金融市场与机构 (9)

- 格式:doc

- 大小:487.50 KB

- 文档页数:13

考试时间: 周一一、名词解释(20分)5道1.累积优先股累积优先股(Cumulative preferred shares):是指当公司在某个时期内的盈利不足以支付优先股股息时, 则累计到次年或以后某一年盈利时, 在普通股的红利发放之前, 连同本年优先股的股息一并发放。

2.货币市场货币市场是短期资金市场, 是指融资期限在一年以下的金融市场, 是金融市场的重要组成部分。

包括同业拆借市场、票据贴现市场、短期政府债券市场、证券回购市场等。

3.大额可转让定期存单大额可转让定期存单是由商业银行发行的、可以在市场上转让的存款凭证。

其一般不记名、不可以提前支取, 但可以在二级市场上流通和转让。

4.欧洲债券一国筹资者在本国以外的国际债券市场上发行的, 以第三国货币为面值并由一国或几国金融机构组成辛迪加承销的证券。

5.证券投资基金证券投资基金是一种利益共享、风险共提的集合证券投资方式, 即通过发行基金份额, 集中投资者的资金, 由基金托管人托管, 由基金管理人管理和运用资金, 从事股票、债券等金融工具投资, 并将投资收益按照基金投资的投资比例进行分配的一种间接投资方式。

6.金融租赁由出租人根据承租人的要求, 按照双方事先合同约定, 向承租人指定的出卖人, 购买承租人指定的固定资产, 在出租人拥有固定资产所有权的前提下, 以承租人支付所有租金为条件, 将一个时期该固定资产的占有、使用和收益权让渡给承租人, 具有融资和融物的双重功能。

7、ETF在交易所上市交易, 基金份额可变的一种开放式基金。

投资者既可以在二级市场买卖ETF份额, 也可以向基金管理公司申购或赎回ETF份额, 但必须以一篮子股票(或少量现金)换取基金份额或以基金份额换回一篮子股票(或少量现金)8、股指期货以股票价格指数为标的的标准化期货合约, 双方约定在未来的某个特定日期, 按照事先确定的股价指数大小, 进行标的指数的买卖。

双方交易的是一定期后的股指价格水平, 通过现金结算差价来进行交割。

与财务管理专业相关的书籍财务管理是一个广泛且复杂的领域,包含了诸多主题,如企业财务、投资分析、风险管理等。

以下是一些与财务管理专业相关的推荐书籍,这些书籍涵盖了从基础理论到高级应用的各个方面:1.《公司财务》("Corporate Finance")by StephenRoss, Randolph Westerfield, Jeffrey Jaffe:这本书被广泛认为是学习公司财务的经典教材,它全面介绍了公司财务的基本原理和实践。

2.《投资学》("Principles of Investments")byZvi Bodie, Alex Kane, Alan Marcus:这本书是投资学的标准教科书,覆盖了投资的基本概念、工具和策略。

3.《金融市场与机构》("Financial Markets andInstitutions")by Frederic S. Mishkin,Stanley Eakins:这本书提供了金融市场和机构运作的全面视角,对理解金融系统的结构和功能非常有帮助。

4.《风险管理与金融机构》("Risk Management andFinancial Institutions")by John C. Hull:专注于金融风险管理的实践,适用于那些希望在金融行业进行风险评估和管理的专业人士。

5.《财务会计原理》("Financial AccountingTheory")by William R. Scott:这本书深入探讨了财务会计的理论基础,适合那些对会计准则和实践有深入兴趣的读者。

6.《财务建模与估值》("Financial Modeling andValuation")by Paul Pignataro:这本实用书籍教授如何构建财务模型,进行公司估值,是金融分析师和投资银行家的重要工具。

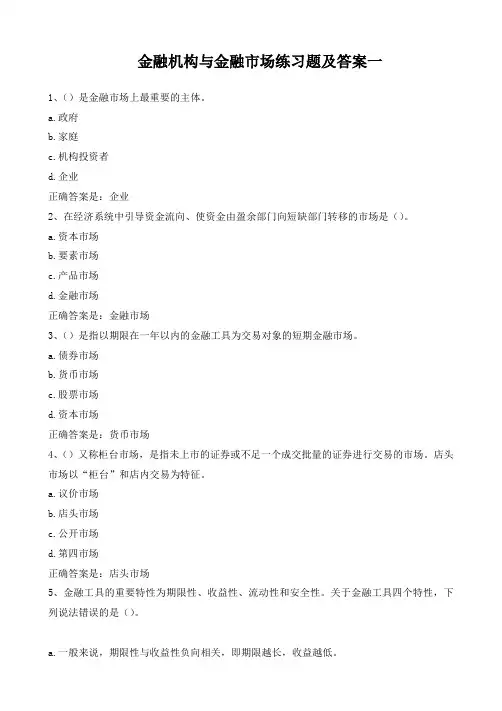

金融机构与金融市场练习题及答案一1、()是金融市场上最重要的主体。

a.政府b.家庭c.机构投资者d.企业正确答案是:企业2、在经济系统中引导资金流向、使资金由盈余部门向短缺部门转移的市场是()。

a.资本市场b.要素市场c.产品市场d.金融市场正确答案是:金融市场3、()是指以期限在一年以内的金融工具为交易对象的短期金融市场。

a.债券市场b.货币市场c.股票市场d.资本市场正确答案是:货币市场4、()又称柜台市场,是指未上市的证券或不足一个成交批量的证券进行交易的市场。

店头市场以“柜台”和店内交易为特征。

a.议价市场b.店头市场c.公开市场d.第四市场正确答案是:店头市场5、金融工具的重要特性为期限性、收益性、流动性和安全性。

关于金融工具四个特性,下列说法错误的是()。

b.正是期限性、流动性、安全性和收益性相互间的不同组合导致了金融工具的丰富性和多样性,使之能够满足多元化的资金需求和对“四性”的不同偏好。

c.一般来说,流动性、安全性与收益性成反向相关,安全性、流动性越高的金融工具其收益性越低。

d.一般来说,期限性与收益性正向相关,即期限越长,收益越高。

正确答案是:一般来说,期限性与收益性负向相关,即期限越长,收益越低。

6、家庭在金融市场中的主要活动领域是()。

a.黄金市场b.资本市场c.货币市场d.外汇市场正确答案是:资本市场7、金融市场中最主要的经纪人有()a.货币经纪人b.证券承销人c.证券经纪人d.黄金经纪人e.外汇经纪人正确答案是:货币经纪人,证券经纪人,黄金经纪人,外汇经纪人8、证券公司具有以下职能()a.管理金融工具交易价格b.充当证券市场重要的投资人c.充当证券市场中介人d.充当证券市场资金供给者e.提高证券市场运行效率正确答案是:充当证券市场中介人,充当证券市场重要的投资人,提高证券市场运行效率9、金融工具交易或买卖过程中所产生的运行机制,是金融市场的深刻内涵和自然发展,其中最核心的是价格机制,金融工具的价格成为金融市场的要素。

