高鸿业(宏观经济学)第6版 第十三章

- 格式:ppt

- 大小:357.00 KB

- 文档页数:42

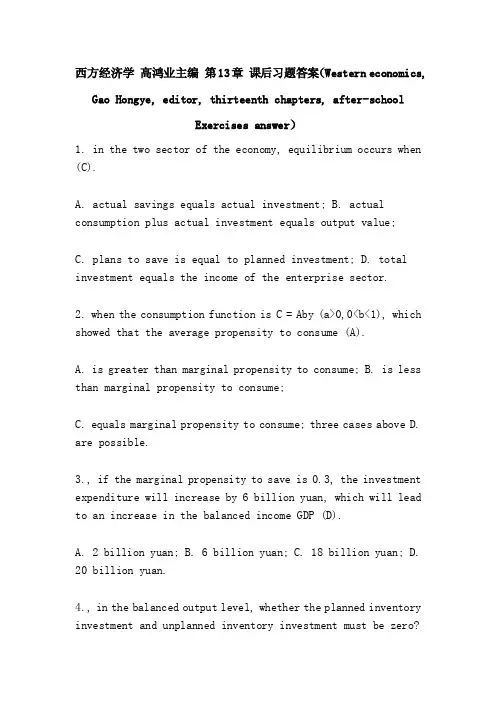

西方经济学高鸿业主编第13章课后习题答案(Western economics, Gao Hongye, editor, thirteenth chapters, after-schoolExercises answer)1. in the two sector of the economy, equilibrium occurs when(C).A. actual savings equals actual investment;B. actual consumption plus actual investment equals output value;C. plans to save is equal to planned investment;D. total investment equals the income of the enterprise sector.2. when the consumption function is C = Aby (a>0,0<b<1), which showed that the average propensity to consume (A).A. is greater than marginal propensity to consume;B. is less than marginal propensity to consume;C. equals marginal propensity to consume; three cases aboveD. are possible.3., if the marginal propensity to save is 0.3, the investment expenditure will increase by 6 billion yuan, which will lead to an increase in the balanced income GDP (D).A. 2 billion yuan;B. 6 billion yuan;C. 18 billion yuan;D.20 billion yuan.4., in the balanced output level, whether the planned inventory investment and unplanned inventory investment must be zero?Answer: when a balanced production level is reached, the planned inventory investment is generally not zero, rather than the planned inventory investment must be zero. This is because the planned inventory investment is part of the planned investment, and the balanced output equals the output of the consumption plus planned investment, so the planned inventory is not necessarily zero. When the planned inventory increases, the inventory investment is greater than zero; when the planned inventory decreases, the inventory investment is less than zero. It should be pointed out that the stock is the stock, the stock investment is the flow, and the stock investment refers to the stock change. At the equilibrium level of output and inventory investment plan is part of a plan to invest, it is not zero, but the non planned inventory investment must be zero, if unplanned inventory investment is not zero, then it is not a balanced output. For example, enterprises wrongly estimated the situation, exceeded the market demand and produced more products, resulting in unplanned inventory investment.5. can the marginal propensity to consume and the average propensity to consume be always greater than zero and less than 1?Answer: consumption tendency is the relation between consumption expenditure and income, also called consumption function. The relationship between consumption expenditure and income can be studied from two aspects, one is the relationship between consumption expenditure and income variables, this is the marginal propensity to consume (can use the formula MPC = y or MPC = delta C delta dcdy), two is to investigate certainincome level of consumer spending in the relationship between the quantity and the this is the amount of income, the average propensity to consume (can use the formula APC = CY). The marginal propensity to consume is greater than zero and less than 1 of the total, because generally, increased consumer income, not only does not increase consumption is MPC = delta C delta y = 0, also won't increase revenue to increase consumption, the general situation is a part for increasing consumption, the other part is used to increase savings, i.e. y = C + delta delta delta s, therefore, delta C delta y + delta s delta y = 1, so, delta C delta y = 1 delta s delta y. As long as Delta s, delta y is not equal to 1 or 0, there are 0 < C, delta y < 1. However, the average propensity to consume is not always greater than zero, but less than 1. When people earn very little or even zero, they have to consume, even if they borrow money. Then the average propensity to consume will be greater than 1.6. what is Keynes's law and what is the social and economic background put forward by Keynes's law?Answer: the so-called Keynes Law refers to, no matter how much for the demand, economic system can provide the supply amount corresponding to the same price, that is to say the total social demand changes, will only cause the yield and income changes, until the supply and demand are equal, without causing a price change. This law is the background of Keynes's writing, "employment, interest and money" a book, the 1929 and 1933 in the western world economic depression, a large number of unemployed workers, a large number of idle resources. In this case, the increase in aggregate social demand will only makeuse of idle resources and increase production, rather than raise resource prices, so that product costs and prices can remain largely the same. The Keynes's law is thought to be suitable for short-term analysis. In the short run, prices are volatile and when social demand changes, firms first consider adjusting output rather than variable prices.7. the government purchase and government transfer payment belong to government spending, why the calculation of total demand of national income is only in government purchases excluding government transfer payments, which is why Cig (y = Xm) rather than Cigtr (y = Xm)?Answer: the government has increased transfer payments, although it has an impact on aggregate demand, but this effect is achieved by increasing disposable income and increasing consumer spending. If the transfer payment is included in the aggregate demand, the repeated calculation in the aggregate demand calculation will be formed. For example, the government increases