税务登记证副本中译英

- 格式:doc

- 大小:21.00 KB

- 文档页数:2

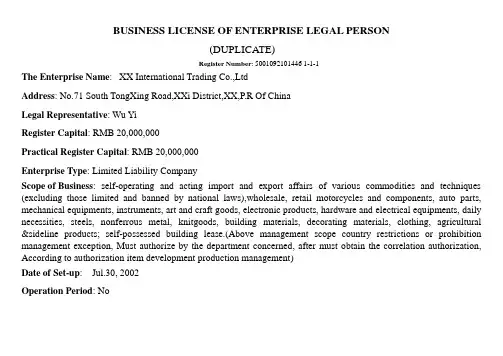

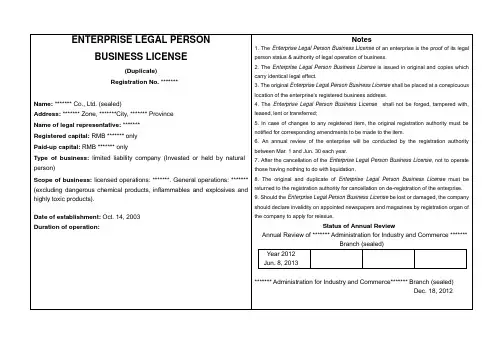

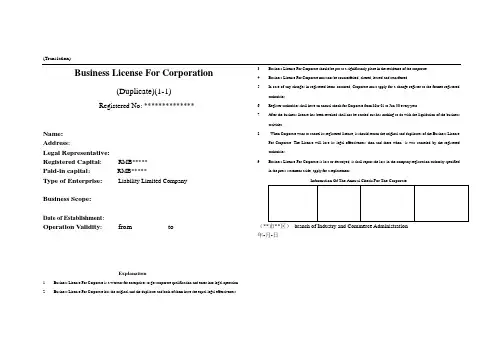

BUSINESS LICENSE OF ENTERPRISE LEGAL PERSON(DUPLICATE)Register Number: 5001092101446 1-1-1The Enterprise Name: XX International Trading Co.,LtdAddress: No.71 South TongXing Road,XXi District,XX,P.R Of ChinaLegal Representative: Wu YiRegister Capital: RMB 20,000,000Practical Register Capital: RMB 20,000,000Enterprise Type: Limited Liability CompanyScope of Business: self-operating and acting import and export affairs of various commodities and techniques (excluding those limited and banned by national laws),wholesale, retail motorcycles and components, auto parts, mechanical equipments, instruments, art and craft goods, electronic products, hardware and electrical equipments, daily necessities, steels, nonferrous metal, knitgoods, building materials, decorating materials, clothing, agricultural &sideline products; self-possessed building lease.(Above management scope country restrictions or prohibition management exception, Must authorize by the department concerned, after must obtain the correlation authorization, According to authorization item development production management)Date of Set-up: Jul.30, 2002Operation Period: NoNOTICE1.The Business License of Enterprise Legal Person is the qualification of the enterprise legal person and legitimate business documents.2.The Business License of Enterprise Legal Person is divided into original and duplicate which have the equal legal effect.3.The original of the Business License of Enterprise Legal Person should be laid up in an eye-catching place of the domicile.4.The Business License of Enterprise Legal Person should not be forged, altered, let out, lent or assigned the business license.5.To change some registered items, the company shall apply for registration of modifications with the company registration authority, and renew The Business License of Enterprise Legal Person.6. In every year from March 1 through June 30, company shall participate in the annual examination.7.After The Business License of Enterprise Legal Person have been revoked, the company shall not engage in businessactivities except liquidation.8.When applying for the cancellation of registration, the company shall return the original and duplicate of the Business License of Enterprise Legal Person.9.If the Business License of Enterprise Legal Person is lost or damaged, the company shall announce it invalid in the newspaper and periodical designated by the company registration authority, and shall apply for a reassurance.Record of Annual Inspection:Registration institute shall inspect the corporation yearly, at any time between March 1 and June 30 each year. No any further notification.Registration Organization: Chongqing Administration For Industry & Commerce, Beibei Branch (Seal)Date: 25, Dec, 2006。

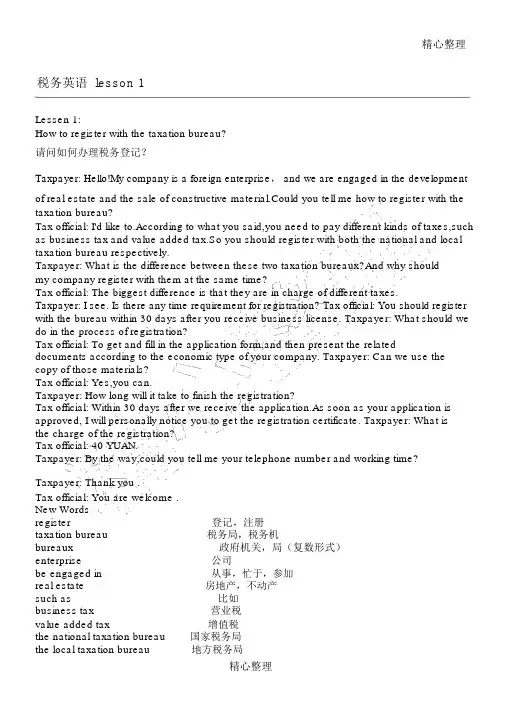

税务英语lesson 1Lessen 1:How to register with the taxation bureau请问如何办理税务登记Taxpayer: Hello!My company is a foreign enterprise,and we are engaged in the development of real estate and the sale of constructive you tell me how to register with the taxation bureau税务英语lesson 2Lessen 2:The declaration is far more important than I have expected!纳税申报比我想象的重要的多!Tax official: look unhappy. What can I do for youTaxpayer: My company has been fined because we didn't file the tax we have not got any income at all.Tax official: Well,according to the Chinese law,the taxpayer must file its taxreturns within the prescribed time,no matter whether it has business income.Taxpayer: If both the tax payment and tax declaration are overdue,what will happenTax official: The taxation bureau will set a new deadline for the declaration and impose a fine on the at the same time,the taxation bureau will levy a overdue payment per day equal %of the overdue tax.Taxpayer: What will happen if the taxpayer files false tax returnsTax official: If it is on purpose,it will be regarded as tax evasion. If the amount does not exceed certain limit,the taxpayer will be fined within five times as much as the the case reaches the criminal limit,we will also find out the taxpayer's criminal responsibility.Taxpayer: What is the criminal limitTax official: The amount exceeds ten thousand YUAN and exceeds 1O%of the amount that he should taxpayer will also be charged as criminal if he files falsely again after receiving administrative penalties twice due to false declaration.Taxpayer: What will happen thenTax official: The taxpayer will be traced about his criminal responsibility in addition to the fine.Taxpayer: Well,the tax declaration is far more important than I have expected is the deadline for itTax official: It depends on different business tax,it is due within the first 10 days of the following month. For individual income tax,it is within the first 7 days. If the deadline is the vacation or holiday,it can be put off in turn.Taxpayer: What you have said is very important to wish that we would not be fined again.Taxofficial: I hope so.New Wordsdeclaration 申报taxreturn 纳税申报表fine 罚款no matter 不论(连词)business income 营业所得,营业收入deadline 截止的期限impose on 加征(税,义务等)于levy on 征收,征集,强迫收集overdue payment 滞纳金overdue 过期的,过时的equal 相同的,相等的be equal to 与……相同on purpose 故意地regard as 视作,认为tax evasion 逃税,偷税,漏税exceed 超过……的范围criminal 犯罪的,犯法的find out 追查criminal responsibility 刑事责任penalty 处罚,罚款due to 由于,起因于responsibility 责任,职责in addition to 除了trace 追查,追究put off 延期,推迟in turn 依次,接连地individual income tax 个人所得税中文对照第二课:纳税申报比我想象的重要的多!税务局: 您好。

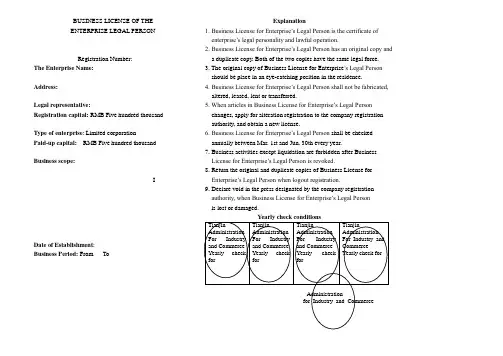

BUSINESS LICENSE OF THEENTERPRISE LEGAL PERSONRegistration Number:The Enterprise Name:Address:Legal representative:Registration capital: RMB Five hundred thousandType of enterprise: Limited corporationPaid-up capital:RMB Five hundred thousand Business scope:IDate of Establishment:Business Period: From ToExplanation1. Business License for Enterprise’s Legal Person is the certificate of enterprise’s legal personality and lawful operation.2. Business License for Enterprise’s Legal Person has an original copy anda duplicate copy. Both of the two copies have the same legal force.3. The original copy of Business License for Enterprise’s Legal Person should be place in an eye-catching position in the residence.4. Business License for Enterprise’s Legal Person shall not be fabricated, altered, leased, lent or transferred.5. When articles in Business License for Enterprise’s Legal Person changes, apply for alteration registration to the company registration authority, and obtain a new license.6. Business License for Enterprise’s Legal Person shall be checked annually between Mar. 1st and Jun. 30th every year.7. Business activities except liquidation are forbidden after Business License for Enterprise’s Legal Person is revoked.8. Return the original and duplicate copies of Business License for Enterprise’s Legal Person when logout registration.9. Declare void in the press designated by the company registration authority, when Business License for Enterprise’s Legal Personis lost or damaged.。

