英文财务报表(模板)

- 格式:xls

- 大小:62.00 KB

- 文档页数:1

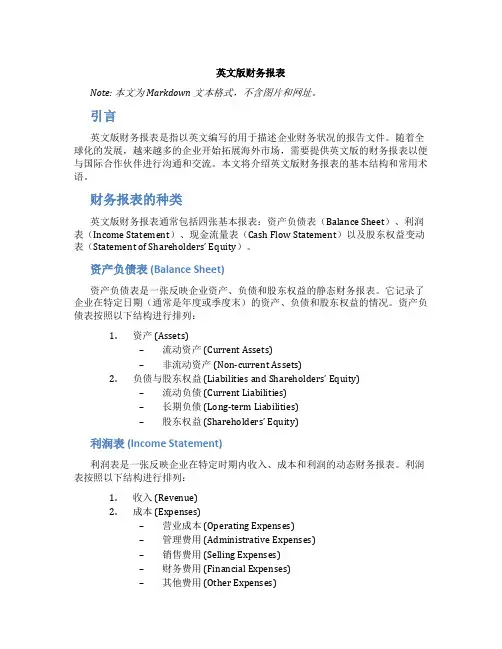

英文版财务报表Note: 本文为Markdown文本格式,不含图片和网址。

引言英文版财务报表是指以英文编写的用于描述企业财务状况的报告文件。

随着全球化的发展,越来越多的企业开始拓展海外市场,需要提供英文版的财务报表以便与国际合作伙伴进行沟通和交流。

本文将介绍英文版财务报表的基本结构和常用术语。

财务报表的种类英文版财务报表通常包括四张基本报表:资产负债表(Balance Sheet)、利润表(Income Statement)、现金流量表(Cash Flow Statement)以及股东权益变动表(Statement of Shareholders’ Equity)。

资产负债表 (Balance Sheet)资产负债表是一张反映企业资产、负债和股东权益的静态财务报表。

它记录了企业在特定日期(通常是年度或季度末)的资产、负债和股东权益的情况。

资产负债表按照以下结构进行排列:1.资产 (Assets)–流动资产 (Current Assets)–非流动资产 (Non-current Assets)2.负债与股东权益(Liabilities and Shareholders’ Equity)–流动负债 (Current Liabilities)–长期负债 (Long-term Liabilities)–股东权益(Shareholders’ Equity)利润表 (Income Statement)利润表是一张反映企业在特定时期内收入、成本和利润的动态财务报表。

利润表按照以下结构进行排列:1.收入 (Revenue)2.成本 (Expenses)–营业成本 (Operating Expenses)–管理费用 (Administrative Expenses)–销售费用 (Selling Expenses)–财务费用 (Financial Expenses)–其他费用 (Other Expenses)3.利润 (Profit) 或亏损 (Loss)现金流量表 (Cash Flow Statement)现金流量表是一张反映企业现金流入和流出情况的动态财务报表。

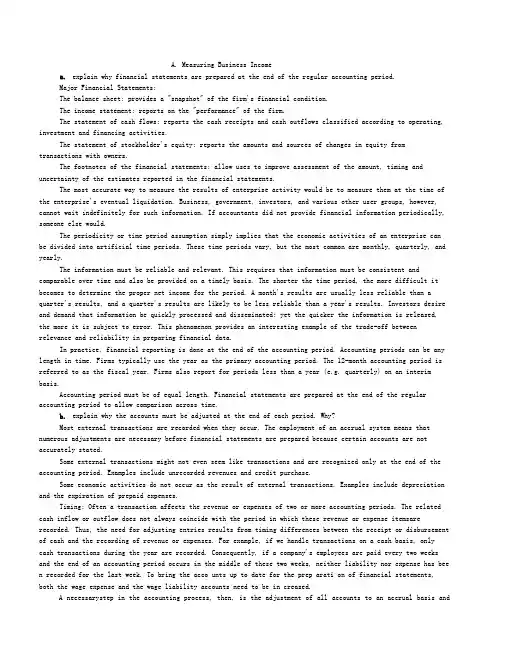

XX Co., Ltd.Annual Audit Report YZXXZ (2016) No. 2XX56XX Certified Public Accountants Co., Ltd.ContentI. Audit report Page 1-2II. Financial statements Page 3-6 (i) Balance Sheet Page 3 (ii) Income Statement Page 4 (iii) Cash Flow Statement Page 5 (iv) Change Statement of Owners’ Equity Page 6III. Explanatory notes of financial statements Page 7-23XX CERTIFIED PUBLIC ACCOUNTANTS CO., LTDAudit ReportYZXXZ (2016) No. 2XX56XX Co., Ltd.,We have audited the accompanying financial statements of XX Co., Ltd. (hereinafter referred to as “your company”), including the balance sheet as at December 31, 2015, the income statement, cash flow statement and cha nge statement of owners’ equity of 2015 as well as explanatory notes of financial statements.I. Management’s responsibility for the financial statementsManagement of your company is responsible for the preparation and fair presentation of financial statements. This responsibility includes: (1) preparing the financial statements and reflecting fair representation in accordance with provisions of the Accounting Standards for Business Enterprises; (2) designing, implementing and maintaining the necessary internal control in order to free financial statements from material misstatement, whether due to fraud or error.II. Auditor’s responsibilityOur responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with provisions of the Chinese Certified Public Accountants Auditing Standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether d ue to fraud or error. In making those riskassessments, the certified public accountants consider the internal control relevant to the preparation and fair presentation of the financial statements in order to design audit procedures that area appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.III. Audit opinionIn our opinion, the financial statements of your company have been prepared in accordance with provisions of the Accounting Standards for Business Enterprises in all material aspects, and present fairly the financial position of your company as of December 31, 2015 and the results of its operations and cash flows of 2015.XX Certified Public Accountants Co., Ltd. Chinese Certified Public A ccountant:Guangdong, China Chinese Certified Public A ccountant:February 29, 2016Balance SheetDecember 31, 2015KQ 011 yearOther current assetsTotal current assetsNon-current assets: Available for sale financial assetsHeld-to-maturity investments Long-term account receivable Long-term equity investment Investing real estateFixed assetProject in construction Engineering material Fixed asset disposal 7available liabilities for saleNon-current liabilities duewithin 1 yearOther current liabilitiesTotal current liabilitiesNon-current liabilities:Long-term borrowingsBonds payableIncluding: Preferred sharesPerpetual capital securitiesLong-term account payableLong-term employees’compensation payableSpecial payablesAccrued liabilitiesDeferred incomeDeferred tax liabilitiesOther non-current liabilitiesTotal non-current liabilitiesTotal liabilitiesOwners’ equity (orshareholders’ equity)Paid-in capital (or sharecapital)Other equity instruments16Income StatementYear of 2015KQ 024Cash Flow StatementYear of 2015KQ 035。

