25, Clara's total consumer surplus for all the CDs she buys wouldA) decrease by $40.B) remain unchanged.C) decrease by $90.D) increase by $80.Answer: ATopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills48) The above figure shows Dana's marginal benefit curve for ice cream. If the price of ice cream is $2 per gallon, then the maximum that Dana is willing to pay for the 8th gallon of ice cream isA) $1.B) $2.C) $3.D) $5.Answer: CTopic: Value, Willingness to Pay, and DemandSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills49) In the above figure, the individual's consumer surplus will be highest ifA) the price of ice cream is $5 per gallon.B) the price of ice cream is $3 per gallon.C) the price of ice cream is $2 per gallon.D) ice cream is free.Answer: DTopic: Consumer SurplusSkill: ConceptualQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills$2 per gallon, then Dana's consumer surplus from the 4th gallon of ice cream isA) $0.B) $2.C) $3.D) $10.Answer: BTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills51) The above figure shows Dana's marginal benefit curve for ice cream. If the price of ice cream is $2 per gallon, then Dana's consumer surplus from the 4th gallonA) is greater than her consumer surplus from the 8th gallon.B) is the same as her consumer surplus from the 8th gallon.C) is less than her consumer surplus from the 8th gallon.D) could be greater than, equal to, or less than the consumer surplus from the 8th gallon. Answer: ATopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills52) The above figure shows Dana's marginal benefit curve for ice cream. If the price of ice cream is $2 per gallon, then the gallon that gives Dana exactly zero consumer surplus isA) the 8th gallon.B) the 12th gallon.C) the 16th gallon.D) the 20th gallon.Answer: BTopic: Consumer SurplusSkill: AnalyticalQuestion history: Previous edition, Chapter 5AACSB: Analytical Skills。

