河南工程学院毕业论文设计

- 格式:doc

- 大小:86.50 KB

- 文档页数:20

成人高等教育毕业设计(论文)目________________________________________ 学生姓名专业学历层次学号指导教师(职称)完成时间年月日3号黑体,论文题目不得超过25个汉字所填内容为黑体3号固定内容为宋体3号河南工程学院成人高等教育本科毕业设计(论文)撰写规范为规范我校毕业设计(论文)的写作,使学生掌握规范的论文写作要求和方法,特制定“河南工程学院成人高等教育本科生毕业设计(论文)撰写规范”。

学生在进行毕业设计(论文)写作时应严格遵照规则的要求,指导教师应按此规则指导学生毕业设计(论文)的写作。

毕业设计(论文)文档资料包括:版权使用授权书、原创性声明、中文摘要与中文关键词、外文摘要与外文关键词、目录、正文、参考文献、致谢、附录、毕业设计(论文)任务书、毕业设计(论文)指导教师评语、毕业设计(论文)评阅人评语、毕业设计(论文)答辩小组评语、翻译用的外文资料原文及译文。

对各部分的要求分述如下:一、论文印装毕业论文采用A4幅面打印。

正文用宋体小四号字;版面页边距:上2.5cm,下2.5cm,左3cm,右2.5cm;行距:1.5倍行距;字间距:正常;页码用小五号字底端居中;靠左边装订。

毕业设计(论文)要求胶装。

二、论文结构及要求毕业论文由以下部分组成:A.封面;B.版权使用授权书;C.原创性声明;D.毕业设计(论文)任务书;E.目录;F.中文摘要;G.英文摘要;H.正文;I.致谢;J.参考文献;K.附录(若图纸中有大于A3幅面时,所有图纸应单独装订成册)。

(一)封面及毕业设计(论文)任务书封面:由校本部提供。

版权使用授权书、原创性声明在封面之后,学校制定有统一模板。

毕业设计(论文)的发明属于职务发明,其知识产权属于培养单位。

要十分注意发掘毕业设计(论文)成果的经济效益,努力使成果尽快转化为生产力,并按有关法规进行成果的有偿服务和转让。

“原创性声明”要求毕业设计(论文)者尊重他人研究成果,不得抄袭他人研究成果。

河南工程学院毕业设计(论文)当前包装设计中的传统元素的应用分析学生姓名系(部)专业指导教师蔺辉辉艺术设计系装潢胡娅静、申洋2009年 5 月30 日河南工程学院毕业设计(或论文)摘要如今,中国传统元素备受青睐,设计师们频频将中国传统元素融入设计当中,这也为中国传统文化的传播提供了一个全新的平台。

现代包装设计是一门以文化为本位,以生活为基础,以现代为导向的设计学科。

我们无论是在理论上,还是在实践中,都应该将包装设计作为一种文化形态来对待。

同时,设计文化又要牢牢把握现代社会对视觉效果的重视与追求。

现代设计发展到当今的多元化时代,更多优秀的设计师开始重新审视各民族传统文化艺术在大众心中所积淀的生存情感心理和散射出的人性生命光彩,从而引导着大众的生活方式和审美趋向。

对传统文化的传承与超越才是探索与发展本土包装设计的必由之路.设计是紧随时代、重在观念的.传统文化元素于现代包装设计中的应用,在视觉审美上的取舍,都应以与现代文明相融合为基本出发点。

意大利著名设计师索特萨斯认为,“保持传统并非是单纯的重复传统”。

设计的创新和对传统文化的传承,不是一场文艺复兴运动,而是各民族重新认识本民族文化、重新认识人与自然之间关系的一场社会哲学思想领域的深刻革命。

中国是茶的故乡,是茶文化起源和传播的中心。

作为茶这一传统商品的包装,笔者在设计创作中主张以人为本、传统为根、现代为用的原则,努力探究并汲取中国传统茶文化的内涵与精神实质,进而在视觉传达、形态模式等方面运用形象化的直观方式和情感语言自然地流露。

.。

关键词:关键词:中国传统元素包装设计设计应用数字化时代I 河南工程学院毕业设计(或论文)AbstractToday, populartraditional Chinese elements, designers have been integrated into thetraditional Chinese design elements, this is also forthe dissemination of traditionalChineseculture provides a new platform。

河南工程学院毕业设计豫牛乳业公司宣传网页设计学生姓名:王清霞系部:电气信息工程系专业:电子信息工程技术指导教师:牛雅莉年月日摘要本论文将对网页的设计和制作进行研究和探讨。

作品的主要技术指标包括:1、制作出一个具有静态和动态技术的“关于公司的宣传网页”;2、在制作的过程中,加强和深化以前所学的关于网页设计的方法,同时更好的理解参考资料上的方法和理论;3、最后是追求后台操作的稳定性。

本设计的主要内容包括:1、公司宣传网页的设计思想,整体规划及相关基础知识;2、公司宣传网页的前台设计,包括汇编HTML语言程序及效果图;3、公司宣传网页后台设计(通过后台操作实现对网页内容的修改);4、公司宣传网页的调试。

