财务报表分析第十一章

- 格式:ppt

- 大小:456.00 KB

- 文档页数:88

Chapter 11 SolutionsOverview:Problem Length Problem #s{S} 1 - 4, 9, 11, 12, 15, 16, 21, 22{M} 5, 7, 8, 10, 13, 14, 17, 18, 20, 23, 24 {L} 6, 19, 251.{S}(i) Interest expense = 12% x $10,000 (beginning balance oflease obligation) = $1,200.(ii)The lease obligation will be reduced by $100 ($1,300 - $1,200) leaving an obligation of $9,900.(iii)Cash from Operations will be reduced by the interest payment of $1,200. Cash from investing activities willnot be affected. (However, the firm will report thecapi tal lease as a “noncash investment and financingactivity.” Cash from financing will be reduced by theamount of the principal payment of $100.(iv)Under an operating lease there is no lease obligation on the balance sheet. The only effect on income isRent Expense of $1,300. Similarly, CFO is reduced by$1,300. (CFI and CFF are not affected).2.{S}(i) In a take-or-pay arrangement, a company contracts tobuy or pay for a certain amount of a supplier’scommodity at a predetermined price over a stated timeperiod. The company, by entering the contract, incursan economic liability. However, since it is only acontract, no accounting liability is recorded on thebalance sheet – it is off balance sheet.(ii) In a sale of receivable, a company “sells” its receivables to a third-party, usually a financialinstitution. Typically, the sale is made at adiscounted price from the face value and the sellermay retain some or all of the default risk. The sale,in substance, is a financing arrangement with thereceivables being used as collateral. However, underGAAP, the transaction is treated as a sale and thedebt does not appear on the balance sheet.(iii)A joint venture represents an investment of 50% or less by one company (the “investor”) in anothercompany. Under GAAP, since ownership is not over 50%,the assets and liabilities of the joint venture neednot be consolidated with the parent’s assets andliabilities. Hence, any debt taken on by the jointventure remains off balance sheet even when theinvestor is liable for the debt.11-13.{S} Effect of choice of interest rate on lessee:4.{S}a. Pallavi must capitalize the lease because the leaseagreement contains a bargain purchase option. Notethat the lease also meets one other capitalizationcriterion: The present value of minimum lease paymentsexceeds 90% of the fair market value of the equipment(see part b for computations).b. The fair market value of the asset is $125,000. Thepresent value of the MLPs is $127,785 (at 8%, thelower of the lessee and lessor rates); the asset mustbe capitalized at the (lower) fair market value. (Notethat the lease obligation is the sum of the presentvalues of the MLPs and the bargain purchase option –the latter is not provided.)11-2c.Leases must be capitalized at the lesser of thepresent value of lease payments or the fair value ofthe lease; in this case, the lease must be capitalizedat the fair value of $125,000.d. The existence of the bargain purchase option requiresdepreciation over the estimated economic life of theasset rather than the (shorter) lease term.e. The option creates the presumption that the asset willbe held past the expiration date of the lease.Otherwise it must be assumed that use of the assetwill revert to the lessor at expiration, requiring thelessee to depreciate the leased asset over the(shorter) lease term.5.{M}a. The following states the effects of Tolrem using thecapital lease method as compared with the operatinglease method.(i) Cash from operations is higher as only theinterest portion of lease expense is deductedfrom operating cash flows; total lease expense isdeducted for operating leases.(ii) Financing cash flow is lower for capital lease, as part of lease rental is treated asamortization of liability and classified asfinancing cash outflow.(iii)Investing cash flow is not affected by the lease treatment. However, the firm will report capitalleases in the statement of cash flows (or afootnote) as noncash investment activities.(iv) Net cash flow reflects the actual rental payment and is unaffected by the financial reportingtreatment of the lease.(v) Debt/equity ratio is higher for capital lease, as it records the present value of minimum leasepayments as debt and reduces net income (andtherefore equity) in first year.(vi) Interest coverage ratio is usually (not always) lower for capital lease method, which reportsinterest expense but also higher EBIT, see (vii).For coverage ratios well above 1.0, the ratiowill decline. If the increase in interest expenseexceeds the increase in EBIT, the ratio willdecline even for firms with very low coverageratios.11-3(vii)Operating income is lower for operating lease because the total lease payment is an operatingexpense; for capital lease, interest portion oflease expense is nonoperating.(viii)Net income is higher for operating lease; total lease expense (interest plus depreciation) ishigher for capital lease.(ix) Deferred tax assets are higher for capital lease;as lease treatment for tax purposes is unaffectedby accounting choice, capital lease will generatea deferred tax asset as taxable income (operatinglease) exceeds pretax income (capital lease).(x) Taxes paid are unaffected by choice of method.