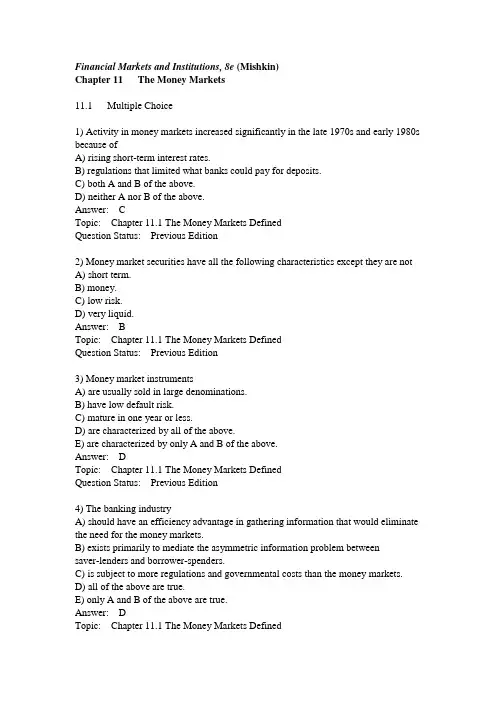

Financial Markets and Institutions, 8e (Mishkin)Chapter 11 The Money Markets11.1 Multiple Choice1) Activity in money markets increased significantly in the late 1970s and early 1980s because ofA) rising short-term interest rates.B) regulations that limited what banks could pay for deposits.C) both A and B of the above.D) neither A nor B of the above.Answer: CTopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition2) Money market securities have all the following characteristics except they are notA) short term.B) money.C) low risk.D) very liquid.Answer: BTopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition3) Money market instrumentsA) are usually sold in large denominations.B) have low default risk.C) mature in one year or less.D) are characterized by all of the above.E) are characterized by only A and B of the above.Answer: DTopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition4) The banking industryA) should have an efficiency advantage in gathering information that would eliminate the need for the money markets.B) exists primarily to mediate the asymmetric information problem betweensaver-lenders and borrower-spenders.C) is subject to more regulations and governmental costs than the money markets.D) all of the above are true.E) only A and B of the above are true.Answer: DTopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition5) In situations where asymmetric information problems are not severe,A) the money markets have a distinct cost advantage over banks in providing short-term funds.B) the money markets have a distinct cost advantage over banks in providinglong-term funds.C) banks have a distinct cost advantage over the money markets in providing short-term funds.D) the money markets cannot allocate short-term funds as efficiently as banks can. Answer: ATopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition6) Brokerage firms that offered money market security accounts in the 1970s had a cost advantage over banks in attracting funds because the brokerage firmsA) were not subject to deposit reserve requirements.B) were not subject to the deposit interest rate ceilings.C) were not limited in how much they could borrow from depositors.D) had the advantage of all the above.E) had the advantage of only A and B of the above.Answer: ETopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition7) Which of the following statements about the money markets are true?A) Not all commercial banks deal for their customers in the secondary market.B) Money markets are used extensively by businesses both to warehouse surplus funds and to raise short-term funds.C) The single most influential participant in the U.S. money market is the U.S. Treasury Department.D) All of the above are true.E) Only A and B of the above are true.Answer: ETopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition8) Which of the following statements about the money markets are true?A) Most money market securities do not pay interest. Instead, the investor pays less for the security than it will be worth when it matures.B) Pension funds invest a portion of their assets in the money market to have sufficient liquidity to meet their obligations.C) Unlike most participants in the money market, the U.S. Treasury Department is always a demander of money market funds and never a supplier.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 11.3 Who Participates in the Money Markets? Question Status: Previous Edition9) Which of the following are true statements about participants in the money markets?A) Large banks participate in the money markets by selling large negotiable CDs.B) The U.S. government and corporations borrow in the money markets because cash inflows and outflows are rarely synchronized.C) The Federal Reserve is the single most influential participant in the U.S. money market.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition10) The most influential participant(s) in the U.S. money marketA) is the Federal Reserve.B) is the U.S. Treasury Department.C) are the large money center banks.D) are the investment banks that underwrite securities.Answer: ATopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition11) The Fed is an active participant in money markets mainly because of its responsibility toA) lower borrowing costs to encourage capital investment.B) control the money supply.C) increase the interest income of retirees holding money market instruments.D) assist the Securities and Exchange Commission in regulating the behavior of other money market participants.Answer: BTopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition12) Commercial banks are large holders of ________ and are the major issuer of________.A) negotiable certificates of deposit; U.S. government securitiesB) U.S. government securities; negotiable certificates of depositC) commercial paper; EurodollarsD) Eurodollars; commercial paperAnswer: BTopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition13) The primary function of large diversified brokerage firms in the money market is toA) sell money market securities to the Federal Reserve for its open market operations.B) make a market for money market securities by maintaining an inventory from which to buy or sell.C) buy money market securities from corporations that need liquidity.D) buy T-bills from the U.S. Treasury Department.Answer: BTopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition14) Finance companies raise funds in the money market by sellingA) commercial paper.B) federal funds.C) negotiable certificates of deposit.D) Eurodollars.Answer: ATopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition15) Finance companies play a unique role in money markets byA) giving consumers indirect access to money markets.B) combining consumers' investments to purchase money market securities on their behalf.C) borrowing in capital markets to finance purchases of money market securities.D) assisting the government in its sales of U.S. Treasury securities.Answer: ATopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition16) When inflation rose in the late 1970s,A) consumers moved money out of money market mutual funds because their returns did not keep pace with inflation.B) banks solidified their advantage over money markets by offering higher deposit rates.C) brokerage houses introduced highly popular money market mutual funds, which drew significant amounts of money out of bank deposits.D) consumers were unable to take advantage of higher rates in money markets because of the requirement of large transaction sizes.Answer: CTopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition17) Which of the following is the largest borrower in the money markets?A) Commercial banksB) Large corporationsC) The U.S. TreasuryD) U.S. firms engaged in foreign tradeAnswer: CTopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition18) Money market instruments issued by the U.S. Treasury are calledA) Treasury bills.B) Treasury notes.C) Treasury bonds.D) Treasury strips.Answer: ATopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition19) Which of the following statements are true of Treasury bills?A) The market for Treasury bills is extremely deep and liquid.B) Occasionally, investors find that earnings on T-bills do not compensate them for changes in purchasing power due to inflation.C) By volume, most Treasury bills are sold to individuals who submit noncompetitive bids.D) All of the above are true.E) Only A and B of the above are true.Answer: ETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition20) Suppose that you purchase a 91-day Treasury bill for $9,850 that is worth $10,000 when it matures. The security's annualized yield if held to maturity is aboutA) 4 percent.B) 5 percent.C) 6 percent.D) 7 percent.Answer: CTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition21) Suppose that you purchase a 182-day Treasury bill for $9,850 that is worth $10,000 when it matures. The security's annualized yield if held to maturity is aboutA) 1.5%.B) 2%.C) 3%.D) 6%.Answer: CTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition22) Treasury bills do notA) pay interest.B) have a maturity date.C) have a face amount.D) have an active secondary market.Answer: ATopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition23) If your competitive bid for a Treasury bill is successful, then you willA) certainly pay less than if you had submitted a noncompetitive bid.B) probably pay more than if you had submitted a noncompetitive bid.C) pay the average of prices offered in other successful competitive bids.D) pay the same as other successful competitive bidders.Answer: BTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition24) If your noncompetitive bid for a Treasury bill is successful, then you willA) certainly pay less than if you had submitted a competitive bid.B) certainly pay more than if you had submitted a competitive bid.C) pay the average of prices offered in other noncompetitive bids.D) pay the same as other successful noncompetitive bidders.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition25) Federal fundsA) are short-term funds transferred between financial institutions, usually for a period of one day.B) actually have nothing to do with the federal government.C) provide banks with an immediate infusion of reserves.D) are all of the above.E) are only A and B of the above.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition26) Federal funds areA) usually overnight investments.B) borrowed by banks that have a deficit of reserves.C) lent by banks that have an excess of reserves.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition27) The Fed can influence the federal funds interest rate by adjusting the level of reserves available to banks. The Fed canA) lower the federal funds interest rate by adding reserves.B) raise the federal funds interest rate by removing reserves.C) remove reserves by selling securities.D) do all of the above.E) do only A and B of the above.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition28) The Federal Reserve can influence the federal funds interest rate by buying securities, which ________ reserves, thereby ________ the federal funds rate.A) adds; raisingB) removes; loweringC) adds; loweringD) removes; raisingAnswer: CTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition29) The Fed can lower the federal funds interest rate by ________ securities, thereby ________ reserves.A) selling; addingB) selling; loweringC) buying; addingD) buying; loweringAnswer: CTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition30) If the Fed wants to lower the federal funds interest rate, it will ________ the banking system by ________ securities.A) add reserves to; sellingB) add reserves to; buyingC) remove reserves from; sellingD) remove reserves from; buyingAnswer: BTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition31) If the Fed wants to raise the federal funds interest rate, it will ________ securities to ________ the banking system.A) sell; add reserves toB) sell; remove reserves fromC) buy; add reserves toD) buy; remove reserves fromAnswer: BTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition32) Government securities dealers frequently engage in repos toA) manage liquidity.B) take advantage of anticipated changes in interest rates.C) lend or borrow for a day or two with what is essentially a collateralized loan.D) do all of the above.E) do only A and B of the above.