网页规划包含的内容很多,如网页的结构、栏目的设置、网页的风格、颜色搭配、版面布局、文字图片的运用等,也只有如此制作出来的网页才能有个性、有特色,具有吸引力。

网页主题就是所要包含的主要内容,一个网页必须要有一个明确的主题。

特别是对于个人网页,不可能像综合网站那样做得内容大而全,包罗万象。

所以必须要找准一个自己最感兴趣内容,做深、做透,办出自己的特色,这样才能给人留下深刻的印象。

关键词:宣传网页基本原则制作步骤网页主题AbstractThis will be web page design and production of research and discussion. Works of the main technical indicators include: To produce a static and dynamic technology " company pages"; In the process of strengthening and deepening of previously learned about web design methods, while a better understanding of Reference Information on the methods and theories; Finally, the pursuit of stability of the background operation.The design of the main contents include:company web page design ideas, the overall planning and relevant basic knowledge; company web pages front design, including the compilation of HTML language program and effect diagram; Personal web pages background design (back-office operations through the implementation of the web content changes); Personal web pages debugging.Page plan includes a great many things, such as the page structure, and column settings, web style, color combinations, layout, text, images and other use of, and only this website in order to have produced personality characteristics, attractive.Web theme is to be included in the main contents of a web page must have a clear theme. Especially for personal web pages, it is impossible to do, as an integrated Web site content as large and comprehensive, all-inclusive. Must be necessary to identify one most interested in their own content, so deep, be thorough, to do its own characteristics, so as to give the left a deep impression.Key words:Company Homepage Ground Rules Process Web Theme目录摘要 (1)前言 (2)第一章、系统分析 (6)1.1关于公司宣传网页的网站建设发展历程 (6)1.2关于公司宣传网页的网站建设的必要性分析 (7)1.3本选题的现实意义.................................................................................. 9) 第二章、豫牛乳业公司宣传网站的设计 . (11)2.1关于公司宣传网站的特点 (12)2.2豫牛乳业公司宣传网站的基本组成结构 (12)第三章、具体网站的分析 (13)3.1需求分析 (14)3.2系统运行环境分析 (15)3.3系统设计流程图 (15)第四章、开发工具的选用及介绍 (17)4.1 Asp 脚本语言介绍 .............................................................................(184.2 Dreamweaver简介 (18)4.3 SQL Server 数据库简介 (19)4.4 网站图片制作工具Photoshop简介 (19)第五章、网站前台界面的设计与实现 (20)5.1 网站前台首页 (20)5.2 站内搜索功能的实现 (21)5.3 网站前台界面的设计与实现分析 (21)附录 (22)参考文献 (23)致谢 (24)前言随着网络技术的不断发展,如今的公司越来越倾向于在网络上进行宣传产品,网页设计成了企业展示自身形象、发布产品信息、联系网上客户的新平台、新天地,进而可以通过电子商务开拓新的市场,以极少的投入获得极大的收益和利润。

河南工程学院毕业论文黄金周旅游热经济发展分析学生姓名:李瑞彬系别:经贸系专业:涉外旅游管理年级: 2004 级 1 班指导教师:胡俊成绩:2007年 6 月 8 日目录目录 (1)摘要与关键词 (2)正文 (3)一、黄金周的由来 (3)(一)国内................................................................... . (3)(二)国外 (3)(三)黄金周带来的积极影响 (3)二、黄金周旅游热的负面影响 (4)(一)黄金周旅游活动对景区自然环境的影响..........................................5(二).黄金周对国民经济的负面影响......................................................6(三).对旅游企业的影响.....................................................................6(四)对旅游地传统社会文化的影响....................................................6三、关于黄金周的旅游热带来的问题的解决办法. (7)(一)政府方面.................................................................... ...........7(二)带薪休假.................................................................................7(三)增加新的假期,分散集中假期......................................................8(四)完善旅游法律和法规....................................................................8(五)旅游产品方面....................................................................................... .........9(六)景区方面........................................................................................................9(七)旅游规划方面.................................... ............. ............................... .. (10)(八)交通方面............................................................ (10)(九)企业制度 (10)四、结语 (11)五、参考文献 (12)六、附件 (13)(一)毕业设计(论文)任务书 (13)(二)毕业设计(论文)开题报告 (15)(三)毕业设计(论文)中期检查报告 (16)(四)毕业设计(论文)评价意见 (19)摘要由于我国经济发展的需要,我国政府采取促进促进旅游业发展的政策,如实行“五一”、“十一”、春节黄金周等政策。

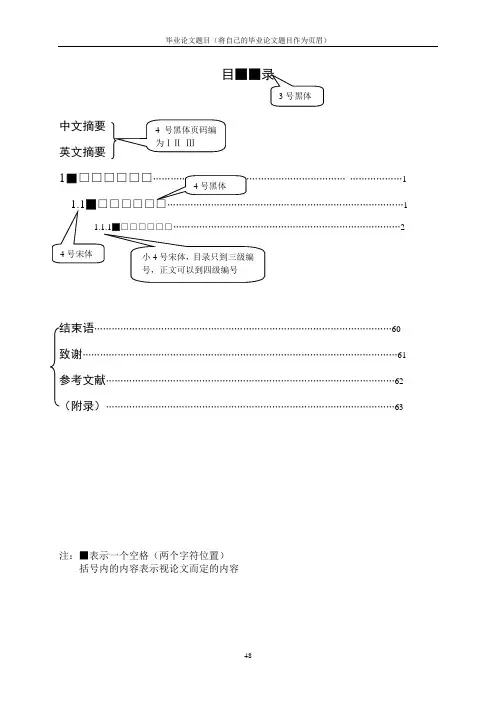

目■■中文摘要英文摘要1■□□□□□□ (1)12结束语......................................................................................................60 致谢............................................................................................................61 参考文献...................................................................................................62 (附录) (63)注:■表示一个空格(两个字符位置) 括号内的内容表示视论文而定的内容空1行空1行■■□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□。