(xi) Pretax return on assets is higher for operating leases as pretax income is higher and no assetsare reported as the result of the lease; acapital lease reduces income and reports leaseassets. Post-tax return on assets is higher forthe same reasons.(xii)Pretax return on equity: both pretax income and equity are higher for operating than for capitalleases. The higher pretax income should increasethe ratio in all but exceptional cases. Post-taxreturn on equity should be higher for same reason.However as increase in post-tax income equals(for first year) increase in equity, there may bemore exceptional cases.b. Net income (viii) will be lower for the operatinglease after the "crossover" point. As total net income over the life of the lease is unaffected by the accounting choice, higher net income (operating lease) in the early years must be offset by lower net income in later years.c. Consistent use of the operating lease method in placeof capitalization will not change the direction of the effects shown in part A, but will increase their magnitude. In aggregate, new leases will keep Tolrem from reaching the crossover point for net income, keeping net income and return ratios higher than if the leases were capitalized.11-46.{L}a. and b.4 payment annuity of $10,000 per year at 8%). Assuming zero residualvalue, depreciation = $43,121/5 = $8,624.2Interest expense = 8% x ($43,121 - $10,000) = $2,650Caramino's EBIT is $1,376 higher; Aglianico reportsrental expense but no depreciation expense since itdoes not record an asset. Because total lease expense(depreciation plus interest) is higher than the leaserental, Caramino's EBT is lower by $1,274. After adeferred income tax offset of $510, Caramino's netincome is $764 lower.Caramino's deferred tax debit (asset) results from thedifference between financial reporting (capital lease)and tax reporting (operating lease). The $1,274 timingdifference results in a deferred tax debit of $1,274x .40 = $510c. andd. Comparison of Cash Flow Statementshave been collected by the end of the year.11-5Caramino reports higher cash from operations by $10,000. Since the tax rate is 40%, Aglianico (operating lease firm) reports aftertax operating cash outflow of $6,000. Caramino (capital lease firm) pays no interest but, since it uses the operating lease method for taxes, receives a tax deduction of $4,000 for the annual payment of $10,000. Caramino's aftertax operating cash inflow is $4,000.The difference ($6,000 + $4,000 = $10,000) is recorded by Caramino as a financing cash outflow; this is the amount of the lease payment considered a reduction of the capitalized lease liability for 2002. [Note that the lease payment made on January 1, 2002 has no interest component; there is no accrued interest as the lease has just begun. Interest accrued during the year will be paid January 1, 2003.]e. There is no impact on investing cash flow for eitherfirm. Caramino would report the present value of the capital lease as a noncash investment activity.f. The net cash outflow for each firm is the leasepayment of $10,000 less the tax deduction of $4,000 (40% tax rate). Only the classification of cash flow components is affected by the lease method used.g. By using the capital lease method, Caramino reportshigher debt and lower income. However the firm also reports higher cash from operations. The choice of method may reflect different debt covenants or simplya preference among financial characteristics.11-67.(M) a. Since it is the first year:Capital lease obligations $2,596,031Repayment of capital lease obligations 3,969Capital lease at inception $2,600,000b. Amortization expense =$2,600,000 - $2,479,570 = $120,430Assuming the asset is being amortized on a straightline basis over the lease term, the lease term =$2,600,000/$120,430 = 21.6 or 22 yearsTotal expense = interest + amortization =$120,430 + $223,733 = $344,163c. CFO was reduced by the interest expense of $223,733and CFF was reduced by the “repayment of capital leaseobligations” of $ 3,969d. Free cash flows should be reduced by $2,600,000 – the“cost” of the leased asset.e. (i) Lease expense would be lease payment =$223,733 + $3,969 = $227,702(ii) CFO would be reduced by lease payment of $227,702f. Using 1999 payment only: $223,733/$2,600,000 = 8.6%Using all the payments, we have exact MLP’s for thesix years 1999 –2004. The “thereafter” MLP’s totaling$4,596 thousand are spread over 16 years; i.e. $287.25thousand/year. Equating this stream to the presentvalue of $2,600,000 yields a rate (IRR) of 9.3%.The two methods yield rates within “range” of eachother especially when we consider that the ratederived from the first method is typically downwardbiased.11-78.{M}a. The adjustment involves the addition of the interestcomponent of minimum lease payments to stated interestexpense. The adjustment reflects a partial, de factocapitalization of operating leases.