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition33) Repos areA) usually low-risk loans.B) usually collateralized with Treasury securities.C) low interest rate loans.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition34) A negotiable certificate of depositA) is a term security because it has a specified maturity date.B) is a bearer instrument, meaning whoever holds the certificate at maturity receives the principal and interest.C) can be bought and sold until maturity.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition35) Negotiable certificates of depositA) are bearer instruments because their holders earn the interest and principal at maturity.B) typically have a maturity of one to four months.C) are usually denominated at $100,000.D) are all of the above.E) are only A and B of the above.Answer: ETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition36) Commercial paper securitiesA) are issued only by the largest and most creditworthy corporations, as they are unsecured.B) carry an interest rate that varies according to the firm's level of risk.C) never have a term to maturity that exceeds 270 days.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition37) Unlike most money market securities, commercial paperA) is not generally traded in a secondary market.B) usually has a term to maturity that is longer than a year.C) is not popular with most money market investors because of the high default risk.D) all of the above.E) only A and B of the above.Answer: ATopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition38) A banker's acceptance isA) used to finance goods that have not yet been transferred from the seller to the buyer.B) an order to pay a specified amount of money to the bearer on a given date.C) a relatively new money market security that arose in the 1960s as international trade expanded.D) all of the above.E) only A and B of the above.Answer: ETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition39) Banker's acceptancesA) can be bought and sold until they mature.B) are issued only by large money center banks.C) carry low interest rates because of the very low default risk.D) are all of the above.E) are only A and B of the above.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition40) EurodollarsA) are time deposits with fixed maturities and are, therefore, somewhat illiquid.B) may offer the borrower a lower interest rate than can be received in the domestic market.C) are limited to London banks.D) are all of the above.E) are only A and B of the above.Answer: ETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition41) Which of the following statements about money market securities are true?A) The interest rates on all money market instruments move very closely together over time.B) The secondary market for Treasury bills is extensive and well developed.C) There is no well-developed secondary market for commercial paper.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition42) Money market transactionsA) do not take place in any one particular location or building.B) are usually arranged purchases and sales between participants over the phone by traders and completed electronically.C) are both A and B of the above.D) are none the the above.Answer: CTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition43) Two important characteristics of any financial market are flexibility andA) risk.B) innovation.C) tolerance.D) capital.Answer: BTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition44) The main role of investment companies in the money market is toA) trade on behalf of commercial accounts.B) mediate the symmetric information problem between server-lender and borrower-spenders.C) both A and B of the above.D) neither A nor B of the above.Answer: ATopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition45) In a direct placementA) the issuer bypasses the dealer and sells indirectly to the end investor.B) the dealer sells directly to the end investor.C) the issuer bypasses the dealer and sells directly to the end investor.D) none of the above.Answer: ATopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition46) The advantage of mutual funds is that theyA) require no cash up front.B) give investors with relatively small amounts of cash to invest access tolarge-denomination securities.C) always yield the highest returns.D) both A and B of the above.Answer: BTopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition47) Asset-backed commercial paper differs from conventional commercial paper in thatA) it is backed (secured) by some bundle of assets.B) its maturity usually extends well beyond 1 year.C) both A and B of the above.D) neither A nor B of the above.Answer: ATopic: Chapter 11.4 Money Market InstrumentsQuestion Status: New Question48) The usual maturity range for commercial paper is ________.A) 1 to 270 daysB) 1 to 15 daysC) 4, 13, and 26 weeksD) 1 to 7 daysAnswer: ATopic: Chapter 11.5 Comparing Money Market SecuritiesQuestion Status: New Question49) The usual maturity range for fed funds is ________.A) 1 to 270 daysB) 1 to 15 daysC) 4, 13, and 26 weeksD) 1 to 7 daysAnswer: DTopic: Chapter 11.5 Comparing Money Market SecuritiesQuestion Status: New Question11.2 True/False1) Money market securities are short-term instruments with an original maturity of less than one year.Answer: TRUETopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition2) Money market securities include Treasury bills, commercial paper, federal funds, repurchase agreements, negotiable certificates of deposit, banker's acceptances, and Eurodollars.Answer: TRUETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition3) The term money market is actually a misnomer, because liquid securities are traded in these markets rather than money.Answer: TRUETopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition4) Money markets are referred to as retail markets because small individual investors are the primary buyers of money market securities.Answer: FALSETopic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition5) The U.S. Treasury Department is the single most influential participant in the U.S. money market.Answer: FALSETopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition6) The U.S. Treasury Department is the single largest borrower in the U.S. money market.Answer: TRUETopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition7) Banks are unusual participants in the money market because they buy, but do not sell, money market instruments.Answer: FALSETopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition8) Money markets are used extensively by businesses both to warehouse surplus funds and to raise short-term funds.Answer: TRUETopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition9) The market for U.S. Treasury bills is a shallow market because so few individual investors buy T-bills.Answer: FALSETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition10) The T-bill is not an investment to be used for anything but temporary storage of excess funds because it barely keeps up with inflation.Topic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition11) The main purpose of federal funds is to provide banks with an immediate infusion of reserves should they be short.Answer: TRUETopic: Chapter 11.2 The Purpose of the Money MarketsQuestion Status: Previous Edition12) The Fed can influence the federal funds rate by adjusting the level of reserves in the banking system.Answer: TRUETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition13) Commercial paper securities are unsecured promissory notes, issued by corporations, that mature in no more than 270 days.Answer: TRUETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition14) A banker's acceptance is an order to pay a specified amount of money to the bearer on a given date. Banker's acceptances have been used since the twelfth century. Answer: TRUETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition15) Interest rates on banker's acceptances are low because the risk of default is very low.Answer: TRUETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition16) The size of the asset-backed commercial paper market nearly doubled between 2004 and 2007 to about $1 trillion.Answer: TRUETopic: Chapter 11.4 Money Market Instruments17) In general, money market instruments are low-risk, high-yield securities. Answer: FALSETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition18) Commercial paper has been used in various forms since the 1930s.Topic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition19) The Treasury accepts noncompetitive bids in ascending order of yield until the accepted bids reach the offering amount.Answer: FALSETopic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition20) Not all commercial banks deal in the secondary money market for their customers.Answer: TRUETopic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition11.3 Essay1) Explain why banks, which would seem to have a comparative advantage in gathering information, have not eliminated the need for the money markets. Topic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition2) Explain how the Federal Reserve can influence the federal funds interest rate. Topic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition3) Explain why the money markets are referred to as wholesale markets.Topic: Chapter 11.1 The Money Markets DefinedQuestion Status: Previous Edition4) Explain why money market interest rates move so closely together over time. Topic: Chapter 11.5 Comparing Money Market SecuritiesQuestion Status: Previous Edition5) How are Treasury bills sold? How do competitive and noncompetitive bids differ? Topic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition6) What are the main characteristics of money market securities?Topic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition7) What are the major types of securities and who are the major participants in the money markets?Topic: Chapter 11.3 Who Participates in the Money Markets?Question Status: Previous Edition8) Explain how and why repurchase agreements would be used.Topic: Chapter 11.4 Money Market InstrumentsQuestion Status: Previous Edition9) The size of the asset-backed commercial paper market nearly doubled between 2004 and 2007 to about $1 trillion. Discuss how the subprime meltdown and collapse of the ABCP market almost led to the collapse of the money market mutual fundmarket as well.Topic: Chapter 11.4 Money Market InstrumentsQuestion Status: New Question10) Why would we expect rates on money market securities to move together? Topic: Chapter 11.5 Comparing Money Market SecuritiesQuestion Status: New Question。