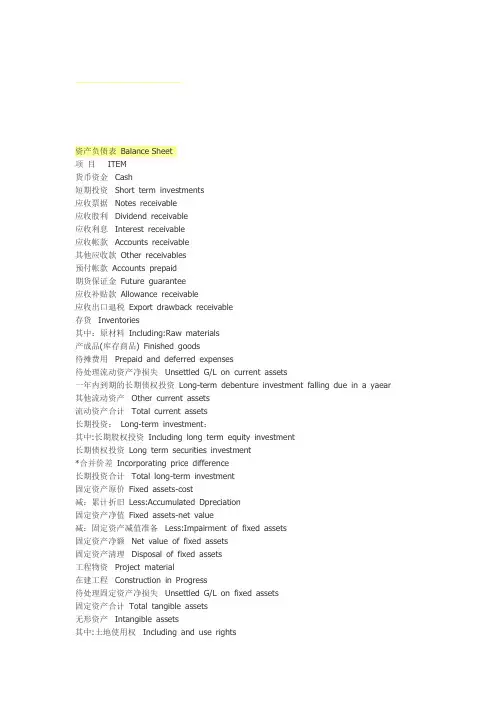

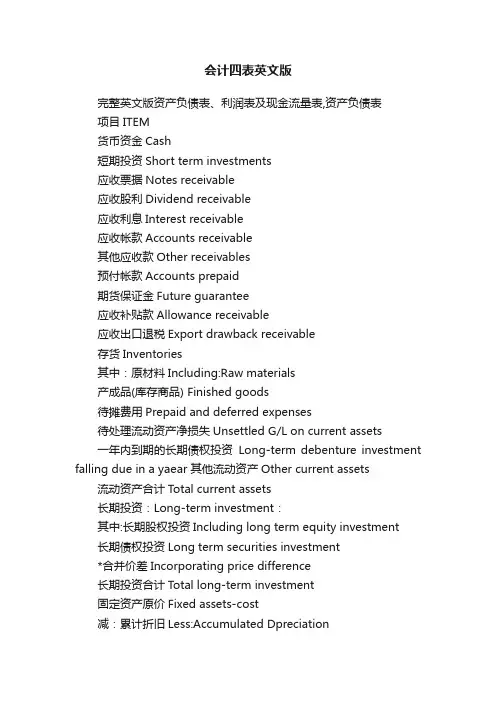

资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STATEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。

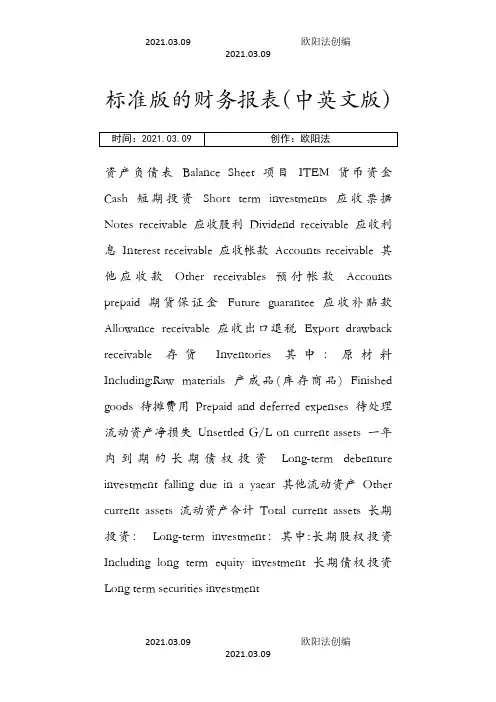

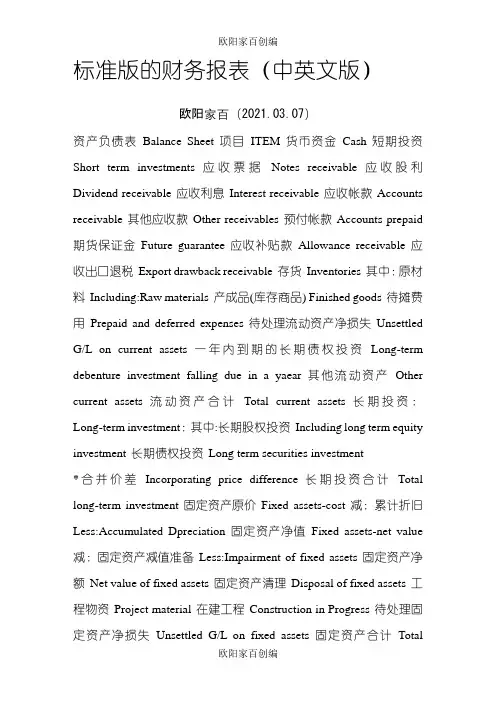

标准版的财务报表(中英文版)资产负债表Balance Sheet 项目ITEM 货币资金Cash 短期投资Short term investments 应收票据Notes receivable 应收股利Dividend receivable 应收利息Interest receivable 应收帐款Accounts receivable 其他应收款Other receivables 预付帐款Accounts prepaid 期货保证金Future guarantee 应收补贴款Allowance receivable 应收出口退税Export drawback receivable 存货Inventories 其中:原材料Including:Raw materials 产成品(库存商品) Finished goods 待摊费用Prepaid and deferred expenses 待处理流动资产净损失Unsettled G/L on current assets 一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets 流动资产合计Total current assets 长期投资:Long-term investment:其中:长期股权投资Including long term equity investment 长期债权投资Long term securities investment*合并价差Incorporating price difference 长期投资合计Total long-term investment 固定资产原价Fixed assets-cost 减:累计折旧Less:Accumulated Dpreciation 固定资产净值Fixed assets-net value 减:固定资产减值准备Less:Impairment of fixed assets 固定资产净额Net value of fixed assets 固定资产清理Disposal of fixed assets 工程物资Project material 在建工程Construction in Progress 待处理固定资产净损失Unsettled G/L on fixed assets 固定资产合计Total tangible assets 无形资产Intangible assets 其中:土地使用权Including and use rights 递延资产(长期待摊费用)Deferred assets 其中:固定资产修理Including:Fixed assets repair 固定资产改良支出Improvement expenditure of fixed assets 其他长期资产Other long term assets 其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets 递延税款借项Deferred assets debits 资产总计Total Assets 资产负债表(续表) Balance Sheet 项目ITEM 短期借款Short-term loans 应付票款Notes payable 应付帐款Accounts payab1e 预收帐款Advances from customers 应付工资Accrued payro1l 应付福利费Welfare payable 应付利润(股利) Profits payab1e 应交税金Taxes payable 其他应交款Other payable to government 其他应付款Other creditors 预提费用Provision for expenses 预计负债Accrued liabilities 一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities 流动负债合计Total current liabilities 长期借款Long-term loans payable 应付债券Bonds payable 长期应付款long-term accounts payable 专项应付款Special accounts payable 其他长期负债Other long-term liabilities 其中:特准储备资金Including:Special reserve fund 长期负债合计Total long term liabilities 递延税款贷项Deferred taxation credit 负债合计Total liabilities* 少数股东权益Minority interests 实收资本(股本) Subscribed Capital 国家资本National capital 集体资本Collective capital 法人资本Legal person"s capital 其中:国有法人资本Including:State-owned legal person"s capital 集体法人资本Collective legal person"s capital个人资本Personal capital 外商资本Foreign businessmen"s capital 资本公积Capital surplus 盈余公积surplus reserve 其中:法定盈余公积Including:statutory surplus reserve 公益金public welfare fund 补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss 未分配利润Retained earnings 外币报表折算差额Converted difference in Foreign Currency Statements 所有者权益合计Total shareholder"s equity 负债及所有者权益总计Total Liabilities & Equity================================== ==================================利润表INCOME STATEMENT 项目ITEMS 产品销售收入Sales of products 其中:出口产品销售收入Including:Export sales 减:销售折扣与折让Less:Sales discount and allowances 产品销售净额Net sales of products 减:产品销售税金Less:Sales tax 产品销售成本Cost of sales 其中:出口产品销售成本Including:Cost of export sales 产品销售毛利Gross profit on sales 减:销售费用Less:Selling expenses 管理费用General and administrative expenses 财务费用Financial expenses 其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains) 产品销售利润Profit on sales 加:其他业务利润Add:profit from other operations 营业利润Operating profit 加:投资收益Add:Income on investment 加:营业外收入Add:Non-operating income 减:营业外支出Less:Non-operating expenses 加:以前年度损益调整Add:adjustment of loss and gain for previous years 利润总额Total profit 减:所得税Less:Income tax 净利润Net profit ================================== ================================现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed 44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash Equivalents Supplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from OperatingActivities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash Equivalents Supplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from OperatingActivities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents 现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。