(i)Unadjusted Ratio of Earnings to Fixed Charges:Pretax earnings $ 2,363,646Interest on indebtedness 68,528Earnings before interest and taxes (EBIT) $ 2,432,174Fixed Charges:Interest on indebtedness $ 68,528Unadjusted Ratio of Earnings to Fixed Charges 35.5X(ii) The unadjusted ratio is almost four times the adjusted ratio. Note: the SEC rule that governsthis calculation assumes that the interestcomponent is one-third of the MLP. The trueinterest component may be higher or lower,changing the coverage ratio.b. Reported debt-to-equity = $550,000/$2,233,303 = 0.25c. Calculation of amounts adjusted for leasecapitalization:The Limited, Inc.1999 Working Capital Position and Capitalization Table1 Working capital is reduced by the principal component of the 2000MLPs calculated as$436,670 = [($643,828 - (.06 x $3,452,628)],where $3,452,628 is the present value calculated in note 2 below.2 Present value of MLPs using an interest rate of 6%. The “thereafter”MLPs are spread using the constant rate assumption; ($502,880 in 2005and 2006 and $422,102 in 2007).11-89.{S} Note: all amounts in $millionsa. Debt to equity = ($2,416 + $235)/$4,448 = 0.60b. (i) Interest portion of 2001 payment = $63-$39 = $24Therefore interest rate = $24/$235 = 10.2%(ii)Using the constant rate assumption yields theThe IRR that equates the above to $235 is 7.9%c. Under the constant rate assumption, the payment streamto be discounted at 10.2% isThe present value is $7,435d. Adjusted debt-to-equity is($2,416 + $235 + $7,435)/$4,448 = 2.27The adjustment increases the ratio almost four-fold.The real effect is greater as equity would be lower ifDelta had capitalized its operating leases at theirinception.e. After adjustment, both AMR’s and Delta’s ratios are atsimilar levels of 2.3x.Had the lower rate been used, the present value ofDelta’s operating lease would be significantly higheras would its debt-to-equity ratio.f. The adjustments are appropriate for two reasons(1)To obtain the appropriate levels of the ratio foreach firm. For both companies, the reported ratiosunderstate their financial leverage.(2)For comparison purposes. Before adjustment,Delta’s ratio at 0.6x is 50% lower than AMR’s 0.9x.After adjustment, that superiority is removed asboth firms have similar ratios.11-910.{M}a. The following MLP stream is assumed (€ million):At a rate of 7%, the present value is €505.3 millio nb. (i) €1,294/€14,145 = 0.09(ii)(€1,294 + €505)/€14,145 = 0.13c.Another assumption would be to find a decline ratefrom the initial payment of €166.5 such that the sumof the years 2 to 5 payments using that decline rateequals €275.2; i.e. solve for d i n the followingequation(d + d2 + d3 + d4 ) x €166.5 = €275.2The above can be solved by trial and error and thesolution is d = 67.66% with a MLP stream of €112.6,€76.2, €51.5 and €34.9.Using this MLP stream would increase the present valueof the operating lease obligation.11.{S}a. We use the constant rate assumption, yielding thefollowing payment stream (€ millions)At a discount rate of 7%, the present value is €12,543.b. (i) Reported debt-to-equity = €1,294/€14,145 = 0.09Adjusted for part a:(€1,294 + €12,543)/€14,145 = 0.98(ii) Adjusting for operating leases as well(€1,294 + €12,543 + €505)/€14,145 = 1.0111-1012.{S}a. The cash outflow of $25.6 million represents thedecrease in the balance of sold but uncollectedreceivables ($192.8 - $167.2). It represents netcollections (by Arkla as the firm continues to servicethe receivables) of receivables sold; amountscollected from previously sold receivables were paidto the purchasers of those receivables.b. Receivables sold but uncollected as of 12/31/93 can bededuced to be:Outstanding 3/31/94 $118.7 millionDecrease during quarter 107.7Outstanding 12/31/93 $226.4 millionc. The required adjustments to Arkla's CFO for quartersended:March 31, 1994 March 31, 1995 Cash outflow $107.7 $25.6These amounts are the decrease in receivables soldduring the respective quarters. The adjustment isrequired because the cash flow was recognized when thereceivables were sold rather than when customers paid.This adjustment produces a measure of CFO based onwhen the receivables were collected.13.{S} All amounts in $millionsa. (i) Current ratio was increased by 15% from 1.61 to1.86 as a result of receivable sale.Reported = $686/$369 = 1.86Adjusted = ($686 + $153.1)/($369 + $153.1) = 1.61 (ii) & (iii)Average receivables as reported =.5($546 + $312) = $429Adjusting for sale of receivables would increaseaverage receivables by.5($153.1 + $115) = $134 to $563Reported turnover = $2,951/$429 = 6.88# of days = 365/6.88 = 53 daysAdjusted turnover = $2,951/$563 = 5.24# of days = 365/5.24 = 70 daysAs a result of the receivable sale the cash cyclelooked better than it really was by (70 –53) =17 days and the receivables turnover “improved”from 5.24 to 6.8811-11b. Reported debt/equity = $1,096/$950 = 1.15Debt should be adjusted upwards by the receivablessold to ($1,096 + $153.1 =) $1,249.1 with a resultantdebt to equity ratio of $1,249.1/$950 = 1.31.c. Reported cash flow from operations increased by $154million from ($96) million to $58 million. Theseamounts were inflated by the increase in receivablessold and should be adjusted by that increase:Adjusted CFO 1998 = ($96) – ($115 – $103.3) = ($107.7)Adjusted CFO 1999 = $58 - ($153.1 – $115) = $19.9After removing the effects of the receivable sales,CFO increased by $127.6 million from ($107.7) millionto $19.9 million. The actual level and trend in CFO isconsiderably lower than the amounts reported.14.