金融市场与机构(15)解析

- 格式:doc

- 大小:496.00 KB

- 文档页数:18

证券从业资格金融市场基础知识(金融市场体系、证券市场主体)模拟试卷1(题后含答案及解析)题型有:1. 选择题 2. 综合型选择题选择题1.中央银行提高法定存款准备金率时,( )。

A.商业银行可用资金增多、贷款上升,导致货币供应量增多B.商业银行可用资金增多、贷款下降,导致货币供应量减少C.商业银行可用资金减少、贷款上升,导致货币供应量增多D.商业银行可用资金减少、贷款下降,导致货币供应量减少正确答案:D解析:当中央银行提高法定存款准备金率时,商业银行需要上缴中央银行的法定存款准备金增加,可直接运用的超额准备金减少,商业银行的可用资金减少,在其他情况不变的条件下,商业银行贷款或投资下降,导致货币供应量减少。

知识模块:金融市场体系2.法定存款准备金率由( )决定。

A.银监会B.中国人民银行C.国务院D.中国银行业协会正确答案:B解析:法定存款准备金是商业银行按照其存款的一定比例向中央银行缴存的存款,这个比例通常是由中国人民银行决定的,被称为法定存款准备金率。

知识模块:金融市场体系3.( )相对比较灵活,但调节过程可能较慢,存在时滞。

A.法律手段B.经济手段C.行政手段D.市场手段正确答案:B解析:经济手段是通过运用利率政策、公开市场业务、信贷政策、税收政策等经济手段,对证券市场进行干预。

这种手段相对比较灵活,但调节过程可能较慢,存在时滞。

知识模块:金融市场体系4.某国有银行通过公开发行股票融资的方式属于( )。

A.直接融资B.间接融资C.吸收投资D.民间借款正确答案:A解析:直接融资亦称“直接金融”,是指没有金融中介机构介入的资金融通方式。

上市公司通过公开发行股票融资的方式属于直接融资。

知识模块:金融市场体系5.金融市场按照( )划分为货币市场、资本市场、外汇市场:金融衍生品市场、保险市场和黄金市场。

A.金融市场构成要素B.金融工具发行和流通特征C.金融市场交易标的物D.金融商品交易的分割方式正确答案:C解析:按照交易标的物的不同,金融市场划分为货币市场、资本市场、金额衍生品市场、外汇市场、保险市场和黄金及其他投资品市场。

2016年10月高等教育自学考试金融市场学真题(总分100, 做题时间150分钟)单项选择题1.大额可转让定期存单是由()首先发行的。

SSS_SINGLE_SELA美国联邦银行B纽约花旗银行C英格兰银行D日本银行分值: 1答案:B起源于20世纪初,首先由美国花旗银行的发行。

2.按照价格形成机制不同,可以把金融市场划分为()。

SSS_SINGLE_SELA一级市场、二级市场B现货市场、期货市场C竞价市场、议价市场D发行市场、期货市场分值: 1答案:C按照价格形成机制不同,可以把金融市场划分为竞价市场和议价市场。

3.近年来在美国出现了一种场外交易形式。

股票买卖双方不通过证券经纪商,彼此间利用电讯手段进行大宗股票交易,这种方式叫做()。

SSS_SINGLE_SELA场外交易B第三市场交易C第四市场交易D柜台交易分值: 1答案:C第四市场是指各种机构投资者和很富有的个人投资者完全绕开通常的证券商,相互间直接进行的债券买卖交易。

4.优先股是指()。

SSS_SINGLE_SELA具有优先表决权和选举权的股票B具有优先认股权和新股转让的股票C能获得高额股利的股票D在领取股息和取得资产方面优先的股票分值: 1答案:D优先股是享有优先权的股票。

优先股的股东对公司资产、利润分配等享有优先权,其风险较小。

但是优先股股东对公司事务无表决权。

5.以下各项中,不属于债券的发行条件的是()。

SSS_SINGLE_SEL票面利率B市场利率C债券价格D偿还期限分值: 1答案:B债券的发行条件的是票面利率、债券价格、偿还期限。

6.股票流通市场的主要组织形式是()。

SSS_SINGLE_SELA场内交易B场外交易C第三市场D第四市场分值: 1答案:A场内交易是股票流通市场的主要组织形式。

7.根据运作方式的不同,基金可分为()。

SSS_SINGLE_SELA契约型基金、公司型基金B封闭式基金、开放式基金C主动型基金、被动型基金公募基金、私募基金分值: 1答案:B根据运作方式的不同,基金可分为封闭式基金、开放式基金。