Chapter 01Thinking Like an Economist Multiple Choice Questions1. Economics is best defined as the study of:A. prices and quantities.B. inflation and interest rates.C. how people make choices under the conditions of scarcity and the results of those choices.D. wages and incomes.2. Economic questions always deal with:A. financial matters.B. political matters.C. insufficient resources.D. choice in the face of limited resources.3. The range of topics or issues that fit within the definition of economics is:A. limited to market activities, e.g., buying soap.B. limited to individuals and firms.C. extremely wide, requiring only the ideas of choice and scarcity.D. very limited.4. The central concern of economics is:A. poverty.B. scarcity.C. wealth accumulation.D. overconsumption.5. The scarcity principle indicates that:A. no matter how much one has, it is never enough.B. compared to 100 years ago, individuals have less time today.C. with limited resources, having more of "this" means having less of "that."D. because tradeoffs must be made, resources are therefore scarce.6. The logical implication of the scarcity principle is that:A. one will never be satisfied with what one has.B. as wealth increases, making choices becomes less necessary.C. as wealth decreases, making choices becomes less necessary.D. choices must be made.7. If all the world's resources were to magically increase a hundredfold, then:A. the scarcity principle would still govern behavior.B. economics would no longer be relevant.C. the scarcity principle would disappear.D. tradeoffs would become unnecessary.8. The principle of scarcity applies to:A. the poor exclusively.B. all consumers.C. all firms.D. everyone—consumers, firms, governments, and nations.9. At the very least, Joe Average and Bill Gates are both identically limited by:A. their wealth.B. the 24 hours that comprise a day.C. their knowledge.D. their influence.10. Forest is a mountain man living in complete isolation in Montana. He is completely self-sufficient through hunting, fishing, and farming. He has not been in the city to buy anything in five years. One can infer:A. the scarcity principle does not apply to Forest.B. Forest is not required to make choices.C. the scarcity principle still applies because more hunting means less fishing and farming.D. Forest is very satisfied.11. The scarcity principle applies to:A. all decisions.B. only market decisions, e.g., buying a car.C. only non-market decisions, e.g., watching a sunset.D. only the poor.12. Chris has a one-hour break between classes every Wednesday. Chris can either stay at the library and study or go to the gym and work out. The decision Chris must make is:A. not an economic problem because neither one costs money.B. not an economic problem because it's an hour that is wasted no matter what Chris does.C. an economic problem because the tuition Chris pays covers both the gym and the library.D. an economic problem because Chris has only one hour during which he can study or work out.13. Josh wants to go to the football game this weekend, but he has a paper due on Monday. It will take him the whole weekend to write the paper. Josh decided to stay home and work on the paper. According to the scarcity principle, the reason Josh didn't go to the game is that:A. Josh prefers schoolwork to football games.B. writing the paper is easier than going to the game.C. Josh doesn't have enough time for writing the paper and going to the game.D. it's too expensive to go to the game.14. Whether studying the size of the U.S. economy or the number of children a couple will choose to have, the unifying concept is that wants are:A. limited, resources are limited, and thus choices must be made.B. unlimited, resources are limited, and thus choices must be made.C. unlimited, resources are limited to some but not to others, and thus some people must make choices.D. unlimited, resources are limited, and thus government needs to do more.15. The cost-benefit principle indicates that an action should be taken:A. if the total benefits exceed the total costs.B. if the average benefits exceed the average costs.C. if the net benefit (benefit minus cost) is zero.D. if the extra benefit is greater than or equal to the extra costs.16. When a person decides to pursue an activity as long as the extra benefits are at least equal to the extra costs, that person is:A. violating the cost-benefit principle.B. following the scarcity principle.C. following the cost-benefit principle.D. pursuing the activity too long.17. Choosing to study for an exam until the extra benefit (improved score) equals the extra cost (mental fatigue) is:A. not rational.B. an application of the cost-benefit principle.C. an application of the scarcity principle.D. the relevant opportunity cost.18. The scarcity principle tells us that __________, and the cost-benefit principle tells us __________.A. choices must be made; how to make the choicesB. choices must be made; that the costs can never outweigh the benefits of the choicesC. rare goods are expensive; that the costs should outweigh the benefits of the choicesD. rare goods are expensive; that the costs can never outweigh the benefits of the choices19. According to the cost-benefit principle:A. the lowest cost activity usually gives the lowest benefit.B. a person should always choose the activity with the lowest cost.C. a person should always choose the activity with the greatest benefit.D. the extra costs and benefits of an activity are more important considerations than the total costs and benefits.20. A rational person is one who:A. is reasonable.B. makes choices that are easily understood.C. possesses well-defined goals and seeks to achieve them.D. is highly cynical.21. The seventh glass of soda that Tim consumes will produce an extra benefit of 10 cents and has an extra cost of zero (Tim is eating at the cafeteria). Thecost-benefit principle predicts that Tim will:A. realize he has had too much soda to drink and go home.B. drink the seventh glass and continue until the marginal benefit of drinking another glass of soda is zero.C. volunteer to empty out the fountain.D. not drink the seventh glass.22. Janie must either mow the lawn or wash clothes, earning her a benefit of $30 or $45, respectively. She dislikes both equally and they both take the same amount of time. Janie will therefore choose to _________ because the economic surplus is ________.A. mow the lawn; greaterB. wash