Managing Bank Liquidity Risk

- 格式:pdf

- 大小:616.62 KB

- 文档页数:27

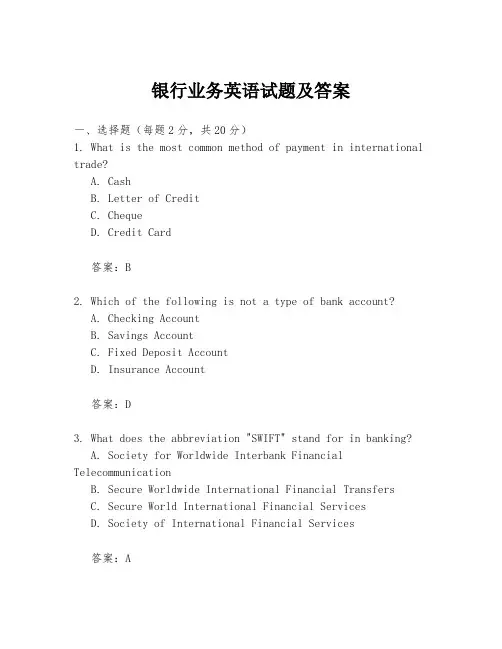

银行业务英语试题及答案一、选择题(每题2分,共20分)1. What is the most common method of payment in international trade?A. CashB. Letter of CreditC. ChequeD. Credit Card答案:B2. Which of the following is not a type of bank account?A. Checking AccountB. Savings AccountC. Fixed Deposit AccountD. Insurance Account答案:D3. What does the abbreviation "SWIFT" stand for in banking?A. Society for Worldwide Interbank Financial TelecommunicationB. Secure Worldwide International Financial TransfersC. Secure World International Financial ServicesD. Society of International Financial Services答案:A4. What is the primary function of a bank?A. To provide loansB. To accept deposits and make loansC. To sell insuranceD. To offer investment advice答案:B5. What is the term used for the process of verifying the authenticity of a document?A. NotarizationB. AuthenticationC. VerificationD. Certification答案:B6. Which of the following is a type of risk associated with banking?A. Market RiskB. Credit RiskC. Liquidity RiskD. All of the above答案:D7. What is the term used for the interest rate at which banks lend money to each other?A. Prime RateB. LIBORC. APRD. APRA答案:B8. What is the term used for the process of transferring money from one bank to another?A. RemittanceB. Wire TransferC. Cheque ClearingD. Cash Withdrawal答案:B9. What is the term used for the practice of offering a lower exchange rate to customers than the market rate?A. ArbitrageB. SpreadC. MarkupD. Discount答案:C10. What does the term "forfaiting" refer to in banking?A. The sale of goods on creditB. The buying and selling of foreign currenciesC. The discounting of bills of exchange without recourseD. The process of issuing a letter of credit答案:C二、填空题(每题1分,共10分)11. The ________ is a document issued by a bank guaranteeing the payment of a specified amount to a named payee.答案:Letter of Credit12. Banks often offer ________ services to their customers to help them manage their finances.答案:Banking13. The ________ is a document that represents the ownership of goods and is used in international trade.答案:Bill of Lading14. A ________ is a financial instrument that represents a debt owed by one party to another.答案:Bond15. The ________ is the process of converting one currency to another.答案:Foreign Exchange16. Banks use ________ to protect themselves against the risk of a borrower defaulting on a loan.答案:Collateral17. The ________ is the rate at which a bank lends to its most creditworthy customers.答案:Prime Rate18. A ________ is a financial statement that shows a company's assets, liabilities, and equity at a particular point in time.答案:Balance Sheet19. The ________ is the process of determining the creditworthiness of a potential borrower.答案:Credit Assessment20. A ________ is a type of investment account that allowsfor tax-deferred growth.答案:Retirement Account三、简答题(每题5分,共30分)21. What are the main functions of a commercial bank?答案:The main functions of a commercial bank include accepting deposits, providing loans, facilitating payments and money transfers, offering financial advice, and managing risk.22. Explain the concept of "fractional reserve banking."答案:Fractional reserve banking is a system where banks are only required to hold a fraction of their customers' deposits in reserve, while the rest can be lent out to generate income.23. What is the role of the central bank in an economy?答案:The role of the central bank includes implementing monetary policy, regulating the financial system, maintaining financial stability, managing the country's foreign exchange reserves, and issuing currency.24. Describe the process of a bank loan application.答案:The process of a bank loan application typicallyinvolves the borrower submitting an application, providing necessary documentation, undergoing a credit assessment, and, if approved, signing a loan agreement.四、论述题(共40分)25.。

泽稷网校——财务金融在线教育领导品牌泽稷网校——商业银行流动性风险管理之道银行单靠资本充足率无法支持其安然度过流动性危机,而增加稳定资金来源在融资组合的占比、通过压力测试来评估经营模式中的风险点、相应的高质量流动资产以及应急融资方案才是流动性风险管理的重点。

流动性风险是商业银行经营与管理过程中最基本的风险种类,根据银监会有关《商业银行流动性风险管理办法》,流动性风险是指商业银行无法及时获得或者无法以合理成本获得充足资金,以偿付到期债务或其他支付义务、满足资产增长或其他业务发展需要的风险。

流动性风险可分为融资流动性风险和市场流动性风险,其中,融资流动性风险是指商业银行在不影响日常经营或财务状况的情况下,无法及时有效满足资金需求的风险;市场流动性风险是指由于市场深度不足或市场动荡,商业银行无法以合理的市场价格出售资产以获得资金的风险。

流动性风险因其具有较强的隐蔽性、不确定性、来源广泛等特点,加大了风险管理的挑战,流动性风险管理(liquidity risk management,LRM)也成为了商业银行持续经营管理的重要内容之一。

虽然流动性风险不是银行特有的风险,但银行吸收存款与其他资金来源、提供贷款与其他融资的经营模式,使得流动性风险管理对银行而言尤为重要。

2008年的美国次贷危机以及后来引发的全球流动性危机,更加深刻地暴露了全球银行流动性管理实践及各国流动性风险管理和监管制度中的一些弊端,也说明了对流动性风险的管理与监管更利于维持银行持续经营与整个金融体系的安全与稳定。

商业银行和监管机构应该充分了解流动性风险并对其管理及监管措施进行反省和调整。

商业银行流动性风险现状中国人民银行行长周小川5月11日在出席“清华五道口全球金融论坛”时称, 4月份银行间市场利率有些飙升,央行逆周期微调一直在做,在积攒到一定程度时需要向典型的货币政策工具、数量型工具迈台阶。

从目前情况来看,国务院明确宏观调控要有定力,不会采取大规模刺激政策。

流动性风险应急演练自查报告例文英文回答:As part of our ongoing efforts to ensure the safety and stability of our operations, we recently conducted a liquidity risk emergency drill to test our preparedness for potential crises. The exercise involved simulating various scenarios where liquidity could become constrained, such as a sudden withdrawal of funds by a large client or a disruption in the financial markets.During the drill, we were able to identify several areas where our processes could be improved to better handle liquidity risk. For example, we found that our communication protocols during a crisis were not as clear as they could be, leading to confusion among team members. This highlighted the importance of having a well-defined chain of command and clear lines of communication in place.Additionally, we realized that our liquidity riskmanagement tools needed to be updated to reflect the changing market conditions. For instance, we noticed that our stress testing models did not adequately capture the potential impact of a severe market downturn, which could leave us vulnerable to liquidity shortages.Moving forward, we are taking steps to address these issues and strengthen our liquidity risk management framework. This includes updating our policies and procedures, enhancing our communication protocols, and conducting more frequent stress tests to ensure we are adequately prepared for any potential liquidity challenges.Overall, the emergency drill was a valuable learning experience that highlighted the importance of being proactive in managing liquidity risk. By identifying and addressing potential weaknesses in our processes, we are better positioned to navigate any future crises that may arise.中文回答:作为我们持续努力确保运营安全和稳定性的一部分,我们最近进行了一次流动性风险应急演练,以测试我们对潜在危机的应对准备情况。