经济学院金融专业硕士《金融市场与金融机

构》复试大纲

经济学院

一、考试内容

第一部分绪论

第1章为什么研究金融市场与金融机构

1.1 为什么研究金融市场

1.2 为什么研究金融机构

1.3 应用管理视角

1.4 如何研究金融市场和金融机构

第2章金融体系概览

2.1 金融市场的功能

2.2 金融市场的结构

2.3 金融市场国际化

2.4 金融中介的功能:间接融资

2.5 金融中介的种类

2.6 金融体系的监管

第二部分金融市场基础

第3章利率的含义及其在定价中的作用

3.1 利率的衡量

3.2 实际利率和名义利率的区别

3.3 利率和收益率的区别

第4章为什么利率会变化

4.1 资产需求的决定因素

4.2 债券市场的供求

4.3 均衡利率的变动

第5章利率的风险结构和期限结构如何影响利率

5.1 利率的风险结构

5.2 利率的期限结构

第6章金融市场是否有效

6.1 有效市场假说

6.2 有效市场假说的实证

6.3 行为金融

第三部分金融机构基础

第7章金融机构的成立。

单选题(每题6分,共5道)题目1未回答满分6.00未标记标记题目题干经济货币化与经济商品化成( )。

选择一项:A. 波动变化B. 无法预知C. 正比D. 反比反馈知识点提示:经济货币化与经济商品化的关系。

参见教材本章第四节。

正确答案是:正比题目2未回答满分6.00未标记标记题目题干金融创新增强了货币供给的()。

选择一项:A. 内生性B. 可控性C. 可测性D. 外生性反馈知识点提示:金融创新对货币供求的影响。

参见教材本章第二节。

正确答案是:内生性题目3未回答满分6.00未标记标记题目题干金融创新对金融发展和经济发展的作用是()。

选择一项:A. 利弊均衡B. 有利无弊D. 利大于弊反馈知识点提示:金融创新对经济的作用。

参见教材本章第二节正确答案是:利大于弊题目4未回答满分6.00未标记标记题目题干金融深化表现为金融与经济发展形成一种()状态。

选择一项:A. 频繁变动B. 良性循环C. 恶性循环D. 无序反馈知识点提示:金融发展与经济发展的关系。

参见教材本章第一节。

正确答案是:良性循环题目5未回答满分6.00未标记标记题目题干新型金融市场不断形成属于()创新。

选择一项:A. 金融业务创新B. 金融制度创新C. 金融机构创新D. 金融组织结构创新反馈知识点提示:金融创新的分类。

参见教材本章第二节。

正确答案是:金融业务创新未标记标记题目信息文本多选题(每题8分,共5道)题目6未回答未标记标记题目题干形成一个国家或地区金融结构的基础性条件主要有()。

选择一项或多项:A. 经济发展的商品化和货币化程度B. 商品经济的发展程度C. 信用关系的发展程度D. 经济主体行为的理性化程度E. 文化、传统、习俗与偏好反馈知识点提示:形成金融结构的基础性条件。

参见教材本章第三节The correct answers are: 经济发展的商品化和货币化程度, 商品经济的发展程度, 信用关系的发展程度, 经济主体行为的理性化程度, 文化、传统、习俗与偏好题目7未回答满分8.00未标记标记题目题干金融创新对金融和经济发展的推动,是通过以下()途径来实现的。

第一部分章节精练(含历年真题)第一章金融、资产管理与投资基金单选题(以下备选答案中只有一项最符合题目要求)1.货币市场是交易期限在(),以短期金融工具为媒介进行资金融通和借贷的交易市场。

[2016年4月真题]A.六个月以内B.一年以内C.一年以上D.二年以上【答案】B【解析】货币市场又称短期金融市场,是指专门融通一年以内短期资金的场所。

2.()不是我国保险资产管理公司的资产管理业务内容。

[2016年4月真题]A.企业年金B.第三方保险资产管理计划C.集合资金信托D.投资联结保险账户管理【答案】C【解析】保险资产管理公司的资产管理业务包括企业年金、保险资产管理计划、第三方保险资产管理计划、投资联结保险账户管理。

C项,集合资金信托是信托公司的资产管理业务。

3.投资基金中最主要的一种类别是()。

[2016年4月真题]A.对冲基金B.风险投资基金C.证券投资基金D.另类投资基金【答案】C【解析】人们日常接触到的投资基金分类,主要是按照所投资的对象的不同进行区分的,其主要可以分为证券投资基金、私募股权基金、风险投资基金、对冲基金、另类投资基金。

其中证券投资基金是投资基金中最主要的一种类别,又可分为公募证券投资基金和私募证券投资基金等种类。

4.以下均为债权类金融资产的是()。

[2015年12月真题]A.基金、国债期货B.城投债、限售股C.可转债、票据D.现金、定期分红蓝筹股【答案】C【解析】金融资产一般分为债权类金融资产和股权类金融资产。

债权类金融资产以票据、债券等契约型投资工具为主,股权类金融资产以各类股票为主。

5.以下关于投资概念的描述,错误的是()。

[2015年12月真题]A.投资未来收益具有不确定性B.投资者期望投资回报应该能补偿预期的通货膨胀率C.投资者期望投资回报应该能补偿资金被占用的时间D.投资的产出会大于投入【答案】D【解析】投资是指投资者当期投入一定数额的资金而期望在未来获得回报,所得回报应该能补偿投资资金被占用的时间,预期的通货膨胀率以及期望更多的未来收益,未来收益具有不确定性。