the transfer payment by 1 billion yuan, assuming that the marginal propensity to consume is 0.8, which will increase consumption by 800 million yuan. Here, the first round of aggregate demand increased by 800 million yuan, not 1 billion 800 million yuan. But if the 1 billion yuan transfer payment is also regarded as an increase in aggregate demand, then it is repeated calculation, that is, 1 billion yuan at a time,It's 800 million yuan at a time.8. why some western economists believe that a portion of national income from the rich to the poor will increase thetotal income level? Answer: their reason is that the rich consumption tendency and lower propensity to save is higher, while the poor and high consumption propensity (because of the poor low income, in order to maintain the basic living standards, the proportion of their spending in income must be greater than the rich, so) will be part of the national income from the rich to the poor that can improve the whole society consumption tendency, so as to improve the whole society's total consumption expenditure level, so the total output or total income will increase.9., why is the absolute value of the government expenditure multiplier larger than the absolute value of the government tax multiplier and the government transfer payment multiplier?Answer: the government (purchase) expenditure directly affects total expenditure, the change of both is the same direction. Changes in total expenditure are several times the amount of government purchases. This multiple is the government's purchase multiplier. But taxation does not directly affect total expenditure, which affects consumer spending by changing people's disposable income, and then affects total expenditure. Tax changes are in reverse direction with changes in total expenditure. When taxes increase (tax rates rise or tax base increases), people's disposable income decreases, consumption decreases, and total expenditure decreases. Total expenditure reductions are several times greater than taxes, and vice versa. This multiple is the tax multiplier. Since tax revenue does not directly affect total expenditure, it will affect consumer spending by changing people's disposable income, and then affect total expenditure. Therefore, the absolute value of thetax multiplier is less than the absolute value of the government purchase expenditure. For example, an increase of 1 billion yuan to buy a government, to increase 1 billion yuan of total demand, but the tax 1 billion yuan, will make people more disposable income of 1 billion yuan, if the marginal propensity to consume is 0.8, one begins to increase consumer demand is only 800 million yuan, so the government spending multiplier of the absolute values of it must be greater than the tax multiplier.Government transfer payment impact on total expenditure is similar to tax, also indirectly affect the total expenditure, but also by changing people's disposable income to affect consumer spending and spending; the absolute value and the government transfer payment multiplier and the tax multiplier is as large as the. But unlike taxes, the government transfers payments in the same direction as the government purchases, but the government transfer payment multiplier is smaller than the government purchase multiplier.10. what is the mechanism of the balanced budget multiplier?Answer: a balanced budget multiplier is the ratio of changes in national revenues to changes in government revenues and expenditures when the amount of government revenue and expenditure increases or decreases in the same amount. In theory, the balanced budget multiplier equals 1. That is to say, if the government increases the expenditure of one yuan and increases the tax on one yuan of money, it will increase the national income by one yuan, because the government's expenditure multiplier is larger than the tax multiplier. Ifyou use the formula that is t = delta delta G (assuming that the transfer payment, and income tr constant) change is determined by the total expenditure changes, that is y = C + I + delta delta delta G, delta I assumes that the investment is unchanged, namely = 0, y = C +, delta delta delta G. The delta C = YD = beta (beta delta delta y delta T), therefore, there is y = P (Y - t) + delta G = P (Y - G) + delta (delta T = g for a g), the authors obtainedY (1 - beta) = delta G (1 - beta)Visible, delta y = g = 1 - beta 1 - beta = 1, i.e. balanced budget multiplier (expressed in KB), KB = g, delta y = 1.This conclusion can also be obtained by directly adding the government purchase expenditure multiplier and the tax multiplierKgkt = 11 - beta (1t) + - beta (1t) beta 1 (1t) = 111., why have some of the multipliers in the closed economy become smaller after foreign trade?Answer: in the closed economy, investment and government expenditures increase multiples of the national income increase is 11 - and beta have foreign trade after the multiple became M (11 - beta beta here and M denote the marginal propensity to consume and the marginal propensity to import), obviously the multiplier becomes small, this is mainly due to a part of the increase the income now used to buy imported goods.12. what is the difference between the three ways in which taxes, government purchases and transfer payments affect aggregate demand?Answer: aggregate demand consists of four components: consumer spending, investment spending, government purchases, and net exports.Taxation does