clothes; greaterC. mow the lawn; smallerD. wash clothes; smaller23. Dean decided to play golf rather than prepare for tomorrow's exam in economics. One can infer that:A. Dean has made an irrational choice.B. Dean is doing poorly in his economics class.C. the economic surplus from playing golf exceeded the surplus from studying.D. the cost of studying was less than the cost of golfing.Larry was accepted at three different graduate schools, and must choose one. Elite U costs $50,000 per year and did not offer Larry any financial aid. Larry values attending Elite U at $60,000 per year. State College costs $30,000 per year, and offered Larry an annual $10,000 scholarship. Larry values attending State College at $40,000 per year. NoName U costs $20,000 per year, and offered Larry a full $20,000 annual scholarship. Larry values attending NoName at $15,000 per year.24. The opportunity cost of attending Elite U is:A. $50,000B. $10,000C. $20,000D. $15,00025. The opportunity cost of attending State College is:A. $30,000B. $20,000C. $15,000D. $10,00026. Larry maximizes his surplus by attending:A. Elite U, because $60,000 is greater than the benefit at the other schools.B. State College, because the difference between the benefit and cost is greatest there.C. NoName U, because Larry has a full scholarship there.D. Elite U, because the opportunity costs of attending Elite U are the lowest.27. Larry has decided to go to Elite U. Assuming that all of the values described are correct, for Larry to decide on Elite U, he must have:A. calculated his surplus from each choice and picked the one with the highest surplus.B. underestimated the benefits of attending NoName.C. miscalculated the surplus of attending Elite U.D. determined the opportunity cost of each choice and picked the one with the lowest opportunity cost.28. Jen spends her afternoon at the beach, paying $1 to rent a beach umbrella and $11 for food and drinks rather than spending an equal amount of money to go to a movie. The opportunity cost of going to the beach is:A. the $12 she spent on the umbrella, food and drinks.B. only $1 because she would have spent the money on food and drinks whether or not she went to the beach.C. the movie she missed seeing.D. the movie she missed seeing plus the $12 she spent on the umbrella, food and drinks.29. Relative to a person who earns minimum wage, a person who earns $30 per hour has:A. a lower opportunity cost of working longer hours.B. a higher opportunity cost of taking a day off.C. a lower opportunity cost of driving farther to work.D. the same opportunity cost of spending time on leisure activities.30. The opportunity cost of an activity is the value of:A. an alternative forgone.B. the next-best alternative forgone.C. the least-best alternative forgone.D. the difference between the chosen activity and the next-best alternative forgone.31. Amy is thinking about going to the movies tonight. A ticket costs $7 and she will have to cancel her dog-sitting job that pays $30. The cost of seeing the movie is:A. $7.B. $30.C. $37.D. $37 minus the benefit of seeing the movie.32. Economic surplus is:A. the benefit gained by taking an action.B. the price paid to take an action.C. the difference between the benefit gained and the cost incurred of taking an action.D. the wage someone would have to earn in order to take an action.33. The Governor of your state has cut the budget for the University and increased spending on Medicaid. This is an example of:A. the pitfalls of considering average costs instead of marginal costs.B. poor normative economic decision making.C. poor positive economic decision making.D. choice in the face of limited resources.34. Sally earned $25,000 per year before she became a mother. After she becamea mother, she told her employer that her opportunity cost of working is now $50,000, and so she is not willing to work for anything less. Her decision is based on:A. the high cost of raising a child.B. her desire to save for her child's college expenses.C. her increased value to her employer.D. the value she places on spending time with her child.35. Alex received a four-year scholarship to State U. that covered tuition and fees, room and board, and books and supplies. As a result:A. attending State U. for four years is costless for Alex.B. Alex has no incentive to work hard while at State U.C. the cost of attending State U. is the amount of money Alex could have earned working for four years.D. the cost of attending State U. is the sum of the benefits Alex would have had attending each of the four other schools to which Alex had been admitted.36. Suppose Mary is willing to pay up to $15,000 for a used Ford pick-up truck, but she finds one for $12,000. Her __________ is __________.A. benefit; $12,000B. cost; $15,000C. economic surplus; $3,000D. economic surplus; $12,00037. In general, rational decision making requires one to choose the actions that yield the:A. largest total benefits.B. smallest total costs.C. smallest net benefits.D. largest economic surpluses.38. Suppose the most you would be willing to pay for a plane ticket home is $250, but you buy one online for $175. The economic surplus of buying the online ticket is:A. $175.B. $250.C. $75.D. $0.39. The use of economic models, like the cost-benefit principle, means economists believe that:A. this is exactly how people choose between alternatives.B. this is a reasonable abstraction of how people choose between alternatives.C. those who explicitly make decisions this way are smarter.D. with enough education, all people will start to explicitly make decisions this way.40. Jenna decides to see a movie that costs $7 for the ticket and has an opportunity cost of $20. After the movie, she says to one of her friends that the movie was not worth it. Apparently:A. Jenna failed to apply the cost-benefit model to her decision.B. Jenna was not rational.C. Jenna overestimated the benefits of the movie.D. Jenna underestimated the benefits of the movie.41. Most of us make sensible decisions most of the time, because:A. we know the cost-benefit principle.B. subconsciously we are weighing costs and benefits.C. most people know about the scarcity principle.D. we conduct hypothetical mental auctions when we make decisions.42. Suppose a person makes a choice that seems inconsistent with the cost-benefit principle. Which of the following statements represents the most reasonable conclusion to draw?A. The person (explicitly