2019年中级银行职业资格《银行管理》试题(网友回忆版)[单选题]1.金融工作的永恒主题是()。

[(江南博哥)2019年6月真题]A.深化金融改革B.服务三农和小微企业C.防范化解金融风险D.扩大金融开放参考答案:C参考解析:防范化解金融风险,特别是防止发生系统性金融风险,是金融工作的根本性任务,也是金融工作的永恒主题。

[单选题]2.根据《银行业监督管理法》,下列不属于国务院银行业监督管理机构可以采取的监管强制措施的是()。

[2019年6月真题]A.责令撤换董事、高级管理人员或者限制其权利B.责令控股股东转让股权或者限制有关股东的权利C.责令分支机构终止营业D.责令暂停部分业务、停止批准开办新业务参考答案:C参考解析:根据《银行业监督管理法》第三十七条,监管强制措施可以分为以下几种类型:①对银行业金融机构的措施,具体包括责令暂停部分业务、停止批准开办新业务、停止增设分支机构申请的审查批准;限制资金转让;限制分配红利和其他收入。

②对银行业金融机构股东的措施,监管部门可以责令控股方转让股权或者限制部分股东的权利。

③对银行业金融机构董事、高级管理人员的措施,监管部门有权责令银行业金融机构撤换董事、高级管理人员或者限制其权利。

[单选题]3.企业A要并购企业B,两家企业同为在国内经营的企业,企业A向甲银行融资,下列不属于该笔贷款主要风险点的是()。

[2019年6月真题]A.交易价格是否合理反映企业B价值B.并购过程中的资金过境风险C.企业A和企业B能否形成协同D.该笔并购交易是否按有关规定已经或即将获得批准参考答案:B参考解析:资金过境风险出现在跨境并购中,A、B两家企业均是国内经营的企业,所以不存在并购过程中的资金过境风险。

[单选题]4.根据《银行业金融机构绩效考评监管指引》,银行业金融机构应突出()的重要性,其权重应当明显高于其他类指标。

[2019年6月真题]A.发展转型类指标和社会责任类指标B.经营效益类指标和合规经营类指标C.风险管理类指标和发展转型类指标D.合规经营类指标和风险管理类指标参考答案:D参考解析:银行应建立科学的考核激励机制,按照《银行业金融机构绩效考评监管指引》的要求,合规经营类指标和风险管理类指标权重应当明显高于其他类指标。

2024年经济师考试金融高级经济实务自测试题(答案在后面)一、案例分析题(本大题有3个案例题,第一题20分,其他每题25分,共70分)第一题案例材料:假设你是一家大型商业银行的高级经济师,负责管理一个投资组合。

最近,由于全球市场的波动性增加以及某些国家的货币政策调整,你需要对银行的投资策略进行重新评估。

当前的投资组合包括以下资产类别:•国债(占总资金的30%)•企业债券(占总资金的25%)•股票(占总资金的20%)•外汇(占总资金的15%)•商品期货(占总资金的10%)在过去的几个月里,国债收益率下降了0.5%,企业债券信用利差扩大了0.2%,股市指数下跌了8%,美元相对其他主要货币贬值了4%,而商品价格则上涨了6%。

根据以上信息,请回答以下问题:1、请分析当前投资组合面临的主要风险,并提出相应的风险管理建议。

2、鉴于当前市场状况,你认为应该怎样调整投资组合中的资产分配?3、请设计一套基于当前市场条件下的新的投资策略,并说明理由。

第二题:经济师考试金融高级经济实务案例分析案例材料:某国有商业银行A银行,为了应对金融市场的竞争,近年来一直在积极拓展业务,提升服务质量和效率。

A银行在拓展业务的过程中,采取了一系列措施,包括:1.加强内部管理,优化组织架构,提高员工素质;2.推出了一系列创新产品,如理财产品、信用卡、消费贷款等;3.积极开展线上线下营销活动,扩大客户群体;4.加强与金融机构、企业的合作,拓宽业务渠道;5.优化审批流程,提高贷款审批效率。

近期,A银行在业务拓展过程中遇到了以下问题:1.部分创新产品因操作复杂、收益不稳定,客户接受度不高;2.线上线下营销活动效果不佳,客户转化率低;3.与金融机构、企业的合作过程中,部分合作方存在信用风险。