会计财务常用Excel表格-英文财务报表(一)Accounting and financial reporting are crucial for maintaining a company's financial stability. To achieve this, companies need to use various tools and technologies, with Excel being the most common one. In this article, we will discuss some of the commonly used Excel spreadsheets for financial reporting purposes.1. Income StatementThe income statement is one of the essential financial statements that summarises the revenue generated, expenses incurred and the resulting net income or loss for a company over a particular period. Excel provides an easy way to create and update an income statement using predefined formulas and formatting.2. Balance SheetA balance sheet is another critical financial report that summarises a company's financial position, including its assets, liabilities and equity. By using Excel, companies can quickly generate a well-formatted balance sheet that highlights the current financial standing of their business. This also helps to identify financial trends over time.3. Cash Flow StatementA cash flow statement is a financial report that shows the cash inflows and outflows for a business during a specific period. Excel provides several formula functions to make iteasier to create a cash flow statement and track cash flow movements. It allows financial managers to immediatelyidentify areas of concern and address them appropriately.4. Budgeting and Forecasting SpreadsheetBudgeting and forecasting are crucial components of financial planning and are best done using Excel spreadsheets. It enables companies to prepare estimates for future revenue and expenses and to track the actual performance against the budget. Excel has several templates for budgeting and forecasting spreadsheets which are easy to customise andadapt according to specific business needs.5. Financial Ratio AnalysisFinancial ratios are useful indicators of a company'sfinancial health, and Excel provides a range of templates for calculating and interpreting these ratios. This spreadsheet allows companies to analyse their financial performance by comparing different ratios with industry benchmarks, thereby identifying areas of strength and weakness.In conclusion, Excel is a powerful tool for financialanalysis that can be used to create a wide range of financial reports and analyses. By using these spreadsheets effectively, companies can identify trends, forecast future performanceand make informed decisions about financial planning and management.。

英文财务报表Introduction:Financial statements are essential documents that provide a comprehensive overview of a company's financial performance and position. In this article, we will delve into the different types of financial statements commonly used by companies and explore their key components in detail.1. Balance Sheet:The balance sheet, also known as the statement of financial position, provides a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time. It consists of three main sections: assets, liabilities, and equity. The assets section includes current assets, such as cash, accounts receivable, and inventory, as well as long-term assets like property, plant, and equipment. Liabilities encompass both current and long-term obligations, such as accounts payable, loans, and bonds. Shareholders' equity represents the residual value after deducting liabilities from assets.2. Income Statement:The income statement, also referred to as the statement of comprehensive income or profit and loss statement, details a company's revenues, expenses, gains, and losses over a certain period. It begins with the company's revenues, such as sales revenue and other operating income. Next, various expenses are deducted, including cost of goods sold, operating expenses, interest expenses, and income taxes. The resulting figure is the net income or net loss for the period.3. Cash Flow Statement:The cash flow statement tracks the inflow and outflow of cash and cash equivalents during a specific period. It is divided into three categories: operating activities, investing activities, and financing activities. Operating activities include cash flows from daily operations, such as cash received from customers and cash paid to suppliers. Investing activities relate to the acquisition or sale of long-term assets, such as property, plant, and equipment. Financing activities involve cash flows generated from or used for financing the company's operations, such as taking out loans or issuing stocks.4. Statement of Changes in Equity:The statement of changes in equity highlights the changes in shareholders' equity during a given period. It outlines the beginning and ending balances of equity and includes items such as net income, dividends, and additional investments made by shareholders.Conclusion:Financial statements play a vital role in assessing a company's financial health and performance. The balance sheet, income statement, cash flow statement, and statement of changes in equity provide different perspectives on a company's financial status. Investors, creditors, and other stakeholders rely on these statements to make informed decisions. Mastering the understanding and analysis of financial statements is crucial for individuals and businesses alike in managing their finances effectively.。

会计四表英文版完整英文版资产负债表、利润表及现金流量表,资产负债表项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets 流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets 其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials无形及其他资产合计Total intangible assets and other assets 递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital 集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investmentloss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计T otal shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STA TEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain forprevious years利润总额Total profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)V alue added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash/doc/2e18298201.html, Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve inCash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities/doc/2e18298201.html, Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金/doc/2e18298201.html,增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量/doc/2e18298201.html,增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。