税务英语lesson 1Lessen 1:How to register with the taxation bureau?请问如何办理税务登记?Taxpayer: Hello!My company is a foreign enterprise,and we are engaged in the development of real estate and the sale of constructive material.Could you tell me how to register with the taxation bureau?Tax official: I'd like to.According to what you said,you need to pay different kinds of taxes,such as business tax and value added tax.So you should register with both the national and local taxation bureau respectively.Taxpayer: What is the difference between these two taxation bureaux?And why should my company register with them at the same time?Tax official: The biggest difference is that they are in charge of different taxes. Taxpayer: I see. Is there any time requirement for registration? Tax official: You should register with the bureau within 30 days after you receive business license. Taxpayer: What should we do in the process of registration?Tax official: To get and fill in the application form,and then present the related documents according to the economic type of your company.Taxpayer: Can we use the copy of those materials?Tax official: Yes,you can.Taxpayer: How long will it take to finish the registration?Tax official: Within 30 days after we receive the application.As soon as your application is approved, I will personally notice you to get the registration certificate. Taxpayer: What is the charge of the registration?Tax official: 40 YUAN.Taxpayer: By the way,could you tell me your telephone number and working time?Tax official: Our telephone number is 64004857.We work from 8:30 AM to 11:30 AM and from 1:30 PM to 5:00 PM. Taxpayer: Thank you .Tax official: You are welcome .New Wordsregister 登记,注册taxation bureau 税务局,税务机bureaux 政府机关,局(复数形式)enterprise 企业be engaged in 从事,忙于,参加real estate 房地产,不动产such as例如business tax 营业税value added tax 增值税the national taxation bureau 国家税务局the local taxation bureau 地方税务局respectively 分别地,各自地at the same time 同时in charge of 负责business license 营业执照application form 申请表prescribe 规定according to 根据registration certificate 登记证approve 认可,批准,同意You are welcome. 别客气!中文对照第一课:请问如何办理税务登记?纳税人: 您好,我是一家外企公司,被批准从事房地产开发,兼营建材销售。

(Translation)Business License For Corporation(Duplicate)(1-1)Registered No: **************Name:Address:Legal Representative:Registered Capital: RMB*****Paid-in capital:RMB*****Type of Enterprise:Liability Limited CompanyBusiness Scope:Date of Establishment:Operation Validity: from toExplanation1.Business License For Corporate is a warrant for enterprises to get corporate qualification and enter into legal operation.2.Business License For Corporate has the original and the duplicate and both of them have the equal legal effectiveness.3.Business License For Corporate should be put at a significantly place in the residence of the corporate.4.Business License For Corporate must not be counterfeited, altered, leased and transferred.5.In case of any changes in registered items occurred, Corporate must apply for a change register to the former registeredauthorities.6.Register authorities shall have an annual check for Corporate from Mar-01 to Jun-30 every year.7.After the business license has been revoked shall not be carried out has nothing to do with the liquidation of the businessactivities8.When Corporate want to cancel its registered license, it should return the original and duplicates of the Business LicenseFor Corporate. The License will lose its legal effectiveness then and there when it was canceled by the registered authorities.9.Business License For Corporate is lost or destroyed, it shall report the loss in the company registration authority specifiedin the press statement aside, apply for a replacementInformation Of The Annual Check For The Corporate年-月-日。

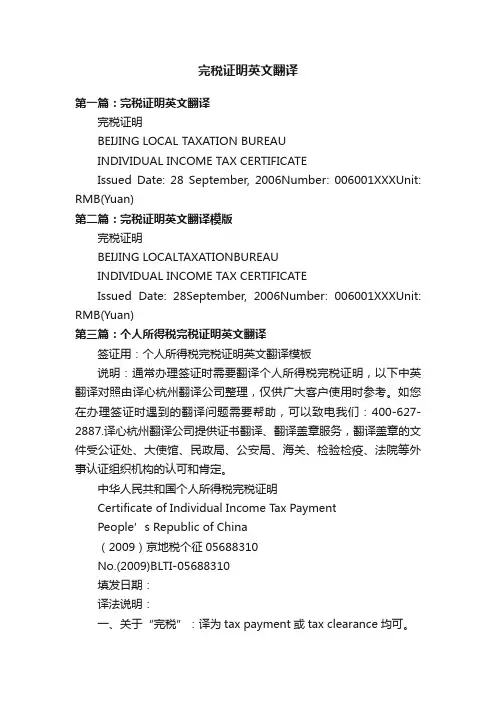

完税证明英文翻译第一篇:完税证明英文翻译完税证明BEIJING LOCAL TAXATION BUREAUINDIVIDUAL INCOME TAX CERTIFICATEIssued Date: 28 September, 2006Number: 006001XXXUnit: RMB(Yuan)第二篇:完税证明英文翻译模版完税证明BEIJING LOCALTAXATIONBUREAUINDIVIDUAL INCOME TAX CERTIFICATEIssued Date: 28September, 2006Number: 006001XXXUnit: RMB(Yuan)第三篇:个人所得税完税证明英文翻译签证用:个人所得税完税证明英文翻译模板说明:通常办理签证时需要翻译个人所得税完税证明,以下中英翻译对照由译心杭州翻译公司整理,仅供广大客户使用时参考。

如您在办理签证时遇到的翻译问题需要帮助,可以致电我们:400-627-2887.译心杭州翻译公司提供证书翻译、翻译盖章服务,翻译盖章的文件受公证处、大使馆、民政局、公安局、海关、检验检疫、法院等外事认证组织机构的认可和肯定。

中华人民共和国个人所得税完税证明Certificate of Individual Income Tax PaymentPeople’s Republic of China(2009)京地税个征05688310No.(2009)BLTI-05688310填发日期:译法说明:一、关于“完税”:译为tax payment或tax clearance均可。

二、关于完税证明编号的翻译:此处“(2009)京地税个征05688310”译为“No.(2009)BLTI-05688310”,其中BLT表示“北京地方税务”、I表示“个人所得税”,仅供参考。

怎么译都可以,只要像那么回事。

三、关于“税款所属时期”:这里按其涵义译为“charging period of tax”。

税务英语对话文稿归稿存档编号:[KKUY-KKIO69-OTM243-OLUI129-G00I-FDQS58-税务英语lesson 1Lessen 1: How to register with the taxation bureau 请问如何办理税务登记Taxpayer: Hello!My company is a foreign enterprise,and we are engaged in the development of real estate and the sale of constructive material.Could youtell me how to register with the taxation bureau税务英语lesson 2Lessen 2:The declaration is far more important than I have expected!纳税申报比我想象的重要的多!Tax official: Hello.You look unhappy. What can I do for youTaxpayer: My company has been fined because we didn't file the tax returns.But we have not got any income at all.Tax official: Well,according to the Chinese law,the taxpayer must file its taxreturns within the prescribed time,no matter whether it has business income.Taxpayer: If both the tax payment and tax declaration are overdue,what will happenTax official: The taxation bureau will set a new deadline for the declaration and impose a fine on the taxpayer.Also at the same time,the taxation bureau will levy a overdue payment per day equal toO.2%of the overdue tax.Taxpayer: What will happen if the taxpayer files false tax returnsTax official: If it is on purpose,it will be regarded as tax evasion. If the amount does not exceed certain limit,the taxpayer will be fined within five times as much as the amount.If the case reaches the criminal limit,we will also find out the taxpayer's criminal responsibility.Taxpayer: What is the criminal limitTax official: The amount exceeds ten thousand YUAN and exceeds 1O%of the amount that he should declare.The taxpayer will also be charged as criminal if he files falsely again after receiving administrative penalties twice due to false declaration.Taxpayer: What will happen thenTax official: The taxpayer will be traced about his criminal responsibility in addition to the fine.Taxpayer: Well,the tax declaration is far more important than I have expected before.What is the deadline for itTax official: It depends on different taxes.For business tax,it is due within the first 10 days of the following month. For individual income tax,it is within the first 7 days. If the deadline is the vacation or holiday,it can be put off in turn.Taxpayer: What you have said is very important to us.I wish that we would not be fined again. Taxofficial: I hope so. New Words declaration 申报 taxreturn 纳税申报表 fine 罚款 no matter 不论(连词) business income 营业所得,营业收入deadline 截止的期限 impose on 加征(税,义务等)于 levy on 征收,征集,强迫收集 overdue payment 滞纳金 overdue 过期的,过时的 equal 相同的,相等的 be equal to 与……相同 on purpose 故意地 regard as 视作,认为 tax evasion 逃税,偷税,漏税 exceed 超过……的范围 criminal 犯罪的,犯法的 find out 追查criminal responsibility 刑事责任 penalty 处罚,罚款 due to 由于,起因于responsibility 责任,职责 in addition to 除了 trace 追查,追究 put off 延期,推迟 in turn 依次,接连地 individual income tax 个人所得税中文对照第二课:纳税申报比我想象的重要的多! 税务局: 您好。

