管理专业毕业设计外文翻译--内部控制透视:理论与概念

- 格式:doc

- 大小:120.00 KB

- 文档页数:11

会计内部控制中英文对照外文翻译文献(文档含英文原文和中文翻译)内部控制系统披露—一种可替代的管理机制根据代理理论,各种治理机制减少了投资者和管理者之间的代理问题(Jensen and Meckling,1976; Gillan,2006)。

传统上,治理机制已经被认定为内部或外部的。

内部机制包括董事会及其作用、结构和组成(Fama,1980;Fama and Jensen,1983),管理股权(Jensen and Meckling,1976)和激励措施,起监督作用的大股东(Demsetz and Lehn,1985),内部控制系统(Bushman and Smith,2001),规章制度和章程条款(反收购措施)和使用的债务融资(杰森,1993)。

外部控制是由公司控制权市场(Grossman and Hart,1980)、劳动力管理市场(Fama,1980)和产品市场(哈特,1983)施加的控制。

各种各样的金融丑闻,动摇了世界各地的投资者,公司治理最佳实践方式特别强调了内部控制系统在公司治理中起到的重要作用。

内部控制有助于通过提供保证可靠性的财务报告,和临时议会对可能会损害公司经营目标的事项进行评估和风险管理来保护投资者的利益。

这些功能已被的广泛普及内部控制系统架构设计的广泛认可,并指出了内部控制是用以促进效率,减少资产损失风险,帮助保证财务报告的可靠性和对法律法规的遵从(COSO,1992)。

尽管有其相关性,但投资者不能直接观察,因此也无法得到内部控制系统设计和发挥功能的信息,因为它们都是组织内的内在机制、活动和过程(Deumes and Knechel,2008)。

由于投资者考虑到成本维持监控管理其声称的(Jensen and Meckling,1976),内部控制系统在管理激励信息沟通上的特性,以告知投资者内部控制系统的有效性,是当其他监控机制(该公司的股权结构和董事会)比较薄弱,从而为其提供便捷的监控(Leftwich et等, 1981)。

工程技术协调与社会经济建模的公共政策的影响:交通基础设施管理中的应用摘要:持续的基础设施投资不足和显著增长的商业及非商业的交通需求,已经使美国的当前和未来的交通设施消化不良。

显然我们的交通基础设施条件的改善必须建立在更可持续的和积极的方法上,并且满足存在的差距之间的短期和长期需要的承诺。

本文演示了长期投资克服基础设施改造的历史障碍的价值,包括需要积极的政治体系来弥补公共责任的缺陷,以及对交通基础设施的故障造成的社会经济影响的缺乏了解。

而这些过程可以避免即将到来的灾难。

本文提出了一种建模范式,描述了一种系统的制度中,一个长期的交通基础设施建设的建模,多个利益相关者的视角和涉及公共政策的构思。

该方法促进了利益相关者和决策者他们共同的利益和个人决定的协调,实现更多的符合条件的系统目标的整体系统的水准。

为了说明该建模方案的实用性,把它应用到一个桥梁的维修问题中,我们综合讨论了已有的工程实践和社会经济因素,帮助简化基础设施的长期目标与短期需求。

并且我们可以从该系统方法论点到为了基础设施维护采取一种更具前瞻性和协作性的公共政策中获得见解。

2013Elsevier 公司保留所有权利1.引言美国的交通基础设施,几十年来一直在恶化。

然而,恶化的过程是缓慢的,更广泛的影响并不总是显而易见。

今天,这种退化过程的影响比以往任何时候都更加明显和不祥,众多的报告表明,各种各样的后果会导致交通基础设施建设的失败。

这些措施包括,增加经济成本的货运拥挤,美国全球竞争力下降,增加了旅行成本和减少旅客的安全等等。

美国土木工程师学会(ASCE)表明,美国现有交通基础设施未能维持经济增长,以及各种各样的解决方案将建立在各级政府确保未来基础设施的正常运转这一条件上(ASCE,2011)。

在应对这一挑战,奥巴马总统已经要求立法者建立一个国家基础设施银行,并批准20亿美元改善国家的交通基础设施的预算。

如果实施基础改善方案失败了,将会导致美国企业和家庭的开支显著加大。

![毕业论文-外文资料翻译[管理资料]](https://uimg.taocdn.com/b6d118d2192e45361166f5e2.webp)

附件1:外文资料翻译译文数据库简介1.数据库管理系统(DBMS)。

众所周知,数据库是逻辑上相关的数据元的集合。

这些数据元可以按不同的结构组织起来,以满足单位和个人的多种处理和检索的需要。

数据库本身不是什么新鲜事——早期的数据库记录在石头上或写在名册上,以及写入索引卡中。

而现在,数据库普遍记录再可磁化的介质上,并且需要用计算机程序来执行必需的存储和检索操作。

在后文中你将看到除了简单的以外,所有数据库中都有复杂的数据关系及其连接。

处理与创建、访问以及维护数据库记录有关的复杂任务的系统软件包叫做数据库管理系统(DBMS)。

DBMS软件包中的程序在数据库极其用户间建立了接口(这些用户可以是应用程序员、管理员以及其他需要信息和各种操作系统的人员)。

DBMS可组织、处理和显示从数据库中选择的数据元。

该功能使决策者可以搜索、试探和查询数据库的内容,从而对在正式报告中没有的、不再出现的且无计划的问题作出回答。

这些问题最初可能是模糊的并且是定义不清的,但是人们可以浏览数据库直到获得问题的答案。

也就是说DBMS将“管理”存储的数据项,并从公共数据库中汇集所需的数据项以回答那些非程序员的询问。

在面向文件的系统中,需要特定信息的用户可以将他们的要求传送给程序员。

该程序员在时间允许时,将编写一个或多个程序以提取数据和准备信息。

但是,使用DBMS可为用户提供一种更快的、用户可以选择的通信方式。

顺序的、直接的以及其它的文件处理方式常用于单个文件中数据的组织和构造,而DBMS能够访问和检索非关键记录字段的数据,即DBMS能够将几个大文件中逻辑相关的数据组织并连接在一起。

逻辑结构。

确定这些逻辑关系是数据管理者的任务,由数据定义语言完成。

DBMS 在存储、访问和检索操作过程中可选用以下逻辑结构技术:(1)表结构。

在该逻辑方式中,记录通过指针链接在一起。

指针是记录中的一个数据项,它指出另一个逻辑相关的记录的存储位置,例如,顾客主文件的记录将包含每个顾客的姓名和地址,而且该文件中的每个记录都由一个帐号标识。

财务管理类本科毕业论文外文翻译〔原文+译文〕财务管理类本科毕业论文外文翻译译文:[美]卡伦·A·霍契.《什么是财务风险管理?》.《财务风险管理要点》. 约翰.威立国际出版公司,2022:P1-22.财务风险管理尽管近年来金融风险大大增加,但风险和风险管理不是当代的主要问题。