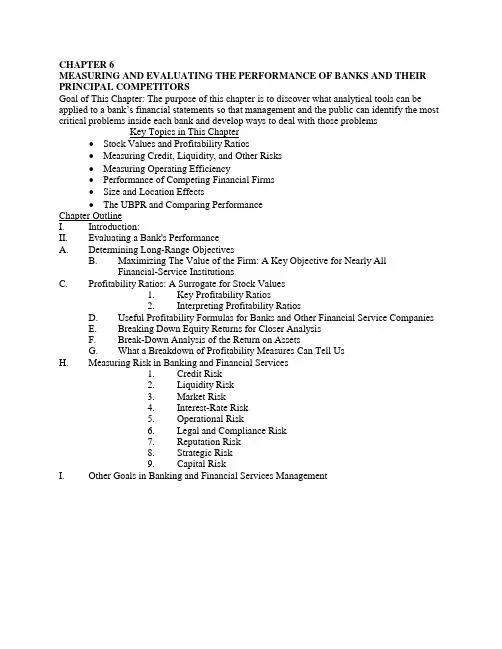

CHAPTER 6MEASURING AND EVALUATING THE PERFORMANCE OF BANKS AND THEIR PRINCIPAL COMPETITORSGoal of This Chapter: The purpose of this chapter is to discover what analytical tools can be applied to a bank’s financial statements so that management and the public can identify the most critical problems inside each bank and develop ways to deal with those problemsKey Topics in This Chapter•Stock Values and Profitability Ratios•Measuring Credit, Liquidity, and Other Risks•Measuring Operating Efficiency•Performance of Competing Financial Firms•Size and Location Effects•The UBPR and Comparing PerformanceChapter OutlineI. Introduction:II. Evaluating a Bank's PerformanceA. Determining Long-Range ObjectivesB. Maximizing The Value of the Firm: A Key Objective for Nearly AllFinancial-Service InstitutionsC. Profitability Ratios: A Surrogate for Stock Values1. Key Profitability Ratios2. Interpreting Profitability RatiosD. Useful Profitability Formulas for Banks and Other Financial Service CompaniesE. Breaking Down Equity Returns for Closer AnalysisF. Break-Down Analysis of the Return on AssetsG. What a Breakdown of Profitability Measures Can Tell UsH. Measuring Risk in Banking and Financial Services1. Credit Risk2. Liquidity Risk3. Market Risk4. Interest-Rate Risk5. Operational Risk6. Legal and Compliance Risk7. Reputation Risk8. Strategic Risk9. Capital RiskI. Other Goals in Banking and Financial Services ManagementIII. Performance Indicators among Banking’s Key CompetitorsIV. The Impact of Size on PerformanceA. Size, Location and Regulatory Bias in Analyzing The Performance of Banks andCompeting Financial InstitutionsB. Using Financial Ratios and Other Analytical Tools to Track BankPerformance--The UBPR.V. Summary of the ChapterAppendix to the Chapter - Improving the Performance of Financial Firms Through Knowledge: Sources of Information on the Financial-Services IndustryConcept Checks6-1. Why should banks and other corporate financial firms be concerned about their level of profitability and exposure to risk?Banks in the U.S. and most other countries are private businesses that must attract capital from the public to fund their operations. If profits are inadequate or if risk is excessive, they will have greater difficulty in obtaining capital and their funding costs will grow, eroding profitability. Bank stockholders, depositors, and bank examiners representing the regulatory community are all interested in the quality of bank performance. The stockholders are primarily concerned with profitability as a key factor in determining their total return from holding bank stock, while depositors (especially large corporate depositors) and examiners typically focus on bank risk exposure.6-2. What individuals or groups are likely to be interested in these dimensions of performance for a bank or other financial institution?The individuals or groups likely to be interested in bank profitability and risk include other banks lending to a particular bank, borrowers, large depositors, holders of long-term debt capital issued by banks, bank stockholders, and the regulatory community.6-3. What factors influence the stock price of a financial-services corporation?A bank's stock price is affected by all those factors affecting its profitability and risk exposure, particularly its rate of return on equity capital and risk to shareholder earnings. A bank can raise its stock price by creating an expectation in the minds of investors of greater earnings in the future, by lowering the bank's perceived risk exposure, or by a combination of increases in expected earnings and reduced risk.6-4. Suppose that a bank is expected to pay an annual dividend of $4 per share on its stock in the current period and dividends are expected to grow 5 percent a year every year, and the minimum required return to equity capital based on the bank's perceived level of risk is 10 percent. Can you estimate the current value of the bank's stock?In this constant dividend growth rate problem the current value of the bank's stock would be: P o = D1 / (k – g) = $4 / (0.10 – 0.05) = $80.6-5. What is return on equity capital and what aspect of performance is it supposed to measure? Can you see how this performance measure might be useful to the managers of financial firms? Return on equity capital is the ratio of Net Income/Total Equity Capital. It represents the rate of return earned on the funds invested in the bank by its stockholders. Financial firms have stockholders, too who are interested in the return on the funds that they invested.6-6 Suppose a bank reports that its net income for the current year is $51 million, its assets totally $1,144 million, and its liabilities amount to $926 million. What is its return on equity capital? Is the ROE you have calculated good or bad? What information do you need to answer this last question?The bank's return on equity capital should be:ROE = Net Income = $51 million = .098 or 9.8 percentEquity Capital $1,444 mill.-$926 mill.In order to evaluate the performance of the bank, you have to compare the ROE to the ROE of some major competitors or some industry average.6-7 What is the return on assets (ROA), and why is it important? Might the ROA measure be important to banking’s key competitors?Return on assets is the ratio of Net Income/Total Assets. The rate of return secured on a bank's total assets indicates the efficiency of its management in generating net income from all of the resources (assets) committed to the institution. This would be important to banks and their major competitors.6-8. A bank estimates that its total revenues will amount to $155 million and its total expenses (including taxes) will equal $107 million this year. Its liabilities total $4,960 million while its equity capital amounts to $52 million. What is the bank's return on assets? Is this ROA high or low? How could you find out?The bank's return on assets would be:ROA = Net Income = $155 mill. - $107 mill. = 0.0096 or 0.96 percent Total Assets $4,960 mill. + $52 mill.The size of this bank's ROA should be compared with the ROA's of other banks similar in size and location to determine if this bank's ROA is high or low relative to the average forcomparable banks.6-9. Why do the managers of financial firms often pay close attention today to the net interest margin and noninterest margin? To the earnings spread?The net interest margin (NIM) indicates how successful the bank has been in borrowing funds from the cheapest sources and in maintaining an adequate spread between its returns on loans and security investments and the cost of its borrowed funds. If the NIM rises, loan and security income must be rising or the average cost of funds must be falling or both. A declining NIM is undesirable because the bank's interest spread is being squeezed, usually because of rising interest costs on deposits and other borrowings and because of increased competition today.In contrast, the noninterest margin reflects the banks spread between its noninterest income (such as service fees on deposits) and its noninterest expenses (especially salaries and wages and overhead expenses). For most banks the noninterest margin is negative. Management will usually attempt to expand fee income, while controlling closely the growth of noninterest expenses in order to make a negative noninterest margin less negative.The earnings spread measures the effectiveness of the bank's intermediation function of borrowing and lending money, which, of course, is the bank's primary way of generating earnings. As competition increases, the spread between the average yields on assets and the average cost of liabilities will be squeezed, forcing the bank's management to search for alternative sources of income, such as fees from various services the bank offers.6-10. Suppose a banker tells you that his bank in the year just completed had total interest expenses on all borrowings of $12 million and noninterest expense of $5 million, while interest income from earning assets totaled $16 million and noninterest revenues added to a total of $2 million. Suppose further that assets amounted to $480 million of which earning assets represented 85 percent of total assets, while total interest-bearing liabilities amounted to 75 percent of total assets. See if you can determine this bank's net interest and noninterest margins and its earnings base and earnings spread for the most recent year.The bank's net interest and noninterest margins must be:Net Interest = $16 mill. - $12 mill. Noninterest = $2 mill. - $5 mill.Margin $480 mill. Margin $480 mill.