精心整理税务英语 lesson 1Lessen 1:How to register with the taxation bureau?请问如何办理税务登记?Taxpayer: Hello!My company is a foreign enterprise, and we are engaged in the development of real estate and the sale of constructive material.Could you tell me how to register with the taxation bureau?Tax official: I'd like to.According to what you said,you need to pay different kinds of taxes,such as business tax and value added tax.So you should register with both the national and local taxation bureau respectively.Taxpayer: What is the difference between these two taxation bureaux?And why shouldmy company register with them at the same time?Tax official: The biggest difference is that they are in charge of different taxes.Taxpayer: I see. Is there any time requirement for registration? Tax official: You should register with the bureau within 30 days after you receive business license. Taxpayer: What should we do in the process of registration?Tax official: To get and fill in the application form,and then present the relateddocuments according to the economic type of your company. Taxpayer: Can we use the copy of those materials?Tax official: Yes,you can.Taxpayer: How long will it take to finish the registration?Tax official: Within 30 days after we receive the application.As soon as your application is approved, I will personally notice you to get the registration certificate. Taxpayer: What isthe charge of the registration?Tax official: 40 YUAN.Taxpayer: By the way,could you tell me your telephone number and working time?Taxpayer: Thank you .Tax official: You are welcome .New Wordsregister登记,注册taxation bureau税务局,税务机bureaux政府机关,局(复数形式)enterprise公司be engaged in从事,忙于,参加real estate房地产,不动产such as比如business tax营业税value added tax增值税the national taxation bureau国家税务局精心整理respectively分别地,各自地at the same time同时in charge of负责business license营业执照application form申请表prescribe规定according to依据registration certificate登记证approve认同,赞同,赞同You are welcome.别客气!税务英语 lesson 2Lessen 2:The declaration is far more important than I have expected!纳税申报比我想象的重要的多!Tax official: Hello.You look unhappy. What can I do for you?Taxpayer: My company has been fined because we didn't file the tax returns.But we have not got any income at all.Tax official: Well,according to the Chinese law,the taxpayer must file its taxreturns within the prescribed time,no matter whether it has business income.Taxpayer: If both the tax payment and tax declaration are overdue,what will happen?Tax official: The taxation bureau will set a new deadline for the declaration and impose a fine on the taxpayer.Also at the same time,the taxation bureau will levy a overdue payment per day equal toO.2%of the overdue tax.Taxpayer: What will happen if the taxpayer files false tax returns?Tax official: If it is on purpose,it will be regarded as tax evasion. If the amount does not exceed certain limit,the taxpayer will be fined within five times as much as the amount.If the case reaches the criminal limit,we will also find out the taxpayer's criminal responsibility.Taxpayer: What is the criminal limit?Tax official: The amount exceeds ten thousand YUAN and exceeds 1O%of the amount that he should declare.The taxpayer will also be charged as criminal if he files falsely again after receiving administrative penalties twice due to false declaration.精心整理Taxpayer: What will happen then?Tax official: The taxpayer will be traced about his criminal responsibility in addition to the fine.Taxpayer: Well ,the tax declaration is far more important than I have expected before.What is the deadline for it?Tax official: It depends on different taxes.For business tax,it is due within the first 10 days of the following month. For individual income tax ,it is within the first 7 days. If the deadline is the vacation or holiday,it can be put offinturn.Taxpayer: What you have said is very importanttous.I wish that we would not be fined again.Taxofficial: I hope so.New Wordsdeclaration 申taxreturn 税申表fine 款no matter 不()business income 所得,收入deadline 截止的限期impose on 加征(税,等)于levy on 征收,搜集,迫采集overdue payment 滞金overdue 期的,的equal 同样的,相等的be equal to 与⋯⋯同样on purpose 成心地精心整理regard as 作,tax evasion 逃税,税,漏税exceed 超⋯⋯的范criminal 犯罪的,犯罪的find out 追criminal responsibility 刑事任penalty ,款due to 因为,因因为responsibility 任,in addition to 除了trace 追,追查put off 缓期,推in turn 挨次,接地individual income tax 个人所得税税务英语 lesson 3Lessen 3:Could you give me some introduction of the business tax?Taxpayer: My company will begin business soon.Could you give me some introduction of the business tax?Tax official: OK.Generally speaking,the business tax is levied on the taxable service,the transfer of intangible asset and the sale of the real estate in China.Taxpayer: What is the taxable service? .Tax official: It is clearly stipulated in the tax law, such as transportation, construction, finance and insurance,post and tele-communication,culture and sport,entertainment and精心整理service.However it does not include the processing,repair and replace- ment service,because they are subject to the value added tax.Taxpayer: It is easy to understand the real estate,but what is the intangible asset?Tax official: It means the asset that is not in the form of material object but can bring profit,such as patent right,know-how,copyright,trade mark right and the land-useright,etc.Taxpayer: What about the taxable income?Tax officid: In most case,it is the total income received,including additional fees and charges. Taxpayer: Does that include the income received in advance?Tax official: Yes,it is in the transfer of land-use right and immovable property.Taxpayer: And what about the donation?Tax official: The donation of immovable property is considered as sale,and the taxation bureau will verify the taxable income.Taxpayer: What should we do if we receive income in foreign currency?Tax official: For the financial institutions,the income will be conversed to RMB at the exchange rate of either the date on which the taxable item happened or the end of the quaner.If your company is not a financial institution,your income will be conversed into RMB at the exchange rate of either the date on which the taxable item happened or the first day of the month.Taxpayer: How about the tax rate?Tax official: In general,the rate is from 3% t05%. For the entertainment,it is from 5% to 20% .Taxpayer: What you have said is very helpful,thank you.New Wordsgenerally speaking 一般地说,一般而言taxable 应纳税的,可收税的transfer ,与,移intangible asset 无形stipulate 定,定transportation 交通运construction 建筑安装finance 金融insurance 保post and tele-communication 通讯culture 文化entertainmentbe subject to 听从⋯,受制于⋯profit 利patent right 利know-how 有技,技奥密copyright 版,着作trade mark 商land-useright 土地使用etc 等等taxable income 税收入,税收入in advance 先donation 捐,送verify 审定financial institution 金融机构converse 换算,兑换quarter 季度exchange rate 汇率item 项目tax rate 税率税务英语 lesson 4Lessen 4:How to pay business tax for leasing?租借财富如何纳营业税?Taxpayer: Hello,I am from a for-eign company,would you tell me something about how to pay business tax for leasing?Tax official: I'd like to.Can you tell me what kind of property your company wants to lease? Taxpayer: We have not decided yet,is that important?Tax official: Yes,it is very important.If your company leases movable property and inChina sets up organizations related to leasing,your company should pay tax.Taxpayer: Do you mean the representative office by organization?Tax official: Not only the representative office,it also includes the management and business organization,workingplace and the agent.Taxpayer: I see. What about leasing intangible asset?Tax official: If the intangible asset is used in China,the leasing operation is taxable,no matter whether the company has organizations in China.So is leasing immovable property, if the property is located in China.Taxpayer: Any other requirement?精心整理Tax official: When calculating the taxable income,we should distinguish the financialleasing from the operational leasing.Taxpayer: what is the financial leasing?Tax official: It means that the leasing operation has a financial nature and the ownership of the leased property will ultimately be passed to the borrower at the end of the leasing period.In this case,the taxable income is the net value calculated by deducting the real cost of the leased asset from the whole income (includingad-ditional fees).Taxpayer: The operational leasing does not involve the ownership,is that right?Tax official: Yes.Different from the financial leasing,the whole rental income of the operational leasing is taxable.Taxpayer: How about the tax rate?Tax official: It is 5%.Taxpayer: Thank you very much.New Wordslease 租借property 财富movable property 动产set up 建立,成立organization 机构,集体representative office 代表处working place 作业场所,生产地区agent 代理人financial lease 金融租借operational lease 经营租借精心整理ownership 全部权deduct 扣除,减除realcost 实质成本involve 波及税务英语 lesson 5Lessen 5:How do we beneficially invest the land-use right?如何投资土地使权才合算?Taxpayer: Our company is engaged in development of real estate. Recently,we planed to cooperate with another company to build houses.I would like to know something about paying business tax forit.Tax official: Can you explain your plan in detail?Taxpayer: My company provides the land-use right and the other party invests themoney needed. At the end of project,my company will get a part of the houses.Tax official: This means that your company exchanges the land- use right for the ownership of the houses.In this case,for transfering the intangible asset,your company should pay businesstax,equal to 5% of the transfering income.lf you want to resell that part of the houses,you need to pay business tax and the land appreciation tax(LAT)again for the transfer of immovable property.Taxpayer: How do we determine the taxable income if the transfer does not conduct in formof currency?Tax official: The taxation bureau will refer to the local similar price or the cost of houses to decide your income.Taxpayer: Will it be profitable if the two companies establish joint venture?Tax official: Do you mean that you invest the right as your shares in the joint venture?精心整理Taxpayer: Yes.Tax official: It depends.If your company and your partner share profits,risks and losses in proportion to respective shares,you do not pay business tax for the transfer of intangible asset.The joint venture will pay the business tax and the land appreciation tax on selling houses.Taxpayer: If we do not involve in management and only receive income or dividends ina proportion or in a solid amount,should we pay tax?Tax official: In this case,your company is not considered as real contribution,so you shouldpay tax as the above.Taxpayer: It looks like more beneficial that we establish the formal stock company.Tax official: It is up to you.New Wordscooperate 合作,力,相当合in detail 仔,the land appreciation tax(LAT) 土地增税refer to 依据,参照joint venture 合企share 股份 (名 ) 分担,分享 ()proportion 比率in proportion to 按⋯⋯的比率respective 各自的,个的involve 使卷入,使参加dividend 股息,本利solid 固定的contribution 出入股精心整理stock company 股份公司税务英语 lesson 6Lessen 6:How to pay taxes for the transfer of equity?股权转让怎么纳税?Taxpayer: Hello, may I ask you a question?Taxofficial: You are Welcome .Taxpayer: Well,we are planning to combine with another foreign company,and I want to know how my company should pay business tax on the transfer of equity.Tax official: It will depend on the way that the equity came into being.Taxpayer: I do not understand it.Taxofficial: Well ,as you know,there are three ways to form the equity,namely intangible asset,immovable property and other forms,such as money,labor,etc. Only in the lastcase,the transfer of equity is exempt from taxation.Taxpayer: Can you explain the other two cases in detail?Taxofficial: There are different tax treatments in these two cases. For the first case,it is actually the transfer of intangible asset, so the business tax is exempt if it is transferred for free.Taxpayer: How about the second case?Taxofficial: For the transfer of immovable property, business tax will be levied on nomatter whether it is free or not.Taxpayer: If it is for free, how do we determine the taxable income?Taxofficial: The taxation bureau will assess and determine it.精心整理Taxpayer: By the way,should we pay enterprise income tax if we received net income by the transfer?Taxofficial: I think so,but it is subject to the national taxation bureau.Finally,I would like to remind you to pay stamp tax on the contract of transfer.New wordsequity 股本益,股combinewith 与⋯⋯归并exempt from 免去的,没有的treatment 待,置,理for free 免的,无的assess and determine审定remind 提示stamp tax 印花税Contract 合同税务英语 lesson 7Lessen 7:Does your headquarter deal in self-employed trade?机构是自易?Taxpayer: Welcomed to our representa-tive office.Have you received our application for tax exemp-tion presented by us?Taxofficial: Yes,we have.But I would like to know some detailed situa-tions of your company.Taxpayer: Well,let me introduce my office first. We provide liaison service in China forour headquarter.Tax official: Have you accept the consignment from other companies including the clientsof your headquarter?Taxpayer: No, we have not .Tax official: Do you sign contract in China on behalf of your headquarter?Taxpayer: No, we have not either .Tax official: Can you provide the selling contract and invoice of your headquarter? Taxpayer: Yes.Tax official: Ok.Is your headquarter a group company?Taxpayer: No.Tax official: Is it an equity controlling company?Taxpayer: No.Tax Official: What is the business scope?Taxpayer: The trade in the field Of telecommunication.Tax official: Is the trade self-employed?Taxpayer: Yes.Tax official: Can you provide the contract signed between your headquarter and the foreign maker?Taxpayer: Yes,here is the copy.Tax official: Thank you. Well ,from the date of signing the contract,I think that the selling is earlier than the purchasing.It means that your headquarter does not sell the product owned by itself and the transaction is not self-employed trade.New Wordsdeal in 经营,买卖self-employed trade 自营贸易application 申请liaison 联系headquarter 总公司,总部consignment 拜托,寄售on behalf of 代表,为了的利益invoice 发票,装货清单group company 公司公司controlling company 控股公司sign 签订税务英语 lesson 8Lessen 8:How many ways to tax on the representative 0ffice?对代表处的收税方法有几种?Taxpayer: Our representative office has been set up recently. Can you introduce the method of taxing on the representative office?Tax official: Yes. Generally speaking, there are three ways of taxation, namely declaration, verification, and conversion.Taxpayer: Which kind of office is applicable for declaration?Tax official: It is the one that can provide the whole materials about the contracts and commissions and can establish account books to make the receipt and expense clear.Taxpayer: We can do like that. But sometimes we serve the clients withoutrecording commissions separately, what shall we do ?Tax official: In agency operation , commissions are calculated as the price difference of selling and purchasing .Taxpayer: Some contracts indicate the commissions orpice difference , but some do not .精心整理Tax official: In this case, if you can provide the whole contract documents, which introducethe bargain in China ,the taxable commissions can be calculated as 3% of the whole contract turnover.Taxpayer: I see .By the way , some service are provided for the clients in cooperation withthe headquarter. My question is whether the service provided out of China can be exempt?Tax official: Yes. As long as you can provide valid proof, and divide correctly the commissions shared by office and headquarter respectively. Otherwise your office is applicable for the method of conversion.Taxpayer: What is conversion?Tax official: Well, since we can not acquire necessary materials, we can calculate your taxable income from your expense .Taxpayer: I see. Are there any other kinds of representative office applicable for this method?Tax official: Those that cannot determine whether their operations are taxable ,and those that can not correctly declare.Taxpayer: How can you decide the way in which our office will be taxed ?Tax official: You can apply according to the former introduction and your situation, and we will decide it after verification .New Wordsdeclaration 申verification 审定,核算 ;核conversion 算be applicable for ⋯⋯ 合用的commission 佣金account book 簿receipt 收入agency operation 代理price difference 差价精心整理turnover 营业额,销售额bargain 契约,合同,交易valid 有效的,经过正当手续的,正当的,有依据的Proof 凭证,依照税务英语 lesson 9Lessen 9:How does the board president pay personal income tax ?董事长的所得如何纳税?Tax official: Can I help you ?Taxpayer: Yes ,I am the board president of ABC company. I would like to know something about paying my personal income tax.Tax official: Can you explain you conditions in detail ? I have an obligation to keep secret for the taxpayer .Taxpayer: I obtain my income in the form of director's fees and dividends .Tax official: Do you have any management position?Taxpayer: No. But the general manager has always been abroad, so I am actually responsible for the operation in China.Tax official: According to what you said, in fact you play the role of general manager. Taxpayer: What do you mean ?Tax official: I mean that your personal income actually includes three parts: director's fees, dividends and salary of general manager.Taxpayer: How do I pay tax on it ?Tax official: Can you provide the regulation of your company and the agreement of boardof directors ?Taxpayer: Yes , I can .精心整理Tax official: Are you American? Well, the dividends obtained by a foreigner are exemptfrom taxation .Taxpayer: Oh, that is good.Tax official: The leftparts of your income should be divided into director's fees and salaries.Taxpayer: How do you determine the salaries? After all, I do not receive salaries directly from my company.Tax official: We can refer to the salary level in the same area, in the similar industry or in the enterprise with similar scale.Taxpayer: I know a little about levying tax on salary, but how do I pay tax on director's fees?Tax official: The director's fees are regarded as remuneration and taxed in the way remuneration is taxed.Taxpayer: What is the difference between the tax on salary and the tax on remuneration? Tax official: They are different in tax rate and deduction.Now Wordsboard president 董事长personal income tax 个人所得税obligation 职责,责任keep secret 保密director's fee 董事费dividend 分成,资本盈利 ;股息position 职位the general manager 总经理abroad 在外国in facts 事实上board of directors 董事会refer to 参照,参照scale 规模remuneration 酬金,酬劳deduction 扣除税务英语 lesson 10Lessen 10:Should l pay tax on my income from oversea?我的境外收入纳税吗?Taxpayer: Excuse me,I am the chiefrep-resentative of the Beijing office of Japanese ABC company.My question is whether I should pay personal income tax on my income from Japan?Tax official: Well,it depends on how long you have been in China.Taxpayer: can you explain it in detail?Taxofficial: Any individual who has resided in China for less than one year will only needto pay tax on his domestic income.Income from oversea will not be taxed on.Taxpayer: What will happen if one have resided in China for a full year?Tax official: First ,the concept of one full year is that one has resided in China for full 365 days , not deducting temporary exit.Taxpayer: What is the meaing of the temporary exit?Tax official: The temporary exit means that any individual has left China for less than 3Odays one time and for less than 90 days altogether.Taxpayer: I see.Tax official: If any individual has resided in China for more than one year but less than 5 years, he needs to pay tax on the income from oversea but paid within China.Taxpayer: What if I have resided in China for more than 5 years?Tax official: It depends on different conditions in the sixth year.Taxpayer: Can you explain it?Tax official: If you have resided in China for another full year after 5 successive full years ,you will pay tax for all your income including the income from oversea. If the sixth year is not full,the income from oversea is exempt;If less than 90 days ,the period of five year will berecounted.Taxpayer: My nationality is Japan. If I must pay tax on all sources of income in both China and Japan,what should I do?Tax official: In this case ,you should provide the detailed information and rely on the negotiation made by the two countries.Taxpayer: I appreciate your explanation . Thank you .New Wordschiefrepresentatlve 首席代表domestic 国内的,境内的reside 居留,居住deduct 扣除temporary 暂时的,暂时的exit 离境successive 连续的nationality 国籍appreciate 感谢,重视negotiation 磋商,商讨,谈判税务英语 lesson 11精心整理Lessen 11:Which kind of subsidy can be exempt from taxation?哪些补助能够免税?Tax official: Hello!This is the foreign taxation bureau.Taxpayer: Hello! This is George Brown from ABC company. I'd like to speak to Mr.Li.Tax official: Hold the line, please.Mr.Li. : Li Tong speaking .What can I help you ,Brown?Taxpayer: I have a question to consult with you . Is the subsidy taxed on like salary?Mr.Li. : It is different from salary, and there are many exemptions for the foreigners . Taxpayer: Could you explain it in detail?Mr.Li. : Subsidies, such as house ,meal, and laundry allowance, are exempt ,as long as they are not paid by cash and can be reimbursed for the actual expenses.Taxpayer: What about the moving house fee happening in the course of leaving office ?Mr.Li. : The amount actually happening can be exempt, but it is unreasonable if the moneyis paid every month in the name of moving house.Taxpayer: How about the allowance of trip on business?Mr.Li. : If you can provide the accurate evidences to the fares and lodging fees and can present the related stipulation of your company, it can be exempt.Taxpayer: Does that include the allowance of trip abroad?Mr.Li. : Yes.Taxpayer: Is the home leave fare exempt from taxation?Mr.Li. : If it is for an expatriate himself and both the amount and the frequency every yearare considered reasonable, it can be exempt .Taxpayer: What about the language training and children education fees?精心整理Mr.Li. : If the expenses happen within China and the amount is reasonable , they can be exempt .Taxpayer: Thank you for your help. Bye for now .Mr.Li. : Bye .New Wordsthe foreign taxation bureau 涉外分局hold the line 稍等 (用 ) subsidy 助金,津allowance 津,be reimbursed for the actual expensemove house 迁居in the course of 在⋯⋯的程中leave office 去,离in the name of 以⋯⋯的名on business 出差fare ,船lodging fee 住宿stipulation 定home leave 探expatriate 居于外国之人,民frequency 率中文照 :税务英语 lesson 12Lessen 12:How does the foreign actor pay tax when performing in China?精心整理境外明星来华演出如何纳税Lawyer: Mr.George Brown is a famous American singer.As his lawyer,I was entrustedto consult how to pay tax on his performing in China.Tax official: Is he in the name of group or himself?Lawyer: Is there any difference?Tax official: Yes.Some treatments are same,and some are different.Lawyer: Can you explain it in detail?Tax official: Both are the same in paying business tax.The tax-able income is calculated as gross income minus the expense paid to the performance place,the performance company andthe agent.The tax rate is 3%.Lawyer: What about the income tax?Tax official: In the case of group,the group should pay enterprise income tax. If the group can establish account books and make the receipts and expenses clear,the actor should pay personal income tax on the salary paid by the group.Taxpayer: What will happen if the group's account book fails to meet the requirement?Tax official: In this case,the taxation bureau will assess the taxable income, Since the expense has been considered in the assessment,the actor will not pay personal income tax.Lawyer: What about in the name of himself?Tax official: First,he should pay business tax on his total income. Then he should pay personal income tax on his remuneration. Can you give me some detailed materials about the personal income tax?Tax official: Sure.Lawyer: By the way,should the actor declare the prsonal income tax on the place of performance?精心整理Tax official: Yes.He can file the tax return on the place of performance,or the performance company can withhold the tax when it pays salary to the actor.New Wordsentrust 拜托minus 减去enterprise income tax 公司所得税fail to 不可以够,没能够declare 申报withhold 拘留,扣款,扣除税务英语 lesson 13Lessen 13:Can you give me some directions to fill in the tax return form?能指点我填写申报表吗?Tax official: What can I do for you?Taxpayer: It is my first time to file the tax return.Can you give me any direction?Tax official: My pleasure. Look, please fill in your name,nationality and tax code here. Taxpayer: Can I use your pen? Thank you.ok.Tax official: Then please fill in your working unit and telephone number here. Andyour position?Taxpayer: Permanent representative.Tax official: Ok,please fill in your position here. And have you any part-time job? Taxpayer: No, I have not. Should I fill in the salary and bonus respectively?Tax official: Yes. Please indicate the period in which you made your income. And the income received in different currency should be also filled in respectively.Taxpayer: I had been back to my motherland temporary, shall I indicate it?Tax official: Yes,you should make clear the date of departure and the date when you came back. Taxpayer: Need I calculate the tax amount by myself ?Tax official: No, you needn't .Our computer can do it using the information you fill in. Taxpayer: That is great .Tax official: Please make sure all the items written in the form again, and then put on your signature or signethere .Taxpayer: All right .Tax official: Please deposit your tax money in the bank before the prescribed time .Taxpayer: Cash or check ?Tax official: Both will do .You can deposit the cash in any branch of the Industrial and Commercial Bank .If you use check, you should go to the bank in which you open your bank account .Taxpayer: Where is the nearest branch of the Industrial and Commercial Bank ?Tax official: Go west to the crossroads, then turn to the south ,and the branch is about 100 meter ahead on the western side of the road.New Wordsdirection 说明,指导,引导my pleasure 特别愿意,十分愿意tax code 纳税编码working unit 工作单位signature 署名signet 签章deposit 存款 ;押金 ;保证金。