or implicitly) over-estimated the benefits orunder-estimated the costs or both.B. The cost-benefit principle is rarely true.C. The person does not grasp how decisions should be made.D. The person is simply irrational.43. Economic models are intended to:A. apply to all examples equally well.B. eliminate differences in the way people behave.C. generalize about patterns in decision-making.D. distinguish economics students from everyone else.44. Economic models claim to be:A. reasonable abstractions of how people make choices, highlighting the most important factors.B. exact replications of the decision-making process people use.C. interesting chalkboard exercises with little applicability to the real world.D. exceptionally accurate methods of predicting nearly all behavior of everyone.45. The cost-benefit model used by economists is:A. unrealistic because it is too detailed and specific to apply to a variety of situations.B. unrealistic because everyone can think of times when he or she violated the principle.C. useful because everyone follows it all of the time.D. useful because most people follow it most of the time.46. Barry owns a clothing store in the mall and has asked two economic consultants to develop models of consumer behavior that he can use to increase sales. Barry should choose the model that:A. does not include simplifying assumptions.B. is the most detailed and complex.C. assumes that consumers apply the cost-benefit principle.D. predicts that consumers will always prefer Barry's store to the competing stores.47. Economists use abstract models because:A. every economic situation is unique, so it is impossible to make generalizations.B. every economic situation is essentially the same, so specific details are unnecessary.C. they are useful for describing general patterns of behavior.D. computers have allowed economists to develop abstract models.48. Most people make some decisions based on intuition rather than calculation. This is:A. irrational, because intuition is often wrong.B. consistent with the economic model of decision-making, because calculating costs and benefits leads to decision-making pitfalls.C. consistent with the economic model because people intuitively compare the relative costs and benefits of the choices they face.D. inconsistent with the economic model, but rational because intuition takes into account non-financial considerations.49. Moe has a big exam tomorrow. He considered studying this evening, but decided to go out with Curly instead. Since Moe always chooses rationally, it must be true that:A. the opportunity cost of studying tonight is less than the value Moe gets from spending time with Curly.B. the opportunity cost of studying tonight is equal to the value Moe gets from spending time with Curly minus the cost of earning a low grade on the exam.C. Moe gets more benefit from spending time with Curly than from studying.D. Moe gets less benefit from spending time with Curly than from studying.50. If one fails to account for implicit costs in decision making, then applying the cost-benefit rule will be flawed because:A. the benefits will be overstated.B. the costs will be understated.C. the benefits will be understated.D. the costs will be overstated.Your classmates from the University of Chicago are planning to go to Miami for spring break, and you are undecided about whether you should go with them. The round-trip airfares are $600, but you have a frequent-flyer coupon worth $500 that you could use to pay part of the airfare. All other costs for the vacation are exactly $900. The most you would be willing to pay for the trip is $1400. Your only alternative use for your frequent-flyer coupon is for your trip to Atlanta two weeks after the break to attend your sister's graduation, which your parents are forcing you to attend. The Chicago-Atlanta round-trip airfares are $450.51. If you do not use the frequent-flyer coupon to fly, should you go to Miami?A. Yes, your benefit is more than your cost.B. No, your benefit is less than your cost.C. Yes, your benefit is equal to your cost.D. No, because there are no benefits in the trip.52. What is the opportunity cost of using the coupon for the Miami trip?A. $100B. $450C. $500D. $55053. If you use the frequent-flyer coupon to fly to Atlanta, would you get any economic surplus by making the trip?A. No, there is a loss of $50.B. Yes, surplus of $350.C. Yes, surplus of $400.D. Yes, surplus of $100.54. If the Chicago-Atlanta round-trip air fare is $350, should you go to Miami?A. No, there is a loss of $50.B. No, there is a loss of $100.C. Yes, there is economic surplus of $50.D. Yes, there is economic surplus of $400.55. Pat earns $25,000 per year (after taxes), and Pat's spouse, Chris, earns $35,000 (after taxes). They have two pre-school children. Childcare for their children costs $12,000 per year. Pat has decided to stay home and take care of the children. Pat must:A. value spending time with the children by more than $25,000.B. value spending time with the children by more than $12,000.C. value spending time with the children by more than $13,000.D. value spending time with the children as much as does Chris.You paid $35 for a ticket (which is non-refundable) to see SPAM, a local rock band, in concert on Saturday. (Assume that you would not have been willing to pay any more than $35 for this concert.) Your boss called and she is looking for someone to cover a shift on Saturday at the same time as the concert. You will have to work 4 hours and she will pay you time and a half, which is $9/hr.56. Should you go to the concert instead of working Saturday?A. Yes, your benefit is more than your cost.B. No, your benefit is less than your cost.C. Yes, your benefit is equal to your cost.D. No, because there are no benefits in the concert.57. What is the opportunity cost of going to the concert?A. $1B. $9C. $35D. $3658. What is your opportunity cost, if you go to work on Saturday?A. $0B. $9C. $35D. $3659. Your economic surplus of going to work on Saturday is:A. $0B. $1C. $35D. $36Matt has decided to purchase his textbooks for the semester. His options are to purchase the books via the Internet with next day delivery to his home at a cost of $175, or to drive to campus tomorrow to buy the books at the university bookstore at a cost of $170. Last week he drove to campus to buy a concert ticket because they offered 25 percent off the regular price of $16.因为他们提供75折的正常价格16美元。