全球市场越来越多的问题是,风险可能来自几千英里以外的与这些事件无关的国外市场。

意味着需要的信息可以在瞬间得到,而其后的市场反响,很快就发生了。

经济气候和市场可能会快速影响外汇汇率变化、利率及大宗商品价格,交易对手会迅速成为一个问题。

因此,重要的一点是要确保金融风险是可以被识别并且管理得当的。

准备是风险管理工作的一个关键组成局部。

什么是风险?风险给时机提供了根底。

风险和暴露的条款让它们在含义上有了细微的差异。

风险是指有损失的可能性,而暴露是可能的损失,尽管他们通常可以互换。

风险起因是由于暴露。

金融市场的暴露影响大多数机构,包括直接或间接的影响。

当一个组织的金融市场暴露,有损失的可能性,但也是一个获利或利润的时机。

金融市场的暴露可以提供战略性或竞争性的利益。

风险损失的可能性事件来自如市场价格的变化。

事件发生的可能性很小,但这可能导致损失率很高,特别麻烦,因为他们往往比预想的要严重得多。

换句话说,可能就是变异的风险回报。

由于它并不总是可能的,或者能满意地把风险消除,在决定如何管理它中了解它是很重要的一步。

识别暴露和风险形式的根底需要相应的财务风险管理策略。

财务风险是如何产生的呢?无数金融性质的交易包括销售和采购,投资和贷款,以及其他各种业务活动,产生了财务风险。

它可以出现在合法的交易中,新工程中,兼并和收购中,债务融资中,能源局部的本钱中,或通过管理的活动,利益相关者,竞争者,外国政府,或天气出现。

当金融的价格变化很大,它可以增加本钱,降低财政收入,或影响其他有不利影响的盈利能力的组织。

金融波动可能使人们难以规划和预算商品和效劳的价格,并分配资金。

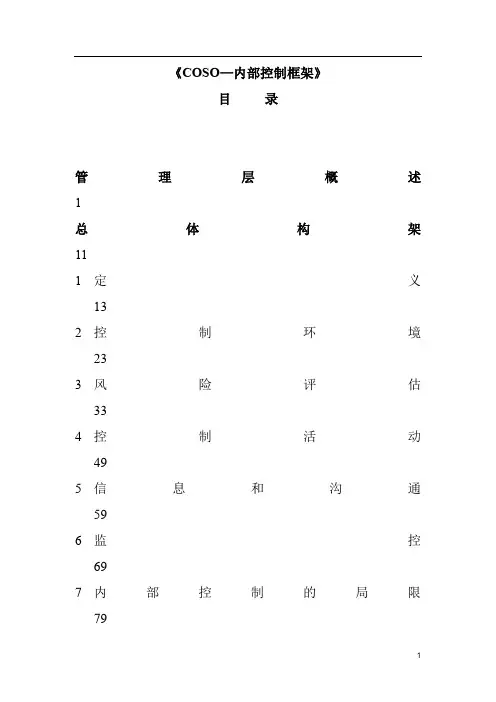

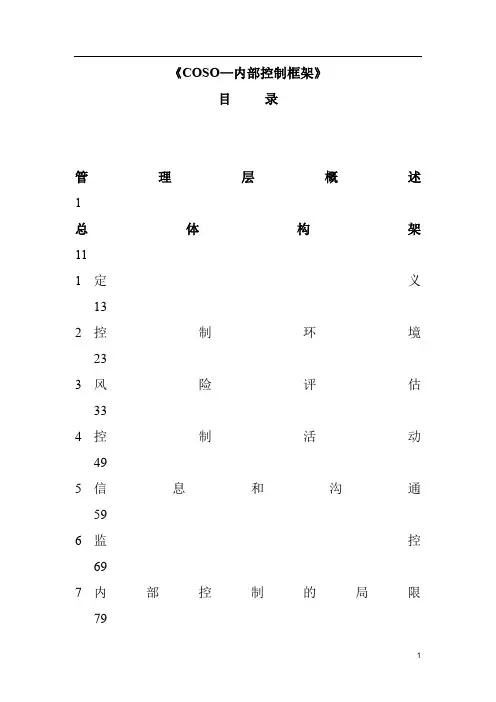

《COSO—内部控制框架》目录管理层概述1总体构架111定义132控制环境233风险评估334控制活动495信息和沟通596监控697内部控制的局限798作用和职责83附录A学习本文的相关事项及背景知识93B方法体系99C对定义的看法和使用105D反馈意见111E术语119内部控制——整体构架管理层概述构架对外界的报告“对外界的报告”附录管理层概述高层管理人员一直在探求更好的企业经营控制之道。

内部控制致力于促使企业向着赢利和完成自身使命的目标运行,并使这一过程中的意外最小化。

内部控制使管理层能够应对瞬息万变的经济和竞争环境,客户不断变换的需求和偏好,并进行重组以利于公司的未来发展。

内部控制有利于提高企业经营效率,降低资产损失风险,有助于保证财务报表的可靠性、企业经营活动的合法合规性。

鉴于内部控制具有上述的重要性,因此对提高内控系统及其报告质量的需求日益增加。

内部控制日益被视为诸多潜在问题的解决方案。

什么是内部控制内部控制对不同的人有不同的含义。

这一概念在商业界人士、法律界人士、监管当局和其他人士之间容易引起混淆。

由此造成的误解和期望值的差异往往给企业带来问题。

一旦内部控制这一名词未经清楚定义就写入法律、规章或规则,问题便复杂化了。

本文是针对管理层的需要和期望而写的。

本文对内部控制的定义服务于以下目的:确立一个满足各方需要通用的定义。

●提供一个标准——无论规模大小、公用和私人性质、赢利和非赢利,使各类企业都能以此对其内部控制制度进行评估和改进。

内部控制广义上可定义为一个受企业董事会、经理层和其他人员影响的,为达到下列目标提供合理的保证的程序:●经营的效果和效率●财务报告的可靠性●法律法规的遵循性第一类目标指企业的基本经营目标,包括业绩、赢利指标和资源保护。

第二类目标指编制可靠的公开财务报表的,包括中期和简略财务报表,以及从这些财务报表中摘出的数据(如利润分配数据)。

第三类目标指企业经营必须符合相关的法律法规。

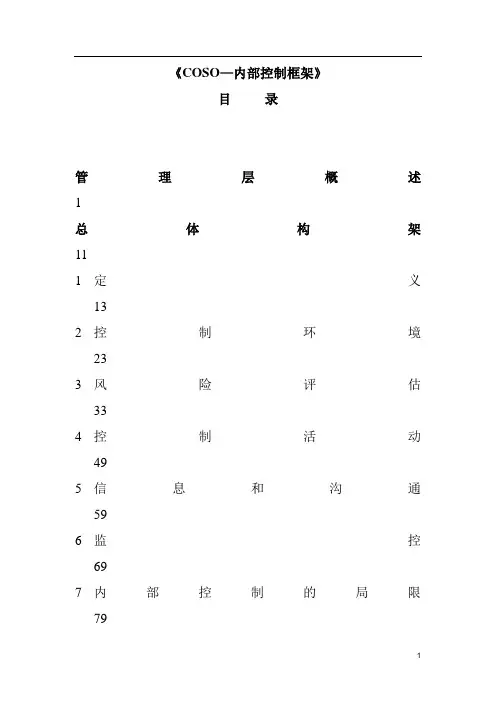

《COSO—内部控制框架》目录管理层概述1总体构架111定义132控制环境233风险评估334控制活动495信息和沟通596监控697内部控制的局限798作用和职责83附录A学习本文的相关事项及背景知识93B方法体系99C对定义的看法和使用105D反馈意见111E术语119内部控制——整体构架➢管理层概述构架对外界的报告“对外界的报告”附录管理层概述高层管理人员一直在探求更好的企业经营控制之道。