not directly affect aggregate demand. It affects consumer spending by changing people's disposable income, and then affects aggregate demand. The change in taxation is in reverse direction with the change in aggregate demand. As taxes increase (tax rates rise or tax base increases), people's disposable income decreases, consumption decreases, and aggregate demand decreases. The decrease in aggregate demand is several times the increase in taxes, and vice versa. This multiple is the tax multiplier.Government purchase expenditure directly affects aggregate demand, and both change in the same direction. Changes in aggregate demand are also several times the amount of government purchases,This multiple is the government's buying multiplier.The impact of government transfer payments on aggregate demand is similar to taxation, which indirectly affects aggregate demand, as well as changes in people's disposable income, thereby affecting consumer spending and aggregate demand. Moreover, the absolute value of the government transfer payment multiplier and the tax multiplier is the same. But unlike taxes,the government transfer payments change in the same way as the government purchases, but the government transfer payment multiplier is smaller than the government purchase multiplier.These three variables (taxes, government purchases and government transfer payments) are variables that the government can control, and policies that control these variables are called fiscal policies. The government can regulate the economic operation through fiscal policy.For example, an increase of $1 in government spending initially increased aggregate demand by $1, as government purchases were directly related to the demand for end products. But increase the transfer payment of 1 dollars and 1 dollars to reduce taxes, just make people disposable income increased by $1, if the marginal propensity to consume is 0.8, while consumer spending increased only $0.8, the $0.8 is $1 increase transfer payments and tax cuts of $1 in the first round of the final product demand increases, the the difference between the government transfer payment and tax multipliers are equal and opposite, the absolute value of the government purchase multiplier is greater than the government transfer payment multiplier and the absolute value of the tax multiplier.The 13. assumption of an economy's consumption function is C = 1000.8yd investment, I = 50, g = 200 government purchase expenditure, government transfer payment tr = 62.5, t = 250 (tax unit for $1 billion).(1) seeking balanced income.(2) try to find the investment multiplier, the government expenditure multiplier, the tax multiplier, the transfer payment multiplier and the balanced budget multiplier.Answer: (1) by equationsSolvable y = 1000 ($100 million), so the balanced income level is $100 billion.(2) we can obtain the multiplier value directly according to the formula of the multiplier in the three sector economyInvestment Multiplier: ki = 11 - beta = 110.8 = 5Government spending multiplier: kg = 5 (equal to the investment multiplier)Tax Multiplier: KT = - 1 - beta beta = 0.810.8 = 4Transfer Payment Multiplier: KTR = 1 beta beta = 0.810.8 = 4The balanced budget multiplier is equal to the sum of government spending (purchase) multiplier and tax multiplierKB = Kgkt = 5 (4) = 1In the 14. part, assuming that the society to achieve the needs of full employment, national income is 1200, ask: (1) increase in government purchases; (2) to reduce taxes; (3) with the same amount of increase in government purchases and taxes (in order to balance the budget) to achieve full employment, the amountof how much?Answer: the question clearly uses a variety of multipliers. Originally balanced income is 1000, now need to reach 1200, then the gap = y = 200.(1) increase the government purchase of delta G = ykG = 2005 = 40.(2) decrease of tax = t = 200|kt| = 2004 = 50.(3) from the balanced budget multiplier equals 1, we can see that 200 of the government purchases and 200 of the tax revenue can achieve full employment.15. assume that the consumption function of economy and society in a C = 300.8yd, net tax total tax minus government transfer payment amount after TN = 50, investment I = 60, g = 50 government purchase expenditure and net export balance that exports minus imports after NX = 500.05y, for: (1) balance of income; (2) in the equilibrium level of income on the net export balance; (3) investment multiplier; (4) investment from 60 to 70 when the balance of income and net export balance; (5) when the equilibrium income net exports from NX = 50 to NX = 40 0.05y - 0.05y and net export balance.Answer: (1) disposable income: YD = Ytn = Y50Consumption: C = 300.8 (Y50)= 300.8y40= 0.8y10Equilibrium income: y = Cignx= 0.8y106050500.05y= 0.75y150The solution is y = 1500.25 = 600, i.e., the equilibrium income is 600.(2) net export balance:Nx = 500.05y = 500.05 x 600 = 20(3) investment multiplier ki = 110.80.05 = 4.(4) when the investment increased from 60 to 70, there wereY = Cignx= 0.8y107050500.05y= 0.75y160The solution is y = 1600.25 = 640, i.e., the equilibrium income is 640.Net export balance:Nx = 500.05y = 500.05 x 640 = 5032 = 18(5) the equilibrium income of the net export function changed from NX = 50 - 0.05y to NX = 40 - 0.05y:Y = Cignx= 0.8y106050400.05y= 0.75y140The solution is y = 1400.25 = 560, i.e., the equilibrium income is 560.Net export balance:Nx = 400.05y = 400.05 560 40 28×=-=12。