空1行/□□□/空3行空2行■■□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□□。

河南工程学院本科毕业设计(论文)工作管理条例1.查阅文献资料不少于15篇(列入参考文献中),其中外文文献不少于2篇。

根据查阅的文献资料情况,写出文献综述,字数不少于3000字;翻译外文文献一篇,译文字数不少于3000字,并分别单独装订成册。

2.在毕业设计(论文)开始两周内写出“开题报告”并完成“开题答辩”。

“开题报告”内容主要包括:调研资料准备情况,设计的目的、要求、技术路线与成果形式,工作任务分解,各段完成的内容及时间分配、存在的问题等。

交指导教师审查批准后正式开始设计(论文)工作。

学生完成开题报告工作后,应包括查阅资料、外文文献翻译(3000字)、文献综述(3000字)等这些工作也要完成。

3.第八学期第8周填写“毕业设计(论文)学生自查表”(附表九)4. 学生应在第八学期第12周之前完成毕业设计(论文)的初稿,并将正文电子文档交学生所在院(部),以备学校进行学术不端检测。

毕业设计(论文)答辩开始日前一周,学生须提交出毕业设计(论文)全部成果,文档部分按规定装订成册,并向指导教师提出答辩申请,指导教师同意后,方能进入答辩程序。

5.学生答辩前需进行充分准备:写出设计说明书或论文提要、发言提纲,绘制必要的图表等。

参加院(部)级、校级答辩需准备PPT汇报提纲。

6.答辩后,学生应交回所有资料(包括设计说明书、图纸、论文、阶段资料、实验原始记录、译文、软件文档等)。

对设计内容中涉及的有关技术资料负有保密责任,未经许可不得擅自对外发表或转让。

7.中期检查时学生应完成如下内容:开题、综述、外文翻译。

9.我校实行三级答辩,即校级答辩、院(部)级答辩、教研室答辩。

10.毕业设计(论文)资料袋内文档材料包括:1、开题报告、开题答辩记录表;2、学生自查表(中期教学检查用);3、本科毕业设计(论文)工作记录本;4、指导教师意见书;5、评阅人评审表;6、答辩评审表;7、文献翻译(与原文(复印)装订成册);8、文献综述;9、毕业设计(论文)及附图;并按顺序排放。

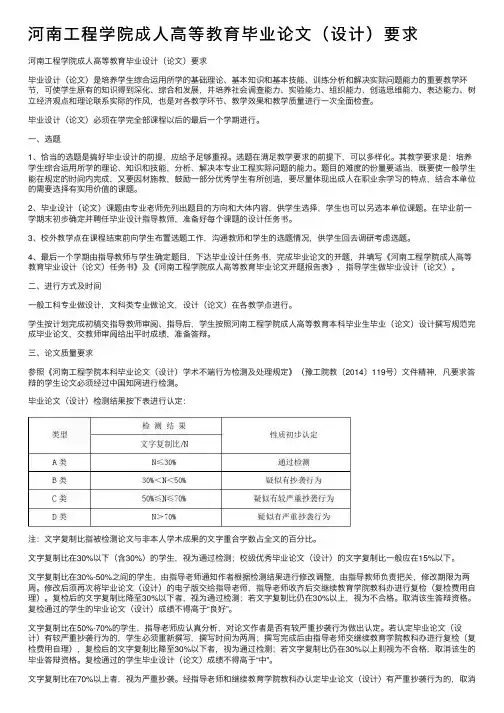

河南⼯程学院成⼈⾼等教育毕业论⽂(设计)要求河南⼯程学院成⼈⾼等教育毕业设计(论⽂)要求毕业设计(论⽂)是培养学⽣综合运⽤所学的基础理论、基本知识和基本技能、训练分析和解决实际问题能⼒的重要教学环节,可使学⽣原有的知识得到深化、综合和发展,并培养社会调查能⼒、实验能⼒、组织能⼒、创造思维能⼒、表达能⼒、树⽴经济观点和理论联系实际的作风,也是对各教学环节、教学效果和教学质量进⾏⼀次全⾯检查。

毕业设计(论⽂)必须在学完全部课程以后的最后⼀个学期进⾏。

⼀、选题1、恰当的选题是搞好毕业设计的前提,应给予⾜够重视。

选题在满⾜教学要求的前提下,可以多样化。

其教学要求是:培养学⽣综合运⽤所学的理论、知识和技能,分析、解决本专业⼯程实际问题的能⼒。

题⽬的难度的份量要适当,既要使⼀般学⽣能在规定的时间内完成,⼜要因材施教,⿎励⼀部分优秀学⽣有所创造,要尽量体现出成⼈在职业余学习的特点,结合本单位的需要选择有实⽤价值的课题。

2、毕业设计(论⽂)课题由专业⽼师先列出题⽬的⽅向和⼤体内容,供学⽣选择,学⽣也可以另选本单位课题。

在毕业前⼀学期末初步确定并聘任毕业设计指导教师,准备好每个课题的设计任务书。

3、校外教学点在课程结束前向学⽣布置选题⼯作,沟通教师和学⽣的选题情况,供学⽣回去调研考虑选题。

4、最后⼀个学期由指导教师与学⽣确定题⽬,下达毕业设计任务书,完成毕业论⽂的开题,并填写《河南⼯程学院成⼈⾼等教育毕业设计(论⽂)任务书》及《河南⼯程学院成⼈⾼等教育毕业论⽂开题报告表》,指导学⽣做毕业设计(论⽂)。