曼昆《经济学原理(微观经济学分册)》(第6版)第9章应用:国际贸易课后习题详解跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

一、概念题1.世界价格(world price)答:世界价格也称世界市场价格,指一种物品在世界市场上交易的价格。

世界价格是由商品的国际价值决定的。

国际价值是世界市场商品交换的惟一依据,各国商品的国别价值都必须还原为国际价值,以便在国际市场上交换。

而各国商品的国别价值在多大程度上表现为国际价值,是与各国的经济技术水平、劳动强度和劳动生产率密切相关的。

一般来说,一国的经济技术水平和劳动生产率越高,其商品价值就越低于国际商品价值,若按照国际商品价值出售,就能获得较好的经济效益;相反则会在竞争中处于不利的地位。

2.关税(tariff)答:关税是指对在国外生产而在国内销售的物品征收的税。

与其他税收相比,关税有两个主要特点:第一,关税的征收对象是进出境的货物和物品;第二,关税具有涉外性,是对外贸易政策的重要手段。

征收关税的作用主要有两个方面:一是增加本国财政收入;二是保护本国的产业和国内市场。

其中以前者为目的而征收的关税称为财政关税,以后者为目的而征收的关税称为保护关税。

与任何一种物品销售税一样,关税会扭曲激励,使得稀缺资源的配置背离最优水平,使市场接近于没有贸易时的均衡,因此,减少了贸易的好处。

关税虽然使国内生产者的状况变好,而且政府增加了收入,但造成消费者的损失大于获得的这些好处。

关税造成的无谓损失具体表现为:第一,关税使国内生产者能收取的价格高于世界价格,结果,鼓励他们增加低效率地生产。

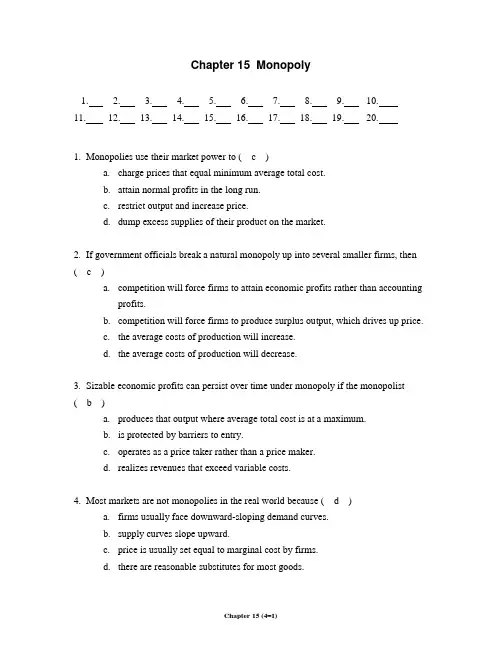

Chapter 15 Monopoly1. 2. 3. 4. 5. 6. 7. 8. 9. 10. _ __11. 12. 13. 14. 15. 16. 17. 18. 19. 20. _ __1. Monopolies use their market power to ( c )a.charge prices that equal minimum average total cost.b.attain normal profits in the long run.c.restrict output and increase price.d.dump excess supplies of their product on the market.2. If government officials break a natural monopoly up into several smaller firms, then ( c )petition will force firms to attain economic profits rather than accountingprofits.petition will force firms to produce surplus output, which drives up price.c.the average costs of production will increase.d.the average costs of production will decrease.3. Sizable economic profits can persist over time under monopoly if the monopolist ( b )a.produces that output where average total cost is at a maximum.b.is protected by barriers to entry.c.operates as a price taker rather than a price maker.d.realizes revenues that exceed variable costs.4. Most markets are not monopolies in the real world because ( d )a.firms usually face downward-sloping demand curves.b.supply curves slope upward.c.price is usually set equal to marginal cost by firms.d.there are reasonable substitutes for most goods.Consider the following demand and cost information for a monopoly.QUANTITY PRICE TOTAL COST0 $40 $101 $30 $152 $20 $253 $10 $404 $0 $605. The marginal revenue of the second unit is ( a )a.$10b. $20c. $30d. $406. The marginal cost of the fourth unit is ( c )a.$60b. $40c. $20d. $107. The maximum profit this monopolist can earn is ( d )a.$40b. $30c. $20d. $158. To maximize profit, the monopolist sets price at ( b )a.$40b. $20c. $0d. $109. If a monopolist has zero marginal costs ( a )a.it will produce the output at which total revenue is maximized.b.it will produce in the range in which marginal revenue is still increasing.c.it will produce at the point at which marginal revenue is at a maximum.d.it will produce in the range in which marginal revenue is negative.10. The supply curve for the monopolist ( d )a.is horizontal. c. is a 45-degree line.b.is vertical. d. does not exist.11. Many economists criticize monopolists because they produce at output levels that are not efficient. That is to say, monopolists ( a d )a.charge too high a price.b.don’t innovate.c.produce a large quantity of waste.d.have no incentive to produce at their minimum ATC.12. Suppose potatoes were produced in Canada by many, many firms in perfect competition. In Belgium, only one firm produces potatoes for the Belgium market. Suppose further that for the competitive firms and the monopoly minimum ATC is the same. We would expect that in Belgium the price of potatoes is ______ and ______ potatoes are produced and sold than in Canada. ( c )a.higher; more c. higher; fewerb.lower; more d. lower; fewer13. “Monopolists do not worry about efficient production and cost saving since they can jus t pass along any increase in costs to their consumers.” The statement is ( a )a.false; price increases will mean fewer sales, and lower costs will mean higherprofits (or smaller losses).b.true; this is the primary reason why economists believe that monopolies resultin economic inefficiency.c.false; the monopolist is a price taker.d.true; consumers in a monopoly market have no substitutes to turn to when themonopolist raises prices.14. Concerning public utilities, the stated reason for resorting to regulation of a monopoly, rather than promoting competition through antitrust, is that the industry in question is believed to be a ( d )a.profit-maximizing monopoly.b.producer of externalities.c.revenue-maximizing monopoly.d.natural monopoly.15. Splitting up a monopoly is often justified on the grounds that ( c )a.consumers prefer dealing with small firms.b.small firms have lower costs.petition is inherently efficient.d.nationalization is a less preferred option.16. The first major piece of antitrust legislation in the United States was the ( c )a.Clayton Act. c. Sherman Act.b.Celler-Kefauver Act. d. Robinson-Patman Act.。