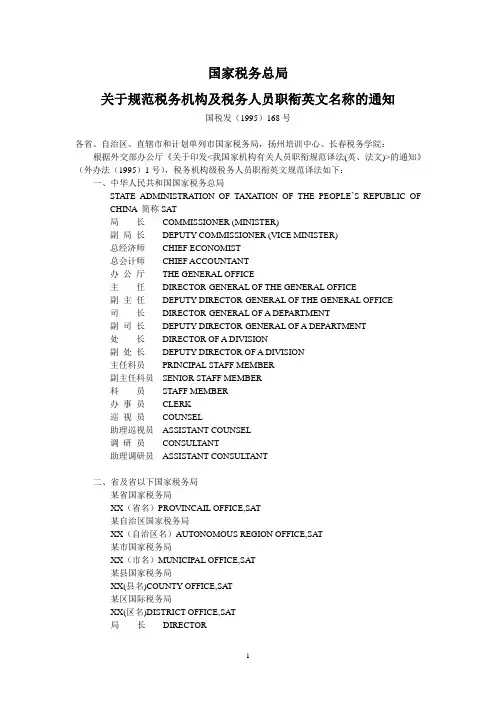

国家税务总局关于规范税务机构及税务人员职衔英文名称的通知国税发(1995)168号各省、自治区、直辖市和计划单列市国家税务局,扬州培训中心、长春税务学院:根据外交部办公厅《关于印发<我国家机构有关人员职衔规范译法(英、法文)>的通知》(外办法(1995)1号),税务机构级税务人员职衔英文规范译法如下:一、中华人民共和国国家税务总局STATE ADMINISTRATION OF TAXATION OF THE PEOPLE’S REPUBLIC OFCHINA 简称SAT局长COMMISSIONER (MINISTER)副局长DEPUTY COMMISSIONER (VICE MINISTER)总经济师CHIEF ECONOMIST总会计师CHIEF ACCOUNTANT办公厅THE GENERAL OFFICE主任DIRECTOR-GENERAL OF THE GENERAL OFFICE副主任DEPUTY DIRECTOR-GENERAL OF THE GENERAL OFFICE司长DIRECTOR-GENERAL OF A DEPARTMENT副司长DEPUTY DIRECTOR-GENERAL OF A DEPARTMENT处长DIRECTOR OF A DIVISION副处长DEPUTY DIRECTOR OF A DIVISION主任科员PRINCIPAL STAFF MEMBER副主任科员SENIOR STAFF MEMBER科员STAFF MEMBER办事员CLERK巡视员COUNSEL助理巡视员ASSISTANT COUNSEL调研员CONSULTANT助理调研员ASSISTANT CONSULTANT二、省及省以下国家税务局某省国家税务局XX(省名)PROVINCAIL OFFICE,SAT某自治区国家税务局XX(自治区名)AUTONOMOUS REGION OFFICE,SAT某市国家税务局XX(市名)MUNICIPAL OFFICE,SAT某县国家税务局XX(县名)COUNTY OFFICE,SAT某区国际税务局XX(区名)DISTRICT OFFICE,SAT局长DIRECTOR副局长DEPUTY DIRECTOR总经济师CHIEF ECONOMIST总会计师CHIEF ACCOUNTANT局长助理ASSISTANT DIRECTOR巡视员COUNSEL助理巡视员ASSISTANT COUNSEL调研员CONSULTANT助理调研员ASSISTANT CONSULTANT科长SECTION CHIEF副科长DEPUTY SECTION CHIEF股长HEAD OF GROUP副股长DEPUTY HEAD OF GROUP三、省、自治区、直辖市、县(市)地区地方税务局(译法供参考)局长DIRECTOR副局长DEPUTY DIRECTOR特此通知。

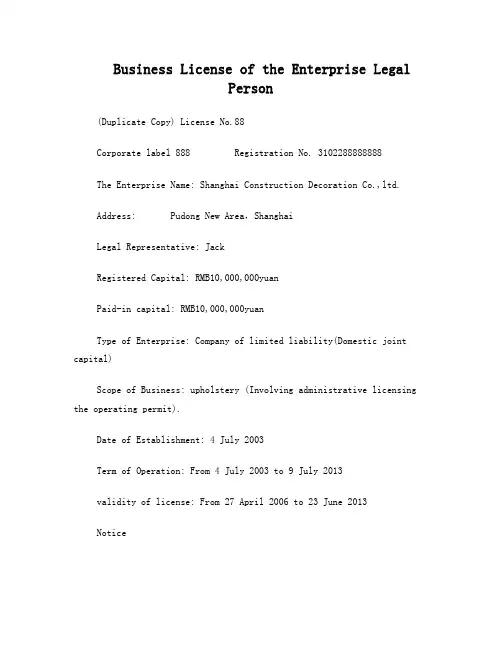

Business License of the Enterprise LegalPerson(Duplicate Copy) License No.88Corporate label 888 Registration No. 3102288888888The Enterprise Name: Shanghai Construction Decoration Co.,ltd.Address: Pudong New Area,ShanghaiLegal Representative: JackRegistered Capital: RMB10,000,000yuanPaid-in capital: RMB10,000,000yuanType of Enterprise: Company of limited liability(Domestic joint capital)Scope of Business: upholstery (Involving administrative licensing the operating permit).Date of Establishment: 4 July 2003Term of Operation: From 4 July 2003 to 9 July 2013validity of license: From 27 April 2006 to 23 June 2013Notice1. BUSINESS LICENSE FOR ENTERPRISE LEGAL PERSON is the certificateof the qualifications of enterprise legal persons and its legal operations.2. BUSINESS LICENSE FOR ENTERPRISE LEGAL PERSON is divided into an original and duplicates, both of which enjoy equal legal effect.3. The original of Business License of Enterprise Legal Personshall be laid up in an eye-catching place of the domicile.4. BUSINESS LICENSE FOR ENTERPRISE LEGAL PERSON shall not be forged, altered, let out, lent and assigned.5. Any change in the registered items shall be registered with the company registration authority so as to replace the BUSINESS LICENSE FOR ENTERPRISE LEGAL PERSON.6. Annual examination shall be conducted in every year from March 1 through June 30.7. No business activity relating to the liquidation may, after the revocation of the BUSINESS LICENSE FOR ENTERPRISE LEGAL PERSON, be conducted .8. To cancel its registration, the company shall have the original copy and duplicates of BUSINESS LICENSE FOR ENTERPRISE LEGAL PERSON returned.9. Should BUSINESS LICENSE FOR ENTERPRISE LEGAL PERSON be lost or damaged, the company shall announce it invalid in the newspaper andperiodical designated by the company registration authority, and shall apply for a reassurance.Annual ExaminationDate of annual examination is from March 1 to June 30. Please put in the documents before June 30.Pudong Branch Administration of Industry & Commerce ofShanghai(seal)14 May 2010。