{M}a.11-12The sale of receivables allowed the company to show an improved receivable turnover and cash cycle; the improvement was more significant for 1999 as the amount of receivables sold increased and sales declined.b. The effect on the current ratio is minimal as the sameamount is added to both numerator and denominator of the ratio and that ratio is close to 1. The debt-to-equity ratio adjustment is more significant in 1999 due to the increase in receivables sold and the lower equity amount.c. As the calculation below indicates, both the level andtrend in CFO are overstated as a result of the sale of receivables.11-1315.{S}a. The cash from investment amounts are equivalent to thechange in the “Receivables sold by Funding topurchaser”. (Reca ll that 1997 was the first year ofreceivable sales.)b.receivable balances 17% to 21% less than their actuallevels.c. The sale of receivables should be reported as cashfrom financing as they are, in effect, borrowings(using receivables as collateral).16.{S} Aluminum producers that have take-or-pay contracts forenergy and/or bauxite have converted significantvariable costs into fixed costs. Therefore, theirmarginal costs are much lower than if these contractshad not been entered into. Under these conditions,aluminum producers will continue production as long asrevenue exceeds marginal costs, even though they losemoney based on total costs.17.{M}a. By transferring receivables to a (unconsolidated)subsidiary, Lucent removed the receivables from itsreceivable balance and reported them as “Investments,”a somewhat different asset category. Analyticaladjustment is required to eliminate the artificialreported “improvements” in receivables turnover, thecurrent ratio and the cash cycle.b. The adjustment requires adding $700 million (inaddition to the balance of uncollected receivables) tothe 1999 accounts receivable and current assets. Theeffect is to increase the growth in receivables,reduce the receivable turnover and increase the numberof days receivables outstanding. This adjustmentreinforces the conclusion (see text page 381) thatLucent’s receivables growth outpaced the growth insales. On the other hand, the adjustment improves the1999 current ratio.11-14Note: The bold values indicate which amounts were altered from Exhibit 11-4. The Exhibit 11-4 amounts for those items affected by the adjustment are shown in parentheses.11-1518.{M}a. Debt should be increased by:$ 20 million (present value of operating lease)5 (guarantee)7 (present value of take-or-pay agreement)$ 32 millionThere is no effect on equity as each obligation isoffset by a corresponding asset:Leased assets for operating leaseReceivable for Crockett's obligation to repay debtSupply agreementThe recomputed debt-to-equity ratio is:($12 + $32)/$20 = 2.2X as compared to .6X beforeadjustmentb. Additional interest expense is:Lease (effective interest rate is about 18%).18 x $20 = $3.6 millionBond guarantee .10 x 5 = 0.5Total $ 4.1 millionBefore adjustment, the interest expense is $1.0 millionand the times interest earned ratio is 5.0, implyingEBIT of $5.0 million.After adjustment, the ratio is:($5.0 + $4.1)/($1.0 + $4.1) = 1.78XNo adjustment has been made for the take-or-paycontract, as it does not affect 1993 interest expense.Adjustments in future years will be based on theimplicit interest rate of 21%.c. Reasons for entering into off-balance-sheet obligations:1. Avoidance of or mitigation of the risk of violatingdebt covenant restrictions.2. Leased assets revert to lessor after eight years,limiting risk of obsolescence.3. Guarantee of Crockett's debt may lower interestcosts, increasing profitability of investment.4. Contract with PEPE secures source of supply andpossibly advantageous pricing.11-16d. Additional information needed for full evaluation:1. (Lease) Useful life of leased assets; conditionsunder which lease can be canceled; nature ofleased assets.2. (Guarantee) Financial condition of Crockett; bondcovenants.3. (Take-or-pay) Alternate sources of supply;quantity to be purchased relative to total needs;price provisions of contract.19.{L}a. As the table below indicates, the declining paymentassumption using a 92% declining rate (the averagerate over the first five years (2000 - 2004)) is agood approximation for JC Penney. The present value is$3,320; a deviation of one-half of one percent fromthe stated present value of $3,302. If the constantpayment assumption is made, the error is about fourpercent.11-17b. Using only the first year payment: Payment = $66 andcurrent portion = $16; therefore interest portion = $50 and interest rate = $50/$417 =12%.Using all payments:Constant payment assumption implies MLP’s of $54 from 2004 through 2017 and $12 in 2018. Equating this payment stream to $417 yields an IRR of 11.8%For the declining payment assumption, we would use a declining rate of 95%, the average of (2000 - 2004).Using this rate yields an IRR of 10.44%The rate seems to be between 10.4%-12%. Given that two of the methods yield estimates closer to the high end of the range, using a rate of approximately 11.5% would be an appropriate estimate.c. The rate used by Sears is somewhat higher than that ofJ.C. Penney. That may be a function of (1)higher credit rating for Penney, (2)differing risk characteristics of the leased properties, or (3) Sears leases were entered into in periods of higher interest rates.d. Given the rapid decline over the first four years, wechoose to use the declining payment assumption. Usinga decline rate of .86 (the average over the first fiveyears) and a discount rate of 11.5% (from part b), the present value of the operating leases is $1,375 million.11-1820.