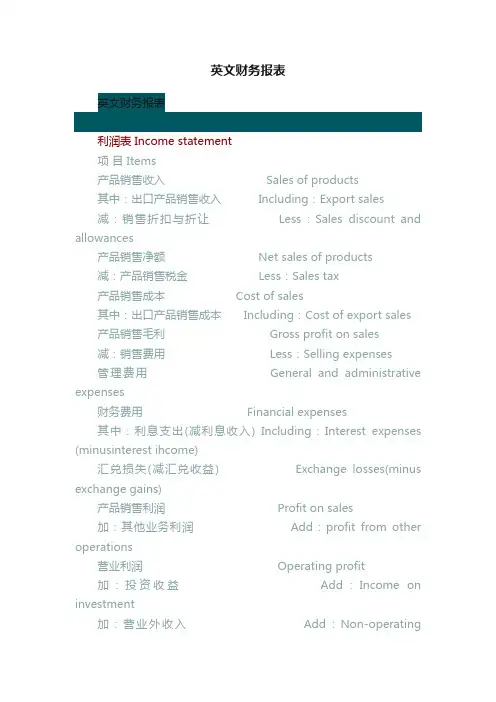

英文财务报表英文财务报表利润表 Income statement项目 Items产品销售收入Sales of products其中:出口产品销售收入 Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额 Net sales of products减:产品销售税金 Less:Sales tax产品销售成本 Cost of sales其中:出口产品销售成本Including:Cost of export sales 产品销售毛利 Gross profit on sales减:销售费用 Less:Selling expenses管理费用General and administrative expenses财务费用 Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome)汇兑损失(减汇兑收益) Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operatingincome减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额 Total profit减:所得税 Less:Income tax净利润 Net profit资产负债表 BALANCE SHEET资产 Assets流动资产:Current assets现金Cash on hand备用金Pretty cash银行存款Cash in banks有价证券Marketable receivable应收票据Notes receivable应收帐款Accounts receivable减:坏帐准备Less:allowance for bad debts预付货款Prepayments-supplies内部往来Inter-company accounts其他应收款 Other receivables待摊费用 Prepaid and deferred expenses存货Inventories减:存货变现损失准备:Less:allowance on inventory reduction to market已转未完工生产成本Transferred in production cost transforming一年内到期的长期投资Matured long time investments within a year流动资产合计Total current assets|长期投资:LONG TERM INVESTMENT长期投资Long term investments拨付所属资金Funds to burnchs一年以上的应收款项Accounts receivable over a year固定资产:FIXED ASSETS固定资产原价Fixed assets-cost减:累计折旧Less:amumulated depreciation固定资产净值Fixed assets-net value固定资产清理Disposal of fixed assets融资租入固定资产原价:Fixed assets-cost on financial lease减:融资租入固定资产折旧Less:amumulated depreciation融资租入固定资产净值:Fixed assets-net value on financial lease在建工程:CONSTRUCTION WORK IN PROCESS在建工程 Construction work in process ☆无形资产INTANGIBLE ASSETS场地使用权 Right to the use of a site工业产权及专有技术Industrial property right anf patents其他无形资产 Other intangibles无形资产合计 T otal intangible assets其它资产 OTHER ASSETS开办费 Organization espenses筹建期间汇兑损失Exchange losses during organization period递延投资损失 Deferred investment losses递延税款借项 Debit side of deferred tax其他递延支出 Other deferred expuditures待转销汇兑损益Prepaid and deferred exchange loss其他递延借款 Debit side of other deferred 其他资产合计 T otal other Assets资产总计 TOTAL ASSETS负债及所有者权 LIABILITIES AND CAPITAL流动负债:CURRENT LIABILITIES短期借款Short term loans应付票据Notes payable应付帐款Accounts payable内部往来Inter-company accounts预收货款Items received in advance-supplies应付工资Accured payroll应交税金Taxes payable应付股利Dividendes payable其他应付款Other payables预提费用 Accrued expenses职工奖励及福利费用Bonus and welfare funds一年内到期的长期负债Matured long term liabilities within a year其他流动负债 Other current liabilities流动负债合计 Total current liabilities长期负债: LONG TREM LIABILITIES长期借款 long term loans应付公司债 Bouds payable应公司债溢价(折价)Premium on bonds payable (discount)一年以上的应付款项Accounts payable over a year长期负债合计:Total long term liabilities其他负债:OTHER LIABILITIES筹建期间汇兑收益Exchange gains during organization period递延投资收益Deferred investment gains递延税款贷项Credit side of deferred tax其他递延贷项Credit side of other tax待转销汇兑收益Prepaid and deferred exchange profit 其他负债合计Total other liabilities负债合计Total liabilities所有者权益Investor’s equity资本总额(货币名称及金额) Authorized capital(*___________) 实收资本(外币金额期末数) Paid in capital(☆__________)其中Including中方投资(外币金额期末数)Chinese investments(☆__________)外方投资(外币金额期末数Foreign investments(☆__________)减:已归还投资 Less: Returned investments资本公积 Accumulation of capital公司拨入资金 Funds from head office储备基金 Reserve funds企业发展基金 Expansion funds利润归还投资Investment returned with profit本年利润 Current profit未分配利润 Retained earnings货币换算差额Currency translation difference所有者权益合计T otal investor’s equity负债及所有者权益合计TOTAL LIABILITIES ANDINVESTORS EQUITY附注: 1.委托加工材料元; 2.受托代销商品元; 3.代管商品物资元; 4.由企业负责的应收票据贴现元; 5.租入固定资产元; 6.本年支付的进口环节税金。

标准版的财务报表(中英文版)欧阳家百(2021.03.07)资产负债表Balance Sheet 项目ITEM 货币资金Cash 短期投资Short term investments 应收票据Notes receivable 应收股利Dividend receivable 应收利息Interest receivable 应收帐款Accounts receivable 其他应收款Other receivables 预付帐款Accounts prepaid 期货保证金Future guarantee 应收补贴款Allowance receivable 应收出口退税Export drawback receivable 存货Inventories 其中:原材料Including:Raw materials 产成品(库存商品) Finished goods 待摊费用Prepaid and deferred expenses 待处理流动资产净损失Unsettled G/L on current assets 一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets 流动资产合计Total current assets 长期投资:Long-term investment:其中:长期股权投资Including long term equity investment 长期债权投资Long term securities investment*合并价差Incorporating price difference 长期投资合计Total long-term investment 固定资产原价Fixed assets-cost 减:累计折旧Less:Accumulated Dpreciation 固定资产净值Fixed assets-net value 减:固定资产减值准备Less:Impairment of fixed assets 固定资产净额Net value of fixed assets 固定资产清理Disposal of fixed assets 工程物资Project material 在建工程Construction in Progress 待处理固定资产净损失Unsettled G/L on fixed assets 固定资产合计Totaltangible assets 无形资产Intangible assets 其中:土地使用权Including and use rights 递延资产(长期待摊费用)Deferred assets 其中:固定资产修理Including:Fixed assets repair 固定资产改良支出Improvement expenditure of fixed assets 其他长期资产Other long term assets 其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets 递延税款借项Deferred assets debits 资产总计Total Assets 资产负债表(续表) Balance Sheet 项目ITEM 短期借款Short-term loans 应付票款Notes payable 应付帐款Accounts payab1e 预收帐款Advances from customers 应付工资Accrued payro1l 应付福利费Welfare payable 应付利润(股利) Profits payab1e 应交税金Taxes payable 其他应交款Other payable to government 其他应付款Other creditors 预提费用Provision for expenses 预计负债Accrued liabilities 一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities 流动负债合计Total current liabilities 长期借款Long-term loans payable 应付债券Bonds payable 长期应付款long-term accounts payable 专项应付款Special accounts payable 其他长期负债Other long-term liabilities 其中:特准储备资金Including:Special reserve fund 长期负债合计Total long term liabilities 递延税款贷项Deferred taxation credit 负债合计Total liabilities* 少数股东权益Minority interests 实收资本(股本) Subscribed Capital 国家资本National capital 集体资本Collective capital 法人资本Legal person"s capital 其中:国有法人资本Including:State-owned legal person"s capital 集体法人资本Collective legal person"s capital 个人资本Personal capital 外商资本Foreign businessmen"s capital 资本公积Capital surplus 盈余公积surplus reserve 其中:法定盈余公积Including:statutory surplus reserve 公益金public welfare fund 补充流动资本Supplermentary current capital * 未确认的投资损失(以“-”号填列)Unaffirmed investment loss 未分配利润Retained earnings 外币报表折算差额Converted difference in Foreign Currency Statements 所有者权益合计Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity=================================================== =================利润表INCOME STATEMENT 项目ITEMS 产品销售收入Sales of products 其中:出口产品销售收入Including:Export sales 减:销售折扣与折让Less:Sales discount and allowances 产品销售净额Net sales of products 减:产品销售税金Less:Sales tax 产品销售成本Cost of sales 其中:出口产品销售成本Including:Cost of export sales 产品销售毛利Gross profit on sales 减:销售费用Less:Selling expenses 管理费用General and administrative expenses 财务费用Financial expenses 其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains) 产品销售利润Profit on sales 加:其他业务利润Add:profit from other operations 营业利润Operating profit 加:投资收益Add:Income on investment 加:营业外收入Add:Non-operating income 减:营业外支出Less:Non-operating expenses 加:以前年度损益调整Add:adjustment of loss and gain for previous years 利润总额Total profit 减:所得税Less:Income tax 净利润Net profit=================================================== ===============现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed 44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash Equivalents Supplemental Information1.Investing and Financing Activities that do not Involve inCash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits 46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash Equivalents Supplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents 现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。