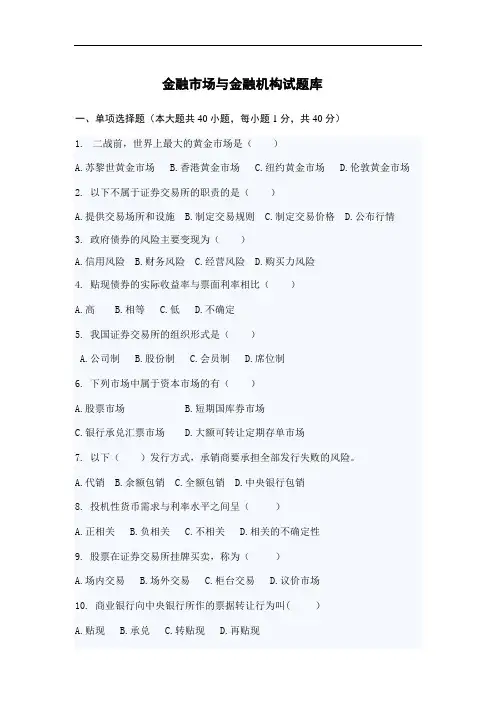

金融市场与金融机构试题库一、单项选择题(本大题共40小题,每小题1分,共40分)1.二战前,世界上最大的黄金市场是()A.苏黎世黄金市场B.香港黄金市场C.纽约黄金市场D.伦敦黄金市场2. 以下不属于证券交易所的职责的是()A.提供交易场所和设施B.制定交易规则C.制定交易价格D.公布行情3. 政府债券的风险主要变现为()A.信用风险B.财务风险C.经营风险D.购买力风险4. 贴现债券的实际收益率与票面利率相比()A.高B.相等C.低D.不确定5. 我国证券交易所的组织形式是()A.公司制B.股份制C.会员制D.席位制6. 下列市场中属于资本市场的有()A.股票市场B.短期国库券市场C.银行承兑汇票市场D.大额可转让定期存单市场7. 以下()发行方式,承销商要承担全部发行失败的风险。

A.代销B.余额包销C.全额包销D.中央银行包销8. 投机性货币需求与利率水平之间呈()A.正相关B.负相关C.不相关D.相关的不确定性9. 股票在证券交易所挂牌买卖,称为()A.场内交易B.场外交易C.柜台交易D.议价市场10. 商业银行向中央银行所作的票据转让行为叫( )A.贴现B.承兑C.转贴现D.再贴现11. 只靠收取佣金获利的经纪人被称为()A.货币中间商B.票据经纪人C.佣金经纪人D.短期证券经纪人12. 社会公共设施的建立和维护属于()A.企业储蓄B.企业投资C.政府储蓄D.政府投资13. 推动同业拆借市场形成和发展的直接原因是()A.存款准备金制度B.再贴现政策C.公开市场政策D.存款派生机制14. 对于以金融工具形式保有财富的持有者,金融市场提供了低风险变现的机会。

这体现了金融市场的()功能A.储蓄B.流动性C.风险D.信用15. 银行承兑汇票的转让一般通过()方式进行。

A.承兑B.贴现C.再贴现D.转贴现16. 可转换债券转换为普通股,会导致公司()A.资产总额增加B.资产总额减少C.自有资本增加D.自有资本减少17. 根据市场组织形式的不同,可以将股票流通市场划分为()A.发行市场和流通市场B.国内市场和国外市场C.场内市场和场外市场D.现货市场和期货市场18. 证券交易所形成证券交易价格的方式是()A.协商定价B.拍卖C.投标D.公开竞价19. 借款人在境外市场发行,不以发行所在国货币为面值的国际债券是()A.欧洲债券B.外国债券C.扬基债券D.武士债券20. 投资者可以享受税收优惠的债券是()A.优先股票B.公司债券C.政府债券D.金融债券21.以下对商业银行贷款的描述,不正确的是( )A.贷款是商业银行的基本负债业务,收益率较高但流动性较差,而且存在违约风险。

金融机构与金融市场练习题及答案二1、同业拆借市场的最重要参与者是()A.保险公司B.中央银行C.证券公司D.商业银行正确答案是:商业银行2、同业拆借市场产生于()政策的实施。

A.金融监管B.利率C.存款准备金D.财税正确答案是:存款准备金3、回购市场是通过()进行短期资金融通交易的市场。

A.债券B.证券C.回购协议D.抵押贷款正确答案是:回购协议4、货币市场共同基金一般属于()。

A.开放型基金B.封闭型基金C.公司型基金D.契约型基金正确答案是:开放型基金5、衡量货币市场基金表现好坏的标准是其()。

A.风险系数B.投资收益率C.基金评级D.基金排名正确答案是:投资收益率6、货币市场就其结构而言,包括()。

A.回购市场B.货币市场共同C.同业拆借市场D.商业票据市场正确答案是:同业拆借市场,回购市场,商业票据市场,货币市场共同7、回购协议市场的主要资金需求者包括()A.非银行金融机构B.中央银行C.政府证券交易商D.商业银行正确答案是:商业银行,政府证券交易商8、商业票据市场的要素包括()。

A.投资者B.信用评估C.发行者D.销售正确答案是:投资者,发行者,销售,信用评估9、货币市场共同基金提供一种有限制的存款账户。

正确答案是:“对”。

10、国库券被认为是没有违约风险的。

正确答案是:“对”。

11、从本质上说,回购协议是一种抵押贷款,其抵押品为证券。

正确的答案是“对”。

12、回购协议中证券的交付一般采用实物交付的方式。

13、美国银行法规定出售合规的银行承兑汇票所取得的资金不要求缴纳准备金。

正确的答案是“对”。

14、债券利息支出属于公司的()。

A.直接成本B.费用范围C.营销经费D.利润正确答案是:费用范围15、政府债券的最初功能是()。

A.弥补财政赤字B.便于调控宏观经济C.筹措建设资金D.便于金融调控正确答案是:弥补财政赤字16、按照我国的《个人所得税法》规定,下列收入中可免缴个人所得税的是()。