{M} Adjusting for the operating lease results in adeterioration of the ratios in each case.* Year 2000 MLP = $352. Interest portion is equal to 11.5% x $1,325 = $158; Therefore, current portion of debt = $352 -$158 = $194** Present Value of operating leases as calculated in Problem 19 part d.† Assumes interest this year (1999) is approximately equal to next year’s (2000) interest levels.Note: No adjustment is made for pretax income, which maybe higher or lower depending on the age” of the lease.The earlier (later) in the lease term, expense is higher(lower) for the capital lease. On average the expense isidentical.As we do not know the relative age of theleases we assume no change.11-1921.{S} Sears’ MDA reports securitized (credit card) balancessold of $6,579 and $6,626 million in 1999 and 1998respectively. Adjusting for these balances (in 1999)requires adding $6,579 to accounts receivable andcurrent liabilities (assuming the debt is short-term)and increasing CFO by ($6,626 – $6,579) $47 million. Asthe table below indicates, the impact on these threeratios is considerable.22.{S} The adjusted ratios are poorer than those based on Sears’reported data. The adjustment for securitization ofreceivables accounts for far more of the impact than theoperating leases.Note: See problems 11-19, 11-20, and 11-21 for explanation of these adjustments11-2023.{M}a. Using th e constant rate assumption (MLP’s of $59million from 2004 - 2017 and $8 million in 2018), theimplicit interest rate is 4.19%.Note that Texaco has not guaranteed all of this lease.The total present value of the guaranteed portion ofthe lease is approximately ($336/44%) $764 million.b. The rate is somewhat lower than the 5% - 5.5% ratecalculated for Texaco in the chapter (page 385).c. Equilon may have less debt (in relation to theirassets) than Texaco, or the nature of its business (orof the leased assets) may be operationally less risky.The leases may have been entered into when interestrates were especially low.Assets are higher because inventory is replaced with (higher) receivables because of the recognition of manufacturing profit. Assets remain higher throughout the lease term.Revenues are higher in Year 1 as the sales-type lease recognizes a sale whereas the operating lease method does not. In later years, interest revenue from the sales-type lease should be lower than lease revenue for the operating lease. This effect is more pronounced over time; in year 9, interest income is low given the small remaining receivable.The revenue effect increases the asset turnover ratio in the first year. But the revenue effect reduces turnover in the ninth year.11-21Expenses are higher in year 1 due to the recognition of cost of goods sold. In later years, there is no expense for the sales-type lease; the operating lease method reports depreciation expense in every year, however.Initial period income and income-related ratios are higher for the sales-type lease because the sale (and income) is recognized at the inception of the lease. In later years, however, income is higher for the operating lease.Income taxes paid are the same since the lease cannot be considered a completed sale for tax purposes.Cash from operations is higher for the first year due to recognition of the sale (the investment in the lease is classified as an investing cash outflow). In later years the operating lease method shows higher cash from operations as rental income exceeds the interest income recorded for the sales-type lease (income taxes paid are the same).[See Exhibit 11-8 and the accompanying text for further explanation of these effects.]25.{L}a. The present value of the minimum lease paymentsreceivable of $170,271 (at 10%, the lower of lesseeand lessor rates) is more than 90% of the fair marketvalue of $185,250. Therefore, the lessee, Baldes,should capitalize the lease. It would be useful toknow whether the lessee has guaranteed the residualvalue of the leased asset.b. Leased assets $ 170,271Long-term lease obligation 167,298Current portion of lease obligation 2,973Total lease obligation $ 170,271Note that there are no income or cash flow statementeffects at the inception of the lease.11-2211-23c. (i) Balance sheet effects of capital lease:No impact on balance sheet if operating lease method applied. [Deferred tax assets reflecting the difference between total expense under the two methods would also be reported.](ii) Income statement effects of capital lease:1Interest expense for: 2001 = .10 x $170,271 2002 = .10 x $167,298 2Deprecation expense = $170,271/20 for each yearThe income statement would show lease expense of $20,000 each year under the operating lease method.(iii) Statement of cash flow effects of capital lease:The operating lease method reports $20,000 cash outflow from operations for each year.。