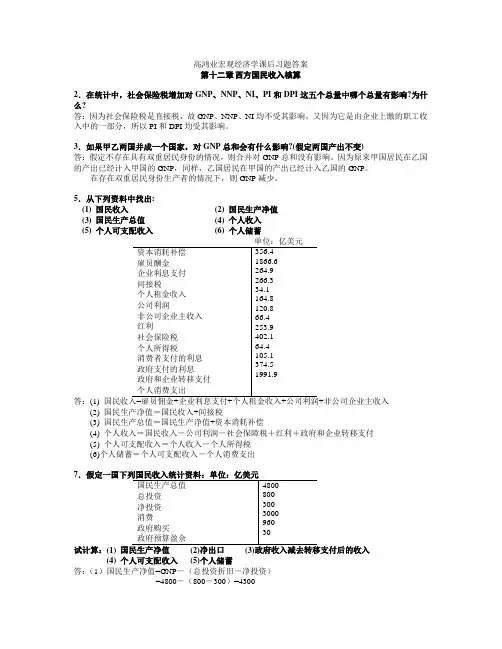

高鸿业宏观经济学课后习题答案第十二章西方国民收入核算2.在统计中,社会保险税增加对GNP、NNP、NI、PI和DPI这五个总量中哪个总量有影响?为什么?答:因为社会保险税是直接税,故GNP、NNP、NI均不受其影响,又因为它是由企业上缴的职工收入中的一部分,所以PI和DPI均受其影响。

3.如果甲乙两国并成一个国家,对GNP总和会有什么影响?(假定两国产出不变)答:假定不存在具有双重居民身份的情况,则合并对GNP总和没有影响。

因为原来甲国居民在乙国的产出已经计入甲国的GNP,同样,乙国居民在甲国的产出已经计入乙国的GNP。

在存在双重居民身份生产者的情况下,则GNP减少。

5.从下列资料中找出:(1) 国民收入(2) 国民生产净值(3) 国民生产总值(4) 个人收入(5) 个人可支配收入(6) 个人储蓄答:(1) 非公司企业主收入(2) 国民生产净值=国民收入+间接税(3) 国民生产总值=国民生产净值+资本消耗补偿(4) 个人收入=国民收入-公司利润-社会保障税+红利+政府和企业转移支付(5) 个人可支配收入=个人收入-个人所得税(6)个人储蓄=个人可支配收入-个人消费支出7试计算:(1)(4) 个人可支配收入(5)个人储蓄答:(1)国民生产净值=GNP-(总投资折旧-净投资)=4800-(800-300)=4300(2)净出口=GNP-(消费+总投资+政府购买)=4800-(3000+800+960)=40(3)政府税收减去转移支付后的收入=政府购买+政府预算盈余=960+30=990(4)个人可支配收入=NNP-税收+政府转移支付=NNP-(税收-政府转移支付)=4300-990=3310(5)个人储蓄=个人可支配收入-消费=3310-3000=3108.假设国民生产总值是5000,个人可支配收入是4100,政府预算赤字是200,消费是3800,贸易赤字是100(单位:亿元),试计算:(1) 储蓄(2) 政府支出(3) 投资答:(1)储蓄=DPI-C=4100-3800=300(2)因为:I+G+(X-M)=S+T所以:I=S+(T-G)-(X-M)=300-200-(-100)=200(3)政府支出G=1100第十三章简单国民收入决定理论1.在均衡产出水平上,是否计划存货投资和非计划存货投资都必然为零?答:在均衡产出水平上,计划存货投资不一定为0,而非计划存货投资则应该为0。

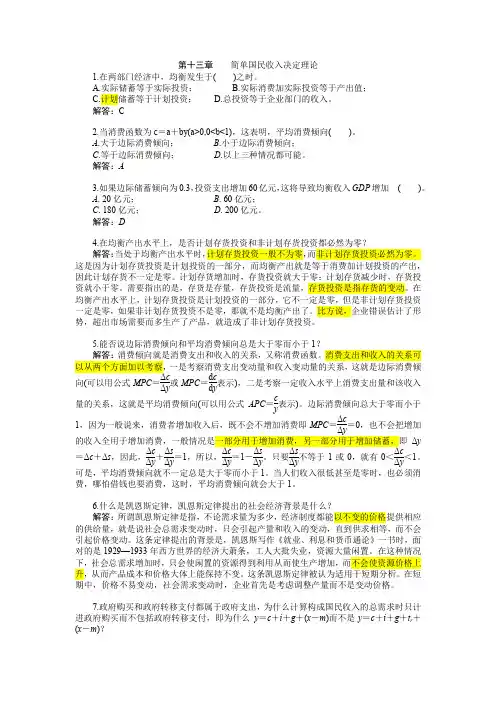

高鸿业《西方经济学(宏观部分)》第6版名校考研真题详解第十三章国民收入的决定:收入—支出模型一、名词解释1.均衡产出(武汉大学2001研;中国政法大学2005研)答:均衡产出是指和总需求相一致的产出,也就是经济社会的收入正好等于全体居民和企业想要有的支出。