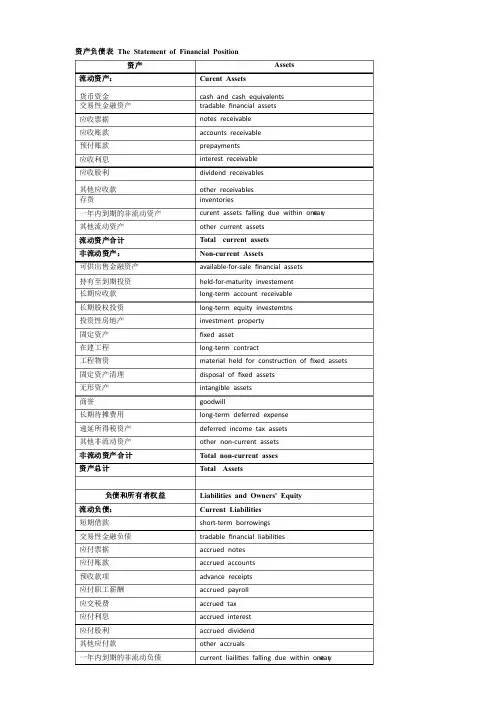

资产负债表 The Statement of Financial Position 资产Assets 流动资产: Curent Assets 货币资金货币资金cash and cash equivalents 交易性金融资产交易性金融资产 tradable financial assets 应收票据应收票据 notes receivable 应收账款应收账款 accounts receivable 预付账款预付账款 prepayments 应收利息应收利息 interest receivable 应收股利应收股利 dividend receivables 其他应收款其他应收款 other receivables 存货存货inventories 一年内到期的非流动资产一年内到期的非流动资产 curent assets falling due within one y ear 其他流动资产其他流动资产 other current assets 流动资产合计 Total current assets 非流动资产: Non-current Assets 可供出售金融资产可供出售金融资产 available-for-sale financial assets 持有至到期投资持有至到期投资 held-for-maturity investement 长期应收款长期应收款 long-term account receivable 长期股权投资长期股权投资 long-term equity investemtns 投资性房地产投资性房地产 investment property 固定资产固定资产 fixed asset 在建工程在建工程 long-term contract 工程物资工程物资 material held for construc on of fixed assets 固定资产清理固定资产清理 disposal of fixed assets 无形资产无形资产 intangible assets 商誉商誉goodwill 长期待摊费用长期待摊费用 long-term deferred expense 递延所得税资产递延所得税资产 deferred income tax assets 其他非流动资产其他非流动资产 other non-current assets 非流动资产合计 Total non-current asses 资产总计 Total Assets 负债和所有者权益Liabilities and Owners' Equity 流动负债: Current Liabilities 短期借款短期借款 short-term borrowings 交易性金融负债交易性金融负债 tradable financial liabili es 应付票据应付票据 accrued notes 应付账款应付账款 accrued accounts 预收款项预收款项 advance receipts 应付职工薪酬应付职工薪酬 accrued payroll 应交税费应交税费 accrued tax 应付利息应付利息 accrued interest 应付股利应付股利 accrued dividend 其他应付款其他应付款other accruals 一年内到期的非流动负债一年内到期的非流动负债current liaili es falling due within one y ear 其他流动负债其他流动负债 other current liabili es 流动负债合计 Total of current liabilities 非流动负债: Non-current Liabilities 长期借款长期借款 long-term loan 应付债券应付债券 bonds pay a ble able 长期应付款长期应付款 long-term accounts payable 专项应付款专项应付款 accounts payable for specialised terms 预计负债预计负债 provision for liabili es 递延所得税负债递延所得税负债 deferred income tax liabili es 其他非流动负债其他非流动负债 other non-current liabili es 非流动负债合计 Total of non-current liabilities 负债合计 Total of liabilities 所有者权益: Owners' equity 实收资本实收资本 capital 资本公积资本公积 capital reserve 减:库存股减:库存股 less: treasury stock 盈余公积盈余公积 earnings reserve 未分配利润未分配利润 retained earnings 所有者权益总计 Total of owners' equity负债和所有者权益总计 Total of liabilities and owners' equity股本:Called up share captial 股本溢价:Share premium account 股东权益:Shareholders equity in total 少数股东权益:Minority interest in equity 利润表 the statement of comprehensive income项目items一、营业收入 Operating revenue 减:营业成本减:营业成本 Less:operating costs 营业税金及附加营业税金及附加 Operating tax 销售费用销售费用 Sales expense 管理费用管理费用 Administrative expense 财务费用财务费用 Financial expense 资产减值准备资产减值准备Loss of impairment of assets 加:公允价值变动收益加:公允价值变动收益 Plus:return on fair value adjustment 投资收益投资收益 Investment income 二:营业利润 Operating profit加:营业外收入加:营业外收入 Plus:non-operating revenue 减:营业外支出减:营业外支出 Less:non-operating costs 三、利润总额 Profit before tax 减:所得税费用减:所得税费用 Less:tax 四、净利润 Net profit五、每股收益 Earnings per share (一)基本每股收益(一)基本每股收益 Basic earnings per share (二)稀释每股收益(二)稀释每股收益Diluted earnings per share 现金流量表 Cash Flows Statement Cash Flows from Operating 经营活动产生的现金流量Cash received from sales of goods or rendering service 销售商品、提供劳务收到的现金 returning of taxations 收到的税费返还收到的税费返还other cash received relating to operating activities 收到的其他与经营活动有关的现金 Sub-total of cash inflows 现金流入小计cash paid for goods and service 购买商品、接受劳务支付的现金 cash paid to and on behalf of employees 支付给职工以及为职工支付的现金 taxes paid 支付的各项税费支付的各项税费other cash paid relating to operating activities 支付的其他与经营活动有关的现金 Sub-total of cash outflows现金流出小计Net cash flows from operating activities 经营活动产生的现金流量净值 Cash flows from investing activities 投资活动产生的现金流量procceds from sales of non-dealing securities 收回投资所收到的现金收回投资所收到的现金(销售非交易性债券收到(销售非交易性债券收到的现金)的现金)Dividends received 取得投资收益所收到的现金(应收股利) proceeds from the disposal of fixed assets,intangible assets and other assets 处置固定资产、处置固定资产、无形资产和其他长期资产所收到无形资产和其他长期资产所收到的现金的现金other proceeding relating to investing activities 收到的其他与投资活动有关的现金 Sub-total of cash inflows现金流入小计 Cash paid to acquire fixed assets ,intangible assets and other assets 购建固定资产、购建固定资产、无形资产和其他长期资产所支付无形资产和其他长期资产所支付的现金的现金cash paid to acquire investment 投资所支付的现金投资所支付的现金other cash paid relating to investment activities 支付的其他与投资活动有关的现金 Sub-total of cash outflows现金流出小计Net cash flows from investing activities 投资活动产生的现金流量净值 Cash flows from financing activities 筹资活动产生的现金流量 Proceeds from issuing shares 吸收投资所收到的现金吸收投资所收到的现金 Proceeds from borrowings 借款所收到的现金借款所收到的现金other proceeding relating to financing activities收到的其他与筹资活动有关的现金 Sub-total of cash inflows现金流入小计cash payments of debt 偿还债务所支付的现金偿还债务所支付的现金Cash payments of dividents and profits,interest expense 分配股利、利润或偿付利息所支付的现金 Other payments relating to financing activities支付的其他与筹资活动有关的现金 Sub-total of cash outflows现金流出小计Net cash flows from financing activities 筹资活动产生的现金流量净值 Effect of foreign exchangs rate changes on cash 汇率变动对现金及现金等价物的影响 Net increase in cash and cash equivalents 现金及现金等价物净增加额现金及现金等价物净增加额。

