金融英语测试题自测 打印版

- 格式:doc

- 大小:32.61 KB

- 文档页数:28

金融英语模拟试题及答案Reading Comprehension: (10 points)Joseph Glass, CFA, is a consultant who provides advisory services to large manufacturing companies. Glass has been retained by ABCO, a leading manufacturer of widgets for automobiles in the United States. ABCO has hired Glass to evaluate the possibility of e*panding their current base of operations by building an additional facility in South America. Management of ABCO has identified an increase in demand for widgets in South America over the past decade, and any new manufacturing facility would produce goods to satisfy that void and would be distributed and sold across South America.Glass is not familiar with the current economic climate in South America, but is aware that several governments have attempted to encourage economic development in their countries through the enactment of pro-business legislation. Two of these countries, Venezuela and Peru, both have the reputations of being “friendly” to foreign economic investment withintheir borders. The two countries share some similarities: both, until the past twenty years, were primarily agricultural economies with little industrial development. Also, both countries can offer a relatively low-cost labor force, although their workers in general, are not highly skilled.The government of Peru has declared that protecting the country’s environment is of utmost importance, and has established a regulatory body that oversees any environmental concerns that may arise as the country becomes more industrialized. Fairly stringent regulations have already been put into place in order to ensure that going forward, the operating practices of manufacturers within their country’s borders will be in balance with the government’s concern for their county’s natural resources. Regulations cover areas of concern such as air emissions, water conservation and the use of sustainable resources. Glass advised ABCO that a cost-benefit analysis must be performed to accurately determine both the direct and indirect costs of compliance with the regulations.The Venezuelan government has taken steps to ensurethat it can carefully manage the development of its country’s emerging economy, and to ensure that a competitive market is maintained. A regulatory agency was established five years ago to provide guidance for any new manufacturing concern seeking to operate in Venezuela. The head of the agency is Juan Santos, the former CEO of one of the first modernized manufacturing facilities in the country. During his tenure as head of the agency, he has demonstrated his ability to render decisions that attempt to simultaneously satisfy legislators, industry participants, and consumers. Glass is impressed by Santos’ work so far, but realizes that over the past five years, Venezuela has e*perienced a period of relatively slow economic development. Glass believes that Santos’ skills will truly be put to the test in the upcoming years of the anticipated economic e*pansion.Glass acknowledges the need for governmental regulation of industry, but recognizes that there always are offsetting costs, both short-term and long-term of such controls. Based upon his knowledge of events that have occurred in the United States over thepast thirty years, Glass recommends that ABCO continue to carefully monitor economic developments in both countries even after a site for a new manufacturing facility is selected.Part 1)Should ABCO build a new facility in either of the two countries, it is almost a certainty that they would be the low-cost producer of widgets, with the capacity to satisfy nearly all demand in the region. A natural monopolist operating in an unregulated industry will produce at the point where:A. Marginal costs equal marginal revenue.B. Average costs equal marginal revenue.C. Average costs equal average revenue.D. The marginal cost curve intersects the demand schedule.Part 2)The social regulation policies enacted by the government of Peru would least likely to cause which of the following outcomes? ()A. Higher costs of production.B. A disproportionately higher compliance e*pensefor larger firms rather than smaller firms.C. Higher prices for the end consumer.D. Attempts by industry participants to avoid compliance through creative response.Part 3)If ABCO were to build its new facility in Peru, compliance with the country’s regulatory policies will increase the price of their product by appro*imately ten percent. Some consumers may respond by not replacing the widgets in their automobiles as frequently as before, which will cause decreased fuel efficiency. This unintended effect of regulation is an e*ample of: ()A. The capture hypothesis.B. A creative response.C. A feedback effect.D. The share-the-gains, share-the-pains theory.Part 4)The appointment of Santos, an industry “insider”, to head the regulatory agency in Venezuela has the potential to cause a reaction predicted by which of the following theories of regulatory behavior? ()A. Rate-of-return regulation.B. Share-the-gains, share-the-pains theory.C. The capture hypothesis.D. Cost-of-service regulation.Part 5)Santos, as the head of the main regulatory body in Venezuela, must decide how to manage the effects of an unanticipated sharp increase in the cost of electricity. Santos proposed regulation that will allow manufacturers to pass on the increased costs at scheduled intervals over a five year period. This approach is an e*ample of: ()A. Rate of return regulation.B. Cost-of-service regulation.C. Share-the-gains, share-the-pains theory.D. Social regulation.E*planations of terms:(10 points)1. Liquidity2. Cost-push inflation3. Surveillance4. E*ternal debt5. Foreign reserveQuestion3: How many factors to e*plain the reserveholdings?Question4: What is The Monetary Policy Instruments of the Central Bank?Question5: What is Concept of Trust Market?And what the composition of it is?Question6: What is the Money Laundering?。