内部控制致力于促使企业向着赢利和完成自身使命的目标运行,并使这一过程中的意外最小化。

内部控制使管理层能够应对瞬息万变的经济和竞争环境,客户不断变换的需求和偏好,并进行重组以利于公司的未来发展。

内部控制有利于提高企业经营效率,降低资产损失风险,有助于保证财务报表的可靠性、企业经营活动的合法合规性。

鉴于内部控制具有上述的重要性,因此对提高内控系统及其报告质量的需求日益增加。

内部控制日益被视为诸多潜在问题的解决方案。

什么是内部控制内部控制对不同的人有不同的含义。

这一概念在商业界人士、法律界人士、监管当局和其他人士之间容易引起混淆。

由此造成的误解和期望值的差异往往给企业带来问题。

一旦内部控制这一名词未经清楚定义就写入法律、规章或规则,问题便复杂化了。

本文是针对管理层的需要和期望而写的。

本文对内部控制的定义服务于以下目的:确立一个满足各方需要通用的定义。

●提供一个标准——无论规模大小、公用和私人性质、赢利和非赢利,使各类企业都能以此对其内部控制制度进行评估和改进。

内部控制广义上可定义为一个受企业董事会、经理层和其他人员影响的,为达到下列目标提供合理的保证的程序:●经营的效果和效率●财务报告的可靠性●法律法规的遵循性第一类目标指企业的基本经营目标,包括业绩、赢利指标和资源保护。

第二类目标指编制可靠的公开财务报表的,包括中期和简略财务报表,以及从这些财务报表中摘出的数据(如利润分配数据)。

第三类目标指企业经营必须符合相关的法律法规。

会计学内部控制外文文献外文翻译J.Wild,Ken W.Shaw,Barbara Ghiappetta. Principles of Accounting本节将介绍内部控制及其基本原则,并讨论科学技术对内部控制的影响和控制程序的局限性。

一、内部控制的目的小型企业的管理者(或老板)常常需要控制企业整体经营。

他们要负责资产的采购、员工的雇佣和管理、合约洽谈以及支票签发。

这些管理者通过亲自接触和观察来了解企业是否取得了已进行过支付的资产或劳务。

但更多企业无法通过这种监督方式保证企业的运转,他们必须划分责任并依靠正式程序来控制企业经营活动。

管理者使用内部控制制度监督和控制企业的各种活动。

内部控制制度(internal control system)是由各种政策和程序构成的,管理者通常使用他们: , 保护企业资产。

, 确保会计录的可靠性。

, 提高运营效率。

, 保证公司政策的贯彻执行。

一套设计完善的内部控制制度是系统设计、分析和实施的关键环节。

管理者之所以重视内部控制制度是因为他可以预防可避免的损失,帮助经营者制定运营计划,监督企业运营期情况和员工表现。

尽管内部控制无法提供担保,但可以降低企业遭受损失的风险。

二、内部控制的原则隐隐无性质和企业规模等因素的不同,不同企业采用的内部控制政策和程序也各不相同。

但有些基本原则是普遍适用的,这些普遍适用的内部控制原则(principles of internal control)包括:, 明确责任。

, 保持适当的记录, 为资产投保,并为关键员工投保忠诚险, 保证资产报关与记录相分离, 划分相关交易的责任, 应用各种控制技术, 定期实施独立核查本节将介绍这七项原则以及如何使用内部控制将偷窃和欺诈风险减值最小。

这些程序也将增加会计记录的可靠性和准确性。

1( 明确责任良好的内部控制意味着将各工作任务的职责划分清楚并指派给适credit history, individual score of the borrower, loan purpose, source of payments, repayment options, guarantor of basic information and for loan amount, term, interest rate, payment methods, such as recommendations, if the customer agreed to process the business 当的员工,否则在发生差措施将很难确定是谁的责任。

当我做毕业设计的时候我遇到过这样或那样的问题,苦于手上没有本专业的毕业设计的参考文本。

现在毕业都快一年了,本着推己及人的态度将我的毕业设计所有资料放出,方便后来者翻阅,仅供参考,善哉,善哉……B-to-C电子商务多维信任形成模式:概念框架、学术角度和从业者角度的内容分析1.说明信任在社会关系中是一个很重要的组成,在商务上也是如此。

作为一种人际关系,信任一个人就更容易被那个人伤害。

作为一种在社会上的人与人之间的结构关系,信任是共有体制属性。

信任在商务领域有利于长久的合作。

交易可能存在于个人与个人之间,个人与企业之间,或者企业和企业之间。

信誉已被确认为在市场营销和电子商务论文中的重要组成部分。

信任问题从不同的角度被提出,包括技术,多主体的方法。

巴里认为信任是最强大的营销工具。

根据厄邦的研究,消费者在互联网上以商家信誉为基础做出购买的决定。

毫无疑问,信誉在任何涉及金钱的商业活动中扮演着重要的角色。

电子商务的信任是建立在消费者对该事物的信心。

与此截然不同的是,对实体店的信任是建立在个人与企业之间的关系和消费者与商家的互动,以及个人或公司的水平的基础上的。

皮特在其关于信任在线平台的文章中支持在线商务的成功的关键是建立信任。

所以,在线销售商应该创造一种让潜在消费者感到轻松而且有信心的环境。

为了创造一个能够信任的电子商务环境,了解影响消费者信任形成的因素是极其必要的。

尽管知道信任对于电子商务的重要性,但是相关的研究比较少,尤其是在了解影响消费者的信任形成的因素。

在本文中,我们试图填补这一空白。

首先,我们提出一个全面的、多层面的信任形成的模式,从电子商务交易复杂的现象中捕捉并精简地描绘形成的信任。

其次,根据调查的层面,我们利用内容分析和网上调查比较和对照律师和学者以了解不同的专家的观点。

他们的观点反映了在电子商务领域信誉的概念如何运用,哪些因素需要强调以促进电子交易。

2.面向过程的信任形成的多维模型信任本身很难直接地观察和测量。

论企业内部控制评价体系的构建摘要:内部控制评价是内部控制本身的二级控制,是实现内部控制目标的重要环节。

目前我国内部控制评价主要是针对审计工作的,它对评价主体和评价标准存在一定的局限性,制约了内部控制的有效实施。

因此,建立一套完善、实用、可操作的企业内部控制评价体系势在必行。

关键词:内部控制评价;内部控制评价体系;问题;建议近年来国内外出现了一系列的财务丑闻,内部控制作为企业内部管理的重要手段之一,引起了全社会空前的关注。

内部控制评价的发展是从内部控制理论和实践的发展开始,因为内部控制评价是保证内部控制顺利和有效实施的关键环节,所以也成为值得深入研究的问题。

一、基本概念A.内部控制内部控制制度是第十八世纪工业革命后企业规模化和资本普及的结果。

内部控制理论的发展和完善来源于丰富的内部控制思想和实践经验,发展过程大致经历了四个阶段:内部控制阶段、内部控制制度理论阶段、内部控制结构理论阶段和内部控制框架阶段。