金融市场基础知识-9(总分100, 做题时间90分钟)单项选择题1.深圳证券交易所选取成分股时,需结合考虑的因素不包括______。

SSS_SINGLE_SELA 公司近年来的财务状况B 公司发展前景C 公司的规模D 公司的地区该题您未回答:х该问题分值: 2.5答案:C[解析] 深圳证券交易所选取成分股时,需结合下列各项因素选出成分股:公司股票在一段时间内的平均市盈率,公司的行业代表性及所属行业的发展前景,公司近年来的财务状况、盈利记录、发展前景及管理素质等,公司的地区、板块代表性等。

2.下列选项中,不属于国际证监会公布的证券监管目标的是______。

SSS_SINGLE_SELA 保护投资者B 保证证券市场的公平、效率和透明C 降低非系统风险D 降低系统性风险该题您未回答:х该问题分值: 2.5答案:C[解析] 国际证监会公布了证券监管的三个目标:(1)保护投资者。

(2)保证证券市场的公平。

(3)降低系统性风险3.______是指交易参与人向深圳证券交易所申请设立的、参与深圳证券交易与接受深圳证券交易所监管及服务的基本业务单位。

SSS_SINGLE_SELA 交易大厅B 参与者交易业务单元C 交易主机D 交易单元该题您未回答:х该问题分值: 2.5答案:D4.关于我国发行的普通国债的总体情况,说法错误的是______。

SSS_SINGLE_SELA 规模越来越大B 发行方式区域市场化C 期限区域单调化D 市场创新日新月异该题您未回答:х该问题分值: 2.5答案:C[解析] A、B、D三项是关于我国发行的普通国债的总体概括正确。

5.若对股票和债券的配置比例均为40%—60%左右,则该种基金属于______基金。

SSS_SINGLE_SELA 股债平衡型B 偏股型C 偏债型D 灵活配置型该题您未回答:х该问题分值: 2.5答案:A[解析] 股债平衡型基金对股票和债券的配置较为均衡,约为40%—60%左右。

第一单元单选题1 下列不属于初级市场活动内容的是()。

A. 发行股票B. 发行债券C. 转让股票D. 增发股票2 下列关于初级市场与二级市场关系的论述正确的是()。

A. 初级市场是二级市场的前提B. 二级市场是初级市场的前提C. 没有二级市场初级市场仍可存在D. 没有初级市场二级市场仍可存在3 目前我国有()家证券交易所。

A. 1B. 2C. 3D. 44 目前一些经济发达国家以证券交易方式实现的金融交易,已占有越来越大的份额。

人们把这种趋势称为()。

A. 资本化B. 市场化C. 证券化D. 电子化5 金融市场上的交易主体指金融市场的()。

A. 供给者B. 需求者C. 管理者D. 参加者6 下列不属于直接金融工具的是()。

A. 可转让大额定期存单B. 公司债券C. 股票D. 政府债券7 短期资金市场又称为()。

A. 初级市场B. 货币市场C. 资本市场D. 次级市场8 下列属于短期资金市场的是()。

A. 票据市场B. 债券市场C. 资本市场D. 股票市场9 长期资金市场又称为()。

A. 初级市场B. 货币市场C. 资本市场D. 次级市场1 0 下列属于所有权凭证的金融工具是()。

A. 公司债券B. 股票C. 政府债券D. 可转让大额定期存单 第一单元判断题1 新证券的发行,有公募与私募两种形式。

√2 可转换债券是利率衍生工具的一种。

×3 期货合约的买卖双方可能形成的收益或损失都是有限的。

国家债券是由政府发行的,主要用于政府贷款。

期权买方的损失可能无限大。

×4 ×5 ×6 偿还期限是指债务人必须全部归还利息之前所经历的时间。

金融自由化的标志之一就是政府放弃对金融业的干预。

传统的商业票据有本票和支票两种。

×7 ×8 ×9 二级市场的主要场所是证券交易所,但也扩及交易所之外。

√1 0 金融市场发达与否是一国金融发达程度及制度选择取向的重要标志。

金融市场与金融机构第九版中文1.金融市场是现代经济的重要组成部分。

The financial market is an important part of the modern economy.2.金融市场是资金融通的地方。

The financial market is where funds are transferred.3.金融市场包括债券市场、股票市场和外汇市场。

The financial market includes bond market, stock market, and foreign exchange market.4.金融市场提供了公司融资的途径。

The financial market offers a way for companies to raise funds.5.金融机构是金融市场的参与者。

Financial institutions are participants in the financial market.6.金融机构包括银行、证券公司和保险公司。

Financial institutions include banks, securities firms, and insurance companies.7.金融机构提供了资金媒介和风险管理服务。

Financial institutions provide fund intermediation and risk management services.8.金融机构的角色是促进资金在金融市场的流动。

The role of financial institutions is to facilitate the flow of funds in the financial market.9.金融机构也承担着资金监管和监督的责任。

Financial institutions also have the responsibility of fund regulation and supervision.10.金融机构通常受到政府监管。