1、分析A银行在业务拓展过程中遇到的问题产生的原因。

2、针对A银行遇到的问题,提出相应的解决方案。

3、结合案例分析,谈谈A银行在今后业务拓展中应如何提升竞争力。

证劵投资试题库(附参考答案)一、单选题(共52题,每题1分,共52分)1.( )是中国证券市场中历史最悠久、数据最完整的成分股指数。

A、上证综指B、沪深300指数C、深证成分指数D、行业分类指数正确答案:C答案解析:深证成分指数是中国证券市场中历史最悠久、数据最完整的成分股指数。

2.波浪理论认为一个完整的周期分为( )。

A、上升5浪,调整3浪B、上升3浪,调整3浪C、上升4浪,调整2浪D、上升5浪,调整2浪正确答案:A3.能够开发设计出更多具有复杂特性的金融衍生产品的是( )。

A、建构模块工具B、结构化金融衍生工具C、金融远期合约D、金融互换正确答案:B答案解析:考查结构化金融衍生工具相关概念。

4.债券票面利率是债券年利息与债券票面价值的比率,又称为()。

A、名义利率B、实际收益率C、持有期收益率D、到期收益率正确答案:A5.将金融市场划分为一级市场和二级市场的标准是()。

A、交易工具B、发行流通性质C、交割方式D、金融资产的种类正确答案:B答案解析:本题主要考查金融市场的分类,不同的划分标准,划分结果不同。

6.商业汇票属于()。

A、资本证券B、有价证券C、商品证券D、货币证券正确答案:D7.对基金取得的股利收入、债券的利息收、储蓄存款利息收入,由上市公司、发行债券的企业和银行在向基金支付上述收入时代收代缴( )的个人所得税。

A、15%B、20%C、30%D、25%正确答案:B8.在上升趋势中,如果下一次未创新高,即未突破压力线,往后的股价反而向下突破了这个上升趋势的支撑线,通常这意味着( )。

A、上升趋势的结束B、没有特殊意义C、上升趋势的开始D、上升趋势的中继正确答案:A9.上市公司的财务报表必须依法及时向社会公开,这体现了证券交易的()原则。

A、透明B、及时C、公开D、公平正确答案:C答案解析:证券交易原则的理解运用。

10.( )认为收盘价是最重要的价格。

A、形态理论B、切线理论C、波浪理论D、道氏理论正确答案:D11.做市商收取买卖证券差价的证券交易机制是( )。

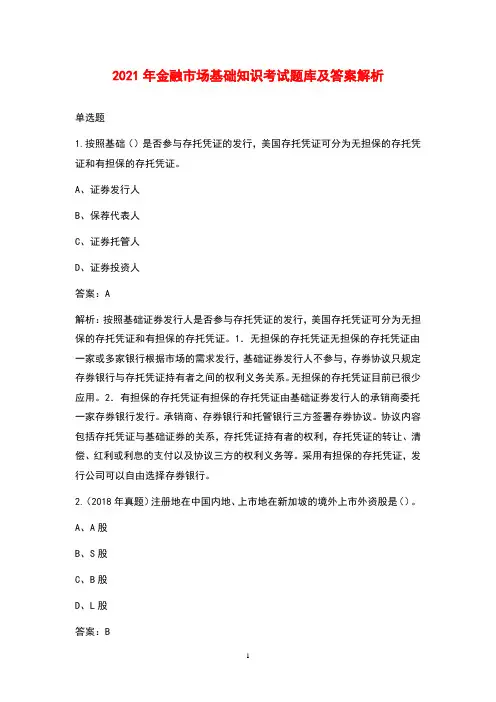

2021年金融市场基础知识考试题库及答案解析单选题1.按照基础()是否参与存托凭证的发行,美国存托凭证可分为无担保的存托凭证和有担保的存托凭证。

A、证券发行人B、保荐代表人C、证券托管人D、证券投资人答案:A解析:按照基础证券发行人是否参与存托凭证的发行,美国存托凭证可分为无担保的存托凭证和有担保的存托凭证。

1.无担保的存托凭证无担保的存托凭证由一家或多家银行根据市场的需求发行,基础证券发行人不参与,存券协议只规定存券银行与存托凭证持有者之间的权利义务关系。

无担保的存托凭证目前已很少应用。

2.有担保的存托凭证有担保的存托凭证由基础证券发行人的承销商委托一家存券银行发行。

承销商、存券银行和托管银行三方签署存券协议。

协议内容包括存托凭证与基础证券的关系,存托凭证持有者的权利,存托凭证的转让、清偿、红利或利息的支付以及协议三方的权利义务等。

采用有担保的存托凭证,发行公司可以自由选择存券银行。

2.(2018年真题)注册地在中国内地、上市地在新加坡的境外上市外资股是()。

A、A股B、S股C、B股D、L股答案:B解析:境外上市外资股主要由H股、N股、L股和S股等构成。

H股是指在中国内地注册的公司在香港上市的外资股,认购和交易均用港币。

香港的英文是HON GKONG,取其首字母,在中国香港上市的外资股被称为“H股”。

依此类推,纽约的第一个英文字母是N,新加坡的第一个英文字母是S,伦敦的第一个英文字母是L,因此,在纽约、新加坡、伦敦上市的外资股分别被称为“N股”“S股”“L 股”。

3.证券公司从事资产管理业务,以下说法错误的是()。

A、为单一投资者设立单一资产管理计划B、为多个投资者设立集合资产管理计划C、单一资产管理计划可以接受货币资金委托,或者接受其他金融资产资金委托D、集合资产管理计划原则上应接受投资者合法持有的股票、债券等其他金融资产资金委托答案:D解析:证券公司从事资产管理业务时,集合资产管理计划原则上应接受货币资金委托。