Balance SheetDecember 31, 2015KQ 01 Enterprise name: XX Co., Ltd. Unit: RMB YuanAccount paid in advance Account received inadvanceInterest receivable Employees’ compensationpayableDividend receivable Tax payableOther accounts receivable Interest payable Inventory Dividend payableAssets divided as availableassets for saleOther accounts payableNon-current assets due within 1 year Liabilities divided as available liabilities for saleOther current assets Non-current liabilities duewithin 1 yearTotal current assets Other current liabilitiesTotal current liabilitiesNon-current liabilities:Long-term borrowingsBonds payableIncluding: Preferred sharesPerpetual capital securitiesLong-term account payableLong-term employees’compensation payable Non-current assets: Special payables Available for sale financialAccrued liabilitiesassetsHeld-to-maturity investments Deferred incomeLong-term account receivable Deferred tax liabilities Long-term equity investment Other non-current liabilities Investing real estate Total non-current liabilities Fixed asset 7 Total liabilities2Income StatementYear of 2015KQ 02 Enterprise name: XX Co., Ltd. Unit: RMB YuanIncluding: Income from investment in affiliated enterprise andjoint enterpriseII. Operating profit (loss with “-”)Plus: Non-business income 5 Including: Gain from non-current asset disposalMinus: Non-business expenditure 6 Including: Loss from non-current asset disposalIII. Total profit (total loss with “-”)Minus: Income tax expense 7 IV. Net profit (net loss with “-”)V. Net after-tax amount of other comprehensive incomes(i) Other comprehensive incomes not reclassified into profit andloss in future1. Changes for net liability or net asset of remeasured and resetbenefit plan2. Shares enjoyed in other comprehensive incomes not reclassified into profit and loss by the invested unit(ii) Other comprehensive incomes reclassified into profit and loss in future1. Shares enjoyed in other comprehensive incomes reclassified into profit and loss by the invested unit in future2. Profit and loss from fair value change of financial assets available for sale3. Profit and loss from held-to-maturity investment reclassified to financial assets available for sale4. Effective part for hedging profit and loss of cash flow5. Translation balance of foreign currency financial statements6. OthersVI. Total comprehensive incomesVII. Earnings per share(i) Basic earnings per share (Yuan/ Share)4Cash Flow StatementYear of 2015KQ 03 Enterprise name: XX Co., Ltd. Unit: RMB YuanPayments of all types of taxesOther cash paid relating to operating activitiesSub-total of cash outflows from operating activitiesNet cash flows from operating activitiesII. Cash flow from investing activities:Cash flow from disposal of investmentsCash received from returns of investmentsCash received from incomes on investmentsNet cash received from disposal of fixed assets, intangible assets and other long-term assetsOther cash received relating to investing activitiesSub-total of cash inflows from investing activitiesCash paid to acquire fixed assets, intangible assets and other long-term assetsCash paid to acquire investmentsNet cash received from the subsidiary company and other business unitsOther cash payments relating to investing activitiesSub-total of cash outflows from investing activitiesNet cash flows from investing activitiesIII. Cash flows from financing activities:Cash received from capital contributionCash received from borrowingsOther cash received relating to financing activitiesSub-total of cash inflows from financing activitiesCash repayments of amounts borrowedCash payments for interest expenses and distribution of dividends or profitOther cash payments relating to financing activitiesSub-total of cash outflows from financing activities5。