Chapter 10The Bond MarketPurpose of the Capital MarketCapital Market ParticipantsCapital Market TradingOrganized Securities ExchangesOver-the-Counter MarketsTypes of BondsTreasury Notes and BondsTreasury Bond Interest RatesTreasury Inflation Protected Securities (TIPS)Treasury StripsAgency BondsMunicipal BondsRisk in the Municipal Bond MarketCorporate BondsCharacteristics of Corporate BondsTypes of Corporate BondsFinancial Guarantees for BondsCurrent Yield CalculationCurrent YieldFinding the Value of Coupon BondsFinding the Price of Semiannual BondsInvesting in BondsOverview and Teaching TipsChapter 10 examines securities that have an original maturity that is greater than one year. These types of securities are traded in capital markets and the best known securities are stocks and bonds. This chapter focuses on the characteristics of the bonds while the next chapter extends the capital market discussion to stocks. Capital markets are used for long term financing and investments. The beginning of the chapter discusses the purpose of and the participants in the capital market so students will get a better understanding of the topic when it is discussed in depth in later sections. We explore two categories of capital markets: bonds and stocks. Show the students Table 1 because it gives a clear understanding of the different types of Treasury securities. Treasury securities are free of default risk, but not risk-free, and have a very low interest rate. Bonds issued by local, county, and state governments are municipal bonds and are used to finance public interest projects. Point out to students that municipal bonds are not free of default. Corporate bonds usually have a face value of $1,000 and can be redeemed at anytime.52 Mishkin/Eakins •Financial Markets and Institutions, Sixth EditionThe chapter concludes by showing how to compute the value of bonds. An example focuses specifically on valuing semiannual bonds. This valuation model can be used to show that interest-rate risk will affect the wealth of investors in bonds.Answers to End-of-Chapter Questions1. Investors use capital markets for long-term investment purposes. They use money markets, whichhave lower yields, primarily for temporary or transaction purposes.2. The primary capital market securities are stocks and bonds. Most of these are purchased and ownedby households.3. The primary market is for securities being issued for the very first time, and the issuer receives thefunds paid for the security. The secondary market is for securities that have been issued previously but are being traded among investors.4. The par value is the amount the issuer will pay the holder when the bond matures. The coupon interestrate is multiplied times the par value to determine the interest payment the issuer must make each year.The maturity date is when the issuer must pay the holder the par value.5. Treasury bills mature in less than 1 year, Treasury notes mature in 1 to 10 years, and Treasury bondsmature in 10 to 30 years.6. The risk that a bond’s price will change due to changes in market interest rates is call interestrate risk.7. Agencies that issue securities include Ginnie Mae (formerly the Government National MortgageAssociation), the Federal Housing Administration, the Veterans Administration, the Federal National Mortgage Association, and the Student Loan Marketing Association. The first four fund mortgage loans and the last funds college student loans.8. Firms like having the flexibility to adjust their capital structure by paying off debt they no longerneed. They also need to pay off debt to remove restrictive covenants. Call provisions permit both these actions at the issuer’s discretion.9. A sinking fund contains funds set aside by the issuer of a bond to pay for the redemption of the bondwhen it matures. Because a sinking fund increases the likelihood that a firm will have the funds to pay off the bonds as required, investors like the feature. As a result, interest rates are lower onsecurities with sinking funds.10. The list of terms of a bond is known as the indenture.11. Capital market securities may be sold in a public offering or in a private placement. In a publicoffering, investment bankers register the security with the SEC and market it through a network of brokerage houses. In a private placement, the firm or an investment banker sells the securities to a very limited number of investors, who each buy a large quantity.Chapter 10 The Bond Market 53Quantitative Problems1. A bond pays $80 per year in interest (8% coupon). The bond has 5 years before it matures at whichtime it will pay $1,000. Assuming a discount rate of 10%, what should be the price of the bond(Review Chapter 3)?Solution:$924.182. A zero coupon bond has a par value of $1,000 and matures in 20 years. Investors require a 10%annual return on these bonds. For what price should the bond sell? (note, zero coupon bonds do not pay any interest) (Review Chapter 3)?Solution: $148.643. Consider the two bonds described below:Bond A Bond BMaturity 15 yrs 20 yrs10% 6%Coupon Rate(Paid semiannually)Par Value $1,000 $1,000a. If both bonds had a required return of 8%, what would the bonds’ prices be?b. Describe what it means if a bond sells at a discount, a premium, and at its face amount(par value). Are these two bonds selling at a discount, premium, or par?c. If the required return on the two bonds rose to 10%, what would the bonds’ prices be?Solution:a. Bond A = $1,172.92Bond B = $802.07b. Bond A is selling at a premiumBond B is selling at a discountc. Bond A = $1,000Bond B = $656.824. A 2-year $1,000 par zero-coupon bond is currently priced at $819.00. A 2-year $1,000 annuity iscurrently priced at $1,712.52. If you want to invest $10,000 in one of the two securities, which is a better buy? You can assumea. the pure expectations theory of interest rates holds,b. neither bond has any default risk, maturity premium, or liquidity premium, andc. you can purchase partial bonds.Solution: With PV= $819, FV= $1,000, PMT= 0 and N= 2, the yield to maturity on the two-year zero-coupon bonds is 10.5% for the two-year annuities, PV= $1,712.52, PMT= 0,FV= $2,000 and N= 2 gives a yield to maturity of 8.07%. The zero-coupon bonds arethe better buy.54 Mishkin/Eakins • Financial Markets and Institutions, Sixth Edition5. Consider the following cash flows. All market interest rates are 12%.Year0 1 2 3 4 Cash Flow 160 170 180 230a. What price would you pay for these cash flows? What total wealth do you expect after 2½ yearsif you sell the rights to the remaining cash flows? Assume interest rates remain constant.b. What is the duration of these cash flows?c. Immediately after buying these cash flows, all market interest rates drop to 11%. What is theimpact on your total wealth after 2½ years?Solution: a. 234160170180230Price 552.671.12 1.12 1.12 1.12=+++= 1.555 1.5180230Expected Wealth 160(1.12)170(1.12)$733.691.12 1.12=⨯+⨯++= b. 234160170180230(1)(2)(3)1.12 1.12 1.12 1.12Duration 2.50552.67+++== c. Expected Wealth = 1.5.5.5 1.5180230160(1.11)170(1.11)$733.741.11 1.11⨯+⨯++= Since you are holding the cash flows for their duration, you are essentially immunized from interestrate changes (in this simplistic example).6. The yield on a corporate bond is 10% and it is currently selling at par. The marginal tax rate is 20%.A par value municipal bond with a coupon rate of 8.50% is available. Which security is a better buy? Solution: The equivalent tax-free rate = taxable interest rate ⨯ (1 - marginal tax rate). In this case,0.10 ⨯ (1 - 0.20) = 8%. The corporate bond offers a lower after-tax yield given themarginal tax rate, so the municipal bond is a better buy.7. If the municipal bond rate is 4.25% and the corporate bond rate is 6.25%, what is the marginal taxrate assuming investors are indifferent between the two bonds?Solution: The equivalent tax-free rate = taxable interest rate ⨯ (1 - marginal tax rate). In this case,0.0425 = 0.0625 ⨯ (1 - X ), or X = 32%.8. M&E Inc. has an outstanding convertible bond. The bond can be converted into 20 shares of commonequity (currently trading at $52/share). The bond has 5 years of remaining maturity, a $1,000 par value, and a 6% annual coupon. M&E’s straight debt is currently trading to yield 5%. What is the minimum price of the bond?Solution: The price must exceed the straight bond value or the value of conversion (you will seewhy in the next question).If converted, the debt is worth $52 ⨯ 20 = $1,040.Assuming a 5% YTM is correct, the price of straight debt is computed as:PMT = 60; N = 5; FV = 1000; I = 5Compute PV ; PV = 1,043.29The bond must be trading for at least 1,043.29.Chapter 10 The Bond Market 55 9. Assume the debt in the previous question is trading at 1,035. How can you earn a riskless profit fromthis situation (arbitrage)?Solution:a. Short 20 shares of M&E at $52/share.Cash $1,0470*b. Purchase a convertible bond. ($1,0.35)$5c. Convert the bond to shares, and use to close short position.Assuming these transactions are completed simultaneously, you make a riskless profit of $5.*Typically, small investors cannot short stock and have use of the proceeds—the broker retains it as collateral. So, this doesn’t quite work. But the idea is correct.10. A 10-year, 1,000 par value bond with a 5% annual coupon is trading to yield 6%. What is the currentyield?Solution: The current price of the bond is computed as follows:PMT= 50; N= 10; FV= 1000; I= 6Compute PV; PV= 926.40The current yield = 50/926.40 = 5.4%11. A $1,000 par bond with an annual coupon has only 1 year until maturity. Its current yield is6.713% and its yield to maturity is 10%. What is the price of the bond?Solution:a. CY= 0.06713 = Coupon/Price, or Coupon = 0.06713 ⨯ Priceb. Price = (Coupon + 1000)/1.10.Substituting from (1), Price = (0.06713 ⨯ Price + 1000)/1.10Solve for Price, Price = $968.1712. A 1-year discount bond with a face value of $1,000 was purchased for $900. What is the yield tomaturity? What is the yield on a discount basis?Solution: 900 = 1000/(1 + YTM), or YTM = 11.11%YDB = (1000 – 900)/1000 ⨯ (360/365) = 9.86%13. A 7-year, $1,000 par bond has an 8% annual coupon and is currently yielding 7.5%. The bond canbe called in 2 years at a call price of $1,010. What is the bond yielding, assuming it will be called (known as the yield to call)?Solution: The current price of the bond is computed as follows:PMT= 80; N= 7; FV= 1000; I= 7.5Compute PV; PV= 1,026.48Using this, the yield to call is calculated as follows:PMT= 80; N= 2; FV= 1010; PV= 1,026.48Compute I; I= 7.018%56 Mishkin/Eakins •Financial Markets and Institutions, Sixth Edition14. A 20-year $1,000 par value bond has a 7% annual coupon. The bond is callable after the 10th yearfor a call premium of $1,025. If the bond is trading with a yield to call of 6.25%, the bond’s yield to maturity is what?Solution: The current price of the bond is computed using the yield to call as follows:PMT= 70; N= 10; FV= 1025; I= 6.25Compute PV; PV= 1,068.19Using this, the yield to maturity is calculated as follows:PMT= 70; N= 20; FV= 1000; PV= 1,068.19Compute I; I= 6.39%15. A 10-year $1,000 par value bond has a 9% semi-annual coupon and a nominal yield to maturity of8.8%. What is the price of the bond?Solution: The price of the bond is computed as follows:PMT= 45; N = 20; FV= 1000; I= 8.8Compute PV; PV= 1,013.1216. Your company owns the following bonds:Bond Market Value DurationA $13 million 2B $18 million 4C $20 million 3If general interest rates rise from 8% to 8.5%, what is the approximate change in the value of the portfolio?Solution: Portfolio duration = 2 ⨯ (13/51) + 4 ⨯ (18/51) + 3 ⨯ (20/51) = 3.09∆ Value =-Duration ⨯ (∆i/(1 +i)) ⨯ Original Value∆ Value =-3.09 ⨯ (0.005/1.08) ⨯ $51 million = $729,583。