=.00833 = -.00625The bank's earnings spread and earnings base are:Earnings = $16 mill. - $12 mill.Spread $480 mill * 0.85 $480 mill. * 0.75= .0392 =.0333Earnings Base = $480 mill. - $480 mill. * 0.15 = 0.85 or 85 percent$480 mill.6-11. What are the principal components of ROE and what do each of these components measure?The principal components of ROE are:a. The net profit margin or net after-tax income to operating revenues which reflects the effectiveness of a bank's expense control program;b. The degree of asset utilization or ratio of operating revenues to total assets which measures the effectiveness of managing the bank's assets, especially the loan portfolio; and,c. The equity multiplier or ratio of total assets to total equity capital which measures a bank's use of leverage in funding its operations.6-12. Suppose a bank has an ROA of 0.80 percent and an equity multiplier of 12x. What is its ROE? Suppose this bank's ROA falls to 0.60 percent. What size equity multiplier must it have to hold its ROE unchanged?The bank's ROE is:ROE = 0.80 percent *12 = 9.60 percent.If ROA falls to 0.60 percent, the bank's ROE and equity multiplier can be determined from: ROE = 9.60% = 0.60 percent * Equity MultiplierEquity Multiplier = 9.60 percent = 16x.0.60 percent6-13. Suppose a bank reports net income of $12, before-tax net income of $15, operating revenues of $100, assets of $600, and $50 in equity capital. What is the bank's ROE?Tax-management efficiency indicator? Expense control efficiency indicator? Asset management efficiency indicator? Funds management efficiency indicator?The bank's ROE must be: ROE = 50$12$ = 0.24 or 24 percent Its tax-management, expense control, asset management, and funds management efficiency indicators are:Tax Management = $12 Expense Control = $15Efficiency indicator $15 Efficiency Indicator $100= .8 or 80 percent =.15 or 15 percentAsset Management = $100 Funds Management = $600Efficiency Indicator $600 Efficiency Indicator $50= 0.1666 or 16.67 percent = 12 x6-14. What are the most important components of ROA and what aspects of a financial institution’s performance do they reflect?The principal components of ROA are:a. Total Interest Income Less Total Interest Expense divided by Total Assets, measuring a bank's success at intermediating funds between borrowers and lenders;b. Provision for Loan Losses divided by Total Assets which measures management's ability to control loan losses and manage a bank's tax exposure;c. Noninterest Income less Noninterest Expenses divided by Total Assets, which indicates the ability of management to control salaries and wages and other noninterest costs and generate tee income;d. Net Income Before Taxes divided by Total Assets, which measures operating efficiency and expense control; ande. Applicable Taxes divided by Total Assets, which is an index of tax management effectiveness. 6-15. If a bank has a net interest margin of 2.50%, a noninterest margin of -1.85%, and a ratio of provision for loan losses, taxes, security gains, and extraordinary items of -0.47%, what is its ROA?The bank's ROA must be:ROA = 2.50 percent - 1.85 percent - 0.47 percent = 0.18 percent6-16. To what different kinds of risk are banks and their financial-service competitors subjected today?a. Credit Risk -- the probability that loans and securities the bank holds will not pay out as promised.b. Liquidity Risk -- the probability the bank will not have sufficient cash on hand in the volume needed precisely when cash demands arise.c. Market Risk -- the probability that the value of assets held by the bank will decline due to falling market prices.d. Interest-Rate Risk - the possibility or probability interest rates will change, subjecting the bank to lower profits or a lower value for the firm’s capital.e. Operational Risk –the uncertainly regarding a financial firm’s earnings due to failures in computer systems, employee misconduct, floods, lightening strikes and other similar events.f. Legal and Compliance Risk –the uncertainty regarding a financial firm’s earnings due to actions taken by our legal system or due to a violation of rules and regulationsg. Reputation Risk – the uncertainty due to public opinion or the variability in earnings due to positive or negative publicity about the financial firmh. Strategic Risk – the uncertainty in earnings due to adverse business decisions, lack or responsiveness to changes and other poor decisions by managementi. Capital Risk – the risk that the value of the assets will decline below the value of the liabilities. All of the other risks listed above can affect earnings and the value of the assets and liabilities and therefore can have an effect on the capital position of the firm.6-17. What items on a bank's balance sheet and income statement can be used to measure its risk exposure? To what other financial institutions do these risk measures apply?There are several alternative measures of risk in banking and financial service firms. Capital risk is often measured by bank capital ratios, such as the ratio of total capital to total assets or total capital to risk assets. Credit risk can be tracked by such ratios as net loan losses to total loans or relative to total capital. Liquidity risk can be followed by using such ratios as cash assets to total assets or by total loans to total assets. Interest-rate risk may be indicated by such ratios as interest-sensitive liabilities to interest-sensitive assets or the ratio of money-market borrowings to money-market assets.6-18. A bank reports that the total amount of its net loans and leases outstanding is $936 million,its assets total $1,324 million, its equity capital amounts to $110 million, and it holds $1,150 million in deposits, all expressed in book value. The estimated market values of the bank's total assets and equity capital are $1,443 million and $130 million, respectively. The bank's stock is currently valued at $60 per share with annual per-share earnings of $2.50. Uninsured deposits amount to $243 million and money market borrowings total $132 million, while nonperforming loans currently amount to $43 million and the bank just charged off $21 million in loans. Calculateas many of the bank's risk measures as you can from the foregoing data.Net Loans and Leases = $936 mill. Uninsured Deposits $243 mill.Total Assets $1,324 mill. Total Deposits $1,150 mill.0.7069 or 70.69 percent 0.2113 or 21.13 percentEquity Capital = $130 mill. Stock Price $60Total Assets $1,443 mill. Earnings Per Share $2.50 = 0.0901 or 9.01 percent = 24 XNonperforming Assets = $43 mill. =0.0459 or 4.59 percentNet Loans and Leases $936 mill.Charge-offs of loans = $21 Purchased Funds = $243 mill. + $132 mill. Total Loans and Leases $936 Total Liabilities $1,324 mill. - $110 mill.=.0224 or 2.24 percent .3089 or 30.89 percentBook Value of Assets = $1324 =0.9175 or 91.75 percentMarket Value of Assets $1443Problems6-1. An investor holds the stock of First National Bank of Imoh and expects to receive a dividend of $12 per share at the end of the year. Stock analysts have recently predicted that the bank’s dividends will grow at approximately 3 percent a yea r indefinitely into the future. If this is true, and if the appropriate risk-adjusted cost of capital (discount rate) for the bank is 15 percent, what should be the current stock price per share of Imoh’s stock?6-2. Suppose that stockbrokers have projected that Poquoson Bank and Trust Company will pay a dividend of $3 per share on its common stock at the end of the year; a dividend of $4.50 per share is expected for the next year and $6 per share in the following year. The risk-adjusted cost of capital for banks in Poquoson’s risk class is 17 percent. If an investor holding Poquoson’s stock plans to hold that stock for only three years and hopes to sell it at a price of $55 per share, what should the value of the bank’s stock be in today’s market?P0 = $43.94 per share.6-3 Depositors Savings Association has a ratio of equity capital to total assets of 7.5 percent. In contrast, Newton Savings reports an equity capital to asset ratio of 6 percent. What is the value of the equity multiplier for each of these institutions? Suppose that both institutions have an ROA of 0.85 percent. What must each institution’s return on equity capital be? What do your calculations tell you about the benefits of having as little equity capital as regulations or the marketplace will allow?Depositors Savings Association has an equity-to-asset ratio of 7.5 percent which means its equity multiplier must be:= 1 / 0.075 = 13.33x1/ (Equity Capital / Assets) = AssetsEquityCapitalIn contrast, Newton Savings has an equity multiplier of:= 16.67x1/ (Equity Capital / Assets) = 10.06With an ROA of 0.85 percent Depositors Savings Association would have an ROE of: ROE = 0.85 x 13.33x = 11.33 percent.With an ROA of .85 percent Newton Savings would have an ROE of:ROE = 0.85 x 16.67x = 14.17 percentIn this case Newton Savings is making