⼆、进⾏⽅式及时间⼀般⼯科专业做设计,⽂科类专业做论⽂,设计(论⽂)在各教学点进⾏。

学⽣按计划完成初稿交指导教师审阅、指导后,学⽣按照河南⼯程学院成⼈⾼等教育本科毕业⽣毕业(论⽂)设计撰写规范完成毕业论⽂,交教师审阅给出平时成绩,准备答辩。

三、论⽂质量要求参照《河南⼯程学院本科毕业论⽂(设计)学术不端⾏为检测及处理规定》(豫⼯院教〔2014〕119号)⽂件精神,凡要求答辩的学⽣论⽂必须经过中国知⽹进⾏检测。

河南工程学院实习设计(论文)印刷过程中的色彩管理学生姓名:李智乐学号:201020201208系(部):材料与化学工程系专业:印刷技术指导老师:楚高利2011年11月23日印刷过程中的色彩管理李智乐(河南工程学院,郑州450007)摘要:探讨如何正确认识和使用印刷色彩管理,并通过实施印刷色彩管理来优化印刷生产,进而提升印刷企业整体效率。

认为印刷色彩管理是自动化颜色控制,是持续的、循环的过程。

对印刷生产的优化包括设备状态的优化与生产过程的优化。

关键词:印刷、色彩管理、自动化颜色控制一、什么是色彩管理?色彩管理是指色彩空间(如扫描仪、显示器、打印机、冲印机、印刷机等)的管理,就是如何控制并描述我们在计算机屏幕上看见的,扫描仪捕获的,彩色样张上的和印刷机印刷的图像色彩。

色彩管理是随图像输出产生的,被应用到越来越多的领域。

从图像创建或色彩捕获到最终图像输出,执行色彩转换是以系统化的方式进行的。

在从一个设备到另一个设备的转换过程(无论是从计算机到印刷机,还是从样张到印刷机),色彩管理系统尽量保持并优化颜色的保真度。

简而言之,色彩管理就是为了保证颜色在输入,处理,输出的整个过程中始终保证一致,也就是常说的"所见即所得"。

不同类型的设备往往会有不同的颜色特征和功能。

例如,对于同一组颜色,显示器无法显示出打印机能够打印出来的色彩效果。

这是因为每个设备呈现彩色内容的过程是根本不同的。

扫描仪和相机的颜色特征也不同。

甚至不同的程序有时对颜色的解释和处理也不同。

如果没有一致的颜色管理系统,相同的图片在各个设备上的显示效果便会不同。

彩色内容的显示效果还取决于查看条件(例如周围的光照条件)。

这是因为人眼在不同条件下对颜色的感觉不同,即便是在查看相同的图片时也是如此。

因此,色彩管理将维护彩色内容中的关系,从而在具有不同的颜色功能的设备上以及在不同的查看条件下能够获得可以接受的显示效果。

二、正确认识印刷色彩管理色彩是印刷品质量控制的核心。

河南工程学院关于本科毕业论文(设计)学术不端行为的检测及处理规定(试行)根据《国务院学位委员会关于在学位授予工作中加强学术道德和学术规范建设的意见》(学位【2010】9号)、《教育部关于严肃处理高等学校学术不端行为的通知》(教社科【2009】3号)、《教育部关于加强学术道德的若干意见》(教人【2002】4号)、《教育部关于对学位论文作假行为的暂行处理办法(征求意见稿)》精神,结合《河南工程学院本科毕业论文(设计)管理办法》的有关要求,为了维护学术道德,端正学风,规范学生学术行为,保证我校本科学生毕业论文(设计)的质量,学校决定从2013届本科毕业生开始的实施“本科毕业论文(设计)学术不端行为”检测,以打击、杜绝在毕业论文(设计)撰写中弄虚作假、抄袭剽窃他人成果的不端行为。

现就开展这项工作的具体程序和实施意见作如下规定。

一、学术不端行为的界定1、照搬他人已发表或者未发表的作品原文,或者是从不同资料来源中对原文词句进行拼接,且未注明来源;2、使用他人的思想见解或语言表述而不申明其来源,具体表现为:总体剽窃,即整体立论、构思、框架等方面的抄袭;复述他人行文、变换措辞使用他人的论点和论证,呈示他人的思路等且均不申明其来源;3、转引但不予注明;4、捏造或篡改研究成果、调查数据或文献资料;5、买卖、他人代写。

二、检测对象与内容检测对象:拟申请学位的我校全日制普通本科毕业学生;检测内容:毕业论文(设计)正文。

三、检测时间及检测方式检测时间:第八学期(第四学年第二学期)第十三周;复检时间为第十五周。

检测方式:由各学院组织全面检测,教务处抽检。

检测时各学院教科办将学位论文(设计)电子版集中收齐,电子版要求为:拟检测毕业论文(设计)word 文档正文全部(即第一章至最后一章,命名方式为:学院名称-学位-专业-姓名.doc。

(如“会计学院-管理学学士-会计学-张三.doc”)。

第十三周由各学院组织检测,第十五周为教务处复检或抽检。

毕业论文-浅谈实施品牌战略,增强企业竞争河南工程学院毕业论文浅谈实施品牌战略,增强企业竞争学生姓名系(部) 专业指导教师2010年05月28号河南工程学院毕业设计毕业设计(论文)任务书题目名称:学生姓名所学专业班级指导教师姓名所学专业职称一、设计(论文)主要内容及进度本篇论文在分析了当前我国品牌在我国发展的现状后,在结合对维雪啤酒厂实施品牌战略过程中的优势和不足之处,对品牌能够提升企业竞争力的问题进行探究与分析,并对品牌发展存在的问题发表了看法,提出了一些意见。