税务英语lesson 1Lessen 1:How to register with the taxation bureau?请问如何办理税务登记?Taxpayer: Hello!My company is a foreign enterprise,and we are engaged in the development of real estate and the sale of constructive material.Could you tell me how to register with the taxation bureau?Tax official: I'd like to.According to what you said,you need to pay different kinds of taxes,such as business tax and value added tax.So you should register with both the national and local taxation bureau respectively.Taxpayer: What is the difference between these two taxation bureaux?And why should my company register with them at the same time?Tax official: The biggest difference is that they are in charge of different taxes. Taxpayer: I see. Is there any time requirement for registration? Tax official: You should register with the bureau within 30 days after you receive business license. Taxpayer: What should we do in the process of registration?Tax official: To get and fill in the application form,and then present the related documents according to the economic type of your company.Taxpayer: Can we use the copy of those materials?Tax official: Yes,you can.Taxpayer: How long will it take to finish the registration?Tax official: Within 30 days after we receive the application.As soon as your application is approved, I will personally notice you to get the registration certificate. Taxpayer: What is the charge of the registration?Tax official: 40 YUAN.Taxpayer: By the way,could you tell me your telephone number and working time?Tax official: Our telephone number is 64004857.We work from 8:30 AM to 11:30 AM and from 1:30 PM to 5:00 PM.Taxpayer: Thank you .Tax official: You are welcome .New Wordsregister 登记,注册taxation bureau 税务局,税务机bureaux 政府机关,局(复数形式)enterprise 企业be engaged in 从事,忙于,参加real estate 房地产,不动产such as例如business tax 营业税value added tax 增值税the national taxation bureau 国家税务局the local taxation bureau 地方税务局respectively 分别地,各自地at the same time 同时in charge of 负责business license 营业执照application form 申请表prescribe 规定according to 根据registration certificate 登记证approve 认可,批准,同意You are welcome. 别客气!中文对照第一课:请问如何办理税务登记?纳税人: 您好,我是一家外企公司,被批准从事房地产开发,兼营建材销售。