greater use of financial leverage and is generating a higher return on equity capital.6-4. The latest report of condition and income and expense statement for Galloping Merchants National Bank are as shown in the following tables:Galloping Merchants National BankInterest Fees on Loans $65Interest Dividends on Securities 12Total Interest Income 77Interest Paid on Deposits 49Interest on Nondeposit Borrowings 6Total Interest Expense 55Net Interest Income 22Provision for Loan Losses 2Noninterest Income and Fees 7Noninterest Expenses:Salaries and Employee Benefits 12Overhead Expenses 5Other Noninterest Expenses 3Total Noninterest Expenses 20Net Noninterest Income -13Pre Tax Operating Income 7Securities Gains (or Losses) 1Pre Tax Net Operating Income 8Taxes 1Net Operating Income 7Net Extraordinary Income -1Net Income $6FTE 40Galloping Merchants National BankReport of ConditionCash and Due From Banks $100 Demand Deposits $190Investment Securities $150 Savings Deposts $180Federal Funds Sold $10 Time Deposits $470Net Loans $670 Federal Funds Purch $69(ALL 25) Total Liabilities $900(Unearned Income 5) Common Stock $20Plant and Equipment $50 Surplus $25Retained Earnings $35Total Assets $980 Total Ca $80Total Earnings Assets $830 Interest BearingDeposits $650Fill in the missing items on the income and expense statement. Using these statements, calculate the following performance measures:6-5. The following information is for Shallow National BankInterest Income $2,100Interest Expense $1,400Total Assets $30,000Securities Gains (losses) $21Earning Assets $25,000Total Liabilities $27,000Taxes Paid $16Shares of Common Stock 5,000Noninterest income $700Noninterest Expense $900Provision for LoanLosses $100ROE = $405 ROA = $405$30,000 -$27,000$30,0000.135 or 13.5 percent 0.0135 or 1.35percentEarnings = $405 = $.081 per sharePer Share 5000Net Interest = $2100 -$1400 = $700 = 0.028 or 2.8percentMargin $25,000 $25,000Net Noninterest = $700 -$900= -$200 = 0.008or .8 percent Margin $25,000 $25,000Net Operating = ($2100 + $700) – ($1,400 + $900+ $100) = $400 =0.0133or 1.33percentMargin $30,000 $30,000Suppose interest income, interest expenses, noninterest income, and noninterest expenses each increase by 5 percent, with all other items remaining unchanged.Interest Income $2,205Interest Expense $1,470Total Assets $30,000Securities Gains (losses) $21Earning Assets $25,000Total Liabilities $27,000Taxes Paid $16Shares of Common Stock 5,000Noninterest income $735Noninterest Expense $945Provision for LoanLosses $100ROE = $430 ROA = $430$30,000 -$27,000$30,0000.1433 or 14.33 percent 0.0143 or 1.43percentEarnings = $430 = $.086 per sharePer Share 5000Net Interest = $2205 -$1470 = $735 = 0.0294 or 2.94percentMargin $25,000 $25,000Net Noninterest = $735 -$945 = -$210 = 0.0084 or .84percentMargin $25,000 $25,000Net Operating = ($2205 + $735) – ($1,470 + $945+ $100) = $425 =0.0142or 1.42percentMargin $30,000 $30,000On the other hand, suppose Shallow’s interest income, interest expenses, noninterest income, and noninterest expenses decline by 5 percent, again with all other factors held equal. How would the bank’s ROE, ROA and per share earnings change?Interest Income $1995Interest Expense $1,330Total Assets $30,000Securities Gains (losses) $21Earning Assets $25,000Total Liabnilities $27,000Taxes Paid $16Shares of Common Stock 5,000Noninterest income $665Noninterest Expense $855Provision for LoanLosses $100ROE = $380 ROA = $380$30,000 -$27,000$30,0000.1267 or 12.67 percent 0.0127 or 1.27percentEarnings = $380 = $.076 per sharePer Share 5000Net Interest = $1995 -$1330 = $665 = 0.0266 or 2.66percentMargin $25,000 $25,000Net Noninterest = $665 -$855 = -$190 = 0.0076 or .76percentMargin $25,000 $25,000Net Operating = ($1995 + $665) – ($1,330 + $855+ $100) = $375 =0.0125or 1.25percentMargin $30,000 $30,0006-6. Blue and White National Bank holds total assets of $1.69 billion and equity capital of $139 million and has just posted an ROA of 1.1 percent. What is this bank’s ROE?:ROE = ROA * Total AssetsEquity Capital = 0.011 * $1,690$139= 0.1337 or 13.37%R0A increases by 50%, with no change in assets or equity capital.Therefore, the new ROA = 0.011 * 1.5 = 0.0165 or 1.65%.New ROE = 1.65% * 12.16 = 20.06%This represents a 50% increase in ROE. With no changes in assets or equity, the investors' funds are more effectively utilized, generating additional income and making the bank more profitable. Alternative Scenario 2:ROA decreases by 50%, with no change in equity or assets.Therefore, the new ROA = 0.011 * 0.5 = 0.0055 or 0.55%.New ROE = 0.55% * 12.16 = 6.69%This represents a 50% decrease in ROE. The bank's management has been less efficient, in this case, in managing their lending and/or investing functions or their operating costs.Alternative Scenario 3:ROA = 0.011 or 1.1% (as in the original problem)Total assets double in size to $3.38 billion and equity capital doubles in size to $278 million. Therefore, the equity multiplier (i.e. total assets/equity capital) remains the same (E.M. =$3,380/$278 = 12.16). As a result, there is no change in ROE from the original situation (i.e.), 1.1% * 12.16 = 13.38%).Alternative Scenario 4:This, of course, is just the reverse of scenario 3. Since the changes in both assets and equity capital are the same, the ratio of the two (i.e., the equity multiplier) remains constant. As a result, there is again no change in ROE.E.M. = Total Assets/Equity Capital = $845/$69.5 = 12.16.Therefore, ROE = 1.1% * 12.16 = 13.38%.6-7. Monarch State Bank reports total operating revenues of $135 million, with total operating expenses of $121 million, and owes taxes of $2 million. It has total assets of $1.00 billion and total liabilities of $900 million and has just posed an ROA of 1.1o percent. What is the bank’s ROE? Net Income after Taxes = $135 million -$121 million -$2 million = $12 millionEquity Capital = $1.00 billion - $900 million = $100 million= $12 million / $100 million = 0.12 or 12%.ROE = Net Income after TaxesEquity CapitalAlternative Scenario 1: How will the ROE for Monarch State Bank change if total operating expenses, taxes and total operating revenues each grow by 10 percent while assets and liabilities stay fixed.Total revenues = $135 million * 1.10 = $148.5 millionTotal expenses = $121 million * 1.10 = $133.1 millionTax liability = $2 million * 1.10 = $2.2 millionNet Income after Taxes = $148.5 - $133.1 - $2.2 = $13.2 millionROE = $13.2 million/$100 million = 0.132 or 13.2%Change in ROE = (13.2%-12%)/12% = 10%Alternative Scenario 2: Suppose Monarch State’s total assets and total liabilities increase by 10 percent, but its revenues and expenses (including taxes) are unchanged. How will the bank’s ROE change?Total assets increase by 10% (Total assets = $ 1.0 * 1.10 = $1.1 billion)Total liabilities increase by 10% (Total liabilities = $900 million * 1.10 = $990Revenues and expenses (including taxes) remain unchanged.Solution: Equity Capital = $1.1 billion - $990 million = $110 millionROE = $12 = .1091$110 10.91 percent= 10.91% - 12% = -1.09% = -.0908% Therefore change inROE12% 12% (ROE decreases by9.08%)Alternative Scenario 3: Can you determine what will happen to ROE if both operating revenues and expenses (including taxes) decline by 10 percent, with the bank’s total assets and liabilities held constant?Total revenues decline by 10% (Total revenues = $135 million * 0.90 = $121.5 million)Total expenses decline by 10% (Total expenses = $121 million * 0.9 = $108.9 million)Tax liability declines by 10% (Tax liability = $2 * 0.9 = $1.8 million)Assets and liabilities remain unchanged (Therefore, equity remains unchanged)Solution: Net Income after Tax = $121.5 million - 108.9 million - $1.8 million = $10.8 ROE = $10.8 million = 0.108 = 10.8%$100 millionTherefore change in ROE = 10.8% - 12% = -1.2% = -.1012% 12% (ROE decreases by 10%) Alternative Scenario 4: What does ROE become if Monarch State’s assets and liabilities decreaseby 10 percent, while its operating revenues, taxes and operating expenses do not change?Total assets = $1.0 billion * 0.9 = $900 millionTotal liabilities = $900 million * 0.9 =$810 millionEquity capital = $900 million - $810 million = $90 millionROE = $12 = .1333$90 13.33 percent6-8. Suppose a stockholder owned thrift institution is projected to achieve a 1.25 percent ROA during the coming year. What must its ratio of total assets to total equity capital be if it is to achieveits target ROE of 12 percent? If ROA unexpectedly falls to .75 percent, what assets-to-capital ratio must it then have to reach a 12 percent ROE?ROE = ROA * (Total Assets/Equity Capital)Total Assets = ROE = 12% = 9.6 xEquity Capital ROA 1.25%If ROA unexpectedly falls to 0.75% and target ROE remains 12%:12% = .75% * Total AssetsEquity CapitalTotal Assets = 12% =16 xEquity Capital .75%。