从而探讨出我国中小企业品牌发展过程中的主要问题及解决对策,同时,对我国企业的品牌发展前景进行了预测。

前期选定论文题目,确定论文提纲;中期由初稿、二稿到三稿,确定论文预备稿件;后期确定论文正式稿件,上交正式打印稿件.二、主要技术指标(或研究目标)本文主要是研究我国品牌发展现状及其发展过程中存在的不足之处。

并结合维雪啤酒公司的品牌发展战略的优势和不足,从而进一步探讨我国中小型企业品牌发展中遇到的问题及解决方法,以促进我国企业品牌的发展和竞争力的提高。

三、进度计划2.16前,选定论文题目,提交论文开题报告4.11――15 收集资料,交初稿5.11――15 经过修改,交二稿5.18――5.25 整理修改后的论文,交三稿6. 6――6. 8定稿,交正式打印稿。

四、重要参考文献[1]秦秋莉.核心竞争力的成功模式与误区[M].北京:中国纺织出版社,2005.[2]金占明.战略管理——超竞争环境下的选择(第二版)[M].北京:清华大学出版社,2004. [3]罗仲伟,朱彤.拥有持久的竞争优势[M].北京:民主与建设出版社,2003.[4]吴德庆,马月才(编).《管理经济学》[M].中国人民大学出版社,2006.[5]邵晓峰,季建华,黄培清.供应链竞争力评价指标体系的研究.预测,2000(6):52,56 [6]刘解龙:《科学技术第一价值创造力论》,《当代经济研究》1998年第6期[7]周三多.管理学.北京:高等教育出版社,2005教研室主任签字: 年月日I河南工程学院毕业设计毕业设计(论文)开题报告题目名称学生姓名专业工商企业管理班级一、选题的依据和意义随着经济的发展,消费者的购买行为并不仅仅取决于购买力或一般的心理、生理需要,而主要取决于对某个企业、某种品牌的综合印象。

河南工程学院毕业设计(论文)撰写规范为了提高我院院毕业设计(论文)的质量,实现毕业设计在内容和格式上的规范化与统一化,特制定《河南工程学院毕业设计(论文)撰写规范》。

具体规范要求如下。

一、毕业设计(论文)撰写的主要内容与基本要求1、题目设计(论文)课题名称,要求应简短、明确,有概括性。

标题字一般不宜超过20个字,如该标题不足以说明问题时,也可以使用副标题。

2、中外文摘要及关键词摘要是论文内容的简要陈述,包括论文的主要论点、创新见解概括,同时具有独立性和完整性;中文摘要在300字左右,英文摘要在250个实词左右,英文摘要与中文摘要内容基本对应。

设计摘要主要介绍设计任务、设计标准、设计原则及主要特点,中文字数在600以内,外文400个实词左右。

关键词3-5个。

3、目录①目录是毕业设计(论文)各组成部分的小标题,文字应简明扼要。

②目录按章节排列编写,标明页数,便于阅读。

③章节、小节分别以一、(一)、1、(1)等数字依次标出。

要求标题层次清晰。

④目录中的标题应与正文中的标题一致。

4、前言应说明本课题的意义、依据及对现有情况的评述;说明本课题所要解决的问题和采用的手段、方法;概述成果及意义。

5、正文正文是对研究和设计工作的表述,主要内容包括:问题的提出、研究方案设计(设计内容及过程)、结果分析、理论在实际中的应用、结论等。

6、参考文献所引用的文献必须是本人真正阅读过,且以近期发表的与设计或论文工作直接相关的文献为主。

设计和论文至少应列出主要文献10篇或以上(本科必须有外文文献)。

7、附录将各种篇幅较大的图纸、数据表格、计算机程序等作为附录附于说明书之后。

8、致谢简述自己通过本设计(论文)的体会,并对指导老师和协助完成设计的有关人员表示谢意。

二、毕业设计(论文)几种类型及具体要求1、论文类:理论研究类论文选题要密切结合社会实际,防止题目过大。

学生要完成5000字以上的论文。

2、设计类(1)实验类:实验研究类学生要独立完成一个完整的实验,取得足够的实验数据,实验要有探索,字数6000字左右。

河南工程学院毕业设计(论文)YWZ630/121制动器设计及螺旋弹簧有限元分析学生姓名系别机械工程系专业机械设计制造及其自动化年级指导教师成绩__________________________目录摘要制动器是用于机构或机器减速或使其停止的制动装置。

有时也用作调节或限制机构或机器运动速度。

它是保证机构或机器安全工作的重要部件。

本次毕业设计选择的型号是外抱式制动器里的YWZ630/121型制动器。

它主要用于起重、运输、冶金、矿山、港口建设等机械驱动装置和减速停车制动。

它具有制动平稳、无噪音、寿命长、体积小、重量轻、维修方便等优点。

制动衬垫为卡装饰整体型结构,更换方便、快捷。

制动器工作过程:当推动器的电机通电时,电动机带动转轴上的叶轮旋转,在油路中产生压力,此压力将油由活塞上部吸到活塞的下部,活塞上下的液压油产生一个压力差。

此压力差迫使活塞和固定在其上的活塞推杆迅速上升,当活塞开到顶端位置时,活塞下部保持恒定的压力,此过程通过杠杆作用,压缩主弹簧产生力矩,把制动瓦打开(松闸);当断电时,叶轮停止转动。