1. Usually the low in terest rate curre ncy trades at a ____ to the high in terest rate curre ncy in the forward market.A. premiumB. parC. disco untD. bar2. Which of the followi ng stateme nts about sta ndby letters of credit is true ___ .A. They can serve as a guara ntee to a buyer aga inst a seller default ingB. They are contrary to the general rule that letters of credit may only be used for the actual moveme nt of goodsC. They are un like a ten der (or other) bond in their legal sta nding and method of operati onD. They are unlike a tender bond with its fixed expiry date3. The most liquid of all assets is _____ .A. the stock of commercial banksB. M 1C. i ntellige neeD. the debt of major corporati ons4. Beta and sta ndard deviati on differ as risk measures in that beta measures ____ .A. only unsystematic risk, while standard deviation measures total riskB. only systematic risk, while standard deviation measures total riskC. both systematic and un systematic risk, while sta ndard deviati on measures on ly un systematic riskD. both systematic and un systematic risk, while sta ndard deviatio n measures only systematic risk5. What information would you find in a statement of cash flows that you would not be able to get from the other two primary finan cial stateme nts ____ .A. Cash provided by or used in financing activitiesB. Cash bala nee at the end of the periodC. Total liabilities due to creditors at the end of the periodD. Net in come6. An an alyst estimates that a stock has the follow ing probabilities of retur n depe nding on the state of the economy:The expected return of the stock is _____ .A. 7.8% C. %D. %B. %7. Accordi ng to the rules of debit and credit for bala nee sheet acco unts ____ .A. i ncreases in asset, liability, and own er's equity acco unts are recorded by debitsB. decreases in asset and liability accounts are recorded by creditsC. in creases in asset and own er's equity acco unts are recorded by debitsD. decreases in liability and owner's equity accounts are recorded by debits 2658. In dividuals will accept the medium of excha nge in retur n for goods and services only if they are con fide nt that ____ .A. the inflation rate is zeroB. it possesses intrin sic valueC. they can pass it on to othersD. they can excha nge it for gold9. Whe n a coun try's curre ncy appreciates, the coun try's goods abroad become _______ a nd foreig n goods in that country become _____ .A. cheaper... more expe nsiveB. more expe nsive... cheaperC. cheaper...cheaperD. more expe nsive... more expe nsive10. A US compa ny is biddi ng for a con tract in Chi na. Its Chin ese customer asks for a performa nee bond. What is the most likely course of acti on ____ .A. It asks its bank to issue a tender bond which can be converted into a performance bondB. It gives up its bidC. It consults its bank about issuing a standby letter of creditD. It asks its bank to issue a performance bond11. ABCCo. Ltd. has a $3 500 accou nt receivable from XYZStore. On March 20, XYZmakes a partial payme nt of $2 100 to ABC. The journal entry made on Mdrch 20 by ABC to record this tran sacti on in cludes _______ .A. a debit to the cash received acco unt of $2 100B. a credit to the Acco unts Receivable acco unt of $2 100C. a debit to the Cash accou nt of $1 400D. a debit to the Accou nts Receivable accou nt of $1 40012. I nterve ntio n in the foreig n excha nge market means the gover nment _ .A. restricts in dividuals from buying and selli ng foreig n excha ngeB. restricts the importation of certain goodsC. or cen tral bank buys or sells foreig n excha ngeD. devalues the curre ncy in the foreig n-excha nge market13. Which of the followi ng is not a form of coun tertrade ____ .A. Coun terpurchaseB. Buy-backC. OffsetD. Bala nee trade14. A credit to a reve nue acco unt _____ .A. decreases reve nuesB. in creases equityC. decreases equityD. in creases assets15. If the gover nment guara nteed that anyone wishi ng a job would be provided one, the likely result would be _____ .A. massive layoffsB. an in crease in the money supplyC. an in crease in in flatio nary expectati onsD. the developme nt of a barter system16. Given $100 000 to invest, what is the expected risk premium in dollars of investing in equitiesA. $20000B. $18000C. $15000D. $1300017. Econo mists assume that most people take risks ____A. because doing so is excit ingB. on ly whe n they have no riskless alter nativeC. very in freque ntlyD. if they are compensated for taking the risks18. The Phillips Curve shows the relationship between ____ .A. aggregate demand and aggregate supplyB. interest rates and inflationC. recessions and boomsD. inflation and the unemployment rate19. In a fixed exchange rate system, speculative selling of a currency is based on anticipation of .A. appreciationB. devaluationC. a foreign trade surplusD. interest rate increase20. A collecting bank is employed by ____ .A. the principalB. the remitting bankC. the drawerD. the drawee, who is its customer21. The following statements describing net income are all correct except that ____ .A. net income is computed in the income statement, appears in the statement of owner's equity, and increases owner's equity in the balance sheetB. net income is equal to revenues minus expensesC. net income is computed in the income statement, appears in the statement of owner's equity, and increases the amount of cash shown in the balance sheetD. net income can be determined using the account balances appearing in an adjusted trial balance22. A strong dollar encourages _____ .A. travel to the United States by foreignersB. purchase of American goods by foreignersC. Americans to travel abroadD. Americans to save dollars23. In what circumstances would the beneficiary of a confirmed documentary credit not receive payment ____________ .A. Failure of the applicantB. Failure of the issuing bankC. Failure to fulfil the credit termsD. Failure to fulfil the commercial contract24. The balance in the owner's capital account of ABC Co. Ltd. at the beginning of the year was $65 000. During the year, the company earned revenue of $430 000 and incurred expenses of $360 000, the owner withdrew $50 000 in assets, and the balance of the Cash account increasedby $10 000. At year-end, the company's net income and the year-end balance in the owner's capital account were, respectively .A. $20 000 and $95 000B. $70 000 and $95 000C. $70 000 and $85 000D. $60 000 and $75 00025. Assume the inflation rate is expected to be 5 percent and the unemployment rate is 8 percent. If workers wish to get a 2 percent real wage increase, they should bargain for a money wage increase of __________ .A. 3 percentB. 5 percentC. 7 percentD. 13 percent26. Which statement about portfolio diversification is correct .A. Proper diversification can reduce or eliminate systematic riskB. As more securities are added to a portfolio, total risk typically would be expected to fall at a decreasing rateC. The risk-reducing benefits of diversification do not occur meaningfully until at least 30 individual securities are included in the portfolioD. Diversification reduces the portfolio's expected return because it reduces a portfolio's total risk27. Your customer is the applicant for a documentary credit. Which of the following points would appear to be illogical if they appeared on the application form __________ .A. Invoice price shown as FOB, bills of lading to be marked freight paidB. Last date for shipment one week before expiry dateC. Invoice price shown as C&F, but no insurance document requestedD. No mention of the latest date of shipment28. Portfolio theory as described by Markowitz is most concerned with ___ .A. the effect of diversification on portfolio riskB. B. the elimination of systematic riskC. active portfolio management to enhance returnD. the identification of unsystematic risk29. Commercial bank deposits with the central bank are part of the bank'sA. net worthB. demand depositsC. loan portfolioD. reserves30. Foreign trade can be conducted on the following terms except for ____ .A. open accountB. documentary collectionC. documentary creditsD. public bonds31。

⾦融英语练习题(附答案)Multiple Choice1. The People’s Bank of China shall have the power to demand financial institutions to submit balance sheets, statements ofD and other financial and accounting reports and materials in pursuance of regulations.A. accountB. financial positionC. cash flowD. profit and loss2. A credit card such as Visa will D .A. gurantee chequesB. enable the holder to cash cheques at any bankC. enable the holder to buy goods on creditD. enable the holder to buy goods, up to certain amounts, on credit from certain persons3. Foreign trade can be conducted on the following terms except for DA. open accountB. documentary collectionC. documentary creditsD. public bonds4. Customers trading abroad in foreign currencies may protect against the exchange risk by arranging C .A. a contract of international sale of goodsB. a contract of marine insuranceC. a forward contract to fix the exchange rate in advance5. The danger to the exporter in open account trading is that by surrendering the shipping documents to the importer, heB before he has obtained payment for them.A. is in control of the goodsB. losses control of the goodsB. retain control of the goods D. gives up control of the goods6. Leasing is an arrangement whereby one party obtains on a long-term basis A which belongs to another party.A. the use of a capital assetB. the use of a current assetC. the use of working capitalD. the use of current liabilities7. From a Chinese bank’s point of view, the currency account which it maintains abroad is known as , while a RMB account operated in China for a foreign bank is termed B .A. a vostro account, a nostro accountB. a nostro account, a vostro accountC. a mirror account, a nostro accountD. a vostro account, a mirror account8. Find the interest on US $65,000 for 14 days at 3 percent per annum.B .A. US $37.91B. US $75.83C. US $113.74D. US $227.499. Which of the following can not be included in the functions ofmoney?D 。

金融英语考试试题金融英语考试试题金融英语考试是衡量金融从业人员英语水平的重要指标之一。

这种考试旨在测试考生在金融领域的专业英语知识和技能。

下面将介绍一些常见的金融英语考试试题,以帮助考生更好地准备考试。

一、阅读理解阅读理解是金融英语考试中常见的题型之一。

考生需要阅读一篇关于金融领域的文章,并回答相关问题。

以下是一个例子:文章:The Role of Central Banks in the EconomyCentral banks play a crucial role in the economy by controlling the money supply and interest rates. They are responsible for maintaining price stability and promoting economic growth. Central banks achieve this through various monetary policy tools, such as open market operations and reserve requirements.Question: What is the role of central banks in the economy?答案:The role of central banks in the economy is to control the money supply and interest rates, maintain price stability, and promote economic growth.二、词汇选择词汇选择题是考察考生对金融领域词汇的理解和应用能力。

以下是一个例子:Question: The process of converting an asset into cash is called _______.a) liquidityb) inflationc) diversificationd) leverage答案:a) liquidity三、填空题填空题是考察考生对金融英语词汇和术语的掌握程度。

1.Which of the following is not a function of money?______。

A.To act as a medium of exchangeB.To act as a unit of accountC.To act as a store of valueD.To provide a double coincidence of wantsE.To act as a means of payment2.The price in the foreign exchange market is called ______。

A.the trade surplusB.the exchange rateC.the money priceD.the currency rate3.Market risk refers to the risk of______。

A.financial prices fluctuationsB.defaultC.fraudD.deferred payments4.Which of the following is not among the generally accepted accounting principles?______。

A.Cash basisB.PrudenceC.ConsistencyD.Going concernE.Money measurement。

5.What is a documentary letter of credit?______。

A.A conditional bank undertaking to pay an exporter on production of stipulated documentationB.A method of lending against documentary securityC.An international trade settlement system biased in favour of importersD.All of the above6.Holding a group of assets reduces risk as long as the assets ______。