在两部门经济中,总需求由居民消费和企业投资构成,于是均衡产出可用公式表示为:y c i=+。

c、i分别代表计划消费、计划投资数量,而不是国民收入构成公式中实际发生的消费和投资。

对均衡产出这一概念可以用图13-1来表示。

图13-1均衡产出的决定在图13-1中,纵轴表示支出,横轴表示收入,从原点出发的45°线上的各点都表示支出和收入相等。

当总收入大于总支出时,非意愿存货投资就大于零,企业会削减生产。

反之,当总收入小于总支出时,非意愿存货投资就小于零,企业会扩大生产。

图13-1中,B点对应的产出水平即为均衡产出。

经济社会的收入正好等于全体居民和企业想要有的支出时经济社会达到均衡。

在这个模型中,存货在调整过程中起着重要的作用。

从图13-1可以看出,非计划存货投资是一种产量调节机制,不是价格调节机制。

2.边际消费倾向(山东大学2001研;辽宁大学2002研;武汉大学2002研;中南财经政法大学2001、2010研;中南大学2004研;北京化工大学2006研;东北财经大学2006、2011研;财政部财政科学研究所2015研)答:边际消费倾向(marginal propensity to consume,简称为MPC )指增加1单位收入中用于增加消费部分的比率,其公式为:CMPC Y∆=∆式中,C ∆表示增加的消费,Y ∆表示增加的收入。

按照凯恩斯的观点,收入和消费之间存在着一条心理规律:随着收入的增加,消费也会增加,但消费的增加不及收入增加多。

因此,一般而言,边际消费倾向在0和1之间波动。

当消费函数为线性函数时,MPC β=。

可以看出,一般情况下,1MPC 0<<,即存在边际消费倾向递减规律。

第十三章 简单国民收入决定理论1.在两部门经济中,均衡发生于( )之时。

A.实际储蓄等于实际投资; B.实际消费加实际投资等于产出值;C.计划储蓄等于计划投资;D.总投资等于企业部门的收入。

解答:C2.当消费函数为c =a +by(a>0,0<b<1),这表明,平均消费倾向( )。

A .大于边际消费倾向;B .小于边际消费倾向;C .等于边际消费倾向;D .以上三种情况都可能。

解答:A3.如果边际储蓄倾向为0.3,投资支出增加60亿元,这将导致均衡收入GDP 增加 ( )。

A . 20亿元;B . 60亿元;C . 180亿元;D . 200亿元。

解答:D4.在均衡产出水平上,是否计划存货投资和非计划存货投资都必然为零?解答:当处于均衡产出水平时,计划存货投资一般不为零,而非计划存货投资必然为零。

这是因为计划存货投资是计划投资的一部分,而均衡产出就是等于消费加计划投资的产出,因此计划存货不一定是零。

计划存货增加时,存货投资就大于零;计划存货减少时,存货投资就小于零。

需要指出的是,存货是存量,存货投资是流量,存货投资是指存货的变动。

在均衡产出水平上,计划存货投资是计划投资的一部分,它不一定是零,但是非计划存货投资一定是零,如果非计划存货投资不是零,那就不是均衡产出了。

比方说,企业错误估计了形势,超出市场需要而多生产了产品,就造成了非计划存货投资。

5.能否说边际消费倾向和平均消费倾向总是大于零而小于1?解答:消费倾向就是消费支出和收入的关系,又称消费函数。

消费支出和收入的关系可以从两个方面加以考察,一是考察消费支出变动量和收入变动量的关系,这就是边际消费倾向(可以用公式MPC =Δc Δy 或MPC =d c d y表示),二是考察一定收入水平上消费支出量和该收入量的关系,这就是平均消费倾向(可以用公式APC =c y表示)。

边际消费倾向总大于零而小于1,因为一般说来,消费者增加收入后,既不会不增加消费即MPC =Δc Δy=0,也不会把增加的收入全用于增加消费,一般情况是一部分用于增加消费,另一部分用于增加储蓄,即Δy=Δc +Δs ,因此,Δc Δy +Δs Δy =1,所以,Δc Δy =1-Δs Δy 。