活塞在制动弹簧回复力及本身质量作用下,迅速下降,迫使油通过油导向器,重新流入活塞上部。

这时仍通过杠杆作用,把制动瓦合拢(抱闸),便达到制动的目的。

螺旋弹簧的校核运用了有限元法,这样可以缩短设计周期,也有利于查找变形的截面。

关键词制动器制动臂杠杆拉杆有限元分析AbstractThe brake is used in mechanism or machine deceleration or braking device to stop. It is also sometimes used as a regulating or restricting mechanism or machine movement speed. It is to ensure that the body or machine safety work important component.This graduation design choice of models is the YWZ external-contacting brake type brake. It is mainly used for lifting, transportation, metallurgy, mining, port construction machinery drive and deceleration parking brake. It has a smooth braking, no noise, long service life, small volume, light weight, convenient repair.Brake pad for card decoration overall structure, convenient replacement, fast. Brake work process: when the drive motor is energized, the motor to drive the rotating shaft of impeller rotation, in the oil pressure, the pressure oil from the piston top suction to the lower portions of the piston, the piston of hydraulic oil to produce a pressure differential. This pressure difference forces the piston and fixed on the piston rod rises quickly, when the piston is at the top position, the lower portion of the piston to maintain a constant pressure, this process through the lever action, the main compression spring to generate torque, the brake open ( loosen ); When the power is off, the impeller stops rotating. The piston in the brake spring restoring force and quality function, decreased rapidly, forcing the oil through the oil guide, back into the upper part of the piston. This is still the leverage, the brake shoe closure ( brake ), then achieve the brake.Spiral spring check using the finite element method, which can shorten the design cycle, but also conducive to find the deformation of cross section.Key word:Brake Brake arm Lever Pull rod Finite element analysis摘要及关键词 (2)引言 (3)一制动器概述及分类 (4)二制动器的选择与设 (4)三制动器总体设计 (6)四制动器的杠杆比计算 (8)五制动器主弹簧的设计与计算及校核 (10)六受力分析 (14)七制动臂强度计算和校核 (16)八销轴的计算与校核 (20)九推杆的计算及其稳定性校核 (23)十制动器使用条件和使用规范及维修 (25)致谢 (26)参考文献 (27)附录 (28)YWZ630/121型制动器设计及螺旋弹簧有限元分析摘要制动器是用于机构或机器减速或使其停止的制动装置。

河南工程学院毕业设计(论文)金属切削车床的变频调速系统学生姓名:王青系(部):机械电子工程系专业:机电一体化指导教师:2008年05 月23 日摘要随着变频技术的提高,交流电动机的应用越来越广泛,采用变频调速,可以提高生产机械的控制精度、生产效率和产品质量,有利于实现生产过程的自动化,使电力拖动系统具有优良的控制性能,而且在许多生产场合具有显著的节能效果。

变频调速的核心设备是变频调速器,变频器与电动机的控制配合构成了变频调速系统。

传统的金属切削车床速度控制为人工换挡,调速范围有限,调速精度低,而电机始终在额定转速运行,利用效率差,齿轮箱体积庞大复杂,电器控制部分故障较多。

将变频器应用于各种大型自动化生产线和机械加工中,会大大提高金属切削车床的调速系统的静态、动态性能,保证系统的安全可靠经济运行。

该系统选用三菱FR-A500系列变频器,采用普通继电器实现逻辑控制。

主电动机可以正反转运行,速度有低、中、高三档,并具有点动微调功能。

关键词:变频技术电力拖动变频器金属切削车床的调速系统AbstractWith the increased frequency technology, exchange more and more extensive application of the motor, using Frequency Control, can improve the control precision machinery production, production efficiency and product quality, conducive to the realization of the production process automation, the electric drive system is excellent Control performance, and in many occasions have significant production of energy-saving effect. Frequency Control is the core of Frequency Control, the inverter and motor control with constitutes a Frequency Control System. The traditional metal-cutting lathe speed control for manual shifting, speed limited in scope, low-speed precision, and the motor always running in the rated speed, poor efficiency, volume of large and complex gear box, electrical control of the fault more. Converter will be applied to all kinds of large-scale automated production lines and machinery processing, will greatly enhance the speed metal-cutting lathe system of static, dynamic performance, and ensure safe and reliable system of economic operations. <br> The system chosen Mitsubishi FR-A500 series inverter, a general realization of the relay logic control. Positive and the main motor can run, speed is low, middle and high third gear and have to move the fine-tuning function.Key words:Inverter Technology Power Inverter Drag The Metal-cuttingLathe Speed Control System目录前言....................................................第一章交流变频调速器第一节变频器的变频与变压..............................................................第二节变频器的构成与功能..............................................................第二章通用变频器的介绍第一节通用变频器........................................................................一、组成与功能.............................................................................二、变频器的主要外接电路......................................................第二节变频器主要参数简介一、启停控制方式........................................................................二、与频率设定相关的参数.........................................................三、频率给定方式..........................................................................四、变频器的控制方式...................................................................五、工艺参数..................................................................................六、变频器参数..............................................................................七、PID调节功能参数..................................................................八、报警与故障参数...................................................................... 第三章金属切削车床的变频调速系统第一节主运动的负载性质及对主拖动系统的要求..............一、主运动的负载性质...................................二、主运动对主拖动系统的要求...........................第二节变频调速系统的设计方案.............................一、变频器的容量选择.....................................二、变频器控制方式的选择................................三、其他器件............................................第三节、变频调速系统控制系统及其工作过程...................一、变频器接线....................................二、继电器控制电路.................................参考文献..............................................附录..................................................致谢前言机床技术水平高低及其在金属切削加工机床产量和总拥有量的百分比,是衡量一个国家国民经济发展和工业制造整体水平的重要标志之一。