税务英语lesson 1Lessen 1:How to register with the taxation bureau?请问如何办理税务登记?Taxpayer: Hello!My company is a foreign enterprise,and we are engaged in the development of real estate and the sale of constructive you tell me how to register with the taxation bureau?Tax official: I'd like to what you said,you need to pay different kinds of taxes,such as business tax and value added you should register with both the national and local taxation bureau respectively.Taxpayer: What is the difference between these two taxation bureaux?And why should my company register with them at the same time? Tax official: The biggest difference is that they are in charge of different taxes.税务英语lesson 2Lessen 2:The declaration is far more important than I have expected!纳税申报比我想象的重要的多!Tax official: look unhappy. What can I do for you?Taxpayer: My company has been fined because we didn't file the tax we have not got any income at all.Tax official: Well,according to the Chinese law,the taxpayer must file its taxreturns within the prescribed time,no matter whether it has business income.Taxpayer: If both the tax payment and tax declaration are overdue,what will happen?Tax official: The taxation bureau will set a new deadline for the declaration and impose a fine on the at the same time,the taxation bureau will levy a overdue payment per day equal %of the overdue tax.Taxpayer: What will happen if the taxpayer files false tax returns?Tax official: If it is on purpose,it will be regarded as tax evasion. If the amount does not exceed certain limit,the taxpayer will be fined within five times as much as the the case reaches the criminal limit,we will also find out the taxpayer's criminal responsibility.Taxpayer: What is the criminal limit?Tax official: The amount exceeds ten thousand YUAN and exceeds 1O%of the amount that he should taxpayer will also be charged as criminal if he files falsely again after receiving administrative penalties twice due to false declaration.Taxpayer: What will happen then?Tax official: The taxpayer will be traced about his criminal responsibility in addition to the fine.Taxpayer: Well,the tax declaration is far more important than I have expected is the deadline for it?Tax official: It depends on different business tax,it is due within the first 10 days of the following month. For individual income tax,it is within the first 7 days. If the deadline is the vacation or holiday,it can be put offinturn.Taxpayer: What you have said is very wish that we would not be fined again.Taxofficial: I hope so.New Wordsdeclaration 申报taxreturn 纳税申报表fine 罚款no matter 不论(连词)business income 营业所得,营业收入deadline 截止的期限impose on 加征(税,义务等)于levy on 征收,征集,强迫收集overdue payment 滞纳金overdue 过期的,过时的equal 相同的,相等的be equal to 与……相同on purpose 故意地regard as 视作,认为tax evasion 逃税,偷税,漏税exceed 超过……的范围criminal 犯罪的,犯法的find out 追查criminal responsibility 刑事责任penalty 处罚,罚款due to 由于,起因于responsibility 责任,职责in addition to 除了trace 追查,追究put off 延期,推迟in turn 依次,接连地individual income tax 个人所得税税务英语lesson 3Lessen 3:Could you give me some introduction of the business tax?Taxpayer: My company will begin business you give me some introduction of the business tax?Tax official: speaking,the business tax is levied on the taxable service,the transfer of intangible asset and the sale of the real estate in China.Taxpayer: What is the taxable service? .Tax official: It is clearly stipulated in the tax law, such as transportation, construction, finance and insurance,post andtele-communication,culture and sport,entertainment and it does not include the processing,repair and replace- ment service,because they are subject to the value added tax.Taxpayer: It is easy to understand the real estate,but what is the intangible asset?Tax official: It means the asset that is not in the form of material object but can bring profit,such as patent right,know-how,copyright,trade mark right and the land-useright,etc.Taxpayer: What about the taxable income?Tax officid: In most case,it is the total income received,including additional fees and charges.Taxpayer: Does that include the income received in advance?Tax official: Yes,it is in the transfer of land-use right and immovable property.Taxpayer: And what about the donation?Tax official: The donation of immovable property is considered as sale,and the taxation bureau will verify the taxable income.Taxpayer: What should we do if we receive income in foreign currency?Tax official: For the financial institutions,the income will be conversed to RMB at the exchange rate of either the date on which the taxable item happened or the end of the your company is not a financial institution,your income will be conversed into RMB at the exchange rate of either the date on which the taxable item happened or the first day of the month.Taxpayer: How about the tax rate?Tax official: In general,the rate is from 3% t05%. For the entertainment,it is from 5% to 20%.Taxpayer: What you have said is very helpful,thank you.New Wordsgenerally speaking 一般地说,一般而言taxable 应纳税的,可征税的service 劳务,服务transfer 转让,让与,转移intangible asset 无形资产stipulate 规定,订定transportation 交通运输construction 建筑安装finance 金融insurance 保险post and tele-communication 邮电通信culture 文化entertainment 娱乐be subject to 应服从…,应受制于… profit 利润patent right 专利权know-how 专有技术,技术秘密copyright 版权,着作权trade mark 商标land-useright 土地使用权etc 等等taxable income 应税收入,计税收入in advance 预先donation 捐赠,赠送verify 核定foreign currency 外币,外汇financial institution 金融机构converse 换算,兑换quarter 季度exchange rate 汇率item 项目tax rate 税率税务英语lesson 4Lessen 4:How to pay business tax for leasing?租赁财产怎样纳营业税?Taxpayer: Hello,I am from a for-eign company,would you tell me something about how to pay business tax for leasing?Tax official: I'd like you tell me what kind of property your company wants to lease?Taxpayer: We have not decided yet,is that important?Tax official: Yes,it is very your company leases movable property and in China sets up organizations related to leasing,your company should pay tax.Taxpayer: Do you mean the representative office by organization?Tax official: Not only the representative office,it also includes the management and business organization,workingplace and the agent.Taxpayer: I see. What about leasing intangible asset?Tax official: If the intangible asset is used in China,the leasing operation is taxable,no matter whether the company has organizations in is leasing immovable property, if the property is located in China.Taxpayer: Any other requirement?Tax official: When calculating the taxable income,we should distinguish the financial leasing from the operational leasing.Taxpayer: what is the financial leasing?Tax official: It means that the leasing operation has a financial nature and the ownership of the leased property will ultimately be passed to the borrower at the end of the leasing this case,the taxable income is the net value calculated by deducting the real cost of the leased asset from the whole income (includingad-ditional fees).Taxpayer: The operational leasing does not involve the ownership,is that right?Tax official: from the financial leasing,the whole rental income of the operational leasing is taxable.Taxpayer: How about the tax rate?Tax official: It is 5%.Taxpayer: Thank you very much.New Wordslease 租赁property 财产movable property 动产set up 设立,建立organization 机构,团体representative office 代表处working place 作业场所,生产区域agent 代理人financial lease 金融租赁operational lease 经营租赁nature 性质,特征ownership 所有权realcost 实际成本involve 涉及税务英语lesson 5Lessen 5:How do we beneficially invest the land-use right?怎样投资土地使权才合算?Taxpayer: Our company is engaged in development of real estate. Recently,we planed to cooperate with another company to build would like to know something about paying business tax forit.Tax official: Can you explain your plan in detail?Taxpayer: My company provides the land-use right and the other party invests the money needed. At the end of project,my company will get a part of the houses.Tax official: This means that your company exchanges the land- use right for the ownership of the this case,for transfering the intangible asset,your company should pay business tax,equal to 5%need to pay business tax and the land appreciation tax(LAT)again for the transfer of immovable property.Taxpayer: How do we determine the taxable income if the transfer does not conduct in form of currency?Tax official: The taxation bureau will refer to the local similar price or the cost of houses to decide your income.Taxpayer: Will it be profitable if the two companies establish joint venture?Tax official: Do you mean that you invest the right as your shares in the joint venture?Taxpayer: Yes.Tax official: It your company and your partner share profits,risks and losses in proportion to respective shares,you do not pay business tax for the transfer of intangible joint venture will pay the business tax and the land appreciation tax on selling houses.Taxpayer: If we do not involve in management and only receive incomeTax official: In this case,your company is not considered as real contribution,so you should pay tax as the above.Taxpayer: It looks like more beneficial that we establish the formal stock company.Tax official: It is up to you.New Wordscooperate 合作,协力,相配合in detail 仔细,详细the land appreciation tax(LAT) 土地增值税refer to 根据,参考joint venture 合资企业share 股份 (名词) 分担,分享 (动词)proportion 比例in proportion to 按……的比例respective 各自的,个别的involve 使卷入,使参与dividend 股息,资本红利solid 固定的contribution 出资入股stock company 股份公司税务英语lesson 6Lessen 6:How to pay taxes for the transfer of equity?股权转让怎么纳税?Taxpayer: Hello, may I ask you a question?Taxofficial: You are Welcome.Taxpayer: Well,we are planning to combine with another foreign company,and I want to know how my company should pay business tax on the transfer of equity.Tax official: It will depend on the way that the equity came into being.Taxpayer: I do not understand it.Taxofficial: Well,as you know,there are three ways to form the equity,namely intangible asset,immovable property and otherforms,such as money,labor,etc. Only in the last case,the transfer of equity is exempt from taxation.Taxpayer: Can you explain the other two cases in detail?Taxofficial: There are different tax treatments in these two cases. For the first case,it is actually the transfer of intangible asset, so the business tax is exempt if it is transferred for free.Taxpayer: How about the second case?Taxofficial: For the transfer of immovable property, business tax will be levied on no matter whether it is free or not.Taxpayer: If it is for free, how do we determine the taxable income?Taxofficial: The taxation bureau will assess and determine it.Taxpayer: By the way,should we pay enterprise income tax if we received net income by the transfer?Taxofficial: I think so,but it is subject to the national taxation ,I would like to remind you to pay stamp tax on the contract of transfer.New wordsequity 股本权益,股权 combinewith 与……合并exempt from 免除的,没有义务的treatment 对待,处置,处理for free 免费的,无偿的assess and determine 核定remind 提醒stamp tax 印花税Contract 合同税务英语lesson 7Lessen 7:Does your headquarter deal in self-employed trade?总机构是自营贸易吗?Taxpayer: Welcomed to our representa-tive you received our application for tax exemp-tion presented by us?Taxofficial: Yes,we I would like to know some detailed situa-tions of your company.Taxpayer: Well,let me introduce my office first. We provide liaison service in China for our headquarter.Tax official: Have you accept the consignment from other companies including the clients of your headquarter?Taxpayer: No, we have not .Tax official: Do you sign contract in China on behalf of your headquarter?Taxpayer: No, we have not either .Tax official: Can you provide the selling contract and invoice of your headquarter?Taxpayer: Yes.Tax official: your headquarter a group company?Taxpayer: No.Tax official: Is it an equity controlling company?Taxpayer: No.Tax Official: What is the business scope?Taxpayer: The trade in the field Of telecommunication.Tax official: Is the trade self-employed?Taxpayer: Yes.Tax official: Can you provide the contract signed between your headquarter and the foreign maker?Taxpayer: Yes,here is the copy.Tax official: Thank you. Well,from the date of signing the contract,I think that the selling is earlier than the means that your headquarter does not sell the product owned by itself and the transaction is not self-employed trade.New Wordsdeal in 经营,买卖self-employed trade 自营贸易situation 状况,事态,情况liaison 联络headquarter 总公司,总部consignment 委托,寄售on behalf of 代表,为了的利益invoice 发票,装货清单group company 集团公司controlling company 控股公司sign 签定税务英语lesson 8Lessen 8:How many ways to tax on the representative 0ffice?