2012年金融英语考试模拟试题及答案(1)2012年金融英语考试模拟试题及答案(1) SECTION ONE (Compulsory):Answer all ten questions in this section. Each question carries 1 mark.1. Multiple-choice questions: from the following four options, select a correct and fill in its labeling the brackets. (A total of 10 points)1. Only what happens if the supply is less than demand? ()A. actual price is lower than the equilibrium priceB. actual price is higher than the equilibrium priceC. equilibrium price equivalent to the actual priceD. eliminate the scarcity of goods2. When the Consumer income and established conditions for commodity prices is still, consumers can buy the two commodities to the greatest number of combinations. What did the Line call? ()A. No difference curveB. consumption may LineC. Line and its outputD. enterprise budget line3. Opportunity cost: ()A. Is always measurable in money terms.B. Is an indicator of productivity performance.C. Relates peculiarly to business affairs alone.D. Measures the cost of doing "x" in terms of what else might be done.4. The normal downward slope of demand curves is necessarily explained by: ()A. Growth in the size of the population.B. The adroitness of advertisers.C. Limited spending power.D. Technological advance.5. For a closed two-good economy, the output of the two goods should be at the point where: ()A. The highest indifference curve touches the production possibility curve.B. The lowest indifference curve touches the production possibility curve.C. The indifference curve crosses the production possibility curve.D. The marginal cost curve touches the production possibility curve.6. The "J-curve" shows that following depreciation: ()A. The quantity of exports falls, making the current account balance worse.B. Here is an initial drop in imports but this is later reversed.C. The cost of imports rises immediately from the price effect, worsening the current account bal-ance, but later quantities of imports and exports respond and the current account balance im-proves.D. There is an improvement in the balance of payments so long as the Marshall-Lerner conditions are met.7. Which of the following statements about standby letters of credit is true? :()A. They can serve as a guarantee to a buyer against a seller defaultingB. They are contrary to the general rule that letters of credit may only be used for the actual movement of goodsC. They are unlike a tender (or other) bond in their legal standing and method of operationD. They are unlike a tender bond with its fixed expiry date8. What information would you find in a statement of cash flows that you would not be able to get from the other two primary financial statements? ()A. Cash provided by or used in financing activitiesB. Cash balance at the end of the periodC. Total liabilities due to creditors at the end of the periodD. Net income9. Which of these best describes the U.S. Federal Reserve? ()A. Responsible for monetary policy/moneysupplyB. Prints money.C. Keeps the country out of debt.D. Helps people in need.10. What is the basic purpose of profits in our market economy? ()A. Pay for wages and salaries of workers.B. Lead businesses to produce what consumers want.C. Transfer income to the wealthy.D. All of the above.SECTION TWO(Compulsory):Answer the questions in this section.Reading Comprehension: (10 points)Laura James is the head portfolio manager for National Fund, a U.S. based mutual fund with a well-respected track record. National’s primary focus is on large-cap domestic equities, and the fund has consistently posted high returns relative to its peer group over the past seven years. Much of National’s recent success is from its investments in the U.S. automobileindustry, which have posted extraordinary returns due to a favorable economic scenario. Over the past seven years, the U.S. economy has been expanding, foreign competition has not met consumer expectations, and oil prices have remained low. These factors have contributed to an increase in market share for the domestic producers (at the expense of foreign competitors), and the result has been strong earnings for the top U.S. automakers.Ford Motor Company, in particular, has enjoyed tremendous success in this environment. Ford has capitalized on the trend toward bigger vehicles, particularly sport utility vehicles (SUVs), and has outperformed the other domestic auto makers. Ford jumped on the SUV bandwagon early, and established its dominance. Other domestic auto makers followed, with foreign producers being the last to embrace the trend. Ford has increased its market share in an increasingly competitive industry.James is constantly reviewing economicforecasts and industry data in order to assess the expected performance of the investments in National’s portfolio. Due to changes in economic policy and recent volatility in energy prices, James now believes that current market conditions exhibit signs of contraction (recession). In addition, the automobile sector may be facing additional negative factors. In particular, James has concerns regarding the SUV segment of the automobile industry. Although she believes they will remain popular, she is concerned that the market may be reaching a point of saturation. In addition, volatile energy prices may dampen consumers’enthusiasm for large vehicles. Lastly, foreign competitors have increased efforts toward the production of SUVs, thus “crowding”the market with many new models.Part 1)Assume an industry exhibits tendencies of “regression toward the mean.”This could mean all of the following EXCEPT: ()A. Profits are high and competition increases from other firms in the industry.B. Profits increase as firms enter the industry.C. Profits are low and firms flee the industry.D. Prices could increase or decrease depending on the level of profits.Part 2)In a recessionary environment, an automaker such as Ford would be expected to: ()A. Produce higher end vehicles.B. Maintain the same product mix as 5 years ago.C. Gain market share if it produces high end vehicles.D. Produce lower end vehicles.Part 3)Assume domestic automakers are growing at a rate of –2%. Ford expects to increase its market share by 0.5%. What is Ford’s growthrate? ()A. 1.5%.B. -3.0%.C. -1.5%.D. 3.0%.Part 4)Suppose instead that Ford’s growth of firm sales is expected to be –3% and the growth of industry sales is 1%. What is Ford’s expected change in market share? ()A. 3%.B. -3%.C. -4%.D. 4%.Part 5)Which of the following scenarios would be most likely to have a positive impact on Ford’s market share? ()A. New carmakers enter the market.B. An increase in its marketing budget.C. War with an oil producing country.D. The overall number of cars soldincreases.Explanations of terms:(10 points)1. Official interest rate2. Fiat money3. GDP4. Mean5. Primary marketsQuestion3: What are the basic objectives of economic policies?Question4: What is the Money Market Mutual Funds?Question5: Why Should I Lease Equipment Instead of Buy?Quetion6:Tell us The Practice of China’s Monetary Policy since Economic Reform and Opening up briefly? 1. B A D C A,C A C A BReading Comprehension: (10 points)Part 1)Your answer: B was correct!Profitability in a particular industry attracts competition from other firms, whichthen forces prices down, eventually reducing profits back to a long-run normal level. The opposite holds true for industries experiencing losses.Part 2)Your answer: D was correct!During economic downturns, producers of low-cost products increase their market share at the expense of high-cost producers. This also is true within firms that produce various priced products.Part 3)Your answer: B was incorrect. The correct answer was C!(1 + growth of firm sales) = (1 + growth of industry sales) x (1 + fractional change of market share)= 0.98 x 1.005= 0.9849Growth of firm sales = –1.51%Part 4)Your answer: B was incorrect. The correctanswer was C!0.97 = 1.01 x (1 + x)0.9604 = 1 + x–3.96% = xPart 5)Your answer: The correct answer was B!An increase in its marketing budget.The percentage change in a firm’s market share is directly proportional to the percentage change in its marketing expenditures. An increase in the overall number of cars sold would not necessarily change Ford’s market share. New competition would be negative, as would war, as Ford’s share of the SUV market (gas guzzlers) is large.Explanations of terms:(10 points)1. Official interest rate :Official interest rate is the rate set by the central bank or monetary authorities. The interest rate is one of levers used by governments to regulate economy.2. Fiat money:Money proclaimed to be money by fiat or government decree is sometimes called fiat money.3. GDP:The monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.4. Mean:A measure of central tendency of the probability distribution of a random variable that equals the weighted average of all possible outcomes using their probabilities as weights.5. Primary markets:Financial markets in which newly issued debt or equity claims are sold to initial buyers by private borrowers to raise funds for durable-goods purchases or new ventures and by governments to finance budget deficits.Question3:Answer:Since the Great Depression of the 1930s, governments have actively pursued the goal of economic stability at full employment. Known as internal balance, this objective has two dimensions; (D a fully employed economy, and ©no inflation—or, more realistically, a reasonable amount of inflation. Nations