学校代码:11517学号:*******HENAN INSTITUTE OFENGINEERING毕业论文题目学生姓名专业班级学号学院指导老师(职称)***(讲师)、***(校外)完成时间20** 年**月**日河南工程学院毕业设计(论文)版权使用授权书本人完全了解河南工程学院关于收集、保存、使用学位毕业设计(论文)的规定,同意如下各项内容:按照学校要求提交毕业设计(论文)的印刷本和电子版本;学校有权保存毕业设计(论文)的印刷本和电子版,并采用影印、缩印、扫描、数字化或其它手段保存别业设计(论文);学校有权提供目录检索以与提供本毕业设计(论文)全文或者部分的阅览服务;学校有权按有关规定向国家有关部门或者机构送交毕业设计(论文)的复印件和电子版;在不以赢利为目的的前提下,学校可以适当复制毕业设计(论文)的部分或全部内容用于学术活动。

毕业设计(论文)作者签名:年月日河南工程学院毕业设计(论文)原创性声明本人郑重声明:所呈交的毕业设计(论文),是本人在指导教师指导下,进行研究工作所取得的成果。

除文中已经注明引用的内容外,本毕业设计(论文)的研究成果不包含任何他人创作的、已公开发表或者没有公开发表的作品的内容。

对本毕业设计(论文)所涉与的研究工作做出贡献的其他个人和集体,均已在文中以明确方式标明。

本学位毕业设计(论文)原创性声明的法律责任由本人承担。

毕业设计(论文)作者签名:年月日目录摘要 (1)ABSTRACT (2)第1章绪论 (3)第2章排版算法的可行性研究 (4)2.1 关于目录修改后的排版技巧 (4)2.1.1 关于目录的制作和修改 (4)2.1.2 此处为三级标题 (4)2.2 关于图片、表格、公式的解决 (5)2.2.1 表格的样式 (5)2.2.2 此处为三级标题 (6)2.3 页眉和页码的设置 (7)2.4 脚注和参考文献上标 (7)2.4.1 脚注和参考文献上标范例 (7)2.4.2 此处为三级标题 (7)第3章PaperYes论文一键排版的概念 (9)3.1 一键排版的概念 (9)3.1.1 此处为三级标题 (9)3.1.2 此处为三级标题 (9)3.2 一键排版的概念 (10)3.2.1 此处为三级标题 (10)3.2.2 此处为三级标题 (11)第4章总结 (12)参考文献 (13)致谢 (14)附录 (15)摘要本论文主要内容是基于本高校的论文格式要求,利用论文排版机器人PaperYes的人工智能引擎排版出来的论文模板。

工程学院毕业设计论信用证支付方式的风险防对策学生:00 00 00学号:000000000000 系(部):空空空空系专业:指导教师:2012年2月22日摘要随着国际贸易的发展,信用证方式逐渐成为国际贸易常使用的一种支付方式。

信用证是国际贸易发展到一定程度的历史产物,是银行与金融机构参与国际贸易结算的过程中逐步形成的,与此同时,它也促进了国际贸易的发展。

信用证支付方式把由进口人履行付款责任,转为由银行来付款,保证出口人安全迅速收到货款,买方按时收到货运单据。

因此,在一定程度上解决了进出口人之间互不信任的矛盾;同时,也为进出口双方提供了资金融通的便利。

所以,自出现信用证以来,这种支付方式发展很快,并在国际贸易中被广泛运用。

当今,信用证付款已成为国际贸易中普遍采用的一种主要的支付方式。

虽然信用证因受到各国进出口商的青睐,但是由于信用证一般都用于国际性的交易,涉及多方交易主体,进出口双方及各国银行往往以各自的利益为出发点办事。

因此,信用证各有关当事人之间的争议和纠纷经常发生,特别是在经济危机、市场不景气的时候,进口商和开证行往往挑剔单据上某些容不符要求,借口提出异议,拖延甚至拒绝付款,这就引起了一定的风险,所以说,信用证支付方式还是存在一定的风险的。