对代表处的征税方法有几种?Taxpayer: Our representative office has been set up recently. Can you introduce the method of taxing on the representative office?Tax official: Yes. Generally speaking, there are three ways of taxation, namely declaration, verification, and conversion.Taxpayer: Which kind of office is applicable for declaration?Tax official: It is the one that can provide the whole materials about the contracts and commissions and can establish account books to make the receipt and expense clear.Taxpayer: We can do like that. But sometimes we serve the clients without recording commissions separately, what shall we do ?Tax official: In agency operation , commissions are calculated as the price difference of selling and purchasing .Taxpayer: Some contracts indicate the commissions orpice difference , but some do not .Tax official: In this case, if you can provide the whole contract documents, which introduce the bargain in China ,the taxable commissions can be calculated as 3% of the whole contract turnover.Taxpayer: I see .By the way , some service are provided for the clients in cooperation with the headquarter. My question is whether the service provided out of China can be exempt?Tax official: Yes. As long as you can provide valid proof, and divide correctly the commissions shared by office and headquarterrespectively. Otherwise your office is applicable for the method of conversion.Taxpayer: What is conversion?Tax official: Well, since we can not acquire necessary materials, we can calculate your taxable income from your expense .Taxpayer: I see. Are there any other kinds of representative office applicable for this method?Tax official: Those that cannot determine whether their operations are taxable ,and those that can not correctly declare.Taxpayer: How can you decide the way in which our office will be taxed ?Tax official: You can apply according to the former introduction and your situation, and we will decide it after verification .New Wordsdeclaration 申报verification 核定,核算;核实be applicable for 对……适用的commission 佣金account book 帐簿receipt 收入agency operation 代理业务price difference 差价turnover 营业额,销售额bargain 契约,合同,交易valid 有效的,经过正当手续的,正当的,有根据的 Proof 证据,依据税务英语lesson 9Lessen 9:How does the board president pay personal income tax ?董事长的所得如何纳税?Tax official: Can I help you ?Taxpayer: Yes ,I am the board president of ABC company. I would like to know something about paying my personal income tax.Tax official: Can you explain you conditions in detail ? I have an obligation to keep secret for the taxpayer .Taxpayer: I obtain my income in the form of director's fees and dividends .Tax official: Do you have any management position?Taxpayer: No. But the general manager has always been abroad, so I am actually responsible for the operation in China.Tax official: According to what you said, in fact you play the role of general manager.Taxpayer: What do you mean ?Tax official: I mean that your personal income actually includes three parts: director's fees, dividends and salary of general manager.Taxpayer: How do I pay tax on it ?Tax official: Can you provide the regulation of your company and the agreement of board of directors ?Taxpayer: Yes , I can .Tax official: Are you American? Well, the dividends obtained by a foreigner are exempt from taxation .Taxpayer: Oh, that is good.Tax official: The leftparts of your income should be divided into director's fees and salaries.Taxpayer: How do you determine the salaries? After all, I do not receive salaries directly from my company.Tax official: We can refer to the salary level in the same area, in the similar industry or in the enterprise with similar scale.Taxpayer: I know a little about levying tax on salary, but how do I pay tax on director's fees?Tax official: The director's fees are regarded as remuneration and taxed in the way remuneration is taxed.Taxpayer: What is the difference between the tax on salary and the tax on remuneration?Now Wordsboard president 董事长personal income tax 个人所得税obligation 职责,责任keep secret 保密director's fee 董事费dividend 分红,资本红利;股息position 职位the general manager 总经理abroad 在国外in facts 事实上regulation 章程board of directors 董事会refer to 参考,参照scale 规模remuneration 酬劳,报酬deduction 扣除税务英语lesson 10Lessen 10:Should l pay tax on my income from oversea?我的境外收入纳税吗?Taxpayer: Excuse me,I am the chiefrep-resentative of the Beijing office of Japanese ABC question is whether I should pay personal income tax on my income from Japan?Tax official: Well,it depends on how long you have been in China.Taxpayer: can you explain it in detail?Taxofficial: Any individual who has resided in China for less than one year will only need to pay tax on his domestic from oversea will not be taxed on.Taxpayer: What will happen if one have resided in China for a full year?Tax official: First,the concept of one full year is that one has resided in China for full 365 days , not deducting temporary exit.Taxpayer: What is the meaing of the temporary exit?Tax official: The temporary exit means that any individual has left China for less than 3O days one time and for less than 90 days altogether.Taxpayer: I see.Tax official: If any individual has resided in China for more than one year but less than 5 years, he needs to pay tax on the income from oversea but paid within China.Taxpayer: What if I have resided in China for more than 5 years?Tax official: It depends on different conditions in the sixth year.Taxpayer: Can you explain it?Tax official: If you have resided in China for another full year after 5 successive full years ,you will pay tax for all your income including the income from oversea. If the sixth year is not full,the income from oversea is exempt;If less than 90 days ,the period of five year will be recounted.Taxpayer: My nationality is Japan. If I must pay tax on all sourcesTax official: In this case,you should provide the detailed information and rely on the negotiation made by the two countries.Taxpayer: I appreciate your explanation . Thank you .New Wordschiefrepresentatlve 首席代表domestic 国内的,境内的reside 居留,居住deduct 扣除temporary 临时的,暂时的exit 离境successive 连续的nationality 国籍appreciate 感激,重视negotiation 协商,商议,谈判税务英语lesson 11Lessen 11:Which kind of subsidy can be exempt from taxation?哪些补贴可以免税?Tax official: Hello!This is the foreign taxation bureau.Taxpayer: Hello! This is George Brown from ABC company. I'd like to speak to .Tax official: Hold the line, please.. : Li Tong speaking .What can I help you ,Brown?Taxpayer: I have a question to consult with you . Is the subsidy taxed on like salary?. : It is different from salary, and there are many exemptions for the foreigners .Taxpayer: Could you explain it in detail?. : Subsidies, such as house ,meal, and laundry allowance, are exempt ,as long as they are not paid by cash and can be reimbursed for the actual expenses.Taxpayer: What about the moving house fee happening in the course of leaving office ?. : The amount actually happening can be exempt, but it is unreasonable if the money is paid every month in the name of moving house.Taxpayer: How about the allowance of trip on business?. : If you can provide the accurate evidences to the fares and lodging fees and can present the related stipulation of your company, it can be exempt.Taxpayer: Does that include the allowance of trip abroad?. : Yes.Taxpayer: Is the home leave fare exempt from taxation?. : If it is for an expatriate himself and both the amount and the frequency every year are considered reasonable, it can be exempt .Taxpayer: What about the language training and children education fees?. : If the expenses happen within China and the amount is reasonable , they can be exempt .Taxpayer: Thank you for your help. Bye for now . . : Bye .New Wordsthe foreign taxation bureau 涉外分局hold the line 请稍等 (电话用语) subsidy 补助金,津贴allowance 津贴,补偿be reimbursed for the actual expense 实报实销move house 搬家in the course of 在……的过程中leave office 去职,离职in the name of 以……的名义on business 出差fare 车费,船费lodging fee 住宿费stipulation 规定home leave 探亲expatriate 居于国外之人,侨民frequency 频率中文对照:税务英语lesson 12Lessen 12:How does the foreign actor pay tax when performing in China?境外明星来华演出如何纳税Lawyer: Brown is a famous American his lawyer,I was entrusted to consult how to pay tax on his performing in China.Tax official: Is he in the name of group or himself?Lawyer: Is there any difference?Tax official: treatments are same,and some are different.Lawyer: Can you explain it in detail?Tax official: Both are the same in paying business tax-able income is calculated as gross income minus the expense paid to the performance place,the performance company and the tax rate is 3%.Lawyer: What about the income tax?Tax official: In the case of group,the group should pay enterprise income tax. If the group can establish account books and make thereceipts and expenses clear,the actor should pay personal income tax on the salary paid by the group.Taxpayer: What will happen if the group's account book fails to meet the requirement?Tax official: In this case,the taxation bureau will assess the taxable income, Since the expense has been considered in the assessment,the actor will not pay personal income tax.Lawyer: What about in the name of himself?Tax official: First,he should pay business tax on his total income. Then he should pay personal income tax on his remuneration. Can you give me some detailed materials about the personal income tax?Tax official: Sure.Lawyer: By the way,should the actor declare the prsonal income tax on the place of performance?Tax official: can file the tax return on the place of performance,or the performance company can withhold the tax when it pays salary to the actor.New Wordsentrust 委托minus 减去enterprise income tax 企业所得税fail to 不能够,没能够declare 申报withhold 扣留,扣款,扣除税务英语lesson 13Lessen 13:Can you give me some directions to fill in the tax return form?能指点我填写申报表吗?Tax official: What can I do for you?Taxpayer: It is my first time to file the tax you give me any direction?Tax official: My pleasure. Look, please fill in your name,nationality and tax code here.Taxpayer: Can I use your pen? Thank .Tax official: Then please fill in your working unit and telephone number here. And your position?Taxpayer: Permanent representative.Tax official: Ok,please fill in your position here. And have you any part-time job?Taxpayer: No, I have not. Should I fill in the salary and bonus respectively?Tax official: Yes. Please indicate the period in which you made your income. And the income received in different currency should be also filled in respectively.Taxpayer: I had been back to my motherland temporary,shall I indicate it?Tax official: Yes,you should make clear the date of departure and the date when you came back.Taxpayer: Need I calculate the tax amount by myself ?Tax official: No, you needn't .Our computer can do it using the information you fill in.Taxpayer: That is great .Tax official: Please make sure all the items written in the form again, and then put on your signature or signethere .Taxpayer: All right .Tax official: Please deposit your tax money in the bank before the prescribed time .Taxpayer: Cash or check ?Tax official: Both will do .You can deposit the cash in any branch of the Industrial and Commercial Bank .If you use check, you should go to the bank in which you open your bank account .Taxpayer: Where is the nearest branch of the Industrial and Commercial Bank ?Tax official: Go west to the crossroads, then turn to the south ,and the branch is about 100 meter ahead on the western side of the road.New Wordsdirection 说明,指导,指引my pleasure 非常愿意,十分乐意tax code 纳税编码working unit 工作单位signature 签名signet 签章deposit 存款;押金;保证金branch 分支行,分理处Industrial and Commercial Bank 工商银行crossroads 十字路口税务英语lesson 14Lessen 14:I overpaid the tax last month.我上月的税款多缴了Taxpayer: Can you tell me which department is in charge of tax refund? Tax official: Please go to Room 1107 and look for .Taxpayer: Is here?: I am Li in and sit down can I do for you?Taxpayer: I overpaid the personal income tax last month.: Can you explain it in detail?Taxpayer: I am a Chinese employee in a foreign investment enterprise.I had been sent abroad to work for aperiod of time. Last month when I calculate the personal income tax, I did not separate the domestic income from the income from oversea.: The deduction for income from oversea should be RMB 4000,but you used RMB 800. Is that right?Taxpayer: is what I mean.Mr. Li: First please register and get the application form. Then write clearly the reasons and fill in all the columns by referring to the instruction.Taxpayer: Are there any other materials needed ?Mr. Li: In addition to the application form, you need to provide the tax payment bill of last month .Taxpayer: Original or copy?Mr. Li: Both .Taxpayer: When should I hand in those materials ?Mr. Li: You know ,it will take some time to verify your circumstance . So if you want your tax refund quickly ,you'd better hand it in as soon as possible .Taxpayer: How long will the tax be refunded ?Mr. Li: If you circumstance is true, we will refund the tax within 60 days after receiving your application.Taxpayer: I appreciate your help very much .Mr. Li: You are welcome .New Wordsin charge of 负责管理tax refund 退税refer to 参考,参阅the tax payment bill 纳税缴款单as soon as possible 尽快税务英语lesson 15Lessen 15:Must all the personal income tax be with-held and paid by institution?个人所得税都是代扣代缴的吗?Taxpayer: All the foreign enter-prises are obliged to withhold the personal income tax.Is that right?Tax official: , all the organizations in China must withhold personal income tax when they pay salary to their employees,except embassy.Taxpayer: Does it mean that all the personal income taxes are withheld?。