第十一章财务报表一、单项选择题1.会计报表中项目的数字直接来源于()。

A.原始凭证B.记账凭证C.日记账D.账簿记录2.财务报表是指企事业单位对外提供的反映企事业单位某一特定日期财务状况以及某一会计期间经营成果、现金流量等会计信息的文件,主要是由()组成的。

A.资产负债表和利润表B.资产负债表、利润表和现金流量表C.会计报表和财务情况说明书D.会计报表和附注3.将报表分为静态报表和动态表示按报表的()划分的。

A.服务对象B.编报主体C.编报时间D.经济内容4.资产负债表中的报表项目()。

A.都是根据账户余额直接填列B.都是对账户发生额进行分析计算后填列C.大多数项目可以直接根据账户余额填列,少数报表项目需要根据有关账户发生额分析计算后才能填列D.大多数项目可以直接根据账户余额填列,少数报表项目需要根据有关账户余额分析计算后才能填列5.资产负债表中,“应收账款”项目应根据()填列。

A.“应收账款”总分类账户期末余额B.“应收账款”总分类账户所属明细账的期末余额C.“应收账款”和“应付账款”中所属各明细分类账户的期末借方余额合计D.“应收账款”和“预收账款”总分类账所属各明细分类账户的期末借方余额合计6.多步式利润表是通过多步计算来确定当期损益的,通常把利润的计算分解为()。

A.营业利润、利润总额、净利润和每股收益B.营业收入、营业利润、应税利润和净利润C.营业收入、营业利润、利润总额和净利润D.营业利润、利润总额和净利润二、多项选择题1.会计报表主要包括()。

A.资产负债表B. 利润表C.现金流量表D.所有者权益变动表E.报表附注2. 财务报告的使用者有()。

A.投资者B.债权人C.捐赠者D.上级主管部门和财税部门E.其内部管理人员和广大职工群众3.下列报表中,属于内部报表的是()。

A.单位报表B.商品产品成本表C.制造费用明细表D.期间费用明细表E.产品成本明细表4. 资产负债表中的“存货”项目应根据()等账户的期末借方余额之和填列。

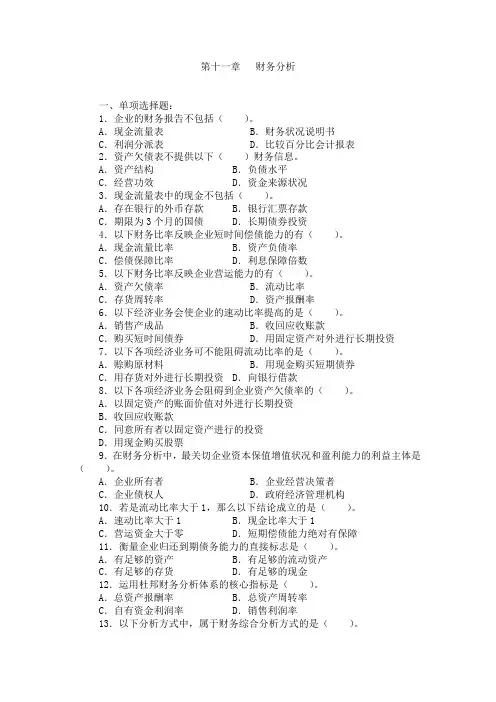

第十一章财务分析一、单项选择题:1.企业的财务报告不包括()。

A.现金流量表B.财务状况说明书C.利润分派表D.比较百分比会计报表2.资产欠债表不提供以下()财务信息。

A.资产结构B.负债水平C.经营功效D.资金来源状况3.现金流量表中的现金不包括()。

A.存在银行的外币存款B.银行汇票存款C.期限为3个月的国债D.长期债券投资4.以下财务比率反映企业短时间偿债能力的有()。

A.现金流量比率B.资产负债率C.偿债保障比率D.利息保障倍数5.以下财务比率反映企业营运能力的有()。

A.资产欠债率B.流动比率C.存货周转率D.资产报酬率6.以下经济业务会使企业的速动比率提高的是()。

A.销售产成品B.收回应收账款C.购买短时间债券D.用固定资产对外进行长期投资7.以下各项经济业务可不能阻碍流动比率的是()。

A.赊购原材料B.用现金购买短期债券C.用存货对外进行长期投资D.向银行借款8.以下各项经济业务会阻碍到企业资产欠债率的()。

A.以固定资产的账面价值对外进行长期投资B.收回应收账款C.同意所有者以固定资产进行的投资D.用现金购买股票9.在财务分析中,最关切企业资本保值增值状况和盈利能力的利益主体是()。