在美国COSO委员会1992年发布的《内部控制整体框架》一文中,将内部控制定义为:“内部控制是一个过程,这是受董事会,管理层和其他人员的影响,实现效率和商业活动的有效性,保证财务报告的可靠性,遵守相关法律法规等。

”这一观点被国内外普遍接受。

B.内部控制评价随着市场经济的发展,在国内和国外,许多财务欺诈和会计造假案件频繁发生,包括一些拥有完善的内部控制制度的企业。

由此我们可以发现,企业的内部控制失效有时并不能完全归因于合理的内部控制制度的缺失,而是因为严格的内部控制系统无法有效实施。

内部控制评价是完善公司内部控制制度并保证其有效实施的重要手段之一。

二、内部控制评价体系的理论框架A.评价目标和范围内部控制评价的目标不是单一的。

从历史的角度看,有很多方面是激发内部控制评价的需求,所以目标也是多方面的。

一方面,它可以满足审计的需要,评估内部控制特别是对财务报告的可靠性有着重要的影响。

另一方面,它也能满足管理上对系统全面地评价内部控制的需要。

xxxxxx大学本科毕业设计外文翻译ProjectCostControl:theWayitWorks项目成本控制:它的工作方式学院(系):xxxxxxxxxxxx专业:xxxxxxxx学生姓名:xxxxx学号:xxxxxxxxxx指导教师:xxxxxx评阅教师:完成日期:xxxx大学项目成本控制:它的工作方式在最近的一次咨询任务中,我们意识到对于整个项目成本控制体系是如何设置和应用的,仍有一些缺乏理解。

所以我们决定描述它是如何工作的。

理论上,项目成本控制不是很难跟随。

首先,建立一组参考基线。

然后,随着工作的深入,监控工作,分析研究结果,预测最终结果并比较参考基准。

如果最终的结果不令人满意,那么你要对正在进行的工作进行必要的调整,并在合适的时间间隔重复。

如果最终的结果确实不符合基线计划,你可能不得不改变计划。

更有可能的是,会(或已经)有范围变更来改变参考基线,这意味着每次出现这种情况你必须改变基线计划。

但在实践中,项目成本控制要困难得多,通过项目数量无法控制成本也证明了这一点。

正如我们将看到的,它还需要大量的工作,我们不妨从一开始启用它。

所以,要跟随项目成本控制在整个项目的生命周期。

同时,我们会利用这一机会来指出几个重要文件的适当的地方。

其中包括商业案例,请求(资本)拨款(执行),工作包和工作分解结构,项目章程(或摘要),项目预算或成本计划、挣值和成本基线。

所有这些有助于提高这个组织的有效地控制项目成本的能力。

业务用例和应用程序(执行)的资金重要的是要注意,当负责的管理者对于项目应如何通过项目生命周期展开有很好的理解时,项目成本控制才是最有效的。

这意味着他们在主要阶段的关键决策点之间行使职责。

他们还必须识别项目风险管理的重要性,至少可以确定并计划阻止最明显的潜在风险事件。

在项目的概念阶段?每个项目始于确定的机会或需要的人。

通常是有着重要性和影响力的人,如果项目继续,这个人往往成为项目的赞助。

?确定潜在项目的适用性,大多数组织呼吁编制“商业案例”和“量级”成本,用来证明项目的价值,以便使其可以与其他所有的项目竞争。

《COSO—内部控制框架》目录管理层概述1总体构架111定义132控制环境233风险评估334控制活动495信息和沟通596监控697内部控制的局限798作用和职责83附录A学习本文的相关事项及背景知识93B方法体系99C对定义的看法和使用105D反馈意见111E术语119内部控制——整体构架管理层概述构架对外界的报告“对外界的报告”附录管理层概述高层管理人员一直在探求更好的企业经营控制之道。

内部控制致力于促使企业向着赢利和完成自身使命的目标运行,并使这一过程中的意外最小化。

内部控制使管理层能够应对瞬息万变的经济和竞争环境,客户不断变换的需求和偏好,并进行重组以利于公司的未来发展。

内部控制有利于提高企业经营效率,降低资产损失风险,有助于保证财务报表的可靠性、企业经营活动的合法合规性。

鉴于内部控制具有上述的重要性,因此对提高内控系统及其报告质量的需求日益增加。

内部控制日益被视为诸多潜在问题的解决方案。

什么是内部控制内部控制对不同的人有不同的含义。

这一概念在商业界人士、法律界人士、监管当局和其他人士之间容易引起混淆。

由此造成的误解和期望值的差异往往给企业带来问题。

一旦内部控制这一名词未经清楚定义就写入法律、规章或规则,问题便复杂化了。

本文是针对管理层的需要和期望而写的。

本文对内部控制的定义服务于以下目的:确立一个满足各方需要通用的定义。

●提供一个标准——无论规模大小、公用和私人性质、赢利和非赢利,使各类企业都能以此对其内部控制制度进行评估和改进。

内部控制广义上可定义为一个受企业董事会、经理层和其他人员影响的,为达到下列目标提供合理的保证的程序:●经营的效果和效率●财务报告的可靠性●法律法规的遵循性第一类目标指企业的基本经营目标,包括业绩、赢利指标和资源保护。

第二类目标指编制可靠的公开财务报表的,包括中期和简略财务报表,以及从这些财务报表中摘出的数据(如利润分配数据)。

第三类目标指企业经营必须符合相关的法律法规。

内部控制的概念界定及其要素摘要:内部控制在很大程度上影响着企业稳定与发展,因此内控研究有很强的必要性;内部控制不是千篇一律与一成不变的,不同类型的企业内部控制体系是不相同的,这一特殊性又决定了企业内部控制的研究,必须建立在准确的企业定位与科学的理论分析基础上。

关键词:内部控制;风险评估;控制环境一、内部控制的概念内部控制是企业发展和组织效率提高的产物,内部控制的内涵和外延都随着企业组织形态进化、社会环境的发展而发生了深刻的变化。