第十三章 简单国民收入决定理论1.在两部门经济中,均衡发生于( )之时。

A.实际储蓄等于实际投资; B.实际消费加实际投资等于产出值;C.计划储蓄等于计划投资;D.总投资等于企业部门的收入。

解答:C2.当消费函数为c =a +by(a>0,0<b<1),这表明,平均消费倾向( )。

A .大于边际消费倾向;B .小于边际消费倾向;C .等于边际消费倾向;D .以上三种情况都可能。

解答:A3.如果边际储蓄倾向为0.3,投资支出增加60亿元,这将导致均衡收入GDP 增加 ( )。

A . 20亿元;B . 60亿元;C . 180亿元;D . 200亿元。

解答:D4.在均衡产出水平上,是否计划存货投资和非计划存货投资都必然为零?解答:当处于均衡产出水平时,计划存货投资一般不为零,而非计划存货投资必然为零。

这是因为计划存货投资是计划投资的一部分,而均衡产出就是等于消费加计划投资的产出,因此计划存货不一定是零。

计划存货增加时,存货投资就大于零;计划存货减少时,存货投资就小于零。

需要指出的是,存货是存量,存货投资是流量,存货投资是指存货的变动。

在均衡产出水平上,计划存货投资是计划投资的一部分,它不一定是零,但是非计划存货投资一定是零,如果非计划存货投资不是零,那就不是均衡产出了。

比方说,企业错误估计了形势,超出市场需要而多生产了产品,就造成了非计划存货投资。

5.能否说边际消费倾向和平均消费倾向总是大于零而小于1?解答:消费倾向就是消费支出和收入的关系,又称消费函数。

消费支出和收入的关系可以从两个方面加以考察,一是考察消费支出变动量和收入变动量的关系,这就是边际消费倾向(可以用公式MPC =Δc Δy 或MPC =d c d y表示),二是考察一定收入水平上消费支出量和该收入量的关系,这就是平均消费倾向(可以用公式APC =c y表示)。

边际消费倾向总大于零而小于1,因为一般说来,消费者增加收入后,既不会不增加消费即MPC =Δc Δy=0,也不会把增加的收入全用于增加消费,一般情况是一部分用于增加消费,另一部分用于增加储蓄,即Δy=Δc +Δs ,因此,Δc Δy +Δs Δy =1,所以,Δc Δy =1-Δs Δy 。

宏观经济学复习提纲⾼鸿业《宏观经济学》复习提纲⼀、宏观经济学基本框架⼆、各章知识点分析第12章国民收⼊核算⼀、了解与识记1、宏观经济学研究对象和研究⽅法:即均衡国民收⼊理论和总量分析⽅法2、GDP的内涵,(知道什么项⽬计⼊GDP,GDP与GNP的关系,实际GDP与名义GDP的关系)3、核算国民收⼊的三种⽅法(⽀出法、收⼊法、增殖法需要了解)4、中间产品与最终产品区别5、GDP折算数⼆、理解与分析1、国民收⼊各个核算指标之间的关系第13章简单国民收⼊核算理论⼀、了解与识记1、简单国民收⼊决定理论的含义及简章经济的假设条件2、均衡产出的含义及条件3、凯恩斯的绝对收⼊消费理论(理解与分析消费函数与储蓄函数的关系)4、其他消费理论⼆、理解与分析1、两部门、三部门、四部门(略)国民收⼊的决定及变动(重点)2、两部门、三部门、四部门(略)的各个乘数(重点)第14章产品市场和货币市场的⼀般均衡(重点章节)⼀、了解与识记1、经济学投资的概念、投资函数、投资的影响因素2、IS曲线的含义3、货币需求函数、交易需求及投机需求4、凯恩斯陷阱、古典极端5、LM曲线的含义6、货币的供给(名义供给与实际供给)⼆、理解与分析1、两部门、三部门IS曲线(⽅程)及其移动(IS曲线的推导——图形分析)2、均衡利率的决定及其变动(LM曲线的推导——图形分析)3、产品市场和货币市场⼀般均衡及均衡的变动4、失衡的区域及失衡的恢复第15章宏观经济政策分析(重点章节)⼀、了解与识记1、财政政策和货币政策的影响⼆、理解与分析1、财政政策效果的IS-LM图形分析(⼀般情形、极端情形)2、货币政策效果的IS-LM图形分析(⼀般情形、极端情形)3、挤出效应的内涵、图形分析、影响因素。

4、两种政策混合使⽤的政策效应第16章宏观经济政策实践(重点章节)⼀、了解与识记1、⾃然失业率(结合第18章充分理解)2、财政政策、政策⼯具(哪些是扩张性的,哪些是紧缩性的?)、局限性3、财政政策和货币政策实施的总原则是什么?——“逆经济风向⾏事”4、证券市场基础知识(证券价格决定,买空(多头),卖空(空头),⼀级市场,⼆级市场,主板市场,⼆板市场)(可以略看)⼆、理解与分析1、经济政策的⽬标及相互关系⽬标:经济持续均衡增长、充分就业、价格稳定、国际收⽀平衡关系:四个⽬标是⽭盾统⼀的。