商业银行风险控制国内外研究文献综述商业银行是金融体系中最主要的组成部分之一。

风险控制对商业银行的稳定运营至关重要。

本文旨在综述国内外关于商业银行风险控制的研究文献,探讨不同研究视角和方法对于风险控制的贡献。

一、风险控制的概念和重要性风险控制是商业银行保持金融稳定的基本要求。

通过建立科学的风险评估和风险管理体系,商业银行可以降低风险暴露,减少潜在损失。

风险控制涉及多个方面,包括信用风险、市场风险、操作风险和流动性风险等。

二、信用风险管理信用风险是商业银行面临的最主要风险之一。

国内外研究通过不同的途径来探讨信用风险的管理。

一些研究关注信用评级模型的建立和应用,例如通过借鉴特定行业的信用评级标准来评估客户的信用风险。

另一些研究则从银行内部的角度出发,探讨如何优化信贷审批流程,加强对借款人的审查和监控。

三、市场风险管理市场风险是商业银行在金融市场中面临的风险,主要包括股票、债券和外汇等市场价格波动带来的风险。

国内外研究提出了一些有效的风险管理方法。

例如,一些研究通过建立风险预警模型,及时发现市场波动的风险信号。

另一些研究则着眼于风险分散的方法,例如通过投资组合的多样化来降低风险暴露。

四、操作风险管理操作风险是商业银行内部管理不善带来的风险。

操作风险包括人为错误、管理失控、信息系统故障等。

国内外研究提出了一些有效的操作风险管理方法。

例如,一些研究强调建立完善的内部控制和审计制度,加强对员工行为和操作流程的监督。

另一些研究则关注信息技术的应用,例如使用人工智能和大数据技术来提高操作风险管理的效率和准确性。

五、流动性风险管理流动性风险是商业银行面临的一种特殊风险,指在特定时期,银行无法满足债务偿还和经营活动所需现金流的情况。

国内外研究提出了一些流动性风险管理的方法。

例如,一些研究关注监管要求和政策对银行流动性管理的影响,通过合理配置储备资金、制定灵活的流动性管理策略来降低流动性风险。

综上所述,商业银行风险控制是保持金融稳定的基本要求。

国际商业银行流动性风险管理介绍及对国内银行的启示Liquidity Risk Management of Commercial Banks:International Experiences and Enlightenments to China徐 冕流动性风险管理是银行正常经营最重要的基础和保障。

经过多年的发展,国内银行业流动性风险管理虽然得到了蓬勃发展,但与国际先进银行相比,仍存在多方面的差距。

该文通过回顾国际商业银行流动性风险管理思想的衍变,分析介绍国际流动性风险管理的先进经验,从而为国内银行提供借鉴。

Liquidity risk management is the most important foundation and safeguard for the normal operation of banks. With years of development, the liquidity risk management of China’s banking industry has been improved significantly, yet there are still gaps compared with the international advanced banks. By reviewing the evolution of liquidity risk management theories of international commercial banks, this paper analyzes and introduces the advanced experiences of liquidity risk management, aiming to provide references for domestic banks.自银行产生以来,银行经营管理的两大核心是资产负债错配和流动性风险管理。