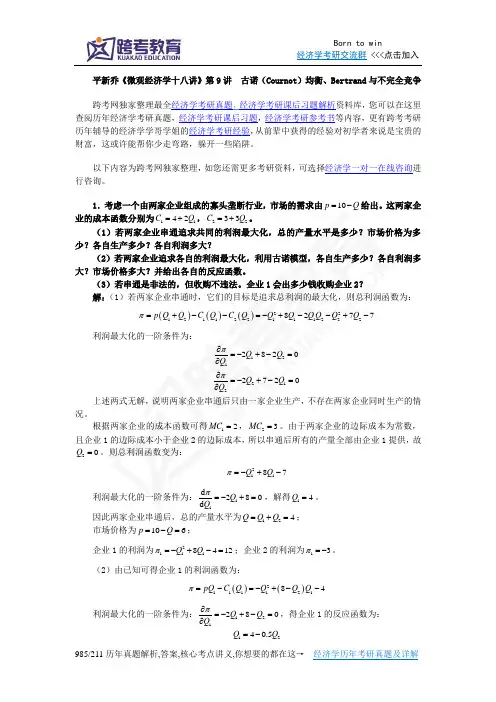

平新乔《微观经济学十八讲》第9讲 古诺(Cournot )均衡、Bertrand 与不完全竞争 跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

1.考虑一个由两家企业组成的寡头垄断行业,市场的需求由10p Q =-给出。

这两家企业的成本函数分别为1142C Q =+,2233C Q =+。

(1)若两家企业串通追求共同的利润最大化,总的产量水平是多少?市场价格为多少?各自生产多少?各自利润多大?(2)若两家企业追求各自的利润最大化,利用古诺模型,各自生产多少?各自利润多大?市场价格多大?并给出各自的反应函数。

(3)若串通是非法的,但收购不违法。

企业1会出多少钱收购企业2? 解:(1)若两家企业串通时,它们的目标是追求总利润的最大化,则总利润函数为:()()()221211221112228277p Q Q C Q C Q Q Q Q Q Q Q π=+--=-+--+-利润最大化的一阶条件为:1212820Q Q Q π∂=-+-=∂ 2122720Q Q Q π∂=-+-=∂ 上述两式无解,说明两家企业串通后只由一家企业生产,不存在两家企业同时生产的情况。

根据两家企业的成本函数可得12MC =,23MC =。

由于两家企业的边际成本为常数,且企业1的边际成本小于企业2的边际成本,所以串通后所有的产量全部由企业1提供,故20Q =。

则总利润函数变为:21187Q Q π=-+-利润最大化的一阶条件为:11d 280d Q Q π=-+=,解得14Q =。

因此两家企业串通后,总的产量水平为124Q Q Q =+=; 市场价格为106p Q =-=;企业1的利润为21118412Q Q π=-+-=;企业2的利润为13π=-。