本文参照《企业内部控制基本规范》的指导,将内部控制理解为:是一项整体性的工作,是企业的各个成员不分级别都应该实施和参与并努力实现本单位的内部控制目标的过程。

1.1 明确对内部控制的“责任”。

内部控制的制定与实施不仅仅是领导层的义务,更是每一个员工的职责。

明确“全民参与”的观点,能够使得企业员工主动的维护内控制度,而不仅仅是被动的执行。

1.2 明确内部控制应贯穿在企业经营管理过程之中。

企业的经营过程是指通过规划、执行与监督等基本的管理过程对企业进行管理。

作为企业经营的一部分,内部控制绝对不是凌驾于企业正常业务之上的,它作为管理的一部分,是为了监督企业生产经营能够按照预期目标有计划的进行,不能取代管理。

1.3 明确内部控制是一个“动态机制”。

正如其他的经营管理活动,内部控制也是一个动态、持续的过程。

内控制度制定完成后,完美的实施不是机械的执行,而是随信息反馈-解决问题-效果评估-着企业经营管理环境的变化越来越趋于完善,沿着发现问题-逐步修正循环往复的进行。

1.4 重视“软管理”。

按照理论界的定义,软管理是指精神层面、无形的事物,比如管理风格、企业文化等内容。

内部控制特别需要“软管理”的措施,不仅仅重视规章制度等方面,找到符合自身情况的管理风格,营造良好的企业文化都十分重要。

毕业设计(论文)--伊利集团内部控制的调查分析本科生毕业论文(设计)伊利集团内部控制的调查分析姓名学号专业会计学指导教师苏庆华讲师2011年5月30日摘要随着社会经济的日益发展和现代化科学管理方法的产生和运用,内部控制已经发展到企业经营管理的各个领域,成为现代企业管理的重要手段。

企业通过内部控制的建立和完善,可以提高企业内部管理水平和企业竞争力。

在当今全球经济联系日益密切和竞争尤为激烈的环境下,企业更应该极其重视内部控制的作用,以提高自身竞争力,在竞争中立于不败之地,同时这也是我们对它进行理论研究的重要原因之一。

本文采用理论联系实际的方法,以伊利集团为例,详细阐述了企业内部控制的理论及其实际应用。

文章总体上分成两大部分,即理论部分和案例部分。

理论部分主要是介绍内部控制的发展、内部控制的内容及对内部控制体系的评价。

案例部分结合伊利集团的实际情况,主要从伊利集团内部控制环境建设的几个方面、伊利集团风险管理应对危机以及对伊利集团内部控制管理的评价等方面详细介绍了伊利集团内部控制理论的实际应用。

关键词:内部控制;评价;伊利集团AbstractWith the socioeconomic development and the production and use of scientific management method, internal control has been developed to all areas of business management and has become an important tool of modern business management. Through the establishment and improvement of internal control, enterprises can improve the internal management and business competitiveness. In today relation closer and more competitive global economic environment, companies should pay particular attention to the role of internal control in order to improve their own competitiveness to an invincible position in the competition, while as this is one of the important reasons for our theoretical study.In this paper, I use the theory plus practical ways to elaborate the internal control theory and its practical application of Yili Group. Generally speaking the article is divided into two parts, a theoretical part and a case part.Theoretical part mainly introduces the concept of the development of internal control, the content of internal control and evaluation of internal control system. Then make an introduction of the practical application of internal control theory combined with the actual situation of Yili Group : mainly from the internal control environment of Yili Group, the risk management of several aspects of the financial crisis and evaluation of internal control of Yili Group and management aspects of the internal details of the Yili Group.Keywords: Internal Control; Evaluation; Yili Group目录引言1一、企业内部控制理论3(一)内部控制理论的发展 3(二)内部控制的内容 4(三)企业风险管理的内容 4(四)内部控制的评价 5二、伊利集团内部控制的现状 5(一)伊利集团的简介 5(二)伊利集团内部控制的信息披露7(三)伊利集团内部控制环境建设 8(四)伊利集团的风险管理9三、伊利集团内部控制的分析评价 10(一)伊利集团的战略分析10(二)伊利集团的SWOT分析11(三)对伊利集团内控环境的评述 13(四)对伊利集团风险管理的评述 14四、启示和建议15(一)从伊利集团看我国企业内部控制存在的问题 15 (二)从伊利集团看我国企业内控问题的解决措施 16 (三)结论16参考文献18致谢19引言20世纪90年代,英国伦敦巴林银行久负盛名,以信誉良好而著名,由于其新加坡巴林公司期货经理尼克??里森错误地估计了日本股市的走向而导致整个银行集团的破产倒闭。

摘要本文通过对内部会计控制制度的发展、内容及其在企业中的应用作用、重要的原则和方法乃至实施内部会计控制的关键等问题进行了全面而细致的分析后认为:在现代企业制度条件下,内部会计控制制度的内涵和外延都发生了极大的变化,建立和完善内部会计控制制度,提高职工素质是管制会计信息失真的重大举措.会计信息失真是一个世界性的问题,本文还通过对国内外大型公司企业在内部会计控制上采用的不同方法和态度的对比,较为明确的指出了我们存在的漏洞和弊端及其解决现存问题的方法和应采取的相关措施等等,在一定程度上把国外的先进管理和控制理念引入国内,让我们更加重视内部会计控制制度及其体系的建立和监管,这些问题的逐步完善不但会使得我们的企业迈向国际先进管理企业的行列,而且会使得我们国家更加重视内部会计控制这个特殊的领域,让我们的企业更好的发展。

全文共为四个方面:第一章主要对内部会计控制的概念在企业中的作用以及内部会计控制的目标、原则和方法进行了概述;第二章着重介绍了我国企业内部会计控制现状;第三章对企业的概况进行了简要的介绍后对企业在内部会计控制上存在的问题进行了详细的分析;第四章,这一章是对全文的总结,最后强调对内部会计控制体系的设计,将如何完整建立内部会计控制的全过程表述出来。

关键词:科鑫集团,会计控制,问题研究AbstractThis article through controlled the system to internal accountant development, the content and its question and so on。

Key which after enterprise’s application function, the important principle and the method and even implementation interior accountant controlled carries on has been comprehensive but the careful analysis to think that:Under the condition of the modern business enterprise system, the content of the internal and extension accountancy control system has all had the enormous change The establishment and consummation interior accountant controls system,improves the staff quality controls the significant action which the accounting information distorts。