traditionally have considered internal balance to be of primary importance and have formulated economic policies to attain this goal.Policy makers are also aware of a nation’s balance-of-payments (BOP) position. A nation is said to be an in external balance when it realizes neither BOP deficits nor BOP surpluses. In practice, policy makers usually express external balance in terms of a BOP sub account, such as the current account. In this context, external balance occurs when the current account is neither so deeply in deficit that the home nation is incapable of repaying its foreign debts in thefuture nor so strongly in surplus that foreign nations cannot repay their debts to it. Although nations usually consider internal balance to be the highest priority, they are sometimes forced to modify priority when confronted with large and persistent external imbalances.Question 4Answer:The money markets are wholesale markets where most securities trade in large denominations. This characteristic effectively blocks most individuals from investing directly in these securities. However, the markets usually find a way to correct for such deficiencies, especially when potential customers are available. Money market mutual funds represent one such correction.Money market mutual funds (MMMFs) are funds that aggregate money from a group of small investors and invest it in money market. They have grown enormously popular since their inception in the early 1970s because theyprovide a means for small investors to take advantage of the returns offered on money market securities. These securities would be out of reach to most small investors because of their large minimum denominations.Question5:Answer:(1) Leasing is flexible. Companies have different needs, different cash flow patterns, different irregular streams of income. For example, start-up companies typically are characterized by little cash and limited debt lines. Mature companies might have other needs: to keep debt lines free, to comply with debt covenants, and to avoid committing to equipment that may quickly become obsolete. Therefore, your business conditions—cash flow, specific equipment needs, and tax situation—may help define the terms of your lease. Moreover, a lease provides the use of equipment for specific periods of time at fixed rental payments. Therefore, leasing allows you to bemore flexible in the management of your equipment.(2) Leasing is practical. By leasing, you transfer the uncertainties and risks of equipment ownership to the lessor, which allows you to concentrate on using that equipment as a productive part of your business.(3) Leasing is cost effective. Equipment is costly and some of the costs are unexpected. When you lease, your risk of getting caught with obsolete equipment is lower because you can upgrade or add equipment to best meet your needs.Further, your equipment needs can change over time due to changes in your company, such as diversification. Leasing allows you to stay on the cutting edge of technology. Sophisticated business managers have learned that the primary benefits of higher productivity and profit come from the use of equipment, not owning it.(4) Leasing has tax advantages. Rather thandealing with depreciation schedules and Alternative Minimum Tax (AMT) problems, you, the lessee, simply make the lease payment and deduct it as a business expense.(5) Leasing helps conserve your operating capital. Leasing keeps your lines of credit open. You don’t tie up your cash in equity. Also, you avoid costly down payments. With other advantages such as offbalance sheet financing, leasing helps you better manage your balance sheet.Question6:Answer:Under the traditional planned economic system, there were only such concepts as credit management, cash management and so on. As a comprehensive concept monetary policy came into being in China in the process of economic reform and establishment of the market economy when the experience of money and credit management in western countries was used for reference.China’s monetary policy, in general sense, is the same as the concept of monetary policy in western economics, including such factors as operating instruments, operating targets, intermediate targets and final targets. The impact of monetary policy on China’s macro-economy is produced through the transmission of those factors one by one.(1) The final targets of China’s monetary policyThe present final target of China’s monetary policy is “to maintain a steady currency and promote economic growth". Price stability is the precondition and basis of normal operation of economy. If too much money is issued and inflation occurs, it is hard to control market prices, stabilize people’s living standard and maintain steady economic growth. Economic development in turn provides material base for stabilizing currency. Only by supporting the reasonable demand for productive funds and increasing supply ofcommodities needed in the market can there bea reliable material base for steady currency.(2) The operating and intermediate targets of China’s monetary policyBefore 1984 when the PBC functioned as a central bank, the operating and intermediate targets of monetary policy were credit quota and the amount of cash issue. After 1984, the central bank lending to financial institutions was included in "operating targets" and has become important ever since. In 1993, the Decision on Financial Reform issued by the State Council stipulated that intermediate and operating targets are “money supply, the total credit, and the inter-bank offered rate and bank reserve rate". In 1995, the PBC started its attempt to take M, and M2 as the intermediate target. In 1996, the PBC regularly adopted M and M2 in the intermediate targets of its monetary policy.(3) The monetary policy instrumentsUp to now, credit plan and cash plan havebeen the basic monetary policy instruments in China. But officially set deposit and lending interest rates, basic interest rate, required reserve ratio, bank reserve rate, the central bank lending rate, discount rate, special deposits and open market operations have become monetary policy instruments one after another and played a more and more important role. The Law of the People’s Republic of China on the People’s Bank of China passed in March 1995 stipulates that monetary policy instruments are reserve requirement, basic interest rate, the central bank lending rate, discount rate, open market operations and other monetary policy instruments set by the State Council. So the system of monetary policy instruments that conform to the socialist market economy has been lawfully set up.With the establishment of socialist market economy the gradual shift from direct to indirect monetary policy instruments has greatly improved transmission mechanism ofmonetary policy and effectiveness of macroeconomic management in China. But in a transition period the potency of monetary policy is still subject to various factors as follows:●Government’s intervention. In economic activities, intervention by governments at each level is still strong. It is not rarely seen that local governments often force banks to make loans for the sake of development of local economy, which interferes the independence of the central bank’s monetary policy and blurs monetary policy targets, so monetary policy instruments are partly ineffective.●Less developed markets. In the transition period market mechanism is not perfect while the planned mechanism has lost much of its share. So the vacuum in management of national economy appears. As a result distribution of resources is in disorder and the contradiction in economic structure is obvious. The central government has to increase investment in order to better economic structure, so it’s hard tocontract investment size, wipe out investment expansion of fixed assets and control the money supply. So implementation of monetary policy of the central bank is interfered with.●Imperfect self-constraint mechanism of financial institutions. As China’s financial institutions are still under reform, their behavior is not standardized because of imperfect self-constraint mechanism. So the impact of the central bank’s monetary policy on reserves of financial institutions is not sure and the operating targets can not respond sensitively.●Lack of self-constraint mechanism of enterprises. In order to maintain certain increasing rate of production enterprises in China have a strong demand for funds from outside as they usually have low level of accumulation. At present the supply of funds from outside enterprises mainly comes from commercial bank. It places great pressure on the credit control by commercial banks and thecentral bank and is harmful to the central bank’s control on the money supply.●Less developed financial markets with fewer types and amount of financial assets. As there is fewer types and amount of financial assets it’s difficult for the open market operation to play its role in regulating macro-economy. To sum up, the central bank’s experience in managing macro economy has been richer and its ability to adapt to new environment has become stronger with the deepening of China’s economic and financial reform. Though there are short points existing in both micro-entities and the central bank, it-is true to the fact that the operation of monetary policy in China is becoming more and more experienced. 来源:考。