第十二章国民收入核算1、解答:政府转移支付不计入GDP,因为政府转移支付只是简单地通过税收(包括社会保障税)和社会保险及社会救济等把收入从一个人或一个组织转移到另一个人或另一个组织手中,并没有相应的货物或劳物发生。

例如,政府给残疾人发放救济金,并不是残疾人创造了收入;相反,倒是因为他丧失了创造收入的能力从而失去生活来源才给予救济的。

购买一辆用过的卡车不计入GDP,因为在生产时已经计入过。

购买普通股票不计入GDP,因为经济学上所讲的投资是增加或替换资本资产的支出,即购买新厂房,设备和存货的行为,而人们购买股票和债券只是一种证券交易活动,并不是实际的生产经营活动。

购买一块地产也不计入GDP,因为购买地产只是一种所有权的转移活动,不属于经济意义的投资活动,故不计入GDP。

2、解答:社会保险税实质是企业和职工为得到社会保障而支付的保险金,它由政府有关部门(一般是社会保险局)按一定比率以税收形式征收的。

社会保险税是从国民收入中扣除的,因此社会保险税的增加并不影响GDP ,NDP和NI,但影响个人收入PI。

社会保险税增加会减少个人收入,从而也从某种意义上会影响个人可支配收入。

然而,应当认为,社会保险税的增加并不影响可支配收入,因为一旦个人收入决定以后,只有个人所得税的变动才会影响个人可支配收入DPI。

3、如果甲乙两国合并成一个国家,对GDP总和会有影响。

因为甲乙两国未合并成一个国家时,双方可能有贸易往来,但这种贸易只会影响甲国或乙国的GDP,对两国GDP总和不会有影响。

举例说:甲国向乙国出口10台机器,价值10万美元,乙国向甲国出口800套服装,价值8万美元,从甲国看,计入GDP的有净出口2万美元,计入乙国的有净出口–2万美元;从两国GDP总和看,计入GDP的价值为0。

如果这两个国家并成一个国家,两国贸易变成两个地区的贸易。

甲地区出售给乙地区10台机器,从收入看,甲地区增加10万美元;从支出看乙地区增加10万美元。

第13章国民收入的决定:收入-支出模型13.1 复习笔记现代宏观经济学的奠基人凯恩斯的学说的中心内容就是国民收入决定理论。

凯恩斯主义的全部理论涉及四个市场:产品市场、货币市场、劳动市场和国际市场。

仅包括产品市场的理论称为简单国民收入决定理论。

一、均衡产出社会产出水平究竟由社会总需求还是由社会总供给能力决定,这实际上是从凯恩斯开始的现代宏观经济学与凯恩斯以前的古典和新古典传统经济学的分水岭。

在20世纪30年代经济大萧条的背景下(编者注:建议读者结合大萧条的背景来理解凯恩斯学说的理论体系),凯恩斯在名著《就业、利息和货币通论》一书中提出了生产和收入取决于总需求的理论。

1.短期分析假设前提(1)经济中存在着生产能力的闲置生产能力的闲置包括两层含义:①劳动力资源没有得到充分利用,即存在着失业;②厂房、机器等资本品没有得到充分利用,即存在着开工率不足。

(2)价格水平固定不变凯恩斯认为,在短期内,价格机制是一种僵化的、不易变动的机制,即存在价格刚性。

价格刚性表现为两个方面:①在劳动力市场,即使存在失业,工资也不会下降;②在产品市场,即使存在生产过剩,物价也不会下降。

(3)在既定的价格水平上,总供给是无限的在既定的价格水平上,总供给是无限的。

反映在图表上,体现为总供给曲线平行于横轴。

其经济含义为:由于存在资源闲置,在固定的价格水平下,要什么有什么,要多少有多少。

(4)由于总供给无限,所以均衡的国民收入由总需求单方面决定(总需求分析)在短期中,国民收入决定于总需求,这是凯恩斯经济学的一个基本原理。

产量由总需求决定,是就非充分就业状态而言的,而非充分就业是一种通常的状态。

2.均衡产出与非计划存货投资均衡产出是指和总需求相等的产出。

在两部门经济中,即经济中只有居民户和厂商(暂时不考虑政府部门和国外部门,在后面的章节会引入政府部门和国外部门),总需求由居民消费和企业投资构成,于是均衡产出可用公式表示为:y=c+i。

c、i分别代表计划消费、计划投资,而不是国民收入构成公式中实际发生的消费和投资。

第十二章国民收入核算1。

宏观经济学和微观经济学有什么联系和区别?为什么有些经济活动从微观看是合理的,有效的,而从宏观看却是不合理的,无效的?解答:两者之间的区别在于:(1)研究的对象不同.微观经济学研究组成整体经济的单个经济主体的最优化行为,而宏观经济学研究一国整体经济的运行规律和宏观经济政策。