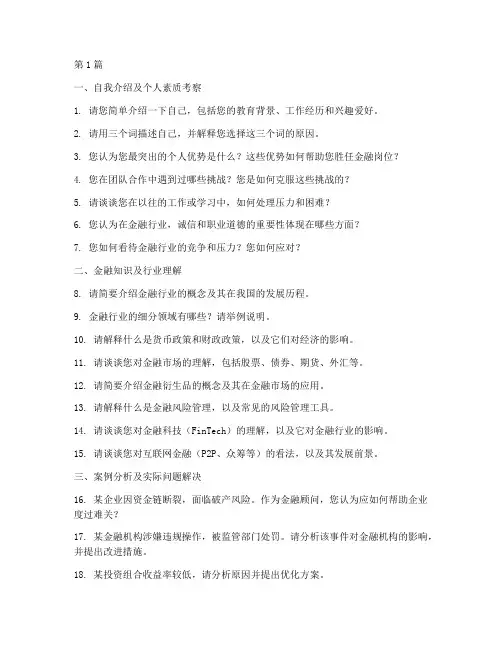

第1篇一、自我介绍及个人素质考察1. 请您简单介绍一下自己,包括您的教育背景、工作经历和兴趣爱好。

2. 请用三个词描述自己,并解释您选择这三个词的原因。

3. 您认为您最突出的个人优势是什么?这些优势如何帮助您胜任金融岗位?4. 您在团队合作中遇到过哪些挑战?您是如何克服这些挑战的?5. 请谈谈您在以往的工作或学习中,如何处理压力和困难?6. 您认为在金融行业,诚信和职业道德的重要性体现在哪些方面?7. 您如何看待金融行业的竞争和压力?您如何应对?二、金融知识及行业理解8. 请简要介绍金融行业的概念及其在我国的发展历程。