金融英语业务知识练习试卷20(题后含答案及解析)题型有:1.54B.RMB1 000C.RMB951.98D.RMB1 037.62正确答案:A解析:答案为A项。

决定债券价格的根本因素是债券息票收入和到期票面价值的现值总和,通常市场利率若等于债券的票面利率,则债券平价(ac par)销售;若市场利率高于债券的票面利率,则债券折价销售(below par);若市场利率低于债券的票面利率,则债券溢价销售(above par)。

本题的债券销售价格为:l 000×10%/(1+8%)+1 000×10%/ (1+8%)2+l 000><10%/(1+8%)3+1 000/(1+8%)3=l054。

故本题选A项。

知识模块:金融英语业务知识5.Which of the following is a reason why a company might issue a stock dividend?______.A.To show that the company is performing wellB.To give stockholders a nontaxable distributionC.To increase the shares outstanding, while keeping the price per share low enough to attract small investorsD.All of the above正确答案:D解析:答案为D项。

stock dividend“股份股利,股票股利”,即上市公司以本公司的股票代替现金作为股利向股东分红的一种形式。

这种分红形式即送红股的形式。

所送红股是由红利转增资本或盈余公积金转增资本形成的,属于无偿增资发行股票。

股票股利的发放显示了发行公司经营状况良好;股票股利是免所得税的;股票股利的发放将使每股市场价保持在较低的价位,以吸引小投资者,增加发行在外的股票数量。

银行金融英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a type of financial instrument?A. StockB. BondC. DerivativeD. Insurance答案:D2. The term "leverage" in finance refers to:A. The use of borrowed money to investB. The process of selling goodsC. The act of buying and selling securitiesD. The ability to predict market movements答案:A3. What does "NPV" stand for in financial analysis?A. Net Present ValueB. Net Profit ValueC. New Product ValueD. None of the above答案:A4. A "bear market" is characterized by:A. A long period of rising pricesB. A long period of falling pricesC. A market with a lot of buyersD. A market with a lot of sellers答案:B5. The primary function of a central bank is to:A. Facilitate international tradeB. Regulate the money supplyC. Provide financial advice to individualsD. Manage a country's foreign exchange reserves答案:B6. What is the meaning of "LIBOR"?A. London Interbank Borrowed RateB. London International Banking OrganizationC. London International Business ReportD. London International Bond Offering Rate答案:A7. A "futures contract" is an agreement to:A. Buy or sell a specific commodity or financial instrument at a predetermined price at a specified time in the futureB. Exchange currencies at a set rateC. Invest in a mutual fundD. Purchase real estate答案:A8. "Forex" stands for:A. Foreign ExchangeB. Financial ExchangeC. Forward ExchangeD. Future Exchange答案:A9. What is the role of a "broker" in the financial market?A. To provide financial adviceB. To facilitate the buying and selling of securitiesC. To manage a portfolio of investmentsD. To underwrite securities答案:B10. "Risk management" in finance involves:A. Maximizing returns on investmentsB. Identifying, assessing, and prioritizing risks to minimize or avoid potential lossesC. Predicting market trendsD. Managing a company's cash flow答案:B二、填空题(每题1分,共10分)11. The process of converting future cash flows into their present value equivalents is known as _________.答案:Discounting12. An investment that is considered to have a low risk is often referred to as a _________.答案:Blue-chip13. The term "short selling" refers to the practice ofselling _________ that you do not own, with the hope of buying them back at a lower price.答案:Securities14. A financial institution that provides a variety of services such as deposits, loans, and wealth management is known as a _________.答案:Banking institution15. The _________ is a measure of a company's profitability, calculated as net income divided by revenue.答案:Profit margin16. An investor who believes that the price of a securitywill fall is known as a _________.答案:Bear17. The _________ is a type of investment account that allows individuals to invest in a range of assets without incurring capital gains tax.答案:Retirement account18. A financial statement that shows a company's assets, liabilities, and equity at a particular point in time is known as the _________.答案:Balance sheet19. The _________ is a measure of the return on an investment, expressed as a percentage of the investment.答案:Rate of return20. A _________ is a financial contract that obligates the buyer to purchase an asset, or the seller to sell an asset,at a predetermined future date and price.答案:Forward contract三、简答题(每题5分,共30分)21. Explain the concept of diversification in investment.答案:Diversification is a risk management strategy that involves spreading investments across various financial instruments, industries, and other categories to minimize the impact of any single investment's poor performance on the overall portfolio.22. What is the role of the Federal Reserve in the United States?答案:The Federal Reserve, often referred to as the Fed,is the central banking system of the United States. It playsa critical role in formulating and implementing monetary policy, supervising and regulating banks, maintaining the。