最新版微观经济学精品习题英文版ch02Chapter 2 Thinking Like an Economist1. A simplifying assumption ( )a.affects the important conclusions of an economic model.b.increases the level of detail in an economic model.c.limits the validity of an economic model’s conclusion.d.eliminates unnecessary details from an economic model.2. The ultimate purpose of an economic model is to ( )a.explain reality as completely as possible.b.establish assumptions that closely resemble reality.c.help us to understand economic behavior.d.guide government policy decisions.3. An economic model ( )/doc/7818111235.html,es equations to understand normative economic phenomena.b.often omits crucial elements.c.simplifies reality in order to focus on crucial elements.d.cannot be proven wrong.4. Which of the following activities would occur in a market for factors of production?( )a.Reesa buys a new computer to help balance her personal checkbook.b.Randy pays a speeding ticket.c.Ian mows his grass.d.General Motors hires additional workers to run a third-shift at a factory.5. Which of the following activities would occur in a market for goods and services? ( )a.Harry mows his grass.b.General Motors hires additional workers to run a third shift at a factory.c.Jane bakes pies for Thanksgiving dinner.d.Dolly buys a ticket to a ball game.6. The three sources of income for the household are ( )a.taxes, subsidies from the government, and rent.b.wages, rent, and profit.c.wages, rent, and subsidies from the government.d.wages, rebates, and rent.7. Households play what role(s) in the circular flow diagram? ( )a.purchasers of factors of production and sellers of services.b.purchasers of factors of production and sellers of goods.c.purchasers of goods and services only.d.purchasers of goods and services and sellers of factors of production.8. Which of the following is not an assumption that underlies an economy’s production possibilities frontier? ( )a.fixed income.b.fixed resources.c.unchanged technology.d.fully employed resources.9. Which of the following would not result in an outward shift of a nation’s production possibilities frontier? ( )a. a reduction in the unemployment rate.b. a rise in labor productivity.c.advances in technology.d.an expanding resource base.10. The production possibilities frontier demonstrates the basic economic principle that( )a.economies are always efficient.b.assuming full employment, supply will always determine demand.c.assuming full employment, an economy is efficient only when the productionof capital goods in a particular year is greater than the production ofconsumption goods in that year.d.assuming full employment, to produce more of any one thing, the economymust produce less of at least one other good.11. Opportunity costs most often increase as you move downa production possibilities frontier because ( )a.resources are not completely adaptable to alternative uses.b.factors of production are limited and human wants are unlimited.c.efficiencies are generated by large-scale production.d.economic efficiency is only possible in the short run.。

CHAPTER 2THE BASICS OF SUPPLY AND DEMAND REVIEW QUESTIONSshape of the demand curve it faces by raising the price and observing the change in quantity sold. The university official is not observing the entire demand curve, but rather only the equilibrium price and quantity over the last 15 years. If demand is shifting upward, as supply shifts u pward, demand could have any elasticity. (See Figure 2.7, for example.) Demand80 20 16100 18 18120 16 20a. Calculate the price elasticity of demand when the price is $80. When theprice is $100.We know that the price elasticity of demand may be calculated usingequation 2.1 from the text:EQQPPPQQPDDDDD ==∆∆∆∆.With each price increase of $20, the quantity demanded decreases by 2. Therefore,.1.0202-=-=⎪⎭⎫ ⎝⎛∆∆P Q D At P = 80, quantity demanded equals 20 and().40.01.02080-=-⎪⎭⎫⎝⎛=D ESimilarly, at P = 100, quantity demanded equals 18 and().56.01.018100-=-⎪⎭⎫ ⎝⎛=D Eb.Calculate the price elasticity of supply when the price is $80. When the price is $100.The elasticity of supply is given by:E Q Q P PP Q Q PS SS SS ==∆∆∆∆.With each price increase of $20, quantity supplied increases by 2. Therefore,.1.0202==⎪⎭⎫⎝⎛∆∆P Q S At P = 80, quantity supplied equals 16 and()5.01.01680=⎪⎭⎫ ⎝⎛=S E .Similarly, at P = 100, quantity supplied equals 18 and().56.01.018100=⎪⎭⎫⎝⎛=S Ec.What are the equilibrium price and quantity?The equilibrium price and quantity are found where the quantity supplied equals the quantity demanded at the same price. As we see from the table, the equilibrium price is $100 and the equilibrium quantity is 18 million.d.Suppose the government sets a price ceiling of $80. Will there be a shortage, and, if so, how large will it be?With a price ceiling of $80, consumers would like to buy 20 million, butproducers will supply only 16 million. This will result in a shortage of 4 million.3. Refer to Example 2.5 on the market for wheat. At the end of 1998, both Brazil and Indonesia opened their wheat markets to US farmers. Suppose that these new market add 200 million bushels of U.S. wheat. What would the free market price of wheat have been and what quantity would have been produced and sold by U.S. farmers?The following equations describe the market for wheat in 1985:Q S = 1,800 + 240PandQ D = 2,580 - 194P .If these new market add 200 million bushels of wheat, the new demand curve 'Q D, would be equal to Q ED + 200, or 'Q D= (2,580 - 194P ) + 200 = 2,780 - 194P Equating supply and the new demand, we may determine the new equilibrium price,1,800 + 240P = 2,780 - 194P , or 434P = 980, or P* = $2.26 per bushel.To find the equilibrium quantity, substitute the price into either the supply or demand equation, e.g.,Q S = 1,800 + (240)(2.26) = 2,342andQ D = 2,780 - (194)(2.26) = 2,342.CHAPTER 3CONSUMER BEHAVIOR2. Draw the indifference curves for the following individuals’ preferences for two goods: hamburgers and soft drinks. Indicate the direction in which the individuals ’ satisfaction (or utility) is increasing.a. Joe has convex indifferences curves and dislikes both hamburgers and soft drinks. hamburgerssoft drinks.b.Jane loves hamburgers and dislikes soft drinks, If she is served a soft drink, she willpour it down the drain rather than drink it.hamburgerssoft drinksc. Bob loves hamburgers and dislikes soft drinks, If he is served a soft drink, he will drinkit to be polite. hamburgersdrinksd. Molly loves hamburgers and soft drinks, but insists on consuming exactly one softdrink for every two hamburgers that s he eats.Soft drinks1 2 324 6e.Bill likes hamburgers, but neither likes nor dislikes soft drinks。