9. 金融行业的细分领域有哪些?请举例说明。

10. 请解释什么是货币政策和财政政策,以及它们对经济的影响。

11. 请谈谈您对金融市场的理解,包括股票、债券、期货、外汇等。

12. 请简要介绍金融衍生品的概念及其在金融市场的应用。

13. 请解释什么是金融风险管理,以及常见的风险管理工具。

14. 请谈谈您对金融科技(FinTech)的理解,以及它对金融行业的影响。

15. 请谈谈您对互联网金融(P2P、众筹等)的看法,以及其发展前景。

三、案例分析及实际问题解决16. 某企业因资金链断裂,面临破产风险。

作为金融顾问,您认为应如何帮助企业度过难关?17. 某金融机构涉嫌违规操作,被监管部门处罚。

请分析该事件对金融机构的影响,并提出改进措施。

18. 某投资组合收益率较低,请分析原因并提出优化方案。

19. 某企业欲发行债券融资,请分析其可行性,并为其设计合理的债券发行方案。

20. 某银行客户信用等级较低,请评估其贷款风险,并提出相应的风险控制措施。

四、情景模拟及沟通能力考察21. 您所在的公司拟开展一项新业务,但相关部门对此持反对意见。

请模拟与相关部门负责人沟通,争取支持。

22. 某客户对银行理财产品收益表示质疑,请模拟与客户沟通,解释理财产品收益构成及风险。

23. 某投资者对某支股票表示担忧,请模拟与投资者沟通,分析该股票的风险及投资价值。

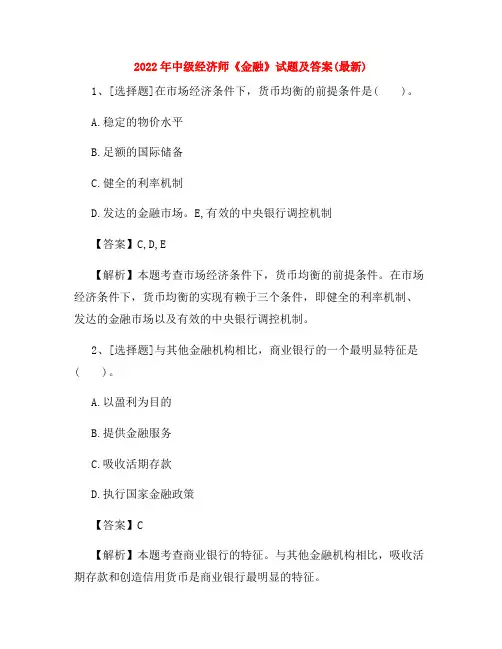

2022年中级经济师《金融》试题及答案(最新)1、[选择题]在市场经济条件下,货币均衡的前提条件是( )。

A.稳定的物价水平B.足额的国际储备C.健全的利率机制D.发达的金融市场。

E,有效的中央银行调控机制【答案】C,D,E【解析】本题考查市场经济条件下,货币均衡的前提条件。

在市场经济条件下,货币均衡的实现有赖于三个条件,即健全的利率机制、发达的金融市场以及有效的中央银行调控机制。

2、[选择题]与其他金融机构相比,商业银行的一个最明显特征是( )。

A.以盈利为目的B.提供金融服务C.吸收活期存款D.执行国家金融政策【答案】C【解析】本题考查商业银行的特征。

与其他金融机构相比,吸收活期存款和创造信用货币是商业银行最明显的特征。

3、[选择题]如果某公司的股票口系数为1.4,市场组合的收益率为6%,无风险收益率为2%,则该公司股票的预期收益率是( )。

A.2.8%B.5.6%C.7.6%D.8.4%【答案】C【解析】本题考查股票预期收益率的计算。

股票预期收益率=1.4×(6%一2%)+2%=7.6%。

4、[单选题]某投资银行存入银行1000万元,一年期利率是4%,每半年结算一次利息,按复利计算,则这笔存款一年后税前所得利息是()。

A.40.2B.40.4C.80.3D.81.6【答案】B【解析】半年利率=4%/2=2%,1000×(1+2%)(1+2%)-1000=40.45、[选择题]在金融衍生品市场上,以风险对冲为主要交易目的的市场参与者是( )。

A.套期保值者B.投机者C.套利者D.经纪人【答案】A【解析】本题间接考查套期保值者的概念。

套期保值者又称风险对冲者,他们从事衍生品交易是为了减少未来的不确定性,降低甚至消除风险。

6、[试题]商业银行经营的核心是()。

A.市场营销B.利润最大化C.风险管理D.提高流动性【答案】A,7、[选择题]我国某商业银行在某发达国家新设一家分行,获准开办所有的金融业务。

中级经济师《金融专业知识与实务》试卷及解析一、单项选择题(共60题,每题1分。

每题的备选项中,只有1个最符合题意)1.金融衍生品市场上重要的套期保值主体是()。

A.企业B.家庭C.政府D.金融机构2.同业拆借活动都是在金融机构之间进行,对参与者要求严格,因此,其拆借活动基本上都是()拆借。

A.质押B.抵押C.担保D.信用3.超短期融资券市场的期限在()天以内。

A.150B.170C.270D.2904.金融工具在金融市场上能够转化为现金的能力,是指金融工具的()。

A.期限性B.流动性C.收益性D.风险性5.我国债券市场中,以下不属于交易所市场的交易品种的是()。

A.质押式回购B.融资融券C.远期交易D.现券交易6.下列各项中,()属于“虚拟”资本。

中级经济师《金融专业知识与实务》试卷及解析A.会计资本B.监管资本C.经济资本D.实收资本7.某人借款100万元,年利率为10%,2年后还本付息。

如果按复利每年计息一次,则第二年末借款人应支付的本息和总计为()万元。

A.110.00B.110.25C.121.00D.121.258.1998年6月1日成立的欧洲中央银行的组织形式属于()制度。

A.一元式中央银行B.二元式中央银行C.跨国的中央银行D.准中央银行9.面值1000元的两年期零息债券,购买价格为950元,如果按半年复利计算,那么债券的到期收益率是()。

A.2.58%B.2.59%C.5.00%D.5.26%10.在商业银行资产负债管理中,规模对称原理的动态平衡的基础是()。

A.合理经济体制B.合理经济结构C.合理经济规模D.合理经济增长11.现代商业银行财务管理的核心是基于()的管理。

A.利润最大化B.效率最大化C.价值最大化D.核心资本增值12.由境内外金融机构、境内非金融机构企业法人、境内自然人出资,在农村地区设立的主要为当地农民、农业和农村经济发展提供服务的金融机构是()。