金融英语业务知识练习试卷30(题后含答案及解析) 题型有: 2. 单项选择题单项选择题1. A futures market participant might receive a margin call if he is______futures contracts and prices______.A.long...riseB.long...fallC.short...riseD.short...fallE.both B and C正确答案:E解析:答案为E项。

margin call“追加保证金通知”。

在期货市场上,指由于市场价格朝着不利客户的方向变化,而使得客户的保证金余额低于维持保证金水平时,经纪人向该客户发出的要求追加保证金的通知。

本题中B项和C项的情况如发牛,客户将遭受损失,因此,可能会接到追加保证金通知。

故本题选E 项。

知识模块:金融英语业务知识2.Suppose you have to deposit an initial margin of $2 000 on a futures contract and the maintenance margin level is $1 500. When the value of your account drops to $1 400, you are requested to deposit an additional______to avoid position liquidation.A.$100B.$600C.500D.900正确答案:B解析:答案为B项。

当期货交易者连连亏损,保证金余额不足最低维持水平时,经纪人发…追加保证金通知,要求交易者在规定时间内追交保证金直达初始保证金水半,而非维持保证金水平。

如果交易者不能补足保证金,交易者的期货合约将被平仓(liquidation)了结。

本题之意:交易者必须补足的保证金=$2 000一$l 400=$600,故选B项。

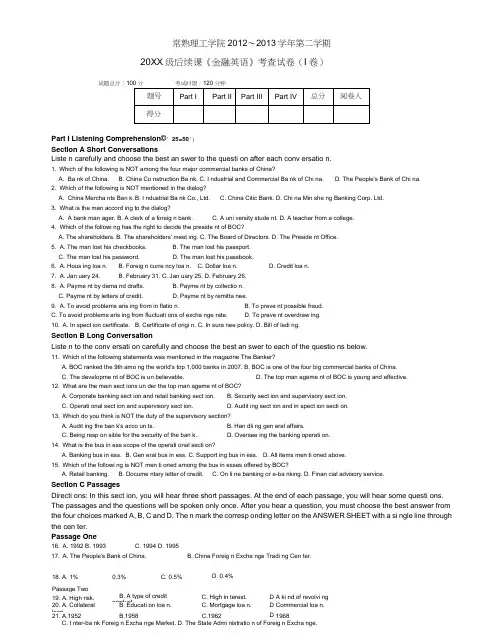

常熟理工学院2012〜2013学年第二学期20XX 级后续课《金融英语》考查试卷(I 卷)试题总分:Part I Listening Comprehension©' 25=50')Section A Short ConversationsListe n carefully and choose the best an swer to the questi on after each conv ersatio n.1. Which of the following is NOT among the four major commercial banks of China?A. Ba nk of China.B. China Co nstruction Ba nk.C. I ndustrial and Commercial Ba nk of Chi na.D. The People's Bank of Chi na.2. Which of the following is NOT mentioned in the dialog?A. China Mercha nts Ban k.B. I ndustrial Ba nk Co., Ltd.C. China Citic Bank.D. Chi na Min she ng Banking Corp. Ltd. 3. What is the man accord ing to the dialog?A. A bank man ager.B. A clerk of a foreig n bank.C. A uni versity stude nt.D. A teacher from a college.4. Which of the followi ng has the right to decide the preside nt of BOC?A. The shareholders.B. The shareholders' meet ing.C. The Board of Directors.D. The Preside nt Office.5. A. The man lost his checkbooks.B. The man lost his passport.C. The man lost his password.D. The man lost his passbook. 6. A. Hous ing loa n.B. Foreig n curre ncy loa n.C. Dollar loa n.D. Credit loa n. 7. A. Jan uary 24. B. February 31. C. Jan uary 25. D. February 26.8. A. Payme nt by dema nd drafts. B. Payme nt by collectio n.C. Payme nt by letters of credit.D. Payme nt by remitta nee. 9. A. To avoid problems aris ing from in flatio n.B. To preve nt possible fraud.C. To avoid problems aris ing from fluctuati ons of excha nge rate.D. To preve nt overdraw ing. 10. A. In spect ion certificate. B. Certificate of origi n. C. In sura nee policy. D. Bill of ladi ng.Section B Long ConversationListe n to the conv ersati on carefully and choose the best an swer to each of the questio ns below.11. Which of the following statements was mentioned in the magazine The Banker?A. BOC ranked the 9th amo ng the world's top 1,000 banks in 2007.B. BOC is one of the four big commercial banks of China.C. The developme nt of BOC is un believable.D. The top man ageme nt of BOC is young and effective. 12. What are the main sect ions un der the top man ageme nt of BOC?A. Corporate banking sect ion and retail banking sect ion.B. Security sect ion and supervisory sect ion.C. Operati onal sect ion and supervisory sect ion.D. Audit ing sect ion and in spect ion secti on. 13. Which do you think is NOT the duty of the supervisory section?A. Audit ing the ban k's acco un ts.B. Han dli ng gen eral affairs.C. Being resp on sible for the security of the ban k..D. Oversee ing the banking operati on. 14. What is the bus in ess scope of the operati onal secti on?A. Banking bus in ess.B. Gen eral bus in ess.C. Support ing bus in ess.D. All items men ti oned above.15. Which of the followi ng is NOT men ti oned among the bus in esses offered by BOC?A. Retail banking.B. Docume ntary letter of credit.C. On li ne banking or e-ba nking.D. Finan cial advisory service. Section C PassagesDirecti ons: In this sect ion, you will hear three short passages. At the end of each passage, you will hear some questi ons. The passages and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked A, B, C and D. The n mark the corresp onding letter on the ANSWER SHEET with a si ngle line through the cen ter.Passage One16. A. 1992 B. 1993 C. 1994 D. 199517. A. The People's Bank of China. B. China Foreig n Excha nge Tradi ng Cen ter.C. I nter-ba nk Foreig n Excha nge Market.D. The State Admi nistratio n of Foreig n Excha nge.18. A. 1%0.3% C. 0.5% Passage Two19. A. High risk. B. A type of credit product. 20. A. Collateral loan. B. Educati on loa n.21. A.1952 B.1958 D. 0.4% C. High in terest. D . A ki nd of revolvi ng loa n C. Mortgage loa n. D . Commercial loa n. C.1962 D . 1968C. Public con fide nce in the in surers rema ined low.D. A rise in Tokyo stock helped improve the bala nce sheets of life in surers.Part II. Reading Comprehension (30 ')Section A (1 '*10=10 ')Directions: Each of the following sentences is provided with four choices. Choose the one that best completes the sentence.26. Although the compa ny showed a profit, the bala nce sheet looks in creas in gly .A. brightB. dimC. shallowD. fragile 27. _ money refers to curre ncy issued on the basis of ban k's credit in stead of gold reserve. A. Fair B. Fiduciary C. FixedD. Deposit 28. In creased flows of world capital inten sify finan cial competiti on among n ati ons. This trend places pressures on n ati onal gover nment to their domestic markets and liberalize intern ati onal capital moveme nts.A. removeB. settleC. deregulateD. con trol 29. Many finan cial tran sacti ons are _ sheet items such as in terest rate swaps and are not clearly ide ntified through the usual report ingcha nn els.A. zeroB. capitalC. off-bala nceD. major30. The ban kers _ the steel compa ny's new shares, which means the share issue will be sold to the ban kers in stead of the public directly. A. un derwrite B. un dercharge C. un dertakeD. un derestimate 31. With no in terest rate _ on deposits or restrict ions on maturities, banks can offer any deposit product customers dema nd. A. cutB. ceili ngsC. dema ndD. con tract 32. From ban k's perspective, liabilities have become more in terest elastic, so that small rate cha nges can produce large fluctuati ons in bala nces.A. outsta ndingB. outreach ingC. rema iningD. dema nding33. Checks are attractive because they are readily accepted and provide formal _______________ of payment. A. credit B. verificati onC. clarityD. collectio n 34. Normally, ____ capital loans are secured by accounts receivable or by pledges of inventory and carry a floating interest rate on theamounts actually borrowed aga inst the approved credit line.A. curre ntB. stockC. work ingD. Ion g-term35. Dealers in gover nment and private securities n eed short-term financing to purchase new securities and carry their exist ing portfolios ofsecurities un til those securities are sold to customers or reach ________ .A. bus in essB. marketsC. maturityD. objectiveSection B (2*10=20 * Directi ons: Read the passages and choose the right an swer for each questio n.Passage 1Text ?36. How many types of banks or banking in stitutio ns are men ti oned in the lecture?A. 5.B. 4.C. 52.D. 183.37. Which of the follow ing is NOT a join t-equity commercial bank? A. China Min she ng Ba nki ng Corp. Ltd. B. Bank of East Asia.C. China Citic Bank.D. Bank of Commun icati ons.38. How many bran ches and sub-bra nches have foreig n banks set up in China accord ing to the speaker?A. 264.B. 177.C. 183.D. 235. 39. Which of the follow ing was once ran ked amon gst the top three stron gest banks in Chin a's mainland?A. Chi na In dustrial Ba nk.B. Ba nk of East Asia.C. China Mercha nts Ba nk.D. Sha nghai Pudo ng Developme nt Ban k.40. Which of the following is a wholly foreign-owned bank?A. Chi na Min she ng Ba nki ng Corp., Ltd.B. Chi na Citic Bank.C. Hong Kong & Shan ghai Banking Corporati on Limited.D. China Export & Import Bank.Passage 2Liabilities are "outsider claims ” , whiche economic obligations, debts payable to outsiders. These outside parties are called creditors.Financial statement users such as creditors are interested in the due dates of an entity's liabilities. The sooner a liability must be paid, the more curre nt it is. Liabilities that must be paid on the earliest future date create the greatest stra in on cash. Therefore, the bala nce sheet lists liabilities in the order in which they are due. Knowing how many of a bus in ess's liabilities are curre nt and how many are Ion g-term helps creditors assess the likelihood of collecting from the entity. Balance sheets usually have at least two liability classifications: current liabilities and Iong-term liabilities.Current liabilities are debts that are due to be paid with in one year or with the en tity's operati ng cycle. Notes payable due with in one year, salary 22. A. It is a ki nd of short-term loa n.C. It is supposed to pay back at one time.Passage Three23. A. A rise in Tokyo stock.B. It is also called bridge loa n. D. Its maturity exceeds five years.C. Negative spread.24. A. Rise. B. Fall. 25. A. The value of outsta nding policies went dow n. B. Japa n's life in sura nee firms. D. Japa nese life in surers' difficult situati on.C. Rema in un cha nged.D. Not sure. B. Life in surers' n egative spreads ten ded to grow small.payable, unearned reve nue, and in terest payable owed on no tes payable are curre nt liabilities.Long-term liabilities are those liabilities other than current ones.41. The liabilities are classified as current or Iong-term liabilities according to _ .A. the liquidity of the liabilityB. the future date when the liability must be paidC. the operati ng cycleD. one year42. Liabilities are __ .A. money borrowed from banksB. money received from creditorsC. "outsider claims ” which are economic obligations, debts payable to outsidersD. notes receivable43. Which of the followi ng is current liability?A. cashB. inventoryC. salary payableD. money from the bank44. Which of the following is Iong-term liability?A. debt payable due with 10 yearsB. inven toryC. unearned revenueD. note payable due withi n 6 mon ths45. For a note payable to be paid in in stallme nts with in 5 years, which of the follow ing stateme nts is correct?A. The first installment due within one year is a current liability.B. The first installment due within one year is a Iong-term liability.C. All the in stallme nts due are Ion g-term liabilities.D. All the in stallme nts due are curre nt liabilities.Part ill. Translation (2‘ *=10')Part IV. Writing (10 ')Directions: You are asked to write a report on Bank of China with 120 words to make the brief introduction of BOC s orga ni zati ons and developme nt.。