(2)解决的问题不同。

微观经济学要解决资源配置问题,而宏观经济学要解决资源利用问题.(3)中心理论不同。

微观经济学的中心理论是价格理论,所有的分析都是围绕价格机制的运行展开的,而宏观经济学的中心理论是国民收入(产出)理论,所有的分析都是围绕国民收入(产出)的决定展开的。

(4)研究方法不同。

微观经济学采用的是个量分析方法,而宏观经济学采用的是总量分析方法。

两者之间的联系主要表现在:(1)相互补充。

经济学研究的目的是实现社会经济福利的最大化。

为此,既要实现资源的最优配置,又要实现资源的充分利用。

微观经济学是在假设资源得到充分利用的前提下研究资源如何实现最优配置的问题,而宏观经济学是在假设资源已经实现最优配置的前提下研究如何充分利用这些资源。

它们共同构成经济学的基本框架。

(2)微观经济学和宏观经济学都以实证分析作为主要的分析和研究方法。

(3)微观经济学是宏观经济学的基础.当代宏观经济学越来越重视微观基础的研究,即将宏观经济分析建立在微观经济主体行为分析的基础上。

由于微观经济学和宏观经济学分析问题的角度不同,分析方法也不同,因此有些经济活动从微观看是合理的、有效的,而从宏观看是不合理的、无效的。

例如,在经济生活中,某个厂商降低工资,从该企业的角度看,成本低了,市场竞争力强了,但是如果所有厂商都降低工资,则上面降低工资的那个厂商的竞争力就不会增强,而且职工整体工资收入降低以后,整个社会的消费以及有效需求也会降低。

同样,一个人或者一个家庭实行节约,可以增加家庭财富,但是如果大家都节约,社会需求就会降低,生产和就业就会受到影响。

西方经济学(宏观部分)第六版第十三章课后习题答案中国人民大学出版社第十三章 简单国民收入决定理论1、解答:在均衡产出水平上,计划存货投资一般不为零,而非计划存货投资必然为零.我们先看图1----45:假设消费者函数C=a + by d ,税收函数T = To + ty ,AD= c + + = [a + ++ b (– T o ) ]+ b (1 - t)y ,如图1----45所示.在图中,B 线为没有计划投资时的需要线,AD 线和B 线的纵向距离为i. .图中的 线表示了收入恒等式. 线与B 线之差称为实际投资,从图中显然可以看出,只有在E 点实际投资等于计划投资,这时经济处于均衡状态.而计划存货投资是计划投资部分的一部分,一般不为零.除E 点以外,实际投资和计划投资不等,村在非计划存货投资IU ,如图所示;而在E 点,产出等于需求,非计划存货投资为零。

i g i g tr yd ;22WL C1= * YL WL NL1 ;C2= * YL (1000750250)NL c p p p c t g yt y y y ∂∂∏⊥∂∂'=-=-=∂∏i [(To)](1)B a g b tr b t y =++-+-45︒45︒2、解答:消费倾向就是消费支出和收入的关系,有称消费函数.消费支出和收入的关系可以从两个方面加以考察,意识考察消费指出变动量和收入变动量关系,这就是边际消费倾向,二是考察一定收入水平上消费指出量和该收入量的关系,这就是平均消费倾向。

边际消费倾向总大于零而小于 1.因为一般说来,消费者加收入后,既不会分文消费不增加,也不会把增加的收入全用于增加消费,一般情况是一部分用于增加消费,另一部分用于增加储蓄,即,因此,所以 ,只要 不等于1或0,就有。

可是,平均消费倾向就不一定总是大于零而小于 1.当人们收入很低甚至是零时,也必须消费,哪怕借钱也要消费,这时,平均消费倾向就会大于 1.例如,在图1----46中,当收入低于y o 时,平均消费倾向就大于1.从图可见,当收入低于y o 时,消费曲线上任一点与原点相连的连线与横轴所形成的夹角总大于,因而这时。

目 录第十二章 宏观经济的基本指标及其衡量

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题

第十三章 国民收入的决定:收入—支出模型

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、证明题

六、计算题

第十四章 国民收入的决定:IS-LM模型

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题

第十五章 国民收入的决定:总需求—总供给模型

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题

六、论述题

第十六章 失业与通货膨胀

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题

六、论述题

第十七章 宏观经济政策

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题

六、论述题

第十八章 开放经济下的短期经济模型

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题

六、论述题

第十九章 经济增长

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题

六、论述题

第二十章 宏观经济学的微观基础

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题

第二十一章 新古典宏观经济学和新凯恩斯主义经济学

一、名词解释

二、判断题

三、单项选择题

四、简答题

五、计算题。