文献信息:文献标题:Regulation by disclosure: the case of internal control(从信息披露规则角度看企业内部控制)国外作者:Laura F. Spira, Michael Page文献出处:《Journal of Management & Governance》,2010, 14(4):409-433字数统计:英文2253单词,12476字符;中文3543汉字外文文献:Regulation by disclosure: the case of internal control1.Lntroduction: disclosure as a regulatory toolThe traditional framework of corporate accountability relies on disclosure of information to stakeholders. The form, content and reliability of this disclosure have been a matter of concern and debate ever since the establishment of legislative protection for investors and creditors in the mid nineteenth century. Financial scandals typically prompt calls for improvements in disclosure. The assumption underlying this form of disclosure is that stakeholders will be provided with information through which they may hold company management to account for the use of resources provided—a stewardship approach.A different view of the purpose of disclosure underlies developments in standardising financial reporting which have been justified on the basis that users of financial statements need information in order to make a broad range of economic decisions about their relationships with corporations, an assumption which underpins the development of conceptual frameworks for financial reporting.More recently, disclosure has become viewed as a tool of regulation. For example, the UK Companies Act 2006 has required companies to make disclosures relating to risks and futureprospects. This approach to disclosure as a regulatory tool is reflected in recent discussions of European policy. The Winter Report1 of 2002 stated: Disclosure requirements can sometimes provide a more efficient regulatory tool than substantive regulation through more or less detailed rules. Such disclosure creates a lighter regulatory environment and allows for greater flexibility and adaptability. (p. 34) The discussion paper “Risk Management and Internal Control in the EU” states that:…if regulation is necessary, then disclosu re of information should be the preferred regulatory tool because it puts power in the hands of shareholders and markets rather than leaving it entirely with regulators (Federation des Experts Comptables Europeens 2005, p. 4)Disclosure is thus seen to be beneficial from three linked and overlapping perspectives: in securing corporate accountability and the exercise of good corporate governance on behalf of stakeholders; in enabling better investment decisions and the smooth running of capital markets; and as a form of indirect regulation that achieves the goals of regulators.In the US, securities legislation has relied on mandated disclosure since the 1930s. Although disclosure is central to its regime of corporate accountability, the UK approach to corporate legislation has been significantly different: recognition of this difference has been heightened in much of the recent …rules v. principles5 debate following the Enron debacle (Bush 2005). The response to such apparent failings of the system of accountability is typically a demand for fuller disclosure of information.The development of UK corporate governance policy has been characterised by a 'softer' approach, based on the principle of …comply or explain5, under which disclosure of information about compliance becomes mandatory, although code compliance remains voluntary. Arguments in support of this approach rest on the need for flexibility to recognise the range of diversity among companies and their activities and the assumption that the information provided about compliance will allow enforcement through market discipline.Studies of disclosure tend to focus on the readily observable —the content of the disclosures themselves -rather than the behavioural effects in corporate policies and processes which disclosure is intended to secure but which are far more difficult to assess. However, the knowledge that disclosure is required may have an earlier and equally important effect on management behaviour as that produced by market response. This is hinted at in the comment of William L Cary, former chairman of the Securities and Exchange Commission who wrote in 1967 that:Disclosure is the most realistic means of coping with the ever-present problem ofconflicts of interest. In some instances our conduct is motivated by what we think is right, without regard to anything else. But, perhaps equally important, ethical behaviour-and wise counselling-results from estimating the public reaction to a full knowledge of a planned course of conduct. The requirement of disclosure in certain instances, and its possibility always, is thus a most important regulatory force in our society. Disclosure is the foundation of reliance on self-regulatory approaches to conflict problems and is the clearest alternative to greater governmental or institutional intervention. [Cary 1967: 408] Although statements such as those above identify disclosure as a regulatory tool, Cary's is unusual in that it attempts to describe the mechanisms by which it works. In this paper we focus on a specific form of disclosure-that relating to internal control-in a specific context-that of the UK's “comply or explain” corporate governance regime. Our choice of internal control as a disclosure topic reflects the continuing focus on this area. In 1999 the Institute of Chartered Accountants in England and Wales (ICAEW) published “Internal Control: Guidance for Directors on the Combined Code” [Internal Control Working Party (The Turnbull Report) 1999]. It was prepared by an Internal Control Working Party chaire d by Nigel Turnbull and is often referred to as “the Turnbull report” or “the Turnbull guidance”. The Financial Reporting Council later set up the Turnbull Review Group which published revised guidance in 2005 (Turnbull Review Group 2005). Almost simultaneously ICAEW published a briefing document “Implementing Turnbull-a Boardroom Briefing” (Jones and Sutherland 1999). We consider the impact of internal control disclosure requirements by examining the nature of the disclosures made in accordance with theTurnbull guidance for directors reporting on internal control. We observe that the format and content of such disclosures may converge into a standardised 'boilerplate' and we discuss the implications of this.In contrast to other recent studies (e.g. Beattie et al. 2004; Beretta and Bozzolan 2004; Abraham et al. 2005; Linsley and Shrives 2005) which have sought to measure disclosure quality through the adoption of a content analysis approach, our research method is informed by grounded theory as an appropriate means of generating insights into the presentation and interpretation of disclosures.The paper begins with an outline of the development of the concept of internalcontrol, noting the difficulties encountered in arriving at a suitable definition for purposes of disclosure, and its recent identification with risk management. Focusing onthe disclosure requirements of the UK Turnbull guidance, we investigate disclosers' responses to the “comply or explain” regime through an analysis of selected disclosure narratives. We conclude by identifying a disclosure life cycle which highlights issuesthat policy-makers endorsing the use of disclosure as a means of regulation may need to address.2.Internal control and its disclosurethe subject of internal control, once a guaranteed remedy for sleeplessness, has made a spectacular entry onto political and regulatory agendas. (Power 1997: 57)In his analysis of the development of the role of audit, Power observes that internal control has become increasingly important as part of a system of regulation which relies on making internal mechanisms visible through forms of self-validation and disclosure. Corporate governance requirements have frequently been couched in the form of codes of practice on the principle of 'comply or explain' rather than prescriptive legislation. The monitoring role of the board of directors, which forms the apex of the internal control system of an organisation, has been emphasised. The influence of particular interest groups has been important in the negotiation of these developments. Auditors, bothinternal and external, can claim expertise in internal control, advancing their organisational position in the case of internal auditors (Spira and Page 2003) and increasing the potential for sales of specialised services in the case of external auditors. Regulators and legislators have focused on internal control issues as a policy response to crises (Cunningham 2004).The use of internal control as a corporate governance device reflects a subtle but significant change in its conception, moving from the original “supportive” notion that internal control systems were an integral part of the structure of an organisation which enabled its goals to be achieved, to the more recent view of internal control as a substantially “preventive” system, designed to minimise obstructions to goal achievement and carrying significantly greater expectations of the effectiveness of such systems. AsPage and Spira (2004) note, companies have also increasingly taken 'risk-based' approaches to internal control because of the increased pace of organisational change—control systems change too fast to be rigidly documented and companies may not even have full documentation relating to some of their IT based systems. For these reasons there has been an increase in 'delegation' of control downwards in the organisation and there is likely to be no central record of control systems.The emergence of risk-based approaches to internal control has resulted in a confluence of internal control and risk management to the point that an influential publication (Jones and Sutherland 1999) issued at the same time as the Turnbull guidance referred frequently to “internal control and risk management” as a single concept in providing practical assistance for boards in complying with the Turnbull disclosure requirements.The demonstration of “good” corporate governance is a challenge for boards of directors but describing structural mechanisms such as internal control processes may be one way of meeting demands for transparency. Thus, what was once an internal interest becomes a means of demonstrating regulatory compliance.Concerns about internal control in the US and the UK arose initially from a desire to establish the boundaries of external auditor responsibility. The difficulties of defining internal control are illustrated in the earliest US experience, as summarised in a lecture by Mautz (1980). He quotes the 1949 AICPA definition: Internal control comprises the plan of organization and all of the coordinate methods and measures adopted within a business to safeguard its assets, check the accuracy and reliability of its accounting data, promote operational efficiency, and encourage adherence to prescribed managerial policies. and describes the concern of firms' legal counsel about the broadness of this definition. This concern led to a new definition issued in 1958 which split the four parts of the original definition between “accounting control” (safeguarding assets and checking reliability and accuracy of accounting data) and “administrative control” (promotion of operational efficiency and encouragement of adherence to prescribed management policies) and defined auditors' responsibility as reviewing accounting controls only. A further narrowing took place in 1972 when the US auditing profession limited the two components of “accounting control” even more.Up to this point, the definition was really only of concern to companies and their auditors but the passing of the Foreign Corrupt Practices Act in 1977 changed this. The Act was passed in response to bribery scandals and for the first time envisaged the use of internal control as regulation. It was based on a narrow conception of internal control newly described as “internal accounting control”. It also changed the focus of internal control: whereas the concerns of “accounting control” had been at low organisational levels and clerical procedures, the Act now shifted attention to controls at board level for the first time.Further concern about inadequacies in financial reporting led to a private sector initiative which established the Treadway Commission on Fraudulent Financial Reporting in 1987. Its recommendations included a call for a review of the varying concepts of internal control to develop a consistent approach. The Committee of Sponsoring Organizations (COSO 1992) subsequently produced an integrated framework for internal control in 1992, defining internal control as: A process designed to provide reasonable assurance regarding the achievement of objectives in the following categories:•Effectiveness and efficiency of operations.•Reliability of financial reporting.•Compliance with applicable laws and regulations (COSO 1992, p. 9)However, the Sarbanes Oxley legislation of 2002 introduced a further definition: “internal control over financial reporting”3 which suggests that consistency has not yet been achieved and ambiguity still exists.In the UK, internal control first entered the corporate governance agenda when the Cadbury Committee, reporting in 1992 on the financial aspects of corporate governance, adopted the view that directors5 responsibilities with regard to internal control should be clarified. They recommended that directors should report on the effectiveness of internal control systems and that auditors should report on that statement but passed responsibility for implementing this to the accountancy profession.In 1994 the Rutteman working party defined internal control using the US definition of 1958 and also replaced the Cadbury recommendation that directors should report on the effectiveness of internal controls with the suggestion that they may wish to do so. In 1998the Hampel review of the Cadbury Code weakened this recommendation even further but, forthe first time, suggested that internal control and risk management were related.This link was built on by the internal control working party chaired by Nigel Turnbull which was charged with producing guidance for directors in interpreting the Code's requirements for reporting on internal control, finally grasping the nettle avoided by Cadbury, Rutteman and Hampel. Using a broad definition of internal control, the Turnbull guidance views it as a key component of risk management. In terms of the apparent satisfaction of disclosers and their audiences, the guidance appears to have proved remarkably successful, judging by the responses to the consultation initiated by the Financial Reporting Council Turnbull Review Group in 2005. The guidance has also beenwidely adopted in the public sector.中文译文:从信息披露规则角度看企业内部控制1.引言:作为监管工具的披露传统的企业责任框架依赖于利益相关者的信息披露。