Managing Bank Liquidity Risk:How Deposit-Loan Synergies Vary with Market ConditionsEvan GatevBoston CollegeTil SchuermannFederal Reserve Bank of New York and Wharton Financial Institutions Center Philip E.StrahanBoston College,Wharton Financial Institutions Center,and National Bureau of Economic ResearchLiquidity risk in banking has been attributed to transactions deposits and their potential to spark runs or panics.We show instead that transactions deposits help banks hedge liquidity risk from unused loan commitments.Bank stock-return volatility increases with unused commitments,but only for banks with low levels of transactions deposits.This deposit-lending hedge becomes more powerful during periods of tight liquidity,when nervous investors move funds into their banks.Our results reverse the standard notion of liquidity risk at banks,where runs from depositors had been seen as the cause of trouble.(JEL G18,G21) Much theory attempts tofind dimensions of“bank specialness,”typically from a synergy of combining deposits with loans.Banks’role as delegated moni-tor explains why they tend to hold large and well-diversified loan portfolios, and why they tend to fund themselves mostly with debt(Diamond,1984). Deposits—banks’main source of debt—tend to be short term and subject to a“sequential service constraint,”meaning that priority of payment is on a first-come,first-served basis.This unique capital structure stems from bank loan opaqueness.Loans make“bad”collateral because outsiders cannot value them;by subjecting themselves to the possibility of a run,banks increase their borrowing capacity against their loans(Calomiris and Kahn,1991;Flannery, 1994;Diamond and Rajan,2001).We would like to thank the FDIC Center for Financial Research forfinancial support,as well as for helpful comments on the research.We would also like to thank seminar participants at Boston College,Ohio University, Tilburg University,and the University of Amsterdam,and participants at the2nd FIRS(Financial Intermediation Research Society)Conference in Shanghai and the China International Conference in Finance(CICF)in Xian,as well as Robert de Young,Paul Kupiec,Tobias Moskowitz(the editor),and an anonymous referee.Kristin Wilson assisted with preparation of the data.Any views expressed represent those of the authors only and not necessarily those of the Federal Reserve Bank of New York or the Federal Reserve System.Send correspondence to P.E. Strahan,Boston College,140Commonwealth Avenue,Chestnut Hill,MA02467,United States,telephone:(617) 552-6430.E-mail:philip.strahan@.C The Author2007.Published by Oxford University Press on behalf of The Society for Financial Studies. All rights reserved.For Permissions,please e-mail:journals.permissions@.doi:10.1093/rfs/hhm060Advance Access publication November20,2007The Review of Financial Studies/v22n32009Fama(1985)argues that liquidity production helps explain what is different about banks.Private information from the business checking account gives banks an advantage in lending over other intermediaries.1Banks provide liq-uidity not only to demand depositors,however,but also to borrowers via lines of credit and undrawn loan commitments(we use these terms interchangeably).2 Both contracts allow customers to receive cash on demand.The liquidity in-surance role of banks exposes them to the risk that they will have insufficient cash to meet random demands from their depositors or borrowers.This article shows that banks reduce their liquidity risk by combining transactions deposits with loan commitments,thus helping to explain a key feature of the industry.Our point of departure is the model presented by Kashyap,Rajan,and Stein (2002),hereafter KRS,who explain why banks combine transactions deposits with loan commitments using a risk-management motivation:as long as the demand for liquidity from depositors is not highly correlated with liquidity demands from borrowers,an intermediary can reduce its need to hold cash by serving both customers.Thus,their model yields a diversification synergy between demand deposits(or transactions deposits more generally)and loan commitments.As evidence,KRS report a positive correlation across banks between unused loan commitments and transactions deposits.The correlation is robust to variations in the definition of loan commitments and to bank size, and is also consistent across time.KRS do not,however,test the key implication of their model—the idea that by exposing themselves to asset-side and liability-side liquidity risks simultaneously,banks can enjoy a diversification,or risk-reducing synergy.We test the basic premise of the KRS model—that liquidity risks stemming from the two fundamental businesses of banking yield a diversification benefit. The results suggest that bank risk,measured by stock-return volatility,increases with unused loan commitments,reflecting asset-side liquidity risk exposure. This increase,however,is mitigated by transactions deposits.In fact,risk does not increase with loan commitments for banks with high levels of transactions deposits.Table1illustrates our keyfinding in a simple and intuitive way.The table reports our measure of risk(average stock-return volatility,equal to the annu-alized return standard deviation)for large,publicly traded banks,along with 1Mester,Nakamura,and Renault(2006)offer some empirical evidence for this notion.Gatev(2006)argues that banks also have unique information about systematic(as opposed tofirm-specific)liquidity shocks,allowing them to lend to opaquefirms such as hedge funds.2Early literature attempts to understand how banks’role in liquidity production leads to fragility.Diamond and Dybvig(1983)argue that by pooling their funds in an intermediary,agents can insure against idiosyncratic liquidity shocks while still investing most of their wealth in high-return but illiquid projects.This structure leads to the potential for a self-fulfilling bank run and sets up a policy rationale for deposit insurance.More recent theoretical and empirical studies focus on liquidity risk from the asset side.For example,Berger and Bouwman (2006)document the importance of banks in liquidity production on both sides of bank balance sheets,and show that this role has grown sharply over time.There is also a growing literature showing that liquidity-risk management or liquidity shocks to banks affect loan supply.See Paravisini(2006),Khwaja and Mian(2005), Loutskina(2005),and Loutskina and Strahan(2006).996Managing Bank Liquidity RiskTable1Mean bank characteristics,by transactions deposits and unused commitmentsTransactions deposits/total deposits(TD)TD<33rd33rd pct.≥TD<67th pct.≤percentile67th pct.TD(1)(2)(3)Unused commitments/(commitments+loans)(LC)LC<33rd percentileStock-return volatility0.280.290.32 (Cash+securities)/assets0.320.310.33 Assets(billions of$s)10.5810.207.14 Fed funds purchased/assets0.070.080.07 Equity/assets0.080.080.11 33rd percentile≤LC<67th percentileStock-return volatility0.290.290.30 (Cash+securities)/assets0.320.310.33 Assets(billions of$s)17.8521.6416.53 Fed funds purchased/assets0.090.100.11 Equity/assets0.080.080.07 67th percentile≤LCStock-return volatility0.360.320.31 (Cash+securities)/assets0.340.300.33 Assets(billions of$s)34.6389.1083.36 Fed funds purchased/assets0.070.100.10 Equity/assets0.080.080.08 Mean commitments ratio0.300.310.37 Average bank characteristics and stock-return volatility,equal to the annualized return standard deviation,for large,publicly traded banks.Data on unused commitments,transactions deposits,as well as the other bank characteristics,come from the most recent quarter of the Reports of Income and Condition prior to the time at which we measure the stock-return variability.The observations are sorted vertically by the percentiles of the distribution of level of loan commitments(unused commitments divided by unused commitments plus loans) and horizontally by the level of transactions deposits relative to total deposits.Each of the nine cells reports the simple average for all observations in that part of the distribution.several bank characteristics,including a liquidity ratio(cash+securities to assets),total assets,Fed funds purchased to assets,and the ratio of equity to assets.We divide the data into nine cells,based on the level of loan commit-ments(unused commitments divided by unused commitments plus loans)and the level of transactions deposits(relative to total deposits).Each cell reports the simple average for all observations in that part of the distribution.Stock-return volatility(our measure of risk)clearly increases with loan commitments for banks with low and moderate levels of transactions deposits(columns1 and2).Risk does not increase for banks with high levels of transactions de-posits(column3).Loan commitments do not expose banks with high levels of transactions deposits to much risk.Table1also shows that banks with high levels of unused commitments tend to be larger than average.Banks exposed to commitments that operate without the benefit of high levels of transactions deposits also hold more cash than other banks(last row of column1).3Thus,the high balance-sheet liquidity held by these banks does not fully offset the risk from liquidity exposure associated 3The cash ratio is not monotonically increasing in liquidity exposure from transactions deposits.997The Review of Financial Studies/v22n32009with high levels of unused commitments.Banks with unused commitments seem to conserve on cash by funding themselves with transactions deposits.Figure1paints a similar picture.We