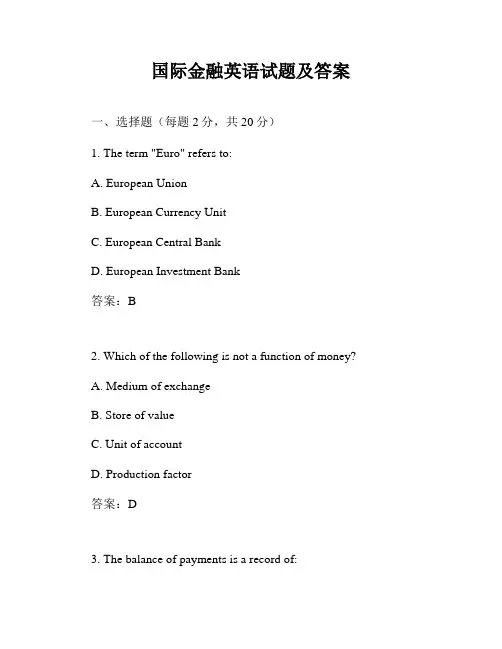

国际金融英语试题及答案一、选择题(每题2分,共20分)1. The term "Euro" refers to:A. European UnionB. European Currency UnitC. European Central BankD. European Investment Bank答案:B2. Which of the following is not a function of money?A. Medium of exchangeB. Store of valueC. Unit of accountD. Production factor答案:D3. The balance of payments is a record of:A. All international transactionsB. All international tradeC. All international financial flowsD. All international investments答案:A4. In international finance, the term "hot money" refers to:A. Money invested in foreign countriesB. Money invested in risky assetsC. Money that moves quickly in and out of countriesD. Money used for illegal activities答案:C5. The International Monetary Fund (IMF) was established to:A. Promote world tradeB. Facilitate the development of member countriesC. Promote international monetary cooperationD. Regulate global financial markets答案:C6. The process of converting one currency into another is known as:A. ArbitrageB. HedgingC. ExchangeD. Speculation答案:C7. A country's current account balance includes:A. Trade balanceB. Capital accountC. Financial accountD. All of the above答案:D8. The exchange rate between two currencies is the price of one currency in terms of the other. This is known as:A. Bid priceB. Ask priceC. Spot rateD. Forward rate答案:C9. Which of the following is not a type of international financial market?A. Foreign exchange marketB. Money marketC. Bond marketD. Retail market答案:D10. The Bretton Woods system was established in:A. 1944B. 1945C. 1946D. 1947答案:A二、填空题(每题2分,共20分)11. The ________ is the largest market for trading currencies in the world.答案:Foreign exchange market12. A ________ is a financial instrument that represents an obligation to repay a loan.答案:Bond13. The ________ is a system of fixed exchange rates where each currency is pegged to gold.答案:Gold standard14. A ________ is a financial institution that accepts deposits, extends credit, and performs other financial services.答案:Bank15. The ________ is the process of converting a company's financial statements from one currency to another.答案:Translation exposure16. The ________ is the risk that the value of a currency will change due to market forces.答案:Exchange rate risk17. A ________ is a financial instrument that allows the holder to buy or sell an asset at a specified price on or before a certain date.答案:Option18. The ________ is the risk that a borrower will default on a loan.答案:Credit risk19. A ________ is a financial institution that provides insurance and investment products.答案:Insurance company20. The ________ is the risk that the value of an investment will change due to changes in interest rates.答案:Interest rate risk三、简答题(每题10分,共30分)21. Explain the concept of "floating exchange rates."答案:Floating exchange rates refer to a system where currency values are determined by market forces of supply and demand. In this system, central banks do not intervene to maintain a fixed exchange rate, allowing the currency to fluctuate freely against other currencies.22. What are the main functions of the World Bank?答案:The main functions of the World Bank include providing financial and technical assistance to developing countries for development projects, promoting economic development, and reducing poverty. It also offers policy advice and knowledge sharing to help countries achieve sustainable development.23. Describe the role of the International Monetary Fund (IMF) in global finance.答案:The International Monetary Fund (IMF) plays a crucial role in global finance by providing financial assistance to countries facing balance of payments issues, monitoring the global economy and exchange rates, and offering policy advice to its member countries. It also promotes international monetary cooperation and financial stability.四、论述题(共30分)24. Discuss the impact of globalization on international finance.答案:Globalization has significantly impacted international finance by increasing the flow of capital across borders, leading to the integration of financial markets, and fostering the growth of multinational corporations. It has also led to the development of new financial instruments and services, as well as increased competition among financial institutions. However, globalization has also raised concerns about financial stability, as it can lead to contagion effects during crises and exacerbate income inequality.25. Analyze the benefits and challenges of international trade.答案:International trade offers numerous benefits, such as access to a wider variety of goods and services, economies of scale, and increased competition, which can lead to lower prices and higher quality products. It also promotes economic growth, job creation, and the transfer of technology. However, international trade also presents challenges, including job displacement due to competition, environmental concerns, and the potential for trade imbalances that can lead to economic instability.26. Explain the importance of risk management in international finance.答案:Risk management is crucial in international finance as it helps financial institutions and corporations to identify, assess, and mitigate various types of risks, such as exchange rate risk, credit risk, and interest rate risk. Effective risk management strategies can protect against financial losses, maintain stability, and ensure the long-term viability of businesses operating in the global market. It also enables institutions to make informed decisions and allocate resources efficiently.。

金融英语练习题一、词汇填空1. The company's stock price has been quite ________ due to the economic downturn.A. volatileB. stableC. predictableD. consistent2. The ________ of the company's financial statements is crucial for investors to make informed decisions.A. accuracyB. relevanceC. timelinessD. All of the above3. The ________ market has been experiencing significant growth in recent years.A. emergingB. matureC. decliningD. stagnant4. The company's ________ strategy involves diversifying its investments across various sectors.A. hedgingB. expansionC. consolidationD. diversification5. The ________ rate is a key indicator of a country's economic health.A. inflationB. unemploymentC. GDP growthD. interest二、阅读理解Read the following passage and answer the questions:The global financial market has been experiencing a period of uncertainty due to various geopolitical events. Investors are increasingly looking for ways to mitigate risks and protect their portfolios. One approach that has gained popularity is the use of derivatives, which allow investors to hedge against potential losses. These financial instruments can be complex and require a deep understanding of the underlying assets and market dynamics.1. What is the main reason for the uncertainty in the global financial market?A. Economic downturnB. Geopolitical eventsC. High inflation ratesD. Low interest rates2. What are investors looking for in the current marketconditions?A. High-risk investmentsB. Ways to increase returnsC. Ways to mitigate risksD. Stable investments3. What is the purpose of using derivatives in the context of the passage?A. To increase potential gainsB. To speculate on market movementsC. To hedge against potential lossesD. To simplify financial instruments4. What is required to effectively use derivatives?A. Basic knowledge of financial marketsB. A deep understanding of the underlying assets and market dynamicsC. A focus on short-term gainsD. A disregard for market risks三、完形填空The financial crisis of 2008 was a turning point for the global economy. It exposed the vulnerabilities in the financial system and led to a reevaluation of risk management practices. Banks and other financial institutions were forced to ________ their lending practices and increase theircapital reserves to ensure stability. Governments around the world also had to ________ their regulatory frameworks to prevent future crises. The crisis highlighted the importance of ________ and transparency in financial markets, which hasled to a greater focus on these areas in recent years.A. tightenB. loosenC. strengthenD. weaken四、翻译请将以下句子翻译成英文:1. 投资者应该密切关注市场动态,以便及时做出投资决策。

金融英语模拟题(二)T2P1-Listening金融英语模拟题(二)听力1.A. Financial markets must support sound financial institutions.B. Sound financial institutions are made by financial markets.C. Financial markets should be backed by strong financial institutions.D. Financial markets are sound because of financial institutions.2.A. US dollar is going higher vs. Japanese Yen.B. US dollar is going higher vs. Pound Sterling.C. US dollar is going lower vs. Japanese Yen.D. US dollar is going lower vs. Deutsche Mark.3.A. Please remit us the bill amount through Barclay's bank on due date.B. Please claim the bill amount on Barclay's Bank on due date.C. Please pay the bill amount to Barclay's Bank.D. Please inform Barclay's Bank to reimburse us on due date.4.A. The People's Bank of China may not provide loans for organizations or individuals.B. The People's Bank of China may not give financial support to enterprises.C. The People's Bank of China may act as a financial guarantor fororganizations or individuals.D. The People's Bank of China may not effect a financial guarantee forindividuals or organizations.5.A. Policy is the only factor that affects stock prices.B. Policy is one factor that affects stock prices.C. Monetary policy is one of the factors that affect stock prices.D. Monetary policy is the only factor that affects stock prices.6.A. I wish to cash some cheques.B. I wish to cash some traveler's cheques.C. I wish to pay cash for my expenses here.D. I wish to pay for my traveller's cheques here.7.A. The L/C will be confirmed by our bank.B. Our bank's agent will confirm the L/C.C. The credit will be opened by our bank's agent.D. Our branch in San Francisco will confirm the L/C.8.A. U.S. dollar is dearer.B. U.S. dollar is higher.C. Japanese yen is weaker.D. Japanese yen is stronger.9.A. The draft is a sight one.B. The draft is payable by Citibank.C. The bill is drawn on Citi Branch.D. The bill is not negotiable.10.A. We paid you early as required.B. Your documents came to us as required.C. Your documents have been correctly presented as required.D. You did not present the documents as required.Section Two (10%)Directions: In this section, you will hear 10 short conversations. At the end of each conversation a question will be asked about what was said. The conversations and questions will be spoken only once. During the pause, you must read the four suggested answers marked a, b, c, and d, and decide which is the best answerNow you will hear :M: Does our bank have a direct correspondent relationship with the Bradalys' Bank?W:No, we don't. So we have to advise this L/C via another bank.Q: Which of the following is right?Now you will read:A. We can advise this L/C to the Bradlays' Bank.B. The Bradlays' Bank is our correspondent.C. The L/C has to be advised by a third bank.D. We should advise this L/C by ourselves.From the conversation we know that we have to advise this L/C via another bank. The best answer is C. Therefore you should choose answer C.11.A. To apply for rolling over the loan for another period.B. To default on repayment.C. To repay it immediately.D. To apply for a new loan.12.A. 827.28B. 829.19C. 826.71D. Not mentioned.13.A. He sold a house.B. He borrows some money from the man.C. He borrowed some money from the bank.D. He visited a new house.14.A. She pays a visit to the bank.B. She deals with a transaction with her customer.C. She wants to check Parks' cash and transactions of the day.D. She pays a visit to the Auditing Department.15.A. About remitting money.B. About getting a bill of exchange.C. About discounting a bill of exchange.D. About quotation of buying rate.16.A. she definitely accepted the request.B. She will not do what the man requested.C. She will use her car.D. She definitely refused the request.17.A. How to get a ticket to Paris.B. How to go to Paris.C. How to transfer money to Paris.D. How to fill the form.18.A. To open a current account.B. To open a savings account.C. To cash her cheques.D. To draw money from her savings account.19.A. 5%B. 3%C. 8%D. 6%20.A. The interest rate will be lowered.B. The interest rate will be stable.C. The interest rate will increase.D. The interest rate will be floating.Section Three (10%)Directions: In this section, you will hear 3 short passages. At the end of each passage you will hear some questions about what was said. The passages and questions will be spoken only once. During the pause, you must read the four suggested answers marked a, b, c, and d, and decide which is the best answer Questions 21--23 are based on passage 121.A. 4:00 p.m.B. 5:30 p.m.C. 6:00 p.m.D. 6:30 p.m.22.A. He goes to concerts.B. He visits his friends.C. He meets his customers.D. He works at home.23.A. The bank's staff.B. The bank's location.C. The bank's long hours of services.D. The bank's balance sheet.Questions 24-26 are based on passage 224.A. Short term loans without guarantees by banks.B. Long term loans without guarantees by their respective governments.C. Long term loans under guarantees by their respective governments.D. Medium term loans under guarantees by their respective banks.25.A. International banks.B. industrial nations.C. Syndicates of international banks.D. Developed countries.26.A. Yes, they are.B. No, they are not.C. Yes, they are. They represent unusual risk to banks.D. No, they are not. They represent usual risk to banks.Questions 27-30 are based on Passage 327.A. 146B. 159C. 194D. 16828.A. US$ 32.1 billionB. US$ 37.4billion.C. US$ 27.3 billion.D. US$ 4.8 billion.29.A. Allowing more foreign banks to do RMB business in Pudong.B. Extending the experimentation to Shenzhen.C. Increasing the limit on the RMB position of the foreign banks on a case-by-case basis.D. All of the above.30.A. To introduce new products and expertise.B. To improve efficiency in financial intermediation.C. To introduce more foreign capital into China.D. Both A and B。