内部审计在沙特阿拉伯的发展:协会理论透视内部审计职能的价值1早先的研究已经运用各种各样的方法来制定适当的标准以评估内部审计职能的有效率。

比如说,视遵照标准的程度为影响内部审计表现的其中因素之一。

一份1988年国际会计师协会英国协会的研究报告就致力与研究内部审计作用价值中高级管理层和外部审计员的认知力。

这项研究证明了衡量所提供服务的价值的艰难性就是做评估的主要障碍。

收益性,费用标准以及资源利用率都被确认为服务价值的衡量标准。

在这项研究里,它强调了确保内部审计工作应遵从SPPIA的必要性。

在美国,1988的Albrechta研究过内部审计的地位和作用,还为了能有效的评估内部审计的效率特别制定出一套框架。

他们发现有四个能让内部审计部门发展从而提高内部审计效率的要件:一个合适的企业环境,高级管理层的支持,具备高素质的内部审计人员以及高质量的内部审计工作。

在这项研究里学者们强调管理层和审计人员都应该承认内部审计职能对于企业来说是一种具有增值性的职能。

在英国,1997年,Ridley 和D’Silva证明遵循专业标准的重要性是促进内部审计职能增值功能的最重要的因素。

遵循SPPIA大量的研究都特别专注于内部审计部门对于SPPIA遵从性的研究。

1992年,Powell et al对11个国家的国际会计师协会的成员进行了一项全球性的调查以证明是否有全球性的内部审计文化。

他们发现对这11个国家的国际会计师协会成员的调查中,有82%的是遵循SPPIA的。

这个蛮高的百分比率促使学者们建议SPPIA提供内部审计这个职业全球化的证据。

许多的研究已经关注涉及到独立性的SPPIA标准。

1981年,Clark et al发现内部审计部门的独立性和内部审计人员所做报告的权威性是影响他们工作客观性的最至关重要的两个因素。

1985年,Plumlee致力于研究影响内部审计人员客观性的潜在威胁,特别是参与内部控制制度的设计是否会影响到关于该制度质量与有效率的决断力。

毕业论文(设计)外文翻译原文来源:R es e a r ch P a p e r, J u l y2009,S o c i al S c i en c e R e s ea r c hN e t w o rk中文译文:内部控制透视:理论与概念学院专业姓名学号指导教师年月日A Clear Look at Internal Controls: Theory and ConceptsHammed Arad (Philae)Department of accounting, Islamic Azad University, Hamadan, IranBarak Jamshedy-NavidFaculty Member of Islamic Azad University, Kerman-shah, IranAbstract: internal control is an accounting procedure or system designed to promote efficiency or assure the implementation of a policy or safeguard assets or avoid fraud and error. Internal Control is a major part of managing an organization. It comprises the plans, methods, and procedures used to meet missions, goals, and objectives and, in doing so, support performance-based management. Internal Control which is equal with management control helps managers achieve desired results through effective stewardship of resources. Internal controls should reduce the risks associated with undetected errors or irregularities, but designing and establishing effective internal controls is not a simple task and cannot be accomplished through a short set of quick fixes. In this paper the concepts of internal controls and different aspects of internal controls are discussed. Keywords: Internal Control, management controls, Control Environment, Control Activities, Monitoring1. IntroductionThe necessity of control in new variable business environment is not latent for any person and management as a response factor for stockholders and another should implement a great control over his/her organization. Control is the activity of managing or exerting control over something. he emergence and development of systematic thoughts in recent decade required a new attention to business resource and control over this wealth. One of the hot topic a bout controls over business resource is analyzing the cost-benefit of each control.Internal Controls serve as the first line of defense in safeguarding assets and preventing and detecting errors and fraud. We can say Internal control is a whole system of controls financial and otherwise, established by the management for the smooth running of business; it includes internal cheek, internal audit and other forms of controls.COSO describe Internal Control as follow. Internal controls are the methods employed to help ensure the achievement of an objective. In accounting and organizational theory, Internal control is defined as a process effected by an organization's structure, work and authority flows, people and management information systems, designed to help the organization accomplish specific goals or objectives. It is a means by which an organization's resources are directed, monitored, and measured. It plays an important role in preventing and detecting fraud and protecting the organization's resources, both physical (e.g., machinery and property) and intangible (e.g., reputation or intellectual property such as trademarks). At the organizational level, internal control objectives relate to the reliability of financial reporting, timely feedback on the achievement of operational or strategic goals, and compliance with laws and regulations. At the specific transaction level, internal control refers to the actions taken to achieve a specific objective (e.g., how to ensure the organization's payments to third parties are for valid services rendered.) Internal controlprocedures reduce process variation, leading to more predictable outcomes. Internal controls within business entities are called also business controls. They are tools used by manager's everyday.* Writing procedures to encourage compliance, locking your office to discourage theft, and reviewing your monthly statement of account to verify transactions are common internal controls employed to achieve specific objectives.All managers use internal controls to help assure that their units operate according to plan, and the methods they use--policies, procedures, organizational design, and physical barriers-constitute. Internal control is a combination of the following:1. Financial controls, and2. Other controlsAccording to the institute of chartered accountants of India internal control is the plan of organization and all the methods and procedures adopted by the management of an entity to assist in achieving management objective of ensuring as far as possible the orderly and efficient conduct of its business including adherence to management policies, the safe guarding of assets prevention and detection of frauds and error the accuracy and completeness of the accounting records and timely preparation of reliable financial information, the system of internal control extends beyond those matters which relate to the function of accounting system. In other words internal control system of controls lay down by the management for the smooth running of the business for the accomplishment of its objects. These controls can be divided in two parts i.e. financial control and other controls.Financial controls:- Controls for recording accounting transactions properly.- Controls for proper safe guarding company assets like cash stock bank debtor etc- Early detection and prevention of errors and frauds.- Properly and timely preparation of financial records I e balance sheet and profit and loss account.