scatter bank stock-return volatility (with one time-averaged observation per bank)against unused commitments.For banks with below-median levels of transactions deposits,risk increases with unused commitments(Panel A).The slope coefficient in this simple regression equals0.28(t=5.55),meaning that moving from the25th to the75th percentile of the distribution of unused commitments comes with an increase in volatility of about10%.Banks with high levels of transactions deposits face no increase in risk with asset-side liquidity exposure(Panel B).If anything,risk falls slightly with commitments for these banks.In the empirical analysis next,we show that the simple results in Table1 and Figure1hold up in multivariate models,even after controlling for bank size(which is correlated with unused commitments),as well as measures of market and credit risk exposure.The result is robust to alternative measures of stock-return volatility,to different statistical modeling approaches,as well as to variations in the set of control variables included in the model.We then extend the benchmark results by testing how the deposit-lending diversification synergy varies with market conditions.We show that the hedg-ing synergy is stronger when market-wide liquidity supply is low,which we proxy with the Commercial Paper–Treasury Bill spread(wide spreads indi-cate low liquidity).The hedge strengthens because greater takedown demand from borrowers occurs just as new fundsflow into bank transactions deposit accounts(Gatev and Strahan,2006).Inflows and outflows of liquidity offset, thus mitigating the risk.Bank ex ante exposure to liquidity shocks,however, does not increase during these short-term episodes.We can,therefore,rule out reverse causality—the possibility that safer banks choose higher exposures to both asset-side and liability-side liquidity risk.Our results show that transactions deposits play a critically important role in allowing banks to manage their liquidity risk,especially during periods of market pullbacks.Thefindings strengthen the KRS theoretical argument,and help explain the robust positive correlation across banks between transactions deposits and loan commitments.1.Background and Previous ResearchThe growth of the commercial paper market and subsequently of the junk bond market in the1980s and1990s has reduced banks’role as credit suppliers for large corporations(Mishkin and Strahan,1998).Other innovations,such as mortgage and credit card securitization,have also expanded the role of securities markets for households.This evolution toward the securities markets, however,has not rendered banks irrelevant(see Boyd and Gertler,1994).They remain important to largefirms as providers of backup mercial 998Managing Bank Liquidity RiskFigure1aStock Return V olatility for Low Transactions Deposit Banks,1990-2002Figure1bStock Return V olatility for High Transactions Deposit Banks,1990-2002999The Review of Financial Studies/v22n32009paper issuers regularly support their program with backup lines from banks.4 In addition,while mostfirms do not issue commercial paper,almost all secure a line of credit from a bank.Sufi(2006)finds that at least75%of Compustatfirms disclose a bank line of credit and that these lines relax liquidity constraints. Households also receive liquidity from banks through credit cards and home equity lines.Banks,of course,continue to provide liquidity through their role as issuers of transactions deposits.Why do banks provide liquidity to both borrowers and depositors?KRS present a model in which a risk-management motive explains the combination of transactions deposits and loan commitments.They argue that as long as liquidity demand from depositors and borrowers is not too correlated,an inter-mediary will reduce its cash buffer by serving both customers.Holding cash raises costs for both agency and tax reasons(Myers and Rajan,1998).Thus, their model yields a diversification synergy between transactions deposits and unused loan commitments.This synergy helps explain one of the basic features of banking.KRS show that banks offering more transactions deposits tend also to make more loan commitments.In Gatev and Strahan(2006),we suggest a stronger hypothesis, supported by ourfindings that the correlation is not only low but is often negative.Transactions deposits can be viewed as a natural hedge becauseflows into these accounts offset the systematic liquidity risk exposure stemming from issuing loan commitments and lines of credit.Our previous work extends KRS by considering the possibility that liquid-ity production could expose banks to systematic liquidity risk.A bank with many open credit lines may face a problem if systematic increases in liquid-ity demand occur periodically.5Gatev and Strahan(2006)show that funding to banks increases when market liquidity declines,meaning that liquidity de-mands become negatively correlated in tight markets.Why do banks enjoy funding inflows when liquidity dries up?First,the banking system has explicit guarantees of its liabilities.6Second,banks have access to emergency liquidity 4Banks began offering liquidity insurance for largefirms early in the development of the commercial paper market. In1970,Penn Central Transportation Companyfiled for bankruptcy with more than$80million in commercial paper outstanding.As a result of their default,investors lost confidence in other issuers,making it difficult for some of thesefirms to refinance their paper as it matured.The Federal Reserve responded to the Penn Central crisis by lending aggressively to banks through the discount window and encouraging them,in turn,to provide liquidity to their large borrowers.In response to this difficulty,commercial paper issuers began purchasing backup lines of credit from banks to insure against future funding disruptions(Kane,1974;Calomiris,1994;and Calomiris,1989).5For example,during thefirst weeks of October1998,following the coordinated restructuring of the hedge fund Long-Term Capital Management,spreads between safe treasury securities and risky commercial paper rose dramatically.Many largefirms were consequently unable to roll over their commercial paper as it came due, leading to a sharp reduction in the amount of commercial paper outstanding and a corresponding increase in takedowns on preexisting lines of credit(Saidenberg and Strahan,1999).As a result of this market pullback, banks faced a spike in demand for cash as many of their largest customers drew funds from preexisting backup lines of credit.6Deposit insurance limits have recently been expanded for thefirst time since1980.In addition,some small banks have begun to avoid binding limits on deposit insurance by splitting very large deposits across multiple 1000Managing Bank Liquidity Risksupport from the central bank.Third,large banks such as Continental Illinois have been supported in the face offinancial distress(O’Hara and Shaw,1990). Thus,funding inflows occur because banks are rationally viewed as a safe haven for funds.Consistent with this notion,Pennacchi(2006)finds that during the years before the introduction of federal deposit insurance,bank funding supply did not increase when spreads tightened.In a case study,Gatev,Schuermann,and Strahan(2006)focus on the behavior of depositflows across banks during the1998crisis.During the three months leading up to the crisis,bank stock prices were buffetted by news of the Russian default,followed by the demise of LTCM in late September,andfinally by the drying up of the commercial paper market in thefirst weeks of October.7 Figure2shows the aggregate effects of the1998crisis on stock-return volatility. We plot bank stock volatility and volatility of the S&P500,measured as the conditional volatility from an EGARCH(1,1)model.Thefigure highlights the difference between bank risk exposures in different business conditions.During the crisis,bank stock prices fell more than the stock prices of non-financialfirms (Panel A),and return volatility became higher than overall general market volatility(in contrast to the“normal”precrisis period—Panel B).8To understand how banks weathered the1998storm,in Gatev,Schuermann, and Strahan(2006)we explore the cross-sectional patterns in depositflows. Wefindfirst that investors moved funds from markets into banks;second,that banks with higher levels of transactions deposits before the crisis had the largest flows of new money during the crisis;and third,that all of theflows of new money were concentrated in bank demand deposits.So,banks structured to bear increased demands for liquidity from borrowers(i.e.,banks with transactions deposits)could meet those demands easily(because moneyflowed into those accounts).Thus,government safety nets can explain why banks generally receive funding during crises,but the evidence from Gatev,Schuermann,and Strahan(2006)and Kashyap,Rajan,and Stein(2002)suggests that the structure of banks matters too.Before the introduction of government safety nets,transactions deposits could sometimes expose banks to liquidity risk when consumers together re-moved deposits,either to increase consumption or because they had lost con-fidence in the banking system.This bank-run problem has traditionally been institutions.For a broad discussion of deposit insurance and policy ramifications,see Kroszner and Strahan (2005).7For policy discussion on LTCM,see Edwards(1999).For a discussion of bank exposure to hedge funds,see Kho,Lee,and Stulz(2000)and Furfine(2006).8Chava and Purnanandam(2006)provide evidence that the CP market ceased to function at