Chapter 10 Externalities1. 2. 3. 4. 5. 6. 7. 8. 9. 10. .11. 12. 13. 14. 15. .1. Market failure in the form of externalities arises when ( )a.production costs are included in the prices of goods.b.not all costs and benefits are included in the prices of goods.c.the benefits exceed the costs of consuming goods.d.the market fails to achieve equilibrium.2. Which of the following is an example of a positive externality? ( )a.Air pollution.b. A person litters in a public park.c. A nice garden in front of your neighbor’s house.d.The pollution of a stream.3. The social cost of a good is ( )a.its benefit to the people who buy and consume it.b.its total benefit to everyone in society.c.its cost to everyone in the society that occurs in addition to the private costs.d.the cost paid by the firm that produces and sells it.4. The private benefit of consuming a good is ( )a.its benefit to the people who buy and consume it.b.its total benefit to everyone in the society.c.its cost to everyone in the society.d.the cost paid by the firm that produces and sells it.5. When a person drives a car that pollutes the air ( )a.the private cost of consuming the car’s services exceeds the social cost.b.the private benefit of consuming the car’s services exceeds the social benefit.c.the social cost of consuming the car’s services exceeds the private cost.d.the social benefit of consuming the car’s services exceeds the private benefits.6. If a perfectly competitive industry is not forced to take account of a negative externality it creates, it will produce where ( )a.the marginal cost of production equals the marginal private benefit.b.the marginal cost of production equals the marginal social benefit.c.the marginal social cost of production equals the marginal social benefit.d.price equals marginal social benefit.7. Flu shots are associated with a positive externality. (Those who come in contact with people who are inoculated are helped as well.) Given perfect competition with no government intervention in the vaccination market, which of the following holds? ( )a.At the current output level, the marginal social benefit exceeds the marginalprivate benefit.b.The current output level is inefficiently low.c. A per-shot subsidy could turn an inefficient situation into an efficient one.d.All of the above hold.8. Because there are positive externalities from higher education, ( )a.private markets would provide too little of it.b.private markets would provide too much of it.c.the government should impose a tax on college students.d.the government should impose a tax on students’ families.9. Internalizing an externality means ( )a.the good becomes a public good.ernment regulations or taxes are sufficient to eliminate the externalitycompletely.ernment imposes regulations that eliminate the externality completely.d.incentives are altered so that people take account of the external effects oftheir actions.10. Why can’t private individuals always internalize an externality without the help of government? ( )a.Legal restrictions prevent side payments between individuals.b.Transactions costs may be too high.c.Side payments between individuals are inefficient.d.Side payments between individuals violate equity standards.11. A dentist shared an office building with a radio station. The electrical current from the dentist’s drill causes static in the radio bro adcast, causing the radio station to lose $10,000 in discounted future profits. The radio station could put up a shield at a cost of $30,000; the dentist could buy a new drill that causes less interference for $6,000. Either would restore the radio stati on’s lost profits. What is the economically efficient outcome? ( )a.The radio station puts up a shield, which it pays for.b.The radio station puts up a shield, which the dentist pays for.c.The radio station does not put up a shield and the dentist does not buy a newdrill.d.The dentist gets a new drill and it does not matter who pays for it.12. What economic argument suggests that if transactions costs are sufficiently low, the equilibrium is economically efficient regardless of how property rights are distributed? ( )a.The Coase Theorem.b.Say’s Law.c.The Law of Comparative Advantage.d.The Law of Supply.13. A benefit of taxes over regulation to internalize externalities is ( )a.it is easier to choose the optimal amount of taxes than the optimal amount ofregulation.b.regulations are more difficult to impose than taxes.c.taxes equate the social costs with the social benefits.d.taxes provide incentives to adopt new methods to reduce the externality.14. If the government wants to tax a polluter, the economically efficient outcome occurs when ( )a.the marginal tax equals the marginal cost to other people from the pollution.b.the average tax equals the average cost to other people from the pollution.c.the total tax equals the total cost to other people from the pollution.d.the tax is high enough to stop pollution completely.。