- To maximize profit and minimize cost.Other controls: Other controls include the following:Quality controls.Control over raw materials.Control over finished products.Marketing control, etc6. Parties responsible for and affected by internal controlWhile all of an organization's people are an integral part of internal control, certain parties merit special mention. These include management, the board of directors (including the audit commit tee), internal auditors, and external auditors.The primary responsibility for the development and maintenance of internal control rests with an organization's management. With increased significance placed on the control environment, the focus of internal control has changed from policies and procedures to an overriding philosophy and operating style within the organization. Emphasis on these intangible aspects highlights the importance of top management's involvement in the internal control system. If internal control is not a priority for management, then it will not be one for people within the organization either.As an indication of management's responsibility, top management at a publicly owned organization will include in the organization's annual financial report to the shareholders a statement indicating that management has established a system of internal control that management believes is effective. The statement may also provide specific details about the organization's internal control system.Internal control must be evaluated in order to provide management with some assurance regarding its effectiveness. Internal control evaluation involves everything management does to control the organization in the effort to achieve its objectives. Internal control would be judged as effective if its components are present and function effectively for operations, financial reporting, and compliance. he boards of directors and its audit committee have responsibility for making sure the internal control system within the organization is adequate. This responsibility includes determining the extent to which internal controls are evaluated. Two parties involved in the evaluation of internal control are the organization's internal auditors and their external auditors.Internal auditors' responsibilities typically include ensuring the adequacy of the system of internal control, the reliability of data, and the efficient use of the organization's resources. Internal auditors identify control problems and develop solutions for improving and strengthening internal controls. Internal auditors are concerned with the entire range of an organization's internal controls, including operational, financial, and compliance controls.Internal control will also be evaluated by the external auditors. External auditors assess the effectiveness of internal control within an organization to plan the financial statement audit. In contrast to internal auditors, external auditors focus primarily on controls that affect financial reporting. External auditors have a responsibility to report internal control weaknesses (as well as reportable conditions about internal control) to the audit committee of the board of directors.8. Limitations of an Entity's Internal ControlInternal control, no matter how well designed and operated, can provide only reasonable assurance of achieving an entity's control objectives. The likelihood of achievement is affected by limitations inherent to internal control. These include the realities that human judgment in decision-making can be faulty and that breakdowns in internal control can occur because of human failures such as simple errors or mistakes. For example, errors may occur in designing,Maintaining, or monitoring automated controls. If an entity’s IT personnel do not completely understand how an order entry system processes sales transactions, they may erroneously design changes to the system to process sales for a new line of products. On the other hand, such changes may be correctly designed but misunderstood by individuals who translate the design into program code. Errors also may occur in the use of information produced by IT. For example, automated controls may be designed to report transactions over a specified dollar limit for management review, but individuals responsible for conducting the review may not understand the purpose of such reports and, accordingly, may fail to review them or investigate unusual items.Additionally, controls, whether manual or automated, can be circumvented by the collusion of two or more people or inappropriate management override of internal control. For example, management may enter into side agreements with customers that alter the terms and conditions of the entity’s standard sales contract in ways that would preclude revenuerecognition. Also, edit routines in a software program that are designed to identify and report transactions that exceed specified credit limits may be overridden or disabled.Internal control is influenced by the quantitative and qualitative estimates and judgments made by management in evaluating the cost-benefit relationship of an entity’s internal control. The cost of an entity's internal control should not exceed the benefits that are expected to be derived. Although the cost-benefit relationship is a primary criterion that should be considered in designing internal control, the precise measurement of costs and benefits usually is not possible.Custom, culture, and the corporate governance system may inhibit fraud, but they are not absolute deterrents. An effective control environment, too, may help reduce the risk of fraud. For example, an effective board of directors, audit committee, and internal audit function may constrain improper conduct by management. Alternatively, the control environment may reduce the effectiveness of other components. For example, when the nature of management incentives increases the risk of material misstatement of financial statements, the effectiveness of control activities may be reduced.9. Balancing Risk and ControlRisk is the probability that an event or action will adversely affect the organization. The primary categories of risk are errors, omissions, delay and fraud In order to achieve goals and objectives, management needs to effectively balance risks and controls. Therefore, control procedures need to be developed so that they decrease risk to a level where management can accept the exposure to that risk. By performing this balancing act "reasonable assurance” can be attained. As it relates to financial and compliance goals, being out of balance can causebe proactive, value-added, and cost-effective and address exposure to risk.11. ConclusionThe concept of internal control and its aspects in any organization is so important, therefore understanding the components and standards of internal controls should be attend by management. Internal Control is a major part of managing an organization. Internal control is an accounting procedure or system designed to promote efficiency or assure the implementation of a policy or safeguard assets or avoid fraud and error. According to custom definition, Internal Control is a process affected by an entity's board of directors, management and other personnel designed to provide reasonable assurance regarding the achievement of objectives in the following categories namely. The major factors of internal control are Control environment, Risk assessment, Control activities, Information and communication, Monitoring. This article reviews the main standards and principles of internal control and described the relevant concepts of internal control for all type of company.内部控制透视:理论与概念哈米德阿拉德(Philae)会计系,伊斯兰阿扎德大学,哈马丹,伊朗巴克Joshed -纳维德哈尼学院会员伊斯兰阿扎德大学,克尔曼伊朗国王,伊朗摘要:内部控制是会计程序或控制系统,旨在促进效率或保证一个执行政策或保护资产或避免欺诈和错误。