考试题型I.Choose the best answer to complete the passages below.(two passages) (每小题1分,共1分×10题=10分)II.Read the following passages and determine whether the sentences are "Right" or "Wrong". If there is not enough information to answer "Right" or "Wrong", choose "Not mentioned".(3 passages)(每小题1分,共1分×10题=10分)III.There are 3 passages in this section. Each passage is followed by some questions or unfinished statements. For each of them there are four choices marked A, B, C, and D.You should make the best choice. (每小题2分,共2分×15题=30分)(3 passages)IV.Match the terms with their definitions. (每小题1分,共10分)V.Translation. (40分)Section A. Put the following terms into Chinese. (每小题2分,共10分)Section B. Put the following terms into English. (每小题2分,共10分)Section C. Put the underlined parts into Chinese.(每小题10分,共20分)参考术语、释义及短文1. a rental property2.APR (annual percentagerate)3.ATM4.Bank Cards5.Branch Banking6.collateralmercial Banks8.Corporate banking9.cover (v.)10.Credit Cards11.Currency exchange12.current accounts13.current deposit14.Debit Cards15.deflation16.deposit17.depreciate (v.) 18.down payment19.fixed accounts20.foreclosure21.foreign exchange22.inflation23.Installment24.Insurance policy25.Insurer26.interest rate27.Internet Banking28.investment29.Joint-equity commercialbanks30.loans31.mature (v.)32.Mobile Banking33.Mortgage loan34.Opening an account35.Overdraft36.Personal banking37.Personal Banking38.PIN(personalidentification number )39.Policy Banks40.Portfolio41.principal42.repayment43.real estate44.savings account45.secured loans46.Stock Market47.Telephone Banking48.The Central Bank49.unsecured loans50.withdraw (v.)1.money or property which is used as a guarantee that someone will repay a loan.2.foreign currency that is obtained through the foreign exchange system.3. a bank card that you can use to pay for things. When you use it the money is taken out ofyour bank account immediately.4. a contract (generally a standard form contract) between the insurer and the insured, known asthe policyholder, which determines the claims which the insurer is legally required to pay.5.banking that requires banking institutions to carry out business transactions and dealingsdirectly with their customers and the consumers of their products, rather than directly with other banks or corporations.6. a sum of money which is in a bank account or savings account, especially a sum which willbe left there for some time.7.the combination of investments that a particular person or company owns.8. a specific legal process in which a lender attempts to recover the balance of a loan from aborrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.9.the original amount of the loan, on which you pay interest.10. a thing that is borrowed, especially a sum of money that is expected to be paid back withinterest11. a general increase in the prices of goods and services in a country.12.to take out money from a bank13.(of a loan, security, etc)to reach the end of its term and be due for payment14.to lose in value15.to protect by insurancePassage 1There are two main kinds of loans - secured and unsecured loans. The key difference between the two types of loans is that with secured loans you are required to provide security or collateral against the amount you are borrowing whereas an unsecured loan does not. But the difference does not end there. Each type of loan entails different repayment terms and interest rates and depending on your circumstances one or the other may be a better choice for you.Secured loans entail the borrower providing some form of security to the lender, like a home or car. If you cannot repay the loan this may mean the loss the home or car as the lender seeks to recover the amount they lent you and the interest on the loan. Secured loans usually give you the option of higher borrowing limits and lower interest rates and are generally easier to obtain. The amount you can borrow will be partly determined by the value of the asset you are borrowing against. Secured loans are sometimes called Homeowner loans.Unsecured loans do not require any form of collateral so you will not lose your house or car if you cannot keep up with payments. The lender will make a decision to give you a loan based on your income and your credit history. Common types of unsecured loans include Personal loans, student loans and payday loans. Unsecured loans typically carry a higher interest rate than secured loans.担保贷款要求借款人提供某种形式的抵押品给贷款人,如房子或车辆。

打印版-金融英语测试题自测 第一章: 1、equity(股本)

2、financial system

3、portfolio(投资组合)

4、bond

5、stock

1. another way for Intel to raise funds to build a new semi-conductor factory is to sell stock in the company. Stock represents ownership in a firm and is, therefore a claim to the profits that the firm makes. For example, if Intel sells a total of 1000000 shares of stocks, then share represents ownership of 1/1000000 of the business

2. A mutual fund is an institution that sells

shares to the public and uses the proceeds to buy a selection, or portfolio, of various types of stocks, bonds, or both stocks and bonds. The shareholder of the mutual fund accepts all the risks and returns associated with the portfolio. If the value of the portfolio rises, the shareholder benefits, if the value of the portfolio falls, the shareholder suffers the loss.

第二章: 1、commodity money

2、fiate money

3、bank note

4、Treasury Bill

5、money supply

Most countries today have an “independent” central bank, that is, one which operates under rules designed to prevent political interference. Examples include the European Central Bank, the US Federal Reserve, the Reserve Bank of Australia, the Reserve Bank of India, the Bank of England, the Bank of Canada, etc. Some central banks are publicly owned, and others are, in theory, privately owned. In practice, there is little difference between public and private ownership, since in the latter case almost all profit of the bank are paid to the government either as a tax or a transfer to the government.

Central banks implement a country's chosen monetary policy. At the most basic level, this involves establishing what form of currency the country may have, whether a fiat currency, gold-backed currency ( disallowed for countries with membership

of the IMF ), currency board or a currency union. When a country has its own national currency, this involves the issue of some form of standardized currency, which is essentially a form of promissory note: a promise to exchange the note for “money” under certain circumstances.

第三章: Interest rate

Inflation

monetary policy

Federal Reserve Act

Discount loan

Serious disagreements existed over whether the central bank should be a private bank or

a government institution. Because of the heated debates on these issues, a compromise was struck. In American tradition, Congress wrote an elaborate system of checks and balances into the Federal Reserve Act of 1913, which created the Federal Reserve System with its 12 regional Federal Reserve Banks.

All national banks (commercial banks chartered by the Office of the Comptroller of the Currency) are required to be members of the Federal Reserve System. Commercial banks chartered by the states are not required to be members, but they can choose to join. Currently, around one third of the commercial banks in the United Stated are members of the Federal Reserve System, having declined from a peak figure of 49% in 1947.

第四章: Exchange rate

Consolidation payment and settlement system

China Banking Regulatory Commission

deposit insurance

在国务院的领导下,中国人民银行依法独立实施货币政策、履行人行职能、开展人行业务,其决策不受地方政府、各级政府部门、公共组织或者任何个人的影响

Faced with the complicated and severe economic situation both at home and abroad, in line with the changing situation, the PBC,

under the leadership of the CPC Central Committee and the State Council, resolutely studied and implemented the scientific development approach, earnestly fulfilled its responsibilities as the central bank, responded promptly to the intense impact of the international financial crisis, pressed ahead with developing the coordination mechanism for financial regulation, strengthened the monitoring and assessment of financial risks, speeded up the designing of the deposit insurance system, enhanced