A.村镇银行B.小额贷款公司C.农村信用社D.邮政储蓄银行13.当投资银行帮助发行人向投资者发售收益凭证时,投资银行在证券运作中承担()角色。

第14章测试题单选题(每题6分,共5道)题目1不正确获得6.00分中的0.00分标记题目题干防止内幕交易和防止操纵市场是对()监管的主要内容。

选择一项:A.证券业B.银行夜C.保险业.租赁、信托业反馈知识点提示:金融监管的实施。

参见教材本章第三节。

正确答案是:证券业题目2正确获得6.00分中的6.00分标记题目题干对证券市场监管的主要任务是()。

选择一项:A.保护投保人的合法权益B.保护存款人的合法权益C.保护投资者的合法权益.保护企业并购重组中的合法权益反馈知识点提示:对证券市场的监管。

参见教材本章第三节。

正确答案是:保护投资者的合法权益题目3不正确获得6.00分中的0.00分标记题目题干金融监管理论体系中不包括()。

选择一项:A.相关理论B.基础理论C.自然理论.应用理论反馈知识点提示:监管理论体系。

参见教材本章第一节。

正确答案是:自然理论题目4由被监管者的道德风险引起的损失或成本称之为()。

正确答案是:间接效率损失题目5不正确获得6.00分中的0.00分标记题目题干金融监管中由政府负担的成本是()。

选择一项:A.行政成本B.直接资源成本C.奉行成本.间接效率损失反馈知识点提示:金融监管的成本与边界。

参见教材本章第一节。

正确答案是:行政成本标记题目10不正确获得8.00分中的0.00分标记题目正确获得6.00分中的6.00分标记题目题干金融监管中由政府负担的成本是奉行成本。

选择一项:对错反馈知识点提示:金融监管的成本与边界。

参见教材本章第一节。

答案解析:政府负担的成本是行政成本。

正确的答案是“错”。

题目12不正确获得6.00分中的0.00分标记题目题干金融监管从对象上看,主要是对商业银行、金融市场的监管,非银行金融机构则不在其列。

选择一项:对错反馈知识点提示:金融监管体制的变迁。

参见教材本章第二节。

答案解析:金融监管不仅是对商业银行、金融市场的监管,也包括对非银行金融机构的监管,如对保险业的监管。

2016《金融市场基础知识》考试真题及答案一、单项选择题1.证券交易市场通常分为( )和场外交易市场。

A.证券交易所市场B.OTC市场C.地方股权交易中心市场D.A股市场【答案】A【解析】证券交易市场分为证券交易所市场和场外交易市场。

2.在Ms=m×B中,m是货币乘数,B是基础货币,Ms是( )。

A.虚拟货币B.货币供给C.名义货币D.货币需求【答案】B【解析】货币供给(量)等于基础货币与货币乘数之积。

即:Ms=m×B,其中,Ms表示货币供给(量);m表示货币乘数;B表示基础货币。

3.下列各项中,属于专门为投资者买卖人民币特种股票而设置的账户是( )。

A.A股账户B.基金账户C.期权账户D.B股账户【答案】D【解析】人民币特种股票账户简称B股账户,是专门用于为投资者买卖人民币特种股票(即B股,也称境内上市外资股)而设置的。

4.优先认股权是指当股份公司为增加公司资本而决定增加发行新的股票时,原普通股股东享有的按其持股比例,以( )优先认购一定数量新发行股票的权利。

A.低于市场价格的任意价格B.高于市场价格C.与市场价格相同的价格D.低于市场价格的某一特定价格【答案】D【解析】优先认股权是指当股份公司为增加公司资本而决定增加发行新的股票时,原普通股股东享有的按其持股比例、以低于市价的某一特定价格优先认购一定数量新发行股票的权利。

5.下列不属于股票特征的是( )。

A.收益性B.风险性C.流动性D.保本性【答案】D【解析】股票具有以下特征:收益性、风险性、流动性、永久性和参与性。

6.对股份有限公司而言,发行优先股票的作用在于可以筹集( )的公司股本。

A.长期稳定B.中短期C.中期D.短期【答案】A【解析】对股份公司而言,发行优先股票的作用在于可以筹集长期稳定的公司股本,又因其股息率固定,可以减轻利润的分派负担。

7.OTC市场是( )的简称。

A.场内市场B.场外市场C.发行市场D.交易市场【答案】B【解析】无形市场称为场外市场或柜台市场,简称OTC市场,是指没有固定交易场所的市场。

第五章金融市场概述一、名词解释1、金融市场:(P118)是资金供求双方借助金融工具进行货币资金融通与配置的市场。

其含义有广义和狭义之分。

广义金融市场既包括直接金融市场,又包括间接金融市场;狭义金融市场则仅包括直接金融市场。

2、金融工具:(P119)是金融市场至关重要的构成要素,因为金融市场中所有的货币资金交易都以金融工具为载体,资金供求双方通过买卖金融工具实现资金的相互融通。

3、股票:(P122)是股份有限公司在筹集资本金时向出资人发行的,用以证明其股东身份和权益的一种所有权凭证。

4、债券:(P121)是政府、金融机构、工商企业等直接向社会借债筹措资金时,向投资者出具的、承诺按约定条件支付利息和到期归还酬金的债权债务凭证。

5、政府债券:(P121)是指由中央政府和地方政府发行的债券,它以政府的信誉作保证,因而通常无需抵押品,其风险在各种债券中是最低的,利率水平也抵于金融债券和企业债券。

6、金融债券:(P121)发行主体是银行或非银行金融机构。

发行目的一般是为了筹集长期资金,金融债券的信用风险要低于公司债券,其利率水平也相应低于公司债券。

7、公司债券:(P121)又被称为企业债券,是由公司企业为筹集资金而发行的债券。

8、可转换债券:(P122)是指公司债券附加可转换条款,赋予债券持有人在一定期限内按预先确定的比例将债券转换为该公司普通股的选择权。

9、可赎回债券:(P122)是指该债券的发行公司被允许在债券到期日之前以事先确定的价格和方式赎回部分或全部债券。

10、偿还基金债券:(P122)要求发行公司按发债总额每年从盈利中提取一定比例存入信托基金,定期偿还本金,即从债券持有人手中购回一定量的债券。

11、带认股权证的债券:(P122)是指公司债券可把认股权证作为合同的一部分附带发行。

12、优先股:(P122)是股份有限公司发行的具有收益分配和剩余资产分配优先权的股票。

其具有两种优先权:一是优先分配权;二是优先求偿权。

2023金融市场基础知识试题与答案9题目单选题按照深圳证券交易所的规定,每个交易日有()个时间段为集合竞价时间。

A、1B、2C、3D、4【正确答案】:B【答案解析】:深圳证券交易所规定,每个交易日的9:15~9:25为开盘集合竞价时间;14:57~15:0为收盘集合竞价时间。