关键词:信用证支付方式存在的风险防对策AbstractWith the development of international trade, letter of credit in international trade has gradually become a commonly used means of payment. Letters of credit in international trade has developed to a certain degree of historical product of the banking and financial institutions to participate in international trade settlementprocess of evolving at the same time, it also promoted the development of international trade. Means a letter of credit from the importer to fulfill payment obligations, to the payment by the bank to ensure the safety of the rapid export of receiving payment, the buyer shipping documents received on time. Therefore, to some extent solved the distrust between the import and export the conflict; At the same time, both for import and export financing provided convenience. Therefore, since the emergence of the letter of credit, such payments developed rapidly, and in international trade have been widely used. Today, the letter of credit has become widely used in international trade as a major method of payment.Although the letter of credit to importers and exporters due to the favor of all countries, but generally as a result of letters of credit for international transactions, the main multi-party transactions, both import and export and international banks tend to their business interests. Therefore, the relevant letter of credit disputes between the parties and disputes often occur, particularly in the economic crisis, the market downturn, the importer and the issuing firms tend to find fault with some of the content of documents does not match the requirements of an excuse to raise objections, delay or even refuse to payment, which caused a certain amount of risk, so that the existence of the letter of credit or payment of a certain degree of risk.目录摘要 (1)前言 (5)一、信用证的特点 (5)(一)、信用证是银行以自己的信用作出的付款保证 (5)(二)、信用证是一种自足文件,不依附于贸易合同而独立存在 (5)(三)、信用证业务是纯粹的单据买卖 (5)二、信用证存在的风险 (6)(一)、进口商的风险 (6)1、出口商不守信用带来的风险 (7)2、出口商与承运人勾结带来的风险 (7)3、承运人不守信用带来的风险 (7)(二)、出口商的风险 (7)1、单证不符带来的风险 (7)2、不按合同交货带来的风险 (7)3、开证银行或保兑银行的资信出现问题带来的风险 (8)4、买方通过伪造信用证、“软条款”信用证带来的风险 (8)(三)、银行存在的风险 (8)1、议付银行的风险 (8)2、开证银行的风险 (9)3、进出口双方合谋欺诈给银行带来的风险 (9)三、信用证支付方式风险的防措施 (9)(一)、进口商的防措施 (10)1、必须事先调查出口商的资信资产及经营道德 (10)2、选用恰当的贸易术语 (10)3、进口商应要求银行严格审查出口商所提供的单据.......................................10(二)、出口商的防措施 (10)1、必须认真、仔细地审核信用证,确保信用证中无“陷阱”和“软条款” (10)2、必须认真审查开证行的资信能力,加强对开证行的资信调查 (10)3、加强出口企业业务人员对信用证专业知识的培训 (10)4、认真买卖合同 (10)(三)、银行的防措施 (10)1、加强对进出口企业的资信调查 (11)2、加强银行部的管理和调控 (11)3、开证行加强对单据的控制 (11)(四)、其他方面的防措施 (11)1、努力提高业务人员素质,保持高度的警惕性 (11)2、认真缮制单据,严把单据制作关 (11)3、信用证的当事人应各行其责 (11)结论 (12)致谢 (13)参考文献 (14)前言信用证支付方式是随着国际贸易的发展,在银行与金融机构参与国际贸易结算中逐步形成的信用证支付方式把进口人履行付款责任转为由银行来付款保证出口人安全迅速收到货款买方按时收到货运单据因此在一定程度上解决了进出口人之间互不信任的矛盾:同时,也为进出口双方提供了资金融通的便利。

所以,自出现信用证以来这种支付方式发展很快,是目前世界上一种主要的国际结算方式,尤其是在发展中国家的对外贸易结算中占较大比重。

信用证作为一种成熟的国际结算方式,给进出口双方及银行都带来一定的好处和作用。

但同时存在一些漏洞与弊端,也会给当事人带来一定的风险。

一、信用证的特点(一)、信用证是银行以自己的信用作出的付款保证信用证是银行以自己的信用作出的付款保证,所以,在信用证方式下,银行承担第一性的付款责任,即信用证是以银行信用取代了商业信用,这一特点极大地减少了由于商人间交易的不确定性而造成的付款不确定性,为进出口双方提供了很大的保障作用。

(二)、信用证是一种自足文件,不依附于贸易合同而独立存在信用证虽以贸易合同为基础,但它一经开立,就成为独立于合同以外的一项契约。

《UCP600》第3条规定信用证与其可能作为其依据的销售合同是相互独立的交易,即使信用证中提及该合同,银行也与该合同无关,并且不受其约束。

由此可见,信用证的所有当事人仅凭信用证条款办事,以信用证为唯一的依据。

出口方如果提交了与信用证条款完全一致的单证,就能保证安全迅速收汇。

出口方履行了信用证条款,并出具了与信用证条款相符的单据,并不保证他完全履行了合同,相反,如果出口方认真履行了合同,却未能提供与信用证相符的单据时,也会遭到银行拒付。

(三)、信用证业务是纯粹的单据买卖信用证业务是纯粹的单据买卖。

《UCP500》第4条规定:在信用证业务中,各有关方所处理的是单据,而不是与单据所涉及的货物、服务或其他行为。

银行只看单据,不看货物。

只要求受益人所提供的单据表面上与信用证条款相符合,而对于所装货物的实际情况如何,是否中途遗失,是否如期到达目的港,货物与单据是否相符等等概不负责;银行有义务合理小心地审核一切单据,以确定单据表面是否符合信用证条款,银行对任何单据的形式、完整性、准确性、真实性以及伪造或法律效力等概不负责。

因此,信用证是一种相对于托收、电汇等方式而言信用度较高的一种支付方式。

交易双方通过信用证业务,就某笔交易,建立起商业信用加银行信用,这样的双重信用给了买卖双方更大的安全。

买方可从信用证规定的单据中获得所需的物品和服务,而卖方如果履行了信用证项下的义务,提交正确的单据便可以从银行得到偿付。

信用证业务由于有了银行的参与,较大程度上解决了进出口双方互不信任的问题,可以帮助降低国际贸易风险,并使双方得到资金融通。

二、信用证存在的风险信用证就进出口双方及银行而言存在一定的弊端与风险主要表现在:(一)、进口商的风险进口商的风险使用信用证支付方式银行只认单不认货,只要出口商做出的单据能够表面上符合信用证的要求,就能从银行取得承兑或货款。