the beginning of October by comparing abnormal returns forfirms with and without access to this market.They showfirst that stock prices of CP issuers fell much less than otherfirms when bankfinancial condition deteriorated during September1998(while markets continued to function).During thefirst two weeks of October,however,the stock prices of allfirms,regardless of their ability to access the CP market,fell equally.Thus,allfirms became bank dependent—even CP issuers—during those weeks because CP markets ceased to function and even large corporations relied on banks for liquidity.1001The Review of Financial Studies/v22n32009Figure2aBank Stock-Price Index.Figure2bBank Conditional Stock-Return V olatility.viewed as the primary source of liquidity risk and creates a public policy ra-tionale for FDIC insurance as well as for reserve requirements for demand deposits(Diamond and Dybvig,1983).In crisis,investors now run to banks, not away from them(at least they do in the US),and banks funded with 1002Managing Bank Liquidity Risktransactions accounts receive the inflow.Thus,rather than open banks to liq-uidity risk,transactions deposits today help banks hedge that risk,which now stems more from the lending side.We now turn to our direct tests of this idea.2.Empirical Methods2.1SampleWe start by identifying the100largest publicly traded domestic banks(based on market capitalization)at the beginning of each year from1990to2002.9 We focus on large banks for several reasons.First,large-bank stocks trade frequently,so daily stock returns are available and reliable.For smaller banks, lack of active trading every day poses problems in estimating the conditional volatility model(see the following text).Second,large banks hold the vast majority of the banking system’s assets.For example,about60%of bank assets were held by the100largest banks during our sample.Third,large banks are more actively engaged in commitment lending than small banks.After identifying the top100,we drop all banks that engaged in a merger or acquisition(M&A)during the year of the deal itself(but not in other years).For example,15of the large banks were involved in M&A in1990,leaving 85in our sample.10Next,we construct the weekly conditional volatility for stock returns for these banks(details follow).For our purpose,a week begins and ends on Wednesday,as this is the weekday with the fewest public holidays which might close the markets.We repeat this sampling procedure for every year between1990and2002.Note that it is important to drop both acquirers and targets around M&A announcements because speculation about such deals generates a large amount of stock-price volatility having nothing to do with the basic risks banks face(market,credit,liquidity,etc.).So,for example,we drop both JP Morgan and Chase during the year of their merger,but these two banks are included as two separate banks in the years prior to the merger,and as a single bank in the year after the merger.As a result,the maximum number of banks in any year is98(2002),and the minimum is68(1996).The sample-generating procedure leaves us with170banks,and almost50,000bank-week observations overall.2.2Conditional mean volatilityWe construct our conditional stock-return volatilities byfirstfitting daily returns to a GARCH(1,1)model for each bank-year,as follows.Let r i,t+1be the return 9We begin in1990because that is thefirst year when unused retail loan commitments are available,which we shall control for as a robustness check.Prior to1990,only total commitments are reported.10Traded equity reflects the profits and risk of the entire bank holding company,so our use of the term“bank”refers to the whole holding company.In collecting characteristics,we use data for the lead bank within the holding company.1003The Review of Financial Studies /v 22n 32009for bank i from t to t +1.Then,bank returns may be characterized byr i ,t +1=µi +εi ,t +1σ2i ,t +1=ω+αε2i ,t +βσ2i ,t ,ω,α,β>0,(1)where µi is a nonzero drift.For estimation,the innovation εi ,t +1is assumed to be conditionally normally distributed with time-varying GARCH(1,1)volatility as specified in the second equation of (1).Based on the coefficients estimated in the GARCH model,we construct daily conditional volatility,and then we aggregate up the daily volatilities to weekly frequency.11Table 1reports the simple average level of these conditional volatilities,normalized to represent the annualized standard deviation of the stock return.We split the data into nine cells,based on the joint distribution of the level of the ratio of transactions deposits to total deposits and the level of unused loan commitments to total commitments plus total loans (our measure of asset-side liquidity exposure).This admittedly simple table illustrates the main hedging idea of our research:banks with high levels of transactions deposits have similar levels of risk regardless of their loan-liquidity exposure (column 3).In contrast,risk increases with loan liquidity risk (unused loan commitments)for banks at the low end of the transactions deposits distributions (column 1).Increasing unused loan commitments comes with an increase in risk of nearly 30%for these banks (from 0.28to 0.36).The same patterns show up in the medians within each cell (not reported).The deposit base,therefore,seems to act as a natural hedge against liquidity exposure from loan commitments.122.3Regression specificationTo demonstrate these results more systematically,we estimate an empirical model of the conditional volatility as a function of bank liquidity exposure,deposits,and other market-level and bank-level characteristics,as follows:Log(σit )=β0+β1LoanCommitments i ,t −1+β2DepositBase i ,t −1+β3(LoanCommitments i ,t −1×DepositBase i ,t −1)+Bank-Level and Market-Level Control Variables +u i ,t ,(2)where σit is the conditional stock-return volatility for bank i at time t from the first-stage GARCH (1,1)model in Equation (1);LoanCommitments i ,t −1is the ratio of unused loan commitments to commitments plus loans (measured in the previous quarter);and DepositBase i ,t −1is the ratio of transactions deposits 11To aggregate volatilities from daily to lower frequencies,say weekly,we take the average over that week and scale by √5,allowing for the possibility of missing days due to,for instance,holidays.12Notice that the hedge seems to go both ways.That is,for banks with low levels of loan commitments (first row),higher transactions deposits come with higher risk (from 0.28to 0.32).On the other hand,for banks with high levels of commitments,higher transactions deposits come with lower risk (from 0.36to 0.31).1004to total deposits(again,from the prior quarter).If deposits help banks hedge asset-side liquidity risk,as suggested by Table1,thenβ3<0.132.4Variable definitions and data sourcesAs time-varying controls in the regression,we include the contemporaneous stock-return volatility for the S&P500as a whole,estimated with a GARCH (1,1)model in the same fashion as the bank-specific volatilities;the3-month treasury-bill rate;and the spread between the high-grade3-month commercial paper rate and the3-month treasury-bill rate.To be consistent with the condi-tional volatilities,the interest rate data are taken for the Wednesday of a given week.For bank-level controls,we include the following:the log of assets(size control),the ratio of cash plus securities to total assets(liquid asset measure),the ratio of capital to assets(capital adequacy measure),and the ratio of Fed funds purchased to assets(a measure of access to the Fed funds market,a liquidity pool).Controlling for size is particularly important given its correlation with loan commitments(recall Table1).We also consider a second loan commitment variable as a robustness test that removes retail commitments(e.g.,credit card lines)from both the numerator and the denominator of LoanCommitments i,t−1. Unused retail commitments may be less likely to expose banks to risk compared to business-loan commitments,where takedown demand is both less predictable and more likely to have a systematic component such as the one observed in the fall of1998.Data on unused commitments,transactions deposits,as well as the other bank characteristics,come from the most recent quarter of the Reports of Income and Condition(“call reports”)prior to the time at which we measure the stock-return variability.For example,all weeks in the second quarter of 1990are matched to call report data for thefirst quarter of1990.Stock return data come from the Center for Research in Securities Prices(CRSP),inclusive of dividend payments and adjusted to account for stock splits.Data on interest rates are available daily from the Federal Reserve Board of Governors.Note that since the regulatory data is available only at quarterly intervals,the bank characteristics remain unchanged for all weeks within a given quarter.2.5Summary statisticsTable2reports the summary statistics for all of the variables reported in the regressions.Bank-stock volatility averages about30%per year,well above the 16%for the S&P500index.We would expect,of course,index volatility to be lower due to portfolio effects.In our sample,the mean loan commitment ratio is about0.32and the mean level of transactions deposits to total deposits equals about0.26.As in KRS,banks with high levels of loan commitment also 13We have also estimated regressions like(1)using the level of volatility as well as the square of volatility(variance).These results are similar in terms of statistical and economic significance to those reported here.1005。