Chapter 9The Money MarketsMultiple Choice Questions1. Activity in money markets increased significantly in the late 1970s and early 1980s because of(a) rising short-term interest rates.(b) regulations that limited what banks could pay for deposits.(c) both (a) and (b).(d) neither (a) nor (b).Answer: C2. Money market securities have all the following characteristics except they are not(a) short term.(b) money.(c) low risk.(d) very liquid.Answer: B3. Money market instruments(a) are usually sold in large denominations.(b) have low default risk.(c) mature in one year or less.(d) are characterized by all of the above.(e) are characterized by only (a) and (b) of the above.Answer: D4. The banking industry(a) should have an efficiency advantage in gathering information that would eliminate the need forthe money markets.(b) exists primarily to mediate the asymmetric information problem between saver-lenders andborrower-spenders.(c) is subject to more regulations and governmental costs than are the money markets.(d) all of the above are true.(e) only (a) and (b) of the above are true.Answer: D112 Mishkin/Eakins •Financial Markets and Institutions, Fifth Edition5. In situations where asymmetric information problems are not severe,(a) the money markets have a distinct cost advantage over banks in providing short-term funds.(b) the money markets have a distinct cost advantage over banks in providing long-term funds.(c) banks have a distinct cost advantage over the money markets in providing short-term funds.(d) the money markets cannot allocate short-term funds as efficiently as banks can.Answer: A6. Brokerage firms that offered money market security accounts in the 1970s had a cost advantage overbanks in attracting funds because the brokerage firms(a) were not subject to deposit reserve requirements.(b) were not subject to the deposit interest rate ceilings.(c) were not limited in how much they could borrow from depositors.(d) had the advantage of all the above.(e) had the advantage of only (a) and (b) of the above.Answer: E7. Which of the following statements about the money market are true?(a) Not all commercial banks deal for their customers in the secondary market.(b) Money markets are used extensively by businesses both to warehouse surplus funds and to raiseshort-term funds.(c) The single most influential participant in the U.S. money market is the U.S. TreasuryDepartment.(d) All of the above are true.(e) Only (a) and (b) of the above are true.Answer: E8. Which of the following statements about the money markets are true?(a) Most money market securities do not pay interest. Instead the investor pays less for the securitythan it will be worth when it matures.(b) Pension funds invest a portion of their assets in the money market to have sufficient liquidity tomeet their obligations.(c) Unlike most participants in the money market, the U.S. Treasury Department is always ademander of money market funds and never a supplier.(d) All of the above are true.(e) Only (a) and (b) of the above are true.Answer: D9. Which of the following are true statements about participants in the money markets?(a) Large banks participate in the money markets by selling large negotiable CDs.(b) The U.S. government and corporations borrow in the money markets because cash inflows andoutflows are rarely synchronized.(c) The Federal Reserve is the single most influential participant in the U.S. money market.(d) All of the above are true.(e) Only (a) and (b) of the above are true.Answer: DChapter 9 The Money Markets 11310. The most influential participant(s) in the U.S. money market(a) is the Federal Reserve.(b) is the U.S. Treasury Department.(c) are the large money center banks.(d) are the investment banks that underwrite securities.Answer: A11. The Fed is an active participant in money markets mainly because of its responsibility to(a) lower borrowing costs to encourage capital investment.(b) control the money supply.(c) increase the interest income of retirees holding money market instruments.(d) assist the Securities and Exchange Commission in regulating the behavior other money marketparticipants.Answer: B12. Commercial banks are large holders of _________ and are the major issuer of _________.(a) negotiable certificates of deposit; U.S. government securities(b) U.S. government securities; negotiable certificates of deposit(c) commercial paper; Eurodollars(d) Eurodollars; commercial paperAnswer: B13. The primary function of large diversified brokerage firms in the money market is to(a) sell money market securities to the Federal Reserve for its open market operations.(b) make a market for money market securities by maintaining an inventory from which to buyor sell.(c) buy money market securities from corporations that need liquidity.(d) buy T-bills from the U.S. Treasury Department.Answer: B14. Finance companies raise funds in the money market by selling(a) commercial paper.(b) federal funds.(c) negotiable certificates of deposit.(d) Eurodollars.Answer: A15. Finance companies play a unique role in money markets by(a) giving consumers indirect access to money markets.(b) combining consumers’ investments to purchase money market securities on their behalf.(c) borrowing in capital markets to finance purchases of money market securities.(d) assisting the government in its sales of U.S. Treasury securities.Answer: A114 Mishkin/Eakins •Financial Markets and Institutions, Fifth Edition16. When inflation rose in the late 1970s,(a) consumers moved money out of money market mutual funds because their returns did not keeppace with inflation.(b) banks solidified their advantage over money markets by offering higher deposit rates.(c) brokerage houses introduced highly popular money market mutual funds, which drewsignificant amounts of money out of bank deposits.(d) consumers were unable to take advantage of higher rates in money markets because of therequirement of large transaction sizes.Answer: C17. Which of the following is the largest borrower in the money markets?(a) commercial banks(b) large corporations(c) the U.S. Treasury(d) U.S. firms engaged in foreign tradeAnswer: C18. Money market instruments issued by the U.S. Treasury are called(a) Treasury bills.(b) Treasury notes.(c) Treasury bonds.(d) Treasury strips.Answer: A19. The Treasury auctions 91-day and 182-day Treasury bills once a week. It auctions 52-week bills(a) once a month.(b) once every 13 weeks.(c) once a year.(d) every two weeks.Answer: A20. Which of the following statements are true of Treasury bills?(a) The market for Treasury bills is extremely deep and liquid.(b) Occasionally, investors find that earnings on T-bills do not compensate them for changes inpurchasing power due to inflation.(c) By volume, most Treasury bills are sold to individuals who submit noncompetitive bids.(d) All of the above are true.(e) Only (a) and (b) of the above are true.Answer: E21. Suppose that you purchase a 91-day Treasury bill for $9,850 that is worth $10,000 when it matures.The security’s annualized yield if held to maturity is about(a) 4 percent.(b) 5 percent.(c) 6 percent.(d) 7 percent.Chapter 9 The Money Markets 115 Answer: C116 Mishkin/Eakins •Financial Markets and Institutions, Fifth Edition22. Suppose that you purchase a 182-day Treasury bill for $9,850 that is worth $10,000 when it matures.The security’s annualized yield if held to maturity is about(a) 1.5%(b) 2%(c) 3%(d) 6%Answer: C23. Treasury bills do not(a) pay interest.(b) have a maturity date.(c) have a face amount.(d) have an active secondary market.Answer: A24. If your competitive bid for a Treasury bill is successful, then you will(a) certainly pay less than if you had submitted a noncompetitive bid.(b) probably pay more than if you had submitted a noncompetitive bid.(c) pay the average of prices offered in other successful competitive bids.(d) pay the same as other successful competitive bidders.Answer: B25. If your noncompetitive bid for a Treasury bill is successful, then you will(a) certainly pay less than if you had submitted a competitive bid.