中英文版财务报表资产负债表:1 资产assets11~ 12 流动资产current assets111 现金及约当现金cash and cash equivalents [ɪ'kwɪvələnt]1111 库存现金cash on hand1112 零用金/周转金petty cash/revolving funds1113 银行存款cash in banks1116 在途现金cash in transit1117 约当现金cash equivalents1118 其它现金及约当现金other cash and cash equivalents112 短期投资short-term investment1121 短期投资-股票short-term investments - stock1122 短期投资-短期票券short-term investments - short-term notes and bills1123 短期投资-政府债券short-term investments - government bonds1124 短期投资-受益凭证short-term investments - beneficiary certificates1125 短期投资-公司债short-term investments - corporate bonds1128 短期投资-其它short-term investments - other1129 备抵短期投资跌价损失allowance for reduction of short-term investment to market113 应收票据notes receivable1131 应收票据notes receivable1132 应收票据贴现discounted notes receivable1137 应收票据-关系人notes receivable - related parties1138 其它应收票据other notes receivable1139 备抵呆帐-应收票据allowance for uncollec- tible accounts- notes receivable114 应收帐款accounts receivable1141 应收帐款accounts receivable1142 应收分期帐款installment accounts receivable1147 应收帐款-关系人accounts receivable - related parties1149 备抵呆帐-应收帐款allowance for uncollec- tible accounts - accounts receivable118 其它应收款other receivables1181 应收出售远汇款forward exchange contract receivable1182 应收远汇款-外币forward exchange contract receivable - foreign currencies 1183 买卖远汇折价discount on forward ex-change contract1184 应收收益earned revenue receivable1187 其它应收款- 关系人other receivables - related parties1188 其它应收款- 其它other receivables - other1189 备抵呆帐- 其它应收款allowance for uncollec- tible accounts - other receivables121~122 存货inventories1211 商品存货merchandise ['mɝtʃəndaɪs] inventory1212 寄销商品consigned goods1213 在途商品goods in transit1219 备抵存货跌价损失allowance for reduction of inventory to market1221 制成品finished goods1222 寄销制成品consigned finished goods1223 副产品by-products1224 在制品work in process1225 委外加工work in process - outsourced1226 原料raw materials1227 物料supplies1228 在途原物料materials and supplies in transit1229 备抵存货跌价损失allowance for reduction of inventory to market125 预付费用prepaid expenses1251 预付薪资prepaid payroll1252 预付租金prepaid rents1253 预付保险费prepaid insurance1254 用品盘存office supplies1255 预付所得税prepaid income tax1258 其它预付费用other prepaid expenses126 预付款项prepayments1261 预付货款prepayment for purchases1268 其它预付款项other prepayments128~129 其它流动资产other current assets1281 进项税额VAT paid ( or input tax)1282 留抵税额excess VAT paid (or overpaid VAT)1283 暂付款temporary payments1284 代付款payment on behalf of others1285 员工借支advances to employees1286 存出保证金refundable deposits1287 受限制存款certificate of deposit-restricted1293 业主(股东)往来owners(stockholders) current account1294 同业往来current account with others1298 其它流动资产-其它other current assets - other13 基金及长期投资funds and long-term investments131 基金funds1311 偿债基金redemption fund (or sinking fund)1312 改良及扩充基金fund for improvement and expansion1313 意外损失准备基金contingency fund1314 退休基金pension fund1318 其它基金other funds132 长期投资long-term investments1321 长期股权投资long-term equity investments1322 长期债券投资long-term bond investments1323 长期不动产投资long-term real estate in-vestments1324 人寿保险现金解约价值cash surrender value of life insurance1328 其它长期投资other long-term investments1329 备抵长期投资跌价损失allowance for excess of cost over market value of long-term investments14~ 15 固定资产property , plant, and equipment141 土地land1411 土地land1418 土地-重估增值land - revaluation increments142 土地改良物land improvements1421 土地改良物land improvements1428 土地改良物-重估增值land improvements - revaluation increments1429 累积折旧-土地改良物accumulated depreciation - land improvements143 房屋及建物buildings1431 房屋及建物buildings1438 房屋及建物-重估增值buildings -revaluation increments1439 累积折旧-房屋及建物accumulated depreciation - buildings144~146 机(器)具及设备machinery and equipment1441 机(器)具machinery1448 机(器)具-重估增值machinery - revaluation increments1449 累积折旧-机(器)具accumulated depreciation - machinery151 租赁资产leased assets1511 租赁资产leased assets1519 累积折旧-租赁资产accumulated depreciation - leased assets1529 累积折旧- 租赁权益改良accumulated depreciation - leasehold improvements156 未完工程及预付购置设备款construction in progress and prepayments for equipment 1561 未完工程construction in progress1562 预付购置设备款prepayment for equipment158 杂项固定资产miscellaneous property, plant, and equipment1581 杂项固定资产miscellaneous property, plant, and equipment1588 杂项固定资产-重估增值miscellaneous property, plant, and equipment - revaluation increments1589 累积折旧- 杂项固定资产accumulated depreciation - miscellaneous property, plant, and equipment16 递耗资产depletable assets161 递耗资产depletable assets1611 天然资源natural resources1618 天然资源-重估增值natural resources -revaluation increments1619 累积折耗-天然资源accumulated depletion - natural resources17 无形资产intangible assets171 商标权trademarks172 专利权patents173 特许权franchise174 著作权copyright175 计算机软件computer software176 商誉goodwill177 开办费organization costs178 其它无形资产other intangibles1781 递延退休金成本deferred pension costs1782 租赁权益改良leasehold improvements1788 其它无形资产-其它other intangible assets - other18 其它资产other assets181 递延资产deferred assets1811 债券发行成本deferred bond issuance costs1812 长期预付租金long-term prepaid rent1813 长期预付保险费long-term prepaid insurance1818 其它递延资产other deferred assets182 闲置资产idle assets1821 闲置资产idle assets184 长期应收票据及款项与催收帐款long-term notes , accounts and overdue receivables1841 长期应收票据long-term notes receivable1842 长期应收帐款long-term accounts receivable1843 催收帐款overdue receivables1847 长期应收票据及款项与催收帐款-关系人long-term notes, accounts and overdue receivables- related parties1848 其它长期应收款项other long-term receivables1849 备抵呆帐-长期应收票据及款项与催收帐款allowance for uncollectible accounts - long-term notes, accounts and overdue receivables185 出租资产assets leased to others1851 出租资产assets leased to others1858 出租资产-重估增值assets leased to others - incremental value from revaluation1859 累积折旧-出租资产accumulated depreciation - assets leased to others186 存出保证金refundable deposit1861 存出保证金refundable deposits188 杂项资产miscellaneous assets1881 受限制存款certificate of deposit - restricted1888 杂项资产-其它miscellaneous assets - other2 负债liabilities21~ 22 流动负债current liabilities211 短期借款short-term borrowings(debt)2111 银行透支bank overdraft2112 银行借款bank loan2114 短期借款-业主short-term borrowings - owners2115 短期借款-员工short-term borrowings - employees2117 短期借款-关系人short-term borrowings- related parties2118 短期借款-其它short-term borrowings - other212 应付短期票券short-term notes and bills payable2121 应付商业本票commercial paper payable2122 银行承兑汇票bank acceptance2128 其它应付短期票券other short-term notes and bills payable2129 应付短期票券折价discount on short-term notes and bills payable213 应付票据notes payable2131 应付票据notes payable214 应付帐款accounts pay able2141 应付帐款accounts payable2147 应付帐款-关系人accounts payable - related parties216 应付所得税income taxes payable2161 应付所得税income tax payable217 应付费用accrued expenses2171 应付薪工accrued payroll2172 应付租金accrued rent payable2173 应付利息accrued interest payable2174 应付营业税accrued VAT payable2175 应付税捐-其它accrued taxes payable- other2178 其它应付费用other accrued expenses payable218~219 其它应付款other payables2181 应付购入远汇款forward exchange contract payable2182 应付远汇款-外币forward exchange contract payable - foreign currencies2183 买卖远汇溢价premium on forward exchange contract2184 应付土地房屋款payables on land and building purchased2185 应付设备款Payables on equipment2187 其它应付款-关系人other payables - related parties2191 应付股利dividend payable2192 应付红利bonus payable2193 应付董监事酬劳compensation payable to directors and supervisors2198 其它应付款-其它other payables - other226 预收款项advance receipts2261 预收货款sales revenue received in advance2262 预收收入revenue received in advance2268 其它预收款other advance receipts227 一年或一营业周期内到期长期负债long-term liabilities -current portion2271 一年或一营业周期内到期公司债corporate bonds payable - current portion2272 一年或一营业周期内到期长期借款long-term loans payable - current portion2273 一年或一营业周期内到期长期应付票据及款项long-term notes and accounts payable due within one year or one operating cycle2277 一年或一营业周期内到期长期应付票据及款项-关系人long-term notes and accounts payables to related parties - current portion2278 其它一年或一营业周期内到期长期负债other long-term lia- bilities - current portion228~229 其它流动负债other current liabilities2281 销项税额VAT received(or output tax)2283 暂收款temporary receipts2284 代收款receipts under custody2285 估计售后服务/保固负债estimated warranty liabilities2291 递延所得税负债deferred income tax liabilities2292 递延兑换利益deferred foreign exchange gain2293 业主(股东)往来owners current account2294 同业往来current account with others2298 其它流动负债-其它other current liabilities - others23 长期负债long-term liabilities231 应付公司债corporate bonds payable2311 应付公司债corporate bonds payable2319 应付公司债溢(折)价premium(discount) on corporate bonds payable232 长期借款long-term loans payable2321 长期银行借款long-term loans payable - bank2324 长期借款-业主long-term loans payable - owners2325 长期借款-员工long-term loans payable - employees2327 长期借款-关系人long-term loans payable - related parties2328 长期借款-其它long-term loans payable - other233 长期应付票据及款项long-term notes and accounts payable2331 长期应付票据long-term notes payable2332 长期应付帐款long-term accounts pay-able2333 长期应付租赁负债long-term capital lease liabilities2337 长期应付票据及款项-关系人Long-term notes and accounts payable - related parties 2338 其它长期应付款项other long-term payables234 估计应付土地增值税accrued liabilities for land value increment tax2341 估计应付土地增值税estimated accrued land value incremental tax pay-able235 应计退休金负债accrued pension liabilities2351 应计退休金负债accrued pension liabilities238 其它长期负债other long-term liabilities2388 其它长期负债-其它other long-term liabilities - other28 其它负债other liabilities281 递延负债deferred liabilities2811 递延收入deferred revenue2814 递延所得税负债deferred income tax liabilities2861 存入保证金guarantee deposit received288 杂项负债miscellaneous liabilities2888 杂项负债-其它miscellaneous liabilities损益表:项目ITEMS产品销售收入Sales其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discounts and allowances产品销售净额Net sales减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit减:销售费用Less:Selling expense管理费用General and administrative expense财务费用Financial expense其中:利息支出(减利息收入) Including:Interest expense ( less interest income ) 汇兑损失(减汇兑收益) Exchange loss ( less exchange gain )产品销售利润Income from main operation加:其他业务利润Add:Income from other operations营业利润Operating income加:投资收益Add:Investment income营业外收入Non-operating income减:营业外支出Less:Non-operating expense加:以前年度损益调整Add:Adjustment to prior year\'s income and expense利润总额Income before tax减:所得税Less:Income tax净利润NET INCOME流动资产:Current asset货币资金Cash(currency fund)Bank短期投资Short-term investment应收票据Notes receivable应收股利Dividends receivable应收利息Interests receivable应收账款Accounts receivable其他应收款Other receivable预付账款Advances to suppliers应收补贴款Subsidies receivable存货Inventories待摊费用Prepaid expenses一年内到期的长期债券投资Long-term investments maturing within one year 其他流动资产Other current assets流动资产合计Total current assets长期投资:LONG TERM INVESTMENTS长期股权投资Long-term equity investment长期债权投资Long-term debt investment长期投资合计Total long term investment固定资产:FIXED ASSETS:固定资产原值Fixed assets-cost减:累计折旧Less:Accumulated depreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less: Impairment of fixed assets固定资产净额Fixed assets-book value工程物资Materials for projects在建工程Construction in progress固定资产清理Disposal of fixed assets固定资产合计Total Fixed Assets无形资产及其它资产INTANGIBLE ASSETS AND OTHER ASSETS:无形资产Intangible assets长期待摊费用Long-term deferred expenses其他长期资产Other long-term assets无形资产及其他资产合计Total intangible assets and other assets递延税项Deferred tax递延税款借项Deferred tax debit资产总计TOTAL ASSETS短期借款Short-term loans应付票据Notes payable应付账款Accounts payable预收账款Advances from customers应付工资Accrued payroll应付福利费Accrued Employee’s welfare expenses应付股利Dividends payable未交税金Taxes payable其他应交款Other taxes and expenses payable其他应付款Other payables预提费用Accrued expenses预提负债Provisions一年内到期的长期负债Long-term liabilities due within one year其他流动负债Other current liabilities长期借款Long-term loans应付债券Bonds payable长期应付款Long-term accounts payable专项应付款Specific accounts payable其他长期负债Other long-term liabilities长期负债合计Total long-term liabilities递延税项:Deferred tax递延税款贷项Deferred tax credit实收资本(或股本)Paid-in capital减:已归还投资Less:Investments returned实收资本(或股本)净额Paid-in capital-net资本公积Capital surplus盈余公积Surplus from profits其中:法定公益金Including:statutory public welfare fund未分配利润Undistributed profit所有者权益(或股东权益)合计Total owner`s equity负债及所有者权益(或股东权益)合计TOTAL LIABILITIES AND OWNER`S EQUITY项目ITEMS一、营业收入Income from main减:营业成本Less:Cost of main operation营业税金及附加Tax and additional expense二、经营利润Income from main operation加:其他业务利润Add:Income from other operation 减:营业费用Less:Operating expense管理费用General and administrative expense财务费用Financial expense三、营业利润Operating Income加:投资收益Add:Investment income补贴收入Income from subsidies营业外收入Non-operating income减:营业外支出Less:Non-operating expense四、利润总额Income before tax减:所得税Less:Income tax五、净利润NET INCOME。