A.企业所有者B.企业经营决策者C.企业债权人D.政府经济管理机构10.若是流动比率大于1,那么以下结论成立的是()。

A.速动比率大于1 B.现金比率大于1C.营运资金大于零D.短期偿债能力绝对有保障11.衡量企业归还到期债务能力的直接标志是()。

A.有足够的资产B.有足够的流动资产C.有足够的存货D.有足够的现金12.运用杜邦财务分析体系的核心指标是()。

A.总资产报酬率B.总资产周转率C.自有资金利润率D.销售利润率13.以下分析方式中,属于财务综合分析方式的是()。

A.趋势分析法B.杜邦分析法C.比率分析法D.因素分析法14.权益乘数是指()A.1÷(1-产权比率)B.1÷(1-资产欠债纺)C.产权比率1÷(1-产权比率)D.资产欠债率1÷(1-资产欠债率)15.有形净值债务率中的“有形净值”是指()。

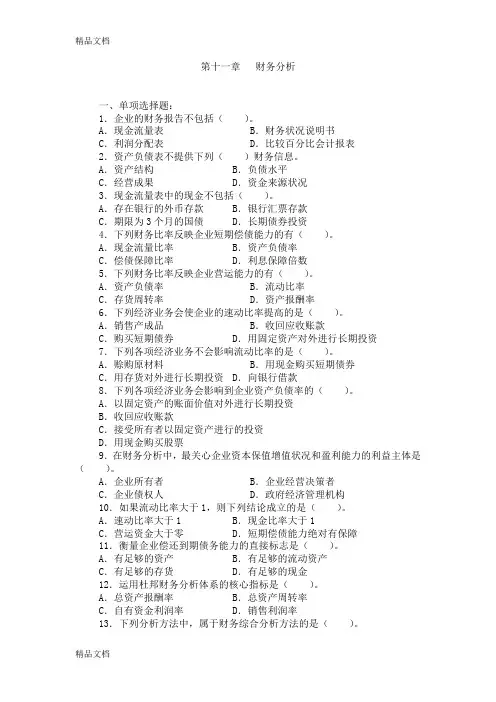

第十一章财务分析一、单项选择题:1.企业的财务报告不包括()。

A.现金流量表B.财务状况说明书C.利润分配表D.比较百分比会计报表2.资产负债表不提供下列()财务信息。

A.资产结构B.负债水平C.经营成果D.资金来源状况3.现金流量表中的现金不包括()。

A.存在银行的外币存款B.银行汇票存款C.期限为3个月的国债D.长期债券投资4.下列财务比率反映企业短期偿债能力的有()。

A.现金流量比率B.资产负债率C.偿债保障比率D.利息保障倍数5.下列财务比率反映企业营运能力的有()。

A.资产负债率B.流动比率C.存货周转率D.资产报酬率6.下列经济业务会使企业的速动比率提高的是()。

A.销售产成品B.收回应收账款C.购买短期债券D.用固定资产对外进行长期投资7.下列各项经济业务不会影响流动比率的是()。

A.赊购原材料B.用现金购买短期债券C.用存货对外进行长期投资D.向银行借款8.下列各项经济业务会影响到企业资产负债率的()。

A.以固定资产的账面价值对外进行长期投资B.收回应收账款C.接受所有者以固定资产进行的投资D.用现金购买股票9.在财务分析中,最关心企业资本保值增值状况和盈利能力的利益主体是()。

A.企业所有者B.企业经营决策者C.企业债权人D.政府经济管理机构10.如果流动比率大于1,则下列结论成立的是()。

A.速动比率大于1 B.现金比率大于1C.营运资金大于零D.短期偿债能力绝对有保障11.衡量企业偿还到期债务能力的直接标志是()。

A.有足够的资产B.有足够的流动资产C.有足够的存货D.有足够的现金12.运用杜邦财务分析体系的核心指标是()。

A.总资产报酬率B.总资产周转率C.自有资金利润率D.销售利润率13.下列分析方法中,属于财务综合分析方法的是()。

A.趋势分析法B.杜邦分析法C.比率分析法D.因素分析法14.权益乘数是指()A.1÷(1-产权比率)B.1÷(1-资产负债纺)C.产权比率1÷(1-产权比率)D.资产负债率1÷(1-资产负债率)15.有形净值债务率中的“有形净值”是指()。