企业法⼈营业执照英⽂翻译模板(正副本)enterprise business license (template)正本:ENTERPRISEBUSINESS LICENSEREGISTERED NO.: 110000450#######DATE OF ESTABLISHMENT: 9/03/2010REGISTRATION AUTHORITY: BEIJING ADMINISTRATION FOR INDUDTRY AND COMMERCEDATE: 09/03/2019No.1040936COMPANY NAME: BEIJING ABC CO., LTDADDRESS:ROOM##, FLOOR #, CHINA LIFE BUILDING, CHAOWAI STREET NO.16, CHAOYANG DISTRICT, BEIJINGLEGAL REPRESATIVE: #####REGISTERED CAPITAL 100,000dollarCAPTITAL PAID-IN: 0 dollarCOMPANY TYPE: CORPORATE LIMITED (Taiwan HK MACAO enterprise)BUSINESS SCOPEItem per approval: noneGeneral item: Food and beverages consulting, social economic consulting, economic information consulting, economic trading consulting; company management consulting; investment consulting; Corporate Planning consulting; public relationship service. INVESTOR(S): THE RICCI GROUP LIMITEDBUSINESS TERM: FROM 03/09/2010 TO 08/03/2040副本:ENTERPRISE BUSINESS LICENSE(Duplicate) (2-1)REGISTERED NO.110000450######COMPANY NAME: ABC CONSULTING(BEIJING) CO.,LTDADDRESS:ROOM #, FLOOR #, CHINA LIFE BUILDING, CHAOWAI STREET NO.16, CHAOYANG DISTRICT, BEIJINGLEGAL REPRESATIVE: #####REGISTERED CAPITAL 100,000DOLLARCAPTITAL PAID-IN: 0 DOLLARCOMPANY TYPE: CORPORATE LIMITED (Taiwan HK MACAO enterprise) BUSINESS SCOPE:item per approval: noneGeneral item: Food and beverages consulting, social economic consulting, economic information consulting, economic trading consulting; company management consulting; investment consulting; Corporate Planning consulting; public relationship service. INVESTOR(S): THE RICCI GROUP LIMITEDBUSINESS TERM: FROM 03/09/2010 TO 08/03/2040DATE OF ESTABLISHMENT: 03/09/2010No. 1096657Notes1. The Business License is the legal certificate for the corporate capacity of the enterpriseand its legal operation.2. The Business License is divided into originals and duplicates, which have the equallegal effect.3. The Business License shall be put on the place of the office where it can be seen.4. The Business License is not allowed to be forged, altered, rent, leased or transferred.5. Any registration item changed, it shall apply with the original authority to do the changes,and get a new Business License.6. The company shall attend the annual survey on any date between 1 March and 30 June.7. When the Business License is cancelled, any business activities not concerning theliquidation shall not be allowed.8. When the cancellation procedures going on, the original and duplicate of the BusinessLicense shall be returned.9. If the Business License is lost or damaged, the company shall make a statement ofinvalidation in the newspaper designated by the original authority,and then apply a new one.ANNUAL SURVEY STATUSRegistration authority: Beijing administration for industry and commerce 03/09/2010。