现金流量附表: Supplementary Information:

1.将净利润调节为经营活动的现金流量:Reconciliation of Net Profit to Cash Flow from Operating Activities:

净利润Net Profit

加:少数股东损益Add: Minority interest

加:计提的资产减值准备Impairment losses on assets

固定资产折旧Depreciation of fixed assets

无形资产摊销Amortisation of intangible assets

长期待摊费用摊销Amortisation of long-term deferred expenses

待摊费用减少(减:增加)Decrease (increase) in deferred expenses

预提费用增加(减:减少)Increase (decrease) in accrued expenses

处置固定资产、无形资产和其他长期资产的损失(减、Losses (gains) on disposal of fixed assets, intangible assets and other long-term assets

固定资产报废损失Losses on write-off of fixed assets

财务费用Finance expense (income)

投资损失(减、收益)Losses (gains) arising from investments

递延税款贷款(减、借项)Deferred tax credit (debit)

存货的减少(减、增加)Decrease (increase) in inventories

经营性应收项目的减少(减、增加)Decrease (increase) in receivables under operating activities

经营性应付项目的增加(减、减少)Increase (decrease) in payables under operating activities

其他Others

经营活动产生的现金流量净额Net cash flow from operating activities

2.不涉及现金收支的投资和筹资活动:Investing and Financing Activities that do not Involve Cash Receipts and Payments:

债务转为资本Conversion of debt into capital

一年内到期的可转换公司债券Reclassification of convertible bonds expiring within one year as current liability

融资租入固定资产Fixed assets acquired under finance leases

3.现金及现金等价物净增加情况:Net Increase in Cash and Cash Equivalents:

现金的期末余额Cash at the end of the period

减:现金的期初余额Less: cash at the beginning of the year

加:现金等价物的期末余额Add: cash equivalents at the end of the period

减:现金等价物的期初余额Less: cash equivalents at the beginning of the period

现金及现金等价物净增加额Net increase in cash and cash equivalents