题目单项选择题下列关于封闭式基金和开放式基金的交易价格是否包含交易手续费的说法中,正确的是()。

A、两者均不包含B、两者都包含C、前者不包含,后者包含D、前者包含,后者不包含【正确答案】:D【答案解析】:投资者在买卖封闭式基金时,在基金价格之外要支付手续费;投资者在买卖开放式基金时,则要支付申购费和赎回费。

题目单项选择题除按规定分得本期固定股息外,无权再参与对本期剩余营利分配的优先股票,称为()。

A、非累积优先股票B、非参与优先股票C、可赎回优先股票D、股息率固定优先股票【正确答案】:B【答案解析】:非参与优先股票是指除了按规定分得本期固定股息外,无权再参与对本期剩余营利分配的优先股票。

非参与优先股票是一般意义上的优先股票,其优先权不是体现在股息多少上,而是在分配顺序上。

题目单项选择题上海证券交易所规定,当日无交易的,其即时行情显示的当日收盘价格为()。

A、前开盘价B、前结算价C、前收盘价D、前最高价【正确答案】:C【答案解析】:上海证券交易所规定,当日无成交的,以前收盘价为当日收盘价。

题目单项选择题优先股票作为一种股权证书,代表着对公司的(。

)A、所有权B、债权C、索取权D、管理权【正确答案】:A【答案解析】:优先股票作为一种股权证书,代表着对公司的所有权题目单项选择题从事中间介绍业务的证券公司应当在其经营场所显著位置或者其网站,公开从事介绍业务的管理人员和业务人员的()。

A、业务范围B、名单和照片C、过往经验D、联系方式【正确答案】:B【答案解析】:从事中间介绍业务的证券公司应当在其经营场所显著位置或者其网站,公开从事介绍业务的管理人员和业务人员的名单和照片。

Chapter 15 Why Do Financial Institutions Exist?

Multiple Choice Questions 1. Of the following sources of external finance for American nonfinancial businesses, the least important is

(a) loans from banks. (b) stocks. (c) bonds and commercial paper. (d) nonbank loans. Answer: B

2. Of the following sources of external finance for American nonfinancial businesses, the most important is

(a) loans from banks. (b) stocks. (c) bonds and commercial paper. (d) nonbank loans. Answer: D

3. Of the sources of external funds for nonfinancial businesses in the United States, bonds account for approximately _________ of the total.

(a) 10 percent (b) 20 percent (c) 30 percent (d) 50 percent Answer: C

4. Of the sources of external funds for nonfinancial businesses in the United States, stocks account for approximately _________ of the total.

(a) 10 percent (b) 20 percent (c) 30 percent (d) 40 percent Answer: A 186 Mishkin/Eakins • Financial Markets and Institutions, Fifth Edition 5. With regard to external sources of financing for nonfinancial businesses in the United States, which of the following are accurate statements?

(a) Marketable securities account for a larger share of external business financing in the United States than in most other countries. (b) Since 1970, less than 5 percent of newly issued corporate bonds and commercial paper have been sold directly to American households. (c) The stock market accounted for the largest share of the financing of American businesses in the 1970–2000 period. (d) All of the above. (e) Only (a) and (b) of the above. Answer: E

6. With regard to external sources of financing for nonfinancial businesses in the United States, which of the following are accurate statements?

(a) Direct finance is used in less than 5 percent of the external financing of American businesses. (b) Only large, well-established corporations have access to securities markets to finance their activities. (c) Loans from banks and other financial intermediaries in the United States provide five times more financing of corporate activities than do stock markets. (d) All of the above. (e) Only (a) and (b) of the above. Answer: D

7. (I) In the United States nonbank loans are the most important source of external funds for nonfinancial businesses. (II) In Germany and Japan, issuing stocks and bonds is the most important source of external for nonfinancial businesses.

(a) (I) is true, (II) false. (b) (I) is false, (II) true. (c) Both are true. (d) Both are false. Answer: A

8. Which of the following is not one of the eight basic facts about financial structure? (a) Debt contracts are typically extremely complicated legal documents that place substantial restrictions on the behavior of the borrower. (b) Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financial markets. (c) Collateral is a prevalent feature of debt contracts for both households and business. (d) New security issues are the most important source of external funds to finance businesses. Answer: D Chapter 15 Why Do Financial Institutions Exist? 187 9. Which of the following is not one of the eight basic facts about financial structure? (a) The financial system is among the most heavily regulated sectors of the economy. (b) Issuing marketable securities is the primary way businesses finance their operations. (c) Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financial markets. (d) Financial intermediaries are the most important source of external funds to finance businesses. Answer: B

10. Because information is scarce, (a) equity contracts are used much more frequently to raise capital than are debt contracts. (b) monitoring managers gives rise to costly state verification. (c) government regulations, such as standard accounting principles, can help reduce moral hazard. (d) all of the above are true. (e) only (b) and (c) of the above are true. Answer: E

11. Which of the following best explains the recent decline in the role of financial intermediaries? (a) Private production and sale of information (b) Government regulation to increase information (c) Improvements in information technology (d) None of the above can explain the recent decline Answer: C