(b) certainly pay more than if you had submitted a competitive bid.(c) pay the average of prices offered in other noncompetitive bids.(d) pay the same as other successful noncompetitive bidders.Answer: D26. Federal funds(a) are short-term funds transferred between financial institutions, usually for a period of one day.(b) actually have nothing to do with the federal government.(c) provide banks with an immediate infusion of reserves.(d) are all of the above.(e) are only (a) and (b) of the above.Answer: D27. Federal funds are(a) usually overnight investments.(b) borrowed by banks that have a deficit of reserves.(c) lent by banks that have an excess of reserves.(d) all of the above.(e) only (a) and (b) of the above.Answer: DChapter 9 The Money Markets 117 28. The Fed can influence the federal funds interest rate by adjusting the level of reserves available tobanks. The Fed can(a) lower the federal funds interest rate by adding reserves.(b) raise the federal funds interest rate by removing reserves.(c) remove reserves by selling securities.(d) do all of the above.(e) do only (a) and (b) of the above.Answer: D29. The Federal Reserve can influence the federal funds interest rate by buying securities, which_________ reserves, thereby _________ the federal funds rate.(a) adds; raising(b) removes; lowering(c) adds; lowering(d) removes; raisingAnswer: C30. The Fed can lower the federal funds interest rate by _________ securities, thereby _________reserves.(a) selling; adding(b) selling; lowering(c) buying; adding(d) buying; loweringAnswer: C31. If the Fed wants to lower the federal funds interest rate, it will _________ the banking system by_________ securities.(a) add reserves to; selling(b) add reserves to; buying(c) remove reserves from; selling(d) remove reserves from; buyingAnswer: B32. If the Fed wants to raise the federal funds interest rate, it will _________ securities to _________the banking system.(a) sell; add reserves to(b) sell; remove reserves from(c) buy; add reserves to(d) buy; remove reserves fromAnswer: B33. Government securities dealers frequently engage in repos to(a) manage liquidity.(b) take advantage of anticipated changes in interest rates.(c) lend or borrow for a day or two with what is essentially a collateralized loan.(d) do all of the above.(e) do only (a) and (b) of the above.118 Mishkin/Eakins •Financial Markets and Institutions, Fifth Edition Answer: DChapter 9 The Money Markets 11934. Repos are(a) usually low risk loans.(b) usually collateralized with Treasury securities.(c) low interest rate loans.(d) all of the above.(e) only (a) and (b) of the above.Answer: D35. A negotiable certificate of deposit(a) is a term security because it has a specified maturity date.(b) is a bearer instrument, meaning whoever holds the certificate at maturity receives the principaland interest.(c) can be bought and sold until maturity.(d) all of the above.(e) only (a) and (b) of the above.Answer: D36. Negotiable certificates of deposit(a) are bearer instruments because their holders earn the interest and principal at maturity.(b) typically have a maturity of one to four months.(c) are usually denominated at $100,000.(d) are all of the above.(e) are only (a) and (b) of the above.Answer: E37. Commercial paper securities(a) are issued only by the largest and most creditworthy corporations, as they are unsecured.(b) carry an interest rate that varies according to the firm’s level of risk.(c) never have a term to maturity that exceeds 270 days.(d) all of the above.(e) only (a) and (b) of the above.Answer: D38. Unlike most money market securities, commercial paper(a) is not generally traded in a secondary market.(b) usually has a term to maturity that is longer than a year.(c) is not popular with most money market investors because of the high default risk.(d) all of the above.(e) only (a) and (b) of the above.Answer: A120 Mishkin/Eakins •Financial Markets and Institutions, Fifth Edition39. A banker’s acceptance is(a) used to finance goods that have not yet been transferred from the seller to the buyer.(b) an order to pay a specified amount of money to the bearer on a given date.(c) a relatively new money market security that arose in the 1960s as international trade expanded.(d) all of the above.(e) only (a) and (b) of the above.Answer: E40. Banker’s acceptances(a) can be bought and sold until they mature.(b) are issued only by large money center banks.(c) carry low interest rates because of the very low default risk.(d) are all of the above.(e) are only (a) and (b) of the above.Answer: D41. Eurodollars(a) are time deposits with fixed maturities and are, therefore, somewhat illiquid.(b) may offer the borrower a lower interest rate than can be received in the domestic market.(c) are limited to London banks.(d) are all of the above.(e) are only (a) and (b) of the above.Answer: E42. Which of the following statements about money market securities are true?(a) The interest rates on all money market instruments move very closely together over time.(b) The secondary market for Treasury bills is extensive and well developed.(c) There is no well-developed secondary market for commercial paper.(d) All of the above are true.(e) Only (a) and (b) of the above are true.Answer: DChapter 9 The Money Markets 121 True/False1. Money market securities are short-term instruments with an original maturity of less than one year.Answer: TRUE2. Money market securities include Treasury bills, commercial paper, federal funds, repurchaseagreements, negotiable certificates of deposit, banker’s acceptances, and Eurodollars.Answer: TRUE3. The term money market is actually a misnomer, because liquid securities are traded in these marketsrather than money.Answer: TRUE4. Money markets are referred to as retail markets because small individual investors are the primarybuyers of money market securities.Answer: FALSE5. The U.S. Treasury Department is the single most influential participant in the U.S. money market.Answer: FALSE6. The U.S. Treasury Department is the single largest borrower in the U.S. money market.Answer: TRUE7. Banks are unusual participants in the money market because they buy, but do not sell, money marketinstruments.Answer: FALSE8. Money markets are used extensively by businesses both to warehouse surplus funds and to raiseshort-term funds.Answer: TRUE9. The market for U.S. Treasury bills is a shallow market because so few individual investors buyT-bills.Answer: FALSE10. The T-bill is not an investment to be used for anything but temporary storage of excess fundsbecause it barely keeps up with inflation.Answer: TRUE11. The main purpose for federal funds is to provide banks with an immediate infusion of reservesshould they be short.Answer: TRUE122 Mishkin/Eakins •Financial Markets and Institutions, Fifth Edition12. The Fed can influence the federal funds rate by adjusting the level of reserves in the banking system.Answer: TRUE13. Commercial paper securities are unsecured promissory notes, issued by corporations, that mature inno more than 270 days.Answer: TRUE14. A banker’s acceptance is an order to pay a specified amount of money to the bearer on a given date.Banker’s acceptances have been used since the twelfth century.Answer: TRUE15. Interest rates on banker’s acceptances are low because the risk of default is very low.Answer: TRUE16. In general, money market instruments are low risk, high yield securities.Answer: FALSEChapter 9 The Money Markets 123 Essay1. Explain why banks, which would seem to have a comparative advantage in gathering information,have not eliminated the need for the money markets.2. Explain how the Federal Reserve can influence the federal funds interest rate.3. Explain why the money markets are referred to as wholesale markets.4. Explain why money market interest rates move so closely together over time.5. How are Treasury bills sold? How do competitive and noncompetitive bids differ?6. What are the main characteristics of money market securities?7. What are the major types of securities and who are the major participants in the money markets?。