工程经济自考本科教学各章节重点知识点及概念解析(一)工程经济是一门非常重要的学科,涉及到工程的财务决策和投资项目的评估。

工程经济自考本科教学共有十二章,下面我们来分别介绍各章节的重点知识点及概念解析。

第一章:工程经济概论本章主要介绍了工程经济的基本概念、方法和应用领域。

重点知识点包括:1. 工程经济的定义:指利用数学方法和经济学原理,在工程建设过程中综合考虑成本、效益和风险等因素,对各种工程投资决策问题进行分析和决策的学科。

2. 工程经济应用的领域:主要包括项目评估、投资决策、经济分析和管理决策等。

3. 工程经济分析的原则:主要有货币时间价值原则、边际分析原则、风险分析原则、效率性原则等。

第二章:单利和复利本章主要介绍单利和复利两种计息方式的概念及其应用。

重点知识点包括:1. 单利:指将本金和利息分别计算,分别计提利息,不进行加算,一次性付清的利息。

2. 复利:指将本金和利息合并计算,每个计息周期内都会计算并合并利息,再基于本金和利息汇总计算下一个计息周期的复利。

3. 单利和复利的公式计算。

第三章:基本核算方法本章主要介绍工程经济分析的基本核算方法。

重点知识点包括:1. 总收益和总成本的概念。

2. 平衡点概念及计算方法。

3. 折旧费用的概念和计算方法。

4. 盈亏平衡分析。

第四章:财务报表分析本章主要介绍财务报表的基本结构和基本分析方法。

重点知识点包括:1. 财务报表的种类和内容。

2. 经营活动产生的现金流量表的作用及其编制方法。

3. 财务比率分析方法。

4. 费用指标的概念及其计算方法。

本章主要介绍成本测算的基本方法和技巧。

重点知识点包括:1. 总成本构成和单价计算的方法。

2. 特定成本的计算方法。

3. 基于成本的定价策略分析。

第六章:资本预算本章主要介绍资本预算的概念及其应用。

重点知识点包括:1. 资本预算的定义、作用及其重要性。

2. 财务现值和净现值的概念及其计算方法。

3. 资本回收期、内部收益率、资本成本概念及其计算方法。

第1篇目录第一章引言第二章财务报告概述第三章财务报表分析第四章财务比率分析第五章财务报表综合分析第六章财务报表分析工具与方法第七章财务报表分析在实际中的应用第八章财务报表分析的风险与注意事项第九章总结第一章引言随着市场经济的发展,企业财务报告分析已成为企业管理者、投资者和分析师等各界人士关注的重要领域。

财务报告是企业对外展示其财务状况、经营成果和现金流量等方面的信息窗口。

通过对财务报告的分析,可以了解企业的经营状况、盈利能力、偿债能力、发展潜力等,为决策提供有力支持。

本电子书旨在为读者提供系统、全面的财务报告分析知识,帮助读者掌握财务报告分析的技巧和方法。

第二章财务报告概述2.1 财务报告的定义与作用2.2 财务报告的构成2.3 财务报告的编制原则2.4 财务报告的披露要求第三章财务报表分析3.1 资产负债表分析3.1.1 资产分析3.1.2 负债分析3.1.3 股东权益分析3.2 利润表分析3.2.1 收入分析3.2.2 成本费用分析3.2.3 利润分析3.3 现金流量表分析3.3.1 经营活动现金流量分析3.3.2 投资活动现金流量分析3.3.3 筹资活动现金流量分析第四章财务比率分析4.1 偿债能力比率4.1.1 流动比率4.1.2 速动比率4.1.3 资产负债率4.2 运营能力比率4.2.1 存货周转率4.2.2 应收账款周转率4.2.3 总资产周转率4.3 盈利能力比率4.3.1 毛利率4.3.2 净利率4.3.3 净资产收益率4.4 发展能力比率4.4.1 营业收入增长率4.4.2 净利润增长率4.4.3 资产增长率第五章财务报表综合分析5.1 财务报表综合分析的意义5.2 财务报表综合分析方法5.2.1 趋势分析法5.2.2 对比分析法5.2.3 因素分析法5.3 财务报表综合分析案例第六章财务报表分析工具与方法6.1 财务报表分析软件6.2 数据分析软件6.3 财务模型构建6.4 案例分析第七章财务报表分析在实际中的应用7.1 投资决策7.2 信贷决策7.3 企业并购7.4 企业绩效评价第八章财务报表分析的风险与注意事项8.1 数据来源风险8.2 分析方法风险8.3 分析结论风险8.4 注意事项第九章总结通过对财务报告的分析,可以全面了解企业的经营状况和财务状况,为决策提供有力支持。